Geospatial Intelligence Market - Global Forecast To 2030

地理空間インテリジェンス市場 - GeoAI(エージェントGIS、モデルカタログ)、地理空間分析(従来のGISソリューション、位置情報インテリジェンス、データ処理とETL)、取得システム(PNT、GNSS)、テクノロジー(ラスター、画像分析) - 2030年までの世界予測

Geospatial Intelligence Market by GeoAI (Agentic GIS, Model Catalogs), Geospatial Analytics (Traditional GIS Solutions, Location Intelligence, Data Processing & ETL), Acquisition Systems (PNT, GNSS), Technology (Raster, Imagery Analytics) - Global Forecast to 2030

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年01月 |

| ページ数 | 521 |

| 図表数 | 688 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-11905 |

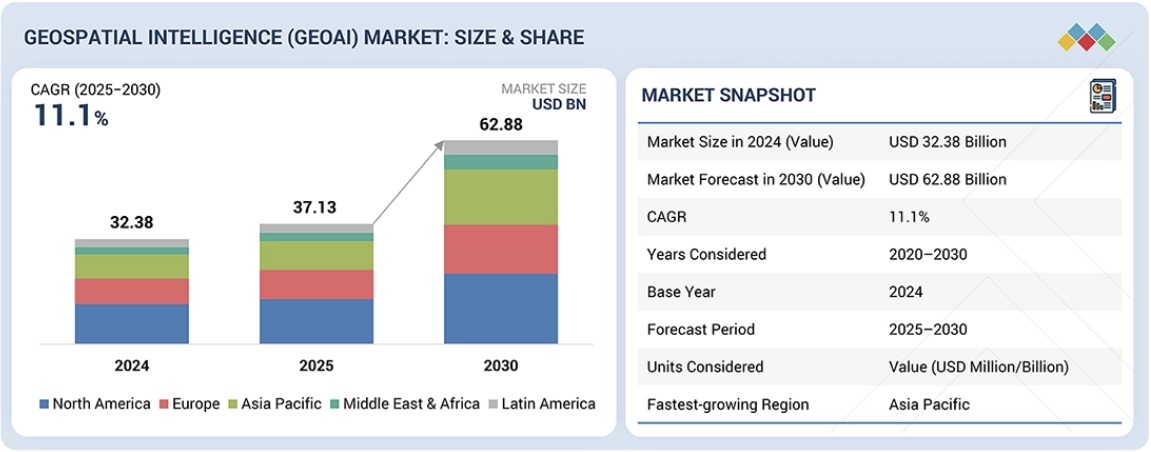

地理空間インテリジェンス(GeoAI)市場は、2025年の371億3,000万米ドルから2030年には628億8,000万米ドルに拡大し、予測期間中に年平均成長率(CAGR)11.1%で成長すると予測されています。市場の成長は、衛星、ドローン、センサー、コネクテッドデバイスから生成される複雑な地理空間データセットを分析するための人工知能(AI)と機械学習の利用増加に牽引されています。防衛、インフラ、ヘルスケア、環境モニタリングなどの分野で、組織は意思決定、リスク評価、運用効率の向上を目的とした地理空間インテリジェンスソリューションを導入しています。クラウドコンピューティング、データ融合、リアルタイム分析の進歩により、地理空間インテリジェンスプラットフォームの拡張性とアクセシビリティが向上しています。同時に、スマートインフラ、公共安全、気候変動へのレジリエンスへの投資増加により、高度なGeoAI機能に対する需要がさらに高まっています。

調査対象範囲

本調査レポートは、地理空間インテリジェンス(GeoAI)市場を網羅し、提供内容、コアテクノロジーアーキテクチャ、データタイプ、および業種別に分類しています。提供内容セグメントは、ソフトウェア、地理空間情報取得システム、およびサービスで構成されています。ソフトウェアセグメントには、GeoAIおよびMLプラットフォーム(エージェント型GISおよびAIコパイロット、GeoAIクラウドネイティブプラットフォーム、GeoAIモデルカタログなど)、地理空間分析(従来型GISソリューション(デスクトップGIS、Web/エンタープライズGIS、空間データベース、3D/4Dマッピングツール)、ロケーションインテリジェンス(空間クエリおよびインデックスエンジン、地理空間可視化エンジン、ロケーションエンリッチメントツール、空間APIおよびマイクロサービス)、およびデータ処理およびETL(ジオコーディングエンジン、空間データ統合ツール、ラスター/ベクター/CRSデータ変換)が含まれます。地理空間取得システムセグメントは、センシング&キャプチャ(衛星画像センサー、航空カメラ、LIDAR/3Dスキャナー)と測位&トラッキング(GNSS受信機[RTK/PPP]、慣性測定装置[IMU]、PNT[位置、ナビゲーション、タイミング]システム)に分かれています。サービスセグメントは、コアサービス(コンサルティング、導入・統合、カスタムアプリ開発、トレーニング・イネーブルメント、データ統合サービス)とマネージドサービスで構成されています。コアテクノロジーアーキテクチャセグメントは、ベクターおよびGIS分析(幾何学的分析、空間統計、ネットワーク分析)、ラスターおよび画像分析(衛星/航空画像処理、コンピュータービジョン、スペクトル分析)、ストリーミングおよびリアルタイム分析(ライブデータ処理、イベント検出、動的最適化)、地理視覚化(ダッシュボードおよびレポート作成、テーママッピング、3D/AR/VRオーバーレイ)をカバーしています。データタイプセグメントは、画像データ(衛星画像、航空/UAV画像、ハイパースペクトルデータ、SARデータ)、非画像データ(ベクターデータ、3D空間データ、クラウドソーシングデータ、LiDARデータ)、および地理時間・融合データ(センサー/IoTデータ、ソーシャルメディアのジオタグデータ、モバイルデバイスの位置情報データ)をカバーしています。

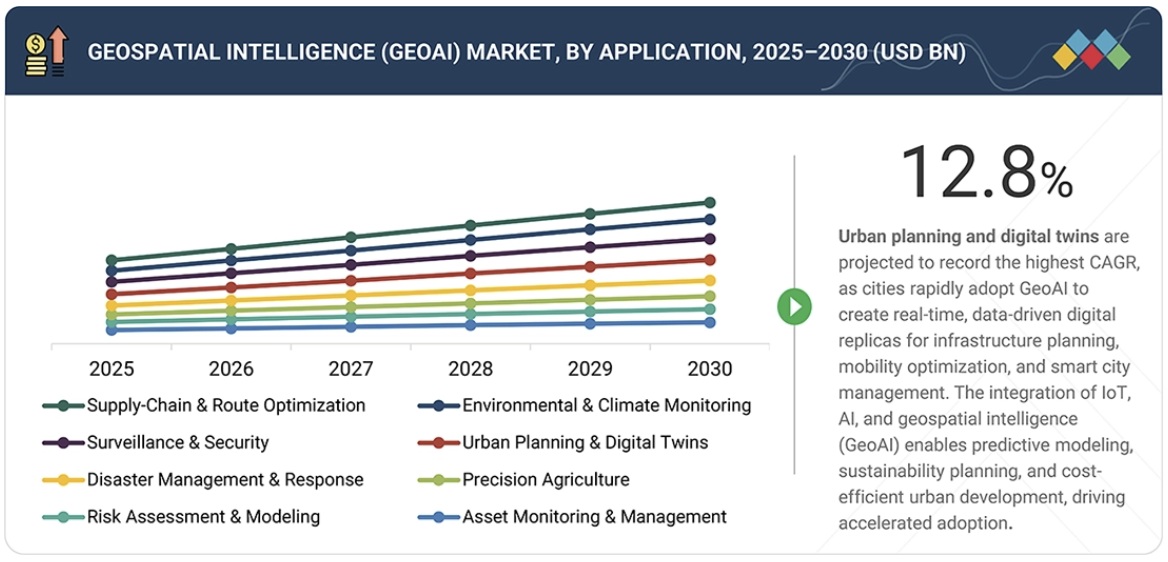

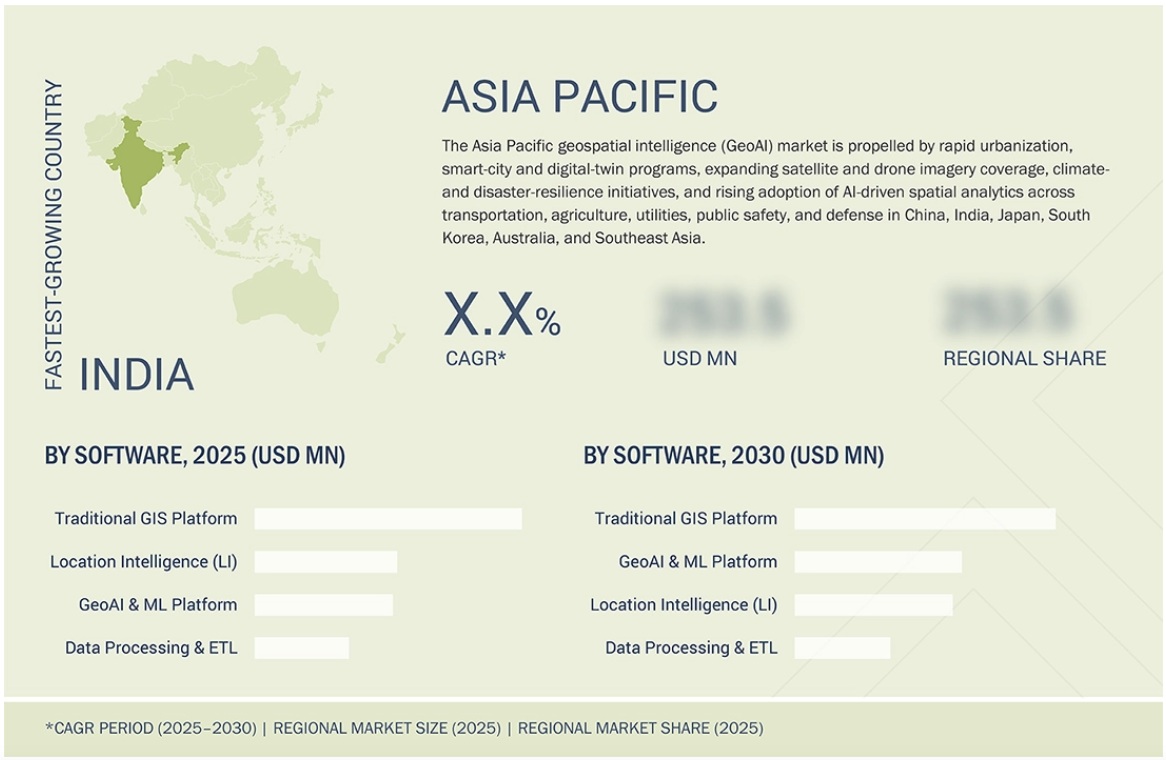

アプリケーションセグメントは、資産監視・管理、リスク評価・モデリング、精密農業、災害管理・対応、都市計画・デジタルツイン、監視・セキュリティ、サプライチェーン・ルート最適化、環境・気候モニタリングをカバーしています。垂直セグメントは、エネルギー・公益事業、政府・防衛、通信、保険・金融サービス、不動産・建設、自動車・輸送、ヘルスケア・ライフサイエンス、鉱業、農業、その他の垂直分野(小売・eコマース、メディア・エンターテインメント、教育、観光を含む)に分かれています。地理空間インテリジェンス(GeoAI)市場の地域分析は、北米、ヨーロッパ、アジア太平洋、中東・アフリカ(MEA)、ラテンアメリカを対象としています。

レポート購入の主なメリット

本レポートは、市場リーダー/新規参入企業に対し、地理空間インテリジェンス(GeoAI)市場全体とそのサブセグメントの収益数値の近似値に関する情報を提供します。これにより、関係者は競争環境を理解し、ビジネスポジショニングの改善と適切な市場開拓戦略の策定に役立つ洞察を得ることができます。また、市場の動向を把握し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報も提供します。

本レポートでは、以下の点について洞察を提供しています。

- 主要な推進要因(セキュリティ、インフラ、商用運用における意思決定タイムラインの短縮、持続的な地球観測と位置情報データソースの急増、防衛分野を超えて民間および商用の意思決定への地理空間インテリジェンスの拡大、予測的・先見的なインテリジェンスにおける空間コンテキストの重要性の高まり)、制約(規制上の制約と国境を越えたデータ管理の管理、リアルタイムの地理空間インテリジェンスの導入を制限するインフラとネットワークの制約)、機会(地理基盤モデルと転移学習パイプラインによる新たな価値の創出、データ融合と来歴サービスによる企業の信頼の拡大、垂直化されコンプライアンスに準拠した地理空間インテリジェンス・プラットフォームの提供、運用統合による予測的地理空間インテリジェンスの収益化)、課題(運用規模での高品質なラベルと検証の維持、安全な複数当事者間の地理空間コラボレーションとフェデレーション分析の実現)の分析

- 製品開発/イノベーション:地理空間インテリジェンス(GeoAI)市場における今後の技術、研究開発活動、新製品・新サービスの発売に関する詳細な洞察

- 市場開発:収益性の高い市場に関する包括的な情報。本レポートでは、様々な地域における地理空間インテリジェンス(GeoAI)市場を分析しています。

- 市場の多様化:地理空間インテリジェンス(GeoAI)市場における新製品・新サービス、未開拓地域、最近の動向、投資に関する包括的な情報

- 競合評価:Google(米国)、IBM(米国)、Alteryx(米国)、ESRI(米国)、Hexagon AB(スウェーデン)、TomTom(オランダ)、Trimble(米国)、Ouster(米国)、Vantor(米国)、Lanteris Space Systems(米国)、Precisely(米国)、Caliper Corporation(米国)、RMSI(インド)、MapLarge(米国)、General Electric(米国)、Airbus(フランス)、Fugro(オランダ)、Planet Labs(米国)、Microsoft(米国)、CGI(カナダ)、Teledyne Technologies(カナダ)、Bentley Systems(米国)、Here Technologies(米国)、NVS Geospatial(米国)、AWS(米国)、SBL(インド)、BAE Systems(英国)、ECS(米国)、Vexcel Imaging(オーストリア)、Mapbox(米国)、EOS Data Analytics(米国)、Magnasoft(インド)、EarthDaily Analytics(カナダ)、Mapideaなどの主要企業の市場シェア、成長戦略、サービス提供に関する詳細な評価。地理空間インテリジェンス(GeoAI)市場において、Geospin(ドイツ)、Sparkgeo(カナダ)、Mapular(ニュージーランド)、Carto(米国)、Blue Sky Analytics(オランダ)、Latitudo40(イタリア)、Ecopia AI(カナダ)、Spatial AI(米国)、Dista(米国)、Capella Space(米国)、Wherobots(米国)、Geowgs84.ai(米国)、Europa Technologies(英国)など、数多くの企業が参入しています。本レポートは、地理空間インテリジェンス(GeoAI)市場の動向を把握し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供することで、関係者を支援するものです。

Report Description

The geospatial intelligence (GeoAI) market is projected to grow from USD 37.13 billion in 2025 to USD 62.88 billion by 2030, at a CAGR of 11.1% during the forecast period. Market growth is driven by the increasing use of artificial intelligence and machine learning to analyze complex geospatial datasets generated from satellites, drones, sensors, and connected devices. Organizations across defense, infrastructure, healthcare, and environmental monitoring are adopting geospatial intelligence solutions to enhance decision-making, risk assessment, and operational efficiency. Advancements in cloud computing, data fusion, and real-time analytics are improving the scalability and accessibility of geospatial intelligence platforms. In parallel, growing investments in smart infrastructure, public safety, and climate resilience initiatives are further strengthening demand for advanced GeoAI capabilities.

Geospatial Intelligence Market – Global Forecast To 2030

“Sensing and capture segment, by offering, is projected to grow at the highest CAGR during the forecast period.”

Sensing and capture represent the fastest-growing segment within geospatial acquisition systems in the geospatial intelligence (GeoAI) market. This segment includes satellites, aerial platforms, drones, LiDAR systems, and ground-based sensors used to collect geospatial data. Growth is driven by the expanding deployment of earth observation satellites, the increased use of unmanned aerial systems, and the demand for high-frequency data collection. These acquisition systems provide the foundational data required for downstream geospatial intelligence and analytics. Continuous improvements in sensor resolution, coverage, and cost efficiency are driving the acceleration of adoption across various use cases, including defense, infrastructure monitoring, environmental assessment, and disaster response.

“Imagery data segment is expected to hold the largest share of the geospatial intelligence (GeoAI) market.”

Imagery data represents the largest data type segment in the geospatial intelligence (GeoAI) market. Satellite and aerial imagery are widely used for surveillance, mapping, change detection, and asset monitoring applications. High-resolution imagery supports AI-driven feature extraction, object recognition, and predictive spatial analysis across multiple sectors. Continuous improvements in image resolution, revisit rates, and analytics capabilities are enhancing the value of imagery-based intelligence. Strong adoption across defense, urban planning, environmental monitoring, and commercial applications sustains the dominant position of the imagery data segment.

Geospatial Intelligence Market – Global Forecast To 2030 – region

“North America to lead the geospatial intelligence (GeoAI) market, while Asia Pacific emerges as the fastest-growing region.”

North America is expected to hold the largest share of the geospatial intelligence (GeoAI) market during the forecast period. The region benefits from strong adoption across defense, public safety, infrastructure, and healthcare applications, supported by sustained government spending and a mature geospatial technology ecosystem. Widespread use of satellite imagery, geospatial analytics, and AI-enabled intelligence platforms across federal agencies and enterprises drives market leadership. The presence of major geospatial technology providers and cloud service platforms further accelerates deployment.

Asia Pacific is projected to register the highest growth rate in the geospatial intelligence (GeoAI) market. Rapid urbanization, increasing investments in smart city initiatives, and the expansion of earth observation programs across countries such as China, India, and Southeast Asian nations are driving the adoption. Governments in the region are leveraging geospatial intelligence for infrastructure development, environmental monitoring, and disaster management. The growing availability of satellite data and improving analytics capabilities position the Asia Pacific as a key growth region over the forecast period.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the geospatial intelligence (GeoAI) market.

- By Company: Tier 1 – 35%, Tier 2 – 45%, and Tier 3 – 20%

- By Designation: C-level Executives – 35%, D-level Executives – 25%, and Others – 40%

- By Region: North America – 40%, Europe – 25%, Asia Pacific – 20%, Middle East & Africa – 10%, and Latin America – 5%

Geospatial Intelligence Market – Global Forecast To 2030 – ecosystem

The report includes the study of key players offering geospatial intelligence solutions and services. It profiles major vendors in the geospatial intelligence (GeoAI) market. The major players in the s market include Google (US), IBM (US), Alteryx (US), ESRI (US), Hexagon AB (Sweden), TomTom (Netherlands), Trimble (US), Ouster (US), Vantor (US), Lanteris Space Systems (US), Precisely (US), Caliper Corporation (US), RMSI (India), MapLarge (US), General Electric (US), Airbus (France), Fugro (Netherlands), Planet Labs (US), Microsoft (US), CGI (Canada), Teledyne Technologies (Canada), Bentley Systems (US), Here Technologies (US), NVS Geospatial (US), AWS (US), SBL (India), BAE Systems (UK), ECS (US), Vexcel Imaging (Austria), Mapbox (US), EOS Data Analytics (US), Magnasoft (India), EarthDaily Analytics (Canada), Mapidea (Portugal), Geospin (Germany), Sparkgeo (Canada), Mapular (New Zealand), Carto (US), Blue Sky Analytics (Netherlands), Latitudo40 (Italy), Ecopia AI (Canada), Spatial AI (US), Dista (US), Capella Space (US), Whereobots (US), Geowgs84.ai (US), and Europa Technologies (UK).

Research coverage

This research report covers the geospatial intelligence (GeoAI) market and is segmented by offering, core technology architecture, data type, and vertical. The offering segment comprises software, geospatial acquisition systems, and services. The software segment contains GeoAI & ML platforms (agentic GIS & AI copilot, GeoAI cloud-native platform, GeoAI model catalogs, and others), geospatial analytics (traditional GIS solutions [desktop GIS, web/enterprise GIS, spatial databases, 3D/4D mapping tools), location intelligence (spatial query & indexing engines, geospatial visualization engines, location enrichment tools, and spatial apis & microservices), and data processing & ETL (geocoding engines, spatial data integration tools, raster/vector/crs data conversion). The geospatial acquisition systems segment is divided into sensing & capture (satellite imaging sensors, aerial cameras, and LIDAR/3D scanners) and positioning & tracking (GNSS receivers [RTK/PPP], inertial measurement units [IMU], and PNT [position, navigation, and timing] systems). The services segment comprises core services (consulting, deployment & integration, custom app development, training & enablement, and data integration services) and managed services. The core technology architecture segment covers vector & GIS analytics (geometric analysis, spatial statistics, network analysis), raster & imagery analytics (satellite/aerial image processing, computer vision, spectral analysis), streaming & real-time analytics (live data processing, event detection, dynamic optimization) and geovisualization (dashboard & reporting, thematic mapping, 3D/AR/VR overlays). The data type segment covers Imagery Data (satellite imagery, aerial/UAV imagery, hyperspectral data, SAR data), non-imagery data (vector data, 3D spatial data, crowd-sourced data, LiDAR data), and geotemporal & fusion (sensor/IoT data, social media geotagged data, mobile device location data). the application segment covers asset monitoring & management, risk assessment & modeling, precision agriculture, disaster management & response, urban planning & digital twins, surveillance & security, supply-chain & route optimization, and environmental & climate monitoring. The vertical segment is split into energy & utilities, government & defense, telecommunications, insurance & financial services, real estate & construction, automotive & transportation, healthcare & life sciences, mining, agriculture, and other verticals (including retail & e-commerce, media & entertainment, education, and tourism). The regional analysis of the geospatial intelligence (GeoAI) market covers North America, Europe, Asia Pacific, the Middle East & Africa (MEA), and Latin America.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall geospatial intelligence (GeoAI) market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (compression of decision timelines across security, infrastructure, and commercial operations, proliferation of persistent earth observation and location-aware data sources, expansion of geospatial intelligence beyond defense into civilian and commercial decision-making, rising importance of spatial context for predictive and anticipatory intelligence), restraints (managing regulatory constraints and cross-border data controls, infrastructure and network constraints limiting real-time geospatial intelligence adoption), opportunities (unlocking new value with geo foundation models and transfer learning pipelines, scaling enterprise trust through data fusion and provenance services, delivering verticalized, compliance-aligned geospatial intelligence platforms, monetizing predictive geospatial intelligence through operational integration), and challenges (maintaining high-quality labels and validation at operational scale, enabling secure multi-party geospatial collaboration and federated analytics)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the geospatial intelligence (GeoAI) market

- Market Development: Comprehensive information about lucrative markets; the report analyzes the geospatial intelligence (GeoAI) market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the geospatial intelligence (GeoAI) market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Google (US), IBM (US), Alteryx (US), ESRI (US), Hexagon AB (Sweden), TomTom (Netherlands), Trimble (US), Ouster (US), Vantor (US), Lanteris Space Systems (US), Precisely (US), Caliper Corporation (US), RMSI (India), MapLarge (US), General Electric (US), Airbus (France), Fugro (Netherlands), Planet Labs (US), Microsoft (US), CGI (Canada), Teledyne Technologies (Canada), Bentley Systems (US), Here Technologies (US), NVS Geospatial (US), AWS (US), SBL (India), BAE Systems (UK), ECS (US), Vexcel Imaging (Austria), Mapbox (US), EOS Data Analytics (US), Magnasoft (India), EarthDaily Analytics (Canada), Mapidea (Portugal), Geospin (Germany), Sparkgeo (Canada), Mapular (New Zealand), Carto (US), Blue Sky Analytics (Netherlands), Latitudo40 (Italy), Ecopia AI (Canada), Spatial AI (US), Dista (US), Capella Space (US), Wherobots (US), Geowgs84.ai (US), and Europa Technologies (UK) among others in the geospatial intelligence (GeoAI) market. The report also helps stakeholders understand the pulse of the Geospatial Intelligence (GeoAI) market, providing them with information on key market drivers, restraints, challenges, and opportunities.

Table of Contents

1 INTRODUCTION 48

1.1 STUDY OBJECTIVES 48

1.2 MARKET DEFINITION 48

1.2.1 INCLUSIONS AND EXCLUSIONS 49

1.3 MARKET SCOPE 50

1.3.1 MARKET SEGMENTATION 50

1.3.2 STUDY YEARS CONSIDERED 51

1.4 CURRENCY CONSIDERED 51

1.5 STAKEHOLDERS 51

1.6 SUMMARY OF CHANGES 52

2 EXECUTIVE SUMMARY 54

2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS 54

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 56

2.3 DISRUPTIVE TRENDS IN GEOSPATIAL INTELLIGENCE (GEOAI) MARKET 57

2.4 HIGH-GROWTH SEGMENTS 58

2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST 59

3 PREMIUM INSIGHTS 60

3.1 ATTRACTIVE OPPORTUNITIES IN GEOSPATIAL INTELLIGENCE (GEOAI) MARKET 60

3.2 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET: TOP THREE APPLICATIONS 61

3.3 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING AND END USER 61

3.4 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION 62

4 MARKET OVERVIEW 63

4.1 INTRODUCTION 63

4.2 MARKET DYNAMICS 63

4.2.1 DRIVERS 64

4.2.1.1 Compression of decision timelines across security, infrastructure, and commercial operations 64

4.2.1.2 Proliferation of persistent Earth observation and location-aware data sources 65

4.2.1.3 Expansion of geospatial intelligence beyond defense into civilian and commercial decision-making 65

4.2.1.4 Rising importance of spatial context for predictive and anticipatory intelligence 65

4.2.2 RESTRAINTS 66

4.2.2.1 Managing regulatory constraints and cross-border data controls 66

4.2.2.2 Infrastructure and network constraints limiting real-time geospatial intelligence adoption 66

4.2.3 OPPORTUNITIES 67

4.2.3.1 Unlocking new value with geo foundation models and transfer learning pipelines 67

4.2.3.2 Scaling enterprise trust through data fusion and provenance services 67

4.2.3.3 Delivering verticalized, compliance-aligned geospatial intelligence platforms 68

4.2.3.4 Monetizing predictive geospatial intelligence through operational integration 68

4.2.4 CHALLENGES 69

4.2.4.1 Maintaining high-quality labels and validation at operational scale 69

4.2.4.2 Enabling secure multi-party geospatial collaboration and federated analytics 69

4.3 UNMET NEEDS AND WHITE SPACES 70

4.3.1 UNMET NEEDS IN GEOSPATIAL INTELLIGENCE (GEOAI) MARKET 70

4.3.2 WHITE SPACE OPPORTUNITIES 70

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 71

4.4.1 INTERCONNECTED MARKETS 71

4.4.2 CROSS-SECTOR OPPORTUNITIES 72

4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 73

4.5.1 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 73

5 INDUSTRY TRENDS 74

5.1 EVOLUTION OF GEOSPATIAL INTELLIGENCE (GEOAI) 74

5.2 PORTER’S FIVE FORCES ANALYSIS 76

5.2.1 THREAT OF NEW ENTRANTS 77

5.2.2 THREAT OF SUBSTITUTES 77

5.2.3 BARGAINING POWER OF SUPPLIERS 77

5.2.4 BARGAINING POWER OF BUYERS 77

5.2.5 INTENSITY OF COMPETITIVE RIVALRY 78

5.3 MACROECONOMIC OUTLOOK 78

5.3.1 INTRODUCTION 78

5.3.2 GDP TRENDS AND FORECAST 78

5.3.3 TRENDS IN GLOBAL BIG DATA AND ANALYTICS INDUSTRY 80

5.3.4 TRENDS IN GLOBAL CYBERSECURITY INDUSTRY 80

5.4 SUPPLY CHAIN ANALYSIS 81

5.5 ECOSYSTEM ANALYSIS 83

5.5.1 GEOSPATIAL ACQUISITION SYSTEM PROVIDERS 85

5.5.1.1 Sensing & capture providers 85

5.5.1.2 Positioning & tracking providers 86

5.5.2 SOFTWARE PROVIDERS 86

5.5.2.1 Location intelligence providers 86

5.5.2.2 Traditional GIS providers 86

5.5.2.3 Data processing & ETL providers 86

5.5.2.4 GeoAI & ML platform providers 86

5.5.3 SERVICE PROVIDERS 87

5.5.3.1 Core services 87

5.5.3.1.1 Consulting services 87

5.5.3.1.2 Data integration services 87

5.5.3.2 Managed services 87

5.6 PRICING ANALYSIS 87

5.6.1 AVERAGE SELLING PRICE OF OFFERINGS (GEOSPATIAL ACQUISITION SYSTEMS), BY KEY PLAYER, 2025 89

5.6.2 AVERAGE SELLING PRICE OF SOFTWARE AND SERVICES, 2025 89

5.7 TRADE ANALYSIS 91

5.7.1 IMPORT SCENARIO (HS CODE 9015) 91

5.7.2 EXPORT SCENARIO (HS CODE 9015) 93

5.8 KEY CONFERENCES AND EVENTS, 2025–2026 94

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 95

5.10 INVESTMENT AND FUNDING SCENARIO 96

5.11 CASE STUDY ANALYSIS 97

5.11.1 CGI AND BELL CANADA TRANSFORM NETWORK WITH ENTERPRISE GEOSPATIAL PLATFORM 97

5.11.2 WHEROBOTS AND AARDEN.AI OVERCOME SCALING CHALLENGES WITH UNIFIED GEOSPATIAL PLATFORM 98

5.11.3 SOUTH KOREA AND NV5 INTEGRATE REMOTE SENSING TO IMPROVE FOREST GHG REPORTING 98

5.11.4 SYMAPS AND MAPBOX ENHANCE LOCATION INTELLIGENCE WITH GLOBAL MOVEMENT DATA 99

5.11.5 BAJAJ FINSERV IMPLEMENTS ESRI’S GEOSPATIAL PLATFORM SOLUTION TO IMPROVE CUSTOMER SERVICE 99

5.12 IMPACT OF 2025 US TARIFF – GEOSPATIAL INTELLIGENCE (GEOAI) MARKET 100

5.12.1 INTRODUCTION 100

5.12.1.1 Tariff/trade policy updates (August–December 2025) 101

5.12.2 KEY TARIFF RATES 101

5.12.3 PRICE IMPACT ANALYSIS 102

5.12.3.1 Strategic shifts and emerging trends 102

5.12.4 IMPACT ON COUNTRIES/REGIONS 103

5.12.4.1 US 103

5.12.4.2 China 104

5.12.4.3 Europe 105

5.12.4.4 Asia Pacific (excluding China) 106

5.12.5 IMPACT ON END-USE INDUSTRIES 107

5.12.5.1 Energy & utilities 107

5.12.5.2 Government & defense 107

5.12.5.3 Telecommunications 108

5.12.5.4 Insurance & financial services 108

5.12.5.5 Real estate & construction 108

5.12.5.6 Automotive & transportation 109

5.12.5.7 Healthcare & life sciences 109

5.12.5.8 Mining 109

5.12.5.9 Agriculture 109

5.12.5.10 Other verticals (retail & e-commerce, media & entertainment, education, tourism) 110

6 STRATEGIC DISRUPTION: PATENTS, DIGITAL, AND AI ADOPTIONS 111

6.1 KEY EMERGING TECHNOLOGIES 111

6.1.1 ADVANCED AI/ML TECHNIQUES 111

6.1.2 REMOTE SENSING, EO, & MULTI-SENSOR DATA FUSION 111

6.1.3 HIGH-FIDELITY 3D MAPPING & DIGITAL TWINS 111

6.1.4 CLOUD & EDGE COMPUTING 112

6.2 COMPLEMENTARY TECHNOLOGIES 112

6.2.1 INTERNET OF THINGS (IOT) & SENSOR NETWORKS 112

6.2.2 5G CONNECTIVITY 113

6.2.3 FEDERATED LEARNING (FL) & PRIVACY-PRESERVING AI 113

6.3 ADJACENT TECHNOLOGIES 113

6.3.1 SPATIAL COMPUTING 113

6.3.2 GENERATIVE AI & GEOLLMS 114

6.3.3 BLOCKCHAIN 114

6.4 TECHNOLOGY ROADMAP 114

6.4.1 SHORT TERM (2025–2027): FOUNDATION AND STANDARDIZATION PHASE 115

6.4.2 MID TERM (2028–2030): CONVERGENCE AND AUTOMATION PHASE 115

6.4.3 LONG TERM (2031–2035): AUTONOMOUS AND COGNITIVE INTEROPERABILITY PHASE 116

6.5 PATENT ANALYSIS 116

6.5.1 METHODOLOGY 116

6.5.2 PATENTS FILED, BY DOCUMENT TYPE, 2016–2025 117

6.5.3 INNOVATION AND PATENT APPLICATIONS 117

7 REGULATORY LANDSCAPE 121

7.1 REGIONAL REGULATIONS AND COMPLIANCE 121

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 121

7.1.2 KEY REGULATIONS 124

7.1.2.1 North America 124

7.1.2.1.1 Geospatial Data Act (GDA) of 2018 (US) 124

7.1.2.1.2 Open Government Directive of 2014 (Canada) 125

7.1.2.2 Europe 125

7.1.2.2.1 INSPIRE Directive 2007/2 (European Commission) 125

7.1.2.2.2 General Data Protection Regulation (European Union) 126

7.1.2.2.3 Copernicus Regulation 2021/696 (European Union) 126

7.1.2.3 Asia Pacific 126

7.1.2.3.1 Geospatial Information Regulation Act 2016 (India) 126

7.1.2.3.2 Surveying and Mapping Law 2002, Revised 2017 (China) 127

7.1.2.3.3 Basic Act on Advancement of Utilizing Geospatial Information, 2007 (Japan) 127

7.1.2.4 Middle East & Africa 128

7.1.2.4.1 Survey and Mapping Law (Saudi Arabia) 128

7.1.2.4.2 Spatial Data Infrastructure Act 54 of 2003 (South Africa) 128

7.1.2.5 Latin America 128

7.1.2.5.1 National Geospatial Data Infrastructure (INDE) Law (Brazil) 128

7.1.2.5.2 Geospatial Data Law 2020 (Mexico) 129

7.1.3 INDUSTRY STANDARDS 129

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR 132

8.1 DECISION-MAKING PROCESS 132

8.2 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA 134

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 134

8.2.2 BUYING CRITERIA 134

8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES 135

8.4 UNMET NEEDS OF VARIOUS INDUSTRY VERTICALS 136

9 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING 139

9.1 INTRODUCTION 140

9.1.1 OFFERING: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS 140

9.2 SOFTWARE 141

9.2.1 GEOAI & ML PLATFORMS 143

9.2.1.1 Advancing intelligent spatial analysis through integrated AI-driven platform capabilities 143

9.2.1.2 Agentic GIS & AI copilot 144

9.2.1.3 GeoAI cloud-native platform 144

9.2.1.4 GeoAI model catalogs 145

9.2.1.5 Other GeoAI & ML platforms 145

9.2.2 GEOSPATIAL ANALYTICS 146

9.2.2.1 Traditional GIS Solutions 146

9.2.2.1.1 Strengthening spatial decision-making through expanding demand for foundational GIS capabilities 146

9.2.2.1.2 Desktop GIS 147

9.2.2.1.3 Web/Enterprise GIS 148

9.2.2.1.4 Spatial databases 148

9.2.2.1.5 3D/4D mapping tools 148

9.2.2.2 Location intelligence (LI) 149

9.2.2.2.1 Enhancing spatial decision-making through advanced location intelligence capabilities 149

9.2.2.2.2 Spatial query & indexing engines 150

9.2.2.2.3 Geospatial visualization engines 150

9.2.2.2.4 Location enrichment tools 150

9.2.2.2.5 Spatial APIs & microservices 150

9.2.2.3 Data Processing & ETL 151

9.2.2.3.1 Advancing organizational security with unified policy enforcement 151

9.2.2.3.2 Geocoding engines 152

9.2.2.3.3 Spatial data integration tools 152

9.2.2.3.4 Raster/vector/CRS data conversion 152

9.3 GEOSPATIAL ACQUISITION SYSTEMS 153

9.3.1 SENSING & CAPTURE 154

9.3.1.1 Enhancing spatial data fidelity through advanced multimodal sensing innovations 154

9.3.1.2 Satellite imaging sensors 155

9.3.1.3 Aerial cameras 156

9.3.1.4 LiDAR/3D scanners 156

9.3.2 POSITIONING & TRACKING 156

9.3.2.1 Optimizing precision movement through advanced geospatial tracking technologies 156

9.3.2.2 GNSS receivers (RTK/PPP) 157

9.3.2.3 Inertial Measurement Units (IMU) 157

9.3.2.4 PNT (Position, Navigation, Timing) systems 158

9.4 SERVICES 158

9.4.1 CORE SERVICES 160

9.4.1.1 Accelerating adoption through expert-led integration and high-quality geospatial services 160

9.4.1.2 Consulting 161

9.4.1.3 Deployment & integration 161

9.4.1.4 Custom application development 161

9.4.1.5 Training & enablement 161

9.4.1.6 Data-integration services 162

9.4.2 MANAGED SERVICES 162

9.4.2.1 Accelerating scalable geospatial readiness through continuous cloud delivery and automation 162

9.4.2.2 Data-as-a-Service (DaaS) 163

9.4.2.3 Analytics-as-a-Service (AaaS) 163

10 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE 164

10.1 INTRODUCTION 165

10.1.1 CORE TECHNOLOGY ARCHITECTURE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS 165

10.2 VECTOR & GIS ANALYTICS 166

10.2.1 ACCELERATING PRECISION MAPPING THROUGH AI-ENHANCED VECTOR ANALYSIS AND AUTOMATED GEOPROCESSING 166

10.2.2 GEOMETRIC ANALYSIS 167

10.2.3 SPATIAL STATISTICS 167

10.2.4 NETWORK ANALYSIS 168

10.3 RASTER & IMAGERY ANALYTICS 168

10.3.1 DRIVING REAL-TIME INSIGHT THROUGH AI-POWERED IMAGERY INTERPRETATION AND AUTOMATED CHANGE DETECTION 168

10.3.2 SATELLITE/AERIAL IMAGE PROCESSING 169

10.3.3 COMPUTER VISION 169

10.3.4 SPECTRAL ANALYSIS 170

10.4 STREAMING & REAL-TIME ANALYTICS 170

10.4.1 ENHANCING SITUATIONAL AWARENESS THROUGH AI-OPTIMIZED REAL-TIME GEOSPATIAL DATA PROCESSING 170

10.4.2 LIVE DATA PROCESSING 171

10.4.3 EVENT DETECTION 171

10.4.4 DYNAMIC OPTIMIZATION 172

10.5 GEOVISUALIZATION 172

10.5.1 ELEVATING DECISION CLARITY THROUGH INTERACTIVE SPATIAL VISUALIZATION AND AI-DRIVEN VISUAL INSIGHTS 172

10.5.2 DASHBOARD & REPORTING 173

10.5.3 THEMATIC MAPPING 173

10.5.4 3D/AR/VR OVERLAYS 174

11 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE 175

11.1 INTRODUCTION 176

11.1.1 DATA TYPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS 176

11.2 IMAGERY DATA 177

11.2.1 ADVANCING HIGH-PRECISION INSIGHTS THROUGH INTELLIGENT UTILIZATION OF RICH IMAGERY DATA 177

11.2.2 SATELLITE IMAGERY 178

11.2.3 AERIAL/UAV IMAGERY 178

11.2.4 HYPERSPECTRAL DATA 179

11.2.5 SAR DATA 179

11.3 NON-IMAGERY DATA 179

11.3.1 STRENGTHENING CONTEXT-AWARE DECISION INTELLIGENCE THROUGH NON-IMAGERY SPATIAL DATA UTILIZATION 179

11.3.2 VECTOR DATA 180

11.3.3 3D SPATIAL DATA 181

11.3.4 CROWD-SOURCED DATA 181

11.3.5 LIDAR DATA 181

11.4 GEOTEMPORAL & FUSION 182

11.4.1 ADVANCING PREDICTIVE INSIGHT THROUGH INTEGRATED GEOTEMPORAL ANALYSIS AND MULTIMODAL DATA FUSION 182

11.4.2 SENSOR/IOT DATA 183

11.4.3 SOCIAL MEDIA GEOTAGGED DATA 183

11.4.4 MOBILE DEVICE LOCATION DATA 183

12 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION 184

12.1 INTRODUCTION 185

12.1.1 APPLICATION: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS 185

12.2 ASSET MONITORING & MANAGEMENT 187

12.2.1 DRIVING ASSET RELIABILITY THROUGH INTELLIGENT GEOSPATIAL MONITORING AND PREDICTIVE INSIGHT 187

12.3 RISK ASSESSMENT & MODELING 188

12.3.1 ENHANCING HAZARD FORESIGHT THROUGH INTELLIGENT GEOSPATIAL RISK MODELLING 188

12.4 PRECISION AGRICULTURE 189

12.4.1 ADVANCING FARM EFFICIENCY THROUGH INTELLIGENT GEOSPATIAL CROP OPTIMIZATION 189

12.5 DISASTER MANAGEMENT & RESPONSE 190

12.5.1 ENHANCING EMERGENCY PREPAREDNESS THROUGH ADVANCED GEOAI-DRIVEN DISASTER RESPONSE CAPABILITIES 190

12.6 URBAN PLANNING & DIGITAL TWINS 191

12.6.1 DRIVING ENTERPRISE EFFICIENCY, SECURITY, AND VISIBILITY IN SAAS OPERATIONS 191

12.7 SURVEILLANCE & SECURITY 192

12.7.1 ADVANCING THREAT DETECTION THROUGH GEOAI-ENABLED SURVEILLANCE AND SECURITY SYSTEMS 192

12.8 SUPPLY CHAIN & ROUTE OPTIMIZATION 193

12.8.1 BOOSTING LOGISTICS PERFORMANCE THROUGH GEOAI-ENABLED ROUTING AND SUPPLY CHAIN OPTIMIZATION 193

12.9 ENVIRONMENTAL & CLIMATE MONITORING 194

12.9.1 STRENGTHENING CLIMATE RESILIENCE THROUGH GEOAI-DRIVEN ENVIRONMENTAL MONITORING SYSTEMS 194

13 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL 196

13.1 INTRODUCTION 197

13.1.1 VERTICAL: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS 197

13.2 ENERGY & UTILITIES 199

13.2.1 ENHANCING GRID RESILIENCE AND ASSET INTELLIGENCE THROUGH ADVANCED SPATIAL ANALYTICS 199

13.3 GOVERNMENT & DEFENSE 200

13.3.1 STRENGTHENING NATIONAL SECURITY THROUGH AI-DRIVEN SPATIAL INTELLIGENCE AND SURVEILLANCE 200

13.4 TELECOMMUNICATION 201

13.4.1 NETWORK DENSIFICATION AND 5G EXPANSION DRIVING ADVANCED SPATIAL INTELLIGENCE ADOPTION 201

13.5 INSURANCE & FINANCIAL SERVICES 202

13.5.1 CLIMATE RISK TRANSPARENCY AND CLAIMS AUTOMATION DRIVING LOCATION-CENTRIC INTELLIGENCE ADOPTION 202

13.6 REAL ESTATE & CONSTRUCTION 203

13.6.1 RAPID URBAN DENSITY AND REGULATORY COMPLIANCE PRESSURES ACCELERATING SPATIAL INTELLIGENCE ADOPTION 203

13.7 AUTOMOTIVE & TRANSPORTATION 204

13.7.1 RISING DEMAND FOR REAL-TIME TRAFFIC OPTIMIZATION AND SMART FLEET ORCHESTRATION 204

13.8 HEALTHCARE & LIFE SCIENCES 205

13.8.1 EXPANDING PREVENTIVE CARE MODELS AND OUTBREAK PREPAREDNESS STRENGTHENING SPATIAL ANALYTICS ADOPTION 205

13.9 MINING 206

13.9.1 RISING COMMODITY DEMAND AND AUTOMATION IMPERATIVES ACCELERATING SPATIAL INTELLIGENCE INTEGRATION 206

13.10 AGRICULTURE 207

13.10.1 CLIMATE VOLATILITY AND PRECISION YIELD OPTIMIZATION ACCELERATING SPATIAL INTELLIGENCE ADOPTION 207

13.11 OTHER VERTICALS 208

14 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION 211

14.1 INTRODUCTION 212

14.2 NORTH AMERICA 214

14.2.1 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS 214

14.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK 215

14.2.3 US 221

14.2.3.1 Smart infrastructure and BIM-led digitization to accelerate location-based intelligence adoption 221

14.2.4 CANADA 226

14.2.4.1 Open data mandates and startup-driven innovation powering nationwide geospatial adoption 226

14.3 EUROPE 231

14.3.1 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS 232

14.3.2 EUROPE: MACROECONOMIC OUTLOOK 232

14.3.3 UK 238

14.3.3.1 Government initiatives and defense partnerships to fuel advanced location Intelligence adoption 238

14.3.4 GERMANY 243

14.3.4.1 Satellite services, smart cities, and sustainability programs to drive advanced spatial innovation 243

14.3.5 FRANCE 249

14.3.5.1 Defense modernization, smart cities, and climate missions to support adoption of AI-driven spatial intelligence 249

14.3.6 ITALY 254

14.3.6.1 Satellite analytics and smart infrastructure programs accelerating digital location capabilities 254

14.3.7 REST OF EUROPE 260

14.4 ASIA PACIFIC 266

14.4.1 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS 266

14.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK 267

14.4.3 CHINA 273

14.4.3.1 Advancements in satellite technology, telecom infrastructure, and national security to drive growth 273

14.4.4 INDIA 279

14.4.4.1 Government-led geospatial policy, international collaboration, and infrastructure digitization to drive market expansion 279

14.4.5 JAPAN 284

14.4.5.1 Increase in focus on disaster management and adoption of GIS-based mapping technologies to fuel market growth 284

14.4.6 ASEAN 290

14.4.6.1 Smart cities, climate resilience, and cross-border trade to drive GeoAI adoption 290

14.4.7 REST OF ASIA PACIFIC 295

14.5 MIDDLE EAST & AFRICA 301

14.5.1 MIDDLE EAST & AFRICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS 302

14.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK 302

14.5.3 SAUDI ARABIA 308

14.5.3.1 Vision 2030, smart cities, and space investments to propel advanced spatial intelligence growth 308

14.5.4 UAE 314

14.5.4.1 Geospatial data leveraged for projects such as Smart Dubai and Abu Dhabi’s TAMM platform 314

14.5.5 TURKEY 319

14.5.5.1 Smart infrastructure modernization and disaster risk management to fuel geospatial adoption 319

14.5.6 SOUTH AFRICA 325

14.5.6.1 Mining automation, climate risk, and smart cities to fuel spatial AI adoption 325

14.5.7 REST OF MIDDLE EAST & AFRICA 330

14.6 LATIN AMERICA 336

14.6.1 LATIN AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET DRIVERS 337

14.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK 337

14.6.3 BRAZIL 342

14.6.3.1 Initiatives like National Institute for Space Research to monitor Amazon and other critical ecosystems to boost market 342

14.6.4 MEXICO 348

14.6.4.1 Strategic push for nearshoring and focus on environmental sustainability to amplify demand 348

14.6.5 REST OF LATIN AMERICA 353

15 COMPETITIVE LANDSCAPE 360

15.1 OVERVIEW 360

15.2 KEY PLAYER STRATEGIES, 2020–2025 360

15.3 REVENUE ANALYSIS, 2020–2024 362

15.4 MARKET SHARE ANALYSIS, 2024 363

15.4.1 MARKET RANKING ANALYSIS, 2024 364

15.5 BRAND COMPARATIVE ANALYSIS 366

15.5.1 BRAND COMPARATIVE ANALYSIS, BY GEOSPATIAL ACQUISITION SYSTEMS 366

15.5.1.1 Airbus (France) 367

15.5.1.2 Planet Labs (US) 367

15.5.1.3 Fugro (Netherlands) 367

15.5.1.4 Vexcel Imaging (Austria) 367

15.5.1.5 Capella Space (US) 367

15.5.2 BRAND COMPARATIVE ANALYSIS, BY GEOSPATIAL INTELLIGENCE (GEOAI) SOFTWARE 368

15.5.2.1 Google (US) 368

15.5.2.2 ESRI (US) 368

15.5.2.3 Hexagon AB (Sweden) 369

15.5.2.4 TomTom (Netherlands) 369

15.5.2.5 Carto (US) 369

15.6 COMPANY EVALUATION MATRIX: KEY PLAYERS (SOFTWARE & SERVICES VENDORS) 369

15.6.1 STARS 369

15.6.2 EMERGING LEADERS 369

15.6.3 PERVASIVE PLAYERS 370

15.6.4 PARTICIPANTS 370

15.6.5 COMPANY FOOTPRINT: KEY PLAYERS (SOFTWARE & SERVICES VENDORS) 371

15.6.5.1 Company footprint 371

15.6.5.2 Regional footprint 372

15.6.5.3 Offering footprint 373

15.6.5.4 Core technology architecture footprint 374

15.6.5.5 Application footprint 375

15.6.5.6 Vertical footprint 376

15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS (GEOSPATIAL ACQUISITION SYSTEMS VENDORS) 377

15.7.1 STARS 377

15.7.2 EMERGING LEADERS 377

15.7.3 PERVASIVE PLAYERS 377

15.7.4 PARTICIPANTS 377

15.7.5 COMPANY FOOTPRINT: KEY PLAYERS (GEOSPATIAL ACQUISITION SYSTEMS VENDORS) 379

15.7.5.1 Company footprint 379

15.7.5.2 Regional footprint 379

15.7.5.3 Offering footprint 380

15.7.5.4 Core technology architecture footprint 380

15.7.5.5 Application footprint 381

15.7.5.6 Vertical footprint 381

15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES 382

15.8.1 PROGRESSIVE COMPANIES 382

15.8.2 RESPONSIVE COMPANIES 382

15.8.3 DYNAMIC COMPANIES 382

15.8.4 STARTING BLOCKS 383

15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 384

15.8.5.1 Detailed list of key startups/SMEs 384

15.8.5.2 Competitive benchmarking of key startups/SMEs 385

15.9 COMPANY VALUATION AND FINANCIAL METRICS 386

15.10 COMPETITIVE SCENARIO 387

15.10.1 PRODUCT LAUNCHES AND ENHANCEMENTS 387

15.10.2 DEALS 388

16 COMPANY PROFILES 390

16.1 INTRODUCTION 390

16.2 KEY PLAYERS 390

16.2.1 GOOGLE 390

16.2.1.1 Business overview 390

16.2.1.2 Products/Solutions/Services offered 392

16.2.1.3 Recent developments 392

16.2.1.3.1 Product launches & enhancements 392

16.2.1.3.2 Deals 394

16.2.1.4 MnM view 395

16.2.1.4.1 Key strengths 395

16.2.1.4.2 Strategic choices 395

16.2.1.4.3 Weaknesses and competitive threats 396

16.2.2 HEXAGON AB 397

16.2.2.1 Business overview 397

16.2.2.2 Products/Solutions/Services offered 398

16.2.2.3 Recent developments 400

16.2.2.3.1 Product launches & enhancements 400

16.2.2.3.2 Deals 401

16.2.2.4 MnM view 403

16.2.2.4.1 Key strengths 403

16.2.2.4.2 Strategic choices 403

16.2.2.4.3 Weaknesses and competitive threats 403

16.2.3 TOMTOM 404

16.2.3.1 Business overview 404

16.2.3.2 Products/Solutions/Services offered 405

16.2.3.3 Recent developments 406

16.2.3.3.1 Product launches & enhancements 406

16.2.3.3.2 Deals 407

16.2.3.4 MnM view 410

16.2.3.4.1 Key strengths 410

16.2.3.4.2 Strategic choices 410

16.2.3.4.3 Weaknesses and competitive threats 410

16.2.4 ALTERYX 411

16.2.4.1 Business overview 411

16.2.4.2 Products/Solutions/Services offered 411

16.2.4.3 Recent developments 412

16.2.4.3.1 Product launches & enhancements 412

16.2.4.3.2 Deals 413

16.2.4.4 MnM view 413

16.2.4.4.1 Key strengths 413

16.2.4.4.2 Strategic choices 413

16.2.4.4.3 Weaknesses and competitive threats 414

16.2.5 IBM 415

16.2.5.1 Business overview 415

16.2.5.2 Products/Solutions/Services offered 416

16.2.5.3 Recent developments 417

16.2.5.3.1 Product launches & enhancements 417

16.2.5.3.2 Deals 419

16.2.5.4 MnM view 419

16.2.5.4.1 Key strengths 419

16.2.5.4.2 Strategic choices 419

16.2.5.4.3 Weaknesses and competitive threats 420

16.2.6 AIRBUS 421

16.2.6.1 Business overview 421

16.2.6.2 Products/Solutions/Services offered 422

16.2.6.3 Recent developments 425

16.2.6.3.1 Product launches & enhancements 425

16.2.6.3.2 Deals 425

16.2.7 TRIMBLE 426

16.2.7.1 Business overview 426

16.2.7.2 Products/Solutions/Services offered 427

16.2.7.3 Recent developments 429

16.2.7.3.1 Product launches & enhancements 429

16.2.7.3.2 Deals 430

16.2.8 CALIPER CORPORATION 431

16.2.8.1 Business overview 431

16.2.8.2 Products/Solutions/Services offered 431

16.2.8.3 Recent developments 432

16.2.8.3.1 Product launches & enhancements 432

16.2.8.3.2 Deals 433

16.2.9 PRECISELY 434

16.2.9.1 Business overview 434

16.2.9.2 Products/Solutions/Services offered 434

16.2.9.3 Recent developments 435

16.2.9.3.1 Product launches & enhancements 435

16.2.9.3.2 Deals 436

16.2.10 ESRI 437

16.2.10.1 Business overview 437

16.2.10.2 Products/Solutions/Services offered 437

16.2.10.3 Recent developments 438

16.2.10.3.1 Product launches & enhancements 438

16.2.10.3.2 Deals 440

16.2.11 MICROSOFT 442

16.2.11.1 Business overview 442

16.2.11.2 Products/Solutions/Services offered 443

16.2.11.3 Recent developments 444

16.2.11.3.1 Product launches & enhancements 444

16.2.11.3.2 Deals 444

16.2.12 BENTLEY SYSTEMS 446

16.2.12.1 Business overview 446

16.2.12.2 Products/Solutions/Services offered 447

16.2.12.3 Recent developments 448

16.2.12.3.1 Product launches 448

16.2.12.3.2 Deals 449

16.2.13 HERE TECHNOLOGIES 450

16.2.13.1 Business overview 450

16.2.13.2 Products/Solutions/Services offered 451

16.2.13.3 Recent developments 451

16.2.13.3.1 Product launches and enhancements 451

16.2.13.3.2 Deals 452

16.2.14 NV5 GEOSPATIAL 454

16.2.14.1 Business overview 454

16.2.14.2 Products/Solutions/Services offered 454

16.2.14.3 Recent developments 456

16.2.14.3.1 Product launches 456

16.2.15 TELEDYNE GEOSPATIAL 457

16.2.15.1 Business overview 457

16.2.15.2 Products/Solutions/Services offered 458

16.2.15.3 Recent developments 460

16.2.15.3.1 Product launches 460

16.2.15.3.2 Deals 460

16.2.16 RMSI 461

16.2.17 LANTERIS SPACE SYSTEMS 462

16.2.18 VANTOR 463

16.2.19 MAPLARGE 464

16.2.20 BAE SYSTEMS 465

16.2.21 GENERAL ELECTRIC 466

16.2.22 FUGRO 467

16.2.23 PLANET LABS 468

16.2.24 SBL 469

16.2.25 ECS 470

16.2.26 AWS 471

16.2.27 CGI 472

16.3 STARTUPS/SMES 473

16.3.1 VEXEL IMAGING 473

16.3.2 CAPELLA SPACE 473

16.3.3 EARTHDAILY ANALYTICS 474

16.3.4 MAPIDEA 475

16.3.5 GEOSPIN (EMA SMARTSERVICE) 475

16.3.6 SPARKGEO 476

16.3.7 CARTO 476

16.3.8 MAPBOX 477

16.3.9 BLUE SKY ANALYTICS 478

16.3.10 LATITUDO40 479

16.3.11 ECOPIA.AI 480

16.3.12 SPATIAL.AI 481

16.3.13 DISTA 482

16.3.14 EOS DATA ANALYTICS 483

16.3.15 MAGNASOFT 484

16.3.16 WHEROBOTS 485

16.3.17 OUSTER 486

16.3.18 GEOWGS84.AI 487

16.3.19 EUROPA TECHNOLOGIES 488

16.3.20 MAPULAR 489

17 RESEARCH METHODOLOGY 490

17.1 RESEARCH DATA 490

17.1.1 SECONDARY DATA 491

17.1.2 PRIMARY DATA 491

17.1.2.1 Breakup of primary profiles 492

17.1.2.2 Key industry insights 492

17.2 DATA TRIANGULATION 493

17.3 MARKET SIZE ESTIMATION 494

17.3.1 TOP-DOWN APPROACH 494

17.3.2 BOTTOM-UP APPROACH 494

17.4 MARKET FORECAST 498

17.5 RESEARCH ASSUMPTIONS 499

17.6 RESEARCH LIMITATIONS 501

18 ADJACENT AND RELATED MARKETS 502

18.1 INTRODUCTION 502

18.2 GEOSPATIAL IMAGERY ANALYTICS MARKET – GLOBAL FORECAST TO 2030 502

18.2.1 MARKET DEFINITION 502

18.2.2 MARKET OVERVIEW 502

18.2.2.1 Geospatial imagery analytics market, by offering 502

18.2.2.2 Geospatial imagery analytics market, by data modality 503

18.2.2.3 Geospatial imagery analytics market, by vertical 504

18.2.2.4 Geospatial imagery analytics market, by region 505

18.3 LOCATION-BASED SERVICES (LBS) AND REAL-TIME LOCATION SYSTEMS (RTLS) MARKET – GLOBAL FORECAST TO 2028 506

18.3.1 MARKET DEFINITION 506

18.3.2 MARKET OVERVIEW 507

18.3.2.1 LBS and RTLS Market, by offering 507

18.3.2.2 LBS and RTLS market, by location type 508

18.3.2.3 LBS and RTLS market, by application 509

18.3.2.4 LBS and RTLS market, by vertical 510

18.3.2.5 LBS and RTLS market, by region 511

19 APPENDIX 512

19.1 DISCUSSION GUIDE 512

19.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 517

19.3 CUSTOMIZATION OPTIONS 519

19.4 RELATED REPORTS 519

19.5 AUTHOR DETAILS 520

LIST OF TABLES

TABLE 1 INCLUSIONS AND EXCLUSIONS 49

TABLE 2 US DOLLAR EXCHANGE RATE, 2019–2023 51

TABLE 3 IMPACT OF PORTER’S FIVE FORCES ON GEOSPATIAL INTELLIGENCE (GEOAI) MARKET 76

TABLE 4 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021–2030 79

TABLE 5 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET: ROLE OF COMPANIES IN ECOSYSTEM 83

TABLE 6 AVERAGE SELLING PRICE OF OFFERINGS, BY KEY PLAYER, 2025 89

TABLE 7 AVERAGE SELLING PRICE OF SOFTWARE AND SERVICES, 2025 90

TABLE 8 IMPORT DATA FOR HS CODE 9015-COMPLIANT PRODUCTS, BY COUNTRY,

2020–2024 (USD MILLION) 92

TABLE 9 EXPORT DATA FOR HS CODE 9015, BY COUNTRY, 2020–2024 (USD MILLION) 93

TABLE 10 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025–2026 94

TABLE 11 TARIFF/TRADE POLICY UPDATES (AUGUST–DECEMBER 2025) 101

TABLE 12 US ADJUSTED RECIPROCAL TARIFF RATES 101

TABLE 13 PATENTS FILED, 2016–2025 117

TABLE 14 LIST OF TOP PATENTS IN GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

2024–2025 118

TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 121

TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 122

TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 123

TABLE 18 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 123

TABLE 19 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 124

TABLE 20 GLOBAL INDUSTRY STANDARDS FOR GEOSPATIAL DATA FORMATS & ENCODING 130

TABLE 21 GLOBAL INDUSTRY STANDARDS FOR METADATA & CATALOGING 130

TABLE 22 GLOBAL INDUSTRY STANDARDS FOR COORDINATE REFERENCE SYSTEMS (CRS) & GEODETIC 130

TABLE 23 GLOBAL INDUSTRY STANDARDS FOR EARTH OBSERVATION (EO) & REMOTE SENSING 131

TABLE 24 GLOBAL INDUSTRY STANDARDS FOR GEOSPATIAL SECURITY, PRIVACY, & COMPLIANCE 131

TABLE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS 134

TABLE 26 KEY BUYING CRITERIA FOR TOP THREE VERTICALS 135

TABLE 27 UNMET NEEDS IN GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY INDUSTRY VERTICAL 137

TABLE 28 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2020–2024 (USD MILLION) 141

TABLE 29 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2025–2030 (USD MILLION) 141

TABLE 30 SOFTWARE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY TYPE,

2020–2024 (USD MILLION) 142

TABLE 31 SOFTWARE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY TYPE,

2025–2030 (USD MILLION) 142

TABLE 32 SOFTWARE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION,

2020–2024 (USD MILLION) 143

TABLE 33 SOFTWARE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION,

2025–2030 (USD MILLION) 143

TABLE 34 GEOAI & ML PLATFORMS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2020–2024 (USD MILLION) 144

TABLE 35 GEOAI & ML PLATFORMS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2025–2030 (USD MILLION) 144

TABLE 36 GEOSPATIAL ANALYTICS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 146

TABLE 37 GEOSPATIAL ANALYTICS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 146

TABLE 38 TRADITIONAL GIS SOLUTIONS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2020–2024 (USD MILLION) 147

TABLE 39 TRADITIONAL GIS SOLUTIONS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2025–2030 (USD MILLION) 147

TABLE 40 LOCATION INTELLIGENCE (LI): GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2020–2024 (USD MILLION) 149

TABLE 41 LOCATION INTELLIGENCE (LI): GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2025–2030 (USD MILLION) 149

TABLE 42 DATA PROCESSING & ETL: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2020–2024 (USD MILLION) 151

TABLE 43 DATA PROCESSING & ETL: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2025–2030 (USD MILLION) 152

TABLE 44 GEOSPATIAL ACQUISITION SYSTEMS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY TYPE, 2020–2024 (USD MILLION) 153

TABLE 45 GEOSPATIAL ACQUISITION SYSTEMS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY TYPE, 2025–2030 (USD MILLION) 154

TABLE 46 GEOSPATIAL ACQUISITION SYSTEMS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 154

TABLE 47 GEOSPATIAL ACQUISITION SYSTEMS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 154

TABLE 48 SENSING & CAPTURE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 155

TABLE 49 SENSING & CAPTURE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 155

TABLE 50 POSITIONING & TRACKING: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2020–2024 (USD MILLION) 157

TABLE 51 POSITIONING & TRACKING: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2025–2030 (USD MILLION) 157

TABLE 52 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICES,

2020–2024 (USD MILLION) 159

TABLE 53 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICES,

2025–2030 (USD MILLION) 159

TABLE 54 SERVICES: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION,

2020–2024 (USD MILLION) 159

TABLE 55 SERVICES: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION,

2025–2030 (USD MILLION) 159

TABLE 56 CORE SERVICES: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 160

TABLE 57 CORE SERVICES: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 160

TABLE 58 MANAGED SERVICES: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 162

TABLE 59 MANAGED SERVICES: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 163

TABLE 60 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2020–2024 (USD MILLION) 166

TABLE 61 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2025–2030 (USD MILLION) 166

TABLE 62 VECTOR & GIS ANALYTICS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2020–2024 (USD MILLION) 167

TABLE 63 VECTOR & GIS ANALYTICS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2025–2030 (USD MILLION) 167

TABLE 64 RASTER & IMAGERY ANALYTICS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2020–2024 (USD MILLION) 169

TABLE 65 RASTER & IMAGERY ANALYTICS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2025–2030 (USD MILLION) 169

TABLE 66 STREAMING & REAL-TIME ANALYTICS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 171

TABLE 67 STREAMING & REAL-TIME ANALYTICS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 171

TABLE 68 GEOVISUALIZATION: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 173

TABLE 69 GEOVISUALIZATION: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 173

TABLE 70 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2020–2024 (USD MILLION) 177

TABLE 71 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2025–2030 (USD MILLION) 177

TABLE 72 IMAGERY DATA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION,

2020–2024 (USD MILLION) 178

TABLE 73 IMAGERY DATA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION,

2025–2030 (USD MILLION) 178

TABLE 74 NON-IMAGERY DATA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 180

TABLE 75 NON-IMAGERY DATA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 180

TABLE 76 GEOTEMPORAL & FUSION: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2020–2024 (USD MILLION) 182

TABLE 77 GEOTEMPORAL & FUSION: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2025–2030 (USD MILLION) 182

TABLE 78 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2020–2024 (USD MILLION) 186

TABLE 79 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 187

TABLE 80 ASSET MONITORING & MANAGEMENT: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 188

TABLE 81 ASSET MONITORING & MANAGEMENT: GEOSPATIAL INTELLIGENCE (GEOAI),

BY REGION, 2025–2030 (USD MILLION) 188

TABLE 82 RISK ASSESSMENT & MODELING: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 189

TABLE 83 RISK ASSESSMENT & MODELING: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 189

TABLE 84 PRECISION AGRICULTURE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2020–2024 (USD MILLION) 190

TABLE 85 PRECISION AGRICULTURE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2025–2030 (USD MILLION) 190

TABLE 86 DISASTER MANAGEMENT & RESPONSE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 191

TABLE 87 DISASTER MANAGEMENT & RESPONSE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 191

TABLE 88 URBAN PLANNING & DIGITAL TWINS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 192

TABLE 89 URBAN PLANNING & DIGITAL TWINS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 192

TABLE 90 SURVEILLANCE & SECURITY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2020–2024 (USD MILLION) 193

TABLE 91 SURVEILLANCE & SECURITY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2025–2030 (USD MILLION) 193

TABLE 92 SUPPLY CHAIN & ROUTE OPTIMIZATION: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 194

TABLE 93 SUPPLY CHAIN & ROUTE OPTIMIZATION: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 194

TABLE 94 ENVIRONMENTAL & CLIMATE MONITORING: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 195

TABLE 95 ENVIRONMENTAL & CLIMATE MONITORING: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 195

TABLE 96 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2020–2024 (USD MILLION) 198

TABLE 97 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2025–2030 (USD MILLION) 199

TABLE 98 ENERGY & UTILITIES: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 200

TABLE 99 ENERGY & UTILITIES: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 200

TABLE 100 GOVERNMENT & DEFENSE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2020–2024 (USD MILLION) 201

TABLE 101 GOVERNMENT & DEFENSE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2025–2030 (USD MILLION) 201

TABLE 102 TELECOMMUNICATION: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 202

TABLE 103 TELECOMMUNICATION: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 202

TABLE 104 INSURANCE & FINANCIAL SERVICES: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 203

TABLE 105 INSURANCE & FINANCIAL SERVICES: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 203

TABLE 106 REAL ESTATE & CONSTRUCTION: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2020–2024 (USD MILLION) 204

TABLE 107 REAL ESTATE & CONSTRUCTION: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2025–2030 (USD MILLION) 204

TABLE 108 AUTOMOTIVE & TRANSPORTATION: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 205

TABLE 109 AUTOMOTIVE & TRANSPORTATION: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 205

TABLE 110 HEALTHCARE & LIFE SCIENCES: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2020–2024 (USD MILLION) 206

TABLE 111 HEALTHCARE & LIFE SCIENCES: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET,

BY REGION, 2025–2030 (USD MILLION) 206

TABLE 112 MINING: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION,

2020–2024 (USD MILLION) 207

TABLE 113 MINING: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION,

2025–2030 (USD MILLION) 207

TABLE 114 AGRICULTURE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION,

2020–2024 (USD MILLION) 208

TABLE 115 AGRICULTURE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION,

2025–2030 (USD MILLION) 208

TABLE 116 OTHER VERTICALS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2020–2024 (USD MILLION) 210

TABLE 117 OTHER VERTICALS: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION, 2025–2030 (USD MILLION) 210

TABLE 118 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION,

2020–2024 (USD MILLION) 213

TABLE 119 GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY REGION,

2025–2030 (USD MILLION) 213

TABLE 120 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING, 2020–2024 (USD MILLION) 216

TABLE 121 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING, 2025–2030 (USD MILLION) 216

TABLE 122 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE, 2020–2024 (USD MILLION) 216

TABLE 123 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE, 2025–2030 (USD MILLION) 216

TABLE 124 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2020–2024 USD MILLION) 217

TABLE 125 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2025–2030 (USD MILLION) 217

TABLE 126 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE, 2020–2024 USD MILLION) 217

TABLE 127 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE, 2025–2030 (USD MILLION) 217

TABLE 128 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2020–2024 (USD MILLION) 218

TABLE 129 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2025–2030 (USD MILLION) 218

TABLE 130 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE, 2020–2024 (USD MILLION) 218

TABLE 131 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE, 2025–2030 (USD MILLION) 218

TABLE 132 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION, 2020–2024 (USD MILLION) 219

TABLE 133 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 219

TABLE 134 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL, 2020–2024 (USD MILLION) 220

TABLE 135 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL, 2025–2030 (USD MILLION) 220

TABLE 136 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY COUNTRY, 2020–2024 (USD MILLION) 220

TABLE 137 NORTH AMERICA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 221

TABLE 138 US: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2020–2024 (USD MILLION) 221

TABLE 139 US: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2025–2030 (USD MILLION) 222

TABLE 140 US: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2020–2024 (USD MILLION) 222

TABLE 141 US: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2025–2030 (USD MILLION) 222

TABLE 142 US: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2020–2024 USD MILLION) 222

TABLE 143 US: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2025–2030 (USD MILLION) 223

TABLE 144 US: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2020–2024 USD MILLION) 223

TABLE 145 US: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2025–2030 (USD MILLION) 223

TABLE 146 US: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2020–2024 (USD MILLION) 223

TABLE 147 US: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2025–2030 (USD MILLION) 224

TABLE 148 US: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2020–2024 (USD MILLION) 224

TABLE 149 US: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2025–2030 (USD MILLION) 224

TABLE 150 US: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2020–2024 (USD MILLION) 225

TABLE 151 US: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 225

TABLE 152 US: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2020–2024 (USD MILLION) 226

TABLE 153 US: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2025–2030 (USD MILLION) 226

TABLE 154 CANADA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2020–2024 (USD MILLION) 227

TABLE 155 CANADA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2025–2030 (USD MILLION) 227

TABLE 156 CANADA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2020–2024 (USD MILLION) 227

TABLE 157 CANADA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2025–2030 (USD MILLION) 228

TABLE 158 CANADA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2020–2024 USD MILLION) 228

TABLE 159 CANADA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2025–2030 (USD MILLION) 228

TABLE 160 CANADA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2020–2024 USD MILLION) 228

TABLE 161 CANADA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2025–2030 (USD MILLION) 229

TABLE 162 CANADA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2020–2024 (USD MILLION) 229

TABLE 163 CANADA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2025–2030 (USD MILLION) 229

TABLE 164 CANADA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2020–2024 (USD MILLION) 229

TABLE 165 CANADA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2025–2030 (USD MILLION) 230

TABLE 166 CANADA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2020–2024 (USD MILLION) 230

TABLE 167 CANADA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 230

TABLE 168 CANADA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2020–2024 (USD MILLION) 231

TABLE 169 CANADA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2025–2030 (USD MILLION) 231

TABLE 170 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2020–2024 (USD MILLION) 233

TABLE 171 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2025–2030 (USD MILLION) 233

TABLE 172 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2020–2024 (USD MILLION) 233

TABLE 173 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2025–2030 (USD MILLION) 234

TABLE 174 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2020–2024 USD MILLION) 234

TABLE 175 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2025–2030 (USD MILLION) 234

TABLE 176 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2020–2024 USD MILLION) 234

TABLE 177 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2025–2030 (USD MILLION) 235

TABLE 178 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2020–2024 (USD MILLION) 235

TABLE 179 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2025–2030 (USD MILLION) 235

TABLE 180 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2020–2024 (USD MILLION) 235

TABLE 181 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2025–2030 (USD MILLION) 236

TABLE 182 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2020–2024 (USD MILLION) 236

TABLE 183 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 236

TABLE 184 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2020–2024 (USD MILLION) 237

TABLE 185 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2025–2030 (USD MILLION) 237

TABLE 186 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY COUNTRY,

2020–2024 (USD MILLION) 238

TABLE 187 EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 238

TABLE 188 UK: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2020–2024 (USD MILLION) 239

TABLE 189 UK: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2025–2030 (USD MILLION) 239

TABLE 190 UK: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2020–2024 (USD MILLION) 239

TABLE 191 UK: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2025–2030 (USD MILLION) 240

TABLE 192 UK: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2020–2024 USD MILLION) 240

TABLE 193 UK: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2025–2030 (USD MILLION) 240

TABLE 194 UK: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2020–2024 USD MILLION) 240

TABLE 195 UK: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2025–2030 (USD MILLION) 241

TABLE 196 UK: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2020–2024 (USD MILLION) 241

TABLE 197 UK: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2025–2030 (USD MILLION) 241

TABLE 198 UK: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2020–2024 (USD MILLION) 241

TABLE 199 UK: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2025–2030 (USD MILLION) 242

TABLE 200 UK: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2020–2024 (USD MILLION) 242

TABLE 201 UK: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 242

TABLE 202 UK: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2020–2024 (USD MILLION) 243

TABLE 203 UK: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2025–2030 (USD MILLION) 243

TABLE 204 GERMANY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2020–2024 (USD MILLION) 244

TABLE 205 GERMANY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2025–2030 (USD MILLION) 244

TABLE 206 GERMANY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2020–2024 (USD MILLION) 245

TABLE 207 GERMANY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2025–2030 (USD MILLION) 245

TABLE 208 GERMANY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2020–2024 USD MILLION) 245

TABLE 209 GERMANY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2025–2030 (USD MILLION) 245

TABLE 210 GERMANY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2020–2024 USD MILLION) 246

TABLE 211 GERMANY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2025–2030 (USD MILLION) 246

TABLE 212 GERMANY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2020–2024 (USD MILLION) 246

TABLE 213 GERMANY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2025–2030 (USD MILLION) 246

TABLE 214 GERMANY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2020–2024 (USD MILLION) 247

TABLE 215 GERMANY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2025–2030 (USD MILLION) 247

TABLE 216 GERMANY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2020–2024 (USD MILLION) 247

TABLE 217 GERMANY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 248

TABLE 218 GERMANY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2020–2024 (USD MILLION) 248

TABLE 219 GERMANY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2025–2030 (USD MILLION) 249

TABLE 220 FRANCE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2020–2024 (USD MILLION) 250

TABLE 221 FRANCE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2025–2030 (USD MILLION) 250

TABLE 222 FRANCE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2020–2024 (USD MILLION) 250

TABLE 223 FRANCE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2025–2030 (USD MILLION) 250

TABLE 224 FRANCE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2020–2024 USD MILLION) 251

TABLE 225 FRANCE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2025–2030 (USD MILLION) 251

TABLE 226 FRANCE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2020–2024 USD MILLION) 251

TABLE 227 FRANCE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2025–2030 (USD MILLION) 251

TABLE 228 FRANCE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2020–2024 (USD MILLION) 252

TABLE 229 FRANCE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2025–2030 (USD MILLION) 252

TABLE 230 FRANCE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2020–2024 (USD MILLION) 252

TABLE 231 FRANCE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2025–2030 (USD MILLION) 252

TABLE 232 FRANCE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2020–2024 (USD MILLION) 253

TABLE 233 FRANCE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 253

TABLE 234 FRANCE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2020–2024 (USD MILLION) 254

TABLE 235 FRANCE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2025–2030 (USD MILLION) 254

TABLE 236 ITALY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2020–2024 (USD MILLION) 255

TABLE 237 ITALY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2025–2030 (USD MILLION) 255

TABLE 238 ITALY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2020–2024 (USD MILLION) 256

TABLE 239 ITALY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2025–2030 (USD MILLION) 256

TABLE 240 ITALY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2020–2024 USD MILLION) 256

TABLE 241 ITALY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2025–2030 (USD MILLION) 256

TABLE 242 ITALY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2020–2024 USD MILLION) 257

TABLE 243 ITALY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2025–2030 (USD MILLION) 257

TABLE 244 ITALY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2020–2024 (USD MILLION) 257

TABLE 245 ITALY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2025–2030 (USD MILLION) 257

TABLE 246 ITALY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2020–2024 (USD MILLION) 258

TABLE 247 ITALY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2025–2030 (USD MILLION) 258

TABLE 248 ITALY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2020–2024 (USD MILLION) 258

TABLE 249 ITALY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 259

TABLE 250 ITALY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2020–2024 (USD MILLION) 259

TABLE 251 ITALY: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2025–2030 (USD MILLION) 260

TABLE 252 REST OF EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING, 2020–2024 (USD MILLION) 261

TABLE 253 REST OF EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING, 2025–2030 (USD MILLION) 261

TABLE 254 REST OF EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE, 2020–2024 (USD MILLION) 262

TABLE 255 REST OF EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE, 2025–2030 (USD MILLION) 262

TABLE 256 REST OF EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2020–2024 USD MILLION) 262

TABLE 257 REST OF EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2025–2030 (USD MILLION) 262

TABLE 258 REST OF EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE, 2020–2024 USD MILLION) 263

TABLE 259 REST OF EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE, 2025–2030 (USD MILLION) 263

TABLE 260 REST OF EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2020–2024 (USD MILLION) 263

TABLE 261 REST OF EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2025–2030 (USD MILLION) 263

TABLE 262 REST OF EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE, 2020–2024 (USD MILLION) 264

TABLE 263 REST OF EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE, 2025–2030 (USD MILLION) 264

TABLE 264 REST OF EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION, 2020–2024 (USD MILLION) 264

TABLE 265 REST OF EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 265

TABLE 266 REST OF EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL, 2020–2024 (USD MILLION) 265

TABLE 267 REST OF EUROPE: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL, 2025–2030 (USD MILLION) 266

TABLE 268 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2020–2024 (USD MILLION) 268

TABLE 269 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2025–2030 (USD MILLION) 268

TABLE 270 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE, 2020–2024 (USD MILLION) 268

TABLE 271 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE, 2025–2030 (USD MILLION) 268

TABLE 272 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2020–2024 USD MILLION) 269

TABLE 273 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2025–2030 (USD MILLION) 269

TABLE 274 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2020–2024 USD MILLION) 269

TABLE 275 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2025–2030 (USD MILLION) 269

TABLE 276 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2020–2024 (USD MILLION) 270

TABLE 277 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2025–2030 (USD MILLION) 270

TABLE 278 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2020–2024 (USD MILLION) 270

TABLE 279 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2025–2030 (USD MILLION) 270

TABLE 280 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION, 2020–2024 (USD MILLION) 271

TABLE 281 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 271

TABLE 282 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2020–2024 (USD MILLION) 272

TABLE 283 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2025–2030 (USD MILLION) 272

TABLE 284 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY COUNTRY,

2020–2024 (USD MILLION) 273

TABLE 285 ASIA PACIFIC: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 273

TABLE 286 CHINA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2020–2024 (USD MILLION) 274

TABLE 287 CHINA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2025–2030 (USD MILLION) 274

TABLE 288 CHINA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2020–2024 (USD MILLION) 275

TABLE 289 CHINA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2025–2030 (USD MILLION) 275

TABLE 290 CHINA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2020–2024 USD MILLION) 275

TABLE 291 CHINA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY GEOSPATIAL ACQUISITION SYSTEM, 2025–2030 (USD MILLION) 275

TABLE 292 CHINA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2020–2024 USD MILLION) 276

TABLE 293 CHINA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SERVICE,

2025–2030 (USD MILLION) 276

TABLE 294 CHINA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2020–2024 (USD MILLION) 276

TABLE 295 CHINA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY CORE TECHNOLOGY ARCHITECTURE, 2025–2030 (USD MILLION) 276

TABLE 296 CHINA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2020–2024 (USD MILLION) 277

TABLE 297 CHINA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY DATA TYPE,

2025–2030 (USD MILLION) 277

TABLE 298 CHINA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2020–2024 (USD MILLION) 277

TABLE 299 CHINA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 278

TABLE 300 CHINA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2020–2024 (USD MILLION) 278

TABLE 301 CHINA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY VERTICAL,

2025–2030 (USD MILLION) 279

TABLE 302 INDIA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2020–2024 (USD MILLION) 280

TABLE 303 INDIA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY OFFERING,

2025–2030 (USD MILLION) 280

TABLE 304 INDIA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2020–2024 (USD MILLION) 280

TABLE 305 INDIA: GEOSPATIAL INTELLIGENCE (GEOAI) MARKET, BY SOFTWARE,

2025–2030 (USD MILLION) 281