| 出版社 | Mordor Intelligence |

| 出版年月 | 2025年6月 |

Touch Screen Controllers – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 – 2030)

タッチ スクリーン コントローラー市場レポートは、テクノロジー (抵抗型、静電容量型など)、インターフェイス (I2C、SPI、USB、UART)、タッチ ポイント (シングル タッチ、マルチ タッチ)、ディスプレイ サイズ (5 インチ未満、5 ~ 10 インチ、10 インチ以上)、エンド ユーザー業界 (民生用電子機器、工業および製造、小売および POS 端末など)、および地域別にセグメント化されています。

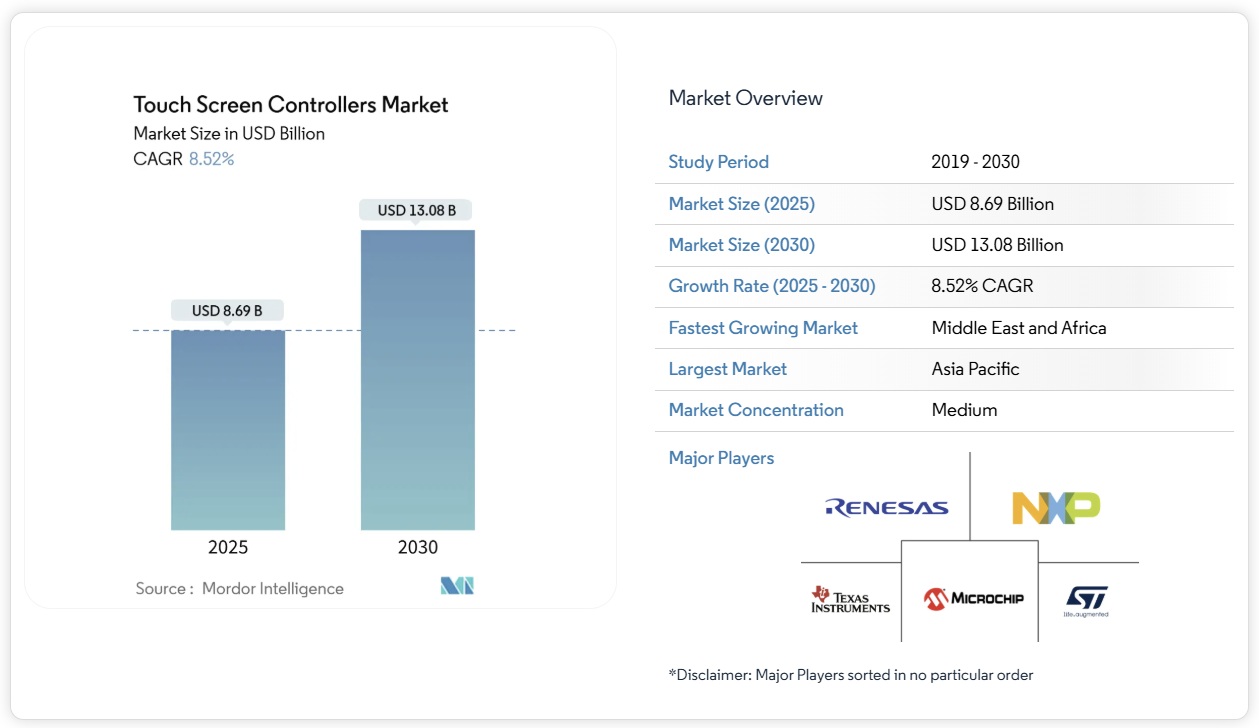

タッチスクリーンコントローラ市場規模は、2025年に86億9,000万米ドルに達すると推定され、2030年には130億8,000万米ドルに達し、年平均成長率(CAGR)8.52%で成長すると予測されています。この成長は、スマートフォンにおけるマルチタッチインターフェースの採用増加、車載ディスプレイの大型化、そして投影型静電容量(PCAP)パネルへの産業移行によって推進されています。供給側では、タッチおよびディスプレイ統合ドライバIC(TDDI)によって部品点数が削減され、デバイスプロファイルの薄型化が実現しています。また、継続的なウェーハレベルの制約により、車載および医療用ソリューションの価格が高騰しています。需要は、小売業の自動化、超低消費電力の32ビットコントローラを必要とするウェアラブル機器、そしてコントローラアルゴリズムを複雑なエッジ検出や手のひら拒否へと押し上げるフレキシブルOLEDスクリーンの利用拡大によって押し上げられています。地域的な勢いは、電子機器製造拠点が密集しているアジア太平洋地域で最も大きく、スマートシティプロジェクトやセルフチェックアウトの導入を通じて中東およびアフリカでもビジネスチャンスが拡大しています。

Touch Screen Controllers Market Analysis

The touch screen controllers market size is estimated at USD 8.69 billion in 2025 and is projected to reach USD 13.08 billion by 2030, reflecting an 8.52% CAGR. Growth is propelled by rising adoption of multi-touch interfaces in smartphones, larger in-vehicle displays, and industrial migration to projected capacitive (PCAP) panels. On the supply side, integrated touch-and-display driver ICs (TDDI) are trimming component counts and enabling thinner device profiles, while ongoing wafer-level constraints encourage premium-priced automotive and medical solutions. Demand is reinforced by retail automation, wearables that require ultra-low-power 32-bit controllers, and expanding use of flexible OLED screens that push controller algorithms toward complex edge detection and palm rejection. Regional momentum is greatest in Asia Pacific because of its dense electronics manufacturing base, with incremental opportunities building in the Middle East and Africa through smart-city projects and self-checkout deployments.

Touch Screen Controllers – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 – 2030)

List of Companies Covered in this Report:

- NXP Semiconductors

- Renesas Electronics Corporation

- Samsung Electronics Co. Ltd.

- Texas Instruments Incorporated

- Analog Devices Inc.

- STMicroelectronics

- Microchip Technology Inc.

- Cypress (Infineon Technologies AG)

- Synaptics Incorporated

- Goodix Technology Inc.

- FocalTech Systems Co. Ltd.

- MELFAS Co. Ltd.

- Elan Microelectronics Corp.

- Novatek Microelectronics Corp.

- Ilitek I-SFT Technology Inc.

- Silicon Labs

- Himax Technologies Inc.

- Semtech Corporation

- Broadcom Inc.

- PixArt Imaging Inc.

- ROHM Semiconductor

- AMS OSRAM AG

- Raydium Semiconductor Corp.

Segment Analysis

Capacitive solutions captured 71.5% of the touch screen controllers market share in 2024, reflecting strong adoption in phones, tablets, and vehicle cockpits. Their ability to sense through cover-glass and to support ten-plus touch points secures design wins where durability, optical clarity, and gesture richness matter. The segment benefits from ongoing migration to integrated TDDI chips that lower bezel count and shrink module thickness. Conversely, resistive products continue serving glove-based factory consoles and point-of-sale terminals, though incremental volumes decline as PCAP pricing falls.

Infrared controllers post the highest 10.8% CAGR to 2030. Bezel-mounted emitter-receiver arrays let integrators scale beyond 100 inches at moderate cost, a key advantage for classrooms, digital signage, and heavy-duty kiosks. Efficiency gains in IR LED drivers combined with refined line-of-sight algorithms are reducing latency and improving ambient light immunity, prompting education boards and corporate meeting rooms to consider interactive walls. This dynamic keeps technology diversity alive inside the touch screen controllers market, encouraging vendors to maintain parallel product lines across PCAP, IR, and niche acoustic or optical imaging solutions.

The I2C protocol delivered 43% revenue in 2024 thanks to its two-wire simplicity, low pin count, and multi-master capability, catering to system-on-chip environments. Smartphones, wearables, and many automotive displays rely on I2C for low-noise, low-power communication between the controller and host processor. SPI holds steady in panel PCs and higher-resolution tablets where bandwidth requirements rise, while UART persists in legacy industrial terminals seeking minimal firmware updates.

USB emerges as the fastest-growing at a 9.2% CA,GR given its plug-and-play nature and high throughput that supports stylus data and hover sensing. ODMs targeting kiosks, medical carts, and detachable monitors appreciate the standard connector and host-agnostic enumeration process. White-box PC makers also favor USB touch due to the cost avoidance of additional bridge ICs. This interface flexibility widens application reach, adds volumes to the touch screen controllers market, and pressures vendors to supply multi-interface firmware capable of seamless field reconfiguration.

The Touch Screen Controllers Market Report is Segmented by Technology (Resistive, Capacitive, and More), Interface (I2C, SPI, USB, and UART), Touch Points (Single-Touch, and Multi-Touch), Display Size (Less Than 5 Inch, 5-10 Inch, and Above 10 Inch), End-User Industry (Consumer Electronics, Industrial and Manufacturing, Retail and POS Terminals, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).