Paints & Coatings Market - Global Forecast To 2030

塗料およびコーティング市場 - 樹脂の種類(アクリル、アルキド、エポキシ、ポリウレタン、フッ素樹脂)、技術(水性塗料、溶剤系塗料、粉体塗料)、最終用途産業(建築、工業)、地域別 - 2030年までの世界予測

Paints & Coatings Market by Resin Type (Acrylic, Alkyd, Epoxy, Polyurethane, Fluoropolymer), Technology (Waterborne Coatings, Solventborne Coatings, Powder Coatings), End-use Industry (Architectural, Industrial), Region - Global Forecast to 2030

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年01月 |

| ページ数 | 399 |

| 図表数 | 646 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-12487 |

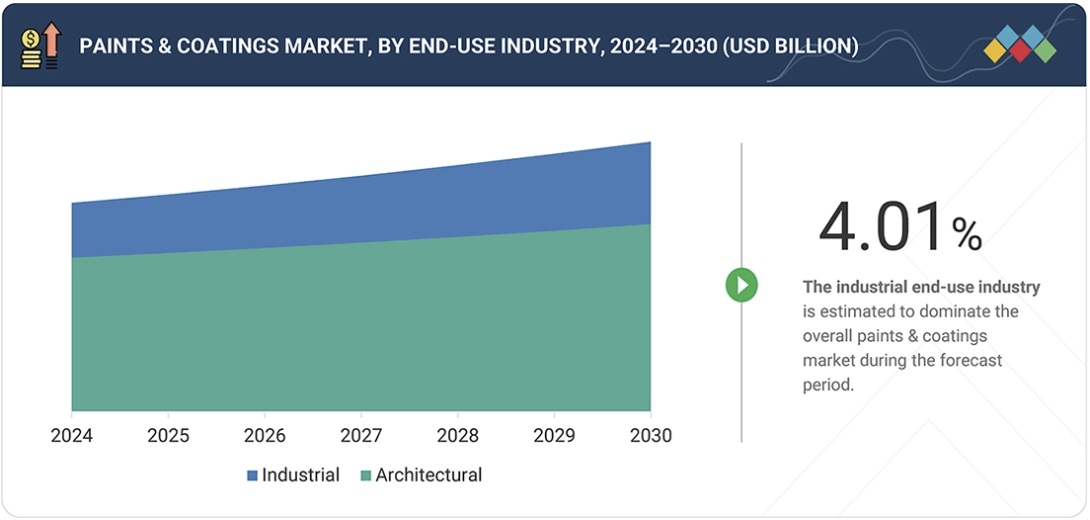

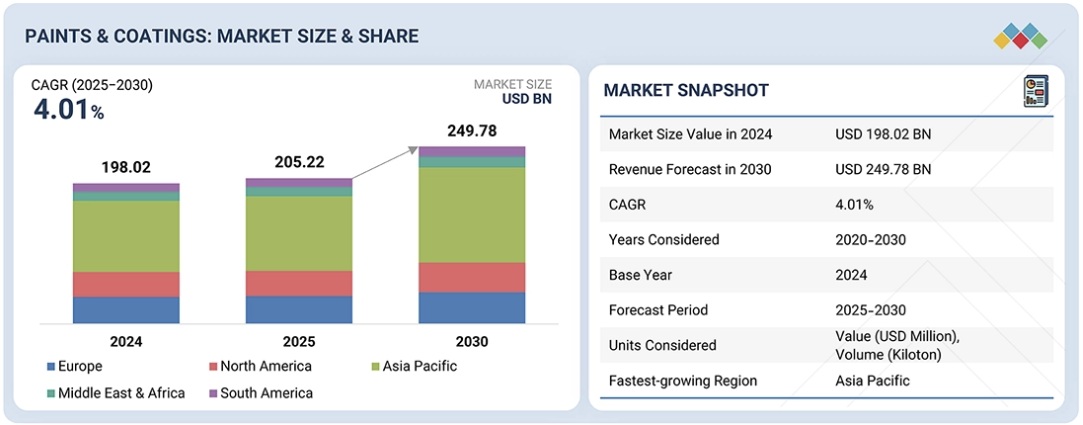

塗料およびコーティング市場は、予測期間中に年平均成長率 (CAGR) 4.01% で成長し、2025 年の 2,052.2 億米ドルから 2030 年までに 2,497.8 億米ドルに達すると予測されています。

調査対象範囲

本レポートは、塗料・コーティング市場を樹脂の種類、技術、最終用途産業、地域に基づいてセグメント化し、様々な地域における市場全体の推定価値(百万米ドル)を示しています。主要業界プレーヤーの詳細な分析を実施し、塗料・コーティング市場に関連する各社の事業概要、サービス、主要戦略に関する洞察を提供しています。

このレポートを購入する理由

この調査レポートは、業界分析(業界動向)、主要企業の市場シェア分析、企業プロファイルといった様々なレベルの分析に焦点を当てており、これらを組み合わせることで、塗料・コーティング市場における競争環境、新興・高成長セグメント、高成長地域、市場牽引要因、制約要因、機会といった全体像を把握できます。

本レポートは、以下の点について洞察を提供します。

- 市場浸透:世界市場における主要企業が提供する塗料・コーティングに関する包括的な情報

- 塗料・コーティング市場の成長に影響を与える主要な推進要因(環境規制によるVOCフリーコーティングの需要増加、建築・建設業界におけるティルトアップコンクリートへのエラストマーコーティングの普及拡大、粉体塗装技術の進歩)、制約要因(粉体塗装における薄膜形成の難しさ、塗料・コーティング業界における原材料不足)、機会(建築・建設業界におけるフッ素樹脂の用途拡大、高性能フッ素樹脂系コーティングの需要増加)、課題(厳格な規制政策)の分析

- 製品開発/イノベーション:塗料・コーティング市場における今後の技術、研究開発活動、新製品・新サービスの投入に関する詳細な洞察

- 市場開発:成長著しい新興市場に関する包括的な情報。本レポートでは、地域をまたいで塗料・コーティング市場を分析しています。

- 市場多様化:世界の塗料・コーティング市場における新製品、未開拓地域、最近の動向に関する包括的な情報

- 競合評価:塗料・コーティング市場における主要企業の市場シェア、戦略、製品、製造能力に関する詳細な評価

Report Description

The paints & coatings market is projected to grow from USD 205.22 billion in 2025 and to reach USD 249.78 billion by 2030, at a Compound Annual Growth Rate (CAGR) of 4.01% during the forecast period.

Paints & Coatings Market – Global Forecast To 2030

“Regulatory pressure and sustainability mandates to accelerate paints & coatings market growth”

Environmental regulations and sustainability goals are significantly influencing the paint & coatings market. Rules on emissions and hazardous substances are getting stricter and only products with lower environmental impacts are preferred globally. Demand for water based, zero to minimal VOC, and high solid coating solutions that cause less pollution and are safer for workers is thus being driven by this changing demand. Also, companies have set sustainability targets and decide to work with the companies who support greener operations. In construction and industrial sectors, where environmentally friendly coatings are used, companies not only meet compliance requirements but also improve their brand image. Consumers are also getting more conscious of indoor air quality and surface safety, particularly in homes, schools, and hospitals. Therefore, the manufacturers are responding to this need by creating products that not only deliver performance but are also environmentally friendly. The move towards cleaner solutions driven by regulations and society is still the primary factor driving the growth of the paints & coatings market in all segments.

“Epoxy resins to witness the highest CAGR during forecast period“

Epoxy coatings withstand mechanical stress, impact or abrasion, which drives their adoption in the paints & coatings market. Pipelines, storage tanks and heavy machinery surfaces require coatings that endure constant wear without cracking or peeling. Epoxy resins provide high hardness also excellent adhesion, which protects substrates under demanding operating conditions. This durability reduces maintenance frequency and lifecycle costs, which is particularly valuable in industrial next to commercial facilities. As asset owners prioritize long term performance over short term savings, epoxy resins continue to gain preference for heavy duty protective applications.

“Fluoropolymer resins are projected to be the second fastest-growing resin type of paints & coatings during forecast period”

Fluoropolymer resins are projected to be the second fastest-growing resin type of paints & coatings, between 2025 and 2030. Fluoropolymer resins are valued for their unparalleled resistance to sun, rain, heat, and pollution for a long period of time. Coatings produced from these resins, even after several decades of exposure to outdoor weather, can retain color, gloss, and surface strength, making them appropriate for external parts of buildings, monuments, bridges, and premium architectural projects where it is not only costly but also difficult to repaint. Property owners and developers thus, seek long duration with little fading or chalking. With cities growing and more structures becoming landmarks, the need for these kinds of coatings, which remain stable even under harsh outdoor conditions, continues to drive the fluoropolymer resin share in the paints & coatings market.

Paints & Coatings Market – Global Forecast To 2030 – region

“North America accounted for third-largest share in global paints & coatings market, in terms of value, in 2024”

North America held the third-largest share in the overall paints & coatings market, in terms of value, in 2024. The North American region houses an extensive base of industries from sectors such as machinery, equipment, consumer goods, aerospace, and heavy industries. Coatings are widely used in these industries and factories to safeguard floors, machines, storage areas, and finished products. These coatings make it possible to counteract the effects of wear, chemical, and heat exposure. The use of coatings rises since the companies continue to modernize their facilities and elevate safety and quality standards. This strong industrial presence makes industrial paints & coatings a key growth pillar in the regional market.

- By Company Type: Tier 1 – 55%, Tier 2 – 25%, and Tier 3 – 20%

- By Designation: Directors – 50%, Managers – 30%, and Others – 20%

- By Region: North America – 40%, Europe – 35%, Asia Pacific – 20%, RoW– 5%

Paints & Coatings Market – Global Forecast To 2030 – ecosystem

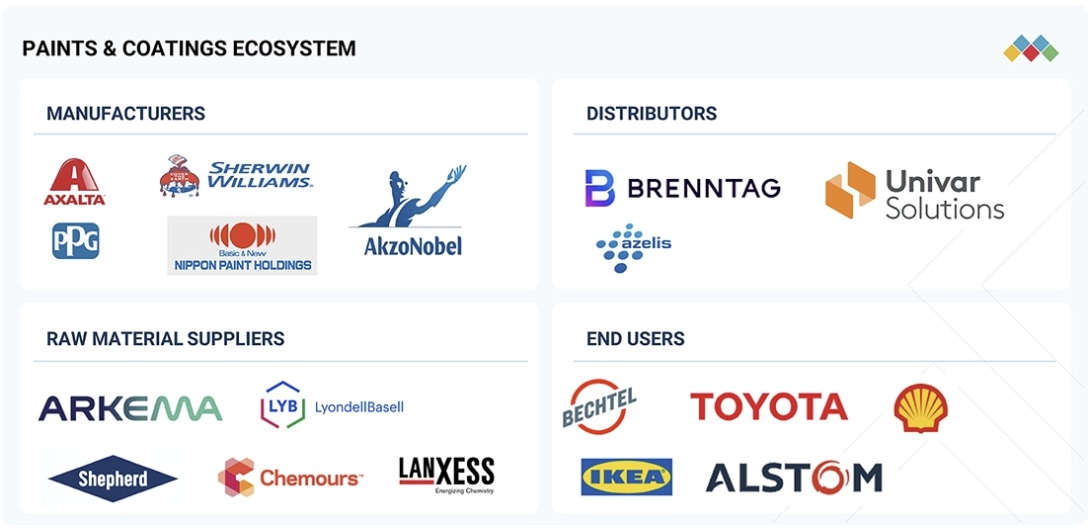

The key players profiled in the report include The Sherwin-Williams Company (US), PPG Industries, Inc. (US), Akzo Nobel N.V. (The Netherlands), Nippon Paint Holdings Co., Ltd. (Japan), Axalta Coating Systems LLC (US), Asian Paints Limited (India), Kansai Paint Co., Ltd. (Japan), RPM International Inc. (US), BASF Coatings GmbH (Germany), and Jotun A/S (Norway).

Study Coverage

This report segments the market for paints & coatings based on resin type, technology, end-use industry, and region, and provides estimations of value (in USD Million) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, and key strategies associated with the paints & coatings market.

Reasons to Buy this Report

This research report is focused on various levels of analysis—industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the paints & coatings market, high-growth regions, and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on paints & coatings offered by top players in the global market

- Analysis of key drivers: (Environmental regulations boosting demand for VOC-free coatings, growing popularity of elastomeric coatings in tilt-up concrete in building & construction industry, and technological advancements in powder coating technology), restraints (Difficulty in obtaining thin films in powder coatings, raw material shortage in paints & coatings industry), opportunities (Increasing applications of fluoropolymers in building & construction industry, growing demand for high-performance fluorine resin-based coatings) and challenges (Stringent regulatory policies) influencing the growth of paints & coatings market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the paints & coatings market

- Market Development: Comprehensive information about lucrative emerging markets—the report analyzes the market for paints & coatings across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global paints & coatings market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the paints & coatings market

Table of Contents

1 INTRODUCTION 39

1.1 STUDY OBJECTIVES 39

1.2 MARKET DEFINITION 39

1.3 STUDY SCOPE 40

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 40

1.3.2 INCLUSIONS AND EXCLUSIONS 41

1.3.3 MARKET DEFINITION AND INCLUSIONS, BY RESIN TYPE 41

1.3.4 MARKET DEFINITION AND INCLUSIONS, BY TECHNOLOGY 42

1.3.5 MARKET DEFINITION AND INCLUSIONS, BY END-USE INDUSTRY 42

1.3.6 YEARS CONSIDERED 42

1.3.7 CURRENCY CONSIDERED 43

1.3.8 UNIT CONSIDERED 43

1.4 STAKEHOLDERS 43

1.5 SUMMARY OF CHANGES 43

2 EXECUTIVE SUMMARY 45

2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS 45

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 46

2.3 DISRUPTIVE TRENDS IN PAINTS & COATINGS MARKET 47

2.4 HIGH-GROWTH SEGMENTS 48

2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST 49

3 PREMIUM INSIGHTS 50

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PAINTS & COATINGS MARKET 50

3.2 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY AND REGION 51

3.3 PAINTS & COATINGS MARKET, BY TECHNOLOGY 51

3.4 PAINTS & COATINGS MARKET, BY COUNTRY 52

4 MARKET OVERVIEW 53

4.1 INTRODUCTION 53

4.2 MARKET DYNAMICS 54

4.2.1 DRIVERS 54

4.2.1.1 Environmental regulations boosting demand for VOC-free coatings 54

4.2.1.2 Growing popularity of elastomeric coatings in tilt-up concrete in building & construction 55

4.2.1.3 Technological advancements in powder coating technology 55

4.2.2 RESTRAINTS 55

4.2.2.1 Difficulty in obtaining thin films in powder coatings 55

4.2.2.2 Raw material shortage in paints & coatings industry 56

4.2.3 OPPORTUNITIES 56

4.2.3.1 Increasing applications of fluoropolymers in building & construction industry 56

4.2.3.2 Growing demand for high-performance fluorine resin-based coatings 56

4.2.4 CHALLENGES 57

4.2.4.1 Stringent regulatory policies 57

4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 57

4.3.1 INTERCONNECTED MARKETS 57

4.3.2 CROSS-SECTOR OPPORTUNITIES 58

4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 58

5 INDUSTRY TRENDS 59

5.1 PORTER’S FIVE FORCES ANALYSIS 59

5.1.1 THREAT OF NEW ENTRANTS 60

5.1.2 THREAT OF SUBSTITUTES 60

5.1.3 BARGAINING POWER OF BUYERS 60

5.1.4 BARGAINING POWER OF SUPPLIERS 60

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 61

5.2 MACROECONOMIC OUTLOOK 61

5.2.1 INTRODUCTION 61

5.2.2 GDP TRENDS AND FORECAST 61

5.2.3 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY 63

5.3 SUPPLY CHAIN ANALYSIS 64

5.3.1 RAW MATERIALS 64

5.3.2 MANUFACTURERS 64

5.3.3 DISTRIBUTION NETWORK 65

5.3.4 END USERS 65

5.4 ECOSYSTEM ANALYSIS 65

5.5 PRICING ANALYSIS 67

5.5.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY END-USE INDUSTRY, 2024 67

5.5.2 AVERAGE SELLING PRICE TREND OF PAINTS & COATINGS, BY REGION, 2022–2025 68

5.6 TRADE ANALYSIS 69

5.6.1 IMPORT SCENARIO (HS CODE 3209) 69

5.6.2 EXPORT SCENARIO (HS CODE 3209) 70

5.7 KEY CONFERENCES & EVENTS, 2025-2026 71

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 72

5.8.1 REVENUE SHIFTS & REVENUE POCKETS FOR PAINTS & COATINGS MARKET 72

5.9 INVESTMENT AND FUNDING SCENARIO 72

5.10 CASE STUDY ANALYSIS 73

5.10.1 IMPROVING INDUSTRIAL FLOOR DURABILITY AND REDUCING MAINTENANCE 73

5.10.2 EXTENDING PIPELINE LIFE WITH CORROSION PROTECTION 74

5.11 IMPACT OF 2025 US TARIFF – OVERVIEW 74

5.11.1 INTRODUCTION 74

5.11.2 KEY TARIFF RATES 75

5.11.3 PRICE IMPACT ANALYSIS 75

5.11.4 IMPACT ON COUNTRIES/REGIONS 76

5.11.4.1 US 76

5.11.4.2 Europe 76

5.11.4.3 Asia Pacific 77

5.11.5 IMPACT ON END-USE INDUSTRIES 77

6 REGULATORY LANDSCAPE AND SUSTAINABILITY INITIATIVES 78

6.1 REGIONAL REGULATIONS AND COMPLIANCE 78

6.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 78

6.1.2 INDUSTRY STANDARDS 82

6.2 SUSTAINABILITY INITIATIVES 83

6.2.1 CARBON IMPACT REDUCTION 83

6.2.2 ECO-APPLICATION ENABLEMENT 83

6.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES 84

6.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 85

7 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 86

7.1 DECISION-MAKING PROCESS 86

7.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA 87

7.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 87

7.2.2 BUYING CRITERIA 88

7.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 89

7.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES 90

8 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS 91

8.1 KEY EMERGING TECHNOLOGIES 91

8.1.1 WATERBORNE COATINGS TECHNOLOGY 91

8.1.2 SOLVENTBORNE COATINGS TECHNOLOGY 91

8.1.3 POWDER COATING TECHNOLOGY 91

8.2 COMPLEMENTARY TECHNOLOGIES 92

8.2.1 SURFACE PREPARATION AND PRETREATMENT TECHNOLOGIES 92

8.2.2 COLOR MATCHING AND DIGITAL FORMULATION TECHNOLOGIES 92

8.3 TECHNOLOGY/PRODUCT ROADMAP 92

8.3.1 SHORT-TERM (2025–2027) | FORMULATION REFINEMENT & EARLY MARKET ENTRY 92

8.3.2 MID-TERM (2027–2030) | PERFORMANCE SCALE-UP & MARKET STANDARDIZATION 93

8.3.3 LONG-TERM (2030–2035+) | ADVANCED MATERIALS & SUSTAINABLE INDUSTRY TRANSITION 94

8.4 PATENT ANALYSIS 94

8.4.1 APPROACH 94

8.4.2 DOCUMENT TYPES 95

8.4.3 TOP APPLICANTS 96

8.4.4 JURISDICTION ANALYSIS 98

8.5 IMPACT OF AI/GEN AI ON PAINTS & COATINGS MARKET 99

8.5.1 TOP USE CASES AND MARKET POTENTIAL 100

8.5.2 BEST PRACTICES IN PAINTS & COATINGS PROCESSING 101

8.5.3 CASE STUDIES OF AI IMPLEMENTATION IN PAINTS & COATINGS MARKET 101

8.5.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 101

8.5.5 CLIENTS’ READINESS TO ADOPT GENERATIVE AI IN PAINTS & COATINGS MARKET 101

9 PAINTS & COATINGS MARKET, BY TECHNOLOGY 102

9.1 INTRODUCTION 103

9.2 WATERBORNE COATINGS 107

9.2.1 USE OF ENVIRONMENT-FRIENDLY RAW MATERIALS TO DRIVE DEMAND 107

9.3 SOLVENTBORNE COATINGS 110

9.3.1 RISING PREFERENCE IN HUMID ENVIRONMENTS TO BOOST DEMAND 110

9.4 POWDER COATINGS 113

9.4.1 LOW VOC EMISSION AND COST EFFICIENCY TO DRIVE MARKET 113

9.5 OTHER TECHNOLOGIES 116

10 PAINTS & COATINGS MARKET, BY RESIN TYPE 118

10.1 INTRODUCTION 119

10.2 ACRYLIC RESINS 124

10.2.1 HIGH DEMAND IN AUTOMOTIVE AND BUILDING & CONSTRUCTION INDUSTRIES TO DRIVE MARKET 124

10.3 ALKYD RESINS 127

10.3.1 WIDE APPLICATION ON WOOD AND CONCRETE WALLS TO BOOST DEMAND 127

10.4 EPOXY RESINS 130

10.4.1 GOOD ADHESION AND HIGH CHEMICAL RESISTANCE TO BOOST MARKET 130

10.5 POLYESTER RESINS 132

10.5.1 RISING DEMAND IN LOW-VOC WATERBORNE FORMULATIONS TO DRIVE MARKET 132

10.6 POLYURETHANE RESINS 133

10.6.1 SURGE IN USE OF CONVENTIONAL SOLVENT-BORNE TECHNOLOGIES TO BOOST MARKET 133

10.7 FLUOROPOLYMER RESINS 136

10.7.1 RISING ADOPTION OF LIGHTWEIGHT HIGH-PERFORMANCE MATERIALS IN AEROSPACE INDUSTRY TO FUEL GROWTH 136

10.8 VINYL RESINS 138

10.8.1 EXCELLENT TOUGHNESS AND GOOD WATER & CHEMICAL RESISTANCE TO DRIVE MARKET 138

10.9 OTHER RESIN TYPES 140

11 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY 143

11.1 INTRODUCTION 144

11.2 ARCHITECTURAL 145

11.2.1 RESIDENTIAL 149

11.2.1.1 New construction 151

11.2.1.1.1 High income levels and economic growth to drive market 151

11.2.1.2 Remodel & repaint 153

11.2.1.2.1 Increased expenditure on home renovation projects to drive demand 153

11.2.2 NON RESIDENTIAL 155

11.2.2.1 Commercial 156

11.2.2.1.1 Growing investment in private sector and increasing commercial office spaces to drive market 156

11.2.2.2 Industrial 158

11.2.2.2.1 Growth in industrial sector to boost demand for architectural coatings 158

11.2.2.3 Infrastructure 160

11.2.2.3.1 Rise in infrastructural developments in emerging economies to boost market 160

11.3 INDUSTRIAL 161

11.3.1 GENERAL INDUSTRIAL 165

11.3.1.1 Surge in use of powder-coated products to fuel demand for general industrial equipment 165

11.3.2 PROTECTIVE 167

11.3.2.1 Wide applications in consumer products and heavy machinery to boost demand 167

11.3.3 AUTOMOTIVE REFINISH 169

11.3.3.1 Increase in vehicle use to propel demand for coatings 169

11.3.4 AUTOMOTIVE OEMS 170

11.3.4.1 Pressing need for electric vehicles to drive market 170

11.3.5 WOOD 172

11.3.5.1 Increasing construction and infrastructure activities to drive demand for wood coatings 172

11.3.6 MARINE 174

11.3.6.1 Rise in offshore drilling to boost demand for marine coatings 174

11.3.7 COIL 175

11.3.7.1 Wide application in automotive and construction sectors to drive demand 175

11.3.8 PACKAGING 177

11.3.8.1 Improved lifestyles and changing food habits to fuel demand for packaging coatings 177

11.3.9 AEROSPACE 179

11.3.9.1 Development of chrome-free coating technology to drive market 179

11.3.10 RAIL 180

11.3.10.1 High-speed and modern rail expansion to drive coatings demand 180

12 PAINTS & COATINGS MARKET, BY REGION 183

12.1 INTRODUCTION 184

12.2 ASIA PACIFIC 186

12.2.1 CHINA 199

12.2.1.1 Rapid industrialization and urbanization to drive market 199

12.2.2 INDIA 201

12.2.2.1 Growth of industrial manufacturing clusters to drive demand 201

12.2.3 JAPAN 202

12.2.3.1 Increased investments in infrastructural sector by public and private sectors to boost demand 202

12.2.4 INDONESIA 203

12.2.4.1 Growth of marine and shipbuilding activities to propel market 203

12.2.5 THAILAND 205

12.2.5.1 Growth of automotive component exports to fuel demand 205

12.3 NORTH AMERICA 206

12.3.1 US 218

12.3.1.1 Presence of major manufacturers to boost market 218

12.3.2 CANADA 220

12.3.2.1 Expansion of residential housing and multi-family projects to fuel growth 220

12.3.3 MEXICO 221

12.3.3.1 Expansion of industrial and manufacturing facilities to boost demand 221

12.4 EUROPE 222

12.4.1 GERMANY 237

12.4.1.1 Rising demand for electric vehicles to drive market 237

12.4.2 UK 238

12.4.2.1 Rising demand for energy-efficient buildings to drive market 238

12.4.3 FRANCE 239

12.4.3.1 Integration of decorative and protective coatings in heritage restoration to propel growth 239

12.4.4 ITALY 241

12.4.4.1 Increasing use of advanced coatings in automotive OEM production to drive market 241

12.4.5 SPAIN 242

12.4.5.1 Increasing demand for machinery & equipment to drive market 242

12.4.6 TURKEY 243

12.4.6.1 Expansion of industrial and chemical manufacturing to drive demand 243

12.5 MIDDLE EAST & AFRICA 244

12.5.1 GCC COUNTRIES 258

12.5.1.1 UAE 258

12.5.1.1.1 Government policies and R&D investments to drive market 258

12.5.1.2 Saudi Arabia 260

12.5.1.2.1 Increasing government investments in chemical manufacturing to drive market 260

12.5.2 SOUTH AFRICA 261

12.5.2.1 Increasing use of industrial and protective coatings to drive demand 261

12.5.3 EGYPT 262

12.5.3.1 Expansion of infrastructure projects and rail modernization to drive demand 262

12.6 SOUTH AMERICA 264

12.6.1 BRAZIL 276

12.6.1.1 Expansion of automotive OEM and refinish production to fuel growth 276

12.6.2 ARGENTINA 277

12.6.2.1 Increasing population and improved economic conditions to drive demand 277

13 COMPETITIVE LANDSCAPE 279

13.1 INTRODUCTION 279

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2020–NOVEMBER 2025 279

13.3 MARKET SHARE ANALYSIS, 2024 281

13.4 REVENUE ANALYSIS, 2020–2024 283

13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 284

13.5.1 STARS 284

13.5.2 EMERGING LEADERS 284

13.5.3 PERVASIVE PLAYERS 284

13.5.4 PARTICIPANTS 284

13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 286

13.5.5.1 Company footprint 286

13.5.5.2 Region footprint 287

13.5.5.3 Resin type footprint 288

13.5.5.4 Technology footprint 289

13.5.5.5 End-use industry footprint 290

13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 291

13.6.1 PROGRESSIVE COMPANIES 291

13.6.2 RESPONSIVE COMPANIES 291

13.6.3 DYNAMIC COMPANIES 291

13.6.4 STARTING BLOCKS 291

13.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 292

13.6.5.1 Detailed list of key startups/SMES 292

13.6.5.2 Competitive benchmarking of key startups/SMEs 293

13.7 PRODUCT COMPARISON ANALYSIS 293

13.8 COMPANY VALUATION AND FINANCIAL METRICS 294

13.9 COMPETITIVE SCENARIO 295

13.9.1 PRODUCT LAUNCHES 295

13.9.2 DEALS 300

13.9.3 EXPANSIONS 304

14 COMPANY PROFILES 307

14.1 KEY PLAYERS 307

14.1.1 THE SHERWIN-WILLIAMS COMPANY 307

14.1.1.1 Business overview 307

14.1.1.2 Products/Services/Solutions offered 308

14.1.1.3 Recent developments 310

14.1.1.3.1 Product launches 310

14.1.1.3.2 Deals 312

14.1.1.3.3 Expansions 313

14.1.1.4 MnM view 313

14.1.1.4.1 Right to win 313

14.1.1.4.2 Strategic choices 313

14.1.1.4.3 Weaknesses and competitive threats 314

14.1.2 PPG INDUSTRIES, INC. 315

14.1.2.1 Business overview 315

14.1.2.2 Products/Services/Solutions offered 316

14.1.2.3 Recent developments 318

14.1.2.3.1 Product launches 318

14.1.2.3.2 Deals 320

14.1.2.3.3 Expansions 321

14.1.2.4 MnM view 322

14.1.2.4.1 Right to win 322

14.1.2.4.2 Strategic choices 322

14.1.2.4.3 Weaknesses and competitive threats 322

14.1.3 AKZO NOBEL N.V. 323

14.1.3.1 Business overview 323

14.1.3.2 Products/Services/Solutions offered 324

14.1.3.3 Recent developments 326

14.1.3.3.1 Product launches 326

14.1.3.3.2 Deals 327

14.1.3.3.3 Expansions 328

14.1.3.4 MnM view 329

14.1.3.4.1 Right to win 329

14.1.3.4.2 Strategic choices 330

14.1.3.4.3 Weaknesses and competitive threats 330

14.1.4 NIPPON PAINT HOLDINGS CO., LTD. 331

14.1.4.1 Business overview 331

14.1.4.2 Products/Services/Solutions offered 332

14.1.4.3 Recent developments 333

14.1.4.3.1 Product Launches 333

14.1.4.3.2 Deals 334

14.1.4.3.3 Expansions 335

14.1.4.4 MnM view 335

14.1.4.4.1 Right to win 335

14.1.4.4.2 Strategic choices 335

14.1.4.4.3 Weaknesses and competitive threats 335

14.1.5 AXALTA COATING SYSTEMS LLC 336

14.1.5.1 Business overview 336

14.1.5.2 Products/Services/Solutions offered 337

14.1.5.3 Recent developments 338

14.1.5.3.1 Product launches 338

14.1.5.3.2 Deals 340

14.1.5.3.3 Expansions 341

14.1.5.4 MnM view 342

14.1.5.4.1 Right to win 342

14.1.5.4.2 Strategic choices 342

14.1.5.4.3 Weaknesses and competitive threats 342

14.1.6 ASIAN PAINTS LIMITED 343

14.1.6.1 Business overview 343

14.1.6.2 Products/Services/Solutions offered 344

14.1.6.3 Recent developments 345

14.1.6.3.1 Product launches 345

14.1.6.3.2 Deals 346

14.1.6.3.3 Expansions 346

14.1.7 KANSAI PAINT CO., LTD. 347

14.1.7.1 Business overview 347

14.1.7.2 Products/Services/Solutions offered 348

14.1.7.3 Recent developments 349

14.1.7.3.1 Product launches 349

14.1.7.3.2 Deals 350

14.1.7.3.3 Expansions 351

14.1.8 RPM INTERNATIONAL INC. 352

14.1.8.1 Business overview 352

14.1.8.2 Products/Services/Solutions offered 353

14.1.8.3 Recent developments 354

14.1.8.3.1 Product launches 354

14.1.8.3.2 Deals 355

14.1.8.3.3 Expansions 355

14.1.9 BASF COATINGS GMBH 356

14.1.9.1 Business overview 356

14.1.9.2 Products/Services/Solutions offered 357

14.1.9.3 Recent developments 358

14.1.9.3.1 Product launches 358

14.1.9.3.2 Expansions 359

14.1.10 JOTUN A/S 360

14.1.10.1 Business overview 360

14.1.10.2 Products/Services/Solutions offered 361

14.1.10.3 Recent developments 362

14.1.10.3.1 Product launches 362

14.1.10.3.2 Deals 363

14.1.10.3.3 Expansions 363

14.2 STARTUP/SMES 364

14.2.1 HEMPEL A/S 364

14.2.2 BERGER PAINTS INDIA LIMITED 365

14.2.3 SHALIMAR PAINTS 365

14.2.4 MASCO CORPORATION 366

14.2.5 S.K. KAKEN CO., LTD. 366

14.2.6 BECKERS GROUP 367

14.2.7 DUNN-EDWARDS CORPORATION 367

14.2.8 TIGER COATINGS GMBH & CO. KG 368

14.2.9 SACAL INTERNATIONAL GROUP LTD. 368

14.2.10 DIAMOND VOGEL 369

14.2.11 VISTA PAINT CORPORATION 369

14.2.12 INDIGO PAINTS PVT. LTD. 370

14.2.13 BENJAMIN MOORE & CO. 370

14.2.14 DAW SE 371

14.2.15 HIS PAINT MANUFACTURING COMPANY 371

15 ADJACENT & RELATED MARKETS 372

15.1 INTRODUCTION 372

15.2 LIMITATION 372

15.3 POWDER COATINGS MARKET 372

15.3.1 MARKET DEFINITION 372

15.3.2 MARKET OVERVIEW 372

15.4 POWDER COATINGS MARKET, BY REGION 373

15.4.1 ASIA PACIFIC 373

15.4.2 EUROPE 375

15.4.3 NORTH AMERICA 377

15.4.4 MIDDLE EAST & AFRICA 378

15.4.5 SOUTH AMERICA 380

16 RESEARCH METHODOLOGY 382

16.1 RESEARCH DATA 382

16.1.1 SECONDARY DATA 383

16.1.1.1 Key data from secondary sources 383

16.1.2 PRIMARY DATA 383

16.1.2.1 Key data from primary sources 384

16.1.2.2 Primary interview – demand side and supply side 384

16.1.2.3 Breakdown of primary interviews 384

16.1.2.4 Key industry insights 385

16.2 MARKET SIZE ESTIMATION 385

16.2.1 BOTTOM-UP APPROACH 386

16.2.2 TOP-DOWN APPROACH 387

16.3 GROWTH FORECAST 388

16.3.1 SUPPLY SIDE 388

16.3.2 DEMAND SIDE 388

16.4 DATA TRIANGULATION 389

16.5 FACTOR ANALYSIS 391

16.6 RESEARCH ASSUMPTIONS 391

16.7 RESEARCH LIMITATIONS 392

16.8 RISK ASSESSMENT 392

17 APPENDIX 393

17.1 DISCUSSION GUIDE 393

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 395

17.3 CUSTOMIZATION OPTIONS 397

17.4 RELATED REPORTS 397

17.5 AUTHOR DETAILS 398

LIST OF TABLES

TABLE 1 KEY MOVES AND STRATEGIC FOCUS 58

TABLE 2 PAINTS & COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS 59

TABLE 3 GDP TRENDS AND FORECAST OF MAJOR ECONOMIES, 2021–2030 (USD BILLION) 61

TABLE 4 PRODUCTION TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY,

2021–2024 (USD MILLION) 63

TABLE 5 PAINTS & COATINGS MARKET: ROLE OF COMPANIES IN ECOSYSTEM 66

TABLE 6 AVERAGE SELLING PRICE OF KEY PLAYERS FOR TOP END-USE INDUSTRIES,

2024 (USD/KG) 68

TABLE 7 AVERAGE SELLING PRICE TREND OF PAINTS & COATINGS, BY REGION,

2022–2025 (USD/KG) 69

TABLE 8 IMPORT DATA RELATED TO PAINTS & COATINGS, BY REGION,

2019–2024 (USD MILLION) 70

TABLE 9 EXPORT DATA RELATED TO PAINTS & COATINGS, BY REGION,

2019–2024 (USD MILLION) 71

TABLE 10 PAINTS & COATINGS MARKET: LIST OF CONFERENCES & EVENTS, 2025–2026 71

TABLE 11 PAINTS & COATINGS MARKET: FUNDING/INVESTMENT SCENARIO, 2021–2025 73

TABLE 12 US ADJUSTED RECIPROCAL TARIFF RATES 75

TABLE 13 GLOBAL: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 78

TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 79

TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 80

TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 80

TABLE 17 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 81

TABLE 18 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 81

TABLE 19 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN PAINTS & COATINGS MARKET 85

TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO END-USE INDUSTRIES (%) 88

TABLE 21 KEY BUYING CRITERIA FOR TOP TWO END-USE INDUSTRIES 88

TABLE 22 PAINTS & COATINGS MARKET: UNMET NEEDS IN KEY END-USE INDUSTRIES 90

TABLE 23 LIST OF MAJOR PATENTS RELATED TO PAINTS & COATINGS, 2014–2024 97

TABLE 24 TOP USE CASES AND MARKET POTENTIAL 100

TABLE 25 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES 101

TABLE 26 PAINTS & COATINGS MARKET: CASE STUDIES RELATED TO GEN AI IMPLEMENTATION 101

TABLE 27 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 101

TABLE 28 PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2020–2024 (USD MILLION) 103

TABLE 29 PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION) 103

TABLE 30 PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2020–2024 (KILOTON) 104

TABLE 31 PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2025–2030 (KILOTON) 104

TABLE 32 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2020–2024 (USD MILLION) 105

TABLE 33 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2025–2030 (USD MILLION) 105

TABLE 34 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2020–2024 (KILOTON) 105

TABLE 35 ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2025–2030 (KILOTON) 105

TABLE 36 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2020–2024 (USD MILLION) 106

TABLE 37 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2025–2030 (USD MILLION) 106

TABLE 38 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2020–2024 (KILOTON) 107

TABLE 39 INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2025–2030 (KILOTON) 107

TABLE 40 WATERBORNE COATINGS: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY REGION, 2020–2024 (USD MILLION) 108

TABLE 41 WATERBORNE COATINGS: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY REGION, 2025–2030 (USD MILLION) 108

TABLE 42 WATERBORNE COATINGS: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY REGION, 2020–2024 (KILOTON) 108

TABLE 43 WATERBORNE COATINGS: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY REGION, 2025–2030 (KILOTON) 109

TABLE 44 WATERBORNE COATINGS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 109

TABLE 45 WATERBORNE COATINGS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 109

TABLE 46 WATERBORNE COATINGS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 110

TABLE 47 WATERBORNE COATINGS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 110

TABLE 48 SOLVENTBORNE COATINGS: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY REGION, 2020–2024 (USD MILLION) 111

TABLE 49 SOLVENTBORNE COATINGS: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY REGION, 2025–2030 (USD MILLION) 111

TABLE 50 SOLVENTBORNE COATINGS: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY REGION, 2020–2024 (KILOTON) 111

TABLE 51 SOLVENTBORNE COATINGS: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY REGION, 2025–2030 (KILOTON) 112

TABLE 52 SOLVENTBORNE COATINGS: INDUSTRIAL PAINTS & COATINGS MARKET,

BY REGION, 2020–2024 (USD MILLION) 112

TABLE 53 SOLVENTBORNE COATINGS: INDUSTRIAL PAINTS & COATINGS MARKET,

BY REGION, 2025–2030 (USD MILLION) 112

TABLE 54 SOLVENTBORNE COATINGS: INDUSTRIAL PAINTS & COATINGS MARKET,

BY REGION, 2020–2024 (KILOTON) 113

TABLE 55 SOLVENTBORNE COATINGS: INDUSTRIAL PAINTS & COATINGS MARKET,

BY REGION, 2025–2030 (KILOTON) 113

TABLE 56 POWDER COATINGS: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 114

TABLE 57 POWDER COATINGS: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 114

TABLE 58 POWDER COATINGS: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 114

TABLE 59 POWDER COATINGS: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 115

TABLE 60 POWDER COATINGS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 115

TABLE 61 POWDER COATINGS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 115

TABLE 62 POWDER COATINGS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 116

TABLE 63 POWDER COATINGS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 116

TABLE 64 OTHER TECHNOLOGIES: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 116

TABLE 65 OTHER TECHNOLOGIES: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 117

TABLE 66 OTHER TECHNOLOGIES: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 117

TABLE 67 OTHER TECHNOLOGIES: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 117

TABLE 68 PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (USD MILLION) 119

TABLE 69 PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (USD MILLION) 119

TABLE 70 PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (KILOTON) 120

TABLE 71 PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (KILOTON) 120

TABLE 72 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2020–2024 (USD MILLION) 121

TABLE 73 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2025–2030 (USD MILLION) 121

TABLE 74 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2020–2024 (KILOTON) 122

TABLE 75 ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2025–2030 (KILOTON) 122

TABLE 76 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2020–2024 (USD MILLION) 123

TABLE 77 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2025–2030 (USD MILLION) 123

TABLE 78 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (KILOTON) 123

TABLE 79 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (KILOTON) 124

TABLE 80 ACRYLIC RESINS: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 124

TABLE 81 ACRYLIC RESINS: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 125

TABLE 82 ACRYLIC RESINS: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 125

TABLE 83 ACRYLIC RESINS: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 125

TABLE 84 ACRYLIC RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (USD MILLION) 126

TABLE 85 ACRYLIC RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (USD MILLION) 126

TABLE 86 ACRYLIC RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (KILOTON) 126

TABLE 87 ACRYLIC RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (KILOTON) 127

TABLE 88 ALKYD RESINS: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 127

TABLE 89 ALKYD RESINS: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 128

TABLE 90 ALKYD RESINS: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 128

TABLE 91 ALKYD RESINS: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 128

TABLE 92 ALKYD RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (USD MILLION) 129

TABLE 93 ALKYD RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (USD MILLION) 129

TABLE 94 ALKYD RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (KILOTON) 129

TABLE 95 ALKYD RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (KILOTON) 130

TABLE 96 EPOXY RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (USD MILLION) 130

TABLE 97 EPOXY RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (USD MILLION) 131

TABLE 98 EPOXY RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (KILOTON) 131

TABLE 99 EPOXY RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (KILOTON) 131

TABLE 100 POLYESTER RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 132

TABLE 101 POLYESTER RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 132

TABLE 102 POLYESTER RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 133

TABLE 103 POLYESTER RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 133

TABLE 104 POLYURETHANE RESINS: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY REGION, 2020–2024 (USD MILLION) 134

TABLE 105 POLYURETHANE RESINS: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY REGION, 2025–2030 (USD MILLION) 134

TABLE 106 POLYURETHANE RESINS: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY REGION, 2020–2024 (KILOTON) 134

TABLE 107 POLYURETHANE RESINS: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY REGION, 2025–2030 (KILOTON) 135

TABLE 108 POLYURETHANE RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 135

TABLE 109 POLYURETHANE RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 135

TABLE 110 POLYURETHANE RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 136

TABLE 111 POLYURETHANE RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 136

TABLE 112 FLUOROPOLYMER RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 137

TABLE 113 FLUOROPOLYMER RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 137

TABLE 114 FLUOROPOLYMER RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 137

TABLE 115 FLUOROPOLYMER RESINS: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 138

TABLE 116 VINYL RESINS: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (USD MILLION) 138

TABLE 117 VINYL RESINS: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (USD MILLION) 139

TABLE 118 VINYL RESINS: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (KILOTON) 139

TABLE 119 VINYL RESINS: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (KILOTON) 139

TABLE 120 OTHER RESIN TYPES: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 140

TABLE 121 OTHER RESIN TYPES: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 140

TABLE 122 OTHER RESIN TYPES: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 141

TABLE 123 OTHER RESIN TYPES: ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 141

TABLE 124 OTHER RESIN TYPES: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 141

TABLE 125 OTHER RESIN TYPES: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 142

TABLE 126 OTHER RESIN TYPES: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 142

TABLE 127 OTHER RESIN TYPES: INDUSTRIAL PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 142

TABLE 128 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (USD MILLION) 144

TABLE 129 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 144

TABLE 130 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (KILOTON) 145

TABLE 131 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 145

TABLE 132 ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 146

TABLE 133 ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 146

TABLE 134 ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 147

TABLE 135 ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 147

TABLE 136 ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (USD MILLION) 148

TABLE 137 ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (USD MILLION) 148

TABLE 138 ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (KILOTON) 148

TABLE 139 ARCHITECTURAL PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (KILOTON) 149

TABLE 140 RESIDENTIAL: PAINTS & COATINGS MARKET, BY SUB-SEGMENT,

2020–2024 (USD MILLION) 149

TABLE 141 RESIDENTIAL: PAINTS & COATINGS MARKET, BY SUB-SEGMENT,

2025–2030 (USD MILLION) 149

TABLE 142 RESIDENTIAL: PAINTS & COATINGS MARKET, BY SUB-SEGMENT,

2020–2024 (KILOTON) 150

TABLE 143 RESIDENTIAL: PAINTS & COATINGS MARKET, BY SUB-SEGMENT,

2025–2030 (KILOTON) 150

TABLE 144 RESIDENTIAL: PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (USD MILLION) 150

TABLE 145 RESIDENTIAL: PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (USD MILLION) 150

TABLE 146 RESIDENTIAL: PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 151

TABLE 147 RESIDENTIAL: PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 151

TABLE 148 RESIDENTIAL (NEW CONSTRUCTION): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 152

TABLE 149 RESIDENTIAL (NEW CONSTRUCTION): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 152

TABLE 150 RESIDENTIAL (NEW CONSTRUCTION): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 152

TABLE 151 RESIDENTIAL (NEW CONSTRUCTION): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 153

TABLE 152 RESIDENTIAL (REMODEL & REPAINT): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 153

TABLE 153 RESIDENTIAL (REMODEL & REPAINT): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 154

TABLE 154 RESIDENTIAL (REMODEL & REPAINT): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 154

TABLE 155 RESIDENTIAL (REMODEL & REPAINT): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 154

TABLE 156 NON RESIDENTIAL: PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (USD MILLION) 155

TABLE 157 NON RESIDENTIAL: PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (USD MILLION) 155

TABLE 158 NON RESIDENTIAL: PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (KILOTON) 156

TABLE 159 NON RESIDENTIAL: PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (KILOTON) 156

TABLE 160 NON RESIDENTIAL (COMMERCIAL): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 157

TABLE 161 NON RESIDENTIAL (COMMERCIAL): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 157

TABLE 162 NON RESIDENTIAL (COMMERCIAL): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 157

TABLE 163 NON RESIDENTIAL (COMMERCIAL): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 158

TABLE 164 NON RESIDENTIAL (INDUSTRIAL): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 158

TABLE 165 NON RESIDENTIAL (INDUSTRIAL): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 159

TABLE 166 NON RESIDENTIAL (INDUSTRIAL): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 159

TABLE 167 NON RESIDENTIAL (INDUSTRIAL): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 159

TABLE 168 NON RESIDENTIAL (INFRASTRUCTURE): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 160

TABLE 169 NON RESIDENTIAL (INFRASTRUCTURE): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 160

TABLE 170 NON RESIDENTIAL (INFRASTRUCTURE): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 161

TABLE 171 NON RESIDENTIAL (INFRASTRUCTURE): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 161

TABLE 172 INDUSTRIAL: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 162

TABLE 173 INDUSTRIAL: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 163

TABLE 174 INDUSTRIAL: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 163

TABLE 175 INDUSTRIAL: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 164

TABLE 176 INDUSTRIAL: PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (USD MILLION) 164

TABLE 177 INDUSTRIAL: PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (USD MILLION) 164

TABLE 178 INDUSTRIAL: PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 165

TABLE 179 INDUSTRIAL: PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 165

TABLE 180 INDUSTRIAL (GENERAL INDUSTRIAL): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 166

TABLE 181 INDUSTRIAL (GENERAL INDUSTRIAL): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 166

TABLE 182 INDUSTRIAL (GENERAL INDUSTRIAL): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 166

TABLE 183 INDUSTRIAL (GENERAL INDUSTRIAL): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 167

TABLE 184 INDUSTRIAL (PROTECTIVE): PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (USD MILLION) 167

TABLE 185 INDUSTRIAL (PROTECTIVE): PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (USD MILLION) 168

TABLE 186 INDUSTRIAL (PROTECTIVE SEGMENT): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 168

TABLE 187 INDUSTRIAL (PROTECTIVE SEGMENT): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 168

TABLE 188 INDUSTRIAL (AUTOMOTIVE REFINISH): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 169

TABLE 189 INDUSTRIAL (AUTOMOTIVE REFINISH): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 169

TABLE 190 INDUSTRIAL (AUTOMOTIVE REFINISH): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 170

TABLE 191 INDUSTRIAL (AUTOMOTIVE REFINISH): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 170

TABLE 192 INDUSTRIAL (AUTOMOTIVE OEM): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 171

TABLE 193 INDUSTRIAL (AUTOMOTIVE OEM): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 171

TABLE 194 INDUSTRIAL (AUTOMOTIVE OEM): PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 171

TABLE 195 INDUSTRIAL (AUTOMOTIVE OEM): PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 172

TABLE 196 INDUSTRIAL (WOOD): PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (USD MILLION) 172

TABLE 197 INDUSTRIAL (WOOD): PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (USD MILLION) 173

TABLE 198 INDUSTRIAL (WOOD): PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (KILOTON) 173

TABLE 199 INDUSTRIAL (WOOD): PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (KILOTON) 173

TABLE 200 INDUSTRIAL (MARINE): PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (USD MILLION) 174

TABLE 201 INDUSTRIAL (MARINE): PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (USD MILLION) 174

TABLE 202 INDUSTRIAL (MARINE): PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (KILOTON) 175

TABLE 203 INDUSTRIAL (MARINE): PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (KILOTON) 175

TABLE 204 INDUSTRIAL (COIL): PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (USD MILLION) 176

TABLE 205 INDUSTRIAL (COIL): PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (USD MILLION) 176

TABLE 206 INDUSTRIAL (COIL): PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (KILOTON) 176

TABLE 207 INDUSTRIAL (COIL): PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (KILOTON) 177

TABLE 208 INDUSTRIAL (PACKAGING): PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (USD MILLION) 177

TABLE 209 INDUSTRIAL (PACKAGING): PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (USD MILLION) 178

TABLE 210 INDUSTRIAL (PACKAGING): PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (KILOTON) 178

TABLE 211 INDUSTRIAL (PACKAGING): PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (KILOTON) 178

TABLE 212 INDUSTRIAL (AEROSPACE): PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (USD MILLION) 179

TABLE 213 INDUSTRIAL (AEROSPACE): PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (USD MILLION) 179

TABLE 214 INDUSTRIAL (AEROSPACE): PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (KILOTON) 180

TABLE 215 INDUSTRIAL (AEROSPACE): PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (KILOTON) 180

TABLE 216 INDUSTRIAL (RAIL): PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (USD MILLION) 181

TABLE 217 INDUSTRIAL (RAIL): PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (USD MILLION) 181

TABLE 218 INDUSTRIAL (RAIL): PAINTS & COATINGS MARKET, BY REGION,

2020–2024 (KILOTON) 181

TABLE 219 INDUSTRIAL (RAIL): PAINTS & COATINGS MARKET, BY REGION,

2025–2030 (KILOTON) 182

TABLE 220 PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (USD MILLION) 184

TABLE 221 PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (USD MILLION) 185

TABLE 222 PAINTS & COATINGS MARKET, BY REGION, 2020–2024 (KILOTON) 185

TABLE 223 PAINTS & COATINGS MARKET, BY REGION, 2025–2030 (KILOTON) 185

TABLE 224 ASIA PACIFIC: PAINTS & COATINGS MARKET, BY COUNTRY,

2020–2024 (USD MILLION) 187

TABLE 225 ASIA PACIFIC: PAINTS & COATINGS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 187

TABLE 226 ASIA PACIFIC: PAINTS & COATINGS MARKET, BY COUNTRY, 2020–2024 (KILOTON) 187

TABLE 227 ASIA PACIFIC: PAINTS & COATINGS MARKET, BY COUNTRY, 2025–2030 (KILOTON) 188

TABLE 228 ASIA PACIFIC: ARCHITECTURAL PAINTS & COATINGS MARKET, BY COUNTRY, 2020–2024 (USD MILLION) 188

TABLE 229 ASIA PACIFIC: ARCHITECTURAL PAINTS & COATINGS MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 188

TABLE 230 ASIA PACIFIC: ARCHITECTURAL PAINTS & COATINGS MARKET, BY COUNTRY, 2020–2024 (KILOTON) 189

TABLE 231 ASIA PACIFIC: ARCHITECTURAL PAINTS & COATINGS MARKET, BY COUNTRY, 2025–2030 (KILOTON) 189

TABLE 232 ASIA PACIFIC: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY,

2020–2024 (USD MILLION) 189

TABLE 233 ASIA PACIFIC: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 190

TABLE 234 ASIA PACIFIC: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY,

2020–2024 (KILOTON) 190

TABLE 235 ASIA PACIFIC: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 190

TABLE 236 ASIA PACIFIC: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (USD MILLION) 191

TABLE 237 ASIA PACIFIC: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (USD MILLION) 191

TABLE 238 ASIA PACIFIC: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (KILOTON) 191

TABLE 239 ASIA PACIFIC: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (KILOTON) 192

TABLE 240 ASIA PACIFIC: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2020–2024 (USD MILLION) 192

TABLE 241 ASIA PACIFIC: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2025–2030 (USD MILLION) 192

TABLE 242 ASIA PACIFIC: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2020–2024 (KILOTON) 193

TABLE 243 ASIA PACIFIC: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2025–2030 (KILOTON) 193

TABLE 244 ASIA PACIFIC: ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2020–2024 (USD MILLION) 193

TABLE 245 ASIA PACIFIC: ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION) 194

TABLE 246 ASIA PACIFIC: ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2020–2024 (KILOTON) 194

TABLE 247 ASIA PACIFIC: ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2025–2030 (KILOTON) 194

TABLE 248 ASIA PACIFIC: INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2020–2024 (USD MILLION) 195

TABLE 249 ASIA PACIFIC: INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION) 195

TABLE 250 ASIA PACIFIC: INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2020–2024 (KILOTON) 195

TABLE 251 ASIA PACIFIC: INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2025–2030 (KILOTON) 196

TABLE 252 ASIA PACIFIC: ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (USD MILLION) 196

TABLE 253 ASIA PACIFIC: ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 196

TABLE 254 ASIA PACIFIC: ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (KILOTON) 197

TABLE 255 ASIA PACIFIC: ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 197

TABLE 256 ASIA PACIFIC: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (USD MILLION) 198

TABLE 257 ASIA PACIFIC: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 198

TABLE 258 ASIA PACIFIC: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (KILOTON) 199

TABLE 259 ASIA PACIFIC: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 199

TABLE 260 CHINA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 200

TABLE 261 CHINA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 200

TABLE 262 CHINA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 200

TABLE 263 CHINA: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 201

TABLE 264 INDIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 201

TABLE 265 INDIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 201

TABLE 266 INDIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 202

TABLE 267 INDIA: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 202

TABLE 268 JAPAN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 202

TABLE 269 JAPAN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 203

TABLE 270 JAPAN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 203

TABLE 271 JAPAN: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 203

TABLE 272 INDONESIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 204

TABLE 273 INDONESIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 204

TABLE 274 INDONESIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 204

TABLE 275 INDONESIA: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 204

TABLE 276 THAILAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 205

TABLE 277 THAILAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 205

TABLE 278 THAILAND: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 205

TABLE 279 THAILAND: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 206

TABLE 280 NORTH AMERICA: PAINTS & COATINGS MARKET, BY COUNTRY,

2020–2024 (USD MILLION) 207

TABLE 281 NORTH AMERICA: PAINTS & COATINGS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 207

TABLE 282 NORTH AMERICA: PAINTS & COATINGS MARKET, BY COUNTRY,

2020–2024 (KILOTON) 207

TABLE 283 NORTH AMERICA: PAINTS & COATINGS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 207

TABLE 284 NORTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY COUNTRY, 2020–2024 (USD MILLION) 208

TABLE 285 NORTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 208

TABLE 286 NORTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY COUNTRY, 2020–2024 (KILOTON) 208

TABLE 287 NORTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY COUNTRY, 2025–2030 (KILOTON) 208

TABLE 288 NORTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY, 2020–2024 (USD MILLION) 209

TABLE 289 NORTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 209

TABLE 290 NORTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY, 2020–2024 (KILOTON) 209

TABLE 291 NORTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY, 2025–2030 (KILOTON) 209

TABLE 292 NORTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (USD MILLION) 210

TABLE 293 NORTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (USD MILLION) 210

TABLE 294 NORTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (KILOTON) 210

TABLE 295 NORTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (KILOTON) 211

TABLE 296 NORTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (USD MILLION) 211

TABLE 297 NORTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (USD MILLION) 211

TABLE 298 NORTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (KILOTON) 212

TABLE 299 NORTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (KILOTON) 212

TABLE 300 NORTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY TECHNOLOGY, 2020–2024 (USD MILLION) 212

TABLE 301 NORTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY TECHNOLOGY, 2025–2030 (USD MILLION) 213

TABLE 302 NORTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY TECHNOLOGY, 2020–2024 (KILOTON) 213

TABLE 303 NORTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY TECHNOLOGY, 2025–2030 (KILOTON) 213

TABLE 304 NORTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2020–2024 (USD MILLION) 214

TABLE 305 NORTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION) 214

TABLE 306 NORTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2020–2024 (KILOTON) 214

TABLE 307 NORTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2025–2030 (KILOTON) 215

TABLE 308 NORTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (USD MILLION) 215

TABLE 309 NORTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 215

TABLE 310 NORTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (KILOTON) 216

TABLE 311 NORTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 216

TABLE 312 NORTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (USD MILLION) 217

TABLE 313 NORTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 217

TABLE 314 NORTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (KILOTON) 218

TABLE 315 NORTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 218

TABLE 316 US: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 219

TABLE 317 US: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 219

TABLE 318 US: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (KILOTON) 219

TABLE 319 US: PAINTS & COATINGS MARKET, BY END USE INDUSTRY, 2025–2030 (KILOTON) 219

TABLE 320 CANADA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 220

TABLE 321 CANADA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 220

TABLE 322 CANADA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 220

TABLE 323 CANADA: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 221

TABLE 324 MEXICO: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 221

TABLE 325 MEXICO: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 221

TABLE 326 MEXICO: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 222

TABLE 327 MEXICO: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 222

TABLE 328 EUROPE: PAINTS & COATINGS MARKET, BY COUNTRY, 2020–2024 (USD MILLION) 223

TABLE 329 EUROPE: PAINTS & COATINGS MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 224

TABLE 330 EUROPE: PAINTS & COATINGS MARKET, BY COUNTRY, 2020–2024 (KILOTON) 224

TABLE 331 EUROPE: PAINTS & COATINGS MARKET, BY COUNTRY, 2025–2030 (KILOTON) 224

TABLE 332 EUROPE: ARCHITECTURAL PAINTS & COATINGS MARKET, BY COUNTRY,

2020–2024 (USD MILLION) 225

TABLE 333 EUROPE: ARCHITECTURAL PAINTS & COATINGS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 225

TABLE 334 EUROPE: ARCHITECTURAL PAINTS & COATINGS MARKET, BY COUNTRY,

2020–2024 (KILOTON) 226

TABLE 335 EUROPE: ARCHITECTURAL PAINTS & COATINGS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 226

TABLE 336 EUROPE: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY,

2020–2024 (USD MILLION) 226

TABLE 337 EUROPE: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 227

TABLE 338 EUROPE: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY,

2020–2024 (KILOTON) 227

TABLE 339 EUROPE: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 228

TABLE 340 EUROPE: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2020–2024 (USD MILLION) 228

TABLE 341 EUROPE: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2025–2030 (USD MILLION) 228

TABLE 342 EUROPE: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2020–2024 (KILOTON) 229

TABLE 343 EUROPE: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2025–2030 (KILOTON) 229

TABLE 344 EUROPE: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2020–2024 (USD MILLION) 229

TABLE 345 EUROPE: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2025–2030 (USD MILLION) 230

TABLE 346 EUROPE: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2020–2024 (KILOTON) 230

TABLE 347 EUROPE: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE,

2025–2030 (KILOTON) 231

TABLE 348 EUROPE: ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2020–2024 (USD MILLION) 231

TABLE 349 EUROPE: ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2025–2030 (USD MILLION) 231

TABLE 350 EUROPE: ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2020–2024 (KILOTON) 232

TABLE 351 EUROPE: ARCHITECTURAL PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2025–2030 (KILOTON) 232

TABLE 352 EUROPE: INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2020–2024 (USD MILLION) 232

TABLE 353 EUROPE: INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2025–2030 (USD MILLION) 232

TABLE 354 EUROPE: INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2020–2024 (KILOTON) 233

TABLE 355 EUROPE: INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY,

2025–2030 (KILOTON) 233

TABLE 356 EUROPE: ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (USD MILLION) 233

TABLE 357 EUROPE: ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 234

TABLE 358 EUROPE: ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (KILOTON) 234

TABLE 359 EUROPE: ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 235

TABLE 360 EUROPE: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (USD MILLION) 235

TABLE 361 EUROPE: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 236

TABLE 362 EUROPE: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (KILOTON) 236

TABLE 363 EUROPE: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 237

TABLE 364 GERMANY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 237

TABLE 365 GERMANY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 238

TABLE 366 GERMANY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 238

TABLE 367 GERMANY: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 238

TABLE 368 UK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 239

TABLE 369 UK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 239

TABLE 370 UK: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (KILOTON) 239

TABLE 371 UK: PAINTS & COATINGS MARKET, BY END USE INDUSTRY, 2025–2030 (KILOTON) 239

TABLE 372 FRANCE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 240

TABLE 373 FRANCE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 240

TABLE 374 FRANCE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 240

TABLE 375 FRANCE: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 240

TABLE 376 ITALY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 241

TABLE 377 ITALY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 241

TABLE 378 ITALY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 241

TABLE 379 ITALY: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 242

TABLE 380 SPAIN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 242

TABLE 381 SPAIN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 242

TABLE 382 SPAIN: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 243

TABLE 383 SPAIN: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 243

TABLE 384 TURKEY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 243

TABLE 385 TURKEY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 244

TABLE 386 TURKEY: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 244

TABLE 387 TURKEY: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 244

TABLE 388 MIDDLE EAST & AFRICA: PAINTS & COATINGS MARKET, BY COUNTRY,

2020–2024 (USD MILLION) 245

TABLE 389 MIDDLE EAST & AFRICA: PAINTS & COATINGS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 245

TABLE 390 MIDDLE EAST & AFRICA: PAINTS & COATINGS MARKET, BY COUNTRY,

2020–2024 (KILOTON) 246

TABLE 391 MIDDLE EAST & AFRICA: PAINTS & COATINGS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 246

TABLE 392 MIDDLE EAST & AFRICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY COUNTRY, 2020–2024 (USD MILLION) 246

TABLE 393 MIDDLE EAST & AFRICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY COUNTRY, 2025–2030 (USD MILLION) 247

TABLE 394 MIDDLE EAST & AFRICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY COUNTRY, 2020–2024 (KILOTON) 247

TABLE 395 MIDDLE EAST & AFRICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY COUNTRY, 2025–2030 (KILOTON) 248

TABLE 396 MIDDLE EAST & AFRICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY, 2020–2024 (USD MILLION) 248

TABLE 397 MIDDLE EAST & AFRICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 248

TABLE 398 MIDDLE EAST & AFRICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY, 2020–2024 (KILOTON) 249

TABLE 399 MIDDLE EAST & AFRICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY, 2025–2030 (KILOTON) 249

TABLE 400 MIDDLE EAST & AFRICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (USD MILLION) 250

TABLE 401 MIDDLE EAST & AFRICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (USD MILLION) 250

TABLE 402 MIDDLE EAST & AFRICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (KILOTON) 250

TABLE 403 MIDDLE EAST & AFRICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (KILOTON) 251

TABLE 404 MIDDLE EAST & AFRICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (USD MILLION) 251

TABLE 405 MIDDLE EAST & AFRICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (USD MILLION) 251

TABLE 406 MIDDLE EAST & AFRICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (KILOTON) 252

TABLE 407 MIDDLE EAST & AFRICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (KILOTON) 252

TABLE 408 MIDDLE EAST & AFRICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY TECHNOLOGY, 2020–2024 (USD MILLION) 252

TABLE 409 MIDDLE EAST & AFRICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY TECHNOLOGY, 2025–2030 (USD MILLION) 253

TABLE 410 MIDDLE EAST & AFRICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY TECHNOLOGY, 2020–2024 (KILOTON) 253

TABLE 411 MIDDLE EAST & AFRICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY TECHNOLOGY, 2025–2030 (KILOTON) 253

TABLE 412 MIDDLE EAST & AFRICA: INDUSTRIAL PAINTS & COATINGS MARKET,

BY TECHNOLOGY, 2020–2024 (USD MILLION) 254

TABLE 413 MIDDLE EAST & AFRICA: INDUSTRIAL PAINTS & COATINGS MARKET,

BY TECHNOLOGY, 2025–2030 (USD MILLION) 254

TABLE 414 MIDDLE EAST & AFRICA: INDUSTRIAL PAINTS & COATINGS MARKET,

BY TECHNOLOGY, 2020–2024 (KILOTON) 254

TABLE 415 MIDDLE EAST & AFRICA: INDUSTRIAL PAINTS & COATINGS MARKET,

BY TECHNOLOGY, 2025–2030 (KILOTON) 255

TABLE 416 MIDDLE EAST & AFRICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY END-USE INDUSTRY, 2020–2024 (USD MILLION) 255

TABLE 417 MIDDLE EAST & AFRICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 255

TABLE 418 MIDDLE EAST & AFRICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY END-USE INDUSTRY, 2020–2024 (KILOTON) 256

TABLE 419 MIDDLE EAST & AFRICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY END-USE INDUSTRY, 2025–2030 (KILOTON) 256

TABLE 420 MIDDLE EAST & AFRICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (USD MILLION) 256

TABLE 421 MIDDLE EAST & AFRICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 257

TABLE 422 MIDDLE EAST & AFRICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (KILOTON) 257

TABLE 423 MIDDLE EAST & AFRICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 258

TABLE 424 UAE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 259

TABLE 425 UAE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 259

TABLE 426 UAE: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 259

TABLE 427 UAE: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 259

TABLE 428 SAUDI ARABIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 260

TABLE 429 SAUDI ARABIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 260

TABLE 430 SAUDI ARABIA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 261

TABLE 431 SAUDI ARABIA: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 261

TABLE 432 SOUTH AFRICA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 261

TABLE 433 SOUTH AFRICA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 262

TABLE 434 SOUTH AFRICA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 262

TABLE 435 SOUTH AFRICA: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 262

TABLE 436 EGYPT: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 263

TABLE 437 EGYPT: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 263

TABLE 438 EGYPT: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 263

TABLE 439 EGYPT: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 263

TABLE 440 SOUTH AMERICA: PAINTS & COATINGS MARKET, BY COUNTRY,

2020–2024 (USD MILLION) 264

TABLE 441 SOUTH AMERICA: PAINTS & COATINGS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 264

TABLE 442 SOUTH AMERICA: PAINTS & COATINGS MARKET, BY COUNTRY,

2020–2024 (KILOTON) 264

TABLE 443 SOUTH AMERICA: PAINTS & COATINGS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 265

TABLE 444 SOUTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY COUNTRY, 2020–2024 (USD MILLION) 265

TABLE 445 SOUTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 265

TABLE 446 SOUTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY COUNTRY, 2020–2024 (KILOTON) 265

TABLE 447 SOUTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY COUNTRY, 2025–2030 (KILOTON) 266

TABLE 448 SOUTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY,

2020–2024 (USD MILLION) 266

TABLE 449 SOUTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 266

TABLE 450 SOUTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY,

2020–2024 (KILOTON) 267

TABLE 451 SOUTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 267

TABLE 452 SOUTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (USD MILLION) 267

TABLE 453 SOUTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (USD MILLION) 267

TABLE 454 SOUTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (KILOTON) 268

TABLE 455 SOUTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (KILOTON) 268

TABLE 456 SOUTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (USD MILLION) 268

TABLE 457 SOUTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (USD MILLION) 269

TABLE 458 SOUTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2020–2024 (KILOTON) 269

TABLE 459 SOUTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2025–2030 (KILOTON) 270

TABLE 460 SOUTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY TECHNOLOGY, 2020–2024 (USD MILLION) 270

TABLE 461 SOUTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY TECHNOLOGY, 2025–2030 (USD MILLION) 270

TABLE 462 SOUTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY TECHNOLOGY, 2020–2024 (KILOTON) 271

TABLE 463 SOUTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET,

BY TECHNOLOGY, 2025–2030 (KILOTON) 271

TABLE 464 SOUTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2020–2024 (USD MILLION) 271

TABLE 465 SOUTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2025–2030 (USD MILLION) 271

TABLE 466 SOUTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2020–2024 (KILOTON) 272

TABLE 467 SOUTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2025–2030 (KILOTON) 272

TABLE 468 SOUTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (USD MILLION) 272

TABLE 469 SOUTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 273

TABLE 470 SOUTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (KILOTON) 273

TABLE 471 SOUTH AMERICA: ARCHITECTURAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 274

TABLE 472 SOUTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (USD MILLION) 274

TABLE 473 SOUTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 275

TABLE 474 SOUTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2020–2024 (KILOTON) 275

TABLE 475 SOUTH AMERICA: INDUSTRIAL PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 276

TABLE 476 BRAZIL: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 276

TABLE 477 BRAZIL: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 277

TABLE 478 BRAZIL: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 277

TABLE 479 BRAZIL: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 277

TABLE 480 ARGENTINA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (USD MILLION) 278

TABLE 481 ARGENTINA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 278

TABLE 482 ARGENTINA: PAINTS & COATINGS MARKET, BY END-USE INDUSTRY,

2020–2024 (KILOTON) 278

TABLE 483 ARGENTINA: PAINTS & COATINGS MARKET, BY END USE INDUSTRY,

2025–2030 (KILOTON) 278

TABLE 484 STRATEGIES ADOPTED BY KEY PAINTS & COATINGS MANUFACTURERS,

JANUARY 2020–NOVEMBER 2025 279

TABLE 485 PAINTS & COATINGS MARKET: DEGREE OF COMPETITION 281

TABLE 486 PAINTS & COATINGS MARKET: REGION FOOTPRINT 287

TABLE 487 PAINTS & COATINGS MARKET: RESIN TYPE FOOTPRINT 288

TABLE 488 PAINTS & COATINGS MARKET: TECHNOLOGY FOOTPRINT 289

TABLE 489 PAINTS & COATINGS MARKET: END-USE INDUSTRY FOOTPRINT 290

TABLE 490 PAINTS & COATINGS MARKET: DETAILED LIST OF KEY STARTUPS/SMES 292

TABLE 491 PAINTS & COATINGS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES 293

TABLE 492 PAINTS & COATINGS MARKET: PRODUCT LAUNCHES,

JANUARY 2020–NOVEMBER 2025 295

TABLE 493 PAINTS & COATINGS MARKET: DEALS, JANUARY 2020–NOVEMBER 2025 300

TABLE 494 PAINTS & COATINGS MARKET: EXPANSIONS, JANUARY 2020–NOVEMBER 2025 304

TABLE 495 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW 307