Climate Change Consulting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Climate Change Consulting Market Report is Segmented by Service Type (Risk Assessment and Scenario Analysis, and More), End-User Industry (Energy and Power, and More), Organization Size (Large Enterprises, and More), Consultancy Type (Multidisciplinary Engineering Firms, and More), Delivery Mode (On-Site Advisory, and More), and Geography (North America, and More).

気候変動コンサルティング市場レポートは、サービスタイプ(リスク評価、シナリオ分析など)、エンドユーザー産業(エネルギーおよび電力など)、組織規模(大企業など)、コンサルティングタイプ(多分野にわたるエンジニアリング会社など)、提供モード(オンサイトアドバイザリなど)、および地域(北米など)別にセグメント化されています。

| 出版 | Mordor Intelligence |

| 出版年月 | 2026年02月 |

| ページ数 | 134 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,750 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-13215 |

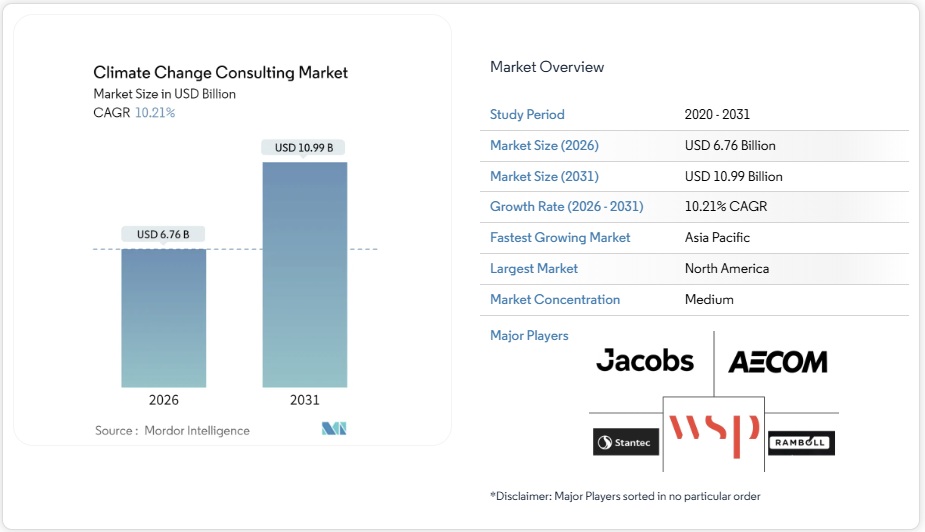

気候変動コンサルティング市場は2025年に61億3,000万米ドルと評価され、2026年の67億6,000万米ドルから2031年には109億9,000万米ドルに達し、予測期間(2026~2031年)中に年平均成長率(CAGR)10.21%で成長すると予測されています。この成長加速は、情報開示規則の厳格化、投資家からの圧力、サステナビリティ連動型ファイナンスの需要拡大、AIを活用したリスク分析の急速な進歩を反映しています。欧州連合(EU)、米国、アジア太平洋地域におけるESG報告の義務化により、数千社もの企業が外部助言を求めるようになり、プライベートエクイティの所有者や資産運用会社は、ポートフォリオ企業への融資前に詳細なカーボンシャドウ監査を期待しています。同時に、気候リスクモデリングの飛躍的進歩により、コンサルタントは移行および物理的ハザードをこれまでにない粒度で定量化できるようになり、対応可能な顧客基盤が拡大しています。 OEM(相手先商標製造会社)が課すサプライチェーンの脱炭素化義務により、中小企業(SME)の間で新たな収益プールが開拓され、デジタル配信モデルによって大きな移動の負担なく地理的範囲が拡大しています。

Climate Change Consulting Market Analysis

The climate change consulting market was valued at USD 6.13 billion in 2025 and estimated to grow from USD 6.76 billion in 2026 to reach USD 10.99 billion by 2031, at a CAGR of 10.21% during the forecast period (2026-2031). This acceleration reflects tighter disclosure rules, investor pressure, growing demand for sustainability-linked finance, and rapid advances in AI-enabled risk analytics. Mandatory ESG reporting across the European Union, the United States, and Asia-Pacific is forcing thousands of companies to seek external advice, while private-equity owners and asset managers expect detailed carbon-shadow audits before financing portfolio firms. At the same time, breakthroughs in climate-risk modeling allow consultants to quantify transition and physical hazards with unprecedented granularity, expanding the addressable client base. Supply-chain decarbonization mandates imposed by original equipment manufacturers (OEMs) are opening new revenue pools among small and medium enterprises (SMEs), and digital delivery models are widening geographic reach without heavy travel footprints.

Global Climate Change Consulting Market Trends and Insights

Mandatory ESG disclosures tightening worldwide

New disclosure regimes such as the Corporate Sustainability Reporting Directive (CSRD) cover roughly 50,000 European companies, and many are turning to external advisors to interpret double-materiality rules. Singapore, Hong Kong, Malaysia, and Taiwan have adopted International Sustainability Standards Board (ISSB) baselines that phase in from 2025, widening the compliance net. In the United States, pending Securities and Exchange Commission rules have already spurred preparatory scenario analysis and emissions reporting exercises. Enterprises view compliance as a value-creation lever rather than a cost center, which underpins sustained spending on advisory services. Consultants who combine regulatory interpretation with technology platforms are winning multiyear mandates.

Investor-led carbon-shadow audits

Asset managers such as BlackRock demand granular verification of Scope 1, 2, and 3 emissions before allocating capital, elevating the rigour of sustainability due diligence workstreams. Private-equity buyers now embed decarbonization milestones in shareholder agreements, creating recurring advisory revenue around progress tracking. Carbon-shadow audits have proliferated in energy, materials, and transport portfolios where transition risk is pronounced. Consultants offering audit-ready data protocols and third-party verification gain preferred-supplier status with institutional investors. This trend cascades into middle-market deals as lenders embed emissions covenants in credit facilities.

Scarcity of verifiable Scope 3 data

Supply-chain emissions account for as much as 90% of a corporation’s footprint, yet data heterogeneity and lack of supplier engagement impede accurate measurement. Consultants often rely on proxy values, which erode confidence among investors and regulators. Smaller suppliers in emerging economies lack monitoring tools, further constraining disclosure reliability. Verification backlogs delay assurance statements, limiting advisory turnover. Market participants, therefore, demand interoperable data standards and third-party validation services to unlock scale.

Other drivers and restraints analyzed in the detailed report include:

- Sustainability-linked finance boom

- OEM-driven supply-chain decarbonization

- Talent shortage at climate–finance interface

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Risk Assessment and Scenario Analysis accounted for 22.95% of the climate change consulting market share in 2025, underscoring corporate appetite for forward-looking climate models that meet Task Force on Climate-related Financial Disclosures requirements. The segment’s growth is propelled by banks, insurers, and energy companies seeking quantitative insights into transition and physical risk exposure. Sustainable Finance and ESG Integration, while smaller, is outpacing every other category with a 14.10% CAGR to 2031 as loan-pricing incentives hinge on credible targets. Consultants are packaging analytics with advisory to create integrated solutions that bundle scenario inputs, KPI design, and external verification.

Demand for GHG Accounting and Reporting remains steady because it provides the data foundation for downstream strategy. Climate Adaptation and Resilience Planning gains traction among infrastructure owners that face material physical threats such as flooding and heat stress. Carbon Offset and Trading Advisory sees episodic volume spikes linked to voluntary-market price swings and regulatory clarity on quality standards. Emerging niches such as nature-based solutions advisory and circular-economy design round out the portfolio, representing option value for early movers that can scale frameworks quickly.

The Public Sector commanded 18.75% of the climate change consulting market size in 2025, thanks to stimulus-funded decarbonization projects and sovereign-level disclosure obligations. Yet Financial Services is the clear momentum leader, expanding at 12.85% per year as prudential supervisors embed climate risk into capital frameworks. Banks require sophisticated scenario models to stress-test portfolios, while asset managers seek stewardship roadmaps to engage investee firms.

Energy and Power clients remain large spenders on transition planning because net-zero roadmaps involve complex asset-retirement and renewable-integration decisions. Manufacturing industries invest in Scope 3 decarbonization programs to keep OEM contracts, while Mining and Metals firms pursue nature-positive strategies to secure financing. ICT providers focus on data-center efficiency and circular-hardware programs, whereas Agriculture and Food players tackle methane reduction and regenerative practices. Transport companies look for fleet electrification blueprints that balance cost, range, and infrastructure risk.

The Climate Change Consulting Market Report is Segmented by Service Type (Risk Assessment and Scenario Analysis, and More), End-User Industry (Energy and Power, and More), Organization Size (Large Enterprises, and More), Consultancy Type (Multidisciplinary Engineering Firms, and More), Delivery Mode (On-Site Advisory, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained leadership with 29.85% climate change consulting market share in 2025 on the back of Securities and Exchange Commission draft rules and robust investor activism. Major financial centers such as New York and Toronto host both Big Four hubs and pure-play boutiques, creating dense talent clusters. The region also leads AI-based climate-risk analytics adoption as enterprises pilot digital twins to test asset resilience.

Europe remains a powerhouse thanks to the CSRD, EU taxonomy, and carbon-border adjustment rules that collectively expand the compliance universe to roughly 50,000 firms. Germany, the United Kingdom, and France drive deal flow, while Spain and Italy catch up via energy-transition stimulus. Consultants with pan-European delivery networks and multilingual teams enjoy an advantaged positioning because regulatory nuances differ among member states.

Asia-Pacific records the fastest growth at 11.05% CAGR through 2031 as China’s 2060 net-zero pledge, India’s massive renewable roll-out, and Southeast Asia’s ISSB adoption converge to create unprecedented advisory demand. Japan and South Korea require advanced scenario planning to manage export exposure to EU carbon tariffs. Australia leans on consulting support to implement nature-based carbon removal and adaptation strategies in infrastructure planning.

South America and the Middle East & Africa represent emerging but volatile markets. Brazil’s deforestation-related disclosure rules, Argentina’s renewable auctions, and Colombia’s green-bond pipeline are early catalysts. In the Middle East, Saudi Arabia and the United Arab Emirates seek diversification from hydrocarbons, generating mandates in hydrogen road-mapping and green-finance structuring. Africa’s demand is concentrated in South Africa’s carbon-tax compliance and Kenya’s climate-resilient agriculture initiatives, albeit constrained by fiscal capacity and data gaps. Consultants that package global best practices with localized delivery endure lower project margins but gain strategic footholds for future expansion.

List of Companies Covered in this Report:

- Jacobs Solutions Inc.

- AECOM

- WSP Global Inc.

- Stantec Inc.

- Ramboll Group A/S

- Tetra Tech Inc.

- ERM International Group Ltd.

- Arup Group Ltd.

- GHD Group Pty Ltd.

- Sweco AB

- Deloitte Touche Tohmatsu Ltd.

- PricewaterhouseCoopers International Ltd.

- KPMG International Ltd.

- Ernst and Young Global Ltd.

- McKinsey and Company

- Boston Consulting Group Inc.

- ICF International Inc.

- South Pole Holding AG

- Carbon Trust Advisory Ltd.

- Sustainalytics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

1 INTRODUCTION

1.1 Study Assumptions and Market Definition

1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

4.1 Market Overview

4.2 Market Drivers

4.2.1 Mandatory ESG disclosures tightening worldwide

4.2.2 Corporate carbon-shadow audits demanded by investors

4.2.3 Rapid scaling of sustainability-linked finance instruments

4.2.4 Supply-chain decarbonisation pressures from OEMs

4.2.5 Breakthroughs in AI-driven climate-risk analytics

4.2.6 Growing demand for nature-based carbon removal advisory

4.3 Market Restraints

4.3.1 Scarcity of verifiable Scope 3 emissions data

4.3.2 Talent shortage in climate science and finance interface

4.3.3 Inconsistent regional carbon-pricing mechanisms

4.3.4 Green-washing litigation risk discouraging advisory uptake

4.4 Industry Value Chain Analysis

4.5 Regulatory Landscape

4.6 Technological Outlook

4.7 Porter’s Five Forces Analysis

4.7.1 Bargaining Power of Suppliers

4.7.2 Bargaining Power of Buyers

4.7.3 Threat of New Entrants

4.7.4 Threat of Substitutes

4.7.5 Competitive Rivalry

4.8 Service Trend Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

5.1 By Service Type

5.1.1 Risk Assessment and Scenario Analysis

5.1.2 GHG Accounting and Reporting

5.1.3 Decarbonisation Strategy and Road-mapping

5.1.4 Climate Adaptation and Resilience Planning

5.1.5 Carbon Offset and Trading Advisory

5.1.6 Sustainable Finance and ESG Integration

5.1.7 Other Services

5.2 By End-User Industry

5.2.1 Energy and Power

5.2.2 Mining and Metals

5.2.3 Public Sector

5.2.4 Manufacturing

5.2.5 Financial Services

5.2.6 ICT and Telecom

5.2.7 Agriculture and Food

5.2.8 Transportation and Logistics

5.2.9 Other Industries

5.3 By Organization Size

5.3.1 Large Enterprises

5.3.2 Small and Medium Enterprises

5.4 By Consultancy Type

5.4.1 Multidisciplinary Engineering Firms

5.4.2 Pure-play Sustainability Boutiques

5.4.3 Big Four Accounting Firms

5.4.4 Management Consulting Firms

5.4.5 Think Tanks and NGOs

5.5 By Delivery Mode

5.5.1 On-site Advisory

5.5.2 Remote / Virtual Advisory

5.5.3 Hybrid Engagements

5.6 By Geography

5.6.1 North America

5.6.1.1 United States

5.6.1.2 Canada

5.6.1.3 Mexico

5.6.2 Europe

5.6.2.1 Germany

5.6.2.2 United Kingdom

5.6.2.3 France

5.6.2.4 Spain

5.6.2.5 Italy

5.6.2.6 Rest of Europe

5.6.3 Asia-Pacific

5.6.3.1 China

5.6.3.2 Japan

5.6.3.3 India

5.6.3.4 South Korea

5.6.3.5 Rest of Asia-Pacific

5.6.4 South America

5.6.4.1 Brazil

5.6.4.2 Argentina

5.6.4.3 Rest of South America

5.6.5 Middle East and Africa

5.6.5.1 Middle East

5.6.5.1.1 Israel

5.6.5.1.2 Saudi Arabia

5.6.5.1.3 United Arab Emirates

5.6.5.1.4 Turkey

5.6.5.1.5 Rest of Middle East

5.6.5.2 Africa

5.6.5.2.1 South Africa

5.6.5.2.2 Egypt

5.6.5.2.3 Rest of Africa

6 COMPETITIVE LANDSCAPE

6.1 Market Concentration

6.2 Strategic Moves

6.3 Market Share Analysis

6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

6.4.1 Jacobs Solutions Inc.

6.4.2 AECOM

6.4.3 WSP Global Inc.

6.4.4 Stantec Inc.

6.4.5 Ramboll Group A/S

6.4.6 Tetra Tech Inc.

6.4.7 ERM International Group Ltd.

6.4.8 Arup Group Ltd.

6.4.9 GHD Group Pty Ltd.

6.4.10 Sweco AB

6.4.11 Deloitte Touche Tohmatsu Ltd.

6.4.12 PricewaterhouseCoopers International Ltd.

6.4.13 KPMG International Ltd.

6.4.14 Ernst and Young Global Ltd.

6.4.15 McKinsey and Company

6.4.16 Boston Consulting Group Inc.

6.4.17 ICF International Inc.

6.4.18 South Pole Holding AG

6.4.19 Carbon Trust Advisory Ltd.

6.4.20 Sustainalytics

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

7.1 White-space and Unmet-need Assessment