| 出版社 | Mordor Intelligence |

| 出版年月 | 2025年9月 |

Robotics – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 – 2030)

ロボティクス市場レポートは、ロボットの種類(産業用ロボット、サービスロボットなど)、コンポーネント(ハードウェア、ソフトウェア、サービス)、用途(製造・組立、物流・倉庫、医療・外科など)、エンドユーザー産業(自動車、電子機器・半導体、食品・飲料など)、および地域別にセグメント化されています。市場予測は金額(米ドル)で提供されます。

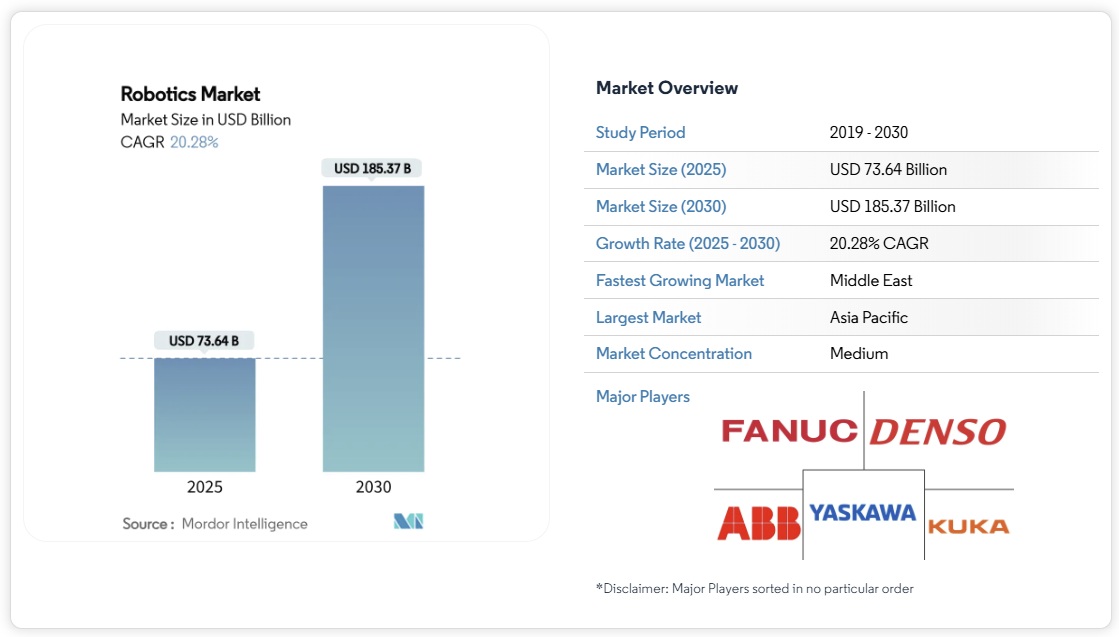

世界のロボット市場は2025年に736.4億米ドルに達し、2030年までに1,853.7億米ドルに拡大し、20.28%の健全な年平均成長率(CAGR)につながると予測されています。この成長軌道は、先進国における構造的な労働力不足、自動化ハードウェアの体系的なコストデフレ、およびロボットをオプションの資本財ではなく戦略的インフラとして扱う政府支援の国内回帰プログラムを反映しています。大企業は賃金圧力の中で生産を安定させるために導入を加速する一方で、中小企業は現在、協働システムやRobotic-as-a-Service(サービスとしてのロボット)契約を通じてアクセスを獲得しています。地域的な勢いは変化しており、アジア太平洋地域は数量面で主導的な地位を維持していますが、ソブリンファンドがテクノロジー主導の多角化を追求する中、中東が最も速いペースで成長しています。供給側では、部品コストの低下とローコードプログラミングプラットフォームにより、バリューチェーンがソフトウェアインテリジェンスへと再編され、人工知能ベースの制御を習得したベンダーに継続的な収益源が確立されます。サイバーセキュリティの弱点、輸出管理の摩擦、小規模ユーザー間のスキル格差は依然としてブレーキ力となっていますが、安全な導入とライフサイクルサポートを中心に、専門的なサービスニッチも開拓しています。

Robotics Market Analysis by Mordor Intelligence

The global robotics market reached USD 73.64 billion in 2025 and is forecast to expand to USD 185.37 billion by 2030, translating into a healthy 20.28% CAGR. This growth trajectory reflects structural labor shortages in advanced economies, systematic cost deflation in automation hardware, and government-backed reshoring programs that treat robots as strategic infrastructure rather than optional capital goods. Large enterprises accelerate adoption to stabilise production amid wage pressure, while small and medium firms now gain access through collaborative systems and Robot-as-a-Service contracts. Regional momentum is shifting: Asia-Pacific retains volume leadership, but the Middle East shows the quickest pace as sovereign funds pursue technology-driven diversification. On the supply side, declining component costs and low-code programming platforms reshape the value chain toward software intelligence, setting up recurring revenue streams for vendors that master artificial-intelligence-based control. Cyber-security weaknesses, export-control friction, and skill gaps among smaller users remain braking forces, yet they also open specialist service niches, especially around secure deployment and lifecycle support.

Robotics – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 – 2030)

Key Report Takeaways

- By robot type, industrial robots led with 71.4% revenue share in 2024; collaborative robots are projected to post a 26.71% CAGR to 2030.

- By component, hardware captured 63.8% of the global robotics market share in 2024, while software is expected to rise at a 23.62% CAGR through 2030.

- By application, logistics and warehousing accounted for 39.6% share of the global robotics market size in 2024; medical and surgical robots are advancing at a 21.93% CAGR to 2030.

- By end-user industry, automotive held 29.2% share in 2024, whereas healthcare providers are forecast to expand at a 22.05% CAGR up to 2030.

- By geography, Asia-Pacific commanded 38.1% of the global robotics market share in 2024, while the Middle East registers the fastest expansion at a 21.84% CAGR between 2025 and 2030.

Drivers Impact Analysis

| Driver | (~) % Impact on CAGR Forecast | Geographic Relevance | Impact Timeline |

|---|---|---|---|

| Rising labour-shortage led automation demand | +4.2% | Global, with acute impact in North America, Europe, Japan | Medium term (2-4 years) |

| Declining average robot price per functional hour | +3.8% | Global, particularly emerging markets in APAC and MEA | Short term (≤ 2 years) |

| Proliferation of low-code robot-programming platforms | +2.9% | Global, with early adoption in North America and Europe | Medium term (2-4 years) |

| Fiscal incentives for reshoring manufacturing in G-7 | +3.1% | North America, Europe, Japan | Long term (≥ 4 years) |

| Warehouse AMR roll-outs by e-commerce 3PLs | +3.7% | Global, concentrated in major e-commerce markets | Short term (≤ 2 years) |

| Nation-level humanoid R&D missions | +2.5% | China, Japan, South Korea, with spillover to global markets | Long term (≥ 4 years) |

Robotics Industry Overview

In the robotics market, global and regional players vie for dominance in a fiercely competitive arena. Competition hinges on factors like pricing, product offerings, and market share, as well as the vigor with which firms engage in the market. Leading companies wield significant influence through their R&D and consolidation efforts. However, the market is marked by high penetration and growing fragmentation.

Innovation is key to securing a lasting competitive edge in this landscape. Established players strategically focus on product differentiation and expand their market reach to maintain their positions. Acquisitions, partnerships with industry participants, and new product/service rollouts have been key competitive strategies exhibited by vendors in the market.

Some of the major players in the market are ABB Ltd, Yaskawa Electric Corporation, Denso Corporation, Fanuc Corporation, and KUKA AG, among others. Competition hinges on factors like pricing, product offerings, and market share, as well as the vigor with which firms engage in the market. Leading companies wield significant influence through their R&D and consolidation efforts.