Synchronous Condenser Market - Global Forecast To 2030

Synchronous Condenser Market by Cooling Type (Hydrogen-cooled, Air-Cooled, Water-Cooled), Type (New & Refurbished), Starting Method (Static Frequency Converter, Pony Motor), End User, Reactive Power Rating, and Region - Global Forecast to 2030

同期調相機(ロータリーコンデンサ)市場 - 冷却方式(水素冷却、空冷、水冷)、タイプ(新設・改修)、始動方式(静止型周波数変換器、ポニーモーター)、エンドユーザー、無効電力定格、地域別 - 2030年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年02月 |

| ページ数 | 238 |

| 図表数 | 278 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-13622 |

同期調相機(ロータリーコンデンサ)市場は、2025年の7億2,000万米ドルから2030年には8億4,000万米ドルに成長し、予測期間中に3.3%のCAGRで成長すると予測されています。主要経済国におけるインフラ開発の加速と送電網の拡張により、グリッドの安定性と信頼性を高めるための同期コンデンサの需要が大幅に増加しています。インドでは、配電部門改革計画(RDSS)などの野心的な国家イニシアチブ、超高圧送電線、再生可能エネルギー線、スマートグリッドプログラムへの多額の投資により、この需要が牽引されています。これらのプロジェクトには高度な無効電力管理と慣性サポートが必要であり、同期コンデンサは、急速に成長する高電圧ネットワークにおける電圧不安定性の解消、故障時の対応の確保、安全で効率的な電力フローの促進に向けた取り組みの最前線に位置付けられています。

調査範囲:

本レポートは、世界の同期調相機(ロータリーコンデンサ)市場を、タイプ、無効電力定格、冷却技術、始動方法、エンドユーザー、地域別に定義、説明、予測しています。また、市場の詳細な定性・定量分析も提供しています。主要な市場推進要因、制約要因、機会、課題を包括的に分析しています。さらに、市場の様々な重要な側面を網羅しており、競争環境、市場ダイナミクス、市場規模予測、同期コンデンサ市場の将来動向などを分析しています。

本レポートを購入する主なメリット

- 本レポートは、同期調相機(ロータリーコンデンサ)市場の成長に影響を与える主要な推進要因(再生可能エネルギーの急速な拡大と系統規模の容量増加、老朽化した系統インフラの近代化への重点化)、制約要因(現代の電力網における技術的および統合上の課題)、機会(同期発電機から同期コンデンサへの転換、高電圧直流システムの導入増加)、課題(低コストの代替品の入手可能性)に関する分析を提供します。

- 市場動向:収益性の高い市場に関する包括的な情報 – 本レポートは、さまざまな地域の同期コンデンサ市場を分析します。

- 市場の多様化:同期調相機(ロータリーコンデンサ)市場における新製品やサービス、未開拓地域、最近の動向、投資に関する包括的な情報。

- 競合評価:同期発電市場におけるABB(スイス)、イートン(アイルランド)、シーメンス・エナジー(ドイツ)、GEベルノバ(米国)、WEG(ブラジル)、三菱電機パワープロダクツ(米国)、アンドリッツ(オーストリア)、アンサルド・エネルギア(イタリア)、Voith GmbH & Co. KGaA(ドイツ)、Bharat Heavy Electricals Limited(インド)、斗山シュコダ・パワー(チェコ共和国)、ベーカー・ヒューズ(米国)、IDEAL ELECTRIC POWER CO.(米国)、Power Systems & Controls, Inc.(米国)、Electromechanical Engineering Associates, Inc.(米国)、安徽中電電有限公司(中国)、上海電気(中国)、Ingeteam(スペイン)、日立エネルギー株式会社(スイス)、臥龍電機集団(中国)などの主要企業の市場シェア、成長戦略、サービス提供の詳細な評価。コンデンサー市場。

- 製品イノベーション/開発:同期調相機(ロータリーコンデンサ)市場では、特にデジタル制御システムや予知保全機能の導入により、製品の導入とアップグレードが活発化しています。再生可能エネルギーの統合、スマートグリッド、高電圧送電網におけるユースケースの増加に伴い、水素冷却システム、高効率化のための先端材料、モジュール式/コンパクト設計といった持続可能な技術革新が大きな注目を集めています。シーメンス・エナジーやGE Vernovaといった先進エネルギー生産者が提供するソリューションに見られるように、ハイブリッドソリューション(同期コンデンサとSTATCOMやバッテリーエネルギーストレージなどのパワーエレクトロニクスを組み合わせたもの)の進化も進んでおり、これらのソリューションは、強化されたデジタル制御、人工知能(AI)を活用した予知保全、最適化されたローター/絶縁設計を特徴としており、導入の簡素化、設置面積の削減、そして現代の電力システムに向けた強化された慣性および無効電力サポートを提供します。

Report Description

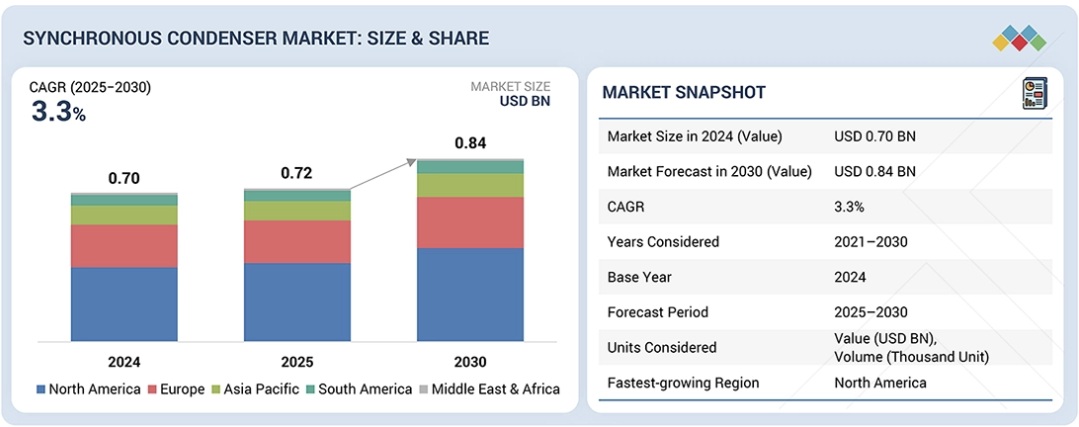

The synchronous condenser market is estimated to grow from USD 0.72 billion in 2025 to USD 0.84 billion by 2030, at a CAGR of 3.3% during the forecast period. The acceleration of infrastructure development and the expansion of transmission networks in major economies are significantly increasing the demand for synchronous condensers to enhance grid stability and reliability. In India, this demand is driven by ambitious national initiatives, such as the Revamped Distribution Sector Scheme (RDSS), as well as substantial investments in ultra-high-voltage transmission corridors, renewable energy corridors, and smart grid programs. These projects require advanced reactive power management and inertia support, placing synchronous condensers at the forefront of efforts to eliminate voltage instability, ensure fault ride-through, and facilitate secure and efficient power flow in rapidly growing high-voltage networks.

Synchronous Condenser Market – Global Forecast To 2030

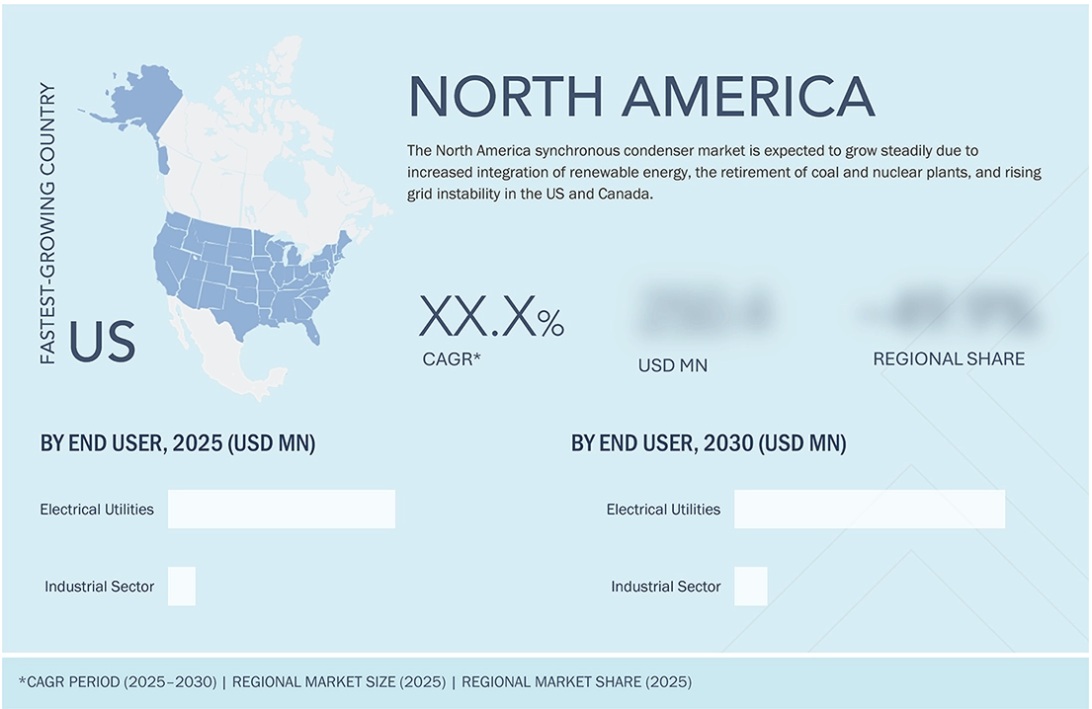

In the US, extensive federal programs, including major funding under the Bipartisan Infrastructure Law and the Inflation Reduction Act, are aimed at modernizing the grid, connecting remote renewable energy sources, and improving resilience to extreme weather events. This encourages the widespread use of synchronous condensers, which provide critical momentary circuit strength, dynamic voltage control, and artificial inertia in established transmission systems. These advancements enable the significant integration of variable generation sources while reducing curtailment and ensuring reliable delivery of clean energy across interconnected grids, addressing the limitations of traditional infrastructure.

“By cooling technology, the hydrogen-cooled synchronous condenser segment is expected to be the largest cooling technology segment in the synchronous condenser market during the forecast period.”

The hydrogen-cooled segment is expected to account for the largest share of the synchronous condenser market during the forecast period, as it offers superior thermal conductivity, enhanced heat dissipation, and the ability to support high-capacity operations in large-scale utility and transmission projects. Hydrogen-cooled synchronous condensers offer high power density, low energy loss, and higher performance under heavy loads, and are suitable for grids with high inertia requirements and high demand for high-MVAR-rated units (usually above 200 MVAR). These systems offer reduced windage loss, enhanced overall efficiency, longer equipment lifespan, and better thermal control than air-cooled or water-cooled systems, which are typically chosen for smaller ratings or cost-sensitive installations. The shift to hydrogen-cooled synchronous condensers has become a key trend in modern power system designs. This is particularly important for large-scale renewable energy integration and high-voltage direct current (HVDC) interconnection, as utilities and grid operators prioritize reliable, high-performance solutions for voltage regulation and grid stability.

“By starting method, the static frequency converter segment is projected to register the fastest growth in the synchronous condenser market during the forecast period.”

The static frequency converter segment is expected to be the fastest-growing starting method in the synchronous condenser market throughout the forecast period as a result of a broad combination of growing demands in efficient and reliable grid stabilization solutions, development of power electronics technologies, and compliance with global trends in the direction of modernized transmission infrastructure and integration of renewable energy. The static frequency converter offers very accurate, independent control of starting frequency and voltage, can be started smoothly without relying on grid conditions or load changes, has a lower noise level, requires less space, and is more reliable than pony motor methods. These properties contribute to the fact that SFCs are especially well adapted to large-scale utility use with high capacity synchronous condensers, in which they can be used to provide increased inertia, respond to reactive power requirements, and control voltages in grids with high levels of renewable penetration better than pony motor options which in most cases have a limited range of applications to simpler and smaller locations.

Synchronous Condenser Market – Global Forecast To 2030 – region

“By region, Europe is estimated to account for the second-largest market share during the forecast period.”

Europe is expected to become the second-largest market for synchronous condensers during the forecast period. This expectation is supported by aggressive renewable energy targets, significant investments in grid modernization, and the need for improved grid stability due to the high penetration of intermittent energy sources like wind and solar. Synchronous condensers can provide essential services such as inertia, reactive power compensation, and voltage regulation, aligning with Europe’s decarbonization goals and the need for a reliable power supply in an evolving energy landscape. The robust policy framework in Europe, including the EU Green Deal, ambitious renewable integration targets, and initiatives to support grid upgrades and high-voltage direct current (HVDC) expansions, drives the demand for synchronous condensers. These systems help minimize transmission losses, manage voltage fluctuations, and enhance the resilience of utility networks and transmission infrastructure.

In-depth interviews have been conducted with key industry participants, subject-matter experts, C-level executives of leading market players, and industry consultants, among others, to obtain and verify critical qualitative and quantitative information and to assess future market prospects. The distribution of primary interviews is as follows:

- By Company Type: Tier 1 – 65%, Tier 2 – 24%, and Tier 3 – 11%

- By Designation: C-level Executives – 30%, Directors – 25%, and Others – 45%

- By Region: North America – 33%, Europe – 27%, Asia Pacific – 20%, Middle East & Africa – 8%, and South America – 12%

Notes: The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: > USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: < USD 500 million.

Other designations include sales managers, engineers, and regional managers.

Synchronous Condenser Market – Global Forecast To 2030 – ecosystem

ABB (Switzerland), Siemens Energy (Germany), GE Vernova (US), Eaton (Ireland), and WEG (Brazil) are some of the major players in the synchronous condenser market. The study includes an in-depth competitive analysis of these key players, including their company profiles, recent developments, and key market strategies.

Research Coverage:

The report defines, describes, and forecasts the global synchronous condenser market by type, reactive power rating, cooling technology, starting method, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report comprehensively reviews the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the synchronous condenser market.

Key Benefits of Buying the Report

- It provides an analysis of key drivers (rapid expansion of renewable energy and grid-scale capacity additions, increasing emphasis on modernization aging grid infrastructure), restraints (technical and Integration challenges in modern power grids), opportunities (conversion of synchronous generators into synchronous condensers, rising adoption of high-voltage direct current systems), challenges (availability of low-cost substitutes) influencing the growth of the synchronous condenser market.

- Market Development: Comprehensive information about lucrative markets – the report analyses the synchronous condenser market across varied regions.

- Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the synchronous condenser market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like ABB (Switzerland), Eaton (Ireland), Siemens Energy (Germany), GE Vernova (US), WEG (Brazil), Mitsubishi Electric Power Products, Inc. (US), Andritz (Austria), Ansaldo Energia (Italy), Voith GmbH & Co. KGaA (Germany), Bharat Heavy Electricals Limited (India), Doosan Škoda Power (Czech Republic), Baker Hughes (US), IDEAL ELECTRIC POWER CO. (US), Power Systems & Controls, Inc. (US), Electromechanical Engineering Associates, Inc. (US), Anhui Zhongdian Electric Co., Ltd. (China), Shanghai Electric (China), Ingeteam (Spain), Hitachi Energy Ltd. (Switzerland), and Wolong Electric Group (China), among others, in the synchronous condenser market.

- Product Innovation/Development: The synchronous condenser market is witnessing high product introduction and upgrades, especially with the introduction of digital control systems and predictive maintenance functionalities. With more use cases in renewable energy integration, smart grids, and high-voltage transmission networks, sustainable advancements such as hydrogen-cooled systems, advanced materials for greater efficiency, and modular/compact designs are gaining significant traction. The evolution of hybrid solutions (synchronous condensers with power electronics such as STATCOMs or battery energy storage) is also moving forward, as in solutions from the advanced energy producers such as Siemens Energy and GE Vernova, which feature enhanced digital controls, artificial intelligence (AI)-enabled predictive maintenance, and optimized rotor/insulation designs to simplify deployment, reduce footprints, and provide enhanced inertia and reactive power supports for modern power systems.

Table of Contents

1 INTRODUCTION 24

1.1 STUDY OBJECTIVES 24

1.2 MARKET DEFINITION 24

1.3 STUDY SCOPE 25

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 25

1.3.2 INCLUSIONS AND EXCLUSIONS 26

1.3.3 YEARS CONSIDERED 26

1.4 CURRENCY CONSIDERED 26

1.5 UNITS CONSIDERED 27

1.6 STAKEHOLDERS 27

1.7 SUMMARY OF CHANGES 27

2 EXECUTIVE SUMMARY 28

2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS 28

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 29

2.3 DISRUPTIVE TRENDS IN SYNCHRONOUS CONDENSER MARKET 30

2.4 HIGH-GROWTH SEGMENTS 31

2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST 32

3 PREMIUM INSIGHTS 33

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SYNCHRONOUS CONDENSER MARKET 33

3.2 SYNCHRONOUS CONDENSER MARKET, BY TYPE AND REGION 34

3.3 SYNCHRONOUS CONDENSER MARKET, BY TYPE 34

3.4 SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY 35

3.5 SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD 35

3.6 SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING 36

3.7 SYNCHRONOUS CONDENSER MARKET, BY END USER 36

3.8 SYNCHRONOUS CONDENSER MARKET, BY COUNTRY 37

4 MARKET OVERVIEW 38

4.1 INTRODUCTION 38

4.2 MARKET DYNAMICS 38

4.2.1 DRIVERS 39

4.2.1.1 Rapid expansion of renewable energy and grid-scale capacity additions 39

4.2.1.2 Rising emphasis on modernizing aging grid infrastructure 40

4.2.2 RESTRAINTS 41

4.2.2.1 High capital costs and complex deployment requirements 41

4.2.3 OPPORTUNITIES 41

4.2.3.1 Conversion of synchronous generators into synchronous condensers 41

4.2.3.2 Rising adoption of high-voltage direct current (HVDC) systems 42

4.2.4 CHALLENGES 43

4.2.4.1 Availability of low-cost substitutes 43

4.3 UNMET NEEDS AND WHITE SPACES 44

4.3.1 UNMET NEEDS IN SYNCHRONOUS CONDENSER MARKET 44

4.3.2 WHITE SPACE OPPORTUNITIES 44

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 45

4.4.1 INTERCONNECTED MARKETS 45

4.4.2 CROSS-SECTOR OPPORTUNITIES 45

4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 46

4.5.1 KEY MOVES AND STRATEGIC FOCUS 46

5 INDUSTRY TRENDS 47

5.1 PORTER’S FIVE FORCES ANALYSIS 47

5.1.1 BARGAINING POWER OF SUPPLIERS 48

5.1.2 BARGAINING POWER OF BUYERS 49

5.1.3 THREAT OF NEW ENTRANTS 49

5.1.4 THREAT OF SUBSTITUTES 49

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 49

5.2 MACROECONOMIC OUTLOOK 50

5.2.1 INTRODUCTION 50

5.2.2 GDP TRENDS AND FORECAST 50

5.2.3 INFLATION 51

5.2.4 MANUFACTURING VALUE ADDED (% OF GDP) 51

5.2.5 TRENDS IN GLOBAL ELECTRICAL INDUSTRY 52

5.2.6 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY 53

5.3 VALUE CHAIN ANALYSIS 53

5.3.1 COST ANALYSIS FOR SYNCHRONOUS CONDENSER (HYDROGEN, AIR, AND WATER COOLED) 55

5.3.2 ANALYSIS ON ADDITIONAL EQUIPMENT REQUIRED FOR SYNCHRONOUS CONDENSER 56

5.4 ECOSYSTEM ANALYSIS 56

5.5 PRICING ANALYSIS 58

5.5.1 INDICATIVE SELLING PRICE TREND, BY REACTIVE POWER RATING, 2024 58

5.5.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022–2024 59

5.6 TRADE ANALYSIS 59

5.6.1 EXPORT SCENARIO (HS CODE 8501) 59

5.6.2 IMPORT SCENARIO (HS CODE 8501) 61

5.7 KEY CONFERENCES AND EVENTS, 2025–2026 62

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 63

5.9 INVESTMENT AND FUNDING SCENARIO 63

5.10 CASE STUDY ANALYSIS 64

5.10.1 CASE STUDY 1: USE OF GE’S SYNCHRONOUS CONDENSERS IN NORTHWEST VERMONT RELIABILITY PROJECT 64

5.10.2 CASE STUDY 2: REFURBISHMENT OF SYNCHRONOUS GENERATORS TO SYNCHRONOUS CONDENSERS 65

5.11 IMPACT OF 2025 US TARIFFS—SYNCHRONOUS CONDENSER MARKET 65

5.11.1 INTRODUCTION 65

5.11.2 KEY TARIFF RATES 66

5.11.3 PRICE IMPACT ANALYSIS 67

5.11.4 IMPACT ON COUNTRIES/REGIONS 67

5.11.4.1 US 67

5.11.4.2 Europe 68

5.11.4.3 Asia Pacific 68

5.11.5 IMPACT ON END-USE INDUSTRIES 69

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS 70

6.1 KEY EMERGING TECHNOLOGIES 70

6.1.1 HYBRID SYNCHRONOUS CONDENSER WITH FLYWHEEL ENERGY STORAGE 70

6.2 ADJACENT TECHNOLOGIES 70

6.2.1 STATCOM (STATIC SYNCHRONOUS COMPENSATOR) 70

6.2.2 GRID-SCALE BATTERY ENERGY STORAGE SYSTEMS (BESS) 71

6.3 TECHNOLOGY ROADMAP 71

6.4 PATENT ANALYSIS 72

6.5 FUTURE APPLICATIONS 73

6.6 IMPACT OF AI/GEN AI ON SYNCHRONOUS CONDENSER MARKET 74

6.6.1 BEST TOP USE CASES AND MARKET POTENTIAL 74

6.6.2 BEST PRACTICES FOLLOWED BY MANUFACTURERS 75

6.6.3 CASE STUDIES OF AI IMPLEMENTATION 75

6.6.4 INTERCONNECTED ADJACENT ECOSYSTEMS AND IMPACT ON MARKET PLAYERS 76

6.6.5 CLIENTS’ READINESS TO ADOPT GENERATIVE AI 76

7 SUSTAINABILITY AND REGULATORY LANDSCAPE 77

7.1 REGIONAL REGULATIONS AND COMPLIANCE 77

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 77

7.1.2 INDUSTRY STANDARDS 81

7.1.2.1 Codes and regulations related to synchronous condensers 81

7.2 SUSTAINABILITY INITIATIVES 82

7.2.1 INTRODUCTION 82

7.2.2 SUSTAINABILITY INITIATIVES 82

7.2.3 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES 83

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 84

8.1 INTRODUCTION 84

8.2 DECISION-MAKING PROCESS (SYNCHRONOUS CONDENSER VS STATCOM) 84

8.3 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA 86

8.3.1 KEY STAKEHOLDERS IN BUYING PROCESS 86

8.3.2 BUYING CRITERIA 87

8.4 ADOPTION BARRIERS & INTERNAL CHALLENGES 87

8.5 UNMET NEEDS OF VARIOUS END-USE INDUSTRIES 88

8.6 MARKET OPPORTUNITIES 88

9 SYNCHRONOUS CONDENSER MARKET, BY TYPE 89

9.1 INTRODUCTION 90

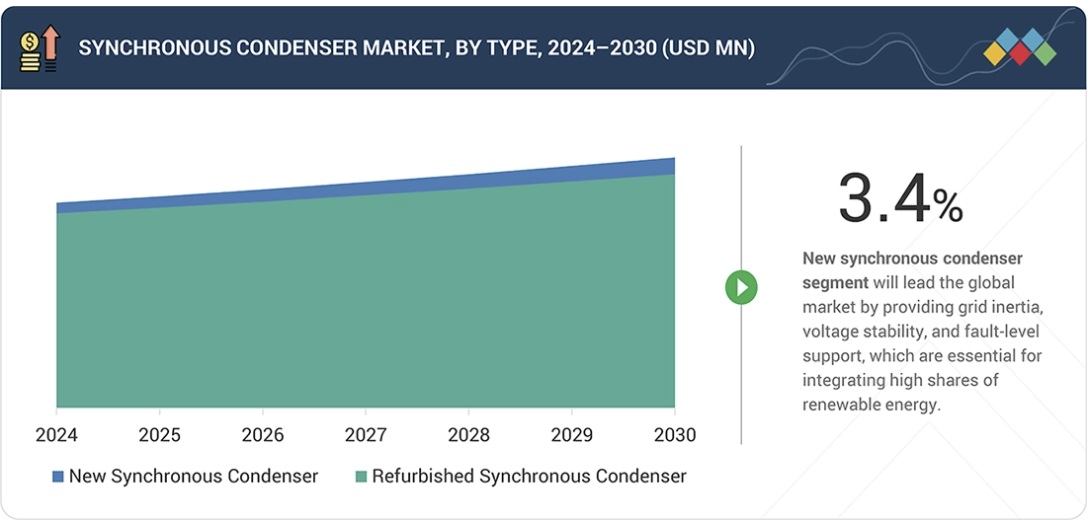

9.2 NEW SYNCHRONOUS CONDENSERS 91

9.2.1 RISING EXPANSION OF HVDC NETWORKS TO INCREASE INSTALLATION OF NEW SYNCHRONOUS CONDENSERS 91

9.3 REFURBISHED SYNCHRONOUS CONDENSERS 92

9.3.1 LOW COST OF REFURBISHED CONDENSERS TO FUEL DEMAND 92

10 SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING 94

10.1 INTRODUCTION 95

10.2 UP TO 100 MVAR 96

10.2.1 RISING USE OF LOCALIZED GRID STABILIZATION AND POWER QUALITY IMPROVEMENT TO FUEL MARKET GROWTH 96

10.3 101–200 MVAR 97

10.3.1 INCREASING REQUIREMENT FOR FLEXIBLE, HIGH-PERFORMANCE VOLTAGE SUPPORT SOLUTIONS TO FUEL MARKET GROWTH 97

10.4 ABOVE 200 MVAR 98

10.4.1 HIGH-CAPACITY GRID REINFORCEMENT DRIVING DEMAND FOR ABOVE

200 MVAR SYNCHRONOUS CONDENSERS 98

11 SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY 100

11.1 INTRODUCTION 101

11.2 HYDROGEN-COOLED SYNCHRONOUS CONDENSERS 102

11.2.1 RISING GRID STABILITY REQUIREMENTS TO FUEL MARKET GROWTH 102

11.3 AIR-COOLED SYNCHRONOUS CONDENSERS 103

11.3.1 EXCELLENT COOLING EFFICACY TO PROPEL DEMAND 103

11.4 WATER-COOLED SYNCHRONOUS CONDENSERS 104

11.4.1 HIGHER EFFICIENCY THAN HYDROGEN-COOLED CONDENSERS

TO FUEL DEMAND 104

12 SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD 106

12.1 INTRODUCTION 107

12.2 STATIC FREQUENCY CONVERTER 108

12.2.1 LOW INSTALLATION COST OF STATIC FREQUENCY CONVERTER TO FUEL DEMAND 108

12.3 PONY MOTOR 109

12.3.1 LOW COST AND ABILITY TO START LOW-CAPACITY SYNCHRONOUS CONDENSERS TO FUEL DEMAND GROWTH 109

12.4 OTHER STARTING METHODS 110

13 SYNCHRONOUS CONDENSER MARKET, BY END USER 112

13.1 INTRODUCTION 113

13.2 ELECTRICAL UTILITIES 114

13.2.1 RISING NEED TO MAINTAIN GRID STABILITY AMID RISING PENETRATION OF INVERTER-BASED RENEWABLE ENERGY SOURCES TO FUEL THE MARKET 114

13.3 INDUSTRIAL SECTOR 115

13.3.1 GOVERNMENT EXPANSION OF ENERGY-INTENSIVE OPERATIONS TO BOOST MARKET GROWTH 115

14 SYNCHRONOUS CONDENSER MARKET, BY REGION 117

14.1 INTRODUCTION 118

14.2 NORTH AMERICA 120

14.2.1 US 125

14.2.1.1 Transition toward inverter-dominated power systems to boost demand 125

14.2.2 CANADA 126

14.2.2.1 Hydro-dominated and renewable-heavy networks drive long-term adoption 126

14.3 EUROPE 127

14.3.1 DENMARK 132

14.3.1.1 Government-led initiatives and world-leading wind integration to fuel demand for synchronous condensers 132

14.3.2 ITALY 133

14.3.2.1 Terna’s advanced synchronous condenser fleet and southern grid reinforcement strategy fueling market growth 133

14.3.3 GERMANY 133

14.3.3.1 Energiewende acceleration, massive solar/wind expansion, and TSO inertia procurement boosting market growth 133

14.3.4 NORWAY 134

14.3.4.1 Hydropower-rich backbone combined with growing offshore wind requiring enhanced grid inertia solutions 134

14.3.5 REST OF EUROPE 135

14.4 ASIA PACIFIC 136

14.4.1 CHINA 140

14.4.1.1 Rising advanced grid modernization programs to fuel market growth 140

14.4.2 AUSTRALIA 141

14.4.2.1 Rise of domestic mineral processing and battery-material refining to fuel market growth 141

14.4.3 REST OF ASIA PACIFIC 142

14.5 SOUTH AMERICA 143

14.5.1 BRAZIL 147

14.5.1.1 Expanding hydropower, wind, and solar projects to offer growth opportunities 147

14.5.2 REST OF SOUTH AMERICA 148

14.6 MIDDLE EAST & AFRICA 149

14.6.1 KENYA 153

14.6.1.1 High renewable penetration and KETRACO’s transmission upgrades driving demand for synchronous condensers 153

14.6.2 REST OF MIDDLE EAST & AFRICA 154

15 COMPETITIVE LANDSCAPE 156

15.1 OVERVIEW 156

15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2026 156

15.3 MARKET SHARE ANALYSIS, 2024 157

15.4 REVENUE ANALYSIS, 2020–2024 160

15.5 PRODUCT COMPARISON 161

15.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 162

15.6.1 STARS 162

15.6.2 EMERGING LEADERS 162

15.6.3 PERVASIVE PLAYERS 162

15.6.4 PARTICIPANTS 162

15.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 164

15.6.5.1 Company footprint 164

15.6.5.2 Region footprint 165

15.6.5.3 End-user footprint 166

15.6.5.4 Cooling technology footprint 167

15.6.5.5 Reactive Power rating footprint 168

15.7 COMPANY VALUATION AND FINANCIAL METRICS 169

15.8 COMPETITIVE SCENARIO 170

15.8.1 DEALS 170

15.8.2 EXPANSIONS 171

15.8.3 OTHER DEVELOPMENTS 171

16 COMPANY PROFILES 173

16.1 KEY PLAYERS 173

16.1.1 ABB 173

16.1.1.1 Business overview 173

16.1.1.2 Products/Solutions/Services offered 174

16.1.1.3 Recent developments 175

16.1.1.3.1 Deals 175

16.1.1.3.2 Other developments 175

16.1.1.4 MnM view 176

16.1.1.4.1 Key strengths/Right to win 176

16.1.1.4.2 Strategic choices 176

16.1.1.4.3 Weaknesses/Competitive threats 176

16.1.2 SIEMENS ENERGY 177

16.1.2.1 Business overview 177

16.1.2.2 Products/Solutions/Services offered 178

16.1.2.3 Recent developments 179

16.1.2.3.1 Deals 179

16.1.2.3.2 Other developments 179

16.1.2.4 MnM view 180

16.1.2.4.1 Key strengths/Right to win 180

16.1.2.4.2 Strategic choices 180

16.1.2.4.3 Weaknesses/Competitive threats 180

16.1.3 GE VERNOVA 181

16.1.3.1 Business overview 181

16.1.3.2 Products/Solutions/Services offered 182

16.1.3.3 Recent developments 183

16.1.3.3.1 Other developments 183

16.1.3.4 MnM view 183

16.1.3.4.1 Key strengths 183

16.1.3.4.2 Strategic choices 184

16.1.3.4.3 Weaknesses/Competitive threats 184

16.1.4 WEG 185

16.1.4.1 Business overview 185

16.1.4.2 Products/Services/Solutions offered 186

16.1.4.3 Recent developments 187

16.1.4.3.1 Deals 187

16.1.4.3.2 Other developments 187

16.1.4.3.3 Expansions 188

16.1.4.4 MnM view 188

16.1.4.4.1 Key strengths/Right to win 188

16.1.4.4.2 Strategic choices 188

16.1.4.4.3 Weaknesses/Competitive threats 188

16.1.5 EATON 189

16.1.5.1 Business overview 189

16.1.5.2 Products/Solutions/Services offered 190

16.1.5.3 Recent developments 191

16.1.5.3.1 Deals 191

16.1.5.4 MnM view 191

16.1.5.4.1 Key strengths/Right to win 191

16.1.5.4.2 Strategic choices 191

16.1.5.4.3 Weaknesses/Competitive threats 191

16.1.6 ANDRITZ 192

16.1.6.1 Business overview 192

16.1.6.2 Products/Solutions/Services offered 193

16.1.6.3 Recent developments 194

16.1.6.3.1 Other developments 194

16.1.7 ANSALDO ENERGIA 196

16.1.7.1 Business overview 196

16.1.7.2 Products/Services/Solutions offered 197

16.1.7.3 Recent developments 198

16.1.7.3.1 Other developments 198

16.1.7.3.2 Expansions 198

16.1.8 VOITH GMBH & CO. KGAA 199

16.1.8.1 Business overview 199

16.1.8.2 Products/Services/Solutions offered 199

16.1.9 MITSUBISHI ELECTRIC POWER PRODUCTS, INC. 200

16.1.9.1 Business overview 200

16.1.9.2 Products/Solutions/Services offered 200

16.1.9.3 Recent developments 201

16.1.9.3.1 Deals 201

16.1.9.3.2 Other developments 201

16.1.10 BHARAT HEAVY ELECTRICALS LIMITED 202

16.1.10.1 Business overview 202

16.1.10.2 Products/Solutions/Services offered 203

16.1.11 DOOSAN ŠKODA POWER 204

16.1.11.1 Business overview 204

16.1.11.2 Products/Solutions/Services offered 205

16.1.12 SHANGHAI ELECTRIC 206

16.1.12.1 Business overview 206

16.1.12.2 Products/Solutions/Services offered 207

16.1.12.3 Recent developments 207

16.1.12.3.1 Other developments 207

16.1.13 BAKER HUGHES COMPANY 208

16.1.13.1 Business overview 208

16.1.13.2 Products/Solutions/Services offered 209

16.1.13.3 Recent developments 210

16.1.13.3.1 Deals 210

16.1.14 HITACHI ENERGY LTD 211

16.1.14.1 Business overview 211

16.1.14.2 Products/Solutions/Services offered 212

16.1.14.3 Recent developments 213

16.1.14.3.1 Other developments 213

16.1.15 WOLONG ELECTRIC GROUP 214

16.1.15.1 Business overview 214

16.1.15.2 Products/Solutions/Services offered 214

16.2 OTHER PLAYERS 215

16.2.1 INGETEAM 215

16.2.2 ANHUI ZHONGDIAN ELECTRIC CO., LTD. 216

16.2.3 IDEAL ELECTRIC POWER CO. 216

16.2.4 POWER SYSTEMS & CONTROLS, INC. 217

16.2.5 ELECTROMECHANICAL ENGINEERING ASSOCIATES, INC. 217

17 RESEARCH METHODOLOGY 218

17.1 RESEARCH DATA 218

17.2 SECONDARY AND PRIMARY RESEARCH 219

17.2.1 SECONDARY DATA 219

17.2.1.1 List of key secondary sources 219

17.2.1.2 Key data from secondary sources 220

17.2.2 PRIMARY DATA 220

17.2.2.1 List of primary interview participants 220

17.2.2.2 Key industry insights 221

17.2.2.3 Breakdown of primaries 221

17.2.2.4 Key data from primary sources 222

17.3 MARKET SIZE ESTIMATION METHODOLOGY 222

17.3.1 BOTTOM-UP APPROACH 222

17.3.2 TOP-DOWN APPROACH 223

17.3.3 DEMAND-SIDE ANALYSIS 224

17.3.3.1 Demand-side assumptions 224

17.3.3.2 Demand-side calculations 224

17.3.4 SUPPLY-SIDE ANALYSIS 225

17.3.4.1 Supply-side assumptions 226

17.3.4.2 Supply-side calculations 226

17.4 FORECAST 227

17.5 MARKET BREAKDOWN AND DATA TRIANGULATION 228

17.6 RESEARCH LIMITATIONS 229

17.7 RISK ANALYSIS 229

18 APPENDIX 230

18.1 DISCUSSION GUIDE 230

18.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 234

18.3 CUSTOMIZATION OPTIONS 236

18.4 RELATED REPORTS 236

18.5 AUTHOR DETAILS 237

LIST OF TABLES

TABLE 1 SYNCHRONOUS CONDENSER MARKET: INCLUSIONS AND EXCLUSIONS 26

TABLE 2 COMPARISON BETWEEN SYNCHRONOUS CONDENSER AND ITS SUBSTITUTES 43

TABLE 3 PORTER’S FIVE FORCES ANALYSIS 47

TABLE 4 WORLDWIDE GDP GROWTH PROJECTION, 2021–2028 (USD TRILLION) 50

TABLE 5 INFLATION RATE, AVERAGE CONSUMER PRICES, ANNUAL PERCENT

CHANGE (2024%) 51

TABLE 6 MANUFACTURING, VALUE ADDED (% OF GDP), BY COUNTRY, 2023 52

TABLE 7 COST ANALYSIS FOR COOLING TECHNOLOGY 56

TABLE 8 ROLE OF COMPANIES IN SYNCHRONOUS CONDENSER ECOSYSTEM 57

TABLE 9 INDICATIVE SELLING PRICE TREND OF SYNCHRONOUS CONDENSERS,

BY REACTIVE POWER RATING, 2024 (USD MILLION) 58

TABLE 10 AVERAGE SELLING PRICE TREND OF SYNCHRONOUS CONDENSERS,

BY REGION, 2022–2024 (USD/KVAR) 59

TABLE 11 EXPORT DATA FOR HS CODE 8501-COMPLIANT PRODUCTS, BY COUNTRY,

2021–2024 (USD THOUSAND) 60

TABLE 12 IMPORT DATA FOR HS CODE 8501-COMPLIANT PRODUCTS, BY COUNTRY,

2021–2024 (USD THOUSAND) 61

TABLE 13 KEY CONFERENCES AND EVENTS, 2025–2026 62

TABLE 14 US-ADJUSTED RECIPROCAL TARIFF RATES, 2024 (USD BILLION) 66

TABLE 15 LIST OF KEY PATENTS RELATED TO SYNCHRONOUS CONDENSER TECHNOLOGY, 2020–2025 73

TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 77

TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 78

TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 79

TABLE 19 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 80

TABLE 20 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 80

TABLE 21 SYNCHRONOUS CONDENSER MARKET: CODES AND REGULATIONS 81

TABLE 22 TECHNICAL COMPARISON: SYNCHRONOUS CONDENSER VS. STATCOM 85

TABLE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS 86

TABLE 24 KEY BUYING CRITERIA FOR TOP END USERS 87

TABLE 25 SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2021–2024 (USD MILLION) 90

TABLE 26 SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2025–2030 (USD MILLION) 90

TABLE 27 NEW SYNCHRONOUS CONDENSER MARKET, BY REGION,

2021–2024 (USD MILLION) 91

TABLE 28 NEW SYNCHRONOUS CONDENSER MARKET, BY REGION,

2025–2030 (USD MILLION) 91

TABLE 29 REFURBISHED SYNCHRONOUS CONDENSER MARKET, BY REGION,

2021–2024 (USD MILLION) 92

TABLE 30 REFURBISHED SYNCHRONOUS CONDENSER MARKET, BY REGION,

2025–2030 (USD MILLION) 92

TABLE 31 SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING,

2021–2024 (USD MILLION) 95

TABLE 32 SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING,

2025–2030 (USD MILLION) 96

TABLE 33 UP TO 100 MVAR: SYNCHRONOUS CONDENSER MARKET, BY REGION,

2021–2024 (USD MILLION) 97

TABLE 34 UP TO 100 MVAR: SYNCHRONOUS CONDENSER MARKET, BY REGION,

2025–2030 (USD MILLION) 97

TABLE 35 101–200 MVAR: SYNCHRONOUS CONDENSER MARKET, BY REGION,

2021–2024 (USD MILLION) 98

TABLE 36 101–200 MVAR: SYNCHRONOUS CONDENSER MARKET, BY REGION,

2025–2030 (USD MILLION) 98

TABLE 37 ABOVE 200 MVAR: SYNCHRONOUS CONDENSER MARKET, BY REGION,

2021–2024 (USD MILLION) 99

TABLE 38 ABOVE 200 MVAR: SYNCHRONOUS CONDENSER MARKET, BY REGION,

2025–2030 (USD MILLION) 99

TABLE 39 SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY,

2021–2024 (USD MILLION) 101

TABLE 40 SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY,

2025–2030 (USD MILLION) 102

TABLE 41 HYDROGEN-COOLED SYNCHRONOUS CONDENSER MARKET, BY REGION,

2021–2024 (USD MILLION) 103

TABLE 42 HYDROGEN-COOLED SYNCHRONOUS CONDENSER MARKET, BY REGION,

2025–2030 (USD MILLION) 103

TABLE 43 AIR-COOLED SYNCHRONOUS CONDENSER MARKET, BY REGION,

2021–2024 (USD MILLION) 104

TABLE 44 AIR-COOLED SYNCHRONOUS CONDENSER MARKET, BY REGION,

2025–2030 (USD MILLION) 104

TABLE 45 WATER-COOLED SYNCHRONOUS CONDENSER MARKET, BY REGION,

2021–2024 (USD MILLION) 105

TABLE 46 WATER-COOLED SYNCHRONOUS CONDENSER MARKET, BY REGION,

2025–2030 (USD MILLION) 105

TABLE 47 SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD,

2021–2024 (USD MILLION) 107

TABLE 48 SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD,

2025–2030 (USD MILLION) 108

TABLE 49 STATIC FREQUENCY CONVERTER: SYNCHRONOUS CONDENSER MARKET,

BY REGION, 2021–2024 (USD MILLION) 108

TABLE 50 STATIC FREQUENCY CONVERTER: SYNCHRONOUS CONDENSER MARKET,

BY REGION, 2025–2030 (USD MILLION) 109

TABLE 51 PONY MOTOR: SYNCHRONOUS CONDENSER MARKET, BY REGION,

2021–2024 (USD MILLION) 110

TABLE 52 PONY MOTOR: SYNCHRONOUS CONDENSER MARKET, BY REGION,

2025–2030 (USD MILLION) 110

TABLE 53 OTHER STARTING METHODS: SYNCHRONOUS CONDENSER MARKET,

BY REGION, 2021–2024 (USD MILLION) 111

TABLE 54 OTHER STARTING METHODS: SYNCHRONOUS CONDENSER MARKET,

BY REGION, 2025–2030 (USD MILLION) 111

TABLE 55 SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021–2024 (USD MILLION) 113

TABLE 56 SYNCHRONOUS CONDENSER MARKET, BY END USER, 2025–2030 (USD MILLION) 114

TABLE 57 ELECTRICAL UTILITIES: SYNCHRONOUS CONDENSER MARKET, BY REGION,

2021–2024 (USD MILLION) 114

TABLE 58 ELECTRICAL UTILITIES: SYNCHRONOUS CONDENSER MARKET, BY REGION,

2025–2030 (USD MILLION) 115

TABLE 59 INDUSTRIAL SECTOR: SYNCHRONOUS CONDENSER MARKET, BY REGION,

2021–2024 (USD MILLION) 115

TABLE 60 INDUSTRIAL SECTOR: SYNCHRONOUS CONDENSER MARKET, BY REGION,

2025–2030 (USD MILLION) 116

TABLE 61 SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021–2024 (USD MILLION) 119

TABLE 62 SYNCHRONOUS CONDENSER MARKET, BY REGION, 2025–2030 (USD MILLION) 119

TABLE 63 SYNCHRONOUS CONDENSER MARKET, BY REGION, 2021–2024 (UNITS) 120

TABLE 64 SYNCHRONOUS CONDENSER MARKET, BY REGION, 2025–2030 (UNITS) 120

TABLE 65 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY TYPE,

2021–2024 (USD MILLION) 122

TABLE 66 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY TYPE,

2025–2030 (USD MILLION) 122

TABLE 67 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021–2024 (USD MILLION) 122

TABLE 68 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2025–2030 (USD MILLION) 122

TABLE 69 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021–2024 (USD MILLION) 123

TABLE 70 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2025–2030 (USD MILLION) 123

TABLE 71 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021–2024 (USD MILLION) 123

TABLE 72 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2025–2030 (USD MILLION) 123

TABLE 73 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY END USER

2021–2024 (USD MILLION) 124

TABLE 74 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2025–2030 (USD MILLION) 124

TABLE 75 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 124

TABLE 76 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 124

TABLE 77 US: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2021–2024 (USD MILLION) 125

TABLE 78 US: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2025–2030 (USD MILLION) 126

TABLE 79 CANADA: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2021–2024 (USD MILLION) 126

TABLE 80 CANADA: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2025–2030 (USD MILLION) 127

TABLE 81 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY TYPE,

2021–2024 (USD MILLION) 128

TABLE 82 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY TYPE,

2025–2030 (USD MILLION) 128

TABLE 83 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021–2024 (USD MILLION) 129

TABLE 84 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2025–2030 (USD MILLION) 129

TABLE 85 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD,

2021–2024 (USD MILLION) 129

TABLE 86 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD,

2025–2030 (USD MILLION) 129

TABLE 87 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021–2024 (USD MILLION) 130

TABLE 88 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2025–2030 (USD MILLION) 130

TABLE 89 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2021–2024 (USD MILLION) 130

TABLE 90 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2025–2030 (USD MILLION) 131

TABLE 91 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 131

TABLE 92 EUROPE: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 131

TABLE 93 DENMARK: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2021–2024 (USD MILLION) 132

TABLE 94 DENMARK: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2025–2030 (USD MILLION) 132

TABLE 95 ITALY: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2021–2024 (USD MILLION) 133

TABLE 96 ITALY: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2025–2030 (USD MILLION) 133

TABLE 97 GERMANY: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2021–2024 (USD MILLION) 134

TABLE 98 GERMANY: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2025–2030 (USD MILLION) 134

TABLE 99 NORWAY: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2021–2024 (USD MILLION) 135

TABLE 100 NORWAY: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2025–2030 (USD MILLION) 135

TABLE 101 REST OF EUROPE: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2021–2024 (USD MILLION) 136

TABLE 102 REST OF EUROPE: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2025–2030 (USD MILLION) 136

TABLE 103 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY TYPE,

2021–2024 (USD MILLION) 137

TABLE 104 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY TYPE,

2025–2030 (USD MILLION) 137

TABLE 105 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021–2024 (USD MILLION) 137

TABLE 106 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2025–2030 (USD MILLION) 138

TABLE 107 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021–2024 (USD MILLION) 138

TABLE 108 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2025–2030 (USD MILLION) 138

TABLE 109 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021–2024 (USD MILLION) 138

TABLE 110 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2025–2030 (USD MILLION) 139

TABLE 111 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2021–2024 (USD MILLION) 139

TABLE 112 ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2025–2030 (USD MILLION) 139

TABLE 113 ASIA PACIFIC: INDUCTION HEATING MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 139

TABLE 114 ASIA PACIFIC: INDUCTION MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 140

TABLE 115 CHINA: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2021–2024 (USD MILLION) 141

TABLE 116 CHINA: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2025–2030 (USD MILLION) 141

TABLE 117 AUSTRALIA: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2021–2024 (USD MILLION) 142

TABLE 118 AUSTRALIA: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2025–2030 (USD MILLION) 142

TABLE 119 REST OF ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET,

BY END USER, 2021–2024 (USD MILLION) 143

TABLE 120 REST OF ASIA PACIFIC: SYNCHRONOUS CONDENSER MARKET,

BY END USER, 2025–2030 (USD MILLION) 143

TABLE 121 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY TYPE,

2021–2024 (USD MILLION) 144

TABLE 122 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY TYPE,

2025–2030 (USD MILLION) 144

TABLE 123 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021–2024 (USD MILLION) 144

TABLE 124 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2025–2030 (USD MILLION) 144

TABLE 125 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021–2024 (USD MILLION) 145

TABLE 126 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2025–2030 (USD MILLION) 145

TABLE 127 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021–2024 (USD MILLION) 145

TABLE 128 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2025–2030 (USD MILLION) 146

TABLE 129 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2021–2024 (USD MILLION) 146

TABLE 130 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2025–2030 (USD MILLION) 146

TABLE 131 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 146

TABLE 132 SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 147

TABLE 133 BRAZIL: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2021–2024 (USD MILLION) 147

TABLE 134 BRAZIL: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2025–2030 (USD MILLION) 148

TABLE 135 REST OF SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021–2024 (USD MILLION) 148

TABLE 136 REST OF SOUTH AMERICA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2025–2030 (USD MILLION) 149

TABLE 137 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY TYPE,

2021–2024 (USD MILLION) 149

TABLE 138 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY TYPE,

2025–2030 (USD MILLION) 150

TABLE 139 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2021–2024 (USD MILLION) 150

TABLE 140 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2025–2030 (USD MILLION) 150

TABLE 141 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2021–2024 (USD MILLION) 151

TABLE 142 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2025–2030 (USD MILLION) 151

TABLE 143 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2021–2024 (USD MILLION) 151

TABLE 144 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2025–2030 (USD MILLION) 152

TABLE 145 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2021–2024 (USD MILLION) 152

TABLE 146 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY END USER, 2025–2030 (USD MILLION) 152

TABLE 147 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 152

TABLE 148 MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 153

TABLE 149 KENYA: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2021–2024 (USD MILLION) 154

TABLE 150 KENYA: SYNCHRONOUS CONDENSER MARKET, BY END USER,

2025–2030 (USD MILLION) 154

TABLE 151 REST OF MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET,

BY END USER, 2021–2024 (USD MILLION) 155

TABLE 152 REST OF MIDDLE EAST & AFRICA: SYNCHRONOUS CONDENSER MARKET,

BY END USER, 2025–2030 (USD MILLION) 155

TABLE 153 OVERVIEW OF KEY STRATEGIES ADOPTED BY KEY PLAYERS, 2021–2026 156

TABLE 154 SYNCHRONOUS CONDENSER MARKET: DEGREE OF COMPETITION 158

TABLE 155 SYNCHRONOUS CONDENSER MARKET: REGION FOOTPRINT 165

TABLE 156 SYNCHRONOUS CONDENSER MARKET: END-USER FOOTPRINT 166

TABLE 157 SYNCHRONOUS CONDENSER MARKET: COOLING TECHNOLOGY FOOTPRINT 167

TABLE 158 SYNCHRONOUS CONDENSER MARKET: REACTIVE POWER RATING FOOTPRINT 168

TABLE 159 SYNCHRONOUS CONDENSER MARKET: DEALS, JANUARY 2021–JANUARY 2026 170

TABLE 160 SYNCHRONOUS CONDENSER MARKET: EXPANSIONS,

JANUARY 2021–JANUARY 2026 171

TABLE 161 SYNCHRONOUS CONDENSER MARKET: OTHER DEVELOPMENTS,

JANUARY 2021–JANUARY 2026 171

TABLE 162 ABB: COMPANY OVERVIEW 173

TABLE 163 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED 174

TABLE 164 ABB: DEALS 175

TABLE 165 ABB: OTHER DEVELOPMENTS 175

TABLE 166 SIEMENS ENERGY: COMPANY OVERVIEW 177

TABLE 167 SIEMENS ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED 178

TABLE 168 SIEMENS ENERGY: DEALS 179

TABLE 169 SIEMENS ENERGY: OTHER DEVELOPMENTS 179

TABLE 170 GE VERNOVA: COMPANY OVERVIEW 181

TABLE 171 GE VERNOVA: PRODUCTS/SOLUTIONS/SERVICES OFFERED 182

TABLE 172 GE VERNOVA: OTHER DEVELOPMENTS 183

TABLE 173 WEG: COMPANY OVERVIEW 185

TABLE 174 WEG: PRODUCTS/SERVICES/SOLUTIONS OFFERED 186

TABLE 175 WEG: DEALS 187

TABLE 176 WEG: OTHER DEVELOPMENTS 187

TABLE 177 WEG: EXPANSIONS 188

TABLE 178 EATON: COMPANY OVERVIEW 189

TABLE 179 EATON: PRODUCTS/SOLUTIONS/SERVICES OFFERED 190

TABLE 180 EATON: DEALS 191

TABLE 181 ANDRITZ: COMPANY OVERVIEW 192

TABLE 182 ANDRITZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED 193

TABLE 183 ANDRITZ: OTHER DEVELOPMENTS 194

TABLE 184 ANSALDO ENERGIA: COMPANY OVERVIEW 196

TABLE 185 ANSALDO ENERGIA: PRODUCTS/SERVICES/SOLUTIONS OFFERED 197

TABLE 186 ANSALDO ENERGIA: OTHER DEVELOPMENTS 198

TABLE 187 ANSALDO ENERGIA: EXPANSIONS 198

TABLE 188 VOITH GMBH & CO. KGAA: COMPANY OVERVIEW 199

TABLE 189 VOITH GMBH & CO. KGAA: PRODUCTS/SERVICES/SOLUTIONS OFFERED 199

TABLE 190 MITSUBISHI ELECTRIC POWER PRODUCTS, INC.: COMPANY OVERVIEW 200

TABLE 191 MITSUBISHI ELECTRIC POWER PRODUCTS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 200

TABLE 192 MITSUBISHI ELECTRIC POWER PRODUCTS, INC.: DEALS 201

TABLE 193 MITSUBISHI ELECTRIC POWER PRODUCTS, INC.: OTHER DEVELOPMENTS 201

TABLE 194 BHARAT HEAVY ELECTRICALS LIMITED: COMPANY OVERVIEW 202

TABLE 195 BHARAT HEAVY ELECTRICALS LIMITED: PRODUCTS/SOLUTIONS/

SERVICES OFFERED 203

TABLE 196 DOOSAN ŠKODA POWER: COMPANY OVERVIEW 204

TABLE 197 DOOSAN ŠKODA POWER: PRODUCTS/SOLUTIONS/SERVICES OFFERED 205

TABLE 198 SHANGHAI ELECTRIC: COMPANY OVERVIEW 206

TABLE 199 SHANGHAI ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED 207

TABLE 200 SHANGHAI ELECTRIC: OTHER DEVELOPMENTS 207

TABLE 201 BAKER HUGHES COMPANY: COMPANY OVERVIEW 208

TABLE 202 BAKER HUGHES COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED 209

TABLE 203 BAKER HUGHES COMPANY: DEALS 210

TABLE 204 HITACHI ENERGY LTD: COMPANY OVERVIEW 211

TABLE 205 HITACHI ENERGY LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 212

TABLE 206 HITACHI ENERGY LTD: OTHER DEVELOPMENTS 213

TABLE 207 WOLONG ELECTRIC GROUP: COMPANY OVERVIEW 214

TABLE 208 WOLONG ELECTRIC GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED 214

TABLE 209 LIST OF PRIMARY INTERVIEW PARTICIPANTS 220

TABLE 210 DATA OBTAINED FROM PRIMARY SOURCES 222

LIST OF FIGURES

FIGURE 1 SYNCHRONOUS CONDENSER MARKET SEGMENTATION AND REGIONAL SCOPE 25

FIGURE 2 MARKET SCENARIO 28

FIGURE 3 GLOBAL SYNCHRONOUS CONDENSER MARKET, 2021–2030 29

FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN SYNCHRONOUS CONDENSER MARKET, 2021–2025 29

FIGURE 5 DISRUPTIONS INFLUENCING SYNCHRONOUS CONDENSER MARKET GROWTH 30

FIGURE 6 HIGH-GROWTH SEGMENTS IN SYNCHRONOUS CONDENSER MARKET, 2024 31

FIGURE 7 NORTH AMERICA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD 32

FIGURE 8 EXPANDING RENEWABLE ENERGY & GRID MODERNIZATION TO OFFER GROWTH OPPORTUNITIES 33

FIGURE 9 NEW SYNCHRONOUS CONDENSER TYPE SEGMENT AND NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARES IN 2024 34

FIGURE 10 NEW SYNCHRONOUS CONDENSERS TO HOLD DOMINANT MARKET SHARE 34

FIGURE 11 HYDROGEN-COOLED CONDENSERS TO HOLD LARGEST MARKET SHARE TILL 2030 35

FIGURE 12 STATIC FREQUENCY CONVERTERS TO EMERGE AS LARGEST MARKET SEGMENT 35

FIGURE 13 ABOVE 200 MVAR SEGMENT TO REGISTER HIGHEST DEMAND DURING

FORECAST PERIOD 36

FIGURE 14 ELECTRICAL UTILITIES FORM THE LARGER END-USER SEGMENT 36

FIGURE 15 NORWAY TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD 37

FIGURE 16 SYNCHRONOUS CONDENSER MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES 38

FIGURE 17 INSTALLED RENEWABLE ELECTRICITY GENERATING CAPACITY, 2025–2035 40

FIGURE 18 SYNCHRONOUS CONDENSER MARKET: PORTER’S FIVE FORCES ANALYSIS 48

FIGURE 19 SYNCHRONOUS CONDENSER MARKET: VALUE CHAIN ANALYSIS 54

FIGURE 20 SYNCHRONOUS CONDENSER MARKET: ECOSYSTEM ANALYSIS 57

FIGURE 21 AVERAGE SELLING PRICE TREND OF SYNCHRONOUS CONDENSERS,

BY REGION, 2022–2024 59

FIGURE 22 EXPORT SCENARIO FOR HS CODE 8501-COMPLIANT PRODUCTS IN

TOP 5 COUNTRIES, 2021–2024 60

FIGURE 23 IMPORT SCENARIO FOR HS CODE 8501-COMPLIANT PRODUCTS IN

TOP 5 COUNTRIES, 2021–2024 62

FIGURE 24 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS 63

FIGURE 25 INVESTMENT AND FUNDING SCENARIO, BY COMPANY 64

FIGURE 26 SYNCHRONOUS CONDENSER MARKET: PATENTS APPLIED AND GRANTED,

2015–2024 72

FIGURE 27 DECISION-MAKING PROCESS 85

FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF SYNCHRONOUS CONDENSER MARKET 86

FIGURE 29 KEY BUYING CRITERIA FOR END USERS 87

FIGURE 30 SYNCHRONOUS CONDENSER MARKET, BY TYPE, 2024 90

FIGURE 31 SYNCHRONOUS CONDENSER MARKET, BY REACTIVE POWER RATING, 2024 95

FIGURE 32 SYNCHRONOUS CONDENSER MARKET, BY COOLING TECHNOLOGY, 2024 101

FIGURE 33 SYNCHRONOUS CONDENSER MARKET, BY STARTING METHOD, 2024 107

FIGURE 34 SYNCHRONOUS CONDENSER MARKET, BY END USER, 2024 113

FIGURE 35 NORWAY TO REGISTER THE HIGHEST CAGR IN SYNCHRONOUS CONDENSER MARKET DURING FORECAST PERIOD 118

FIGURE 36 NORTH AMERICA HELD LARGEST MARKET SHARE IN 2024 119

FIGURE 37 NORTH AMERICA: SYNCHRONOUS CONDENSER MARKET SNAPSHOT 121

FIGURE 38 EUROPE: SYNCHRONOUS CONDENSER MARKET SNAPSHOT 128

FIGURE 39 MARKET SHARE ANALYSIS OF COMPANIES OFFERING SYNCHRONOUS CONDENSERS, 2024 158

FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS IN SYNCHRONOUS CONDENSER

MARKET, 2020–2024 160

FIGURE 41 SYNCHRONOUS CONDENSER MARKET: PRODUCT COMPARISON 161

FIGURE 42 SYNCHRONOUS CONDENSER MARKET: COMPANY EVALUATION

MATRIX (KEY PLAYERS), 2024 163

FIGURE 43 SYNCHRONOUS CONDENSER MARKET: COMPANY FOOTPRINT 164

FIGURE 44 COMPANY VALUATION 169

FIGURE 45 FINANCIAL METRICS 169

FIGURE 46 ABB: COMPANY SNAPSHOT 174

FIGURE 47 SIEMENS ENERGY: COMPANY SNAPSHOT 178

FIGURE 48 GE VERNOVA: COMPANY SNAPSHOT 182

FIGURE 49 WEG: COMPANY SNAPSHOT 186

FIGURE 50 EATON: COMPANY SNAPSHOT 190

FIGURE 51 ANDRITZ: COMPANY SNAPSHOT 193

FIGURE 52 ANSALDO ENERGIA: COMPANY SNAPSHOT 197

FIGURE 53 BHARAT HEAVY ELECTRICALS LIMITED: COMPANY SNAPSHOT 203

FIGURE 54 DOOSAN ŠKODA POWER: COMPANY SNAPSHOT 205

FIGURE 55 SHANGHAI ELECTRIC: COMPANY SNAPSHOT 206

FIGURE 56 BAKER HUGHES COMPANY: COMPANY SNAPSHOT 209

FIGURE 57 HITACHI ENERGY LTD: COMPANY SNAPSHOT 212

FIGURE 58 SYNCHRONOUS CONDENSER MARKET: RESEARCH DESIGN 219

FIGURE 59 KEY DATA FROM SECONDARY SOURCES 220

FIGURE 60 INSIGHTS FROM INDUSTRY EXPERTS 221

FIGURE 61 SYNCHRONOUS CONDENSER MARKET: BOTTOM-UP APPROACH 223

FIGURE 62 SYNCHRONOUS CONDENSER MARKET: TOP-DOWN APPROACH 223

FIGURE 63 KEY METRICS CONSIDERED TO ANALYZE DEMAND FOR SYNCHRONOUS CONDENSER 224

FIGURE 64 KEY METRICS CONSIDERED TO ASSESS SUPPLY OF SYNCHRONOUS CONDENSER 225

FIGURE 65 SYNCHRONOUS CONDENSER MARKET: SUPPLY-SIDE ANALYSIS 226

FIGURE 66 INDUSTRY CONCENTRATION, 2024 227

FIGURE 67 SYNCHRONOUS CONDENSER MARKET: DATA TRIANGULATION 228

FIGURE 68 SYNCHRONOUS CONDENSER MARKET: RESEARCH LIMITATIONS 229