Automotive HVAC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Automotive HVAC Market Report is Segmented by Technology Type (Manual/Semi-automatic HVAC and Automatic HVAC), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Component (Compressor, Condenser, and More), Propulsion Type (ICE Vehicles, Hybrid and Plug-In Hybrid Vehicles, and More), Sales Channel (OEM Factory-Fit and More), and Geography.

自動車用HVAC 市場レポートは、テクノロジー タイプ (手動/半自動 HVAC および自動 HVAC)、車両タイプ (乗用車、小型商用車など)、コンポーネント (コンプレッサー、コンデンサーなど)、推進タイプ (ICE 車、ハイブリッド車およびプラグイン ハイブリッド車など)、販売チャネル (OEM 工場装着など)、および地域別にセグメント化されています。

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年02月 |

| ページ数 | 150 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,750 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-13231 |

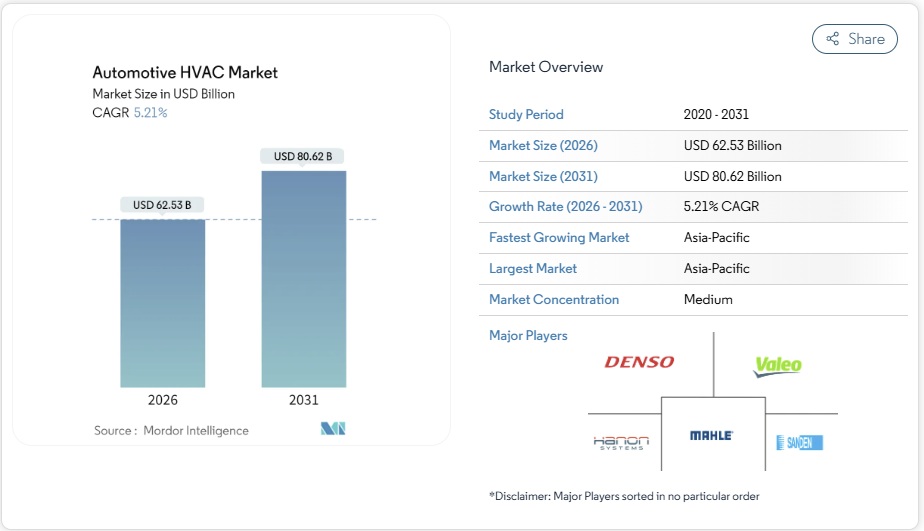

自動車用HVAC市場は2025年に594.4億米ドルと評価され、2026年の625.3億米ドルから2031年には806.2億米ドルに達し、予測期間(2026~2031年)中に5.21%のCAGRで成長すると予測されています。この着実な拡大は、このセクターの電動パワートレインへの移行、より厳格な快適性規制、そして高まる消費者の期待を反映しています。アジア太平洋地域は依然として主要な製造拠点であり、厳格化する排出ガス規制は熱管理技術の継続的なアップグレードを促進しています。一方、自動気候制御システムは量販車のラインナップに導入され、かつては高級車に限定されていた価格プレミアムを圧縮しています。部品サプライヤーは、電子制御、高度な濾過、低GWP冷媒適合性によって差別化を図り、HVACを補助的な快適モジュールから車両電動化の重要な実現要素へと再配置しています。

Automotive HVAC Market Analysis

The automotive HVAC market was valued at USD 59.44 billion in 2025 and estimated to grow from USD 62.53 billion in 2026 to reach USD 80.62 billion by 2031, at a CAGR of 5.21% during the forecast period (2026-2031). This steady expansion reflects the sector’s transition toward electrified powertrains, stricter comfort regulations, and rising consumer expectations. Asia-Pacific remains the principal manufacturing hub, and its tightening emissions rules spur continuous upgrades of thermal-management technology. Meanwhile, automatic climate-control systems enter mass-market vehicle lines, compressing the price premium that once confined them to luxury models. Component suppliers differentiate through electronic control, advanced filtration, and low-GWP refrigerant compatibility, repositioning HVAC from an auxiliary comfort module to a critical enabler of vehicle electrification.

Global Automotive HVAC Market Trends and Insights

HVAC Efficiency Requirements for EV Heat-Pump Systems

BEV adoption turns HVAC into a range-critical subsystem. Heat pumps that achieve a coefficient of performance above 3.0 at –10 °C can save up to 11 kWh during a 300 km winter drive, mitigating the 40% range penalty seen with resistive heaters. Automakers integrate coolant loops among battery, power electronics, and cabin to harvest waste heat, prompting suppliers to deliver multi-port valves and inverter-driven compressors tuned for low-temperature vapor injection. Regulatory incentives that reward vehicle efficiency, such as China’s MIIT credits, incentivize OEMs to specify premium HVAC even for entry-segment EVs.

Demand for Automatic Climate-Control Comfort

Consumer preference for automatic systems intensifies as vehicles migrate to connected architectures that enable remote pre-conditioning, voice commands, and user-profile learning. Precise temperature maintenance reduces driver fatigue and distraction, aligning with safety priorities as SUVs with larger cabin volumes proliferate. OEMs bundle automatic HVAC with infotainment packages to lift average transaction prices, and falling sensor costs encourage deployment in compact models. Uptake accelerates in emerging economies where rising incomes elevate comfort expectations. In BEVs, automatic control also orchestrates energy-efficient cabin warming strategies that preserve battery state of charge during urban commutes.

Higher Unit Cost and Complexity for Automatic HVAC

Electronic expansion valves, stepper-motor actuators, and multi-sensor clusters elevate bill-of-materials cost by up to 50% relative to manual systems, limiting penetration in entry-segment hatchbacks. Service networks require diagnostic scan tools and technician retraining, further inflating lifecycle expense. Semiconductor shortages introduce procurement volatility, encouraging OEMs in Brazil and Indonesia to delay standardization of automatic climate control despite consumer interest.

Other drivers and restraints analyzed in the detailed report include:

- Post-Pandemic Focus on Cabin Air-Quality and Filtration

- Safety and Comfort Regulations in Emerging Markets

- HVAC Load Cutting EV Driving-Range Targets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Automatic systems capture incremental share as sensor prices fall and OEMs exploit telematics platforms to deliver comfort subscriptions. In 2025, manual and semi-automatic solutions still dominated with a 58.12% of the automotive HVAC market share in 2025. However, automatic setups will expand at a 9.25% CAGR through 2031, adding nearly USD 16.8 billion in incremental value. AI-based learning profiles elevate the user experience, while integration with battery preconditioning benefits BEVs.

Standardizing single-zone automatic control in C-segment cars compresses the cost gap relative to manual rotary dials. In premium models, dual- and tri-zone configurations underpin add-on pricing. Suppliers that mastered in-house algorithm development now cross-sell software consultancy, while legacy mechanical firms partner with microcontroller specialists to stay competitive.

Passenger cars account for 79.62% of the automotive HVAC market share in 2025, yet buses and coaches will outpace at a 6.55% CAGR to 2031 as governments legislate passenger comfort mandates. Ride-sharing minibus services favor roof-mounted units with integrated HEPA filtration to win municipal contracts.

Light commercial vehicles serving last-mile logistics adopt auxiliary electric air-conditioning to allow engine-off parcel drops, reducing idling penalties in low-emission zones. Medium and heavy trucks in India, Indonesia, and Mexico shift toward factory-fit AC to comply with new safety rules, enlarging volume for robust compressor designs that tolerate dusty duty cycles.

The Automotive HVAC Market Report is Segmented by Technology Type (Manual/Semi-automatic HVAC and Automatic HVAC), Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Component (Compressor, Condenser, and More), Propulsion Type (ICE Vehicles, Hybrid and Plug-In Hybrid Vehicles, and More), Sales Channel (OEM Factory-Fit and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 48.55% of the automotive HVAC market share in 2025 and is set to maintain the lead with a 5.55% CAGR through 2031. China’s 2025 NEV sales quota compels local OEMs to adopt integrated heat-pump modules that operate efficiently in -20 °C northern winters. India’s blanket AC mandate for heavy trucks fuels bulk orders for rugged compressors built to tolerate high vibration. Japan and South Korea export high-precision electronic expansion valves, reinforcing the region’s value-chain completeness.

North America reflects a mature yet technologically progressive market. Pickup trucks and SUVs require high-capacity condensers to serve large cabin volumes, and frigid climates in Canada and the northern United States validate cold-weather heat-pump performance. Mitsubishi Electric’s USD 143.5 million retrofit of its Kentucky plant for variable-speed compressor lines underscores the region’s strategic focus on domestically sourced HVAC for EV applications.

Europe enforces the most aggressive low-GWP refrigerant timeline, accelerating the adoption of R1234yf and pushing suppliers toward natural refrigerant R744 prototypes for post-2030 compliance. Urban bus electrification programs in Germany and France stipulate energy-efficient heat-pump systems to meet tender requirements. ISO 13043:2011 sets performance benchmarks that ripple through supplier quality-management systems, ensuring system integrity across the continent .

List of Companies Covered in this Report:

- Denso Corporation

- Valeo Group

- Hanon Systems Co., Ltd.

- MAHLE GmbH

- Sanden Corporation

- Marelli Holdings Co., Ltd.

- Keihin Corporation

- Japan Climate Systems Corporation

- Mitsubishi Heavy Industries, Ltd.

- Samvardhana Motherson International Limited

- HELLA GmbH & Co. KGaA

- Subros Ltd.

- Aisin Corporation

- Eberspächer Group

- Brose Fahrzeugteile

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Table of Contents

1 Introduction

1.1 Study Assumptions & Market Definition

1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

4.1 Market Overview

4.2 Market Drivers

4.2.1 HVAC Efficiency Requirements for EV Heat-Pump Systems

4.2.2 Demand for Automatic Climate-Control Comfort

4.2.3 Post-Pandemic Focus on Cabin Air-Quality and Filtration

4.2.4 Safety and Comfort Regulations in Emerging Markets

4.2.5 Ride-Hailing Fleet Retro-Fit Demand Surge

4.2.6 AI-Based Predictive and Zonal Climate Functions

4.3 Market Restraints

4.3.1 Higher Unit Cost and Complexity for Automatic HVAC

4.3.2 HVAC Load Cutting EV Driving-Range Targets

4.3.3 Costly Transition to Low-GWP Refrigerants

4.3.4 Shortage of Technicians Trained on New Refrigerants

4.4 Value / Supply-Chain Analysis

4.5 Regulatory Landscape

4.6 Technological Outlook

4.7 Porter’s Five Forces Analysis

4.7.1 Bargaining Power of Suppliers

4.7.2 Bargaining Power of Buyers

4.7.3 Threat of New Entrants

4.7.4 Threat of Substitutes

4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

5.1 By Technology Type

5.1.1 Manual / Semi-automatic HVAC

5.1.2 Automatic HVAC

5.2 By Vehicle Type

5.2.1 Passenger Cars

5.2.2 Light Commercial Vehicles (LCV)

5.2.3 Medium and Heavy Commercial Vehicles

5.2.4 Buses and Coaches

5.3 By Component

5.3.1 Compressor

5.3.2 Condenser

5.3.3 Evaporator

5.3.4 Expansion Valve / Orifice Tube

5.3.5 Receiver-Dryer and Accumulator

5.3.6 Electronic and Sensor Suite

5.4 By Propulsion Type

5.4.1 ICE Vehicles

5.4.2 Hybrid and Plug-in Hybrid Vehicles

5.4.3 Battery-Electric Vehicles

5.5 By Sales Channel

5.5.1 OEM Factory-Fit

5.5.2 Aftermarket Retro-Fit and Service

5.6 By Geography

5.6.1 North America

5.6.1.1 United States

5.6.1.2 Canada

5.6.1.3 Rest of North America

5.6.2 South America

5.6.2.1 Brazil

5.6.2.2 Argentina

5.6.2.3 Rest of South America

5.6.3 Europe

5.6.3.1 Germany

5.6.3.2 United Kingdom

5.6.3.3 France

5.6.3.4 Italy

5.6.3.5 Spain

5.6.3.6 Russia

5.6.3.7 Rest of Europe

5.6.4 Asia-Pacific

5.6.4.1 China

5.6.4.2 Japan

5.6.4.3 India

5.6.4.4 South Korea

5.6.4.5 Rest of Asia-Pacific

5.6.5 Middle East and Africa

5.6.5.1 United Arab Emirates

5.6.5.2 Saudi Arabia

5.6.5.3 Turkey

5.6.5.4 Egypt

5.6.5.5 South Africa

5.6.5.6 Rest of Middle East and Africa

6 Competitive Landscape

6.1 Market Concentration

6.2 Strategic Moves

6.3 Market Share Analysis

6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

6.4.1 Denso Corporation

6.4.2 Valeo Group

6.4.3 Hanon Systems Co., Ltd.

6.4.4 MAHLE GmbH

6.4.5 Sanden Corporation

6.4.6 Marelli Holdings Co., Ltd.

6.4.7 Keihin Corporation

6.4.8 Japan Climate Systems Corporation

6.4.9 Mitsubishi Heavy Industries, Ltd.

6.4.10 Samvardhana Motherson International Limited

6.4.11 HELLA GmbH & Co. KGaA

6.4.12 Subros Ltd.

6.4.13 Aisin Corporation

6.4.14 Eberspächer Group

6.4.15 Brose Fahrzeugteile

7 Market Opportunities & Future Outlook

7.1 White-Space & Unmet-Need Assessment