Carbon Credit Validation, Verification, and Certification Market - Global Forecast to 2030

Carbon Credit Validation, Verification, and Certification Market by Type (Voluntary, Compliance), Service (Validation, Verification, Certification), Application (Energy & Utilities, Agriculture & Forestry, Industrial) & Region - Global Forecast to 2030

カーボンクレジットの検証&妥当性確認と認証(VVC)市場 - タイプ(自主、コンプライアンス)、サービス(検証、検証、認証)、アプリケーション(エネルギー・公益事業、農林業、工業)および地域別 - 2030年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年02月 |

| ページ数 | 264 |

| 図表数 | 257 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-4899 |

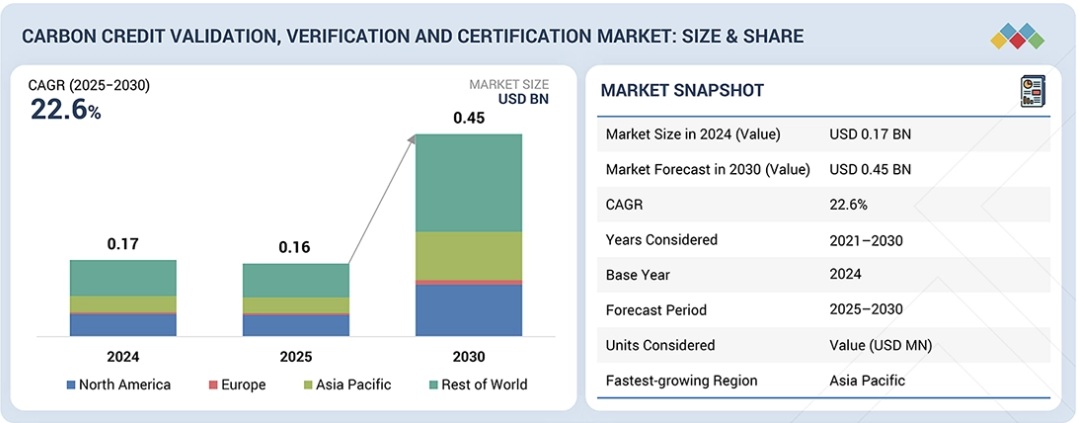

世界のカーボンクレジットの検証&妥当性確認と認証(VVC)市場は、2025年の1億6,160万米ドルから2030年には4億4,800万米ドルに達し、年平均成長率(CAGR)22.6%で成長すると予測されています。規制強化の要請や、企業と社会における気候変動への意識の高まりを背景に、世界市場の将来性は非常に明るいと見込まれています。各国政府が厳格な炭素削減義務を継続的に実施し、より多くの企業がネットゼロ戦略を採用するにつれて、検証・認証済みの炭素クレジットに対する需要は大幅に増加すると予想されます。こうした需要の増加は、特にリモートセンシング、GIS、ブロックチェーン分野における技術革新とイノベーションを促進し、検証・認証プロセスの効率性と透明性を高めるでしょう。

調査範囲:

本レポートは、サービス(検証、検証、認証)、タイプ(コンプライアンス、規制)、セクター(エネルギー・公益事業、運輸、工業、農林業、その他)、地域(アジア太平洋、北米、欧州、その他)といった様々なパラメータに基づき、炭素クレジットの検証、検証、認証市場について包括的な定義、説明、予測を提供しています。また、主要な市場推進要因、制約、機会、課題を網羅した、炭素クレジットの検証、検証、認証市場の徹底的な定性・定量分析も提供しています。さらに、競争環境の評価、市場ダイナミクスの分析、価値ベースの市場予測、炭素クレジットの検証、検証、認証市場における将来動向など、市場の重要な側面を網羅しています。さらに、主要プレーヤーの投資および資金調達に関する情報も提供しています。

レポート購入の主なメリット

- 本レポートは、カーボンクレジットの検証&妥当性確認と認証(VVC)市場における既存の業界リーダーと新規参入企業の両方にメリットをもたらすよう、綿密に設計されています。市場全体と個々のサブセグメントの信頼性の高い収益予測を提供します。このデータは、ステークホルダーにとって貴重なリソースとなり、競争環境を包括的に理解し、自社にとって効果的な市場戦略を策定するのに役立ちます。さらに、本レポートは、ステークホルダーが現在の市場状況を理解するためのチャネルとして機能し、市場の推進要因、制約、課題、そして成長機会に関する重要な洞察を提供します。これらの洞察を活用することで、ステークホルダーは十分な情報に基づいた意思決定を行い、カーボンクレジットの検証、検証、認証業界の絶えず変化する動向について常に最新情報を得ることができます。

- カーボンクレジットの検証&妥当性確認と認証(VVC)市場の成長に影響を与える主な推進要因(炭素クレジットの健全性に関する監視の強化、気候情報開示および報告要件の拡大、既存プロジェクトからの継続的な検証需要)、制約要因(新規炭素クレジット プロジェクト登録数の減少、プロジェクト開発者のコストに対する高い感度、世界の炭素市場における規制の不確実性)、機会(第 6 条および新しいコンプライアンス メカニズムの出現、自然ベースおよび除去プロジェクトの増加、デジタル MRV および高度な監視技術の採用)、課題(低品質または物議を醸すプロジェクトによる評判リスク、容量の制約および認証のボトルネック、市場の断片化および調和の欠如)の分析。

- 製品開発/イノベーション:カーボンクレジットの検証&妥当性確認と認証(VVC)市場は絶えず進化しており、特に事業拡大とパートナーシップに重点が置かれています。VERRA、Gold Standard、TÜV SÜD、DNV GLといった業界をリードする企業は、変化する需要と環境への配慮に対応するため、製品ラインナップの進化を最前線で進めています。

- 市場動向:気候変動への意識の高まり、パリ協定などの国際協定、そしてカーボンニュートラルへの企業コミットメントの拡大を背景に、世界の炭素クレジットの検証・認証市場は大きな発展を遂げています。ブロックチェーン、リモートセンシング、AIといった技術の進歩は、炭素クレジットプロセスの精度と透明性を高め、市場への参入者を増やしています。さらに、規制枠組みの進化と自主市場の拡大は、持続可能性目標の達成において検証済み炭素クレジットの重要性を認識する業界や地域の増加に伴い、力強い成長を促進しています。こうした発展は、炭素クレジットのグローバル市場の標準化と効率化につながっています。

- 市場の多様化:世界の炭素クレジットの検証、検証、認証市場における市場の多様化は、炭素クレジット・イニシアチブに参加するセクターと地理的範囲の拡大を伴います。従来はエネルギーや工業製造などのセクターが市場を支配していましたが、現在では農業、林業、水・廃水管理、そしてテクノロジー主導のプロジェクトが大きな関与を見せています。地理的には、北米とヨーロッパが主要なプレーヤーであったものの、アジア、ラテンアメリカ、アフリカの新興市場が市場の成長にますます貢献しています。この多様化は、リスクの軽減、市場の安定性の向上、そして炭素クレジット・メカニズムが世界の持続可能性への取り組みに与える影響の拡大に貢献します。

- 競合評価:カーボンクレジットの検証&妥当性確認と認証(VVC)市場における主要企業の市場プレゼンス、成長戦略、サービス内容を精査するため、包括的な評価を実施しました。これらの主要企業には、VERRA(米国)、Gold Standard(スイス)、ACR(American Carbon Registry)(米国)、Climate Action Reserve(米国)、SGS Société Générale de Surveillance SA(スイス)、DNV GL(ノルウェー)、TUV SUD(ドイツ)、Intertek Group plc(英国)、Bureau Veritas(フランス)、The ERM International Group Limited(英国)、SCS Global Services(米国)、Climate Impact Partners(英国)、RINA S.p.(英国)が含まれます。 A.(イタリア)、Aenor(スペイン)、SustainCERT(ルクセンブルク)、Aster Global Environmental Solutions, Inc.(米国)、Carbon Check(インド)、Ancer Climate, LLC(米国)、Carbon Trust(英国)、First Environment Inc.(米国)、CRS(米国)、Cotecna(スイス)、Our Offset Nonprofit LLC.(ハンガリー)、Carbon credit Capital(米国)、Control Union(オランダ)。本分析では、これらの主要企業の競争上の優位性、市場成長を促進するためのアプローチ、そしてカーボンクレジットの検証&妥当性確認と認証(VVC)市場における提供サービスの範囲について、詳細な洞察を提供します。

Report Description

The global carbon credit validation, verification, and certification market is projected to reach USD 448.0 million in 2030 from USD 161.6 million in 2025, with a CAGR of 22.6%. The future prospects of the global market are highly promising, driven by escalating regulatory demands and heightened corporate and public awareness of climate change. As governments worldwide continue to implement stringent carbon-reduction mandates and more companies adopt net-zero strategies, demand for validated and certified carbon credits is expected to rise substantially. This increasing demand will spur technological advancements and innovations, particularly in remote sensing, GIS, and blockchain, enhancing the efficiency and transparency of validation and verification processes.

Carbon Credit Validation, Verification, and Certification Market – Global Forecast to 2030

Moreover, the expansion of carbon markets, including compliance and voluntary markets, will further fuel the growth of the validation, verification, and certification industry. With new revenue opportunities emerging from sectors such as agriculture, forestry, and industrial manufacturing, and growing investments in sustainable projects, the market is poised for significant growth. As a result, businesses engaged in these processes will play a critical role in ensuring the integrity and reliability of carbon credits, thus supporting global efforts to mitigate climate change.

“Industrial segment, by application, will hold the third-largest market share in 2024.”

In 2024, the industrial segment accounted for the third-largest share of the carbon credit validation, verification, and certification market because industries such as cement, steel, chemicals, and heavy manufacturing represent some of the most material sources of greenhouse gas emissions globally, driving sustained demand for robust independent assurance services as companies seek to measure, verify, and monetize emission reductions. Many industrial enterprises face both increasing regulatory pressures from emissions reporting mandates and market pressures from corporate net-zero commitments, prompting them to engage third-party validators and verifiers to support credible carbon credit generation, compliance reporting, and voluntary offset procurement.

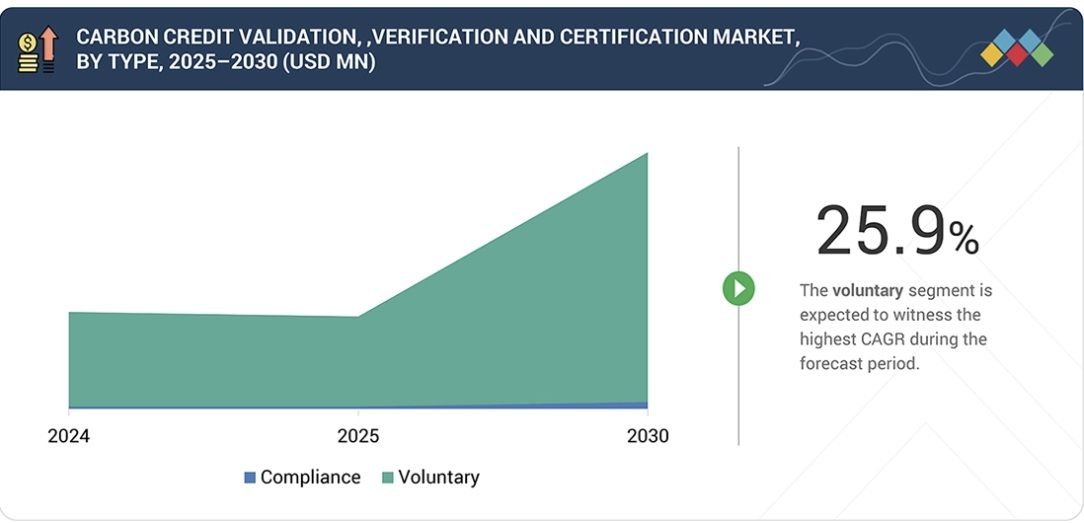

“The compliance segment, by type, is projected to be the second-largest market from 2025 to 2030.”

The compliance market holds the second-largest market share in the global carbon credit validation, verification, and certification sector due to stringent regulatory frameworks and government mandates that require industries to adhere to emission reduction targets. Compliance markets, such as the European Union Emissions Trading System (EU ETS) and California’s Cap-and-Trade Program, create a substantial demand for verified carbon credits to meet legal obligations. This drives continuous investment in the validation, verification, and certification processes to ensure that credits are credible and meet regulatory standards, thereby supporting the growth and stability of the compliance carbon credit market.

Carbon Credit Validation, Verification, and Certification Market – Global Forecast to 2030 – region

Breakdown of Primaries:

In-depth interviews with key industry participants, subject-matter experts, C-level executives of leading market players, and industry consultants, among others, were conducted to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The primary interviews were distributed as follows:

- By Company Type: Tier 1-30%, Tier 2-55%, and Tier 3-15%

- By Designation: C-Level-30%, D-Level-20%, and Others-50%

- By Region: North America–18%, Europe–8%, Asia Pacific–60%, South America–4% and Middle East & Africa–10%.

Note: “Others” include sales managers, engineers, and regional managers

The tiers of companies are defined based on their total revenue as of 2021: Tier 1: >USD 1 billion; Tier 2: USD 500 million–1 billion; and Tier 3: <USD 500 million.

The carbon credit validation, verification, and certification market is predominantly governed by well-established global leaders. Notable players in the market include VERRA (US), Gold Standard (Switzerland), ACR (American Carbon Registry) (US), Climate Action Reserve (US), SGS Société Générale de Surveillance SA. (Switzerland), DNV GL (Norway), TUV SUD (Germany), Intertek Group plc (UK), Bureau Veritas (France), The ERM International Group Limited (UK), SCS Global Services (US), Climate Impact Partners (UK), RINA S.p. A. (Italy), Aenor (Spain), SustainCERT (Luxembourg), Aster Global Environmental Solutions, Inc. (US), Carbon Check (India), Ancer Climate, LLC (US), Carbon Trust (UK), First Environment Inc. (US), CRS (US), Cotecna (Switzerland), Our Offset Nonprofit LLC. (Hungary), Carbon credit Capital (US), Control Union (Netherlands).

Carbon Credit Validation, Verification, and Certification Market – Global Forecast to 2030 – ecosystem

Research Coverage:

The report provides a comprehensive definition, description, and forecast of the carbon credit validation, verification, certification market based on various parameters, including service (Validation, Verification, Certification), type (Compliance, Regulatory), sector (Energy & Utilities, Transportation, Industrial, Agriculture & Forestry, Others), and region (Asia Pacific, North America, Europe, Rest of World). The report also offers a thorough qualitative and quantitative analysis of carbon credit validation, verification, and certification, encompassing an examination of key market drivers, limitations, opportunities, and challenges. Additionally, it covers critical facets of the market, such as an assessment of the competitive landscape, an analysis of market dynamics, value-based market estimates, and future trends in the carbon credit validation, verification, and certification market. The report provides investment and funding information of key players in the market.

Key Benefits of Buying the Report

The report is thoughtfully designed to benefit both established industry leaders and newcomers in the carbon credit validation, verification, and certification market. It provides reliable revenue forecasts for the entire market and its individual sub-segments. This data is a valuable resource for stakeholders, enabling them to gain a comprehensive understanding of the competitive landscape and formulate effective market strategies for their businesses. Furthermore, the report serves as a channel for stakeholders to understand the current market landscape, providing essential insights into market drivers, constraints, challenges, and growth opportunities. By incorporating these insights, stakeholders can make well-informed decisions and stay informed about the constantly evolving dynamics of the carbon credit validation, verification, and certification industry.

- Analysis of key drivers (Increasing scrutiny on carbon credit integrity, expansion of climate disclosure and reporting requirements, continued verification demand from legacy projects), restraints (decline in new carbon credit project registrations, high cost sensitivity among project developers, regulatory uncertainty in global carbon markets), opportunities (emergence of Article 6 and new compliance mechanisms, growth in nature-based and removal projects, adoption of digital MRV and advanced monitoring technologies), and challenges (reputational risk from low-quality or controversial projects, capacity constraints and accreditation bottlenecks, market fragmentation and lack of harmonization) influencing the growth of the carbon credit validation, verification, and certification market.

- Product Development/ Innovation: The carbon credit validation, verification, and certification market is in a constant state of evolution, with a primary focus on expansion and partnerships. Leading industry players like VERRA, Gold Standard, TÜV SÜD, and DNV GL are at the forefront of advancing their product offerings to address shifting demands and environmental considerations.

- Market Development: The global carbon credit validation, verification, and certification market is witnessing significant development driven by increasing climate change awareness, international agreements such as the Paris Agreement, and growing corporate commitments to carbon neutrality. Technological advancements such as blockchain, remote sensing, and AI are enhancing the accuracy and transparency of carbon credit processes, attracting more participants to the market. Additionally, evolving regulatory frameworks and expanding voluntary markets are fostering robust growth, as more industries and regions recognize the importance of verified carbon credits in achieving sustainability goals. This development is leading to a more standardized and efficient global market for carbon credits.

- Market Diversification: Market diversification in the global carbon credit validation, verification, and certification market involves expanding the range of sectors and geographic regions participating in carbon credit initiatives. Traditionally dominated by sectors like energy and industrial manufacturing, the market is now seeing significant involvement from agriculture, forestry, water and wastewater management, and technology-driven projects. Geographically, while North America and Europe have been prominent players, emerging markets in Asia, Latin America, and Africa are increasingly contributing to market growth. This diversification helps mitigate risks, enhances market stability, and broadens the impact of carbon credit mechanisms on global sustainability efforts.

- Competitive Assessment: A comprehensive evaluation has been conducted to scrutinize the market presence, growth strategies, and service offerings of key players in the carbon credit validation, verification, and certification market. These prominent companies include VERRA (US), Gold Standard (Switzerland), ACR (American Carbon Registry) (US), Climate Action Reserve (US), SGS Société Générale de Surveillance SA. (Switzerland), DNV GL (Norway), TUV SUD (Germany), Intertek Group plc (UK), Bureau Veritas (France), The ERM International Group Limited (UK), SCS Global Services (US), Climate Impact Partners (UK), RINA S.p. A. (Italy), Aenor (Spain), SustainCERT (Luxembourg), Aster Global Environmental Solutions, Inc. (US), Carbon Check (India), Ancer Climate, LLC (US), Carbon Trust (UK), First Environment Inc. (US), CRS (US), Cotecna (Switzerland), Our Offset Nonprofit LLC. (Hungary), Carbon credit Capital (US), and Control Union (Netherlands). This analysis provides in-depth insights into the competitive positions of these major players, their approaches to driving market growth, and the range of services they offer within the carbon credit validation, verification, and certification market.

Table of Contents

1 INTRODUCTION 25

1.1 STUDY OBJECTIVES 25

1.2 MARKET DEFINITION 26

1.3 STUDY SCOPE 26

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 26

1.3.2 INCLUSIONS AND EXCLUSIONS 27

1.3.3 YEARS CONSIDERED 28

1.4 CURRENCY CONSIDERED 28

1.5 UNIT CONSIDERED 28

1.6 LIMITATIONS 29

1.7 STAKEHOLDERS 29

1.8 SUMMARY OF CHANGES 30

2 EXECUTIVE SUMMARY 31

2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS 31

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 33

2.3 DISRUPTIVE TRENDS IN CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET 34

2.4 HIGH-GROWTH SEGMENTS 35

2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST 36

3 PREMIUM INSIGHTS 37

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET 37

3.2 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET

IN ASIA PACIFIC, BY TYPE AND APPLICATION 38

3.3 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE 39

3.4 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET,

BY APPLICATION 39

3.5 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY REGION 40

4 MARKET OVERVIEW 41

4.1 INTRODUCTION 41

4.2 MARKET DYNAMICS 42

4.2.1 DRIVERS 42

4.2.1.1 Heightened scrutiny on carbon credit integrity 42

4.2.1.2 Increasing need for climate disclosure and reporting 43

4.2.2 RESTRAINTS 44

4.2.2.1 Decline in new carbon credit project registrations 44

4.2.2.2 High-cost sensitivity among project developers 44

4.2.3 OPPORTUNITIES 45

4.2.3.1 Gradual implementation of Article 6 mechanisms under Paris Agreement 45

4.2.3.2 Rising emphasis on nature-based solutions and carbon removal projects 46

4.2.4 CHALLENGES 47

4.2.4.1 Limited number of accredited validators and verifiers 47

4.2.4.2 Inconsistent regulatory frameworks across different regions 47

4.3 UNMET NEEDS AND WHITE SPACES 48

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 50

4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS 51

4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 52

5 INDUSTRY TRENDS 54

5.1 PORTER’S FIVE FORCES ANALYSIS 54

5.1.1 THREAT OF NEW ENTRANTS 55

5.1.2 THREAT OF SUBSTITUTES 56

5.1.3 BARGAINING POWER OF SUPPLIERS 56

5.1.4 BARGAINING POWER OF BUYERS 56

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 57

5.2 MACROECONOMIC OUTLOOK 57

5.2.1 INTRODUCTION 57

5.2.2 GDP TRENDS AND FORECAST 57

5.2.3 TRENDS IN GLOBAL ENERGY & UTILITIES INDUSTRY 59

5.2.4 TRENDS IN GLOBAL AGRICULTURE & FORESTRY INDUSTRY 59

5.3 SUPPLY CHAIN ANALYSIS 60

5.4 ECOSYSTEM ANALYSIS 62

5.5 KEY CONFERENCES AND EVENTS, 2026 63

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 64

5.7 INVESTMENT AND FUNDING SCENARIO 65

5.8 CASE STUDY ANALYSIS 66

5.8.1 VERRA AND FCPF COLLABORATE TO GENERATE HIGH-QUALITY CARBON CREDITS FOR REDD+ PROGRAMS 66

5.8.2 GOLD STANDARD HELPS REDUCE EMISSIONS AND ENHANCE SUSTAINABILITY THROUGH LOMI’S DECENTRALIZED ORGANIC WASTE PROCESSING TECHNIQUE 66

5.8.3 ACR’S GREENTREES PROJECT ENSURES BIODIVERSITY CONSERVATION

AND HIGH-QUALITY CARBON CREDIT GENERATION IN MISSISSIPPI ALLUVIAL VALLEY 67

5.8.4 SCS GLOBAL SERVICES PROVIDES CERTIFICATION FOR FRESH DEL MONTE PRODUCE’S CARBON-NEUTRAL PINEAPPLE PRODUCTION WITH CUTTING-EDGE SUSTAINABILITY PRACTICES 67

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACTS,

PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS 68

6.1 KEY EMERGING TECHNOLOGIES 68

6.1.1 MONITORING, REPORTING, AND VERIFICATION (MRV) SYSTEMS 68

6.1.2 THIRD-PARTY VALIDATION AND VERIFICATION METHODOLOGIES 68

6.2 COMPLEMENTARY TECHNOLOGIES 69

6.2.1 REMOTE SENSING AND SATELLITE MONITORING 69

6.2.2 DATA ANALYTICS AND AI-BASED ANOMALY DETECTION 69

6.3 ADJACENT TECHNOLOGIES 69

6.3.1 BLOCKCHAIN AND DISTRIBUTED LEDGER TECHNOLOGIES (DLT) 69

6.3.2 CARBON ACCOUNTING AND ENVIRONMENTAL, SOCIAL,

AND GOVERNANCE (ESG) REPORTING SOFTWARE 70

6.4 TECHNOLOGY/PRODUCT ROADMAP 70

6.5 PATENT ANALYSIS 73

6.6 PRICING ANALYSIS 75

6.6.1 PRICING RANGE OF CARBON CREDIT SERVICES, 2024 75

6.7 FUTURE APPLICATIONS 76

6.8 IMPACT OF AI/GEN AI ON CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET 78

6.8.1 TOP USE CASES AND MARKET POTENTIAL 79

6.8.2 BEST PRACTICES FOLLOWED BY ORGANIZATIONS IN CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET 79

6.8.3 CASE STUDIES RELATED TO AI/GEN AI IMPLEMENTATION IN CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET 80

6.8.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS 80

6.8.5 CLIENTS’ READINESS TO ADOPT AI/GEN AI-INTEGRATED CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION SERVICES 81

7 REGULATORY LANDSCAPE AND SUSTAINABILITY INITIATIVES 82

7.1 REGIONAL REGULATIONS AND COMPLIANCE 82

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 82

7.1.2 CODES AND REGULATIONS 85

7.1.3 INDUSTRY STANDARDS 87

7.2 SUSTAINABILITY INITIATIVES 88

7.2.1 CARBON IMPACT REDUCTION 88

7.2.2 ECO-APPLICATIONS 89

7.3 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES 89

7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 90

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR 91

8.1 DECISION-MAKING PROCESS 91

8.2 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND EVALUATION CRITERIA 92

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 92

8.2.2 BUYING CRITERIA 93

8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES 94

8.4 UNMET NEEDS OF VARIOUS APPLICATIONS 94

8.5 MARKET PROFITABILITY 95

9 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION SERVICES 96

9.1 INTRODUCTION 96

9.2 VALIDATION 96

9.3 VERIFICATION 97

9.4 CERTIFICATION 98

10 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE 99

10.1 INTRODUCTION 100

10.2 VOLUNTARY 102

10.2.1 GROWING FOCUS OF CORPORATIONS AND CLIMATE-CONSCIOUS BUYERS ON CREDIBLE OFFSETS TO FUEL SEGMENTAL GROWTH 102

10.3 COMPLIANCE 103

10.3.1 RISING IMPLEMENTATION OF EMISSION-REDUCTION OBLIGATIONS BY NATIONAL OR REGIONAL AUTHORITIES TO DRIVE MARKET 103

11 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY APPLICATION 106

11.1 INTRODUCTION 107

11.2 ENERGY & UTILITIES 108

11.2.1 ONGOING EVOLUTION OF INTERNATIONAL CARBON FRAMEWORKS TO ACCELERATE SEGMENTAL GROWTH 108

11.3 TRANSPORTATION 109

11.3.1 REPLACEMENT OF INTERNAL COMBUSTION ENGINES WITH ELECTRIC ALTERNATIVES TO MEET DECARBONIZATION TARGETS TO DRIVE MARKET 109

11.4 AGRICULTURE & FORESTRY 111

11.4.1 GLOBAL FOREST RESTORATION AND SUSTAINABILITY EFFORTS TO FOSTER SEGMENTAL GROWTH 111

11.5 WATER & WASTEWATER MANAGEMENT 113

11.5.1 NEED TO MITIGATE METHANE AND NITROUS OXIDE EMISSIONS TO ACCELERATE SEGMENTAL GROWTH 113

11.6 INDUSTRIAL 114

11.6.1 STRONG FOCUS ON IMPLEMENTING ENERGY MANAGEMENT SYSTEMS TO EXPEDITE SEGMENTAL GROWTH 114

11.7 OTHER APPLICATIONS 116

12 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY REGION 118

12.1 INTRODUCTION 119

12.2 NORTH AMERICA 121

12.2.1 US 124

12.2.1.1 Rapidly scaling corporate voluntary demand and net-zero commitments to expedite market growth 124

12.2.2 CANADA 126

12.2.2.1 Tight emission benchmarks and voluntary market coverage to foster market growth 126

12.2.3 MEXICO 127

12.2.3.1 Federal climate policy and sustained demand for third-party VVC services to bolster market growth 127

12.3 ASIA PACIFIC 128

12.3.1 CHINA 132

12.3.1.1 Ambitious climate policies and robust regulatory frameworks to fuel market growth 132

12.3.2 INDIA 133

12.3.2.1 Rollout of national compliance carbon market and tightening industrial regulations to augment market growth 133

12.3.3 REST OF ASIA PACIFIC 134

12.4 EUROPE 135

12.4.1 GERMANY 138

12.4.1.1 High climate policy ambitions and compliance frameworks to contribute to market growth 138

12.4.2 UK 139

12.4.2.1 Strong corporate participation in compliance and voluntary carbon markets to spur demand for carbon credit VVC services 139

12.4.3 REST OF EUROPE 140

12.5 ROW 142

12.5.1 SOUTH AMERICA 145

12.5.1.1 Colombia 147

12.5.1.1.1 Growing participation in international voluntary carbon markets to boost market growth 147

12.5.1.2 Brazil 147

12.5.1.2.1 Extensive forestry and land-use project base to contribute to market growth 147

12.5.1.3 Rest of South America 147

12.5.2 MIDDLE EAST & AFRICA 148

12.5.2.1 Strong pipeline of renewable energy, clean cooking,

and nature-based projects to facilitate market growth 148

12.5.2.2 GCC 150

12.5.2.2.1 UAE 150

12.5.2.2.1.1 Emergence as hub for voluntary carbon trading and climate finance to accelerate market growth 150

12.5.2.2.2 Rest of GCC 150

12.5.2.3 Kenya 151

12.5.2.3.1 Focus on high-quality verification processes to bolster market growth 151

12.5.2.4 Rest of Middle East & Africa 151

13 COMPETITIVE LANDSCAPE 152

13.1 OVERVIEW 152

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2026 152

13.3 MARKET SHARE ANALYSIS, 2024 154

13.4 REVENUE ANALYSIS, 2020–2024 155

13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 157

13.5.1 STARS 157

13.5.2 EMERGING LEADERS 157

13.5.3 PERVASIVE PLAYERS 157

13.5.4 PARTICIPANTS 157

13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 159

13.5.5.1 Company footprint 159

13.5.5.2 Region footprint 160

13.5.5.3 Type footprint 161

13.5.5.4 Application footprint 162

13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 163

13.6.1 PROGRESSIVE COMPANIES 163

13.6.2 RESPONSIVE COMPANIES 163

13.6.3 DYNAMIC COMPANIES 163

13.6.4 STARTING BLOCKS 163

13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 165

13.6.5.1 Detailed list of startups/SMEs 165

13.6.5.2 Competitive benchmarking of key startups/SMEs 165

13.7 COMPANY VALUATION AND FINANCIAL METRICS 166

13.8 BRAND/PRODUCT COMPARISON 167

13.9 COMPETITIVE SCENARIO 168

13.9.1 PRODUCT LAUNCHES 168

13.9.2 DEALS 171

13.9.3 EXPANSIONS 180

13.9.4 OTHER DEVELOPMENTS 183

14 COMPANY PROFILES 184

14.1 KEY PLAYERS 184

14.1.1 VERRA 184

14.1.1.1 Business overview 184

14.1.1.2 Products/Solutions/Services offered 185

14.1.1.3 Recent developments 186

14.1.1.3.1 Product launches 186

14.1.1.3.2 Deals 187

14.1.1.4 MnM view 188

14.1.1.4.1 Key strengths/Right to win 188

14.1.1.4.2 Strategic choices 188

14.1.1.4.3 Weaknesses/Competitive threats 188

14.1.2 GOLD STANDARD 189

14.1.2.1 Business overview 189

14.1.2.2 Products/Solutions/Services offered 189

14.1.2.3 Recent developments 190

14.1.2.3.1 Product launches 190

14.1.2.3.2 Deals 191

14.1.2.3.3 Other developments 192

14.1.2.4 MnM view 193

14.1.2.4.1 Key strengths/Right to win 193

14.1.2.4.2 Strategic choices 193

14.1.2.4.3 Weaknesses/Competitive threats 193

14.1.3 CLIMATE ACTION RESERVE 194

14.1.3.1 Business overview 194

14.1.3.2 Products/Solutions/Services offered 194

14.1.3.3 Recent developments 195

14.1.3.3.1 Deals 195

14.1.3.3.2 Expansions 195

14.1.3.4 MnM view 196

14.1.3.4.1 Key strengths/Right to win 196

14.1.3.4.2 Strategic choices 196

14.1.3.4.3 Weaknesses/Competitive threats 196

14.1.4 TÜV SÜD 197

14.1.4.1 Business overview 197

14.1.4.2 Products/Solutions/Services offered 198

14.1.4.3 Recent developments 199

14.1.4.3.1 Deals 199

14.1.4.4 MnM view 199

14.1.4.4.1 Key strengths/Right to win 199

14.1.4.4.2 Strategic choices 200

14.1.4.4.3 Weaknesses/Competitive threats 200

14.1.5 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA 201

14.1.5.1 Business overview 201

14.1.5.2 Products/Solutions/Services offered 202

14.1.5.3 Recent developments 203

14.1.5.3.1 Deals 203

14.1.5.3.2 Expansions 203

14.1.5.3.3 Others developments 204

14.1.5.4 MnM view 204

14.1.5.4.1 Key strengths/Right to win 204

14.1.5.4.2 Strategic choices 204

14.1.5.4.3 Weaknesses/Competitive threats 204

14.1.6 ACR 205

14.1.6.1 Business overview 205

14.1.6.2 Products/Solutions/Services offered 205

14.1.6.3 Recent developments 206

14.1.6.3.1 Product launches 206

14.1.6.3.2 Deals 206

14.1.6.3.3 Expansions 206

14.1.7 DNV GL 207

14.1.7.1 Business overview 207

14.1.7.2 Products/Solutions/Services offered 207

14.1.7.3 Recent developments 208

14.1.7.3.1 Expansions 208

14.1.8 INTERTEK GROUP PLC 209

14.1.8.1 Business overview 209

14.1.8.2 Products/Solutions/Services offered 210

14.1.8.3 Recent developments 211

14.1.8.3.1 Product launches 211

14.1.8.3.2 Deals 211

14.1.9 BUREAU VERITAS 212

14.1.9.1 Business overview 212

14.1.9.2 Products/Solutions/Services offered 213

14.1.9.3 Recent developments 214

14.1.9.3.1 Deals 214

14.1.9.3.2 Expansions 214

14.1.10 THE ERM INTERNATIONAL GROUP LIMITED 215

14.1.10.1 Business overview 215

14.1.10.2 Products/Solutions/Services offered 215

14.1.10.3 Recent developments 216

14.1.10.3.1 Product launches 216

14.1.10.3.2 Deals 216

14.1.10.3.3 Expansions 217

14.1.11 SCS GLOBAL SERVICES 218

14.1.11.1 Business overview 218

14.1.11.2 Products/Solutions/Services offered 218

14.1.11.3 Recent developments 219

14.1.11.3.1 Product launches 219

14.1.11.3.2 Expansions 219

14.1.12 CLIMATE IMPACT PARTNERS 220

14.1.12.1 Business overview 220

14.1.12.2 Products/Solutions/Services offered 220

14.1.12.3 Recent developments 221

14.1.12.3.1 Deals 221

14.1.13 RINA S.P.A. 223

14.1.13.1 Business overview 223

14.1.13.2 Products/Solutions/Services offered 223

14.1.13.3 Recent developments 224

14.1.13.3.1 Developments 224

14.1.14 AENOR 225

14.1.14.1 Business overview 225

14.1.14.2 Products/Solutions/Services offered 226

14.1.15 SUSTAINCERT 227

14.1.15.1 Business overview 227

14.1.15.2 Products/Solutions/Services offered 227

14.1.15.3 Recent developments 228

14.1.15.3.1 Product launches 228

14.1.15.3.2 Deals 228

14.1.16 CARBONCHECK 230

14.1.16.1 Business overview 230

14.1.16.2 Products/Solutions/Services offered 230

14.1.16.3 Recent developments 231

14.1.16.3.1 Expansions 231

14.1.16.3.2 Other developments 231

14.1.17 ANEW CLIMATE, LLC 232

14.1.17.1 Business overview 232

14.1.17.2 Products/Solutions/Services offered 232

14.1.17.3 Recent developments 233

14.1.17.3.1 Deals 233

14.1.17.3.2 Expansions 234

14.1.18 THE CARBON TRUST 235

14.1.18.1 Business overview 235

14.1.18.2 Products/Solutions/Services offered 235

14.1.19 FIRST ENVIRONMENT INC. 236

14.1.19.1 Business overview 236

14.1.19.2 Products/Solutions/Services offered 236

14.1.20 ASTER GLOBAL ENVIRONMENTAL SOLUTIONS, INC. 237

14.1.20.1 Business overview 237

14.1.20.2 Products/Solutions/Services offered 237

14.2 OTHER PLAYERS 238

14.2.1 CENTER FOR RESOURCE SOLUTIONS 238

14.2.2 COTECNA 239

14.2.3 OUROFFSET NONPROFIT LLC 240

14.2.4 CARBON CREDIT CAPITAL 241

14.2.5 CONTROL UNION 242

15 RESEARCH METHODOLOGY 243

15.1 RESEARCH DATA 243

15.1.1 SECONDARY DATA 244

15.1.1.1 List of key secondary sources 244

15.1.1.2 Key data from secondary sources 244

15.1.2 PRIMARY DATA 245

15.1.2.1 Key data from primary sources 245

15.1.2.2 List of primary interview participants 246

15.1.2.3 Key industry insights 246

15.1.2.4 Breakdown of primary interviews 247

15.2 MARKET SIZE ESTIMATION 247

15.2.1 BOTTOM-UP APPROACH 247

15.2.2 TOP-DOWN APPROACH 248

15.2.3 MARKET SIZE CALCULATION FOR BASE YEAR 250

15.2.3.1 Demand-side analysis 250

15.2.3.1.1 Demand-side assumptions 250

15.2.3.1.2 Demand-side calculations 251

15.2.3.2 Supply-side analysis 252

15.2.3.2.1 Supply-side assumptions 253

15.2.3.2.2 Supply-side calculations 253

15.3 MARKET FORECAST APPROACH 253

15.3.1 SUPPLY SIDE 253

15.3.2 DEMAND SIDE 253

15.4 DATA TRIANGULATION 254

15.5 FACTOR ANALYSIS 255

15.6 RESEARCH ASSUMPTIONS AND LIMITATIONS 255

15.7 RISK ANALYSIS 256

16 APPENDIX 257

16.1 INSIGHTS FROM INDUSTRY EXPERTS 257

16.2 DISCUSSION GUIDE 257

16.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 260

16.4 CUSTOMIZATION OPTIONS 262

16.5 RELATED REPORTS 262

16.6 AUTHOR DETAILS 263

LIST OF TABLES

TABLE 1 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: INCLUSIONS AND EXCLUSIONS 27

TABLE 2 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: SUMMARY OF CHANGES 30

TABLE 3 INTERCONNECTED MARKETS 50

TABLE 4 STRATEGIC FOCUS OF TIER-1/2/3 PLAYERS 52

TABLE 5 IMPACT OF PORTER’S FIVE FORCES ANALYSIS 54

TABLE 6 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021–2029 57

TABLE 7 ROLE OF COMPANIES IN CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION ECOSYSTEM 62

TABLE 8 LIST OF KEY CONFERENCES AND EVENTS, 2026 63

TABLE 9 VERRA PARTNERS WITH FCPF TO CREATE CARBON CREDITING STANDARD

FOR REDD+ ACTIVITIES 66

TABLE 10 GOLD STANDARD APPROVES GROUNDBREAKING METHODOLOGY FOR DECENTRALIZED ORGANIC WASTE PROCESSING DEVELOPED BY LOMI

TO REDUCE WASTE 66

TABLE 11 MISSISSIPPI ALLUVIAL VALLEY ACHIEVES BIODIVERSITY CONSERVATION AND CARBON CREDIT GENERATION THROUGH ACR’S GREENTREES PROJECT 67

TABLE 12 SCS GLOBAL SERVICES CERTIFIES FRESH DEL MONTE PRODUCE’S NEW DEL MONTE ZERO PINEAPPLES TO MEET DEMAND FOR SUSTAINABLE PRODUCTS 67

TABLE 13 LIST OF KEY PATENTS, 2022–2025 74

TABLE 14 PRICING RANGE OF CARBON CREDIT SERVICES, 2024 75

TABLE 15 ENERGY, UTILITIES & INDUSTRIAL DECARBONIZATION 77

TABLE 16 NATURE-BASED SOLUTIONS (AGRICULTURE & FORESTRY) 77

TABLE 17 WATER & WASTEWATER MANAGEMENT 78

TABLE 18 TOP USE CASES AND MARKET POTENTIAL 79

TABLE 19 AI-RELATED USE CASES OF ORGANIZATIONS IN CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET 79

TABLE 20 CASE STUDIES RELATED TO AI/GEN AI IMPLEMENTATION 80

TABLE 21 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS 80

TABLE 22 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 82

TABLE 23 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 83

TABLE 24 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 84

TABLE 25 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 85

TABLE 26 CODES AND REGULATIONS 85

TABLE 27 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION STANDARDS 87

TABLE 28 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 90

TABLE 29 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR KEY APPLICATIONS 92

TABLE 30 KEY BUYING CRITERIA FOR KEY APPLICATIONS 93

TABLE 31 UNMET NEEDS, BY APPLICATION 94

TABLE 32 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET,

BY TYPE, 2021–2024 (USD MILLION) 100

TABLE 33 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET,

BY TYPE, 2025–2030 (USD MILLION) 101

TABLE 34 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET,

BY TYPE, 2021–2024 (MILLION TONS) 101

TABLE 35 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET,

BY TYPE, 2025–2030 (MILLION TONS) 101

TABLE 36 VOLUNTARY: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY REGION, 2021–2024 (USD MILLION) 103

TABLE 37 VOLUNTARY: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY REGION, 2025–2030 (USD MILLION) 103

TABLE 38 COMPLIANCE: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY REGION, 2021–2024 (USD MILLION) 104

TABLE 39 COMPLIANCE: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY REGION, 2025–2030 (USD MILLION) 105

TABLE 40 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET,

BY APPLICATION, 2021–2024 (USD MILLION) 107

TABLE 41 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET,

BY APPLICATION, 2025–2030 (USD MILLION) 108

TABLE 42 ENERGY & UTILITIES: CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET, BY REGION, 2021–2024 (USD MILLION) 109

TABLE 43 ENERGY & UTILITIES: CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET, BY REGION, 2025–2030 (USD MILLION) 109

TABLE 44 TRANSPORTATION: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY REGION, 2021–2024 (USD MILLION) 110

TABLE 45 TRANSPORTATION: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY REGION, 2025–2030 (USD MILLION) 111

TABLE 46 AGRICULTURE & FORESTRY: CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET, BY REGION, 2021–2024 (USD MILLION) 112

TABLE 47 AGRICULTURE & FORESTRY: CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET, BY REGION, 2025–2030 (USD MILLION) 112

TABLE 48 WATER & WASTEWATER MANAGEMENT: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY REGION,

2021–2024 (USD MILLION) 114

TABLE 49 WATER & WASTEWATER MANAGEMENT: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY REGION,

2025–2030 (USD MILLION) 114

TABLE 50 INDUSTRIAL: CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET, BY REGION, 2021–2024 (USD MILLION) 115

TABLE 51 INDUSTRIAL: CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET, BY REGION, 2025–2030 (USD MILLION) 115

TABLE 52 OTHER APPLICATIONS: CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET, BY REGION, 2021–2024 (USD MILLION) 116

TABLE 53 OTHER APPLICATIONS: CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET, BY REGION, 2025–2030 (USD MILLION) 117

TABLE 54 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET,

BY REGION, 2021–2024 (USD MILLION) 120

TABLE 55 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET,

BY REGION, 2025–2030 (USD MILLION) 120

TABLE 56 NORTH AMERICA: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 122

TABLE 57 NORTH AMERICA: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 123

TABLE 58 NORTH AMERICA: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 123

TABLE 59 NORTH AMERICA: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 123

TABLE 60 NORTH AMERICA: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2021–2024 (USD MILLION) 124

TABLE 61 NORTH AMERICA: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2025–2030 (USD MILLION) 124

TABLE 62 US: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET,

BY TYPE, 2021–2024 (USD MILLION) 125

TABLE 63 US: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET,

BY TYPE, 2025–2030 (USD MILLION) 126

TABLE 64 CANADA: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2021–2024 (USD MILLION) 127

TABLE 65 CANADA: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2025–2030 (USD MILLION) 127

TABLE 66 MEXICO: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2021–2024 (USD MILLION) 128

TABLE 67 MEXICO: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2025–2030 (USD MILLION) 128

TABLE 68 ASIA PACIFIC: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 130

TABLE 69 ASIA PACIFIC: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 130

TABLE 70 ASIA PACIFIC: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 130

TABLE 71 ASIA PACIFIC: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 131

TABLE 72 ASIA PACIFIC: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2021–2024 (USD MILLION) 131

TABLE 73 ASIA PACIFIC: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2025–2030 (USD MILLION) 131

TABLE 74 CHINA: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2021–2024 (USD MILLION) 132

TABLE 75 CHINA: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2025–2030 (USD MILLION) 132

TABLE 76 INDIA: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2021–2024 (USD MILLION) 133

TABLE 77 INDIA: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET BY TYPE, 2025–2030 (USD MILLION) 134

TABLE 78 REST OF ASIA PACIFIC: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2021–2024 (USD MILLION) 134

TABLE 79 REST OF ASIA PACIFIC: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2025–2030 (USD MILLION) 135

TABLE 80 EUROPE: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET BY COUNTRY, 2021–2024 (USD MILLION) 136

TABLE 81 EUROPE: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 136

TABLE 82 EUROPE: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 136

TABLE 83 EUROPE: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 137

TABLE 84 EUROPE: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2021–2024 (USD MILLION) 137

TABLE 85 EUROPE: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2025–2030 (USD MILLION) 137

TABLE 86 GERMANY: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET BY TYPE, 2021–2024 (USD MILLION) 138

TABLE 87 GERMANY: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2025–2030 (USD MILLION) 139

TABLE 88 UK: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET,

BY TYPE, 2021–2024 (USD MILLION) 140

TABLE 89 UK: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET

BY TYPE, 2025–2030 (USD MILLION) 140

TABLE 90 REST OF EUROPE: CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET, BY TYPE, 2021–2024 (USD MILLION) 142

TABLE 91 REST OF EUROPE: CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET, BY TYPE, 2025–2030 (USD MILLION) 142

TABLE 92 ROW: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY REGION, 2021–2024 (USD MILLION) 143

TABLE 93 ROW: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY REGION, 2025–2030 (USD MILLION) 143

TABLE 94 ROW: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 143

TABLE 95 ROW: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 144

TABLE 96 ROW: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2021–2024 (USD MILLION) 144

TABLE 97 ROW: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2025–2030 (USD MILLION) 144

TABLE 98 SOUTH AMERICA: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2021–2024 (USD MILLION) 145

TABLE 99 SOUTH AMERICA: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY TYPE, 2025–2030 (USD MILLION) 146

TABLE 100 SOUTH AMERICA: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 146

TABLE 101 SOUTH AMERICA: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 146

TABLE 102 MIDDLE EAST & AFRICA: CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET, BY TYPE, 2021–2024 (USD MILLION) 148

TABLE 103 MIDDLE EAST & AFRICA: CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET, BY TYPE, 2025–2030 (USD MILLION) 149

TABLE 104 MIDDLE EAST & AFRICA: CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 149

TABLE 105 MIDDLE EAST & AFRICA: CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 149

TABLE 106 GCC: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 149

TABLE 107 GCC: CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 150

TABLE 108 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: OVERVIEW OF KEY STRATEGIES ADOPTED BY KEY PLAYERS, FEBRUARY

2022–FEBRUARY 2026 152

TABLE 109 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: DEGREE OF COMPETITION, 2024 154

TABLE 110 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: REGION FOOTPRINT 160

TABLE 111 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET:

TYPE FOOTPRINT 161

TABLE 112 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: APPLICATION FOOTPRINT 162

TABLE 113 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: DETAILED LIST OF KEY STARTUPS/SMES 165

TABLE 114 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES 165

TABLE 115 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: PRODUCT LAUNCHES, FEBRUARY 2022–FEBRUARY 2026 168

TABLE 116 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET:

DEALS, FEBRUARY 2022–FEBRUARY 2026 171

TABLE 117 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: EXPANSIONS, FEBRUARY 2022–FEBRUARY 2026 180

TABLE 118 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET:

OTHER DEVELOPMENTS, FEBRUARY 2022–FEBRUARY 2026 183

TABLE 119 VERRA: COMPANY OVERVIEW 184

TABLE 120 VERRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED 185

TABLE 121 VERRA: PRODUCT LAUNCHES 186

TABLE 122 VERRA: DEALS 187

TABLE 123 GOLD STANDARD: COMPANY OVERVIEW 189

TABLE 124 GOLD STANDARD: PRODUCTS/SOLUTIONS/SERVICES OFFERED 189

TABLE 125 GOLD STANDARD: PRODUCT LAUNCHES 190

TABLE 126 GOLD STANDARD: DEALS 191

TABLE 127 GOLD STANDARD: OTHER DEVELOPMENTS 192

TABLE 128 CLIMATE ACTION RESERVE: COMPANY OVERVIEW 194

TABLE 129 CLIMATE ACTION RESERVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED 194

TABLE 130 CLIMATE ACTION RESERVE: DEALS 195

TABLE 131 CLIMATE ACTION RESERVE: EXPANSIONS 195

TABLE 132 TÜV SÜD: COMPANY OVERVIEW 197

TABLE 133 TÜV SÜD: PRODUCTS/SOLUTIONS/SERVICES OFFERED 198

TABLE 134 TÜV SÜD: DEALS 199

TABLE 135 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA: COMPANY OVERVIEW 201

TABLE 136 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA: PRODUCTS/SOLUTIONS/ SERVICES OFFERED 202

TABLE 137 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA: DEALS 203

TABLE 138 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA: EXPANSIONS 203

TABLE 139 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA: OTHER DEVELOPMENTS 204

TABLE 140 ACR: COMPANY OVERVIEW 205

TABLE 141 ACR: PRODUCTS/SOLUTIONS/SERVICES OFFERED 205

TABLE 142 ACR: PRODUCT LAUNCHES 206

TABLE 143 ACR: DEALS 206

TABLE 144 ACR: EXPANSIONS 206

TABLE 145 DNV GL: COMPANY OVERVIEW 207

TABLE 146 DNV GL: PRODUCTS/SOLUTIONS/SERVICES OFFERED 207

TABLE 147 DNV GL: EXPANSIONS 208

TABLE 148 INTERTEK GROUP PLC: COMPANY OVERVIEW 209

TABLE 149 INTERTEK GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED 210

TABLE 150 INTERTEK GROUP PLC: PRODUCT LAUNCHES 211

TABLE 151 INTERTEK GROUP PLC: DEALS 211

TABLE 152 BUREAU VERITAS: COMPANY OVERVIEW 212

TABLE 153 BUREAU VERITAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED 213

TABLE 154 BUREAU VERITAS: DEALS 214

TABLE 155 BUREAU VERITAS: EXPANSIONS 214

TABLE 156 THE ERM INTERNATIONAL GROUP LIMITED: COMPANY OVERVIEW 215

TABLE 157 THE ERM INTERNATIONAL GROUP LIMITED: PRODUCTS/SOLUTIONS/

SERVICES OFFERED 215

TABLE 158 THE ERM INTERNATIONAL GROUP LIMITED: PRODUCT LAUNCHES 216

TABLE 159 THE ERM INTERNATIONAL GROUP LIMITED: DEALS 216

TABLE 160 THE ERM INTERNATIONAL GROUP LIMITED: EXPANSIONS 217

TABLE 161 SCS GLOBAL SERVICES: COMPANY OVERVIEW 218

TABLE 162 SCS GLOBAL SERVICES: PRODUCTS/SOLUTIONS/SERVICES OFFERED 218

TABLE 163 SCS GLOBAL SERVICES: PRODUCT LAUNCHES 219

TABLE 164 SCS GLOBAL SERVICES: EXPANSIONS 219

TABLE 165 CLIMATE IMPACT PARTNERS: COMPANY OVERVIEW 220

TABLE 166 CLIMATE IMPACT PARTNERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED 220

TABLE 167 CLIMATE IMPACT PARTNERS: DEALS 221

TABLE 168 RINA S.P.A.: COMPANY OVERVIEW 223

TABLE 169 RINA S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 223

TABLE 170 RINA S.P.A.: DEVELOPMENTS 224

TABLE 171 AENOR: COMPANY OVERVIEW 225

TABLE 172 AENOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED 226

TABLE 173 SUSTAINCERT: COMPANY OVERVIEW 227

TABLE 174 SUSTAINCERT: PRODUCTS/SOLUTIONS/SERVICES OFFERED 227

TABLE 175 SUSTAINCERT: PRODUCT LAUNCHES 228

TABLE 176 SUSTAINCERT: DEALS 228

TABLE 177 CARBONCHECK: COMPANY OVERVIEW 230

TABLE 178 CARBONCHECK: PRODUCTS/SOLUTIONS/SERVICES OFFERED 230

TABLE 179 CARBONCHECK: EXPANSIONS 231

TABLE 180 CARBONCHECK: OTHER DEVELOPMENTS 231

TABLE 181 ANEW CLIMATE, LLC: COMPANY OVERVIEW 232

TABLE 182 ANEW CLIMATE, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED 232

TABLE 183 ANEW CLIMATE, LLC: DEALS 233

TABLE 184 ANEW CLIMATE, LLC: EXPANSIONS 234

TABLE 185 THE CARBON TRUST: COMPANY OVERVIEW 235

TABLE 186 THE CARBON TRUST: PRODUCTS/SOLUTIONS/SERVICES OFFERED 235

TABLE 187 FIRST ENVIRONMENT INC.: COMPANY OVERVIEW 236

TABLE 188 FIRST ENVIRONMENT INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 236

TABLE 189 ASTER GLOBAL ENVIRONMENT SOLUTIONS, INC.: COMPANY OVERVIEW 237

TABLE 190 ASTER GLOBAL ENVIRONMENT SOLUTIONS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 237

TABLE 191 CENTER FOR RESOURCE SOLUTIONS: COMPANY OVERVIEW 238

TABLE 192 COTECNA: COMPANY OVERVIEW 239

TABLE 193 OUROFFSET NONPROFIT LLC: COMPANY OVERVIEW 240

TABLE 194 CARBON CREDIT CAPITAL: COMPANY OVERVIEW 241

TABLE 195 CONTROL UNION: COMPANY OVERVIEW 242

TABLE 196 MAJOR SECONDARY SOURCES 244

TABLE 197 PRIMARY INTERVIEW PARTICIPANTS, BY COMPANY 246

TABLE 198 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET:

RISK ANALYSIS 256

LIST OF FIGURES

FIGURE 1 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET SEGMENTATION AND REGIONAL SCOPE 26

FIGURE 2 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: DURATION CONSIDERED 28

FIGURE 3 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION

MARKET SCENARIO 32

FIGURE 4 GLOBAL CARBON CREDIT VALIDATION, VERIFICATION AND CERTIFICATION MARKET, 2021–2030 32

FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET, 2022–2026 33

FIGURE 6 DISRUPTIONS IMPACTING GROWTH OF CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET 34

FIGURE 7 HIGH-GROWTH SEGMENTS IN CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET, 2025–2030 35

FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD 36

FIGURE 9 EXPANSION OF HIGH-INTEGRITY CARBON PROJECTS TO DRIVE MARKET

BETWEEN 2025 AND 2030 37

FIGURE 10 VOLUNTARY AND AGRICULTURE & FORESTRY SEGMENTS HELD LARGEST SHARES OF MARKET IN ASIA PACIFIC IN 2024 38

FIGURE 11 VOLUNTARY SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030 39

FIGURE 12 AGRICULTURE & FORESTRY SEGMENT TO HOLD LARGEST SHARE OF CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET IN 2030 39

FIGURE 13 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR BETWEEN 2025 AND 2030 40

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES 42

FIGURE 15 NATURE-BASED SOLUTIONS LEAD CARBON CREDIT ISSUANCE, FOLLOWED

BY RENEWABLE ENERGY AND HOUSEHOLD DEVICES, IN 2024 46

FIGURE 16 PORTER’S FIVE FORCES ANALYSIS 55

FIGURE 17 SUPPLY CHAIN ANALYSIS 60

FIGURE 18 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION ECOSYSTEM 62

FIGURE 19 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS 65

FIGURE 20 INVESTMENT AND FUNDING SCENARIO, 2021–2024 65

FIGURE 21 PATENTS APPLIED AND GRANTED, 2016–2025 73

FIGURE 22 FUTURE APPLICATIONS OF CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION SERVICES 76

FIGURE 23 SUCCESS STORIES AND REAL-WORLD APPLICATIONS 81

FIGURE 24 DECISION-MAKING FACTORS 91

FIGURE 25 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR MAJOR APPLICATIONS 92

FIGURE 26 KEY BUYING CRITERIA FOR MAJOR APPLICATIONS 93

FIGURE 27 VOLUNTARY SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2024 100

FIGURE 28 AGRICULTURE & FORESTRY SEGMENT CAPTURED LARGEST MARKET SHARE

IN 2024 107

FIGURE 29 ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2025 TO 2030 120

FIGURE 30 NORTH AMERICA: CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET SNAPSHOT 122

FIGURE 31 ASIA PACIFIC: CARBON CREDIT VALIDATION, VERIFICATION,

AND CERTIFICATION MARKET SNAPSHOT 129

FIGURE 32 MARKET SHARE ANALYSIS OF COMPANIES OFFERING CARBON CREDIT, VALIDATION, VERIFICATION, AND CERTIFICATION SERVICES, 2024 154

FIGURE 33 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: REVENUE ANALYSIS OF TOP THREE PLAYERS, 2020–2024 155

FIGURE 34 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024 158

FIGURE 35 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: COMPANY FOOTPRINT 159

FIGURE 36 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 164

FIGURE 37 COMPANY VALUATION 166

FIGURE 38 FINANCIAL METRICS 166

FIGURE 39 BRAND/PRODUCT COMPARISON 167

FIGURE 40 VERRA: COMPANY SNAPSHOT 185

FIGURE 41 TÜV SÜD: COMPANY SNAPSHOT 198

FIGURE 42 SGS SOCIÉTÉ GÉNÉRALE DE SURVEILLANCE SA: COMPANY SNAPSHOT 202

FIGURE 43 INTERTEK GROUP PLC: COMPANY SNAPSHOT 210

FIGURE 44 BUREAU VERITAS: COMPANY SNAPSHOT 213

FIGURE 45 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: RESEARCH DESIGN 243

FIGURE 46 DATA CAPTURED FROM SECONDARY SOURCES 244

FIGURE 47 DATA CAPTURED FROM PRIMARY SOURCES 245

FIGURE 48 CORE FINDINGS FROM INDUSTRY EXPERTS 246

FIGURE 49 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION,

AND REGION 247

FIGURE 50 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: BOTTOM-UP APPROACH 248

FIGURE 51 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET:

TOP-DOWN APPROACH 249

FIGURE 52 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: DEMAND-SIDE ANALYSIS 250

FIGURE 53 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: DEMAND-SIDE CALCULATIONS 251

FIGURE 54 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION SERVICES 252

FIGURE 55 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: SUPPLY-SIDE ANALYSIS 252

FIGURE 56 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET:

DATA TRIANGULATION 254

FIGURE 57 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION:

FACTOR ANALYSIS 255

FIGURE 58 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: RESEARCH ASSUMPTIONS AND LIMITATIONS 255

FIGURE 59 CARBON CREDIT VALIDATION, VERIFICATION, AND CERTIFICATION MARKET: INSIGHTS FROM INDUSTRY EXPERTS 257