Industrial Fasteners Market - Global Forecast to 2032

Industrial Fasteners Market by Material (Metal, Plastic), Type (Bolts, Screws, Nuts, Washers, Rivets), Product (Externally Threaded, Internally Threaded, Non-Threaded, and Aerospace Grade), Application, Sales Channel, and Region – Global Forecast to 2032

産業用ファスナー市場 - 材質(金属、プラスチック)、種類(ボルト、ネジ、ナット、ワッシャー、リベット)、製品(外ネジ、内ネジ、ネジなし、航空宇宙グレード)、用途、販売チャネル、地域別 - 2032年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年02月 |

| ページ数 | 483 |

| 図表数 | 765 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-6847 |

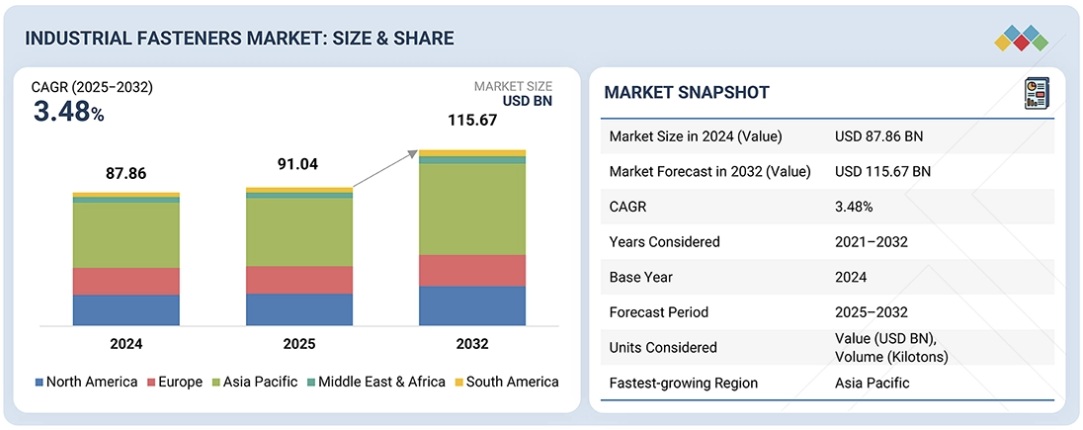

産業用ファスナー市場は、2025年の910.4億米ドルから2032年には1,156.7億米ドルに拡大し、予測期間中に3.48%の年平均成長率(CAGR)で成長すると予測されています。産業用ファスナー市場は、世界的なインフラ投資の増加、自動車部門からの需要増加、そして製造技術の進歩に牽引され、急速な成長が見込まれています。

調査対象範囲

本調査レポートは、産業用ファスナー市場を、材質(金属、プラスチック、その他)、種類(ボルト、ねじ、ナット、ワッシャー、リベット、その他)、製品(外ねじ、内ねじ、非ねじ、航空宇宙グレード)、販売チャネル(直接販売、間接販売)、用途(自動車、建築・建設、一般産業、重機、電子機器、新エネルギー、太陽光発電、その他)、地域(アジア太平洋、北米、欧州、南米、中東・アフリカ)に基づいて分類しています。本レポートは、産業用ファスナー市場の成長に影響を与える推進要因、制約要因、課題、機会に関する詳細な情報を網羅しています。主要業界プレーヤーの詳細な分析を実施し、産業用ファスナー市場における各社の事業概要、製品ラインナップ、主要戦略(提携、製品発売、事業拡大、買収など)に関する洞察を提供しています。本レポートは、産業用ファスナー市場における新興企業の競合分析を提供しています。

レポートを購入する理由

本レポートは、市場リーダー企業および新規参入企業に対し、産業用ファスナー市場全体とそのサブセグメントにおける収益の概算値に関する情報を提供します。ステークホルダーが競争環境を理解し、自社のポジショニングに関するより深い洞察を獲得し、効果的な市場開拓戦略を策定するのに役立ちます。また、ステークホルダーが市場の動向を把握し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供するのに役立ちます。

本レポートでは、以下の点について洞察を提供しています。

主要な推進要因(世界的なインフラ投資の増加と製造技術の進歩に牽引された自動車セクターからの需要増加)、制約要因(原材料価格の変動と高度な接合技術への置き換え)、機会(アフリカとアジアにおける急速な都市化、航空宇宙および再生可能エネルギーセクターの拡大、スマートファスナーソリューションの開発、軽量で高性能かつ持続可能な素材への移行、成長するエレクトロニクスセクターからの需要)、課題(偽造および品質問題、多様な地域規制)の分析。

- 製品開発/イノベーション:産業用ファスナー市場における今後の技術、研究開発活動、製品・サービスの投入に関する詳細な洞察。

- 市場開発:収益性の高い市場に関する包括的な情報。本レポートでは、様々な地域における産業用ファスナー市場を分析しています。

- 市場の多様化:産業用ファスナー市場における新製品・サービス、未開拓地域、最近の動向、投資に関する包括的な情報。

- 競合評価:Illinois Tool Works Inc.(米国)、Stanley Black & Decker, Inc.(米国)、SFS AG(スイス)、Lisi Group(フランス)、Bulten AB(スウェーデン)、Koelner Rawlplug IP(ポーランド)、FONTANA GRUPPO(イタリア)、Birmingham Fastener and Supply Inc(米国)、MW Industries, Inc.(米国)、Hilti Group(リヒテンシュタイン)といった主要企業の市場シェア、成長戦略、サービス提供に関する詳細な評価。

Report Description

The industrial fasteners market is projected to grow from USD 91.04 billion in 2025 to USD 115.67 billion in 2032, at a CAGR of 3.48% during the forecast period. The industrial fasteners market is poised for rapid growth, driven by rising global infrastructure investments, increasing demand from the automotive sector, and advances in manufacturing technologies.

Industrial Fasteners Market – Global Forecast to 2032

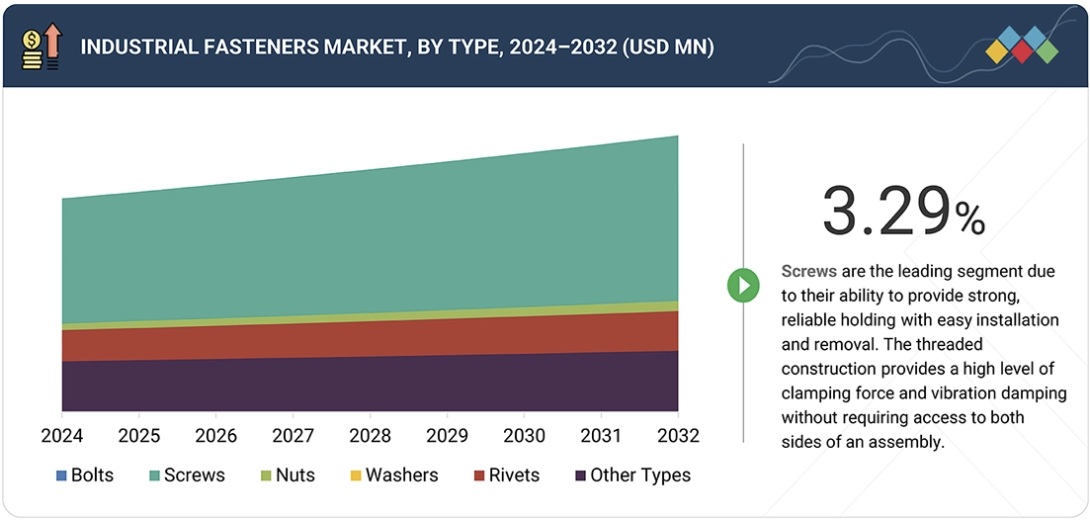

“The screws segment is projected to be the largest segment during the forecast period.”

The most common industrial fasteners are screws, which hold the largest market share due to their ability to provide reliable holding with easy installation and removal. The threaded construction provides a high level of clamping force and vibration damping without requiring access to both sides of an assembly. Screws are compatible with a broad spectrum of materials, including metal, plastic, and wood, which facilitates automation and allows control of torque, saving time and money on assembly and reducing maintenance; they are suitable for mass production.

“The indirect sales segment is projected to hold the largest market share during the forecast period.”

The highest share in the market of industrial fasteners on the basis of sales channel is the indirect sales channel due to the fact that the majority of the fasteners are sold by distributors, wholesalers, and dealers as opposed to the manufacturers themselves. These distributors provide a broad range of products, offer bulk purchasing, and can easily deliver them, which is essential in industries such as construction, automotive, and machinery that require fasteners of different sizes, materials, and specifications. Technical assistance, stock keeping, and quicker access to special or certified fasteners are also available through indirect channels, saving the end user time.

“The building & construction segment is expected to have the second-largest growth during the forecast period.”

The second-largest application of industrial fasteners is the building & construction industry, as construction projects (residential, commercial, and infrastructure) require large volumes of bolts, screws, nuts, and anchors to assemble structures, clad buildings, and install interior finishes. Constant demand is supported by rapid urbanization, renovation, and infrastructure modernization. The fasteners used in this industry should be based on the strength, safety, and durability standards, particularly in steel structures, concrete anchoring, and facade installations. Also, prefabricated construction and modular building trends are driving increased use of fasteners, as the building and construction industry is a significant, consistent consumer of industrial fasteners, following the automotive and manufacturing industries.

Industrial Fasteners Market – Global Forecast to 2032 – region

“In terms of value, the Asia Pacific industrial fasteners market is projected to grow at the highest CAGR during the forecast period.”

The Asia Pacific market is the largest and fastest-growing market for industrial fasteners, driven by a strong manufacturing base, high industrialization, and broad infrastructure development. Industrial fastening is a basic element in the auto assembly, heavy machinery, infrastructure, and production machinery. With increased vehicle production, industry output, and construction efforts, demand for large quantities of fasteners rises, making the region the largest and fastest-growing market for industrial fasteners worldwide. Some of the leading manufacturing countries, such as China, India, South Korea, and Japan, are also located in the region, further driving market development.

- By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

- By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

- By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: <USD 500 million

Companies Covered: Illinois Tool Works Inc. (US), Stanley Black & Decker, Inc. (US), SFS AG (Switzerland), Lisi Group (France), Bulten AB (Sweden), Koelner Rawlplug IP (Poland), FONTANA GRUPPO (Italy), Birmingham Fastener and Supply Inc (US), MW Industries, Inc. (US), and Hilti Group (Liechtenstein), among others, are covered in the report.

Industrial Fasteners Market – Global Forecast to 2032 – ecosystem

The study includes an in-depth competitive analysis of these key players in the industrial fasteners market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the Industrial fasteners market based on by material (metal, plastic, other materials), by type (bolts, screws, nuts, washers, rivets, other types), by product (externally threaded, internally threaded, non-threaded, aerospace grade), by sales channel( direct, indirect), by application (automotive, building & construction, general industrial, heavy equipment, electronics, new energy, solar, other applications), and region (Asia Pacific, North America, Europe, South America, and Middle East & Africa). The report’s scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the industrial fasteners market. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, product offerings, and key strategies, including partnerships, product launches, expansions, and acquisitions, in the industrial fasteners market. This report provides a competitive analysis of upcoming startups in the industrial fasteners market.

Reasons to Buy the Report

The report will provide market leaders/new entrants with information on the closest approximations of revenue for the overall industrial fasteners market and its subsegments. It will help stakeholders understand the competitive landscape, gain deeper insights into positioning their businesses, and plan effective go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (are increasing demand from the automotive sector, driven by growing infrastructure investments across the globe, and advancements in manufacturing technology), restraints ( Fluctuating raw material prices and replacement by advanced joining technologies), opportunities (Rapid urbanization in Africa and Asia and Expansion in Aerospace & Renewable Energy sector, development of smart fastener solutions, shift towards lightweight high performance and sustainable materials, and demand from growing electronics sector), and challenges (Counterfeiting and quality issues and diverse regional regulations).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the industrial fasteners market.

- Market Development: Comprehensive information about profitable markets – the report analyzes the industrial fasteners market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the industrial fasteners market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Illinois Tool Works Inc. (US), Stanley Black & Decker, Inc. (US), SFS AG (Switzerland), Lisi Group (France), Bulten AB (Sweden), Koelner Rawlplug IP (Poland), FONTANA GRUPPO (Italy), Birmingham Fastener and Supply Inc (US), MW Industries, Inc. (US), and Hilti Group (Liechtenstein).

Table of Contents

1 INTRODUCTION 42

1.1 STUDY OBJECTIVES 42

1.2 MARKET DEFINITION 42

1.3 MARKET SCOPE 43

1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE 43

1.3.2 INCLUSIONS AND EXCLUSIONS 44

1.3.3 YEARS CONSIDERED 45

1.3.4 CURRENCY CONSIDERED 45

1.3.5 UNITS CONSIDERED 45

1.4 LIMITATIONS 45

1.5 STAKEHOLDERS 46

1.6 SUMMARY OF CHANGES 46

2 EXECUTIVE SUMMARY 47

2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS 47

2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS 48

2.3 DISRUPTIVE TRENDS SHAPING MARKET 49

2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS 50

2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST 51

3 PREMIUM INSIGHTS 52

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL FASTENERS MARKET 52

3.2 ASIA PACIFIC: INDUSTRIAL FASTENERS, BY MATERIAL AND COUNTRY 53

3.3 INDUSTRIAL FASTENERS MARKET, BY TYPE 54

3.4 INDUSTRIAL FASTENERS MARKET, BY MATERIAL 54

3.5 INDUSTRIAL FASTENERS MARKET, BY PRODUCT 55

3.6 INDUSTRIAL FASTENERS MARKET, BY APPLICATION 55

3.7 INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL 56

3.8 INDUSTRIAL FASTENERS MARKET, BY COUNTRY 56

4 MARKET OVERVIEW 57

4.1 INTRODUCTION 57

4.1.1 DRIVERS 58

4.1.1.1 Increasing demand for fasteners from automotive sector 58

4.1.1.2 Growing infrastructure investments globally 59

4.1.1.3 Advancements in manufacturing technology 60

4.1.2 RESTRAINTS 61

4.1.2.1 Fluctuating raw material prices 61

4.1.2.2 Replacement by advanced joining technologies 62

4.1.3 OPPORTUNITIES 62

4.1.3.1 Rapid urbanization in Africa and Asia 62

4.1.3.2 Expansion in aerospace and renewable energy sectors 63

4.1.3.3 Development of smart fastening solutions 65

4.1.3.4 Shift towards lightweight, high performance, and

sustainable materials 66

4.1.3.5 Demand from rapidly growing electronics sector 66

4.1.4 CHALLENGES 67

4.1.4.1 Counterfeiting and quality issues 67

4.1.4.2 Diverse regional regulations 68

4.2 UNMET NEEDS AND WHITE SPACES 68

4.2.1 INSTALLATION EFFICIENCY AND ON-SITE PRODUCTIVITY 68

4.2.2 DIGITAL VISIBILITY AND TRACEABILITY 68

4.2.3 SUSTAINABILITY AND CIRCULARITY EXPECTATIONS 68

4.2.4 APPLICATION-SPECIFIC SOLUTIONS FOR ENERGY TRANSITION MARKETS 69

4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 69

4.3.1 INTERCONNECTED MARKETS 69

4.3.2 CROSS-SECTOR OPPORTUNITIES 70

4.3.2.1 Automotive → Renewable Energy 70

4.3.2.2 Automotive → General industrial 70

4.3.2.3 Electronics → Aerospace 70

4.3.2.4 Heavy Equipment → Building & Construction 70

4.3.2.5 Solar → Building & Construction 70

4.3.2.6 General Industrial→ Heavy Equipment 70

4.4 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS 71

4.4.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING CONSOLIDATION

AND INNOVATION 71

4.4.1.1 Illinois Tool Works Inc.’s AugerBolt Through Bolt Fastening

product launch 71

4.4.1.2 Stanley Black & Decker’s divestment of aerospace business 71

4.4.1.3 SFS Group AG’s acquisition of Gödde GmbH, Oltrogge Werkzeuge GmbH and Hch. Perschmann GmbH 71

4.4.2 TIER 2 PLAYERS: REGIONAL INNOVATORS AND NICHE LEADERS 71

4.4.2.1 Koelner Rawlplug IP’s collaboration to enhance

technological offering 71

4.4.2.2 Fontana Gruppo’s acquisition of Right Tight Fasteners 71

4.4.3 TIER 3 PLAYERS: AGILE INNOVATORS AND SPECIALIZED PROVIDERS 72

4.4.3.1 MacLean-Fogg’s new brand of fasteners 72

4.4.3.2 Böllhoff Group’s launch of QUICK FLOW Plus fasteners 72

5 INDUSTRY TRENDS 73

5.1 PORTER’S FIVE FORCES ANALYSIS 73

5.1.1 THREAT OF NEW ENTRANTS 74

5.1.2 THREAT OF SUBSTITUTES 74

5.1.3 BARGAINING POWER OF SUPPLIERS 75

5.1.4 BARGAINING POWER OF BUYERS 75

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 76

5.2 MACROECONOMIC ANALYSIS 76

5.2.1 INTRODUCTION 76

5.2.2 GDP TRENDS AND FORECASTS 76

5.2.3 TRENDS IN GLOBAL INDUSTRIAL FASTENERS MARKET 77

5.2.4 URBANIZATION AND DEMOGRAPHIC SHIFTS 77

5.3 VALUE CHAIN ANALYSIS 78

5.4 ECOSYSTEM ANALYSIS 79

5.5 PRICING ANALYSIS 81

5.5.1 AVERAGE SELLING PRICE TREND AMONG KEY PLAYERS,

BY APPLICATION, 2024 81

5.5.2 AVERAGE SELLING PRICE TREND, BY REGION, 2021–2025 82

5.6 TRADE ANALYSIS 83

5.6.1 EXPORT DATA FOR HS CODE 7318 83

5.6.2 IMPORT DATA FOR HS CODE 7318 84

5.7 KEY CONFERENCES AND EVENTS, 2025–2026 86

5.8 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS 86

5.9 INVESTMENT AND FUNDING SCENARIO 87

5.10 CASE STUDY ANALYSIS 88

5.10.1 PLASTIC FAILURES ASSOCIATED WITH METAL FASTENERS 88

5.10.2 RESOLVING FLANGE JOINT FAILURES IN BALL MILL 88

5.10.3 DRIVING SUSTAINABLE LOCAL MANUFACTURING THROUGH

STRATEGIC FASTENER SUPPLY 89

5.11 IMPACT OF 2025 US TARIFF ON INDUSTRIAL FASTENERS MARKET 89

5.11.1 INTRODUCTION 89

5.11.2 KEY TARIFF RATES 90

5.11.3 PRICE IMPACT ANALYSIS 90

5.11.4 1.16.4. KEY IMPACT ON VARIOUS REGIONS 90

5.11.4.1 US 90

5.11.4.2 Europe 90

5.11.4.3 Asia Pacific 90

5.11.5 END-USE SECTOR IMPACT 90

6 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR 92

6.1 DECISION-MAKING PROCESS 92

6.2 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA 93

6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 93

6.2.2 BUYING CRITERIA 94

6.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 94

6.4 UNMET NEEDS FROM VARIOUS APPLICATIONS 95

6.5 MARKET PROFITABILITY 97

6.5.1 REVENUE POTENTIAL 97

6.5.2 COST DYNAMICS 97

6.6 MARGIN OPPORTUNITIES, BY END-USE APPLICATION 97

6.6.1 AUTOMOTIVE 97

6.6.2 ELECTRONICS 97

6.6.3 GENERAL INDUSTRIAL 97

6.6.4 BUILDING & CONSTRUCTION 98

6.6.5 HEAVY EQUIPMENT 98

6.6.6 NEW ENERGY 98

6.6.7 SOLAR 98

7 SUSTAINABILITY AND REGULATORY LANDSCAPE 99

7.1 REGIONAL REGULATIONS AND COMPLIANCE 99

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 99

7.1.2 INDUSTRY STANDARDS 103

7.2 SUSTAINABILITY INITIATIVES 104

7.2.1 RECYCLED MATERIALS 105

7.2.2 ECO-FRIENDLY COATINGS 105

7.2.3 COLD FORMING MANUFACTURING TECHNIQUE 105

7.2.4 BIODEGRADABLE POLYMERS 105

7.2.5 RENEWABLE ENERGY–DRIVEN MANUFACTURING 105

7.3 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES 105

7.4 CERTIFICATIONS, LABELING, ECO-STANDARDS 106

8 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS,

DIGITAL, AND AI ADOPTIONS 107

8.1 KEY EMERGING TECHNOLOGIES 107

8.1.1 SMART FASTENERS 107

8.1.2 ADDITIVE MANUFACTURING 107

8.1.3 HYBRID FASTENERS 107

8.1.4 CERAMIC FASTENERS 107

8.1.5 SUSTAINABLE FASTENERS 107

8.2 COMPLEMENTARY TECHNOLOGIES 108

8.2.1 SURFACE TREATMENT AND COATING TECHNOLOGIES 108

8.2.2 ADVANCED MANUFACTURING TECHNIQUES 108

8.2.3 INTELLIGENT FASTENERS 108

8.3 TECHNOLOGY/PRODUCT ROADMAP 108

8.3.1 SHORT-TERM (2025–2027) | MATERIAL OPTIMIZATION & DIGITAL TRANSITION PHASE 108

8.3.2 MID-TERM (2027–2030): ADVANCED MATERIALS & SMART MANUFACTURING PHASE 109

8.3.3 LONG-TERM (2030–2035+): INTEGRATED ECO-SYSTEM AND

NEXT-GENERATION MATERIALS PHASE 109

8.4 PATENT ANALYSIS 110

8.4.1 INTRODUCTION 110

8.4.2 APPROACH 110

8.4.3 DOCUMENT TYPE 110

8.4.4 JURISDICTION ANALYSIS 111

8.4.5 TOP APPLICANTS 112

8.5 FUTURE APPLICATIONS 115

8.5.1 SMART SENSOR-INTEGRATED FASTENERS (IOT/CONDITION MONITORING) 115

8.5.2 SELF-LOCKING AND REVERSIBLE SMART FASTENERS 115

8.5.3 FASTENERS WITH EMBEDDED ENERGY HARVESTING 115

8.5.4 FASTENERS WITH ADDITIVE MANUFACTURING 116

8.6 IMPACT OF AI/GEN AI ON INDUSTRIAL FASTENERS MARKET 116

8.6.1 TOP USE CASES AND MARKET POTENTIAL 116

8.6.2 BEST PRACTICES FOLLOWED BY MANUFACTURERS/OEMS

IN INDUSTRIAL FASTENERS 117

8.6.3 CASE STUDIES OF AI IMPLEMENTATION IN INDUSTRIAL FASTENERS MARKET 118

8.6.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS 118

8.6.5 CLIENTS’ READINESS TO ADAPT AI-INTEGRATED INDUSTRIAL FASTENERS 119

9 INDUSTRIAL FASTENERS MARKET, BY MATERIAL 120

9.1 INTRODUCTION 121

9.2 METALS 122

9.2.1 SUPERIOR STRENGTH AND DURABILITY OF FASTENERS 122

9.3 PLASTICS 123

9.3.1 SURGING DEMAND FOR LIGHTWEIGHT AND NON-CONDUCTIVE FASTENERS 123

9.4 OTHER MATERIALS 124

10 INDUSTRIAL FASTENERS MARKET, BY TYPE 125

10.1 INTRODUCTION 126

10.2 BOLTS 128

10.2.1 INDUSTRIAL EXPANSION AND RISING AUTOMOTIVE PRODUCTION 128

10.3 SCREWS 129

10.3.1 INCREASING DEMAND FROM CONSTRUCTION INDUSTRY 129

10.4 NUTS 130

10.4.1 ESSENTIAL USE WITH BOLTS FOR SECURE AND VERSATILE FASTENING 130

10.5 WASHERS 130

10.5.1 RISING DEMAND FOR WASHERS IN CONSTRUCTION AND

AUTOMOTIVE INDUSTRIES 130

10.6 RIVETS 131

10.6.1 SURGING NEED IN CONSTRUCTION SECTOR 131

10.7 OTHER TYPES 132

11 INDUSTRIAL FASTENERS MARKET, BY PRODUCT 133

11.1 INTRODUCTION 134

11.2 EXTERNALLY THREADED 135

11.2.1 SUPERIOR LOAD-BEARING CAPACITY AND EASE OF ASSEMBLY 135

11.3 INTERNALLY THREADED 135

11.3.1 INDUSTRIAL GROWTH AND NEED FOR SECURE, DURABLE CONNECTIONS 135

11.4 NON-THREADED 136

11.4.1 INCREASING DEMAND FROM AUTOMOTIVE, CONSTRUCTION,

ELECTRONICS, AND CONSUMER GOODS INDUSTRIES 136

11.5 AEROSPACE GRADE 137

11.5.1 INCREASED PRODUCTION OF AIRCRAFT COMPONENTS AND

ADVANCEMENTS IN AIRCRAFT TECHNOLOGY 137

12 INDUSTRIAL FASTENERS MARKET, BY APPLICATION 138

12.1 INTRODUCTION 139

12.2 AUTOMOTIVE 141

12.2.1 INCREASING DEMAND FOR ELECTRIC VEHICLES 141

12.3 BUILDING & CONSTRUCTION 143

12.3.1 GROWTH IN CONSTRUCTION AND RENOVATION ACTIVITIES 143

12.3.1.1 Data centers 144

12.3.1.2 Others 146

12.4 GENERAL INDUSTRIAL 147

12.4.1 STRUCTURAL INTEGRITY, VIBRATION RESISTANCE, AND EQUIPMENT STABILITY REQUIREMENTS 147

12.5 HEAVY EQUIPMENT 149

12.5.1 EXPANDING GLOBAL EQUIPMENT DEPLOYMENT 149

12.6 ELECTRONICS 150

12.6.1 INCREASING DEMAND FOR HOME APPLIANCES 150

12.7 NEW ENERGY 152

12.7.1 SURGING DEMAND FOR RENEWABLE ENERGY 152

12.8 SOLAR 154

12.8.1 RISING ADOPTION OF SOLAR ENERGY 154

12.9 OTHER APPLICATIONS 155

13 INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL 157

13.1 INTRODUCTION 158

13.2 DIRECT 159

13.2.1 NEED FOR QUALITY CONTROL AND STRONGER CUSTOMER RELATIONSHIPS 159

13.3 INDIRECT 160

13.3.1 EXPANDED MARKET REACH AND ENHANCED ACCESSIBILITY VIA E-COMMERCE PLATFORMS 160

14 INDUSTRIAL FASTENERS MARKET, BY REGION 161

14.1 INTRODUCTION 162

14.2 NORTH AMERICA 164

14.2.1 US 179

14.2.1.1 Growing demand for fasteners in automobile sector 179

14.2.2 CANADA 184

14.2.2.1 Growth of manufacturing, mining, and service sectors 184

14.2.3 MEXICO 189

14.2.3.1 Government initiatives for investments in power sector 189

14.3 ASIA PACIFIC 195

14.3.1 CHINA 210

14.3.1.1 Growing government investments in urbanization and

infrastructure projects 210

14.3.2 JAPAN 215

14.3.2.1 Surge in wind energy projects to drive demand for industrial fasteners 215

14.3.3 INDIA 220

14.3.3.1 Thriving automotive industry to fuel demand for fasteners 220

14.3.4 SOUTH KOREA 224

14.3.4.1 Rapid growth of semiconductor investment and manufacturing 224

14.3.5 MALAYSIA 229

14.3.5.1 Growth of manufacturing sector 229

14.3.6 REST OF ASIA PACIFIC 234

14.4 EUROPE 239

14.4.1 GERMANY 255

14.4.1.1 Increased production of automobiles to drive demand for

industrial fasteners 255

14.4.2 FRANCE 259

14.4.2.1 Increase in EV adoption 259

14.4.3 ITALY 264

14.4.3.1 Surge in demand for electric vehicles 264

14.4.4 UK 270

14.4.4.1 Growing offshore wind capacities to impact industrial

fasteners industry 270

14.4.5 SPAIN 274

14.4.5.1 Boom in construction and infrastructure projects 274

14.4.6 ROMANIA 279

14.4.6.1 Expansion of roadways and railways 279

14.4.7 SLOVAKIA 283

14.4.7.1 Rising investments in residential and commercial projects 283

14.4.8 POLAND 288

14.4.8.1 Growing investment in aerospace sector 288

14.4.9 CZECH REPUBLIC 293

14.4.9.1 Robust industrial base 293

14.4.10 REST OF EUROPE 298

14.5 MIDDLE EAST & AFRICA 303

14.5.1 GCC COUNTRIES 318

14.5.2 SAUDI ARABIA 322

14.5.2.1 Saudi Vision 2030 to play pivotal role in driving market growth 322

14.5.3 UAE 327

14.5.3.1 Smart and sustainable mobility to drive market 327

14.5.4 REST OF GCC COUNTRIES 332

14.5.5 SOUTH AFRICA 337

14.5.5.1 Government initiatives to improve housing, transportation

networks, and renewable energy projects 337

14.5.6 MOROCCO 342

14.5.6.1 Expanding construction sector to drive growth 342

14.5.7 REST OF MIDDLE EAST & AFRICA 346

14.6 SOUTH AMERICA 352

14.6.1 BRAZIL 367

14.6.1.1 Booming renewable energy industry to drive market 367

14.6.2 ARGENTINA 371

14.6.2.1 Growth of automotive industry to drive market 371

14.6.3 REST OF SOUTH AMERICA 376

15 COMPETITIVE LANDSCAPE 382

15.1 OVERVIEW 382

15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 382

15.3 REVENUE ANALYSIS, 2020–2024 384

15.4 MARKET SHARE ANALYSIS, 2024 385

15.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025 386

15.6 BRAND/PRODUCT COMPARISON 388

15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 389

15.7.1 STARS 389

15.7.2 EMERGING LEADERS 389

15.7.3 PERVASIVE PLAYERS 389

15.7.4 PARTICIPANTS 389

15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 391

15.7.5.1 Company footprint 391

15.7.5.2 Regional footprint 392

15.7.5.3 Material footprint 392

15.7.5.4 Type footprint 393

15.7.5.5 Product footprint 393

15.7.5.6 Application footprint 394

15.7.5.7 Sales channel footprint 394

15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 395

15.8.1 PROGRESSIVE COMPANIES 395

15.8.2 RESPONSIVE COMPANIES 395

15.8.3 DYNAMIC COMPANIES 395

15.8.4 STARTING BLOCKS 395

15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 397

15.8.5.1 Detailed list of key startups/SMEs 397

15.8.5.2 Competitive benchmarking of key startups/SMEs 398

15.9 COMPETITIVE SCENARIO 400

15.9.1 PRODUCT LAUNCHES 400

15.9.2 DEALS 402

15.9.3 EXPANSIONS 407

15.9.4 OTHER DEVELOPMENTS 408

16 COMPANY PROFILES 409

16.1 KEY PLAYERS 409

16.1.1 ILLINOIS TOOL WORKS INC. 409

16.1.1.1 Business overview 409

16.1.1.2 Products offered 410

16.1.1.3 Recent developments 411

16.1.1.3.1 Product launches 411

16.1.1.3.2 Deals 412

16.1.1.3.3 Other developments 412

16.1.1.4 MnM view 412

16.1.1.4.1 Right to win 412

16.1.1.4.2 Strategic choices 413

16.1.1.4.3 Weaknesses and competitive threats 413

16.1.2 STANLEY BLACK & DECKER, INC. 414

16.1.2.1 Business overview 414

16.1.2.2 Products offered 415

16.1.2.3 Recent developments 417

16.1.2.3.1 Deals 417

16.1.2.4 MnM view 417

16.1.2.4.1 Right to win 417

16.1.2.4.2 Strategic choices 418

16.1.2.4.3 Weaknesses and competitive threats 418

16.1.3 SFS GROUP AG 419

16.1.3.1 Business overview 419

16.1.3.2 Products offered 420

16.1.3.3 Recent developments 422

16.1.3.3.1 Product launches 422

16.1.3.3.2 Deals 422

16.1.3.3.3 Expansions 423

16.1.3.4 MnM view 424

16.1.3.4.1 Right to win 424

16.1.3.4.2 Strategic choices 424

16.1.3.4.3 Weaknesses and competitive threats 424

16.1.4 LISI GROUP 425

16.1.4.1 Business overview 425

16.1.4.2 Products offered 426

16.1.4.3 Recent developments 428

16.1.4.3.1 Deals 428

16.1.4.4 MnM view 429

16.1.4.4.1 Right to win 429

16.1.4.4.2 Strategic choices 429

16.1.4.4.3 Weaknesses and competitive threats 429

16.1.5 BULTEN AB 430

16.1.5.1 Business overview 430

16.1.5.2 Products offered 431

16.1.5.3 Recent developments 432

16.1.5.3.1 Deals 432

16.1.5.3.2 Expansions 433

16.1.5.3.3 Other developments 433

16.1.5.4 MnM view 434

16.1.5.4.1 Right to win 434

16.1.5.4.2 Strategic choices 434

16.1.5.4.3 Weaknesses and competitive threats 434

16.1.6 KOELNER RAWLPLUG IP 435

16.1.6.1 Business overview 435

16.1.6.2 Products offered 436

16.1.6.3 Recent developments 437

16.1.6.3.1 Deals 437

16.1.6.3.2 Product launches 437

16.1.6.3.3 Expansions 438

16.1.6.4 MnM view 438

16.1.6.4.1 Right to win 438

16.1.6.4.2 Strategic choices 438

16.1.6.4.3 Weaknesses and competitive threats 438

16.1.7 FONTANA GRUPPO 439

16.1.7.1 Business overview 439

16.1.7.2 Products offered 439

16.1.7.3 Recent developments 440

16.1.7.3.1 Deals 440

16.1.7.4 MnM view 441

16.1.8 BIRMINGHAM FASTENER AND SUPPLY INC. 442

16.1.8.1 Business overview 442

16.1.8.2 Products offered 442

16.1.8.2.1 Deals 443

16.1.8.2.2 Expansions 444

16.1.8.3 MnM view 444

16.1.9 MW INDUSTRIES (MWI) 445

16.1.9.1 Business overview 445

16.1.9.2 Products offered 445

16.1.9.3 Recent developments 446

16.1.9.3.1 Deals 446

16.1.9.4 MnM view 447

16.1.10 HILTI GROUP 448

16.1.10.1 Business overview 448

16.1.10.2 Products offered 448

16.1.10.3 MnM view 449

16.2 OTHER PLAYERS 450

16.2.1 MACLEAN-FOGG COMPONENT SOLUTIONS (MFCS) 450

16.2.2 MISUMI GROUP INC. 451

16.2.3 PRECISION CASTPARTS CORP. 452

16.2.4 VESCOVINI GROUP 453

16.2.5 DEEPAK FASTENERS LIMITED 454

16.2.6 BÖLLHOFF GROUP 455

16.2.7 AGRATI GROUP 456

16.2.8 KONINKLIJKE NEDSCHROEF 457

16.2.9 NIFCO INC. 458

16.2.10 PEINER UMFORMTECHNIK GMBH 459

16.2.11 PÜHL GMBH & CO. KG 460

16.2.12 GROWERMETAL S.P.A. 461

16.2.13 SESCO INDUSTRIES 462

16.2.14 BRUGOLA OEB INDUSTRIALE S.P.A. 463

16.2.15 SHANGHAI AUTOCRAFT CO., LTD. 464

17 RESEARCH METHODOLOGY 465

17.1 RESEARCH DATA 465

17.2 SECONDARY DATA 466

17.2.1 LIST OF KEY SECONDARY SOURCES 466

17.2.2 KEY DATA FROM SECONDARY SOURCES 467

17.3 PRIMARY DATA 467

17.3.1 LIST OF PRIMARY INTERVIEW PARTICIPANTS 467

17.3.2 KEY DATA FROM PRIMARY SOURCES 468

17.3.3 KEY INDUSTRY INSIGHTS 468

17.3.4 BREAKDOWN OF INTERVIEWS WITH EXPERTS 469

17.4 MARKET SIZE ESTIMATION 469

17.5 GROWTH FORECAST 471

17.6 DATA TRIANGULATION 471

17.7 RESEARCH ASSUMPTIONS 472

17.8 RISK ASSESSMENT 473

17.9 FACTOR ANALYSIS 473

17.10 RESEARCH LIMITATIONS 474

18 APPENDIX 475

18.1 DISCUSSION GUIDE 475

18.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 479

18.3 CUSTOMIZATION OPTIONS 481

18.4 RELATED REPORTS 481

18.5 AUTHOR DETAILS 482

LIST OF TABLES

TABLE 1 INTERCONNECTED MARKETS AND APPLICATIONS 69

TABLE 2 PORTER’S FIVE FORCES ANALYSIS 73

TABLE 3 WORLD REAL GDP (ANNUAL PERCENTAGE CHANGE) OF DIFFERENT REGIONS, 2024–2026 76

TABLE 4 WORLD REAL GDP (ANNUAL PERCENTAGE CHANGE) OF TOP

COUNTRIES, 2024–2026 77

TABLE 5 ROLES OF COMPANIES IN INDUSTRIAL FASTENERS ECOSYSTEM 80

TABLE 6 AVERAGE SELLING PRICE TREND OF INDUSTRIAL FASTENERS OFFERED

BY KEY PLAYERS, BY APPLICATION, 2024 (USD/KG) 82

TABLE 7 AVERAGE SELLING PRICE TREND OF INDUSTRIAL FASTENERS,

BY REGION, 2021–2025 (USD/KG) 83

TABLE 8 EXPORT DATA FOR HS CODE 7318, BY COUNTRY, 2020–2024 (USD MILLION) 84

TABLE 9 IMPORT DATA FOR HS CODE 7318, BY COUNTRY, 2020–2024 (USD MILLION) 85

TABLE 10 INDUSTRIAL FASTENERS: KEY CONFERENCES AND EVENTS, 2025–2026 86

TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS 93

TABLE 12 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS 94

TABLE 13 UNMET NEEDS IN INDUSTRIAL FASTENERS MARKET BY APPLICATION 96

TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT

AGENCIES, AND OTHER ORGANIZATIONS 99

TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 100

TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 101

TABLE 17 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT

AGENCIES, AND OTHER ORGANIZATIONS 102

TABLE 18 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT

AGENCIES, AND OTHER ORGANIZATIONS 103

TABLE 19 GLOBAL INDUSTRY STANDARDS IN INDUSTRIAL FASTENERS MARKET 103

TABLE 20 CERTIFICATIONS, LABELING, ECO-STANDARDS IN INDUSTRIAL

FASTENERS MARKET 106

TABLE 21 INDUSTRIAL FASTENERS MARKET: TOTAL NUMBER OF PATENTS,

JANUARY 2016–DECEMBER 2025 110

TABLE 22 KEY PATENTS, 2025 113

TABLE 23 TOP USE CASES AND MARKET POTENTIAL 116

TABLE 24 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES 117

TABLE 25 INDUSTRIAL FASTENERS MARKET: CASE STUDIES RELATED TO

GEN AI IMPLEMENTATION 118

TABLE 26 INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (USD MILLION) 121

TABLE 27 INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (USD MILLION) 122

TABLE 28 INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (KILOTON) 122

TABLE 29 INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (KILOTON) 122

TABLE 30 INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (USD MILLION) 126

TABLE 31 INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (USD MILLION) 127

TABLE 32 INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 127

TABLE 33 INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 127

TABLE 34 TYPES OF RIVETS WITH THEIR APPLICATION 131

TABLE 35 INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 134

TABLE 36 INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 135

TABLE 37 INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2021–2023 (USD MILLION) 140

TABLE 38 INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2024–2032 (USD MILLION) 140

TABLE 39 INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2021–2023 (KILOTON) 141

TABLE 40 INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2024–2032 (KILOTON) 141

TABLE 41 AUTOMOTIVE: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 143

TABLE 42 AUTOMOTIVE: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 143

TABLE 43 BUILDING & CONSTRUCTION: INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 143

TABLE 44 BUILDING & CONSTRUCTION: INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 144

TABLE 45 DATA CENTERS: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 145

TABLE 46 DATA CENTERS: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 146

TABLE 47 OTHERS: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 147

TABLE 48 OTHERS: INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 147

TABLE 49 GENERAL INDUSTRIAL: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 148

TABLE 50 GENERAL INDUSTRIAL: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 148

TABLE 51 HEAVY EQUIPMENT: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 149

TABLE 52 HEAVY EQUIPMENT: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 150

TABLE 53 ELECTRONICS: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 151

TABLE 54 ELECTRONICS: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 152

TABLE 55 NEW ENERGY: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 153

TABLE 56 NEW ENERGY: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 153

TABLE 57 SOLAR: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 154

TABLE 58 SOLAR: INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 155

TABLE 59 OTHER APPLICATIONS: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 155

TABLE 60 OTHER APPLICATIONS: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 156

TABLE 61 INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL,

2021–2023 (USD MILLION) 158

TABLE 62 INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL,

2024–2032 (USD MILLION) 158

TABLE 63 INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL, 2021–2023 (KILOTON) 159

TABLE 64 INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL, 2024–2032 (KILOTON) 159

TABLE 65 INDUSTRIAL FASTENERS MARKET, BY REGION, 2021–2023 (USD MILLION) 163

TABLE 66 INDUSTRIAL FASTENERS MARKET, BY REGION, 2024–2032 (USD MILLION) 163

TABLE 67 INDUSTRIAL FASTENERS MARKET, BY REGION, 2021–2023 (KILOTON) 163

TABLE 68 INDUSTRIAL FASTENERS MARKET, BY REGION, 2024–2032 (KILOTON) 164

TABLE 69 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY COUNTRY,

2021–2023 (USD MILLION) 165

TABLE 70 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY COUNTRY,

2024–2032 (USD MILLION) 166

TABLE 71 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY COUNTRY,

2021–2023 (KILOTON) 166

TABLE 72 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY COUNTRY,

2024–2032 (KILOTON) 166

TABLE 73 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (USD MILLION) 167

TABLE 74 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (USD MILLION) 167

TABLE 75 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (KILOTON) 167

TABLE 76 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (KILOTON) 168

TABLE 77 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 168

TABLE 78 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 168

TABLE 79 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (KILOTON) 169

TABLE 80 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (KILOTON) 169

TABLE 81 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 169

TABLE 82 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 170

TABLE 83 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 170

TABLE 84 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 171

TABLE 85 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL,

2021–2023 (USD MILLION) 171

TABLE 86 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL,

2024–2032 (USD MILLION) 171

TABLE 87 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL,

2021–2023 (KILOTON) 172

TABLE 88 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL,

2024–2032 (KILOTON) 172

TABLE 89 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 172

TABLE 90 NORTH AMERICA: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 172

TABLE 91 NORTH AMERICA: AUTOMOTIVE INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 173

TABLE 92 NORTH AMERICA: AUTOMOTIVE INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 173

TABLE 93 NORTH AMERICA: BUILDING & CONSTRUCTION INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 173

TABLE 94 NORTH AMERICA: BUILDING & CONSTRUCTION INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 174

TABLE 95 NORTH AMERICA: DATA CENTERS INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 174

TABLE 96 NORTH AMERICA: DATA CENTERS INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 174

TABLE 97 NORTH AMERICA: OTHERS INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 175

TABLE 98 NORTH AMERICA: OTHERS INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 175

TABLE 99 NORTH AMERICA: GENERAL INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 175

TABLE 100 NORTH AMERICA: GENERAL INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 176

TABLE 101 NORTH AMERICA: HEAVY EQUIPMENT INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (USD MILLION) 176

TABLE 102 NORTH AMERICA: HEAVY EQUIPMENT INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (KILOTON) 176

TABLE 103 NORTH AMERICA: ELECTRONICS INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 177

TABLE 104 NORTH AMERICA: ELECTRONICS INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 177

TABLE 105 NORTH AMERICA: NEW ENERGY INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 177

TABLE 106 NORTH AMERICA: NEW ENERGY INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 178

TABLE 107 NORTH AMERICA: SOLAR INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 178

TABLE 108 NORTH AMERICA: SOLAR INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 178

TABLE 109 NORTH AMERICA: OTHER APPLICATIONS INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (USD MILLION) 179

TABLE 110 NORTH AMERICA: OTHER APPLICATIONS INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (KILOTON) 179

TABLE 111 US: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (USD MILLION) 180

TABLE 112 US: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (USD MILLION) 180

TABLE 113 US: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 181

TABLE 114 US: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 181

TABLE 115 US: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (USD MILLION) 181

TABLE 116 US: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (USD MILLION) 182

TABLE 117 US: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (KILOTON) 182

TABLE 118 US: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (KILOTON) 182

TABLE 119 US: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 182

TABLE 120 US: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 183

TABLE 121 US: INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2021–2023 (KILOTON) 183

TABLE 122 US: INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2024–2032 (KILOTON) 184

TABLE 123 CANADA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (USD MILLION) 185

TABLE 124 CANADA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (USD MILLION) 185

TABLE 125 CANADA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 186

TABLE 126 CANADA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 186

TABLE 127 CANADA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 186

TABLE 128 CANADA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 187

TABLE 129 CANADA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (KILOTON) 187

TABLE 130 CANADA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (KILOTON) 187

TABLE 131 CANADA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 188

TABLE 132 CANADA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 188

TABLE 133 CANADA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 189

TABLE 134 CANADA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 189

TABLE 135 MEXICO: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (USD MILLION) 190

TABLE 136 MEXICO: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (USD MILLION) 191

TABLE 137 MEXICO: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 191

TABLE 138 MEXICO: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 191

TABLE 139 MEXICO: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 192

TABLE 140 MEXICO: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 192

TABLE 141 MEXICO: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (KILOTON) 192

TABLE 142 MEXICO: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (KILOTON) 192

TABLE 143 MEXICO: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 193

TABLE 144 MEXICO: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 193

TABLE 145 MEXICO: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 194

TABLE 146 MEXICO: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 194

TABLE 147 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY COUNTRY,

2021–2023 (USD MILLION) 196

TABLE 148 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY COUNTRY,

2024–2032 (USD MILLION) 196

TABLE 149 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY COUNTRY,

2021–2023 (KILOTON) 197

TABLE 150 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY COUNTRY,

2024–2032 (KILOTON) 197

TABLE 151 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (USD MILLION) 197

TABLE 152 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (USD MILLION) 198

TABLE 153 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 198

TABLE 154 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 198

TABLE 155 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 199

TABLE 156 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 199

TABLE 157 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (KILOTON) 199

TABLE 158 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (KILOTON) 199

TABLE 159 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 200

TABLE 160 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 200

TABLE 161 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 201

TABLE 162 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 201

TABLE 163 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL,

2021–2023 (USD MILLION) 201

TABLE 164 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL,

2024–2032 (USD MILLION) 202

TABLE 165 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL,

2021–2023 (KILOTON) 202

TABLE 166 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL,

2024–2032 (KILOTON) 202

TABLE 167 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 202

TABLE 168 ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 203

TABLE 169 ASIA PACIFIC: AUTOMOTIVE INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 203

TABLE 170 ASIA PACIFIC: AUTOMOTIVE INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 203

TABLE 171 ASIA PACIFIC: BUILDING & CONSTRUCTION INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (USD MILLION) 204

TABLE 172 ASIA PACIFIC: BUILDING & CONSTRUCTION INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (KILOTON) 204

TABLE 173 ASIA PACIFIC: DATA CENTERS INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 204

TABLE 174 ASIA PACIFIC: DATA CENTERS INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 205

TABLE 175 ASIA PACIFIC: OTHERS INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 205

TABLE 176 ASIA PACIFIC: OTHERS INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 205

TABLE 177 ASIA PACIFIC: GENERAL INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 206

TABLE 178 SIA PACIFIC: GENERAL INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 206

TABLE 179 ASIA PACIFIC: HEAVY EQUIPMENT INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 206

TABLE 180 ASIA PACIFIC: HEAVY EQUIPMENT INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 207

TABLE 181 ASIA PACIFIC: ELECTRONICS INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 207

TABLE 182 ASIA PACIFIC: ELECTRONICS INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 207

TABLE 183 ASIA PACIFIC: NEW ENERGY INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 208

TABLE 184 ASIA PACIFIC: NEW ENERGY INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 208

TABLE 185 ASIA PACIFIC: SOLAR INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 208

TABLE 186 ASIA PACIFIC: SOLAR INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 209

TABLE 187 ASIA PACIFIC: OTHER APPLICATIONS INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (USD MILLION) 209

TABLE 188 ASIA PACIFIC: OTHER APPLICATIONS INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (KILOTON) 209

TABLE 189 CHINA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (USD MILLION) 211

TABLE 190 CHINA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (USD MILLION) 211

TABLE 191 CHINA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 212

TABLE 192 CHINA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 212

TABLE 193 CHINA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 212

TABLE 194 CHINA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 213

TABLE 195 CHINA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (KILOTON) 213

TABLE 196 CHINA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (KILOTON) 213

TABLE 197 CHINA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 213

TABLE 198 CHINA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 214

TABLE 199 CHINA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 214

TABLE 200 CHINA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 215

TABLE 201 JAPAN: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (USD MILLION) 216

TABLE 202 JAPAN: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (USD MILLION) 216

TABLE 203 JAPAN: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 217

TABLE 204 JAPAN: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 217

TABLE 205 JAPAN: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 217

TABLE 206 JAPAN: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 218

TABLE 207 JAPAN: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (KILOTON) 218

TABLE 208 JAPAN: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (KILOTON) 218

TABLE 209 JAPAN: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 218

TABLE 210 JAPAN: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 219

TABLE 211 JAPAN: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 219

TABLE 212 JAPAN: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 219

TABLE 213 INDIA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (USD MILLION) 221

TABLE 214 INDIA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (USD MILLION) 221

TABLE 215 INDIA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 221

TABLE 216 INDIA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 222

TABLE 217 INDIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 222

TABLE 218 INDIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 222

TABLE 219 INDIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (KILOTON) 222

TABLE 220 INDIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (KILOTON) 223

TABLE 221 INDIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 223

TABLE 222 INDIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 223

TABLE 223 INDIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2021–2023 (KILOTON) 224

TABLE 224 INDIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2024–2032 (KILOTON) 224

TABLE 225 SOUTH KOREA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (USD MILLION) 225

TABLE 226 SOUTH KOREA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (USD MILLION) 225

TABLE 227 SOUTH KOREA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (KILOTON) 226

TABLE 228 SOUTH KOREA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (KILOTON) 226

TABLE 229 SOUTH KOREA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 226

TABLE 230 SOUTH KOREA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 227

TABLE 231 SOUTH KOREA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (KILOTON) 227

TABLE 232 SOUTH KOREA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (KILOTON) 227

TABLE 233 SOUTH KOREA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 228

TABLE 234 SOUTH KOREA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 228

TABLE 235 SOUTH KOREA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 229

TABLE 236 SOUTH KOREA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 229

TABLE 237 MALAYSIA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (USD MILLION) 230

TABLE 238 MALAYSIA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (USD MILLION) 230

TABLE 239 MALAYSIA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 231

TABLE 240 MALAYSIA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 231

TABLE 241 MALAYSIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 231

TABLE 242 MALAYSIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 232

TABLE 243 MALAYSIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (KILOTON) 232

TABLE 244 MALAYSIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (KILOTON) 232

TABLE 245 MALAYSIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 233

TABLE 246 MALAYSIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 233

TABLE 247 MALAYSIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 234

TABLE 248 MALAYSIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 234

TABLE 249 REST OF ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (USD MILLION) 235

TABLE 250 REST OF ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (USD MILLION) 235

TABLE 251 REST OF ASIA PACIFIC : INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (KILOTON) 236

TABLE 252 REST OF ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (KILOTON) 236

TABLE 253 REST OF ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 236

TABLE 254 REST OF ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 237

TABLE 255 REST OF ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (KILOTON) 237

TABLE 256 REST OF ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (KILOTON) 237

TABLE 257 REST OF ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 238

TABLE 258 REST OF ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 238

TABLE 259 REST OF ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 239

TABLE 260 REST OF ASIA PACIFIC: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 239

TABLE 261 EUROPE: INDUSTRIAL FASTENERS MARKET, BY COUNTRY,

2021–2023 (USD MILLION) 240

TABLE 262 EUROPE: INDUSTRIAL FASTENERS MARKET, BY COUNTRY,

2024–2032 (USD MILLION) 241

TABLE 263 EUROPE: INDUSTRIAL FASTENERS MARKET, BY COUNTRY, 2021–2023 (KILOTON) 241

TABLE 264 EUROPE: INDUSTRIAL FASTENERS MARKET, BY COUNTRY, 2024–2032 (KILOTON) 242

TABLE 265 EUROPE: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (USD MILLION) 242

TABLE 266 EUROPE: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (USD MILLION) 242

TABLE 267 EUROPE: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 243

TABLE 268 EUROPE: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 243

TABLE 269 EUROPE: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 243

TABLE 270 EUROPE: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 244

TABLE 271 EUROPE: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (KILOTON) 244

TABLE 272 EUROPE: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (KILOTON) 244

TABLE 273 EUROPE: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 245

TABLE 274 EUROPE: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 245

TABLE 275 EUROPE: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 246

TABLE 276 EUROPE: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 246

TABLE 277 EUROPE: INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL,

2021–2023 (USD MILLION) 246

TABLE 278 EUROPE: INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL,

2024–2032 (USD MILLION) 247

TABLE 279 EUROPE: INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL,

2021–2023 (KILOTON) 247

TABLE 280 EUROPE: INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL,

2024–2032 (KILOTON) 247

TABLE 281 EUROPE: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 247

TABLE 282 EUROPE: INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 248

TABLE 283 EUROPE: AUTOMOTIVE INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 248

TABLE 284 EUROPE: AUTOMOTIVE INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 248

TABLE 285 EUROPE: BUILDING & CONSTRUCTION INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (USD MILLION) 249

TABLE 286 EUROPE: BUILDING & CONSTRUCTION INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (KILOTON) 249

TABLE 287 EUROPE: DATA CENTERS INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 249

TABLE 288 EUROPE: DATA CENTERS INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 250

TABLE 289 EUROPE: OTHERS INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 250

TABLE 290 EUROPE: OTHERS INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 250

TABLE 291 EUROPE: GENERAL INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 251

TABLE 292 EUROPE: GENERAL INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 251

TABLE 293 EUROPE: HEAVY EQUIPMENT INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 251

TABLE 294 EUROPE: HEAVY EQUIPMENT INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 252

TABLE 295 EUROPE: ELECTRONICS INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 252

TABLE 296 EUROPE: ELECTRONICS INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 252

TABLE 297 EUROPE: NEW ENERGY INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 253

TABLE 298 EUROPE: NEW ENERGY INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 253

TABLE 299 EUROPE: SOLAR INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 253

TABLE 300 EUROPE: SOLAR INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 254

TABLE 301 EUROPE: OTHER APPLICATIONS INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 254

TABLE 302 EUROPE: OTHER APPLICATIONS INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 254

TABLE 303 GERMANY: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (USD MILLION) 256

TABLE 304 GERMANY: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (USD MILLION) 256

TABLE 305 GERMANY: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 256

TABLE 306 GERMANY: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 257

TABLE 307 GERMANY: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 257

TABLE 308 GERMANY: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 257

TABLE 309 GERMANY: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (KILOTON) 257

TABLE 310 GERMANY: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (KILOTON) 258

TABLE 311 GERMANY: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 258

TABLE 312 GERMANY: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 258

TABLE 313 GERMANY: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 259

TABLE 314 GERMANY: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 259

TABLE 315 FRANCE: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (USD MILLION) 260

TABLE 316 FRANCE: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (USD MILLION) 261

TABLE 317 FRANCE: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 261

TABLE 318 FRANCE: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 261

TABLE 319 FRANCE: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 262

TABLE 320 FRANCE: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 262

TABLE 321 FRANCE: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (KILOTON) 262

TABLE 322 FRANCE: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (KILOTON) 262

TABLE 323 FRANCE: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 263

TABLE 324 FRANCE: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 263

TABLE 325 FRANCE: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 264

TABLE 326 FRANCE: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 264

TABLE 327 ITALY: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (USD MILLION) 265

TABLE 328 ITALY: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (USD MILLION) 266

TABLE 329 ITALY: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 266

TABLE 330 ITALY: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 266

TABLE 331 ITALY: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 267

TABLE 332 ITALY: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 267

TABLE 333 ITALY: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (KILOTON) 267

TABLE 334 ITALY: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (KILOTON) 267

TABLE 335 ITALY: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 268

TABLE 336 ITALY: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 268

TABLE 337 ITALY: INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2021–2023 (KILOTON) 269

TABLE 338 ITALY: INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2024–2032 (KILOTON) 269

TABLE 339 UK: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (USD MILLION) 271

TABLE 340 UK: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (USD MILLION) 271

TABLE 341 UK: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 271

TABLE 342 UK: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 272

TABLE 343 UK: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (USD MILLION) 272

TABLE 344 UK: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (USD MILLION) 272

TABLE 345 UK: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (KILOTON) 272

TABLE 346 UK: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (KILOTON) 273

TABLE 347 UK: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 273

TABLE 348 UK: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 273

TABLE 349 UK: INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2021–2023 (KILOTON) 274

TABLE 350 UK: INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2024–2032 (KILOTON) 274

TABLE 351 SPAIN: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (USD MILLION) 275

TABLE 352 SPAIN: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (USD MILLION) 275

TABLE 353 SPAIN: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 276

TABLE 354 SPAIN: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 276

TABLE 355 SPAIN: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 276

TABLE 356 SPAIN: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 277

TABLE 357 SPAIN: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (KILOTON) 277

TABLE 358 SPAIN: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (KILOTON) 277

TABLE 359 SPAIN: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 277

TABLE 360 SPAIN: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 278

TABLE 361 SPAIN: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 278

TABLE 362 SPAIN: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 279

TABLE 363 ROMANIA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (USD MILLION) 280

TABLE 364 ROMANIA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (USD MILLION) 280

TABLE 365 ROMANIA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 280

TABLE 366 ROMANIA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 281

TABLE 367 ROMANIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 281

TABLE 368 ROMANIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 281

TABLE 369 ROMANIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (KILOTON) 281

TABLE 370 ROMANIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (KILOTON) 282

TABLE 371 ROMANIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 282

TABLE 372 ROMANIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 282

TABLE 373 ROMANIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 283

TABLE 374 ROMANIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 283

TABLE 375 SLOVAKIA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (USD MILLION) 284

TABLE 376 SLOVAKIA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (USD MILLION) 284

TABLE 377 SLOVAKIA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 285

TABLE 378 SLOVAKIA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 285

TABLE 379 SLOVAKIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 285

TABLE 380 SLOVAKIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 286

TABLE 381 SLOVAKIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (KILOTON) 286

TABLE 382 SLOVAKIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (KILOTON) 286

TABLE 383 SLOVAKIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 287

TABLE 384 SLOVAKIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 287

TABLE 385 SLOVAKIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 288

TABLE 386 SLOVAKIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 288

TABLE 387 POLAND: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (USD MILLION) 289

TABLE 388 POLAND: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (USD MILLION) 289

TABLE 389 POLAND: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 290

TABLE 390 POLAND: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 290

TABLE 391 POLAND: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 290

TABLE 392 POLAND: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 291

TABLE 393 POLAND: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (KILOTON) 291

TABLE 394 POLAND: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (KILOTON) 291

TABLE 395 POLAND: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 292

TABLE 396 POLAND: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 292

TABLE 397 POLAND: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 293

TABLE 398 POLAND: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 293

TABLE 399 CZECH REPUBLIC: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (USD MILLION) 294

TABLE 400 CZECH REPUBLIC: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (USD MILLION) 294

TABLE 401 CZECH REPUBLIC: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (KILOTON) 295

TABLE 402 CZECH REPUBLIC: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (KILOTON) 295

TABLE 403 CZECH REPUBLIC: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 295

TABLE 404 CZECH REPUBLIC: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 296

TABLE 405 CZECH REPUBLIC: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (KILOTON) 296

TABLE 406 CZECH REPUBLIC: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (KILOTON) 296

TABLE 407 CZECH REPUBLIC: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 297

TABLE 408 CZECH REPUBLIC: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 297

TABLE 409 CZECH REPUBLIC: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 298

TABLE 410 CZECH REPUBLIC: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 298

TABLE 411 REST OF EUROPE: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (USD MILLION) 299

TABLE 412 REST OF EUROPE: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (USD MILLION) 299

TABLE 413 REST OF EUROPE: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (KILOTON) 299

TABLE 414 REST OF EUROPE: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (KILOTON) 300

TABLE 415 REST OF EUROPE: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 300

TABLE 416 REST OF EUROPE: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 300

TABLE 417 REST OF EUROPE: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (KILOTON) 301

TABLE 418 REST OF EUROPE: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (KILOTON) 301

TABLE 419 REST OF EUROPE: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 301

TABLE 420 REST OF EUROPE: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 302

TABLE 421 REST OF EUROPE: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 302

TABLE 422 REST OF EUROPE: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 303

TABLE 423 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY COUNTRY,

2021–2023 (USD MILLION) 304

TABLE 424 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY COUNTRY,

2024–2032 (USD MILLION) 304

TABLE 425 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY COUNTRY,

2021–2023 (KILOTON) 305

TABLE 426 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY COUNTRY,

2024–2032 (KILOTON) 305

TABLE 427 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (USD MILLION) 305

TABLE 428 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (USD MILLION) 306

TABLE 429 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (KILOTON) 306

TABLE 430 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (KILOTON) 306

TABLE 431 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 307

TABLE 432 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 307

TABLE 433 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (KILOTON) 307

TABLE 434 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (KILOTON) 307

TABLE 435 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2021–2023 (USD MILLION) 308

TABLE 436 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2024–2032 (USD MILLION) 308

TABLE 437 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2021–2023 (KILOTON) 309

TABLE 438 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2024–2032 (KILOTON) 309

TABLE 439 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL, 2021–2023 (USD MILLION) 309

TABLE 440 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL, 2024–2032 (USD MILLION) 310

TABLE 441 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL, 2021–2023 (KILOTON) 310

TABLE 442 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY SALES CHANNEL, 2024–2032 (KILOTON) 310

TABLE 443 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (USD MILLION) 310

TABLE 444 MIDDLE EAST & AFRICA: INDUSTRIAL FASTENERS MARKET, BY PRODUCT,

2024–2032 (KILOTON) 311

TABLE 445 MIDDLE EAST & AFRICA: AUTOMOTIVE INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (USD MILLION) 311

TABLE 446 MIDDLE EAST & AFRICA: AUTOMOTIVE INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (KILOTON) 311

TABLE 447 MIDDLE EAST & AFRICA: BUILDING & CONSTRUCTION INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 312

TABLE 448 MIDDLE EAST & AFRICA: BUILDING & CONSTRUCTION INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 312

TABLE 449 MIDDLE EAST & AFRICA: DATA CENTERS INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (USD MILLION) 312

TABLE 450 MIDDLE EAST & AFRICA: DATA CENTERS INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (KILOTON) 313

TABLE 451 MIDDLE EAST & AFRICA: OTHERS INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 313

TABLE 452 MIDDLE EAST & AFRICA: OTHERS INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 313

TABLE 453 MIDDLE EAST & AFRICA: GENERAL INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (USD MILLION) 314

TABLE 454 MIDDLE EAST & AFRICA: GENERAL INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (KILOTON) 314

TABLE 455 MIDDLE EAST & AFRICA: HEAVY EQUIPMENT INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (USD MILLION) 314

TABLE 456 MIDDLE EAST & AFRICA: HEAVY EQUIPMENT INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (KILOTON) 315

TABLE 457 MIDDLE EAST & AFRICA: ELECTRONICS INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (USD MILLION) 315

TABLE 458 MIDDLE EAST & AFRICA: ELECTRONICS INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (KILOTON) 315

TABLE 459 MIDDLE EAST & AFRICA: NEW ENERGY INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (USD MILLION) 316

TABLE 460 MIDDLE EAST & AFRICA: NEW ENERGY INDUSTRIAL FASTENERS MARKET,

BY PRODUCT, 2024–2032 (KILOTON) 316

TABLE 461 MIDDLE EAST & AFRICA: SOLAR INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 316

TABLE 462 MIDDLE EAST & AFRICA: SOLAR INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 317

TABLE 463 MIDDLE EAST & AFRICA: OTHER APPLICATIONS INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (USD MILLION) 317

TABLE 464 MIDDLE EAST & AFRICA: OTHER APPLICATIONS INDUSTRIAL FASTENERS MARKET, BY PRODUCT, 2024–2032 (KILOTON) 317

TABLE 465 GCC COUNTRIES: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (USD MILLION) 318

TABLE 466 GCC COUNTRIES: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (USD MILLION) 318

TABLE 467 GCC COUNTRIES: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (KILOTON) 319

TABLE 468 GCC COUNTRIES: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (KILOTON) 319

TABLE 469 GCC COUNTRIES: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 319

TABLE 470 GCC COUNTRIES: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 320

TABLE 471 GCC COUNTRIES: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (KILOTON) 320

TABLE 472 GCC COUNTRIES: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (KILOTON) 320

TABLE 473 GCC COUNTRIES: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 321

TABLE 474 GCC COUNTRIES: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 321

TABLE 475 GCC COUNTRIES: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 322

TABLE 476 GCC COUNTRIES: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 322

TABLE 477 SAUDI ARABIA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2021–2023 (USD MILLION) 323

TABLE 478 SAUDI ARABIA: INDUSTRIAL FASTENERS MARKET, BY TYPE,

2024–2032 (USD MILLION) 323

TABLE 479 SAUDI ARABIA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 324

TABLE 480 SAUDI ARABIA: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 324

TABLE 481 SAUDI ARABIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 324

TABLE 482 SAUDI ARABIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (USD MILLION) 325

TABLE 483 SAUDI ARABIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2021–2023 (KILOTON) 325

TABLE 484 SAUDI ARABIA: INDUSTRIAL FASTENERS MARKET, BY MATERIAL,

2024–2032 (KILOTON) 325

TABLE 485 SAUDI ARABIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 326

TABLE 486 SAUDI ARABIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 326

TABLE 487 SAUDI ARABIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (KILOTON) 327

TABLE 488 SAUDI ARABIA: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (KILOTON) 327

TABLE 489 UAE: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (USD MILLION) 328

TABLE 490 UAE: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (USD MILLION) 328

TABLE 491 UAE: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2021–2023 (KILOTON) 329

TABLE 492 UAE: INDUSTRIAL FASTENERS MARKET, BY TYPE, 2024–2032 (KILOTON) 329

TABLE 493 UAE: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (USD MILLION) 329

TABLE 494 UAE: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (USD MILLION) 330

TABLE 495 UAE: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2021–2023 (KILOTON) 330

TABLE 496 UAE: INDUSTRIAL FASTENERS MARKET, BY MATERIAL, 2024–2032 (KILOTON) 330

TABLE 497 UAE: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 331

TABLE 498 UAE: INDUSTRIAL FASTENERS MARKET, BY APPLICATION,

2024–2032 (USD MILLION) 331

TABLE 499 UAE: INDUSTRIAL FASTENERS MARKET, BY APPLICATION, 2021–2023 (KILOTON) 332