| 出版社 | Mordor Intelligence |

| 出版年月 | 2025年9月 |

US Automotive Service – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 – 2030)

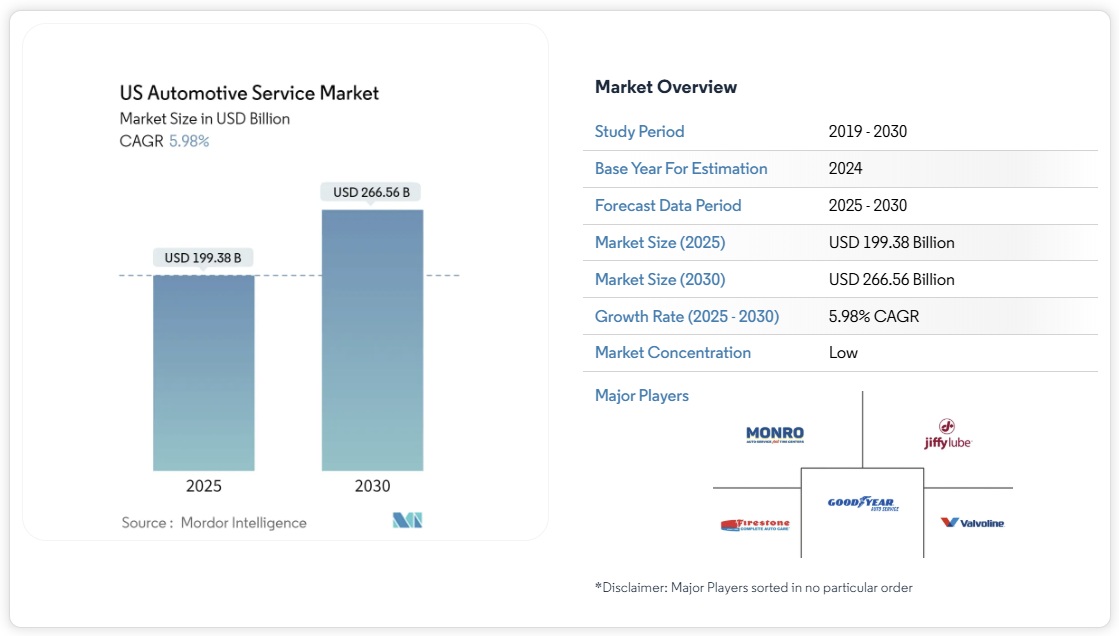

米国の自動車サービス市場規模は、2025年には1,993.8億米ドルに達すると推定され、予測期間(2025~2030年)中に5.98%のCAGRで成長し、2030年には2,665.6億米ドルに達すると予想されています。

2020年のロックダウン期間中、COVID-19パンデミックによる自動車関連企業の約95%が従業員の雇用を停止せざるを得ませんでした。しかし、米国は他の国々と比較して、ロックダウン期間はわずか数週間でした。米国は自動車需要が高く、自動車産業は活発な状況にあります。自動車および部品小売業はCOVID-19パンデミックから急速に回復し、1.5兆米ドルを超える売上高を上げています。一方、世界的な自動車用半導体不足は業界にとって課題となっており、2020年4月以降、月次在庫売上高比率は低下傾向にあります。

長期的には、自動車サービス企業は顧客基盤の拡大を目指し、車両検査に人工知能(AI)ベースの自動車両検査技術を導入するケースが増えています。例えば、2022年2月には、米国のテクノロジー企業Scope TechnologyがMicrosoftのAzureクラウドコンピューティングと提携し、AIを活用した自動車両検査技術を開発しました。この目視検査は5分未満で完了し、コストを50%削減します。

The US Automotive Service Market size is estimated at USD 199.38 billion in 2025, and is expected to reach USD 266.56 billion by 2030, at a CAGR of 5.98% during the forecast period (2025-2030).

The COVID-19 pandemic compelled about 95% of all automotive-related companies to put their workforces on hold during the lockdowns in the year 2020. However, the United States witnessed a lockdown for only a few weeks compared to other countries worldwide. The country’s high motor vehicle demand fuels an active automotive industry. The road vehicle and parts retail trade has quickly recovered from the COVID-19 pandemic, generating over USD 1.5 trillion in revenue. The global automotive chip shortage, on the other hand, poses a challenge to the industry, and the monthly inventory-to-sales ratio has been falling since April 2020.

US Automotive Service – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 – 2030)

Over the long term, automotive service companies are increasingly using artificial intelligence-based automated vehicle inspection technology for vehicle inspection to widen their customer base. For instance, In February 2022, Scope Technology, a US-based tech firm, collaborated with Microsoft’s Azure cloud computation to develop AI-automated vehicle inspection technology. This visual inspection takes less than 5 minutes and saves 50% on costs.

The increasing age of vehicles will benefit industry growth because older vehicles require more frequent maintenance and replacement parts. Furthermore, increasing demand for shared mobility is one of the key factors increasing yearly maintenance spending on cabs or shared vehicles owing to a higher yearly distance driven.

The increasing penetration of electric vehicles will have a significant impact on market growth. The rapid adoption of electric vehicles can be attributed to government initiatives and support for improving environmental quality to reduce reliance on crude oil. Overall, battery electric vehicle repair and maintenance costs are expected to be around 40% lower than ICE vehicle costs.

The establishments typically include a variety of service bays to provide repair and maintenance services for a wide range of vehicles, including hatchbacks, sedans, MPVs, and SUVs, as well as two-wheelers. Lowering overhead costs contributes significantly to lowering overall service charges. Effective communication and independent mechanics improve customer relationships and foster customer goodwill. The ability to serve multiple vehicle brands and the easier availability of spare parts are driving market demand even higher.

The Bureau of Automotive Repair (BAR), a division of the Department of Consumer Affairs (DCA), protects Californians by effectively supervising the automotive repair industry and administering vehicle emissions reduction and safety programs.

US Automotive Service Industry Overview

The United States automotive service market is fragmented with market players, such as Firestone Complete Auto Care, Jiffy Lube International, Inc., Meineke Car Care Centers, LLC., Midas International, LLC, MONRO, INC., and Safelite Group, who hold the most significant shares. Companies are making joint ventures, and partnerships, and launching new products with advanced technology to have the edge over their competitors. For instance,

- In April 2022, Tesla, Inc. proposed constructing a 100,000-square-foot facility in St. Pete, Florida. The new Tesla center will handle sales, service, and deliveries in the area. The new Tesla facility will be built on a 4.21-acre plot that houses a 100,000-square-foot Kanes Furniture liquidation center.

- In July 2022, FullSpeed Automotive®, one of the nation’s largest franchisors and operators of automotive aftermarket repair facilities and the parent company of flagship brands Grease Monkey® and SpeeDee Oil Change & Auto Service®, is accelerating growth with an acquisition strategy aimed at achieving its 1,000-unit expansion goal by the end of 2023.

- In Mar 2021- Monro, Inc. signed a definitive agreement to acquire mountain view tire & Service, Inc. Acquisition of 30 California-based stores, adding USD 45 million in expected annualized sales, expanding its presence in an attractive western region with a total of 116 stores.

- In January 2021, Jiffy Lube International, Inc. continued its focus on expanding its footprint by establishing more than 2,081 franchisee-owned service centers across North America. 45 new Jiffy Lube International, Inc. service centers were opened in the United States.