Process Oil Market - Global Forecast To 2030

Process Oil Market by Type (Aromatic, Paraffinic, Naphthenic, Non-Carcinogenic), Application (Tire & Rubber, Polymer, Personal Care, Textile), Function (Extender Oil, Plasticizer, Solvent, Defoamer), and Region - Global Forecast to 2030

プロセスオイル市場 - タイプ(芳香族、パラフィン系、ナフテン系、非発がん性)、用途(タイヤ・ゴム、ポリマー、パーソナルケア、繊維)、機能(伸展油、可塑剤、溶剤、消泡剤)、地域別 - 2030年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年02月 |

| ページ数 | 272 |

| 図表数 | 337 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-13800 |

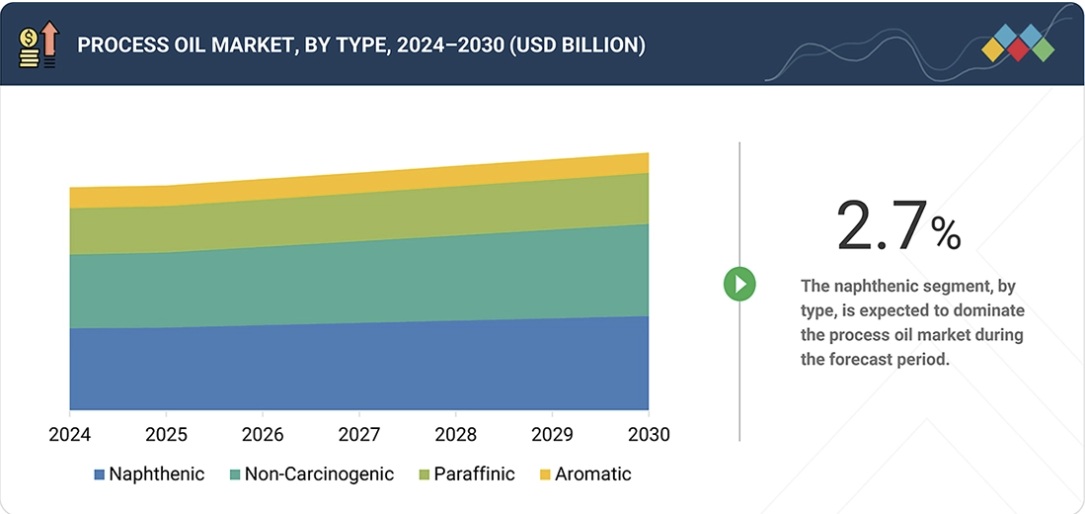

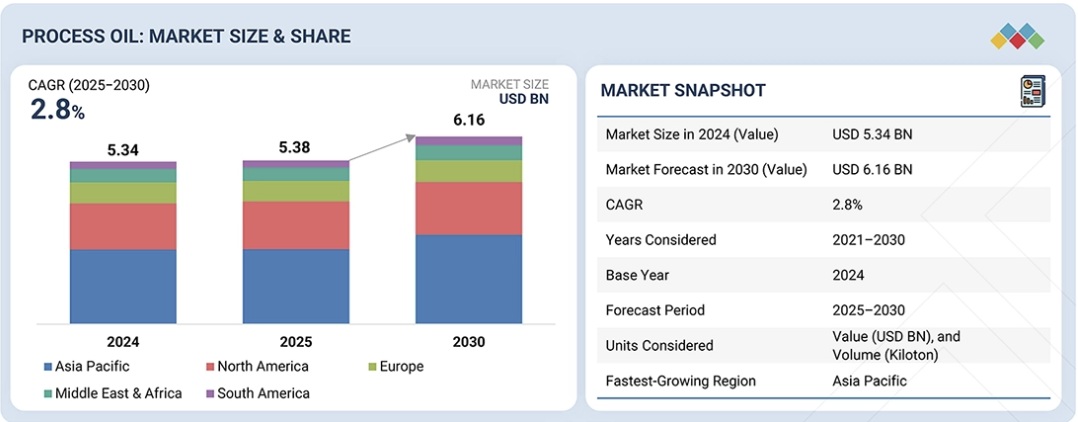

世界のプロセスオイル市場は、予測期間中に2.8%のCAGRで成長し、2025年の53億8,000万米ドルから2030年には61億6,000万米ドルに達すると予測されています。プロセスオイルは、複数の業界において、材料の性能、柔軟性、および加工性を向上させる上で重要な役割を果たしています。用途別に見ると、市場はタイヤ・ゴム、ポリマー、パーソナルケア、繊維、その他の用途に分類されます。オイルは、タイヤや工業用ゴム製品などの製品の弾力性、耐久性、および加工性を向上させます。ポリマーでは、消費財、工業部品、包装材料の可塑化と加工性を向上させます。パーソナルケアでは、プロセスオイルを使用して、クリーム、ローション、化粧品の質感、エモリエント特性、および保湿性を向上させます。繊維では、繊維や織物の潤滑剤および仕上げ剤として機能します。接着剤、コーティング、塗料、インクなどの他の用途では、オイルが作業性と性能を最適化します。市場の成長は、自動車業界や消費財業界からの需要の増加、より安全な非発がん性オイルへの規制の重点、そして高純度で持続可能な代替品を提供するガス・ツー・リキッド(GTL)やバイオベースオイルなどの技術革新によって推進されています。

調査範囲:

本レポートは、プロセスオイル市場を種類、用途、機能、生産技術、原料、エンドユーザー、地域に基づいてセグメント化しています。市場の成長に影響を与える主要要因(牽引要因、制約要因、機会、課題など)に関する詳細な情報を提供しています。プロセスオイルメーカーを戦略的にプロファイルし、市場シェアとコアコンピテンシーを包括的に分析しています。

本レポートを購入する理由:

本レポートは、プロセスオイル市場とそのセグメントの収益数値に最も近い概算値を提供することで、市場リーダー/新規参入企業を支援することが期待されています。また、本レポートは、市場関係者が市場の競争環境をより深く理解し、事業ポジションを向上させるための洞察を引き出し、適切な市場参入戦略を策定するのに役立つことが期待されています。さらに、市場動向を把握し、主要な市場牽引要因、制約要因、課題、機会に関する情報を提供することで、市場関係者を支援します。

本レポートでは、以下の点について考察しています。

重要な推進要因(タイヤ製造およびポリマー加工産業の成長によるプロセスオイルの安定した需要の維持、工業化と都市化によるプラスチック、接着剤、その他プロセスオイルを必要とする材料の使用増加)、制約要因(高PAH芳香族油の規制により、特定の従来グレードの使用が減少、特定の用途における植物油および合成代替油への移行増加)、機会(低PAH、水素化処理、環境に優しいプロセスオイルの需要増加)、課題(原油価格の変動により、コスト安定性と生産計画に継続的な課題が生じている)の分析

- 製品開発/イノベーション:プロセスオイル市場における今後の技術と研究開発活動に関する詳細な洞察

- 市場開発:収益性の高い市場に関する包括的な情報 – 本レポートでは、様々な地域のプロセスオイル市場を分析しています。

- 競合評価:プロセスオイル市場におけるエクソンモービル社(米国)、シェブロン社(米国)、シェル社(英国)、ペトロリアム・ナショナル・ベルハド(ペトロナス)(マレーシア)、出光興産株式会社(日本)などの主要企業の市場シェア、成長戦略、製品ラインナップに関する詳細な評価

Report Description

The global process oil market is projected to grow from USD 5.38 billion in 2025 to USD 6.16 billion in 2030, at a CAGR of 2.8% during the forecast period. Process oils play a vital role in enhancing the performance, flexibility, and processability of materials across multiple industries. By application, the market is segmented into tire & rubber, polymer, personal care, textile, and other applications. Oils improve elasticity, durability, and processing of products such as tires and industrial rubber goods. In polymers, they enhance plasticization and processability for consumer goods, industrial components, and packaging materials. Personal care uses process oils to improve texture, emollient properties, and moisturization in creams, lotions, and cosmetics. In textiles, they act as lubricants and finishing agents for fibers and fabrics; in other applications, such as adhesives, coatings, paints, and inks, oils optimize workability and performance. Market growth is driven by rising demand from the automotive and consumer goods industries, regulatory focus on safer non-carcinogenic oils, and technological innovations such as gas-to-liquid (GTL) and bio-based oils, offering high purity and sustainable alternatives.

Process Oil Market – Global Forecast To 2030

“By type, the non-carcinogenic segment is expected to account for the second-largest share during the forecast period, in terms of value.”

Non-carcinogenic process oils are refined oils that deliver high performance while minimizing health risks associated with conventional aromatic oils. By type, Non-Carcinogenic process oils account for the second-largest share of the global process oil market during the forecast period, reflecting their widespread use across industries. They are applied in Tire & Rubber, Polymer, and Other Applications, enhancing elasticity, durability, and processability. In Tire & Rubber, Non-Carcinogenic process oils improve the performance and flexibility of tires and industrial rubber products. In Polymer applications, they aid in plasticization, softness, and handling of engineering and commodity plastics. Market growth is driven by regulatory emphasis on safe chemicals, rising adoption in automotive and consumer goods, growing awareness of occupational safety, and technological advancements in high-purity, non-toxic oils.

“By application, the polymer segment will account for the second-largest market share during the forecast period.”

The polymer segment, by application, accounts for the second-largest share of the global process oil market during the forecast period. Process oils in this segment are used to enhance flexibility, plasticization, softness, and processability of polymer materials, improving manufacturing efficiency and the quality of finished products. In polymer applications, these oils support the production of plastics for consumer goods, industrial components, and packaging, ensuring that the resulting materials are durable, easy to handle, and meet performance requirements. The growth of the Polymer segment drives the overall process oil market by creating consistent demand from industries that rely on high-performance plastics. Additionally, increased focus on regulatory compliance, material safety, and technological advancements in high-purity, sustainable process oils is further strengthening market adoption.

Process Oil Market – Global Forecast To 2030 – region

“North America is projected to account for the second-largest market share during the forecast period.”

North America accounts for the second-largest share of the global process oil market during the forecast period. The region’s demand is supported by extensive applications across Tire & Rubber, Polymer, Personal Care, Textile, and Other Applications, where process oils enhance flexibility, durability, plasticization, and processability of materials. In tire & rubber, oils improve the elasticity and performance of tires and industrial rubber products. In Polymer applications, they aid in softening, plasticization, and handling of plastics used in consumer goods, packaging, and industrial components. Personal Care applications benefit from oils that improve texture, enhance emollient properties, and enhance product performance, while in textile applications, they serve as lubricants and finishing agents for fibers and fabrics. Other applications include adhesives, coatings, paints, and inks, where oils optimize workability and quality. Market growth in North America is driven by strong industrial activity in the automotive, manufacturing, and consumer goods sectors, combined with increased regulatory focus on non-carcinogenic, sustainable oils. Technological advancements in high-purity, bio-based oils further strengthen adoption, enabling manufacturers to meet performance, safety, and environmental requirements efficiently.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 – 65%, Tier 2 – 20%, and Tier 3 – 15%

- By Designation: Directors – 25%, Managers – 30%, and Others – 45%

- By Region: North America – 30%, Asia Pacific – 40%, Europe – 20%, Middle East & Africa – 7%, and South America – 3%

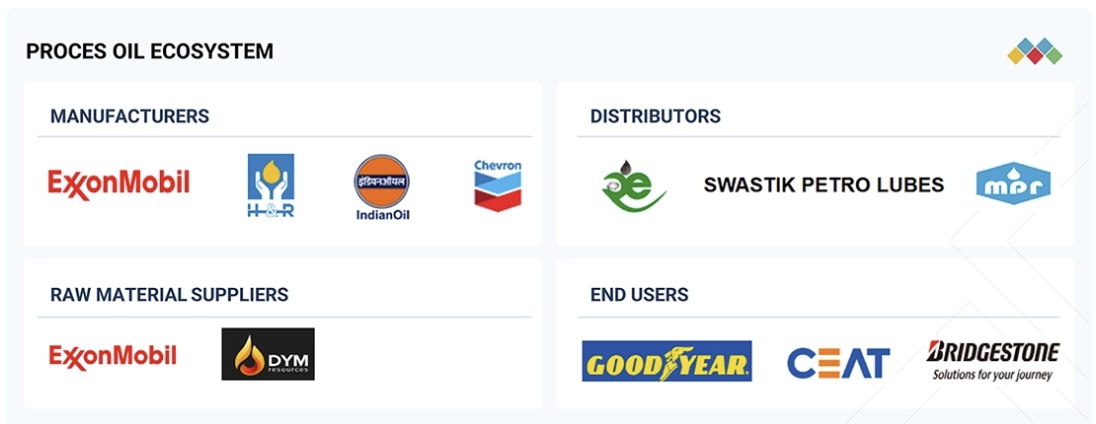

Exxon Mobil Corporation (US), Chevron Corporation (US), Shell (UK), Petroliam Nasional Berhad (PETRONAS) (Malaysia), and Idemitsu Kosan Co., Ltd. (Japan) are some of the major players operating in the process oil market.

Process Oil Market – Global Forecast To 2030 – ecosystem

Research Coverage:

The report segments the process oil market based on type, application, function, production technology, feedstock, end user, and region. It provides detailed information on the major factors influencing the market’s growth, including drivers, restraints, opportunities, and challenges. It strategically profiles process oil manufacturers, comprehensively analyzing their market shares and core competencies.

Reasons to Buy the Report:

The report is expected to help market leaders/new entrants by providing the closest approximations of revenue figures for the process oil market and its segments. This report is also expected to help stakeholders gain a better understanding of the market’s competitive landscape, develop insights to improve their businesses’ positions, and develop suitable go-to-market strategies. It also enables stakeholders to understand the market’s pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of critical Drivers (Growth in tire production and polymer-processing industries supporting steady demand for process oils; and Industrialization and urban growth increasing the use of plastics, adhesives, and other materials that rely on process oils), Restraints (Regulations limiting high-PAH aromatic oils reducing the use of certain traditional grades; and Increasing shift toward vegetable oils and synthetic alternatives in select applications), Opportunities (Rising demand for low-PAH, hydrotreated, and eco-friendly process oils), and Challenges (Crude-oil price volatility posing ongoing challenges to cost stability and production planning)

- Product Development/Innovation: Detailed insights on upcoming technologies and research & development activities in the process oil market

- Market Development: Comprehensive information about lucrative markets – the report analyses the process oil market across varied regions.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Exxon Mobil Corporation (US), Chevron Corporation (US), Shell (UK), Petroliam Nasional Berhad (PETRONAS) (Malaysia), and Idemitsu Kosan Co., Ltd. (Japan) in the process oil market

Table of Contents

1 INTRODUCTION 26

1.1 STUDY OBJECTIVES 26

1.2 MARKET DEFINITION 26

1.3 MARKET SCOPE 27

1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE 27

1.3.2 INCLUSIONS AND EXCLUSIONS 28

1.3.3 YEARS CONSIDERED 28

1.3.4 CURRENCY CONSIDERED 29

1.3.5 UNITS CONSIDERED 29

1.4 STAKEHOLDERS 29

1.5 SUMMARY OF CHANGES 30

2 EXECUTIVE SUMMARY 31

2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS 31

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 32

2.3 DISRUPTIVE TRENDS IN PROCESS OIL MARKET 33

2.4 HIGH GROWTH SEGMENTS 34

2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST 35

3 PREMIUM INSIGHTS 36

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PROCESS OIL MARKET 36

3.2 PROCESS OIL MARKET, BY FUNCTION AND REGION 37

3.3 PROCESS OIL MARKET, BY APPLICATION 37

3.4 PROCESS OIL MARKET, BY TYPE 38

3.5 PROCESS OIL MARKET, BY COUNTRY 38

4 MARKET OVERVIEW 39

4.1 INTRODUCTION 39

4.2 MARKET DYNAMICS 39

4.2.1 DRIVERS 40

4.2.1.1 Growth in tire production and polymer-processing industries supporting steady demand for process oils 40

4.2.1.2 Extensive use of plastics, adhesives, and other materials to increase demand 42

4.2.2 RESTRAINTS 42

4.2.2.1 Regulations limiting high-PAH aromatic oils, reducing use of certain traditional grades 42

4.2.2.2 Increasing shift toward vegetable oils and synthetic alternatives in select applications 43

4.2.3 OPPORTUNITIES 43

4.2.3.1 Rising demand for low-PAH, hydrotreated, and eco-friendly

process oils 43

4.2.4 CHALLENGES 43

4.2.4.1 Impact on cost and production planning due to crude

oil price volatility 43

4.3 UNMET NEEDS AND WHITE SPACES 44

4.3.1 UNMET NEEDS IN PROCESS OIL MARKET 44

4.3.2 WHITE SPACE OPPORTUNITIES 45

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 45

4.4.1 INTERCONNECTED MARKETS 45

4.4.2 CROSS-SECTOR OPPORTUNITIES 46

4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 46

4.5.1 KEY MOVES AND STRATEGIC FOCUS 47

5 INDUSTRY TRENDS 48

5.1 PORTER’S FIVE FORCES ANALYSIS 48

5.1.1 BARGAINING POWER OF SUPPLIERS 49

5.1.2 BARGAINING POWER OF BUYERS 49

5.1.3 THREAT OF NEW ENTRANTS 50

5.1.4 THREAT OF SUBSTITUTES 50

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 50

5.2 GLOBAL MACROECONOMIC OUTLOOK 51

5.2.1 INTRODUCTION 51

5.2.2 GDP TRENDS AND FORECAST 51

5.2.3 TRENDS IN GLOBAL PROCESS OIL INDUSTRY 53

5.3 SUPPLY CHAIN ANALYSIS 53

5.4 ECOSYSTEM ANALYSIS 55

5.5 PRICING ANALYSIS 56

5.5.1 AVERAGE SELLING PRICE TREND OF PROCESS OIL, BY REGION, 2022–2025 56

5.5.2 AVERAGE SELLING PRICE OF PROCESS OIL TYPE, BY KEY PLAYERS, 2025 57

5.6 TRADE ANALYSIS 58

5.6.1 IMPORT SCENARIO (HS CODE 2709) 58

5.6.2 EXPORT SCENARIO (HS CODE 2709) 59

5.7 KEY CONFERENCES AND EVENTS, 2025–2026 61

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 61

5.9 INVESTMENT AND FUNDING SCENARIO 62

5.10 CASE STUDY ANALYSIS 63

5.10.1 RRII(RUBBER RESEARCH INSTITUTE)–INDIAN OIL COLLABORATION ON ADVANCED PROCESS OIL APPLICATIONS 63

5.10.2 REPSOL’S BIOEXTENSOIL – A CIRCULAR AND HIGH-PERFORMANCE ALTERNATIVE TO MINERAL PROCESS OILS 63

5.10.3 SHELL FLAVEX 595 – ENABLING COMPLIANCE AND HIGH-PERFORMANCE TIRE MANUFACTURING 64

5.11 IMPACT OF 2025 US TARIFF – PROCESS OIL MARKET 65

5.11.1 KEY TARIFF RATES IMPACTING MARKET 65

5.11.2 PRICE IMPACT ANALYSIS 65

5.11.3 KEY IMPACT ON VARIOUS REGIONS 65

5.11.3.1 US 65

5.11.3.2 Europe 66

5.11.3.3 Asia Pacific 66

5.11.4 IMPACT ON END-USE INDUSTRIES OF PROCESS OIL 66

5.11.4.1 Tire & rubber industry 66

5.11.4.2 Personal care industry 66

5.11.4.3 Textile industry 66

5.11.4.4 Polymer industry 67

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS 68

6.1 KEY EMERGING TECHNOLOGIES 68

6.1.1 GREEN RUBBER PROCESS OIL 68

6.2 COMPLEMENTARY TECHNOLOGIES 69

6.2.1 BIO-BASED BASE OIL 69

6.3 TECHNOLOGY/PRODUCT ROADMAP 70

6.3.1 SHORT-TERM (2025–2027) | PROCESS EFFICIENCY & LOW-PCA TRANSITION 70

6.3.2 MID-TERM (2027–2030) | FORMULATION ADVANCEMENT & SPECIALTY GRADE EXPANSION 70

6.3.3 LONG-TERM (2030–2035+) | BIO-BASED TRANSITION &

NEXT-GEN PERFORMANCE OILS 71

6.4 PATENT ANALYSIS 72

6.4.1 METHODOLOGY 72

6.5 FUTURE APPLICATIONS 74

6.5.1 TIRE & RUBBER: IMPROVED FLEXIBILITY, SOFTENING, AND PROCESSING EFFICIENCY 75

6.5.2 POLYMER: ENHANCED MELT FLOW, DISPERSION, AND MOLDABILITY 75

6.5.3 PERSONAL CARE: ENHANCED SKIN FEEL AND FORMULATION STABILITY 76

6.5.4 TEXTILE: IMPROVED YARN LUBRICATION, SMOOTHNESS, AND FINISHING 76

6.6 IMPACT OF GENERATIVE AI ON PROCESS OIL MARKET 77

6.6.1 INTRODUCTION 77

6.6.2 AI-ENABLED PROCESS OPTIMIZATION 77

6.6.3 AI-DRIVEN PREDICTIVE MAINTENANCE AND RELIABILITY 77

6.6.4 AI-SUPPORTED QUALITY ASSURANCE AND PRODUCT CONSISTENCY 78

6.6.5 AI-ENHANCED SUPPLY CHAIN AND DEMAND FORECASTING 78

7 REGULATORY LANDSCAPE AND SUSTAINABILITY INITIATIVES 79

7.1 REGIONAL REGULATIONS AND COMPLIANCE 79

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 79

7.1.2 INDUSTRY STANDARDS 81

7.1.3 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 82

7.2 SUSTAINABILITY INITIATIVES 83

7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF PROCESS OIL 83

7.2.1.1 Carbon impact reduction 83

7.2.1.2 Eco-applications 83

7.3 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES 84

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 85

8.1 INTRODUCTION 85

8.2 DECISION-MAKING PROCESS 85

8.3 KEY STAKEHOLDERS AND BUYING CRITERIA 86

8.3.1 KEY STAKEHOLDERS IN BUYING PROCESS 86

8.3.2 BUYING CRITERIA 87

8.4 ADOPTION BARRIERS & INTERNAL CHALLENGES 88

8.5 UNMET NEEDS IN VARIOUS APPLICATIONS 90

8.6 MARKET PROFITABILITY 91

8.6.1 REVENUE POTENTIAL 91

8.6.2 COST DYNAMICS 91

8.6.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS 91

9 PROCESS OIL MARKET, BY FEEDSTOCK 92

9.1 INTRODUCTION 92

9.2 PETROLEUM 92

9.2.1 BROAD AVAILABILITY AND WELL-ESTABLISHED REFINING

INFRASTRUCTURE TO DRIVE MARKET 92

9.3 NATURAL GAS 92

9.3.1 EMERGING CLEANER ALTERNATIVES IN PROCESS OIL PRODUCTION

TO INCREASE DEMAND 92

9.4 COAL TAR 93

9.4.1 NICHE AROMATIC SOURCE FOR HIGH-SOLVENCY PROCESS OILS

TO PROPEL MARKET 93

10 PROCESS OIL MARKET, BY END USER 94

10.1 INTRODUCTION 94

10.2 AUTOMOTIVE 94

10.2.1 EXTENSIVE ROLE IN RUBBER AND POLYMER TO DRIVE MARKET 94

10.3 CONSTRUCTION 94

10.3.1 SUPPORTING DURABILITY AND FLEXIBILITY IN INFRASTRUCTURE

MATERIALS TO PROPEL MARKET 94

10.4 MANUFACTURING 95

10.4.1 BROAD-BASED CONSUMPTION ACROSS INDUSTRIAL PROCESSING ACTIVITIES TO INCREASE DEMAND 95

10.5 ENERGY 95

10.5.1 USE IN POWER GENERATION EQUIPMENT, ELECTRICAL INSULATION MATERIALS, AND SPECIALTY LUBRICATING SYSTEMS TO INCREASE DEMAND 95

10.6 PHARMACEUTICALS 95

10.6.1 USE IN OINTMENTS, CREAMS, GELS, AND MEDICAL-GRADE

ELASTOMERS TO PROPEL MARKET 95

10.7 OIL AND GAS 96

10.7.1 ENABLING PERFORMANCE AND RELIABILITY IN HARSH OPERATING ENVIRONMENTS TO DRIVE MARKET 96

11 PROCESS OIL MARKET, BY TYPE 97

11.1 INTRODUCTION 98

11.2 NAPHTHENIC 100

11.2.1 VERSATILITY AND RELIABLE PERFORMANCE ACROSS MULTIPLE MANUFACTURING APPLICATIONS 100

11.3 PARAFFINIC 101

11.3.1 NEED FOR CONSISTENT, RELIABLE, AND STABLE PROCESSING

IN HIGH-VOLUME MANUFACTURING TO DRIVE DEMAND 101

11.4 AROMATIC 103

11.4.1 ESTABLISHED USE IN TRADITIONAL RUBBER AND INDUSTRIAL MANUFACTURING 103

11.5 NON-CARCINOGENIC 105

11.5.1 GROWING EMPHASIS ON SAFETY, REGULATORY COMPLIANCE,

AND SUSTAINABLE PRACTICES 105

12 PROCESS OIL MARKET, BY PRODUCTION TECHNOLOGY 107

12.1 INTRODUCTION 107

12.2 CONVENTION ROUTE 107

12.2.1 ESTABLISHED REFINING INFRASTRUCTURE AND RELIABLE

LARGE-SCALE SUPPLY 107

12.3 GAS-TO-LIQUID (GTL) 107

12.3.1 DEMAND FOR HIGH-PURITY, PERFORMANCE-CONSISTENT PROCESS

OILS WITH STABLE PROCESSING BEHAVIOR 107

12.4 BIO-BASED 108

12.4.1 GROWING EMPHASIS ON RENEWABLE SOURCING AND SUSTAINABILITY-ALIGNED MANUFACTURING 108

13 PROCESS OIL MARKET, BY FUNCTION 109

13.1 INTRODUCTION 110

13.2 EXTENDER OIL 112

13.2.1 WIDESPREAD USE OF PROCESS OILS AS EXTENDERS IN RUBBER

AND POLYMER FORMULATIONS 112

13.3 PLASTICIZER 112

13.3.1 DEMAND FOR FLEXIBLE AND EFFICIENTLY PROCESSED RUBBER

AND POLYMER PRODUCTS 112

13.4 SOLVENT 112

13.4.1 NEED FOR STABLE FORMULATIONS AND EFFICIENT DISPERSION

ACROSS INDUSTRIAL AND CONSUMER APPLICATIONS 112

13.5 DEFOAMER 113

13.5.1 NEED TO CONTROL FOAM AND MAINTAIN STABLE, EFFICIENT MANUFACTURING PROCESSES 113

13.6 OTHER FUNCTIONS 113

14 PROCESS OIL MARKET, BY APPLICATION 114

14.1 INTRODUCTION 115

14.2 TIRE & RUBBER 117

14.2.1 LARGEST AND MOST ESTABLISHED USE OF PROCESS OIL TO DRIVE MARKET 117

14.3 POLYMER 117

14.3.1 MODIFY VISCOSITY, IMPROVE FLOW BEHAVIOR, AND ENHANCE COMPATIBILITY DURING PROCESSING 117

14.4 PERSONAL CARE 117

14.4.1 HIGH-PURITY PROCESS OILS FOR STABILITY AND SENSORY PERFORMANCE TO INCREASE DEMAND 117

14.5 TEXTILE 118

14.5.1 ENHANCES PRODUCTIVITY AND MINIMIZES DEFECTS DURING HIGH-SPEED TEXTILE PROCESSING TO INCREASE DEMAND 118

14.6 OTHER APPLICATIONS 118

15 PROCESS OIL MARKET, BY REGION 119

15.1 INTRODUCTION 120

15.2 ASIA PACIFIC 122

15.2.1 CHINA 126

15.2.1.1 Rising passenger car and commercial vehicle production, translating into higher tire manufacturing output 126

15.2.2 JAPAN 128

15.2.2.1 Steady production of automotive tires and rubber components, coupled with high demand for compliant non-carcinogenic

process oil 128

15.2.3 INDIA 130

15.2.3.1 Rising replacement tire demand, expanding automotive production, and focus on quality and regulatory compliance 130

15.2.4 SOUTH KOREA 131

15.2.4.1 Rising passenger car and commercial vehicle production, leading

to higher tire and automotive rubber manufacturing activity 131

15.2.5 INDONESIA 133

15.2.5.1 Expanding automotive production, supported by strong domestic rubber processing and rising replacement tire demand 133

15.2.6 THAILAND 135

15.2.6.1 Strong automotive-driven tire manufacturing, supported by polymer processing and textile industry activities 135

15.2.7 REST OF ASIA PACIFIC 136

15.3 NORTH AMERICA 138

15.3.1 US 142

15.3.1.1 Rising electric vehicle adoption, driving demand for specialized tire production and rubber processing 142

15.3.2 CANADA 144

15.3.2.1 Steady rubber and polymer processing activities to drive market 144

15.3.3 MEXICO 146

15.3.3.1 Sustained automotive production and tire manufacturing

activity driving market 146

15.4 EUROPE 147

15.4.1 RUSSIA 152

15.4.1.1 Steady rubber and polymer processing activity, supported

by domestic manufacturing and automotive-related demand 152

15.4.2 GERMANY 154

15.4.2.1 Rising BEV and PHEV registrations, replacement tire demand,

and polymer processing activities 154

15.4.3 UK 155

15.4.3.1 Replacement-driven tire demand, supported by polymer and personal care manufacturing activity 155

15.4.4 FRANCE 157

15.4.4.1 Rising new car registrations, supported by steady polymer

and personal care manufacturing activities 157

15.4.5 SPAIN 159

15.4.5.1 Ongoing tire and rubber manufacturing, supported by polymer processing and textile applications 159

15.4.6 ITALY 160

15.4.6.1 Demand from value-added rubber goods, polymer processing,

and specialty textile manufacturing 160

15.4.7 REST OF EUROPE 162

15.5 MIDDLE EAST & AFRICA 164

15.5.1 GCC COUNTRIES 168

15.5.1.1 Saudi Arabia 168

15.5.1.1.1 Rising vehicle registrations and Vision 2030 to drive market 168

15.5.1.2 UAE 170

15.5.1.2.1 Replacement-driven automotive activity, supported by polymer and personal care manufacturing 170

15.5.1.3 Rest of GCC countries 171

15.5.2 REST OF MIDDLE EAST & AFRICA 173

15.6 SOUTH AMERICA 175

15.6.1 BRAZIL 178

15.6.1.1 Strong automotive and tire manufacturing, supported by polymer, textile, and personal care production 178

15.6.2 ARGENTINA 180

15.6.2.1 Growing domestic tire and rubber manufacturing, supported

by polymer processing 180

15.6.3 REST OF SOUTH AMERICA 182

16 COMPETITIVE LANDSCAPE 184

16.1 INTRODUCTION 184

16.2 KEY PLAYERS’ STRATEGIES/RIGHT TO WIN 184

16.3 REVENUE ANALYSIS 185

16.4 MARKET SHARE ANALYSIS, 2024 186

16.5 BRAND/PRODUCT COMPARISON 188

16.6 COMPANY VALUATION AND FINANCIAL METRICS 190

16.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 191

16.7.1 STARS 191

16.7.2 EMERGING LEADERS 191

16.7.3 PERVASIVE PLAYERS 192

16.7.4 PARTICIPANTS 192

16.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 193

16.7.5.1 Company footprint 193

16.7.5.2 Region footprint 194

16.7.5.3 Type footprint 195

16.7.5.4 Application footprint 196

16.7.5.5 End user footprint 197

16.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 198

16.8.1 PROGRESSIVE COMPANIES 198

16.8.2 RESPONSIVE COMPANIES 198

16.8.3 DYNAMIC COMPANIES 198

16.8.4 STARTING BLOCKS 198

16.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 200

16.8.5.1 Detailed list of key startups/SMEs 200

16.8.6 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES 201

16.9 COMPETITIVE SCENARIO 202

16.9.1 PRODUCT LAUNCHES 202

16.9.2 DEALS 203

17 COMPANY PROFILES 204

17.1 MAJOR PLAYERS 204

17.1.1 SHELL 204

17.1.1.1 Business overview 204

17.1.1.2 Products/Solutions/Services offered 205

17.1.1.3 Recent developments 206

17.1.1.3.1 Deals 206

17.1.1.4 MnM view 206

17.1.1.4.1 Right to win 206

17.1.1.4.2 Strategic choices 207

17.1.1.4.3 Weaknesses and competitive threats 207

17.1.2 EXXON MOBIL CORPORATION 208

17.1.2.1 Business overview 208

17.1.2.2 Products/Solutions/Services offered 209

17.1.2.3 MnM view 209

17.1.2.3.1 Right to win 209

17.1.2.3.2 Strategic choices 209

17.1.2.3.3 Weaknesses and competitive threats 210

17.1.3 CHEVRON CORPORATION 211

17.1.3.1 Business overview 211

17.1.3.2 Products/Solutions/Services offered 212

17.1.3.3 MnM view 212

17.1.3.3.1 Right to win 212

17.1.3.3.2 Strategic choices 212

17.1.3.3.3 Weaknesses and competitive threats 213

17.1.4 PETROLIAM NASIONAL BERHAD (PETRONAS) 214

17.1.4.1 Business overview 214

17.1.4.2 Products/Solutions/Services offered 215

17.1.4.3 MnM view 215

17.1.4.3.1 Right to win 215

17.1.4.3.2 Strategic choices 215

17.1.4.3.3 Weaknesses and competitive threats 216

17.1.5 IDEMITSU KOSAN CO., LTD. 217

17.1.5.1 Business overview 217

17.1.5.2 Products/Solutions/Services offered 218

17.1.5.3 MnM view 219

17.1.5.3.1 Right to win 219

17.1.5.3.2 Strategic choices 219

17.1.5.3.3 Weaknesses and competitive threats 219

17.1.6 INDIAN OIL CORPORATION LTD. 220

17.1.6.1 Business overview 220

17.1.6.2 Products/Solutions/Services offered 221

17.1.7 GANDHAR OIL REFINERY (INDIA) LIMITED 222

17.1.7.1 Business overview 222

17.1.7.2 Products/Solutions/Services offered 223

17.1.8 HF SINCLAIR CORPORATION 224

17.1.8.1 Business overview 224

17.1.8.2 Products offered 225

17.1.9 BEHRAN OIL CO. 226

17.1.9.1 Business overview 226

17.1.9.2 Products/Solutions/Services offered 226

17.1.10 ORGKHIM BIOCHEMICAL HOLDING 227

17.1.10.1 Business overview 227

17.1.10.2 Products offered 227

17.1.11 REPSOL 228

17.1.11.1 Business overview 228

17.1.11.2 Products/Solutions/Services offered 229

17.1.12 HINDUSTAN PETROLEUM CORPORATION LIMITED 230

17.1.12.1 Business overview 230

17.1.12.2 Products/Solutions/Services offered 232

17.1.13 ORLEN UNIPETROL 233

17.1.13.1 Business overview 233

17.1.13.2 Products/Solutions/Services offered 234

17.1.14 PANAMA PETROCHEM LTD. 235

17.1.14.1 Business overview 235

17.1.14.2 Products/Solutions/Services offered 237

17.1.14.3 Recent developments 237

17.1.15 NYNAS AB 238

17.1.15.1 Business overview 238

17.1.15.2 Products/Solutions/Services offered 239

17.1.15.3 Recent developments 241

17.1.16 H&R GROUP 242

17.1.16.1 Business overview 242

17.1.16.2 Products/Solutions/Services offered 244

17.1.16.3 Recent developments 244

17.1.17 CPC CORPORATION 245

17.1.17.1 Business overview 245

17.1.17.2 Products/Solutions/Services offered 245

17.1.17.3 Recent developments 245

17.1.18 IRANOL COMPANY 246

17.1.18.1 Business overview 246

17.1.18.2 Products/Solutions/Services offered 246

17.1.18.3 Recent developments 247

17.1.19 ERGON, INC. 248

17.1.19.1 Business overview 248

17.1.19.2 Products/Solutions/Services offered 248

17.1.19.3 Recent developments 248

17.2 OTHER PLAYERS 249

17.2.1 APAR INDUSTRIES LTD. 249

17.2.2 CROSS OIL 250

17.2.2.1 Recent developments 250

17.2.2.1.1 Deals 250

17.2.3 EASTERN PETROLEUM 251

17.2.4 GPPL 251

17.2.5 LODHA PETRO 252

17.2.6 PETRO GULF INTERNATIONAL FZE 252

17.2.7 STERLITE LUBRICANTS 253

17.2.8 TAURUS PETROLEUMS PRIVATE LIMITED 253

17.2.9 VINTROL LUBES PRIVATE LIMITED 254

17.2.10 WITMANS INDUSTRIES PVT. LTD 254

18 RESEARCH METHODOLOGY 255

18.1 RESEARCH DATA 255

18.1.1 SECONDARY DATA 256

18.1.1.1 Key data from secondary sources 256

18.1.2 PRIMARY DATA 256

18.1.2.1 Key data from primary sources 257

18.1.2.2 List of primary interview participants (demand and supply sides) 257

18.1.2.3 Key industry insights 257

18.1.2.4 Breakdown of interviews with experts 258

18.2 MATRIX CONSIDERED FOR DEMAND-SIDE ANALYSIS 258

18.3 MARKET SIZE ESTIMATION 259

18.3.1 BOTTOM-UP APPROACH & TOP-DOWN APPROACH 259

18.3.1.1 Calculations for supply-side analysis 261

18.4 GROWTH FORECAST 261

18.5 DATA TRIANGULATION 261

18.6 RESEARCH ASSUMPTIONS 262

18.7 RESEARCH LIMITATIONS 263

18.8 RISK ASSESSMENT 263

19 APPENDIX 264

19.1 DISCUSSION GUIDE 264

19.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 268

19.3 CUSTOMIZATION OPTIONS 270

19.4 RELATED REPORTS 270

19.5 AUTHOR DETAILS 271

LIST OF TABLES

TABLE 1 PROCESS OIL MARKET: PORTER’S FIVE FORCES ANALYSIS 49

TABLE 2 REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE),

BY KEY COUNTRY, 2022–2024 (%) 51

TABLE 3 UNEMPLOYMENT RATE, BY KEY COUNTRY, 2022–2024 (%) 52

TABLE 4 INFLATION RATE AVERAGE CONSUMER PRICES, BY KEY COUNTRY, 2022–2024 (%) 52

TABLE 5 FOREIGN DIRECT INVESTMENT, BY REGION, 2022–2023 (USD BILLION) 52

TABLE 6 ROLES OF COMPANIES IN PROCESS OIL ECOSYSTEM 55

TABLE 7 AVERAGE SELLING PRICE TREND OF PROCESS OIL, BY REGION,

2022–2025 (USD/TON) 56

TABLE 8 AVERAGE SELLING PRICE OF PROCESS OIL TYPE, BY KEY PLAYERS,

2025 (USD/TON) 57

TABLE 9 IMPORT DATA FOR HS CODE 2709, BY KEY COUNTRY,

2021–2024 (USD THOUSAND) 59

TABLE 10 EXPORT DATA FOR HS CODE 2709, BY KEY COUNTRY,

2021–2024 (USD THOUSAND) 60

TABLE 11 PROCESS OIL MARKET: KEY CONFERENCES AND EVENTS, 2025–2026 61

TABLE 12 PROCESS OIL MARKET: LIST OF MAJOR PATENTS, 2014–2024 73

TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 79

TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 80

TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 80

TABLE 16 GLOBAL STANDARDS IN PROCESS OIL MARKET 81

TABLE 17 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN THE PROCESS OIL MARKET 82

TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%) 87

TABLE 19 KEY BUYING CRITERIA, BY APPLICATION 88

TABLE 20 PROCESS OIL MARKET: UNMET NEEDS IN KEY APPLICATIONS 90

TABLE 21 PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 98

TABLE 22 PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 99

TABLE 23 PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 99

TABLE 24 PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 99

TABLE 25 NAPHTHENIC: PROCESS OIL MARKET, BY REGION, 2021–2024 (USD MILLION) 100

TABLE 26 NAPHTHENIC: PROCESS OIL MARKET, BY REGION, 2025–2030 (USD MILLION) 100

TABLE 27 NAPHTHENIC: PROCESS OIL MARKET, BY REGION, 2021–2024 (KILOTON) 101

TABLE 28 NAPHTHENIC: PROCESS OIL MARKET, BY REGION, 2025–2030 (KILOTON) 101

TABLE 29 PARAFFINIC PROCESS OIL MARKET, BY REGION, 2021–2024 (USD MILLION) 102

TABLE 30 PARAFFINIC PROCESS OIL MARKET, BY REGION, 2025–2030 (USD MILLION) 102

TABLE 31 PARAFFINIC PROCESS OIL MARKET, BY REGION, 2021–2024 (KILOTON) 102

TABLE 32 PARAFFINIC PROCESS OIL MARKET, BY REGION, 2025–2030 (KILOTON) 103

TABLE 33 AROMATIC: PROCESS OIL MARKET, BY REGION, 2021–2024 (USD MILLION) 103

TABLE 34 AROMATIC: PROCESS OIL MARKET, BY REGION, 2025–2030 (USD MILLION) 104

TABLE 35 AROMATIC: PROCESS OIL MARKET, BY REGION, 2021–2024 (KILOTON) 104

TABLE 36 AROMATIC: PROCESS OIL MARKET, BY REGION, 2025–2030 (KILOTON) 104

TABLE 37 NON-CARCINOGENIC: PROCESS OIL MARKET, BY REGION,

2021–2024 (USD MILLION) 105

TABLE 38 NON-CARCINOGENIC: PROCESS OIL MARKET, BY REGION,

2025–2030 (USD MILLION) 105

TABLE 39 NON-CARCINOGENIC: PROCESS OIL MARKET, BY REGION, 2021–2024 (KILOTON) 106

TABLE 40 NON-CARCINOGENIC: PROCESS OIL MARKET, BY REGION, 2025–2030 (KILOTON) 106

TABLE 41 PROCESS OIL MARKET, BY FUNCTION, 2021–2024 (USD MILLION) 110

TABLE 42 PROCESS OIL MARKET, BY FUNCTION, 2025–2030 (USD MILLION) 111

TABLE 43 PROCESS OIL MARKET, BY FUNCTION, 2021–2024 (KILOTON) 111

TABLE 44 PROCESS OIL MARKET, BY FUNCTION, 2025–2030 (KILOTON) 111

TABLE 45 PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 115

TABLE 46 PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 116

TABLE 47 PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 116

TABLE 48 PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 116

TABLE 49 PROCESS OIL MARKET, BY REGION, 2021–2024 (USD MILLION) 120

TABLE 50 PROCESS OIL MARKET, BY REGION, 2025–2030 (USD MILLION) 121

TABLE 51 PROCESS OIL MARKET, BY REGION, 2021–2024 (KILOTON) 121

TABLE 52 PROCESS OIL MARKET, BY REGION, 2025–2030 (KILOTON) 121

TABLE 53 ASIA PACIFIC: PROCESS OIL MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 123

TABLE 54 ASIA PACIFIC: PROCESS OIL MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 123

TABLE 55 ASIA PACIFIC: PROCESS OIL MARKET, BY COUNTRY, 2021–2024 (KILOTON) 123

TABLE 56 ASIA PACIFIC: PROCESS OIL MARKET, BY COUNTRY, 2025–2030 (KILOTON) 124

TABLE 57 ASIA PACIFIC: PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 124

TABLE 58 ASIA PACIFIC: PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 124

TABLE 59 ASIA PACIFIC: PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 125

TABLE 60 ASIA PACIFIC: PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 125

TABLE 61 ASIA PACIFIC: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 125

TABLE 62 ASIA PACIFIC: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 125

TABLE 63 ASIA PACIFIC: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 126

TABLE 64 ASIA PACIFIC: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 126

TABLE 65 CHINA: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 127

TABLE 66 CHINA: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 127

TABLE 67 CHINA: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 127

TABLE 68 CHINA: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 128

TABLE 69 JAPAN: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 128

TABLE 70 JAPAN: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 129

TABLE 71 JAPAN: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 129

TABLE 72 JAPAN: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 129

TABLE 73 INDIA: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 130

TABLE 74 INDIA: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 130

TABLE 75 INDIA: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 131

TABLE 76 INDIA: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 131

TABLE 77 SOUTH KOREA: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 132

TABLE 78 SOUTH KOREA: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 132

TABLE 79 SOUTH KOREA: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 132

TABLE 80 SOUTH KOREA: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 133

TABLE 81 INDONESIA: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 133

TABLE 82 INDONESIA: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 134

TABLE 83 INDONESIA: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 134

TABLE 84 INDONESIA: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 134

TABLE 85 THAILAND: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 135

TABLE 86 THAILAND: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 135

TABLE 87 THAILAND: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 136

TABLE 88 THAILAND: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 136

TABLE 89 REST OF THE ASIA PACIFIC: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 137

TABLE 90 REST OF THE ASIA PACIFIC: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 137

TABLE 91 REST OF THE ASIA PACIFIC: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (KILOTON) 137

TABLE 92 REST OF THE ASIA PACIFIC: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (KILOTON) 138

TABLE 93 NORTH AMERICA: PROCESS OIL MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 139

TABLE 94 NORTH AMERICA: PROCESS OIL MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 139

TABLE 95 NORTH AMERICA: PROCESS OIL MARKET, BY COUNTRY, 2021–2024 (KILOTON) 140

TABLE 96 NORTH AMERICA: PROCESS OIL MARKET, BY COUNTRY, 2025–2030 (KILOTON) 140

TABLE 97 NORTH AMERICA: PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 140

TABLE 98 NORTH AMERICA: PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 140

TABLE 99 NORTH AMERICA: PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 141

TABLE 100 NORTH AMERICA: PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 141

TABLE 101 NORTH AMERICA: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 141

TABLE 102 NORTH AMERICA: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 141

TABLE 103 NORTH AMERICA: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 142

TABLE 104 NORTH AMERICA: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 142

TABLE 105 US: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 143

TABLE 106 US: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 143

TABLE 107 US: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 143

TABLE 108 US: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 144

TABLE 109 CANADA: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 144

TABLE 110 CANADA: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 145

TABLE 111 CANADA: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 145

TABLE 112 CANADA: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 145

TABLE 113 MEXICO: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 146

TABLE 114 MEXICO: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 146

TABLE 115 MEXICO: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 147

TABLE 116 MEXICO: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 147

TABLE 117 EUROPE: PROCESS OIL MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 148

TABLE 118 EUROPE: PROCESS OIL MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 149

TABLE 119 EUROPE: PROCESS OIL MARKET, BY COUNTRY, 2021–2024 (KILOTON) 149

TABLE 120 EUROPE: PROCESS OIL MARKET, BY COUNTRY, 2025–2030 (KILOTON) 149

TABLE 121 EUROPE: PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 150

TABLE 122 EUROPE: PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 150

TABLE 123 EUROPE: PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 150

TABLE 124 EUROPE: PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 150

TABLE 125 EUROPE: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 151

TABLE 126 EUROPE: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 151

TABLE 127 EUROPE: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 151

TABLE 128 EUROPE: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 152

TABLE 129 RUSSIA: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 152

TABLE 130 RUSSIA: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 153

TABLE 131 RUSSIA: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 153

TABLE 132 RUSSIA: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 153

TABLE 133 GERMANY: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 154

TABLE 134 GERMANY: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 154

TABLE 135 GERMANY: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 155

TABLE 136 GERMANY: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 155

TABLE 137 UK: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 156

TABLE 138 UK: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 156

TABLE 139 UK: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 156

TABLE 140 UK: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 157

TABLE 141 FRANCE: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 157

TABLE 142 FRANCE: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 158

TABLE 143 FRANCE: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 158

TABLE 144 FRANCE: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 158

TABLE 145 SPAIN: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 159

TABLE 146 SPAIN: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 159

TABLE 147 SPAIN: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 160

TABLE 148 SPAIN: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 160

TABLE 149 ITALY: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 161

TABLE 150 ITALY: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 161

TABLE 151 ITALY: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 161

TABLE 152 ITALY: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 162

TABLE 153 REST OF EUROPE: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 162

TABLE 154 REST OF EUROPE: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 163

TABLE 155 REST OF EUROPE: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (KILOTON) 163

TABLE 156 REST OF EUROPE: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (KILOTON) 163

TABLE 157 MIDDLE EAST & AFRICA: PROCESS OIL MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 164

TABLE 158 MIDDLE EAST & AFRICA: PROCESS OIL MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 164

TABLE 159 MIDDLE EAST & AFRICA: PROCESS OIL MARKET, BY COUNTRY,

2021–2024 (KILOTON) 165

TABLE 160 MIDDLE EAST & AFRICA: PROCESS OIL MARKET, BY COUNTRY,

2025–2030 (KILOTON) 165

TABLE 161 MIDDLE EAST & AFRICA: PROCESS OIL MARKET, BY TYPE,

2021–2024 (USD MILLION) 165

TABLE 162 MIDDLE EAST & AFRICA: PROCESS OIL MARKET, BY TYPE,

2025–2030 (USD MILLION) 165

TABLE 163 MIDDLE EAST & AFRICA: PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 166

TABLE 164 MIDDLE EAST & AFRICA: PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 166

TABLE 165 MIDDLE EAST & AFRICA: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 166

TABLE 166 MIDDLE EAST & AFRICA: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 167

TABLE 167 MIDDLE EAST & AFRICA: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (KILOTON) 167

TABLE 168 MIDDLE EAST & AFRICA: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (KILOTON) 167

TABLE 169 SAUDI ARABIA: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 168

TABLE 170 SAUDI ARABIA: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 169

TABLE 171 SAUDI ARABIA: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 169

TABLE 172 SAUDI ARABIA: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 169

TABLE 173 UAE: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 170

TABLE 174 UAE: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 170

TABLE 175 UAE: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 171

TABLE 176 UAE: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 171

TABLE 177 REST OF GCC COUNTRIES: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 172

TABLE 178 REST OF GCC COUNTRIES: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 172

TABLE 179 REST OF GCC COUNTRIES: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (KILOTON) 172

TABLE 180 REST OF GCC COUNTRIES: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (KILOTON) 173

TABLE 181 REST OF MIDDLE EAST & AFRICA: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 173

TABLE 182 REST OF MIDDLE EAST & AFRICA: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 174

TABLE 183 REST OF MIDDLE EAST & AFRICA: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (KILOTON) 174

TABLE 184 REST OF MIDDLE EAST & AFRICA: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (KILOTON) 174

TABLE 185 SOUTH AMERICA: PROCESS OIL MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 175

TABLE 186 SOUTH AMERICA: PROCESS OIL MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 175

TABLE 187 SOUTH AMERICA: PROCESS OIL MARKET, BY COUNTRY, 2021–2024 (KILOTON) 175

TABLE 188 SOUTH AMERICA: PROCESS OIL MARKET, BY COUNTRY, 2025–2030 (KILOTON) 176

TABLE 189 SOUTH AMERICA: PROCESS OIL MARKET, BY TYPE, 2021–2024 (USD MILLION) 176

TABLE 190 SOUTH AMERICA: PROCESS OIL MARKET, BY TYPE, 2025–2030 (USD MILLION) 176

TABLE 191 SOUTH AMERICA: PROCESS OIL MARKET, BY TYPE, 2021–2024 (KILOTON) 176

TABLE 192 SOUTH AMERICA: PROCESS OIL MARKET, BY TYPE, 2025–2030 (KILOTON) 177

TABLE 193 SOUTH AMERICA: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 177

TABLE 194 SOUTH AMERICA: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 177

TABLE 195 SOUTH AMERICA: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 178

TABLE 196 SOUTH AMERICA: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 178

TABLE 197 BRAZIL: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 179

TABLE 198 BRAZIL: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 179

TABLE 199 BRAZIL: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 179

TABLE 200 BRAZIL: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 180

TABLE 201 ARGENTINA: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 180

TABLE 202 ARGENTINA: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 181

TABLE 203 ARGENTINA: PROCESS OIL MARKET, BY APPLICATION, 2021–2024 (KILOTON) 181

TABLE 204 ARGENTINA: PROCESS OIL MARKET, BY APPLICATION, 2025–2030 (KILOTON) 181

TABLE 205 REST OF SOUTH AMERICA: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 182

TABLE 206 REST OF SOUTH AMERICA: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 182

TABLE 207 REST OF SOUTH AMERICA: PROCESS OIL MARKET, BY APPLICATION,

2021–2024 (KILOTON) 183

TABLE 208 REST OF SOUTH AMERICA: PROCESS OIL MARKET, BY APPLICATION,

2025–2030 (KILOTON) 183

TABLE 209 PROCESS OIL MARKET: OVERVIEW OF STRATEGIES ADOPTED

BY KEY PLAYERS, 2020–2025 184

TABLE 210 PROCESS OIL MARKET: DEGREE OF COMPETITION, 2024 186

TABLE 211 PROCESS OIL MARKET: REGION FOOTPRINT 194

TABLE 212 PROCESS OIL MARKET: TYPE FOOTPRINT 195

TABLE 213 PROCESS OIL MARKET: APPLICATION FOOTPRINT 196

TABLE 214 PROCESS OIL MARKET: END USER FOOTPRINT 197

TABLE 215 PROCESS OIL MARKET: DETAILED LIST OF KEY STARTUPS/SMES 200

TABLE 216 PROCESS OIL MARKET: COMPETITIVE BENCHMARKING OF KEY

STARTUPS/SMES (1/2) 201

TABLE 217 PROCESS OIL MARKET: COMPETITIVE BENCHMARKING OF KEY

STARTUPS/SMES (2/2) 201

TABLE 218 PROCESS OIL MARKET: PRODUCT LAUNCHES, JANUARY 2020–NOVEMBER 2025 202

TABLE 219 PROCESS OIL MARKET: DEALS, JANUARY 2020–NOVEMBER 2025 203

TABLE 220 SHELL: COMPANY OVERVIEW 204

TABLE 221 SHELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED 205

TABLE 222 SHELL: DEALS 206

TABLE 223 EXXON MOBIL CORPORATION: COMPANY OVERVIEW 208

TABLE 224 EXXON MOBIL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 209

TABLE 225 CHEVRON CORPORATION: COMPANY OVERVIEW 211

TABLE 226 CHEVRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 212

TABLE 227 PETROLIAM NASIONAL BERHAD (PETRONAS): COMPANY OVERVIEW 214

TABLE 228 PETROLIAM NASIONAL BERHAD (PETRONAS): PRODUCTS/SOLUTIONS/

SERVICES OFFERED 215

TABLE 229 IDEMITSU KOSAN CO., LTD.: COMPANY OVERVIEW 217

TABLE 230 IDEMITSU KOSAN CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 218

TABLE 231 INDIAN OIL CORPORATION LTD.: COMPANY OVERVIEW 220

TABLE 232 INDIAN OIL CORPORATION LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 221

TABLE 233 GANDHAR OIL REFINERY (INDIA) LIMITED: COMPANY OVERVIEW 222

TABLE 234 GANDHAR OIL REFINERY (INDIA) LIMITED: PRODUCTS/SOLUTIONS/

SERVICES OFFERED 223

TABLE 235 HF SINCLAIR CORPORATION: COMPANY OVERVIEW 224

TABLE 236 HF SINCLAIR CORPORATION: PRODUCTS OFFERED 225

TABLE 237 BEHRAN OIL CO.: COMPANY OVERVIEW 226

TABLE 238 BEHRAN OIL CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 226

TABLE 239 ORGKHIM BIOCHEMICAL HOLDING: COMPANY OVERVIEW 227

TABLE 240 ORGKHIM BIOCHEMICAL HOLDING: PRODUCTS OFFERED 227

TABLE 241 REPSOL: COMPANY OVERVIEW 228

TABLE 242 REPSOL: PRODUCTS/SOLUTIONS/SERVICES OFFERED 229

TABLE 243 HINDUSTAN PETROLEUM CORPORATION LIMITED: COMPANY OVERVIEW 230

TABLE 244 HINDUSTAN PETROLEUM CORPORATION LIMITED: PRODUCTS/ SOLUTIONS/SERVICES OFFERED 232

TABLE 245 ORLEN UNIPETROL: COMPANY OVERVIEW 233

TABLE 246 ORLEN UNIPETROL: PRODUCTS/SOLUTIONS/SERVICES OFFERED 234

TABLE 247 PANAMA PETROCHEM LTD.: COMPANY OVERVIEW 235

TABLE 248 PANAMA PETROCHEM LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 237

TABLE 249 NYNAS AB: COMPANY OVERVIEW 238

TABLE 250 NYNAS AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED 239

TABLE 251 NYNAS AB: PRODUCT LAUNCHES 241

TABLE 252 H&R GROUP: COMPANY OVERVIEW 242

TABLE 253 H&R GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED 244

TABLE 254 CPC CORPORATION: COMPANY OVERVIEW 245

TABLE 255 CPC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 245

TABLE 256 IRANOL COMPANY: COMPANY OVERVIEW 246

TABLE 257 IRANOL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED 246

TABLE 258 ERGON, INC.: COMPANY OVERVIEW 248

TABLE 259 ERGON, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 248

TABLE 260 APAR INDUSTRIES LTD.: COMPANY OVERVIEW 249

TABLE 261 CROSS OIL: COMPANY OVERVIEW 250

TABLE 262 CROSS OIL: DEALS 250

TABLE 263 EASTERN PETROLEUM: COMPANY OVERVIEW 251

TABLE 264 GPPL: COMPANY OVERVIEW 251

TABLE 265 LODHA PETRO: COMPANY OVERVIEW 252

TABLE 266 PETRO GULF INTERNATIONAL FZE: COMPANY OVERVIEW 252

TABLE 267 STERLITE LUBRICANTS: COMPANY OVERVIEW 253

TABLE 268 TAURUS PETROLEUMS PRIVATE LIMITED: COMPANY OVERVIEW 253

TABLE 269 VINTROL LUBES PRIVATE LIMITED: COMPANY OVERVIEW 254

TABLE 270 WITMANS INDUSTRIES PVT. LTD: COMPANY OVERVIEW 254

LIST OF FIGURES

FIGURE 1 PROCESS OIL MARKET SEGMENTATION AND REGIONAL SCOPE 27

FIGURE 2 MARKET SCENARIO 31

FIGURE 3 GLOBAL PROCESS OIL MARKET, 2021–2030 31

FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN PROCESS OIL

MARKET, 2020–2025 32

FIGURE 5 DISRUPTIONS INFLUENCING GROWTH OF PROCESS OIL MARKET 33

FIGURE 6 HIGH-GROWTH SEGMENTS IN PROCESS OIL MARKET 2025–2030 34

FIGURE 7 ASIA PACIFIC TO LEAD THE PROCESS OIL MARKET, IN TERMS OF VALUE,

DURING FORECAST PERIOD 35

FIGURE 8 RISING DEMAND FOR LOW-PAH, HYDROTREATED, AND ECO-FRIENDLY PROCESS OILS TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS 36

FIGURE 9 EXTENDER OIL ACCOUNTED FOR LARGEST MARKET SHARE IN 2024 37

FIGURE 10 TIRE & RUBBER SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024 37

FIGURE 11 NAPHTHENIC SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024 38

FIGURE 12 BRAZIL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD 38

FIGURE 13 PROCESS OIL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES,

AND CHALLENGES 39

FIGURE 14 MOTOR VEHICLES (CARS AND COMMERCIAL VEHICLES)

PRODUCTION, 2021–2024, (MILLION UNITS) 40

FIGURE 15 GLOBAL AUTOMOTIVE TIRE MARKET (MILLION UNITS): 2022–2033 41

FIGURE 16 NEW CAR REGISTRATIONS, 2023–2024, (MILLION UNITS) 41

FIGURE 17 CRUDE OIL FIRST PURCHASE PRICES, 2011–2024 44

FIGURE 18 PROCESS OIL MARKET: PORTER’S FIVE FORCES ANALYSIS 48

FIGURE 19 PROCESS OIL MARKET: SUPPLY CHAIN ANALYSIS 53

FIGURE 20 PROCESS OIL MARKET: ECOSYSTEM MAPPING 55

FIGURE 21 AVERAGE SELLING PRICE TREND OF PROCESS OIL, BY REGION,

2022–2025 (USD/TON) 56

FIGURE 22 AVERAGE SELLING PRICE OF PROCESS OIL TYPE,

BY KEY PLAYERS, 2025 (USD/TON) 57

FIGURE 23 IMPORT DATA RELATED TO HS CODE 2709, BY KEY COUNTRY,

2021–2024 (USD THOUSAND) 58

FIGURE 24 EXPORT DATA RELATED TO HS CODE 2709, BY KEY COUNTRY,

2021–2024 (USD THOUSAND) 60

FIGURE 25 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS 62

FIGURE 26 PROCESS OIL MARKET: INVESTMENT AND FUNDING SCENARIO, 2020–2025 62

FIGURE 27 LIST OF MAJOR PATENTS RELATED TO PROCESS OIL, 2014–2024 72

FIGURE 28 FUTURE APPLICATIONS OF RUBBER PROCESS OIL 74

FIGURE 29 PROCESS OIL MARKET: DECISION-MAKING FACTORS 86

FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION 87

FIGURE 31 KEY BUYING CRITERIA, BY APPLICATION 88

FIGURE 32 ADOPTION BARRIERS & INTERNAL CHALLENGES 89

FIGURE 33 NAPHTHENIC SEGMENT ACCOUNTS FOR LARGEST SHARE OF OVERALL MARKET 98

FIGURE 34 EXTENDER OIL SEGMENT ACCOUNTS FOR THE LARGEST SHARE OF

OVERALL MARKET 110

FIGURE 35 TIRE & RUBBER SEGMENT TO BE THE FASTEST-GROWING SEGMENT

IN THE MARKET DURING THE FORECAST PERIOD 115

FIGURE 36 ASIA PACIFIC TO LEAD PROCESS OIL MARKET DURING FORECAST PERIOD 120

FIGURE 37 ASIA PACIFIC: PROCESS OIL MARKET SNAPSHOT 122

FIGURE 38 NORTH AMERICA: PROCESS OIL MARKET SNAPSHOT 139

FIGURE 39 EUROPE: PROCESS OIL MARKET SNAPSHOT 148

FIGURE 40 PROCESS OIL MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020–2024 185

FIGURE 41 PROCESS OIL MARKET SHARE ANALYSIS, 2024 186

FIGURE 42 PROCESS OIL MARKET: BRAND/PRODUCT COMPARISON 188

FIGURE 43 PROCESS OIL MARKET: EV/EBITDA 190

FIGURE 44 PROCESS OIL MARKET: EV/REVENUE 190

FIGURE 45 PROCESS OIL MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN

AND FIVE-YEAR STOCK BETA OF KEY MANUFACTURERS 191

FIGURE 46 PROCESS OIL MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024 192

FIGURE 47 PROCESS OIL MARKET: COMPANY FOOTPRINT 193

FIGURE 48 PROCESS OIL MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 199

FIGURE 49 SHELL: COMPANY SNAPSHOT 205

FIGURE 50 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT 208

FIGURE 51 CHEVRON CORPORATION: COMPANY SNAPSHOT 211

FIGURE 52 PETROLIAM NASIONAL BERHAD (PETRONAS): COMPANY SNAPSHOT 214

FIGURE 53 IDEMITSU KOSAN CO., LTD.: COMPANY SNAPSHOT 218

FIGURE 54 INDIAN OIL CORPORATION LTD.: COMPANY SNAPSHOT 221

FIGURE 55 GANDHAR OIL REFINERY (INDIA) LIMITED: COMPANY SNAPSHOT 222

FIGURE 56 HF SINCLAIR CORPORATION: COMPANY SNAPSHOT 224

FIGURE 57 REPSOL: COMPANY SNAPSHOT 229

FIGURE 58 HINDUSTAN PETROLEUM CORPORATION LIMITED: COMPANY SNAPSHOT 231

FIGURE 59 ORLEN UNIPETROL: COMPANY SNAPSHOT 234

FIGURE 60 PANAMA PETROCHEM LTD.: COMPANY SNAPSHOT 236

FIGURE 61 NYNAS AB: COMPANY SNAPSHOT 239

FIGURE 62 H&R GROUP: COMPANY SNAPSHOT 243

FIGURE 63 RESEARCH DESIGN 255

FIGURE 64 BOTTOM-UP APPROACH & TOP-DOWN APPROACH 259

FIGURE 65 METHODOLOGY FOR SUPPLY-SIDE SIZING OF PROCESS OIL MARKET (1/2) 260

FIGURE 66 METHODOLOGY FOR SUPPLY-SIDE SIZING OF PROCESS OIL MARKET (2/2) 260

FIGURE 67 DATA TRIANGULATION 262