Extreme Ultraviolet (EUV) Lithography Market - Global Forecast To 2032

Extreme Ultraviolet (EUV) Lithography Market by Component (Light Sources, Optics, Masks), System Type (0.33 NA EUV System (NXE), 0.55 NA EUV System (EXE)), Integrated Device Manufacturers, Foundries, Logic Chips, Memory Chips - Global Forecast to 2032

極端紫外線(EUV)リソグラフィー市場 - コンポーネント(光源、光学系、マスク)、システムタイプ(0.33 NA EUVシステム(NXE)、0.55 NA EUVシステム(EXE))、統合デバイスメーカー、ファウンドリ、ロジックチップ、メモリチップ - 2032年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年02月 |

| ページ数 | 206 |

| 図表数 | 184 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-2473 |

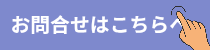

世界の極端紫外線(EUV)リソグラフィ市場は、2026年の158億4,000万米ドルから2032年には303億6,000万米ドルに、年平均成長率(CAGR)11.4%で成長すると予測されています。スマートフォン、ウェアラブル端末、タブレット端末、ゲーム機などの民生用電子機器の急速な進歩により、高性能、小型設計、エネルギー効率に優れた先進的な半導体チップへの需要が持続的に高まっています。メーカーは、処理速度の向上、グラフィックスの強化、バッテリー駆動時間の延長に対応するため、トランジスタの小型化と高密度化を実現するEUVリソグラフィへの依存度を高めています。折りたたみ式ディスプレイ、拡張現実(AR)、仮想現実(VR)などの次世代技術への移行により、チップの複雑さがさらに増し、高精度なEUVベースの製造ニーズが高まっています。民生用電子機器や自律アプリケーション全体で性能と小型化の要件が高まり続ける中、EUVリソグラフィは、先端ノードで信頼性の高い高性能集積回路を製造するための重要な技術となりつつあります。

調査範囲

本レポートは、極端紫外線(EUV)リソグラフィ市場をセグメント化し、その構成部品、システムタイプ、エンドユーザー、アプリケーション、および地域を予測しています。また、市場における推進要因、制約要因、機会、課題についても考察しています。さらに、南北アメリカ、アジア太平洋、EMEAの3つの主要地域における市場の詳細な分析を提供しています。さらに、主要企業のバリューチェーン分析と、EUVリソグラフィ・エコシステムにおける競合分析も含まれています。

本レポートを購入する主なメリット

- 極端紫外線(EUV)リソグラフィ市場の成長に影響を与える主要な推進要因(最先端ファウンドリノードにおけるEUVリソグラフィの導入急増)、制約要因(高額な先行投資)、機会(先進EUVリソグラフィおよび半導体デバイスへの投資増加)、課題(代替リソグラフィ技術との競争)の分析

- 製品/ソリューション/サービス開発/イノベーション:極端紫外線(EUV)リソグラフィ市場における今後のコンポーネント、技術、研究開発活動に関する詳細な洞察

- 市場開発:収益性の高い市場に関する包括的な情報。本レポートでは、様々な地域における極端紫外線(EUV)リソグラフィ市場を分析しています。

- 市場の多様化:未開拓地域における新しいEUVリソグラフィ、最近の動向、そして極端紫外線(EUV)リソグラフィ市場への投資に関する包括的な情報を提供しています。

- 競合評価:KLA Corporation(米国)、ZEISS Group(ドイツ)、TRUMPF(ドイツ)、AGC Inc.(日本)、Lasertec Corporation(日本)など、EUVリソグラフィ関連部品を提供する主要企業の市場シェア、成長戦略、製品・サービスに関する詳細な評価を提供しています。

Report Description

The global extreme ultraviolet (EUV) lithography market is expected to grow from USD 15.84 billion in 2026 to USD 30.36 billion by 2032, at a CAGR of 11.4%. The rapid advancements in consumer electronics, including smartphones, wearables, tablets, and gaming devices, are driving sustained demand for advanced semiconductor chips that offer higher performance, compact designs, and improved energy efficiency. To support faster processing, enhanced graphics, and longer battery life, manufacturers increasingly rely on EUV lithography to enable smaller transistors and higher transistor density. The shift toward next-generation technologies, including foldable displays, augmented reality, and virtual reality, is further increasing chip complexity and reinforcing the need for high-precision EUV-based manufacturing. As performance and miniaturization requirements continue to rise across consumer electronics and autonomous applications, EUV lithography is becoming a critical enabler for producing reliable, high-performance integrated circuits at advanced nodes.

Extreme Ultraviolet (EUV) Lithography Market – Global Forecast To 2032

“Light sources to exhibit highest CAGR from 2026 to 2032.”

Light sources are expected to witness the highest CAGR in the extreme ultraviolet (EUV) lithography market due to their direct impact on system productivity, throughput, and cost efficiency at advanced semiconductor nodes. Continuous demand for higher wafer throughput is driving the need for increased EUV source power, improved stability, and longer uptime, prompting frequent upgrades and replacements of existing light source modules. In addition, the transition toward more advanced process nodes and the gradual shift to next-generation EUV platforms are increasing performance requirements for light sources, accelerating R&D investments and adoption. The high technical complexity, limited supplier base, and strong focus on productivity-driven enhancements further support faster revenue growth for this component compared to other EUV system elements.

“Logic chips held largest share of extreme ultraviolet (EUV) lithography market in 2025.”

Logic chips held the largest market share in the application segment of the extreme ultraviolet (EUV) lithography market in 2025, driven by early and widespread adoption of EUV at advanced process nodes. Leading-edge logic devices at 7 nm, 5 nm, and 3 nm require extremely fine patterning, tight overlay control, and high transistor density, all of which are more efficiently achieved using EUV compared with multi-patterning DUV techniques. The rapid growth of applications such as artificial intelligence, high-performance computing, data centers, and advanced automotive electronics is driving strong demand for high-performance logic chips, accelerating EUV tool utilization and capacity expansion. In contrast, memory manufacturers have adopted EUV more selectively, focusing on specific layers, which further reinforces the dominance of logic chips in overall extreme ultraviolet (EUV) lithography demand.

Extreme Ultraviolet (EUV) Lithography Market – Global Forecast To 2032 – region

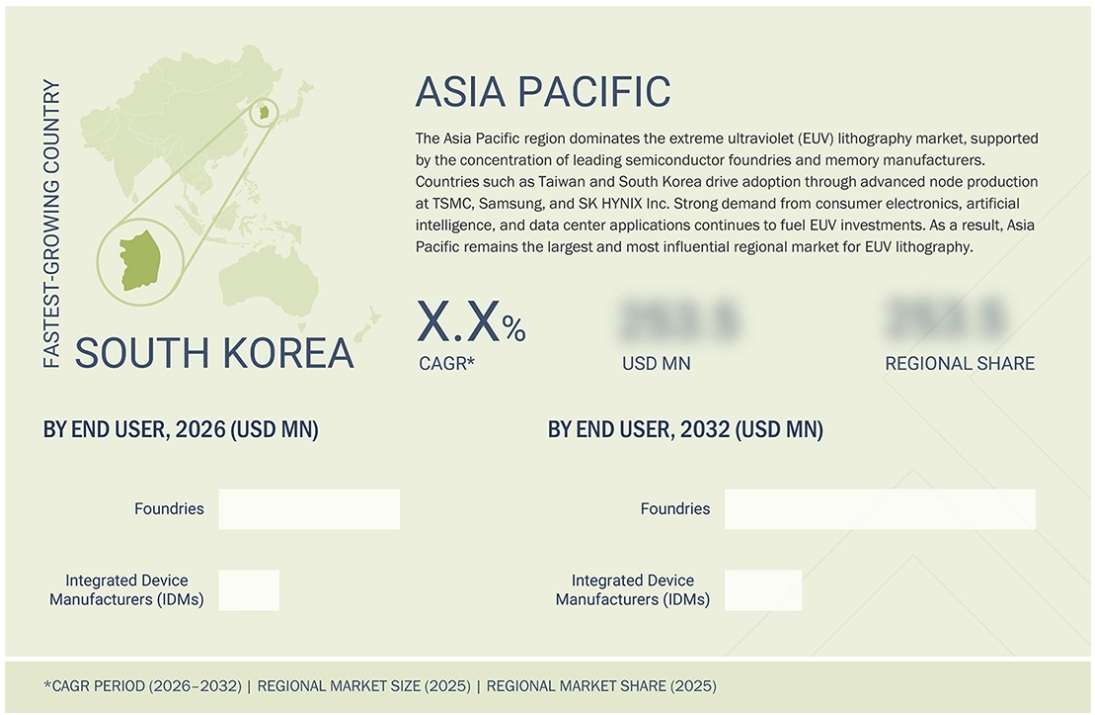

“Asia Pacific to be fastest-growing regional market for EUV lithography from 2026 to 2032.”

Asia Pacific is expected to register the highest CAGR during the forecast period, driven by its strong concentration of leading semiconductor foundries and integrated device manufacturers (IDMs), as well as continuous investments in advanced-node manufacturing. The region’s dominance is supported by large-scale capacity expansions at 5 nm, 3 nm, and sub-3 nm nodes, rising demand for logic chips used in AI, high-performance computing, and advanced consumer electronics, and a mature semiconductor supply chain that enables rapid EUV adoption. In addition, sustained capital expenditure, aggressive technology roadmaps, and government-backed initiatives to strengthen domestic semiconductor capabilities are accelerating EUV tool installations. These factors collectively position Asia Pacific as the primary demand center and growth engine for the global extreme ultraviolet (EUV) lithography market.

Breakdown of Primaries

Various executives from key organizations operating in the extreme ultraviolet (EUV) lithography market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1–30%, Tier 2–50%, and Tier 3–20%

- By Designation: C-level Executives–25%, Directors–35%, and Others–40%

- By Region: Asia Pacific–40%, Americas–25%, and EMEA- 35%

The extreme ultraviolet (EUV) lithography market is dominated by ASML (Netherlands) as the sole manufacturer of EUV lithography products, as well as by component manufacturers such as TRUMPF (Germany), Ushio Inc. (Japan), Energetiq (US), Zeiss Group (Germany), NTT Advanced Technology Corporation (Japan), Rigaku Holdings Corporation (Japan), Edmund Optics Inc. (US), AGC Inc. (Japan), Tekscend Photomask (Japan), Lasertec Corporation (Japan), HOYA Corporation (Japan), NuFlare Technology, Inc. (Japan), KLA Corporation (US), ADVANTEST CORPORATION (Japan), SUSS MicroTec SE (Germany), Applied Materials, Inc. (US), Park Systems (South Korea), Imagine Optic (France), MKS Inc. (US), Taiwan Semiconductor Manufacturing Company Limited (TSMC) (Taiwan), Intel Corporation (US), Samsung (South Korea), SK HYNIX INC. (South Korea), and Micron Technology (US). The study includes an in-depth competitive analysis of these key players in the extreme ultraviolet (EUV) lithography market, with their company profiles, recent developments, and key market strategies.

Extreme Ultraviolet (EUV) Lithography Market – Global Forecast To 2032 – ecosystem

Study Coverage

The report segments the extreme ultraviolet (EUV) lithography market and forecasts its components, system types, end users, applications, and regions. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It provides a detailed view of the market across three main regions—Americas, Asia Pacific, and EMEA. The report includes a value chain analysis of the key players and their competitive analysis of the EUV lithography ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (surging deployment of EUV lithography across leading-edge foundry nodes), restraints (high upfront capital investment), opportunities (increasing investments in advanced EUV lithography and semiconductor devices), and challenges (competition from alternative lithography techniques) influencing the growth of the extreme ultraviolet (EUV) lithography market

- Products/Solution/Service Development/Innovation: Detailed insights into upcoming components, technologies, research, and development activities in the extreme ultraviolet (EUV) lithography market

- Market Development: Comprehensive information about lucrative markets–the report analyzes the extreme ultraviolet (EUV) lithography market across varied regions

- Market Diversification: Exhaustive information about new EUV lithography in untapped geographies, recent developments, and investments in the extreme ultraviolet (EUV) lithography market

- Competitive Assessment: In-depth assessment of market shares and growth strategies, and offerings of leading players offering components of EUV lithography, such as KLA Corporation (US), ZEISS Group (Germany), TRUMPF (Germany), AGC Inc. (Japan), and Lasertec Corporation (Japan)

Table of Contents

1 INTRODUCTION 20

1.1 STUDY OBJECTIVES 20

1.2 MARKET DEFINITION 20

1.3 STUDY SCOPE 21

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 21

1.3.2 INCLUSIONS AND EXCLUSIONS 22

1.3.3 YEARS CONSIDERED 22

1.4 CURRENCY CONSIDERED 23

1.5 UNIT CONSIDERED 23

1.6 LIMITATIONS 23

1.7 STAKEHOLDERS 23

1.8 SUMMARY OF CHANGES 24

2 EXECUTIVE SUMMARY 25

2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS 25

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 26

2.3 DISRUPTIVE TRENDS IN EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET 27

2.4 HIGH-GROWTH SEGMENTS 28

2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST 29

3 PREMIUM INSIGHTS 30

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN

EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET 30

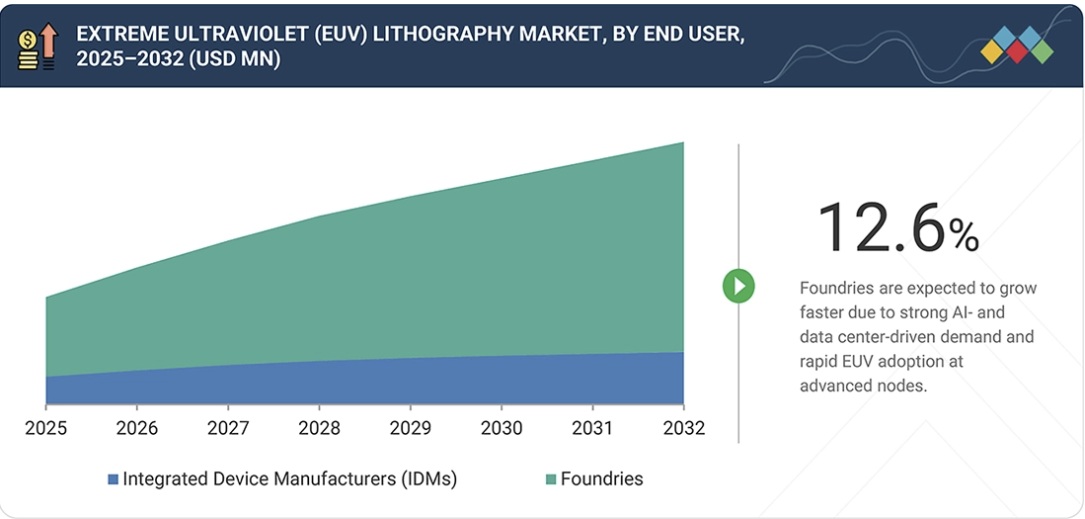

3.2 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER 31

3.3 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY APPLICATION 31

3.4 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY REGION 32

4 MARKET OVERVIEW 33

4.1 INTRODUCTION 33

4.2 MARKET DYNAMICS 33

4.2.1 DRIVERS 34

4.2.1.1 Surging deployment of EUV lithography across leading-edge foundry nodes 34

4.2.1.2 Elevating use of AI accelerators and deep learning processors in HPC systems 34

4.2.1.3 Increasing complexity of integrated circuits 35

4.2.1.4 Rapid advancements in consumer electronics 35

4.2.2 RESTRAINTS 36

4.2.2.1 High upfront capital investment 36

4.2.2.2 Requirement for advanced infrastructure and skilled workforce 37

4.2.3 OPPORTUNITIES 38

4.2.3.1 Increasing investments in advanced EUV lithography and semiconductor devices 38

4.2.3.2 Emerging applications of EUV lithography 38

4.2.3.3 Advancements in memory modules and chips 39

4.2.3.4 Integration of EUV lithography into advanced display manufacturing 39

4.2.3.5 Application of advanced patterning technologies in photonics and optics production 40

4.2.3.6 Commercialization of High-NA EUV lithography 40

4.2.4 CHALLENGES 41

4.2.4.1 Competition from alternative lithography techniques 41

4.2.4.2 Difficulty in sustaining high source power and productivity 42

4.2.4.3 Detecting and addressing mask defects and yield-related challenges 42

5 INDUSTRY TRENDS 44

5.1 INTRODUCTION 44

5.2 PORTER’S FIVE FORCES ANALYSIS 44

5.2.1 INTENSITY OF COMPETITIVE RIVALRY 45

5.2.2 THREAT OF NEW ENTRANTS 45

5.2.3 THREAT OF SUBSTITUTES 45

5.2.4 BARGAINING POWER OF BUYERS 45

5.2.5 BARGAINING POWER OF SUPPLIERS 46

5.3 MACROECONOMIC OUTLOOK 46

5.3.1 INTRODUCTION 46

5.3.2 GDP TRENDS AND FORECAST 46

5.3.3 TRENDS IN FOUNDRIES 48

5.3.4 TRENDS IN INTEGRATED DEVICE MANUFACTURERS (IDMS) 48

5.4 VALUE CHAIN ANALYSIS 48

5.4.1 R&D ENGINEERS 49

5.4.2 RAW MATERIAL PROVIDERS AND COMPONENT MANUFACTURERS 49

5.4.3 SYSTEM INTEGRATORS AND MANUFACTURERS 49

5.4.4 MARKETING & SALES SERVICES PROVIDERS 50

5.4.5 END USERS 50

5.5 ECOSYSTEM ANALYSIS 50

5.6 PRICING ANALYSIS 51

5.6.1 AVERAGE SELLING PRICE TREND OF EUV LITHOGRAPHY SYSTEM TYPES,

BY KEY PLAYER, 2021–2025 52

5.6.2 AVERAGE SELLING PRICE TREND OF EUV LITHOGRAPHY SYSTEM, BY REGION, 2021–2025 53

5.7 TRADE ANALYSIS 53

5.7.1 IMPORT SCENARIO (HS CODE 8442) 54

5.7.2 EXPORT SCENARIO (HS CODE 8442) 55

5.8 KEY CONFERENCES AND EVENTS, 2026–2027 56

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 57

5.10 INVESTMENT AND FUNDING SCENARIO 58

5.11 CASE STUDY ANALYSIS 58

5.11.1 INTEL SECURES EXCLUSIVE HIGH-NA EUV LITHOGRAPHY MACHINES TO RESHAPE SUPPLY CHAIN 58

5.11.2 TSMC DEPLOYS EUV LITHOGRAPHY SYSTEMS TO BOOST PRODUCTION CAPACITY 58

5.11.3 SAMSUNG ELECTRONICS ADVANCES 3 NM GAA PRODUCTION USING EUV LITHOGRAPHY 59

5.12 IMPACT OF 2025 US TARIFF ON EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET 59

5.12.1 INTRODUCTION 59

5.12.2 KEY TARIFF RATES 60

5.12.3 PRICE IMPACT ANALYSIS 61

5.12.4 IMPACT ON COUNTRY/REGION 62

5.12.4.1 US 62

5.12.4.2 Europe 62

5.12.4.3 Asia Pacific 63

5.12.5 IMPACT ON END USERS 63

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS,

AND INNOVATIONS 64

6.1 TECHNOLOGY ANALYSIS 64

6.1.1 KEY EMERGING TECHNOLOGIES 64

6.1.1.1 High-NA EUV lithography technology 64

6.1.1.2 Advanced EUV resist and patterning materials 64

6.1.2 COMPLEMENTARY TECHNOLOGIES 64

6.1.2.1 Mask pellicles 64

6.1.2.2 Plasma generation 65

6.1.3 ADJACENT TECHNOLOGIES 65

6.1.3.1 Extreme ultraviolet reflectometry (EUVR) 65

6.1.3.2 Atomic layer deposition (ALD) 66

6.2 TECHNOLOGY/PRODUCT ROADMAP 66

6.2.1 SHORT-TERM (2025–2027): PRODUCTIVITY OPTIMIZATION & ADVANCED NODE SCALING 66

6.2.2 MID-TERM (2027–2030): HIGH-NA EUV COMMERCIALIZATION & PROCESS MATURITY 67

6.2.3 LONG-TERM (2030–2035+): FULL HIGH-NA DEPLOYMENT & NEXT-GEN LITHOGRAPHY INTEGRATION 68

6.3 PATENT ANALYSIS 69

6.4 IMPACT OF AI ON EUV LITHOGRAPHY 71

6.4.1 TOP USE CASES AND MARKET POTENTIAL 72

6.4.2 BEST PRACTICES IN EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET 72

6.4.3 CASE STUDIES OF AI IMPLEMENTATION IN EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET 73

6.4.4 INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 73

6.4.5 CLIENTS’ READINESS TO ADOPT AI IN EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET 73

7 REGULATORY LANDSCAPE 74

7.1 INTRODUCTION 74

7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 74

7.3 REGULATIONS 75

7.4 STANDARDS 76

7.4.1 SEMI STANDARDS 76

7.4.2 ISO & IEC ELECTRICAL, MECHANICAL, AND SAFETY STANDARDS 76

7.4.3 ISO 9001:2015 QUALITY MANAGEMENT SYSTEM STANDARDS 76

7.4.4 ISO 14001 ENVIRONMENTAL MANAGEMENT STANDARDS 76

7.4.5 ROHS & REACH COMPLIANCE STANDARDS 76

7.4.6 CYBERSECURITY & DATA INTEGRITY STANDARDS 76

7.5 GOVERNMENT REGULATIONS 77

7.5.1 US 77

7.5.2 EUROPE 77

7.5.3 CHINA 77

7.5.4 JAPAN 77

7.5.5 INDIA 77

7.6 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES 78

7.7 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 78

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR 80

8.1 DECISION-MAKING PROCESS 80

8.2 KEY STAKEHOLDERS AND BUYING CRITERIA 82

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 82

8.2.2 BUYING CRITERIA 82

8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES 83

8.4 UNMET NEEDS OF VARIOUS END USERS 84

8.5 MARKET PROFITABILITY 85

9 APPLICATION NODES OF EXTREME ULTRAVIOLET (EUV)

LITHOGRAPHY TECHNOLOGY 86

9.1 INTRODUCTION 86

9.2 7 NM 86

9.3 5 NM 86

9.4 3 NM 87

9.5 2 NM 87

9.6 SUB-2 NM 87

10 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY COMPONENT 88

10.1 INTRODUCTION 89

10.2 LIGHT SOURCES 90

10.2.1 RISING FOCUS ON ENHANCING PRECISION AND THROUGHPUT IN SEMICONDUCTORS TO BOOST DEMAND 90

10.3 OPTICS 91

10.3.1 ELEVATING DEMAND FOR HIGHER NUMERICAL APERTURE (HIGH-NA) EUV SYSTEMS TO SUPPORT SEGMENTAL GROWTH 91

10.4 MASKS 91

10.4.1 GREATER EMPHASIS ON PROCESS EFFICIENCY AND SUSTAINABILITY IN EUV MASK PRODUCTION TO CONTRIBUTE TO SEGMENTAL GROWTH 91

10.5 OTHER COMPONENTS 92

11 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY SYSTEM TYPE 93

11.1 INTRODUCTION 94

11.2 0.33 NA EUV SYSTEMS (NXE) 96

11.2.1 COST EFFICIENCY AND RELIABILITY TO STIMULATE DEMAND 96

11.3 0.55 NA EUV SYSTEMS (EXE) 96

11.3.1 ABILITY TO IMPROVE YIELD FOR ADVANCED LOGIC, MEMORY, AND AI CHIPS TO DRIVE MARKET 96

12 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER 97

12.1 INTRODUCTION 98

12.2 INTEGRATED DEVICE MANUFACTURERS (IDMS) 99

12.2.1 INNOVATION IN ADVANCED AND ENERGY-EFFICIENT MICROCHIPS TO FOSTER MARKET GROWTH 99

12.3 FOUNDRIES 101

12.3.1 STRONG FOCUS ON HIGH-VOLUME SEMICONDUCTOR MANUFACTURING TO SUPPORT SEGMENTAL GROWTH 101

13 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY APPLICATION 104

13.1 INTRODUCTION 105

13.2 LOGIC CHIPS 106

13.2.1 INCREASING COMPLEXITY AND COSTS OF LOGIC DEVICES TO BOOST DEMAND FOR EUV LITHOGRAPHY 106

13.2.2 CPU 106

13.2.3 GPU 106

13.2.4 AI ACCELERATOR 107

13.2.5 SOC 107

13.2.6 ASIC 107

13.3 MEMORY CHIPS 107

13.3.1 GROWING DEMAND FOR ARTIFICIAL INTELLIGENCE, CLOUD COMPUTING, AND HIGH-PERFORMANCE APPLICATIONS TO CREATE OPPORTUNITIES 107

13.3.2 DRAM 107

13.3.3 HBM 108

14 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY REGION 109

14.1 INTRODUCTION 110

14.2 AMERICAS 111

14.2.1 GROWING DEMAND FOR HIGH-PERFORMANCE, ENERGY-EFFICIENT SEMICONDUCTOR SOLUTIONS TO BOOST MARKET 111

14.3 EMEA 113

14.3.1 EARLY-STAGE COMMERCIALIZATION OF EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY TO CREATE GROWTH OPPORTUNITIES 113

14.4 ASIA PACIFIC 115

14.4.1 CHINA 117

14.4.1.1 Domestic semiconductor capacity building and technology localization to drive market 117

14.4.2 JAPAN 118

14.4.2.1 Presence of leading technology providers to contribute to market growth 118

14.4.3 SOUTH KOREA 118

14.4.3.1 Strong global position in memory and logic semiconductor manufacturing to foster market growth 118

14.4.4 TAIWAN 119

14.4.4.1 Significant investments in eco-friendly EUV system components to propel market 119

14.4.5 REST OF ASIA PACIFIC 120

15 COMPETITIVE LANDSCAPE 121

15.1 OVERVIEW 121

15.2 KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN, 2024–2025 121

15.3 REVENUE ANALYSIS, 2021–2025 123

15.4 MARKET SHARE ANALYSIS, 2025 123

15.5 COMPANY VALUATION AND FINANCIAL METRICS 125

15.5.1 COMPANY VALUATION 125

15.5.2 FINANCIAL METRICS 125

15.6 PRODUCT COMPARISON 126

15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025 127

15.7.1 STARS 127

15.7.2 EMERGING LEADERS 127

15.7.3 PERVASIVE PLAYERS 127

15.7.4 PARTICIPANTS 127

15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2025 129

15.7.5.1 Company footprint 129

15.7.5.2 Region footprint 130

15.7.5.3 End user footprint 131

15.7.5.4 Component footprint 132

15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2025 132

15.8.1 PROGRESSIVE COMPANIES 132

15.8.2 RESPONSIVE COMPANIES 133

15.8.3 DYNAMIC COMPANIES 133

15.8.4 STARTING BLOCKS 133

15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2025 134

15.8.5.1 Detailed list of key startups/SMEs 134

15.8.5.2 Competitive benchmarking of key startups/SMEs 134

15.9 COMPETITIVE SCENARIO 135

15.9.1 PRODUCT LAUNCHES 135

15.9.2 DEALS 137

16 COMPANY PROFILES 138

16.1 INTRODUCTION 138

16.2 KEY SYSTEM MANUFACTURERS 138

16.2.1 ASML 138

16.2.1.1 Business overview 138

16.2.1.2 Products/Solutions/Services offered 140

16.2.1.3 Recent developments 141

16.2.1.3.1 Deals 141

16.2.1.4 MnM view 141

16.2.1.4.1 Key strengths/Right to win 141

16.2.1.4.2 Strategic choices 141

16.2.1.4.3 Weaknesses/Competitive threats 141

16.3 KEY COMPONENT MANUFACTURERS 142

16.3.1 LIGHT SOURCE MANUFACTURERS 142

16.3.1.1 TRUMPF 142

16.3.1.1.1 Business overview 142

16.3.1.1.2 Products/Solutions/Services offered 144

16.3.1.1.3 MnM view 144

16.3.1.1.3.1 Key strengths/Right to win 144

16.3.1.1.3.2 Strategic choices 144

16.3.1.1.3.3 Weaknesses/Competitive threats 144

16.3.1.2 Ushio Inc. 145

16.3.1.2.1 Business overview 145

16.3.1.2.2 Products/Solutions/Services offered 146

16.3.1.2.3 MnM view 147

16.3.1.2.3.1 Key strengths/Right to win 147

16.3.1.2.3.2 Strategic choices 147

16.3.1.2.3.3 Weaknesses/Competitive threats 147

16.3.1.3 Energetiq 148

16.3.1.3.1 Business overview 148

16.3.1.3.2 Products/Solutions/Services offered 148

16.3.1.3.3 Recent developments 149

16.3.1.3.3.1 Product launches 149

16.3.1.3.4 MnM view 149

16.3.1.3.4.1 Key strengths/Right to win 149

16.3.1.3.4.2 Strategic choices 150

16.3.1.3.4.3 Weaknesses/Competitive threats 150

16.3.2 OPTICS MANUFACTURERS 151

16.3.2.1 ZEISS Group 151

16.3.2.1.1 Business overview 151

16.3.2.1.2 Products/Solutions/Services offered 153

16.3.2.1.3 Recent developments 154

16.3.2.1.3.1 Product launches 154

16.3.2.1.3.2 Deals 154

16.3.2.2 NTT ADVANCED TECHNOLOGY CORPORATION 155

16.3.2.2.1 Business overview 155

16.3.2.2.2 Products/Solutions/Services offered 156

16.3.2.3 Rigaku Holdings Corporation 157

16.3.2.3.1 Business overview 157

16.3.2.3.2 Products/Solutions/Services offered 158

16.3.2.4 Edmund Optics Inc. 159

16.3.2.4.1 Business overview 159

16.3.2.4.2 Products/Solutions/Services offered 160

16.3.3 MASK MANUFACTURERS 161

16.3.3.1 AGC Inc. 161

16.3.3.1.1 Business overview 161

16.3.3.1.2 Products/Solutions/Services offered 162

16.3.3.2 Tekscend Photomask 163

16.3.3.2.1 Business overview 163

16.3.3.2.2 Products/Solutions/Services offered 164

16.3.3.3 Lasertec Corporation 165

16.3.3.3.1 Business overview 165

16.3.3.3.2 Products/Solutions/Services offered 167

16.3.3.3.3 Recent developments 169

16.3.3.3.3.1 Product launches 169

16.3.3.4 HOYA Corporation 170

16.3.3.4.1 Business overview 170

16.3.3.4.2 Products/Solutions/Services offered 172

16.3.3.5 NuFlare Technology Inc. 173

16.3.3.5.1 Business overview 173

16.3.3.5.2 Products/Solutions/Services offered 173

16.3.4 OTHER COMPONENT MANUFACTURERS 174

16.3.4.1 KLA Corporation 174

16.3.4.2 ADVANTEST CORPORATION 175

16.3.4.3 SUSS MicroTec SE 176

16.3.4.4 Applied Materials, Inc. 177

16.3.4.5 Park Systems 178

16.3.4.6 Imagine Optic 179

16.3.4.7 MKS Inc. 180

16.4 END USERS 181

16.4.1 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED 181

16.4.2 INTEL CORPORATION 182

16.4.3 SAMSUNG 183

16.4.4 SK HYNIX INC. 184

16.4.5 MICRON TECHNOLOGY, INC. 185

17 RESEARCH METHODOLOGY 186

17.1 RESEARCH DATA 186

17.2 SECONDARY AND PRIMARY RESEARCH 187

17.2.1 SECONDARY DATA 189

17.2.1.1 List of key secondary sources 189

17.2.1.2 Key data from secondary sources 189

17.2.2 PRIMARY DATA 190

17.2.2.1 List of primary interview participants 190

17.2.2.2 Breakdown of primaries 190

17.2.2.3 Key data from primary sources 191

17.2.2.4 Key industry insights 191

17.3 MARKET SIZE ESTIMATION 192

17.3.1 BOTTOM-UP APPROACH 192

17.3.1.1 Approach to arrive at market size using bottom-up analysis

(demand side) 193

17.3.2 TOP-DOWN APPROACH 193

17.3.2.1 Approach to arrive at market size using top-down analysis

(supply side) 193

17.4 MARKET SIZE ESTIMATION FOR BASE YEAR 194

17.5 MARKET FORECAST APPROACH 195

17.5.1 SUPPLY SIDE 195

17.5.2 DEMAND SIDE 195

17.6 DATA TRIANGULATION 196

17.7 RESEARCH ASSUMPTIONS 197

17.8 RESEARCH LIMITATIONS 197

17.9 RISK ANALYSIS 198

18 APPENDIX 199

18.1 INSIGHTS FROM INDUSTRY EXPERTS 199

18.2 DISCUSSION GUIDE 199

18.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 202

18.4 CUSTOMIZATION OPTIONS 204

18.5 RELATED REPORTS 204

18.6 AUTHOR DETAILS 205

LIST OF TABLES

TABLE 1 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: INCLUSIONS AND EXCLUSIONS 22

TABLE 2 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: SUMMARY OF CHANGES 24

TABLE 3 PORTER’S FIVE FORCES ANALYSIS: EXTREME ULTRAVIOLET (EUV)

LITHOGRAPHY MARKET 45

TABLE 4 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021–2029 46

TABLE 5 ROLE OF COMPANIES IN EUV LITHOGRAPHY ECOSYSTEM 51

TABLE 6 AVERAGE SELLING PRICE TREND OF EUV LITHOGRAPHY SYSTEM TYPES OFFERED BY ASML, 2021–2025 (USD) 52

TABLE 7 AVERAGE SELLING PRICE TREND OF EUV LITHOGRAPHY SYSTEM, BY REGION, 2021–2025 (USD MILLION) 53

TABLE 8 IMPORT DATA FOR HS CODE 8442-COMPLIANT PRODUCTS, BY COUNTRY,

2020–2024 (USD MILLION) 54

TABLE 9 EXPORT DATA FOR HS CODE 8442-COMPLIANT PRODUCTS, BY COUNTRY,

2020–2024 (USD MILLION) 55

TABLE 10 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: KEY CONFERENCES AND EVENTS, 2026–2027 56

TABLE 11 US-ADJUSTED RECIPROCAL TARIFF RATES 60

TABLE 12 LIST OF MAJOR PATENTS, 2023–2024 70

TABLE 13 TOP USE CASES AND MARKET POTENTIAL 72

TABLE 14 BEST PRACTICES FOLLOWED BY COMPANIES 72

TABLE 15 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION 73

TABLE 16 INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 73

TABLE 17 AMERICAS: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 74

TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 75

TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 75

TABLE 20 EUV LITHOGRAPHY: REGULATIONS 75

TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%) 82

TABLE 22 KEY BUYING CRITERIA FOR END USERS 83

TABLE 23 UNMET NEEDS OF END USERS OF EUV LITHOGRAPHY TECHNOLOGY 85

TABLE 24 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY COMPONENT,

2022–2025 (USD MILLION) 89

TABLE 25 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY COMPONENT,

2026–2032 (USD MILLION) 90

TABLE 26 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY SYSTEM TYPE, IN TERMS OF VALUE AND VOLUME, 2022–2025 94

TABLE 27 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY SYSTEM TYPE, IN TERMS OF VALUE AND VOLUME, 2026–2032 94

TABLE 28 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY SYSTEM TYPE,

2022–2025 (USD MILLION) 95

TABLE 29 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY SYSTEM TYPE,

2026–2032 (USD MILLION) 95

TABLE 30 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER,

2022–2025 (USD MILLION) 98

TABLE 31 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER,

2026–2032 (USD MILLION) 99

TABLE 32 INTEGRATED DEVICE MANUFACTURERS (IDMS): EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY REGION, 2022–2025 (USD MILLION) 100

TABLE 33 INTEGRATED DEVICE MANUFACTURERS (IDMS): EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY REGION, 2026–2032 (USD MILLION) 100

TABLE 34 INTEGRATED DEVICE MANUFACTURERS (IDMS): EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET IN ASIA PACIFIC, BY COUNTRY, 2022–2025 (USD MILLION) 100

TABLE 35 INTEGRATED DEVICE MANUFACTURERS (IDMS): EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET IN ASIA PACIFIC, BY COUNTRY, 2026–2032 (USD MILLION) 101

TABLE 36 FOUNDRIES: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY REGION, 2022–2025 (USD MILLION) 102

TABLE 37 FOUNDRIES: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY REGION, 2026–2032 (USD MILLION) 102

TABLE 38 FOUNDRIES: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET IN

ASIA PACIFIC, BY COUNTRY, 2022–2025 (USD MILLION) 102

TABLE 39 FOUNDRIES: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET IN

ASIA PACIFIC, BY COUNTRY, 2026–2032 (USD MILLION) 103

TABLE 40 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY APPLICATION,

2022–2025 (USD MILLION) 105

TABLE 41 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY APPLICATION,

2026–2032 (USD MILLION) 105

TABLE 42 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY REGION,

2022–2025 (USD MILLION) 110

TABLE 43 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY REGION,

2026–2032 (USD MILLION) 111

TABLE 44 AMERICAS: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2022–2025 (USD MILLION) 112

TABLE 45 AMERICAS: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2026–2032 (USD MILLION) 112

TABLE 46 EMEA: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2022–2025 (USD MILLION) 114

TABLE 47 EMEA: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2026–2032 (USD MILLION) 114

TABLE 48 ASIA PACIFIC: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY COUNTRY, 2022–2025 (USD MILLION) 116

TABLE 49 ASIA PACIFIC: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY COUNTRY, 2026–2032 (USD MILLION) 116

TABLE 50 ASIA PACIFIC: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2022–2025 (USD MILLION) 116

TABLE 51 ASIA PACIFIC: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2026–2032 (USD MILLION) 117

TABLE 52 CHINA: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2022–2025 (USD MILLION) 117

TABLE 53 CHINA: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2026–2032 (USD MILLION) 117

TABLE 54 JAPAN: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2022–2025 (USD MILLION) 118

TABLE 55 JAPAN: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2026–2032 (USD MILLION) 118

TABLE 56 SOUTH KOREA: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET,

BY END USER, 2022–2025 (USD MILLION) 119

TABLE 57 SOUTH KOREA: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET,

BY END USER, 2026–2032 (USD MILLION) 119

TABLE 58 TAIWAN: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2022–2025 (USD MILLION) 119

TABLE 59 TAIWAN: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2026–2032 (USD MILLION) 120

TABLE 60 REST OF ASIA PACIFIC: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET,

BY END USER, 2022–2025 (USD MILLION) 120

TABLE 61 REST OF ASIA PACIFIC: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET,

BY END USER, 2026–2032 (USD MILLION) 120

TABLE 62 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: KEY PLAYER STRATEGIES/ RIGHT TO WIN, 2024–2025 121

TABLE 63 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: DEGREE OF COMPETITION 124

TABLE 64 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: REGION FOOTPRINT, 2025 130

TABLE 65 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET:

END USER FOOTPRINT, 2025 131

TABLE 66 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET:

COMPONENT FOOTPRINT, 2025 132

TABLE 67 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET:

LIST OF KEY STARTUPS/SMES, 2025 134

TABLE 68 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2025 134

TABLE 69 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: PRODUCT LAUNCHES, OCTOBER 2024 TO DECEMBER 2025 135

TABLE 70 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: DEALS,

OCTOBER 2024 TO DECEMBER 2025 137

TABLE 71 ASML: COMPANY OVERVIEW 139

TABLE 72 ASML: PRODUCTS/SOLUTIONS/SERVICES OFFERED 140

TABLE 73 ASML: DEALS 141

TABLE 74 TRUMPF: COMPANY OVERVIEW 142

TABLE 75 TRUMPF: PRODUCTS/SOLUTIONS/SERVICES OFFERED 144

TABLE 76 USHIO INC.: COMPANY OVERVIEW 145

TABLE 77 USHIO INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 146

TABLE 78 ENERGETIQ: COMPANY OVERVIEW 148

TABLE 79 ENERGETIQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED 148

TABLE 80 ENERGETIQ: PRODUCT LAUNCHES 149

TABLE 81 ZEISS GROUP: COMPANY OVERVIEW 151

TABLE 82 ZEISS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED 153

TABLE 83 ZEISS GROUP: PRODUCT LAUNCHES 154

TABLE 84 ZEISS GROUP: DEALS 154

TABLE 85 NTT ADVANCED TECHNOLOGY CORPORATION: COMPANY OVERVIEW 155

TABLE 86 NTT ADVANCED TECHNOLOGY CORPORATION:

PRODUCTS/SOLUTIONS/SERVICES OFFERED 156

TABLE 87 RIGAKU HOLDINGS CORPORATION: COMPANY OVERVIEW 157

TABLE 88 RIGAKU HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 158

TABLE 89 EDMUND OPTICS INC.: COMPANY OVERVIEW 159

TABLE 90 EDMUND OPTICS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 160

TABLE 91 AGC INC.: COMPANY OVERVIEW 161

TABLE 92 AGC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 162

TABLE 93 TEKSCEND PHOTOMASK: COMPANY OVERVIEW 163

TABLE 94 TEKSCEND PHOTOMASK: PRODUCTS/SOLUTIONS/SERVICES OFFERED 164

TABLE 95 LASERTEC CORPORATION: COMPANY OVERVIEW 165

TABLE 96 LASERTEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 167

TABLE 97 LASERTEC CORPORATION: PRODUCT LAUNCHES 169

TABLE 98 HOYA CORPORATION: COMPANY OVERVIEW 170

TABLE 99 HOYA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 172

TABLE 100 NUFLARE TECHNOLOGY INC.: COMPANY OVERVIEW 173

TABLE 101 NUFLARE TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 173

TABLE 102 KLA CORPORATION: COMPANY OVERVIEW 174

TABLE 103 ADVANTEST CORPORATION: COMPANY OVERVIEW 175

TABLE 104 SUSS MICROTEC SE: COMPANY OVERVIEW 176

TABLE 105 APPLIED MATERIALS, INC.: COMPANY OVERVIEW 177

TABLE 106 PARK SYSTEMS: COMPANY OVERVIEW 178

TABLE 107 IMAGINE OPTIC: COMPANY OVERVIEW 179

TABLE 108 MKS INC.: COMPANY OVERVIEW 180

TABLE 109 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED:

COMPANY OVERVIEW 181

TABLE 110 INTEL CORPORATION: COMPANY OVERVIEW 182

TABLE 111 SAMSUNG: COMPANY OVERVIEW 183

TABLE 112 SK HYNIX INC.: COMPANY OVERVIEW 184

TABLE 113 MICRON TECHNOLOGY, INC.: COMPANY OVERVIEW 185

TABLE 114 MAJOR SECONDARY SOURCES 189

TABLE 115 PRIMARY INTERVIEW PARTICIPANTS 190

TABLE 116 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: RISK ANALYSIS 198

LIST OF FIGURES

FIGURE 1 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET SEGMENTATION AND REGIONAL SCOPE 21

FIGURE 2 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: DURATION COVERED 22

FIGURE 3 MARKET SCENARIO 25

FIGURE 4 GLOBAL EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET SIZE, 2022–2032 26

FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, 2024–2025 26

FIGURE 6 DISRUPTIVE TRENDS IMPACTING GROWTH OF EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET 27

FIGURE 7 HIGH-GROWTH SEGMENTS IN EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, 2026–2032 28

FIGURE 8 ASIA PACIFIC TO DOMINATE EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET IN 2026 29

FIGURE 9 RISING DEMAND FOR ADVANCED SEMICONDUCTOR NOTES TO CREATE OPPORTUNITIES FOR MARKET PLAYERS 30

FIGURE 10 FOUNDRIES TO COMMAND EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET IN 2032 31

FIGURE 11 LOGIC CHIPS SEGMENT TO DOMINATE EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET IN 2032 31

FIGURE 12 ASIA PACIFIC TO CAPTURE LARGEST SHARE OF EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET IN 2032 32

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES 33

FIGURE 14 IMPACT ANALYSIS: DRIVERS 36

FIGURE 15 IMPACT ANALYSIS: RESTRAINTS 37

FIGURE 16 IMPACT ANALYSIS: OPPORTUNITIES 41

FIGURE 17 IMPACT ANALYSIS: CHALLENGES 43

FIGURE 18 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: PORTER’S

FIVE FORCES ANALYSIS 44

FIGURE 19 EUV LITHOGRAPHY VALUE CHAIN ANALYSIS 49

FIGURE 20 EUV LITHOGRAPHY ECOSYSTEM ANALYSIS 50

FIGURE 21 AVERAGE SELLING PRICE TREND OF EUV LITHOGRAPHY SYSTEM TYPES OFFERED BY KEY PLAYERS, 2021–2025 52

FIGURE 22 AVERAGE SELLING PRICE TREND OF EUV LITHOGRAPHY SYSTEM, BY REGION, 2021–2025 53

FIGURE 23 IMPORT SCENARIO FOR HS CODE 8442-COMPLIANT PRODUCTS IN

TOP 5 COUNTRIES, 2020–2024 54

FIGURE 24 EXPORT SCENARIO FOR HS CODE 8442-COMPLIANT PRODUCTS IN

TOP 5 COUNTRIES, 2020–2024 55

FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 57

FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2020–2025 58

FIGURE 27 PATENTS APPLIED AND GRANTED, 2015–2024 69

FIGURE 28 DECISION-MAKING FACTORS IN EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET 81

FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS 82

FIGURE 30 KEY BUYING CRITERIA FOR END USERS 82

FIGURE 31 ADOPTION BARRIERS AND INTERNAL CHALLENGES 84

FIGURE 32 LIGHT SOURCES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD 89

FIGURE 33 0.55 NA EUV SYSTEMS (EXE) TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD 95

FIGURE 34 FOUNDRIES TO ACCOUNT FOR LARGER MARKET SHARE IN 2026 98

FIGURE 35 MEMORY CHIPS TO REGISTER HIGHER CAGR DURING FORECAST PERIOD 105

FIGURE 36 ASIA PACIFIC TO DOMINATE EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET THROUGHOUT FORECAST PERIOD 110

FIGURE 37 AMERICAS: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET SNAPSHOT 112

FIGURE 38 EMEA: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET SNAPSHOT 114

FIGURE 39 ASIA PACIFIC: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET SNAPSHOT 115

FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS, 2021–2025 123

FIGURE 41 MARKET SHARE ANALYSIS OF COMPANIES OFFERING EUV LITHOGRAPHY SOLUTIONS, 2025 124

FIGURE 42 COMPANY VALUATION, 2025 125

FIGURE 43 FINANCIAL METRICS, 2025 125

FIGURE 44 PRODUCT COMPARISON 126

FIGURE 45 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2025 128

FIGURE 46 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET:

COMPANY FOOTPRINT, 2025 129

FIGURE 47 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET:

COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2025 133

FIGURE 48 ASML: COMPANY SNAPSHOT 139

FIGURE 49 TRUMPF: COMPANY SNAPSHOT 143

FIGURE 50 USHIO INC.: COMPANY SNAPSHOT 146

FIGURE 51 ZEISS GROUP: COMPANY SNAPSHOT 152

FIGURE 52 RIGAKU HOLDINGS CORPORATION: COMPANY SNAPSHOT 158

FIGURE 53 AGC INC.: COMPANY SNAPSHOT 162

FIGURE 54 TEKSCEND PHOTOMASK: COMPANY SNAPSHOT 164

FIGURE 55 LASERTEC CORPORATION: COMPANY SNAPSHOT 166

FIGURE 56 HOYA CORPORATION: COMPANY SNAPSHOT 171

FIGURE 57 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: RESEARCH DESIGN 187

FIGURE 58 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: RESEARCH APPROACH 188

FIGURE 59 DATA CAPTURED FROM SECONDARY SOURCES 189

FIGURE 60 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE,

DESIGNATION, AND REGION 190

FIGURE 61 DATA CAPTURED FROM PRIMARY SOURCES 191

FIGURE 62 CORE FINDINGS FROM INDUSTRY EXPERTS 191

FIGURE 63 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: RESEARCH FLOW 192

FIGURE 64 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: BOTTOM-UP APPROACH 193

FIGURE 65 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: TOP-DOWN APPROACH 194

FIGURE 66 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE) 194

FIGURE 67 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: DATA TRIANGULATION 196

FIGURE 68 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: RESEARCH ASSUMPTIONS 197