Lithium-ion Battery Materials Market - Global Forecast to 2030

Lithium-Ion Battery Materials Market by Battery Chemistry (LFP, LCO, NMC, NCA, LMO), Material (Cathode, Anode, Electrolyte), Application (Portable Device, Electric Vehicle, Industrial, Power Tool, Medical Device) & Region - Global Forecast to 2030

リチウムイオン電池材料市場 - バッテリーの化学組成(LFP、LCO、NMC、NCA、LMO)、材料(正極、負極、電解液)、用途(携帯機器、電気自動車、産業用、電動工具、医療機器)および地域別 - 2030年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年02月 |

| ページ数 | 258 |

| 図表数 | 353 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-5387 |

世界のリチウムイオン電池材料市場は、2025年の482億9,000万米ドルから2030年には953億4,000万米ドルに拡大し、予測期間中に年平均成長率(CAGR)14.6%で成長すると予測されています。電動化の進展に伴い、大量の正極・負極材料、電解質、その他の先進材料を必要とする電気自動車の需要が高まり、リチウムイオン電池材料市場は着実に成長しています。低排出ガス輸送システムを支援する政府の政策、再生可能エネルギー貯蔵ソリューション、そして消費者向け電子機器製品の需要増加により、ニッケルリッチ正極やシリコン強化負極などのリチウムイオン電池部品の需要が高まっています。電池技術開発の市場機会は、エネルギー貯蔵容量、動作持続時間、安全性を向上させる固体電解質や次世代負極材料を通じて、現状の領域を超えて拡大しています。企業が環境問題への対応と並行して、不安定なリチウム、コバルト、ニッケル供給源への依存を減らすため、リサイクルへの取り組みや持続可能なサプライチェーンの構築に投資する中で、今後10年間で市場は新たな高みに達すると予想されます。

調査範囲:

本レポートでは、リチウムイオン電池材料市場をタイプ、グループ、用途、地域別にセグメント化し、市場規模を予測しています。主要プレーヤーを戦略的にプロファイルし、市場シェアとコアコンピタンスを包括的に分析しています。また、市場における各プレーヤーによる事業拡大、提携、買収といった競争動向も追跡・分析しています。

レポートを購入する理由:

本レポートは、リチウムイオン電池材料市場とそのセグメントの収益に関する最も正確な概算を提供することで、市場リーダー企業や新規参入企業を支援することが期待されています。また、本レポートは、市場関係者が市場の競争環境をより深く理解し、ビジネスポジションを強化するための貴重な洞察を獲得し、効果的な市場開拓戦略を策定する上でも役立つことが期待されています。さらに、市場動向を把握し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供します。

本レポートは、以下の点について洞察を提供します。

- リチウムイオン電池材料市場の成長に影響を与える要因(電気自動車の普及拡大、家電製品の需要急増)、制約要因(リチウムイオン電池搭載機器の安全性への懸念、リチウム、コバルト、天然黒鉛の供給集中による調達リスク、代替品の入手可能性)、機会(リチウムイオン電池価格の低下、リチウムイオン電池のアップグレードに向けた研究開発の増加、リサイクルと二次利用による材料回収、循環型供給の機会の創出)、課題(原材料価格の変動)の分析。

- 製品開発/イノベーション:リチウムイオン電池材料市場における今後の技術や研究開発活動に関する詳細な洞察。

- 市場開発:収益性の高い市場に関する包括的な情報 – 本レポートは、さまざまな地域のリチウムイオン電池材料市場を分析しています。

- 市場の多様化:リチウムイオン電池材料市場における新製品、様々なタイプ、未開拓地域、最近の開発状況、投資に関する包括的な情報。

- 競合評価:リチウムイオン電池材料市場の主要プレーヤーであるUmicore(ベルギー)、住友金属鉱山株式会社(日本)、BASF(ドイツ)、POSCO Future M(韓国)、田中化学工業株式会社(日本)、戸田工業株式会社(日本)、レゾナックホールディングス株式会社(日本)、LANDF Corp(中国)、JFEケミカル株式会社(中国)、3M(米国)、SGL Carbon(ドイツ)、NEI Corporation(米国)、BTR New Materials Group Co., Ltd.(中国)、UBE Corporation(日本)、クラレ株式会社(日本)、Shenzhen Dynanonic Co., Ltd.(中国)、Huayou Cobalt Co., Ltd.(中国)、American Elements(米国)、森田化学工業株式会社(日本)などの主要プレーヤーの市場シェア、成長戦略、および製品提供の詳細な評価。

Report Description

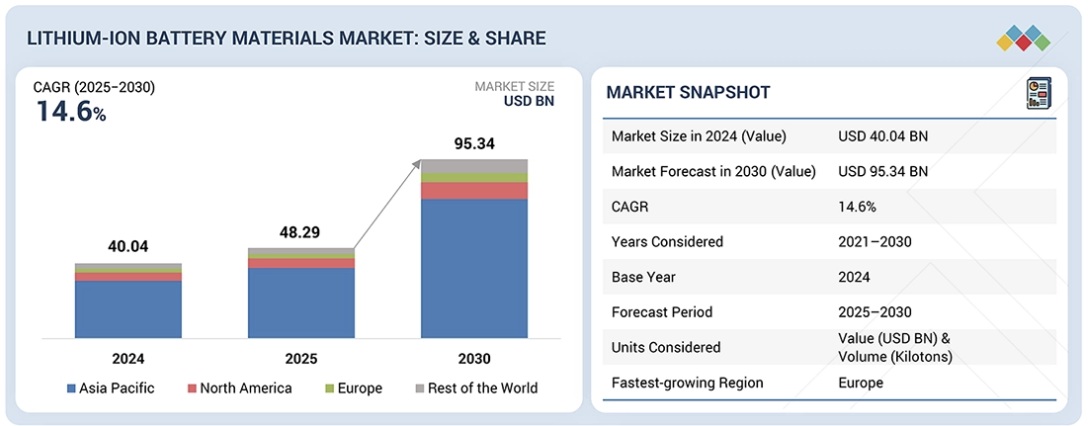

The global lithium-ion battery materials market is projected to grow from USD 48.29 billion in 2025 to USD 95.34 billion by 2030, at a CAGR of 14.6% during the forecast period. The lithium-ion battery materials market is growing steadily as electrification drives demand for electric vehicles that require large amounts of cathode and anode materials, electrolytes, and other advanced materials. Government policies that support low-emission transportation systems, together with renewable energy storage solutions and rising demand for consumer electronics products, create a greater need for lithium-ion battery components, including nickel-rich cathodes and silicon-enhanced anodes. The market opportunities for battery technology development extend beyond their current reach through solid-state electrolytes and next-generation anode materials, which enhance energy storage capacity, operational duration, and safety. The market expansion will reach new heights over the next 10 years as businesses invest in recycling initiatives and sustainable supply chain development to reduce their reliance on unstable sources of lithium, cobalt, and nickel while addressing environmental issues.

Lithium-ion Battery Materials Market – Global Forecast to 2030

“By battery materials, the electrolyte segment is estimated to register the fastest growth, in terms of value, of the lithium-ion battery materials market during the forecast period.”

The electrolyte segment of the lithium-ion battery materials market will experience the fastest growth during the forecast period, as it is a vital component that determines battery operation and is driving market development through new technologies. The movement of ions between the cathode and anode requires electrolytes to perform their function, as they enable charging and discharging processes that determine the energy capacity, safety standards, and operational duration of lithium-ion batteries. The urgent need for electric vehicles, portable electronics, and energy storage systems drives manufacturers to develop new electrolyte products that deliver higher ionic conductivity and thermal stability, compatible with upcoming battery technologies. The segment experiences growth acceleration as solid-state electrolyte technology receives more funding, offering better safety and higher energy density than conventional liquid electrolytes, and as automotive companies and battery manufacturers continue to develop commercial products. The electrolyte segment will drive value growth across the entire battery materials market because production capacity expands and research and development budgets increase.

“By battery chemistry, the lithium iron phosphate (LFP) segment is estimated to be the fastest-growing segment of the lithium-ion battery materials market during the forecast period.”

The lithium iron phosphate (LFP) chemistry segment will achieve the fastest growth during the forecast period because LFP delivers better performance and safety features at lower cost than nickel-manganese-cobalt (NMC) and lithium cobalt oxide lithium-ion battery chemistries. Electric vehicles (EVs) and energy storage systems increasingly adopt LFP batteries because of their superior thermal stability, extended cycle life, and lower production costs, making them suitable for mass-market EVs and grid storage applications that prioritize safety and lifecycle economics. Government electrification policies and manufacturing growth in Asia-Pacific countries have created a funding demand that enables LFP production and adoption to increase. The lithium-ion batteries market segment will offer considerable growth opportunities throughout the forecast period, as envisaged for the battery materials industry.

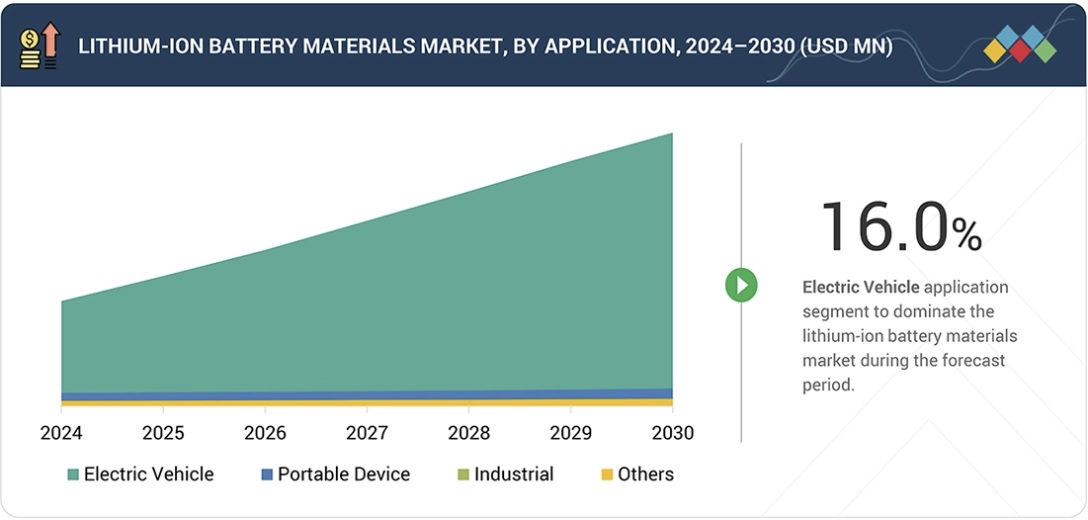

“By application, the electric vehicle segment is estimated to be the fastest-growing segment of the lithium-ion battery materials market during the forecast period.”

The electric vehicle (EV) application segment in the lithium-ion battery materials market will experience the fastest growth during the forecast period, according to estimates, as electrified mobility adoption and carbon-emission reduction regulations are expected to increase market demand. The automotive industry needs advanced battery materials, which include lithium, nickel, and cobalt, and new cathode and anode designs, because EV demand currently extends from passenger cars to commercial vehicles, and automakers are starting to produce new electrified vehicle models. The combination of government incentives, stricter emissions regulations, and growing consumer demand for environmentally friendly transportation options drives continuous market expansion for EVs, which in turn drives lithium-ion battery material consumption throughout the forecast period.

Lithium-ion Battery Materials Market – Global Forecast to 2030 – region

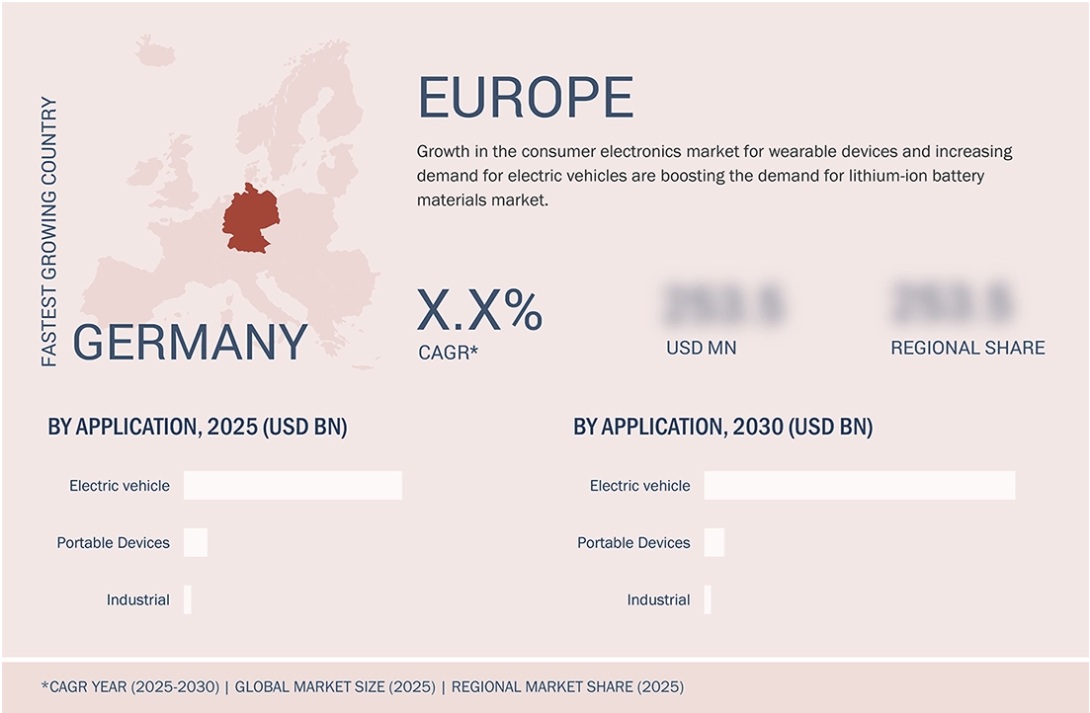

“The lithium-ion battery materials market in Europe is projected to register the fastest growth, in terms of value, during the forecast period.”

The European region will achieve the highest market value growth for lithium-ion battery materials during the forecast period due to three driving factors: strategic policy support, rapid development of electric transportation, and increased domestic battery manufacturing. European governments and the European Union have implemented ambitious decarbonization and electrification targets that are stimulating demand for electric vehicles (EVs) and energy storage systems, thereby boosting demand for lithium-ion battery materials. The establishment and expansion of gigafactories, along with major investments by global battery manufacturers to localize production in countries such as Germany and Hungary, are boosting the region’s market momentum as Europe seeks to strengthen its supply chain and reduce dependence on imports. Regulatory frameworks that support “made in Europe” supply chains, together with incentives for clean energy technologies, create conditions that drive this expansion forward. The European market for lithium-ion battery materials will experience rapid expansion as industrial companies in the region seek essential raw materials and battery technology continues to advance.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 – 45%, Tier 2 – 22%, and Tier 3 – 33%

- By Designation: C-Level Executives– 50%, Directors– 10%, and Others – 40%

- By Region: North America – 17%, Asia Pacific – 17%, Europe – 33%, and Rest of the World – 33%

Leading players operating in the lithium-ion battery materials market include Umicore (Belgium), Sumitomo Metal Mining Co., Ltd. (Japan), BASF (Germany), POSCO Future M (South Korea), Resonac Holdings Corporation (Japan), and others. These key players are significant contributors to the lithium-ion battery materials market. These players have adopted various strategies, including agreements, joint ventures, and expansions, to increase their market share and business revenue.

Lithium-ion Battery Materials Market – Global Forecast to 2030 – ecosystem

Research Coverage:

The report defines segments and projects the size of the lithium-ion battery materials market based on type, group, application, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as expansions, partnerships, and acquisitions undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help market leaders/new entrants by providing the closest approximations of revenue for the lithium-ion battery materials market and its segments. This report is also expected to help stakeholders gain a deeper understanding of the market’s competitive landscape, acquire valuable insights to enhance their business positions, and develop effective go-to-market strategies. It also enables stakeholders to understand the market’s pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of drivers (increasing adoption of electric vehicles, surging demand for consumer electronics), restraints (safety concerns related to gadgets with lithium-ion batteries, supply concentration of lithium, cobalt, and natural graphite create procurement risk, availability of substitutes), opportunities (declining lithium-ion battery prices, growing R&D to upgrade lithium-ion batteries, recycling and second-life material recovery, creating circular supply opportunities), and challenges (fluctuating raw materials prices) are influencing the growth of the lithium-ion battery materials market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities in the lithium-ion battery materials market.

- Market Development: Comprehensive information about lucrative markets – the report analyzes the lithium-ion battery materials market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the lithium-ion battery materials market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Umicore (Belgium), Sumitomo Metal Mining Co., Ltd. (Japan), BASF (Germany), POSCO Future M (South Korea), Tanaka Chemical Corporation (Japan), Toda Kogyo Corp. (Japan), Resonac Holdings Corporation (Japan), LANDF Corp (China), JFE Chemical Corporation (China), 3M (US), SGL Carbon (Germany), NEI Corporation (US), BTR New Materials Group Co., Ltd. (China), UBE Corporation (Japan), Kuraray Co., Ltd. (Japan), Shenzhen Dynanonic Co., Ltd. (China), Huayou Cobalt Co., Ltd. (China), American Elements (US), and Morita Chemical Industries Co., Ltd. (Japan) are the key players in lithium-ion battery materials market.

Table of Contents

1 INTRODUCTION 28

1.1 STUDY OBJECTIVES 28

1.2 MARKET DEFINITION 28

1.3 STUDY SCOPE 29

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 29

1.3.2 INCLUSIONS AND EXCLUSIONS 29

1.3.3 YEARS CONSIDERED 30

1.3.4 CURRENCY CONSIDERED 30

1.3.5 UNIT CONSIDERED 30

1.4 RESEARCH LIMITATIONS 30

1.5 STAKEHOLDERS 31

1.6 SUMMARY OF CHANGES 31

2 EXECUTIVE SUMMARY 32

2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS 32

2.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS 33

2.3 DISRUPTIVE TRENDS SHAPING THE MARKET 34

2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS 35

2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST 36

3 PREMIUM INSIGHTS 37

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LITHIUM-ION BATTERY MATERIALS MARKET 37

3.2 LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL 37

3.3 LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY 38

3.4 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION 38

3.5 LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION 39

3.6 LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY 39

4 MARKET OVERVIEW 40

4.1 INTRODUCTION 40

4.2 MARKET DYNAMICS 40

4.2.1 DRIVERS 41

4.2.1.1 Increasing adoption of electric vehicles 41

4.2.1.2 Surging demand for consumer electronics 41

4.2.2 RESTRAINTS 41

4.2.2.1 Safety concerns related to gadgets with lithium-ion batteries 41

4.2.2.2 Availability of substitutes 42

4.2.2.3 Supply concentration of lithium, cobalt, and natural graphite creating procurement risk 42

4.2.3 OPPORTUNITIES 42

4.2.3.1 Growing R&D to upgrade lithium-ion batteries 42

4.2.3.2 Declining lithium-ion battery prices 43

4.2.3.3 Recycling and second-life material recovery, creating circular supply opportunities 43

4.2.4 CHALLENGES 44

4.2.4.1 Fluctuating raw material prices 44

4.3 UNMET NEEDS AND WHITE SPACES 45

4.3.1 UNMET NEEDS IN LITHIUM-ION BATTERY MATERIALS MARKET 45

4.3.2 WHITE SPACE OPPORTUNITIES 45

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 46

4.4.1 INTERCONNECTED MARKETS 46

4.4.2 CROSS-SECTOR OPPORTUNITIES 47

4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS 47

4.5.1 EMERGING BUSINESS MODELS 47

4.5.2 ECOSYSTEM SHIFTS 47

4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 48

4.6.1 KEY MOVES AND STRATEGIC FOCUS 48

5 INDUSTRY TRENDS 49

5.1 PORTER’S FIVE FORCES ANALYSIS 49

5.1.1 BARGAINING POWER OF SUPPLIERS 50

5.1.2 BARGAINING POWER OF BUYERS 50

5.1.3 THREAT OF NEW ENTRANTS 50

5.1.4 THREAT OF SUBSTITUTES 51

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 51

5.2 MACROECONOMIC OUTLOOK 51

5.2.1 INTRODUCTION 51

5.2.2 GDP TRENDS AND FORECAST 52

5.2.3 TRENDS IN GLOBAL LITHIUM-ION BATTERY MATERIALS INDUSTRY 53

5.3 VALUE CHAIN ANALYSIS 54

5.3.1 RESEARCH & DEVELOPMENT 54

5.3.2 RAW MATERIAL 54

5.3.3 MANUFACTURING 54

5.3.4 DISTRIBUTION NETWORK 54

5.3.5 END-USE INDUSTRIES 55

5.4 ECOSYSTEM ANALYSIS 55

5.5 PRICING ANALYSIS 56

5.5.1 AVERAGE SELLING PRICE TREND OF NATURAL GRAPHITE, BY REGION 56

5.5.2 AVERAGE SELLING PRICE OF LITHIUM-ION BATTERY MATERIALS,

BY ANODE MATERIAL 57

5.5.3 AVERAGE SELLING PRICE OF LITHIUM CARBONATE, BY KEY PLAYERS 58

5.5.4 AVERAGE SELLING PRICE TREND OF COBALT, BY REGION 58

5.5.5 AVERAGE SELLING PRICE TREND OF NICKEL, BY REGION 59

5.6 TRADE DATA 59

5.6.1 IMPORT SCENARIO (HS CODE 850650) 59

5.6.2 EXPORT SCENARIO (HS CODE 850650) 60

5.7 KEY CONFERENCES AND EVENTS 61

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 62

5.9 INVESTMENT AND FUNDING SCENARIO 62

5.10 CASE STUDY ANALYSIS 63

5.10.1 HITACHI’S LESS-VOLATILE ELECTROLYTE ELIMINATES NEED FOR COOLING SYSTEMS IN BATTERIES 63

5.10.2 PALL CASE STUDY: LIQUID ELECTROLYTES IN HIGH ENERGY DENSITY EV BATTERY PRODUCTION 63

5.10.3 PALL CASE STUDY: LIQUID ELECTROLYTES IN ELECTRIC VEHICLE (EV) BATTERY PRODUCTION 64

5.11 US TARIFF IMPACT ON LITHIUM-ION BATTERY MATERIALS MARKET 64

5.11.1 KEY TARIFF RATES IMPACTING THE MARKET 64

5.11.2 PRICE IMPACT ANALYSIS 64

5.11.3 IMPACT ON KEY COUNTRIES/REGIONS 65

5.11.3.1 US 65

5.11.3.2 Europe 65

5.11.3.3 Asia Pacific 65

5.11.4 IMPACT ON END-USE INDUSTRIES OF LITHIUM-ION BATTERY MATERIALS 65

5.11.4.1 Portable devices 65

5.11.4.2 Electric vehicles (EVs) 65

5.11.4.3 Industrial 65

5.11.4.4 Others 65

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS 66

6.1 KEY TECHNOLOGIES 66

6.1.1 HIGH-NICKEL CATHODE 66

6.2 COMPLEMENTARY TECHNOLOGIES 66

6.2.1 LITHIUM METAL BATTERIES 66

6.3 TECHNOLOGY/PRODUCT ROADMAP 67

6.3.1 SHORT-TERM (2025–2027) | PROCESS OPTIMIZATION & SUPPLY CHAIN SECURITY 67

6.3.2 MID-TERM (2027–2030) | SUSTAINABLE MATERIAL INNOVATION & PERFORMANCE ENHANCEMENT 67

6.3.3 LONG-TERM (2030–2035+) | CIRCULARITY, DECARBONIZATION &

NEXT-GENERATION BATTERY CHEMISTRIES 68

6.4 PATENT ANALYSIS 69

6.4.1 METHODOLOGY 69

6.5 FUTURE APPLICATIONS 72

6.5.1 NEXT-GENERATION EV BATTERIES: SOLID-STATE & HIGH-ENERGY DENSITY SYSTEMS 72

6.5.2 GRID-SCALE & LONG-DURATION ENERGY STORAGE: MATERIALS FOR ENERGY TRANSITION 73

6.5.3 FAST-CHARGING & HIGH-POWER BATTERIES: SILICON AND LITHIUM-METAL ANODES 73

6.5.4 CONSUMER & WEARABLE ELECTRONICS: ULTRA-THIN, HIGH-ENERGY MATERIALS 73

6.5.5 CIRCULAR & SUSTAINABLE BATTERY ECOSYSTEMS: RECYCLING &

SECOND-LIFE USE 74

6.6 IMPACT OF AI/GENERATIVE AI ON LITHIUM-ION BATTERY MATERIALS MARKET 74

6.6.1 INTRODUCTION 74

6.6.2 R&D AND MATERIAL DISCOVERY 74

6.6.3 MANUFACTURING AND PROCESS OPTIMIZATION 74

6.6.4 SUPPLY CHAIN AND MARKET INTELLIGENCE 75

6.6.5 BATTERY LIFECYCLE MANAGEMENT AND RECYCLING 75

6.6.6 STRATEGIC AND MARKET IMPLICATIONS 75

7 SUSTAINABILITY AND REGULATORY LANDSCAPE 76

7.1 REGULATORY LANDSCAPE 76

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 76

7.1.2 INDUSTRY STANDARDS 78

7.2 SUSTAINABILITY INITIATIVES 79

7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF LITHIUM-ION BATTERY MATERIALS 79

7.2.1.1 Carbon impact reduction 79

7.2.1.2 Eco-applications 79

7.2.1.3 Carbon impact reduction 80

7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES 80

7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 81

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 83

8.1 DECISION-MAKING PROCESS 83

8.2 KEY STAKEHOLDERS AND BUYING CRITERIA 84

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 84

8.2.2 BUYING CRITERIA 85

8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 86

8.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES 87

8.5 MARKET PROFITABILITY 88

8.5.1 REVENUE POTENTIAL 88

8.5.2 COST DYNAMICS 88

8.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS 89

9 LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL 90

9.1 INTRODUCTION 91

9.2 ANODE MATERIALS 93

9.2.1 INNOVATION IN ANODE MATERIAL DESIGN TO ENHANCE MARKET DEMAND 93

9.3 CATHODE MATERIALS 94

9.3.1 GROWING ELECTRIC VEHICLE ADOPTION TO DRIVE MARKET GROWTH 94

9.4 ELECTROLYTE MATERIALS 96

9.4.1 NEED FOR ENHANCED BATTERY OUTPUT DRIVING DEMAND 96

9.5 OTHER MATERIALS 97

10 LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY 99

10.1 INTRODUCTION 100

10.2 LITHIUM NICKEL MANGANESE COBALT 102

10.2.1 BALANCED PERFORMANCE IN TERMS OF HIGH ENERGY DENSITY, LONG CYCLE LIFE, AND COST OPTIMIZATION TO DRIVE MARKET 102

10.3 LITHIUM IRON PHOSPHATE 103

10.3.1 HIGH SAFETY, LONG SERVICE LIFE, AND COST-EFFECTIVENESS FUELING DEMAND 103

10.4 LITHIUM MANGANESE OXIDE 105

10.4.1 HIGH SAFETY CHARACTERISTICS TO BOOST MARKET GROWTH 105

10.5 LITHIUM COBALT OXIDE 106

10.5.1 WIDE ADOPTION IN CONSUMER ELECTRONICS TO DRIVE MARKET 106

10.6 LITHIUM NICKEL COBALT ALUMINUM OXIDE 107

10.6.1 GROWING DEMAND FOR HIGH-ENERGY DENSITY ELECTRIC VEHICLE BATTERIES AND CONSUMER PRODUCTS TO DRIVE MARKET 107

11 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION 110

11.1 INTRODUCTION 111

11.2 PORTABLE DEVICES 112

11.2.1 RAPID TECHNOLOGICAL CHANGES TO SUPPORT MARKET GROWTH 112

11.3 ELECTRIC VEHICLES 114

11.3.1 GOVERNMENT EFFORTS TO PROMOTE CLEAN ENERGY SOLUTIONS TO DRIVE DEMAND 114

11.4 INDUSTRIAL 115

11.4.1 FOCUS ON ENVIRONMENTAL SAFETY AND EQUIPMENT DURABILITY TO INCREASE DEMAND 115

11.5 OTHER APPLICATIONS 117

12 LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION 119

12.1 INTRODUCTION 120

12.2 EUROPE 122

12.2.1 GERMANY 128

12.2.1.1 Growing demand for electric vehicles to drive market 128

12.2.2 UK 129

12.2.2.1 Rising sales of electric vehicles to support market growth 129

12.2.3 FRANCE 131

12.2.3.1 Increasing demand in automotive and marine industries to boost market 131

12.2.4 REST OF EUROPE 132

12.3 ASIA PACIFIC 134

12.3.1 CHINA 140

12.3.1.1 Growing production of electric vehicles to drive demand 140

12.3.2 JAPAN 141

12.3.2.1 Presence of leading lithium-ion battery manufacturers to propel market 141

12.3.3 INDIA 143

12.3.3.1 Increasing need for clean energy and government initiatives to support market growth 143

12.3.4 SOUTH KOREA 144

12.3.4.1 Government efforts to increase adoption of electric vehicles to fuel market 144

12.3.5 REST OF ASIA PACIFIC 145

12.4 NORTH AMERICA 147

12.4.1 US 152

12.4.1.1 Rising demand for electric vehicles to fuel market 152

12.4.2 CANADA 154

12.4.2.1 Government subsidies for electric vehicles to boost market 154

12.4.3 MEXICO 155

12.4.3.1 Growing demand in automotive sector to drive market 155

12.5 REST OF WORLD 156

12.5.1 SOUTH AMERICA 161

12.5.1.1 Large lithium reserves to create market opportunities 161

12.5.2 MIDDLE EAST & AFRICA 163

12.5.2.1 Expansion of consumer goods and automobile industries to drive demand 163

13 COMPETITIVE LANDSCAPE 165

13.1 INTRODUCTION 165

13.2 KEY PLAYERS’ STRATEGIES/RIGHT TO WIN 165

13.3 REVENUE ANALYSIS, 2024 167

13.4 MARKET SHARE ANALYSIS 168

13.4.1 UMICORE (BELGIUM) 169

13.4.2 POSCO FUTURE M (SOUTH KOREA) 169

13.4.3 BASF (GERMANY) 169

13.4.4 SUMITOMO METAL MINING CO., LTD. (JAPAN) 169

13.4.5 RESONAC HOLDINGS CORPORATION (JAPAN) 169

13.5 BRAND/PRODUCT COMPARISON 170

13.5.1 UMICORE 170

13.5.2 SUMITOMO METAL MINING 170

13.5.3 BASF 170

13.5.4 POSCO FUTURE M 171

13.5.5 TANAKA CHEMICAL CORPORATION 171

13.6 COMPANY VALUATION AND FINANCIAL METRICS 171

13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 173

13.7.1 STARS 173

13.7.2 EMERGING LEADERS 173

13.7.3 PERVASIVE PLAYERS 173

13.7.4 PARTICIPANTS 173

13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 175

13.7.5.1 Company footprint 175

13.7.5.2 Region footprint 176

13.7.5.3 Material footprint 177

13.7.5.4 Battery chemistry footprint 178

13.7.5.5 Application footprint 179

13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 180

13.8.1 PROGRESSIVE COMPANIES 180

13.8.2 RESPONSIVE COMPANIES 180

13.8.3 DYNAMIC COMPANIES 180

13.8.4 STARTING BLOCKS 180

13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 182

13.8.5.1 Detailed list of key startups/SMEs 182

13.8.5.2 Competitive benchmarking of key startups/SMEs 182

13.9 COMPETITIVE SCENARIO 183

13.9.1 DEALS 183

13.9.2 EXPANSIONS 184

14 COMPANY PROFILES 185

14.1 MAJOR PLAYERS 185

14.1.1 UMICORE 185

14.1.1.1 Business overview 185

14.1.1.2 Products/Solutions/Services offered 186

14.1.1.3 Recent developments 186

14.1.1.3.1 Deals 186

14.1.1.3.2 Expansions 188

14.1.1.4 MnM view 188

14.1.1.4.1 Right to win 188

14.1.1.4.2 Strategic choices 189

14.1.1.4.3 Weaknesses and competitive threats 189

14.1.2 SUMITOMO METAL MINING CO., LTD. 190

14.1.2.1 Business overview 190

14.1.2.2 Products/Solutions/Services offered 191

14.1.2.3 Recent developments 191

14.1.2.3.1 Deals 191

14.1.2.3.2 Expansions 192

14.1.2.4 MnM view 192

14.1.2.4.1 Right to win 192

14.1.2.4.2 Strategic choices 193

14.1.2.4.3 Weaknesses and competitive threats 193

14.1.3 BASF 194

14.1.3.1 Business overview 194

14.1.3.2 Products/Solutions/Services offered 195

14.1.3.3 Recent developments 196

14.1.3.3.1 Deals 196

14.1.3.3.2 Expansions 198

14.1.3.4 MnM view 199

14.1.3.4.1 Right to win 199

14.1.3.4.2 Strategic choices 199

14.1.3.4.3 Weaknesses and competitive threats 199

14.1.4 POSCO FUTURE M 200

14.1.4.1 Business overview 200

14.1.4.2 Products/Solutions/Services offered 201

14.1.4.3 Recent developments 202

14.1.4.3.1 Deals 202

14.1.4.3.2 Expansions 204

14.1.4.4 MnM view 205

14.1.4.4.1 Right to win 205

14.1.4.4.2 Strategic choices 205

14.1.4.4.3 Weaknesses and competitive threats 205

14.1.5 RESONAC HOLDINGS CORPORATION 206

14.1.5.1 Business overview 206

14.1.5.2 Products/Solutions/Services offered 207

14.1.5.3 MnM view 208

14.1.5.3.1 Right to win 208

14.1.5.3.2 Strategic choices 208

14.1.5.3.3 Weaknesses and competitive threats 208

14.1.6 TANAKA CHEMICAL CORPORATION 209

14.1.6.1 Business overview 209

14.1.6.2 Products/Solutions/Services offered 210

14.1.7 TODA KOGYO CORP. 211

14.1.7.1 Business overview 211

14.1.7.2 Products/Solutions/Services offered 212

14.1.7.3 Recent developments 212

14.1.7.3.1 Expansions 212

14.1.8 LANDF CORP. 213

14.1.8.1 Business overview 213

14.1.8.2 Products/Solutions/Services offered 214

14.1.8.3 Recent developments 214

14.1.8.3.1 Deals 214

14.1.8.3.2 Expansions 214

14.1.8.3.3 Others 215

14.1.9 JFE CHEMICAL CORPORATION 216

14.1.9.1 Business overview 216

14.1.9.2 Products/Solutions/Services offered 216

14.1.10 3M 217

14.1.10.1 Business overview 217

14.1.10.2 Products/Solutions/Services offered 218

14.1.11 SGL CARBON 219

14.1.11.1 Business overview 219

14.1.11.2 Products/Solutions/Services offered 220

14.1.12 NEI CORPORATION 221

14.1.12.1 Business overview 221

14.1.12.2 Products/Solutions/Services offered 221

14.1.12.3 Recent developments 222

14.1.12.3.1 Product launches 222

14.1.13 BTR NEW MATERIALS GROUP CO., LTD. 223

14.1.13.1 Business overview 223

14.1.13.2 Products/Solutions/Services offered 223

14.1.13.3 Recent developments 224

14.1.13.3.1 Deals 224

14.1.13.3.2 Expansions 224

14.1.14 UBE CORPORATION 225

14.1.14.1 Business overview 225

14.1.14.2 Products/Solutions/Services offered 226

14.1.14.3 Recent developments 226

14.1.14.3.1 Deals 226

14.1.14.3.2 Expansions 226

14.1.15 KURARAY CO., LTD. 227

14.1.15.1 Business overview 227

14.1.15.2 Products/Solutions/Services offered 228

14.1.16 SHENZHEN DYNANONIC CO., LTD. 229

14.1.16.1 Business overview 229

14.1.16.2 Products/Solutions/Services offered 229

14.1.16.3 Recent developments 229

14.1.16.3.1 Deals 229

14.1.17 HUAYOU COBALT CO., LTD. 230

14.1.17.1 Business overview 230

14.1.17.2 Products/Solutions/Services offered 232

14.1.17.3 Recent developments 232

14.1.17.3.1 Deals 232

14.1.18 KUREHA CORPORATION 233

14.1.18.1 Business overview 233

14.1.18.2 Products/Solutions/Services offered 234

14.1.19 AMERICAN ELEMENTS 235

14.1.19.1 Business overview 235

14.1.19.2 Products/Solutions/Services offered 235

14.1.20 MORITA CHEMICAL INDUSTRIES CO., LTD. 237

14.1.20.1 Business overview 237

14.1.20.2 Products/Solutions/Services offered 237

14.2 OTHER PLAYERS 238

14.2.1 ECOPRO 238

14.2.2 CAPCHEM 238

14.2.3 NICHIA CORPORATION 239

14.2.4 ASCEND ELEMENTS, INC. 239

14.2.5 NANO ONE MATERIALS CORP. 240

14.2.6 PULEAD TECHNOLOGY INDUSTRY CO., LTD. 240

15 RESEARCH METHODOLOGY 241

15.1 RESEARCH DATA 241

15.1.1 SECONDARY DATA 242

15.1.1.1 List of key secondary sources 242

15.1.1.2 Key data from secondary sources 243

15.1.2 PRIMARY DATA 243

15.1.2.1 Key data from primary sources 244

15.1.2.2 List of primary interview participants (demand and supply sides) 244

15.1.2.3 Key industry insights 245

15.1.2.4 Breakdown of interviews with experts 245

15.2 DEMAND-SIDE ANALYSIS 246

15.3 SUPPLY-SIDE ANALYSIS 246

15.3.1 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS 247

15.4 MARKET SIZE ESTIMATION 247

15.4.1 BOTTOM-UP APPROACH 247

15.4.2 TOP-DOWN APPROACH 248

15.5 GROWTH FORECAST 249

15.6 DATA TRIANGULATION 249

15.7 FACTOR ANALYSIS 250

15.8 RESEARCH ASSUMPTIONS 250

15.9 RESEARCH LIMITATIONS 251

15.10 RISK ASSESSMENT 251

16 APPENDIX 252

16.1 DISCUSSION GUIDE 252

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 254

16.3 CUSTOMIZATION OPTIONS 256

16.4 RELATED REPORTS 256

16.5 AUTHOR DETAILS 257

LIST OF TABLES

TABLE 1 LITHIUM-ION BATTERY MATERIALS MARKET: IMPACT OF PORTER’S FIVE FORCES 50

TABLE 2 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRIES,

2022–2024 (%) 52

TABLE 3 UNEMPLOYMENT RATE, BY KEY COUNTRIES, 2022–2024 (%) 52

TABLE 4 INFLATION RATE, AVERAGE CONSUMER PRICES, BY KEY COUNTRIES,

2022–2024 (%) 53

TABLE 5 FOREIGN DIRECT INVESTMENT, BY REGION, 2022 & 2023 (USD BILLION) 53

TABLE 6 LITHIUM-ION BATTERY MATERIALS MARKET: ROLES OF COMPANIES IN ECOSYSTEM 55

TABLE 7 AVERAGE SELLING PRICE TREND OF NATURAL GRAPHITE, BY REGION,

2022–2024 (USD/KG) 56

TABLE 8 AVERAGE SELLING PRICE OF LITHIUM-ION BATTERY MATERIALS, BY ANODE MATERIAL, 2024 (USD/KG) 57

TABLE 9 IMPORT DATA FOR HS CODE 850650-COMPLIANT PRODUCTS (LITHIUM CELLS AND BATTERIES), BY KEY COUNTRIES, 2021–2024 (USD THOUSAND) 60

TABLE 10 EXPORT DATA FOR HS CODE 850650-COMPLIANT PRODUCTS (LITHIUM CELLS AND BATTERIES), BY KEY COUNTRIES, 2021–2024 (USD THOUSAND) 61

TABLE 11 LITHIUM-ION BATTERY MATERIALS MARKET: KEY CONFERENCES

AND EVENTS, 2026 61

TABLE 12 LITHIUM-ION BATTERY MATERIALS MARKET: LIST OF MAJOR PATENTS,

2015–2025 70

TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 76

TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 77

TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 77

TABLE 16 GLOBAL STANDARDS IN LITHIUM-ION BATTERY MATERIALS MARKET 78

TABLE 17 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN LITHIUM-ION BATTERY MATERIALS MARKET 81

TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION 84

TABLE 19 KEY BUYING CRITERIA, BY APPLICATION 85

TABLE 20 LITHIUM-ION BATTERY MATERIALS MARKET: UNMET NEEDS IN KEY END-USE INDUSTRIES 87

TABLE 21 LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2021–2024 (KILOTON) 91

TABLE 22 LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2025–2030 (KILOTON) 92

TABLE 23 LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 92

TABLE 24 LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 92

TABLE 25 ANODE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (KILOTON) 93

TABLE 26 ANODE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (KILOTON) 93

TABLE 27 ANODE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (USD MILLION) 93

TABLE 28 ANODE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (USD MILLION) 94

TABLE 29 CATHODE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (KILOTON) 94

TABLE 30 CATHODE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (KILOTON) 95

TABLE 31 CATHODE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (USD MILLION) 95

TABLE 32 CATHODE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (USD MILLION) 95

TABLE 33 ELECTROLYTE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET,

BY REGION, 2021–2024 (KILOTON) 96

TABLE 34 ELECTROLYTE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET,

BY REGION, 2025–2030 (KILOTON) 96

TABLE 35 ELECTROLYTE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET,

BY REGION, 2021–2024 (USD MILLION) 96

TABLE 36 ELECTROLYTE MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET,

BY REGION, 2025–2030 (USD MILLION) 97

TABLE 37 OTHER MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (KILOTON) 97

TABLE 38 OTHER MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (KILOTON) 97

TABLE 39 OTHER MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (USD MILLION) 98

TABLE 40 OTHER MATERIALS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (USD MILLION) 98

TABLE 41 LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY,

2021–2024 (KILOTON) 100

TABLE 42 LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY,

2025–2030 (KILOTON) 101

TABLE 43 LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY,

2021–2024 (USD MILLION) 101

TABLE 44 LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY,

2025–2030 (USD MILLION) 101

TABLE 45 LITHIUM NICKEL MANGANESE COBALT: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (KILOTON) 102

TABLE 46 LITHIUM NICKEL MANGANESE COBALT: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (KILOTON) 102

TABLE 47 LITHIUM NICKEL MANGANESE COBALT: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (USD MILLION) 103

TABLE 48 LITHIUM NICKEL MANGANESE COBALT: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (USD MILLION) 103

TABLE 49 LITHIUM IRON PHOSPHATE: LITHIUM-ION BATTERY MATERIALS MARKET,

BY REGION, 2021–2024 (KILOTON) 103

TABLE 50 LITHIUM IRON PHOSPHATE: LITHIUM-ION BATTERY MATERIALS MARKET,

BY REGION, 2025–2030 (KILOTON) 104

TABLE 51 LITHIUM IRON PHOSPHATE: LITHIUM-ION BATTERY MATERIALS MARKET,

BY REGION, 2021–2024 (USD MILLION) 104

TABLE 52 LITHIUM IRON PHOSPHATE: LITHIUM-ION BATTERY MATERIALS MARKET,

BY REGION, 2025–2030 (USD MILLION) 104

TABLE 53 LITHIUM MANGANESE OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET,

BY REGION, 2021–2024 (KILOTON) 105

TABLE 54 LITHIUM MANGANESE OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET,

BY REGION, 2025–2030 (KILOTON) 105

TABLE 55 LITHIUM MANGANESE OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET,

BY REGION, 2021–2024 (USD MILLION) 105

TABLE 56 LITHIUM MANGANESE OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET,

BY REGION, 2025–2030 (USD MILLION) 106

TABLE 57 LITHIUM COBALT OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (KILOTON) 106

TABLE 58 LITHIUM COBALT OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (KILOTON) 106

TABLE 59 LITHIUM COBALT OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (USD MILLION) 107

TABLE 60 LITHIUM COBALT OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (USD MILLION) 107

TABLE 61 LITHIUM NICKEL COBALT ALUMINUM OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (KILOTON) 108

TABLE 62 LITHIUM NICKEL COBALT ALUMINUM OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (KILOTON) 108

TABLE 63 LITHIUM NICKEL COBALT ALUMINUM OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (USD MILLION) 108

TABLE 64 LITHIUM NICKEL COBALT ALUMINUM OXIDE: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (USD MILLION) 109

TABLE 65 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION,

2021–2024 (KILOTON) 111

TABLE 66 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 111

TABLE 67 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 112

TABLE 68 LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 112

TABLE 69 PORTABLE DEVICES: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (KILOTON) 112

TABLE 70 PORTABLE DEVICES: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (KILOTON) 113

TABLE 71 PORTABLE DEVICES: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (USD MILLION) 113

TABLE 72 PORTABLE DEVICES: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (USD MILLION) 113

TABLE 73 ELECTRIC VEHICLES: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (KILOTON) 114

TABLE 74 ELECTRIC VEHICLES: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (KILOTON) 114

TABLE 75 ELECTRIC VEHICLES: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (USD MILLION) 115

TABLE 76 ELECTRIC VEHICLES: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (USD MILLION) 115

TABLE 77 INDUSTRIAL: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION,

2021–2024 (KILOTON) 116

TABLE 78 INDUSTRIAL: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION,

2025–2030 (KILOTON) 116

TABLE 79 INDUSTRIAL: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION,

2021–2024 (USD MILLION) 116

TABLE 80 INDUSTRIAL: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION,

2025–2030 (USD MILLION) 117

TABLE 81 OTHER APPLICATIONS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (KILOTON) 117

TABLE 82 OTHER APPLICATIONS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (KILOTON) 117

TABLE 83 OTHER APPLICATIONS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (USD MILLION) 118

TABLE 84 OTHER APPLICATIONS: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (USD MILLION) 118

TABLE 85 LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION,

2021–2024 (USD MILLION) 120

TABLE 86 LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION,

2025–2030 (USD MILLION) 121

TABLE 87 LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2021–2024 (KILOTON) 121

TABLE 88 LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION, 2025–2030 (KILOTON) 121

TABLE 89 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 123

TABLE 90 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 123

TABLE 91 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY,

2021–2024 (KILOTON) 123

TABLE 92 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 124

TABLE 93 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 124

TABLE 94 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 124

TABLE 95 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (KILOTON) 125

TABLE 96 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (KILOTON) 125

TABLE 97 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2021–2024 (USD MILLION) 125

TABLE 98 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2025–2030 (USD MILLION) 126

TABLE 99 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2021–2024 (KILOTON) 126

TABLE 100 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2025–2030 (KILOTON) 126

TABLE 101 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 127

TABLE 102 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 127

TABLE 103 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION,

2021–2024 (KILOTON) 127

TABLE 104 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 128

TABLE 105 GERMANY: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 128

TABLE 106 GERMANY: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 128

TABLE 107 GERMANY: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (KILOTON) 129

TABLE 108 GERMANY: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (KILOTON) 129

TABLE 109 UK: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 129

TABLE 110 UK: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 130

TABLE 111 UK: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (KILOTON) 130

TABLE 112 UK: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (KILOTON) 130

TABLE 113 FRANCE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 131

TABLE 114 FRANCE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 131

TABLE 115 FRANCE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (KILOTON) 131

TABLE 116 FRANCE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (KILOTON) 132

TABLE 117 REST OF EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2021–2024 (USD MILLION) 132

TABLE 118 REST OF EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2025–2030 (USD MILLION) 132

TABLE 119 REST OF EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2021–2024 (KILOTON) 133

TABLE 120 REST OF EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2025–2030 (KILOTON) 133

TABLE 121 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 135

TABLE 122 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 135

TABLE 123 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY,

2021–2024 (KILOTON) 135

TABLE 124 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 136

TABLE 125 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 136

TABLE 126 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 136

TABLE 127 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (KILOTON) 137

TABLE 128 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (KILOTON) 137

TABLE 129 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET,

BY BATTERY CHEMISTRY, 2021–2024 (USD MILLION) 137

TABLE 130 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET,

BY BATTERY CHEMISTRY, 2025–2030 (USD MILLION) 138

TABLE 131 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET,

BY BATTERY CHEMISTRY, 2021–2024 (KILOTON) 138

TABLE 132 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET,

BY BATTERY CHEMISTRY, 2025–2030 (KILOTON) 138

TABLE 133 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 139

TABLE 134 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 139

TABLE 135 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION,

2021–2024 (KILOTON) 139

TABLE 136 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 140

TABLE 137 CHINA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 140

TABLE 138 CHINA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 140

TABLE 139 CHINA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (KILOTON) 141

TABLE 140 CHINA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (KILOTON) 141

TABLE 141 JAPAN: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 141

TABLE 142 JAPAN: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 142

TABLE 143 JAPAN: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (KILOTON) 142

TABLE 144 JAPAN: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (KILOTON) 142

TABLE 145 INDIA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 143

TABLE 146 INDIA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 143

TABLE 147 INDIA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (KILOTON) 143

TABLE 148 INDIA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (KILOTON) 144

TABLE 149 SOUTH KOREA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 144

TABLE 150 SOUTH KOREA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 144

TABLE 151 SOUTH KOREA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (KILOTON) 145

TABLE 152 SOUTH KOREA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (KILOTON) 145

TABLE 153 REST OF ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2021–2024 (USD MILLION) 145

TABLE 154 REST OF ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2025–2030 (USD MILLION) 146

TABLE 155 REST OF ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2021–2024 (KILOTON) 146

TABLE 156 REST OF ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2025–2030 (KILOTON) 146

TABLE 157 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 147

TABLE 158 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 148

TABLE 159 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2021–2024 (KILOTON) 148

TABLE 160 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY COUNTRY, 2025–2030 (KILOTON) 148

TABLE 161 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2021–2024 (USD MILLION) 148

TABLE 162 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2025–2030 (USD MILLION) 149

TABLE 163 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2021–2024 (KILOTON) 149

TABLE 164 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2025–2030 (KILOTON) 149

TABLE 165 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY BATTERY CHEMISTRY, 2021–2024 (USD MILLION) 150

TABLE 166 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET,

BY BATTERY CHEMISTRY, 2025–2030 (USD MILLION) 150

TABLE 167 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET,

BY BATTERY CHEMISTRY, 2021–2024 (KILOTON) 150

TABLE 168 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET,

BY BATTERY CHEMISTRY, 2025–2030 (KILOTON) 151

TABLE 169 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 151

TABLE 170 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 151

TABLE 171 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2021–2024 (KILOTON) 152

TABLE 172 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2025–2030 (KILOTON) 152

TABLE 173 US: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 153

TABLE 174 US: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 153

TABLE 175 US: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (KILOTON) 153

TABLE 176 US: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (KILOTON) 153

TABLE 177 CANADA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 154

TABLE 178 CANADA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 154

TABLE 179 CANADA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (KILOTON) 154

TABLE 180 CANADA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (KILOTON) 155

TABLE 181 MEXICO: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 155

TABLE 182 MEXICO: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 155

TABLE 183 MEXICO: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2021–2024 (KILOTON) 156

TABLE 184 MEXICO: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL,

2025–2030 (KILOTON) 156

TABLE 185 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION,

2021–2024 (USD MILLION) 156

TABLE 186 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION,

2025–2030 (USD MILLION) 157

TABLE 187 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION,

2021–2024 (KILOTON) 157

TABLE 188 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY REGION,

2025–2030 (KILOTON) 157

TABLE 189 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2021–2024 (USD MILLION) 157

TABLE 190 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2025–2030 (USD MILLION) 158

TABLE 191 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2021–2024 (KILOTON) 158

TABLE 192 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2025–2030 (KILOTON) 158

TABLE 193 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET,

BY BATTERY CHEMISTRY, 2021–2024 (USD MILLION) 159

TABLE 194 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET,

BY BATTERY CHEMISTRY, 2025–2030 (USD MILLION) 159

TABLE 195 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET,

BY BATTERY CHEMISTRY, 2021–2024 (KILOTON) 159

TABLE 196 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET,

BY BATTERY CHEMISTRY, 2025–2030 (KILOTON) 160

TABLE 197 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 160

TABLE 198 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 160

TABLE 199 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2021–2024 (KILOTON) 161

TABLE 200 REST OF WORLD: LITHIUM-ION BATTERY MATERIALS MARKET, BY APPLICATION, 2025–2030 (KILOTON) 161

TABLE 201 SOUTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2021–2024 (USD MILLION) 161

TABLE 202 SOUTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2025–2030 (USD MILLION) 162

TABLE 203 SOUTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2021–2024 (KILOTON) 162

TABLE 204 SOUTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET, BY MATERIAL, 2025–2030 (KILOTON) 162

TABLE 205 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY MATERIALS MARKET,

BY MATERIAL, 2021–2024 (USD MILLION) 163

TABLE 206 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY MATERIALS MARKET,

BY MATERIAL, 2025–2030 (USD MILLION) 163

TABLE 207 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY MATERIALS MARKET,

BY MATERIAL, 2021–2024 (KILOTON) 164

TABLE 208 MIDDLE EAST & AFRICA: LITHIUM-ION BATTERY MATERIALS MARKET,

BY MATERIAL, 2025–2030 (KILOTON) 164

TABLE 209 LITHIUM-ION BATTERY MATERIALS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS (2020–2025) 165

TABLE 210 LITHIUM-ION BATTERY MATERIALS MARKET: DEGREE OF COMPETITION, 2024 168

TABLE 211 LITHIUM-ION BATTERY MATERIALS MARKET: REGION FOOTPRINT 176

TABLE 212 LITHIUM-ION BATTERY MATERIALS MARKET: MATERIAL FOOTPRINT 177

TABLE 213 LITHIUM-ION BATTERY MATERIALS MARKET: BATTERY CHEMISTRY FOOTPRINT 178

TABLE 214 LITHIUM-ION BATTERY MATERIALS MARKET: APPLICATION FOOTPRINT 179

TABLE 215 LITHIUM-ION BATTERY MATERIALS MARKET: DETAILED LIST OF KEY STARTUPS/SMES 182

TABLE 216 LITHIUM-ION BATTERY MATERIALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES 182

TABLE 217 LITHIUM-ION BATTERY MATERIALS MARKET: DEALS,

JANUARY 2020–DECEMBER 2025 183

TABLE 218 LITHIUM-ION BATTERY MATERIALS MARKET: EXPANSIONS,

JANUARY 2020–DECEMBER 2025 184

TABLE 219 UMICORE: COMPANY OVERVIEW 185

TABLE 220 UMICORE: PRODUCTS/SOLUTIONS/SERVICES OFFERED 186

TABLE 221 UMICORE: DEALS 186

TABLE 222 UMICORE: EXPANSIONS 188

TABLE 223 SUMITOMO METAL MINING CO., LTD.: COMPANY OVERVIEW 190

TABLE 224 SUMITOMO METAL MINING CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 191

TABLE 225 SUMITOMO METAL MINING CO., LTD.: DEALS 191

TABLE 226 SUMITOMO METAL MINING CO., LTD.: EXPANSIONS 192

TABLE 227 BASF: COMPANY OVERVIEW 194

TABLE 228 BASF: PRODUCTS/SOLUTIONS/SERVICES OFFERED 195

TABLE 229 BASF: DEALS 196

TABLE 230 BASF: EXPANSIONS 198

TABLE 231 POSCO FUTURE M: COMPANY OVERVIEW 200

TABLE 232 POSCO FUTURE M: PRODUCTS/SOLUTIONS/SERVICES OFFERED 201

TABLE 233 POSCO FUTURE M: DEALS 202

TABLE 234 POSCO FUTURE M: EXPANSIONS 204

TABLE 235 RESONAC HOLDINGS CORPORATION: COMPANY OVERVIEW 206

TABLE 236 RESONAC HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 207

TABLE 237 TANAKA CHEMICAL CORPORATION: COMPANY OVERVIEW 209

TABLE 238 TANAKA CHEMICAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 210

TABLE 239 TODA KOGYO CORP.: COMPANY OVERVIEW 211

TABLE 240 TODA KOGYO CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 212

TABLE 241 TODA KOGYO CORP.: EXPANSIONS 212

TABLE 242 LANDF CORP.: COMPANY OVERVIEW 213

TABLE 243 LANDF CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 214

TABLE 244 LANDF CORP.: DEALS 214

TABLE 245 LANDF CORP.: EXPANSIONS 214

TABLE 246 LANDF CORP.: OTHERS 215

TABLE 247 JFE CHEMICAL CORPORATION: COMPANY OVERVIEW 216

TABLE 248 JFE CHEMICAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 216

TABLE 249 3M: COMPANY OVERVIEW 217

TABLE 250 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED 218

TABLE 251 SGL CARBON: COMPANY OVERVIEW 219

TABLE 252 SGL CARBON: PRODUCTS/SOLUTIONS/SERVICES OFFERED 220

TABLE 253 NEI CORPORATION: COMPANY OVERVIEW 221

TABLE 254 NEI CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 221

TABLE 255 NEI CORPORATION: PRODUCT LAUNCHES 222

TABLE 256 BTR NEW MATERIALS GROUP CO., LTD.: COMPANY OVERVIEW 223

TABLE 257 BTR NEW MATERIALS GROUP CO., LTD.: PRODUCTS/SOLUTIONS/

SERVICES OFFERED 223

TABLE 258 BTR NEW MATERIAL GROUP CO., LTD.: DEALS 224

TABLE 259 BTR NEW MATERIAL GROUP CO., LTD.: EXPANSIONS 224

TABLE 260 UBE CORPORATION: COMPANY OVERVIEW 225

TABLE 261 UBE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 226

TABLE 262 UBE CORPORATION: DEALS 226

TABLE 263 UBE CORPORATION: EXPANSIONS 226

TABLE 264 KURARAY CO., LTD.: COMPANY OVERVIEW 227

TABLE 265 KURARAY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 228

TABLE 266 SHENZHEN DYNANONIC CO., LTD.: COMPANY OVERVIEW 229

TABLE 267 SHENZHEN DYNANONIC CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 229

TABLE 268 SHENZHEN DYNANONIC CO., LTD.: DEALS 229

TABLE 269 HUAYOU COBALT CO., LTD.: COMPANY OVERVIEW 230

TABLE 270 HUAYOU COBALT CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 232

TABLE 271 HUAYOU COBALT CO., LTD.: DEALS 232

TABLE 272 KUREHA CORPORATION: COMPANY OVERVIEW 233

TABLE 273 KUREHA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 234

TABLE 274 AMERICAN ELEMENTS: COMPANY OVERVIEW 235

TABLE 275 AMERICAN ELEMENTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED 235

TABLE 276 MORITA CHEMICAL INDUSTRIES CO., LTD.: COMPANY OVERVIEW 237

TABLE 277 MORITA CHEMICAL INDUSTRIES CO., LTD.: PRODUCTS/SOLUTIONS/

SERVICES OFFERED 237

TABLE 278 ECOPRO: COMPANY OVERVIEW 238

TABLE 279 CAPCHEM: COMPANY OVERVIEW 238

TABLE 280 NICHIA CORPORATION: COMPANY OVERVIEW 239

TABLE 281 ASCEND ELEMENTS, INC.: COMPANY OVERVIEW 239

TABLE 282 NANO ONE MATERIALS CORP.: COMPANY OVERVIEW 240

TABLE 283 PULEAD TECHNOLOGY INDUSTRY CO., LTD.: COMPANY OVERVIEW 240

LIST OF FIGURES

FIGURE 1 LITHIUM-ION BATTERY MATERIALS MARKET: SEGMENTATION

AND REGIONAL SCOPE 29

FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS 32

FIGURE 3 GLOBAL LITHIUM-ION BATTERY MATERIALS MARKET, 2025–2030 32

FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN LITHIUM-ION BATTERY MATERIALS MARKET (2020–2025) 33

FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF LITHIUM-ION BATTERY

MATERIALS MARKET 34

FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN LITHIUM-ION

BATTERY MATERIALS MARKET 35

FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD 36

FIGURE 8 INCREASING DEMAND FOR ELECTRIC VEHICLES TO DRIVE MARKET DURING FORECAST PERIOD 37

FIGURE 9 CATHODE MATERIALS TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD 37

FIGURE 10 LITHIUM NICKEL MANGANESE COBALT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD 38

FIGURE 11 ELECTRIC VEHICLES SEGMENT TO REGISTER HIGHEST CAGR DURING

FORECAST PERIOD 38

FIGURE 12 ASIA PACIFIC TO DOMINATE GLOBAL LITHIUM-ION BATTERY MATERIALS MARKET 39

FIGURE 13 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD 39

FIGURE 14 LITHIUM-ION BATTERY MATERIALS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES 40

FIGURE 15 LITHIUM-ION BATTERY PACK PRICES, 2013–2025 (USD/KWH) 43

FIGURE 16 LITHIUM CARBONATE PRICES, 2021–2024 44

FIGURE 17 LITHIUM-ION BATTERY MATERIALS MARKET: PORTER’S FIVE FORCES ANALYSIS 49

FIGURE 18 LITHIUM-ION BATTERY MATERIALS MARKET: VALUE CHAIN ANALYSIS 54

FIGURE 19 LITHIUM-ION BATTERY MATERIALS MARKET: ECOSYSTEM MAPPING 55

FIGURE 20 AVERAGE SELLING PRICE TREND OF NATURAL GRAPHITE, BY REGION, 2022–2024 56

FIGURE 21 AVERAGE SELLING PRICE OF LITHIUM-ION BATTERY MATERIALS,

BY ANODE MATERIAL, 2024 57

FIGURE 22 AVERAGE SELLING PRICE OF LITHIUM CARBONATE, BY KEY PLAYERS, 2024 58

FIGURE 23 AVERAGE SELLING PRICE TREND OF COBALT, BY REGION, 2021–2024 58

FIGURE 24 AVERAGE SELLING PRICE TREND OF NICKEL, BY REGION, 2021–2024 59

FIGURE 25 IMPORT SCENARIO FOR HS CODE 850650-COMPLIANT PRODUCT

(LITHIUM CELLS AND BATTERIES), BY KEY COUNTRIES, 2021–2024 59

FIGURE 26 EXPORT SCENARIO FOR HS CODE 850650-COMPLIANT PRODUCTS

(LITHIUM CELLS AND BATTERIES), BY KEY COUNTRIES, 2021–2024, 60

FIGURE 27 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS 62

FIGURE 28 LITHIUM-ION BATTERY MATERIALS MARKET: INVESTMENT AND FUNDING SCENARIO, 2023–2024 62

FIGURE 29 LIST OF MAJOR PATENTS RELATED TO LITHIUM-ION BATTERY MATERIALS,

2015–2025 69

FIGURE 30 FUTURE APPLICATIONS OF LITHIUM-ION BATTERY MATERIALS 72

FIGURE 31 LITHIUM-ION BATTERY MATERIALS MARKET: DECISION-MAKING FACTORS 83

FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION 84

FIGURE 33 KEY BUYING CRITERIA, BY APPLICATION 85

FIGURE 34 ADOPTION BARRIERS & INTERNAL CHALLENGES 86

FIGURE 35 CATHODE MATERIALS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD 91

FIGURE 36 LITHIUM NICKEL MANGANESE COBALT SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD 100

FIGURE 37 ELECTRIC VEHICLES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD 111

FIGURE 38 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING

FORECAST PERIOD 120

FIGURE 39 EUROPE: LITHIUM-ION BATTERY MATERIALS MARKET SNAPSHOT 122

FIGURE 40 ASIA PACIFIC: LITHIUM-ION BATTERY MATERIALS MARKET SNAPSHOT 134

FIGURE 41 NORTH AMERICA: LITHIUM-ION BATTERY MATERIALS MARKET SNAPSHOT 147

FIGURE 42 LITHIUM-ION BATTERY MATERIALS MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2020–2024 167

FIGURE 43 LITHIUM-ION BATTERY MATERIALS MARKET SHARE ANALYSIS, 2024 168

FIGURE 44 LITHIUM-ION BATTERY MATERIALS MARKET: BRAND/PRODUCT COMPARISON 170

FIGURE 45 LITHIUM-ION BATTERY MATERIALS MARKET: EV/EBITDA 171

FIGURE 46 LITHIUM-ION BATTERY MATERIALS MARKET: EV/REVENUE 172

FIGURE 47 LITHIUM-ION BATTERY MATERIALS MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS 172

FIGURE 48 LITHIUM-ION BATTERY MATERIALS MARKET: COMPANY EVALUATION MATRIX

(KEY PLAYERS), 2024 174

FIGURE 49 LITHIUM-ION BATTERY MATERIALS MARKET: COMPANY FOOTPRINT 175

FIGURE 50 LITHIUM-ION BATTERY MATERIALS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 181

FIGURE 51 UMICORE: COMPANY SNAPSHOT 185

FIGURE 52 SUMITOMO METAL MINING CO., LTD.: COMPANY SNAPSHOT 190

FIGURE 53 BASF: COMPANY SNAPSHOT 195

FIGURE 54 POSCO FUTURE M: COMPANY SNAPSHOT 201

FIGURE 55 RESONAC HOLDINGS CORPORATION: COMPANY SNAPSHOT 207

FIGURE 56 TANAKA CHEMICAL CORPORATION: COMPANY SNAPSHOT 209

FIGURE 57 TODA KOGYO CORP.: COMPANY SNAPSHOT 211

FIGURE 58 LANDF CORP.: COMPANY SNAPSHOT 213

FIGURE 59 3M: COMPANY SNAPSHOT 218

FIGURE 60 SGL CARBON: COMPANY SNAPSHOT 220

FIGURE 61 UBE CORPORATION: COMPANY SNAPSHOT 225

FIGURE 62 KURARAY CO., LTD.: COMPANY SNAPSHOT 228

FIGURE 63 HUAYOU COBALT CO., LTD.: COMPANY SNAPSHOT 231

FIGURE 64 KUREHA CORPORATION: COMPANY SNAPSHOT 233

FIGURE 65 LITHIUM-ION BATTERY MATERIALS MARKET: RESEARCH DESIGN 241

FIGURE 66 MAIN MATRIX CONSIDERED TO ASSESS DEMAND FOR LITHIUM-ION

BATTERY MATERIALS 246

FIGURE 67 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH 247

FIGURE 68 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH 248

FIGURE 69 METHODOLOGY USED FOR SUPPLY-SIDE SIZING OF LITHIUM-ION

BATTERY MATERIALS 248

FIGURE 70 LITHIUM-ION BATTERY MATERIALS MARKET: DATA TRIANGULATION 249