Pediatric Vascular Access Device Market - Global Forecast to 2030

小児用血管アクセスデバイス市場 - タイプ(カテーテル(CVC、PIVC、PICC)、ポート、IVセット、輸液ポンプ)、用途(薬剤投与、輸血、診断および検査)、エンドユーザー(病院、ASC) - 2030年までの世界予測

Pediatric Vascular Access Market by Type (Catheters (CVC, PIVC, PICC), Ports, IV Sets, Infusion Pumps), Application (Drug Administration, Blood Transfusion, Diagnostics & Testing), End User (Hospitals, ASCs) - Global Forecast to 2030

| 出版 | MarketsandMarkets |

| 出版年月 | 2025年11月 |

| ページ数 | 189 |

| 図表数 | 132 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-11983 |

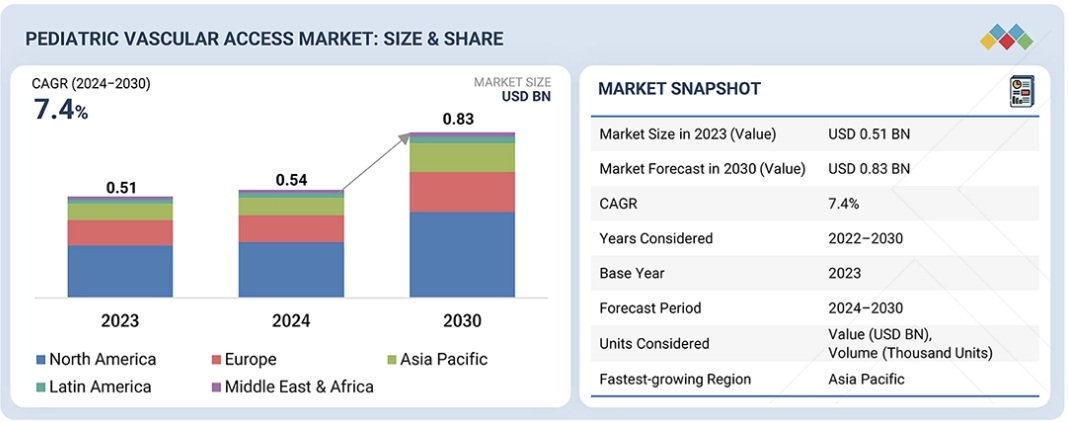

世界の小児用血管アクセスデバイス市場は、2024年の5億4,300万米ドルから2030年には8億3,310万米ドルに達し、予測期間中は年平均成長率(CAGR)7.4%で成長すると予測されています。小児用血管アクセスデバイス市場は、早産、安全性と快適性を考慮したカテーテル材質の進歩、NICU入院件数の増加など、様々な要因により、着実な成長を遂げています。また、特に北米、欧州、アジア太平洋地域では、入院件数が増加しており、スマート血管アクセスデバイスへの移行が進んでいます。全体として、発展途上市場における医療費の増加は、市場成長に新たな機会をもたらしています。

調査範囲

本レポートは、小児用血管アクセスデバイス市場を、種類、用途、エンドユーザー、地域の観点から分析しています。また、市場の成長に影響を与える要因(促進要因、制約要因、機会、課題など)を分析するとともに、市場リーダーの競争環境に関する詳細な情報を提供しています。さらに、ミクロ市場を個々の成長傾向の観点から分析しています。さらに、5つの主要地域(および各地域に所在する国)における市場セグメントの収益予測も提供しています。

レポートを購入する理由

本レポートは、既存企業だけでなく新規参入企業や小規模企業も市場の動向を把握し、市場シェアの拡大に役立てることができます。本レポートを購入した企業は、以下の戦略のいずれか、または組み合わせて活用することで、市場でのプレゼンスを強化できます。

本レポートは、以下の点について洞察を提供します。

- 主要な推進要因(早産率の増加、カテーテル材料の安全性と快適性の進歩、NICU入院件数の増加)、制約要因(血管アクセスデバイスの高価格)、機会(技術の進歩)、課題(イノベーションと費用対効果のバランス)の分析

- 市場浸透:小児用血管アクセスデバイス市場において主要企業が展開する製品群に関する包括的な知識

- 製品開発/イノベーション:小児血管アクセス市場における今後のトレンド、研究開発イニシアチブ、製品投入に関する包括的な理解

- 市場開発:収益性の高い発展途上地域に関する包括的な知識

- 市場多様化:新製品、拡大する地域、小児血管アクセス業界における最新の変化に関する徹底的な知識は、市場の多様化に役立ちます

- 競合評価:BD、Teleflex Incorporated、ICU Medical, Inc.、B. Braun SE、AngioDynamics, Inc.、テルモ株式会社、ニプロメディカル株式会社、Medtronic Plcなどの主要企業の市場シェア、成長戦略、製品提供に関する詳細な評価

Report Description

The global pediatric vascular access market is projected to reach USD 833.1 million by 2030 from USD 543.0 million in 2024, at a CAGR of 7.4% during the forecast period. The pediatric vascular access market is witnessing consistent growth due to various factors such as preterm births, advancement in catheter materials in terms of safety and comfort, and growing NICU admissions. There has also been a shift towards smart vascular access devices, particularly in North America, Europe, and the Asia Pacific, where there is an increase in hospitalizations. Overall, increased healthcare expenditure in developing markets is bringing new opportunities to market growth.

Pediatric Vascular Access Device Market – Global Forecast to 2030

The Peripheral Intravenous Catheters (PIVC) segment of the pediatric vascular access market, by the type of catheters, is expected to hold the highest CAGR during the forecast period.

The Peripheral Intravenous Catheters (PIVC) segment within the Pediatric Vascular Access market is anticipated to exhibit the highest CAGR during the forecast period due to its critical role in facilitating safe and efficient vascular access for high-risk newborns. PIVCs are designed for short-term use, typically lasting 24–96 hours. They are preferred for administering medications, fluids, and blood products in neonatal intensive care units (NICUs), where frequent interventions are required.

The Ambulatory Surgical Centers (ASCs) segment of the pediatric vascular access market, by end user, is expected to show the second-highest growth.

ASCs are increasingly becoming a preferred alternative to traditional hospital settings for certain neonatal interventions due to their cost-effectiveness, convenience, and focus on patient-centered care. ASCs often specialize in procedures that require advanced vascular access devices, such as peripheral intravenous catheters (PIVCs), peripherally inserted central catheters (PICCs), and midline catheters. These devices are essential for managing conditions such as congenital anomalies, preterm complications, or post-surgical recovery in a controlled, less intensive setting. The ability to perform these procedures outside of a full-scale hospital environment reduces costs while maintaining high standards of care, making ASCs an attractive option for providers and patients.

Pediatric Vascular Access Device Market – Global Forecast to 2030 – region

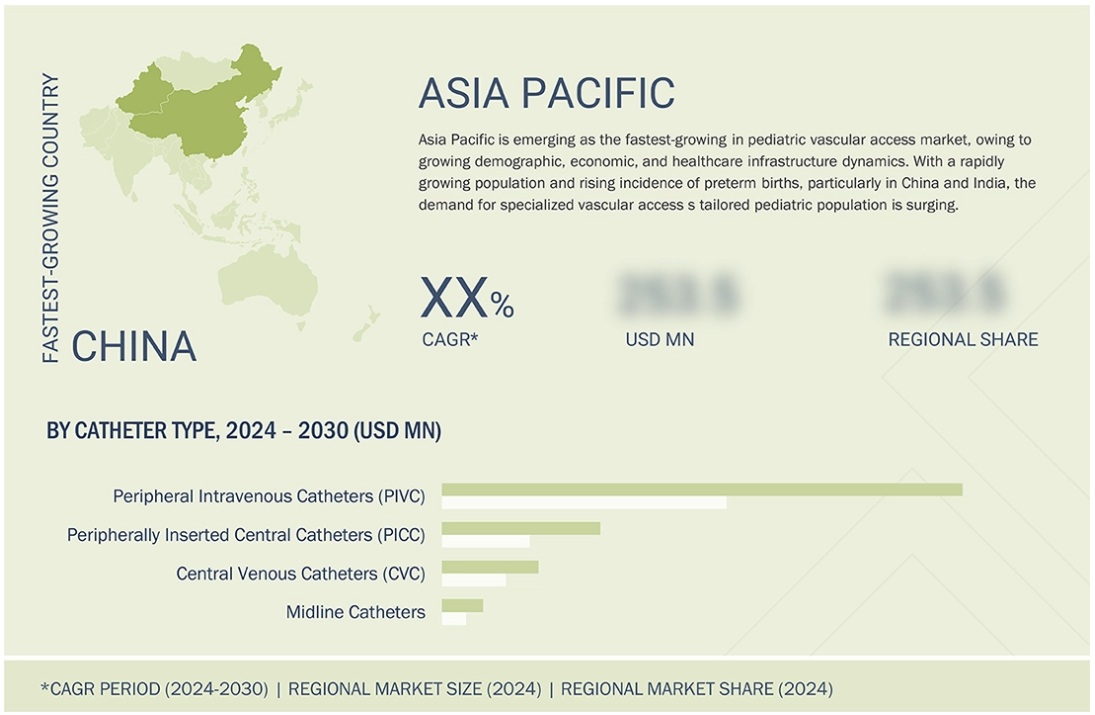

Asia Pacific is expected to grow at the highest CAGR during the forecast period in the pediatric vascular access market.

The pediatric vascular access market in the Asia Pacific region is growing rapidly due to demographic, economic, and healthcare infrastructure dynamics. With a rapidly growing population and rising incidence of preterm births, particularly in China and India, the demand for specialized vascular devices tailored to neonates is surging. Governments across the region are prioritizing improvements in neonatal care, investing in advanced NICUs, and upgrading healthcare facilities to align with global standards. For instance, China’s National Health Commission has launched initiatives to enhance access to critical neonatal interventions, including vascular access technologies. Japan’s sophisticated healthcare ecosystem continues to adopt cutting-edge technologies such as AI-integrated monitoring systems and ultra-miniaturized catheters. Economic expansion in the Asia Pacific is further fueling market growth as rising disposable incomes and expanding middle-class populations increase access to premium medical solutions. South Korea and Singapore are witnessing heightened adoption of smart vascular devices, driven by a culture of technological integration in healthcare.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1: 28%, Tier 2: 34%, and Tier 3: 38%

- By Designation: C-level: 40%, Director Level: 26%, and Others: 34%

- By Region: North America: 25%, Europe: 41%, Asia Pacific: 30%, Latin America: 3%, and Middle East & Africa: 1%

Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.0 billion, Tier 2 = USD 1.0 billion to USD 10.0 billion, and Tier 3 = <USD 1.0 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Pediatric Vascular Access Device Market – Global Forecast to 2030 – ecosystem

The players operating in the Pediatric Vascular Access market include BD (US), Teleflex Incorporated (US), ICU Medical, Inc. (US), B. Braun SE (Germany), Angiodynamics, Inc. (US), Terumo Corporation (Japan), Nipro Medical Corporation (Japan), and Medtronic Plc (Ireland)

Research Coverage

This report studies the pediatric vascular access market based on type, applications, end user, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends. It forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to gain a larger market share. Firms purchasing the report could use one or a combination of the following strategies to strengthen their market presence.

This report provides insights into the following pointers:

- Analysis of key drivers (increasing prevalence of preterm births, advancements in catheter materials in terms of safety and comfort, and growing NICU admissions), restraints (high prices of vascular access devices), opportunities (technological advancements), challenges (balancing innovations with cost-effectiveness)

- Market Penetration: Complete knowledge of the spectrum of products presented by the major companies in the pediatric vascular access market

- Product Development/Innovation: Comprehensive understanding of the forthcoming trends, research and development initiatives, and product launches within the Pediatric Vascular Access market

- Market Development: Complete knowledge about profitable developing regions

- Market Diversification: Exhaustive knowledge of new goods, expanding geographies, and current changes in the pediatric vascular access industry helps to diversify the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as BD, Teleflex Incorporated, ICU Medical, Inc., B. Braun SE, AngioDynamics, Inc., Terumo Corporation, Nipro Medical Corporation, and Medtronic Plc.

Table of Contents

1 INTRODUCTION 18

1.1 STUDY OBJECTIVES 18

1.2 MARKET DEFINITION 18

1.3 STUDY SCOPE 19

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 19

1.3.2 INCLUSIONS AND EXCLUSIONS 19

1.3.3 YEARS CONSIDERED 20

1.4 CURRENCY CONSIDERED 21

1.5 STAKEHOLDERS 21

2 RESEARCH METHODOLOGY 22

2.1 RESEARCH DATA 22

2.1.1 SECONDARY DATA 22

2.1.1.1 List of secondary sources 23

2.1.1.2 Key data from secondary sources 24

2.1.2 PRIMARY DATA 24

2.1.2.1 List of primary sources 25

2.1.2.2 Key data from primary sources 25

2.1.2.3 Breakdown of primary interviews 26

2.1.2.4 Insights from industry experts 26

2.2 MARKET SIZE ESTIMATION 27

2.3 DATA TRIANGULATION 32

2.4 RESEARCH ASSUMPTIONS 33

2.5 RESEARCH LIMITATIONS 33

2.5.1 METHODOLOGY-RELATED LIMITATIONS 33

2.5.2 SCOPE-RELATED LIMITATIONS 33

2.6 RISK ASSESSMENT 34

3 EXECUTIVE SUMMARY 35

4 PREMIUM INSIGHTS 39

4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PEDIATRIC VASCULAR ACCESS MARKET 39

4.2 PEDIATRIC VASCULAR ACCESS MARKET, BY REGION 40

5 MARKET OVERVIEW 41

5.1 INTRODUCTION 41

5.2 MARKET DYNAMICS 41

5.2.1 DRIVERS 42

5.2.1.1 Rapidly growing pediatric population 42

5.2.1.2 Rise of pediatric cancer 42

5.2.1.3 Heightened use of vascular access devices in pediatric patients 42

5.2.2 RESTRAINTS 43

5.2.2.1 Costly placement and maintenance of Pediatric vascular access devices 43

5.2.3 OPPORTUNITIES 43

5.2.3.1 Technological advancements in vascular access devices 43

5.2.4 CHALLENGES 43

5.2.4.1 Shortage of skilled healthcare professionals 43

5.3 TECHNOLOGY ANALYSIS 44

5.3.1 KEY TECHNOLOGIES 44

5.3.1.1 Imaging and navigation 44

5.3.1.2 Catheter securement and stabilization 44

5.3.2 COMPLEMENTARY TECHNOLOGIES 44

5.3.2.1 Artificial intelligence and machine learning 44

5.3.3 ADJACENT TECHNOLOGIES 45

5.3.3.1 Infection control technologies 45

5.4 INDUSTRY TRENDS 45

5.4.1 MINIMALLY INVASIVE VASCULAR ACCESS PROCEDURES 45

5.4.2 INNOVATIONS IN CATHETER MATERIALS AND COATINGS 45

5.5 VALUE CHAIN ANALYSIS 46

5.6 ECOSYSTEM ANALYSIS 47

5.7 SUPPLY CHAIN ANALYSIS 47

5.8 TRADE ANALYSIS 49

5.8.1 IMPORT SCENARIO (HS CODE 901839) 49

5.8.2 EXPORT SCENARIO (HS CODE 901839) 49

5.9 PORTER’S FIVE FORCES ANALYSIS 50

5.9.1 THREAT OF NEW ENTRANTS 51

5.9.2 THREAT OF SUBSTITUTES 51

5.9.3 BARGAINING POWER OF BUYERS 52

5.9.4 BARGAINING POWER OF SUPPLIERS 52

5.9.5 INTENSITY OF COMPETITIVE RIVALRY 52

5.10 KEY STAKEHOLDERS AND BUYING CRITERIA 52

5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS 52

5.10.2 BUYING CRITERIA 53

5.11 REGULATORY LANDSCAPE 54

5.11.1 REGULATORY FRAMEWORK 54

5.11.1.1 North America 54

5.11.1.1.1 US 54

5.11.1.1.2 Canada 55

5.11.1.2 Europe 55

5.11.1.3 Asia Pacific 55

5.11.1.4 Latin America 56

5.11.1.5 Middle East & Africa 56

5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND

OTHER ORGANIZATIONS 56

5.12 PATENT ANALYSIS 58

5.13 PRICING ANALYSIS 60

5.13.1 AVERAGE SELLING PRICE TREND, BY KEY PLAYER 60

5.13.2 AVERAGE SELLING PRICE TREND, BY REGION 61

5.14 KEY CONFERENCES AND EVENTS, 2025–2026 62

5.15 ADJACENT MARKET ANALYSIS 63

5.15.1 VASCULAR ACCESS DEVICE MARKET 63

5.16 UNMET NEEDS/END USER EXPECTATIONS 64

5.17 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS 65

5.18 INVESTMENT AND FUNDING SCENARIO 65

5.19 IMPACT OF AI/GEN AI 66

5.20 US 2025 TARIFF 67

5.20.1 INTRODUCTION 67

5.20.2 KEY TARIFF RATES 68

5.20.3 PRICE IMPACT ANALYSIS 69

5.20.4 IMPACT ON COUNTRY/REGION 69

5.20.4.1 US 69

5.20.4.2 Europe 70

5.20.4.3 Asia Pacific 70

5.20.5 IMPACT ON END-USE INDUSTRY 70

6 PEDIATRIC VASCULAR ACCESS MARKET, BY TYPE 71

6.1 INTRODUCTION 72

6.2 CATHETERS 73

6.2.1 CENTRAL VENOUS CATHETERS 74

6.2.1.1 Increased prevalence of preterm births to drive market 74

6.2.2 PERIPHERAL INTRAVENOUS CATHETERS 74

6.2.2.1 Rapid adoption of minimally invasive procedures to drive market 74

6.2.3 PERIPHERALLY INSERTED CENTRAL CATHETERS 75

6.2.3.1 Need for long-term vascular access in premature neonates to drive market 75

6.2.4 MIDLINE CATHETERS 77

6.2.4.1 Advancements in catheter materials and insertion techniques to drive market 77

6.3 CATHETER SECUREMENT & STABILIZATION 77

6.3.1 IMPROVED AWARENESS ABOUT CATHETER STABILIZATION TO DRIVE MARKET 77

6.4 IMPLANTABLE PORTS 78

6.4.1 RISING INCIDENCES OF PEDIATRIC CANCER TO DRIVE MARKET 78

6.5 PORT NEEDLES 79

6.5.1 INCREASED USE OF IMPLANTABLE PORTS IN PEDIATRIC CARE TO DRIVE MARKET 79

6.6 INFUSION PUMPS 80

6.6.1 HEIGHTENED DEMAND FOR PRECISE DRUG DELIVERY IN PEDIATRIC CARE TO DRIVE MARKET 80

6.7 IV CONNECTORS 80

6.7.1 STRINGENT HOSPITAL PROTOCOLS TO DRIVE MARKET 80

6.8 SYRINGES & NEEDLES 81

6.8.1 NEED FOR SAFE DRUG ADMINISTRATION IN PEDIATRICS TO DRIVE MARKET 81

6.9 VASCULAR CLOSURE DEVICES 82

6.9.1 SURGE IN MINIMALLY INVASIVE PROCEDURES IN PEDIATRIC TO DRIVE MARKET 82

6.10 IV SETS & ACCESSORIES 82

6.10.1 RISE IN PEDIATRIC CONDITIONS REQUIRING INTRAVENOUS THERAPY TO DRIVE MARKET 82

6.11 ANESTHESIA INJECTION DEVICES 83

6.11.1 GROWING PEDIATRICS PROCEDURES TO DRIVE MARKET 83

6.12 GUIDANCE DEVICES 84

6.12.1 ESCALATING DEMAND FOR SAFER AND MORE EFFECTIVE VASCULAR ACCESS PROCEDURES TO DRIVE MARKET 84

6.13 CATHETER CAPS & CLOSURES 84

6.13.1 ADOPTION OF INFECTION PREVENTION PROTOCOLS BY PEDIATRIC CARE UNITS TO DRIVE MARKET 84

6.14 INTRAOSSEOUS INFUSION DEVICES 85

6.14.1 RISING PEDIATRIC EMERGENCIES AND SEPSIS CASES TO DRIVE MARKET 85

6.15 OTHER TYPES 86

7 PEDIATRIC VASCULAR ACCESS MARKET, BY APPLICATION 87

7.1 INTRODUCTION 88

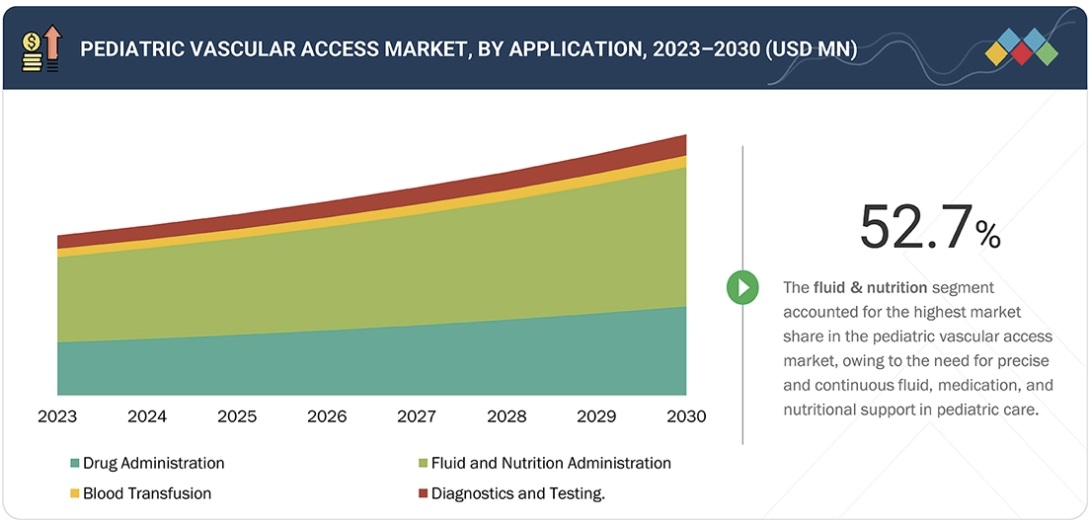

7.2 FLUID & NUTRITION ADMINISTRATION 88

7.2.1 NEED FOR PRECISE, CONTINUOUS THERAPY IN PEDIATRIC POPULATION TO DRIVE MARKET 88

7.3 DRUG ADMINISTRATION 89

7.3.1 RISE IN PEDIATRIC HEALTH COMPLEXITIES TO DRIVE MARKET 89

7.4 DIAGNOSTICS & TESTING 89

7.4.1 ELEVATED DEMAND FOR EARLY DISEASE DETECTION, SEPSIS MANAGEMENT, AND MONITORING TO DRIVE MARKET 89

7.5 BLOOD TRANSFUSION 89

7.5.1 PREVALENCE OF PRETERM BIRTHS AND NEONATAL ANEMIA TO DRIVE MARKET 89

8 PEDIATRIC VASCULAR ACCESS MARKET, BY END USER 90

8.1 INTRODUCTION 91

8.2 HOSPITALS 91

8.2.1 GROWING NICU ADMISSIONS DUE TO PREMATURE BIRTHS AND CONGENITAL CONDITIONS TO DRIVE MARKET 91

8.3 AMBULATORY SURGICAL CENTERS & CLINICS 92

8.3.1 INCREASING PREFERENCE FOR OUTPATIENT CARE TO DRIVE MARKET 92

8.4 HOMECARE SETTINGS 92

8.4.1 EMERGING TREND OF EARLY HOSPITAL DISCHARGE TO DRIVE MARKET 92

8.5 OTHER END USERS 92

9 PEDIATRIC VASCULAR ACCESS MARKET, BY REGION 93

9.1 INTRODUCTION 94

9.2 NORTH AMERICA 95

9.2.1 MACROECONOMIC OUTLOOK 95

9.2.2 US 97

9.2.2.1 Increasing burden of pediatric cancer to drive market 97

9.2.3 CANADA 97

9.2.3.1 Rising preterm births and NICU admissions to drive market 97

9.3 EUROPE 98

9.3.1 MACROECONOMIC OUTLOOK 98

9.4 ASIA PACIFIC 99

9.4.1 MACROECONOMIC OUTLOOK 99

9.4.2 JAPAN 100

9.4.2.1 Growing focus on pediatric care to drive market 100

9.4.3 CHINA 101

9.4.3.1 Substantial investments in healthcare infrastructure to drive market 101

9.4.4 REST OF ASIA PACIFIC 101

10 COMPETITIVE LANDSCAPE 102

10.1 INTRODUCTION 102

10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2024 102

10.3 REVENUE ANALYSIS, 2022–2024 104

10.4 MARKET SHARE ANALYSIS, 2024 104

10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 106

10.5.1 STARS 106

10.5.2 EMERGING LEADERS 106

10.5.3 PERVASIVE PLAYERS 106

10.5.4 PARTICIPANTS 106

10.5.5 COMPANY FOOTPRINT 108

10.5.5.1 Company footprint 108

10.5.5.2 Region footprint 109

10.5.5.3 Type footprint 110

10.5.5.4 Application footprint 112

10.5.5.5 End user footprint 113

10.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024 114

10.6.1 PROGRESSIVE COMPANIES 114

10.6.2 RESPONSIVE COMPANIES 114

10.6.3 DYNAMIC COMPANIES 114

10.6.4 STARTING BLOCKS 114

10.6.5 COMPETITIVE BENCHMARKING 116

10.6.5.1 List of start-ups/SMEs 116

10.6.5.2 Competitive benchmarking of start-ups/SMEs 116

10.7 COMPANY VALUATION AND FINANCIAL METRICS 117

10.8 BRAND/PRODUCT COMPARISON 118

10.9 COMPETITIVE SCENARIO 119

10.9.1 PRODUCT LAUNCHES & APPROVALS 119

10.9.2 DEALS 120

10.9.3 OTHER DEVELOPMENTS 121

11 COMPANY PROFILES 122

11.1 KEY PLAYERS 122

11.1.1 BECTON, DICKINSON AND COMPANY 122

11.1.1.1 Business overview 122

11.1.1.2 Products offered 123

11.1.1.3 MnM view 129

11.1.1.3.1 Key strengths 129

11.1.1.3.2 Strategic choices 129

11.1.1.3.3 Weaknesses & competitive threats 129

11.1.2 TELEFLEX INCORPORATED 130

11.1.2.1 Business overview 130

11.1.2.2 Products offered 131

11.1.2.3 Recent developments 134

11.1.2.3.1 Product launches & approvals 134

11.1.2.3.2 Deals 135

11.1.2.3.3 Other developments 135

11.1.2.4 MnM view 135

11.1.2.4.1 Key strengths 135

11.1.2.4.2 Strategic choices 135

11.1.2.4.3 Weaknesses & competitive threats 136

11.1.3 ICU MEDICAL, INC. 137

11.1.3.1 Business overview 137

11.1.3.2 Products offered 138

11.1.3.3 Recent developments 142

11.1.3.3.1 Deals 142

11.1.3.4 MnM view 142

11.1.3.4.1 Right to win 142

11.1.3.4.2 Strategic choices 142

11.1.3.4.3 Weaknesses & competitive threats 142

11.1.4 B. BRAUN SE 143

11.1.4.1 Business overview 143

11.1.4.2 Products offered 144

11.1.4.3 Recent developments 149

11.1.4.3.1 Product launches & approvals 149

11.1.4.3.2 Deals 149

11.1.4.4 MnM view 150

11.1.4.4.1 Right to win 150

11.1.4.4.2 Strategic choices 150

11.1.4.4.3 Weaknesses & competitive threats 150

11.1.5 TERUMO CORPORATION 151

11.1.5.1 Business overview 151

11.1.5.2 Products offered 152

11.1.5.3 MnM view 153

11.1.5.3.1 Right to win 153

11.1.5.3.2 Strategic choice 153

11.1.5.3.3 Weaknesses & competitive threats 153

11.1.6 MEDTRONIC 154

11.1.6.1 Business overview 154

11.1.6.2 Products offered 155

11.1.7 VYGON 156

11.1.7.1 Business overview 156

11.1.7.2 Products offered 156

11.1.8 NIPRO CORPORATION 159

11.1.8.1 Business overview 159

11.1.8.2 Products offered 161

11.1.9 ANGIODYNAMICS 162

11.1.9.1 Business overview 162

11.1.9.2 Products offered 163

11.1.9.3 Recent developments 164

11.1.9.3.1 Product launches & approvals 164

11.1.9.3.2 Deals 164

11.1.10 COOK MEDICAL 165

11.1.10.1 Business overview 165

11.1.10.2 Products offered 165

11.2 OTHER PLAYERS 166

11.2.1 CANADIAN HOSPITAL SPECIALTIES LIMITED 166

11.2.2 MERIT MEDICAL SYSTEMS, INC. 167

11.2.3 MEDICAL COMPONENTS, INC. 168

11.2.4 AMECATH 169

11.2.5 ARGON MEDICAL DEVICES 170

11.2.6 HEALTH LINE INTERNATIONAL CORPORATION 171

11.2.7 DELTA MED 172

11.2.8 ACCESS VASCULAR, INC. 173

11.2.9 PAKUMEDMEDICAL PRODUCTS GMBH 174

11.2.10 GUANGDONG BAIHE MEDICAL TECHNOLOGY CO., LTD. 175

11.2.11 PFM MEDICAL 176

11.2.12 POLY MEDICURE LTD 177

11.2.13 NEWTECH MEDICAL DEVICES PVT. LTD. 178

11.2.14 SHANGHAI PUYI MEDICAL INSTRUMENTS CO., LTD. 179

11.2.15 ANGIPLAST PRIVATE LIMITED 180

12 APPENDIX 181

12.1 DISCUSSION GUIDE 181

12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 186

12.3 CUSTOMIZATION OPTIONS 188

12.4 RELATED REPORTS 188

12.5 AUTHOR DETAILS 189

LIST OF TABLES

TABLE 1 STANDARD CURRENCY CONVERSION RATES 21

TABLE 2 IMPORT DATA FOR HS CODE 901839-COMPLIANT PRODUCTS, BY COUNTRY, 2019–2024 (USD THOUSAND) 49

TABLE 3 EXPORT DATA FOR HS CODE 901839-COMPLIANT PRODUCTS,

BY COUNTRY, 2019–2024 (USD THOUSAND) 50

TABLE 4 PORTER’S FIVE FORCES ANALYSIS 50

TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR

TOP THREE TYPES 53

TABLE 6 KEY BUYING CRITERIA FOR TOP THREE TYPES 53

TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 56

TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 57

TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 57

TABLE 10 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 58

TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 58

TABLE 12 AVERAGE SELLING PRICE TREND, BY KEY PLAYERS, 2022–2024 (USD) 60

TABLE 13 AVERAGE SELLING PRICE TREND, BY REGION, 2022–2024 (USD) 61

TABLE 14 KEY CONFERENCES AND EVENTS, 2025–2026 62

TABLE 15 UNMET NEEDS/END USER EXPECTATIONS 64

TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES 68

TABLE 17 KEY PRODUCT-RELATED TARIFF EFFECTIVE FOR VASCULAR ACCESS DEVICES 69

TABLE 18 PEDIATRIC VASCULAR ACCESS MARKET, BY TYPE,

2023–2030 (USD MILLION) 72

TABLE 19 PEDIATRIC VASCULAR ACCESS MARKET FOR CATHETERS,

BY REGION, 2023–2030 (THOUSAND UNITS) 73

TABLE 20 PEDIATRIC VASCULAR ACCESS MARKET FOR CATHETERS,

BY TYPE, 2023–2030 (USD MILLION) 73

TABLE 21 PEDIATRIC VASCULAR ACCESS MARKET FOR CENTRAL VENOUS CATHETERS,

BY REGION, 2023–2030 (USD MILLION) 74

TABLE 22 PEDIATRIC VASCULAR ACCESS MARKET FOR PERIPHERAL INTRAVENOUS CATHETERS, BY REGION, 2023–2030 (USD MILLION) 75

TABLE 23 PEDIATRIC VASCULAR ACCESS MARKET FOR PERIPHERALLY INSERTED CENTRAL CATHETERS, BY REGION, 2023–2030 (USD MILLION) 75

TABLE 24 PEDIATRIC VASCULAR ACCESS MARKET FOR MIDLINE CATHETERS, BY REGION, 2023–2030 (USD MILLION) 77

TABLE 25 PEDIATRIC VASCULAR ACCESS MARKET FOR CATHETER SECUREMENT & STABILIZATION, BY REGION, 2023–2030 (USD MILLION) 78

TABLE 26 PEDIATRIC VASCULAR ACCESS MARKET FOR IMPLANTABLE PORTS, BY REGION, 2023–2030 (USD MILLION) 79

TABLE 27 PEDIATRIC VASCULAR ACCESS MARKET FOR PORT NEEDLES,

BY REGION, 2023–2030 (USD MILLION) 79

TABLE 28 PEDIATRIC VASCULAR ACCESS MARKET FOR INFUSION PUMPS, BY REGION, 2023–2030 (USD MILLION) 80

TABLE 29 PEDIATRIC VASCULAR ACCESS MARKET FOR IV CONNECTORS,

BY REGION, 2023–2030 (USD MILLION) 81

TABLE 30 PEDIATRIC VASCULAR ACCESS MARKET FOR SYRINGES & NEEDLES, BY REGION, 2023–2030 (USD MILLION) 81

TABLE 31 PEDIATRIC VASCULAR ACCESS MARKET FOR VASCULAR CLOSURE DEVICES, BY REGION, 2023–2030 (USD MILLION) 82

TABLE 32 PEDIATRIC VASCULAR ACCESS MARKET FOR IV SETS & ACCESSORIES, BY REGION, 2023–2030 (USD MILLION) 83

TABLE 33 PEDIATRIC VASCULAR ACCESS MARKET FOR ANESTHESIA INJECTION DEVICES, BY REGION, 2023–2030 (USD MILLION) 83

TABLE 34 PEDIATRIC VASCULAR ACCESS MARKET FOR GUIDANCE DEVICES, BY REGION, 2023–2030 (USD MILLION) 84

TABLE 35 PEDIATRIC VASCULAR ACCESS MARKET FOR CATHETER CAPS & CLOSURES, BY REGION, 2023–2030 (USD MILLION) 84

TABLE 36 PEDIATRIC VASCULAR ACCESS MARKET FOR INTRAOSSEOUS INFUSION DEVICES, BY REGION, 2023–2030 (USD MILLION) 86

TABLE 37 PEDIATRIC VASCULAR ACCESS MARKET FOR OTHER TYPES,

BY REGION, 2023–2030 (USD MILLION) 86

TABLE 38 PEDIATRIC VASCULAR ACCESS MARKET, BY APPLICATION,

2023–2030 (USD MILLION) 88

TABLE 39 PEDIATRIC VASCULAR ACCESS MARKET, BY END USER,

2023–2030 (USD MILLION) 91

TABLE 40 PEDIATRIC VASCULAR ACCESS MARKET, BY REGION,

2023–2030 (USD MILLION) 95

TABLE 41 NORTH AMERICA: PEDIATRIC VASCULAR ACCESS MARKET,

BY COUNTRY, 2023–2030 (USD MILLION) 96

TABLE 42 US: KEY MACRO INDICATORS 97

TABLE 43 CANADA: KEY MACRO INDICATORS 98

TABLE 44 ASIA PACIFIC: PEDIATRIC VASCULAR ACCESS MARKET,

BY COUNTRY, 2023–2030 (USD MILLION) 100

TABLE 45 JAPAN: KEY MACRO INDICATORS 100

TABLE 46 CHINA: KEY MACRO INDICATORS 101

TABLE 47 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2024 102

TABLE 48 PEDIATRIC VASCULAR ACCESS MARKET:

DEGREE OF COMPETITION 105

TABLE 49 REGION FOOTPRINT 109

TABLE 50 TYPE FOOTPRINT 110

TABLE 51 APPLICATION FOOTPRINT 112

TABLE 52 END USER FOOTPRINT 113

TABLE 53 LIST OF START-UPS/SMES 116

TABLE 54 COMPETITIVE BENCHMARKING OF START-UPS/SMES 116

TABLE 55 PEDIATRIC VASCULAR ACCESS MARKET: PRODUCT LAUNCHES & APPROVALS, 2022–2025 119

TABLE 56 PEDIATRIC VASCULAR ACCESS MARKET: DEALS, 2022–2025 120

TABLE 57 PEDIATRIC VASCULAR ACCESS MARKET:

OTHER DEVELOPMENTS, 2022–2025 121

TABLE 58 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW 122

TABLE 59 BECTON, DICKINSON AND COMPANY: PRODUCTS OFFERED 123

TABLE 60 TELEFLEX INCORPORATED: COMPANY OVERVIEW 130

TABLE 61 TELEFLEX INCORPORATED: PRODUCTS OFFERED 131

TABLE 62 TELEFLEX INCORPORATED: PRODUCT LAUNCHES & APPROVALS 134

TABLE 63 TELEFLEX INCORPORATED, INC:. DEALS 135

TABLE 64 TELEFLEX INCORPORATED: OTHER DEVELOPMENTS 135

TABLE 65 ICU MEDICAL, INC.: COMPANY OVERVIEW 137

TABLE 66 ICU MEDICAL, INC.: PRODUCTS OFFERED 138

TABLE 67 ICU MEDICAL, INC.: DEALS 142

TABLE 68 B. BRAUN SE: COMPANY OVERVIEW 143

TABLE 69 B. BRAUN SE: PRODUCTS OFFERED 144

TABLE 70 B. BRAUN SE: PRODUCT LAUNCHES & APPROVALS 149

TABLE 71 B. BRAUN SE: DEALS 149

TABLE 72 TERUMO CORPORATION: COMPANY OVERVIEW 151

TABLE 73 TERUMO CORPORATION: PRODUCTS OFFERED 152

TABLE 74 MEDTRONIC: COMPANY OVERVIEW 154

TABLE 75 MEDTRONIC: PRODUCTS OFFERED 155

TABLE 76 VYGON: COMPANY OVERVIEW 156

TABLE 77 VYGON: PRODUCTS OFFERED 156

TABLE 78 NIPRO CORPORATION: COMPANY OVERVIEW 159

TABLE 79 NIPRO CORPORATION: PRODUCTS OFFERED 161

TABLE 80 ANGIODYNAMICS: COMPANY OVERVIEW 162

TABLE 81 ANGIODYNAMICS: PRODUCTS OFFERED 163

TABLE 82 ANGIODYNAMICS: PRODUCT LAUNCHES & APPROVALS 164

TABLE 83 ANGIODYNAMICS: DEALS 164

TABLE 84 COOK MEDICAL: COMPANY OVERVIEW 165

TABLE 85 COOK MEDICAL: PRODUCTS OFFERED 165

LIST OF FIGURES

FIGURE 1 PEDIATRIC VASCULAR ACCESS MARKET SEGMENTATION 19

FIGURE 2 RESEARCH DESIGN 22

FIGURE 3 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS 27

FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH 28

FIGURE 5 MARKET SIZE ESTIMATION: DEMAND-SIDE ANALYSIS 29

FIGURE 6 IMPACT ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES 30

FIGURE 7 PEDIATRIC VASCULAR ACCESS MARKET: CAGR PROJECTIONS 30

FIGURE 8 DATA TRIANGULATION 32

FIGURE 9 CATHETERS TO BE LARGEST SEGMENT DURING FORECAST PERIOD 35

FIGURE 10 FLUID & NUTRITION ADMINISTRATION SEGMENT TO SECURE LEADING POSITION DURING FORECAST PERIOD 36

FIGURE 11 HOSPITALS TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD 37

FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR VASCULAR

ACCESS DEVICES DURING FORECAST PERIOD 38

FIGURE 13 RISE OF PEDIATRIC POPULATION TO DRIVE MARKET 39

FIGURE 14 NORTH AMERICA TO BE DOMINANT DURING FORECAST PERIOD 40

FIGURE 15 PEDIATRIC VASCULAR ACCESS MARKET DYNAMICS 41

FIGURE 16 VALUE CHAIN ANALYSIS 46

FIGURE 17 ECOSYSTEM ANALYSIS 47

FIGURE 18 SUPPLY CHAIN ANALYSIS 48

FIGURE 19 PORTER’S FIVE FORCES ANALYSIS 51

FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE TYPES 53

FIGURE 21 KEY BUYING CRITERIA FOR TOP THREE TYPES 53

FIGURE 22 PATENT ANALYSIS, 2014−2024 59

FIGURE 23 TOP APPLICANT REGIONS, 2014−2025 60

FIGURE 24 AVERAGE SELLING PRICE TREND OF CENTRAL VENOUS CATHETERS, BY REGION, 2022–2024 (USD) 61

FIGURE 25 VASCULAR ACCESS DEVICE MARKET OVERVIEW 63

FIGURE 26 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS 65

FIGURE 27 INVESTMENT AND FUNDING SCENARIO, 2019–2023 65

FIGURE 28 IMPACT OF AI/GEN AI 67

FIGURE 29 PEDIATRIC VASCULAR ACCESS MARKET, BY REGION 94

FIGURE 30 NORTH AMERICA: PEDIATRIC VASCULAR ACCESS

DEVICE MARKET SNAPSHOT 96

FIGURE 31 ASIA PACIFIC: PEDIATRIC VASCULAR ACCESS MARKET SNAPSHOT 99

FIGURE 32 REVENUE ANALYSIS OF TOP THREE PLAYERS, 2022–2024 104

FIGURE 33 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024 104

FIGURE 34 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024 107

FIGURE 35 COMPANY FOOTPRINT 108

FIGURE 36 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024 115

FIGURE 37 EV/EBITDA OF KEY VENDORS 117

FIGURE 38 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK

BETA OF KEY VENDORS 117

FIGURE 39 BRAND/PRODUCT COMPARISON 118

FIGURE 40 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT 123

FIGURE 41 TELEFLEX INCORPORATED: COMPANY SNAPSHOT 131

FIGURE 42 ICU MEDICAL, INC.: COMPANY SNAPSHOT 138

FIGURE 43 B. BRAUN SE: COMPANY SNAPSHOT 144

FIGURE 44 TERUMO CORPORATION: COMPANY SNAPSHOT 152

FIGURE 45 MEDTRONIC: COMPANY SNAPSHOT 155

FIGURE 46 NIPRO CORPORATION: COMPANY SNAPSHOT 160

FIGURE 47 ANGIODYNAMICS: COMPANY SNAPSHOT 163