AI in Mining Market - Global Forecast to 2032

鉱業におけるAI市場 - 提供内容(ソフトウェア、サービス)、採掘タイプ(表面採掘、地下採掘)、導入モード(オンプレミス、クラウド、ハイブリッド)、テクノロジー(生成AI、機械学習、NLP)、アプリケーション、業種、地域別 - 2032年までの世界予測

AI in Mining Market by Offering (Software, Services), Mining Type (Surface, Underground), Deployment Mode (On-Premises, Cloud, Hybrid), Technology (Generative AI, Machine Learning, NLP), Application, Vertical, and Region - Global Forecast to 2032

| 出版 | MarketsandMarkets |

| 出版年月 | 2025年12月 |

| ページ数 | 274 |

| 図表数 | 331 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-11953 |

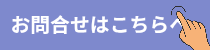

鉱業におけるAI市場は、2025年の26億米ドルから2032年には99億3000万米ドルに拡大し、2025年から2032年にかけて年平均成長率(CAGR)21.1%で成長すると予測されています。鉱業におけるAI市場は、急速なデジタルトランスフォーメーションと、鉱業現場におけるIoT、クラウドコンピューティング、5G接続の導入拡大によって牽引されています。自律走行運搬システム、スマート掘削、フリート管理プラットフォームの導入拡大は、特に複雑でアクセスが困難な鉱業現場における自動化と遠隔操作の実現を加速させます。

調査範囲:

本調査レポートは、マイニングAI市場を、提供内容、マイニングの種類、導入形態、技術、用途、業種、地域に基づいて分類しています。本レポートでは、マイニングAI市場における主要な推進要因、制約要因、課題、機会を解説し、2032年までの予測を示しています。さらに、本レポートには、マイニングAI市場エコシステムに含まれるすべての企業のリーダーシップマッピングと分析も含まれています。

レポート購入の主なメリット

本レポートは、鉱業におけるAI市場全体および各サブセグメントの概算値に関する情報を提供し、市場リーダー企業および新規参入企業にとって役立ちます。また、本レポートは、関係者が競争環境を理解し、ビジネスポジショニングを改善し、適切な市場開拓戦略を策定するための洞察を深めるのに役立ちます。さらに、本レポートは、関係者が市場の動向を把握し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供するのにも役立ちます。

本レポートでは、以下の点について洞察を提供しています。

鉱業におけるAI市場における主要な推進要因(AIを活用した安全性、効率性、生産性の向上への重点)、制約要因(導入コストの高さとレガシーシステムとの複雑な統合)、機会(鉱山事業者のデジタル技術への傾倒)、課題(AIプラットフォーム、センサー、採掘機器間の相互運用性の問題)の分析

- 製品開発/イノベーション:鉱業AI市場における今後の技術、研究開発活動、新製品・新サービスの投入に関する詳細な洞察

- 市場開発:有望な市場に関する包括的な情報。本レポートでは、様々な地域における鉱業AI市場を分析しています。

- 市場多様化:鉱業AI市場における新製品・新サービス、未開拓地域、最近の動向、投資に関する包括的な情報

- 競合評価:鉱業AI市場における主要企業(キャタピラー(米国)、コマツ(日本)、サンドビックAB(スウェーデン)、日立建機(日本)、ヘキサゴンAB(スウェーデン)など)の市場シェア、成長戦略、サービス提供に関する詳細な評価

Report Description

The AI in mining market is anticipated to grow from USD 2.60 billion in 2025 to USD 9.93 billion by 2032, at a CAGR of 21.1% between 2025 and 2032. The AI in mining market is driven by rapid digital transformation and the increasing deployment of IoT, cloud computing, and 5G connectivity across mining sites. The expanding adoption of autonomous haulage systems, smart drilling, and fleet management platforms accelerates automation and enables remote operations, particularly in complex and inaccessible mining locations.

AI in Mining Market – Global Forecast to 2032

“Generative AI technology segment is estimated to hold the largest market share in 2030.”

The generative AI technology segment is expected to account for the largest share of the AI in mining market in 2030 due to its ability to enhance operational efficiency, decision-making, and predictive capabilities across mining processes. Generative AI can analyze massive volumes of geological, operational, and sensor data to generate actionable insights, simulations, and predictive models, enabling mining companies to optimize exploration, drilling, and extraction strategies. By producing accurate 3D models of ore bodies, predicting equipment failures, and simulating mining scenarios, generative AI reduces operational risks, downtime, and costs. Additionally, it accelerates design and planning workflows, allowing engineers to test multiple approaches virtually before implementation. The technology also supports environmental compliance and safety management by generating predictive alerts for hazardous conditions and tailings management. Its integration with other AI tools, such as computer vision and IoT analytics, further amplifies value across end-to-end mining operations. Given the growing demand for advanced analytics, automation, and smarter resource utilization, generative AI provides a scalable and intelligent solution that addresses both operational and strategic challenges, securing its position as the leading technology segment in the AI in mining market.

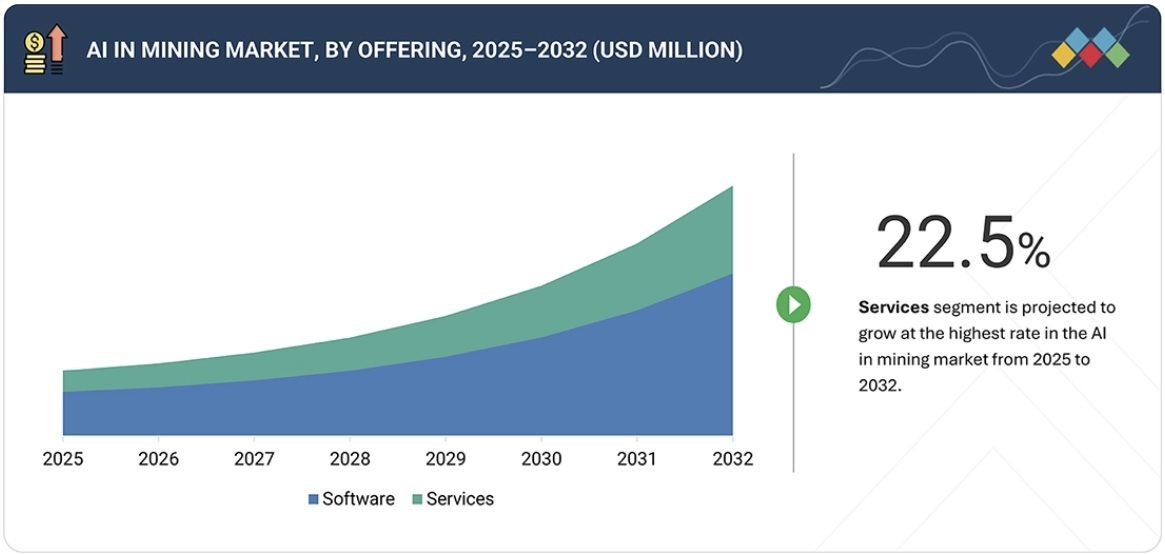

“Services segment is estimated to record the highest CAGR during the forecast period.”

The services segment is expected to grow at the highest CAGR in the AI in mining market during the forecast period due to the increasing reliance of mining companies on consulting, system integration, training, and managed services to successfully deploy and scale advanced AI solutions. As mining operations become more complex and digitally connected, companies require specialized expertise to integrate AI platforms with existing equipment, IoT devices, enterprise systems, and remote operational centers. Services are crucial in customizing AI use cases, such as predictive maintenance, fleet optimization, geological modeling, and safety monitoring, to meet site-specific challenges and regulatory requirements. Additionally, the shortage of skilled AI and data science professionals within the mining sector pushes operators to depend heavily on third-party service providers for ongoing support, real-time performance monitoring, and continuous model improvements. Managed services and subscription-based deployment models further drive the demand by reducing upfront investment costs and ensuring long-term ROI through outcome-based performance contracts. As AI transitions from pilot projects to full-scale implementation, service providers become essential partners, fueling the segmental growth.

AI in Mining Market – Global Forecast to 2032 – region

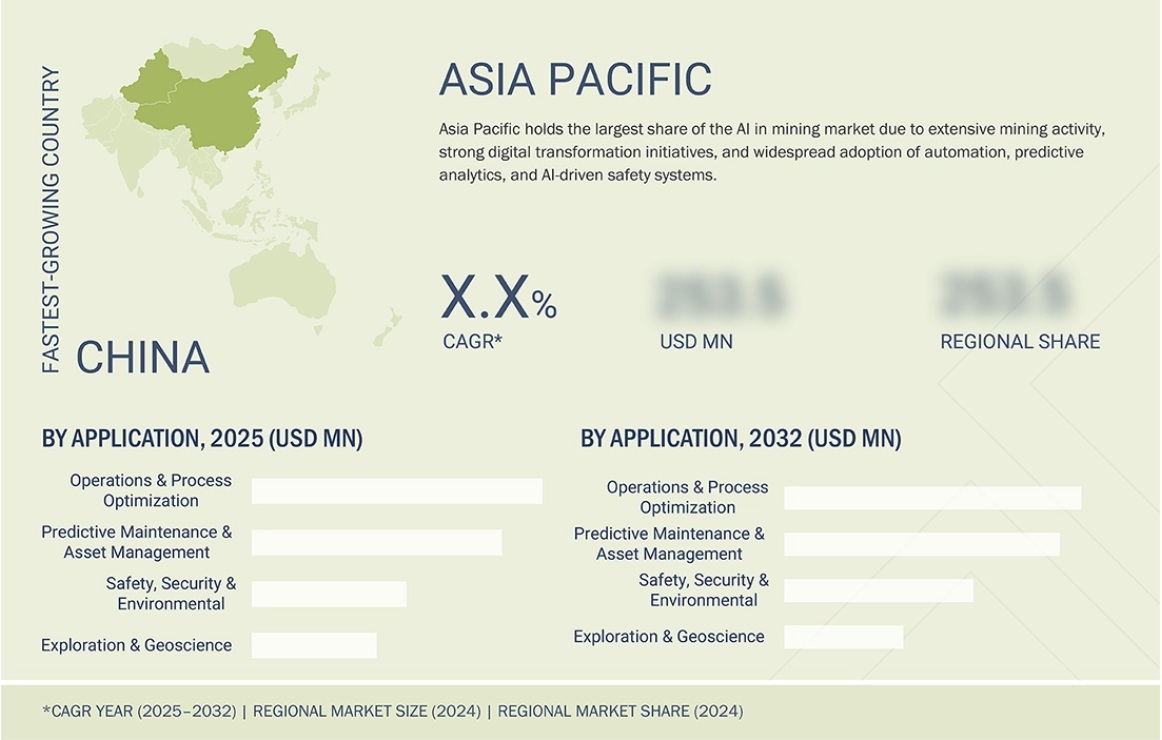

“Asia Pacific is projected to hold the largest share of the AI in mining market in 2030.”

Asia Pacific is estimated to hold the largest market share in 2030 due to the massive mining infrastructure expansion, the growing industrial output, and the rising demand for metals, minerals, and coal required for energy production and manufacturing. China, Australia, India, and Indonesia are among the world’s largest producers of essential raw materials, including iron ore, copper, gold, lithium, and coal, leading to substantial investment in mining modernization. The increasing need for operational efficiency, cost optimization, and high productivity has accelerated the adoption of advanced AI technologies, such as predictive analytics, autonomous haulage systems, AI-powered drilling optimization, and real-time equipment monitoring. Government initiatives supporting digital transformation and Industry 4.0 integration in mining, along with large-scale public and private funding for automation, further strengthen AI deployment. Additionally, the high availability of skilled engineering talent and rapidly evolving digital infrastructure—5G connectivity and cloud computing platforms—enable seamless integration of AI solutions across remote mining sites. As the region continues to scale mineral extraction to support electronics, EV batteries, and renewable energy industries, it is positioned to lead the AI in mining market by 2030.

Extensive primary interviews were conducted with key industry experts in the AI in mining to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is provided below:

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1–40%, Tier 2–35%, and Tier 3–25%

- By Designation: C-level Executives–45%, Directors–40%, and Others–15%

- By Region: North America–30%, Europe–20%, Asia Pacific–35%, and RoW–15%

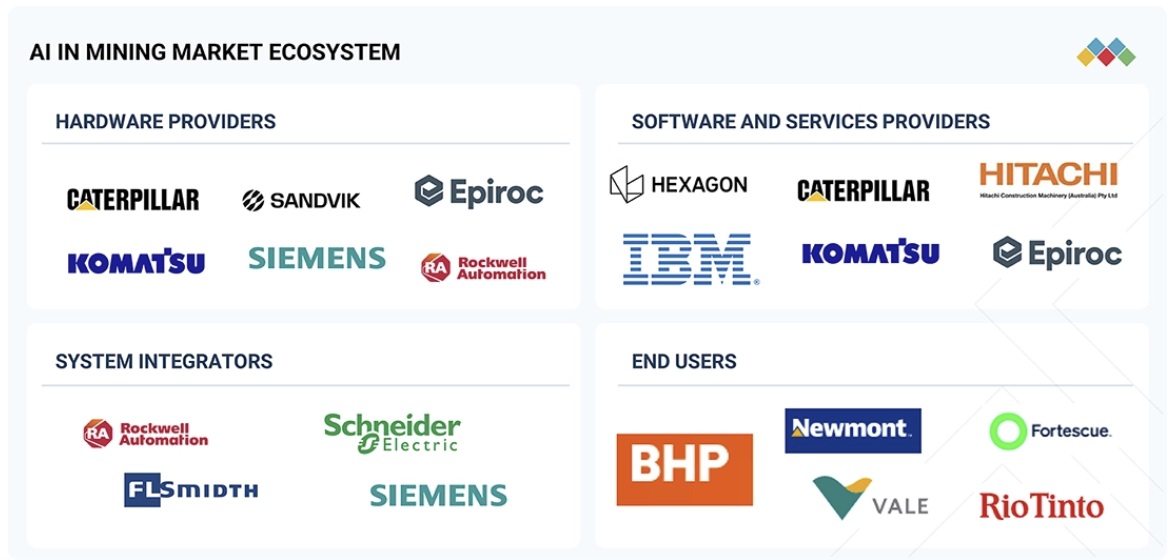

The report profiles key players in the AI in mining market with their respective market ranking analysis. Prominent players profiled in this report are Caterpillar (US), Komatsu Ltd. (Japan), Sandvik AB (Sweden), Epiroc AB (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), Hexagon AB (Sweden), Rockwell Automation (US), Siemens (Germany), Trimble Inc. (US), ABB (Switzerland), Microsoft (US), and SAP SE (Germany), among others.

AI in Mining Market – Global Forecast to 2032 – ecosystem

Apart from this, IBM (US), RPMGLOBAL HOLDINGS LIMITED (Australia), Liebheer (Switzerland), GroundHog (US), Haultrax (Australia), Micromine (Australia), SYMX.AI (Canada), The Tomorrow Companies Inc. (US), VRIFY (US), IntelliSense.io (UK), Orica Limited. (Australia), MineSense Technologies Ltd. (Canada), Exyn Technologies (US), among others, are among the few other companies in the AI in mining market.

Research Coverage:

This research report categorizes the AI in mining market based on offering, mining type, deployment mode, technology, application, vertical, and region. The report describes the major drivers, restraints, challenges, and opportunities pertaining to the AI in mining market and forecasts the same till 2032. Apart from these, the report also consists of leadership mapping and analysis of all the companies included in the AI in mining market ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the numbers for the overall AI in mining market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (strong focus on AI-enabled safety, efficiency, and productivity improvements), restraints (high deployment costs and complex integration with legacy systems), opportunities (inclination of mine operators toward digital technologies), and challenges (interoperability issues between AI platforms, sensors, and mining equipment) of the AI in mining market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AI in mining market

- Market Development: Comprehensive information about lucrative markets–the report analyzes the AI in mining market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AI in mining market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Caterpillar (US), Komatsu Ltd. (Japan), Sandvik AB (Sweden), Hitachi Construction Machinery Co., Ltd. (Japan), and Hexagon AB (Sweden) in the AI in mining market

Table of Contents

1 INTRODUCTION 26

1.1 STUDY OBJECTIVES 26

1.2 MARKET DEFINITION 26

1.3 STUDY SCOPE 27

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 27

1.3.2 INCLUSIONS AND EXCLUSIONS 28

1.3.3 YEARS CONSIDERED 28

1.4 CURRENCY CONSIDERED 29

1.5 LIMITATIONS 29

1.6 STAKEHOLDERS 29

2 EXECUTIVE SUMMARY 30

2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS 30

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 31

2.3 DISRUPTIONS SHAPING AI IN MINING MARKET 32

2.4 HIGH-GROWTH SEGMENTS 32

2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST 33

3 PREMIUM INSIGHTS 35

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AI IN MINING MARKET 35

3.2 AI IN MINING MARKET, BY OFFERING 36

3.3 AI IN MINING MARKET, BY DEPLOYMENT MODE 36

3.4 AI IN MINING MARKET, BY TECHNOLOGY 37

3.5 AI IN MINING MARKET, BY MINING TECHNIQUE 37

3.6 AI IN MINING MARKET, BY MINING TYPE 38

3.7 AI IN MINING MARKET IN ASIA PACIFIC, BY OFFERING AND COUNTRY 38

3.8 AI IN MINING MARKET, BY GEOGRAPHY 39

4 MARKET OVERVIEW 40

4.1 INTRODUCTION 40

4.2 MARKET DYNAMICS 40

4.2.1 DRIVERS 41

4.2.1.1 Growing focus on AI-driven safety, efficiency, and productivity 41

4.2.1.2 Rising adoption of predictive maintenance and real-time monitoring solutions 42

4.2.1.3 High emphasis on data-driven sustainable mining operations 42

4.2.2 RESTRAINTS 43

4.2.2.1 High deployment costs and integration complexities 43

4.2.2.2 Poor data quality and limited digital infrastructure in remote mine sites 43

4.2.3 OPPORTUNITIES 44

4.2.3.1 Inclination toward digital technologies to optimize mining operations 44

4.2.3.2 Rising adoption of smart, connected mining practices 45

4.2.3.3 Reliance on AI for advanced geological modeling and exploration 45

4.2.4 CHALLENGES 46

4.2.4.1 Interoperability issues between AI platforms, sensors, and mining equipment 46

4.2.4.2 Rising sustainability concerns hindering tech-led mining 47

4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 47

4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 48

5 INDUSTRY TRENDS 50

5.1 PORTER’S FIVE FORCES ANALYSIS 50

5.1.1 THREAT OF NEW ENTRANTS 51

5.1.2 THREAT OF SUBSTITUTES 52

5.1.3 BARGAINING POWER OF SUPPLIERS 52

5.1.4 BARGAINING POWER OF BUYERS 52

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 52

5.2 MACROECONOMIC OUTLOOK 53

5.2.1 INTRODUCTION 53

5.2.2 GDP TRENDS AND FORECAST 53

5.2.3 TRENDS IN GLOBAL MINING INDUSTRY 56

5.2.4 TRENDS IN GLOBAL AI INDUSTRY 56

5.3 VALUE CHAIN ANALYSIS 56

5.4 ECOSYSTEM ANALYSIS 58

5.5 PRICING ANALYSIS 59

5.5.1 PRICING RANGE OF AI-POWERED MINING SOFTWARE, BY OFFERING, 2024 60

5.5.2 PRICING RANGE OF AI-POWERED MINING SOFTWARE, BY KEY PLAYER, 2024 60

5.5.3 AVERAGE SELLING PRICE TREND OF AI-POWERED MINING SOFTWARE,

BY REGION, 2021–2024 61

5.6 TRADE ANALYSIS 62

5.6.1 IMPORT SCENARIO (HS CODE 8429) 62

5.6.2 EXPORT SCENARIO (HS CODE 8429) 63

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 64

5.8 INVESTMENT AND FUNDING SCENARIO 64

5.9 KEY CONFERENCES AND EVENTS, 2026 65

5.10 CASE STUDY ANALYSIS 66

5.10.1 ROCKWELL AUTOMATION OFFERS CONTROL SYSTEMS AND VISUALIZATION SOLUTIONS TO MINIMIZE DOWNTIME AND OPERATIONAL COST IN MINING PLANT 66

5.10.2 KOMATSU PROVIDES AUTONOMOUS HAULAGE SYSTEM TO ENHANCE PRODUCTIVITY AND SAFETY IN AITIK COPPER MINE 66

5.10.3 ROCKWELL AUTOMATION DEPLOYS FACTORYTALK SUITE AT AMRUN BAUXITE MINE TO IMPROVE OPERATIONAL VISIBILITY 67

5.10.4 HEXAGON OFFERS OPERATIONS MANAGEMENT SOLUTIONS TO STREAMLINE OPERATIONS AT VALTERRA PLATINUM LIMITED’S MINING SITES 67

5.11 IMPACT OF 2025 US TARIFF – AI IN MINING MARKET 67

5.11.1 INTRODUCTION 67

5.11.2 KEY TARIFF RATES 68

5.11.3 PRICE IMPACT ANALYSIS 69

5.11.4 IMPACT ON COUNTRIES/REGIONS 69

5.11.4.1 US 69

5.11.4.2 Europe 70

5.11.4.3 Asia Pacific 71

5.11.5 IMPACT ON MINING TYPES 71

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACTS, PATENTS,

AND INNOVATIONS 73

6.1 KEY TECHNOLOGIES 73

6.1.1 MACHINE LEARNING AND PREDICTIVE ANALYTICS 73

6.1.2 COMPUTER VISION AND AUTONOMOUS SYSTEMS 73

6.2 COMPLEMENTARY TECHNOLOGIES 73

6.2.1 IOT AND EDGE COMPUTING 73

6.2.2 HIGH-PRECISION MAPPING AND GEOSPATIAL ANALYTICS 74

6.3 PATENT ANALYSIS 74

7 REGULATORY LANDSCAPE 77

7.1 REGIONAL REGULATIONS AND COMPLIANCE 77

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 77

7.1.2 STANDARDS 79

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR 81

8.1 INTRODUCTION 81

8.2 DECISION-MAKING PROCESS 81

8.3 KEY STAKEHOLDERS AND BUYING CRITERIA 83

8.3.1 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA 83

8.3.2 BUYING CRITERIA 84

8.4 ADOPTION BARRIERS AND INTERNAL CHALLENGES 84

8.5 UNMET NEEDS OF VARIOUS MINING TYPES 86

9 AI IN MINING MARKET, BY OFFERING 87

9.1 INTRODUCTION 88

9.2 SOFTWARE 89

9.2.1 HIGH EMPHASIS ON DIGITAL TRANSFORMATION, DATA‑DRIVEN DECISION‑MAKING, AND OPERATIONAL EFFICIENCY TO SPUR DEMAND 89

9.3 SERVICES 91

9.3.1 INCREASING USE OF ADVANCED ANALYTICS, MACHINE LEARNING, AND COMPUTER VISION IN MINING OPERATIONS TO DRIVE MARKET 91

10 AI IN MINING MARKET, BY DEPLOYMENT MODE 94

10.1 INTRODUCTION 95

10.2 ON-PREMISES 96

10.2.1 RELIABILITY, OPERATIONAL INDEPENDENCE, AND SUITABILITY FOR MISSION-CRITICAL MINING ACTIVITIES TO BOOST SEGMENTAL GROWTH 96

10.3 CLOUD-BASED 97

10.3.1 ABILITY TO PROVIDE SCALABLE COMPUTING AND CENTRALIZED DATA ACCESSIBILITY TO AUGMENT SEGMENTAL GROWTH 97

10.4 HYBRID 98

10.4.1 SUPPORT FOR REAL-TIME EDGE-BASED DECISION-MAKING TO CONTRIBUTE TO SEGMENTAL GROWTH 98

11 AI IN MINING MARKET, BY TECHNOLOGY 100

11.1 INTRODUCTION 101

11.2 GENERATIVE AI 102

11.2.1 MOUNTING ADOPTION IN EXPLORATION, MINE PLANNING, AND OPERATIONAL SIMULATION TO FOSTER SEGMENTAL GROWTH 102

11.2.2 RULE-BASED MODELS 103

11.2.3 STATISTICAL MODELS 103

11.2.4 DEEP LEARNING 103

11.2.5 GENERATIVE ADVERSARIAL NETWORKS (GANS) 104

11.2.6 AUTOENCODERS 104

11.2.7 CONVOLUTIONAL NEURAL NETWORKS (CNNS) 105

11.2.8 TRANSFORMER MODELS 105

11.3 MACHINE LEARNING 105

11.3.1 RISING NEED FOR PREDICTIVE AND PRESCRIPTIVE ANALYTICS TO ACCELERATE SEGMENTAL GROWTH 105

11.4 NATURAL LANGUAGE PROCESSING 106

11.4.1 STRONG FOCUS ON ANALYZING UNSTRUCTURED DATA TO DERIVE REAL-TIME ACTIONABLE INTELLIGENCE TO BOLSTER SEGMENTAL GROWTH 106

11.5 COMPUTER VISION 107

11.5.1 HIGH SUPPORT FOR REAL-TIME IMAGE AND VIDEO ANALYTICS TO EXPEDITE SEGMENTAL GROWTH 107

12 AI IN MINING MARKET, BY APPLICATION 108

12.1 INTRODUCTION 109

12.2 PREDICTIVE MAINTENANCE & ASSET MANAGEMENT 110

12.2.1 RISING EQUIPMENT MAINTENANCE COSTS AND ASSET COMPLEXITY TO AUGMENT SEGMENTAL GROWTH 110

12.3 OPERATIONS & PROCESS OPTIMIZATION 112

12.3.1 STRONG FOCUS ON MAXIMIZING RECOVERY RATES AND OPTIMIZING OPERATING MARGINS TO FUEL SEGMENTAL GROWTH 112

12.4 EXPLORATION & GEOSCIENCES 115

12.4.1 URGENT NEED TO SECURE CRITICAL MINERALS FOR RENEWABLE ENERGY AND ELECTRIC VEHICLE SUPPLY CHAINS TO DRIVE MARKET 115

12.5 SAFETY, SECURITY & ENVIRONMENT 117

12.5.1 TIGHTENING ENVIRONMENTAL AND WORKER-SAFETY REGULATIONS TO CONTRIBUTE TO SEGMENTAL GROWTH 117

13 AI IN MINING MARKET, BY MINING TECHNIQUE 120

13.1 INTRODUCTION 121

13.2 SURFACE MINING 122

13.2.1 LOW OPERATIONAL COMPLEXITY, REDUCED SAFETY HAZARDS, AND COST ADVANTAGES TO BOOST SEGMENTAL GROWTH 122

13.3 UNDERGROUND MINING 123

13.3.1 STRONG FOCUS ON WORKER SAFETY, SUSTAINABILITY, AND PRODUCTIVITY TO FACILITATE SEGMENTAL GROWTH 123

14 AI IN MINING MARKET, BY MINING TYPE 125

14.1 INTRODUCTION 126

14.2 MINERAL MINING 127

14.2.1 EMPHASIS ON RESOURCE OPTIMIZATION AND COST-EFFICIENT PRODUCTION TO ACCELERATE SEGMENTAL GROWTH 127

14.3 METAL MINING 129

14.3.1 RISING DEMAND FOR CRITICAL MINERALS FOR ELECTRIC VEHICLES AND NEXT-GENERATION MANUFACTURING TO DRIVE MARKET 129

14.4 COAL MINING 132

14.4.1 FOCUS ON SAFETY, COST OPTIMIZATION, AND AUTOMATION TO BOOST SEGMENTAL GROWTH 132

15 AI IN MINING MARKET, BY REGION 135

15.1 INTRODUCTION 136

15.2 NORTH AMERICA 137

15.2.1 US 141

15.2.1.1 Rapid digitalization of surface and underground mining operations to bolster market growth 141

15.2.2 CANADA 142

15.2.2.1 Strong presence of mineral and metal reserves to fuel market growth 142

15.2.3 MEXICO 143

15.2.3.1 High emphasis on predictive maintenance and advanced geological modeling to augment market growth 143

15.3 EUROPE 144

15.3.1 RUSSIA 148

15.3.1.1 Rapid innovation in AI-powered survey and exploration tools to bolster market growth 148

15.3.2 GERMANY 149

15.3.2.1 Industrial modernization and energy transition to contribute to market growth 149

15.3.3 FRANCE 150

15.3.3.1 Emphasis on enhancing operational efficiency, safety, and sustainability to accelerate market growth 150

15.3.4 KAZAKHSTAN 151

15.3.4.1 Digital transformation and Industry 4.0 adoption to foster market growth 151

15.3.5 REST OF EUROPE 152

15.4 ASIA PACIFIC 153

15.4.1 CHINA 157

15.4.1.1 Energy security priorities and massive coal production scale to expedite market growth 157

15.4.2 INDIA 158

15.4.2.1 Need to enhance mineral discovery, improve operational efficiency, and strengthen regulatory compliance to drive market 158

15.4.3 AUSTRALIA 159

15.4.3.1 Vast mineral reserves and technology-driven mining ecosystem to facilitate market growth 159

15.4.4 INDONESIA 160

15.4.4.1 Mounting production of minerals for EV batteries and clean energy technologies to contribute to market growth 160

15.4.5 REST OF ASIA PACIFIC 161

15.5 ROW 162

15.5.1 MIDDLE EAST & AFRICA 166

15.5.1.1 Abundant mineral and energy resources to boost market growth 166

15.5.1.2 GCC countries 167

15.5.1.3 Africa & Rest of Middle East 168

15.5.2 SOUTH AMERICA 169

15.5.2.1 Global energy transition and thriving electric vehicle industry to expedite market growth 169

16 COMPETITIVE LANDSCAPE 171

16.1 OVERVIEW 171

16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2025 171

16.3 MARKET SHARE ANALYSIS, 2024 173

16.4 REVENUE ANALYSIS, 2020–2024 174

16.5 COMPANY VALUATION AND FINANCIAL METRICS 175

16.6 BRAND/PRODUCT COMPARISON 176

16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 177

16.7.1 STARS 177

16.7.2 EMERGING LEADERS 177

16.7.3 PERVASIVE PLAYERS 177

16.7.4 PARTICIPANTS 177

16.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 179

16.7.5.1 Company footprint 179

16.7.5.2 Region footprint 180

16.7.5.3 Offering footprint 181

16.7.5.4 Mining technique footprint 182

16.7.5.5 Application footprint 183

16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 184

16.8.1 PROGRESSIVE COMPANIES 184

16.8.2 RESPONSIVE COMPANIES 184

16.8.3 DYNAMIC COMPANIES 184

16.8.4 STARTING BLOCKS 184

16.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 186

16.8.5.1 Detailed list of key startups/SMEs 186

16.8.5.2 Competitive benchmarking of key startups/SMEs 187

16.9 COMPETITIVE SCENARIO 188

16.9.1 PRODUCT LAUNCHES 188

16.9.2 DEALS 189

17 COMPANY PROFILES 191

17.1 KEY PLAYERS 191

17.1.1 CATERPILLAR 191

17.1.1.1 Business overview 191

17.1.1.2 Products/Solutions/Services offered 192

17.1.1.3 Recent developments 193

17.1.1.3.1 Product launches 193

17.1.1.3.2 Deals 193

17.1.1.4 MnM view 194

17.1.1.4.1 Key strengths/Right to win 194

17.1.1.4.2 Strategic choices 194

17.1.1.4.3 Weaknesses/Competitive threats 194

17.1.2 KOMATSU LTD. 195

17.1.2.1 Business overview 195

17.1.2.2 Products/Solutions/Services offered 196

17.1.2.3 Recent developments 198

17.1.2.3.1 Deals 198

17.1.2.4 MnM view 199

17.1.2.4.1 Key strengths/Right to win 199

17.1.2.4.2 Strategic choices 199

17.1.2.4.3 Weaknesses/Competitive threats 199

17.1.3 SANDVIK AB 200

17.1.3.1 Business overview 200

17.1.3.2 Products/Solutions/Services offered 201

17.1.3.3 Recent developments 202

17.1.3.3.1 Product launches 202

17.1.3.3.2 Deals 202

17.1.3.4 MnM view 203

17.1.3.4.1 Key strengths/Right to win 203

17.1.3.4.2 Strategic choices 203

17.1.3.4.3 Weaknesses/Competitive threats 203

17.1.4 HITACHI CONSTRUCTION MACHINERY CO., LTD. 204

17.1.4.1 Business overview 204

17.1.4.2 Products/Solutions/Services offered 206

17.1.4.3 Recent developments 207

17.1.4.3.1 Product launches 207

17.1.4.3.2 Deals 208

17.1.4.4 MnM view 208

17.1.4.4.1 Key strengths/Right to win 208

17.1.4.4.2 Strategic choices 208

17.1.4.4.3 Weaknesses/Competitive threats 208

17.1.5 HEXAGON AB 209

17.1.5.1 Business overview 209

17.1.5.2 Products/Solutions/Services offered 211

17.1.5.3 Recent developments 212

17.1.5.3.1 Product launches 212

17.1.5.3.2 Deals 213

17.1.5.3.3 Expansions 213

17.1.5.4 MnM view 213

17.1.5.4.1 Key strengths/Right to win 213

17.1.5.4.2 Strategic choices 214

17.1.5.4.3 Weaknesses/Competitive threats 214

17.1.6 EPIROC AB 215

17.1.6.1 Business overview 215

17.1.6.2 Products/Solutions/Services offered 217

17.1.6.3 Recent developments 218

17.1.6.3.1 Deals 218

17.1.6.3.2 Expansions 218

17.1.7 ROCKWELL AUTOMATION 219

17.1.7.1 Business overview 219

17.1.7.2 Products/Solutions/Services offered 221

17.1.8 SIEMENS 222

17.1.8.1 Business overview 222

17.1.8.2 Products/Solutions/Services offered 224

17.1.8.3 Recent developments 225

17.1.8.3.1 Deals 225

17.1.9 TRIMBLE INC. 226

17.1.9.1 Business overview 226

17.1.9.2 Products/Solutions/Services offered 228

17.1.9.3 Recent developments 229

17.1.9.3.1 Product launches 229

17.1.9.3.2 Deals 229

17.1.10 ABB 230

17.1.10.1 Business overview 230

17.1.10.2 Products/Solutions/Services offered 232

17.1.10.3 Recent developments 233

17.1.10.3.1 Product launches 233

17.1.11 MICROSOFT 234

17.1.11.1 Business overview 234

17.1.11.2 Products/Solutions/Services offered 236

17.1.11.3 Recent developments 236

17.1.11.3.1 Deals 236

17.1.12 SAP SE 237

17.1.12.1 Business overview 237

17.1.12.2 Products/Solutions/Services offered 239

17.1.12.3 Recent developments 239

17.1.12.3.1 Deals 239

17.2 OTHER PLAYERS 240

17.2.1 IBM 240

17.2.2 RPMGLOBAL HOLDINGS LIMITED 241

17.2.3 LIEBHEER 242

17.2.4 GROUNDHOG 243

17.2.5 HAULTRAX 244

17.2.6 MICROMINE PTY LTD. 245

17.2.7 SYMX.AI 246

17.2.8 THE TOMORROW COMPANIES INC. 247

17.2.9 VRIFY 248

17.2.10 INTELLISENSE.IO 249

17.2.11 ORICA LIMITED 250

17.2.12 MINESENSE TECHNOLOGIES LTD. 251

17.2.13 EXYN TECHNOLOGIES 252

18 RESEARCH METHODOLOGY 253

18.1 RESEARCH DATA 253

18.2 SECONDARY AND PRIMARY RESEARCH 254

18.2.1 SECONDARY DATA 255

18.2.1.1 Key data from secondary sources 256

18.2.1.2 List of key secondary sources 256

18.2.2 PRIMARY DATA 256

18.2.2.1 Key data from primary sources 257

18.2.2.2 List of primary interview participants 257

18.2.2.3 Breakdown of primaries 258

18.2.2.4 Key industry insights 258

18.3 MARKET SIZE ESTIMATION 259

18.3.1 BOTTOM-UP APPROACH 260

18.3.2 TOP-DOWN APPROACH 260

18.3.3 MARKET SIZE CALCULATION FOR BASE YEAR 261

18.4 MARKET FORECAST APPROACH 262

18.4.1 SUPPLY SIDE 262

18.4.2 DEMAND SIDE 262

18.5 DATA TRIANGULATION 263

18.6 FACTOR ANALYSIS 264

18.7 RESEARCH ASSUMPTIONS 264

18.8 RESEARCH LIMITATIONS 265

18.9 RISK ANALYSIS 265

19 APPENDIX 266

19.1 DISCUSSION GUIDE 266

19.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 270

19.3 CUSTOMIZATION OPTIONS 272

19.4 RELATED REPORTS 272

19.5 AUTHOR DETAILS 273

LIST OF TABLES

TABLE 1 AI IN MINING MARKET: INCLUSIONS AND EXCLUSIONS 28

TABLE 2 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 48

TABLE 3 STRATEGIC MOVES ADOPTED BY TIER-1/2/3 PLAYERS 48

TABLE 4 IMPACT OF PORTER’S FIVE FORCES 50

TABLE 5 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021–2030 53

TABLE 6 ROLE OF COMPANIES IN AI IN MINING ECOSYSTEM 59

TABLE 7 PRICING RANGE OF AI-POWERED MINING SOFTWARE, 2024 (USD) 60

TABLE 8 PRICING RANGE OF AI-POWERED MINING SOFTWARE OFFERED

BY KEY PLAYERS, 2024 (USD/YEAR) 60

TABLE 9 AVERAGE SELLING PRICE TREND OF AI-POWERED MINING SOFTWARE,

BY REGION, 2021–2024 (USD THOUSAND) 61

TABLE 10 IMPORT DATA FOR HS CODE 8429-COMPLIANT PRODUCTS, BY COUNTRY,

2020–2024 (USD MILLION) 62

TABLE 11 EXPORT DATA FOR HS CODE 8429-COMPLIANT PRODUCTS, BY COUNTRY,

2020–2024 (USD MILLION) 63

TABLE 12 LIST OF KEY CONFERENCES AND EVENTS, 2026 65

TABLE 13 CONTROL SYSTEMS AND VISUALIZATION SOLUTIONS ENSURE INTEGRATED CONTROL AND SAFETY IN MINING PLANT 66

TABLE 14 FRONTRUNNER AUTONOMOUS HAULAGE SYSTEM IMPROVES PRODUCTIVITY

AND ASSET UTILIZATION IN AITIK OPEN-PIT COPPER MINE 66

TABLE 15 FACTORYTALK SUITE AUTOMATION SOLUTIONS MAINTAIN CRITICAL OPERATIONS AT AMRUN BAUXITE MINE 67

TABLE 16 J5 OPERATIONS MANAGEMENT SOLUTIONS STREAMLINES OPERATIONS AT MINING SITES OF VALTERRA PLATINUM LIMITED 67

TABLE 17 US-ADJUSTED RECIPROCAL TARIFF RATES 68

TABLE 18 LIST OF KEY PATENTS, 2023–2024 75

TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 77

TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 78

TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 78

TABLE 22 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 79

TABLE 23 AI IN MINING STANDARDS 80

TABLE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY MINING TYPE (%) 83

TABLE 25 KEY BUYING CRITERIA FOR MINING TYPES 84

TABLE 26 UNMET NEEDS IN AI IN MINING MARKET, BY MINING TYPE 86

TABLE 27 AI IN MINING MARKET, BY OFFERING, 2021–2024 (USD MILLION) 88

TABLE 28 AI IN MINING MARKET, BY OFFERING, 2025–2032 (USD MILLION) 88

TABLE 29 SOFTWARE: AI IN MINING MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 90

TABLE 30 SOFTWARE: AI IN MINING MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 90

TABLE 31 SOFTWARE: AI IN MINING MARKET, BY REGION, 2021–2024 (USD MILLION) 90

TABLE 32 SOFTWARE: AI IN MINING MARKET, BY REGION, 2025–2032 (USD MILLION) 91

TABLE 33 SERVICES: AI IN MINING MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 92

TABLE 34 SERVICES: AI IN MINING MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 92

TABLE 35 SERVICES: AI IN MINING MARKET, BY REGION, 2021–2024 (USD MILLION) 92

TABLE 36 SERVICES: AI IN MINING MARKET, BY REGION, 2025–2032 (USD MILLION) 93

TABLE 37 AI IN MINING MARKET, BY DEPLOYMENT MODE, 2021–2024 (USD MILLION) 95

TABLE 38 AI IN MINING MARKET, BY DEPLOYMENT MODE, 2025–2032 (USD MILLION) 96

TABLE 39 ON-PREMISES: AI IN MINING MARKET, BY REGION, 2021–2024 (USD MILLION) 96

TABLE 40 ON-PREMISES: AI IN MINING MARKET, BY REGION, 2025–2032 (USD MILLION) 97

TABLE 41 CLOUD-BASED: AI IN MINING MARKET, BY REGION, 2021–2024 (USD MILLION) 98

TABLE 42 CLOUD-BASED: AI IN MINING MARKET, BY REGION, 2025–2032 (USD MILLION) 98

TABLE 43 HYBRID: AI IN MINING MARKET, BY REGION, 2021–2024 (USD MILLION) 99

TABLE 44 HYBRID: AI IN MINING MARKET, BY REGION, 2025–2032 (USD MILLION) 99

TABLE 45 AI IN MINING MARKET, BY TECHNOLOGY, 2021–2024 (USD MILLION) 101

TABLE 46 AI IN MINING MARKET, BY TECHNOLOGY, 2025–2032 (USD MILLION) 102

TABLE 47 AI IN MINING MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 109

TABLE 48 AI IN MINING MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 110

TABLE 49 PREDICTIVE MAINTENANCE & ASSET MANAGEMENT: AI IN MINING MARKET,

BY MINING TYPE, 2021–2024 (USD MILLION) 111

TABLE 50 PREDICTIVE MAINTENANCE & ASSET MANAGEMENT: AI IN MINING MARKET,

BY MINING TYPE, 2025–2032 (USD MILLION) 111

TABLE 51 PREDICTIVE MAINTENANCE & ASSET MANAGEMENT: AI IN MINING MARKET,

BY OFFERING, 2021–2024 (USD MILLION) 111

TABLE 52 PREDICTIVE MAINTENANCE & ASSET MANAGEMENT: AI IN MINING MARKET,

BY OFFERING, 2025–2032 (USD MILLION) 111

TABLE 53 PREDICTIVE MAINTENANCE & ASSET MANAGEMENT: AI IN MINING MARKET,

BY REGION, 2021–2024 (USD MILLION) 112

TABLE 54 PREDICTIVE MAINTENANCE & ASSET MANAGEMENT: AI IN MINING MARKET,

BY REGION, 2025–2032 (USD MILLION) 112

TABLE 55 OPERATIONS & PROCESS OPTIMIZATION: AI IN MINING MARKET, BY MINING TYPE, 2021–2024 (USD MILLION) 113

TABLE 56 OPERATIONS & PROCESS OPTIMIZATION: AI IN MINING MARKET, BY MINING TYPE, 2025–2032 (USD MILLION) 113

TABLE 57 OPERATIONS & PROCESS OPTIMIZATION: AI IN MINING MARKET, BY OFFERING, 2021–2024 (USD MILLION) 113

TABLE 58 OPERATIONS & PROCESS OPTIMIZATION: AI IN MINING MARKET, BY OFFERING, 2025–2032 (USD MILLION) 114

TABLE 59 OPERATIONS & PROCESS OPTIMIZATION: AI IN MINING MARKET, BY REGION, 2021–2024 (USD MILLION) 114

TABLE 60 OPERATIONS & PROCESS OPTIMIZATION: AI IN MINING MARKET, BY REGION, 2025–2032 (USD MILLION) 114

TABLE 61 EXPLORATION & GEOSCIENCE: AI IN MINING MARKET, BY MINING TYPE,

2021–2024 (USD MILLION) 115

TABLE 62 EXPLORATION & GEOSCIENCE: AI IN MINING MARKET, BY MINING TYPE,

2025–2032 (USD MILLION) 115

TABLE 63 EXPLORATION & GEOSCIENCE: AI IN MINING MARKET, BY OFFERING,

2021–2024 (USD MILLION) 116

TABLE 64 EXPLORATION & GEOSCIENCE: AI IN MINING MARKET, BY OFFERING,

2025–2032 (USD MILLION) 116

TABLE 65 EXPLORATION & GEOSCIENCE: AI IN MINING MARKET, BY REGION,

2021–2024 (USD MILLION) 116

TABLE 66 EXPLORATION & GEOSCIENCE: AI IN MINING MARKET, BY REGION,

2025–2032 (USD MILLION) 116

TABLE 67 SAFETY, SECURITY & ENVIRONMENTAL: AI IN MINING MARKET, BY MINING TYPE, 2021–2024 (USD MILLION) 117

TABLE 68 SAFETY, SECURITY & ENVIRONMENTAL: AI IN MINING MARKET, BY MINING TYPE, 2025–2032 (USD MILLION) 118

TABLE 69 SAFETY, SECURITY & ENVIRONMENTAL: AI IN MINING MARKET, BY OFFERING, 2021–2024 (USD MILLION) 118

TABLE 70 SAFETY, SECURITY & ENVIRONMENTAL: AI IN MINING MARKET, BY OFFERING, 2025–2032 (USD MILLION) 118

TABLE 71 SAFETY, SECURITY & ENVIRONMENTAL: AI IN MINING MARKET, BY REGION,

2021–2024 (USD MILLION) 118

TABLE 72 SAFETY, SECURITY & ENVIRONMENTAL: AI IN MINING MARKET, BY REGION,

2025–2032 (USD MILLION) 119

TABLE 73 AI IN MINING MARKET, BY MINING TECHNIQUE, 2021–2024 (USD MILLION) 121

TABLE 74 AI IN MINING MARKET, BY MINING TECHNIQUE, 2025–2032 (USD MILLION) 122

TABLE 75 SURFACE MINING: AI IN MINING MARKET, BY MINING TYPE,

2021–2024 (USD MILLION) 122

TABLE 76 SURFACE MINING: AI IN MINING MARKET, BY MINING TYPE,

2025–2032 (USD MILLION) 123

TABLE 77 UNDERGROUND MINING: AI IN MINING MARKET, BY MINING TYPE,

2021–2024 (USD MILLION) 124

TABLE 78 UNDERGROUND MINING: AI IN MINING MARKET, BY MINING TYPE,

2025–2032 (USD MILLION) 124

TABLE 79 AI IN MINING MARKET, BY MINING TYPE, 2021–2024 (USD MILLION) 126

TABLE 80 AI IN MINING MARKET, BY MINING TYPE, 2025–2032 (USD MILLION) 127

TABLE 81 MINERAL MINING: AI IN MINING MARKET, BY REGION, 2021–2024 (USD MILLION) 127

TABLE 82 MINERAL MINING: AI IN MINING MARKET, BY REGION, 2025–2032 (USD MILLION) 128

TABLE 83 MINERAL MINING: AI IN MINING MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 128

TABLE 84 MINERAL MINING: AI IN MINING MARKET, BY APPLICATION,

2025–2032 (USD MILLION) 128

TABLE 85 MINERAL MINING: AI IN MINING MARKET, BY MINING TECHNIQUE,

2021–2024 (USD MILLION) 129

TABLE 86 MINERAL MINING: AI IN MINING MARKET, BY MINING TECHNIQUE,

2025–2032 (USD MILLION) 129

TABLE 87 METAL MINING: AI IN MINING MARKET, BY REGION, 2021–2024 (USD MILLION) 130

TABLE 88 METAL MINING: AI IN MINING MARKET, BY REGION, 2025–2032 (USD MILLION) 130

TABLE 89 METAL MINING: AI IN MINING MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 130

TABLE 90 METAL MINING: AI IN MINING MARKET, BY APPLICATION,

2025–2032 (USD MILLION) 131

TABLE 91 METAL MINING: AI IN MINING MARKET, BY MINING TECHNIQUE,

2021–2024 (USD MILLION) 131

TABLE 92 METAL MINING: AI IN MINING MARKET, BY MINING TECHNIQUE,

2025–2032 (USD MILLION) 131

TABLE 93 COAL MINING: AI IN MINING MARKET, BY REGION, 2021–2024 (USD MILLION) 132

TABLE 94 COAL MINING: AI IN MINING MARKET, BY REGION, 2025–2032 (USD MILLION) 132

TABLE 95 COAL MINING: AI IN MINING MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 133

TABLE 96 COAL MINING: AI IN MINING MARKET, BY APPLICATION,

2025–2032 (USD MILLION) 133

TABLE 97 COAL MINING: AI IN MINING MARKET, BY MINING TECHNIQUE,

2021–2024 (USD MILLION) 133

TABLE 98 COAL MINING: AI IN MINING MARKET, BY MINING TECHNIQUE,

2025–2032 (USD MILLION) 134

TABLE 99 AI IN MINING MARKET, BY REGION, 2021–2024 (USD MILLION) 136

TABLE 100 AI IN MINING MARKET, BY REGION, 2025–2032 (USD MILLION) 137

TABLE 101 NORTH AMERICA: AI IN MINING MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 138

TABLE 102 NORTH AMERICA: AI IN MINING MARKET, BY COUNTRY,

2025–2032 (USD MILLION) 138

TABLE 103 NORTH AMERICA: AI IN MINING MARKET, BY DEPLOYMENT MODE,

2021–2024 (USD MILLION) 139

TABLE 104 NORTH AMERICA: AI IN MINING MARKET, BY DEPLOYMENT MODE,

2025–2032 (USD MILLION) 139

TABLE 105 NORTH AMERICA: AI IN MINING MARKET, BY OFFERING,

2021–2024 (USD MILLION) 139

TABLE 106 NORTH AMERICA: AI IN MINING MARKET, BY OFFERING,

2025–2032 (USD MILLION) 139

TABLE 107 NORTH AMERICA: AI IN MINING MARKET, BY MINING TYPE,

2021–2024 (USD MILLION) 140

TABLE 108 NORTH AMERICA: AI IN MINING MARKET, BY MINING TYPE,

2025–2032 (USD MILLION) 140

TABLE 109 NORTH AMERICA: AI IN MINING MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 140

TABLE 110 NORTH AMERICA: AI IN MINING MARKET, BY APPLICATION,

2025–2032 (USD MILLION) 140

TABLE 111 US: AI IN MINING MARKET, BY MINING TYPE, 2021–2024 (USD MILLION) 141

TABLE 112 US: AI IN MINING MARKET, BY MINING TYPE, 2025–2032 (USD MILLION) 142

TABLE 113 CANADA: AI IN MINING MARKET, BY MINING TYPE, 2021–2024 (USD MILLION) 142

TABLE 114 CANADA: AI IN MINING MARKET, BY MINING TYPE, 2025–2032 (USD MILLION) 143

TABLE 115 MEXICO: AI IN MINING MARKET, BY MINING TYPE, 2021–2024 (USD MILLION) 144

TABLE 116 MEXICO: AI IN MINING MARKET, BY MINING TYPE, 2025–2032 (USD MILLION) 144

TABLE 117 EUROPE: AI IN MINING MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 145

TABLE 118 EUROPE: AI IN MINING MARKET, BY COUNTRY, 2025–2032 (USD MILLION) 146

TABLE 119 EUROPE: AI IN MINING MARKET, BY DEPLOYMENT MODE,

2021–2024 (USD MILLION) 146

TABLE 120 EUROPE: AI IN MINING MARKET, BY DEPLOYMENT MODE,

2025–2032 (USD MILLION) 146

TABLE 121 EUROPE: AI IN MINING MARKET, BY OFFERING, 2021–2024 (USD MILLION) 146

TABLE 122 EUROPE: AI IN MINING MARKET, BY OFFERING, 2025–2032 (USD MILLION) 147

TABLE 123 EUROPE: AI IN MINING MARKET, BY MINING TYPE, 2021–2024 (USD MILLION) 147

TABLE 124 EUROPE: AI IN MINING MARKET, BY MINING TYPE, 2025–2032 (USD MILLION) 147

TABLE 125 EUROPE: AI IN MINING MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 147

TABLE 126 EUROPE: AI IN MINING MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 148

TABLE 127 RUSSIA: AI IN MINING MARKET, BY MINING TYPE, 2021–2024 (USD MILLION) 148

TABLE 128 RUSSIA: AI IN MINING MARKET, BY MINING TYPE, 2025–2032 (USD MILLION) 149

TABLE 129 GERMANY: AI IN MINING MARKET, BY MINING TYPE, 2021–2024 (USD MILLION) 149

TABLE 130 GERMANY: AI IN MINING MARKET, BY MINING TYPE, 2025–2032 (USD MILLION) 150

TABLE 131 FRANCE: AI IN MINING MARKET, BY MINING TYPE, 2021–2024 (USD MILLION) 150

TABLE 132 FRANCE: AI IN MINING MARKET, BY MINING TYPE, 2025–2032 (USD MILLION) 151

TABLE 133 KAZAKHSTAN: AI IN MINING MARKET, BY MINING TYPE,

2021–2024 (USD MILLION) 151

TABLE 134 KAZAKHSTAN: AI IN MINING MARKET, BY MINING TYPE,

2025–2032 (USD MILLION) 152

TABLE 135 REST OF EUROPE: AI IN MINING MARKET, BY MINING TYPE,

2021–2024 (USD MILLION) 152

TABLE 136 REST OF EUROPE: AI IN MINING MARKET, BY MINING TYPE,

2025–2032 (USD MILLION) 153

TABLE 137 ASIA PACIFIC: AI IN MINING MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 154

TABLE 138 ASIA PACIFIC: AI IN MINING MARKET, BY COUNTRY, 2025–2032 (USD MILLION) 155

TABLE 139 ASIA PACIFIC: AI IN MINING MARKET, BY DEPLOYMENT MODE,

2021–2024 (USD MILLION) 155

TABLE 140 ASIA PACIFIC: AI IN MINING MARKET, BY DEPLOYMENT MODE,

2025–2032 (USD MILLION) 155

TABLE 141 ASIA PACIFIC: AI IN MINING MARKET, BY OFFERING, 2021–2024 (USD MILLION) 155

TABLE 142 ASIA PACIFIC: AI IN MINING MARKET, BY OFFERING, 2025–2032 (USD MILLION) 156

TABLE 143 ASIA PACIFIC: AI IN MINING MARKET, BY MINING TYPE, 2021–2024 (USD MILLION) 156

TABLE 144 ASIA PACIFIC: AI IN MINING MARKET, BY MINING TYPE, 2025–2032 (USD MILLION) 156

TABLE 145 ASIA PACIFIC: AI IN MINING MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 156

TABLE 146 ASIA PACIFIC: AI IN MINING MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 157

TABLE 147 CHINA: AI IN MINING MARKET, BY MINING TYPE, 2021–2024 (USD MILLION) 158

TABLE 148 CHINA: AI IN MINING MARKET, BY MINING TYPE, 2025–2032 (USD MILLION) 158

TABLE 149 INDIA: AI IN MINING MARKET, BY MINING TYPE, 2021–2024 (USD MILLION) 159

TABLE 150 INDIA: AI IN MINING MARKET, BY MINING TYPE, 2025–2032 (USD MILLION) 159

TABLE 151 AUSTRALIA: AI IN MINING MARKET, BY MINING TYPE, 2021–2024 (USD MILLION) 160

TABLE 152 AUSTRALIA: AI IN MINING MARKET, BY MINING TYPE, 2025–2032 (USD MILLION) 160

TABLE 153 INDONESIA: AI IN MINING MARKET, BY MINING TYPE, 2021–2024 (USD MILLION) 161

TABLE 154 INDONESIA: AI IN MINING MARKET, BY MINING TYPE, 2025–2032 (USD MILLION) 161

TABLE 155 REST OF ASIA PACIFIC: AI IN MINING MARKET, BY MINING TYPE,

2021–2024 (USD MILLION) 161

TABLE 156 REST OF ASIA PACIFIC: AI IN MINING MARKET, BY MINING TYPE,

2025–2032 (USD MILLION) 162

TABLE 157 ROW: AI IN MINING MARKET, BY REGION, 2021–2024 (USD MILLION) 163

TABLE 158 ROW: AI IN MINING MARKET, BY REGION, 2025–2032 (USD MILLION) 163

TABLE 159 ROW: AI IN MINING MARKET, BY DEPLOYMENT MODE, 2021–2024 (USD MILLION) 164

TABLE 160 ROW: AI IN MINING MARKET, BY DEPLOYMENT MODE, 2025–2032 (USD MILLION) 164

TABLE 161 ROW: AI IN MINING MARKET, BY OFFERING, 2021–2024 (USD MILLION) 164

TABLE 162 ROW: AI IN MINING MARKET, BY OFFERING, 2025–2032 (USD MILLION) 164

TABLE 163 ROW: AI IN MINING MARKET, BY MINING TYPE, 2021–2024 (USD MILLION) 165

TABLE 164 ROW: AI IN MINING MARKET, BY MINING TYPE, 2025–2032 (USD MILLION) 165

TABLE 165 ROW: AI IN MINING MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 165

TABLE 166 ROW: AI IN MINING MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 165

TABLE 167 MIDDLE EAST & AFRICA: AI IN MINING MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 166

TABLE 168 MIDDLE EAST & AFRICA: AI IN MINING MARKET, BY COUNTRY,

2025–2032 (USD MILLION) 166

TABLE 169 MIDDLE EAST & AFRICA: AI IN MINING MARKET, BY MINING TYPE,

2021–2024 (USD MILLION) 167

TABLE 170 MIDDLE EAST & AFRICA: AI IN MINING MARKET, BY MINING TYPE,

2025–2032 (USD MILLION) 167

TABLE 171 GCC COUNTRIES: AI IN MINING MARKET, BY MINING TYPE,

2021–2024 (USD MILLION) 168

TABLE 172 GCC COUNTRIES: AI IN MINING MARKET, BY MINING TYPE,

2025–2032 (USD MILLION) 168

TABLE 173 AFRICA & REST OF MIDDLE: AI IN MINING MARKET, BY MINING TYPE,

2021–2024 (USD MILLION) 169

TABLE 174 AFRICA & REST OF MIDDLE: AI IN MINING MARKET, BY MINING TYPE,

2025–2032 (USD MILLION) 169

TABLE 175 SOUTH AMERICA: AI IN MINING MARKET, BY MINING TYPE,

2021–2024 (USD MILLION) 170

TABLE 176 SOUTH AMERICA: AI IN MINING MARKET, BY MINING TYPE,

2025–2032 (USD MILLION) 170

TABLE 177 AI IN MINING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021–NOVEMBER 2025 171

TABLE 178 AI IN MINING MARKET: DEGREE OF COMPETITION, 2024 173

TABLE 179 AI IN MINING MARKET: REGION FOOTPRINT 180

TABLE 180 AI IN MINING MARKET: OFFERING FOOTPRINT 181

TABLE 181 AI IN MINING MARKET: MINING TECHNIQUE FOOTPRINT 182

TABLE 182 AI IN MINING MARKET: APPLICATION FOOTPRINT 183

TABLE 183 AI IN MINING MARKET: DETAILED LIST OF KEY STARTUPS/SMES 186

TABLE 184 AI IN MINING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES 187

TABLE 185 AI IN MINING MARKET: PRODUCT LAUNCHES, JANUARY 2021–NOVEMBER 2025 188

TABLE 186 AI IN MINING MARKET: DEALS, JANUARY 2021–NOVEMBER 2025 189

TABLE 187 CATERPILLAR: COMPANY OVERVIEW 191

TABLE 188 CATERPILLAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED 192

TABLE 189 CATERPILLAR: PRODUCT LAUNCHES 193

TABLE 190 CATERPILLAR: DEALS 193

TABLE 191 KOMATSU: COMPANY OVERVIEW 195

TABLE 192 KOMATSU: PRODUCTS/SOLUTIONS/SERVICES OFFERED 196

TABLE 193 KOMATSU: DEALS 198

TABLE 194 SANDVIK AB: COMPANY OVERVIEW 200

TABLE 195 SANDVIK AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED 201

TABLE 196 SANDVIK AB: PRODUCT LAUNCHES 202

TABLE 197 SANDVIK AB: DEALS 202

TABLE 198 HITACHI CONSTRUCTION MACHINERY CO., LTD.: COMPANY OVERVIEW 204

TABLE 199 HITACHI CONSTRUCTION MACHINERY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 206

TABLE 200 HITACHI CONSTRUCTION MACHINERY CO., LTD.: PRODUCT LAUNCHES 207

TABLE 201 HITACHI CONSTRUCTION MACHINERY CO., LTD.: DEALS 208

TABLE 202 HEXAGON AB: COMPANY OVERVIEW 209

TABLE 203 HEXAGON AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED 211

TABLE 204 HEXAGON AB: PRODUCT LAUNCHES 212

TABLE 205 HEXAGON AB: DEALS 213

TABLE 206 HEXAGON AB: EXPANSIONS 213

TABLE 207 EPIROC AB: COMPANY OVERVIEW 215

TABLE 208 EPIROC AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED 217

TABLE 209 EPIROC AB: DEALS 218

TABLE 210 EPIROC AB: EXPANSIONS 218

TABLE 211 ROCKWELL AUTOMATION: COMPANY OVERVIEW 219

TABLE 212 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 221

TABLE 213 SIEMENS: COMPANY OVERVIEW 222

TABLE 214 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED 224

TABLE 215 SIEMENS: DEALS 225

TABLE 216 TRIMBLE INC.: COMPANY OVERVIEW 226

TABLE 217 TRIMBLE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 228

TABLE 218 TRIMBLE INC.: PRODUCT LAUNCHES 229

TABLE 219 TRIMBLE INC.: DEALS 229

TABLE 220 ABB: COMPANY OVERVIEW 230

TABLE 221 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED 232

TABLE 222 ABB: PRODUCT LAUNCHES 233

TABLE 223 MICROSOFT: COMPANY OVERVIEW 234

TABLE 224 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED 236

TABLE 225 MICROSOFT: DEALS 236

TABLE 226 SAP SE: COMPANY OVERVIEW 237

TABLE 227 SAP SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED 239

TABLE 228 SAP SE: DEALS 239

TABLE 229 IBM: COMPANY OVERVIEW 240

TABLE 230 RPMGLOBAL HOLDINGS LIMITED: COMPANY OVERVIEW 241

TABLE 231 LIEBHERR: COMPANY OVERVIEW 242

TABLE 232 GROUNDHOG: COMPANY OVERVIEW 243

TABLE 233 HAULTRAX: COMPANY OVERVIEW 244

TABLE 234 MICROMINE PTY LTD.: COMPANY OVERVIEW 245

TABLE 235 SYMX.AI: COMPANY OVERVIEW 246

TABLE 236 THE TOMORROW COMPANIES INC.: COMPANY OVERVIEW 247

TABLE 237 VRIFY: COMPANY OVERVIEW 248

TABLE 238 INTELLISENSE.IO: COMPANY OVERVIEW 249

TABLE 239 ORICA LIMITED: COMPANY OVERVIEW 250

TABLE 240 MINESENSE TECHNOLOGIES LTD.: COMPANY OVERVIEW 251

TABLE 241 EXYN TECHNOLOGIES: COMPANY OVERVIEW 252

TABLE 242 MAJOR SECONDARY SOURCES 256

TABLE 243 PRIMARY INTERVIEW PARTICIPANTS 257

TABLE 244 AI IN MINING MARKET: RESEARCH ASSUMPTIONS 264

TABLE 245 AI IN MINING MARKET: RISK ANALYSIS 265

LIST OF FIGURES

FIGURE 1 AI IN MINING MARKET SEGMENTATION AND REGIONAL SCOPE 27

FIGURE 2 AI IN MINING MARKET: DURATION COVERED 28

FIGURE 3 AI IN MINING MARKET SCENARIO 30

FIGURE 4 GLOBAL AI IN MINING MARKET SIZE, 2021–2032 31

FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN AI IN MINING MARKET,

2021–2025 31

FIGURE 6 DISRUPTIONS INFLUENCING AI IN MINING MARKET GROWTH 32

FIGURE 7 HIGH-GROWTH SEGMENTS IN AI IN MINING MARKET, 2025–2032 32

FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD 33

FIGURE 9 ASIA PACIFIC LEADS GLOBAL GROWTH WITH EXPANDING

ROBOTIC AUTOMATION ADOPTION 35

FIGURE 10 SOFTWARE SEGMENT TO DOMINATE AI IN MINING MARKET

DURING FORECAST PERIOD 36

FIGURE 11 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2032 36

FIGURE 12 MACHINE LEARNING SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2025 37

FIGURE 13 SURFACE MINING SEGMENT TO CAPTURE LARGER MARKET SHARE IN 2032 37

FIGURE 14 METAL MINING SEGMENT TO HOLD LARGEST SHARE OF

AI IN MINING MARKET IN 2032 38

FIGURE 15 SOFTWARE SEGMENT AND CHINA TO HOLD LARGEST SHARES OF ASIA PACIFIC AI IN MINING MARKET IN 2032 38

FIGURE 16 INDIA TO RECORD HIGHEST CAGR IN GLOBAL AI IN MINING MARKET

FROM 2025 TO 2032 39

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES 41

FIGURE 18 IMPACT ANALYSIS: DRIVERS 43

FIGURE 19 IMPACT ANALYSIS: RESTRAINTS 44

FIGURE 20 IMPACT ANALYSIS: OPPORTUNITIES 46

FIGURE 21 IMPACT ANALYSIS: CHALLENGES 47

FIGURE 22 PORTER’S FIVE FORCES ANALYSIS 51

FIGURE 23 AI IN MINING VALUE CHAIN ANALYSIS 57

FIGURE 24 AI IN MINING ECOSYSTEM 58

FIGURE 25 AVERAGE SELLING PRICE TREND OF AI-POWERED MINING SOFTWARE

IN VARIOUS REGIONS, 2021–2024 61

FIGURE 26 IMPORT SCENARIO FOR HS CODE 8429-COMPLIANT PRODUCTS IN TOP FIVE COUNTRIES, 2020–2024 62

FIGURE 27 EXPORT SCENARIO FOR HS CODE 8429-COMPLIANT PRODUCTS IN TOP FIVE COUNTRIES, 2020–2024 63

FIGURE 28 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS 64

FIGURE 29 INVESTMENT AND FUNDING SCENARIO, 2021–2021 65

FIGURE 30 PATENTS APPLIED AND GRANTED, 2015–2024 74

FIGURE 31 DECISION-MAKING FACTORS 82

FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY MINING TYPE 83

FIGURE 33 KEY BUYING CRITERIA, BY MINING TYPE 84

FIGURE 34 AI ADOPTION BARRIERS AND INTERNAL CHALLENGES IN MINING SECTOR 85

FIGURE 35 SOFTWARE SEGMENT TO DOMINATE AI IN MINING MARKET FROM 2025 TO 2032 88

FIGURE 36 ON-PREMISES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD 95

FIGURE 37 GENERATIVE AI SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2025 TO 2032 101

FIGURE 38 OPERATIONS & PROCESS OPTIMIZATION SEGMENT TO

HOLD LARGEST MARKET SHARE IN 2025 109

FIGURE 39 UNDERGROUND MINING SEGMENT TO EXHIBIT HIGHER CAGR

DURING FORECAST PERIOD 121

FIGURE 40 METAL MINING SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2032 126

FIGURE 41 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR BETWEEN 2025 AND 2032 136

FIGURE 42 NORTH AMERICA: AI IN MINING MARKET SNAPSHOT 138

FIGURE 43 EUROPE: MINING AUTOMATION MARKET SNAPSHOT 145

FIGURE 44 ASIA PACIFIC: MINING AUTOMATION MARKET SNAPSHOT 154

FIGURE 45 ROW: MINING AUTOMATION MARKET SNAPSHOT 163

FIGURE 46 MARKET SHARE ANALYSIS OF COMPANIES OFFERING

AI MINING TECHNOLOGIES, 2024 173

FIGURE 47 AI IN MINING MARKET: REVENUE ANALYSIS OF TOP FOUR PLAYERS, 2020–2024 174

FIGURE 48 COMPANY VALUATION 175

FIGURE 49 FINANCIAL METRICS (EV/EBITDA) 175

FIGURE 50 BRAND/PRODUCT COMPARISON 176

FIGURE 51 AI IN MINING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024 178

FIGURE 52 AI IN MINING MARKET: COMPANY FOOTPRINT 179

FIGURE 53 AI IN MINING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 185

FIGURE 54 CATERPILLAR: COMPANY SNAPSHOT 192

FIGURE 55 KOMATSU: COMPANY SNAPSHOT 196

FIGURE 56 SANDVIK AB: COMPANY SNAPSHOT 201

FIGURE 57 HITACHI CONSTRUCTION MACHINERY CO., LTD.: COMPANY SNAPSHOT 205

FIGURE 58 HEXAGON AB: COMPANY SNAPSHOT 210

FIGURE 59 EPIROC AB: COMPANY SNAPSHOT 216

FIGURE 60 ROCKWELL AUTOMATION: COMPANY SNAPSHOT 220

FIGURE 61 SIEMENS: COMPANY SNAPSHOT 223

FIGURE 62 TRIMBLE INC.: COMPANY SNAPSHOT 227

FIGURE 63 ABB: COMPANY SNAPSHOT 231

FIGURE 64 MICROSOFT: COMPANY SNAPSHOT 235

FIGURE 65 SAP SE: COMPANY SNAPSHOT 238

FIGURE 66 AI IN MINING MARKET: RESEARCH DESIGN 253

FIGURE 67 AI IN MINING MARKET: RESEARCH APPROACH 255

FIGURE 68 DATA CAPTURED FROM SECONDARY SOURCES 256

FIGURE 69 DATA CAPTURED FROM PRIMARY SOURCES 257

FIGURE 70 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE,

DESIGNATION, AND REGION 258

FIGURE 71 CORE FINDINGS FROM INDUSTRY EXPERTS 258

FIGURE 72 AI IN MINING MARKET: RESEARCH FLOW 259

FIGURE 73 AI IN MINING MARKET: BOTTOM-UP APPROACH 260

FIGURE 74 AI IN MINING MARKET: TOP-DOWN APPROACH 260

FIGURE 75 AI IN MINING MARKET SIZE ESTIMATION (SUPPLY SIDE) 261

FIGURE 76 AI IN MINING MARKET: DATA TRIANGULATION 263

FIGURE 77 AI IN MINING MARKET: RESEARCH LIMITATIONS 265