Marine Lubricants Market - Global Forecast to 2030

Marine Lubricants Market by Base Oil (Mineral Oil, Synthetic Oil, and Bio-based Oil), Product Type (Engine Oil, Hydraulic Fluid, Compressor Oil), Ship Type (Bulk Carriers, Container Ships, Tankers), and Region - Global Forecast to 2030

船舶用潤滑油市場 - ベースオイル(鉱油、合成油、バイオベースオイル)、製品タイプ(エンジンオイル、油圧作動油、コンプレッサーオイル)、船舶タイプ(ばら積み貨物船、コンテナ船、タンカー)、地域別 - 2030年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年02月 |

| ページ数 | 280 |

| 図表数 | 408 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-13790 |

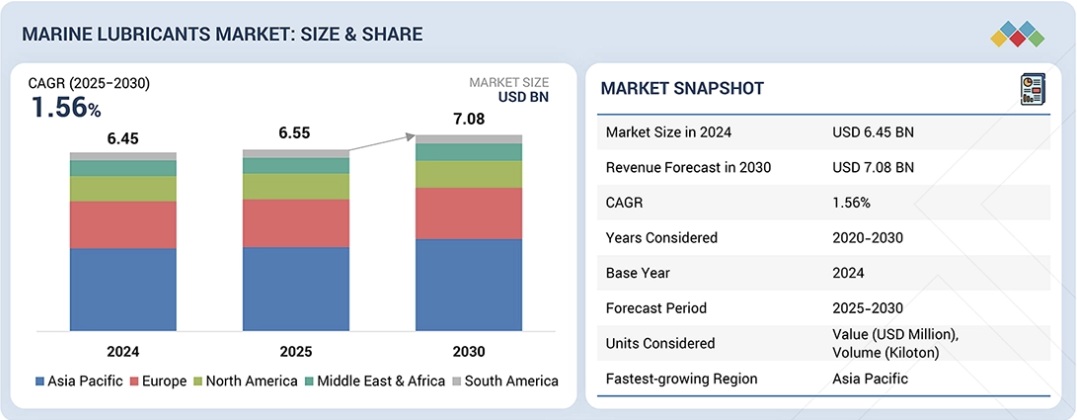

船舶用潤滑油市場規模は2025年に65億5,000万米ドルと評価され、2025年から2030年の間に1.56%のCAGRで成長し、2030年には70億8,000万米ドルに達すると予測されています。

調査対象範囲

本レポートでは、船舶用潤滑油市場をベースオイル、製品タイプ、船舶の種類、地域に基づいてセグメント化し、様々な地域における市場全体の推定価値(百万米ドル)を示しています。主要業界プレーヤーの詳細な分析を実施し、船舶用潤滑油市場に関連する各社の事業概要、サービス、主要戦略に関する洞察を提供しています。

このレポートを購入する理由

この調査レポートは、業界分析(業界動向)、主要企業の市場シェア分析、企業プロファイルといった様々なレベルの分析に焦点を当てており、これらを組み合わせることで、船舶用潤滑油市場における競争環境、新興・高成長セグメント、高成長地域、市場牽引要因、制約要因、機会に関する全体像を把握できます。

本レポートは、以下の点について洞察を提供します。

- 市場浸透:世界市場の主要企業が提供する船舶潤滑油に関する包括的な情報

- 船舶潤滑油市場の成長に影響を与える主要な推進要因(世界の海上貿易と船舶稼働率の増加、世界の船舶老朽化に伴うメンテナンスと潤滑油交換の需要増加、燃費効率の高い高出力の船舶エンジンの導入、オフショアエネルギー、風力発電設備、支援船の拡大、運用信頼性と資産寿命延長への関心の高まり)、制約要因(合成で環境に優しい船舶潤滑油の高コスト、新規配合に対する複雑な承認およびOEM認証要件)、機会(環境に優しい生分解性潤滑油の需要増加、LNG、メタノール、アンモニアなどの代替燃料に対応した潤滑油、状態基準メンテナンスおよび潤滑油モニタリングサービスの成長)、課題(進化と断片化が進む環境規制への準拠、配合経済性に影響を与える原油およびベースオイル価格の変動)の分析

- 製品開発/イノベーション:船舶用潤滑油市場における今後の技術、研究開発活動、製品・サービスの投入に関する詳細な洞察

- 市場開発:収益性の高い新興市場に関する包括的な情報(本レポートでは、地域をまたいで船舶用潤滑油市場を分析しています)

- 市場多様化:新製品、未開拓地域、世界の船舶用潤滑油市場における最近の動向に関する網羅的な情報

- 競合評価:船舶用潤滑油市場における主要企業の市場シェア、戦略、製品、製造能力に関する詳細な評価

Report Description

The marine lubricants market size was valued at USD 6.55 billion in 2025 and is projected to reach USD 7.08 billion by 2030, at a CAGR of 1.56% between 2025 and 2030.

Marine Lubricants Market – Global Forecast to 2030

“Rising maritime trade and regulatory compliance requirements are driving the marine lubricants market growth.”

The marine lubricants market is growing due to the increasing global seaborne trade and stringent environmental regulations related to emissions and vessel efficiency. Ship operators are increasingly using high-performance and environmentally friendly lubricants to meet regulatory demands. This trend reflects the growing emphasis on engine reliability, fuel economy, and equipment longevity, making marine lubricants essential for ship operation.

“The synthetic oil segment accounted for the second-largest market share of marine lubricants.”

In 2024, the synthetic oil segment accounted for the second-largest value share in the overall marine lubricants market. This dominance is driven by its better performance properties. Synthetic oil provides better thermal properties, longer lifespan, and better protection for the engines; therefore, it is widely used in modern marine engines and demanding operating conditions.

“The compressor oil segment is projected to be the fastest-growing product type during the forecast period.”

The compressor oil segment is estimated to be the fastest-growing product type, in terms of value, during the forecast period. This is due to the increased adoption of compressed air systems and the refrigeration compressors on modern vessels. Increasing demand for the high performance of the engines, the reduced maintenance intervals, and the enhanced reliability of the operations are leading to the use of high-performance compressor oils.

Marine Lubricants Market – Global Forecast to 2030 – region

“North America accounted for the third-largest share in the global marine lubricants market, in terms of value, in 2024.”

North America was the third-largest marine lubricants market in 2024. The market in the region is driven by strong maritime trade activity and the presence of a sizable commercial and offshore fleet. The demand is also backed by the offshore oil and gas operations, inland waterway transport, and regular vessel maintenance and upgrade activities. All these factors, along with the regulations for environmental protection and the adoption of high-performance lubricants, support steady market growth of marine lubricants.

- By Company Type: Tier 1 – 55%, Tier 2 – 25%, Tier 3 – 20%

- By Designation: Directors – 50%, Managers – 30%, Others – 20%

- By Region: North America – 40%, Europe – 35%, Asia Pacific – 20%, RoW– 5%

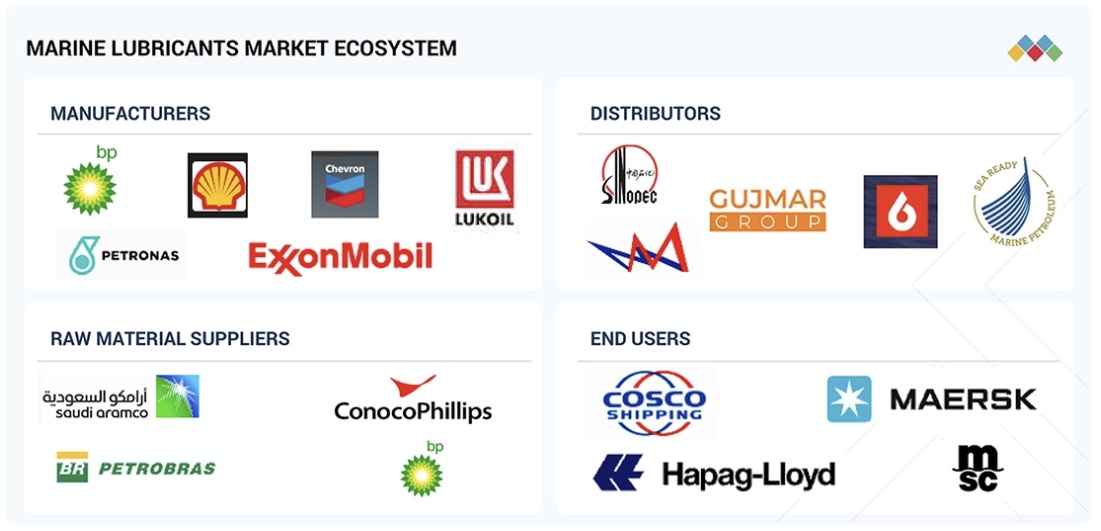

The key players profiled in the report include BP p.l.c. (UK), Chevron Corporation (US), Exxon Mobil Corporation (US), Shell plc (UK), TotalEnergies SE (France), Petronas (Malaysia), LUKOIL (Russia), Idemitsu Kosan Co., Ltd (Japan), China Petroleum & Chemical Corporation (China), ENEOS Holdings, Inc. (Japan), Gulf Oil International Ltd. (UK), Emirates National Oil Company (UAE), ENI S.p.A (Italy), Indian Oil Corporation Limited (India), PetroChina Company Limited (China), Moeve (Spain), FUCHS (Germany), Gazprom (Russia), and Calumet, Inc. (US).

Marine Lubricants Market – Global Forecast to 2030 – ecosystem

Study Coverage

This report segments the market for marine lubricants based on base oil, product type, ship type, and region, and provides estimations of value (in USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies associated with the marine lubricants market.

Reasons to Buy This Report

This research report is focused on various levels of analysis—industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the marine lubricants market, high-growth regions, and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on marine lubricants offered by top players in the global market

- Analysis of key drivers (Growth in global seaborne trade and vessel utilization, aging global fleet increasing demand for maintenance and lubricant replacement, adoption of fuel-efficient and high-output marine engines, expansion of offshore energy, wind installation, and support vessels, and increasing focus on operational reliability and asset life extension), restraints (High cost of synthetic and environmentally acceptable marine lubricants and complex approval and OEM certification requirements for new formulations), opportunities (Rising demand for environmentally acceptable and biodegradable lubricants, lubricants tailored for alternative fuels such as LNG, methanol, and ammonia, and growth in condition-based maintenance and lubricant monitoring services), and challenges (Compliance with evolving and fragmented environmental regulations and volatility in crude oil and base oil prices affecting formulation economics) influencing the growth of the marine lubricants market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the marine lubricants market

- Market Development: Comprehensive information about lucrative emerging markets—the report analyzes the market for marine lubricants across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global marine lubricants market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the marine lubricants market

Table of Contents

1 INTRODUCTION 27

1.1 STUDY OBJECTIVES 27

1.2 MARKET DEFINITION 27

1.3 STUDY SCOPE 28

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 28

1.3.2 INCLUSIONS AND EXCLUSIONS 28

1.3.3 MARKET DEFINITION AND INCLUSIONS, BY BASE OIL 29

1.3.4 MARKET DEFINITION AND INCLUSIONS, BY PRODUCT TYPE 29

1.3.5 MARKET DEFINITION AND INCLUSIONS, BY SHIP TYPE 30

1.3.6 YEARS CONSIDERED 30

1.4 CURRENCY CONSIDERED 30

1.5 UNIT CONSIDERED 31

1.6 STAKEHOLDERS 31

1.7 SUMMARY OF CHANGES 31

2 EXECUTIVE SUMMARY 32

2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS 32

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 33

2.3 DISRUPTIVE TRENDS IN MARINE LUBRICANTS MARKET 34

2.4 HIGH-GROWTH SEGMENTS 35

2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST 36

3 PREMIUM INSIGHTS 37

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MARINE LUBRICANTS MARKET 37

3.2 MARINE LUBRICANTS MARKET, BY BASE OIL AND REGION 37

3.3 MARINE LUBRICANTS MARKET, BY PRODUCT TYPE 38

3.4 MARINE LUBRICANTS MARKET, BY COUNTRY 38

4 MARKET OVERVIEW 39

4.1 INTRODUCTION 39

4.2 MARKET DYNAMICS 39

4.2.1 DRIVERS 40

4.2.1.1 Growth in global seaborne trade and vessel utilization 40

4.2.1.2 Aging global fleet increasing demand for maintenance and lubricant replacement 40

4.2.1.3 Adoption of fuel-efficient and high-output marine engines 40

4.2.1.4 Expansion of offshore energy, wind installation, and support vessels 40

4.2.1.5 Increasing focus on operational reliability and asset life extension 41

4.2.2 RESTRAINTS 41

4.2.2.1 High cost of synthetic and environmentally acceptable marine lubricants 41

4.2.2.2 Complex approval and OEM certification requirements for new formulations 41

4.2.3 OPPORTUNITIES 42

4.2.3.1 Rising demand for environmentally acceptable and biodegradable lubricants 42

4.2.3.2 Lubricants tailored for alternative fuels such as LNG, methanol, and ammonia 42

4.2.3.3 Growth in condition-based maintenance and lubricant monitoring services 42

4.2.4 CHALLENGES 43

4.2.4.1 Compliance with evolving and fragmented environmental regulations 43

4.2.4.2 Volatility in crude oil and base oil prices affecting formulation economics 43

4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 43

4.3.1 INTERCONNECTED MARKETS 43

4.3.2 CROSS-SECTOR OPPORTUNITIES 44

4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 44

4.4.1 KEY MOVES AND STRATEGIC FOCUS 44

5 INDUSTRY TRENDS 45

5.1 PORTER’S FIVE FORCES ANALYSIS 45

5.1.1 THREAT OF SUBSTITUTES 45

5.1.2 THREAT OF NEW ENTRANTS 46

5.1.3 BARGAINING POWER OF SUPPLIERS 46

5.1.4 BARGAINING POWER OF BUYERS 46

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 46

5.2 MACROECONOMIC OUTLOOK 47

5.2.1 INTRODUCTION 47

5.2.2 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES 47

5.3 SUPPLY CHAIN ANALYSIS 49

5.3.1 RAW MATERIAL SUPPLIERS 49

5.3.2 MARINE LUBRICANT MANUFACTURERS 50

5.3.3 MARKETING & DISTRIBUTION 50

5.3.4 END-USE INDUSTRIES 50

5.4 ECOSYSTEM ANALYSIS 50

5.5 PRICING ANALYSIS 52

5.5.1 AVERAGE SELLING PRICE OF MARINE LUBRICANTS OFFERED BY KEY PLAYERS, BY TOP THREE BASE OILS, 2024 52

5.5.2 AVERAGE SELLING PRICE TREND OF MARINE LUBRICANTS, BY REGION, 2023–2030 53

5.6 TRADE ANALYSIS 54

5.6.1 EXPORT SCENARIO (HS CODE-2710) 54

5.6.2 IMPORT SCENARIO (HS CODE-2710) 55

5.7 KEY CONFERENCES & EVENTS IN 2025–2026 56

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 57

5.9 INVESTMENT AND FUNDING SCENARIO 57

5.10 CASE STUDY ANALYSIS 57

5.10.1 LUBRICANT SAVINGS AND CLEANER ENGINE WITH MOBILGARD 5100 57

5.10.2 SUSESEA BULK CARRIER FLEET CUTS CYLINDER OIL FEED BY 33% WITH CHEVRON’S TARO ULTRA ADVANCED 40 58

5.10.3 CHEVRON’S TARO ULTRA ADVANCED 40 ENHANCES ENGINE PERFORMANCE ON MV CARLOS FISCHER 58

5.11 IMPACT OF 2025 US TARIFF – MARINE LUBRICANTS MARKET 59

5.11.1 INTRODUCTION 59

5.11.2 KEY TARIFFS 59

5.11.3 PRICE IMPACT ANALYSIS 60

5.11.4 IMPACT ON COUNTRY/REGION 60

5.11.4.1 US 60

5.11.4.2 Europe 61

5.11.4.3 Asia Pacific 61

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS 62

6.1 KEY EMERGING TECHNOLOGIES 62

6.1.1 BIO-BASED AND ENVIRONMENTALLY ACCEPTABLE MARINE LUBRICANTS (EALS) 62

6.1.2 SMART LUBRICANTS AND CONDITION-RESPONSIVE ADDITIVE SYSTEMS 62

6.2 COMPLEMENTARY TECHNOLOGIES 63

6.2.1 DIGITAL OIL CONDITION MONITORING AND PREDICTIVE ANALYTICS 63

6.2.2 ADVANCED MARINE ENGINE AND FUEL SYSTEM TECHNOLOGIES 63

6.3 TECHNOLOGY/PRODUCT ROADMAP 63

6.3.1 SHORT-TERM (2025–2027) 63

6.3.2 MID-TERM (2027–2030) | EXPANSION & STANDARDIZATION 64

6.3.3 LONG-TERM (2030–2035+) 64

6.4 PATENT ANALYSIS 65

6.4.1 APPROACH 65

6.4.2 DOCUMENT TYPE 65

6.4.3 TOP APPLICANTS 67

6.4.4 JURISDICTION ANALYSIS 68

6.5 IMPACT OF AI/GEN AI ON MARINE LUBRICANTS MARKET 69

6.5.1 ACCELERATED FORMULATION DEVELOPMENT AND REGULATORY COMPLIANCE 69

6.5.2 ENHANCED BLENDING EFFICIENCY AND QUALITY ASSURANCE 69

6.5.3 PREDICTIVE MAINTENANCE AND ASSET RELIABILITY OPTIMIZATION 70

6.5.4 OPTIMIZED DEMAND FORECASTING AND PORT-LEVEL INVENTORY MANAGEMENT 70

7 SUSTAINABILITY AND REGULATORY LANDSCAPE 71

7.1 REGIONAL REGULATIONS AND COMPLIANCE 71

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 71

7.1.2 INDUSTRY STANDARDS 74

7.2 REGULATORY POLICY INITIATIVES 75

7.2.1 SAFETY PROTOCOLS 76

7.2.2 SUSTAINABLE DEVELOPMENT 76

7.2.3 STANDARDIZATION 76

7.2.4 CIRCULAR ECONOMY 76

7.3 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 76

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 78

8.1 DECISION-MAKING PROCESS 78

8.2 KEY STAKEHOLDERS AND BUYING CRITERIA 79

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 79

8.2.2 BUYING CRITERIA 80

8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 80

8.4 UNMET NEEDS IN VARIOUS APPLICATIONS 81

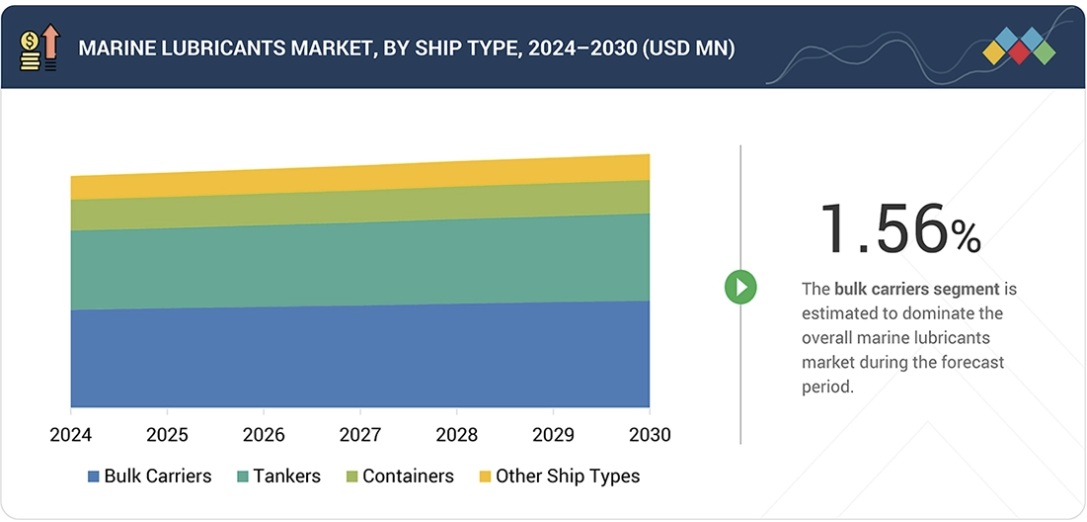

9 MARINE LUBRICANTS MARKET, BY SHIP TYPE 83

9.1 INTRODUCTION 84

9.2 BULK CARRIERS 86

9.2.1 HIGH FLEET DENSITY AND LONG-DURATION VOYAGES 86

9.3 TANKERS (OIL, GAS, CHEMICALS) 86

9.3.1 STRINGENT OPERATIONAL AND COMPLIANCE REQUIREMENTS 86

9.4 CONTAINER SHIPS 86

9.4.1 HIGH-SPEED OPERATIONS AND ENGINE STRESS 86

9.5 OTHER SHIP TYPES 86

10 MARINE LUBRICANTS MARKET, BY PRODUCT TYPE 87

10.1 INTRODUCTION 88

10.2 ENGINE OIL 90

10.2.1 ENGINE RELIABILITY REQUIREMENTS TO DRIVE MARKET FOR ENGINE OIL 90

10.3 HYDRAULIC FLUID 91

10.3.1 EXPANSION OF DECK AND CONTROL SYSTEMS TO DRIVE HYDRAULIC FLUID MARKET 91

10.4 COMPRESSOR OIL 93

10.4.1 INCREASED USE OF COMPRESSED AIR SYSTEMS TO DRIVE COMPRESSOR OIL MARKET 93

10.5 OTHER PRODUCT TYPES 95

11 MARINE LUBRICANTS MARKET, BY BASE OIL 97

11.1 INTRODUCTION 98

11.2 MINERAL OIL 99

11.2.1 COST-EFFECTIVE LUBRICATION SUPPORTING LARGE-SCALE MARINE OPERATIONS 99

11.3 SYNTHETIC OIL 101

11.3.1 PERFORMANCE RELIABILITY UNDER SEVERE AND HIGH-STRESS OPERATING CONDITIONS 101

11.4 BIO-BASED OIL 102

11.4.1 REGULATORY PRESSURE FOR ENVIRONMENTALLY ACCEPTABLE MARINE LUBRICANTS 102

12 MARINE LUBRICANTS MARKET, BY REGION 105

12.1 INTRODUCTION 106

12.2 ASIA PACIFIC 108

12.2.1 CHINA 113

12.2.1.1 High investment in domestic and international maritime trade activities 113

12.2.2 SINGAPORE 114

12.2.2.1 Well-established marine services infrastructure 114

12.2.3 HONG KONG 116

12.2.3.1 Rise in trading activities 116

12.2.4 SOUTH KOREA 117

12.2.4.1 Advanced shipbuilding driving marine lubricants demand 117

12.2.5 MALAYSIA 118

12.2.5.1 Growth in shipbuilding industry 118

12.2.6 JAPAN 120

12.2.6.1 Government support and integrated maritime industry 120

12.2.7 TAIWAN 121

12.2.7.1 Growth in export and maritime trade 121

12.2.8 INDIA 122

12.2.8.1 Economic growth, favorable government policies & incentive framework, and long coastline 122

12.2.9 AUSTRALIA 124

12.2.9.1 Large exports of coal and metals 124

12.3 NORTH AMERICA 125

12.3.1 US 130

12.3.1.1 Rise in domestic and international maritime trade 130

12.3.2 CANADA 131

12.3.2.1 Increase in demand for bulk carriers, oil tankers, and container ships 131

12.3.3 MEXICO 132

12.3.3.1 Rapid industrialization and rising population 132

12.4 EUROPE 134

12.4.1 GERMANY 139

12.4.1.1 Growth of maritime industry 139

12.4.2 NETHERLANDS 140

12.4.2.1 Strong presence of world’s leading manufacturers of high-end yachts and special vessels 140

12.4.3 BELGIUM 142

12.4.3.1 Geographical location makes Belgium an attractive market 142

12.4.4 SPAIN 143

12.4.4.1 Spanish shipbuilding industry plays major role in driving market 143

12.4.5 UK 144

12.4.5.1 Popular manufacturing hub for shipbuilding industry 144

12.4.6 ITALY 146

12.4.6.1 Leading manufacturer of fishing ships and cruise liners 146

12.4.7 FRANCE 147

12.4.7.1 Operational and regulatory drivers supporting marine lubricants demand 147

12.4.8 GREECE 149

12.4.8.1 Growing economy and investment in infrastructure to drive demand for marine lubricants 149

12.4.9 TURKEY 150

12.4.9.1 Rise in development of ships and other naval vessels 150

12.4.10 RUSSIA 151

12.4.10.1 Growing economy and investment in infrastructure 151

12.5 MIDDLE EAST & AFRICA 153

12.5.1 UAE 157

12.5.1.1 Increase in maritime activities owing to oil & gas exports 157

12.5.2 SAUDI ARABIA 158

12.5.2.1 Strong foothold of shipbuilding, shipbreaking, and refurbishment companies 158

12.5.3 SOUTH AFRICA 160

12.5.3.1 Increasing maritime traffic to support market growth 160

12.6 SOUTH AMERICA 161

12.6.1 BRAZIL 165

12.6.1.1 Rapidly expanding economy to drive demand for marine lubricants 165

12.6.2 PANAMA 167

12.6.2.1 Increase in maritime traffic due to opening of Panama Canal to drive demand 167

12.6.3 ARGENTINA 168

12.6.3.1 Rapidly expanding economy to drive demand for marine lubricants 168

13 COMPETITIVE LANDSCAPE 170

13.1 INTRODUCTION 170

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2025 170

13.3 MARKET SHARE ANALYSIS, 2024 171

13.4 REVENUE ANALYSIS, 2020–2024 174

13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 174

13.5.1 STARS 174

13.5.2 EMERGING LEADERS 174

13.5.3 PERVASIVE PLAYERS 175

13.5.4 PARTICIPANTS 175

13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 176

13.5.5.1 Company footprint 176

13.5.5.2 Regional footprint 176

13.5.5.3 Ship type footprint 177

13.5.5.4 Product type footprint 178

13.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024 179

13.6.1 PROGRESSIVE COMPANIES 179

13.6.2 RESPONSIVE COMPANIES 179

13.6.3 DYNAMIC COMPANIES 179

13.6.4 STARTING BLOCKS 179

13.6.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2024 180

13.6.5.1 List of start-ups/SMEs 180

13.6.5.2 Competitive benchmarking of start-ups/SMEs 181

13.7 PRODUCT COMPARISON 181

13.8 COMPANY VALUATION AND FINANCIAL METRICS 182

13.9 COMPETITIVE SCENARIO 183

13.9.1 PRODUCT LAUNCHES 183

13.9.2 DEALS 184

13.9.3 EXPANSIONS 186

14 COMPANY PROFILES 188

14.1 MAJOR PLAYERS 188

14.1.1 BP P.L.C. (UK) 188

14.1.1.1 Business overview 188

14.1.1.2 Products/Solutions/Services offered 189

14.1.1.3 Recent developments 191

14.1.1.3.1 Product launches 191

14.1.1.3.2 Expansions 191

14.1.1.4 MnM View 192

14.1.1.4.1 Right to win 192

14.1.1.4.2 Strategic choices 192

14.1.1.4.3 Weaknesses and competitive threats 192

14.1.2 CHEVRON CORPORATION 193

14.1.2.1 Business overview 193

14.1.2.2 Products/Solutions/Services offered 194

14.1.2.3 Recent developments 196

14.1.2.3.1 Product launches 196

14.1.2.3.2 Deals 196

14.1.2.3.3 Expansions 197

14.1.2.4 MnM View 197

14.1.2.4.1 Right to win 197

14.1.2.4.2 Strategic choices 197

14.1.2.4.3 Weaknesses and competitive threats 197

14.1.3 EXXON MOBIL CORPORATION 198

14.1.3.1 Business overview 198

14.1.3.2 Products/Solutions/Services offered 199

14.1.3.3 Recent developments 201

14.1.3.3.1 Product launches 201

14.1.3.3.2 Deals 202

14.1.3.3.3 Expansions 202

14.1.3.4 MnM View 203

14.1.3.4.1 Right to win 203

14.1.3.4.2 Strategic choices 203

14.1.3.4.3 Weaknesses and competitive threats 203

14.1.4 SHELL PLC 204

14.1.4.1 Business overview 204

14.1.4.2 Products/Solutions/Services offered 205

14.1.4.3 Recent developments 207

14.1.4.3.1 Product launches 207

14.1.4.3.2 Expansions 207

14.1.4.3.3 Deals 208

14.1.4.4 MnM View 208

14.1.4.4.1 Right to win 208

14.1.4.4.2 Strategic choices 208

14.1.4.4.3 Weaknesses and competitive threats 208

14.1.5 TOTALENERGIES SE 209

14.1.5.1 Business overview 209

14.1.5.2 Products/Solutions/Services offered 210

14.1.5.3 Recent developments 211

14.1.5.3.1 Product launches 211

14.1.5.3.2 Expansions 212

14.1.5.3.3 Deals 212

14.1.5.4 MnM View 213

14.1.5.4.1 Right to win 213

14.1.5.4.2 Strategic choices 213

14.1.5.4.3 Weaknesses and competitive threats 213

14.1.6 PETRONAS 214

14.1.6.1 Business overview 214

14.1.6.2 Products/Solutions/Services offered 215

14.1.6.3 Recent developments 216

14.1.6.3.1 Product launches 216

14.1.7 IDEMITSU KOSAN CO., LTD 217

14.1.7.1 Business overview 217

14.1.7.2 Products/Solutions/Services offered 218

14.1.8 CHINA PETROLEUM & CHEMICAL CORPORATION 220

14.1.8.1 Business Overview 220

14.1.8.2 Products/Solutions/Services offered 221

14.1.8.3 Recent developments 222

14.1.8.3.1 Expansions 222

14.1.9 PETROCHINA COMPANY LIMITED 223

14.1.9.1 Business overview 223

14.1.9.2 Products/Solutions/Services offered 224

14.1.10 FUCHS SE 226

14.1.10.1 Business overview 226

14.1.10.2 Products/Solutions/Services offered 227

14.1.10.3 Recent developments 228

14.1.10.3.1 Product launches 228

14.1.10.3.2 Deals 229

14.1.10.3.3 Expansions 229

14.1.11 LUKOIL 230

14.1.11.1 Business overview 230

14.1.11.2 Products/Solutions/Services offered 230

14.1.11.3 Recent developments 231

14.1.11.3.1 Deals 231

14.1.12 ENEOS HOLDINGS, INC. 232

14.1.12.1 Business overview 232

14.1.12.2 Products/Solutions/Services offered 233

14.1.13 GULF OIL INTERNATIONAL LTD. 234

14.1.13.1 Business overview 234

14.1.13.2 Products/Solutions/Services offered 234

14.1.13.3 Recent developments 235

14.1.13.3.1 Product launches 235

14.1.14 EMIRATES NATIONAL OIL COMPANY (ENOC) 236

14.1.14.1 Business overview 236

14.1.14.2 Products/Solutions/Services offered 236

14.1.14.3 Recent developments 237

14.1.14.3.1 Product launches 237

14.1.14.3.2 Deals 237

14.1.15 ENI S.P.A. 238

14.1.15.1 Business overview 238

14.1.15.2 Products/Solutions/Services offered 239

14.1.16 INDIAN OIL CORPORATION LIMITED 240

14.1.16.1 Business overview 240

14.1.16.2 Products/Solutions/Services offered 241

14.1.16.3 Recent developments 242

14.1.16.3.1 Deals 242

14.1.17 MOEVE 243

14.1.17.1 Business overview 243

14.1.17.2 Products/Solutions/Services offered 244

14.1.18 GAZPROM 246

14.1.18.1 Business overview 246

14.1.18.2 Products/Solutions/Services offered 247

14.1.19 CALUMET, INC. 248

14.1.19.1 Business overview 248

14.1.19.2 Products/Solutions/Services offered 249

14.2 STARTUP/SME PLAYERS 250

14.2.1 ADDINOL LUBE OIL GMBH 250

14.2.2 SK ENMOVE CO., LTD. 251

14.2.3 GANDHAR OIL REFINERY (INDIA) LIMITED 251

14.2.4 PENRITE OIL COMPANY 252

14.2.5 SCHAEFFER MANUFACTURING CO. 253

14.2.6 DYADE LUBRICANTS 254

14.2.7 KLÜBER LUBRICATION 254

15 RESEARCH METHODOLOGY 255

15.1 RESEARCH DATA 255

15.1.1 SECONDARY DATA 256

15.1.1.1 Key data from secondary sources 256

15.1.2 PRIMARY DATA 256

15.1.2.1 Key data from primary sources 257

15.1.2.2 Primary participants 257

15.1.2.3 Breakdown of primary interviews 257

15.1.2.4 Key industry insights 258

15.2 MARKET SIZE ESTIMATION 258

15.2.1 BOTTOM-UP APPROACH 259

15.2.2 TOP-DOWN APPROACH 260

15.3 GROWTH FORECAST 261

15.3.1 SUPPLY SIDE 261

15.3.2 DEMAND SIDE 262

15.4 DATA TRIANGULATION 263

15.5 FACTOR ANALYSIS 264

15.6 RESEARCH ASSUMPTIONS 264

15.7 RESEARCH LIMITATIONS 265

15.8 RISK ASSESSMENT 265

16 ADJACENT & RELATED MARKETS 266

16.1 INTRODUCTION 266

16.2 LIMITATIONS 266

16.3 BASE OIL MARKET 266

16.3.1 MARKET DEFINITION 266

16.3.2 MARKET OVERVIEW 267

16.4 BASE OIL MARKET, BY REGION 267

16.4.1 ASIA PACIFIC 267

16.4.2 EUROPE 268

16.4.3 NORTH AMERICA 270

16.4.4 MIDDLE EAST & AFRICA 271

16.4.5 SOUTH AMERICA 272

17 APPENDIX 274

17.1 DISCUSSION GUIDE 274

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 276

17.3 CUSTOMIZATION OPTIONS 278

17.4 RELATED REPORTS 278

17.5 AUTHOR DETAILS 279

LIST OF TABLES

TABLE 1 MARINE LUBRICANTS MARKET: PORTER’S FIVE FORCES ANALYSIS 47

TABLE 2 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2021–2030 (USD BILLION) 47

TABLE 3 MARINE LUBRICANTS MARKET: ROLE IN ECOSYSTEM 52

TABLE 4 AVERAGE SELLING PRICE OF MARINE LUBRICANTS OFFERED BY KEY PLAYERS,

BY BASE OILS, 2024 (USD/KG) 53

TABLE 5 AVERAGE SELLING PRICE OF MARINE LUBRICANTS, BY REGION,

2023–2030 (USD/KG) 54

TABLE 6 EXPORT OF MARINE LUBRICANTS, BY REGION, 2020–2024 (USD BILLION) 55

TABLE 7 IMPORT OF MARINE LUBRICANTS, BY REGION, 2020–2024 (USD BILLION) 56

TABLE 8 MARINE LUBRICANTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2026 56

TABLE 9 TARIFF RATES 59

TABLE 10 PATENT STATUS: PATENT APPLICATIONS AND GRANTED PATENTS 65

TABLE 11 MAJOR PATENTS FOR MARINE LUBRICANTS 66

TABLE 12 PATENTS BY LUBRIZOL CORPORATION 67

TABLE 13 PATENTS BY BASF SE 67

TABLE 14 TOP 10 PATENT OWNERS IN US, 2015–2025 67

TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 71

TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 72

TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 73

TABLE 18 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 74

TABLE 19 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 74

TABLE 20 GLOBAL STANDARDS IN MARINE LUBRICANTS MARKET 75

TABLE 21 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN MARINE LUBRICANTS MARKET 77

TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT TYPE (%) 79

TABLE 23 KEY BUYING CRITERIA, BY PRODUCT TYPE 80

TABLE 24 MARINE LUBRICANTS MARKET: UNMET NEEDS IN KEY APPLICATIONS 81

TABLE 25 MARINE LUBRICANTS MARKET, BY SHIP TYPE, 2020–2024 (USD MILLION) 84

TABLE 26 MARINE LUBRICANTS MARKET, BY SHIP TYPE, 2025–2030 (USD MILLION) 85

TABLE 27 MARINE LUBRICANTS MARKET, BY SHIP TYPE, 2020–2024 (KILOTON) 85

TABLE 28 MARINE LUBRICANTS MARKET, BY SHIP TYPE, 2025–2030 (KILOTON) 85

TABLE 29 MARINE LUBRICANTS MARKET, BY PRODUCT TYPE, 2020–2024 (USD MILLION) 88

TABLE 30 MARINE LUBRICANTS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION) 89

TABLE 31 MARINE LUBRICANTS MARKET, BY PRODUCT TYPE, 2020–2024 (KILOTON) 89

TABLE 32 MARINE LUBRICANTS MARKET, BY PRODUCT TYPE, 2025–2030 (KILOTON) 89

TABLE 33 ENGINE OIL: MARINE LUBRICANTS MARKET, BY REGION,

2020–2024 (USD MILLION) 90

TABLE 34 ENGINE OIL: MARINE LUBRICANTS MARKET, BY REGION,

2025–2030 (USD MILLION) 90

TABLE 35 ENGINE OIL: MARINE LUBRICANTS MARKET, BY REGION, 2020–2024 (KILOTON) 91

TABLE 36 ENGINE OIL: MARINE LUBRICANTS MARKET, BY REGION, 2025–2030 (KILOTON) 91

TABLE 37 HYDRAULIC FLUID: MARINE LUBRICANTS MARKET, BY REGION,

2020–2024 (USD MILLION) 92

TABLE 38 HYDRAULIC FLUID: MARINE LUBRICANTS MARKET, BY REGION,

2025–2030 (USD MILLION) 92

TABLE 39 HYDRAULIC FLUID: MARINE LUBRICANTS MARKET, BY REGION,

2020–2024 (KILOTON) 92

TABLE 40 HYDRAULIC FLUID: MARINE LUBRICANTS MARKET, BY REGION,

2025–2030 (KILOTON) 93

TABLE 41 COMPRESSOR OIL: MARINE LUBRICANTS MARKET, BY REGION,

2020–2024 (USD MILLION) 93

TABLE 42 COMPRESSOR OIL: MARINE LUBRICANTS MARKET, BY REGION,

2025–2030 (USD MILLION) 94

TABLE 43 COMPRESSOR OIL: MARINE LUBRICANTS MARKET, BY REGION,

2020–2024 (KILOTON) 94

TABLE 44 COMPRESSOR OIL: MARINE LUBRICANTS MARKET, BY REGION,

2025–2030 (KILOTON) 94

TABLE 45 OTHER PRODUCT TYPES: MARINE LUBRICANTS MARKET, BY REGION,

2020–2024 (USD MILLION) 95

TABLE 46 OTHER PRODUCT TYPES: MARINE LUBRICANTS MARKET, BY REGION,

2025–2030 (USD MILLION) 95

TABLE 47 OTHER PRODUCT TYPES: MARINE LUBRICANTS MARKET, BY REGION,

2020–2024 (KILOTON) 96

TABLE 48 OTHER PRODUCT TYPES: MARINE LUBRICANTS MARKET, BY REGION,

2025–2030 (KILOTON) 96

TABLE 49 MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 98

TABLE 50 MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 98

TABLE 51 MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 99

TABLE 52 MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 99

TABLE 53 MINERAL OIL: MARINE LUBRICANTS MARKET, BY REGION,

2020–2024 (USD MILLION) 100

TABLE 54 MINERAL OIL: MARINE LUBRICANTS MARKET, BY REGION,

2025–2030 (USD MILLION) 100

TABLE 55 MINERAL OIL: MARINE LUBRICANTS MARKET, BY REGION, 2020–2024 (KILOTON) 100

TABLE 56 MINERAL OIL: MARINE LUBRICANTS MARKET, BY REGION, 2025–2030 (KILOTON) 101

TABLE 57 SYNTHETIC OIL: MARINE LUBRICANTS MARKET, BY REGION,

2020–2024 (USD MILLION) 101

TABLE 58 SYNTHETIC OIL: MARINE LUBRICANTS MARKET, BY REGION,

2025–2030 (USD MILLION) 101

TABLE 59 SYNTHETIC OIL: MARINE LUBRICANTS MARKET, BY REGION,

2020–2024 (KILOTON) 102

TABLE 60 SYNTHETIC OIL: MARINE LUBRICANTS MARKET, BY REGION,

2025–2030 (KILOTON) 102

TABLE 61 BIO-BASED OIL: MARINE LUBRICANTS MARKET, BY REGION,

2020–2024 (USD MILLION) 103

TABLE 62 BIO-BASED OIL: MARINE LUBRICANTS MARKET, BY REGION,

2025–2030 (USD MILLION) 103

TABLE 63 BIO-BASED OIL: MARINE LUBRICANTS MARKET, BY REGION,

2020–2024 (KILOTON) 103

TABLE 64 BIO-BASED OIL: MARINE LUBRICANTS MARKET, BY REGION,

2025–2030 (KILOTON) 104

TABLE 65 MARINE LUBRICANTS MARKET, BY REGION, 2020–2024 (USD MILLION) 106

TABLE 66 MARINE LUBRICANTS MARKET, BY REGION, 2025–2030 (USD MILLION) 107

TABLE 67 MARINE LUBRICANTS MARKET, BY REGION, 2020–2024 (KILOTON) 107

TABLE 68 MARINE LUBRICANTS MARKET, BY REGION, 2025–2030 (KILOTON) 107

TABLE 69 ASIA PACIFIC: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (USD MILLION) 109

TABLE 70 ASIA PACIFIC: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (USD MILLION) 109

TABLE 71 ASIA PACIFIC: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 109

TABLE 72 ASIA PACIFIC: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 109

TABLE 73 ASIA PACIFIC: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE,

2020–2024 (USD MILLION) 110

TABLE 74 ASIA PACIFIC: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE,

2025–2030 (USD MILLION) 110

TABLE 75 ASIA PACIFIC: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE,

2020–2024 (KILOTON) 110

TABLE 76 ASIA PACIFIC: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE,

2025–2030 (KILOTON) 111

TABLE 77 ASIA PACIFIC: MARINE LUBRICANTS MARKET, BY COUNTRY,

2020–2024 (USD MILLION) 111

TABLE 78 ASIA PACIFIC: MARINE LUBRICANTS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 111

TABLE 79 ASIA PACIFIC: MARINE LUBRICANTS MARKET, BY COUNTRY,

2020–2024 (KILOTON) 112

TABLE 80 ASIA PACIFIC: MARINE LUBRICANTS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 112

TABLE 81 CHINA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 113

TABLE 82 CHINA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 113

TABLE 83 CHINA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 114

TABLE 84 CHINA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 114

TABLE 85 SINGAPORE: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (USD MILLION) 114

TABLE 86 SINGAPORE: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (USD MILLION) 115

TABLE 87 SINGAPORE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 115

TABLE 88 SINGAPORE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 115

TABLE 89 HONG KONG: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (USD MILLION) 116

TABLE 90 HONG KONG: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (USD MILLION) 116

TABLE 91 HONG KONG: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 116

TABLE 92 HONG KONG: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 117

TABLE 93 SOUTH KOREA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (USD MILLION) 117

TABLE 94 SOUTH KOREA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (USD MILLION) 117

TABLE 95 SOUTH KOREA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (KILOTON) 118

TABLE 96 SOUTH KOREA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (KILOTON) 118

TABLE 97 MALAYSIA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (USD MILLION) 118

TABLE 98 MALAYSIA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (USD MILLION) 119

TABLE 99 MALAYSIA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 119

TABLE 100 MALAYSIA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 119

TABLE 101 JAPAN: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 120

TABLE 102 JAPAN: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 120

TABLE 103 JAPAN: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 120

TABLE 104 JAPAN: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 121

TABLE 105 TAIWAN: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 121

TABLE 106 TAIWAN: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 121

TABLE 107 TAIWAN: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 122

TABLE 108 TAIWAN: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 122

TABLE 109 INDIA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 123

TABLE 110 INDIA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 123

TABLE 111 INDIA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 123

TABLE 112 INDIA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 123

TABLE 113 AUSTRALIA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (USD MILLION) 124

TABLE 114 AUSTRALIA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (USD MILLION) 124

TABLE 115 AUSTRALIA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 125

TABLE 116 AUSTRALIA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 125

TABLE 117 NORTH AMERICA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (USD MILLION) 126

TABLE 118 NORTH AMERICA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (USD MILLION) 126

TABLE 119 NORTH AMERICA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (KILOTON) 127

TABLE 120 NORTH AMERICA: MARINE LUBRICANTS MARKET, BY BASE OIL

2025–2030 (KILOTON) 127

TABLE 121 NORTH AMERICA: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE,

2020–2024 (USD MILLION) 127

TABLE 122 NORTH AMERICA: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE,

2025–2030 (USD MILLION) 128

TABLE 123 NORTH AMERICA: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE,

2020–2024 (KILOTON) 128

TABLE 124 NORTH AMERICA: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE,

2025–2030 (KILOTON) 128

TABLE 125 NORTH AMERICA: MARINE LUBRICANTS MARKET, BY COUNTRY,

2020–2024 (USD MILLION) 129

TABLE 126 NORTH AMERICA: MARINE LUBRICANTS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 129

TABLE 127 NORTH AMERICA: MARINE LUBRICANTS MARKET, BY COUNTRY,

2020–2024 (KILOTON) 129

TABLE 128 NORTH AMERICA: MARINE LUBRICANTS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 129

TABLE 129 US: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 130

TABLE 130 US: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 130

TABLE 131 US: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 131

TABLE 132 US: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 131

TABLE 133 CANADA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 131

TABLE 134 CANADA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 132

TABLE 135 CANADA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 132

TABLE 136 CANADA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 132

TABLE 137 MEXICO: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 133

TABLE 138 MEXICO: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 133

TABLE 139 MEXICO: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 133

TABLE 140 MEXICO: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 133

TABLE 141 EUROPE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 134

TABLE 142 EUROPE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 135

TABLE 143 EUROPE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 135

TABLE 144 EUROPE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 135

TABLE 145 EUROPE: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE,

2020–2024 (USD MILLION) 136

TABLE 146 EUROPE: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE,

2025–2030 (USD MILLION) 136

TABLE 147 EUROPE: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE,

2020–2024 (KILOTON) 136

TABLE 148 EUROPE: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE,

2025–2030 (KILOTON) 137

TABLE 149 EUROPE: MARINE LUBRICANTS MARKET, BY COUNTRY,

2020–2024 (USD MILLION) 137

TABLE 150 EUROPE: MARINE LUBRICANTS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 138

TABLE 151 EUROPE: MARINE LUBRICANTS MARKET, BY COUNTRY, 2020–2024 (KILOTON) 138

TABLE 152 EUROPE: MARINE LUBRICANTS MARKET, BY COUNTRY, 2025–2030 (KILOTON) 139

TABLE 153 GERMANY: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (USD MILLION) 139

TABLE 154 GERMANY: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (USD MILLION) 140

TABLE 155 GERMANY: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 140

TABLE 156 GERMANY: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 140

TABLE 157 NETHERLANDS: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (USD MILLION) 141

TABLE 158 NETHERLANDS: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (USD MILLION) 141

TABLE 159 NETHERLANDS: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (KILOTON) 141

TABLE 160 NETHERLANDS: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (KILOTON) 142

TABLE 161 BELGIUM: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (USD MILLION) 142

TABLE 162 BELGIUM: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (USD MILLION) 142

TABLE 163 BELGIUM: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 143

TABLE 164 BELGIUM: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 143

TABLE 165 SPAIN: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 143

TABLE 166 SPAIN: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 144

TABLE 167 SPAIN: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 144

TABLE 168 SPAIN: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 144

TABLE 169 UK: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 145

TABLE 170 UK: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 145

TABLE 171 UK: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 145

TABLE 172 UK: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 146

TABLE 173 ITALY: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 146

TABLE 174 ITALY: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 146

TABLE 175 ITALY: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 147

TABLE 176 ITALY: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 147

TABLE 177 FRANCE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 148

TABLE 178 FRANCE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 148

TABLE 179 FRANCE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 148

TABLE 180 FRANCE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 149

TABLE 181 GREECE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 149

TABLE 182 GREECE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 149

TABLE 183 GREECE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 150

TABLE 184 GREECE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 150

TABLE 185 TURKEY: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 150

TABLE 186 TURKEY: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 151

TABLE 187 TURKEY: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 151

TABLE 188 TURKEY: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 151

TABLE 189 RUSSIA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 152

TABLE 190 RUSSIA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 152

TABLE 191 RUSSIA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 152

TABLE 192 RUSSIA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 153

TABLE 193 MIDDLE EAST & AFRICA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (USD MILLION) 153

TABLE 194 MIDDLE EAST & AFRICA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (USD MILLION) 153

TABLE 195 MIDDLE EAST & AFRICA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (KILOTON) 154

TABLE 196 MIDDLE EAST & AFRICA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (KILOTON) 154

TABLE 197 MIDDLE EAST & AFRICA: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE, 2020–2024 (USD MILLION) 154

TABLE 198 MIDDLE EAST & AFRICA: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION) 155

TABLE 199 MIDDLE EAST & AFRICA: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE, 2020–2024 (KILOTON) 155

TABLE 200 MIDDLE EAST & AFRICA: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE, 2025–2030 (KILOTON) 155

TABLE 201 MIDDLE EAST & AFRICA: MARINE LUBRICANTS MARKET, BY COUNTRY,

2020–2024 (USD MILLION) 156

TABLE 202 MIDDLE EAST & AFRICA: MARINE LUBRICANTS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 156

TABLE 203 MIDDLE EAST & AFRICA: MARINE LUBRICANTS MARKET, BY COUNTRY,

2020–2024 (KILOTON) 156

TABLE 204 MIDDLE EAST & AFRICA: MARINE LUBRICANTS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 157

TABLE 205 UAE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 157

TABLE 206 UAE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 157

TABLE 207 UAE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 158

TABLE 208 UAE: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 158

TABLE 209 SAUDI ARABIA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (USD MILLION) 159

TABLE 210 SAUDI ARABIA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (USD MILLION) 159

TABLE 211 SAUDI ARABIA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (KILOTON) 159

TABLE 212 SAUDI ARABIA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (KILOTON) 159

TABLE 213 SOUTH AFRICA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (USD MILLION) 160

TABLE 214 SOUTH AFRICA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (USD MILLION) 160

TABLE 215 SOUTH AFRICA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (KILOTON) 161

TABLE 216 SOUTH AFRICA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (KILOTON) 161

TABLE 217 SOUTH AMERICA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (USD MILLION) 161

TABLE 218 SOUTH AMERICA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (USD MILLION) 162

TABLE 219 SOUTH AMERICA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (KILOTON) 162

TABLE 220 SOUTH AMERICA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (KILOTON) 162

TABLE 221 SOUTH AMERICA: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE,

2020–2024 (USD MILLION) 163

TABLE 222 SOUTH AMERICA: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE,

2025–2030 (USD MILLION) 163

TABLE 223 SOUTH AMERICA: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE,

2020–2024 (KILOTON) 163

TABLE 224 SOUTH AMERICA: MARINE LUBRICANTS MARKET, BY PRODUCT TYPE,

2025–2030 (KILOTON) 164

TABLE 225 SOUTH AMERICA: MARINE LUBRICANTS MARKET, BY COUNTRY,

2020–2024 (USD MILLION) 164

TABLE 226 SOUTH AMERICA: MARINE LUBRICANTS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 164

TABLE 227 SOUTH AMERICA: MARINE LUBRICANTS MARKET, BY COUNTRY,

2020–2024 (KILOTON) 165

TABLE 228 SOUTH AMERICA: MARINE LUBRICANTS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 165

TABLE 229 BRAZIL: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (USD MILLION) 165

TABLE 230 BRAZIL: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (USD MILLION) 166

TABLE 231 BRAZIL: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 166

TABLE 232 BRAZIL: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 166

TABLE 233 PANAMA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (USD MILLION) 167

TABLE 234 PANAMA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (USD MILLION) 167

TABLE 235 PANAMA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 167

TABLE 236 PANAMA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 168

TABLE 237 ARGENTINA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2020–2024 (USD MILLION) 168

TABLE 238 ARGENTINA: MARINE LUBRICANTS MARKET, BY BASE OIL,

2025–2030 (USD MILLION) 168

TABLE 239 ARGENTINA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2020–2024 (KILOTON) 169

TABLE 240 ARGENTINA: MARINE LUBRICANTS MARKET, BY BASE OIL, 2025–2030 (KILOTON) 169

TABLE 241 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2025 170

TABLE 242 MARINE LUBRICANTS MARKET: DEGREE OF COMPETITION, 2024 172

TABLE 243 REGIONAL FOOTPRINT, 2024 176

TABLE 244 SHIP TYPE FOOTPRINT, 2024 177

TABLE 245 PRODUCT TYPE FOOTPRINT, 2024 178

TABLE 246 LIST OF START-UPS/SMES, 2024 180

TABLE 247 COMPETITIVE BENCHMARKING OF START-UPS/SMES, 2024 181

TABLE 248 MARINE LUBRICANTS MARKET: PRODUCT LAUNCHES, JANUARY 2020–SEPTEMBER 2025 183

TABLE 249 MARINE LUBRICANTS MARKET: DEALS, JANUARY 2020– SEPTEMBER 2025 184

TABLE 250 MARINE LUBRICANTS MARKET: EXPANSIONS, JANUARY 2020–DECEMBER 2025 186

TABLE 251 BP P.L.C.: COMPANY OVERVIEW 188

TABLE 252 BP P.L.C.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 189

TABLE 253 BP P.L.C.: PRODUCT LAUNCHES 191

TABLE 254 BP P.L.C.: EXPANSIONS 191

TABLE 255 CHEVRON CORPORATION: COMPANY OVERVIEW 193

TABLE 256 CHEVRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 194

TABLE 257 CHEVRON CORPORATION: PRODUCT LAUNCHES 196

TABLE 258 CHEVRON CORPORATION: DEALS 196

TABLE 259 CHEVRON CORPORATION: EXPANSIONS 197

TABLE 260 EXXON MOBIL CORPORATION: COMPANY OVERVIEW 198

TABLE 261 EXXON MOBIL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 199

TABLE 262 EXXON MOBIL CORPORATION: PRODUCT LAUNCHES 201

TABLE 263 EXXON MOBIL CORPORATION: DEALS 202

TABLE 264 EXXON MOBIL CORPORATION: EXPANSIONS 202

TABLE 265 SHELL PLC: COMPANY OVERVIEW 204

TABLE 266 SHELL PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED 205

TABLE 267 SHELL PLC: PRODUCT LAUNCHES 207

TABLE 268 SHELL PLC: EXPANSIONS 207

TABLE 269 SHELL PLC: DEALS 208

TABLE 270 TOTALENERGIES SE: COMPANY OVERVIEW 209

TABLE 271 TOTALENERGIES SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED 210

TABLE 272 TOTALENERGIES SE: PRODUCT LAUNCHES 211

TABLE 273 TOTALENERGIES SE: EXPANSIONS 212

TABLE 274 TOTALENERGIES SE: DEALS 212

TABLE 275 PETRONAS: COMPANY OVERVIEW 214

TABLE 276 PETRONAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED 215

TABLE 277 PETRONAS: PRODUCT LAUNCHES 216

TABLE 278 IDEMITSU KOSAN CO., LTD: COMPANY OVERVIEW 217

TABLE 279 IDEMITSU KOSAN CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED 218

TABLE 280 CHINA PETROLEUM & CHEMICAL CORPORATION: COMPANY OVERVIEW 220

TABLE 281 CHINA PETROLEUM & CHEMICAL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 221

TABLE 282 CHINA PETROLEUM & CHEMICAL CORPORATION: EXPANSIONS 222

TABLE 283 PETROCHINA COMPANY LIMITED: COMPANY OVERVIEW 223

TABLE 284 PETROCHINA COMPANY LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED 224

TABLE 285 FUCHS SE: COMPANY OVERVIEW 226

TABLE 286 FUCHS SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED 227

TABLE 287 FUCHS SE: PRODUCT LAUNCHES 228

TABLE 288 FUCHS SE: DEALS 229

TABLE 289 FUCHS SE: EXPANSIONS 229

TABLE 290 LUKOIL: COMPANY OVERVIEW 230

TABLE 291 LUKOIL: PRODUCTS/SOLUTIONS/SERVICES OFFERED 230

TABLE 292 LUKOIL: DEALS 231

TABLE 293 ENEOS HOLDINGS, INC.: COMPANY OVERVIEW 232

TABLE 294 ENEOS HOLDINGS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 233

TABLE 295 GULF OIL INTERNATIONAL LTD.: COMPANY OVERVIEW 234

TABLE 296 GULF OIL INTERNATIONAL LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 234

TABLE 297 GULF OIL INTERNATIONAL LTD.: PRODUCT LAUNCHES 235

TABLE 298 EMIRATES NATIONAL OIL COMPANY (ENOC): COMPANY OVERVIEW 236

TABLE 299 EMIRATES NATIONAL OIL COMPANY (ENOC): PRODUCTS/SOLUTIONS/SERVICES OFFERED 236

TABLE 300 EMIRATES NATIONAL OIL COMPANY (ENOC): PRODUCT LAUNCHES 237

TABLE 301 EMIRATES NATIONAL OIL COMPANY (ENOC): DEALS 237

TABLE 302 ENI S.P.A.: COMPANY OVERVIEW 238

TABLE 303 ENI S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 239

TABLE 304 INDIAN OIL CORPORATION LIMITED: COMPANY OVERVIEW 240

TABLE 305 INDIAN OIL CORPORATION LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED 241

TABLE 306 INDIAN OIL CORPORATION LIMITED: DEALS 242

TABLE 307 MOEVE: COMPANY OVERVIEW 243

TABLE 308 MOEVE: PRODUCTS/SOLUTIONS/SERVICES OFFERED 244

TABLE 309 GAZPROM: COMPANY OVERVIEW 246

TABLE 310 GAZPROM: PRODUCTS/SOLUTIONS/SERVICES OFFERED 247

TABLE 311 CALUMET, INC.: COMPANY OVERVIEW 248

TABLE 312 CALUMET, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 249

TABLE 313 ADDINOL LUBE OIL GMBH: COMPANY OVERVIEW 250

TABLE 314 SK ENMOVE CO., LTD.: COMPANY OVERVIEW 251

TABLE 315 GANDHAR OIL REFINERY (INDIA) LIMITED: COMPANY OVERVIEW 251

TABLE 316 PENRITE OIL COMPANY: COMPANY OVERVIEW 252

TABLE 317 SCHAEFFER MANUFACTURING CO.: COMPANY OVERVIEW 253

TABLE 318 DYADE LUBRICANTS: COMPANY OVERVIEW 254

TABLE 319 KLÜBER LUBRICATION: COMPANY OVERVIEW 254

TABLE 320 ASIA PACIFIC: BASE OIL MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 267

TABLE 321 ASIA PACIFIC: BASE OIL MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 267

TABLE 322 ASIA PACIFIC: BASE OIL MARKET, BY COUNTRY, 2021–2024 (KILOTON) 268

TABLE 323 ASIA PACIFIC: BASE OIL MARKET, BY COUNTRY, 2025–2030 (KILOTON) 268

TABLE 324 EUROPE: BASE OIL MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 268

TABLE 325 EUROPE: BASE OIL MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 269

TABLE 326 EUROPE: BASE OIL MARKET, BY COUNTRY, 2021–2024 (KILOTON) 269

TABLE 327 EUROPE: BASE OIL MARKET, BY COUNTRY, 2025–2030 (KILOTON) 269

TABLE 328 NORTH AMERICA: BASE OIL MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 270

TABLE 329 NORTH AMERICA: BASE OIL MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 270

TABLE 330 NORTH AMERICA: BASE OIL MARKET, BY COUNTRY, 2021–2024 (KILOTON) 270

TABLE 331 NORTH AMERICA: BASE OIL MARKET, BY COUNTRY, 2025–2030 (KILOTON) 270

TABLE 332 MIDDLE EAST & AFRICA: BASE OIL MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 271

TABLE 333 MIDDLE EAST & AFRICA: BASE OIL MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 271

TABLE 334 MIDDLE EAST & AFRICA: BASE OIL MARKET, BY COUNTRY, 2021–2024 (KILOTON) 271

TABLE 335 MIDDLE EAST & AFRICA: BASE OIL MARKET, BY COUNTRY, 2025–2030 (KILOTON) 272

TABLE 336 SOUTH AMERICA: BASE OIL MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 272

TABLE 337 SOUTH AMERICA: BASE OIL MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 272

TABLE 338 SOUTH AMERICA: BASE OIL MARKET, BY COUNTRY, 2021–2024 (KILOTON) 273

TABLE 339 SOUTH AMERICA: BASE OIL MARKET, BY COUNTRY, 2025–2030 (KILOTON) 273

LIST OF FIGURES

FIGURE 1 MARINE LUBRICANTS MARKET SEGMENTATION 28

FIGURE 2 KEY INSIGHTS AND MARKET SCENARIO 32

FIGURE 3 GLOBAL MARINE LUBRICANTS MARKET, 2021–2030 33

FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN MARINE LUBRICANTS MARKET 33

FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF MARINE LUBRICANTS MARKET 34

FIGURE 6 HIGH-GROWTH SEGMENTS IN MARINE LUBRICANTS MARKET 35

FIGURE 7 ASIA PACIFIC TO BE LARGEST AND FASTEST-GROWING REGION DURING FORECAST PERIOD 36

FIGURE 8 STRONG GROWTH IN SEABORNE TRADE TO DRIVE MARKET 37

FIGURE 9 MINERAL OIL AND ASIA PACIFIC WERE LEADING SEGMENTS IN 2024 37

FIGURE 10 COMPRESSOR OIL TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD 38

FIGURE 11 INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD 38

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MARINE LUBRICANTS MARKET 39

FIGURE 13 MARINE LUBRICANTS MARKET: PORTER’S FIVE FORCES ANALYSIS 45

FIGURE 14 MARINE LUBRICANTS MARKET: SUPPLY CHAIN ANALYSIS 49

FIGURE 15 MARINE LUBRICANTS MARKET: KEY PARTICIPANTS IN ECOSYSTEM 51

FIGURE 16 MARINE LUBRICANTS MARKET: ECOSYSTEM ANALYSIS 51

FIGURE 17 AVERAGE SELLING PRICE OF MARINE LUBRICANTS OFFERED BY KEY PLAYERS,

BY TOP THREE BASE OILS, 2024 53

FIGURE 18 AVERAGE SELLING PRICE TREND OF MARINE LUBRICANTS, BY REGION,

2023–2030 54

FIGURE 19 EXPORT DATA FOR HS CODE- 2710-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020–2024 55

FIGURE 20 IMPORT DATA FOR HS CODE – 2710-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020–2024 56

FIGURE 21 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 57

FIGURE 22 PATENTS REGISTERED, 2015–2025 65

FIGURE 23 LIST OF MAJOR PATENTS FOR BLACK MASTERBATCH 66

FIGURE 24 LEGAL STATUS OF PATENTS FILED IN MARINE LUBRICANTS MARKET 68

FIGURE 25 MAXIMUM PATENTS FILED IN JURISDICTION OF US 68

FIGURE 26 IMPACT OF AI/GEN AI ON MARINE LUBRICANTS MARKET 69

FIGURE 27 MARINE LUBRICANTS MARKET: DECISION-MAKING FACTORS 78

FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT TYPE 79

FIGURE 29 KEY BUYING CRITERIA, BY PRODUCT TYPE 80

FIGURE 30 ADOPTION BARRIERS & INTERNAL CHALLENGES 81

FIGURE 31 BULK CARRIERS TO LEAD MARINE LUBRICANTS MARKET DURING FORECAST PERIOD 84

FIGURE 32 ENGINE OIL TO LEAD MARINE LUBRICANTS MARKET DURING FORECAST PERIOD 88

FIGURE 33 MINERAL OIL IS PROJECTED TO LEAD MARINE LUBRICANTS MARKET DURING FORECAST PERIOD 98

FIGURE 34 ASIA PACIFIC TO LEAD MARINE LUBRICANTS MARKET BETWEEN 2025 AND 2030 106

FIGURE 35 ASIA PACIFIC: MARINE LUBRICANTS MARKET SNAPSHOT 108

FIGURE 36 NORTH AMERICA: MARINE LUBRICANTS MARKET SNAPSHOT 126

FIGURE 37 EUROPE: MARINE LUBRICANTS MARKET SNAPSHOT 134

FIGURE 38 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024 172

FIGURE 39 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020–2024 (USD MILLION) 174

FIGURE 40 COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024 175

FIGURE 41 COMPANY FOOTPRINT, 2024 176

FIGURE 42 COMPANY EVALUATION MATRIX, START-UPS/SMES, 2024 180

FIGURE 43 PRODUCT COMPARISON 181

FIGURE 44 FINANCIAL METRICS (EV/EBITDA), 2026 182

FIGURE 45 COMPANY VALUATION, 2026 182

FIGURE 46 BP P.L.C.: COMPANY SNAPSHOT 189

FIGURE 47 CHEVRON CORPORATION: COMPANY SNAPSHOT 194

FIGURE 48 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT 199

FIGURE 49 SHELL PLC: COMPANY SNAPSHOT 205

FIGURE 50 TOTALENERGIES SE: COMPANY SNAPSHOT 210

FIGURE 51 PETRONAS: COMPANY SNAPSHOT 215

FIGURE 52 IDEMITSU KOSAN CO., LTD: COMPANY SNAPSHOT 218

FIGURE 53 CHINA PETROLEUM & CHEMICAL CORPORATION: COMPANY SNAPSHOT 221

FIGURE 54 PETROCHINA COMPANY LIMITED: COMPANY SNAPSHOT 224

FIGURE 55 FUCHS SE: COMPANY SNAPSHOT 227

FIGURE 56 ENEOS HOLDINGS, INC.: COMPANY SNAPSHOT 232

FIGURE 57 ENI S.P.A.: COMPANY SNAPSHOT 239

FIGURE 58 INDIAN OIL CORPORATION LIMITED: COMPANY SNAPSHOT 241

FIGURE 59 MOEVE: COMPANY SNAPSHOT 244

FIGURE 60 GAZPROM: COMPANY SNAPSHOT 246

FIGURE 61 CALUMET, INC.: COMPANY SNAPSHOT 248

FIGURE 62 MARINE LUBRICANTS MARKET: RESEARCH DESIGN 255

FIGURE 63 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 1 (SUPPLY SIDE): COLLECTIVE MARKET SHARE OF KEY PLAYERS 259

FIGURE 64 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 2 (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS 259

FIGURE 65 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 3 (DEMAND SIDE) 260

FIGURE 66 TOP-DOWN APPROACH 260

FIGURE 67 CAGR PROJECTIONS FROM SUPPLY SIDE 261

FIGURE 68 GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS 262

FIGURE 69 DATA TRIANGULATION 263