Rubber Process Oil Market - Global Forecast To 2030

ゴムプロセスオイル市場 - タイプ(ナフテン系、パラフィン系、TDAE、DAE、MES、RAE、TRAE)、用途(タイヤ、工業用ゴム製品、油展ポリマー、熱可塑性エラストマー)、粘度、地域 - 2030年までの世界予測

Rubber Process Oil Market by Type (Naphthenic, Paraffinic, TDAE, DAE, MES, RAE, and TRAE), Application (Tires, Industrial Rubber Products, Oil-extended Polymers, and Thermoplastic Elastomers), Viscosity, and Region - Global Forecast to 2030

| 出版 | MarketsandMarkets |

| 出版年月 | 2025年12月 |

| ページ数 | 289 |

| 図表数 | 328 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 企業ライセンス | USD 10,000 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-11478 |

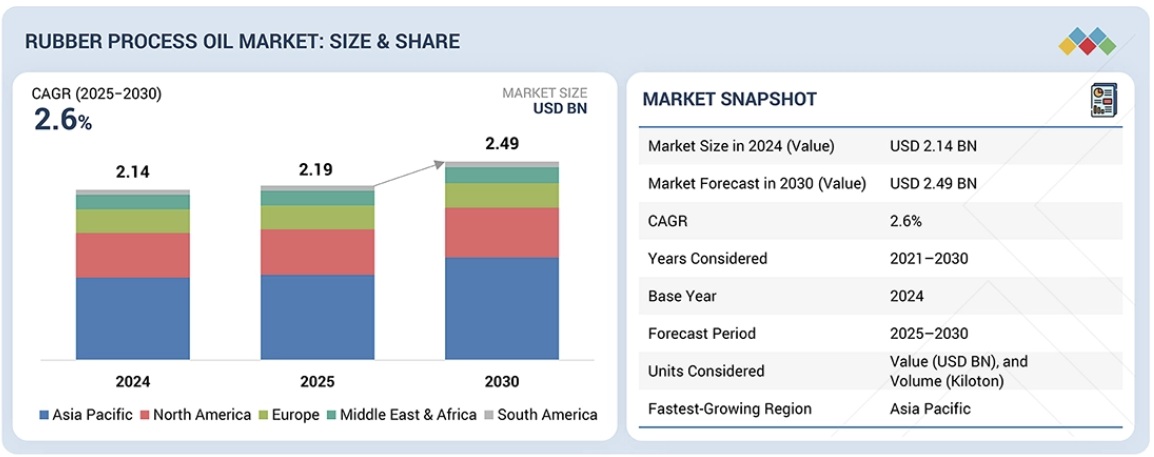

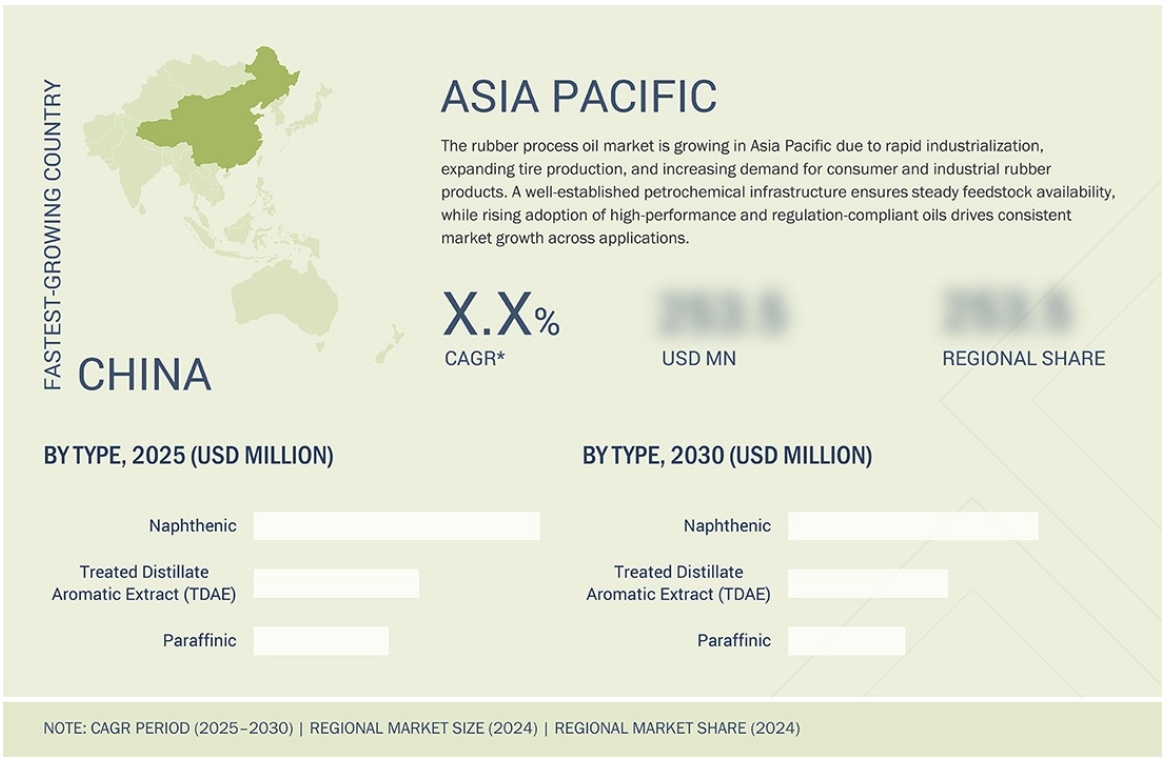

世界のゴムプロセスオイル市場は、2025年の21億9,000万米ドルから2030年には24億9,000万米ドルに成長し、予測期間中に年平均成長率(CAGR)2.6%で成長すると予測されています。ゴムプロセスオイルは、天然ゴムと合成ゴムの両方のコンパウンドの加工挙動と性能特性を改善する上で重要な役割を果たします。充填剤の分散性を高め、粘度を下げ、混合作業をスムーズにすることで、これらのオイルは、タイヤ、工業用ゴム製品、熱可塑性エラストマー、油展ポリマーの安定した生産をサポートします。市場は、変化する配合要件によってますます形成されており、メーカーは、進化する規制基準と性能への期待に応えるため、よりクリーンでPAH含有量が少なく、用途に特化したオイルに注力しています。ゴムの配合がより特殊化し、生産ラインでより高い効率が求められるにつれて、粘度範囲と抽出物タイプ全体にわたるカスタマイズされたRPOグレードの重要性は着実に高まり続けています。

調査範囲:

本レポートは、ゴムプロセスオイル市場をタイプ、粘度、用途、地域に基づいてセグメント化しています。市場の成長に影響を与える主要要因(成長促進要因、制約要因、機会、課題など)に関する詳細な情報を提供しています。ゴムプロセスオイルメーカーを戦略的にプロファイリングし、市場シェアとコアコンピタンスを包括的に分析しています。

レポートを購入する理由:

本レポートは、ゴムプロセスオイル市場とそのセグメントの収益数値に関する最も近似値を提供することで、市場リーダー/新規参入企業に役立つことが期待されています。また、本レポートは、市場関係者が市場の競争環境をより深く理解し、事業の地位を向上させるための洞察を獲得し、適切な市場開拓戦略を策定するのに役立つことが期待されています。さらに、市場動向を把握し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供します。

本レポートでは、以下の点について洞察を提供しています。

重要な推進要因(乗用車、MHCV、オフハイウェイ車を含む世界的な自動車生産の増加と、アフターマーケットでのタイヤ交換の増加がタイヤ生産量を押し上げ、ゴムプロセスオイルの需要を押し上げている。合成ゴム生産の増加、低PAH、低粘度、特殊油の需要増加)、制約要因(芳香族RPOに関する厳格な国際規制(EU、米国、中国)、バイオベース/持続可能な可塑剤への代替、適切なグループI/IIベースオイルの供給減少)、機会(グリーン/生分解性ゴムオイルの需要増加、アジア、中東アフリカ、東ヨーロッパにおける新規タイヤ工場への投資、高級車と電気自動車の需要増加による高性能タイヤの需要増加)、課題(原油由来留出物や芳香族抽出物などの主要なRPO原料の価格変動)の分析

- 製品開発/イノベーション:ゴムプロセスオイル市場における今後の技術と研究開発活動に関する詳細な洞察

- 市場開発:収益性の高い市場に関する包括的な情報 – 本レポートでは、様々な地域におけるゴムプロセスオイル市場を分析しています。

- 競合評価:ゴムプロセスオイル市場における主要企業(シノペック(中国)、エクソンモービル(米国)、ペトロチャイナ・カンパニー・リミテッド(中国)、シェブロン(米国)、シェル(英国)など)の市場シェア、成長戦略、製品ラインナップに関する詳細な評価。

Report Description

The global rubber process oil market is projected to grow from USD 2.19 billion in 2025 to USD 2.49 billion by 2030, at a CAGR of 2.6% during the forecast period. Rubber process oils play a critical role in improving the processing behavior and performance characteristics of both natural and synthetic rubber compounds. By enhancing filler dispersion, reducing viscosity, and enabling smoother mixing operations, these oils support consistent production of tires, industrial rubber goods, thermoplastic elastomers, and oil-extended polymers. The market is increasingly shaped by shifting formulation requirements, where manufacturers are focusing on cleaner, low-PAH, and more application-specific oils to meet evolving regulatory norms and performance expectations. As rubber formulations become more specialized and production lines demand higher efficiency, the relevance of tailored RPO grades—across viscosity ranges and extract types—continues to grow steadily.

Rubber Process Oil Market – Global Forecast To 2030

“By type, treated distillate aromatic extract (TDAE) segment to account for second-largest share during forecast period in terms of value”

The treated distillate aromatic extract (TDAE) segment is estimated to account for the second-largest share of the rubber process oil market. TDAE strikes a strong balance between performance, safety, and cost, making it a preferred choice for a wide range of rubber applications. As regulatory norms continue to phase down high-PAH aromatic oils, many tire and industrial rubber manufacturers are adopting TDAE as a safer and more compliant alternative, yet one that still offers the processing ease, elasticity improvement, and compatibility required in traditional formulations. Its ability to maintain compound softness, enhance dispersion, and support better rolling and heat-resistance characteristics has made it a dependable option for both standard and mid-performance tire categories. At the same time, its availability and affordability keep it accessible for large-volume producers. This combination of regulatory alignment, performance reliability, and cost suitability has positioned TDAE as the second-largest segment in the RPO market, with steady demand across both tire and non-tire rubber products.

Rubber Process Oil Market – Global Forecast To 2030 – by application

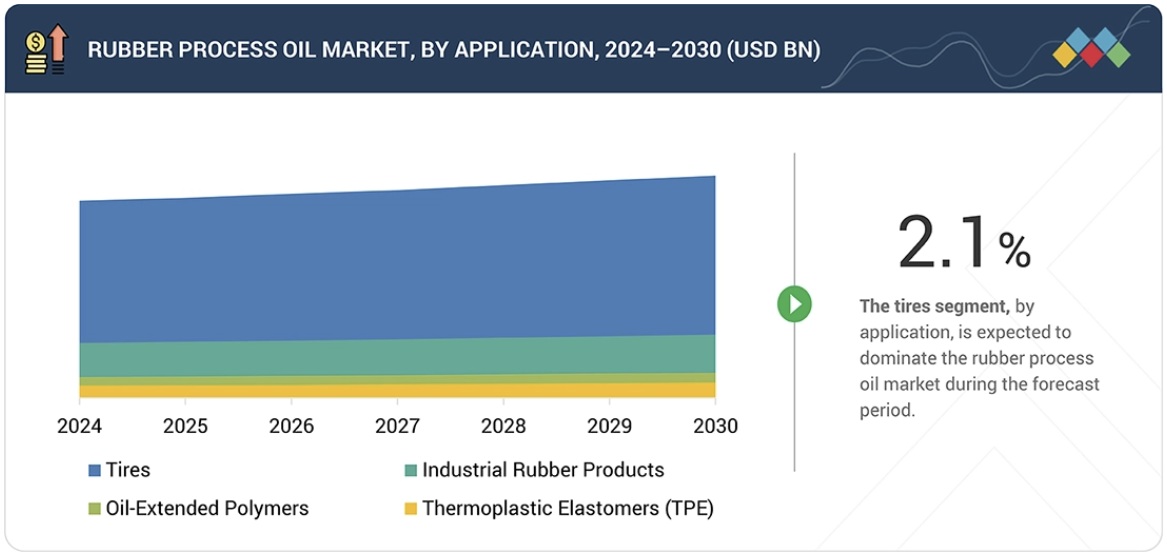

“By application, industrial rubber segment to account for second-largest market share during forecast period”

The industrial rubber segment is projected to be the second-largest application of rubber process oil during the forecast period due to its wide use in products such as belts, hoses, gaskets, seals, and molded components. Rubber process oils enhance flexibility, improve filler dispersion, and ensure consistent processing performance, making them essential for industrial rubber manufacturing. The segment benefits from steady demand driven by industrialization, infrastructure development, and the need for durable and high-performance rubber components across multiple sectors. Additionally, manufacturers increasingly adopt high-quality and low-PAH oils to comply with environmental and regulatory standards while maintaining product performance. Although tire manufacturing remains the largest application segment due to higher overall volume, industrial rubber maintains a strong position because of recurring usage, broad applicability, and rising demand for performance-optimized, regulation-compliant oils.

Rubber Process Oil Market – Global Forecast To 2030 – region

“North America to account for second-largest market share during forecast period”

North America is projected to be the second-largest market for rubber process oil due to its strong presence in automotive manufacturing, a large replacement tire market, and a well-established industrial rubber sector. The region benefits from mature production capabilities for tires, belts, hoses, gaskets, and molded rubber components, all of which rely heavily on consistent and high-quality rubber process oils. Advanced product development in high-performance and specialty rubber materials also drives steady demand for cleaner and more refined RPO grades, including TDAE and low-PAH formulations. In addition, the region’s robust regulatory environment encourages the use of safer, environmentally aligned oils, reinforcing the shift toward higher-value RPO types. A stable refining base, strong customer preference for premium-quality materials, and continuous upgrades in rubber processing technologies collectively position North America as the second-largest regional market, supported by sustained industrial activity and a strong automotive ecosystem.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 – 65%, Tier 2 – 20%, and Tier 3 – 15%

- By Designation: Directors – 25%, Managers – 30%, and Others – 45%

- By Region: North America – 30%, Asia Pacific – 40%, Europe – 20%, Middle East & Africa – 7%, and South America – 3%

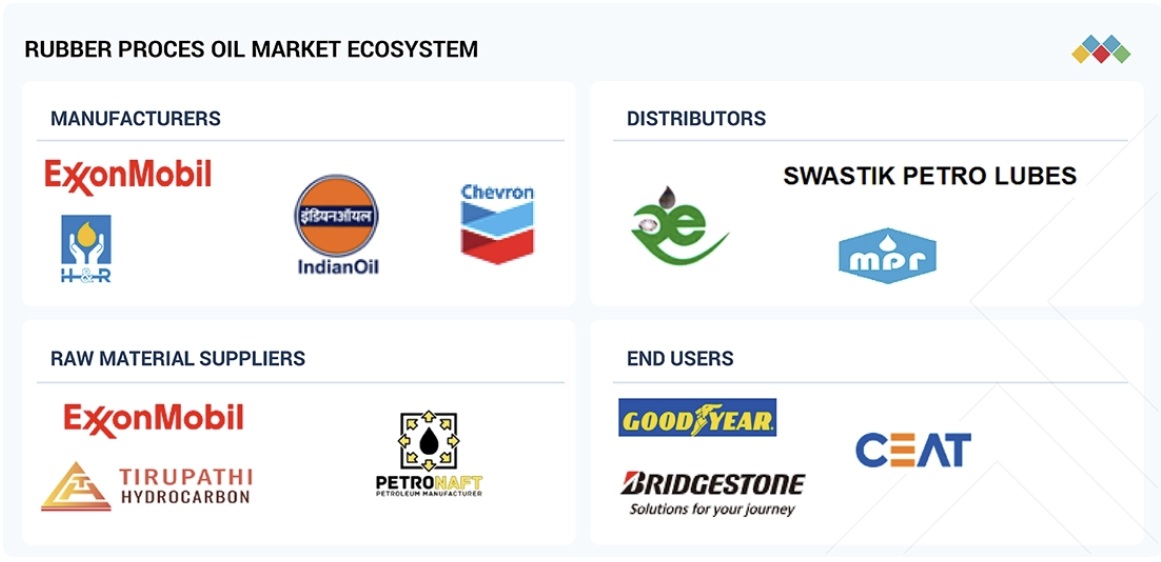

Rubber Process Oil Market – Global Forecast To 2030 – ecosystem

Sinopec (China), Exxon Mobil Corporation (US), PetroChina Company Limited (China), Chevron Corporation (US), and Shell plc (UK) are some of the major players operating in the rubber process oil market.

Research Coverage:

The report segments the rubber process oil market based on type, viscosity, application, and region. It provides detailed information regarding the major factors influencing the market’s growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles rubber process oil manufacturers, comprehensively analyzing their market shares and core competencies.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the rubber process oil market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the market’s competitive landscape, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the market’s pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of critical Drivers (Rising global vehicle production—including passenger cars, MHCVs, and off-highway vehicles—along with increasing aftermarket tire replacements, is boosting tire output and driving demand for rubber process oils; Growth in synthetic rubber production; Rising demand for low-PAH, low-viscosity, and specialty oils), Restraints (Stringent global regulations on aromatic RPO (EU, US, China), Substitution by bio-based/sustainable plasticizers, Declining availability of suitable Group I/II base oils), Opportunities (Rising demand for green/biodegradable rubber oils; New tire plant investments across Asia, MEA, and Eastern Europe; Rising demand for luxury vehicles and electric cars boosting need for high-performance tires), and Challenges (Fluctuating prices of key RPO feedstocks such as crude-derived distillates and aromatic extracts)

- Product Development/Innovation: Detailed insights on upcoming technologies and research & development activities in the rubber process oil market

- Market Development: Comprehensive information about lucrative markets – the report analyses the rubber process oil market across varied regions.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Sinopec (China), Exxon Mobil Corporation (US), PetroChina Company Limited (China), Chevron Corporation (US), and Shell plc (UK) in the rubber process oil market.

Table of Contents

1 INTRODUCTION 28

1.1 STUDY OBJECTIVES 28

1.2 MARKET DEFINITION 28

1.3 STUDY SCOPE 29

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 29

1.3.2 INCLUSIONS AND EXCLUSIONS 30

1.3.3 YEARS CONSIDERED 30

1.3.4 CURRENCY CONSIDERED 30

1.3.5 UNITS CONSIDERED 30

1.4 STAKEHOLDERS 31

1.5 SUMMARY OF CHANGES 31

2 EXECUTIVE SUMMARY 32

2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS 32

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 33

2.3 DISRUPTIVE TRENDS IN RUBBER PROCESS OIL MARKET 34

2.4 HIGH GROWTH SEGMENTS 35

2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST 36

3 PREMIUM INSIGHTS 38

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN RUBBER PROCESS OIL MARKET 38

3.2 RUBBER PROCESS OIL MARKET, BY REGION 38

3.3 RUBBER PROCESS OIL MARKET, BY TYPE 39

3.4 RUBBER PROCESS OIL MARKET, BY KEY COUNTRY 39

4 MARKET OVERVIEW 40

4.1 INTRODUCTION 40

4.2 MARKET DYNAMICS 41

4.2.1 DRIVERS 41

4.2.1.1 Rising global vehicle production, along with increasing aftermarket tire replacements, boosting tire output 41

4.2.1.2 Growth in synthetic rubber production 45

4.2.1.3 Rising demand for low-PAH, low-viscosity, and specialty oils 45

4.2.2 RESTRAINTS 45

4.2.2.1 Stringent global regulations on aromatic RPO (EU, US, China) 45

4.2.2.2 Substitution by bio-based/sustainable plasticizers 46

4.2.2.3 Declining availability of suitable Group I/II base oils 46

4.2.3 OPPORTUNITIES 47

4.2.3.1 Rising demand for green/biodegradable rubber oils 47

4.2.3.2 New tire plant investments across Asia, MEA, and Eastern Europe 47

4.2.3.3 Rising demand for luxury vehicles and electric cars boosting need for high-performance tires 50

4.2.4 CHALLENGES 50

4.2.4.1 Fluctuating prices of key RPO feedstocks, such as crude-derived distillates and aromatic extracts, create cost pressures 50

4.3 UNMET NEEDS AND WHITE SPACES 51

4.3.1 UNMET NEEDS IN RUBBER PROCESS OIL MARKET 51

4.3.2 WHITE SPACE OPPORTUNITIES 52

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 53

4.4.1 INTERCONNECTED MARKETS 53

4.4.2 CROSS-SECTOR OPPORTUNITIES 53

4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 54

4.5.1 KEY MOVES AND STRATEGIC FOCUS 54

5 INDUSTRY TRENDS 55

5.1 PORTER’S FIVE FORCES ANALYSIS 55

5.1.1 BARGAINING POWER OF SUPPLIERS 56

5.1.2 BARGAINING POWER OF BUYERS 56

5.1.3 THREAT OF NEW ENTRANTS 57

5.1.4 THREAT OF SUBSTITUTES 57

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 57

5.2 GLOBAL MACROECONOMIC OUTLOOK 58

5.2.1 INTRODUCTION 58

5.2.2 GDP TRENDS AND FORECAST 58

5.2.3 TRENDS IN GLOBAL RUBBER PROCESS OIL INDUSTRY 60

5.3 SUPPLY CHAIN ANALYSIS 60

5.3.1 RAW MATERIAL SUPPLY 61

5.3.2 RUBBER PROCESS OIL PRODUCTION 61

5.3.3 RUBBER PROCESS OIL TYPES 61

5.3.4 DISTRIBUTORS 61

5.3.5 END-USE INDUSTRIES 61

5.4 ECOSYSTEM ANALYSIS 62

5.5 PRICING ANALYSIS 63

5.5.1 AVERAGE SELLING PRICE TREND OF RUBBER PROCESS OIL, BY REGION, 2022–2025 63

5.5.2 AVERAGE SELLING PRICE OF RUBBER PROCESS OIL TYPE, BY KEY PLAYER, 2025 64

5.6 TRADE ANALYSIS 65

5.6.1 IMPORT SCENARIO (HS CODE 2709) 65

5.6.2 EXPORT SCENARIO (HS CODE 2709) 66

5.7 KEY CONFERENCES AND EVENTS, 2025–2026 68

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 69

5.9 INVESTMENT AND FUNDING SCENARIO 69

5.10 CASE STUDY ANALYSIS 70

5.10.1 RRII (RUBBER RESEARCH INSTITUTE) – INDIAN OIL COLLABORATION ON ADVANCED RUBBER PROCESS OIL APPLICATIONS 70

5.10.2 REPSOL’S BIOEXTENSOIL – A CIRCULAR AND HIGH-PERFORMANCE ALTERNATIVE TO MINERAL RUBBER PROCESS OILS 71

5.10.3 SHELL FLAVEX 595 – ENABLING COMPLIANCE AND HIGH-PERFORMANCE TIRE MANUFACTURING 72

5.11 TRUMP TARIFF IMPACT ON RUBBER PROCESS OIL MARKET 72

5.11.1 KEY TARIFF RATES IMPACTING MARKET 72

5.11.2 PRICE IMPACT ANALYSIS 73

5.11.3 KEY IMPACT ON VARIOUS REGIONS 73

5.11.3.1 US 73

5.11.3.2 Europe 73

5.11.3.3 Asia Pacific 73

5.11.4 IMPACT ON END-USE INDUSTRIES OF RUBBER PROCESS OIL MARKET 73

5.11.4.1 Tires 74

5.11.4.2 Oil-extended polymers 74

5.11.4.3 Industrial rubber products 74

5.11.4.4 Thermoplastic elastomers (TPEs) 74

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS 75

6.1 KEY EMERGING TECHNOLOGIES 75

6.1.1 BIO-BASED RUBBER PROCESS OILS 75

6.1.1.1 Introduction: A shift toward sustainable processing oils 75

6.1.1.2 Renewable feedstocks driving material transformation 75

6.1.1.3 Regulatory alignment and industry-wide adoption momentum 75

6.1.1.4 Market impact and long-term strategic relevance 75

6.2 COMPLEMENTARY TECHNOLOGIES 75

6.2.1 ADVANCED ADDITIVES FOR ENHANCED PERFORMANCE IN RUBBER PROCESS OILS 75

6.2.2 TECHNOLOGY/PRODUCT ROADMAP 76

6.2.2.1 Short-term (2025–2027) | process efficiency & low-PCA compliance 76

6.2.2.2 Mid-term (2027–2030) | sustainability transition & value-added formulations 77

6.2.2.3 Long-term (2030–2035+) | circularity, high-performance synthesis & next-gen RPO 77

6.3 PATENT ANALYSIS 78

6.3.1 METHODOLOGY 78

6.4 FUTURE APPLICATIONS 81

6.4.1 TIRES: ENHANCED FLEXIBILITY AND PROCESSING EFFICIENCY 81

6.4.2 OIL-EXTENDED POLYMERS: IMPROVED POLYMER FLOW AND REDUCED VISCOSITY 82

6.4.3 INDUSTRIAL RUBBER PRODUCTS: SUPPORTED ELASTICITY AND UNIFORM COMPOUNDING 82

6.4.4 THERMOPLASTIC ELASTOMERS (TPE): FACILITATED SOFTENING AND MELT-FLOW BEHAVIOR 83

6.5 IMPACT OF GENERATIVE AI ON RUBBER PROCESS OIL MARKET 83

6.5.1 INTRODUCTION 83

6.5.2 AI-DRIVEN FORMULATION INNOVATION 83

6.5.3 SMART MANUFACTURING AND PROCESS OPTIMIZATION 84

6.5.4 MARKET INSIGHT AND PRODUCT POSITIONING 84

6.5.5 CUSTOMER COLLABORATION AND VALUE-ADDED SERVICES 84

7 SUSTAINABILITY AND REGULATORY LANDSCAPE 85

7.1 REGIONAL REGULATIONS AND COMPLIANCE 85

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 85

7.1.2 INDUSTRY STANDARDS 87

7.2 SUSTAINABILITY INITIATIVES 88

7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF RUBBER PROCESS OIL 88

7.2.1.1 Carbon Impact Reduction 88

7.2.1.2 Eco-applications 89

7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES 90

7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 90

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 92

8.1 DECISION-MAKING PROCESS 92

8.2 KEY STAKEHOLDERS AND BUYING CRITERIA 93

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 93

8.2.2 BUYING CRITERIA 94

8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 95

8.4 UNMET NEEDS IN VARIOUS APPLICATIONS 96

8.5 MARKET PROFITABILITY 97

8.5.1 REVENUE POTENTIAL 97

8.5.2 COST DYNAMICS 98

8.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS 98

9 RUBBER PROCESS OIL MARKET, BY VISCOSITY 99

9.1 INTRODUCTION 100

9.2 LOW VISCOSITY 101

9.2.1 GROWING FOCUS ON EFFICIENT, EASY-PROCESSING RUBBER FORMULATIONS 101

9.3 MEDIUM VISCOSITY 101

9.3.1 BROAD ADAPTABILITY AND CONSISTENT PERFORMANCE 101

9.4 HIGH VISCOSITY 101

9.4.1 RISE IN DEMAND FOR DURABLE, HIGH-PERFORMANCE RUBBER PRODUCTS 101

10 RUBBER PROCESS OIL MARKET, BY APPLICATION 102

10.1 INTRODUCTION 103

10.2 TIRES 104

10.2.1 RISING DEMAND FOR HIGH-PERFORMANCE, DURABLE, AND ENVIRONMENTALLY COMPLIANT TIRES 104

10.3 OIL-EXTENDED POLYMERS 104

10.3.1 GROWING USE OF OIL-EXTENDED POLYMERS IN HIGH-PERFORMANCE RUBBER PRODUCTS 104

10.4 INDUSTRIAL RUBBER PRODUCTS 105

10.4.1 INCREASING NEED FOR DURABLE, HIGH-PERFORMANCE, AND COMPLIANT INDUSTRIAL RUBBER PRODUCTS 105

10.5 THERMOPLASTIC ELASTOMERS (TPE) 105

10.5.1 RISING ADOPTION OF THERMOPLASTIC ELASTOMERS IN VERSATILE AND HIGH-PERFORMANCE APPLICATIONS 105

10.6 OTHER APPLICATIONS 105

11 RUBBER PROCESS OIL MARKET, BY TYPE 106

11.1 INTRODUCTION 107

11.2 TREATED DISTILLATE AROMATIC EXTRACT (TDAE) 109

11.2.1 RISING PREFERENCE FOR CLEANER, REGULATION-COMPLIANT, AND HIGH-PERFORMANCE RUBBER PROCESS OILS 109

11.3 DISTILLATE AROMATIC EXTRACT (DAE) 109

11.3.1 CONTINUED USE OF COST-EFFECTIVE, HIGH-SOLVENCY AROMATIC OILS LIKE DAE IN KEY RUBBER PROCESSING APPLICATIONS 109

11.4 MILD EXTRACTED SOLVATE (MES) 109

11.4.1 INCREASING INDUSTRY SHIFT TOWARD LOW-PAH, ENVIRONMENTALLY COMPLIANT, AND PERFORMANCE-STABLE RUBBER PROCESS OILS 109

11.5 RESIDUAL AROMATIC EXTRACT (RAE) AND TREATED RESIDUAL AROMATIC

EXTRACT (TRAE) 110

11.5.1 STEADY USE OF RAE AND GROWING ADOPTION OF CLEANER TRAE GRADES 110

11.6 PARAFFINIC 110

11.6.1 RISING NEED FOR CLEAN, THERMALLY STABLE, AND HIGH-PERFORMANCE RUBBER FORMULATIONS 110

11.7 NAPHTHENIC 111

11.7.1 NEED FOR EFFICIENT, FLEXIBLE, AND WIDE-COMPATIBILITY PROCESSING OILS 111

12 RUBBER PROCESS OIL MARKET, BY REGION 112

12.1 INTRODUCTION 113

12.2 ASIA PACIFIC 115

12.2.1 CHINA 118

12.2.1.1 Increasing vehicle and tire production in China boosting rubber compounding activity 118

12.2.2 JAPAN 120

12.2.2.1 Advanced tire manufacturing and precision-focused industrial rubber production 120

12.2.3 INDIA 122

12.2.3.1 Strong replacement-driven tire growth and expanding industrial rubber production 122

12.2.4 SOUTH KOREA 123

12.2.4.1 Growing vehicle production and strong industrial rubber manufacturing base 123

12.2.5 INDONESIA 125

12.2.5.1 Expansion of industrial rubber manufacturing base and rise in domestic tire demand 125

12.2.6 THAILAND 127

12.2.6.1 Abundant natural rubber resources and growing domestic tire and industrial rubber production 127

12.2.7 REST OF ASIA PACIFIC 128

12.3 NORTH AMERICA 130

12.3.1 US 134

12.3.1.1 Shift toward electric mobility strengthening demand dynamics for rubber process oils 134

12.3.2 CANADA 135

12.3.2.1 Growth in industrial production base and increasing need for durable, climate-resilient rubber components 135

12.3.3 MEXICO 137

12.3.3.1 Expansion of automotive manufacturing base and rising demand for cost-efficient, high-performance rubber goods 137

12.4 EUROPE 139

12.4.1 RUSSIA 142

12.4.1.1 Growing tire replacement needs and expanding industrial rubber production 142

12.4.2 GERMANY 144

12.4.2.1 Shift toward electric mobility and strong manufacturing demand for rubber-intensive components 144

12.4.3 UK 146

12.4.3.1 Expanding demand for high-quality rubber components and growing EV-related material production 146

12.4.4 FRANCE 147

12.4.4.1 Rising vehicle registrations and strong demand for tire and industrial rubber components 147

12.4.5 SPAIN 149

12.4.5.1 Rising tire demand and expanding industrial rubber manufacturing 149

12.4.6 ITALY 151

12.4.6.1 Strong tire manufacturing activity and rising demand for industrial rubber components 151

12.4.7 REST OF EUROPE 152

12.5 MIDDLE EAST & AFRICA 154

12.5.1 GCC COUNTRIES 157

12.5.1.1 Saudi Arabia 157

12.5.1.1.1 Rising vehicle registrations and industrial expansion under Vision 2030 157

12.5.1.2 UAE 159

12.5.1.2.1 Growing vehicle usage, strong replacement demand, and rising industrial rubber consumption 159

12.5.1.3 Rest of GCC Countries 161

12.5.2 IRAN 162

12.5.2.1 Expanding domestic tire production, increasing self-sufficiency, and rising output across multiple vehicle segments 162

12.5.3 REST OF MIDDLE EAST & AFRICA 164

12.6 SOUTH AMERICA 166

12.6.1 BRAZIL 169

12.6.1.1 Expanding automotive activity, strong tire demand, and broad-based industrial rubber production 169

12.6.2 ARGENTINA 170

12.6.2.1 Sustained tire demand and expanding use of industrial rubber products 170

12.6.3 COLOMBIA 172

12.6.3.1 High demand for tires, mining-related rubber goods, and general industrial rubber components 172

12.6.4 REST OF SOUTH AMERICA 174

13 COMPETITIVE LANDSCAPE 176

13.1 INTRODUCTION 176

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 176

13.3 REVENUE ANALYSIS 177

13.3.1 TOP 5 PLAYERS’ REVENUE ANALYSIS 177

13.4 MARKET SHARE ANALYSIS 178

13.4.1 MARKET SHARE OF KEY PLAYERS 178

13.4.1.1 Sinopec (China) 179

13.4.1.2 PetroChina Company Limited (China) 179

13.4.1.3 Chevron Corporation (US) 180

13.4.1.4 Exxon Mobil Corporation (US) 180

13.4.1.5 Shell plc (UK) 180

13.5 BRAND/PRODUCT COMPARISON 181

13.5.1 POWEROIL FLEXOIL N 182

13.5.2 PANOL C 160-P 182

13.5.3 ENI CELTIS 182

13.5.4 DIVYOL PARAFFINIC OIL 182

13.5.5 CALSOL 182

13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 182

13.6.1 STARS 182

13.6.2 EMERGING LEADERS 183

13.6.3 PERVASIVE PLAYERS 183

13.6.4 PARTICIPANTS 183

13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 185

13.6.5.1 Company footprint 185

13.6.5.2 Region footprint 186

13.6.5.3 Viscosity footprint 187

13.6.5.4 Type footprint 188

13.6.5.5 Application footprint 189

13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 191

13.7.1 PROGRESSIVE COMPANIES 191

13.7.2 RESPONSIVE COMPANIES 191

13.7.3 DYNAMIC COMPANIES 191

13.7.4 STARTING BLOCKS 191

13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 193

13.7.5.1 Detailed list of key startups/SMEs 193

13.7.5.2 Competitive benchmarking of key startups/SMEs 194

13.8 COMPETITIVE SCENARIO 195

13.8.1 PRODUCT LAUNCHES 195

13.8.2 DEALS 196

13.9 COMPANY VALUATION AND FINANCIAL METRICS 196

14 COMPANY PROFILES 199

14.1 KEY PLAYERS 199

14.1.1 SINOPEC 199

14.1.1.1 Business overview 199

14.1.1.2 Products/Solutions/Services offered 200

14.1.1.3 MnM view 200

14.1.1.3.1 Right to win 200

14.1.1.3.2 Strategic choices 201

14.1.1.3.3 Weaknesses and competitive threats 201

14.1.2 PETROCHINA COMPANY LIMITED 202

14.1.2.1 Business overview 202

14.1.2.2 Products/Solutions/Services offered 203

14.1.2.3 MnM view 204

14.1.2.3.1 Right to win 204

14.1.2.3.2 Strategic choices 204

14.1.2.3.3 Weaknesses and competitive threats 205

14.1.3 CHEVRON CORPORATION 206

14.1.3.1 Business overview 206

14.1.3.2 Products/Solutions/Services offered 207

14.1.3.3 MnM view 207

14.1.3.3.1 Right to win 207

14.1.3.3.2 Strategic choices 208

14.1.3.3.3 Weaknesses and competitive threats 208

14.1.4 EXXON MOBIL CORPORATION 209

14.1.4.1 Business overview 209

14.1.4.2 Products/Solutions/Services offered 210

14.1.4.3 MnM view 211

14.1.4.3.1 Right to win 211

14.1.4.3.2 Strategic choices 211

14.1.4.3.3 Weaknesses and competitive threats 211

14.1.5 SHELL PLC 212

14.1.5.1 Business overview 212

14.1.5.2 Products/Solutions/Services offered 213

14.1.5.3 MnM view 214

14.1.5.3.1 Right to win 214

14.1.5.3.2 Strategic choices 214

14.1.5.3.3 Weaknesses and competitive threats 214

14.1.6 APAR INDUSTRIES LTD. 215

14.1.6.1 Business overview 215

14.1.6.2 Products/Solutions/Services offered 216

14.1.7 PANAMA PETROCHEM LTD. 218

14.1.7.1 Business overview 218

14.1.7.2 Products/Solutions/Services offered 219

14.1.8 BEHRAN OIL CO. 221

14.1.8.1 Business overview 221

14.1.8.2 Products/Solutions/Services offered 221

14.1.9 ENILIVE S.P.A. 222

14.1.9.1 Business overview 222

14.1.9.2 Products/Solutions/Services offered 222

14.1.10 GANDHAR OIL REFINERY (INDIA) LIMITED 223

14.1.10.1 Business overview 223

14.1.10.2 Products/Solutions/Services offered 224

14.1.11 HINDUSTAN PETROLEUM CORPORATION LIMITED 226

14.1.11.1 Business overview 226

14.1.11.2 Products/Solutions/Services offered 227

14.1.12 INDIAN OIL CORPORATION LTD 229

14.1.12.1 Business overview 229

14.1.12.2 Products/Solutions/Services offered 230

14.1.13 ORLEN UNIPETROL GROUP 231

14.1.13.1 Business overview 231

14.1.13.2 Products/Solutions/Services offered 232

14.1.14 IDEMITSU KOSAN CO., LTD. 234

14.1.14.1 Business overview 234

14.1.14.2 Products/Solutions/Services offered 235

14.1.15 REPSOL 237

14.1.15.1 Business overview 237

14.1.15.2 Products/Solutions/Services offered 238

14.1.16 ORGKHIM BIOCHEMICAL HOLDING 240

14.1.16.1 Business overview 240

14.1.16.2 Products/Solutions/Services offered 240

14.1.17 GPPL 241

14.1.17.1 Business overview 241

14.1.17.2 Products/Solutions/Services offered 242

14.1.18 IRANOL (LLP) 243

14.1.18.1 Business overview 243

14.1.18.2 Products/Solutions/Services offered 243

14.1.19 PETRO GULF INTERNATIONAL FZE 244

14.1.19.1 Business overview 244

14.1.19.2 Products/Solutions/Services offered 244

14.1.20 CALUMET, INC. 245

14.1.20.1 Business overview 245

14.1.20.2 Products/Solutions/Services offered 246

14.1.21 H&R GROUP 247

14.1.21.1 Business overview 247

14.1.21.2 Products/Solutions/Services offered 248

14.1.22 NYNAS AB 250

14.1.22.1 Business overview 250

14.1.22.2 Products/Solutions/Services offered 251

14.1.22.3 Recent developments 254

14.1.22.3.1 Product launches 254

14.1.23 IRPC PUBLIC COMPANY LIMITED 255

14.1.23.1 Business overview 255

14.1.23.2 Products/Solutions/Services offered 255

14.1.24 PT. ENERCO RPO INTERNASIONAL 256

14.1.24.1 Business overview 256

14.1.24.2 Products/Solutions/Services offered 256

14.1.24.3 Recent developments 257

14.1.24.3.1 Deals 257

14.1.25 WITMANS INDUSTRIES PVT. LTD. 258

14.1.25.1 Business overview 258

14.1.25.2 Products/Solutions/Services offered 258

14.1.26 THAIOIL GROUP 260

14.1.26.1 Business overview 260

14.1.26.2 Products/Solutions/Services offered 261

14.1.27 SHANGDONG TIANYUAN CHEMICAL CO., LTD 262

14.1.27.1 Business overview 262

14.1.27.2 Products/Solutions/Services offered 262

14.1.28 P.S.P. SPECIALTIES PUBLIC COMPANY LIMITED 263

14.1.28.1 Business overview 263

14.1.28.2 Products/Solutions/Services offered 264

14.2 OTHER PLAYERS 265

14.2.1 PETRO NAFT 265

14.2.2 PANOL INDUSTRIES RMC FZE 266

14.2.3 EAGLE PETROCHEM 267

14.2.4 LODHA PETRO 268

14.2.5 RLS PETROCHEM LUBRICANTS LLC 269

14.2.6 GAZPROMNEFT – LUBRICANTS LTD. 270

15 RESEARCH METHODOLOGY 271

15.1 RESEARCH DATA 271

15.1.1 SECONDARY DATA 272

15.1.1.1 Key data from secondary sources 272

15.1.2 PRIMARY DATA 272

15.1.2.1 Key data from primary sources 273

15.1.2.2 List of primary interview participants (demand and supply sides) 273

15.1.2.3 Key industry insights 274

15.1.2.4 Breakdown of interviews with experts 274

15.2 MATRIX CONSIDERED FOR DEMAND-SIDE ANALYSIS 275

15.3 MARKET SIZE ESTIMATION 275

15.3.1 BOTTOM-UP APPROACH 276

15.3.2 TOP-DOWN APPROACH 276

15.3.2.1 Calculations for supply-side analysis 278

15.4 GROWTH FORECAST 278

15.5 DATA TRIANGULATION 279

15.6 RESEARCH ASSUMPTIONS 280

15.7 RESEARCH LIMITATIONS 280

15.8 RISK ASSESSMENT 281

16 APPENDIX 282

16.1 DISCUSSION GUIDE 282

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 285

16.3 CUSTOMIZATION OPTIONS 287

16.4 RELATED REPORTS 287

16.5 AUTHOR DETAILS 288

LIST OF TABLES

TABLE 1 GLOBAL TIRE MANUFACTURING CAPACITY EXPANSIONS 48

TABLE 2 RUBBER PROCESS OIL MARKET: PORTER’S FIVE FORCES ANALYSIS 56

TABLE 3 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE), BY KEY COUNTRY,

2022–2024 (%) 58

TABLE 4 UNEMPLOYMENT RATE, BY KEY COUNTRY, 2022–2024 (%) 59

TABLE 5 INFLATION RATE AVERAGE CONSUMER PRICES, BY KEY COUNTRY, 2022–2024 (%) 59

TABLE 6 FOREIGN DIRECT INVESTMENT, BY REGION, 2022 & 2023 (USD BILLION) 59

TABLE 7 ROLES OF COMPANIES IN RUBBER PROCESS OIL ECOSYSTEM 62

TABLE 8 AVERAGE SELLING PRICE TREND OF LITHIUM-ION RUBBER PROCESS OIL,

BY REGION, 2022–2025 (USD/TON) 64

TABLE 9 AVERAGE SELLING PRICE TREND OF LITHIUM-ION RUBBER PROCESS OIL,

BY KEY PLAYER, 2025 (USD/TON) 65

TABLE 10 IMPORT DATA FOR HS CODE 2709, BY KEY COUNTRY,

2021–2024 (USD THOUSAND) 66

TABLE 11 EXPORT DATA FOR HS CODE 2709, BY KEY COUNTRY,

2021–2024 (USD THOUSAND) 67

TABLE 12 RUBBER PROCESS OIL MARKET: KEY CONFERENCES AND EVENTS, 2025–2026 68

TABLE 13 RUBBER PROCESS OIL MARKET: LIST OF MAJOR PATENTS, 2014–2024 79

TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 85

TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 86

TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 87

TABLE 17 GLOBAL STANDARDS IN RUBBER PROCESS OIL MARKET 87

TABLE 18 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN RUBBER

PROCESS OIL MARKET 90

TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%) 94

TABLE 20 KEY BUYING CRITERIA, BY APPLICATION 95

TABLE 21 RUBBER PROCESS OIL MARKET: UNMET NEEDS IN KEY APPLICATIONS 97

TABLE 22 RUBBER PROCESS OIL MARKET, BY VISCOSITY, 2021–2024 (USD MILLION) 100

TABLE 23 RUBBER PROCESS OIL MARKET, BY VISCOSITY, 2025–2030 (USD MILLION) 101

TABLE 24 RUBBER PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 103

TABLE 25 RUBBER PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 104

TABLE 26 RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 107

TABLE 27 RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 108

TABLE 28 RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 108

TABLE 29 RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 108

TABLE 30 RUBBER PROCESS OIL MARKET, BY REGION, 2021–2024 (USD MILLION) 113

TABLE 31 RUBBER PROCESS OIL MARKET, BY REGION, 2025–2030 (USD MILLION) 114

TABLE 32 RUBBER PROCESS OIL MARKET, BY REGION, 2021–2024 (KILOTON) 114

TABLE 33 RUBBER PROCESS OIL MARKET, BY REGION, 2025–2030 (KILOTON) 114

TABLE 34 ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 116

TABLE 35 ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 116

TABLE 36 ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2021–2024 (KILOTON) 116

TABLE 37 ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2025–2030 (KILOTON) 117

TABLE 38 ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (USD MILLION) 117

TABLE 39 ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (USD MILLION) 117

TABLE 40 ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 118

TABLE 41 ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 118

TABLE 42 CHINA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 119

TABLE 43 CHINA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 119

TABLE 44 CHINA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 119

TABLE 45 CHINA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 120

TABLE 46 JAPAN: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 120

TABLE 47 JAPAN: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 121

TABLE 48 JAPAN: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 121

TABLE 49 JAPAN: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 121

TABLE 50 INDIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 122

TABLE 51 INDIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 122

TABLE 52 INDIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 123

TABLE 53 INDIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 123

TABLE 54 SOUTH KOREA: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (USD MILLION) 124

TABLE 55 SOUTH KOREA: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (USD MILLION) 124

TABLE 56 SOUTH KOREA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 124

TABLE 57 SOUTH KOREA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 125

TABLE 58 INDONESIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 125

TABLE 59 INDONESIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 126

TABLE 60 INDONESIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 126

TABLE 61 INDONESIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 126

TABLE 62 THAILAND: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 127

TABLE 63 THAILAND: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 127

TABLE 64 THAILAND: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 128

TABLE 65 THAILAND: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 128

TABLE 66 REST OF ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (USD MILLION) 129

TABLE 67 REST OF ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (USD MILLION) 129

TABLE 68 REST OF ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (KILOTON) 129

TABLE 69 REST OF ASIA PACIFIC: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (KILOTON) 130

TABLE 70 NORTH AMERICA: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 131

TABLE 71 NORTH AMERICA: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 131

TABLE 72 NORTH AMERICA: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2021–2024 (KILOTON) 132

TABLE 73 NORTH AMERICA: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2025–2030 (KILOTON) 132

TABLE 74 NORTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (USD MILLION) 132

TABLE 75 NORTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (USD MILLION) 133

TABLE 76 NORTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (KILOTON) 133

TABLE 77 NORTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (KILOTON) 133

TABLE 78 US: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 134

TABLE 79 US: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 134

TABLE 80 US: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 135

TABLE 81 US: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 135

TABLE 82 CANADA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 136

TABLE 83 CANADA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 136

TABLE 84 CANADA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 136

TABLE 85 CANADA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 137

TABLE 86 MEXICO: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 137

TABLE 87 MEXICO: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 138

TABLE 88 MEXICO: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 138

TABLE 89 MEXICO: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 138

TABLE 90 EUROPE: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 140

TABLE 91 EUROPE: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 140

TABLE 92 EUROPE: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2021–2024 (KILOTON) 140

TABLE 93 EUROPE: RUBBER PROCESS OIL MARKET, BY COUNTRY, 2025–2030 (KILOTON) 141

TABLE 94 EUROPE: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 141

TABLE 95 EUROPE: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 141

TABLE 96 EUROPE: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 142

TABLE 97 EUROPE: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 142

TABLE 98 RUSSIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 143

TABLE 99 RUSSIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 143

TABLE 100 RUSSIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 143

TABLE 101 RUSSIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 144

TABLE 102 GERMANY: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 144

TABLE 103 GERMANY: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 145

TABLE 104 GERMANY: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 145

TABLE 105 GERMANY: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 145

TABLE 106 UK: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 146

TABLE 107 UK: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 146

TABLE 108 UK: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 147

TABLE 109 UK: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 147

TABLE 110 FRANCE: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 148

TABLE 111 FRANCE: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 148

TABLE 112 FRANCE: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 148

TABLE 113 FRANCE: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 149

TABLE 114 SPAIN: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 149

TABLE 115 SPAIN: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 150

TABLE 116 SPAIN: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 150

TABLE 117 SPAIN: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 150

TABLE 118 ITALY: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 151

TABLE 119 ITALY: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 151

TABLE 120 ITALY: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 152

TABLE 121 ITALY: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 152

TABLE 122 REST OF EUROPE: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (USD MILLION) 153

TABLE 123 REST OF EUROPE: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (USD MILLION) 153

TABLE 124 REST OF EUROPE: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (KILOTON) 153

TABLE 125 REST OF EUROPE: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (KILOTON) 154

TABLE 126 MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 154

TABLE 127 MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 155

TABLE 128 MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2021–2024 (KILOTON) 155

TABLE 129 MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2025–2030 (KILOTON) 155

TABLE 130 MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (USD MILLION) 156

TABLE 131 MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (USD MILLION) 156

TABLE 132 MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (KILOTON) 156

TABLE 133 MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (KILOTON) 157

TABLE 134 SAUDI ARABIA: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (USD MILLION) 158

TABLE 135 SAUDI ARABIA: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (USD MILLION) 158

TABLE 136 SAUDI ARABIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 158

TABLE 137 SAUDI ARABIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 159

TABLE 138 UAE: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 159

TABLE 139 UAE: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 160

TABLE 140 UAE: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 160

TABLE 141 UAE: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 160

TABLE 142 REST OF GCC COUNTRIES: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (USD MILLION) 161

TABLE 143 REST OF GCC COUNTRIES: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (USD MILLION) 161

TABLE 144 REST OF GCC COUNTRIES: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (KILOTON) 162

TABLE 145 REST OF GCC COUNTRIES: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (KILOTON) 162

TABLE 146 IRAN: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 163

TABLE 147 IRAN: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 163

TABLE 148 IRAN: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 163

TABLE 149 IRAN: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 164

TABLE 150 REST OF MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET,

BY TYPE, 2021–2024 (USD MILLION) 164

TABLE 151 REST OF MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET,

BY TYPE, 2025–2030 (USD MILLION) 165

TABLE 152 REST OF MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET,

BY TYPE, 2021–2024 (KILOTON) 165

TABLE 153 REST OF MIDDLE EAST & AFRICA: RUBBER PROCESS OIL MARKET,

BY TYPE, 2025–2030 (KILOTON) 165

TABLE 154 SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 166

TABLE 155 SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 166

TABLE 156 SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2021–2024 (KILOTON) 167

TABLE 157 SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY COUNTRY,

2025–2030 (KILOTON) 167

TABLE 158 SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (USD MILLION) 167

TABLE 159 SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (USD MILLION) 168

TABLE 160 SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (KILOTON) 168

TABLE 161 SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (KILOTON) 168

TABLE 162 BRAZIL: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 169

TABLE 163 BRAZIL: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 169

TABLE 164 BRAZIL: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 170

TABLE 165 BRAZIL: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 170

TABLE 166 ARGENTINA: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (USD MILLION) 171

TABLE 167 ARGENTINA: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (USD MILLION) 171

TABLE 168 ARGENTINA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 171

TABLE 169 ARGENTINA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 172

TABLE 170 COLOMBIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 172

TABLE 171 COLOMBIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 173

TABLE 172 COLOMBIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 173

TABLE 173 COLOMBIA: RUBBER PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 173

TABLE 174 REST OF SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (USD MILLION) 174

TABLE 175 REST OF SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (USD MILLION) 174

TABLE 176 REST OF SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE,

2021–2024 (KILOTON) 175

TABLE 177 REST OF SOUTH AMERICA: RUBBER PROCESS OIL MARKET, BY TYPE,

2025–2030 (KILOTON) 175

TABLE 178 RUBBER PROCESS OIL MARKET: OVERVIEW OF STRATEGIES ADOPTED

BY KEY PLAYERS, (2020–2025) 176

TABLE 179 RUBBER PROCESS OIL MARKET: DEGREE OF COMPETITION, 2024 179

TABLE 180 RUBBER PROCESS OIL MARKET: REGION FOOTPRINT 186

TABLE 181 RUBBER PROCESS OIL MARKET: VISCOSITY FOOTPRINT 187

TABLE 182 RUBBER PROCESS OIL MARKET: TYPE FOOTPRINT 188

TABLE 183 RUBBER PROCESS OIL MARKET: APPLICATION FOOTPRINT 189

TABLE 184 RUBBER PROCESS OIL MARKET: DETAILED LIST OF KEY STARTUPS/SMES 193

TABLE 185 RUBBER PROCESS OIL MARKET: COMPETITIVE BENCHMARKING

OF KEY STARTUPS/SMES 194

TABLE 186 RUBBER PROCESS OIL MARKET: PRODUCT LAUNCHES,

JANUARY 2020– NOVEMBER 2025 195

TABLE 187 RUBBER PROCESS OIL MARKET: DEALS, JANUARY 2020–NOVEMBER 2025 196

TABLE 188 SINOPEC: COMPANY OVERVIEW 199

TABLE 189 SINOPEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED 200

TABLE 190 PETROCHINA COMPANY LIMITED: COMPANY OVERVIEW 202

TABLE 191 PETROCHINA COMPANY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED 203

TABLE 192 CHEVRON CORPORATION: COMPANY OVERVIEW 206

TABLE 193 CHEVRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 207

TABLE 194 EXXON MOBIL CORPORATION: COMPANY OVERVIEW 209

TABLE 195 EXXON MOBIL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 210

TABLE 196 SHELL PLC: COMPANY OVERVIEW 212

TABLE 197 SHELL PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED 213

TABLE 198 APAR INDUSTRIES LTD.: COMPANY OVERVIEW 215

TABLE 199 APAR INDUSTRIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 216

TABLE 200 PANAMA PETROCHEM LTD.: COMPANY OVERVIEW 218

TABLE 201 PANAMA PETROCHEM LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 219

TABLE 202 BEHRAN OIL CO.: COMPANY OVERVIEW 221

TABLE 203 BEHRAN OIL CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 221

TABLE 204 ENILIVE S.P.A.: COMPANY OVERVIEW 222

TABLE 205 ENILIVE S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 222

TABLE 206 GANDHAR OIL REFINERY (INDIA) LIMITED: COMPANY OVERVIEW 223

TABLE 207 GANDHAR OIL REFINERY (INDIA) LIMITED: PRODUCTS/SOLUTIONS/

SERVICES OFFERED 224

TABLE 208 HINDUSTAN PETROLEUM CORPORATION LIMITED: COMPANY OVERVIEW 226

TABLE 209 HINDUSTAN PETROLEUM CORPORATION LIMITED: PRODUCTS/SOLUTIONS/ SERVICES OFFERED 227

TABLE 210 INDIAN OIL CORPORATION LTD: COMPANY OVERVIEW 229

TABLE 211 INDIAN OIL CORPORATION LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED 230

TABLE 212 ORLEN UNIPETROL GROUP: COMPANY OVERVIEW 231

TABLE 213 ORLEN UNIPETROL GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED 232

TABLE 214 IDEMITSU KOSAN CO., LTD.: COMPANY OVERVIEW 234

TABLE 215 IDEMITSU KOSAN CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 235

TABLE 216 REPSOL: COMPANY OVERVIEW 237

TABLE 217 REPSOL: PRODUCTS/SOLUTIONS/SERVICES OFFERED 238

TABLE 218 ORGKHIM BIOCHEMICAL HOLDING: COMPANY OVERVIEW 240

TABLE 219 ORGKHIM BIOCHEMICAL HOLDING: PRODUCTS/SOLUTIONS/SERVICES OFFERED 240

TABLE 220 GPPL: COMPANY OVERVIEW 241

TABLE 221 GPPL: PRODUCTS/SOLUTIONS/SERVICES OFFERED 242

TABLE 222 IRANOL (LLP): COMPANY OVERVIEW 243

TABLE 223 IRANOL (LLP): PRODUCTS/SOLUTIONS/SERVICES OFFERED 243

TABLE 224 PETRO GULF INTERNATIONAL FZE: COMPANY OVERVIEW 244

TABLE 225 PETRO GULF INTERNATIONAL FZE: PRODUCTS/SOLUTIONS/SERVICES OFFERED 244

TABLE 226 CALUMET, INC.: COMPANY OVERVIEW 245

TABLE 227 CALUMET, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 246

TABLE 228 H&R GROUP: COMPANY OVERVIEW 247

TABLE 229 H&R GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED 248

TABLE 230 NYNAS AB: COMPANY OVERVIEW 250

TABLE 231 NYNAS AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED 251

TABLE 232 NYNAS AB: PRODUCT LAUNCHES (JANUARY 2020− NOVEMBER 2025) 254

TABLE 233 IRPC PUBLIC COMPANY LIMITED: COMPANY OVERVIEW 255

TABLE 234 IRPC PUBLIC COMPANY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED 255

TABLE 235 PT. ENERCO RPO INTERNASIONAL: COMPANY OVERVIEW 256

TABLE 236 PT. ENERCO RPO INTERNASIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED 256

TABLE 237 PT. ENERCO RPO INTERNASIONAL: DEALS (JANUARY 2020− NOVEMBER 2025) 257

TABLE 238 WITMANS INDUSTRIES PVT. LTD.: COMPANY OVERVIEW 258

TABLE 239 WITMANS INDUSTRIES PVT. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 258

TABLE 240 THAIOIL GROUP: COMPANY OVERVIEW 260

TABLE 241 THAIOIL GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED 261

TABLE 242 SHANGDONG TIANYUAN CHEMICAL CO., LTD: COMPANY OVERVIEW 262

TABLE 243 SHANGDONG TIANYUAN CHEMICAL CO., LTD: PRODUCTS/SOLUTIONS/

SERVICES OFFERED 262

TABLE 244 P.S.P. SPECIALTIES PUBLIC COMPANY LIMITED: COMPANY OVERVIEW 263

TABLE 245 P.S.P. SPECIALTIES PUBLIC COMPANY LIMITED: PRODUCTS/SOLUTIONS/

SERVICES OFFERED 264

TABLE 246 PETRO NAFT: COMPANY OVERVIEW 265

TABLE 247 PANOL INDUSTRIES RMC FZE: COMPANY OVERVIEW 266

TABLE 248 EAGLE PETROCHEM: COMPANY OVERVIEW 267

TABLE 249 LODHA PETRO: COMPANY OVERVIEW 268

TABLE 250 RLS PETROCHEM LUBRICANTS LLC: COMPANY OVERVIEW 269

TABLE 251 GAZPROMNEFT – LUBRICANTS LTD.: COMPANY OVERVIEW 270

LIST OF FIGURES

FIGURE 1 RUBBER PROCESS OIL MARKET SEGMENTATION AND REGIONAL SCOPE 29

FIGURE 2 MARKET SCENARIO 32

FIGURE 3 GLOBAL RUBBER PROCESS OIL MARKET, 2021–2030 33

FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN RUBBER PROCESS OIL MARKET, 2020–2025 33

FIGURE 5 DISRUPTIONS INFLUENCING GROWTH OF RUBBER PROCESS OIL MARKET 34

FIGURE 6 HIGH-GROWTH SEGMENTS IN RUBBER PROCESS OIL MARKET 2025–2030 35

FIGURE 7 RUBBER PROCESS OIL IN ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD 36

FIGURE 8 RISING DEMAND FOR GREEN/BIODEGRADABLE RUBBER OILS TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS 38

FIGURE 9 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD 38

FIGURE 10 NAPHTHENIC SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030 39

FIGURE 11 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD 39

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN RUBBER PROCESS OIL MARKET 41

FIGURE 13 LIGHT VEHICLE PROPULSION TYPE SALES AND SHARE, BY KEY COUNTRY, 2024 VS. 2030 (PERCENTAGE & MILLION UNITS) 42

FIGURE 14 MOTOR VEHICLES (CARS AND COMMERCIAL VEHICLES) PRODUCTION,

2021–2024, (MILLION UNITS) 43

FIGURE 15 GLOBAL AUTOMOTIVE TIRE MARKET, 2022 TO 2033 (MILLION UNITS) 43

FIGURE 16 NEW CAR REGISTRATIONS, 2023–2024, (MILLION UNITS) 44

FIGURE 17 AUTOMOTIVE GREEN TIRE PRODUCTION, 2023–2025 (MILLION UNITS) 44

FIGURE 18 GLOBAL PARAFFINIC BASE STOCK DEMAND, 2015–2030,

(THOUSAND BARRELS PER DAY) 47

FIGURE 19 GLOBAL LUXURY CAR SALES, BY REGION/COUNTRY, 2021–2033

(THOUSAND UNITS) 50

FIGURE 20 CRUDE OIL FIRST PURCHASE PRICES, 2011 TO 2024 51

FIGURE 21 RUBBER PROCESS OIL MARKET: PORTER’S FIVE FORCES ANALYSIS 55

FIGURE 22 RUBBER PROCESS OIL MARKET: SUPPLY CHAIN ANALYSIS 60

FIGURE 23 RUBBER PROCESS OIL MARKET: ECOSYSTEM MAPPING 62

FIGURE 24 AVERAGE SELLING PRICE TREND OF RUBBER PROCESS OIL, BY REGION,

2022–2025 (USD/TON) 63

FIGURE 25 AVERAGE SELLING PRICE TREND OF RUBBER PROCESS OIL TYPE,

BY KEY PLAYER, 2025 (USD/TON) 64

FIGURE 26 IMPORT DATA RELATED TO HS CODE 2709, BY KEY COUNTRY,

2021–2024 (USD THOUSAND) 66

FIGURE 27 EXPORT DATA RELATED TO HS CODE 2709, BY KEY COUNTRY,

2021–2024 (USD THOUSAND) 67

FIGURE 28 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS 69

FIGURE 29 RUBBER PROCESS OIL MARKET: INVESTMENT AND FUNDING SCENARIO,

2019–2025 70

FIGURE 30 LIST OF MAJOR PATENTS RELATED TO RUBBER PROCESS OIL, 2014–2024 79

FIGURE 31 FUTURE APPLICATIONS OF RUBBER PROCESS OIL 81

FIGURE 32 RUBBER PROCESS OIL MARKET: DECISION-MAKING FACTORS 93

FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION 94

FIGURE 34 KEY BUYING CRITERIA, BY APPLICATION 95

FIGURE 35 ADOPTION BARRIERS & INTERNAL CHALLENGES 96

FIGURE 36 MEDIUM VISCOSITY SEGMENT ACCOUNTS FOR LARGEST SHARE OF RUBBER PROCESS OIL MARKET 100

FIGURE 37 TIRES SEGMENT ACCOUNTS FOR LARGEST SHARE OF RUBBER PROCESS

OIL MARKET 103

FIGURE 38 NAPHTHENIC SEGMENT ACCOUNTS FOR LARGEST SHARE OF RUBBER

PROCESS OIL MARKET 107

FIGURE 39 ASIA PACIFIC TO LEAD RUBBER PROCESS OIL MARKET DURING FORECAST PERIOD 113

FIGURE 40 ASIA PACIFIC: RUBBER PROCESS OIL MARKET SNAPSHOT 115

FIGURE 41 NORTH AMERICA: RUBBER PROCESS OIL MARKET SNAPSHOT 131

FIGURE 42 EUROPE: RUBBER PROCESS OIL MARKET SNAPSHOT 139

FIGURE 43 RUBBER PROCESS OIL MARKET: REVENUE ANALYSIS OF KEY COMPANIES,

2020–2024 (USD BILLION) 178

FIGURE 44 RUBBER PROCESS OIL MARKET SHARE ANALYSIS, 2024 178

FIGURE 45 BRAND/PRODUCT COMPARISON 181

FIGURE 46 RUBBER PROCESS OIL MARKET: COMPANY EVALUATION MATRIX

(KEY PLAYERS), 2024 184

FIGURE 47 RUBBER PROCESS OIL MARKET: COMPANY FOOTPRINT 185

FIGURE 48 RUBBER PROCESS OIL MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 192

FIGURE 49 EV/EBITDA 197

FIGURE 50 ENTERPRISE VALUE 197

FIGURE 51 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK BETA

OF KEY MANUFACTURERS 198

FIGURE 52 SINOPEC: COMPANY SNAPSHOT 200

FIGURE 53 PETROCHINA COMPANY LIMITED: COMPANY SNAPSHOT 203

FIGURE 54 CHEVRON CORPORATION: COMPANY SNAPSHOT 207

FIGURE 55 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT 210

FIGURE 56 SHELL PLC: COMPANY SNAPSHOT 213

FIGURE 57 APAR INDUSTRIES LTD.: COMPANY SNAPSHOT 216

FIGURE 58 PANAMA PETROCHEM LTD.: COMPANY SNAPSHOT 219

FIGURE 59 GANDHAR OIL REFINERY (INDIA) LIMITED: COMPANY SNAPSHOT 224

FIGURE 60 HINDUSTAN PETROLEUM CORPORATION LIMITED: COMPANY SNAPSHOT 227

FIGURE 61 INDIAN OIL CORPORATION LTD: COMPANY SNAPSHOT 230

FIGURE 62 ORLEN UNIPETROL GROUP: COMPANY SNAPSHOT 232

FIGURE 63 IDEMITSU KOSAN CO., LTD.: COMPANY SNAPSHOT 235

FIGURE 64 REPSOL: COMPANY SNAPSHOT 238

FIGURE 65 GPPL: COMPANY SNAPSHOT 241

FIGURE 66 CALUMET, INC.: COMPANY SNAPSHOT 245

FIGURE 67 H&R GROUP: COMPANY SNAPSHOT 248

FIGURE 68 NYNAS AB: COMPANY SNAPSHOT 251

FIGURE 69 IRPC PUBLIC COMPANY LIMITED: COMPANY SNAPSHOT 255

FIGURE 70 THAIOIL GROUP: COMPANY SNAPSHOT 261

FIGURE 71 P.S.P. SPECIALTIES PUBLIC COMPANY LIMITED: COMPANY SNAPSHOT 264

FIGURE 72 RESEARCH DESIGN 271

FIGURE 73 BOTTOM-UP APPROACH 276

FIGURE 74 TOP-DOWN APPROACH 276

FIGURE 75 METHODOLOGY FOR SUPPLY-SIDE SIZING OF RUBBER PROCESS

OIL MARKET (1/2) 277

FIGURE 76 METHODOLOGY FOR SUPPLY-SIDE SIZING OF RUBBER PROCESS

OIL MARKET (2/2) 278

FIGURE 77 DATA TRIANGULATION 279