Dental Laboratories Market - Global Forecast to 2030

Dental Laboratories Market By Practice (Orthodontics), Product [Material (Metal Ceramic, Glass Ceramic), Equipment (CAD/CAM System), Software (Lab management)], Technology (Digital), and Consumer (Dental Hospitals, DSOs) - Global Forecast to 2030

歯科技工所市場 -診療(矯正歯科)、製品 [材料(金属セラミック、ガラスセラミック)、機器(CAD/CAMシステム)、ソフトウェア(ラボ管理) ]、技術(デジタル)、消費者(歯科医院、DSO) - 2030年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2025年12月 |

| ページ数 | 355 |

| 図表数 | 436 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-13772 |

世界の歯科技工所市場は、予測期間中に年平均成長率7.3%で成長し、2025年の92億米ドルから2030年には130億9000万米ドルに達すると予測されています。

歯科技工所市場は、人口動態、臨床、そして技術といった様々な要因の複合的な牽引役となり、大幅な成長が見込まれています。歯科疾患の増加、世界的な人口高齢化の急速な進展、そして審美歯科および修復歯科への意識の高まりは、歯科技工所で製作される歯科ソリューションの需要を牽引しています。デジタル歯科ワークフロー、CAD/CAMシステム、3Dプリンティング、AI対応設計ソフトウェアといった技術の進歩は、生産精度、納期、そしてカスタマイズ能力を大幅に向上させ、歯科技工所における導入の加速につながっています。さらに、口腔衛生の向上、歯科インフラの整備、そして民間およびDSO主導の医療へのアクセス向上を目指した政府の支援策も、市場拡大の牽引役となっています。これらの傾向は、今後数年間、先進国と新興国の両方で力強い成長の勢いを維持すると予想されます。

調査範囲

本レポートは、歯科技工所市場の分析を提供し、製品、診療方法、技術、地域、消費者タイプなど、様々なセグメントにおける市場規模と将来の成長可能性の推定に重点を置いています。さらに、主要企業の競合分析も掲載しており、企業概要、製品・サービス内容、最近の動向、主要な市場戦略を詳細に解説しています。

レポートを購入する理由

本レポートは、歯科技工業界におけるマーケットリーダーと新規参入企業にとって貴重な洞察を提供し、市場全体とそのサブセグメントの概算収益数値を示しています。本レポートは、関係者が競争環境を理解し、事業のポジショニングを改善し、効果的な市場開拓戦略を策定するのに役立ちます。さらに、主要な市場推進要因、制約要因、課題、そして機会を浮き彫りにしており、関係者が市場の現状を評価するのに役立ちます。

本レポートでは、以下の点について洞察を提供します。

主要な推進要因(齲蝕症例の増加とそれに伴う歯の修復処置の増加、歯科技工所への製造機能のアウトソーシングの増加、CAD/CAMへの投資の増加、そして技術的に高度なソリューションの開発)、制約要因(歯科機器・材料の高コスト、手術費用の上昇、そして保険償還へのアクセスの欠如)、機会(歯科サービス組織の急速な成長、新興国への注目の高まり、そして可処分所得の増加)、そして課題(主要市場プレーヤーが直面する価格圧力、そして熟練した歯科技工士の不足)の分析。

- 市場浸透:世界の歯科技工所市場における主要企業が提供する製品ポートフォリオに関する詳細な情報を提供します。本レポートは、製品、診療分野、技術、地域、消費者タイプなど、様々なセグメントを網羅しています。

- 製品の強化/イノベーション:世界の歯科技工所市場における新製品の発売と予想されるトレンドに関する包括的な詳細情報を提供します。

- 市場開発:製品、診療分野、技術、地域、消費者タイプ別に、収益性の高い成長市場に関する詳細な知識と分析を提供します。

- 市場の多様化:世界の歯科技工所市場における新製品、拡大市場、現在の進歩、投資に関する包括的な情報を提供します。

- 競合評価:世界の歯科技工所市場における主要競合他社の市場シェア、成長計画、製品・サービスの提供、および能力に関する徹底的な評価を提供します。

Report Description

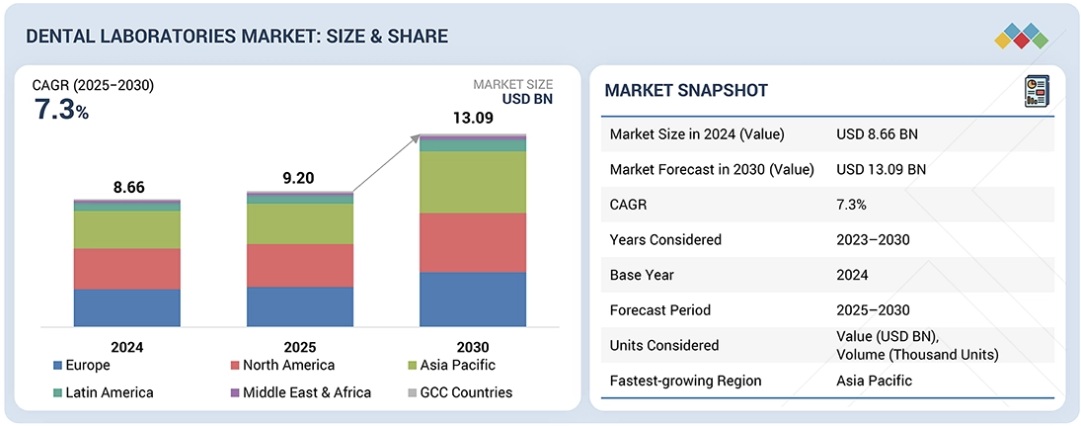

The global dental laboratories market is projected to reach USD 13.09 billion by 2030 from USD 9.20 billion in 2025, at a CAGR of 7.3% during the forecast period.

Dental Laboratories Market – Global Forecast to 2030

The dental laboratories market is poised for significant growth, driven by a combination of demographic, clinical, and technological factors. The increasing prevalence of dental disorders, the rapidly aging global population, and growing awareness of aesthetic and restorative dentistry are fueling the demand for laboratory-fabricated dental solutions. Technological advancements, such as digital dentistry workflows, CAD/CAM systems, 3D printing, and AI-enabled design software, have greatly improved production accuracy, turnaround times, and customization capabilities, leading to faster adoption by dental laboratories. Additionally, supportive government initiatives aimed at improving oral health, better dental infrastructure, and enhanced access to private and DSO-led care are all contributing to market expansion. These trends are expected to sustain strong growth momentum in both developed and emerging economies in the coming years.

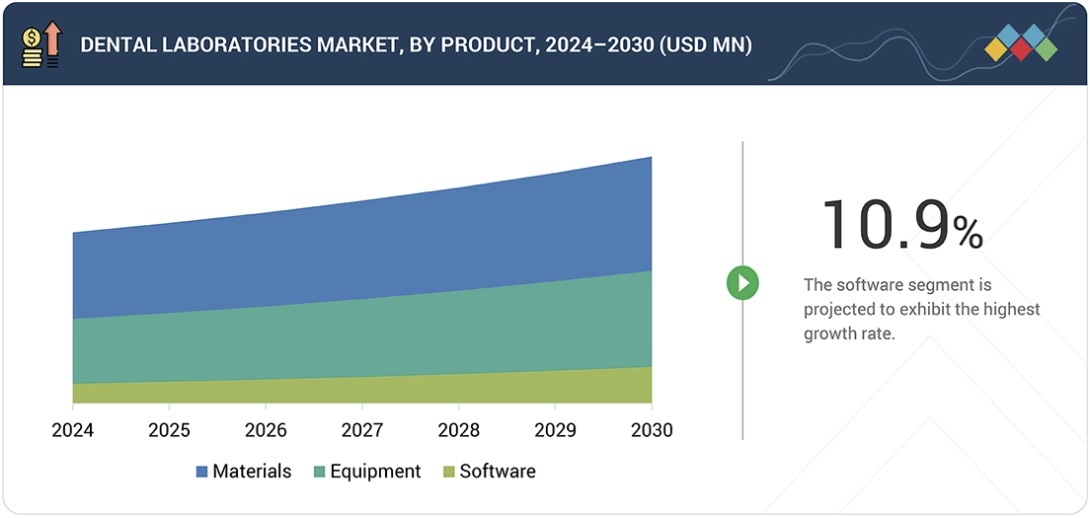

Based on product, the materials segment accounted for the largest share of the dental laboratories market in 2024.

Based on product, the global dental laboratories market is divided into materials, equipment, and software. Among these segments, the materials segment holds the largest share due to the frequent and ongoing use of restorative and prosthetic materials in daily laboratory operations. There is a continuous demand for ceramics, metals, polymers, and resin-based materials across various dental procedures. This demand is driven by increasing case volumes and a growing focus on aesthetic dentistry. Furthermore, the need for regular restocking, shorter product life cycles, and the expansion of applications in both traditional and digital workflows contribute to the dominance of the materials segment.

Based on materials, the CAD/CAM materials segment accounted for the largest share of the dental laboratories market in 2024.

Based on materials, the global dental laboratories market is divided into metal-ceramics, traditional all-ceramics, CAD/CAM materials, plastics, metals, and processing materials. Among these, the CAD/CAM materials segment holds the largest market share. This is primarily due to the widespread adoption of digital workflows and the growing demand for precise, millable restorative solutions. CAD/CAM materials offer consistent quality, faster turnaround times, and a superior fit compared to traditionally fabricated restorations. The increased use of zirconia, glass ceramics, and lithium disilicate in crowns, bridges, and implant restorations further contributes to the growth of this segment. Additionally, the expansion of chairside and lab-side CAD/CAM systems has accelerated the transition toward digitally compatible materials, reinforcing the position of CAD/CAM materials as the leading category in the dental laboratories market.

Dental Laboratories Market – Global Forecast to 2030 – region

North America registered the largest share of the dental laboratories market in 2024.

The global market for dental laboratories is divided into six main regions: North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and the GCC Countries.

North America holds the largest share of the global dental laboratories market. This is driven by its advanced dental healthcare infrastructure, high awareness of oral health and aesthetics, and strong adoption of digital dentistry technologies. The region benefits from the widespread adoption of CAD/CAM systems, intraoral scanners, and 3D printing solutions, all of which are supported by favorable reimbursement policies and a well-established private dental care system. Additionally, North America’s dominant position is further reinforced by the strong presence of leading dental technology and materials companies, continuous product innovation, and strategic collaborations between dental service providers and manufacturers. Factors such as rising dental expenditures, an aging population in need of restorative and prosthetic solutions, and the rapid integration of AI-enabled and connected digital workflows continue to support sustained market growth throughout the region.

A breakdown of the primary participants (supply side) for the dental laboratories market referred to in this report is provided below:

- By Company Type: Tier 1 (30%), Tier 2 (35%), and Tier 3 (35%)

- By Designation: C-level Executives (20%), Director-level Executives (35%), and Others (45%)

- By Region: North America (30%), Europe (25%), Asia Pacific (20%), Latin America (20%), the Middle East & Africa (2%), and the GCC Countries (3%)

Prominent players in the dental laboratories market are Dentsply Sirona (US), Envista (US), Solventum (US), Ivoclar Vivadent AG (Liechtenstein), Planmeca Oy (Finland), GC Corporation (Japan), Mitsui Chemicals, Inc. (Japan), Kuraray Noritake Dental, Inc. (Japan), VOCO GmbH (Germany), Amann Girrbach AG (Austria), BEGO GmbH & Co. KG (Germany), Schütz Dental GmbH (Germany), Institut Straumann AG (Switzerland), VITA Zahnfabrik H. Rauter GmbH & Co. KG (US), Coltene Group (Switzerland), Shofu Inc. (Japan), 3D Systems, Inc. (US), Stratasys (US & Israel), Nakanishi Inc. (Japan), A-dec Inc. (US), Zirkonzahn (Italy), Smart Dent (Brazil), 3Shape A/S (Denmark), SHINING 3D (China), and Exocad (Germany).

Dental Laboratories Market – Global Forecast to 2030 – ecosystem

Research Coverage

The report provides an analysis of the dental laboratories market, focusing on estimating the market size and potential for future growth across various segments, including products, practices, technologies, regions, and consumer types. Additionally, the report features a competitive analysis of the key players in the market, detailing their company profiles, product & service offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report provides valuable insights for market leaders and new entrants in the dental laboratories industry, offering approximate revenue figures for the overall market and its subsegments. It helps stakeholders understand the competitive landscape, enabling them to better position their businesses and develop effective go-to-market strategies. Additionally, the report highlights key market drivers, restraints, challenges, and opportunities, enabling stakeholders to assess the current state of the market.

This report provides insights into the following pointers:

Analysis of key drivers (rising cases of dental caries and subsequent increase in tooth repair procedures, increasing outsourcing of manufacturing functions to dental laboratories, increasing outsourcing of manufacturing functions to dental laboratories, increasing number of dental laboratories investing in CAD/CAM, and development of technologically advanced solutions), restraints (high cost of dental equipment and materials and increasing surgical costs and lack of access to reimbursement), opportunities (rapid growth of dental service organizations and growing focus on emerging economies and rising disposable income levels), and challenges (pricing pressure faced by prominent market players and dearth of skilled lab professionals).

- Market Penetration: It provides detailed information on the product portfolios offered by major players in the global dental laboratories market. The report covers various segments, including product, practice, technology, region, and consumer type.

- Product Enhancement/Innovation: Comprehensive details about new product launches and anticipated trends in the global dental laboratories market.

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product, practice, technology, region, and consumer type.

- Market Diversification: Comprehensive information about newly launched products, expanding markets, current advancements, and investments in the global dental laboratories market.

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings of products and services, and capacities of the major competitors in the global dental laboratories market.

Table of Contents

1 INTRODUCTION 32

1.1 STUDY OBJECTIVES 32

1.2 MARKET DEFINITION 32

1.2.1 INCLUSIONS & EXCLUSIONS 33

1.3 STUDY SCOPE 34

1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE 34

1.3.2 YEARS CONSIDERED 35

1.3.3 CURRENCY CONSIDERED 35

1.4 SUMMARY OF CHANGES 36

2 EXECUTIVE SUMMARY 37

2.1 KEY INSIGHTS & MARKET HIGHLIGHTS 37

2.2 KEY MARKET PARTICIPANTS: INSIGHTS AND DEVELOPMENTS 38

2.3 DISRUPTIVE TRENDS SHAPING MARKET GROWTH 39

2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS 40

2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST 41

3 PREMIUM INSIGHTS 42

3.1 DENTAL LABORATORIES MARKET OVERVIEW 42

3.2 DENTAL LABORATORIES MARKET, BY REGION, 2025 VS. 2030 (USD MILLION) 43

3.3 DENTAL LABORATORIES MARKET, BY PRODUCT AND COUNTRY, 2024 (USD MILLION) 44

3.4 GEOGRAPHIC SNAPSHOT OF DENTAL LABORATORIES MARKET 45

3.5 DENTAL LABORATORIES MARKET: DEVELOPED VS. EMERGING MARKETS 45

4 MARKET OVERVIEW 46

4.1 INTRODUCTION 46

4.2 MARKET DYNAMICS 46

4.2.1 DRIVERS 47

4.2.1.1 Rising cases of dental caries and increase in tooth repair procedures 47

4.2.1.2 Increasing outsourcing of manufacturing functions to dental laboratories 49

4.2.1.3 Increasing number of dental laboratories investing in CAD/CAM 49

4.2.1.4 Development of technologically advanced solutions 50

4.2.2 RESTRAINTS 51

4.2.2.1 High cost of dental equipment and materials 51

4.2.2.2 Increasing surgical costs and lack of access to reimbursement 52

4.2.3 OPPORTUNITIES 53

4.2.3.1 Rapid growth of dental service organizations 53

4.2.3.2 Growing focus on emerging economies and rising disposable

income levels 53

4.2.4 CHALLENGES 54

4.2.4.1 Pricing pressure faced by prominent market players 54

4.2.4.2 Dearth of skilled lab professionals 54

4.3 UNMET NEEDS & WHITE SPACES 55

4.3.1 UNMET NEEDS 55

4.3.2 WHITE SPACE OPPORTUNITIES 55

4.4 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES 56

4.4.1 INTERCONNECTED MARKETS 56

4.4.2 CROSS-SECTOR OPPORTUNITIES 56

4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 57

5 INDUSTRY TRENDS 58

5.1 PORTER’S FIVE FORCES ANALYSIS 58

5.1.1 THREAT OF NEW ENTRANTS 59

5.1.2 INTENSITY OF COMPETITIVE RIVALRY 59

5.1.3 BARGAINING POWER OF BUYERS 59

5.1.4 BARGAINING POWER OF SUPPLIERS 60

5.1.5 THREAT OF SUBSTITUTES 60

5.2 MACROECONOMICS OUTLOOK 60

5.2.1 INTRODUCTION 60

5.2.2 GDP TRENDS AND FORECAST 61

5.2.3 TRENDS IN DENTAL CONSUMABLES INDUSTRY 62

5.2.4 TRENDS IN GLOBAL DENTAL IMPLANTS & PROSTHETICS INDUSTRY 63

5.3 SUPPLY CHAIN ANALYSIS 64

5.4 VALUE CHAIN ANALYSIS 65

5.5 ECOSYSTEM ANALYSIS 66

5.5.1 ROLE IN ECOSYSTEM 67

5.6 PRICING ANALYSIS 68

5.6.1 AVERAGE SELLING PRICE OF DENTAL LABORATORY EQUIPMENT,

BY KEY PLAYER, 2024 68

5.6.2 AVERAGE SELLING PRICE TREND OF DENTAL LABORATORY EQUIPMENT,

BY REGION, 2022–2024 68

5.7 TRADE ANALYSIS 69

5.7.1 IMPORT DATA FOR HS CODE: 9021, 2020–2024 69

5.7.2 EXPORT DATA FOR HS CODE: 9021, 2020–2024 70

5.8 KEY CONFERENCES & EVENTS, 2025–2026 70

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS 71

5.10 INVESTMENT & FUNDING SCENARIO 72

5.11 CASE STUDY ANALYSIS 72

5.11.1 STRATASYS TRUEDENT WITH ROBERT DENTAL LABORATORY TO SCALE DIGITAL DENTURE PRODUCTION WITH FASTER TURNAROUND AND SUPERIOR PRECISION 72

5.11.2 DANTECH DENTAL LAB TO ADOPT INTEGRATED CIMSYSTEM MILLBOX WORKFLOW TO BOOST PRECISION, EFFICIENCY, AND DIGITAL MANUFACTURING CAPABILITIES 73

5.11.3 ADT TO BOOST DENTAL PRODUCTION CAPACITY SEVENFOLD AND REDUCE LABOR WITH STRATASYS J3 DENTAJET 3D PRINTING 73

5.12 IMPACT OF 2025 US TARIFF ON DENTAL LABORATORIES MARKET 74

5.12.1 INTRODUCTION 74

5.12.2 KEY TARIFF RATES 75

5.12.3 PRICE IMPACT ANALYSIS 75

5.12.4 IMPACT ON REGION 76

5.12.4.1 North America 76

5.12.4.1.1 US 76

5.12.4.2 Europe 76

5.12.4.3 Asia Pacific 77

5.12.5 IMPACT ON END-USE INDUSTRIES 77

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS,

AND INNOVATIONS 78

6.1 KEY EMERGING TECHNOLOGIES 78

6.2 COMPLEMENTARY TECHNOLOGIES 78

6.2.1 CONE BEAM COMPUTED TOMOGRAPHY (CBCT) 78

6.3 TECHNOLOGY/PRODUCT ROADMAP 79

6.3.1 SHORT-TERM (2025-2027) | FOUNDATION & EARLY COMMERCIALIZATION 79

6.3.2 MID-TERM (2027-2030) | EXPANSION & STANDARDIZATION 79

6.3.3 LONG-TERM (2030-2035+) | MASS COMMERCIALIZATION & DISRUPTION 80

6.4 PATENT ANALYSIS 80

6.4.1 PATENT PUBLICATION TRENDS FOR DENTAL LABORATORIES MARKET 80

6.4.2 TOP APPLICANTS (COMPANIES) OF DENTAL LABORATORY PATENTS 81

6.4.3 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS IN DENTAL LABORATORIES MARKET 82

6.4.4 LIST OF MAJOR PATENTS 82

6.5 IMPACT OF AI/GEN AI ON DENTAL LABORATORIES MARKET 83

6.5.1 TOP USE CASES AND MARKET POTENTIAL 84

6.5.2 TOP CASE STUDIES OF GEN AI IMPLEMENTATION 84

6.5.3 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 85

6.5.4 CLIENTS’ READINESS TO ADOPT GENERATIVE AI 85

6.6 SUCCESS STORIES & REAL-WORLD APPLICATIONS 85

6.6.1 DENTSPLY SIRONA: PRIMESCAN CONNECT TO STREAMLINE DIGITAL IMPRESSION WORKFLOWS 85

6.6.2 STRAUMANN: DIGITAL DENTAL SOLUTIONS TO FOCUS ON AI-ENABLED WORKFLOW AUTOMATION 86

6.6.3 ALIGN TECHNOLOGY: ITERO & EXOCAD TO HAVE SEAMLESS CLINIC-LAB CONNECTIVITY 86

6.6.4 IVOCLAR: PROGAIA PLATFORM TO BUILD SUSTAINABLE AND AUTOMATED PRODUCTION MODEL 86

7 REGULATORY LANDSCAPE 87

7.1 REGIONAL REGULATIONS & COMPLIANCE 87

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 87

7.1.2 INDUSTRY STANDARDS 89

7.1.2.1 North America 89

7.1.2.1.1 US 89

7.1.2.1.2 Canada 90

7.1.2.2 Europe 90

7.1.2.3 Asia Pacific 90

7.1.2.3.1 China 90

7.1.2.3.2 Japan 91

7.1.2.4 Latin America 91

7.1.2.4.1 Brazil 91

7.1.2.4.2 Mexico 91

7.1.2.5 Middle East 92

7.1.2.6 Africa 92

7.2 CERTIFICATIONS, LABELLING, AND ECO-STANDARDS 93

7.2.1 CERTIFICATIONS, LABELLING, AND ECO-STANDARDS IN DENTAL LABORATORIES MARKET 93

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 94

8.1 DECISION-MAKING PROCESS 94

8.2 BUYER STAKEHOLDERS & BUYING EVALUATION CRITERIA 94

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 94

8.2.2 KEY BUYING CRITERIA 95

8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 96

8.4 UNMET NEEDS IN END-USE INDUSTRIES 97

8.5 MARKET PROFITABILITY 97

8.5.1 REVENUE POTENTIAL 97

8.5.2 COST DYNAMICS 97

8.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS 98

9 DENTAL LABORATORIES MARKET, BY PRACTICE 99

9.1 INTRODUCTION 100

9.2 RESTORATIVE 100

9.2.1 SHIFT TOWARDS DIGITALLY MANUFACTURED OPTIONS TO SUPPORT MARKET GROWTH 100

9.3 ORTHODONTICS 101

9.3.1 EXPANSION OF DIGITAL ORTHODONTIC WORKFLOWS TO DRIVE MARKET GROWTH 101

9.4 IMPLANTS 102

9.4.1 EXPANSION OF DIGITAL IMPLANTOLOGY TO PROPEL MARKET GROWTH 102

9.5 PROSTHODONTICS 104

9.5.1 INCREASING ADOPTION OF DIGITAL DENTURE WORKFLOWS TO FUEL ADOPTION OF DENTAL LABORATORY MATERIALS 104

10 DENTAL LABORATORIES MARKET, BY PRODUCT 105

10.1 INTRODUCTION 106

10.2 MATERIALS 106

10.2.1 METAL CERAMICS 108

10.2.1.1 Established clinical success for restoring damaged or missing teeth to drive growth 108

10.2.2 TRADITIONAL ALL-CERAMICS 109

10.2.2.1 Excellent aesthetic properties to propel segment growth 109

10.2.3 CAD/CAM MATERIALS 111

10.2.4 ZIRCONIA 113

10.2.4.1 Zirconia to hold largest share of CAD/CAM materials segment 113

10.2.5 GLASS CERAMICS 114

10.2.5.1 Focus on production of stronger and tougher materials to aid

market growth 114

10.2.6 LITHIUM DISILICATE 115

10.2.6.1 Popularity for usage in dental restorations in anterior and premolar regions to drive growth 115

10.2.7 OTHER CAD/CAM MATERIALS 116

10.2.8 PLASTICS 118

10.2.8.1 High resistance and flexibility of thermoplastics to support

market growth 118

10.2.9 METALS 120

10.2.9.1 Anti-leakage properties to augment use of metals in dentistry 120

10.2.10 PROCESSING MATERIALS 121

10.2.10.1 Focus on dental laboratory fabrication workflows to drive usage 121

10.3 EQUIPMENT 123

10.3.1 3D PRINTING SYSTEMS 125

10.3.1.1 Need for rapid and cost-efficient fabrication of dental consumables to drive popularity 125

10.3.2 INTEGRATED CAD/CAM SYSTEMS 127

10.3.2.1 Increasing adoption of CAD/CAM systems in dental laboratories to spur market growth 127

10.3.3 CASTING MACHINES 129

10.3.3.1 Continued use of metal-based restorations in cost-sensitive markets to sustain market demand 129

10.3.4 MILLING EQUIPMENT 131

10.3.4.1 Rapid adoption of CAD/CAM workflows results to provide sustained growth 131

10.3.5 FURNACES 133

10.3.5.1 Technological innovations in dental furnaces to ensure sustained end-use demand 133

10.3.6 ARTICULATORS 134

10.3.6.1 Lower cost of articulators to fuel market demand 134

10.3.7 SCANNERS 136

10.3.7.1 Rising demand for digital dental products and increasing need for faster treatment options to propel market growth 136

10.3.8 OTHER EQUIPMENT 137

10.4 SOFTWARE 140

10.4.1 LIMS 141

10.4.1.1 Need for end-to-end visibility into laboratory operations to drive popularity 141

10.4.2 CASE MANAGEMENT SYSTEMS 142

10.4.2.1 Increasing demand for seamless clinic–laboratory coordination to aid market growth 142

10.4.3 OTHER SOFTWARE 144

11 DENTAL LABORATORIES MARKET, BY TECHNOLOGY 145

11.1 INTRODUCTION 146

11.2 CONVENTIONAL TECHNOLOGIES 146

11.2.1 LOWER COST AND WIDESPREAD FAMILIARITY AMONG TECHNICIANS TO SUPPORT MARKET GROWTH 146

11.3 DIGITAL TECHNOLOGIES 147

11.3.1 GROWING DEMAND FOR FASTER, HIGHLY PRECISE, AND STANDARDIZED RESTORATIONS TO DRIVE GROWTH 147

12 DENTAL LABORATORIES MARKET, BY CONSUMER TYPE 149

12.1 INTRODUCTION 150

12.2 DENTAL HOSPITALS & CLINICS 150

12.2.1 RISING NUMBER OF DENTAL HOSPITALS & CLINICS IN EMERGING ECONOMIES TO SUPPORT MARKET GROWTH 150

12.3 DENTAL SERVICE ORGANIZATIONS 152

12.3.1 NEED FOR LARGE-SCALE, BULK PURCHASING OF MATERIALS AND EQUIPMENT TO DRIVE SEGMENT 152

12.4 OTHER CONSUMER TYPES 154

13 DENTAL LABORATORIES MARKET, BY REGION 156

13.1 INTRODUCTION 157

13.2 EUROPE 158

13.2.1 MACROECONOMIC OUTLOOK FOR EUROPE 159

13.2.2 GERMANY 163

13.2.2.1 Favorable government reimbursement policies to drive demand for dental prosthetics 163

13.2.3 ITALY 167

13.2.3.1 Rising penetration of dental products and growing focus on privatized dental care system to aid market growth 167

13.2.4 SPAIN 171

13.2.4.1 Presence of well-established dental healthcare infrastructure to propel market growth 171

13.2.5 FRANCE 174

13.2.5.1 Favorable distribution network and greater awareness about dental health to fuel market demand 174

13.2.6 UK 178

13.2.6.1 Increasing demand for dental implant procedures to drive market 178

13.2.7 REST OF EUROPE 181

13.3 NORTH AMERICA 185

13.3.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA 186

13.3.2 US 190

13.3.2.1 High per capita income and high treatment quality to support

market growth 190

13.3.3 CANADA 194

13.3.3.1 Rising healthcare expenditure and increasing public awareness of oral healthcare to fuel market growth 194

13.4 ASIA PACIFIC 199

13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC 199

13.4.2 SOUTH KOREA 204

13.4.2.1 High geriatric population to support market demand for dental treatments 204

13.4.3 JAPAN 208

13.4.3.1 Rising geriatric population and favorable reimbursement scenario to spur market growth 208

13.4.4 CHINA 211

13.4.4.1 Growing prevalence of dental diseases and increasing geriatric population to drive market 211

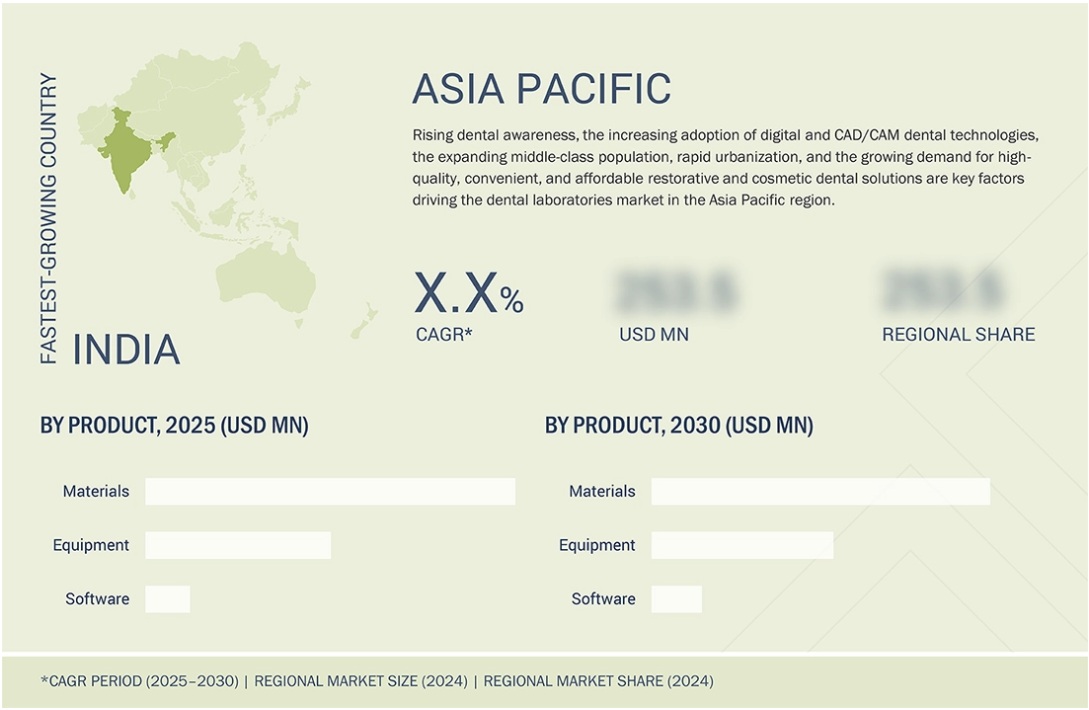

13.4.5 INDIA 215

13.4.5.1 Growing dental tourism and expanding access to dental care to support market growth 215

13.4.6 AUSTRALIA 219

13.4.6.1 Increasing registered dental practitioners to spur market growth 219

13.4.7 REST OF ASIA PACIFIC 224

13.5 LATIN AMERICA 228

13.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA 228

13.5.2 BRAZIL 232

13.5.2.1 Improving access to advanced dental care and rising prevalence of partial edentulism to drive market 232

13.5.3 MEXICO 235

13.5.3.1 Focus on improving healthcare infrastructure and availability of skilled dentists to drive market 235

13.5.4 COLOMBIA 239

13.5.4.1 Lower dental care costs to support market growth 239

13.5.5 REST OF LATIN AMERICA 243

13.6 MIDDLE EAST & AFRICA 246

13.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA 246

13.7 GCC COUNTRIES 251

13.7.1 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES 251

14 COMPETITIVE LANDSCAPE 255

14.1 INTRODUCTION 255

14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 255

14.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN DENTAL

LABORATORIES MARKET 256

14.3 REVENUE ANALYSIS, 2022–2024 256

14.4 MARKET SHARE ANALYSIS, 2024 257

14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 259

14.5.1 STARS 259

14.5.2 EMERGING LEADERS 259

14.5.3 PERVASIVE PLAYERS 259

14.5.4 PARTICIPANTS 259

14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 261

14.5.5.1 Company footprint 261

14.5.5.2 Region footprint 262

14.5.5.3 Product footprint 263

14.5.5.4 Technology footprint 264

14.5.5.5 Consumer type footprint 265

14.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 266

14.6.1 PROGRESSIVE COMPANIES 266

14.6.2 RESPONSIVE COMPANIES 266

14.6.3 DYNAMIC COMPANIES 266

14.6.4 STARTING BLOCKS 266

14.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 268

14.6.5.1 Detailed list of key startups/SMEs 268

14.6.5.2 Competitive benchmarking of key startups/SMEs 268

14.7 COMPANY VALUATION & FINANCIAL METRICS 269

14.7.1 FINANCIAL METRICS 269

14.7.2 COMPANY VALUATION 269

14.8 BRAND/PRODUCT COMPARISON 270

14.9 COMPETITIVE SCENARIO 271

14.9.1 PRODUCT LAUNCHES & UPGRADES 271

14.9.2 DEALS 272

14.9.3 EXPANSIONS 273

15 COMPANY PROFILES 274

15.1 KEY PLAYERS 274

15.1.1 DENTSPLY SIRONA 274

15.1.1.1 Business overview 274

15.1.1.2 Products offered 275

15.1.1.3 Recent developments 279

15.1.1.3.1 Product launches & upgrades 279

15.1.1.3.2 Deals 280

15.1.1.4 MnM view 280

15.1.1.4.1 Right to win 280

15.1.1.4.2 Strategic choices 281

15.1.1.4.3 Weaknesses & competitive threats 281

15.1.2 PLANMECA OY 282

15.1.2.1 Business overview 282

15.1.2.2 Products offered 282

15.1.2.3 Recent developments 283

15.1.2.3.1 Product launches 283

15.1.2.3.2 Expansions 284

15.1.2.4 MnM view 284

15.1.2.4.1 Right to win 284

15.1.2.4.2 Strategic choices 284

15.1.2.4.3 Weaknesses & competitive threats 285

15.1.3 ENVISTA 286

15.1.3.1 Business overview 286

15.1.3.2 Products offered 287

15.1.3.3 Recent developments 288

15.1.3.3.1 Deals 288

15.1.3.4 MnM view 289

15.1.3.4.1 Right to win 289

15.1.3.4.2 Strategic choices 289

15.1.3.4.3 Weaknesses & competitive threats 289

15.1.4 SOLVENTUM 290

15.1.4.1 Business overview 290

15.1.4.2 Products offered 291

15.1.4.3 Recent developments 292

15.1.4.3.1 Product launches 292

15.1.4.3.2 Deals 292

15.1.4.4 MnM view 293

15.1.4.4.1 Right to win 293

15.1.4.4.2 Strategic choices 293

15.1.4.4.3 Weaknesses & competitive threats 293

15.1.5 IVOCLAR VIVADENT 294

15.1.5.1 Business overview 294

15.1.5.2 Products offered 294

15.1.5.3 Recent developments 295

15.1.5.3.1 Product launches 295

15.1.5.3.2 Deals 296

15.1.5.4 MnM view 297

15.1.5.4.1 Right to win 297

15.1.5.4.2 Strategic choices 297

15.1.5.4.3 Weaknesses & competitive threats 297

15.1.6 GC CORPORATION 298

15.1.6.1 Business overview 298

15.1.6.2 Products offered 298

15.1.6.3 Recent developments 300

15.1.6.3.1 Expansions 300

15.1.7 MITSUI CHEMICALS, INC. 301

15.1.7.1 Business overview 301

15.1.7.2 Products offered 302

15.1.7.3 Recent developments 303

15.1.7.3.1 Product launches 303

15.1.7.3.2 Expansions 303

15.1.8 KURARAY NORITAKE DENTAL, INC. 304

15.1.8.1 Business overview 304

15.1.8.2 Products offered 305

15.1.8.3 Recent developments 306

15.1.8.3.1 Expansions 306

15.1.9 VOCO GMBH 307

15.1.9.1 Business overview 307

15.1.9.2 Products offered 307

15.1.9.3 Recent developments 308

15.1.9.3.1 Deals 308

15.1.10 AMANN GIRRBACH AG 309

15.1.10.1 Business overview 309

15.1.10.2 Products offered 309

15.1.10.3 Recent developments 310

15.1.10.3.1 Product launches 310

15.1.10.3.2 Expansions 311

15.1.11 BEGO GMBH & CO. KG 312

15.1.11.1 Business overview 312

15.1.11.2 Products offered 312

15.1.11.3 Recent developments 313

15.1.11.3.1 Deals 313

15.1.12 SCHÜTZ DENTAL GMBH 314

15.1.12.1 Business overview 314

15.1.12.2 Products offered 314

15.1.13 INSTITUT STRAUMANN AG 316

15.1.13.1 Business overview 316

15.1.13.2 Products offered 317

15.1.13.3 Recent developments 318

15.1.13.3.1 Deals 318

15.1.13.3.2 Expansions 319

15.1.14 VITA ZAHNFABRIK H. RAUTER GMBH & CO. KG 320

15.1.14.1 Business overview 320

15.1.14.2 Products offered 320

15.1.15 COLTENE GROUP 321

15.1.15.1 Business overview 321

15.1.15.2 Products offered 322

15.2 OTHER PLAYERS 323

15.2.1 SHOFU INC. 323

15.2.2 3D SYSTEMS, INC. 325

15.2.3 STRATASYS 326

15.2.4 NAKANISHI INC. 327

15.2.5 A-DEC INC. 328

15.2.6 ZIRKONZAHN 329

15.2.7 SMART DENT 330

15.2.8 3SHAPE A/S 331

15.2.9 SHINING 3D 332

15.2.10 EXOCAD 333

16 RESEARCH METHODOLOGY 334

16.1 RESEARCH DATA 334

16.1.1 SECONDARY DATA 335

16.1.1.1 Key secondary sources 335

16.1.1.2 Key data from secondary sources 336

16.1.2 PRIMARY DATA 336

16.1.2.1 Key objectives of primary research 337

16.1.2.2 Key data from primary sources 337

16.1.2.3 Key industry insights 338

16.2 MARKET SIZE ESTIMATION 338

16.2.1 BOTTOM-UP APPROACH 338

16.2.2 TOP-DOWN APPROACH 339

16.2.3 BASE NUMBER ESTIMATION 339

16.2.3.1 Supply-side analysis (revenue share analysis) 339

16.2.3.2 Company presentations and primary interviews 341

16.3 MARKET FORECAST APPROACH 341

16.4 DATA TRIANGULATION 343

16.5 STUDY ASSUMPTIONS 344

16.5.1 MARKET SHARE ASSUMPTIONS 344

16.6 FACTOR ANALYSIS 344

16.7 RISK ASSESSMENT 345

16.8 RESEARCH LIMITATIONS 345

17 APPENDIX 346

17.1 DISCUSSION GUIDE 346

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 351

17.3 CUSTOMIZATION OPTIONS 353

17.4 RELATED REPORTS 353

17.5 AUTHOR DETAILS 354

LIST OF TABLES

TABLE 1 INCLUSIONS & EXCLUSIONS OF DENTAL LABORATORIES MARKET 33

TABLE 2 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD 35

TABLE 3 PROJECTED INCREASE IN ABOVE-65 AGE GROUP, BY REGION, 2019 VS. 2050 48

TABLE 4 TECHNOLOGICAL ADVANCEMENTS IN LAB EQUIPMENT AND

INDIRECT RESTORATIVE MATERIALS 51

TABLE 5 AVERAGE COST OF DENTAL EQUIPMENT (USD) 52

TABLE 6 AVERAGE COST OF DENTAL SURGERIES IN EUROPE AND US (USD) 52

TABLE 7 PER CAPITA NATIONAL INCOME, BY COUNTRY, 2020–2023 (USD) 54

TABLE 8 IMPACT OF PORTER’S FIVE FORCES ON DENTAL LABORATORIES MARKET 58

TABLE 9 GDP PERCENTAGE CHANGE, BY COUNTRY, 2021–2030 61

TABLE 10 DENTAL LABORATORIES MARKET: ROLE IN ECOSYSTEM 67

TABLE 11 AVERAGE SELLING PRICE OF DENTAL LABORATORY EQUIPMENT,

BY KEY PLAYER, 2024 68

TABLE 12 AVERAGE SELLING PRICE TREND OF DENTAL LABORATORY EQUIPMENT,

BY REGION, 2022–2024 (USD) 69

TABLE 13 IMPORT DATA FOR HS CODE: 9021, BY COUNTRY, 2020–2024 (USD THOUSAND) 69

TABLE 14 EXPORT DATA FOR HS CODE: 9021, BY COUNTRY, 2020–2024 (USD THOUSAND) 70

TABLE 15 LIST OF KEY CONFERENCES & EVENTS IN DENTAL LABORATORIES MARKET, JANUARY 2025–DECEMBER 2026 70

TABLE 16 CASE STUDY 1: STRATASYS TRUEDENT WITH ROBERT DENTAL LABORATORY

TO SCALE DIGITAL DENTURE PRODUCTION WITH FASTER TURNAROUND

AND SUPERIOR PRECISION 72

TABLE 17 CASE STUDY 2: DANTECH DENTAL LAB TO ADOPT INTEGRATED CIMSYSTEM MILLBOX WORKFLOW TO BOOST PRECISION, EFFICIENCY, AND DIGITAL MANUFACTURING CAPABILITIES 73

TABLE 18 CASE STUDY 3: ADT TO BOOST DENTAL PRODUCTION CAPACITY SEVENFOLD

AND REDUCE LABOR WITH STRATASYS J3 DENTAJET 3D PRINTING 73

TABLE 19 US-ADJUSTED KEY RECIPROCAL TARIFF RATES 75

TABLE 20 KEY PRODUCT-RELATED TARIFFS EFFECTIVE FOR DENTAL LABORATORY PRODUCTS 75

TABLE 21 LIST OF MAJOR PATENTS IN DENTAL LABORATORIES MARKET 82

TABLE 22 TOP USE CASES AND MARKET POTENTIAL IN DENTAL LABORATORIES MARKET 84

TABLE 23 CASE STUDIES RELATED TO GEN AI IMPLEMENTATION IN DENTAL

LABORATORIES MARKET 84

TABLE 24 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON PLAYERS IN DENTAL LABORATORIES MARKET 85

TABLE 25 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 87

TABLE 26 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 87

TABLE 27 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 88

TABLE 28 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 89

TABLE 29 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 89

TABLE 30 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE DENTAL LABORATORY PRODUCTS 95

TABLE 31 KEY BUYING CRITERIA FOR TOP THREE DENTAL LABORATORY PRODUCTS 95

TABLE 32 ADOPTION BARRIERS & INTERNAL CHALLENGES IN DENTAL

LABORATORIES MARKET 96

TABLE 33 DENTAL LABORATORIES MARKET, BY PRACTICE, 2023–2030 (USD MILLION) 100

TABLE 34 DENTAL LABORATORIES MARKET FOR RESTORATIVE,

BY COUNTRY, 2023–2030 (USD MILLION) 101

TABLE 35 DENTAL LABORATORIES MARKET FOR ORTHODONTICS,

BY COUNTRY, 2023–2030 (USD MILLION) 102

TABLE 36 DENTAL LABORATORIES MARKET FOR IMPLANTS,

BY COUNTRY, 2023–2030 (USD MILLION) 103

TABLE 37 DENTAL LABORATORIES MARKET FOR PROSTHODONTICS,

BY COUNTRY, 2023–2030 (USD MILLION) 104

TABLE 38 DENTAL LABORATORIES MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 106

TABLE 39 DENTAL LABORATORY MATERIALS MARKET, BY TYPE, 2023–2030 (USD MILLION) 106

TABLE 40 DENTAL LABORATORY MATERIALS MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 107

TABLE 41 DENTAL METAL CERAMICS OFFERED BY KEY PLAYERS 108

TABLE 42 DENTAL METAL CERAMICS MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 109

TABLE 43 DENTAL TRADITIONAL ALL-CERAMICS OFFERED BY KEY PLAYERS 110

TABLE 44 DENTAL TRADITIONAL ALL-CERAMICS MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 110

TABLE 45 DENTAL CAD/CAM MATERIALS OFFERED BY KEY PLAYERS 111

TABLE 46 DENTAL CAD/CAM MATERIALS MARKET, BY TYPE, 2023–2030 (USD MILLION) 112

TABLE 47 DENTAL CAD/CAM MATERIALS MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 112

TABLE 48 ZIRCONIA OFFERED BY KEY PLAYERS 113

TABLE 49 ZIRCONIA MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 114

TABLE 50 GLASS CERAMICS MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 115

TABLE 51 LITHIUM DISILICATE MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 116

TABLE 52 OTHER CAD/CAM MATERIALS MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 117

TABLE 53 DENTAL PLASTICS OFFERED BY KEY PLAYERS 118

TABLE 54 DENTAL PLASTICS MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 119

TABLE 55 DENTAL METALS OFFERED BY KEY PLAYERS 120

TABLE 56 DENTAL METALS MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 121

TABLE 57 DENTAL PROCESSING MATERIALS MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 122

TABLE 58 DENTAL EQUIPMENT MARKET, BY TYPE, 2023–2030 (USD MILLION) 123

TABLE 59 DENTAL EQUIPMENT MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 124

TABLE 60 DENTAL 3D PRINTING SYSTEMS OFFERED BY KEY PLAYERS 125

TABLE 61 DENTAL 3D PRINTING SYSTEMS MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 126

TABLE 62 DENTAL 3D PRINTING SYSTEMS MARKET, BY REGION,

2023–2030 (THOUSAND UNITS) 126

TABLE 63 DENTAL INTEGRATED CAD/CAM SYSTEMS OFFERED BY KEY PLAYERS 127

TABLE 64 DENTAL INTEGRATED CAD/CAM SYSTEMS MARKET,

BY COUNTRY, 2023–2030 (USD MILLION) 128

TABLE 65 DENTAL CASTING MACHINES OFFERED BY KEY PLAYERS 129

TABLE 66 DENTAL CASTING MACHINES MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 130

TABLE 67 DENTAL CASTING MACHINES MARKET, BY REGION,

2023–2030 (THOUSAND UNITS) 130

TABLE 68 DENTAL MILLING EQUIPMENT OFFERED BY KEY PLAYERS 131

TABLE 69 DENTAL MILLING EQUIPMENT MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 132

TABLE 70 DENTAL MILLING EQUIPMENT MARKET, BY REGION,

2023–2030 (THOUSAND UNITS) 132

TABLE 71 DENTAL FURNACES OFFERED BY KEY PLAYERS 133

TABLE 72 DENTAL FURNACES MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 134

TABLE 73 DENTAL ARTICULATORS MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 135

TABLE 74 DENTAL SCANNERS OFFERED BY KEY PLAYERS 136

TABLE 75 DENTAL SCANNERS MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 137

TABLE 76 LIGHT-CURING EQUIPMENT OFFERED BY KEY PLAYERS 138

TABLE 77 OTHER DENTAL EQUIPMENT OFFERED BY KEY PLAYERS 138

TABLE 78 OTHER DENTAL EQUIPMENT MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 139

TABLE 79 DENTAL LABORATORY SOFTWARE MARKET, BY TYPE, 2023–2030 (USD MILLION) 140

TABLE 80 DENTAL LABORATORY SOFTWARE MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 141

TABLE 81 DENTAL LIMS MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 142

TABLE 82 DENTAL CASE MANAGEMENT SYSTEMS MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 143

TABLE 83 OTHER DENTAL SOFTWARE MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 144

TABLE 84 DENTAL LABORATORIES MARKET, BY TECHNOLOGY, 2023–2030 (USD MILLION) 146

TABLE 85 DENTAL LABORATORIES MARKET FOR CONVENTIONAL TECHNOLOGIES,

BY COUNTRY, 2023–2030 (USD MILLION) 147

TABLE 86 DENTAL LABORATORIES MARKET FOR DIGITAL TECHNOLOGIES,

BY COUNTRY, 2023–2030 (USD MILLION) 148

TABLE 87 DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 150

TABLE 88 TOP DESTINATIONS FOR COST-EFFECTIVE DENTAL TREATMENT 151

TABLE 89 DENTAL LABORATORIES MARKET FOR DENTAL HOSPITALS & CLINICS,

BY COUNTRY, 2023–2030 (USD MILLION) 152

TABLE 90 US: TOP DENTAL SERVICE ORGANIZATIONS FOR DENTAL PRACTICES 153

TABLE 91 DENTAL LABORATORIES MARKET FOR DENTAL SERVICE ORGANIZATIONS,

BY COUNTRY, 2023–2030 (USD MILLION) 154

TABLE 92 DENTAL LABORATORIES MARKET FOR OTHER CONSUMER TYPES,

BY COUNTRY, 2023–2030 (USD MILLION) 155

TABLE 93 DENTAL LABORATORIES MARKET, BY REGION, 2023–2030 (USD MILLION) 158

TABLE 94 EUROPE: DENTAL LABORATORIES MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 159

TABLE 95 EUROPE: DENTAL LABORATORIES MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 160

TABLE 96 EUROPE: DENTAL LABORATORY MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 160

TABLE 97 EUROPE: DENTAL CAD/CAM MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 160

TABLE 98 EUROPE: DENTAL LABORATORY EQUIPMENT MARKET,

BY TYPE, 2023–2030 (USD MILLION) 161

TABLE 99 EUROPE: DENTAL LABORATORY SOFTWARE MARKET,

BY TYPE, 2023–2030 (USD MILLION) 161

TABLE 100 EUROPE: DENTAL LABORATORIES MARKET, BY PRACTICE,

2023–2030 (USD MILLION) 162

TABLE 101 EUROPE: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 162

TABLE 102 EUROPE: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 162

TABLE 103 TOTAL TURNOVER AND EXPORT IN GERMAN DENTAL INDUSTRY,

2011–2021 (USD BILLION) 163

TABLE 104 GERMANY: KEY MACROINDICATORS 164

TABLE 105 GERMANY: DENTAL LABORATORIES MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 164

TABLE 106 GERMANY: DENTAL LABORATORY MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 164

TABLE 107 GERMANY: DENTAL CAD/CAM MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 165

TABLE 108 GERMANY: DENTAL LABORATORY EQUIPMENT MARKET,

BY TYPE, 2023–2030 (USD MILLION) 165

TABLE 109 GERMANY: DENTAL LABORATORY SOFTWARE MARKET,

BY TYPE, 2023–2030 (USD MILLION) 166

TABLE 110 GERMANY: DENTAL LABORATORIES MARKET, BY PRACTICE,

2023–2030 (USD MILLION) 166

TABLE 111 GERMANY: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 166

TABLE 112 GERMANY: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 167

TABLE 113 ITALY: KEY MACROINDICATORS 168

TABLE 114 ITALY: DENTAL LABORATORIES MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 168

TABLE 115 ITALY: DENTAL LABORATORY MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 168

TABLE 116 ITALY: DENTAL CAD/CAM MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 169

TABLE 117 ITALY: DENTAL LABORATORY EQUIPMENT MARKET, BY TYPE,

2023–2030 (USD MILLION) 169

TABLE 118 ITALY: DENTAL LABORATORY SOFTWARE MARKET, BY TYPE,

2023–2030 (USD MILLION) 169

TABLE 119 ITALY: DENTAL LABORATORIES MARKET, BY PRACTICE, 2023–2030 (USD MILLION) 170

TABLE 120 ITALY: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 170

TABLE 121 ITALY: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 170

TABLE 122 SPAIN: KEY MACROINDICATORS 171

TABLE 123 SPAIN: DENTAL LABORATORIES MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 172

TABLE 124 SPAIN: DENTAL LABORATORY MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 172

TABLE 125 SPAIN: DENTAL CAD/CAM MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 172

TABLE 126 SPAIN: DENTAL LABORATORY EQUIPMENT MARKET, BY TYPE,

2023–2030 (USD MILLION) 173

TABLE 127 SPAIN: DENTAL LABORATORY SOFTWARE MARKET, BY TYPE,

2023–2030 (USD MILLION) 173

TABLE 128 SPAIN: DENTAL LABORATORIES MARKET, BY PRACTICE,

2023–2030 (USD MILLION) 173

TABLE 129 SPAIN: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 174

TABLE 130 SPAIN: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 174

TABLE 131 FRANCE: KEY MACROINDICATORS 175

TABLE 132 FRANCE: DENTAL LABORATORIES MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 175

TABLE 133 FRANCE: DENTAL LABORATORY MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 175

TABLE 134 FRANCE: DENTAL CAD/CAM MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 176

TABLE 135 FRANCE: DENTAL LABORATORY EQUIPMENT MARKET, BY TYPE,

2023–2030 (USD MILLION) 176

TABLE 136 FRANCE: DENTAL LABORATORY SOFTWARE MARKET, BY TYPE,

2023–2030 (USD MILLION) 177

TABLE 137 FRANCE: DENTAL LABORATORIES MARKET, BY PRACTICE,

2023–2030 (USD MILLION) 177

TABLE 138 FRANCE: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 177

TABLE 139 FRANCE: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 178

TABLE 140 UK: KEY MACROINDICATORS 178

TABLE 141 UK: DENTAL LABORATORIES MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 179

TABLE 142 UK: DENTAL LABORATORY MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 179

TABLE 143 UK: DENTAL CAD/CAM MATERIALS MARKET, BY TYPE, 2023–2030 (USD MILLION) 179

TABLE 144 UK: DENTAL LABORATORY EQUIPMENT MARKET, BY TYPE,

2023–2030 (USD MILLION) 180

TABLE 145 UK: DENTAL LABORATORY SOFTWARE MARKET, BY TYPE,

2023–2030 (USD MILLION) 180

TABLE 146 UK: DENTAL LABORATORIES MARKET, BY PRACTICE, 2023–2030 (USD MILLION) 180

TABLE 147 UK: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 181

TABLE 148 UK: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 181

TABLE 149 REST OF EUROPE: DENTAL LABORATORIES MARKET,

BY PRODUCT, 2023–2030 (USD MILLION) 182

TABLE 150 REST OF EUROPE: DENTAL LABORATORY MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 182

TABLE 151 REST OF EUROPE: DENTAL CAD/CAM MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 182

TABLE 152 REST OF EUROPE: DENTAL LABORATORY EQUIPMENT MARKET,

BY TYPE, 2023–2030 (USD MILLION) 183

TABLE 153 REST OF EUROPE: DENTAL LABORATORY SOFTWARE MARKET,

BY TYPE, 2023–2030 (USD MILLION) 183

TABLE 154 REST OF EUROPE: DENTAL LABORATORIES MARKET,

BY PRACTICE, 2023–2030 (USD MILLION) 184

TABLE 155 REST OF EUROPE: DENTAL LABORATORIES MARKET,

BY TECHNOLOGY, 2023–2030 (USD MILLION) 184

TABLE 156 REST OF EUROPE: DENTAL LABORATORIES MARKET,

BY CONSUMER TYPE, 2023–2030 (USD MILLION) 184

TABLE 157 US: DENTAL EXPENDITURE, 2014–2023 (USD BILLION) 185

TABLE 158 NORTH AMERICA: DENTAL LABORATORIES MARKET,

BY COUNTRY, 2023–2030 (USD MILLION) 187

TABLE 159 NORTH AMERICA: DENTAL LABORATORIES MARKET,

BY PRODUCT, 2023–2030 (USD MILLION) 187

TABLE 160 NORTH AMERICA: DENTAL LABORATORY MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 187

TABLE 161 NORTH AMERICA: DENTAL CAD/CAM MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 188

TABLE 162 NORTH AMERICA: DENTAL LABORATORY EQUIPMENT MARKET,

BY TYPE, 2023–2030 (USD MILLION) 188

TABLE 163 NORTH AMERICA: DENTAL LABORATORY SOFTWARE MARKET,

BY TYPE, 2023–2030 (USD MILLION) 189

TABLE 164 NORTH AMERICA: DENTAL LABORATORIES MARKET,

BY PRACTICE, 2023–2030 (USD MILLION) 189

TABLE 165 NORTH AMERICA: DENTAL LABORATORIES MARKET,

BY TECHNOLOGY, 2023–2030 (USD MILLION) 189

TABLE 166 NORTH AMERICA: DENTAL LABORATORIES MARKET,

BY CONSUMER TYPE, 2023–2030 (USD MILLION) 190

TABLE 167 US: MAJOR DENTAL LABORATORIES 191

TABLE 168 US: MACROECONOMIC INDICATORS 191

TABLE 169 US: DENTAL LABORATORIES MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 192

TABLE 170 US: DENTAL LABORATORY MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 192

TABLE 171 US: DENTAL CAD/CAM MATERIALS MARKET, BY TYPE, 2023–2030 (USD MILLION) 192

TABLE 172 US: DENTAL LABORATORY EQUIPMENT MARKET, BY TYPE,

2023–2030 (USD MILLION) 193

TABLE 173 US: DENTAL LABORATORY SOFTWARE MARKET, BY TYPE,

2023–2030 (USD MILLION) 193

TABLE 174 US: DENTAL LABORATORIES MARKET, BY PRACTICE, 2023–2030 (USD MILLION) 193

TABLE 175 US: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 194

TABLE 176 US: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 194

TABLE 177 CANADA: KEY MACROINDICATORS 195

TABLE 178 CANADA: DENTAL LABORATORIES MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 195

TABLE 179 CANADA: DENTAL LABORATORY MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 196

TABLE 180 CANADA: DENTAL CAD/CAM MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 196

TABLE 181 CANADA: DENTAL LABORATORY EQUIPMENT MARKET,

BY TYPE, 2023–2030 (USD MILLION) 197

TABLE 182 CANADA: DENTAL LABORATORY SOFTWARE MARKET, BY TYPE,

2023–2030 (USD MILLION) 197

TABLE 183 CANADA: DENTAL LABORATORIES MARKET, BY PRACTICE,

2023–2030 (USD MILLION) 198

TABLE 184 CANADA: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 198

TABLE 185 CANADA: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 198

TABLE 186 ASIA PACIFIC: DENTAL LABORATORIES MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 200

TABLE 187 ASIA PACIFIC: DENTAL LABORATORIES MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 201

TABLE 188 ASIA PACIFIC: DENTAL LABORATORY MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 201

TABLE 189 ASIA PACIFIC: DENTAL CAD/CAM MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 201

TABLE 190 ASIA PACIFIC: DENTAL LABORATORY EQUIPMENT MARKET, BY TYPE,

2023–2030 (USD MILLION) 202

TABLE 191 ASIA PACIFIC: DENTAL LABORATORY SOFTWARE MARKET, BY TYPE,

2023–2030 (USD MILLION) 202

TABLE 192 ASIA PACIFIC: DENTAL LABORATORIES MARKET, BY PRACTICE,

2023–2030 (USD MILLION) 203

TABLE 193 ASIA PACIFIC: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 203

TABLE 194 ASIA PACIFIC: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 203

TABLE 195 SOUTH KOREA: NUMBER OF FOREIGN PATIENTS VISITING DENTAL

FACILITIES, 2017–2021 204

TABLE 196 SOUTH KOREA: KEY MACROINDICATORS 204

TABLE 197 SOUTH KOREA: DENTAL LABORATORIES MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 205

TABLE 198 SOUTH KOREA: DENTAL LABORATORY MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 205

TABLE 199 SOUTH KOREA: DENTAL CAD/CAM MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 205

TABLE 200 SOUTH KOREA: DENTAL LABORATORY EQUIPMENT MARKET,

BY TYPE, 2023–2030 (USD MILLION) 206

TABLE 201 SOUTH KOREA: DENTAL LABORATORY SOFTWARE MARKET,

BY TYPE, 2023–2030 (USD MILLION) 206

TABLE 202 SOUTH KOREA: DENTAL LABORATORIES MARKET, BY PRACTICE,

2023–2030 (USD MILLION) 207

TABLE 203 SOUTH KOREA: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 207

TABLE 204 SOUTH KOREA: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 207

TABLE 205 JAPAN: KEY MACROINDICATORS 208

TABLE 206 JAPAN: DENTAL LABORATORIES MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 208

TABLE 207 JAPAN: DENTAL LABORATORY MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 209

TABLE 208 JAPAN: DENTAL CAD/CAM MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 209

TABLE 209 JAPAN: DENTAL LABORATORY EQUIPMENT MARKET, BY TYPE,

2023–2030 (USD MILLION) 210

TABLE 210 JAPAN: DENTAL LABORATORY SOFTWARE MARKET, BY TYPE,

2023–2030 (USD MILLION) 210

TABLE 211 JAPAN: DENTAL LABORATORIES MARKET, BY PRACTICE,

2023–2030 (USD MILLION) 210

TABLE 212 JAPAN: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 211

TABLE 213 JAPAN: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 211

TABLE 214 CHINA: KEY MACROINDICATORS 212

TABLE 215 CHINA: DENTAL LABORATORIES MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 212

TABLE 216 CHINA: DENTAL LABORATORY MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 213

TABLE 217 CHINA: DENTAL CAD/CAM MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 213

TABLE 218 CHINA: DENTAL LABORATORY EQUIPMENT MARKET, BY TYPE,

2023–2030 (USD MILLION) 214

TABLE 219 CHINA: DENTAL LABORATORY SOFTWARE MARKET, BY TYPE,

2023–2030 (USD MILLION) 214

TABLE 220 CHINA: DENTAL LABORATORIES MARKET, BY PRACTICE,

2023–2030 (USD MILLION) 214

TABLE 221 CHINA: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 215

TABLE 222 CHINA: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 215

TABLE 223 INDIA: KEY MACROINDICATORS 216

TABLE 224 INDIA: DENTAL LABORATORIES MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 216

TABLE 225 INDIA: DENTAL LABORATORY MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 217

TABLE 226 INDIA: DENTAL CAD/CAM MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 217

TABLE 227 INDIA: DENTAL LABORATORY EQUIPMENT MARKET, BY TYPE,

2023–2030 (USD MILLION) 218

TABLE 228 INDIA: DENTAL LABORATORY SOFTWARE MARKET, BY TYPE,

2023–2030 (USD MILLION) 218

TABLE 229 INDIA: DENTAL LABORATORIES MARKET, BY PRACTICE,

2023–2030 (USD MILLION) 218

TABLE 230 INDIA: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 219

TABLE 231 INDIA: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 219

TABLE 232 AUSTRALIA: ORAL HEALTH STATUS OF CHILDREN AND ADULTS 220

TABLE 233 AUSTRALIA: MACROECONOMIC INDICATORS 220

TABLE 234 AUSTRALIA: DENTAL LABORATORIES MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 220

TABLE 235 AUSTRALIA: DENTAL LABORATORY MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 221

TABLE 236 AUSTRALIA: DENTAL CAD/CAM MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 221

TABLE 237 AUSTRALIA: DENTAL LABORATORY EQUIPMENT MARKET,

BY TYPE, 2023–2030 (USD MILLION) 222

TABLE 238 AUSTRALIA: DENTAL LABORATORY SOFTWARE MARKET,

BY TYPE, 2023–2030 (USD MILLION) 222

TABLE 239 AUSTRALIA: DENTAL LABORATORIES MARKET, BY PRACTICE,

2023–2030 (USD MILLION) 223

TABLE 240 AUSTRALIA: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 223

TABLE 241 AUSTRALIA: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 223

TABLE 242 REST OF ASIA PACIFIC: DENTAL LABORATORIES MARKET,

BY PRODUCT, 2023–2030 (USD MILLION) 224

TABLE 243 REST OF ASIA PACIFIC: DENTAL LABORATORY MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 225

TABLE 244 REST OF ASIA PACIFIC: DENTAL CAD/CAM MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 225

TABLE 245 REST OF ASIA PACIFIC: DENTAL LABORATORY EQUIPMENT MARKET,

BY TYPE, 2023–2030 (USD MILLION) 226

TABLE 246 REST OF ASIA PACIFIC: DENTAL LABORATORY SOFTWARE MARKET,

BY TYPE, 2023–2030 (USD MILLION) 226

TABLE 247 REST OF ASIA PACIFIC: DENTAL LABORATORIES MARKET,

BY PRACTICE, 2023–2030 (USD MILLION) 227

TABLE 248 REST OF ASIA PACIFIC: DENTAL LABORATORIES MARKET,

BY TECHNOLOGY, 2023–2030 (USD MILLION) 227

TABLE 249 REST OF ASIA PACIFIC: DENTAL LABORATORIES MARKET,

BY CONSUMER TYPE, 2023–2030 (USD MILLION) 227

TABLE 250 LATIN AMERICA: DENTAL LABORATORIES MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 229

TABLE 251 LATIN AMERICA: DENTAL LABORATORIES MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 229

TABLE 252 LATIN AMERICA: DENTAL LABORATORY MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 229

TABLE 253 LATIN AMERICA: DENTAL CAD/CAM MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 230

TABLE 254 LATIN AMERICA: DENTAL LABORATORY EQUIPMENT MARKET,

BY TYPE, 2023–2030 (USD MILLION) 230

TABLE 255 LATIN AMERICA: DENTAL LABORATORY SOFTWARE MARKET,

BY TYPE, 2023–2030 (USD MILLION) 231

TABLE 256 LATIN AMERICA: DENTAL LABORATORIES MARKET, BY PRACTICE,

2023–2030 (USD MILLION) 231

TABLE 257 LATIN AMERICA: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 231

TABLE 258 LATIN AMERICA: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 232

TABLE 259 BRAZIL: KEY MACROINDICATORS 232

TABLE 260 BRAZIL: DENTAL LABORATORIES MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 233

TABLE 261 BRAZIL: DENTAL LABORATORY MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 233

TABLE 262 BRAZIL: DENTAL CAD/CAM MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 233

TABLE 263 BRAZIL: DENTAL LABORATORY EQUIPMENT MARKET, BY TYPE,

2023–2030 (USD MILLION) 234

TABLE 264 BRAZIL: DENTAL LABORATORY SOFTWARE MARKET, BY TYPE,

2023–2030 (USD MILLION) 234

TABLE 265 BRAZIL: DENTAL LABORATORIES MARKET, BY PRACTICE,

2023–2030 (USD MILLION) 234

TABLE 266 BRAZIL: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 235

TABLE 267 BRAZIL: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 235

TABLE 268 MEXICO: KEY MACROINDICATORS 236

TABLE 269 MEXICO: DENTAL LABORATORIES MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 236

TABLE 270 MEXICO: DENTAL LABORATORY MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 236

TABLE 271 MEXICO: DENTAL CAD/CAM MATERIALS MARKET, BY TYPE,

2023–2030 (USD MILLION) 237

TABLE 272 MEXICO: DENTAL LABORATORY EQUIPMENT MARKET,

BY TYPE, 2023–2030 (USD MILLION) 237

TABLE 273 MEXICO: DENTAL LABORATORY SOFTWARE MARKET,

BY TYPE, 2023–2030 (USD MILLION) 237

TABLE 274 MEXICO: DENTAL LABORATORIES MARKET, BY PRACTICE,

2023–2030 (USD MILLION) 238

TABLE 275 MEXICO: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 238

TABLE 276 MEXICO: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 238

TABLE 277 COLOMBIA: KEY MACROINDICATORS 239

TABLE 278 COLOMBIA: DENTAL LABORATORIES MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 239

TABLE 279 COLOMBIA: DENTAL LABORATORY MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 240

TABLE 280 COLOMBIA: DENTAL CAD/CAM MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 240

TABLE 281 COLOMBIA: DENTAL LABORATORY EQUIPMENT MARKET,

BY TYPE, 2023–2030 (USD MILLION) 241

TABLE 282 COLOMBIA: DENTAL LABORATORY SOFTWARE MARKET,

BY TYPE, 2023–2030 (USD MILLION) 241

TABLE 283 COLOMBIA: DENTAL LABORATORIES MARKET, BY PRACTICE,

2023–2030 (USD MILLION) 242

TABLE 284 COLOMBIA: DENTAL LABORATORIES MARKET, BY TECHNOLOGY,

2023–2030 (USD MILLION) 242

TABLE 285 COLOMBIA: DENTAL LABORATORIES MARKET, BY CONSUMER TYPE,

2023–2030 (USD MILLION) 242

TABLE 286 REST OF LATIN AMERICA: DENTAL LABORATORIES MARKET,

BY PRODUCT, 2023–2030 (USD MILLION) 243

TABLE 287 REST OF LATIN AMERICA: DENTAL LABORATORY MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 243

TABLE 288 REST OF LATIN AMERICA: DENTAL CAD/CAM MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 244

TABLE 289 REST OF LATIN AMERICA: DENTAL LABORATORY EQUIPMENT MARKET,

BY TYPE, 2023–2030 (USD MILLION) 244

TABLE 290 REST OF LATIN AMERICA: DENTAL LABORATORY SOFTWARE MARKET,

BY TYPE, 2023–2030 (USD MILLION) 245

TABLE 291 REST OF LATIN AMERICA: DENTAL LABORATORIES MARKET,

BY PRACTICE, 2023–2030 (USD MILLION) 245

TABLE 292 REST OF LATIN AMERICA: DENTAL LABORATORIES MARKET,

BY TECHNOLOGY, 2023–2030 (USD MILLION) 245

TABLE 293 REST OF LATIN AMERICA: DENTAL LABORATORIES MARKET,

BY CONSUMER TYPE, 2023–2030 (USD MILLION) 246

TABLE 294 MIDDLE EAST & AFRICA: DENTAL LABORATORIES MARKET,

BY PRODUCT, 2023–2030 (USD MILLION) 247

TABLE 295 MIDDLE EAST & AFRICA: DENTAL LABORATORY MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 248

TABLE 296 MIDDLE EAST & AFRICA: DENTAL CAD/CAM MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 248

TABLE 297 MIDDLE EAST & AFRICA: DENTAL LABORATORY EQUIPMENT MARKET,

BY TYPE, 2023–2030 (USD MILLION) 249

TABLE 298 MIDDLE EAST & AFRICA: DENTAL LABORATORY SOFTWARE MARKET,

BY TYPE, 2023–2030 (USD MILLION) 249

TABLE 299 MIDDLE EAST & AFRICA: DENTAL LABORATORIES MARKET,

BY PRACTICE, 2023–2030 (USD MILLION) 250

TABLE 300 MIDDLE EAST & AFRICA: DENTAL LABORATORIES MARKET,

BY TECHNOLOGY, 2023–2030 (USD MILLION) 250

TABLE 301 MIDDLE EAST & AFRICA: DENTAL LABORATORIES MARKET,

BY CONSUMER TYPE, 2023–2030 (USD MILLION) 250

TABLE 302 GCC COUNTRIES: DENTAL LABORATORIES MARKET,

BY PRODUCT, 2023–2030 (USD MILLION) 251

TABLE 303 GCC COUNTRIES: DENTAL LABORATORY MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 252

TABLE 304 GCC COUNTRIES: DENTAL CAD/CAM MATERIALS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 252

TABLE 305 GCC COUNTRIES: DENTAL LABORATORY EQUIPMENT MARKET,

BY TYPE, 2023–2030 (USD MILLION) 253

TABLE 306 GCC COUNTRIES: DENTAL LABORATORY SOFTWARE MARKET,

BY TYPE, 2023–2030 (USD MILLION) 253

TABLE 307 GCC COUNTRIES: DENTAL LABORATORIES MARKET,

BY PRACTICE, 2023–2030 (USD MILLION) 254

TABLE 308 GCC COUNTRIES: DENTAL LABORATORIES MARKET,

BY TECHNOLOGY, 2023–2030 (USD MILLION) 254

TABLE 309 GCC COUNTRIES: DENTAL LABORATORIES MARKET,

BY CONSUMER TYPE, 2023–2030 (USD MILLION) 254

TABLE 310 STRATEGIES ADOPTED BY KEY PLAYERS IN DENTAL LABORATORIES MARKET, JANUARY 2022–DECEMBER 2025 256

TABLE 311 DENTAL LABORATORIES MARKET: DEGREE OF COMPETITION 258

TABLE 312 DENTAL LABORATORIES MARKET: REGION FOOTPRINT 262

TABLE 313 DENTAL LABORATORIES MARKET: PRODUCT FOOTPRINT 263

TABLE 314 DENTAL LABORATORIES MARKET: TECHNOLOGY FOOTPRINT 264

TABLE 315 DENTAL LABORATORIES MARKET: CONSUMER TYPE FOOTPRINT 265

TABLE 316 DENTAL LABORATORIES MARKET: DETAILED LIST OF

KEY STARTUPS/SME PLAYERS 268

TABLE 317 DENTAL LABORATORIES MARKET: COMPETITIVE BENCHMARKING OF

KEY STARTUPS/ SME PLAYERS, BY PRODUCT AND REGION 268

TABLE 318 DENTAL LABORATORIES MARKET: PRODUCT LAUNCHES & UPGRADES,

JANUARY 2022–DECEMBER 2025 271

TABLE 319 DENTAL LABORATORIES MARKET: DEALS, JANUARY 2022–DECEMBER 2025 272

TABLE 320 DENTAL LABORATORIES MARKET: EXPANSIONS, JANUARY 2022–DECEMBER 2025 273

TABLE 321 DENTSPLY SIRONA: COMPANY OVERVIEW 274

TABLE 322 DENTSPLY SIRONA: PRODUCTS OFFERED 275

TABLE 323 DENTSPLY SIRONA: PRODUCT LAUNCHES & UPGRADES,

JANUARY 2022–DECEMBER 2025 279

TABLE 324 DENTSPLY SIRONA: DEALS, JANUARY 2022–DECEMBER 2025 280

TABLE 325 PLANMECA OY: COMPANY OVERVIEW 282

TABLE 326 PLANMECA OY: PRODUCTS OFFERED 282

TABLE 327 PLANMECA OY: PRODUCT LAUNCHES, JANUARY 2022–DECEMBER 2025 283

TABLE 328 PLANMECA OY: EXPANSIONS, JANUARY 2022–DECEMBER 2025 284

TABLE 329 ENVISTA: COMPANY OVERVIEW 286

TABLE 330 ENVISTA: PRODUCTS OFFERED 287

TABLE 331 ENVISTA: DEALS, JANUARY 2022–DECEMBER 2025 288

TABLE 332 SOLVENTUM: COMPANY OVERVIEW 290

TABLE 333 SOLVENTUM: PRODUCTS OFFERED 291

TABLE 334 SOLVENTUM: PRODUCT LAUNCHES, JANUARY 2022–DECEMBER 2025 292

TABLE 335 SOLVENTUM: DEALS, JANUARY 2022–DECEMBER 2025 292

TABLE 336 IVOCLAR VIVADENT: COMPANY OVERVIEW 294

TABLE 337 IVOCLAR VIVADENT: PRODUCTS OFFERED 294

TABLE 338 IVOCLAR VIVADENT: PRODUCT LAUNCHES, JANUARY 2022–DECEMBER 2025 295

TABLE 339 IVOCLAR VIVADENT: DEALS, JANUARY 2022–DECEMBER 2025 296

TABLE 340 GC CORPORATION: COMPANY OVERVIEW 298

TABLE 341 GC CORPORATION: PRODUCTS OFFERED 298

TABLE 342 GC CORPORATION: EXPANSIONS, JANUARY 2022–DECEMBER 2025 300

TABLE 343 MITSUI CHEMICALS, INC.: COMPANY OVERVIEW 301

TABLE 344 MITSUI CHEMICALS, INC.: PRODUCTS OFFERED 302

TABLE 345 MITSUI CHEMICALS, INC.: PRODUCT LAUNCHES, JANUARY 2022–DECEMBER 2025 303

TABLE 346 MITSUI CHEMICALS, INC.: EXPANSIONS, JANUARY 2022–DECEMBER 2025 303

TABLE 347 KURARAY NORITAKE DENTAL, INC.: COMPANY OVERVIEW 304

TABLE 348 KURARAY NORITAKE DENTAL, INC.: PRODUCTS OFFERED 305

TABLE 349 KURARAY NORITAKE DENTAL, INC.: EXPANSIONS,

JANUARY 2022–DECEMBER 2025 306

TABLE 350 VOCO GMBH: COMPANY OVERVIEW 307

TABLE 351 VOCO GMBH: PRODUCTS OFFERED 307

TABLE 352 VOCO GMBH: DEALS, JANUARY 2022–DECEMBER 2025 308

TABLE 353 AMANN GIRRBACH AG: COMPANY OVERVIEW 309

TABLE 354 AMANN GIRRBACH AG: PRODUCTS OFFERED 309

TABLE 355 AMANN GIRRBACH AG: PRODUCT LAUNCHES, JANUARY 2022–DECEMBER 2025 310

TABLE 356 AMANN GIRRBACH AG: EXPANSIONS, JANUARY 2022–DECEMBER 2025 311

TABLE 357 BEGO GMBH & CO. KG: COMPANY OVERVIEW 312

TABLE 358 BEGO GMBH & CO. KG: PRODUCTS OFFERED 312

TABLE 359 BEGO GMBH & CO. KG: DEALS, JANUARY 2022–DECEMBER 2025 313

TABLE 360 SCHÜTZ DENTAL GMBH: COMPANY OVERVIEW 314

TABLE 361 SCHÜTZ DENTAL GMBH: PRODUCTS OFFERED 314

TABLE 362 INSTITUT STRAUMANN AG: COMPANY OVERVIEW 316

TABLE 363 INSTITUT STRAUMANN AG: PRODUCTS OFFERED 317

TABLE 364 INSTITUT STRAUMANN AG: DEALS, JANUARY 2022–DECEMBER 2025 318

TABLE 365 INSTITUT STRAUMANN AG: EXPANSIONS, JANUARY 2022–DECEMBER 2025 319

TABLE 366 VITA ZAHNFABRIK H. RAUTER GMBH & CO. KG: COMPANY OVERVIEW 320

TABLE 367 VITA ZAHNFABRIK H. RAUTER GMBH & CO. KG: PRODUCTS OFFERED 320

TABLE 368 COLTENE GROUP: COMPANY OVERVIEW 321

TABLE 369 COLTENE GROUP: PRODUCTS OFFERED 322

TABLE 370 SHOFU INC.: COMPANY OVERVIEW 323

TABLE 371 3D SYSTEMS, INC.: COMPANY OVERVIEW 325

TABLE 372 STRATASYS: COMPANY OVERVIEW 326

TABLE 373 NAKANISHI INC.: COMPANY OVERVIEW 327

TABLE 374 A-DEC INC.: COMPANY OVERVIEW 328

TABLE 375 ZIRKONZAHN: COMPANY OVERVIEW 329

TABLE 376 SMART DENT: COMPANY OVERVIEW 330

TABLE 377 3SHAPE A/S: COMPANY OVERVIEW 331

TABLE 378 SHINING 3D: COMPANY OVERVIEW 332

TABLE 379 EXOCAD: COMPANY OVERVIEW 333

TABLE 380 DENTAL LABORATORIES MARKET: RISK ASSESSMENT 345

LIST OF FIGURES

FIGURE 1 DENTAL LABORATORIES MARKET SEGMENTATION & REGIONAL SCOPE 34

FIGURE 2 DENTAL LABORATORIES MARKET: YEARS CONSIDERED 35

FIGURE 3 KEY INSIGHTS & MARKET HIGHLIGHTS 37

FIGURE 4 DENTAL LABORATORIES MARKET SIZE, BY PRODUCT, 2025–2030 (USD MILLION) 38

FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN DENTAL

LABORATORIES MARKET 38

FIGURE 6 DISRUPTIVE TRENDS IMPACTING DENTAL LABORATORIES MARKET GROWTH 39

FIGURE 7 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS IN DENTAL LABORATORIES MARKET (2024) 40

FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD 41

FIGURE 9 RISING DEMAND FOR COMPLEX AND PRECISION-DRIVEN DENTAL RESTORATIONS TO PROPEL MARKET GROWTH 42

FIGURE 10 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING STUDY PERIOD 43

FIGURE 11 CHINA AND MATERIALS ACCOUNTED FOR LARGEST ASIA PACIFIC MARKET

SHARE IN 2024 44

FIGURE 12 JAPAN TO REGISTER HIGHEST CAGR FROM 2025 TO 2030 45

FIGURE 13 EMERGING MARKETS TO REGISTER HIGHEST GROWTH RATES DURING

FORECAST PERIOD 45

FIGURE 14 DENTAL LABORATORIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES,

AND CHALLENGES 46

FIGURE 15 UK: PROJECTED NUMBER OF ADULTS (16 YEARS AND OLDER) WITH DENTAL CARIES, 2020 VS. 2035 VS. 2050 (MILLION) 47

FIGURE 16 DENTAL LABORATORIES MARKET: PORTER’S FIVE FORCES ANALYSIS 58

FIGURE 17 DENTAL LABORATORIES MARKET: SUPPLY CHAIN ANALYSIS 65

FIGURE 18 DENTAL LABORATORIES MARKET: VALUE CHAIN ANALYSIS 66

FIGURE 19 DENTAL LABORATORIES MARKET: ECOSYSTEM ANALYSIS 67

FIGURE 20 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS IN DENTAL LABORATORIES MARKET 71

FIGURE 21 FUNDING AND NUMBER OF DEALS IN DENTAL LABORATORIES MARKET,

2021–2024 (USD BILLION) 72

FIGURE 22 TOP PATENT APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) IN DENTAL LABORATORIES MARKET (JANUARY 2015–NOVEMBER 2025) 81

FIGURE 23 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR DENTAL

LABORATORY PATENTS, 2015–2025 82

FIGURE 24 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR DENTAL LABORATORY PRODUCTS 94

FIGURE 25 KEY BUYING CRITERIA FOR TOP THREE DENTAL LABORATORY PRODUCTS 95

FIGURE 26 GEOGRAPHIC GROWTH OPPORTUNITIES IN DENTAL LABORATORIES MARKET 157

FIGURE 27 NORTH AMERICA: DENTAL LABORATORIES MARKET SNAPSHOT 186

FIGURE 28 ASIA PACIFIC: DENTAL LABORATORIES MARKET SNAPSHOT 200

FIGURE 29 REVENUE ANALYSIS OF KEY PLAYERS IN DENTAL LABORATORIES MARKET,

2022–2024 (USD MILLION) 257

FIGURE 30 MARKET SHARE ANALYSIS OF KEY PLAYERS IN DENTAL LABORATORIES

MARKET (2024) 257

FIGURE 31 DENTAL LABORATORIES MARKET: COMPANY EVALUATION MATRIX

(KEY PLAYERS), 2024 260

FIGURE 32 DENTAL LABORATORIES MARKET: COMPANY FOOTPRINT 261

FIGURE 33 DENTAL LABORATORIES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 267

FIGURE 34 EV/EBITDA OF KEY VENDORS 269

FIGURE 35 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN, AND 5-YEAR STOCK BETA

OF KEY VENDORS 269

FIGURE 36 DENTAL LABORATORIES MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS 270

FIGURE 37 DENTSPLY SIRONA: COMPANY SNAPSHOT 275

FIGURE 38 ENVISTA: COMPANY SNAPSHOT 287

FIGURE 39 SOLVENTUM: COMPANY SNAPSHOT 291

FIGURE 40 MITSUI CHEMICALS, INC.: COMPANY SNAPSHOT 302

FIGURE 41 KURARAY NORITAKE DENTAL, INC.: COMPANY SNAPSHOT 305

FIGURE 42 INSTITUT STRAUMANN AG: COMPANY SNAPSHOT 317

FIGURE 43 COLTENE GROUP: COMPANY SNAPSHOT 322

FIGURE 44 DENTAL LABORATORIES MARKET: RESEARCH DESIGN 334

FIGURE 45 DENTAL LABORATORIES MARKET: KEY DATA FROM SECONDARY SOURCES 336

FIGURE 46 DENTAL LABORATORIES MARKET: KEY PRIMARY SOURCES,

BY COMPANY TYPE, DESIGNATION, AND REGION 336

FIGURE 47 DENTAL LABORATORIES MARKET: KEY DATA FROM PRIMARY SOURCES 337

FIGURE 48 DENTAL LABORATORIES MARKET: KEY INSIGHTS FROM INDUSTRY EXPERTS 338

FIGURE 49 DENTAL LABORATORIES MARKET: BOTTOM-UP APPROACH 339

FIGURE 50 DENTAL LABORATORIES MARKET: TOP-DOWN APPROACH 339

FIGURE 51 SUPPLY-SIDE DENTAL LABORATORIES MARKET SIZE ESTIMATION:

REVENUE SHARE ANALYSIS 340

FIGURE 52 REVENUE SHARE ANALYSIS ILLUSTRATION FOR DENTSPLY SIRONA

IN DENTAL LABORATORIES MARKET 340

FIGURE 53 SUPPLY-SIDE DENTAL LABORATORIES MARKET ESTIMATION (2024) 341

FIGURE 54 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS IN DENTAL LABORATORIES MARKET 342

FIGURE 55 DENTAL LABORATORIES MARKET: DATA TRIANGULATION METHODOLOGY 343

FIGURE 56 FACTORS IMPACTING DENTAL LABORATORIES MARKET, 2024 VS. 2025 VS. 2030 344