| 出版社 | Mordor Intelligence |

| 出版年月 | 2025年9月 |

Japan Commercial Vehicles – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 – 2029)

日本の商用車市場は、車両タイプ(商用車)と駆動方式(ハイブリッド車および電気自動車、ICE)別にセグメント化されています。本レポートでは、市場規模を米ドル建ての市場金額と台数ベースの両方で提供しています。さらに、車両タイプ、車両構成、車体タイプ、駆動方式、燃料カテゴリー別の市場区分も掲載しています。

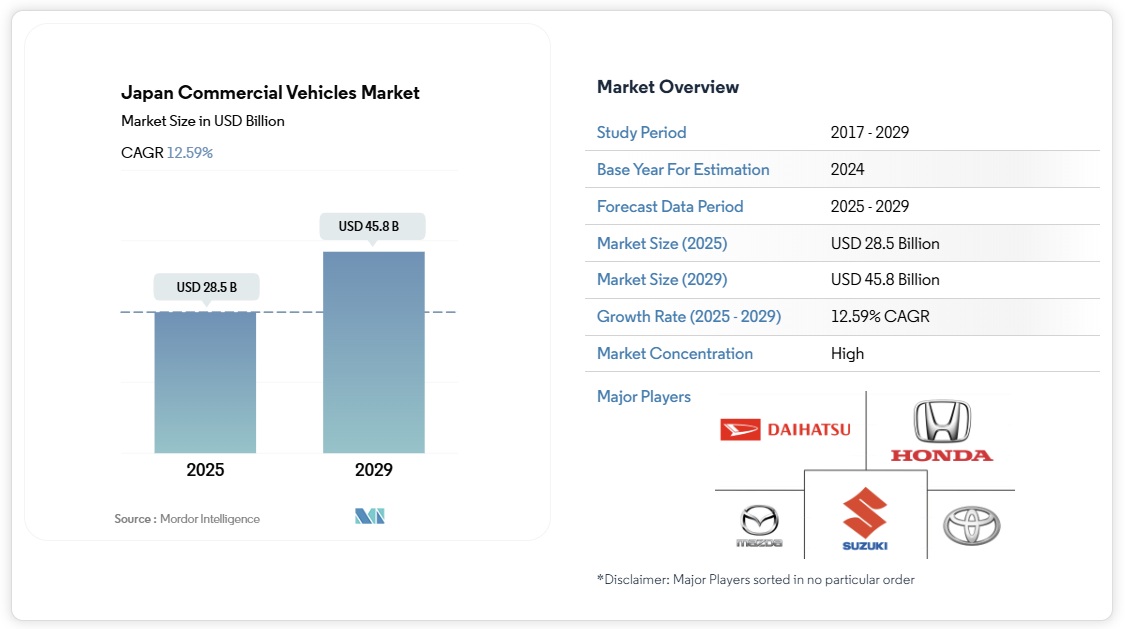

日本の商用車市場規模は、2025年には285億米ドルと推定され、2029年には458億米ドルに達し、予測期間(2025~2029年)中に12.59%のCAGRで成長すると予想されています。

日本の商用車業界は、国の意欲的な環境目標と技術革新を背景に、変革期を迎えています。日本政府はカーボンニュートラルに向けた明確なロードマップを策定し、2050年までに二酸化炭素排出量をゼロにするという目標を掲げています。このコミットメントは、税制優遇措置や財政支援を含む大規模な財政支援によって支えられており、政府は2030年までに環境投資と販売を通じて年間90兆円(8,700億米ドル)の環境負荷削減を目指しています。運輸部門は、日本の総排出量の19%を占め、環境への影響が大きいことから、持続可能なモビリティソリューションへの移行を促進しています。

商用車市場の状況は、特に電気自動車分野において、戦略的提携と技術革新によって大きく変貌を遂げつつあります。業界の主要プレーヤーは、イノベーションと市場浸透を加速させるため、協業体制を構築しています。注目すべき例として、トヨタとスズキが2023年5月に新型軽電気バンとBEVプラットフォームを共同開発する提携を締結したことが挙げられます。これは、業界の電動化へのコミットメントを示すものです。こうした協業は、開発コストの分担と次世代車両の商品化加速に不可欠です。

Japan Commercial Vehicles Market Analysis

The Japan Commercial Vehicles Market size is estimated at 28.5 billion USD in 2025, and is expected to reach 45.8 billion USD by 2029, growing at a CAGR of 12.59% during the forecast period (2025-2029).

Japan’s commercial vehicle industry is undergoing a transformative shift driven by the nation’s ambitious environmental objectives and technological innovation. The Japanese government has established a clear roadmap toward carbon neutrality, setting a target for zero carbon emissions by 2050. This commitment is backed by substantial financial support, with the government offering significant incentives, including tax exemptions and financial incentives, targeting a boost of JPY 90 trillion (USD 870 billion) annually through green investments and sales by 2030. The transportation sector’s significant environmental impact, accounting for 19% of the nation’s total emissions, has catalyzed this transition toward sustainable mobility solutions.

Japan Commercial Vehicles – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 – 2029)

The commercial vehicle market landscape is being reshaped by strategic partnerships and technological advancements, particularly in the electric vehicle segment. Major industry players are forming collaborative ventures to accelerate innovation and market penetration. A notable example is the May 2023 partnership between Toyota and Suzuki to co-develop new mini electric vans and BEV platforms, demonstrating the industry’s commitment to electrification. These collaborations are crucial for sharing development costs and accelerating the commercialization of next-generation vehicles.

Infrastructure development plays a pivotal role in supporting the industry’s transformation, with Japan maintaining a robust charging network comprising 29,400 EV charging stations as of 2022. The government’s commitment to infrastructure development is evident in its comprehensive approach to creating an ecosystem that supports alternative fuel vehicles. This infrastructure expansion is complemented by enhanced support for EV adoption, as demonstrated by the government’s decision in 2022 to double its subsidy for battery electric vehicle purchases to JPY 850,000 (USD 6,500).

The industry is witnessing a significant technological evolution, particularly in the development of alternative powertrains and advanced vehicle systems. Japanese manufacturers are at the forefront of innovation in hybrid and electric vehicle technology, with companies introducing new models equipped with advanced features and improved performance capabilities. The government’s policy to phase out gasoline-powered vehicles by the mid-2030s has accelerated research and development in electric and fuel cell technologies, fostering an environment of continuous innovation and technological advancement in the commercial vehicle sector.

Japan’s electric vehicle market grows gradually due to government and industry partnerships

- The electric vehicle industry in Japan is growing gradually, and the government’s norms and targets to electrify all new car sales by 2035 are shifting the country toward electric mobility. Moreover, government efforts in terms of subsidies and rebates are driving the country’s electric vehicle market. In November 2021, the government of Japan announced that it would provide subsidies on electric vehicles, i.e., up to USD 7200 per vehicle. However, hybrid vehicles are not included in the subsidy program. Such factors contribute to the growth of electric vehicles (passenger cars) by 11.11% in 2022 over 2021.

- Various companies are signing partnerships and ventures to enhance electric mobility in various sectors across Japan. In June 2022, the technology company Sony and the Japanese automaker Honda signed a joint venture to work on electric mobility together. The objective of the venture is to produce and sell electric cars in Japan by 2025. Moreover, Honda has announced the launch of 30 electric vehicles and the production of 2 million vehicles annually by 2030. Each company has invested approximately USD 37.52 million in the venture. Such factors are expected to impact electric mobility positively.

- In April 2022, the US-based automaker General Motors announced an expand its partnership with Honda to produce electric vehicles. As part of the expansion, the companies will develop new affordable electric vehicles, including cars. The production of the vehicles is expected to start in early 2027. Moreover, such international expansions are expected to develop new designs and enhanced cars, which further is expected to raise the sales of electric cars During the 2024-2030 period in Japan, which will also accelerate the demand for battery packs across Japan.