Aluminium Extrusion Market - Global Forecast To 2030

Aluminum Extrusion Market by Product (Solid Profiles, Semi-Hollow Profiles, and Hollow Profiles), Alloy Grade (6xxx, 1xxx, 5xxx, Other grades), Surface Finish, End-use Industry (Construction & Infrastructure, Automotive & Mass Transport, Electrical & Electronics, Machinery & Equipment, and Other End-use Industries), and Region - Global Forecast to 2030

アルミニウム押出成形市場 - 製品(ソリッドプロファイル、セミホロープロファイル、ホロープロファイル)、合金グレード(6xxx、1xxx、5xxx、その他のグレード)、表面仕上げ、最終用途産業(建設・インフラ、自動車・大量輸送、電気・電子機器、機械・設備、その他の最終用途産業)、および地域別 - 2030年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年02月 |

| ページ数 | 255 |

| 図表数 | 275 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-13366 |

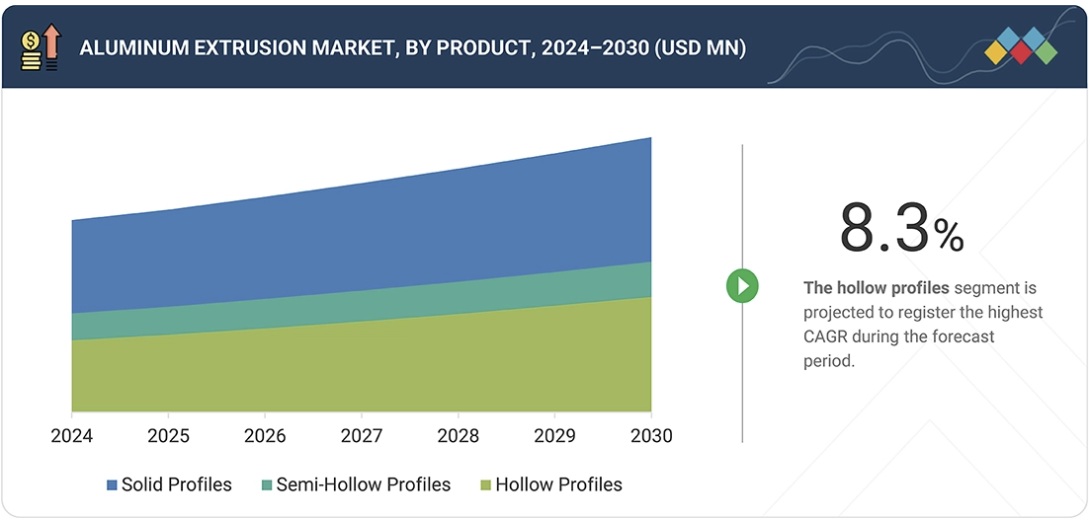

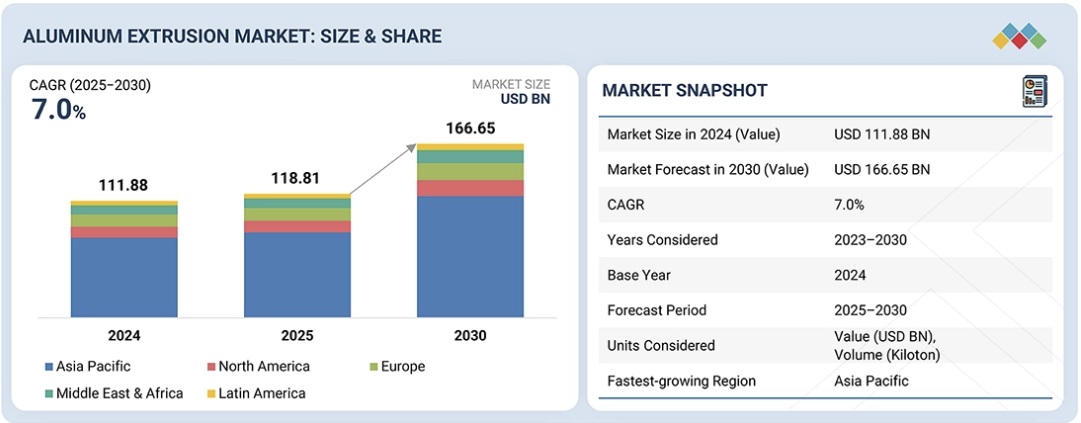

アルミニウム押出成形市場は、2024年には1,118億8,000万米ドルに達すると推定され、2025年から2030年にかけて年平均成長率(CAGR)7.0%で成長し、2030年には1,666億5,000万米ドルに達すると予測されています。ソリッドプロファイルは、製造の簡便性と構造的な堅牢性から、アルミニウム押出成形市場全体を席巻しています。ソリッドプロファイルには、ロッド、バー、フラットバー、アングル(L型)、チャンネル(U型またはC型)、ビームなどの形状があり、内部に開口部がなく、高い材料密度で強度を確保しています。これらの形状は、シンプルなソリッドダイを用いて押し出されるため、半中空プロファイルや中空プロファイルなどの複雑なプロファイルよりも生産が迅速でコスト効率に優れています。

調査範囲

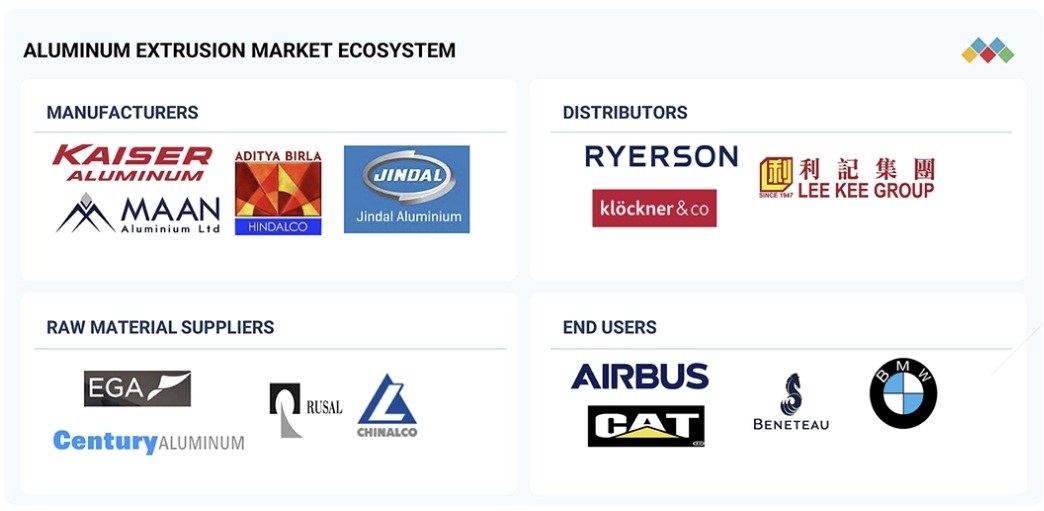

本調査レポートは、アルミニウム押出成形市場を、製品(ソリッドプロファイル、セミホロープロファイル、ホロープロファイル)、合金グレード(6xxx、1xxx、5xxx、その他グレード)、表面仕上げ(ミル仕上げ、陽極酸化処理、粉体塗装)、最終用途産業(建設・インフラ、自動車・大量輸送、電気・電子、機械・設備)、地域(北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ)別に分類しています。本レポートでは、アルミニウム押出成形市場の成長に影響を与える主要要因(成長促進要因、阻害要因、課題、機会など)に関する詳細な情報を提供しています。主要業界プレーヤーを徹底的に調査し、それぞれの事業概要、ソリューション、サービス、主要戦略、契約、パートナーシップ、合意に関する洞察を提供しています。新製品・新サービスの発売、合併・買収、アルミニウム押出成形市場の最新動向などについても網羅しています。本レポートには、アルミニウム押出成形市場のエコシステムにおいて今後参入が期待される新興企業の競合分析も含まれています。

このレポートを購入する理由:

本レポートは、アルミニウム押出成形市場全体および各サブセグメントの収益数値の近似値に関する情報を提供し、市場のリーダー企業および新規参入企業にとって役立ちます。また、本レポートは、ステークホルダーが競争環境を理解し、事業のポジショニングを改善し、適切な市場開拓戦略を策定するための洞察を深めるのに役立ちます。さらに、本レポートは、ステークホルダーが市場の動向を把握し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供するのにも役立ちます。

本レポートは、以下の点について洞察を提供します。

- アルミニウム押出成形市場の成長に影響を与える主要な推進要因(自動車セクターからの需要増加、異業種間の採用)、制約要因(資本集約度、高いエネルギー消費)、機会(高度な製造技術、プレミアム合金やサービスに対する満たされていないニーズ)、課題(原材料価格の変動、エネルギー消費と持続可能性)の分析。

- 製品開発/イノベーション:アルミニウム押出成形市場における今後の技術、研究開発活動、新製品・新サービスの発売に関する詳細な洞察。

- 市場開発:収益性の高い市場に関する包括的な情報 – 本レポートは、様々な地域におけるアルミニウム押出成形市場を分析しています。

- 市場の多様化:アルミニウム押出市場における新製品・サービス、未開拓地域、最近の動向、投資に関する包括的な情報

- 競合評価:アルミニウム押出市場における主要企業(Jindal Aluminum Limited(インド)、Hindalco Industries Ltd.(インド)、Alcoa Corporation(米国)、Aluminum Corporation of China Limited(中国)、RUSAL(ロシア)、Century Aluminum Company(米国)、Norsk Hydro ASA(ノルウェー)、Constellium(フランス)、Kaiser Aluminum(米国)、Hammerer Aluminum Industries(オーストリア)、Banco Aluminium Private Limited(インド)、Maan Aluminium Limited(インド)、Shenzhen Oriental Turdo Ironwares Co., Ltd.(中国)、ETEM(ギリシャ)、Alom Group(インド)など)の市場シェア、成長戦略、サービス提供に関する詳細な評価。

Report Description

The aluminum extrusion market is estimated at USD 111.88 billion in 2024 and is projected to reach USD 166.65 billion by 2030, at a CAGR of 7.0% from 2025 to 2030. Solid profiles dominated the overall aluminum extrusion market owing to the simplicity in manufacturing and structural solidity. Solid profiles include shapes like rods, bars, flat bars, angles (L-profiles), channels (U or C shapes), and beams, offering high material density for strength without internal openings. They are extruded using straightforward solid dies, making production faster and more cost-effective than complex profiles like semi-hollow and hollow profiles.

Aluminium Extrusion Market – Global Forecast To 2030

‘‘By alloy grade, 6xxx alloy grade accounted for the largest share of the overall aluminum extrusion market in 2024.’’

6xxx series aluminum alloys dominate the aluminum extrusion market due to their optimal combination of extrudability, medium-to-high strength, corrosion resistance, and heat-treatable properties. These alloys, primarily alloyed with magnesium (Mg) and silicon (Si) to form magnesium silicide, enable complex shapes and thin-walled profiles essential for extrusions.

6xxx alloys offer excellent formability during extrusion, good weldability with 4xxx or 5xxx fillers, and superior surface finish for anodizing or painting. Common tempers like T5 or T6 enhance strength via precipitation hardening at 160-182°C. They balance tensile strength (18-58 ksi) with ductility, though sensitive to cracking if not managed.

‘‘The mill-finished segment is estimated to be the most preferred surface finish of aluminum extrusion during the forecast period.’’

The mill-finished segment is expected to dominate the market and register the highest CAGR during the forecast period. Lower production costs from skipping finishing processes make mill-finished extrusions attractive for high-volume manufacturing, especially amid rising raw material prices and inflation pressures. This segment benefits from shorter lead times, enabling quick supply to industrial users who apply custom finishes later.

‘‘The construction & infrastructure end-use industry dominated the aluminum extrusion market in 2024.’

The construction & infrastructure sector is projected to grow at the highest CAGR of 6.9% during the forecast period, in terms of value. The construction industry is also one of the major end users of aluminum extruded products. Aluminum is considered one of the most viable building materials due to the wide range of benefits it offers, such as light strength-to-weight ratio, sustainability, recyclability, and versatility. Aluminum is widely used in construction as it helps building projects qualify for green building status under the Leadership in Energy and Environmental Design (LEED) standards.

Aluminium Extrusion Market – Global Forecast To 2030 – region

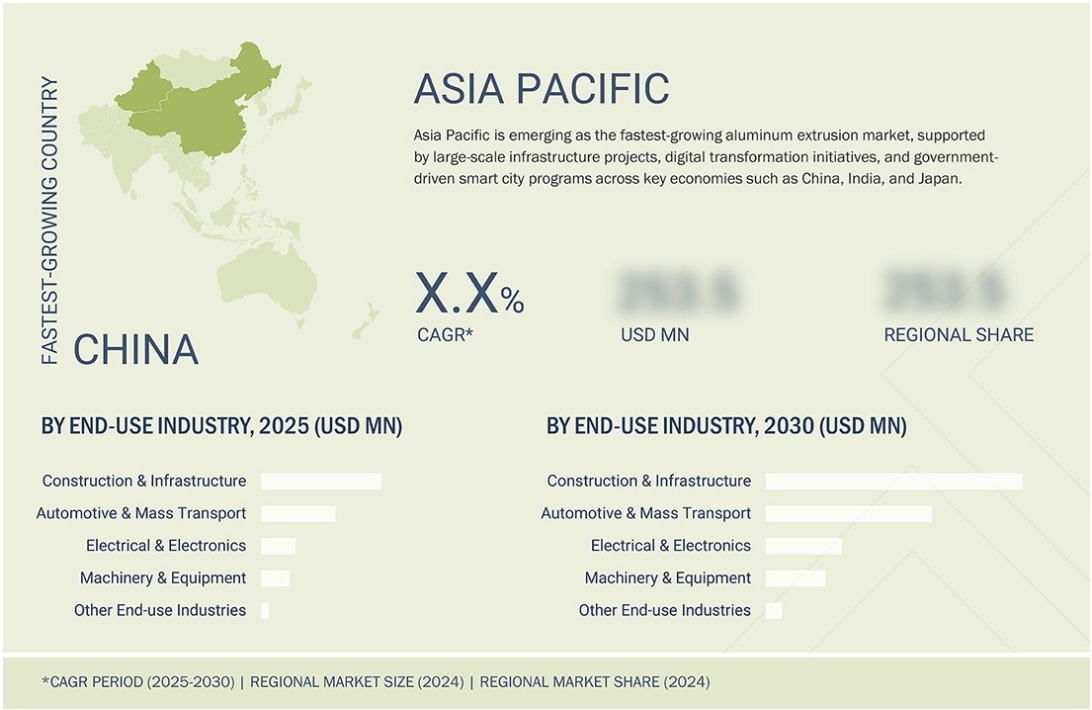

“Asia Pacific is estimated to account for the largest share in the overall aluminum extrusion market.”

Asia Pacific holds the dominant share in the global aluminum extrusion market. This leadership stems from rapid industrialization, urbanization, and surging demand across key sectors. Robust economic growth in countries like China, India, Japan, and South Korea fuels infrastructure projects and high-rise construction, which heavily rely on extruded aluminum for its lightweight strength and corrosion resistance.

The automotive industry in the region prioritizes lightweight materials for fuel-efficient vehicles amid strict emissions rules, with China as the world’s largest auto market. Electronics, machinery, and renewable energy sectors (like solar frames) further boost usage due to aluminum’s conductivity and versatility.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided based on the following three categories:

- By Company Type – Tier 1 – 60%, Tier 2 – 20%, and Tier 3 – 20%

- By Designation – C Level – 33%, Director Level – 33%, and Others – 34%

- By Region – North America – 20%, Europe – 25%, Asia Pacific – 25%, Middle East & Africa -20%, South America – 10%.

The report provides a comprehensive analysis of company profiles:

Prominent companies include Jindal Aluminum Limited (India), Hindalco Industries Ltd. (India), Alcoa Corporation (US), Aluminum Corporation of China Limited (China), RUSAL (Russia), Century Aluminum Company (US), Norsk Hydro ASA (Norway), Constellium (France), Kaiser Aluminum (US), Hammerer Aluminum Industries (Austria), Banco Aluminium Private Limited (India), Maan Aluminium Limited (India), Shenzhen Oriental Turdo Ironwares Co., Ltd. (China), ETEM (Greece), and Alom Group (India).

Aluminium Extrusion Market – Global Forecast To 2030 – ecosystem

Research Coverage

This research report categorizes the aluminum extrusion market by product (solid profiles, semi-hollow profiles, and hollow profiles), alloy grade (6xxx, 1xxx, 5xxx, and other grades), surface finish (mill-finished, anodized, and powder coated), end-use industry (construction & infrastructure, automotive & mass transport, electrical & electronics, and machinery & equipment), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The scope of the report includes detailed information about the major factors influencing the growth of the aluminum extrusion market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted to provide insights into their business overview, solutions, and services, key strategies, contracts, partnerships, and agreements. New product and service launches, mergers & acquisitions, and recent developments in the aluminum extrusion market are all covered. This report includes a competitive analysis of upcoming startups in the aluminum extrusion market ecosystem.

Reasons to buy this report:

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall aluminum extrusion market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising demand from automotive sector, Cross-industry adoption), restraints (Capital Intensity, High Energy Consumption), opportunities (Advanced manufacturing technologies, Unmet needs for premium alloys or services), and challenges (Raw material cost volatility, Energy consumption and sustainability) influencing the growth of the aluminum extrusion market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the aluminum extrusion market.

- Market Development: Comprehensive information about lucrative markets – the report analyses the aluminum extrusion market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the aluminum extrusion market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players, such as Jindal Aluminum Limited (India), Hindalco Industries Ltd. (India), Alcoa Corporation (US), Aluminum Corporation of China Limited (China), RUSAL (Russia), Century Aluminum Company (US), Norsk Hydro ASA (Norway), Constellium (France), Kaiser Aluminum (US), Hammerer Aluminum Industries (Austria), Banco Aluminium Private Limited (India), Maan Aluminium Limited (India), Shenzhen Oriental Turdo Ironwares Co., Ltd. (China), ETEM (Greece), and Alom Group (India) in the aluminum extrusion market.

Table of Contents

1 INTRODUCTION 26

1.1 STUDY OBJECTIVES 26

1.2 MARKET DEFINITION 26

1.3 STUDY SCOPE 27

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 27

1.3.2 INCLUSIONS AND EXCLUSIONS 28

1.3.3 YEARS CONSIDERED 28

1.3.4 CURRENCY CONSIDERED 29

1.3.5 UNIT CONSIDERED 29

1.4 STAKEHOLDERS 29

1.5 SUMMARY OF CHANGES 29

2 EXECUTIVE SUMMARY 30

2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS 30

2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS 31

2.3 DISRUPTIVE TRENDS SHAPING MARKET 32

2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS 33

2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST 34

3 PREMIUM INSIGHTS 35

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ALUMINUM EXTRUSION MARKET 35

3.2 ALUMINUM EXTRUSION MARKET, BY PRODUCT AND REGION 36

3.3 ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE 36

3.4 ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH 37

3.5 ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 37

3.6 ALUMINUM EXTRUSION MARKET, BY COUNTRY 38

4 MARKET OVERVIEW 39

4.1 INTRODUCTION 39

4.2 MARKET DYNAMICS 39

4.2.1 DRIVERS 40

4.2.1.1 Rising demand from automotive sector 40

4.2.1.2 Cross-industry adoption 40

4.2.2 RESTRAINTS 41

4.2.2.1 Capital intensity 41

4.2.2.2 High energy consumption 41

4.2.3 OPPORTUNITIES 42

4.2.3.1 Advanced manufacturing technologies 42

4.2.3.2 Unmet needs for premium alloys or services 42

4.2.4 CHALLENGES 43

4.2.4.1 Raw material cost volatility 43

4.2.4.2 Energy consumption and sustainability 43

4.3 UNMET NEEDS AND WHITE SPACES 44

4.3.1 UNMET NEEDS IN ALUMINUM EXTRUSION MARKET 44

4.3.2 WHITE SPACE OPPORTUNITIES 44

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 45

4.4.1 INTERCONNECTED MARKETS 45

4.4.2 CROSS-SECTOR OPPORTUNITIES 45

4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS 45

4.5.1 EMERGING BUSINESS MODELS 45

4.5.2 ECOSYSTEM SHIFTS 46

4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 46

4.6.1 KEY MOVES AND STRATEGIC FOCUS 46

5 INDUSTRY TRENDS 47

5.1 PORTER’S FIVE FORCES ANALYSIS 47

5.1.1 THREAT OF NEW ENTRANTS 48

5.1.2 THREAT OF SUBSTITUTES 48

5.1.3 BARGAINING POWER OF BUYERS 48

5.1.4 BARGAINING POWER OF SUPPLIERS 48

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 49

5.2 MACROECONOMIC INDICATORS 49

5.2.1 INTRODUCTION 49

5.2.2 GDP TRENDS AND FORECAST 49

5.2.3 TRENDS IN GLOBAL AUTOMOTIVE & MASS TRANSPORT INDUSTRY 51

5.2.4 TRENDS IN GLOBAL AEROSPACE & DEFENSE INDUSTRY 51

5.3 VALUE CHAIN ANALYSIS 52

5.4 ECOSYSTEM ANALYSIS 54

5.5 PRICING ANALYSIS 55

5.5.1 AVERAGE SELLING PRICE BY KEY PLAYERS 56

5.5.2 AVERAGE SELLING PRICE TREND, BY REGION 56

5.6 TRADE ANALYSIS 57

5.6.1 IMPORT SCENARIO (HS CODE 760421) 57

5.6.2 EXPORT SCENARIO (HS CODE 760421) 58

5.7 KEY CONFERENCES AND EVENTS, 2026 59

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 60

5.9 CASE STUDY ANALYSIS 60

5.9.1 HIGH-STRENGTH ALUMINUM ALLOYS IN ADVANCED AIRCRAFT PROGRAM 60

5.9.2 ALCOA ALLOY ADVANCEMENTS: A210 EXTRUSTRONG & C611 EZCAST 61

5.9.3 PROJECT M-LIGHTEN: CONSTELLIUM & GORDON MURRAY GROUP PARTNERSHIP 62

5.10 IMPACT OF 2025 US TARIFF ON ALUMINUM EXTRUSION MARKET 62

5.10.1 INTRODUCTION 62

5.10.2 KEY TARIFF RATES 63

5.10.3 PRICE IMPACT ANALYSIS 63

5.10.4 IMPACT ON COUNTRIES/REGIONS 64

5.10.4.1 US 64

5.10.4.2 Europe 65

5.10.4.3 Asia Pacific 67

5.10.5 IMPACT ON END-USE INDUSTRIES 69

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTION 70

6.1 KEY EMERGING TECHNOLOGIES 70

6.1.1 EXTRUSION TECHNOLOGY 70

6.2 COMPLEMENTARY TECHNOLOGIES 71

6.2.1 LASER POWDER BED FUSION 71

6.3 TECHNOLOGY/PRODUCT ROADMAP 71

6.3.1 SHORT-TERM (2025–2027) | FOUNDATION & EARLY COMMERCIALIZATION 72

6.3.2 MID-TERM (2027–2030) | EXPANSION & STANDARDIZATION 72

6.3.3 LONG-TERM (2030–2035+) | MASS COMMERCIALIZATION & DISRUPTION 73

6.4 ANALYSIS 74

6.4.1 INTRODUCTION 74

6.4.2 METHODOLOGY 74

6.4.3 DOCUMENT TYPE 74

6.4.4 INSIGHTS 75

6.4.5 LEGAL STATUS OF PATENTS 76

6.4.6 JURISDICTION ANALYSIS 76

6.4.7 TOP APPLICANTS 77

6.4.8 LIST OF PATENTS BY JIANGSU GIANSUN PRECISION TECH GROUP CO., LTD. 77

6.4.9 LIST OF PATENTS BY SUZHOU WORTEL PRECISION MOLD MACHINERY CO., LTD. 78

6.4.10 LIST OF PATENTS BY HEBEI AOYI NEW MAT CO., LTD. 78

6.5 FUTURE APPLICATIONS 79

6.5.1 AUTOMOTIVE & MASS TRANSPORT: LIGHTWEIGHTING & STRUCTURAL COMPONENTS 80

6.5.2 BUILDING & CONSTRUCTION: WINDOW FRAMES, FACADES, AND PROFILES 81

6.5.3 ELECTRICAL & ELECTRONICS: HEAT SINKS & ENCLOSURES 82

6.6 IMPACT OF AI/GEN AI ON ALUMINUM EXTRUSION MARKET 82

6.6.1 TOP USE CASES AND MARKET POTENTIAL 83

6.6.2 BEST PRACTICES IN ALUMINUM EXTRUSION PROCESSING 83

6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN ALUMINUM EXTRUSION MARKET 84

6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 84

6.6.5 CLIENTS’ READINESS TO ADOPT GENERATIVE AI IN ALUMINUM EXTRUSION MARKET 84

6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS 85

6.7.1 ALCOA CORPORATION: INNOVATING EV STRUCTURES WITH MEGACASTING ALUMINUM EXTRUDED COMPONENTS 85

6.7.2 CONSTELLIUM: REVOLUTIONIZING COMPONENTS WITH AHEADD CP1 85

6.7.3 BOEING: AI-DRIVEN AUTOMATION FOR 777X AND 737 ASSEMBLY 85

7 SUSTAINABILITY AND REGULATORY LANDSCAPE 86

7.1 REGIONAL REGULATIONS AND COMPLIANCE 86

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 86

7.1.2 INDUSTRY STANDARDS 88

7.2 SUSTAINABILITY INITIATIVES 90

7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF ALUMINUM EXTRUDED PRODUCTS 90

7.2.1.1 Eco-applications 91

7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES 91

7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 92

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 94

8.1 DECISION-MAKING PROCESS 94

8.2 KEY STAKEHOLDERS AND BUYING CRITERIA 95

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 95

8.2.2 BUYING CRITERIA 96

8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 97

8.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES 98

8.5 MARKET PROFITABILITY 98

8.5.1 REVENUE POTENTIAL 99

8.5.2 COST DYNAMICS 99

8.5.3 MARGIN OPPORTUNITIES, BY END-USE INDUSTRY 100

9 ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE 101

9.1 INTRODUCTION 102

9.2 6XXX 103

9.2.1 OPTIMAL COMBINATION OF EXTRUDABILITY AND HEAT-TREATABLE PROPERTIES TO DRIVE DEMAND 103

9.3 1XXX 104

9.3.1 SUPERIOR CONDUCTIVITY TO DRIVE ADOPTION IN ELECTRICAL & ELECTRONICS INDUSTRY 104

9.4 5XXX 105

9.4.1 MAGNESIUM ADDITION OFFERS ADDITIONAL STRENGTH AND EXCELLENT CORROSION RESISTANCE TO PROPEL GROWTH 105

9.5 OTHER GRADES 106

10 ALUMINUM EXTRUSION MARKET, BY PRODUCT 108

10.1 INTRODUCTION 109

10.2 SOLID PROFILES 110

10.2.1 SIMPLICITY IN MANUFACTURING AND STRUCTURAL SOLIDITY TO DRIVE DEMAND 110

10.2.2 RODS & BARS 110

10.2.3 ANGLES & CHANNELS 110

10.2.4 BEAMS 110

10.3 SEMI-HOLLOW PROFILES 112

10.3.1 GROWING DEMAND FROM CONSTRUCTION & INFRASTRUCTURE TO DRIVE MARKET 112

10.3.2 WINDOW FRAMES & TRACK SYSTEMS 112

10.3.3 C-SHAPED PROFILES 112

10.4 HOLLOW PROFILES 113

10.4.1 DEMAND FROM HVAC, AUTOMOTIVE, AND AEROSPACE SECTORS TO BOOST MARKET 113

10.4.2 PIPES & TUBES 113

11 ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH 115

11.1 INTRODUCTION 116

11.2 MILL-FINISHED 117

11.2.1 LOWER PRODUCTION COSTS DRIVING DEMAND 117

11.3 ANODIZED 118

11.3.1 HIGH DURABILITY AND WEATHER RESISTANCE TO DRIVE ADOPTION 118

11.4 POWDER-COATED 119

11.4.1 AUTOMOTIVE AND EV EXPANSION TO BOOST MARKET 119

12 ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 121

12.1 INTRODUCTION 122

12.2 CONSTRUCTION & INFRASTRUCTURE 123

12.2.1 HIGHER STRENGTH-TO-WEIGHT RATIO COMPARED TO OTHER MATERIALS TO DRIVE DEMAND 123

12.3 AUTOMOTIVE & MASS TRANSPORT 124

12.3.1 GROWING ADOPTION IN EV MANUFACTURING TO PROPEL GROWTH 124

12.4 ELECTRICAL & ELECTRONICS 126

12.4.1 SUPERIOR CONDUCTIVITY-TO-WEIGHT RATIO TO DRIVE ADOPTION 126

12.5 MACHINERY & EQUIPMENT 127

12.5.1 LIGHTWEIGHT STRUCTURE & MODULARITY TO DRIVE MARKET 127

12.6 OTHER END-USE INDUSTRIES 128

13 ALUMINUM EXTRUSION MARKET, BY REGION 129

13.1 INTRODUCTION 130

13.2 NORTH AMERICA 131

13.2.1 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE 132

13.2.2 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE 133

13.2.3 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH 134

13.2.4 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 135

13.2.5 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY 136

13.2.6 US 136

13.2.6.1 Strategic investments and capacity expansion by key players to boost market 136

13.2.7 US: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 137

13.2.8 CANADA 138

13.2.8.1 Expansion of sustainable construction and industrial initiatives to drive market 138

13.2.9 CANADA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 138

13.3 EUROPE 139

13.3.1 EUROPE: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE 140

13.3.2 EUROPE: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE 140

13.3.3 EUROPE: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH 141

13.3.4 EUROPE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 142

13.3.5 EUROPE: ALUMINUM EXTRUSION MARKET, BY COUNTRY 143

13.3.6 GERMANY 144

13.3.6.1 Automotive lightweighting and industrial engineering to boost market 144

13.3.7 GERMANY: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 144

13.3.8 FRANCE 145

13.3.8.1 Sustainable construction and transportation modernization to drive market growth 145

13.3.9 FRANCE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 145

13.3.10 UK 146

13.3.10.1 Strong supplier base to fuel growth of market 146

13.3.11 UK: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 146

13.3.12 SPAIN 147

13.3.12.1 Infrastructure development and industrial growth to drive market 147

13.3.13 SPAIN: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 147

13.3.14 ITALY 148

13.3.14.1 Industrial modernization trend to drive market 148

13.3.15 ITALY: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 148

13.3.16 REST OF EUROPE 149

13.3.16.1 Rest of Europe: Aluminum extrusion market, by end-use industry 149

13.4 ASIA PACIFIC 150

13.4.1 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE 150

13.4.2 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE 151

13.4.3 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH 152

13.4.4 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 152

13.4.5 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY COUNTRY 153

13.4.6 CHINA 154

13.4.6.1 Expansion in electric vehicle manufacturing to drive demand 154

13.4.7 CHINA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 154

13.4.8 JAPAN 155

13.4.8.1 Electronics and electrical equipment boost specialized demand in market 155

13.4.9 JAPAN: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 155

13.4.10 INDIA 156

13.4.10.1 Presence of major aluminum extrusion manufacturers drives growth 156

13.4.11 INDIA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 156

13.4.12 SOUTH KOREA 157

13.4.12.1 Favorable government policies and standards to drive market 157

13.4.13 SOUTH KOREA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 157

13.4.14 REST OF ASIA PACIFIC 158

13.4.14.1 Rest of Asia Pacific: Aluminum extrusion market, by end-use industry 158

13.5 MIDDLE EAST & AFRICA 159

13.5.1 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT 159

13.5.2 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE 160

13.5.3 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH 161

13.5.4 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 161

13.5.5 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY 162

13.5.5.1 GCC countries 163

13.5.5.1.1 UAE 163

13.5.5.1.1.1 Presence of major aluminum producers drives growth 163

13.5.5.1.1.2 UAE: Aluminum extrusion market, by end-use industry 164

13.5.5.1.2 Saudi Arabia 164

13.5.5.1.2.1 Shift toward advanced manufacturing and lightweighting to drive growth 164

13.5.5.1.2.2 Saudi Arabia: Aluminum extrusion market, by end-use industry 165

13.5.5.2 Other GCC countries 165

13.5.5.2.1 Other GCC Countries: Aluminum extrusion market, by end-use industry 166

13.5.5.3 South Africa 167

13.5.5.3.1 Expansion of domestic manufacturing and extrusion capabilities to drive market 167

13.5.5.3.2 South Africa: Aluminum extrusion market, by end-use industry 167

13.5.6 REST OF MIDDLE EAST & AFRICA 168

13.5.6.1 Rest of Middle East & Africa: Aluminum extrusion market, By end-use industry 168

13.6 LATIN AMERICA 169

13.6.1 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE 169

13.6.2 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE 170

13.6.3 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH 170

13.6.4 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 171

13.6.5 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY 172

13.6.6 BRAZIL 172

13.6.6.1 Infrastructure development and industrial diversification 172

13.6.7 BRAZIL: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 173

13.6.8 MEXICO 173

13.6.8.1 Automotive manufacturing expansion driving Mexico aluminum extrusion market 173

13.6.9 MEXICO: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY 174

13.6.10 REST OF LATIN AMERICA 174

13.6.10.1 Rest of Latin America: Aluminum extrusion market, by end-use industry 175

14 COMPETITIVE LANDSCAPE 176

14.1 OVERVIEW 176

14.2 KEY PLAYERS’ STRATEGIES/RIGHT TO WIN 176

14.3 REVENUE ANALYSIS 178

14.4 MARKET SHARE ANALYSIS 179

14.5 BRAND/PRODUCT COMPARISON 181

14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 182

14.6.1 STARS 182

14.6.2 EMERGING LEADERS 182

14.6.3 PERVASIVE PLAYERS 182

14.6.4 PARTICIPANTS 183

14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 184

14.6.5.1 Company footprint 184

14.6.5.2 Region footprint 185

14.6.5.3 Product footprint 185

14.6.5.4 Alloy grade footprint 186

14.6.5.5 Surface finish footprint 187

14.6.5.6 End-use industry footprint 188

14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 189

14.7.1 PROGRESSIVE COMPANIES 189

14.7.2 RESPONSIVE COMPANIES 189

14.7.3 DYNAMIC COMPANIES 189

14.7.4 STARTING BLOCKS 189

14.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 190

14.7.5.1 Detailed list of key startups/SMEs 190

14.7.5.2 Competitive benchmarking of key startups/SMEs 191

14.8 COMPANY VALUATION AND FINANCIAL METRICS 192

14.9 COMPETITIVE SCENARIO 193

14.9.1 PRODUCT LAUNCHES 193

14.9.2 DEALS 194

14.9.3 EXPANSIONS 195

15 COMPANY PROFILES 196

15.1 KEY PLAYERS 196

15.1.1 HINDALCO INDUSTRIES LTD. 196

15.1.1.1 Business overview 196

15.1.1.2 Products/Solutions/Services offered 197

15.1.1.3 Recent Developments 198

15.1.1.3.1 Deals 198

15.1.1.3.2 Expansions 199

15.1.1.4 MnM view 199

15.1.1.4.1 Right to win 199

15.1.1.4.2 Strategic choices 199

15.1.1.4.3 Weaknesses and competitive threats 199

15.1.2 ALCOA CORPORATION 200

15.1.2.1 Business overview 200

15.1.2.2 Products/Solutions/Services offered 201

15.1.2.3 Recent developments 201

15.1.3 PRODUCT LAUNCHES 201

15.1.3.1 MnM view 201

15.1.3.1.1 Right to win 201

15.1.3.1.2 Strategic choices 202

15.1.3.1.3 Weaknesses and competitive threats 202

15.1.4 ALUMINIUM CORPORATION OF CHINA LIMITED 203

15.1.4.1 Business overview 203

15.1.4.2 Products/Solutions/Services offered 204

15.1.4.3 MnM view 205

15.1.4.3.1 Right to win 205

15.1.4.3.2 Strategic choices 205

15.1.4.3.3 Weaknesses and competitive threats 205

15.1.5 RUSAL 206

15.1.5.1 Business overview 206

15.1.5.2 Products/Solutions/Services offered 207

15.1.6 KAISER ALUMINUM 208

15.1.6.1 Business overview 208

15.1.6.2 Products/Solutions/Services offered 209

15.1.6.3 MnM view 210

15.1.6.3.1 Right to win 210

15.1.6.3.2 Strategic choices 210

15.1.6.3.3 Weaknesses and competitive threats 210

15.1.7 CENTURY ALUMINUM COMPANY 211

15.1.7.1 Business overview 211

15.1.7.2 Products/Solutions/Services offered 212

15.1.8 CONSTELLIUM 213

15.1.8.1 Business overview 213

15.1.8.2 Products/Solutions/Services offered 214

15.1.8.3 Recent Developments 215

15.1.8.3.1 Deals 215

15.1.9 NORSK HYDRO ASA 216

15.1.9.1 Business overview 216

15.1.9.2 Products/Solutions/Services offered 217

15.1.10 JINDAL ALUMINUM LIMITED 218

15.1.10.1 Business overview 218

15.1.10.2 Products/Solutions/Services offered 218

15.1.10.3 MnM view 220

15.1.10.3.1 Right to win 220

15.1.10.3.2 Strategic choices 220

15.1.10.3.3 Weaknesses and competitive threats 220

15.1.11 HAMMERER ALUMINUM INDUSTRIES 221

15.1.11.1 Business overview 221

15.1.11.2 Products/Solutions/Services offered 221

15.1.12 ALOM GROUP 223

15.1.12.1 Business overview 223

15.1.12.2 Products/Solutions/Services offered 223

15.1.13 BANCO ALUMINUM PRIVATE LIMITED 225

15.1.13.1 Business overview 225

15.1.13.2 Products/Solutions/Services offered 225

15.1.14 MAAN ALUMINIUM LIMITED 227

15.1.14.1 Business overview 227

15.1.14.2 Products/Solutions/Services offered 228

15.1.15 SHENZHEN ORIENTAL TURDO IRONWARES CO., LTD 229

15.1.15.1 Business overview 229

15.1.15.2 Products/Solutions/Services offered 229

15.1.16 ETEM 230

15.1.16.1 Business overview 230

15.1.16.2 Products/Solutions/Services offered 230

15.1.16.3 Recent Developments 231

15.1.16.3.1 Deals 231

15.2 OTHER PLAYERS 232

15.2.1 GUANGDONG ZHENHAN SPECIAL LIGHT ALLOY CO., LTD 232

15.2.2 ALBRAS 233

15.2.3 YK ALUMINIUM 234

15.2.4 ELEANOR INDUSTRIES PVT. LTD 234

15.2.5 ALUPCO 235

15.2.6 ZAHİT ALÜMİNYUM 235

15.2.7 ARCONIC 236

15.2.8 HULAMIN 236

15.2.9 GULF EXTRUSION 237

15.2.10 BENKAM ALU EXTRUSIONS 237

16 RESEARCH METHODOLOGY 238

16.1 RESEARCH DATA 238

16.1.1 SECONDARY DATA 239

16.1.1.1 Key data from secondary sources 239

16.1.2 PRIMARY DATA 239

16.1.2.1 Key data from primary sources 240

16.1.2.2 Key primary interview participants 240

16.1.2.3 Breakdown of primary interviews 241

16.1.2.4 Key industry insights 241

16.2 MARKET SIZE ESTIMATION 242

16.2.1 BOTTOM-UP APPROACH 242

16.2.2 TOP-DOWN APPROACH 242

16.3 BASE NUMBER CALCULATION 243

16.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS 243

16.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS 243

16.4 MARKET FORECAST APPROACH 244

16.4.1 SUPPLY SIDE 244

16.4.2 DEMAND SIDE 244

16.5 DATA TRIANGULATION 244

16.6 FACTOR ANALYSIS 246

16.7 RESEARCH ASSUMPTIONS 246

16.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT 247

17 APPENDIX 248

17.1 DISCUSSION GUIDE 248

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 251

17.3 CUSTOMIZATION OPTIONS 253

17.4 RELATED REPORTS 253

17.5 AUTHOR DETAILS 254

LIST OF TABLES

TABLE 1 ALUMINUM EXTRUSION MARKET: PORTER’S FIVE FORCES ANALYSIS 48

TABLE 2 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021–2029 49

TABLE 3 ALUMINUM EXTRUSION MARKET: ROLE OF COMPANIES IN ECOSYSTEM 55

TABLE 4 AVERAGE SELLING PRICE OF ALUMINUM EXTRUSION IN TOP END-USE INDUSTRIES, BY KEY PLAYERS, 2024 (USD/KG) 56

TABLE 5 AVERAGE SELLING PRICE TREND OF ALUMINUM EXTRUSION, BY REGION,

2023–2024 (USD/KG) 57

TABLE 6 IMPORT DATA FOR HS CODE 760421-COMPLIANT PRODUCTS,

2020–2024 (USD MILLION) 58

TABLE 7 EXPORT DATA FOR HS CODE 760421-COMPLIANT PRODUCTS,

2020–2024 (USD MILLION) 59

TABLE 8 ALUMINUM EXTRUSION MARKET: KEY CONFERENCES AND EVENTS, 2026 59

TABLE 9 US-ADJUSTED RECIPROCAL TARIFF RATES 63

TABLE 10 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFFS 64

TABLE 11 ALUMINUM EXTRUSION MARKET: TOTAL NUMBER OF PATENTS, 2015–2025 74

TABLE 12 TOP USE CASES AND MARKET POTENTIAL 83

TABLE 13 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES 83

TABLE 14 ALUMINUM EXTRUSION MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION 84

TABLE 15 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 84

TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 86

TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 87

TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 87

TABLE 19 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 88

TABLE 20 GLOBAL STANDARDS IN ALUMINUM EXTRUSION MARKET 89

TABLE 21 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN ALUMINUM EXTRUSION MARKET 92

TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%) 96

TABLE 23 KEY BUYING CRITERIA, BY END-USE INDUSTRY 96

TABLE 24 ALUMINUM EXTRUSION MARKET: UNMET NEEDS IN KEY END-USE INDUSTRIES 98

TABLE 25 ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023–2030 (USD MILLION) 102

TABLE 26 ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023–2030 (KILOTON) 103

TABLE 27 6XXX: ALUMINUM EXTRUSION MARKET, BY REGION, 2023–2030 (USD MILLION) 104

TABLE 28 6XXX: ALUMINUM EXTRUSION MARKET, BY REGION, 2023–2030 (KILOTON) 104

TABLE 29 1XXX: ALUMINUM EXTRUSION MARKET, BY REGION, 2023–2030 (USD MILLION) 105

TABLE 30 1XXX: ALUMINUM EXTRUSION MARKET, BY REGION, 2023–2030 (KILOTON) 105

TABLE 31 5XXX: ALUMINUM EXTRUSION MARKET, BY REGION, 2023–2030 (USD MILLION) 106

TABLE 32 5XXX: ALUMINUM EXTRUSION MARKET, BY REGION, 2023–2030 (KILOTON) 106

TABLE 33 OTHER GRADES: ALUMINUM EXTRUSION MARKET, BY REGION,

2023–2030 (USD MILLION) 107

TABLE 34 OTHER GRADES: ALUMINUM EXTRUSION MARKET, BY REGION,

2023–2030 (KILOTON) 107

TABLE 35 ALUMINUM EXTRUSION MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 109

TABLE 36 ALUMINUM EXTRUSION MARKET, BY PRODUCT, 2023–2030 (KILOTON) 109

TABLE 37 SOLID PROFILES: ALUMINUM EXTRUSION MARKET, BY REGION,

2023–2030 (USD MILLION) 111

TABLE 38 SOLID PROFILES: ALUMINUM EXTRUSION MARKET, BY REGION,

2023–2030 (KILOTON) 111

TABLE 39 SEMI-HOLLOW PROFILES: ALUMINUM EXTRUSION MARKET, BY REGION,

2023–2030 (USD MILLION) 112

TABLE 40 SEMI-HOLLOW PROFILES: ALUMINUM EXTRUSION MARKET, BY REGION,

2023–2030 (KILOTON) 113

TABLE 41 HOLLOW PROFILES: ALUMINUM EXTRUSION MARKET, BY REGION,

2023–2030 (USD MILLION) 114

TABLE 42 HOLLOW PROFILES: ALUMINUM EXTRUSION MARKET, BY REGION,

2023–2030 (KILOTON) 114

TABLE 43 ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH, 2023–2030 (USD MILLION) 116

TABLE 44 ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH, 2023–2030 (KILOTON) 116

TABLE 45 MILL-FINISHED: ALUMINUM EXTRUSION MARKET, BY REGION,

2023–2030 (USD MILLION) 117

TABLE 46 MILL-FINISHED: ALUMINUM EXTRUSION MARKET, BY REGION,

2023–2030 (KILOTON) 117

TABLE 47 ANODIZED: ALUMINUM EXTRUSION MARKET, BY REGION,

2023–2030 (USD MILLION) 118

TABLE 48 ANODIZED: ALUMINUM EXTRUSION MARKET, BY REGION, 2023–2030 (KILOTON) 119

TABLE 49 POWDER-COATED: ALUMINUM EXTRUSION MARKET, BY REGION,

2023–2030 (USD MILLION) 119

TABLE 50 POWDER-COATED: ALUMINUM EXTRUSION MARKET, BY REGION,

2023–2030 (KILOTON) 120

TABLE 51 ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 122

TABLE 52 ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON) 123

TABLE 53 CONSTRUCTION & INFRASTRUCTURE: ALUMINUM EXTRUSION MARKET,

BY REGION, 2023–2030 (USD MILLION) 124

TABLE 54 CONSTRUCTION & INFRASTRUCTURE: ALUMINUM EXTRUSION MARKET,

BY REGION, 2023–2030 (KILOTON) 124

TABLE 55 AUTOMOTIVE & MASS TRANSPORT: ALUMINUM EXTRUSION MARKET, BY REGION, 2023–2030 (USD MILLION) 125

TABLE 56 AUTOMOTIVE & MASS TRANSPORT: ALUMINUM EXTRUSION MARKET, BY REGION, 2023–2030 (KILOTON) 125

TABLE 57 ELECTRICAL & ELECTRONICS: ALUMINUM EXTRUSION MARKET, BY REGION, 2023–2030 (USD MILLION) 126

TABLE 58 ELECTRICAL & ELECTRONICS: ALUMINUM EXTRUSION MARKET, BY REGION, 2023–2030 (KILOTON) 126

TABLE 59 MACHINERY & EQUIPMENT: ALUMINUM EXTRUSION MARKET, BY REGION,

2023–2030 (USD MILLION) 127

TABLE 60 MACHINERY & EQUIPMENT: ALUMINUM EXTRUSION MARKET, BY REGION,

2023–2030 (KILOTON) 127

TABLE 61 OTHER END-USE INDUSTRIES: ALUMINUM EXTRUSION MARKET, BY REGION, 2023–2030 (USD MILLION) 128

TABLE 62 OTHER END-USE INDUSTRIES: ALUMINUM EXTRUSION MARKET, BY REGION, 2023–2030 (KILOTON) 128

TABLE 63 ALUMINUM EXTRUSION MARKET, BY REGION, 2023–2030 (USD MILLION) 130

TABLE 64 ALUMINUM EXTRUSION MARKET, BY REGION, 2023–2030 (KILOTON) 131

TABLE 65 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE,

2023–2030 (USD MILLION) 132

TABLE 66 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE,

2023–2030 (KILOTON) 133

TABLE 67 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE,

2023–2030 (USD MILLION) 133

TABLE 68 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE,

2023–2030 (KILOTON) 133

TABLE 69 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH,

2023–2030 (USD MILLION) 134

TABLE 70 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH,

2023–2030 (KILOTON) 134

TABLE 71 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION) 135

TABLE 72 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON) 135

TABLE 73 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 136

TABLE 74 NORTH AMERICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY,

2023–2030 (KILOTON) 136

TABLE 75 US: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 137

TABLE 76 US: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 137

TABLE 77 CANADA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 138

TABLE 78 CANADA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 138

TABLE 79 EUROPE: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE,

2023–2030 (USD MILLION) 140

TABLE 80 EUROPE: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE,

2023–2030 (KILOTON) 140

TABLE 81 EUROPE: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE,

2023–2030 (USD MILLION) 140

TABLE 82 EUROPE: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE,

2023–2030 (KILOTON) 141

TABLE 83 EUROPE: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH,

2023–2030 (USD MILLION) 141

TABLE 84 EUROPE: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH,

2023–2030 (KILOTON) 141

TABLE 85 EUROPE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 142

TABLE 86 EUROPE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 142

TABLE 87 EUROPE: ALUMINUM EXTRUSION MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 143

TABLE 88 EUROPE: ALUMINUM EXTRUSION MARKET, BY COUNTRY, 2023–2030 (KILOTON) 143

TABLE 89 GERMANY: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 144

TABLE 90 GERMANY: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 144

TABLE 91 FRANCE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 145

TABLE 92 FRANCE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 145

TABLE 93 UK: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 146

TABLE 94 UK: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 146

TABLE 95 SPAIN: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 147

TABLE 96 SPAIN: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 147

TABLE 97 ITALY: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 148

TABLE 98 ITALY: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 148

TABLE 99 REST OF EUROPE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION) 149

TABLE 100 REST OF EUROPE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON) 149

TABLE 101 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE,

2023–2030 (USD MILLION) 150

TABLE 102 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE,

2023–2030 (KILOTON) 151

TABLE 103 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE,

2023–2030 (USD MILLION) 151

TABLE 104 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE,

2023–2030 (KILOTON) 151

TABLE 105 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH,

2023–2030 (USD MILLION) 152

TABLE 106 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH,

2023–2030 (KILOTON) 152

TABLE 107 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 152

TABLE 108 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 153

TABLE 109 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 153

TABLE 110 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY COUNTRY,

2023–2030 (KILOTON) 153

TABLE 111 CHINA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 154

TABLE 112 CHINA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 154

TABLE 113 JAPAN: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 155

TABLE 114 JAPAN: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 155

TABLE 115 INDIA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 156

TABLE 116 INDIA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 156

TABLE 117 SOUTH KOREA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 157

TABLE 118 SOUTH KOREA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 157

TABLE 119 REST OF ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION) 158

TABLE 120 REST OF ASIA PACIFIC: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON) 158

TABLE 121 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 159

TABLE 122 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT,

2023–2030 (KILOTON) 159

TABLE 123 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023–2030 (USD MILLION) 160

TABLE 124 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023–2030 (KILOTON) 160

TABLE 125 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH, 2023–2030 (USD MILLION) 161

TABLE 126 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH, 2023–2030 (KILOTON) 161

TABLE 127 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION) 161

TABLE 128 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON) 162

TABLE 129 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 162

TABLE 130 MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY,

2023–2030 (KILOTON) 163

TABLE 131 UAE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 164

TABLE 132 UAE: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 164

TABLE 133 SAUDI ARABIA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 165

TABLE 134 SAUDI ARABIA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 165

TABLE 135 OTHER GCC COUNTRIES: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION) 166

TABLE 136 OTHER GCC COUNTRIES: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON) 166

TABLE 137 SOUTH AFRICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION) 167

TABLE 138 SOUTH AFRICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON) 167

TABLE 139 REST OF MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION) 168

TABLE 140 REST OF MIDDLE EAST & AFRICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON) 168

TABLE 141 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE, 2023–2030 (USD MILLION) 169

TABLE 142 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY PRODUCT TYPE, 2023–2030 (KILOTON) 169

TABLE 143 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023–2030 (USD MILLION) 170

TABLE 144 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY ALLOY GRADE, 2023–2030 (KILOTON) 170

TABLE 145 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH,

2023–2030 (USD MILLION) 170

TABLE 146 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY SURFACE FINISH,

2023–2030 (KILOTON) 171

TABLE 147 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 171

TABLE 148 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 171

TABLE 149 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 172

TABLE 150 LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY COUNTRY,

2023–2030 (KILOTON) 172

TABLE 151 BRAZIL: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 173

TABLE 152 BRAZIL: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 173

TABLE 153 MEXICO: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (USD MILLION) 174

TABLE 154 MEXICO: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY,

2023–2030 (KILOTON) 174

TABLE 155 REST OF LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (USD MILLION) 175

TABLE 156 REST OF LATIN AMERICA: ALUMINUM EXTRUSION MARKET, BY END-USE INDUSTRY, 2023–2030 (KILOTON) 175

TABLE 157 ALUMINUM EXTRUSION MARKET: KEY STRATEGIES ADOPTED BY MAJOR PLAYERS 176

TABLE 158 ALUMINUM EXTRUSION MARKET: DEGREE OF COMPETITION, 2024 179

TABLE 159 ALUMINUM EXTRUSION MARKET: REGION FOOTPRINT 185

TABLE 160 ALUMINUM EXTRUSION MARKET: PRODUCT FOOTPRINT 185

TABLE 161 ALUMINUM EXTRUSION MARKET: ALLOY GRADE FOOTPRINT 186

TABLE 162 ALUMINUM EXTRUSION MARKET: SURFACE FINISH FOOTPRINT 187

TABLE 163 ALUMINUM EXTRUSION MARKET: END-USE INDUSTRY FOOTPRINT 188

TABLE 164 ALUMINUM EXTRUSION MARKET: DETAILED LIST OF KEY STARTUPS/SMES 190

TABLE 165 ALUMINUM EXTRUSION MARKET: COMPETITIVE BENCHMARKING OF

KEY STARTUPS/SMES (1/2) 191

TABLE 166 ALUMINUM EXTRUSION MARKET: COMPETITIVE BENCHMARKING OF

KEY STARTUPS/SMES (2/2) 192

TABLE 167 ALUMINUM EXTRUSION MARKET: PRODUCT LAUNCHES,

JANUARY 2020–DECEMBER 2025 193

TABLE 168 ALUMINUM EXTRUSION MARKET: DEALS, JANUARY 2020–DECEMBER 2025 194

TABLE 169 ALUMINUM EXTRUSION MARKET: EXPANSIONS, JANUARY 2020–DECEMBER 2025 195

TABLE 170 HINDALCO INDUSTRIES LTD.: COMPANY OVERVIEW 196

TABLE 171 HINDALCO INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 197

TABLE 172 HINDALCO INDUSTRIES LTD.: DEALS 198

TABLE 173 HINDALCO INDUSTRIES LTD.: EXPANSIONS 199

TABLE 174 ALCOA CORPORATION: COMPANY OVERVIEW 200

TABLE 175 ALCOA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 201

TABLE 176 ALCOA CORPORATION: PRODUCT LAUNCHES 201

TABLE 177 ALUMINIUM CORPORATION OF CHINA LIMITED: COMPANY OVERVIEW 203

TABLE 178 ALUMINUM CORPORATION OF CHINA LIMITED:

PRODUCTS/SOLUTIONS/SERVICES OFFERED 204

TABLE 179 RUSAL: COMPANY OVERVIEW 206

TABLE 180 RUSAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED 207

TABLE 181 KAISER ALUMINUM: COMPANY OVERVIEW 208

TABLE 182 KAISER ALUMINUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED 209

TABLE 183 CENTURY ALUMINUM COMPANY: COMPANY OVERVIEW 211

TABLE 184 CENTURY ALUMINUM COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED 212

TABLE 185 CONSTELLIUM: COMPANY OVERVIEW 213

TABLE 186 CONSTELLIUM: PRODUCTS/SOLUTIONS/SERVICES OFFERED 214

TABLE 187 CONSTELLIUM: DEALS 215

TABLE 188 NORSK HYDRO ASA: COMPANY OVERVIEW 216

TABLE 189 NORSK HYDRO ASA: PRODUCTS/SOLUTIONS/SERVICES OFFERED 217

TABLE 190 JINDAL ALUMINUM LIMITED: COMPANY OVERVIEW 218

TABLE 191 JINDAL ALUMINUM LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED 218

TABLE 192 HAMMERER ALUMINUM INDUSTRIES: COMPANY OVERVIEW 221

TABLE 193 HAMMERER ALUMINUM INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED 221

TABLE 194 ALOM GROUP: COMPANY OVERVIEW 223

TABLE 195 ALOM GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED 223

TABLE 196 BANCO ALUMINUM PRIVATE LIMITED: COMPANY OVERVIEW 225

TABLE 197 BANCO ALUMINUM PRIVATE LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED 225

TABLE 198 MAAN ALUMINIUM LIMITED: COMPANY OVERVIEW 227

TABLE 199 MAAN ALUMINIUM LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED 228

TABLE 200 SHENZHEN ORIENTAL TURDO IRONWARES CO., LTD: COMPANY OVERVIEW 229

TABLE 201 SHENZHEN ORIENTAL TURDO IRONWARES CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED 229

TABLE 202 ETEM: COMPANY OVERVIEW 230

TABLE 203 ETEM: PRODUCTS/SOLUTIONS/SERVICES OFFERED 230

TABLE 204 ETEM: DEALS 231

TABLE 205 GUANGDONG ZHENHAN SPECIAL LIGHT ALLOY CO., LTD: COMPANY OVERVIEW 232

TABLE 206 ALBRAS: COMPANY OVERVIEW 233

TABLE 207 YK ALUMINIUM.: COMPANY OVERVIEW 234

TABLE 208 ELEANOR INDUSTRIES PVT. LTD: COMPANY OVERVIEW 234

TABLE 209 ALUPCO: COMPANY OVERVIEW 235

TABLE 210 ZAHİT ALÜMİNYUM: COMPANY OVERVIEW 235

TABLE 211 ARCONIC: COMPANY OVERVIEW 236

TABLE 212 HULAMIN: COMPANY OVERVIEW 236

TABLE 213 GULF EXTRUSION: COMPANY OVERVIEW 237

TABLE 214 BENKAM ALU EXTRUSIONS: COMPANY OVERVIEW 237

LIST OF FIGURES

FIGURE 1 ALUMINUM EXTRUSION MARKET SEGMENTATION AND REGIONAL SCOPE 27

FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS 30

FIGURE 3 GLOBAL ALUMINUM EXTRUSION MARKET, 2025–2030 31

FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN ALUMINUM EXTRUSION MARKET (2020–2025) 31

FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF ALUMINUM EXTRUSION MARKET 32

FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN ALUMINUM EXTRUSION MARKET, 2024 33

FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD 34

FIGURE 8 HIGH DEMAND IN CONSTRUCTION & INFRASTRUCTURE TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS 35

FIGURE 9 SOLID PROFILES SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024 36

FIGURE 10 6XXX ALLOY GRADE DOMINATED ALUMINUM EXTRUSION MARKET IN 2024 36

FIGURE 11 MILL-FINISHED SEGMENT LED MARKET IN 2025 37

FIGURE 12 CONSTRUCTION & INFRASTRUCTURE SEGMENT WAS LARGEST IN 2025 37

FIGURE 13 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD 38

FIGURE 14 ALUMINUM EXTRUSION MARKET: DRIVERS, RESTRAINTS,

OPPORTUNITIES, AND CHALLENGES 39

FIGURE 15 LIGHTWEIGHTING POTENTIAL OF ALUMINUM EXTRUDED PRODUCTS FOR AUTOMOTIVE INDUSTRY 40

FIGURE 16 ALUMINUM EXTRUSION MARKET: PORTER’S FIVE FORCES ANALYSIS 47

FIGURE 17 ALUMINUM EXTRUSION MARKET: VALUE CHAIN ANALYSIS 52

FIGURE 18 ALUMINUM EXTRUSION MARKET: KEY PARTICIPANTS IN ECOSYSTEM 54

FIGURE 19 ALUMINUM EXTRUSION MARKET: ECOSYSTEM ANALYSIS 55

FIGURE 20 AVERAGE SELLING PRICE TREND BY REGION, 2023–2024 56

FIGURE 21 IMPORT SCENARIO FOR HS CODE 760421-COMPLIANT PRODUCTS, KEY COUNTRIES, 2020–2024 57

FIGURE 22 EXPORT SCENARIO FOR HS CODE 760421-COMPLIANT PRODUCTS, KEY COUNTRIES, 2020–2024 58

FIGURE 23 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS 60

FIGURE 24 PATENT ANALYSIS, BY DOCUMENT TYPE, 2015–2025 75

FIGURE 25 PATENT PUBLICATION TRENDS, 2015−2025 75

FIGURE 26 ALUMINUM EXTRUSION MARKET: LEGAL STATUS OF PATENTS, JANUARY 2015–DECEMBER 2025 76

FIGURE 27 CHINA REGISTERED HIGHEST SHARE OF PATENTS, 2015–2025 76

FIGURE 28 TOP PATENT APPLICANTS, 2015–2025 77

FIGURE 29 FUTURE APPLICATIONS OF ALUMINUM EXTRUSION 79

FIGURE 30 ALUMINUM EXTRUSION MARKET: DECISION-MAKING FACTORS 95

FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY 95

FIGURE 32 KEY BUYING CRITERIA, BY END-USE INDUSTRY 96

FIGURE 33 ADOPTION BARRIERS & INTERNAL CHALLENGES 97

FIGURE 34 6XXX ALLOY GRADE SEGMENT TO DOMINATE MARKET 102

FIGURE 35 HOLLOW PROFILES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD 109

FIGURE 36 MILL-FINISHED SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD 116

FIGURE 37 CONSTRUCTION & INFRASTRUCTURE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD 122

FIGURE 38 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD 130

FIGURE 39 NORTH AMERICA: ALUMINUM EXTRUSION MARKET SNAPSHOT 132

FIGURE 40 EUROPE: ALUMINUM EXTRUSION MARKET SNAPSHOT 139

FIGURE 41 ASIA PACIFIC: ALUMINUM EXTRUSION MARKET SNAPSHOT 150

FIGURE 42 ALUMINUM EXTRUSION MARKET: REVENUE ANALYSIS OF

KEY PLAYERS, 2020–2024 178

FIGURE 43 ALUMINUM EXTRUSION MARKET SHARE ANALYSIS, 2024 179

FIGURE 44 ALUMINUM EXTRUSION MARKET: BRAND/PRODUCT COMPARISON 181

FIGURE 45 ALUMINUM EXTRUSION MARKET:

COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024 183

FIGURE 46 ALUMINUM EXTRUSION MARKET: COMPANY FOOTPRINT 184

FIGURE 47 ALUMINUM EXTRUSION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 190

FIGURE 48 ALUMINUM EXTRUSION MARKET: EV/EBITDA OF KEY MANUFACTURERS 192

FIGURE 49 ALUMINUM EXTRUSION MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY MANUFACTURERS 193

FIGURE 50 HINDALCO INDUSTRIES LTD.: COMPANY SNAPSHOT 197

FIGURE 51 ALCOA CORPORATION: COMPANY SNAPSHOT 200

FIGURE 52 ALUMINIUM CORPORATION OF CHINA LIMITED: COMPANY SNAPSHOT 204

FIGURE 53 RUSAL: COMPANY SNAPSHOT 207

FIGURE 54 KAISER ALUMINUM: COMPANY SNAPSHOT 209

FIGURE 55 CENTURY ALUMINUM COMPANY: COMPANY SNAPSHOT 212

FIGURE 56 CONSTELLIUM: COMPANY SNAPSHOT 214

FIGURE 57 NORSK HYDRO ASA: COMPANY SNAPSHOT 217

FIGURE 58 MAAN ALUMINIUM: COMPANY SNAPSHOT 227

FIGURE 59 ALUMINUM EXTRUSION MARKET: RESEARCH DESIGN 238

FIGURE 60 ALUMINUM EXTRUSION MARKET: BOTTOM-UP AND TOP-DOWN APPROACH 242

FIGURE 61 ALUMINUM EXTRUSION MARKET: DATA TRIANGULATION 245