Containerized Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Containerized Data Center Market is Segmented by Ownership Type ( Purchase, Lease / “White-Space-As-A-Service”), Container Type (ISO 20-Ft, ISO 40-Ft, Customized/All-in-One Skids), Deployment Location ( Core / Campus, Edge / Micro, Remote / Harsh-Environment), End User Industry (IT and Telecommunications, BFSI and More), and by Geography.

コンテナ型データセンター市場は、所有権タイプ(購入、リース/「サービスとしてのホワイトスペース」)、コンテナタイプ(ISO 20フィート、ISO 40フィート、カスタマイズ/オールインワンスキッド)、展開場所(コア/キャンパス、エッジ/マイクロ、リモート/過酷な環境)、エンドユーザー業界(ITおよび通信、BFSIなど)、および地域によってセグメント化されています。

| 出版 | Mordor Intelligence |

| 出版年月 | 2026年02月 |

| ページ数 | 120 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,750 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-9846 |

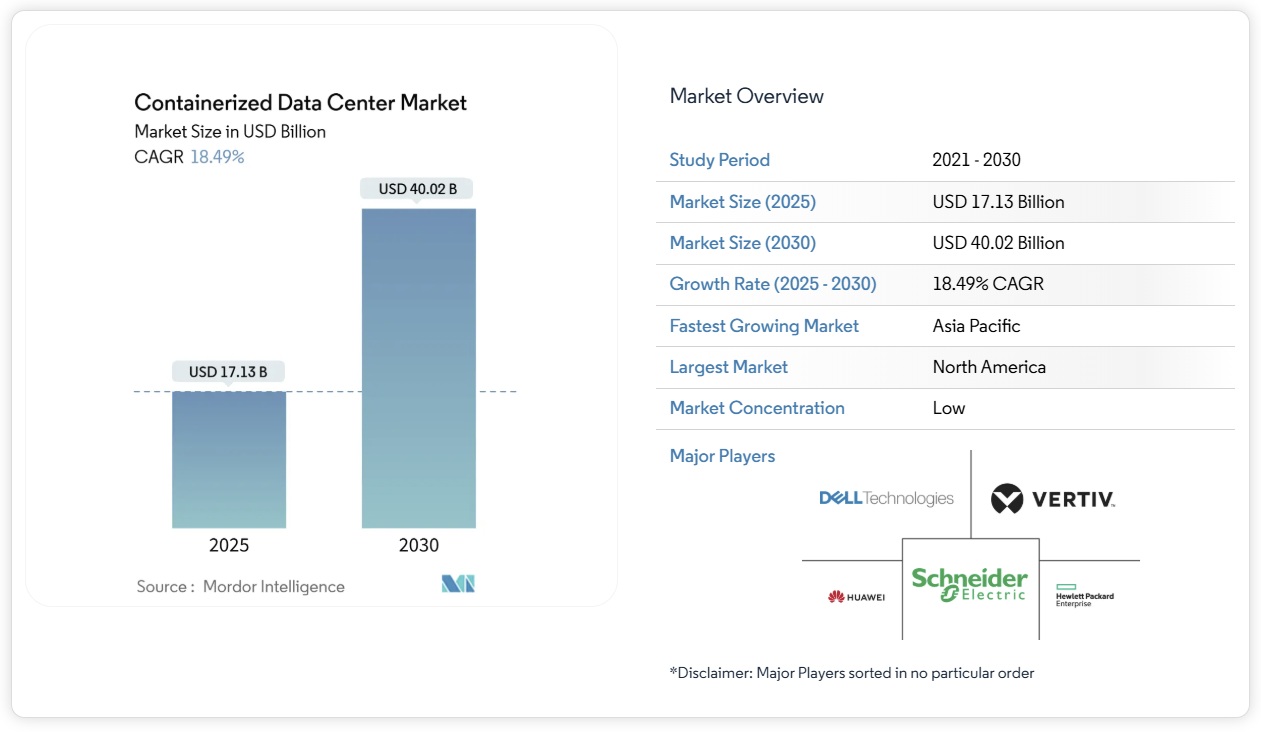

コンテナ型データセンター市場規模は、2026年には202.4億米ドルに達すると推定され、2025年の171.3億米ドルから増加しています。2031年には465.4億米ドルに達すると予測されており、2026年から2031年にかけて年平均成長率(CAGR)18.12%で成長します。5Gの展開、エッジコンピューティング、厳格な持続可能性規制に牽引され、迅速に導入できる容量に対する需要が急増し、受注残は長期化しています。ハイパースケール事業者は、コンテナモジュールを使用して数年にわたる建設の遅れを補い、企業はデータ主権ルールを満たすためにコンテナモジュールを導入しています。プレファブリケーションの効率性により、電力使用効率(PUE)マージンが引き締められ、総所有コスト(TCO)が削減され、モビリティが競争上の差別化要因となっています。ベンダーは、液体冷却、熱回収、原子力または水素マイクログリッドを組み合わせて孤立電力を解放し、コンテナ型データセンター市場を持続的な2桁成長に向けて位置付けています。

Containerized Data Center Market Analysis

The containerized data center market size in 2026 is estimated at USD 20.24 billion, growing from 2025 value of USD 17.13 billion with 2031 projections showing USD 46.54 billion, growing at 18.12% CAGR over 2026-2031. Surging demand for rapid-deployment capacity, driven by 5G rollouts, edge computing, and stricter sustainability mandates, continues to lengthen order books. Hyperscale operators use container modules to bridge multi-year construction lags, while enterprises deploy them to meet data-sovereignty rules. Prefabricated efficiencies are tightening power usage effectiveness (PUE) margins and lowering total cost of ownership, making mobility a competitive differentiator. Vendors combine liquid cooling, heat-recovery, and nuclear or hydrogen micro-grids to unlock stranded power, positioning the containerized data center market for sustained double-digit expansion.

Global Containerized Data Center Market Trends and Insights

Edge/5G build-outs accelerate micro-sites

Telecom carriers are rolling out thousands of micro edge nodes to support ultra-low-latency services, choosing modular units that move from purchase order to “lights on” in weeks. The May 2024 ANSI/TIA-942-C update created Type A and Type B micro-edge ratings, giving operators a uniform compliance path and accelerating procurement cycles. Container form factors let providers relocate capacity as coverage maps evolve, strengthening the containerized data center market presence in dense urban cores and rural gaps alike. Demand spans autonomous vehicles, industrial IoT, and AR/VR, all of which require consistent sub-10 ms latency at the network edge. Vendors now bundle 5G radios, MEC servers, and battery storage into single-lift units, compressing deployment timelines and capital risk. As 5G densification peaks in 2026, a second wave of private-network projects will keep micro-site pipelines active.

Capacity shortages in Tier-1 hubs

Land, power, and permitting bottlenecks in Northern Virginia, Silicon Valley, and London have pushed new hyperscale projects into 2028 commissioning windows, forcing operators to lease interim modular capacity that can be live in 8-12 weeks. The containerized data center market thus shifts from temporary overflow to strategic footprint, enabling cloud firms to preserve customer SLAs despite grid constraints. Real-estate investors in Virginia report occupancy premiums topping 20% for modular campuses positioned near substation upgrades. Enterprises view the modules as insurance against entitlement delays and grid curtailments, and many plan to redeploy units once permanent halls come online.

Limited rack density vs hyperscale needs

ISO 40-foot boxes typically support 10–15 kW per rack, capping a single module at 60–180 kW IT power, whereas purpose-built hyperscale suites reach 20–40 kW densities and 300-500 kW in comparable floor area. AI and HPC clusters demanding hundreds of GPUs per rack therefore require multiple containers or specialized liquid-cooling retrofits, inflating capital cost per MW. The density gap is magnified in high-real-estate markets like Tokyo and Frankfurt, where every square meter carries a premium. Vendors answer with immersed cold-plate designs, yet deployment proof points remain limited. Until density parity closes, some hyperscale architects will reserve containerized systems for peripheral or transitional loads.

Other drivers and restraints analyzed in the detailed report include:

- Energy-efficient prefabrication lowers TCO

- SMR-powered micro-grids enable off-grid DCs

- Legacy estate integration complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Purchase option held 77.60% of containerized data center market share in 2025, fueled by BFSI and government mandates for asset control. However, Lease/“White-Space-as-a-Service” is growing at 19.74% CAGR as CFOs pivot to OpEx models that track utilization. Early adopters note that bundled monitoring and refresh services reduce staffing burdens and de-risk technology obsolescence. Hewlett Packard Enterprise’s Facility-as-a-Service offering guarantees performance SLAs over multi-year terms, signaling that incumbent vendors embrace subscription economics.

Leasing democratizes high-spec capacity for mid-tier firms, swelling the containerized data center market footprint across secondary metros and edge use cases. Start-ups avoid upfront capital outlays, while large enterprises offload residual-value risk. The flexibility to return, relocate, or swap modules after the term also fits volatile AI workload profiles. Purchase models will persist where security classification or custom engineering outweigh leasing’s convenience, yet the service curve is poised to steepen through 2031.

ISO 40-foot shells retained 54.10% of containerized data center market size in 2025, benefiting from global freight standards and lower per-rack cost. Customized/All-in-One Skids, advancing at 19.18% CAGR, integrate higher rack counts, direct-to-chip liquid cooling, and on-board UPS, appealing to AI and analytics clusters. UL 2755 certification assures safety parity with fixed facilities, easing enterprise procurement hurdles.

Demand for bespoke thermal envelopes pushes vendors to engineer 30 kW-plus racks and heat-reuse loops inside nonstandard footprints, lifting average selling price yet compressing deployment times compared with greenfield halls. As rack power escalates post-2026, many hyperscale architects view custom skids as the only pragmatic route to situate GPUs near renewable feed-in points. ISO 20-foot boxes, while niche, remain relevant for telecom edge shelters and space-constrained urban rooftops.

Containerized Data Center Market is Segmented by Ownership Type ( Purchase, Lease / “White-Space-As-A-Service”), Container Type (ISO 20-Ft, ISO 40-Ft, Customized/All-in-One Skids), Deployment Location ( Core / Campus, Edge / Micro, Remote / Harsh-Environment), End User Industry (IT and Telecommunications, BFSI and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 29.05% of 2025 revenue, anchored by hyperscale conversions of crypto mines into AI campuses across Texas, Georgia, and Alberta. The United States absorbs modules to circumvent multi-year queue backlogs for new grid interconnects, while Canada employs ruggedized pods for tar-sand monitoring and Arctic broadband gateways. Mexico’s near-shoring renaissance drives maquiladora plant owners to install edge pods that sync real-time quality data with US logistics hubs. Together these trends reinforce the containerized data center market as a strategic overlay across the continent.

Asia-Pacific, the fastest-growing region at 18.01% CAGR, scales 5G macro builds and smart-city pilots across China, India, and ASEAN. Provinces grant accelerated permits for container clusters that can later shift sites as urban plans evolve. India’s data-localization rulebook boosts demand for micro-regional pods, allowing cloud providers to ring-fence citizen data near consumption zones. Japan and Australia value seismic and cyclone resilience inherent in steel-framed modules. Collectively, diversified drivers keep the region’s order pipeline robust.

List of Companies Covered in this Report:

- Vertiv

- Schneider Electric

- Huawei Technologies

- Dell Technologies

- Hewlett Packard Enterprise

- IBM Corporation

- Cisco Systems

- Rittal GmbH and Co. KG

- Delta Electronics

- Eaton Corporation

- Johnson Controls

- PCX Corporation

- BMarko Structures

- Baselayer Technology

- Flexenclosure (Xerxes)

- Cirrascale Cloud Services

- ZTE Corporation

- AST Modular (subs. of Schneider)

- Cannon Technologies

- EdgeMicro / EDJX

- Compass Datacenters

- EdgeConneX

- Vertiv (Emerson Network Power legacy)

- Stulz GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

1 INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

4.1 Market Overview

4.2 Market Drivers

4.2.1 Portability and rapid deployment

4.2.2 Edge/5G build-outs accelerate micro-sites

4.2.3 Data-center capacity shortages in Tier-1 hubs

4.2.4 Energy-efficient prefabrication lowers TCO

4.2.5 SMR-powered micro-grids enable off-grid DCs

4.2.6 Crypto-to-AI site conversions unlock stranded power

4.3 Market Restraints

4.3.1 Limited rack and compute density vs hyperscale needs

4.3.2 Integration complexity with legacy DC estates

4.3.3 ISO-container supply-chain bottlenecks

4.3.4 Liquid-cooling retrofits raise CAPEX

4.4 Supply-Chain Analysis

4.5 Regulatory Landscape

4.6 Technological Outlook

4.7 Porter’s Five Forces

4.7.1 Bargaining Power of Suppliers

4.7.2 Bargaining Power of Buyers

4.7.3 Threat of New Entrants

4.7.4 Threat of Substitutes

4.7.5 Intensity of Rivalry

4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

5.1 By Ownership Type

5.1.1 Purchase

5.1.2 Lease / White-Space-as-a-Service

5.2 By Container Type

5.2.1 ISO 20-ft

5.2.2 ISO 40-ft

5.2.3 Customized/All-in-One Skids

5.3 By Deployment Location

5.3.1 Core / Campus

5.3.2 Edge / Micro

5.3.3 Remote / Harsh-Environment

5.4 By End-User Industry

5.4.1 IT and Telecommunications

5.4.2 BFSI

5.4.3 Government and Defense

5.4.4 Healthcare

5.4.5 Education

5.4.6 Others

5.5 By Geography

5.5.1 North America

5.5.1.1 United States

5.5.1.2 Canada

5.5.1.3 Mexico

5.5.2 South America

5.5.2.1 Brazil

5.5.2.2 Argentina

5.5.2.3 Rest of South America

5.5.3 Europe

5.5.3.1 Germany

5.5.3.2 United Kingdom

5.5.3.3 France

5.5.3.4 Netherlands

5.5.3.5 Rest of Europe

5.5.4 Asia-Pacific

5.5.4.1 China

5.5.4.2 Japan

5.5.4.3 India

5.5.4.4 South Korea

5.5.4.5 Australia and New Zealand

5.5.4.6 Rest of Asia-Pacific

5.5.5 Middle East and Africa

5.5.5.1 Middle East

5.5.5.1.1 United Arab Emirates

5.5.5.1.2 Saudi Arabia

5.5.5.1.3 Turkey

5.5.5.1.4 Rest of Middle East

5.5.5.2 Africa

5.5.5.2.1 South Africa

5.5.5.2.2 Egypt

5.5.5.2.3 Nigeria

5.5.5.2.4 Rest of Africa

6 COMPETITIVE LANDSCAPE

6.1 Market Concentration

6.2 Strategic Moves

6.3 Market Share Analysis

6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

6.4.1 Vertiv

6.4.2 Schneider Electric

6.4.3 Huawei Technologies

6.4.4 Dell Technologies

6.4.5 Hewlett Packard Enterprise

6.4.6 IBM Corporation

6.4.7 Cisco Systems

6.4.8 Rittal GmbH and Co. KG

6.4.9 Delta Electronics

6.4.10 Eaton Corporation

6.4.11 Johnson Controls

6.4.12 PCX Corporation

6.4.13 BMarko Structures

6.4.14 Baselayer Technology

6.4.15 Flexenclosure (Xerxes)

6.4.16 Cirrascale Cloud Services

6.4.17 ZTE Corporation

6.4.18 AST Modular (subs. of Schneider)

6.4.19 Cannon Technologies

6.4.20 EdgeMicro / EDJX

6.4.21 Compass Datacenters

6.4.22 EdgeConneX

6.4.23 Vertiv (Emerson Network Power legacy)

6.4.24 Stulz GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

7.1 White-space and Unmet-Need Assessment