| 価格 | 記載以外のライセンスについてはお問合せください |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR- |

| 出版社 | Mordor Intelligence |

| 出版年月 | 2025年9月 |

Laundry Detergents – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 – 2030)

世界の洗濯洗剤市場レポートは、製品タイプ(洗剤粉末、洗濯液体など)、パッケージ(ペットボトル、サシェ/ポーチ、その他)、カテゴリー(従来型/合成、オーガニック/天然)、流通チャネル(スーパーマーケット/ハイパーマーケット、コンビニエンスストアなど)、および地域(北米、ヨーロッパ、アジア太平洋地域など)別にセグメント化されています。

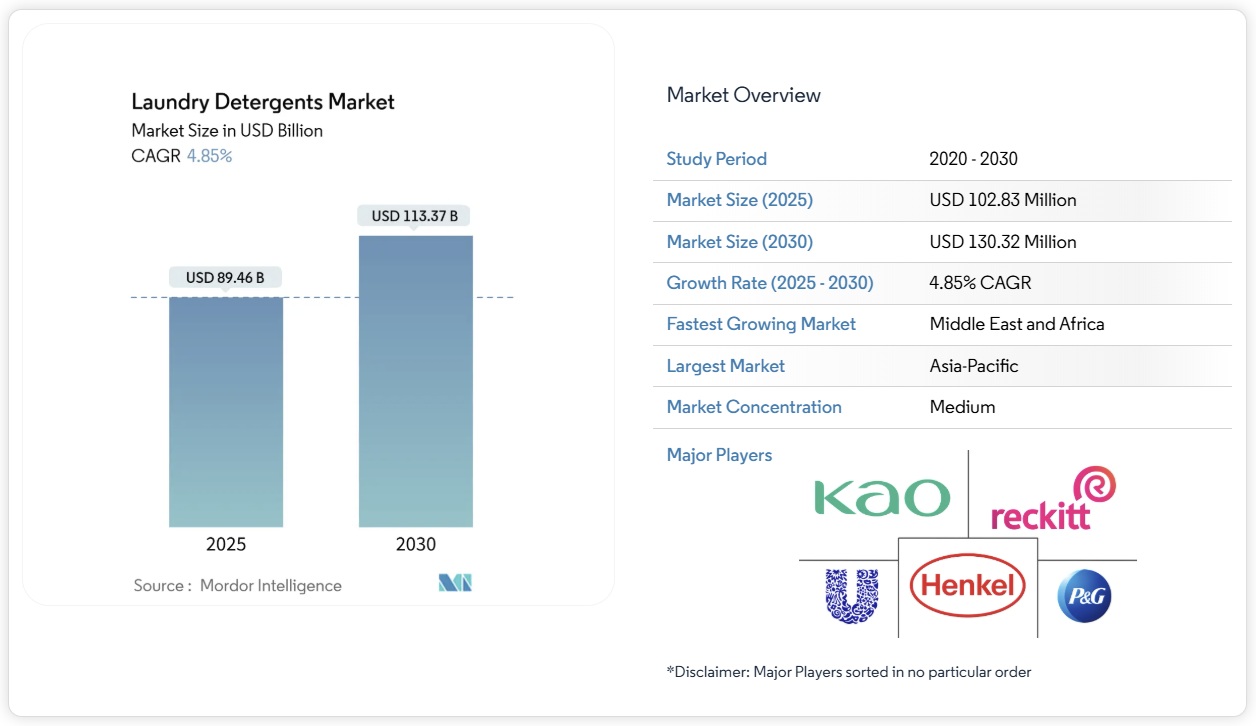

洗濯洗剤市場規模は、2025年には1億283万米ドルに達し、その後年平均成長率(CAGR)4.85%で成長し、2030年には1億332万米ドルに達すると予測されています。市場が成熟する中、メーカーは単なる販売量の増加から、エネルギー効率の高い冷水化学、バイオベース界面活性剤、デジタル配信といったイノベーションへと注力の軸足を移しています。これらの進歩は、変化する消費者の嗜好や環境への懸念に対応することを目的としています。リン酸塩やマイクロプラスチックに関する規制強化を受け、メーカーは製品ポートフォリオの刷新を迫られ、より持続可能で規制に準拠した製品の開発が進んでいます。先進地域と新興地域の両方において、液体洗剤、柔軟剤、スマートランドリーシステムといったプレミアム製品の需要が従来の粉末洗剤の需要を上回っており、利便性と高性能化へのシフトを反映しています。大規模展開のリーダー企業は、研究開発の深さとオムニチャネル展開を活用して競争優位性を維持している一方、地域特化型企業は、サシェ経済と地域に根ざした香りを活用し、特定の市場ニーズに応えることで成功を収めています。このダイナミクスにより、市場全体で中程度の競争激化が生まれています。

Laundry Detergents Market Analysis

The laundry detergents market size is expected to reach USD 102.83 million in 2025 and grow at a CAGR of 4.85% to reach USD 103.32 million by 2030.In a maturing landscape, manufacturers are shifting their focus from sheer volume gains to innovations in energy-efficient cold-water chemistry, bio-based surfactants, and digital distribution. These advancements aim to address evolving consumer preferences and environmental concerns. Regulatory tightening on phosphates and microplastics is prompting manufacturers to renew their portfolios, driving the development of more sustainable and compliant products. In both developed and emerging regions, the demand for premium products like liquids, fabric conditioners, and smart-laundry systems is outpacing that of traditional powders, reflecting a shift toward convenience and enhanced performance. While scale leaders capitalize on their research and development depth and omnichannel reach to maintain a competitive edge, regional specialists are finding success by leveraging sachet economics and localized fragrances, catering to specific market needs. This dynamic has resulted in a moderate competitive intensity across the market.

Laundry Detergents – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 – 2030)

List of Companies Covered in this Report:

- Procter & Gamble Company

- Unilever PLC

- Henkel AG & Co. KGaA

- Reckitt Benckiser Group plc

- The Clorox Company

- Church & Dwight Co., Inc.

- S. C. Johnson & Son, Inc.

- Kao Corporation

- LG Household & Health Care

- Sun Products (Arm & Hammer)

- Colgate-Palmolive Company

- Amway Corporation

- PZ Cussons

- Lion Corporation

- Sodalis Group

- Fena Pvt Ltd

- RSPL Group

- Guangzhou Liby Enterprise

- Nice Group Co., Ltd

- Godrej Consumer Products

Segment Analysis

In 2024, laundry liquids accounted for 43.68% of the total revenue in the laundry detergent market, cementing their status as the top choice for households using automatic washing machines. Their dominance stems from superior performance in cold washes, excellent solubility, and the ability to support advanced formulations that stabilize enzymes and preserve complex fragrances. Furthermore, liquids facilitate premium product development, allowing for higher suggested retail prices (SRP) while ensuring effective stain removal and fabric care. Continuous packaging innovations, such as monomaterial spouts and refill designs, not only comply with extended producer responsibility (EPR) mandates but also resonate with the growing emphasis on sustainability. Additionally, liquids cater to concentrated formulas and enzyme-boosted gels, offering greater value per wash and appealing to eco-conscious consumers. As market trends lean towards convenience, cleanliness, and sensory appeal, laundry liquids stand firm, enjoying robust loyalty in both developed and emerging markets.

Fabric softeners, though a smaller segment of the laundry care market, are set to grow at a brisk CAGR of 6.72% through 2030, positioning them as the fastest-growing product category. Their allure lies in providing a multisensory laundry experience, boosting fragrance, softness, and freshness, serving as a key differentiator for brands aiming to transcend basic cleaning. This growth is fueled by consumers’ increasing willingness to invest in premium garment care, enhancing both the feel and longevity of fabrics. Innovations in scent-release technology and the introduction of allergen-free, plant-based softening agents have expanded their appeal, especially among health- and sustainability-conscious shoppers. Moreover, strategic placement alongside detergents in both brick-and-mortar and online retail channels bolsters cross-selling opportunities, particularly through bundled promotions. As consumers increasingly seek laundry solutions that blend cleaning with fabric conditioning, fabric softeners are set to outpace the growth of other segments in the laundry care market.

In 2024, single-use sachets and pouches commanded a significant 53.84% share of the laundry detergent packaging market. This dominance is largely attributed to micro-purchase behaviors in rapidly growing markets like India, Indonesia, and Nigeria. While these sachets offer an affordable entry point for consumers, aligning with their cash-flow realities, the cost-per-wash tends to be higher. This packaging format has found a stronghold in rural and low-income demographics, providing immediate access without the need for bulk purchases. In many emerging markets, sachets serve as the initial touchpoint for consumers with branded detergents, fostering brand familiarity and loyalty. Yet, as concerns over plastic waste mount, governments are taking notice, launching pilot initiatives to explore paper-based laminate alternatives. Brands catering to these markets now face the challenge of balancing affordability and convenience with the growing emphasis on sustainability and tightening regulations.

PET bottles are set to emerge as the fastest-growing packaging choice in the laundry detergent sector, boasting an expected CAGR of 5.34% during the forecast period. This surge is largely driven by the rise of refill subscription programs, which champion both convenience and environmental stewardship through container reuse. The inherent durability of PET bottles, thanks to their rigid structure, makes them perfect for repeated handling and transport. Moreover, their transparent nature allows brands to highlight color-coded liquids, signaling formulation sophistication and a premium image. Urban markets are particularly embracing PET bottles, bolstered by organized retail’s bundle promotions and recycling incentives. This trend not only resonates with consumers’ evolving sustainability values but also enhances the premium perception of PET bottles, enabling them to capture market share from single-use formats, especially among affluent and environmentally conscious segments. With brands innovating in areas like lightweighting, recycled content, and advanced closure designs, PET bottles are well-positioned for sustained growth in both emerging and established markets.

The Global Laundry Detergent Market Report is Segmented by Product Type (Detergent Powder, Laundry Liquid, and More), Packaging (PET Bottles, Sachets/Pouches, Others), Category (Conventional/Synthetic, Organic/Natural), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, and More), and Geography (North America, Europe, Asia-Pacific and More). The Market Forecasts are Provided in Terms of Value (USD).