Low-Voltage DC Circuit Breaker Market - Global Forecast To 2030

低電圧DCサーキットブレーカ市場 - 電圧(60V未満、60V~120V、120V~380V、380V~1.5kV)、タイプ(エアー、モールドケース、その他)、遮断機構(ソリッドステート、ハイブリッド、機械式)、エンドユーザー、地域別 - 2030年までの世界予測

Low Voltage DC Circuit Breaker Market by Voltage (Below 60V, 60V-120V, 120V-380V, 380V-1.5kV), Type (Air, Molded Case, Others), Breaking Mechanism (Solid-state, Hybrid, Mechanical), End User, and Region - Global Forecast to 2030

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年01月 |

| ページ数 | 287 |

| 図表数 | 334 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-12467 |

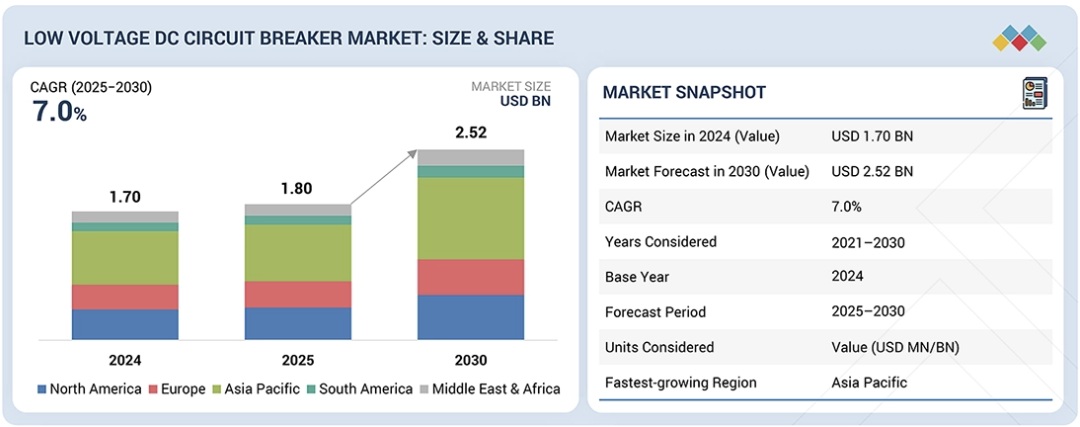

世界の低電圧DCサーキットブレーカ市場は、2025年には18億米ドル、2030年には25億2000万米ドルに達し、予測期間中に年平均成長率(CAGR)7.0%で成長すると予想されています。低電圧DC遮断器の採用を促進する主な理由の1つは、エネルギー、モビリティ、デジタル分野におけるDCベースの電力システムの採用増加です。太陽光発電、BESS、EV充電ステーション、データセンターの採用増加により、高効率で信頼性の高いDC電力保護ソリューションの需要が高まっています。DC電力システムは、ACシステムとは異なり、自然なゼロクロスポイントのない途切れない電流フローなど、特定の制限があるため、DC遮断器が不可欠です。世界各国の政府は、再生可能エネルギーの導入を促進する取り組みの一環として、低電圧DCサーキットブレーカの需要を拡大し続けています。さらに、産業界が業務効率の向上に向けた取り組みを継続していることから、低電圧DC遮断器の需要は計り知れないほど高まっています。商業、通信、産業分野の DC マイクログリッドは、低電圧 DC 回路ブレーカーの需要を補充し続けています。

調査範囲

本レポートは、低電圧DCサーキットブレーカ市場をタイプ、電圧、遮断機構、エンドユーザー、地域別にセグメント化し、予測を行っています。また、市場の成長促進要因、制約要因、機会、課題についても考察しています。北米、欧州、アジア太平洋、南米、中東アフリカの3つの主要地域における市場の詳細な分析を提供しています。さらに、主要企業のバリューチェーン分析と、低電圧DC遮断器エコシステムにおける競合分析も含まれています。

本レポートを購入する主なメリット

- 成長に影響を与える主要な推進要因(バッテリーエネルギー貯蔵システム(BESS)の急速な成長、あらゆる規模の太陽光発電システムの導入加速、EV急速充電インフラの拡大)、制約要因(規格の断片化と相互運用性の欠如、DCアーク遮断装置の高コスト化と技術的複雑さ)、機会(ハイブリッド型およびソリッドステート型DCブレーカーの採用拡大、大規模太陽光発電システムとエネルギー貯蔵システムの統合による高度なDC保護需要の促進、高付加価値需要を生み出す380VDCデータセンターアーキテクチャの台頭)、課題(小型PVおよび住宅用ESSセグメントにおける価格感度、PV、BESS、EV OEMによる長期にわたる認定サイクル)の分析。

- 製品/ソリューション/サービス開発/イノベーション:低電圧DC遮断器市場における今後の技術、研究開発活動に関する詳細な洞察

- 市場開発:有望な市場に関する包括的な情報。本レポートでは、様々な地域における低電圧DC遮断器市場を分析しています。

- 市場多様化:未開拓地域における新しい半導体製造装置、最近の開発状況、低電圧DC遮断器市場への投資に関する包括的な情報

- 競合評価:ABB、シーメンス、シュナイダーエレクトリック、イートン、三菱電機など、主要企業の市場シェア、成長戦略、および製品・サービスに関する詳細な評価。

Report Description

The global low voltage DC circuit breaker market is expected to reach USD 1.80 billion in 2025 and USD 2.52 billion by 2030, exhibiting a CAGR of 7.0% during the forecast period. One key reason propelling the adoption of low voltage DC circuit breakers is the increasing adoption of DC-based power systems in the energy, mobility, and digital space. The increasing adoption of solar PV, BESS, EV charging stations, and data centers has resulted in growing demand for DC power protection solutions that offer high efficiency and reliability. DC power systems, unlike their counterparts in the AC system, have certain limitations, including uninterrupted current flow with no natural zero crossing points, thereby making DC circuit breakers indispensable. Governments around the world, in their efforts to promote the adoption of renewable energy, continue to augment the demand for low voltage DC circuit breakers. Additionally, with industries continuing their efforts towards increasing the efficiency of their operations, the demand for low voltage DC circuit breakers cannot be overstated. DC microgrids in the commercial, telecom, and industrial space continue to supplement the demand for low voltage DC circuit breakers..

Low-Voltage DC Circuit Breaker Market – Global Forecast To 2030

“Molded case circuit breaker in the type segment are expected to hold largest market share in the low voltage DC circuit breaker market during the forecast period”

Molded case circuit breakers (MCCBs) are anticipated to occupy the largest share of the low voltage DC circuit breaker market during the forecast period because of their adaptability, high current rating, and excellent protection mechanisms. MCCBs are applied in various applications like solar PV systems, battery storage solutions, electric vehicle charging stations, and industrial DC distribution systems, where high current ratings and reliable switching of faults are necessary. Compared to MC series circuit breakers, molded case circuit breakers are adjustable, providing improved thermal and magnetic protections along with advanced arc extinguishing properties, making them appropriate for DC systems. Their ability to work efficiently within a high voltage range of 380-1.5kVDC further aids in the adoption of MCCBs. Moreover, MCCBs are generally used within switchgear and-power distribution boards, making it simpler for consumers to design and maintain the system. MCCBs are preferred for large-scale and critical DC application systems because of such benefits.

“Battery energy storage systems in the end user segment to hold second largest market share in the low voltage DC circuit breaker market during the forecast period”

Battery energy storage systems are anticipated to have the second-largest market share in the market for low-voltage DC circuit breakers during the forecast period, owing to the indispensable role of BESS in stabilizing the power distribution of the modern power system. BESS deployment has escalated globally for its application in grids, commercial, and residential projects. Since battery energy inherently works on DC, the use of LV DC circuit breakers has become essential for securing battery strings, inverters, or DC buses against malfunctions, overload, or short circuits. Rising lithium-ion battery energy storage solutions used for solar storage projects, electric vehicle charging stations, or microgrids have contributed considerably to the demand for DC circuit breakers. Moreover, issues regarding thermal runaways and high fault currents have compelled system integrators to choose high-quality DC protection solutions..

Low-Voltage DC Circuit Breaker Market – Global Forecast To 2030 – region

“China is likely to dominate the Asia Pacific low voltage DC circuit breaker market during the forecast period”

China would emerge as a leader in the Asia Pacific market for low voltage DC circuit breakers on account of its vast investments in renewable energy, electric vehicles, and smart grid modernization. China accounts for a massive share of global installations in solar PV energy storage systems in the world. These sectors primarily employ vast capacities of DC power, making way for a massive demand for low voltage DC circuit breakers in China. Moreover, massive support for clean energy technologies such as smart grids and electric vehicles in China fuels a huge demand for low voltage DC circuit breakers in the APAC market. Additionally, China has a well-developed manufacturing infrastructure for electrical devices, making it simpler for low voltage DC circuit breakers to be mass-produced in the APAC market.

Breakdown of Primaries

In-depth interviews have been conducted with chief executive officers (CEOs), Directors, and other executives from various key organizations operating in the biorefinery market.

- By Company Type: Tier 1- 65%, Tier 2- 24%, and Tier 3- 11%

- By Designation: C-level Executives – 30%, Director Level- 25%, and Others- 45%

- By Region: North America – 27%, Europe – 20%, Asia Pacific – 33%, South America – 12%, Middle East & Africa – 8%

Note: Other designations include sales managers, engineers, and regional managers.

Note: tier 1 company—revenue >USD 5 billion, tier 2 company—revenue between USD 1 and USD 5 billion, and tier 3 company—revenue <USD 1 billion.

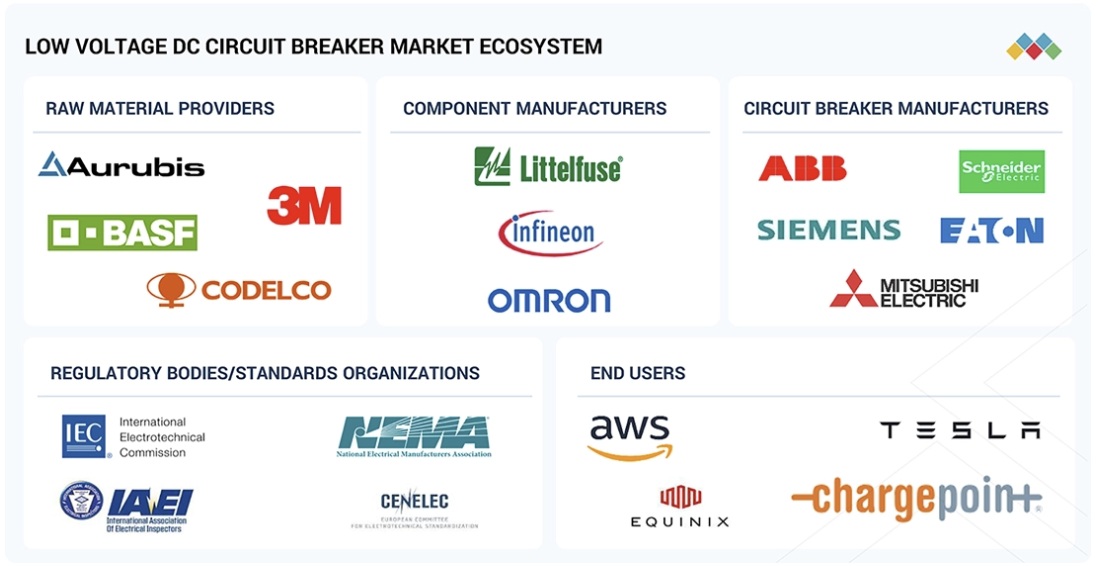

Low-Voltage DC Circuit Breaker Market – Global Forecast To 2030 – ecosystem

The global low voltage DC circuit breaker market is dominated by key players that hold a wide regional presence and offer a diverse range of products. Leading companies in the low voltage DC circuit breaker market include ABB, Siemens, Schneider Electric, Eaton, and MITSUBHI ELECTRIC CORPORATION among others. These players focus on strategies such as product innovations, acquisitions, contracts, and expansions to strengthen their market position. New product launches, coupled with strategic, are key approaches adopted by these companies to maintain competitive advantages in the evolving market landscape.

Study Coverage

The report segments the low voltage DC circuit breaker market and forecasts in by type, voltage, breaking mechanism, end user and region. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It gives a detailed view of the market across three main regions—North America, Europe, Asia Pacific, South America and MEA. The report includes a value chain analysis of the key players and their competitive analysis of the low voltage DC circuit breaker ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (Rapid Growth in Battery Energy Storage Systems (BESS), Accelerated Solar PV Deployment Across All Scales, Expansion of EV Fast-Charging Infrastructure), restraints (Fragmented Standards and Lack of Interoperability, Higher Cost and Technical Complexity of DC Arc Interruption ) opportunities (Growing Adoption of Hybrid and Solid-State DC Breakers, Utility-Scale Solar and Energy Storage Integration Driving Advanced DC Protection Demand, Emerging 380 VDC Data Center Architectures Creating High-Value Demand ), and challenges (Price Sensitivity in Small PV and Residential ESS Segments, Long Qualification Cycles with PV, BESS, and EV OEMs ) influencing the growth.

- Products/Solution/Service Development/Innovation: Detailed insights into upcoming technologies, research, and development activities in the low voltage DC circuit breaker market

- Market Development: Comprehensive information about lucrative markets-the report analyses the low voltage DC circuit breaker market across varied regions.

- Market Diversification: Exhaustive information about new semiconductor manufacturing equipment in untapped geographies, recent developments, and investments in the low voltage DC circuit breaker market

- Competitive Assessment: In-depth assessment of market shares and growth strategies and offerings of leading players, such as ABB, Siemens, Schneider Electric, Eaton, and MITSUBHI ELECTRIC CORPORATION among others.

Table of Contents

1 INTRODUCTION 27

1.1 STUDY OBJECTIVES 27

1.2 MARKET DEFINITION 27

1.3 STUDY SCOPE 28

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 28

1.3.2 INCLUSIONS AND EXCLUSIONS 29

1.3.3 YEARS CONSIDERED 30

1.4 CURRENCY CONSIDERED 30

1.5 UNIT CONSIDERED 30

1.6 LIMITATIONS 30

1.7 STAKEHOLDERS 31

1.8 SUMMARY OF CHANGES 31

2 EXECUTIVE SUMMARY 33

2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS 33

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 34

2.3 DISRUPTIVE TRENDS IN LOW-VOLTAGE DC CIRCUIT BREAKER MARKET 35

2.4 HIGH GROWTH SEGMENTS 36

2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST 37

3 PREMIUM INSIGHTS 38

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LOW-VOLTAGE DC CIRCUIT

BREAKER MARKET 38

3.2 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION 39

3.3 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY VOLTAGE 39

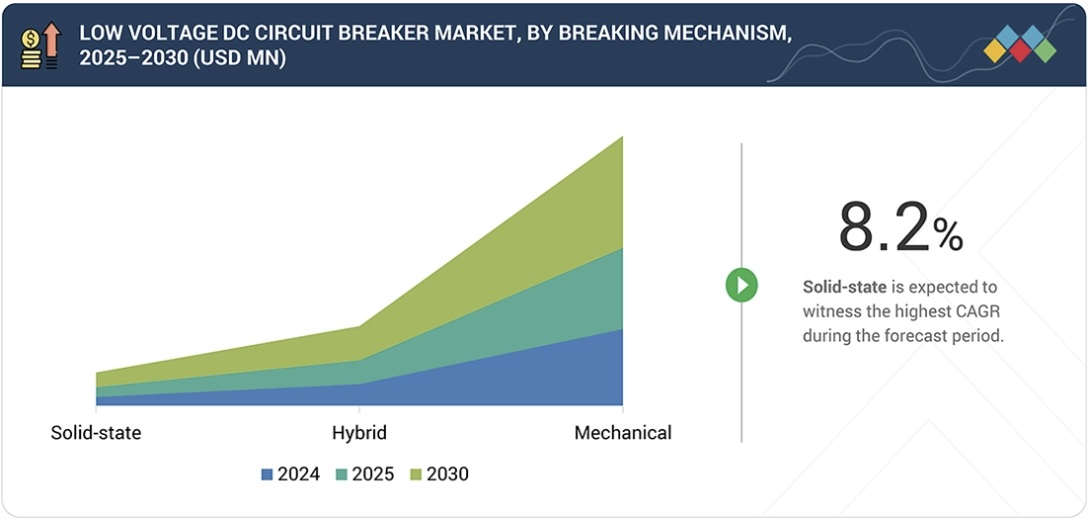

3.4 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY BREAKING MECHANISM 40

3.5 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY TYPE 40

3.6 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE 41

3.7 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET IN ASIA PACIFIC,

BY END USE AND COUNTRY 41

4 MARKET OVERVIEW 42

4.1 INTRODUCTION 42

4.2 MARKET DYNAMICS 43

4.2.1 DRIVERS 43

4.2.1.1 Mounting deployment of battery energy storage systems (BESS) 43

4.2.1.2 Increasing installation of solar photovoltaic (PV) systems 44

4.2.1.3 Rapid expansion of EV fast-charging infrastructure 45

4.2.2 RESTRAINTS 47

4.2.2.1 Lack of DC protection standards and production issues 47

4.2.2.2 High costs resulting from technical complexities 48

4.2.3 OPPORTUNITIES 48

4.2.3.1 Growing popularity of hybrid and solid-state DC circuit breakers 48

4.2.3.2 Increasing co-located utility-scale solar PV and BESS projects 49

4.2.3.3 Shifting preference toward 800 VDC power distribution in data centers 49

4.2.4 CHALLENGES 50

4.2.4.1 Price sensitivity in small PV and residential ESS segments 50

4.2.4.2 Long qualification cycles with PV, BESS, and EV OEMs 50

4.3 UNMET NEEDS AND WHITE SPACES 51

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 52

4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS 54

4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 55

5 INDUSTRY TRENDS 56

5.1 PORTER’S FIVE FORCES ANALYSIS 56

5.1.1 INTENSITY OF COMPETITIVE RIVALRY 57

5.1.2 THREAT OF NEW ENTRANTS 57

5.1.3 BARGAINING POWER OF SUPPLIERS 57

5.1.4 BARGAINING POWER OF BUYERS 57

5.1.5 THREATS OF SUBSTITUTES 58

5.2 MACROECONOMIC OUTLOOK 58

5.2.1 INTRODUCTION 58

5.2.2 GDP TRENDS AND FORECAST 58

5.2.3 TRENDS IN SOLAR PV PLANT INDUSTRY 60

5.2.4 TRENDS IN BATTERY ENERGY STORAGE SYSTEM (BESS) INDUSTRY 60

5.3 VALUE CHAIN ANALYSIS 61

5.4 ECOSYSTEM ANALYSIS 62

5.5 PRICING ANALYSIS 63

5.5.1 PRICING RANGE OF LOW-VOLTAGE DC CIRCUIT BREAKERS, BY VOLTAGE, 2024 63

5.5.2 AVERAGE SELLING PRICE TREND OF LOW-VOLTAGE DC CIRCUIT BREAKERS, BY REGION, 2021–2024 64

5.6 TRADE ANALYSIS 65

5.6.1 IMPORT SCENARIO (HS CODE 853690) 65

5.6.2 EXPORT SCENARIO (HS CODE 853690) 66

5.7 KEY CONFERENCES AND EVENTS, 2026 68

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 68

5.9 CASE STUDY ANALYSIS 69

5.9.1 EATON’S PVGARD DC MOLDED CASE CIRCUIT BREAKERS HELP COMPLY WITH SAFETY STANDARDS IN SOLAR AND STORAGE SITES 69

5.9.2 ABB’S LV-DC BREAKERS IMPROVE FAULT DETECTION IN INDUSTRIAL PLANTS AND TELECOM FACILITIES 69

5.9.3 IGBT-BASED LV SOLID-STATE DC CIRCUIT BREAKER (SSCB) ENHANCES DC MICROGRID RELIABILITY AND SAFETY 70

5.10 IMPACT OF 2025 US TARIFF – LOW-VOLTAGE DC CIRCUIT BREAKER MARKET 70

5.10.1 INTRODUCTION 70

5.10.2 KEY TARIFF RATES 71

5.10.3 PRICE IMPACT ANALYSIS 71

5.10.4 IMPACT ON COUNTRIES/REGIONS 73

5.10.4.1 US 73

5.10.4.2 Europe 73

5.10.4.3 Asia Pacific 74

5.10.5 IMPACT ON TYPES 75

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACTS, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS 77

6.1 KEY EMERGING TECHNOLOGIES 77

6.1.1 DC ARC INTERRUPTION AND QUENCHING TECHNOLOGY 77

6.1.2 THERMAL-MAGNETIC AND ELECTRONIC TRIP UNITS (DC-TUNED) 77

6.2 COMPLEMENTARY TECHNOLOGIES 77

6.2.1 ELECTRONIC AND MICROPROCESSOR-BASED PROTECTION UNITS 77

6.2.2 BIDIRECTIONAL DC INTERRUPTION DESIGN 78

6.3 ADJACENT TECHNOLOGIES 78

6.3.1 DC POWER CONVERSION SYSTEMS 78

6.3.2 DC MICROGRIDS AND RENEWABLE DC NETWORKS 78

6.4 TECHNOLOGY/PRODUCT ROADMAP 78

6.4.1 SHORT-TERM (2025–2027) | DIGITAL & ECO-DESIGN FOUNDATION 79

6.4.2 MID-TERM (2027–2030) | GRID MODERNIZATION & SYSTEM INTEGRATION 79

6.4.3 LONG-TERM (2030–2035+) | AUTONOMOUS, GRID-INTERACTIVE PROTECTION 80

6.5 PATENT ANALYSIS 80

6.6 FUTURE APPLICATIONS 82

6.7 IMPACT OF AI/GEN AI ON LOW-VOLTAGE DC CIRCUIT BREAKER MARKET 84

6.7.1 TOP USE CASES AND MARKET POTENTIAL 84

6.7.2 BEST PRACTICES FOLLOWED BY OEMS IN LOW-VOLTAGE DC CIRCUIT BREAKER MARKET 85

6.7.3 CASE STUDIES RELATED TO AI IMPLEMENTATION IN LOW-VOLTAGE DC CIRCUIT BREAKER MARKET 85

6.7.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS 86

6.7.5 CLIENTS’ READINESS TO ADOPT GEN AI/AI-INTEGRATED LOW-VOLTAGE DC CIRCUIT BREAKERS 86

7 REGULATORY LANDSCAPE AND SUSTAINABILITY INITIATIVES 88

7.1 REGIONAL REGULATIONS AND COMPLIANCE 88

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 88

7.1.2 INDUSTRY STANDARDS 89

7.2 SUSTAINABILITY INITIATIVES 90

7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF MEDIUM FREQUENCY MAGNETICS 90

7.3 IMPACT OF REGULATORY POLICY ON SUSTAINABILITY INITIATIVES 91

7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 92

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR 93

8.1 DECISION-MAKING PROCESS 93

8.2 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND EVALUATION CRITERIA 94

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 94

8.2.2 BUYING CRITERIA 95

8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES 95

8.4 UNMET NEEDS OF VARIOUS END USES 96

8.5 MARKET PROFITABILITY 97

9 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY TYPE 98

9.1 INTRODUCTION 99

9.2 AIR CIRCUIT BREAKERS 100

9.2.1 LARGE-SCALE ELECTRIFICATION AND ENERGY STORAGE PROJECTS TO BOOST SEGMENTAL GROWTH 100

9.3 MOLDED CASE CIRCUIT BREAKERS 101

9.3.1 ABILITY TO ENHANCE SAFETY WHILE ENABLING RELIABLE INTERRUPTION TO EXPEDITE SEGMENTAL GROWTH 101

9.4 OTHERS 102

10 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY VOLTAGE 104

10.1 INTRODUCTION 105

10.2 BELOW 60 V 106

10.2.1 USAGE TO MINIMIZE ELECTRICAL SHOCK RISK AND ENSURE BASIC FAULT PROTECTION TO FOSTER SEGMENTAL GROWTH 106

10.3 60–120 V 108

10.3.1 RELIABLE INTERRUPTION AND COMPACT FORM FACTORS FOR SPACE-CONSTRAINED INSTALLATIONS TO SPUR DEMAND 108

10.4 121–380 V 110

10.4.1 IMPROVED EFFICIENCY AND REDUCED CURRENT LOSSES TO CONTRIBUTE TO SEGMENTAL GROWTH 110

10.5 381 V–1.5 KV 111

10.5.1 ABILITY TO REDUCE CURRENT FLOW, IMPROVE OVERALL SYSTEM EFFICIENCY, AND LOWER CABLING COSTS TO DRIVE MARKET 111

11 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY BREAKING MECHANISM 114

11.1 INTRODUCTION 115

11.2 SOLID-STATE 116

11.2.1 INCREASING USE IN DIGITALLY CONTROLLED AND HIGH-AVAILABILITY ENVIRONMENTS TO BOLSTER SEGMENTAL GROWTH 116

11.3 HYBRID 117

11.3.1 ABILITY TO DELIVER FAST RESPONSE WITHOUT FULL RELIANCE ON SEMICONDUCTORS TO FUEL SEGMENTAL GROWTH 117

11.4 MECHANICAL 118

11.4.1 PROVEN DESIGN, EASE OF INSTALLATION, AND STRAIGHTFORWARD OPERATION TO AUGMENT SEGMENTAL GROWTH 118

12 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE 120

12.1 INTRODUCTION 121

12.2 BATTERY ENERGY STORAGE SYSTEMS 122

12.2.1 FOCUS ON COMPLIANCE WITH EVOLVING FIRE SAFETY AND GRID INTERCONNECTION STANDARDS TO DRIVE MARKET 122

12.3 DATA CENTERS 123

12.3.1 EXPANSION OF HYPERSCALE AND COLOCATION CENTERS TO ACCELERATE SEGMENTAL GROWTH 123

12.4 SOLAR PV PLANTS 124

12.4.1 TRANSITION TOWARD HIGHER-CAPACITY CLEAN ENERGY INSTALLATIONS TO FOSTER SEGMENTAL GROWTH 124

12.5 EV FAST-CHARGING INFRASTRUCTURE 125

12.5.1 NEED TO INTERRUPT STEEP FAULT CURRENTS QUICKLY AND SAFELY TO BOOST SEGMENTAL GROWTH 125

12.6 RAIL TRANSIT & METRO 126

12.6.1 FOCUS ON ENSURING SAFE POWER DISTRIBUTION AND MINIMIZING SERVICE DISRUPTIONS TO EXPEDITE SEGMENTAL GROWTH 126

12.7 INDUSTRIAL 128

12.7.1 EMPHASIS ON PROTECTING SENSITIVE EQUIPMENT FROM ELECTRICAL FAULTS TO BOLSTER SEGMENTAL GROWTH 128

12.8 COMMERCIAL & RESIDENTIAL 129

12.8.1 NEED FOR SAFE INTEGRATION OF DECENTRALIZED ENERGY SYSTEMS TO CONTRIBUTE TO SEGMENTAL GROWTH 129

13 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET FOR DATA CENTERS,

BY VOLTAGE 131

13.1 INTRODUCTION 132

13.2 BELOW 60 V 133

13.2.1 INCREASING AUTOMATION AND DIGITALIZATION OF DATA CENTER OPERATIONS TO FUEL SEGMENTAL GROWTH 133

13.3 60–120 V 134

13.3.1 RISING DEPLOYMENT OF AI SERVERS, HIGH-PERFORMANCE COMPUTING CLUSTERS, AND CLOUD INFRASTRUCTURE TO DRIVE MARKET 134

13.4 121–380 V 134

13.4.1 MOUNTING ADOPTION IN HYPERSCALE AND LARGE COLOCATION DATA CENTERS TO AUGMENT SEGMENTAL GROWTH 134

13.5 381 V–1.5 KV 135

13.5.1 TRANSFORMATION OF HYPERSCALE OPERATORS FROM PILOT IMPLEMENTATIONS TO BROADER ROLLOUTS TO SPUR DEMAND 135

14 LOW-VOLTAGE DC CIRCUIT MARKET, BY REGION 136

14.1 INTRODUCTION 137

14.2 NORTH AMERICA 139

14.2.1 US 143

14.2.1.1 Large-scale electrification across transportation, energy, and digital infrastructure to expedite market growth 143

14.2.2 CANADA 144

14.2.2.1 Strong commitment to clean energy and electrified transportation to bolster market growth 144

14.2.3 MEXICO 145

14.2.3.1 Increasing EV manufacturing and renewable energy deployment to accelerate market growth 145

14.3 EUROPE 147

14.3.1 GERMANY 151

14.3.1.1 Renewable energy transition and industrial electrification to expedite market growth 151

14.3.2 UK 152

14.3.2.1 Push toward digital infrastructure, smart grids, and renewable integration to drive market 152

14.3.3 RUSSIA 154

14.3.3.1 Infrastructure modernization and gradual electrification initiatives to accelerate market growth 154

14.3.4 ITALY 155

14.3.4.1 Increasing solar PV deployment and energy storage investments to fuel market growth 155

14.3.5 FRANCE 156

14.3.5.1 Renewable energy expansion and electrification policies to contribute to market growth 156

14.3.6 REST OF EUROPE 157

14.4 ASIA PACIFIC 159

14.4.1 CHINA 163

14.4.1.1 Mounting demand for battery energy storage systems (BESS) to bolster market growth 163

14.4.2 INDIA 164

14.4.2.1 Grid modernization and data center development to expedite market growth 164

14.4.3 SOUTH KOREA 165

14.4.3.1 Industrial automation and energy storage system adoption to augment market growth 165

14.4.4 JAPAN 167

14.4.4.1 Strong emphasis on smart grid resilience to accelerate market growth 167

14.4.5 REST OF ASIA PACIFIC 168

14.5 MIDDLE EAST & AFRICA 170

14.5.1 GCC 174

14.5.1.1 Saudi Arabia 174

14.5.1.1.1 Growing emphasis on renewable energy expansion and electrification strategies to support market growth 174

14.5.1.2 UAE 175

14.5.1.2.1 Substantial clean energy commitments to contribute to market growth 175

14.5.1.3 Rest of GCC 176

14.5.2 SOUTH AFRICA 178

14.5.2.1 Rising integration of utility-scale and commercial PV systems to bolster market growth 178

14.5.3 REST OF MIDDLE EAST & AFRICA 179

14.6 SOUTH AMERICA 181

14.6.1 BRAZIL 184

14.6.1.1 High investment in distributed and utility-scale PV projects to support market growth 184

14.6.2 ARGENTINA 185

14.6.2.1 Strong focus on stabilizing national grid and reducing dependence on fossil fuels to boost market growth 185

14.6.3 CHILE 186

14.6.3.1 Rising renewable capacity additions to accelerate market growth 186

14.6.4 REST OF SOUTH AMERICA 187

15 COMPETITIVE LANDSCAPE 189

15.1 OVERVIEW 189

15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2025 189

15.3 REVENUE ANALYSIS, 2020–2024 191

15.4 MARKET SHARE ANALYSIS, 2024 191

15.5 COMPANY VALUATION AND FINANCIAL METRICS 194

15.6 BRAND COMPARISON 195

15.6.1 EATON 195

15.6.2 SCHNEIDER ELECTRIC 195

15.6.3 ABB 196

15.6.4 SIEMENS 196

15.6.5 MITSUBISHI ELECTRIC CORPORATION 196

15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 196

15.7.1 STARS 196

15.7.2 EMERGING LEADERS 196

15.7.3 PERVASIVE PLAYERS 197

15.7.4 PARTICIPANTS 197

15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 198

15.7.5.1 Company footprint 198

15.7.5.2 Region footprint 199

15.7.5.3 Type footprint 200

15.7.5.4 Voltage footprint 201

15.7.5.5 End use footprint 202

15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 203

15.8.1 PROGRESSIVE COMPANIES 203

15.8.2 RESPONSIVE COMPANIES 203

15.8.3 DYNAMIC COMPANIES 203

15.8.4 STARTING BLOCKS 203

15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 205

15.8.5.1 Detailed list of key startups/SMEs 205

15.8.5.2 Competitive benchmarking of key startups/SMEs 205

15.9 COMPETITIVE SCENARIO 206

15.9.1 PRODUCT LAUNCHES 206

15.9.2 DEALS 207

15.9.3 EXPANSIONS 209

16 COMPANY PROFILES 211

16.1 KEY PLAYERS 211

16.1.1 ABB 211

16.1.1.1 Business overview 211

16.1.1.2 Products/Solutions/Services offered 212

16.1.1.3 Recent developments 213

16.1.1.3.1 Product launches 213

16.1.1.3.2 Deals 213

16.1.1.3.3 Expansions 214

16.1.1.3.4 Other developments 214

16.1.1.4 MnM view 215

16.1.1.4.1 Key strengths/Right to win 215

16.1.1.4.2 Strategic choices 215

16.1.1.4.3 Weaknesses/Competitive threats 215

16.1.2 EATON 216

16.1.2.1 Business overview 216

16.1.2.2 Products/Solutions/Services offered 217

16.1.2.3 Recent developments 218

16.1.2.3.1 Product launches 218

16.1.2.3.2 Deals 219

16.1.2.3.3 Expansions 219

16.1.2.4 MnM view 220

16.1.2.4.1 Key strengths/Right to win 220

16.1.2.4.2 Strategic choices 220

16.1.2.4.3 Weaknesses/Competitive threats 220

16.1.3 SCHNEIDER ELECTRIC 221

16.1.3.1 Business overview 221

16.1.3.2 Products/Solutions/Services offered 222

16.1.3.3 Recent developments 223

16.1.3.3.1 Product launches 223

16.1.3.3.2 Expansions 224

16.1.3.4 MnM view 224

16.1.3.4.1 Key strengths/Right to win 224

16.1.3.4.2 Strategic choices 224

16.1.3.4.3 Weaknesses/Competitive threats 224

16.1.4 SIEMENS 225

16.1.4.1 Business overview 225

16.1.4.2 Products/Solutions/Services offered 226

16.1.4.3 Recent developments 227

16.1.4.3.1 Deals 227

16.1.4.3.2 Other developments 227

16.1.4.4 MnM view 228

16.1.4.4.1 Key strengths/Right to win 228

16.1.4.4.2 Strategic choices 228

16.1.4.4.3 Weaknesses/Competitive threats 228

16.1.5 MITSUBISHI ELECTRIC CORPORATION 229

16.1.5.1 Business overview 229

16.1.5.2 Products/Solutions/Services offered 230

16.1.5.3 Recent developments 231

16.1.5.3.1 Deals 231

16.1.5.3.2 Other developments 231

16.1.5.4 MnM view 232

16.1.5.4.1 Key strengths/Right to win 232

16.1.5.4.2 Strategic choices 232

16.1.5.4.3 Weaknesses/Competitive threats 232

16.1.6 LS ELECTRIC CO., LTD. 233

16.1.6.1 Business overview 233

16.1.6.2 Products/Solutions/Services offered 234

16.1.7 CHINT GROUP 235

16.1.7.1 Business overview 235

16.1.7.2 Products/Solutions/Services offered 235

16.1.8 FUJI ELECTRIC CO., LTD. 237

16.1.8.1 Business overview 237

16.1.8.2 Products/Solutions/Services offered 238

16.1.8.3 Recent developments 239

16.1.8.3.1 Product launches 239

16.1.8.3.2 Expansions 239

16.1.9 ROCKWELL AUTOMATION 240

16.1.9.1 Business overview 240

16.1.9.2 Products/Solutions/Services offered 241

16.1.9.3 Recent developments 242

16.1.9.3.1 Product launches 242

16.1.10 BENY 243

16.1.10.1 Business overview 243

16.1.10.2 Products/Solutions/Services offered 243

16.1.11 LEGRAND 245

16.1.11.1 Business overview 245

16.1.11.2 Products/Solutions/Services offered 246

16.1.12 SÉCHERON 247

16.1.12.1 Business overview 247

16.1.12.2 Products/Solutions/Services offered 247

16.1.13 CARLING TECHNOLOGIES 248

16.1.13.1 Business overview 248

16.1.13.2 Products/Solutions/Services offered 248

16.1.14 CNC ELECTRIC GROUP CO., LTD. 251

16.1.14.1 Business overview 251

16.1.14.2 Products/Solutions/Services offered 251

16.1.15 ONCCY ELECTRICAL CO., LTD 253

16.1.15.1 Business overview 253

16.1.15.2 Products/Solutions/Services offered 253

16.2 OTHER PLAYERS 255

16.2.1 ENTEC ELECTRIC & ELECTRONIC 255

16.2.2 ZHEJIANG AITE ELECTRIC TECHNOLOGY CO., LTD. 256

16.2.3 MYERS POWER PRODUCTS, INC. 257

16.2.4 NADER 258

16.2.5 LETOP 259

16.2.6 WENZHOU ZHECHI ELECTRIC CO., LTD. 260

16.2.7 ZHEJIANG DABO ELECTRIC CO., LTD. 261

16.2.8 IGOYE SOLAR POWER SYSTEM 262

16.2.9 GEYA ELECTRICAL EQUIPMENT SUPPLY 263

16.2.10 ZHEJIANG GRL ELECTRIC CO., LTD. 264

17 RESEARCH METHODOLOGY 265

17.1 RESEARCH DATA 265

17.1.1 SECONDARY DATA 266

17.1.1.1 List of key secondary sources 266

17.1.1.2 Key data from secondary sources 266

17.1.2 PRIMARY DATA 267

17.1.2.1 Key data from primary sources 267

17.1.2.2 List of primary interview participants 268

17.1.2.3 Key industry insights 268

17.1.2.4 Breakdown of primary interviews 269

17.2 MARKET SIZE ESTIMATION 269

17.2.1 BOTTOM-UP APPROACH 269

17.2.2 TOP-DOWN APPROACH 271

17.2.3 MARKET SIZE CALCULATION FOR BASE YEAR 272

17.2.3.1 Demand-side analysis 272

17.2.3.1.1 Demand-side assumptions 272

17.2.3.1.2 Demand-side calculations 273

17.2.3.2 Supply-side analysis 273

17.2.3.2.1 Supply-side assumptions 274

17.2.3.2.2 Supply-side calculations 274

17.3 MARKET FORECAST APPROACH 274

17.3.1 SUPPLY SIDE 274

17.3.2 DEMAND SIDE 275

17.4 DATA TRIANGULATION 275

17.5 FACTOR ANALYSIS 276

17.6 RESEARCH ASSUMPTIONS AND LIMITATIONS 276

17.7 RISK ANALYSIS 277

18 APPENDIX 278

18.1 INSIGHTS FROM INDUSTRY EXPERTS 278

18.2 DISCUSSION GUIDE 278

18.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 283

18.4 CUSTOMIZATION OPTIONS 285

18.5 RELATED REPORTS 285

18.6 AUTHOR DETAILS 286

LIST OF TABLES

TABLE 1 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: INCLUSIONS AND EXCLUSIONS 29

TABLE 2 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: SUMMARY OF CHANGES 31

TABLE 3 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: INTERCONNECTED MARKETS 52

TABLE 4 KEY MOVES AND STRATEGIC FOCUS OF TIER-1/2/3 PLAYERS 55

TABLE 5 IMPACT OF PORTER’S FIVE FORCES ANALYSIS 56

TABLE 6 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021–2029 58

TABLE 7 ROLE OF COMPANIES IN LOW-VOLTAGE DC CIRCUIT BREAKER ECOSYSTEM 63

TABLE 8 PRICING RANGE OF LOW-VOLTAGE DC CIRCUIT BREAKERS, BY VOLTAGE,

2024 (USD/UNIT) 64

TABLE 9 AVERAGE SELLING PRICE TREND OF LOW-VOLTAGE DC CIRCUIT BREAKERS,

BY REGION, 2021–2024 (USD/UNIT) 65

TABLE 10 IMPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND) 65

TABLE 11 EXPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND) 66

TABLE 12 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: LIST OF KEY CONFERENCES

AND EVENTS, 2026 68

TABLE 13 SOLAR AND STORAGE SITES ADOPT EATON’S PVGARD DC CIRCUIT BREAKERS TO BOOST SYSTEM RELIABILITY 69

TABLE 14 INDUSTRIAL PLANTS AND TELECOM FACILITIES LEVERAGE ABB’S LV-DC BREAKERS TO PROTECT SENSITIVE LOADS 69

TABLE 15 IGBT-BASED LV SSCB ENABLES ULTRA-FAST FAULT CLEARANCE

OF DC MICROGRIDS 70

TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES 71

TABLE 17 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKETS

DUE TO TARIFFS 72

TABLE 18 LIST OF PATENTS, 2021–2025 81

TABLE 19 DC MICROGRIDS AND SMART DC DISTRIBUTION NETWORKS 82

TABLE 20 ELECTRIC VEHICLE (EV) CHARGING INFRASTRUCTURE (DC FAST &

BIDIRECTIONAL CHARGING) 83

TABLE 21 RENEWABLE ENERGY SYSTEMS AND BATTERY ENERGY STORAGE (BESS) 83

TABLE 22 DATA CENTERS AND TELECOM DC POWER SYSTEMS 84

TABLE 23 TOP USE CASES AND LOW-VOLTAGE DC CIRCUIT BREAKER MARKET POTENTIAL 84

TABLE 24 KEY AI/GEN AI USE CASES OF OEMS IN LOW-VOLTAGE DC CIRCUIT

BREAKER MARKET 85

TABLE 25 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: CASE STUDIES RELATED

TO GEN AI/AI IMPLEMENTATION 85

TABLE 26 INTERCONNECTED ECOSYSTEM AND IMPACT ON LOW-VOLTAGE

DC CIRCUIT BREAKER MARKET PLAYERS 86

TABLE 27 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 88

TABLE 28 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 88

TABLE 29 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 89

TABLE 30 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 89

TABLE 31 GLOBAL STANDARDS 89

TABLE 32 LOW-VOLTAGE DC CIRCUIT BREAKER CERTIFICATIONS, LABELING,

AND ECO-STANDARDS 92

TABLE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USES (%) 94

TABLE 34 KEY BUYING CRITERIA FOR END USES 95

TABLE 35 UNMET NEEDS OF KEY END USES 96

TABLE 36 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY TYPE,

2021–2024 (USD MILLION) 99

TABLE 37 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY TYPE,

2025–2030 (USD MILLION) 99

TABLE 38 AIR CIRCUIT BREAKERS: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY REGION, 2021–2024 (USD MILLION) 100

TABLE 39 AIR CIRCUIT BREAKERS: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY REGION, 2025–2030 (USD MILLION) 100

TABLE 40 MOLDED CASE CIRCUIT BREAKERS: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION, 2021–2024 (USD MILLION) 101

TABLE 41 MOLDED CASE CIRCUIT BREAKERS: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION, 2025–2030 (USD MILLION) 102

TABLE 42 OTHERS: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2021–2024 (USD MILLION) 102

TABLE 43 OTHERS: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2025–2030 (USD MILLION) 103

TABLE 44 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY VOLTAGE,

2021–2024 (USD MILLION) 105

TABLE 45 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY VOLTAGE,

2025–2030 (USD MILLION) 106

TABLE 46 BELOW 60 V: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2021–2024 (USD MILLION) 106

TABLE 47 BELOW 60 V: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2025–2030 (USD MILLION) 107

TABLE 48 BELOW 60 V: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 107

TABLE 49 BELOW 60 V: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2025–2030 (THOUSAND UNITS) 107

TABLE 50 60–120 V: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2021–2024 (USD MILLION) 108

TABLE 51 60–120 V: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2025–2030 (USD MILLION) 108

TABLE 52 60–120 V: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 109

TABLE 53 60–120 V: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2025–2030 (THOUSAND UNITS) 109

TABLE 54 121–380 V: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2021–2024 (USD MILLION) 110

TABLE 55 121–380 V: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2025–2030 (USD MILLION) 110

TABLE 56 121–380 V: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 111

TABLE 57 121–380 V: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2025–2030 (THOUSAND UNITS) 111

TABLE 58 381 V–1.5 KV: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2021–2024 (USD MILLION) 112

TABLE 59 381 V–1.5 KV: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2025–2030 (USD MILLION) 112

TABLE 60 381 V–1.5 KV: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 113

TABLE 61 381 V–1.5 KV: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2025–2030 (THOUSAND UNITS) 113

TABLE 62 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY BREAKING MECHANISM,

2021–2024 (USD MILLION) 115

TABLE 63 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY BREAKING MECHANISM,

2025–2030 (USD MILLION) 115

TABLE 64 SOLID-STATE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2021–2024 (USD MILLION) 116

TABLE 65 SOLID-STATE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2025–2030 (USD MILLION) 116

TABLE 66 HYBRID: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2021–2024 (USD MILLION) 117

TABLE 67 HYBRID: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2025–2030 (USD MILLION) 118

TABLE 68 MECHANICAL: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2021–2024 (USD MILLION) 118

TABLE 69 MECHANICAL: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2025–2030 (USD MILLION) 119

TABLE 70 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 121

TABLE 71 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 122

TABLE 72 BATTERY ENERGY STORAGE SYSTEMS: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION, 2021–2024 (USD MILLION) 122

TABLE 73 BATTERY ENERGY STORAGE SYSTEMS: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION, 2025–2030 (USD MILLION) 123

TABLE 74 DATA CENTERS: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION, 2021–2024 (USD MILLION) 123

TABLE 75 DATA CENTERS: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION, 2025–2030 (USD MILLION) 124

TABLE 76 SOLAR PV PLANTS: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION, 2021–2024 (USD MILLION) 125

TABLE 77 SOLAR PV PLANTS: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION, 2025–2030 (USD MILLION) 125

TABLE 78 EV FAST-CHARGING INFRASTRUCTURE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION, 2021–2024 (USD MILLION) 126

TABLE 79 EV FAST-CHARGING INFRASTRUCTURE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION, 2025–2030 (USD MILLION) 126

TABLE 80 RAIL TRANSIT & METRO: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY REGION, 2021–2024 (USD MILLION) 127

TABLE 81 RAIL TRANSIT & METRO: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY REGION, 2025–2030 (USD MILLION) 127

TABLE 82 INDUSTRIAL: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2021–2024 (USD MILLION) 128

TABLE 83 INDUSTRIAL: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2025–2030 (USD MILLION) 128

TABLE 84 COMMERCIAL & RESIDENTIAL: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY REGION, 2021–2024 (USD MILLION) 129

TABLE 85 COMMERCIAL & RESIDENTIAL: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY REGION, 2025–2030 (USD MILLION) 129

TABLE 86 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET FOR DATA CENTERS, BY VOLTAGE, 2021–2024 (USD MILLION) 132

TABLE 87 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET FOR DATA CENTERS, BY VOLTAGE, 2025–2030 (USD MILLION) 133

TABLE 88 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2021–2024 (USD MILLION) 137

TABLE 89 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2025–2030 (USD MILLION) 138

TABLE 90 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 138

TABLE 91 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY REGION,

2025–2030 (THOUSAND UNITS) 138

TABLE 92 NORTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY TYPE,

2021–2024 (USD MILLION) 140

TABLE 93 NORTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY TYPE,

2025–2030 (USD MILLION) 140

TABLE 94 NORTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021–2024 (USD MILLION) 140

TABLE 95 NORTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2025–2030 (USD MILLION) 141

TABLE 96 NORTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY BREAKING MECHANISM, 2021–2024 (USD MILLION) 141

TABLE 97 NORTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY BREAKING MECHANISM, 2025–2030 (USD MILLION) 141

TABLE 98 NORTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE, 2021–2024 (USD MILLION) 142

TABLE 99 NORTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE, 2025–2030 (USD MILLION) 142

TABLE 100 NORTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 142

TABLE 101 NORTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 143

TABLE 102 US: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 144

TABLE 103 US: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 144

TABLE 104 CANADA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 145

TABLE 105 CANADA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 145

TABLE 106 MEXICO: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 146

TABLE 107 MEXICO: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 146

TABLE 108 EUROPE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY TYPE,

2021–2024 (USD MILLION) 148

TABLE 109 EUROPE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY TYPE,

2025–2030 (USD MILLION) 148

TABLE 110 EUROPE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY VOLTAGE,

2021–2024 (USD MILLION) 148

TABLE 111 EUROPE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY VOLTAGE,

2025–2030 (USD MILLION) 148

TABLE 112 EUROPE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY BREAKING MECHANISM, 2021–2024 (USD MILLION) 149

TABLE 113 EUROPE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY BREAKING MECHANISM, 2025–2030 (USD MILLION) 149

TABLE 114 EUROPE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 149

TABLE 115 EUROPE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 150

TABLE 116 EUROPE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 150

TABLE 117 EUROPE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 150

TABLE 118 GERMANY: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 152

TABLE 119 GERMANY: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 152

TABLE 120 UK: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 153

TABLE 121 UK: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 153

TABLE 122 RUSSIA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 154

TABLE 123 RUSSIA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 155

TABLE 124 ITALY: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 156

TABLE 125 ITALY: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 156

TABLE 126 FRANCE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 157

TABLE 127 FRANCE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 157

TABLE 128 REST OF EUROPE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE, 2021–2024 (USD MILLION) 158

TABLE 129 REST OF EUROPE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE, 2025–2030 (USD MILLION) 158

TABLE 130 ASIA PACIFIC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY TYPE,

2021–2024 (USD MILLION) 160

TABLE 131 ASIA PACIFIC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY TYPE,

2025–2030 (USD MILLION) 160

TABLE 132 ASIA PACIFIC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY VOLTAGE,

2021–2024 (USD MILLION) 160

TABLE 133 ASIA PACIFIC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY VOLTAGE,

2025–2030 (USD MILLION) 160

TABLE 134 ASIA PACIFIC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY BREAKING MECHANISM, 2021–2024 (USD MILLION) 161

TABLE 135 ASIA PACIFIC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY BREAKING MECHANISM, 2025–2030 (USD MILLION) 161

TABLE 136 ASIA PACIFIC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 161

TABLE 137 ASIA PACIFIC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 162

TABLE 138 ASIA PACIFIC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 162

TABLE 139 ASIA PACIFIC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 162

TABLE 140 CHINA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 163

TABLE 141 CHINA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 164

TABLE 142 INDIA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 165

TABLE 143 INDIA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 165

TABLE 144 SOUTH KOREA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE, 2021–2024 (USD MILLION) 166

TABLE 145 SOUTH KOREA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE, 2025–2030 (USD MILLION) 166

TABLE 146 JAPAN: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 167

TABLE 147 JAPAN: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 168

TABLE 148 REST OF ASIA PACIFIC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY END USE, 2021–2024 (USD MILLION) 169

TABLE 149 REST OF ASIA PACIFIC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY END USE, 2025–2030 (USD MILLION) 169

TABLE 150 MIDDLE EAST & AFRICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY TYPE, 2021–2024 (USD MILLION) 170

TABLE 151 MIDDLE EAST & AFRICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY TYPE, 2025–2030 (USD MILLION) 170

TABLE 152 MIDDLE EAST & AFRICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY VOLTAGE, 2021–2024 (USD MILLION) 171

TABLE 153 MIDDLE EAST & AFRICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY VOLTAGE, 2025–2030 (USD MILLION) 171

TABLE 154 MIDDLE EAST & AFRICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY BREAKING MECHANISM, 2021–2024 (USD MILLION) 171

TABLE 155 MIDDLE EAST & AFRICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY BREAKING MECHANISM, 2025–2030 (USD MILLION) 172

TABLE 156 MIDDLE EAST & AFRICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY END USE, 2021–2024 (USD MILLION) 172

TABLE 157 MIDDLE EAST & AFRICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY END USE, 2025–2030 (USD MILLION) 172

TABLE 158 MIDDLE EAST & AFRICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY COUNTRY, 2021–2024 (USD MILLION) 173

TABLE 159 MIDDLE EAST & AFRICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY COUNTRY, 2025–2030 (USD MILLION) 173

TABLE 160 GCC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 173

TABLE 161 GCC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 174

TABLE 162 SAUDI ARABIA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE, 2021–2024 (USD MILLION) 175

TABLE 163 SAUDI ARABIA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE, 2025–2030 (USD MILLION) 175

TABLE 164 UAE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 176

TABLE 165 UAE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 176

TABLE 166 REST OF GCC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 177

TABLE 167 REST OF GCC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 177

TABLE 168 SOUTH AFRICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE, 2021–2024 (USD MILLION) 178

TABLE 169 SOUTH AFRICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE, 2025–2030 (USD MILLION) 179

TABLE 170 REST OF MIDDLE EAST & AFRICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE, 2021–2024 (USD MILLION) 180

TABLE 171 REST OF MIDDLE EAST & AFRICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE, 2025–2030 (USD MILLION) 180

TABLE 172 SOUTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY TYPE,

2021–2024 (USD MILLION) 181

TABLE 173 SOUTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY TYPE,

2025–2030 (USD MILLION) 181

TABLE 174 SOUTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2021–2024 (USD MILLION) 181

TABLE 175 SOUTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY VOLTAGE, 2025–2030 (USD MILLION) 182

TABLE 176 SOUTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY BREAKING MECHANISM, 2021–2024 (USD MILLION) 182

TABLE 177 SOUTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY BREAKING MECHANISM, 2025–2030 (USD MILLION) 182

TABLE 178 SOUTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE, 2021–2024 (USD MILLION) 183

TABLE 179 SOUTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE, 2025–2030 (USD MILLION) 183

TABLE 180 SOUTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 183

TABLE 181 SOUTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 184

TABLE 182 BRAZIL: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 185

TABLE 183 BRAZIL: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 185

TABLE 184 ARGENTINA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 186

TABLE 185 ARGENTINA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 186

TABLE 186 CHILE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2021–2024 (USD MILLION) 187

TABLE 187 CHILE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET, BY END USE,

2025–2030 (USD MILLION) 187

TABLE 188 REST OF SOUTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY END USE, 2021–2024 (USD MILLION) 188

TABLE 189 REST OF SOUTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET,

BY END USE, 2025–2030 (USD MILLION) 188

TABLE 190 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2022–SEPTEMBER 2025 189

TABLE 191 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: DEGREE OF COMPETITION, 2024 192

TABLE 192 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: REGION FOOTPRINT 199

TABLE 193 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: TYPE FOOTPRINT 200

TABLE 194 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: VOLTAGE FOOTPRINT 201

TABLE 195 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: END USE FOOTPRINT 202

TABLE 196 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: DETAILED LIST OF KEY STARTUPS/SMES 205

TABLE 197 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: COMPETITIVE

BENCHMARKING OF KEY STARTUPS/SMES 205

TABLE 198 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: PRODUCT LAUNCHES,

JANUARY 2022–SEPTEMBER 2025 206

TABLE 199 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: DEALS,

JANUARY 2022– SEPTEMBER 2025 207

TABLE 200 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: EXPANSIONS,

JANUARY 2022–SEPTEMBER 2025 209

TABLE 201 ABB: COMPANY OVERVIEW 211

TABLE 202 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED 212

TABLE 203 ABB: PRODUCT LAUNCHES 213

TABLE 204 ABB: DEALS 213

TABLE 205 ABB: EXPANSIONS 214

TABLE 206 ABB: OTHER DEVELOPMENTS 214

TABLE 207 EATON: COMPANY OVERVIEW 216

TABLE 208 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED 217

TABLE 209 EATON: PRODUCT LAUNCHES 218

TABLE 210 EATON: DEALS 219

TABLE 211 EATON: EXPANSIONS 219

TABLE 212 SCHNEIDER ELECTRIC: COMPANY OVERVIEW 221

TABLE 213 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED 222

TABLE 214 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES 223

TABLE 215 SCHNEIDER ELECTRIC: EXPANSIONS 224

TABLE 216 SIEMENS: COMPANY OVERVIEW 225

TABLE 217 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED 226

TABLE 218 SIEMENS: DEALS 227

TABLE 219 SIEMENS: OTHER DEVELOPMENTS 227

TABLE 220 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW 229

TABLE 221 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS/SOLUTIONS/

SERVICES OFFERED 230

TABLE 222 MITSUBISHI ELECTRIC CORPORATION: DEALS 231

TABLE 223 MITSUBISHI ELECTRIC CORPORATION: OTHER DEVELOPMENTS 231

TABLE 224 LS ELECTRIC CO., LTD.: COMPANY OVERVIEW 233

TABLE 225 LS ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 234

TABLE 226 CHINT GROUP: COMPANY OVERVIEW 235

TABLE 227 CHINT GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED 235

TABLE 228 FUJI ELECTRIC CO., LTD.: COMPANY OVERVIEW 237

TABLE 229 FUJI ELECTRIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 238

TABLE 230 FUJI ELECTRIC CO., LTD.: PRODUCT LAUNCHES 239

TABLE 231 FUJI ELECTRIC CO., LTD.: EXPANSIONS 239

TABLE 232 ROCKWELL AUTOMATION: COMPANY OVERVIEW 240

TABLE 233 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 241

TABLE 234 ROCKWELL AUTOMATION: PRODUCT LAUNCHES 242

TABLE 235 BENY: COMPANY OVERVIEW 243

TABLE 236 BENY: PRODUCTS/SOLUTIONS/SERVICES OFFERED 243

TABLE 237 LEGRAND: COMPANY OVERVIEW 245

TABLE 238 LEGRAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED 246

TABLE 239 SÉCHERON: COMPANY OVERVIEW 247

TABLE 240 SÉCHERON: PRODUCTS/SOLUTIONS/SERVICES OFFERED 247

TABLE 241 CARLING TECHNOLOGIES: COMPANY OVERVIEW 248

TABLE 242 CARLING TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED 248

TABLE 243 CNC ELECTRIC GROUP CO., LTD.: COMPANY OVERVIEW 251

TABLE 244 CNC ELECTRIC GROUP CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 251

TABLE 245 ONCCY ELECTRICAL CO., LTD.: COMPANY OVERVIEW 253

TABLE 246 ONCCY ELECTRICAL CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 253

TABLE 247 ENTEC ELECTRIC & ELECTRONIC: COMPANY OVERVIEW 255

TABLE 248 ZHEJIANG AITE ELECTRIC TECHNOLOGY CO., LTD.: COMPANY OVERVIEW 256

TABLE 249 MYERS POWER PRODUCTS, INC.: COMPANY OVERVIEW 257

TABLE 250 NADER: COMPANY OVERVIEW 258

TABLE 251 LETOP: COMPANY OVERVIEW 259

TABLE 252 WENZHOU ZHECHI ELECTRIC CO., LTD.: COMPANY OVERVIEW 260

TABLE 253 ZHEJIANG DABO ELECTRIC CO., LTD.: COMPANY OVERVIEW 261

TABLE 254 IGOYE SOLAR POWER SYSTEM: COMPANY OVERVIEW 262

TABLE 255 GEYA ELECTRICAL EQUIPMENT SUPPLY: COMPANY OVERVIEW 263

TABLE 256 ZHEJIANG GRL ELECTRIC CO., LTD.: COMPANY OVERVIEW 264

TABLE 257 MAJOR SECONDARY SOURCES 266

TABLE 258 DATA CAPTURED FROM PRIMARY SOURCES 267

TABLE 259 PRIMARY INTERVIEW PARTICIPANTS 268

TABLE 260 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: RISK ANALYSIS 277

LIST OF FIGURES

FIGURE 1 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET SEGMENTATION

AND REGIONAL SCOPE 28

FIGURE 2 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: DURATION CONSIDERED 30

FIGURE 3 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET SCENARIO 33

FIGURE 4 GLOBAL LOW-VOLTAGE DC CIRCUIT BREAKER MARKET SIZE, 2021–2030 34

FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN LOW-VOLTAGE

DC CIRCUIT BREAKER MARKET, 2022–2025 34

FIGURE 6 DISRUPTIONS IMPACTING GROWTH OF LOW-VOLTAGE DC CIRCUIT

BREAKER MARKET 35

FIGURE 7 HIGH-GROWTH SEGMENTS IN LOW-VOLTAGE DC CIRCUIT BREAKER

MARKET, 2025–2030 36

FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD 37

FIGURE 9 RAPID ADOPTION OF RENEWABLE ENERGY, BATTERY ENERGY STORAGE SYSTEMS, AND EV FAST-CHARGING INFRASTRUCTURE TO DRIVE MARKET 38

FIGURE 10 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN LOW-VOLTAGE DC CIRCUIT BREAKER MARKET FROM 2025 TO 2030 39

FIGURE 11 381 V–1.5 KV SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2030 39

FIGURE 12 MECHANICAL SEGMENT TO CAPTURE LARGEST MARKET SHARE IN 2030 40

FIGURE 13 MOLDED CASE CIRCUIT BREAKERS SEGMENT TO HOLD LARGEST

MARKET SHARE IN 2030 40

FIGURE 14 SOLAR PV PLANTS SEGMENT TO ACCOUNT FOR LARGEST MARKET

SHARE IN 2030 41

FIGURE 15 SOLAR PV PLANTS SEGMENT AND CHINA HELD LARGEST SHARES OF LOW-VOLTAGE DC CIRCUIT BREAKER MARKET IN ASIA PACIFIC IN 2024 41

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES 43

FIGURE 17 GLOBAL RENEWABLE ENERGY GENERATION, BY REGION, 2010–2050 44

FIGURE 18 SOLAR PV ELECTRICITY GENERATION RATE, 2014–2030 45

FIGURE 19 GLOBAL STOCK OF PUBLIC CHARGING POINTS, BY SPEED, 2018–2024 46

FIGURE 20 GLOBAL STOCK OF PUBLIC CHARGING POINTS, BY REGION, 2018–2024 46

FIGURE 21 ANNUAL BATTERY DEMAND, BY APPLICATION AND SCENARIO,

2023 AND 2030 47

FIGURE 22 PORTER’S FIVE FORCES ANALYSIS 56

FIGURE 23 LOW-VOLTAGE DC CIRCUIT BREAKER VALUE CHAIN ANALYSIS 61

FIGURE 24 LOW VOLTAGE DC CIRCUIT BREAKER ECOSYSTEM 62

FIGURE 25 ASP TREND OF LOW-VOLTAGE DC CIRCUIT BREAKERS, BY REGION, 2021–2024 64

FIGURE 26 IMPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS FOR

TOP FIVE COUNTRIES, 2020–2024 66

FIGURE 27 EXPORT DATA FOR HS CODE 853690-COMPLIANT PRODUCTS FOR

TOP FIVE COUNTRIES, 2020–2024 67

FIGURE 28 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS 68

FIGURE 29 PATENTS APPLIED AND GRANTED, 2015–2024 81

FIGURE 30 FUTURE APPLICATIONS OF LOW-VOLTAGE DC CIRCUIT BREAKERS 82

FIGURE 31 SUCCESS STORIES AND REAL-WORLD APPLICATIONS 86

FIGURE 32 LOW VOLTAGE DC CIRCUIT BREAKER MARKET: DECISION-MAKING FACTORS 93

FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES 94

FIGURE 34 KEY BUYING CRITERIA FOR TOP THREE END USES 95

FIGURE 35 MOLDED CASE CIRCUIT BREAKERS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024 99

FIGURE 36 381 V–1.5 KV SEGMENT HELD LARGEST SHARE OF LOW-VOLTAGE DC CIRCUIT BREAKER MARKET IN 2024 105

FIGURE 37 MECHANICAL SEGMENT CAPTURED LARGEST MARKET SHARE IN 2024 115

FIGURE 38 SOLAR PV PLANTS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024 121

FIGURE 39 121–380 V SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024 132

FIGURE 40 ASIA PACIFIC TO WITNESS HIGHEST CAGR IN LOW-VOLTAGE DC CIRCUIT BREAKER MARKET DURING FORECAST PERIOD 137

FIGURE 41 NORTH AMERICA: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET SNAPSHOT 139

FIGURE 42 EUROPE: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET SNAPSHOT 147

FIGURE 43 ASIA PACIFIC: LOW-VOLTAGE DC CIRCUIT BREAKER MARKET SNAPSHOT 159

FIGURE 44 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020–2024 191

FIGURE 45 MARKET SHARE ANALYSIS OF COMPANIES OFFERING LOW-VOLTAGE DC CIRCUIT BREAKERS, 2024 192

FIGURE 46 COMPANY VALUATION 194

FIGURE 47 FINANCIAL METRICS (EV/EBITDA) 194

FIGURE 48 BRAND COMPARISON 195

FIGURE 49 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024 197

FIGURE 50 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: COMPANY FOOTPRINT 198

FIGURE 51 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 204

FIGURE 52 ABB: COMPANY SNAPSHOT 212

FIGURE 53 EATON: COMPANY SNAPSHOT 217

FIGURE 54 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT 222

FIGURE 55 SIEMENS: COMPANY SNAPSHOT 226

FIGURE 56 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT 230

FIGURE 57 LS ELECTRIC CO., LTD.: COMPANY SNAPSHOT 234

FIGURE 58 FUJI ELECTRIC CO., LTD.: COMPANY SNAPSHOT 238

FIGURE 59 ROCKWELL AUTOMATION: COMPANY SNAPSHOT 241

FIGURE 60 LEGRAND: COMPANY SNAPSHOT 246

FIGURE 61 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: RESEARCH DESIGN 265

FIGURE 62 DATA CAPTURED FROM SECONDARY SOURCES 266

FIGURE 63 CORE FINDINGS FROM INDUSTRY EXPERTS 268

FIGURE 64 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION,

AND REGION 269

FIGURE 65 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: BOTTOM-UP APPROACH 270

FIGURE 66 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: TOP-DOWN APPROACH 271

FIGURE 67 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: DEMAND-SIDE ANALYSIS 272

FIGURE 68 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: DEMAND-SIDE CALCULATIONS 272

FIGURE 69 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF LOW-VOLTAGE

DC CIRCUIT BREAKERS 273

FIGURE 70 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: SUPPLY-SIDE ANALYSIS 274

FIGURE 71 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: DATA TRIANGULATION 275

FIGURE 72 LOW VOLTAGE DC CIRCUIT BREAKER: FACTOR ANALYSIS 276

FIGURE 73 LOW-VOLTAGE DC CIRCUIT BREAKER MARKET: RESEARCH ASSUMPTIONS

AND LIMITATIONS 276

FIGURE 74 LOW-VOLTAGE DC VOLTAGE MARKET: INSIGHTS FROM INDUSTRY EXPERTS 278