Automotive Digital Cockpit Market - Global Forecast to 2032

自動車用デジタルコックピット市場 - 装備(フロント、パッセンジャー、リアインフォテインメント、HUD、デジタルインストルメントクラスター、デジタルセンターコンソール、ドライバーモニタリングシステム)、アプリケーション、車両タイプ、EVタイプ、ディスプレイタイプ、ディスプレイサイズ - 2032年までの世界予測

Automotive Digital Cockpit Market by Equipment (Front, Passenger and Rear Infotainment, HUD, Digital Instrument Cluster, Digital Center Console, Driver Monitoring System), Application, Vehicle Type, EV Type, Display Type, Display Size - Global Forecast to 2032

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年01月 |

| ページ数 | 377 |

| 図表数 | 470 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

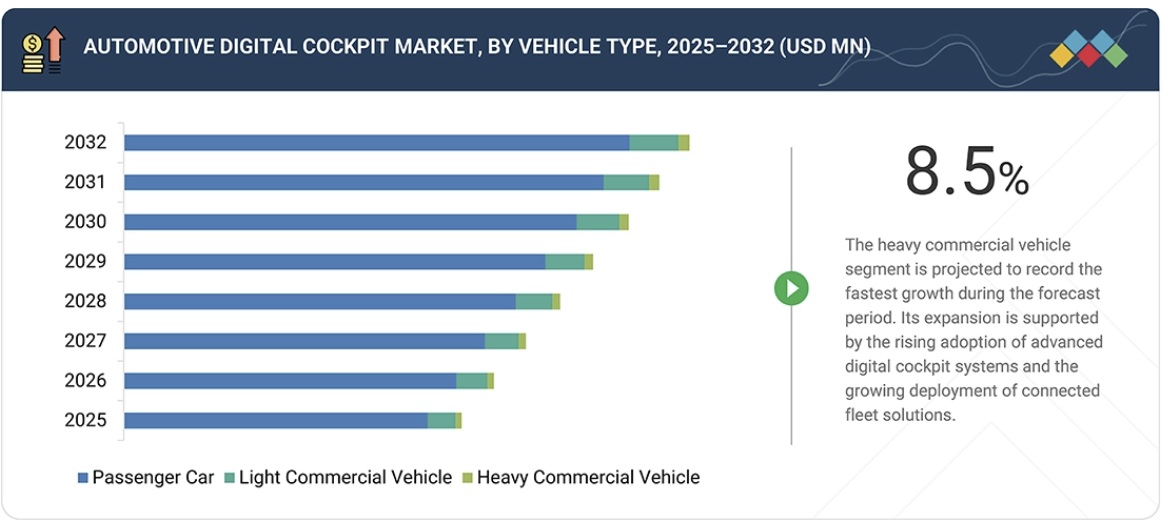

| 商品番号 | SMR-11928 |

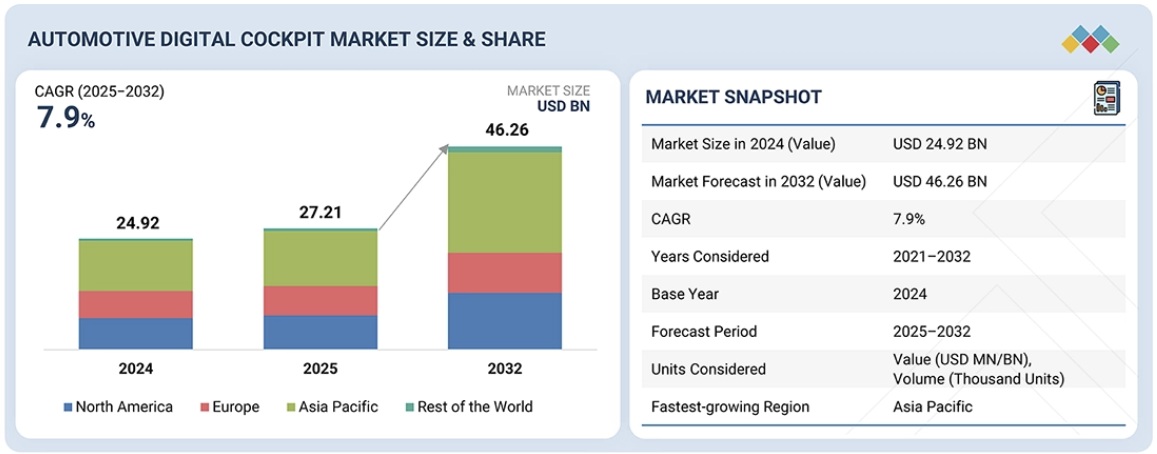

自動車用デジタルコックピット市場は、2025年の272億1,000万米ドルから2032年には462億6,000万米ドルに、年平均成長率7.9%で成長すると予測されています。

自動車メーカーが主要地域においてコネクテッドカーやソフトウェア駆動型車両プラットフォームへの移行を加速させていることから、市場は成長を続けています。大型ディスプレイ、統合型インフォテインメントシステム、デジタルクラスター、インテリジェントドライバーモニタリングといった消費者の採用拡大は、量販車と高級車の両方でコックピットのアップグレードを促進しています。グラフィックス処理、集中型コンピューティング、クラウド連携サービスの進化により、より充実したインターフェースと継続的な機能強化が実現しています。電気自動車の生産台数の増加は、エネルギーに関する洞察やリアルタイム制御機能を提供するコックピットシステムの需要をさらに高めています。デジタルコックピットのイノベーション、音声インタラクション、マルチスクリーンレイアウトへの積極的な投資は、車内体験を向上させています。ドライバーの注意力と安全性に関する規制の強化も、新型車の発売における先進コックピット技術の統合を後押ししています。

調査対象範囲:

本レポートは、自動車用デジタルコックピット市場をセグメント化し、市場規模を機器別(インフォテインメントユニット、リアインフォテインメントユニット、パッセンジャーインフォテインメントユニット、ヘッドアップディスプレイ(HUD)、デジタルインストルメントクラスター、デジタルセンターコンソール、ドライバーモニタリングシステム)、電気自動車の種類別(バッテリー電気自動車およびプラグインハイブリッド電気自動車)、車両の種類別(乗用車、小型商用車、大型商用車)、ディスプレイの種類別(LCD、OLED、TFT LCD)、ディスプレイサイズ別(5インチ未満、5~10インチ、10インチ超)、アプリケーション別(インフォテインメント、ドライバーモニタリング&アシスタンス、車両および快適性制御システム)に予測しています。また、市場促進要因、制約要因、機会、課題についても考察しています。本レポートは、4つの主要地域(北米、欧州、アジア太平洋地域、その他地域)における詳細な市場分析を提供しています。さらに、自動車用デジタルコックピットエコシステムで事業を展開する主要企業のサプライチェーンと競合状況についても分析しています。

本レポートの主なメリット:

主要な推進要因(プレミアムな車内体験に対する消費者の需要の高まり、ソフトウェア定義車両への移行の加速)、制約要因(先進コックピット・エレクトロニクスの高コスト)、機会(マルチモーダルHMI、AR可視化、車内センシングシステムの成長、高速道路運転支援技術の導入増加)、課題(サイバーセキュリティ、データガバナンス、OTA連携の圧力の高まり、分散型コックピットおよび車両コンピューティングユニット全体にわたるOTAの複雑性管理)の分析

- サービス開発/イノベーション:自動車用デジタルコックピット市場における今後の技術、研究開発活動、製品投入に関する詳細な洞察

- 市場開発:さまざまな地域の自動車用デジタルコックピット市場を分析することにより、収益性の高い市場に関する包括的な情報を提供します

- 市場多様化:自動車用デジタルコックピット市場における新製品・サービス、未開拓地域、最近の開発状況、投資に関する包括的な情報

- 競合評価:Continental AG、Robert Bosch GmbH、Denso Corporation、Visteon Corporation、HARMAN Internationalなどの主要企業の市場シェア、成長戦略、サービス提供に関する詳細な評価

Report Description

The automotive digital cockpit market is projected to grow from USD 27.21 billion in 2025 to USD 46.26 billion in 2032 at a CAGR of 7.9%.

The market is growing as automakers accelerate the shift to connected, software-driven vehicle platforms across all major regions. The rising consumer adoption of large displays, integrated infotainment systems, digital clusters, and intelligent driver monitoring is driving cockpit upgrades in both mass-market and premium vehicles. Advancements in graphics processing, centralized computing, and cloud-linked services are enabling richer interfaces and continuous feature enhancements. Growing electric vehicle production is further increasing demand for cockpit systems that provide energy insights and real-time control functions. Strong investments in digital cockpit innovation, voice interaction, and multiscreen layouts are improving in-cabin experiences. Expanding regulatory focus on driver attention and safety is also supporting the integration of advanced cockpit technologies across new model launches.

Automotive Digital Cockpit Market – Global Forecast to 2032

“The 5-10″ display segment accounted for the largest share of the automotive digital cockpit market in 2024.”

The 5-10″ display segment accounted for the largest share of the automotive digital cockpit market in 2024, driven by its extensive deployment across compact, mid-range, and selected premium vehicles. This segment offers the right mix of clarity, cost efficiency, and dashboard adaptability, making it central to digital instrument clusters, infotainment displays, and auxiliary control screens. Automakers favor 5-10″ displays because these displays support essential vehicle functions such as navigation, media, alerts, and system diagnostics while maintaining strong affordability and production scalability. Enhancements in touch responsiveness, brightness control, and high-resolution visuals have improved user experience without raising system expense. As cockpit designs shift toward software-defined architectures, 5-10″ displays remain highly compatible with modern compute platforms and connected services.

“The BEV segment is projected to register the fastest growth during the forecast period.”

The battery electric vehicle (BEV) segment is expected to register the fastest growth in the automotive digital cockpit market during the forecast period. Increasing EV output and the transition to digital-first automotive platforms are driving the need for advanced cockpit solutions that complement electric powertrains. EV users seek feature-rich cabin interfaces that provide charging insights, energy management data, route optimization, and performance updates. This trend is increasing the use of high-resolution screens, smart clusters, and cloud-enabled infotainment systems. Automakers are standardizing domain controller-based architectures to unify cockpit functions with core power management operations. Policy incentives and rapid expansion of charging networks are accelerating the shift toward more sophisticated cockpit setups. EV platforms, with fewer mechanical limitations, also support easier integration of multiscreen and immersive interfaces. With global EV penetration rising steadily, technology providers with strong display and HMI portfolios are positioned to capture substantial growth across EV development pipelines.

“The infotainment segment is projected to hold the largest share of the automotive digital cockpit market in 2032.”

The infotainment segment is expected to hold the largest share of the automotive digital cockpit market in 2032 as demand grows for connected services and personalized media experiences. Automakers are prioritizing platforms that integrate navigation, media, calls, and messaging, smartphone features, and vehicle settings within a single interface. Advancements in graphics processing and software-defined cockpit architectures enable continuous feature upgrades through over-the-air updates. Advancements in processing capability, graphic rendering, and cloud integration are enabling advanced functions such as natural voice interaction, predictive suggestions, and uninterrupted media access. OEMs are also expanding subscription-based offerings that make infotainment a high-value revenue channel. With rising expectations for digital convenience and immersive interaction, infotainment systems are set to remain the dominant application segment by 2032.

Automotive Digital Cockpit Market – Global Forecast to 2032 – region

“The Asia Pacific is projected to hold the largest share of the automotive digital cockpit market in 2032.”

The Asia Pacific accounted for the largest share of the automotive digital cockpit market in 2032. Strong vehicle production in China, India, Japan, and South Korea, combined with rapid EV adoption, is driving substantial demand for advanced cockpit systems. Automakers in the region are integrating digital clusters, infotainment units, passenger displays, and driver monitoring systems to meet rising customer expectations for connected and intelligent in-cabin experiences. Government support for electrification, connectivity standards, and safety compliance is further accelerating technology uptake. With continuous investments in software-defined vehicle platforms and cockpit electronics, the Asia Pacific region remains a crucial market for digital cockpit solutions.

Extensive primary interviews have been conducted with key industry experts in the automotive digital cockpit market to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study draws insights from a range of industry experts, including component suppliers, Tier 1 companies, and OEMs. The break-up of the primaries is as follows:

- By Company Type –OEM – 45%, Tier 1 – 35%, and Others – 20%

- By Designation –Directors– 35%, C- C-level Executives – 35%, and Others – 30%

- By Region – Asia Pacific – 32%, Europe – 28%, North America – 36%, and RoW – 4%

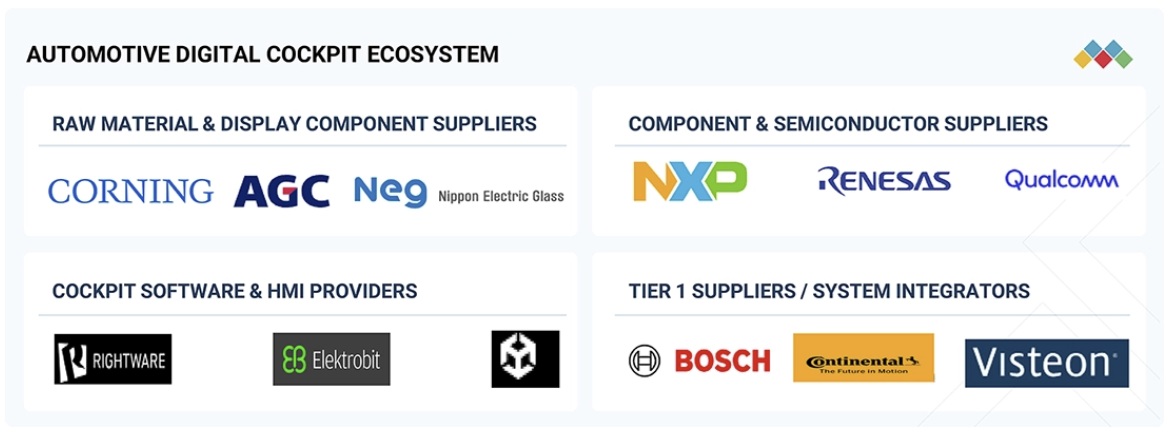

Automotive Digital Cockpit Market – Global Forecast to 2032 – ecosystem

The automotive digital cockpit market is dominated by a few globally established players, such as Continental AG, Robert Bosch GmbH, Denso Corporation, Visteon Corporation, and HARMAN International. The study includes an in-depth competitive analysis of these key players in the automotive digital cockpit market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the automotive digital cockpit market. It forecasts its size by equipment (infotainment unit, rear infotainment unit, passenger infotainment unit, HUD, digital instrument cluster, digital center console, driver monitoring system), by electric vehicle type (battery electric vehicle and plug in hybrid electric vehicle), by vehicle type (passenger car, light commercial vehicle, heavy commercial vehicle), by display type (LCD, OLED, TFT LCD), by display size (<5″, 5 to 10″, >10″), and by application (infotainment, driver monitoring & assistance, vehicle and comfort control system). It also discusses market drivers, restraints, opportunities, and challenges. The report provides detailed market analysis across four key regions (North America, Europe, the Asia Pacific, and the Rest of the World). The report includes a review of the supply chain and the competitive landscape of key players operating in the automotive digital cockpit ecosystem.

Key Benefits of Buying the Report:

Analysis of key drivers (growing consumer demand for premium in-cabin experiences, rising shift toward software-defined vehicles), restraints (high cost of advanced cockpit electronics), opportunities (growth in multimodal HMI, AR visualization, and interior sensing systems, increasing adoption of highway driving assist technology), challenges (increasing cybersecurity, data governance, and OTA coordination pressures, managing OTA complexity across distributed cockpit and vehicle compute units)

- Service Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and product launches in the automotive digital cockpit market

- Market Development: Comprehensive information about lucrative markets by analyzing the automotive digital cockpit market across varied regions

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the automotive digital cockpit market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Continental AG, Robert Bosch GmbH, Denso Corporation, Visteon Corporation, and HARMAN International

Table of Contents

1 INTRODUCTION 33

1.1 STUDY OBJECTIVES 33

1.2 MARKET DEFINITION 34

1.3 STUDY SCOPE 37

1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE 37

1.3.2 INCLUSIONS & EXCLUSIONS 37

1.4 YEARS CONSIDERED 39

1.5 CURRENCY CONSIDERED 39

1.6 STAKEHOLDERS 40

2 EXECUTIVE SUMMARY 41

2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS 41

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 42

2.3 DISRUPTIVE TRENDS IN AUTOMOTIVE DIGITAL COCKPIT MARKET 43

2.4 HIGH-GROWTH SEGMENTS IN AUTOMOTIVE DIGITAL COCKPIT MARKET 43

2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST 44

3 PREMIUM INSIGHTS 46

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE DIGITAL COCKPIT MARKET 46

3.2 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT 46

3.3 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE 47

3.4 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION 47

3.5 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE 48

3.6 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EV TYPE 48

3.7 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY TYPE 49

3.8 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION 49

4 MARKET OVERVIEW 50

4.1 INTRODUCTION 50

4.2 MARKET DYNAMICS 51

4.2.1 DRIVERS 51

4.2.1.1 Rising shift toward software-defined vehicles 51

4.2.1.2 Growing consumer demand for premium in-cabin experiences 53

4.2.1.3 Regulatory mandates driving expansion of cockpit safety technologies 54

4.2.1.4 Expansion of electric vehicles increasing demand for digital-centric cabin interfaces 55

4.2.2 RESTRAINTS 58

4.2.2.1 High cost of advanced cockpit electronics 58

4.2.2.2 Semiconductor and display supply vulnerabilities affecting cockpit system production 59

4.2.3 OPPORTUNITIES 60

4.2.3.1 Increasing investment in AR and HUD technologies 60

4.2.3.2 Increasing adoption of highway driving assist technology 60

4.2.3.3 Growth in multimodal HMI, advanced visualization, and interior sensing systems 62

4.2.4 CHALLENGES 62

4.2.4.1 Increasing cybersecurity, data governance, and OTA coordination pressures in connected cockpits 62

4.2.4.2 Managing OTA complexity across distributed cockpit and vehicle computing units 64

4.3 UNMET NEEDS AND WHITE SPACES 65

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 66

4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS 67

5 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS 68

5.1 TECHNOLOGY ANALYSIS 68

5.1.1 KEY TECHNOLOGIES 68

5.1.1.1 Advanced Display Technologies (LCD, OLED, Mini LED) 68

5.1.1.2 Cockpit Domain Controllers and High-performance SoCs 69

5.1.1.3 Natural Language Processing and Voice Assistants 69

5.1.2 COMPLEMENTARY TECHNOLOGIES 69

5.1.2.1 Interior Cameras and Driver Monitoring Systems 69

5.1.2.2 Gesture Control, Haptic Interaction, and Ambient Interfaces 70

5.1.3 ADJACENT TECHNOLOGIES 70

5.1.3.1 Central Vehicle Compute and Zonal Architectures 70

5.1.3.2 Connectivity, Telematics, and V2X Integration 70

5.2 TECHNOLOGY ROADMAP 71

5.3 PATENT ANALYSIS 73

5.4 FUTURE APPLICATIONS 76

5.5 IMPACT OF AI/GENERATIVE AI ON AUTOMOTIVE DIGITAL COCKPIT MARKET 77

5.5.1 TOP USE CASES AND MARKET POTENTIAL 78

5.5.2 BEST PRACTICES 78

5.5.3 CASE STUDIES 79

5.5.4 ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 79

5.5.5 CLIENTS’ READINESS TO ADOPT AI/GENERATIVE AI 80

5.6 SUCCESS STORIES AND REAL-WORLD APPLICATIONS 80

5.6.1 TOYOTA MOTOR CORPORATION: DIGITAL COCKPIT INTEGRATION THROUGH TOYOTA SAFETY CONNECT 80

5.6.2 HYUNDAI MOTOR COMPANY: PANORAMIC DISPLAY AND DOMAIN-BASED COCKPIT ARCHITECTURE 80

5.6.3 GENERAL MOTORS: GOOGLE BUILT-IN SERVICES FOR CONNECTED COCKPIT EXPERIENCES 80

6 SUSTAINABILITY AND REGULATORY LANDSCAPE 81

6.1 REGIONAL REGULATIONS AND COMPLIANCE 81

6.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 81

6.1.2 REGULATORY LANDSCAPE FOR AUTOMOTIVE DIGITAL COCKPIT SYSTEMS 83

6.1.3 INDUSTRY STANDARDS 85

6.2 SUSTAINABILITY INITIATIVES 87

6.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES 88

6.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 89

7 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 91

7.1 DECISION-MAKING PROCESS 91

7.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA 91

7.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 91

7.2.2 BUYING CRITERIA 92

7.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 94

7.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES 94

7.5 MARKET PROFITABILITY 95

7.5.1 REVENUE POTENTIAL 95

7.5.2 COST DYNAMICS 95

8 INDUSTRY TRENDS 96

8.1 MACROECONOMIC INDICATORS 96

8.1.1 INTRODUCTION 96

8.1.2 GDP TRENDS AND FORECAST 96

8.1.3 TRENDS IN GLOBAL AUTOMOTIVE INFOTAINMENT INDUSTRY 98

8.1.4 TRENDS IN GLOBAL AUTOMOTIVE AND TRANSPORTATION INDUSTRY 99

8.2 ECOSYSTEM ANALYSIS 99

8.2.1 RAW MATERIAL & DISPLAY COMPONENT SUPPLIERS 100

8.2.2 COMPONENT & SEMICONDUCTOR SUPPLIERS 100

8.2.3 COCKPIT SOFTWARE & HMI PROVIDERS 100

8.2.4 TIER 1 SUPPLIERS/SYSTEM INTEGRATORS 101

8.2.5 OEMS (AUTOMAKERS) 101

8.3 SUPPLY CHAIN ANALYSIS 102

8.4 PRICING ANALYSIS 103

8.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT, 2024 103

8.4.2 AVERAGE SELLING PRICE TREND, BY EQUIPMENT, 2022–2024 104

8.4.3 AVERAGE SELLING PRICE TREND, BY REGION, 2022–2024 105

8.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS 105

8.6 INVESTMENT AND FUNDING SCENARIO 106

8.7 FUNDING, BY USE CASE 107

8.8 KEY CONFERENCES AND EVENTS, 2026-2027 108

8.9 TRADE ANALYSIS 108

8.9.1 IMPORT SCENARIO (HS CODE 8537) 109

8.9.2 EXPORT SCENARIO (HS CODE 8537) 110

8.10 CASE STUDY ANALYSIS 111

8.10.1 CONTINENTAL DELIVERED HIGH-PERFORMANCE COCKPIT COMPUTING FOR VOLKSWAGEN 111

8.10.2 VISTEON SUPPLIED SMARTCORE DOMAIN CONTROLLER FOR BMW MINI 111

8.10.3 HARMAN INTERNATIONAL’S READY CARE AI-BASED COGNITIVE DISTRACTION MONITORING FOR BMW 112

8.10.4 LG’S PANORAMIC AUTOMOTIVE DISPLAY FOR MERCEDES-BENZ 112

8.10.5 VALEO DEVELOPED SMARTCOCKPIT DIGITAL SOLUTIONS IN COLLABORATION WITH GOOGLE AND RENAULT 112

8.10.6 MAGNA’S GEN5 FRONT CAMERA MODULE FOR EUROPEAN OEM 113

8.10.7 APTIV’S SOFTWARE-DEFINED VEHICLE COCKPIT PLATFORM FOR GLOBAL OEM 113

8.10.8 DENSO’S ADVANCED DRIVE COMPONENTS FOR LEXUS LS AND TOYOTA MIRAI 113

8.11 IMPACT OF 2025 US TARIFFS 114

8.11.1 INTRODUCTION 114

8.11.2 KEY TARIFF RATES 114

8.11.3 PRICE IMPACT ANALYSIS 115

8.11.4 IMPACT ON COUNTRIES/REGIONS 116

8.11.5 IMPACT ON AUTOMOTIVE INDUSTRY 116

8.12 STRATEGIC SHIFTS IN OEM AND SUPPLIER PROGRAMS 117

8.13 OEM ANALYSIS 118

8.13.1 XPENG 119

8.13.1.1 Digital cockpit strategy overview 119

8.13.1.2 Key digital cockpit technologies and components used 119

8.13.1.3 Key programs and model adoption 119

8.13.2 NIO 120

8.13.2.1 Digital cockpit strategy overview 120

8.13.2.2 Key programs and model adoption 120

8.13.3 LEAPMOTOR 121

8.13.3.1 Digital cockpit strategy overview 121

8.13.3.2 Key programs and component architecture 121

8.13.3.3 Featured models and adoption pathway 122

8.13.4 GEELY ZEEKR 122

8.13.4.1 Digital cockpit strategy overview 122

8.13.4.2 Key programs and model adoption 123

8.13.5 TATA MOTORS 123

8.13.5.1 Digital cockpit strategy overview 123

8.13.5.2 Digital cockpit components used 123

8.13.5.3 Key programs and model adoption 124

8.13.6 VOLKSWAGEN AUDI 124

8.13.6.1 Digital cockpit strategy overview 124

8.13.6.2 Key programs and model adoption 125

8.13.7 BMW 125

8.13.7.1 Digital cockpit strategy overview 125

8.13.7.2 Key programs and model adoption 125

8.13.8 STELLANTIS 126

8.13.8.1 Digital cockpit strategy overview 126

8.13.8.2 Key programs and model adoption 126

8.13.9 MERCEDES BENZ 127

8.13.9.1 Digital cockpit strategy overview 127

8.13.9.2 Key programs and model adoption 128

8.13.10 FORD MOTOR COMPANY 128

8.13.10.1 Digital cockpit strategy overview 128

8.13.10.2 Cockpit architecture and technology focus 129

8.13.10.3 Key programs and model adoption 129

8.13.11 GENERAL MOTORS 130

8.13.11.1 Digital cockpit strategy overview 130

8.13.11.2 Key programs and model adoption 130

9 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT 131

9.1 INTRODUCTION 132

9.1.1 OPERATIONAL DATA 135

9.2 DIGITAL INSTRUMENT CLUSTER 136

9.2.1 SHIFT FROM ANALOG CLUSTERS TO FULLY DIGITAL AND RECONFIGURABLE DISPLAYS TO DRIVE DEMAND 136

9.3 DIGITAL CENTRAL CONSOLE 138

9.3.1 GROWING ADOPTION OF LARGE-FORMAT CENTRAL CONSOLES FOR NAVIGATION, MEDIA, AND CONNECTED SERVICES TO DRIVE DEMAND 138

9.4 INFOTAINMENT UNIT 141

9.4.1 INCREASING INTEGRATION OF CONNECTED INFOTAINMENT PLATFORMS AND EMBEDDED SOFTWARE ECOSYSTEMS TO DRIVE DEMAND 141

9.5 REAR INFOTAINMENT UNIT 143

9.5.1 EXPANDING USE OF REAR INFOTAINMENT SYSTEMS TO ENHANCE ENTERTAINMENT AND CABIN PERSONALIZATION 143

9.6 PASSENGER INFOTAINMENT UNIT 146

9.6.1 INCREASED INSTALLATION OF PASSENGER INFOTAINMENT UNITS FOR CO-NAVIGATION AND ENTERTAINMENT 146

9.7 HEAD-UP DISPLAY (HUD) 148

9.7.1 GROWING USE OF HUDS TO SUPPORT SAFETY VISUALIZATION AND DRIVER AWARENESS 148

9.8 DRIVER MONITORING SYSTEM 151

9.8.1 INCREASED DEPLOYMENT OF CAMERA-BASED DRIVER MONITORING TO SUPPORT SAFETY REGULATION AND ADAS ALIGNMENT 151

9.9 KEY INDUSTRY INSIGHTS 153

10 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE 154

10.1 INTRODUCTION 155

10.2 PASSENGER CAR (PC) 157

10.2.1 PASSENGER VEHICLE DIGITALIZATION DRIVING ADOPTION OF ADVANCED DISPLAYS AND UNIFIED COCKPIT COMPUTE PLATFORMS 157

10.3 LIGHT COMMERCIAL VEHICLE (LCV) 159

10.3.1 EXPANDING FLEET CONNECTIVITY TO DRIVE DEMAND FOR FUNCTIONAL TELEMATICS-DRIVEN COCKPIT PLATFORMS 159

10.4 HEAVY COMMERCIAL VEHICLE (HCV) 162

10.4.1 HIGHER OPERATIONAL COMPLEXITY ACCELERATING DEPLOYMENT OF DURABLE DIAGNOSTICS-FOCUSED COCKPIT SYSTEMS 162

10.5 KEY INDUSTRY INSIGHTS 164

11 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY ELECTRIC VEHICLE TYPE 165

11.1 INTRODUCTION 166

11.2 BATTERY ELECTRIC VEHICLE (BEV) 168

11.2.1 GROWING BEV PENETRATION DRIVING RAPID ADOPTION OF MULTI-DISPLAY AND SOFTWARE-CENTRIC COCKPIT ARCHITECTURES 168

11.3 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV) 170

11.3.1 RISING PHEV ADOPTION INCREASING DEMAND FOR HYBRID MODE VISUALIZATION AND INTEGRATED DUAL POWERTRAIN INTERFACES 170

11.4 KEY INDUSTRY INSIGHTS 173

12 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION 174

12.1 INTRODUCTION 175

12.2 INFOTAINMENT 177

12.2.1 EXPANDING USE OF CONNECTED MEDIA, NAVIGATION, AND CLOUD SERVICES TO DRIVE GROWTH 177

12.3 DRIVER MONITORING & ASSISTANCE 179

12.3.1 INCREASING SOFTWARE INTEGRATION BETWEEN CLUSTER DISPLAYS, HEAD-UP DISPLAYS, AND DRIVER MONITORING SYSTEMS TO DRIVE DEMAND 179

12.4 VEHICLE & COMFORT CONTROL SYSTEM 181

12.4.1 INCREASING SHIFT TOWARD CENTRALIZED DIGITAL CONTROL OF VEHICLE FUNCTIONS TO ENHANCE USER EXPERIENCE 181

12.5 KEY INDUSTRY INSIGHTS 183

13 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE 184

13.1 INTRODUCTION 185

13.2 <5″ 187

13.2.1 GROWING ROLE OF SMALL FORMAT DISPLAYS IN COST-OPTIMIZED VEHICLES TO SUPPORT DEMAND 187

13.3 5–10″ 189

13.3.1 STRONG GROWTH IN COMPACT SUVS AND CROSSOVER MODELS TO SUPPORT DEMAND 189

13.4 >10″ 191

13.4.1 RAPID ELECTRIFICATION AND PREMIUM VEHICLE LAUNCHES TO DRIVE DEMAND 191

13.5 KEY INDUSTRY INSIGHTS 193

14 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY TYPE 194

14.1 INTRODUCTION 195

14.2 LIQUID CRYSTAL DISPLAY (LCD) 197

14.2.1 LCD MAINTAINING BROAD MARKET COVERAGE THROUGH COST EFFICIENCY, RELIABILITY, AND SCALABLE ADOPTION ACROSS GLOBAL VEHICLE SEGMENTS 197

14.3 ORGANIC LIGHT EMITTING DIODE (OLED) 199

14.3.1 OLED ADVANCING PREMIUM COCKPIT EXPERIENCES WITH HIGH CONTRAST OUTPUT, FLEXIBLE FORM FACTORS, AND IMMERSIVE VISUAL PERFORMANCE 199

14.4 THIN FILM TRANSISTOR–LIQUID CRYSTAL DISPLAY (TFT-LCD) 202

14.4.1 TFT LCD STRENGTHENING MID-PREMIUM COCKPIT DEPLOYMENTS THROUGH HIGHER BRIGHTNESS, IMPROVED VIEWING ANGLES, AND STABLE OPERATIONAL RESILIENCE 202

14.5 KEY INDUSTRY INSIGHTS 204

15 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION 205

15.1 INTRODUCTION 206

15.2 ASIA PACIFIC 207

15.2.1 CHINA 210

15.2.1.1 Strengthening domestic digital cockpit ecosystem through technology capability and local supply support to drive market 210

15.2.2 INDIA 213

15.2.2.1 Scaling digital cockpit adoption through connectivity and cost-efficient local engineering to drive market 213

15.2.3 JAPAN 215

15.2.3.1 Advancing digital cockpit systems through engineering quality and connected service expansion to drive market 215

15.2.4 SOUTH KOREA 217

15.2.4.1 Growing software-defined vehicle programs and premium display integration to drive demand 217

15.2.5 THAILAND 220

15.2.5.1 Expanding EV production and local electronics investment to drive market 220

15.2.6 REST OF ASIA PACIFIC 222

15.3 NORTH AMERICA 224

15.3.1 US 226

15.3.1.1 Expansion of connected services and multi-display EV platforms to drive demand 226

15.3.2 CANADA 228

15.3.2.1 Growth in safety regulation compliance and expanding fleet digitalization to drive demand 228

15.3.3 MEXICO 231

15.3.3.1 Strong assembly and export orientation to drive demand 231

15.4 EUROPE 234

15.4.1 GERMANY 236

15.4.1.1 Premium-vehicle programs and software-centric cockpit architectures to drive market 236

15.4.2 FRANCE 238

15.4.2.1 Scaled rollout of modular digital cockpits across mass-market vehicles to drive demand 238

15.4.3 ITALY 241

15.4.3.1 Design-driven cockpit refresh cycles and feature standardization to drive growth 241

15.4.4 SPAIN 243

15.4.4.1 Export-focused compact vehicle manufacturing and compliance-driven feature upgrades to drive demand 243

15.4.5 UK 246

15.4.5.1 Luxury interior differentiation and brand-specific cockpit design to drive market 246

15.4.6 RUSSIA 248

15.4.6.1 Production stabilization and localized platform simplification to sustain cockpit integration 248

15.4.7 REST OF EUROPE 251

15.5 REST OF THE WORLD (ROW) 253

15.5.1 BRAZIL 255

15.5.1.1 High smartphone penetration and standardized infotainment adoption to drive demand 255

15.5.2 IRAN 258

15.5.2.1 Platform continuity and cost-controlled digital upgrades to sustain demand 258

15.5.3 OTHERS 260

16 COMPETITIVE LANDSCAPE 263

16.1 INTRODUCTION 263

16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2025 263

16.3 MARKET SHARE ANALYSIS, 2024 265

16.4 REVENUE ANALYSIS, 2020–2024 267

16.5 COMPANY VALUATION AND FINANCIAL METRICS 268

16.6 BRAND/PRODUCT COMPARISON 269

16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 270

16.7.1 STARS 270

16.7.2 EMERGING LEADERS 270

16.7.3 PERVASIVE PLAYERS 270

16.7.4 PARTICIPANTS 270

16.7.5 COMPANY FOOTPRINT, 2024 272

16.7.5.1 Company footprint, 2024 272

16.7.5.2 Region footprint, 2024 272

16.7.5.3 Equipment footprint, 2024 273

16.7.5.4 Vehicle type footprint, 2024 274

16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 274

16.8.1 PROGRESSIVE COMPANIES 274

16.8.2 RESPONSIVE COMPANIES 275

16.8.3 DYNAMIC COMPANIES 275

16.8.4 STARTING BLOCKS 275

16.8.5 COMPETITIVE BENCHMARKING 276

16.8.5.1 List of startups 276

16.8.5.2 Competitive benchmarking of startups/SMEs 276

16.9 COMPETITIVE SCENARIO 277

16.9.1 PRODUCT LAUNCHES 277

16.9.2 DEALS 278

16.9.3 EXPANSIONS 279

16.9.4 OTHER DEVELOPMENTS 280

17 COMPANY PROFILES 281

17.1 KEY PLAYERS 281

17.1.1 CONTINENTAL AG 281

17.1.1.1 Business overview 281

17.1.1.2 Products/Solutions offered 282

17.1.1.3 Recent developments 283

17.1.1.3.1 Product launches/developments 283

17.1.1.3.2 Expansions 284

17.1.1.3.3 Other developments 284

17.1.1.4 MnM view 284

17.1.1.4.1 Right to win 284

17.1.1.4.2 Strategic choices 284

17.1.1.4.3 Weaknesses and competitive threats 285

17.1.2 ROBERT BOSCH GMBH 286

17.1.2.1 Business overview 286

17.1.2.2 Products/Solutions offered 287

17.1.2.3 Recent developments 288

17.1.2.3.1 Product launches/developments 288

17.1.2.3.2 Deals 289

17.1.2.4 MnM view 290

17.1.2.4.1 Right to win 290

17.1.2.4.2 Strategic choices 290

17.1.2.4.3 Weaknesses and competitive threats 290

17.1.3 HARMAN INTERNATIONAL 291

17.1.3.1 Business overview 291

17.1.3.2 Products/Solutions offered 292

17.1.3.3 Recent developments 293

17.1.3.3.1 Product launches/developments 293

17.1.3.3.2 Deals 294

17.1.3.3.3 Expansions 295

17.1.3.3.4 Other developments 295

17.1.3.4 MnM view 295

17.1.3.4.1 Right to win 295

17.1.3.4.2 Strategic choices 295

17.1.3.4.3 Weaknesses and competitive threats 296

17.1.4 VISTEON CORPORATION 297

17.1.4.1 Business overview 297

17.1.4.2 Products/Solutions offered 298

17.1.4.3 Recent developments 299

17.1.4.3.1 Product launches/developments 299

17.1.4.3.2 Deals 299

17.1.4.3.3 Expansions 300

17.1.4.3.4 Other developments 301

17.1.4.4 MnM view 301

17.1.4.4.1 Right to win 301

17.1.4.4.2 Strategic choices 301

17.1.4.4.3 Weaknesses and competitive threats 302

17.1.5 DENSO CORPORATION 303

17.1.5.1 Business overview 303

17.1.5.2 Products/Solutions offered 304

17.1.5.3 Recent developments 305

17.1.5.3.1 Product launches/developments 305

17.1.5.3.2 Deals 306

17.1.5.4 MnM view 306

17.1.5.4.1 Right to win 306

17.1.5.4.2 Strategic choices 306

17.1.5.4.3 Weaknesses and competitive threats 307

17.1.6 VALEO 308

17.1.6.1 Business overview 308

17.1.6.2 Products/Solutions offered 309

17.1.6.3 Recent developments 310

17.1.6.3.1 Product launches/developments 310

17.1.6.3.2 Expansions 311

17.1.6.4 MnM view 311

17.1.6.4.1 Right to win 311

17.1.6.4.2 Strategic choices 311

17.1.6.4.3 Weaknesses and competitive threats 311

17.1.7 MITSUBISHI ELECTRIC CORPORATION 312

17.1.7.1 Business overview 312

17.1.7.2 Products/Solutions offered 313

17.1.7.3 Recent developments 314

17.1.7.3.1 Product launches/developments 314

17.1.7.3.2 Deals 315

17.1.7.3.3 Other developments 317

17.1.8 TOMTOM INTERNATIONAL BV 318

17.1.8.1 Business overview 318

17.1.8.2 Products offered 319

17.1.8.3 Recent developments 320

17.1.8.3.1 Product launches/developments 320

17.1.8.3.2 Deals 321

17.1.8.3.3 Other developments 324

17.1.9 APTIV 325

17.1.9.1 Business overview 325

17.1.9.2 Products/Solutions offered 326

17.1.9.3 Recent developments 327

17.1.9.3.1 Deals 327

17.1.9.3.2 Expansions 328

17.1.10 LG ELECTRONICS 329

17.1.10.1 Business overview 329

17.1.10.2 Products/Solutions offered 330

17.1.10.2.1 Product launches/developments 331

17.1.10.2.2 Deals 332

17.1.11 FORVIA 333

17.1.11.1 Business overview 333

17.1.11.2 Products/Solutions offered 334

17.1.11.3 Recent developments 335

17.1.11.3.1 Product launches/developments 335

17.1.11.3.2 Deals 336

17.1.12 MAGNA INTERNATIONAL INC. 337

17.1.12.1 Business overview 337

17.1.12.2 Products/Solutions offered 338

17.1.12.3 Recent developments 339

17.1.12.3.1 Product launches/developments 339

17.1.12.3.2 Deals 340

17.1.12.3.3 Expansions 340

17.1.12.3.4 Other developments 340

17.1.13 HYUNDAI MOBIS 341

17.1.13.1 Business overview 341

17.1.13.2 Products/Solutions offered 342

17.1.13.3 Recent developments 343

17.1.13.3.1 Product launches/developments 343

17.1.13.3.2 Deals 344

17.1.13.3.3 Other developments 344

17.1.14 ALPS ALPINE CO., LTD. 345

17.1.14.1 Business overview 345

17.1.14.2 Products/Solutions offered 346

17.1.14.3 Recent developments 347

17.1.14.3.1 Product launches/developments 347

17.1.14.3.2 Deals 347

17.1.14.3.3 Other developments 348

17.2 OTHER PLAYERS 349

17.2.1 QUALCOMM TECHNOLOGIES, INC. 349

17.2.2 NXP SEMICONDUCTORS 350

17.2.3 MARELLI HOLDINGS CO., LTD. 351

17.2.4 ZF FRIEDRICHSHAFEN AG 351

17.2.5 PIONEER CORPORATION 352

17.2.6 SONY CORPORATION 353

17.2.7 INFINEON TECHNOLOGIES AG 354

17.2.8 JVCKENWOOD CORPORATION 355

17.2.9 FUJITSU LIMITED 356

17.2.10 FORYOU CORPORATION 356

17.2.11 MAGNETI MARELLI S.P.A 357

18 RESEARCH METHODOLOGY 358

18.1 RESEARCH DATA 358

18.1.1 SECONDARY DATA 359

18.1.1.1 List of secondary sources 360

18.1.1.2 Key data from secondary sources 361

18.1.2 PRIMARY DATA 361

18.1.2.1 Primary interviews: Demand and supply sides 362

18.1.2.2 Key industry insights and breakdown of primary interviews 362

18.1.2.3 List of primary participants 363

18.2 MARKET SIZE ESTIMATION 363

18.2.1 BOTTOM-UP APPROACH 364

18.2.2 TOP-DOWN APPROACH 365

18.3 DATA TRIANGULATION 366

18.4 FACTOR ANALYSIS 367

18.5 RESEARCH ASSUMPTIONS 367

18.6 RESEARCH LIMITATIONS 368

18.7 RISK ASSESSMENT 369

19 APPENDIX 370

19.1 KEY INSIGHTS FROM INDUSTRY EXPERTS 370

19.2 DISCUSSION GUIDE 370

19.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 373

19.4 CUSTOMIZATION OPTIONS 375

19.4.1 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION, AT THE REGIONAL LEVEL (FOR REGIONS COVERED IN THE REPORT) 375

19.4.2 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE, AT THE REGIONAL LEVEL (FOR THE REGIONS COVERED IN THE REPORT) 375

19.4.3 COMPANY INFORMATION 375

19.4.4 PROFILING OF ADDITIONAL MARKET PLAYERS (UP TO 5) 375

19.5 RELATED REPORTS 375

19.6 AUTHOR DETAILS 376

LIST OF TABLES

TABLE 1 AUTOMOTIVE DIGITAL COCKPIT MARKET DEFINITION, BY EQUIPMENT 34

TABLE 2 AUTOMOTIVE DIGITAL COCKPIT MARKET DEFINITION, BY ELECTRIC VEHICLE TYPE 35

TABLE 3 AUTOMOTIVE DIGITAL COCKPIT MARKET DEFINITION, BY VEHICLE TYPE 35

TABLE 4 AUTOMOTIVE DIGITAL COCKPIT MARKET DEFINITION, BY DISPLAY TYPE 35

TABLE 5 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE 36

TABLE 6 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION 36

TABLE 7 CURRENCY EXCHANGE RATES, 2021–2025 39

TABLE 8 EXAMPLES OF SOFTWARE-DRIVEN VEHICLE PROGRAMS AND CONNECTIVITY IMPACT 52

TABLE 9 COLLABORATIONS BETWEEN TIER 1 COMPANIES AND OEMS 52

TABLE 10 KEY INDICATORS OF RISING CONSUMER DEMAND FOR PREMIUM IN-CABIN EXPERIENCES 53

TABLE 11 VEHICLES EQUIPPED WITH HEAD-UP DISPLAYS, 2021–2024 54

TABLE 12 REGULATORY MILESTONES INFLUENCING COCKPIT SAFETY SYSTEM ADOPTION 55

TABLE 13 DIGITAL COCKPIT COMPONENTS MAPPING FOR TOP SELLING ELECTRIC

VEHICLES, 2024 55

TABLE 14 ELECTRIC VEHICLE GROWTH INDICATORS SUPPORTING DIGITAL-CENTRIC CABIN INTERFACE ADOPTION 57

TABLE 15 MONETARY INCENTIVES FOR ELECTRIC VEHICLES IN WESTERN EUROPE, 2024 57

TABLE 16 COST INDICATORS FOR ADVANCED COCKPIT ELECTRONICS 58

TABLE 17 SUPPLY CHAIN IMPACT INDICATORS 59

TABLE 18 STRATEGIC OPPORTUNITIES IN NEXT-GEN ELECTRIC VEHICLE SILICON 59

TABLE 19 LEVEL OF AUTONOMY IN ELECTRIC VEHICLES, 2019–2024 61

TABLE 20 MARKET INDICATORS FOR MULTIMODAL HMI, AR VISUALIZATION, AND INTERIOR SENSING 62

TABLE 21 VEHICULAR CYBER ATTACKS 63

TABLE 22 AUTOMOTIVE DIGITAL COCKPIT MARKET: IMPACT OF MARKET DYNAMICS 64

TABLE 23 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 66

TABLE 24 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS 67

TABLE 25 CURRENT STATUS AND SHORT, MEDIUM, LONG-TERM PROSPECTS OF DIGITAL COCKPIT TECHNOLOGIES 72

TABLE 26 PATENT ANALYSIS, JANUARY 2022-AUGUST 2025 74

TABLE 27 FUTURE APPLICATIONS OF AUTOMOTIVE DIGITAL COCKPIT SYSTEMS 76

TABLE 28 TOP USE CASES AND MARKET POTENTIAL 78

TABLE 29 COMPANIES IMPLEMENTING AI/GENERATIVE AI 78

TABLE 30 CASE STUDIES OF DIGITAL COCKPIT IMPLEMENTATION IN AUTOMOTIVE MARKET 79

TABLE 31 ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 79

TABLE 32 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 81

TABLE 33 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 82

TABLE 34 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 83

TABLE 35 REGULATORY REQUIREMENTS FOR DIGITAL COCKPIT SYSTEMS 84

TABLE 36 GLOBAL INDUSTRY STANDARDS 85

TABLE 37 POLICY INITIATIVES AFFECTING SUSTAINABILITY, SAFETY, PRIVACY, AND TECHNOLOGY COMPLIANCE FOR DIGITAL COCKPITS 88

TABLE 38 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 89

TABLE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY EQUIPMENT (%) 92

TABLE 40 KEY BUYING CRITERIA FOR AUTOMOTIVE DIGITAL COCKPIT, BY EQUIPMENT 93

TABLE 41 AUTOMOTIVE SEMICONDUCTOR PROFITABILITY, BY COMPONENT 95

TABLE 42 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021–2030 96

TABLE 43 ROLE OF COMPANIES IN ECOSYSTEM 101

TABLE 44 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT, 2024 (USD) 103

TABLE 45 AVERAGE SELLING PRICE TREND, BY EQUIPMENT, 2022–2024 (USD) 104

TABLE 46 AVERAGE SELLING PRICE TREND, BY REGION, 2022−2024 (USD) 105

TABLE 47 KEY CONFERENCES AND EVENTS, 2026-2027 108

TABLE 48 IMPORT DATA FOR HS CODE 8537-COMPLIANT PRODUCTS, BY COUNTRY,

2020–2024 (USD BILLION) 109

TABLE 49 EXPORT DATA FOR HS CODE 8537-COMPLIANT PRODUCTS, BY COUNTRY,

2020–2024 (USD BILLION) 110

TABLE 50 TARIFF SNAPSHOT FOR SEMICONDUCTOR-RELATED GOODS 114

TABLE 51 IMPACT OF TARIFFS ON AUTOMOTIVE DIGITAL COCKPIT COSTS 115

TABLE 52 REGIONAL EXPOSURE PROFILE 116

TABLE 53 INDUSTRY-LEVEL EXPOSURE AND TYPICAL MITIGATION ACTIONS 117

TABLE 54 STRATEGIC INDICATORS OF OEM AND SUPPLIER TRANSFORMATION IN COCKPIT ELECTRONICS 118

TABLE 55 DIGITAL COCKPIT COMPONENT MAPPING FOR XPENG 120

TABLE 56 DIGITAL COCKPIT COMPONENT MAPPING FOR NIO 121

TABLE 57 DIGITAL COCKPIT COMPONENT MAPPING FOR LEAPMOTOR 122

TABLE 58 DIGITAL COCKPIT COMPONENT MAPPING FOR GEELY ZEEKR 123

TABLE 59 DIGITAL COCKPIT COMPONENT MAPPING FOR TATA MOTORS 124

TABLE 60 DIGITAL COCKPIT COMPONENT MAPPING FOR VOLKSWAGEN AUDI 125

TABLE 61 DIGITAL COCKPIT COMPONENT MAPPING FOR BMW 126

TABLE 62 DIGITAL COCKPIT COMPONENT MAPPING FOR STELLANTIS 127

TABLE 63 DIGITAL COCKPIT COMPONENT MAPPING FOR MERCEDES BENZ 128

TABLE 64 DIGITAL COCKPIT COMPONENT MAPPING FOR FORD 129

TABLE 65 DIGITAL COCKPIT COMPONENT MAPPING FOR GENERAL MOTORS 130

TABLE 66 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 133

TABLE 67 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 133

TABLE 68 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 134

TABLE 69 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 134

TABLE 70 EQUIPMENT OFFERINGS BY LEADING DIGITAL COCKPIT SUPPLIERS 135

TABLE 71 FUNCTIONAL DIFFERENTIATION ACROSS DIGITAL COCKPIT EQUIPMENT 135

TABLE 72 MODELS EQUIPPED WITH DIGITAL INSTRUMENT CLUSTERS, 2024 136

TABLE 73 KEY FEATURE COMPARISON ACROSS DIGITAL CLUSTERS 136

TABLE 74 DIGITAL INSTRUMENT CLUSTER: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2021–2024 (THOUSAND UNITS) 137

TABLE 75 DIGITAL INSTRUMENT CLUSTER: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2025–2032 (THOUSAND UNITS) 137

TABLE 76 DIGITAL INSTRUMENT CLUSTER: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2021–2024 (USD MILLION) 137

TABLE 77 DIGITAL INSTRUMENT CLUSTER: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2025–2032 (USD MILLION) 138

TABLE 78 VEHICLE FUNCTIONS ROUTED THROUGH DIGITAL CENTRAL CONSOLE 139

TABLE 79 SOFTWARE PLATFORMS USED FOR CENTRAL CONSOLES ACROSS OEM GROUPS 139

TABLE 80 DIGITAL CENTRAL CONSOLE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 139

TABLE 81 DIGITAL CENTRAL CONSOLE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 140

TABLE 82 DIGITAL CENTRAL CONSOLE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021–2024 (USD MILLION) 140

TABLE 83 DIGITAL CENTRAL CONSOLE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025–2032 (USD MILLION) 140

TABLE 84 INFOTAINMENT SOFTWARE STRATEGIES BY GLOBAL OEMS 141

TABLE 85 INFOTAINMENT FEATURES RELEVANT FOR DIGITAL COCKPIT PERFORMANCE 142

TABLE 86 INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 142

TABLE 87 INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 142

TABLE 88 INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (USD MILLION) 143

TABLE 89 INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (USD MILLION) 143

TABLE 90 KEY FUNCTIONS ENABLED BY REAR INFOTAINMENT UNITS 144

TABLE 91 REAR INFOTAINMENT IMPLEMENTATION ACROSS BRANDS 144

TABLE 92 REAR INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 144

TABLE 93 REAR INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 145

TABLE 94 REAR INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021–2024 (USD MILLION) 145

TABLE 95 REAR INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025–2032 (USD MILLION) 145

TABLE 96 PASSENGER INFOTAINMENT FUNCTIONS 146

TABLE 97 PASSENGER INFOTAINMENT OFFERINGS BY OEM 146

TABLE 98 PASSENGER INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2021–2024 (THOUSAND UNITS) 147

TABLE 99 PASSENGER INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2025–2032 (THOUSAND UNITS) 147

TABLE 100 PASSENGER INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2021–2024 (USD MILLION) 147

TABLE 101 PASSENGER INFOTAINMENT UNIT: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2025–2032 (USD MILLION) 148

TABLE 102 HUD CAPABILITIES ACROSS VEHICLE SEGMENTS 149

TABLE 103 HUD SUPPLIER LANDSCAPE 149

TABLE 104 HUD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 149

TABLE 105 HUD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 150

TABLE 106 HUD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (USD MILLION) 150

TABLE 107 HUD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (USD MILLION) 150

TABLE 108 CORE FUNCTIONS OF DRIVER MONITORING SYSTEMS 151

TABLE 109 DRIVER MONITORING TECHNOLOGY SUPPLIERS AND USE CASES 152

TABLE 110 DRIVER MONITORING SYSTEM: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2021–2024 (THOUSAND UNITS) 152

TABLE 111 DRIVER MONITORING SYSTEM: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2025–2032 (THOUSAND UNITS) 152

TABLE 112 DRIVER MONITORING SYSTEM: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2021–2024 (USD MILLION) 153

TABLE 113 DRIVER MONITORING SYSTEM: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2025–2032 (USD MILLION) 153

TABLE 114 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE,

2021–2024 (THOUSAND UNITS) 155

TABLE 115 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE,

2025–2032 (THOUSAND UNITS) 156

TABLE 116 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE,

2021–2024 (USD MILLION) 156

TABLE 117 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE,

2025–2032 (USD MILLION) 156

TABLE 118 PASSENGER CAR DRIVERS FOR DIGITAL COCKPIT ADOPTION 157

TABLE 119 PASSENGER CAR COCKPIT COMPONENTS AND THEIR FUNCTIONAL ROLE 158

TABLE 120 PASSENGER CAR: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 158

TABLE 121 PASSENGER CAR: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 158

TABLE 122 PASSENGER CAR: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (USD MILLION) 159

TABLE 123 PASSENGER CAR: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (USD MILLION) 159

TABLE 124 LCV DIGITAL COCKPIT USE CASES 160

TABLE 125 COCKPIT PRIORITIES FOR ELECTRIC LIGHT COMMERCIAL VEHICLES 160

TABLE 126 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2021–2024 (THOUSAND UNITS) 160

TABLE 127 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2025–2032 (THOUSAND UNITS) 161

TABLE 128 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2021–2024 (USD MILLION) 161

TABLE 129 LIGHT COMMERCIAL VEHICLE: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2025–2032 (USD MILLION) 161

TABLE 130 HCV DIGITAL COCKPIT FUNCTIONAL REQUIREMENTS 162

TABLE 131 HCV COCKPIT PRIORITIES UNDER ELECTRIFICATION TRENDS 162

TABLE 132 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2021–2024 (THOUSAND UNITS) 163

TABLE 133 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2025–2032 (THOUSAND UNITS) 163

TABLE 134 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2021–2024 (USD MILLION) 163

TABLE 135 HEAVY COMMERCIAL VEHICLE: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2025–2032 (USD MILLION) 164

TABLE 136 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY ELECTRIC VEHICLE TYPE,

2021–2024 (THOUSAND UNITS) 167

TABLE 137 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY ELECTRIC VEHICLE TYPE,

2025–2032 (THOUSAND UNITS) 167

TABLE 138 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY ELECTRIC VEHICLE TYPE,

2021–2024 (USD MILLION) 167

TABLE 139 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY ELECTRIC VEHICLE TYPE,

2025–2032 (USD MILLION) 167

TABLE 140 TOP SELLING BEVS WORLDWIDE IN 2024 AND ASSOCIATED COCKPIT FEATURES 168

TABLE 141 COCKPIT REQUIREMENTS DRIVEN BY BEV OWNERSHIP 169

TABLE 142 BEV: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 169

TABLE 143 BEV: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 169

TABLE 144 BEV: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (USD MILLION) 170

TABLE 145 BEV: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (USD MILLION) 170

TABLE 146 REPRESENTATIVE PHEV MODELS AND KEY COCKPIT SYSTEM CAPABILITIES 171

TABLE 147 COCKPIT INFORMATION REQUIREMENTS FOR PHEV DRIVERS 171

TABLE 148 PHEV: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 172

TABLE 149 PHEV: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 172

TABLE 150 PHEV: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (USD MILLION) 172

TABLE 151 PHEV: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (USD MILLION) 172

TABLE 152 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 176

TABLE 153 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 176

TABLE 154 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 176

TABLE 155 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION,

2025–2032 (USD MILLION) 176

TABLE 156 INFOTAINMENT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 177

TABLE 157 INFOTAINMENT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 178

TABLE 158 INFOTAINMENT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (USD MILLION) 178

TABLE 159 INFOTAINMENT: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (USD MILLION) 178

TABLE 160 COMPONENTS USED IN DRIVER MONITORING SYSTEMS 179

TABLE 161 DRIVER ASSISTANCE & MONITORING: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2021–2024 (THOUSAND UNITS) 180

TABLE 162 DRIVER ASSISTANCE & MONITORING: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2025–2032 (THOUSAND UNITS) 180

TABLE 163 DRIVER ASSISTANCE & MONITORING: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2021–2024 (USD MILLION) 180

TABLE 164 DRIVER ASSISTANCE & MONITORING: AUTOMOTIVE DIGITAL COCKPIT MARKET,

BY REGION, 2025–2032 (USD MILLION) 181

TABLE 165 FUNCTIONS COMMONLY CONTROLLED THROUGH DIGITAL COCKPITS 182

TABLE 166 VEHICLE & COMFORT CONTROL SYSTEM: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 182

TABLE 167 VEHICLE & COMFORT CONTROL SYSTEM: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 182

TABLE 168 VEHICLE & COMFORT CONTROL SYSTEM: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021–2024 (USD MILLION) 183

TABLE 169 VEHICLE & COMFORT CONTROL SYSTEM: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025–2032 (USD MILLION) 183

TABLE 170 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE,

2021–2024 (THOUSAND UNITS) 185

TABLE 171 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE,

2025–2032 (THOUSAND UNITS) 186

TABLE 172 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE,

2021–2024 (USD MILLION) 186

TABLE 173 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE,

2025–2032 (USD MILLION) 186

TABLE 174 VEHICLE PROGRAMS USING SMALL FORMAT DISPLAYS 187

TABLE 175 <5″: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 188

TABLE 176 <5″: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 188

TABLE 177 <5″: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (USD MILLION) 188

TABLE 178 <5″: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (USD MILLION) 188

TABLE 179 COMMON SPECIFICATIONS IN MID-SIZED AUTOMOTIVE DISPLAYS 189

TABLE 180 5-10″: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 190

TABLE 181 5-10″: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 190

TABLE 182 5-10″: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (USD MILLION) 190

TABLE 183 5-10″: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (USD MILLION) 190

TABLE 184 SELECT VEHICLES USING LARGE FORMAT DISPLAYS 191

TABLE 185 >10″: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 192

TABLE 186 >10″: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 192

TABLE 187 >10″: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (USD MILLION) 192

TABLE 188 >10″: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (USD MILLION) 192

TABLE 189 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY TYPE,

2021–2024 (THOUSAND UNITS) 196

TABLE 190 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY TYPE,

2025–2032 (THOUSAND UNITS) 196

TABLE 191 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY TYPE,

2021–2024 (USD MILLION) 196

TABLE 192 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY TYPE,

2025–2032 (USD MILLION) 196

TABLE 193 OEM ADOPTION OF LCD DISPLAYS, 2024 197

TABLE 194 LCD PERFORMANCE SUMMARY 198

TABLE 195 LCD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 198

TABLE 196 LCD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 198

TABLE 197 LCD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (USD MILLION) 198

TABLE 198 LCD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (USD MILLION) 199

TABLE 199 PREMIUM VEHICLES USING OLED DISPLAYS, 2024 200

TABLE 200 OLED PERFORMANCE CHARACTERISTICS 200

TABLE 201 OLED: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 200

TABLE 202 OLED: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 201

TABLE 203 OLED: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (USD MILLION) 201

TABLE 204 OLED: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (USD MILLION) 201

TABLE 205 TFT-LCD ADOPTION ACROSS OEM PORTFOLIOS, 2024 202

TABLE 206 TFT-LCD: ADVANCED ATTRIBUTES 203

TABLE 207 TFT-LCD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 203

TABLE 208 TFT-LCD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 203

TABLE 209 TFT-LCD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (USD MILLION) 203

TABLE 210 TFT-LCD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (USD MILLION) 204

TABLE 211 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 206

TABLE 212 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 207

TABLE 213 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2021–2024 (USD MILLION) 207

TABLE 214 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION, 2025–2032 (USD MILLION) 207

TABLE 215 ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY,

2021–2024 (THOUSAND UNITS) 209

TABLE 216 ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY,

2025–2032 (THOUSAND UNITS) 209

TABLE 217 ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 209

TABLE 218 ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY,

2025–2032 (USD MILLION) 210

TABLE 219 CHINA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 211

TABLE 220 CHINA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 211

TABLE 221 CHINA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 212

TABLE 222 CHINA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 212

TABLE 223 INDIA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 213

TABLE 224 INDIA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 214

TABLE 225 INDIA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 214

TABLE 226 INDIA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 215

TABLE 227 JAPAN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 216

TABLE 228 JAPAN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 216

TABLE 229 JAPAN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 216

TABLE 230 JAPAN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 217

TABLE 231 SOUTH KOREA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 218

TABLE 232 SOUTH KOREA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 218

TABLE 233 SOUTH KOREA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 219

TABLE 234 SOUTH KOREA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 219

TABLE 235 THAILAND: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 220

TABLE 236 THAILAND: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 221

TABLE 237 THAILAND: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 221

TABLE 238 THAILAND: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 222

TABLE 239 REST OF ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021–2024 (THOUSAND UNITS) 223

TABLE 240 REST OF ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025–2032 (THOUSAND UNITS) 223

TABLE 241 REST OF ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021–2024 (USD MILLION) 223

TABLE 242 REST OF ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025–2032 (USD MILLION) 224

TABLE 243 NORTH AMERICA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY,

2021–2024 (THOUSAND UNITS) 225

TABLE 244 NORTH AMERICA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY,

2025–2032 (THOUSAND UNITS) 225

TABLE 245 NORTH AMERICA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 226

TABLE 246 NORTH AMERICA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY,

2025–2032 (USD MILLION) 226

TABLE 247 US: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 227

TABLE 248 US: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 227

TABLE 249 US: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 228

TABLE 250 US: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 228

TABLE 251 CANADA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 229

TABLE 252 CANADA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 230

TABLE 253 CANADA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 230

TABLE 254 CANADA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 231

TABLE 255 MEXICO: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 232

TABLE 256 MEXICO: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 232

TABLE 257 MEXICO: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 233

TABLE 258 MEXICO: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 233

TABLE 259 EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY,

2021–2024 (THOUSAND UNITS) 235

TABLE 260 EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY,

2025–2032 (THOUSAND UNITS) 235

TABLE 261 EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 235

TABLE 262 EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY,

2025–2032 (USD MILLION) 236

TABLE 263 GERMANY: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 237

TABLE 264 GERMANY: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 237

TABLE 265 GERMANY: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 237

TABLE 266 GERMANY: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 238

TABLE 267 FRANCE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 239

TABLE 268 FRANCE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 239

TABLE 269 FRANCE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 240

TABLE 270 FRANCE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 240

TABLE 271 ITALY: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 241

TABLE 272 ITALY: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 242

TABLE 273 ITALY: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 242

TABLE 274 ITALY: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 243

TABLE 275 SPAIN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 244

TABLE 276 SPAIN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 244

TABLE 277 SPAIN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 245

TABLE 278 SPAIN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 245

TABLE 279 UK: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 246

TABLE 280 UK: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 247

TABLE 281 UK: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 247

TABLE 282 UK: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 248

TABLE 283 RUSSIA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 249

TABLE 284 RUSSIA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 249

TABLE 285 RUSSIA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 250

TABLE 286 RUSSIA: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 250

TABLE 287 REST OF EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021–2024 (THOUSAND UNITS) 251

TABLE 288 REST OF EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025–2032 (THOUSAND UNITS) 252

TABLE 289 REST OF EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2021–2024 (USD MILLION) 252

TABLE 290 REST OF EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT, 2025–2032 (USD MILLION) 253

TABLE 291 REST OF THE WORLD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 254

TABLE 292 REST OF THE WORLD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2025–2032 (USD MILLION) 254

TABLE 293 REST OF THE WORLD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2021–2024 (THOUSAND UNITS) 255

TABLE 294 REST OF THE WORLD: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY COUNTRY, 2025–2032 (THOUSAND UNITS) 255

TABLE 295 BRAZIL: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 256

TABLE 296 BRAZIL: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 256

TABLE 297 BRAZIL: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 257

TABLE 298 BRAZIL: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 257

TABLE 299 IRAN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 258

TABLE 300 IRAN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 259

TABLE 301 IRAN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 259

TABLE 302 IRAN: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 260

TABLE 303 OTHERS: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (THOUSAND UNITS) 261

TABLE 304 OTHERS: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (THOUSAND UNITS) 261

TABLE 305 OTHERS: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2021–2024 (USD MILLION) 262

TABLE 306 OTHERS: AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025–2032 (USD MILLION) 262

TABLE 307 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2025 263

TABLE 308 AUTOMOTIVE DIGITAL COCKPIT MARKET: DEGREE OF COMPETITION, 2024 265

TABLE 309 AUTOMOTIVE DIGITAL COCKPIT MARKET: REGION FOOTPRINT 272

TABLE 310 AUTOMOTIVE DIGITAL COCKPIT MARKET: EQUIPMENT FOOTPRINT 273

TABLE 311 AUTOMOTIVE DIGITAL COCKPIT MARKET: VEHICLE TYPE FOOTPRINT 274

TABLE 312 AUTOMOTIVE DIGITAL COCKPIT MARKET: LIST OF STARTUPS 276

TABLE 313 AUTOMOTIVE DIGITAL COCKPIT MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES 276

TABLE 314 AUTOMOTIVE DIGITAL COCKPIT MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2021-NOVEMBER 2025 277

TABLE 315 AUTOMOTIVE DIGITAL COCKPIT MARKET: DEALS, JANUARY 2021-NOVEMBER 2025 278

TABLE 316 AUTOMOTIVE DIGITAL COCKPIT MARKET: EXPANSIONS,

JANUARY 2021-NOVEMBER 2025 279

TABLE 317 AUTOMOTIVE DIGITAL COCKPIT MARKET: OTHER DEVELOPMENTS,

JANUARY 2021-NOVEMBER 2025 280

TABLE 318 CONTINENTAL AG: COMPANY OVERVIEW 281

TABLE 319 CONTINENTAL AG: PRODUCTS/SOLUTIONS OFFERED 282

TABLE 320 CONTINENTAL AG: PRODUCT LAUNCHES/DEVELOPMENTS 283

TABLE 321 CONTINENTAL AG: EXPANSIONS 284

TABLE 322 CONTINENTAL AG: OTHER DEVELOPMENTS 284

TABLE 323 ROBERT BOSCH GMBH: COMPANY OVERVIEW 286

TABLE 324 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS OFFERED 287

TABLE 325 ROBERT BOSCH GMBH: PRODUCT LAUNCHES/DEVELOPMENTS 288

TABLE 326 ROBERT BOSCH GMBH: DEALS 289

TABLE 327 HARMAN INTERNATIONAL: COMPANY OVERVIEW 291

TABLE 328 HARMAN INTERNATIONAL: PRODUCTS/SOLUTIONS OFFERED 292

TABLE 329 HARMAN INTERNATIONAL: PRODUCT LAUNCHES/DEVELOPMENTS 293

TABLE 330 HARMAN INTERNATIONAL: DEALS 294

TABLE 331 HARMAN INTERNATIONAL: EXPANSIONS 295

TABLE 332 HARMAN INTERNATIONAL: OTHER DEVELOPMENTS 295

TABLE 333 VISTEON CORPORATION: COMPANY OVERVIEW 297

TABLE 334 VISTEON CORPORATION: PRODUCTS/SOLUTIONS OFFERED 298

TABLE 335 VISTEON CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS 299

TABLE 336 VISTEON CORPORATION: DEALS 299

TABLE 337 VISTEON CORPORATION: EXPANSIONS 300

TABLE 338 VISTEON CORPORATION: OTHER DEVELOPMENTS 301

TABLE 339 DENSO CORPORATION: COMPANY OVERVIEW 303

TABLE 340 DENSO CORPORATION: PRODUCTS/SOLUTIONS OFFERED 304

TABLE 341 DENSO CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS 305

TABLE 342 DENSO CORPORATION: DEALS 306

TABLE 343 VALEO: COMPANY OVERVIEW 308

TABLE 344 VALEO: PRODUCTS/SOLUTIONS OFFERED 309

TABLE 345 VALEO: PRODUCT LAUNCHES/DEVELOPMENTS 310

TABLE 346 VALEO: EXPANSIONS 311

TABLE 347 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW 312

TABLE 348 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS OFFERED 313

TABLE 349 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS 314

TABLE 350 MITSUBISHI ELECTRIC CORPORATION: DEALS 315

TABLE 351 MITSUBISHI ELECTRIC CORPORATION: OTHER DEVELOPMENTS 317

TABLE 352 TOMTOM INTERNATIONAL BV: COMPANY OVERVIEW 318

TABLE 353 TOMTOM INTERNATIONAL BV: PRODUCTS OFFERED 319

TABLE 354 TOMTOM INTERNATIONAL BV: PRODUCT LAUNCHES/DEVELOPMENTS 320

TABLE 355 TOMTOM INTERNATIONAL BV: DEALS 321

TABLE 356 TOMTOM INTERNATIONAL BV: OTHER DEVELOPMENTS 324

TABLE 357 APTIV: COMPANY OVERVIEW 325

TABLE 358 APTIV: PRODUCTS/SOLUTIONS OFFERED 326

TABLE 359 APTIV: DEALS 327

TABLE 360 APTIV: EXPANSIONS 328

TABLE 361 LG ELECTRONICS: COMPANY OVERVIEW 329

TABLE 362 LG ELECTRONICS: PRODUCTS/SOLUTIONS OFFERED 330

TABLE 363 LG ELECTRONICS: PRODUCT LAUNCHES/DEVELOPMENTS 331

TABLE 364 LG ELECTRONICS: DEALS 332

TABLE 365 FORVIA: COMPANY OVERVIEW 333

TABLE 366 FORVIA: PRODUCTS/SOLUTIONS OFFERED 334

TABLE 367 FORVIA: PRODUCT LAUNCHES/DEVELOPMENTS 335

TABLE 368 FORVIA: DEALS 336

TABLE 369 MAGNA INTERNATIONAL INC.: COMPANY OVERVIEW 337

TABLE 370 MAGNA INTERNATIONAL INC.: PRODUCTS/SOLUTIONS OFFERED 338

TABLE 371 MAGNA INTERNATIONAL INC.: PRODUCT LAUNCHES/DEVELOPMENTS 339

TABLE 372 MAGNA INTERNATIONAL INC.: DEALS 340

TABLE 373 MAGNA INTERNATIONAL INC.: EXPANSIONS 340

TABLE 374 MAGNA INTERNATIONAL INC.: OTHER DEVELOPMENTS 340

TABLE 375 HYUNDAI MOBIS: COMPANY OVERVIEW 341

TABLE 376 HYUNDAI MOBIS: PRODUCTS/SOLUTIONS OFFERED 342

TABLE 377 HYUNDAI MOBIS: PRODUCT LAUNCHES/DEVELOPMENTS 343

TABLE 378 HYUNDAI MOBIS: DEALS 344

TABLE 379 HYUNDAI MOBIS: OTHER DEVELOPMENTS 344

TABLE 380 ALPS ALPINE CO., LTD.: COMPANY OVERVIEW 345

TABLE 381 ALPS ALPINE CO., LTD.: PRODUCTS/SOLUTIONS OFFERED 346

TABLE 382 ALPS ALPINE CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS 347

TABLE 383 ALPS ALPINE CO., LTD.: DEALS 347

TABLE 384 ALPS ALPINE CO., LTD.: OTHER DEVELOPMENTS 348

TABLE 385 QUALCOMM TECHNOLOGIES, INC.: COMPANY OVERVIEW 349

TABLE 386 NXP SEMICONDUCTORS: COMPANY OVERVIEW 350

TABLE 387 MARELLI HOLDINGS CO., LTD.: COMPANY OVERVIEW 351

TABLE 388 ZF FRIEDRICHSHAFEN AG: COMPANY OVERVIEW 351

TABLE 389 PIONEER CORPORATION: COMPANY OVERVIEW 352

TABLE 390 SONY CORPORATION: COMPANY OVERVIEW 353

TABLE 391 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW 354

TABLE 392 JVCKENWOOD CORPORATION: COMPANY OVERVIEW 355

TABLE 393 FUJITSU LIMITED: COMPANY OVERVIEW 356

TABLE 394 FORYOU CORPORATION: COMPANY OVERVIEW 356

TABLE 395 MAGNETI MARELLI S.P.A: COMPANY OVERVIEW 357

LIST OF FIGURES

FIGURE 1 AUTOMOTIVE DIGITAL COCKPIT MARKET SCENARIO 41

FIGURE 2 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE, 2025–2032 41

FIGURE 3 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN AUTOMOTIVE DIGITAL COCKPIT MARKET, 2021–2025 42

FIGURE 4 DISRUPTIONS INFLUENCING GROWTH OF AUTOMOTIVE DIGITAL COCKPIT MARKET 43

FIGURE 5 HIGH-GROWTH SEGMENTS IN AUTOMOTIVE DIGITAL COCKPIT

MARKET, 2025–2032 43

FIGURE 6 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN AUTOMOTIVE DIGITAL COCKPIT MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD 44

FIGURE 7 SOFTWARE-DEFINED VEHICLE ADOPTION AND ADVANCED IN-CABIN DISPLAYS TO DRIVE MARKET 46

FIGURE 8 HUD TO RECORD FASTEST GROWTH DURING FORECAST PERIOD 46

FIGURE 9 PASSENGER CAR SEGMENT TO HOLD LARGEST MARKET SHARE IN 2032 47

FIGURE 10 DRIVER ASSISTANCE & MONITORING TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD 47

FIGURE 11 5-10″ SEGMENT TO LEAD MARKET DURING FORECAST PERIOD 48

FIGURE 12 BEV TO RECORD HIGHER CAGR THAN PHEV DURING FORECAST PERIOD 48

FIGURE 13 TFT-LCD TO LEAD MARKET DURING FORECAST PERIOD 49

FIGURE 14 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR AUTOMOTIVE DIGITAL COCKPIT DURING FORECAST PERIOD 49

FIGURE 15 AUTOMOTIVE DIGITAL COCKPIT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES 51

FIGURE 16 ELECTRIC VEHICLE SALES IN SELECT MARKETS, 2019–2024 57

FIGURE 17 CYBER ATTACK TARGET AREAS IN VEHICLES 63

FIGURE 18 CONVENTIONAL AND AR HEAD-UP DISPLAY DEVELOPMENTS, 2017–2023 68

FIGURE 19 BIOMETRIC DRIVER MONITORING 70

FIGURE 20 CONNECTED VEHICLE 71

FIGURE 21 TRANSITION OF DIGITAL COCKPIT TECHNOLOGIES ACROSS VEHICLE PLATFORMS 71

FIGURE 22 PATENT ANALYSIS, 2015-2024 73

FIGURE 23 AI/GENERATIVE AI IN AUTOMOTIVE MARKET, BY APPLICATION, 2025 (%) 77

FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY EQUIPMENT 92

FIGURE 25 KEY BUYING CRITERIA FOR AUTOMOTIVE DIGITAL COCKPIT, BY EQUIPMENT 93

FIGURE 26 ECOSYSTEM ANALYSIS OF AUTOMOTIVE DIGITAL COCKPIT MARKET 100

FIGURE 27 SUPPLY CHAIN ANALYSIS OF AUTOMOTIVE DIGITAL COCKPIT MARKET 102

FIGURE 28 AVERAGE SELLING PRICE TREND BY KEY PLAYERS, 2024 (USD) 104

FIGURE 29 AVERAGE SELLING PRICE TREND, BY EQUIPMENT, 2022–2024 (USD) 104

FIGURE 30 AVERAGE SELLING PRICE TREND, BY REGION, 2022–2024 (USD) 105

FIGURE 31 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS 106

FIGURE 32 INVESTMENT AND FUNDING SCENARIO, 2022–2025 (USD BILLION) 107

FIGURE 33 IMPORT DATA FOR HS CODE 8537-COMPLIANT PRODUCTS, BY COUNTRY,

2020–2024 (USD BILLION) 109

FIGURE 34 EXPORT DATA FOR HS CODE 8537-COMPLIANT PRODUCTS, BY COUNTRY,

2020–2024 (USD BILLION) 110

FIGURE 35 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY EQUIPMENT,

2025 VS. 2032 (USD MILLION) 132

FIGURE 36 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY VEHICLE TYPE,

2025 VS. 2032 (USD MILLION) 155

FIGURE 37 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY ELECTRIC VEHICLE TYPE,

2025 VS. 2032 (USD MILLION) 166

FIGURE 38 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY APPLICATION,

2025 VS. 2032 (USD MILLION) 175

FIGURE 39 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY SIZE,

2025 VS. 2032 (USD MILLION) 185

FIGURE 40 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY DISPLAY TYPE,

2025 VS. 2032 (USD MILLION) 195

FIGURE 41 AUTOMOTIVE DIGITAL COCKPIT MARKET, BY REGION,

2025 VS. 2032 (USD MILLION) 206

FIGURE 42 ASIA PACIFIC: AUTOMOTIVE DIGITAL COCKPIT MARKET SNAPSHOT 208

FIGURE 43 NORTH AMERICA: AUTOMOTIVE DIGITAL COCKPIT MARKET SNAPSHOT 225

FIGURE 44 EUROPE: AUTOMOTIVE DIGITAL COCKPIT MARKET SNAPSHOT 234

FIGURE 45 REST OF THE WORLD: AUTOMOTIVE DIGITAL COCKPIT MARKET SNAPSHOT 254

FIGURE 46 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024 265

FIGURE 47 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2020–2024 (USD BILLION) 267

FIGURE 48 COMPANY VALUATION (USD BILLION), 2025 268

FIGURE 49 FINANCIAL METRICS (EV/EBITDA), 2025 268

FIGURE 50 BRAND/PRODUCT COMPARISON 269

FIGURE 51 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024 271

FIGURE 52 AUTOMOTIVE DIGITAL COCKPIT MARKET: COMPANY FOOTPRINT, 2024 272

FIGURE 53 COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 275

FIGURE 54 CONTINENTAL AG: COMPANY SNAPSHOT 282

FIGURE 55 ROBERT BOSCH GMBH: COMPANY SNAPSHOT 287

FIGURE 56 HARMAN INTERNATIONAL: COMPANY SNAPSHOT 292

FIGURE 57 VISTEON CORPORATION: COMPANY SNAPSHOT 298

FIGURE 58 DENSO CORPORATION: COMPANY SNAPSHOT 304

FIGURE 59 VALEO: COMPANY SNAPSHOT 309

FIGURE 60 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT 313

FIGURE 61 TOMTOM INTERNATIONAL BV: COMPANY SNAPSHOT 319

FIGURE 62 APTIV: COMPANY SNAPSHOT 326

FIGURE 63 LG ELECTRONICS: COMPANY SNAPSHOT 330

FIGURE 64 FORVIA: COMPANY SNAPSHOT 334

FIGURE 65 MAGNA INTERNATIONAL INC.: COMPANY SNAPSHOT 338

FIGURE 66 HYUNDAI MOBIS: COMPANY SNAPSHOT 342

FIGURE 67 ALPS ALPINE CO., LTD.: COMPANY SNAPSHOT 346

FIGURE 68 AUTOMOTIVE DIGITAL COCKPIT MARKET: RESEARCH DESIGN 358

FIGURE 69 RESEARCH DESIGN MODEL 359

FIGURE 70 KEY INDUSTRY INSIGHTS 362

FIGURE 71 BREAKDOWN OF PRIMARY INTERVIEWS 362

FIGURE 72 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING 364

FIGURE 73 BOTTOM-UP APPROACH 365

FIGURE 74 TOP-DOWN APPROACH 365

FIGURE 75 DATA TRIANGULATION 366