FRP-GRP-GRE Pipe Market - Global Forecast to 2030

FRP/GRP/GREパイプ市場 -タイプ(GRP、GRE、その他)、ガラス繊維の種類(Eガラス、Sガラス、その他)、製造プロセス(フィラメントワインディング、その他)、直径(1200 mm)、最終用途産業(石油・ガス、化学薬品、下水道管、灌漑、その他)および地域別 - 2030年までの予測

FRP/GRP/GRE Pipes Market Size by Type (GRP, GRE, Others), Glass Fiber Type (E-Glass, S-Glass, Others), Manufacturing Process (Filament Winding, Others), Diameter (1200 mm), End-Use Industry (Oil & Gas, Chemicals, Sewage Pipes, Irrigation, Others) and Region - Forecast to 2030

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年01月 |

| ページ数 | 326 |

| 図表数 | 454 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-11920 |

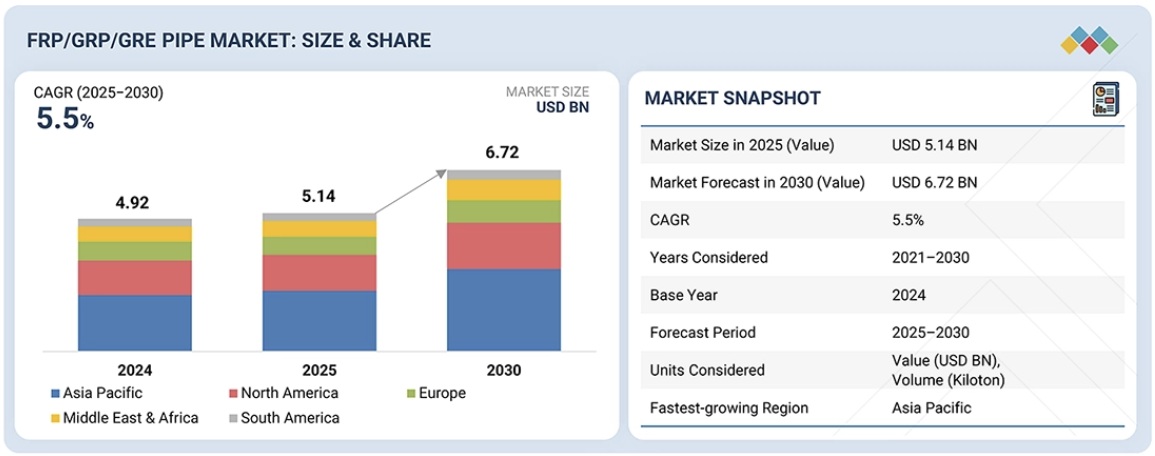

FRP/GRP/GREパイプ市場規模は、2025年に約51億4,000万米ドルと評価され、2025年から2030年の予測期間中に5.5%のCAGRで成長し、2030年までに67億2,000万米ドルに達すると予想されています。

調査対象範囲

本調査レポートは、FRP/GRP/GREパイプ市場を、種類(GRP、GRE、その他)、ガラス繊維の種類(Eガラス、Sガラス、その他)、製造方法(フィラメントワインディング、その他)、直径(300mm未満、300~1200mm、1200mm超)、最終用途産業(石油・ガス、化学、下水道管、灌漑、その他)、地域(北米、欧州、アジア太平洋、中東・アフリカ、南米)別に分類しています。本調査では、FRP/GRP/GREパイプ市場の成長に影響を与える重要な要素(促進要因、抑制要因、課題、機会など)に関する詳細な情報を提供しています。また、主要業界関係者を包括的に調査し、事業概要、ソリューション、サービス、重要な戦略、契約、パートナーシップ、合意に関する洞察を提供しています。 FRP/GRP/GREパイプ分野における新製品・新サービスの発売、合併・買収、そして最新の動向をすべて網羅しています。本レポートには、FRP/GRP/GREパイプ業界エコシステムにおける新興スタートアップ企業の競合分析も含まれています。

このレポートを購入する理由:

本レポートは、FRP/GRP/GREパイプ市場全体および各サブセグメントの収益数値の近似値に関する情報を提供し、市場リーダー/新規参入企業にとって役立ちます。また、ステークホルダーが競争環境を理解し、事業のポジショニングを改善し、適切な市場開拓戦略を策定するための洞察を深めるのに役立ちます。さらに、本レポートは、ステークホルダーが市場の動向を把握し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供するのに役立ちます。

本レポートは、以下の点に関する洞察を提供します。

- FRP/GRP/GREパイプ市場の成長に影響を与える主要な推進要因(非腐食性パイプの需要増加、石油・ガス需要の増加)、制約要因(高材料コスト)、機会(新興国からの需要増加)、課題(大規模製造)の分析。

- 製品開発/イノベーション:FRP/GRP/GREパイプ市場における今後の技術、研究開発活動、新製品・サービス投入に関する詳細な洞察。

- 市場動向:収益性の高い市場に関する包括的な情報 – 本レポートでは、様々な地域におけるFRP/GRP/GREパイプ市場を分析しています。

- 市場の多様化:FRP/GRP/GREパイプ市場における新製品・サービス、未開拓地域、最近の動向、投資に関する包括的な情報を提供しています。

- 競合評価:NOV(米国)、Amiantit Company(サウジアラビア)、Future Pipe Industries(UAE)、Amiblu Holding GmbH(オーストリア)、Graphite India Limited(インド)、Abu Dhabi Pipe Factory(UAE)、Hengrun Group Co., Ltd.(中国)、Hill & Smith PLC(英国)、GRE COMPOSITES(タイ)、Advanced Piping Solutions(サウジアラビア)、Smithline Composites(UAE)など、FRP/GRP/GREパイプ市場における主要企業の市場シェア、成長戦略、サービス提供に関する詳細な評価を提供しています。

Report Description

The FRP/GRP/GRE Pipes market size was valued at approximately USD 5.14 billion in 2025 and is expected to reach USD 6.72 billion by 2030, growing at a CAGR of 5.5% during the forecast period from 2025 to 2030.

FRP-GRP-GRE Pipe Market 2025-2030

“In terms of value, GRE type segment is expected to be the fastest growing market, in terms of value for the forecasted period.”

The segment of GRE type is projected to grow the fastest in terms of value during the forecast period. This is because GRE pipes boast high mechanical strength, excellent pressure handling capability, and superior resistance to aggressive chemicals, which make them highly suitable for various industrial applications. The applications of GRE pipes include oil and gas production, offshore platforms, petrochemical plants, and desalination facilities where higher performance and reliability are desired. GRE pipes ability to bear high temperatures and corrosive environments replaces metallic piping, thus extending the service life at much lower maintenance costs. Driven by increased worldwide energy development, especially in offshore and deepwater areas, demand for solid and lightweight piping systems accelerates, which boosts the demand for GRE pipes directly. Growing infrastructure investments in industrial processing, water treatment, and chemical handling further reinforce the need for GRE pipes making it the fastest growing market for the forecasted period.

‘‘In terms of value, E-glass segment is expected to be the fastest growing segment of the overall FRP/GRP/GRE market.’’

The E-glass market is projected to be the fastest-growing in the glass fiber type segment of the FRP/GRP/GRE market in terms of value, because of its unique combination of properties and cost-effectiveness in a variety of end-use industries. E-glass possesses high electrical insulation resistance, good mechanical strength, corrosion resistance, and ease of handling and processing, which make it a material of choice in various industries such as pipes & tanks, panels, wind turbine blades, construction, and automotive industries. E-glass is produced with a lower cost of production compared to other specialty-grade glass fibers such as S-Glass or R-Glass, making it suitable for widespread usage in massive projects in emerging countries. Moreover, increasing investments in developing infrastructural projects, renewable energy installations, and lightweight composite materials have been increasing the consumption of E-glass composites. Penetration in various industries at a rather affordable cost-performance level is expected to fuel the fast growth of E-glass in the global FRP/GRP/GRE market in terms of value.

FRP-GRP-GRE Pipe Market – Global Forecast to 2030 – region

“During the forecast period, the FRP/GRP/GRE pipes market in North America region is projected to register the second largest market share in 2024.”

The FRP/GRP/GRE pipes market has been studied in North America, Europe, Asia Pacific, the Middle East, Africa, and South America. The North American market for FRP/GRP/GRE pipes is expected to be the second largest market due to large-scale infrastructure renewals, strong industrial demand, and a rising tide of preference for high-performance corrosion-resistant piping systems. The region has an extensive network of aged pipelines across various segments of water supply, wastewater treatment, oil & gas, chemical processing, and power generation, a good number of which were originally installed using steel or concrete several decades ago and presently face partial or full replacement or rehabilitation needs. FRP/GRP/GRE pipes are gaining more appreciation in these uses, mainly due to their ability to maintain good performance against corrosion, a high strength-to-weight ratio, longer service life, and lower lifecycle cost-all fitting for harsh operating environments. In the oil & gas sector, ongoing shale gas development, refinery upgrades, and petrochemical capacity expansions in the United States and Canada are fuelling the demand for GRE and GRP pipes that operate under high pressures and corrosive fluids. The increasing public and private investments in water and wastewater infrastructure coupled with increasing stringency in environmental safety regulations are accelerating the acceptance of advanced composite piping solutions. All these factors taken together reinforce the position of North America as the second largest market for FRP/GRP/GRE pipes in 2024.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 35%, Tier 2- 25%, and Tier 3- 40%

- By Designation- C Level- 35%, Director Level- 30%, and Others- 35%

- By Region- North America- 20%, Europe- 25%, Asia Pacific- 25%, South America- 10%, Middle East & Africa (MEA)-20%

FRP-GRP-GRE Pipe Market – Global Forecast to 2030 – ecosystem

The report provides a comprehensive analysis of company profiles:

Prominent companies include NOV (US), Amiantit Company (Saudi Arabia), Future Pipe Industries (UAE), Amiblu Holding GmbH (Austria), Graphite India Limited (India), Abu Dhabi Pipe Factory (UAE), Hengrun Group Co., Ltd. (China), Hill & Smith PLC (UK), GRE COMPOSITES (Thailand), Advanced Piping Solutions (Saudi Arabia), Smithline Composites (UAE), Kuzeyboru (Turkey), Krah Group (Germany), Gruppo Sarplast (Italy) and Lianyungang Zhongfu Lianzhong Composites Group Co., Ltd. (China) among others.

Research Coverage

This research report categorizes the FRP/GRP/GRE Pipes Market Size By Type (GRP, GRE, Others), Glass Fiber Type (E-Glass, S-Glass, Others), Manufacturing Process(Filament Winding, Others), Diameter(<300 mm, 300-1200 mm, >1200 mm), End-Use Industry (Oil & Gas, Chemicals, Sewage Pipes, Irrigation, Others) and Region (North America, Europe, Asia Pacific, the Middle East & Africa, and South America). The scope of the study includes thorough information on the important elements impacting the growth of the FRP/GRP/GRE Pipes market, such as drivers, restraints, challenges, and opportunities. A comprehensive review of the top industry participants has been conducted in order to provide insights into their business overview, solutions, and services; important strategies; contracts, partnerships, and agreements. New product and service launches, mergers and acquisitions, and current developments in the FRP/GRP/GRE Pipes sector are all covered. The report includes a competitive study of upcoming startups in the FRP/GRP/GRE Pipes industry ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall FRP/GRP/GRE Pipes market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising demand for non-corrosive pipes, Increased demand for oil & gas), restraints (High material cost), opportunities (Increased demand from emerging economies), and challenges (Large scale manufacturing) influencing the growth of the FRP/GRP/GRE Pipes market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the FRP/GRP/GRE Pipes market.

- Market Development: Comprehensive information about lucrative markets – the report analyses the FRP/GRP/GRE Pipes market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the FRP/GRP/GRE Pipes market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like NOV (US), Amiantit Company (Saudi Arabia), Future Pipe Industries (UAE), Amiblu Holding GmbH (Austria), Graphite India Limited (India), Abu Dhabi Pipe Factory (UAE), Hengrun Group Co., Ltd. (China), Hill & Smith PLC (UK), GRE COMPOSITES (Thailand), Advanced Piping Solutions (Saudi Arabia), Smithline Composites (UAE), among others in the FRP/GRP/GRE Pipes market.

Table of Contents

1 INTRODUCTION 32

1.1 STUDY OBJECTIVES 32

1.2 MARKET DEFINITION 32

1.3 STUDY SCOPE 33

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 33

1.3.2 INCLUSIONS AND EXCLUSIONS 34

1.3.3 YEARS CONSIDERED 34

1.3.4 CURRENCY CONSIDERED 35

1.3.5 UNIT CONSIDERED 35

1.4 STAKEHOLDERS 35

1.5 SUMMARY OF CHANGES 35

2 EXECUTIVE SUMMARY 36

2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS 36

2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS 37

2.3 DISRUPTIVE TRENDS SHAPING MARKET 38

2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS 39

2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST 40

3 PREMIUM INSIGHTS 41

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FRP/GRP/GRE PIPE MARKET 41

3.2 FRP/GRP/GRE PIPE MARKET, BY TYPE AND REGION 42

3.3 FRP/GRP/GRE PIPE MARKET, BY FIBER TYPE 42

3.4 FRP/GRP/GRE PIPE MARKET, BY DIAMETER 43

3.5 FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS 43

3.6 FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY 44

3.7 FRP/GRP/GRE PIPE MARKET, BY COUNTRY 44

4 MARKET OVERVIEW 45

4.1 INTRODUCTION 45

4.2 MARKET DYNAMICS 45

4.2.1 DRIVERS 46

4.2.1.1 Rising demand for non-corrosive pipes 46

4.2.1.2 Increased demand for oil & gas 46

4.2.2 RESTRAINTS 46

4.2.2.1 High raw material cost 46

4.2.2.2 Consolidated industry and high capital cost 46

4.2.3 OPPORTUNITIES 47

4.2.3.1 Increasing demand from emerging economies 47

4.2.3.2 Technological advancements in composites driving use in high-pressure oil & gas applications 47

4.2.4 CHALLENGES 47

4.2.4.1 Large-scale manufacturing 47

4.2.4.2 Competition from cheaper alternatives like ductile iron 47

4.3 UNMET NEEDS AND WHITE SPACES 48

4.3.1 UNMET NEEDS IN FRP/GRP/GRE PIPE MARKET 48

4.3.2 WHITE SPACE OPPORTUNITIES 48

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 49

4.4.1 INTERCONNECTED MARKETS 49

4.4.2 CROSS-SECTOR OPPORTUNITIES 49

4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS 50

4.5.1 EMERGING BUSINESS MODELS 50

4.5.2 ECOSYSTEM SHIFTS 50

4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 51

4.6.1 KEY MOVES AND STRATEGIC FOCUS 51

5 INDUSTRY TRENDS 52

5.1 PORTER’S FIVE FORCES ANALYSIS 52

5.1.1 THREAT OF NEW ENTRANTS 53

5.1.2 THREAT OF SUBSTITUTES 53

5.1.3 BARGAINING POWER OF BUYERS 53

5.1.4 BARGAINING POWER OF SUPPLIERS 54

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 54

5.2 MACROECONOMICS INDICATORS 54

5.2.1 INTRODUCTION 54

5.2.2 GDP TRENDS AND FORECAST 54

5.2.3 TRENDS IN GLOBAL SEWAGE INDUSTRY 56

5.2.4 TRENDS IN GLOBAL CHEMICAL INDUSTRY 57

5.3 VALUE CHAIN ANALYSIS 57

5.4 ECOSYSTEM ANALYSIS 59

5.5 PRICING ANALYSIS 60

5.5.1 AVERAGE SELLING PRICE, BY KEY PLAYERS 60

5.5.2 AVERAGE SELLING PRICE TREND, BY REGION 61

5.6 TRADE ANALYSIS 62

5.6.1 IMPORT SCENARIO (HS CODE 3917) 62

5.6.2 EXPORT SCENARIO (HS CODE 3917) 63

5.7 KEY CONFERENCES AND EVENTS, 2025–2026 64

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 65

5.9 CASE STUDY ANALYSIS 66

5.9.1 NATIONAL OILWELL VARCO (NOV) AND PETROBRAS PARTNERED TO DEVELOP FLEXIBLE PIPES FOR DEEPWATER APPLICATIONS 66

5.9.2 AMAINTIT COMPANY COLLABORATED WITH GOVERNMENT OF LIBYA TO DEVELOP WATER INFRASTRUCTURE 66

5.9.3 FUTURE PIPE INDUSTRIES EXPANDED MANUFACTURING CAPACITY FOR COMPOSITE PIPE SYSTEMS 66

5.10 IMPACT OF 2025 US TARIFF ON FRP/GRP/GRE PIPE MARKET 67

5.10.1 INTRODUCTION 67

5.10.2 KEY TARIFF RATES 68

5.10.3 PRICE IMPACT ANALYSIS 68

5.10.4 IMPACT ON COUNTRIES/REGIONS 69

5.10.4.1 US 69

5.10.4.2 Europe 70

5.10.4.3 Asia Pacific 72

5.10.5 IMPACT ON END-USE INDUSTRIES 74

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL,

AND AI ADOPTIONS 75

6.1 KEY EMERGING TECHNOLOGIES 75

6.1.1 FILAMENT WINDING 75

6.2 COMPLEMENTARY TECHNOLOGIES 75

6.2.1 CENTRIFUGAL CASTING 75

6.3 TECHNOLOGY/PRODUCT ROADMAP 76

6.3.1 SHORT-TERM (2025–2027) | FOUNDATION & EARLY COMMERCIALIZATION 76

6.3.2 MID-TERM (2027–2030) | EXPANSION & STANDARDIZATION 76

6.3.3 LONG-TERM (2030–2035+) | MASS COMMERCIALIZATION & DISRUPTION 77

6.4 PATENT ANALYSIS 78

6.4.1 INTRODUCTION 78

6.4.2 METHODOLOGY 78

6.4.3 DOCUMENT TYPE 78

6.4.4 INSIGHTS 79

6.4.5 LEGAL STATUS OF PATENTS 80

6.4.6 JURISDICTION ANALYSIS 80

6.4.7 TOP APPLICANTS 81

6.4.8 LIST OF PATENTS BY SAUDI ARABIAN OIL CO 81

6.4.9 LIST OF PATENTS BY INSTITUTE OF AMIBLU TECH AS. 82

6.4.10 LIST OF PATENTS BY TORAY INDUSTRIES 82

6.5 FUTURE APPLICATIONS 83

6.5.1 LOW CARBON WATER INFRASTRUCTURE 84

6.5.2 ENERGY TRANSITION PROJECTS 84

6.5.3 SEVERE CHEMICAL PROCESSING 85

6.6 IMPACT OF AI/GEN AI ON FRP/GRP/GRE PIPE MARKET 86

6.6.1 TOP USE CASES AND MARKET POTENTIAL 86

6.6.2 BEST PRACTICES IN FRP/GRP/GRE PIPE PROCESSING 86

6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN FRP/GRP/GRE PIPE MARKET 87

6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 87

6.6.5 CLIENTS’ READINESS TO ADOPT GENERATIVE AI IN FRP/GRP/GRE PIPE MARKET 87

6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS 88

6.7.1 FUTURE PIPE INDUSTRIES: DIGITAL TWIN CONCEPT 88

6.7.2 AMIBLU HOLDING GMBH: COMPUTER CONTROLLED CENTRIFUGAL CASTING 88

6.7.3 EPP COMPOSITES PVT. LTD.: SAP IMPLEMENTATION 88

7 SUSTAINABILITY AND REGULATORY LANDSCAPE 89

7.1 REGIONAL REGULATIONS AND COMPLIANCE 89

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 89

7.1.2 INDUSTRY STANDARDS 90

7.2 SUSTAINABILITY INITIATIVES 91

7.2.1 LOWERING LIFECYCLE EMISSIONS 91

7.2.1.1 Material and design initiatives 91

7.2.1.2 Manufacturing and operations 91

7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES 92

7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 93

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 94

8.1 DECISION-MAKING PROCESS 94

8.2 KEY STAKEHOLDERS AND BUYING CRITERIA 95

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 95

8.2.2 BUYING CRITERIA 96

8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 97

8.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES 98

8.5 MARKET PROFITABILITY 98

8.5.1 REVENUE POTENTIAL 99

8.5.2 COST DYNAMICS 99

8.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS 99

9 FRP/GRP/GRE PIPE MARKET, BY TYPE 100

9.1 INTRODUCTION 101

9.2 GRE PIPES 102

9.2.1 CORROSION AND CHEMICAL RESISTANCE TO FUEL MARKET GROWTH 102

9.3 GRP PIPES 104

9.3.1 RISING DEMAND IN HIGH-PERFORMANCE COMPOSITE PIPES DRIVING MARKET 104

9.4 OTHER TYPES 106

10 FRP/GRP/GRE PIPE MARKET, BY FIBER TYPE 108

10.1 INTRODUCTION 109

10.2 E – GLASS 111

10.2.1 LOWER ALKALI CONTENT, GOOD INSULATION, AND HEAT RESISTANCE DRIVING DEMAND 111

10.3 S – GLASS 112

10.3.1 ABILITY TO WITHSTAND EXTREME PRESSURES, CORROSION, AND IMPACT FUELING SEGMENT GROWTH 112

10.4 OTHER GLASS FIBER TYPES 114

11 FRP/GRP/GRE PIPE MARKET, BY DIAMETER 116

11.1 INTRODUCTION 117

11.2 <300 MM 118

11.2.1 SMALL SCALE, LOW- PRESSURE APPLICATIONS DRIVING GROWTH 118

11.3 300 – 1200 MM 120

11.3.1 INFRASTRUCTURE INVESTMENTS PROPELLING GROWTH 120

11.4 >1200 MM 122

11.4.1 EXTREME DURABILITY, LIGHTWEIGHT CONSTRUCTION, AND MINIMAL MAINTENANCE DRIVING MARKET 122

12 FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS 124

12.1 INTRODUCTION 125

12.2 FILAMENT WINDING 126

12.2.1 COST EFFECTIVENESS THROUGH AUTOMATION TO DRIVE DEMAND 126

12.3 OTHER MANUFACTURING PROCESSES 128

13 FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY 131

13.1 INTRODUCTION 132

13.2 SEWAGE 134

13.2.1 SMOOTH INTERIORS PREVENT BUILDUP, BLOCKAGES, AND ABRASION HENCE DRIVING ADOPTION 134

13.3 CHEMICALS 135

13.3.1 EPOXY RESINS USED IN GRE PIPES DRIVING DEMAND DUE TO FAVOURABLE PROPERTIES 135

13.4 OIL & GAS 137

13.4.1 HIGH STRENGTH TO WEIGHT RATIO PROPELLING DEMAND 137

13.5 IRRIGATION 139

13.5.1 CORROSION RESISTANCE AND AVOIDANCE OF PIPE REPLACEMENT COST DRIVING MARKET 139

13.6 OTHER END-USE INDUSTRIES 140

14 FRP/GRP/GRE PIPE MARKET, BY REGION 143

14.1 INTRODUCTION 144

14.2 ASIA PACIFIC 146

14.2.1 FRP/GRP/GRE PIPE MARKET IN ASIA PACIFIC, BY TYPE 146

14.2.2 FRP/GRP/GRE PIPE MARKET IN ASIA PACIFIC, BY GLASS FIBER TYPE 148

14.2.3 FRP/GRP/GRE PIPE MARKET IN ASIA PACIFIC, BY DIAMETER 149

14.2.4 FRP/GRP/GRE PIPE MARKET IN ASIA PACIFIC,

BY MANUFACTURING PROCESS 150

14.2.5 FRP/GRP/GRE PIPE MARKET IN ASIA PACIFIC, BY END-USE INDUSTRY 151

14.2.6 FRP/GRP/GRE PIPE MARKET IN ASIA PACIFIC, BY COUNTRY 152

14.2.6.1 China 154

14.2.6.1.1 Expansion in petrochemical and chemical processing sectors fueling market growth 154

14.2.6.2 Japan 156

14.2.6.2.1 Increasing consumption in end-use industries driving demand 156

14.2.6.3 India 158

14.2.6.3.1 Growing economy and population driving infrastructure development, leading to expanding market 158

14.2.6.4 South Korea 159

14.2.6.4.1 Urbanization and aging pipeline replacements driving demand 159

14.2.6.5 Rest of Asia Pacific 161

14.3 NORTH AMERICA 163

14.3.1 FRP/GRP/GRE PIPE MARKET IN NORTH AMERICA, BY TYPE 164

14.3.2 FRP/GRP/GRE PIPE MARKET IN NORTH AMERICA, BY GLASS FIBER TYPE 165

14.3.3 FRP/GRP/GRE PIPE MARKET IN NORTH AMERICA, BY DIAMETER 166

14.3.4 FRP/GRP/GRE PIPE MARKET IN NORTH AMERICA,

BY MANUFACTURING PROCESS 167

14.3.5 FRP/GRP/GRE PIPE MARKET IN NORTH AMERICA, BY END-USE INDUSTRY 169

14.3.6 FRP/GRP/GRE PIPE MARKET IN NORTH AMERICA, BY COUNTRY 170

14.3.6.1 US 171

14.3.6.1.1 High demand from sewage industry driving market 171

14.3.6.2 Canada 173

14.3.6.2.1 Large-scale, extensive water and wastewater rehabilitation programs driving demand 173

14.3.6.3 Mexico 175

14.3.6.3.1 Infrastructure expansion and industrial demand driving FRP pipe adoption 175

14.4 EUROPE 177

14.4.1 FRP/GRP/GRE PIPE MARKET IN EUROPE, BY TYPE 177

14.4.2 FRP/GRP/GRE PIPE MARKET IN EUROPE, BY GLASS FIBER TYPE 179

14.4.3 FRP/GRP/GRE PIPE MARKET IN EUROPE, BY DIAMETER 180

14.4.4 FRP/GRP/GRE PIPE MARKET IN EUROPE, BY MANUFACTURING PROCESS 181

14.4.5 FRP/GRP/GRE PIPE MARKET IN EUROPE, BY END-USE INDUSTRY 182

14.4.6 FRP/GRP/GRE PIPE MARKET IN EUROPE, BY COUNTRY 184

14.4.6.1 Germany 186

14.4.6.1.1 Engineering-driven adoption of high-performance composite pipes 186

14.4.6.2 France 188

14.4.6.2.1 Municipal infrastructure modernization supporting steady FRP pipe demand 188

14.4.6.3 UK 189

14.4.6.3.1 Water network renewal and energy assets driving demand 189

14.4.6.4 Italy 191

14.4.6.4.1 Water infrastructure upgrades and industrial applications sustaining FRP pipe demand 191

14.4.6.5 Russia 193

14.4.6.5.1 Energy and industrial infrastructure driving demand 193

14.4.6.6 Spain 195

14.4.6.6.1 Market growth driven by investments in municipal water and wastewater infrastructure 195

14.4.6.7 Rest of Europe 197

14.5 MIDDLE EAST & AFRICA 199

14.5.1 FRP/GRP/GRE PIPE MARKET IN MIDDLE EAST & AFRICA, BY TYPE 199

14.5.2 FRP/GRP/GRE PIPE MARKET IN MIDDLE EAST & AFRICA,

BY GLASS FIBER TYPE 201

14.5.3 FRP/GRP/GRE PIPE MARKET IN MIDDLE EAST & AFRICA, BY DIAMETER 202

14.5.4 FRP/GRP/GRE PIPE MARKET IN MIDDLE EAST & AFRICA,

BY MANUFACTURING PROCESS 203

14.5.5 FRP/GRP/GRE PIPE MARKET IN MIDDLE EAST & AFRICA,

BY END-USE INDUSTRY 205

14.5.6 FRP/GRP/GRE PIPE MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY 206

14.5.6.1 GCC Countries 208

14.5.6.1.1 Energy and water led demand driving FRP/GRP/GRE pipe leadership 208

14.5.6.1.2 UAE 210

14.5.6.1.2.1 Strategic investments in infrastructure and industrial growth boosting market growth 210

14.5.6.1.3 Saudi Arabia 212

14.5.6.1.3.1 Mega energy and water projects driving FRP/GRP/GRE pipes demand 212

14.5.6.1.4 Rest of GCC Countries 213

14.5.6.2 Egypt 215

14.5.6.2.1 Growing demand for durable and efficient piping solutions 215

14.5.6.3 Rest of Middle East & Africa 217

14.6 SOUTH AMERICA 219

14.6.1 FRP/GRP/GRE PIPE MARKET IN SOUTH AMERICA, BY TYPE 219

14.6.2 FRP/GRP/GRE PIPE MARKET IN SOUTH AMERICA, BY GLASS FIBER TYPE 220

14.6.3 FRP/GRP/GRE PIPE MARKET IN SOUTH AMERICA, BY DIAMETER 221

14.6.4 FRP/GRP/GRE PIPE MARKET IN SOUTH AMERICA,

BY MANUFACTURING PROCESS 223

14.6.5 FRP/GRP/GRE PIPE MARKET IN SOUTH AMERICA, BY END-USE INDUSTRY 224

14.6.6 FRP/GRP/GRE PIPE MARKET IN SOUTH AMERICA, BY COUNTRY 226

14.6.6.1 Brazil 227

14.6.6.1.1 Rising demand from mining industry fueling market growth 227

14.6.6.2 Argentina 229

14.6.6.2.1 Government initiatives in sewage industry driving demand 229

14.6.6.3 Colombia 230

14.6.6.3.1 Upstream activities and urbanization driving adoption 230

14.6.6.4 Rest of South America 232

15 COMPETITIVE LANDSCAPE 234

15.1 OVERVIEW 234

15.2 KEY PLAYERS’ STRATEGIES/RIGHT TO WIN 234

15.3 REVENUE ANALYSIS 236

15.4 MARKET SHARE ANALYSIS 237

15.5 BRAND COMPARISON 239

15.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 240

15.6.1 STARS 240

15.6.2 EMERGING LEADERS 240

15.6.3 PERVASIVE PLAYERS 241

15.6.4 PARTICIPANTS 241

15.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 242

15.6.5.1 Company footprint 242

15.6.5.2 Region footprint 243

15.6.5.3 Type footprint 243

15.6.5.4 Fiber type footprint 244

15.6.5.5 Diameter footprint 245

15.6.5.6 Manufacturing process footprint 245

15.6.5.7 End-use industry footprint 246

15.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 247

15.7.1 PROGRESSIVE COMPANIES 247

15.7.2 RESPONSIVE COMPANIES 247

15.7.3 DYNAMIC COMPANIES 247

15.7.4 STARTING BLOCKS 247

15.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 249

15.7.5.1 Detailed list of key startups/SMEs 249

15.7.5.2 Competitive benchmarking of key startups/SMEs 250

15.8 COMPANY VALUATION AND FINANCIAL METRICS 251

15.9 COMPETITIVE SCENARIO 253

15.9.1 PRODUCT LAUNCHES 253

15.9.2 DEALS 253

15.9.3 EXPANSIONS 254

16 COMPANY PROFILES 256

16.1 KEY PLAYERS 256

16.1.1 NATIONAL OILWELL VARCO (NOV) 256

16.1.1.1 Business overview 256

16.1.1.2 Products/Solutions/Services offered 257

16.1.1.3 Recent developments 260

16.1.1.3.1 Deals 260

16.1.1.4 MnM view 260

16.1.1.4.1 Key strengths 260

16.1.1.4.2 Strategic choices 260

16.1.1.4.3 Weaknesses and competitive threats 260

16.1.2 AMIANTIT COMPANY 261

16.1.2.1 Business overview 261

16.1.2.2 Products/Solutions/Services offered 262

16.1.2.3 Recent developments 263

16.1.2.3.1 Deals 263

16.1.2.3.2 Contracts 263

16.1.2.4 MnM view 263

16.1.2.4.1 Key strengths 263

16.1.2.4.2 Strategic choices 264

16.1.2.4.3 Weaknesses and competitive threats 264

16.1.3 FUTURE PIPE INDUSTRIES 265

16.1.3.1 Business overview 265

16.1.3.2 Products/Solutions/Services offered 265

16.1.3.3 Recent developments 267

16.1.3.3.1 Expansions 267

16.1.3.4 MnM view 267

16.1.3.4.1 Key strengths 267

16.1.3.4.2 Strategic choices 268

16.1.3.4.3 Weaknesses and competitive threats 268

16.1.4 AMIBLU HOLDING GMBH 269

16.1.4.1 Business overview 269

16.1.4.2 Products offered 269

16.1.4.3 Recent developments 270

16.1.4.3.1 Expansions 270

16.1.4.3.2 Others 271

16.1.4.4 MnM view 272

16.1.4.4.1 Key strengths 272

16.1.4.4.2 Strategic choices 272

16.1.4.4.3 Weaknesses and competitive threats 272

16.1.5 GRAPHITE INDIA LIMITED 273

16.1.5.1 Business overview 273

16.1.5.2 Products offered 274

16.1.5.3 MnM view 274

16.1.5.3.1 Key strengths 274

16.1.5.3.2 Strategic choices 275

16.1.5.3.3 Weaknesses and competitive threats 275

16.1.6 ABU DHABI PIPE FACTORY 276

16.1.6.1 Business overview 276

16.1.6.2 Products offered 276

16.1.6.3 MnM view 277

16.1.6.3.1 Key strengths 277

16.1.6.3.2 Strategic choices 277

16.1.6.3.3 Weaknesses and competitive threats 277

16.1.7 GRE COMPOSITES 278

16.1.7.1 Business overview 278

16.1.7.2 Products offered 279

16.1.7.3 MnM view 279

16.1.7.3.1 Key strengths 279

16.1.7.3.2 Strategic choices 279

16.1.7.3.3 Weaknesses and competitive threats 280

16.1.8 HILL & SMITH PLC 281

16.1.8.1 Business overview 281

16.1.8.2 Products offered 282

16.1.8.3 Recent developments 283

16.1.8.3.1 Product launches 283

16.1.8.4 MnM view 283

16.1.8.4.1 Key strengths 283

16.1.8.4.2 Strategic choices 284

16.1.8.4.3 Weaknesses and competitive threats 284

16.1.9 ADVANCED PIPING SOLUTIONS 285

16.1.9.1 Business overview 285

16.1.9.2 Products offered 285

16.1.9.3 MnM view 286

16.1.9.3.1 Key strengths 286

16.1.9.3.2 Strategic choices 286

16.1.9.3.3 Weaknesses and competitive threats 286

16.1.10 SMITHLINE COMPOSITES 287

16.1.10.1 Business overview 287

16.1.10.2 Products offered 287

16.1.10.3 MnM view 288

16.1.10.3.1 Key strengths 288

16.1.10.3.2 Strategic choices 288

16.1.10.3.3 Weaknesses and competitive threats 288

16.1.11 CHINA NATIONAL BUILDING MATERIALS GROUP 289

16.1.11.1 Business overview 289

16.1.11.2 Products offered 290

16.1.11.3 MnM view 291

16.1.11.3.1 Key strengths 291

16.1.11.3.2 Strategic choices 291

16.1.11.3.3 Weaknesses and competitive threats 292

16.1.12 HENGRUN GROUP CO., LTD. 293

16.1.12.1 Business overview 293

16.1.12.2 Products offered 293

16.1.12.3 MnM view 294

16.1.12.3.1 Key strengths 294

16.1.12.3.2 Strategic choices 294

16.1.12.3.3 Weaknesses and competitive threats 294

16.1.13 GRUPPO SARPLAST S.R.L. 295

16.1.13.1 Business overview 295

16.1.13.2 Products offered 295

16.1.13.3 MnM view 296

16.1.13.3.1 Key strengths 296

16.1.13.3.2 Strategic choices 296

16.1.13.3.3 Weaknesses and competitive threats 296

16.1.14 KRAH GROUP 297

16.1.14.1 Business overview 297

16.1.14.2 Products offered 297

16.1.14.3 MnM view 298

16.1.14.3.1 Key strengths 298

16.1.14.3.2 Strategic choices 298

16.1.14.3.3 Weaknesses and competitive threats 298

16.1.15 KUZEYBORU 299

16.1.15.1 Business overview 299

16.1.15.2 Products offered 300

16.1.15.3 MnM view 300

16.1.15.3.1 Key strengths 300

16.1.15.3.2 Strategic choices 300

16.1.15.3.3 Weaknesses and competitive threats 300

16.2 OTHER PLAYERS 301

16.2.1 KARAMANCI HOLDING A.S. 301

16.2.2 THOMPSON PIPE GROUP 302

16.2.3 PLASTICON COMPOSITES 303

16.2.4 CHEMICAL PROCESS PIPING PVT. LTD. 304

16.2.5 FIBREX 305

16.2.6 ANDRONACO INDUSTRIES 306

16.2.7 AUGUSTA FIBERGLASS COATINGS, INC. 307

16.2.8 HEBEI DONGDING CHEMICAL TRADE CO., LTD. 308

16.2.9 FARASSAN 308

16.2.10 FIBER TECH COMPOSITE PVT. LTD. 309

17 RESEARCH METHODOLOGY 310

17.1 RESEARCH DATA 310

17.1.1 SECONDARY DATA 311

17.1.1.1 Key data from secondary sources 311

17.1.2 PRIMARY DATA 311

17.1.2.1 Key data from primary sources 312

17.1.2.2 Key primary interview participants 312

17.1.2.3 Breakdown of primary interviews 312

17.1.2.4 Key industry insights 313

17.2 MARKET SIZE ESTIMATION 313

17.2.1 BOTTOM-UP APPROACH 313

17.2.2 TOP-DOWN APPROACH 313

17.3 BASE NUMBER CALCULATION 314

17.3.1 APPROACH 1: SUPPLY-SIDE ANALYSIS 314

17.3.2 APPROACH 2: DEMAND-SIDE ANALYSIS 314

17.4 MARKET FORECAST APPROACH 315

17.4.1 SUPPLY SIDE 315

17.4.2 DEMAND SIDE 315

17.5 DATA TRIANGULATION 315

17.6 FACTOR ANALYSIS 317

17.7 RESEARCH ASSUMPTIONS 317

17.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT 318

18 APPENDIX 319

18.1 DISCUSSION GUIDE 319

18.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 322

18.3 CUSTOMIZATION OPTIONS 324

18.4 RELATED REPORTS 324

18.5 AUTHOR DETAILS 325

LIST OF TABLES

TABLE 1 FRP/GRP/GRE PIPE MARKET: PORTER’S FIVE FORCES ANALYSIS 52

TABLE 2 GDP PERCENTAGE CHANGE, BY KEY COUNTRIES, 2021–2029 55

TABLE 3 FRP/GRP/GRE PIPE MARKET: ROLE OF COMPANIES IN ECOSYSTEM 60

TABLE 4 AVERAGE SELLING PRICE OF FRP/GRP/GRE PIPES IN TOP END-USE INDUSTRIES, BY KEY PLAYERS, 2024 (USD/KG) 60

TABLE 5 AVERAGE SELLING PRICE TREND OF FRP/GRP/GRE PIPES, BY REGION,

2023–2024 (USD/KG) 61

TABLE 6 IMPORT DATA FOR HS CODE 3917-COMPLIANT PRODUCTS,

2020–2024 (USD MILLION) 62

TABLE 7 EXPORT DATA FOR HS CODE 380190-COMPLIANT PRODUCTS,

2020–2024 (USD MILLION) 63

TABLE 8 FRP/GRP/GRE PIPE MARKET: LIST OF KEY CONFERENCES AND EVENTS,

2025–2026 64

TABLE 9 US-ADJUSTED RECIPROCAL TARIFF RATES 68

TABLE 10 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFFS 69

TABLE 11 FRP/GRP/GRE PIPE MARKET: TOTAL NUMBER OF PATENTS, 2015–2025 78

TABLE 12 TOP USE CASES AND MARKET POTENTIAL 86

TABLE 13 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES 86

TABLE 14 FRP/GRP/GRE PIPE MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION 87

TABLE 15 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 87

TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 89

TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 89

TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 90

TABLE 19 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 90

TABLE 20 GLOBAL STANDARDS IN FRP/GRP/GRE PIPE MARKET 90

TABLE 21 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN FRP/GRP/

GRE PIPE MARKET 93

TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%) 95

TABLE 23 KEY BUYING CRITERIA, BY END-USE INDUSTRY 96

TABLE 24 FRP/GRP/GRE PIPE MARKET: UNMET NEEDS IN KEY END-USE INDUSTRIES 98

TABLE 25 FRP/GRP/GRE PIPE MARKET, BY TYPE, 2022–2024 (USD MILLION) 101

TABLE 26 FRP/GRP/GRE PIPE MARKET, BY TYPE, 2022–2024 (KILOTON) 101

TABLE 27 FRP/GRP/GRE PIPE MARKET, BY TYPE, 2025–2030 (USD MILLION) 102

TABLE 28 FRP/GRP/GRE PIPE MARKET, BY TYPE, 2025–2030 (KILOTON) 102

TABLE 29 GRE PIPES: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (USD MILLION) 103

TABLE 30 GRE PIPES: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (KILOTON) 103

TABLE 31 GRE PIPES: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (USD MILLION) 104

TABLE 32 GRE PIPES: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (KILOTON) 104

TABLE 33 GRP PIPES: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (USD MILLION) 105

TABLE 34 GRP PIPES: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (KILOTON) 105

TABLE 35 GRP PIPES: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (USD MILLION) 105

TABLE 36 GRP PIPES: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (KILOTON) 106

TABLE 37 OTHER TYPES: FRP/GRP/GRE PIPE MARKET, BY REGION,

2022–2024 (USD MILLION) 106

TABLE 38 OTHER TYPES: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (KILOTON) 107

TABLE 39 OTHER TYPES: FRP/GRP/GRE PIPE MARKET, BY REGION,

2025–2030 (USD MILLION) 107

TABLE 40 OTHER TYPES: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (KILOTON) 107

TABLE 41 FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE, 2022–2024 (USD MILLION) 109

TABLE 42 FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE, 2022–2024 (KILOTON) 110

TABLE 43 FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE, 2025–2030 (USD MILLION) 110

TABLE 44 FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE, 2025–2030 (KILOTON) 110

TABLE 45 E-GLASS: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (USD MILLION) 111

TABLE 46 E-GLASS: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (KILOTON) 111

TABLE 47 E-GLASS: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (USD MILLION) 112

TABLE 48 E-GLASS: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (KILOTON) 112

TABLE 49 S-GLASS: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (USD MILLION) 113

TABLE 50 S-GLASS: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (KILOTON) 113

TABLE 51 S-GLASS: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (USD MILLION) 113

TABLE 52 S-GLASS: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (KILOTON) 114

TABLE 53 OTHER GLASS FIBER TYPES: FRP/GRP/GRE PIPE MARKET, BY REGION,

2022–2024 (USD MILLION) 114

TABLE 54 OTHER GLASS FIBER TYPES: FRP/GRP/GRE PIPE MARKET, BY REGION,

2022–2024 (KILOTON) 115

TABLE 55 OTHER GLASS FIBER TYPES: FRP/GRP/GRE PIPE MARKET, BY REGION,

2025–2030 (USD MILLION) 115

TABLE 56 OTHER GLASS FIBER TYPES: FRP/GRP/GRE PIPE MARKET, BY REGION,

2025–2030 (KILOTON) 115

TABLE 57 FRP/GRP/GRE PIPE MARKET, BY DIAMETER, 2022–2024 (USD MILLION) 117

TABLE 58 FRP/GRP/GRE PIPE MARKET, BY DIAMETER, 2022–2024 (KILOTON) 117

TABLE 59 FRP/GRP/GRE PIPE MARKET, BY DIAMETER, 2025–2030 (USD MILLION) 118

TABLE 60 FRP/GRP/GRE PIPE MARKET, BY DIAMETER, 2025–2030 (KILOTON) 118

TABLE 61 <300 MM: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (USD MILLION) 119

TABLE 62 <300 MM: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (KILOTON) 119

TABLE 63 <300 MM: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (USD MILLION) 119

TABLE 64 <300 MM: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (KILOTON) 120

TABLE 65 300 – 1200 MM: FRP/GRP/GRE PIPE MARKET, BY REGION,

2022–2024 (USD MILLION) 120

TABLE 66 300 – 1200 MM: FRP/GRP/GRE PIPE MARKET, BY REGION,

2022–2024 (KILOTON) 121

TABLE 67 300 – 1200 MM: FRP/GRP/GRE PIPE MARKET, BY REGION,

2025–2030 (USD MILLION) 121

TABLE 68 300 – 1200 MM: FRP/GRP/GRE PIPE MARKET, BY REGION,

2025–2030 (KILOTON) 121

TABLE 69 >1200 MM: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (USD MILLION) 122

TABLE 70 >1200 MM: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (KILOTON) 122

TABLE 71 >1200 MM: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (USD MILLION) 123

TABLE 72 >1200 MM: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (KILOTON) 123

TABLE 73 FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS,

2022–2024 (USD MILLION) 125

TABLE 74 FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS,

2022–2024 (KILOTON) 125

TABLE 75 FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS,

2025–2030 (USD MILLION) 126

TABLE 76 FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS,

2025–2030 (KILOTON) 126

TABLE 77 FILAMENT WINDING: FRP/GRP/GRE PIPE MARKET, BY REGION,

2022–2024 (USD MILLION) 127

TABLE 78 FILAMENT WINDING: FRP/GRP/GRE PIPE MARKET, BY REGION,

2022–2024 (KILOTON) 127

TABLE 79 FILAMENT WINDING: FRP/GRP/GRE PIPE MARKET, BY REGION,

2025–2030 (USD MILLION) 127

TABLE 80 FILAMENT WINDING: FRP/GRP/GRE PIPE MARKET, BY REGION,

2025–2030 (KILOTON) 128

TABLE 81 OTHER MANUFACTURING PROCESSES: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (USD MILLION) 129

TABLE 82 OTHER MANUFACTURING PROCESSES: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (KILOTON) 129

TABLE 83 OTHER MANUFACTURING PROCESSES: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (USD MILLION) 129

TABLE 84 OTHER MANUFACTURING PROCESSES: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (KILOTON) 130

TABLE 85 FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 132

TABLE 86 FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY, 2022–2024 (KILOTON) 133

TABLE 87 FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 133

TABLE 88 FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 133

TABLE 89 SEWAGE: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (USD MILLION) 134

TABLE 90 SEWAGE: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (KILOTON) 134

TABLE 91 SEWAGE: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (USD MILLION) 135

TABLE 92 SEWAGE: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (KILOTON) 135

TABLE 93 CHEMICALS: FRP/GRP/GRE PIPE MARKET, BY REGION,

2022–2024 (USD MILLION) 136

TABLE 94 CHEMICALS: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (KILOTON) 136

TABLE 95 CHEMICALS: FRP/GRP/GRE PIPE MARKET, BY REGION,

2025–2030 (USD MILLION) 136

TABLE 96 CHEMICALS: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (KILOTON) 137

TABLE 97 OIL & GAS: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (USD MILLION) 137

TABLE 98 OIL & GAS: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (KILOTON) 138

TABLE 99 OIL & GAS: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (USD MILLION) 138

TABLE 100 OIL & GAS: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (KILOTON) 138

TABLE 101 IRRIGATION: FRP/GRP/GRE PIPE MARKET, BY REGION,

2022–2024 (USD MILLION) 139

TABLE 102 IRRIGATION: FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (KILOTON) 139

TABLE 103 IRRIGATION: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (MILLION) 140

TABLE 104 IRRIGATION: FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (KILOTON) 140

TABLE 105 OTHER END-USE INDUSTRIES: FRP/GRP/GRE PIPE MARKET, BY REGION,

2022–2024 (USD MILLION) 141

TABLE 106 OTHER END-USE INDUSTRIES: FRP/GRP/GRE PIPE MARKET, BY REGION,

2022–2024 (KILOTON) 141

TABLE 107 OTHER END-USE INDUSTRIES: FRP/GRP/GRE PIPE MARKET, BY REGION,

2025–2030 (USD MILLION) 141

TABLE 108 OTHER END-USE INDUSTRIES: FRP/GRP/GRE PIPE MARKET, BY REGION,

2025–2030 (KILOTON) 142

TABLE 109 FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (USD MILLION) 144

TABLE 110 FRP/GRP/GRE PIPE MARKET, BY REGION, 2022–2024 (KILOTON) 145

TABLE 111 FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (USD MILLION) 145

TABLE 112 FRP/GRP/GRE PIPE MARKET, BY REGION, 2025–2030 (KILOTON) 145

TABLE 113 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY TYPE, 2022–2024 (USD MILLION) 146

TABLE 114 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY TYPE, 2022–2024 (KILOTON) 147

TABLE 115 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY TYPE, 2025–2030 (USD MILLION) 147

TABLE 116 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY TYPE, 2025–2030 (KILOTON) 147

TABLE 117 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE,

2022–2024 (USD MILLION) 148

TABLE 118 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE,

2022–2024 (KILOTON) 148

TABLE 119 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE,

2025–2030 (USD MILLION) 148

TABLE 120 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE,

2025–2030 (KILOTON) 148

TABLE 121 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY DIAMETER,

2022–2024 (USD MILLION) 149

TABLE 122 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY DIAMETER, 2022–2024 (KILOTON) 149

TABLE 123 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY DIAMETER,

2025–2030 (USD MILLION) 149

TABLE 124 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY DIAMETER, 2025–2030 (KILOTON) 149

TABLE 125 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS, 2022–2024 (USD MILLION) 150

TABLE 126 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS, 2022–2024 (KILOTON) 150

TABLE 127 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS, 2025–2030 (USD MILLION) 150

TABLE 128 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS, 2025–2030 (KILOTON) 150

TABLE 129 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 151

TABLE 130 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 151

TABLE 131 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 152

TABLE 132 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 152

TABLE 133 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 152

TABLE 134 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY COUNTRY, 2022–2024 (KILOTON) 153

TABLE 135 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 153

TABLE 136 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET, BY COUNTRY, 2025–2030 (KILOTON) 153

TABLE 137 CHINA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 154

TABLE 138 CHINA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 154

TABLE 139 CHINA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 155

TABLE 140 CHINA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 155

TABLE 141 JAPAN: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 156

TABLE 142 JAPAN: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 156

TABLE 143 JAPAN: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 157

TABLE 144 JAPAN: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 157

TABLE 145 INDIA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 158

TABLE 146 INDIA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 158

TABLE 147 INDIA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 159

TABLE 148 INDIA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 159

TABLE 149 SOUTH KOREA: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 160

TABLE 150 SOUTH KOREA: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 160

TABLE 151 SOUTH KOREA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 160

TABLE 152 SOUTH KOREA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 161

TABLE 153 REST OF ASIA PACIFIC: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 161

TABLE 154 REST OF ASIA PACIFIC: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY, 2022–2024 (KILOTON) 162

TABLE 155 REST OF ASIA PACIFIC: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 162

TABLE 156 REST OF ASIA PACIFIC: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 162

TABLE 157 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY TYPE,

2022–2024 (USD MILLION) 164

TABLE 158 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY TYPE, 2022–2024 (KILOTON) 164

TABLE 159 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY TYPE,

2025–2030 (USD MILLION) 164

TABLE 160 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY TYPE, 2025–2030 (KILOTON) 164

TABLE 161 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE,

2022–2024 (USD MILLION) 165

TABLE 162 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE,

2022–2024 (KILOTON) 165

TABLE 163 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE,

2025–2030 (USD MILLION) 165

TABLE 164 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE,

2025–2030 (KILOTON) 166

TABLE 165 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY DIAMETER,

2022–2024 (USD MILLION) 166

TABLE 166 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY DIAMETER,

2022–2024 (KILOTON) 166

TABLE 167 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY DIAMETER,

2025–2030 (USD MILLION) 167

TABLE 168 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY DIAMETER,

2025–2030 (KILOTON) 167

TABLE 169 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS, 2022–2024 (USD MILLION) 167

TABLE 170 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS, 2022–2024 (KILOTON) 168

TABLE 171 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS, 2025–2030 (USD MILLION) 168

TABLE 172 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS, 2025–2030 (KILOTON) 168

TABLE 173 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 169

TABLE 174 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 169

TABLE 175 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 169

TABLE 176 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 170

TABLE 177 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 170

TABLE 178 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY COUNTRY,

2022–2024 (KILOTON) 170

TABLE 179 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 171

TABLE 180 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY COUNTRY,

2025–2030 (KILOTON) 171

TABLE 181 US: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 172

TABLE 182 US: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 172

TABLE 183 US: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 172

TABLE 184 US: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 173

TABLE 185 CANADA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 173

TABLE 186 CANADA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 174

TABLE 187 CANADA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 174

TABLE 188 CANADA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 174

TABLE 189 MEXICO: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 175

TABLE 190 MEXICO: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 175

TABLE 191 MEXICO: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 176

TABLE 192 MEXICO: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 176

TABLE 193 EUROPE: FRP/GRP/GRE PIPE MARKET, BY TYPE, 2022–2024 (USD MILLION) 177

TABLE 194 EUROPE: FRP/GRP/GRE PIPE MARKET, BY TYPE, 2022–2024 (KILOTON) 178

TABLE 195 EUROPE: FRP/GRP/GRE PIPE MARKET, BY TYPE, 2025–2030 (USD MILLION) 178

TABLE 196 EUROPE: FRP/GRP/GRE PIPE MARKET, BY TYPE, 2025–2030 (KILOTON) 178

TABLE 197 EUROPE: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE,

2022–2024 (USD MILLION) 179

TABLE 198 EUROPE: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE,

2022–2024 (KILOTON) 179

TABLE 199 EUROPE: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE,

2025–2030 (USD MILLION) 179

TABLE 200 EUROPE: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE,

2025–2030 (KILOTON) 179

TABLE 201 EUROPE: FRP/GRP/GRE PIPE MARKET, BY DIAMETER, 2022–2024 (USD MILLION) 180

TABLE 202 EUROPE: FRP/GRP/GRE PIPE MARKET, BY DIAMETER, 2022–2024 (KILOTON) 180

TABLE 203 EUROPE: FRP/GRP/GRE PIPE MARKET, BY DIAMETER, 2025–2030 (USD MILLION) 180

TABLE 204 EUROPE: FRP/GRP/GRE PIPE MARKET, BY DIAMETER, 2025–2030 (KILOTON) 181

TABLE 205 EUROPE: FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS,

2022–2024 (USD MILLION) 181

TABLE 206 EUROPE: FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS,

2022–2024 (KILOTON) 181

TABLE 207 EUROPE: FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS,

2025–2030 (USD MILLION) 182

TABLE 208 EUROPE: FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS,

2025–2030 (KILOTON) 182

TABLE 209 EUROPE: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 182

TABLE 210 EUROPE: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 183

TABLE 211 EUROPE: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 183

TABLE 212 EUROPE: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 183

TABLE 213 EUROPE: FRP/GRP/GRE PIPE MARKET, BY COUNTRY, 2022–2024 (USD MILLION) 184

TABLE 214 EUROPE: FRP/GRP/GRE PIPE MARKET, BY COUNTRY, 2022–2024 (KILOTON) 184

TABLE 215 EUROPE: FRP/GRP/GRE PIPE MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 185

TABLE 216 EUROPE: FRP/GRP/GRE PIPE MARKET, BY COUNTRY, 2025–2030 (KILOTON) 185

TABLE 217 GERMANY: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 186

TABLE 218 GERMANY: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 186

TABLE 219 GERMANY: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 187

TABLE 220 GERMANY: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 187

TABLE 221 FRANCE: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 188

TABLE 222 FRANCE: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 188

TABLE 223 FRANCE: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 189

TABLE 224 FRANCE: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 189

TABLE 225 UK: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 190

TABLE 226 UK: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 190

TABLE 227 UK: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 190

TABLE 228 UK: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 191

TABLE 229 ITALY: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 191

TABLE 230 ITALY: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 192

TABLE 231 ITALY: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 192

TABLE 232 ITALY: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 192

TABLE 233 RUSSIA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 193

TABLE 234 RUSSIA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 193

TABLE 235 RUSSIA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 194

TABLE 236 RUSSIA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 194

TABLE 237 SPAIN: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 195

TABLE 238 SPAIN: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 195

TABLE 239 SPAIN: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 196

TABLE 240 SPAIN: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 196

TABLE 241 REST OF EUROPE: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 197

TABLE 242 REST OF EUROPE: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 197

TABLE 243 REST OF EUROPE: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 198

TABLE 244 REST OF EUROPE: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 198

TABLE 245 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY TYPE,

2022–2024 (USD MILLION) 199

TABLE 246 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY TYPE,

2022–2024 (KILOTON) 199

TABLE 247 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY TYPE,

2025–2030 (USD MILLION) 200

TABLE 248 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY TYPE,

2025–2030 (KILOTON) 200

TABLE 249 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE, 2022–2024 (USD MILLION) 201

TABLE 250 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE, 2022–2024 (KILOTON) 201

TABLE 251 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE, 2025–2030 (USD MILLION) 201

TABLE 252 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE, 2025–2030 (KILOTON) 202

TABLE 253 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY DIAMETER,

2022–2024 (USD MILLION) 202

TABLE 254 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY DIAMETER,

2022–2024 (KILOTON) 202

TABLE 255 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY DIAMETER,

2025–2030 (USD MILLION) 203

TABLE 256 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY DIAMETER,

2025–2030 (KILOTON) 203

TABLE 257 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET,

BY MANUFACTURING PROCESS, 2022–2024 (USD MILLION) 203

TABLE 258 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET,

BY MANUFACTURING PROCESS, 2022–2024 (KILOTON) 204

TABLE 259 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET,

BY MANUFACTURING PROCESS, 2025–2030 (USD MILLION) 204

TABLE 260 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET,

BY MANUFACTURING PROCESS, 2025–2030 (KILOTON) 204

TABLE 261 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 205

TABLE 262 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY, 2022–2024 (KILOTON) 205

TABLE 263 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 205

TABLE 264 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 206

TABLE 265 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 206

TABLE 266 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY COUNTRY,

2022–2024 (KILOTON) 207

TABLE 267 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 207

TABLE 268 MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPE MARKET, BY COUNTRY,

2025–2030 (KILOTON) 207

TABLE 269 GCC COUNTRIES: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 208

TABLE 270 GCC COUNTRIES: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 208

TABLE 271 GCC COUNTRIES: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 209

TABLE 272 GCC COUNTRIES: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 209

TABLE 273 UAE: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 210

TABLE 274 UAE: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 210

TABLE 275 UAE: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 211

TABLE 276 UAE: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 211

TABLE 277 SAUDI ARABIA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 212

TABLE 278 SAUDI ARABIA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 212

TABLE 279 SAUDI ARABIA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 213

TABLE 280 SAUDI ARABIA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 213

TABLE 281 REST OF GCC COUNTRIES: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 214

TABLE 282 REST OF GCC COUNTRIES: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY, 2022–2024 (KILOTON) 214

TABLE 283 REST OF GCC COUNTRIES: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 214

TABLE 284 REST OF GCC COUNTRIES: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 215

TABLE 285 EGYPT: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 215

TABLE 286 EGYPT: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 216

TABLE 287 EGYPT: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 216

TABLE 288 EGYPT: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 216

TABLE 289 REST OF MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPES MARKET,

BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 217

TABLE 290 REST OF MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPES MARKET,

BY END-USE INDUSTRY, 2022–2024 (KILOTON) 217

TABLE 291 REST OF MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPES MARKET,

BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 218

TABLE 292 REST OF MIDDLE EAST & AFRICA: FRP/GRP/GRE PIPES MARKET,

BY END-USE INDUSTRY, 2025–2030 (KILOTON) 218

TABLE 293 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY TYPE,

2022–2024 (USD MILLION) 219

TABLE 294 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY TYPE, 2022–2024 (KILOTON) 219

TABLE 295 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY TYPE,

2025–2030 (USD MILLION) 219

TABLE 296 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY TYPE, 2025–2030 (KILOTON) 220

TABLE 297 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE,

2022–2024 (USD MILLION) 220

TABLE 298 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE,

2022–2024 (KILOTON) 220

TABLE 299 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE,

2025–2030 (USD MILLION) 221

TABLE 300 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY GLASS FIBER TYPE,

2025–2030 (KILOTON) 221

TABLE 301 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY DIAMETER,

2022–2024 (USD MILLION) 221

TABLE 302 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY DIAMETER,

2022–2024 (KILOTON) 222

TABLE 303 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY DIAMETER,

2025–2030 (USD MILLION) 222

TABLE 304 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY DIAMETER,

2025–2030 (KILOTON) 222

TABLE 305 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS, 2022–2024 (USD MILLION) 223

TABLE 306 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS, 2022–2024 (KILOTON) 223

TABLE 307 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS, 2025–2030 (USD MILLION) 223

TABLE 308 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY MANUFACTURING PROCESS, 2025–2030 (KILOTON) 223

TABLE 309 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 224

TABLE 310 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 224

TABLE 311 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 225

TABLE 312 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 225

TABLE 313 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 226

TABLE 314 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY COUNTRY,

2022–2024 (KILOTON) 226

TABLE 315 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 226

TABLE 316 SOUTH AMERICA: FRP/GRP/GRE PIPE MARKET, BY COUNTRY,

2025–2030 (KILOTON) 227

TABLE 317 BRAZIL: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 227

TABLE 318 BRAZIL: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 228

TABLE 319 BRAZIL: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 228

TABLE 320 BRAZIL: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 228

TABLE 321 ARGENTINA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 229

TABLE 322 ARGENTINA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 229

TABLE 323 ARGENTINA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 230

TABLE 324 ARGENTINA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 230

TABLE 325 COLOMBIA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 231

TABLE 326 COLOMBIA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2022–2024 (KILOTON) 231

TABLE 327 COLOMBIA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 231

TABLE 328 COLOMBIA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 232

TABLE 329 REST OF SOUTH AMERICA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 232

TABLE 330 REST OF SOUTH AMERICA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY, 2022–2024 (KILOTON) 233

TABLE 331 REST OF SOUTH AMERICA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 233

TABLE 332 REST OF SOUTH AMERICA: FRP/GRP/GRE PIPES MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 233

TABLE 333 FRP/GRP/GRE PIPE MARKET: KEY STRATEGIES ADOPTED BY MAJOR PLAYERS 234

TABLE 334 FRP/GRP/GRE PIPE MARKET: DEGREE OF COMPETITION, 2024 237

TABLE 335 FRP/GRP/GRE PIPE MARKET: REGION FOOTPRINT 243

TABLE 336 FRP/GRP/GRE PIPE MARKET: TYPE FOOTPRINT 243

TABLE 337 FRP/GRP/GRE PIPE MARKET: FIBER TYPE FOOTPRINT 244

TABLE 338 FRP/GRP/GRE PIPE MARKET: DIAMETER FOOTPRINT 245

TABLE 339 FRP/GRP/GRE PIPE MARKET: MANUFACTURING PROCESS FOOTPRINT 245

TABLE 340 GRP/FRP/GRE PIPES MARKET: END-USE INDUSTRY FOOTPRINT 246

TABLE 341 FRP/GRP/GRE PIPE MARKET: DETAILED LIST OF KEY STARTUPS/SMES 249

TABLE 342 FRP/GRP/GRE PIPE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (1/2) 250

TABLE 343 FRP/GRP/GRE PIPE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (2/2) 251

TABLE 344 FRP/GRP/GRE PIPE MARKET: PRODUCT LAUNCHES,

JANUARY 2020–SEPTEMBER 2025 253

TABLE 345 FRP/GRP/GRE PIPE MARKET: DEALS, JANUARY 2020–SEPTEMBER 2025 254

TABLE 346 FRP/GRP/GRE PIPE MARKET: EXPANSIONS, JANUARY 2020–SEPTEMBER 2025 254

TABLE 347 NATIONAL OILWELL VARCO (NOV): COMPANY OVERVIEW 256

TABLE 348 NATIONAL OILWELL VARCO (NOV).: PRODUCTS OFFERED 257

TABLE 349 NATIONAL OILWELL VARCO: DEALS 260

TABLE 350 AMIANTIT COMPANY: COMPANY OVERVIEW 261

TABLE 351 AMIANTIT COMPANY: PRODUCTS OFFERED 262

TABLE 352 AMIANTIT COMPANY: DEALS 263

TABLE 353 AMIANTIT COMPANY: CONTRACTS 263

TABLE 354 FUTURE PIPE INDUSTRIES: COMPANY OVERVIEW 265

TABLE 355 FUTURE PIPE INDUSTRIES: PRODUCTS OFFERED 265

TABLE 356 FUTURE PIPE INDUSTRIES: EXPANSIONS 267

TABLE 357 AMIBLU HOLDING GMBH: COMPANY OVERVIEW 269

TABLE 358 AMIBLU HOLDING GMBH: PRODUCTS OFFERED 269

TABLE 359 AMIBLU HOLDING GMBH: EXPANSIONS 270

TABLE 360 AMIBLU HOLDING GMBH: OTHERS 271

TABLE 361 GRAPHITE INDIA LIMITED: COMPANY OVERVIEW 273

TABLE 362 GRAPHITE INDIA LIMITED: PRODUCTS OFFERED 274

TABLE 363 ABU DHABI PIPE FACTORY: COMPANY OVERVIEW 276

TABLE 364 ABU DHABI PIPE FACTORY: PRODUCTS OFFERED 276

TABLE 365 GRE COMPOSITES: COMPANY OVERVIEW 278

TABLE 366 GRE COMPOSITES: PRODUCTS OFFERED 279

TABLE 367 HILL & SMITH PLC: COMPANY OVERVIEW 281

TABLE 368 HILL & SMITH PLC: PRODUCTS OFFERED 282

TABLE 369 HILL & SMITH PLC: PRODUCT LAUNCHES 283

TABLE 370 ADVANCED PIPING SOLUTIONS: COMPANY OVERVIEW 285

TABLE 371 ADVANCED PIPING SOLUTIONS: PRODUCTS OFFERED 285

TABLE 372 SMITHLINE COMPOSITES: COMPANY OVERVIEW 287

TABLE 373 SMITHLINE COMPOSITES: PRODUCTS OFFERED 287

TABLE 374 CHINA NATIONAL BUILDING MATERIALS GROUP: COMPANY OVERVIEW 289

TABLE 375 CHINA NATIONAL BUILDING MATERIALS GROUP: PRODUCTS OFFERED 290

TABLE 376 HENGRUN GROUP CO., LTD.: COMPANY OVERVIEW 293

TABLE 377 HENGRUN GROUP CO., LTD.: PRODUCTS OFFERED 293

TABLE 378 GRUPPO SARPLAST S.R.L.: COMPANY OVERVIEW 295

TABLE 379 GRUPPO SARPLAST S.R.L.: PRODUCTS OFFERED 295

TABLE 380 KRAH GROUP: COMPANY OVERVIEW 297

TABLE 381 KRAH GROUP: PRODUCTS OFFERED 297

TABLE 382 KUZEYBORU: COMPANY OVERVIEW 299

TABLE 383 KUZEYBORU: PRODUCTS OFFERED 300

TABLE 384 KARAMANCI HOLDING A.Ş.: COMPANY OVERVIEW 301

TABLE 385 THOMPSON PIPE GROUP: COMPANY OVERVIEW 302

TABLE 386 PLASTICON COMPOSITES: COMPANY OVERVIEW 303

TABLE 387 CHEMICAL PROCESS PIPING PVT. LTD.: COMPANY OVERVIEW 304

TABLE 388 FIBREX: COMPANY OVERVIEW 305

TABLE 389 ANDRONACO INDUSTRIES: COMPANY OVERVIEW 306

TABLE 390 AUGUSTA FIBERGLASS COATINGS, INC.: COMPANY OVERVIEW 307

TABLE 391 HEBEI DONGDING CHEMICAL TRADE CO., LTD.: COMPANY OVERVIEW 308

TABLE 392 FARASSAN: COMPANY OVERVIEW 308

TABLE 393 FIBER TECH COMPOSITE PVT. LTD.: COMPANY OVERVIEW 309

LIST OF FIGURES

FIGURE 1 FRP/GRP/GRE PIPE MARKET SEGMENTATION AND REGIONAL SCOPE 33

FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS 36

FIGURE 3 GLOBAL FRP/GRP/GRE PIPE MARKET, 2025–2030 37

FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN FRP/GRP/GRE PIPES MARKET (2020–2025) 37

FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF FRP/GRP/GRE PIPE MARKET 38

FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN FRP/GRP/GRE PIPE MARKET, 2024 39

FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD 40

FIGURE 8 HIGH DEMAND IN SEWAGE PIPE INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS 41

FIGURE 9 GRE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024 42

FIGURE 10 E-GLASS FIBER TYPE DOMINATED FRP/GRP/GRE PIPE MARKET IN 2024 42

FIGURE 11 300 – 1200 MM DIAMETER SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024 43

FIGURE 12 FILAMENT WINDING SEGMENT ACCOUNTED FOR LARGER MARKET SHARE IN 2024 43

FIGURE 13 SEWAGE PIPE SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024 44

FIGURE 14 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD 44

FIGURE 15 FRP/GRP/GRE PIPE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES,

AND CHALLENGES 45

FIGURE 16 FRP/GRP/GRE PIPE MARKET: PORTER’S FIVE FORCES ANALYSIS 52

FIGURE 17 FRP/GRP/GRE PIPE MARKET: VALUE CHAIN ANALYSIS 57

FIGURE 18 FRP/GRP/GRE PIPE MARKET: KEY PARTICIPANTS IN ECOSYSTEM 59

FIGURE 19 FRP/GRP/GRE PIPE MARKET: ECOSYSTEM ANALYSIS 59

FIGURE 20 AVERAGE SELLING PRICE TREND BY REGION, 2023–2024 61

FIGURE 21 IMPORT SCENARIO FOR HS CODE 3917-COMPLIANT PRODUCTS,

BY KEY COUNTRIES, 2020–2024 62

FIGURE 22 EXPORT SCENARIO FOR HS CODE 3917-COMPLIANT PRODUCTS,

BY KEY COUNTRIES, 2020–2024 63

FIGURE 23 TRENDS/DISRUPTIONS INFLUENCING CUSTOMER BUSINESS 65

FIGURE 24 PATENT ANALYSIS, BY DOCUMENT TYPE, 2015–2025 79

FIGURE 25 PATENT PUBLICATION TRENDS, 2015−2025 79

FIGURE 26 FRP/GRP/GRE PIPE MARKET: LEGAL STATUS OF PATENTS,

JANUARY 2015–DECEMBER 2025 80

FIGURE 27 JURISDICTION OF CHINA REGISTERED HIGHEST SHARE OF PATENTS, 2015–2025 80

FIGURE 28 TOP PATENT APPLICANTS, 2015–2025 81

FIGURE 29 FUTURE APPLICATIONS OF FRP/GRP/GRE PIPE 83

FIGURE 30 FRP/GRP/GRE PIPE MARKET: DECISION-MAKING FACTORS 94

FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY 95

FIGURE 32 KEY BUYING CRITERIA, BY END-USE INDUSTRY 96

FIGURE 33 ADOPTION BARRIERS & INTERNAL CHALLENGES 97

FIGURE 34 GRE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING

FORECAST PERIOD 101

FIGURE 35 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN BULK FRP/GRP/GRE PIPE MARKET DURING FORECAST PERIOD 103

FIGURE 36 E-GLASS FIBER SEGMENT TO LEAD FRP/GRP/GRE PIPE MARKET DURING FORECAST PERIOD 109

FIGURE 37 300 – 1200 MM SEGMENT TO DOMINATE FRP/GRP/GRE PIPE MARKET DURING FORECAST PERIOD 117

FIGURE 38 FILAMENT WINDING SEGMENT TO DOMINATE FRP/GRP/GRE PIPE MARKET DURING FORECAST PERIOD 125

FIGURE 39 SEWAGE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD 132

FIGURE 40 CHINA TO REGISTER HIGHEST GROWTH IN FRP/GRP/GRE PIPE MARKET DURING FORECAST PERIOD 144

FIGURE 41 ASIA PACIFIC: FRP/GRP/GRE PIPE MARKET SNAPSHOT 146

FIGURE 42 NORTH AMERICA: FRP/GRP/GRE PIPE MARKET SNAPSHOT 163

FIGURE 43 EUROPE: FRP/GRP/GRE PIPE MARKET SNAPSHOT 177

FIGURE 44 FRP/GRP/GRE PIPE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020–2024 236

FIGURE 45 FRP/GRP/GRE PIPE MARKET SHARE ANALYSIS, 2024 237

FIGURE 46 FRP/GRP/GRE PIPE MARKET: BRAND COMPARISON 239

FIGURE 47 FRP/GRP/GRE PIPE MARKET: COMPANY EVALUATION MATRIX

(KEY PLAYERS), 2024 241

FIGURE 48 FRP/GRP/GRE PIPE MARKET: COMPANY FOOTPRINT 242

FIGURE 49 FRP/GRP/GRE PIPE MARKET: COMPANY EVALUATION MATRIX

(STARTUPS/SMES), 2024 248

FIGURE 50 FRP/GRP/GRE PIPE MARKET: EV/EBITDA OF KEY MANUFACTURERS 251

FIGURE 51 FRP/GRP/GRE PIPE MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND

5-YEAR STOCK BETA OF KEY MANUFACTURERS 252

FIGURE 52 FRP/GRP/GRE PIPE MARKET: ENTERPRISE VALUATION OF KEY PLAYERS, 2025 252

FIGURE 53 NATIONAL OILWELL VARCO (NOV): COMPANY SNAPSHOT 257

FIGURE 54 AMIANTIT COMPANY: COMPANY SNAPSHOT 262

FIGURE 55 GRAPHITE INDIA LIMITED: COMPANY SNAPSHOT 274

FIGURE 56 HILL & SMITH PLC: COMPANY SNAPSHOT 282

FIGURE 57 CHINA NATIONAL BUILDING MATERIALS GROUP: COMPANY SNAPSHOT 290

FIGURE 58 KUZEYBORU: COMPANY SNAPSHOT 299

FIGURE 59 FRP/GRP/GRE PIPE MARKET: RESEARCH DESIGN 310

FIGURE 60 FRP/GRP/GRE PIPE MARKET: BOTTOM-UP AND TOP-DOWN APPROACH 314

FIGURE 61 FRP/GRP/GRE PIPE MARKET: DATA TRIANGULATION 316