Ammonium Metatungstate Market - Global Forecast to 2030

Ammonium Metatungstate Market by Raw Material (Virgin Ore Route, Secondary/Recycled Route), Form (Powder, Aqueous Solution, Crystalline), Grade (Standard Grade, High-Purity Grade, Reagent Grade), Application, End-use Industry, and Region - Global Forecast to 2030

メタタングステン酸アンモニウム市場 - 原材料(バージン鉱石ルート、二次/リサイクルルート)、形状(粉末、水溶液、結晶)、グレード(標準グレード、高純度グレード、試薬グレード)、用途、最終用途産業、地域別 - 2030年までの世界予測

| 出版 | MarketsandMarkets |

| ページ数 | 288 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-13350 |

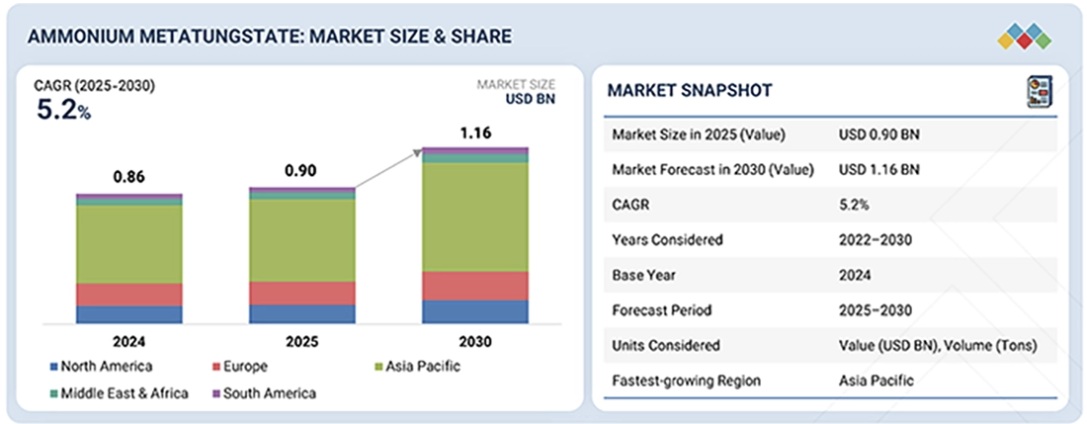

メタタングステン酸アンモニウム市場は、予測期間中に5.2%のCAGRで成長し、2025年の9億米ドルから2030年には11億6,000万米ドルに達すると予測されています。

試薬グレードのメタタングステン酸アンモニウム(AMT)は、研究、分析用途、高精度工業プロセスでの使用拡大に牽引され、予測期間中、金額ベースで2番目に急成長するグレードになると予想されています。試薬グレードのAMTは、優れた純度と化学的一貫性を備えているため、汚染制御が重要な実験室規模の合成、触媒開発、先端材料研究に適しています。その需要は、特に学術研究および産業研究開発分野、さらには再現性と性能信頼性が不可欠な電子機器や特殊触媒などのニッチな用途で高まっています。高純度または電子機器グレードのAMTは特定のハイテク分野で主流ですが、試薬グレードの材料は、コスト、入手可能性、品質仕様のバランスが取れているため、引き続き人気が高まっており、進化するAMT市場環境において、工業グレードと超高純度グレードの重要な中間選択肢としての地位を確立しています。

調査対象範囲

本調査レポートは、AMT市場を原材料(バージン鉱石ルート、二次/リサイクルルート)、形態(粉末、水溶液、結晶)、グレード(標準グレード、高純度グレード、試薬グレード)、用途(触媒、顔料、金属仕上げ、X線遮蔽、分析化学、ガラス・セラミック製造、その他の用途)、最終用途産業(化学、エレクトロニクス、医療、航空宇宙・防衛、冶金、その他の最終用途産業)、地域(北米、欧州、アジア太平洋、中東・アフリカ、南米)別に分類しています。本レポートでは、AMT市場の成長に影響を与える主要要因(成長促進要因、阻害要因、課題、機会など)に関する詳細な情報を提供しています。主要業界プレーヤーを徹底的に調査し、事業概要、ソリューション、サービス、主要戦略、契約、パートナーシップ、合意に関する洞察を提供しています。AMT市場における新製品投入、合併・買収、最近の動向なども網羅しています。このレポートには、AMT 市場エコシステムにおける今後の新興企業の競合分析が含まれています。

このレポートを購入する理由:

本レポートは、AMT市場全体および各サブセグメントの収益数値の近似値に関する情報を提供し、市場リーダー/新規参入企業にとって役立ちます。また、ステークホルダーが競争環境を理解し、ビジネスポジショニングを改善し、適切な市場開拓戦略を策定するための洞察を深めるのに役立ちます。さらに、ステークホルダーが市場の動向を把握し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供するのにも役立ちます。

本レポートでは、以下の点について洞察を提供します。

- 主要な推進要因(最終用途産業における規制遵守、技術進歩、性能優位性)、制約要因(原材料価格の変動と下流アプリケーションにおける技術的複雑性)、機会(高成長技術分野、循環型経済、リサイクル)、課題(サプライチェーンの脆弱性)の分析

製品開発/イノベーション:AMT市場における今後の技術、研究開発活動、サービス開始に関する詳細な洞察。 - 市場動向:収益性の高い市場に関する包括的な情報 – 本レポートでは、様々な地域におけるAMT市場を分析しています。

- 市場の多様化:AMT市場におけるサービス、未開拓地域、最近の動向、投資に関する包括的な情報

- 競合評価:H.C. Starck Tungsten GmbH(ドイツ)、Global Tungsten & Powders(米国)、Masan High-Tech Materials Corporation(ベトナム)、Ganzhou Grand Sea Tungsten Co., Ltd.(中国)、Ereztech LLC(米国)、Ganzhou CF Tungsten Co., Ltd.(中国)、United Wolfram(インド)、ATT Advanced Elemental Materials Co., Ltd.(米国)、Noah Chemicals(米国)、North Metal & Chemical Co.(米国)といった主要企業の市場シェア、成長戦略、サービス提供に関する詳細な評価。

Report Description

The ammonium metatungstate market is projected to grow from USD 0.90 billion in 2025 to USD 1.16 billion by 2030, at a CAGR of 5.2% during the forecast period.

Ammonium Metatungstate Market – Global Forecast to 2030

The reagent grade of ammonium metatungstate (AMT) is expected to be the second-fastest-growing grade in terms of value during the forecast period, driven by its expanding use in research, analytical applications, and high-precision industrial processes. Reagent-grade AMT offers superior purity and chemical consistency, making it suitable for laboratory-scale synthesis, catalyst development, and advanced material research where contamination control is critical. Its demand is rising, particularly in academic and industrial R&D sectors, as well as in niche applications such as electronics and specialty catalysts, where reproducibility and performance reliability are essential. Although high-purity or electronic-grade AMT dominates in certain high-tech segments, reagent-grade material continues to gain traction due to its balanced cost, availability, and quality specifications, positioning it as a key intermediate choice between technical and ultra-high-purity grades in the evolving AMT market landscape.

‘‘In terms of value, catalyst is expected to be the fastest-growing in the overall AMT market during the forecast period.’’

This growth is supported by the accelerating global transition toward cleaner fuels and energy-efficient chemical processes. AMT serves as a critical precursor for manufacturing tungsten-based catalysts used in hydroprocessing, oxidative coupling, and selective catalytic reduction (SCR) systems. Its unique combination of acidity, oxidation potential, and thermal stability enhances catalytic performance, making it highly effective in refining, petrochemical, and environmental applications. Beyond traditional hydrocracking and desulfurization uses, the material is increasingly being explored for green chemistry innovations such as biomass conversion, CO₂ utilization, and ammonia decomposition for hydrogen production. These emerging sustainable technologies are creating new, high-value demand streams for AMT-derived catalysts. Additionally, as refineries and chemical plants modernize to meet stricter emission norms and process efficiency goals, the shift toward tungsten-based catalyst systems is expected to further accelerate the growth of this application segment.

.

“During the forecast period, the chemical end-use industry is projected to register the fastest growth during the forecast period.”

Driven by the rising adoption of tungsten-based intermediates in advanced chemical synthesis and catalytic processes. AMT is increasingly being used as a key ingredient in the manufacture of high-performance catalysts, specialty tungsten compounds, and functional oxides that serve as building blocks for a variety of downstream products. The shift toward cleaner and more energy-efficient chemical production is further stimulating demand, as AMT enables high activity and selectivity in catalytic reactions, reducing waste and improving process economics. Additionally, growth in fine and specialty chemical manufacturing, including advanced coatings, polymer modifiers, and environmental catalysts, is creating new opportunities for AMT utilization. Many chemical producers are also investing in closed-loop tungsten recovery systems, using AMT as a recyclable and environmentally compatible intermediate, aligning with sustainability and circular economy trends. This combination of performance, versatility, and environmental compliance positions the chemical industry as a key growth driver for the global AMT market.

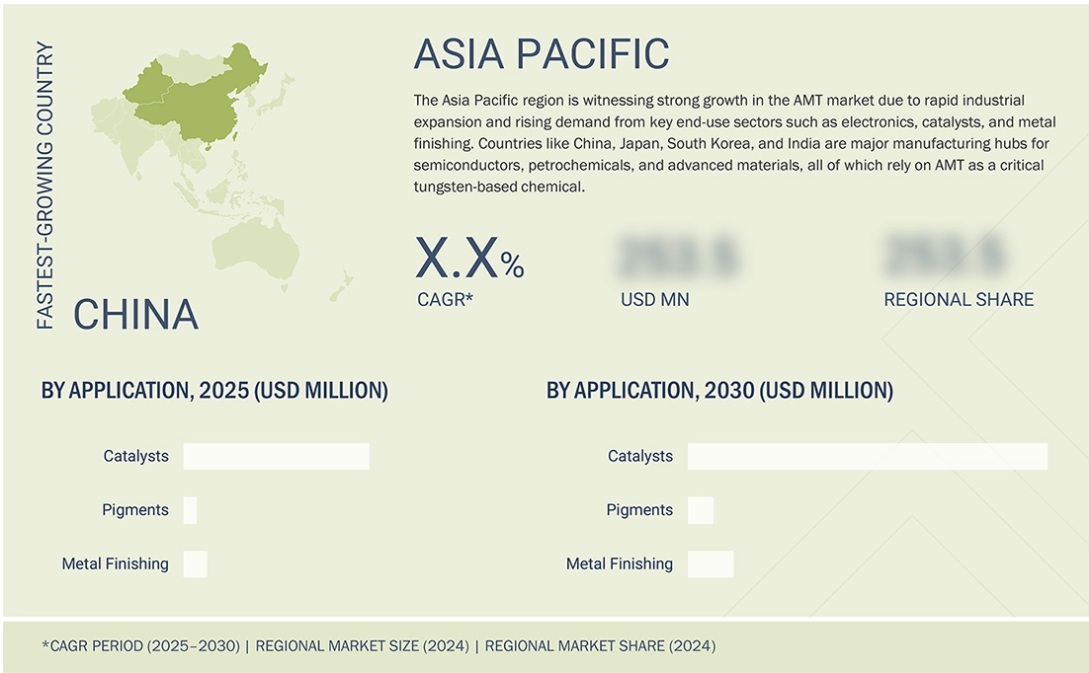

Ammonium Metatungstate Market – Global Forecast to 2030 – region

“The AMT market in Europe is projected to register the second-largest market share during the forecast period.”

This growth is supported by the region’s strong industrial base, advanced technological capabilities, and growing emphasis on sustainable manufacturing. The region hosts several leading tungsten chemical producers and refiners, particularly in Germany, Austria, and the UK, which have well-established infrastructure for high-purity tungsten processing. Europe’s mature petrochemical, automotive, and aerospace industries are key consumers of AMT-based catalysts and materials, driven by strict environmental and performance standards. The ongoing transition toward low-emission fuels and the adoption of circular economy models are encouraging refiners and chemical manufacturers to integrate AMT in catalyst systems and tungsten recovery loops. Additionally, robust R&D initiatives, supported by the European Green Deal and investments in clean energy technologies, are fostering innovation in tungsten-based catalysts and electronic materials. This combination of regulatory push, technological advancement, and industrial maturity positions Europe as a strategically important and stable market, maintaining its status as the second-largest regional hub in the global AMT landscape.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type: Tier 1 – 60%, Tier 2 – 20%, and Tier 3 – 20%

- By Designation: C Level – 33%, Director Level – 33%, and Managers – 34%

- By Region: North America – 20%, Europe – 25%, Asia Pacific – 25%, Middle East & Africa – 15%, and South America – 15%

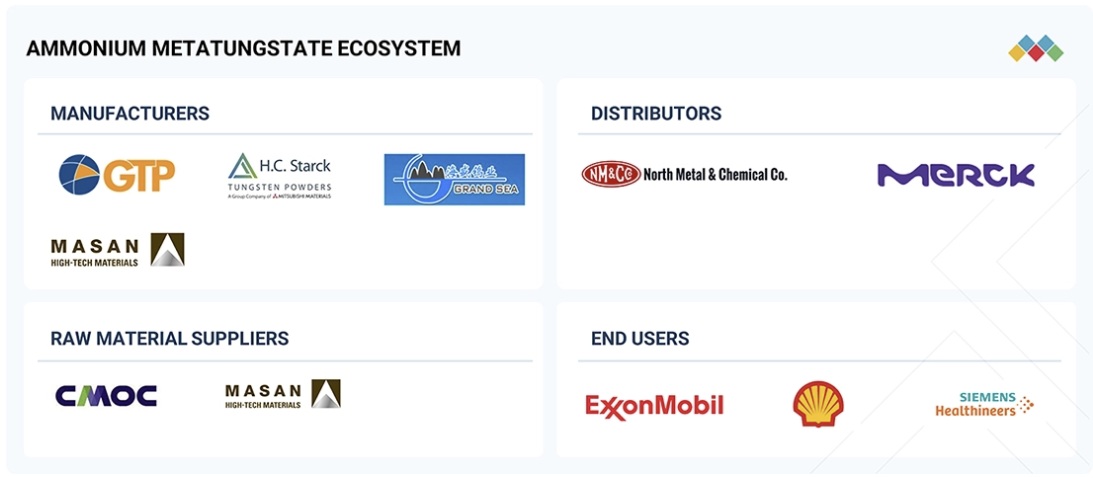

Ammonium Metatungstate Market – Global Forecast to 2030 – ecosystem

The report provides a comprehensive analysis of company profiles:

Prominent companies in this market include H.C. Starck Tungsten GmbH (Germany), Global Tungsten & Powders (US), Masan High-Tech Materials Corporation (Vietnam), Ganzhou Grand Sea Tungsten Co., Ltd. (China), Ereztech LLC (US), Ganzhou CF Tungsten Co., Ltd (China), United Wolfram (India), ATT Advanced Elemental Materials Co., Ltd. (US), Noah Chemicals (US), and North Metal & Chemical Co. (US).

Research Coverage

This research report categorizes the AMT market by raw material (virgin ore route, secondary/recycled route), form (powder, aqueous solution, crystalline), grade (standard grade, high-purity grade, reagent grade), application (catalysts, pigments, metal finishing, x-ray shielding, analytical chemistry, glass & ceramic production, other applications), end-use industry (chemical, electronics, medical, aerospace & defense, metallurgy, other end-use industries), and region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). The scope of the report includes detailed information about the major factors influencing the growth of the AMT market, such as drivers, restraints, challenges, and opportunities. A thorough examination of the key industry players has been conducted in order to provide insights into their business overview, solutions, and services, key strategies, contracts, partnerships, and agreements. Product launches, mergers and acquisitions, and recent developments in the AMT market are all covered. This report includes a competitive analysis of upcoming startups in the AMT market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall AMT market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (regulatory compliance in end-use industries, technological advancement, and performance superiority), restraints (volatility in raw material prices and technical complexity in downstream applications), opportunities (high growth technology sector and circular economy and recycling), and challenges (supply chain vulnerabilities)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and service launches in the AMT market.

- Market Development: Comprehensive information about lucrative markets – the report analyses the AMT market across varied regions.

- Market Diversification: Exhaustive information about services, untapped geographies, recent developments, and investments in the AMT market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like H.C. Starck Tungsten GmbH (Germany), Global Tungsten & Powders (US), Masan High-Tech Materials Corporation (Vietnam), Ganzhou Grand Sea Tungsten Co., Ltd. (China), Ereztech LLC (US), Ganzhou CF Tungsten Co., Ltd. (China), United Wolfram (India), ATT Advanced Elemental Materials Co., Ltd. (US), Noah Chemicals (US), and North Metal & Chemical Co. (US).

Table of Contents

1 INTRODUCTION 25

1.1 STUDY OBJECTIVES 25

1.2 MARKET DEFINITION 25

1.3 STUDY SCOPE 26

1.3.1 AMMONIUM METATUNGSTATE MARKET SEGMENTATION AND REGIONAL SCOPE 26

1.3.2 INCLUSIONS AND EXCLUSIONS 27

1.3.3 YEARS CONSIDERED 27

1.4 CURRENCY CONSIDERED 27

1.5 UNITS CONSIDERED 27

1.6 STAKEHOLDERS 28

2 RESEARCH METHODOLOGY 29

2.1 RESEARCH DATA 29

2.1.1 SECONDARY DATA 30

2.1.1.1 List of key secondary sources 30

2.1.1.2 Key data from secondary sources 30

2.1.2 PRIMARY DATA 31

2.1.2.1 Key data from primary sources 31

2.1.2.2 List of primary interview participants—demand and supply side 31

2.1.2.3 Key industry insights 32

2.1.2.4 Breakdown of interviews with experts 32

2.2 MARKET SIZE ESTIMATION 33

2.2.1 BOTTOM-UP APPROACH 33

2.2.2 TOP-DOWN APPROACH 34

2.3 FORECAST NUMBER CALCULATION 35

2.4 DATA TRIANGULATION 35

2.5 FACTOR ANALYSIS 36

2.6 ASSUMPTIONS 37

2.7 LIMITATIONS & RISKS 37

3 EXECUTIVE SUMMARY 38

4 PREMIUM INSIGHTS 42

4.1 OPPORTUNITIES FOR PLAYERS IN AMMONIUM METATUNGSTATE MARKET 42

4.2 AMMONIUM METATUNGSTATE MARKET, BY RAW MATERIAL 42

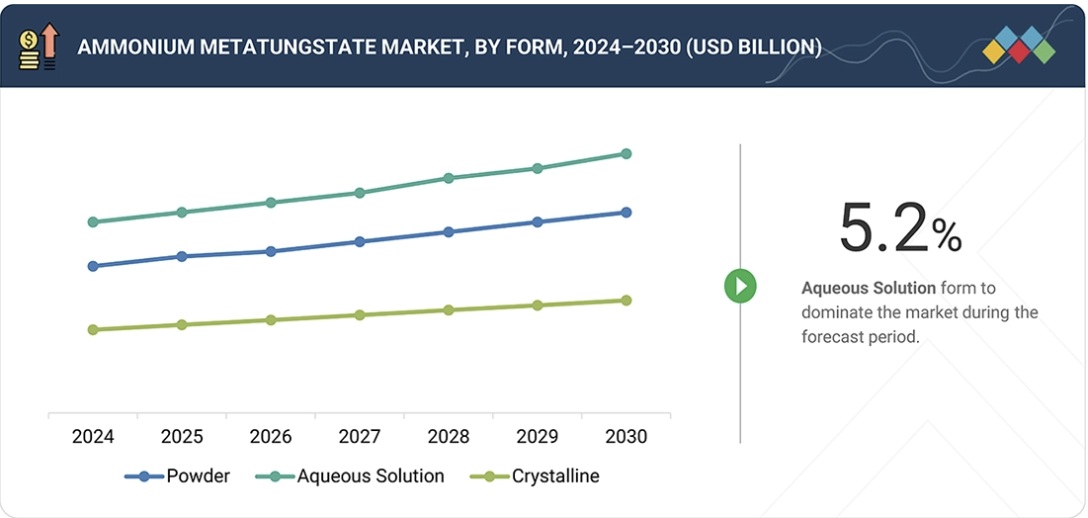

4.3 AMMONIUM METATUNGSTATE MARKET, BY FORM 43

4.4 AMMONIUM METATUNGSTATE MARKET, BY GRADE 43

4.5 AMMONIUM METATUNGSTATE MARKET, BY APPLICATION 44

4.6 AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY 44

4.7 AMMONIUM METATUNGSTATE MARKET, BY KEY COUNTRY 45

5 MARKET OVERVIEW 46

5.1 INTRODUCTION 46

5.2 MARKET DYNAMICS 46

5.2.1 DRIVERS 47

5.2.1.1 Regulatory compliance in end-use industries 47

5.2.1.2 Technological advancement and performance superiority 48

5.2.2 RESTRAINTS 48

5.2.2.1 Volatility in raw material prices 48

5.2.2.2 Technical complexity in downstream applications 48

5.2.3 OPPORTUNITIES 48

5.2.3.1 High-growth technology sectors 48

5.2.3.2 Circular economy and recycling 49

5.2.4 CHALLENGES 49

5.2.4.1 Supply chain vulnerabilities 49

5.2.4.2 High barriers to new production 49

5.3 PORTER’S FIVE FORCES ANALYSIS 50

5.3.1 BARGAINING POWER OF SUPPLIERS 50

5.3.2 BARGAINING POWER OF BUYERS 51

5.3.3 THREAT OF NEW ENTRANTS 51

5.3.4 THREAT OF SUBSTITUTES 52

5.3.5 INTENSITY OF COMPETITIVE RIVALRY 52

5.4 MACROECONOMIC INDICATORS 53

5.4.1 GLOBAL GDP TRENDS 53

5.5 VALUE CHAIN ANALYSIS 54

5.5.1 RAW MATERIAL SUPPLIERS 55

5.5.2 MANUFACTURERS 55

5.5.3 DISTRIBUTORS 55

5.5.4 DOWNSTREAM (PRODUCT MANUFACTURING) 56

5.5.5 END USERS 56

5.6 ECOSYSTEM ANALYSIS 56

5.7 TECHNOLOGY ANALYSIS 57

5.7.1 KEY TECHNOLOGIES 57

5.7.1.1 Next-generation battery anodes 57

5.7.1.2 Biomedical and environmental applications 57

5.7.1.3 Green hydrogen and carbon utilization 57

5.7.2 ADJACENT TECHNOLOGIES 58

5.7.2.1 Innovations in tungsten precursor synthesis and recycling 58

5.7.2.2 Advanced catalyst manufacturing and design 58

5.7.3 COMPLEMENTARY TECHNOLOGIES 58

5.7.3.1 Miniaturization in electronics 58

5.7.3.2 Advanced medical imaging 58

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 58

5.9 TRADE ANALYSIS 59

5.9.1 EXPORT SCENARIO 60

5.9.2 IMPORT SCENARIO 61

5.10 CASE STUDY ANALYSIS 62

5.10.1 SUSTAINABLE PRODUCTION OF AMMONIUM METATUNGSTATE VIA REVERSE OSMOSIS 62

5.10.2 AMMONIUM METATUNGSTATE IN REFORMING CATALYSTS FOR HYDROGEN PRODUCTION 62

5.10.3 AMT IN CATALYST PREPARATION FOR NOₓ SCR – RESEARCH APPLICATION 62

5.11 REGULATORY LANDSCAPE 63

5.11.1 REGULATIONS 63

5.11.1.1 Europe 63

5.11.1.2 Asia Pacific 63

5.11.1.3 North America 64

5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 64

5.12 KEY STAKEHOLDERS & BUYING CRITERIA 65

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS 65

5.12.2 BUYING CRITERIA 66

5.13 KEY CONFERENCES AND EVENTS, 2025–2026 67

5.14 PRICING ANALYSIS 68

5.14.1 AVERAGE SELLING PRICE TREND, BY REGION 68

5.14.2 AVERAGE SELLING PRICE TREND, BY APPLICATION 69

5.15 INVESTMENT AND FUNDING SCENARIO 69

5.16 PATENT ANALYSIS 70

5.16.1 APPROACH 70

5.16.2 DOCUMENT TYPES 70

5.16.3 PUBLICATION TRENDS, 2014–2024 71

5.16.4 INSIGHTS 71

5.16.5 LEGAL STATUS OF PATENTS 72

5.16.6 JURISDICTION ANALYSIS FROM 2014 TO 2024 72

5.16.7 TOP COMPANIES/APPLICANTS 73

5.16.8 TOP 10 PATENT OWNERS (US), 2014–2024 73

5.17 IMPACT OF 2025 US TARIFF ON AMMONIUM METATUNGSTATE MARKET 74

5.17.1 INTRODUCTION 74

5.17.2 KEY TARIFF RATES 74

5.17.3 PRICE IMPACT ANALYSIS 75

5.17.4 IMPACT ON KEY COUNTRIES/REGIONS 75

5.17.4.1 North America 75

5.17.4.2 Europe 76

5.17.4.3 Asia Pacific 76

5.17.5 IMPACT ON END-USE INDUSTRIES 76

6 AMMONIUM METATUNGSTATE MARKET, BY TYPE 78

6.1 INTRODUCTION 78

6.2 PURITY 99% 78

6.2.1 INDUSTRIAL-GRADE AMT FOR CATALYSTS AND TUNGSTEN POWDERS 78

6.3 PURITY 98% 78

6.3.1 AMT FOR CONVENTIONAL INDUSTRIAL APPLICATIONS 78

6.4 OTHERS 79

7 AMMONIUM METATUNGSTATE MARKET, BY RAW MATERIAL 80

7.1 INTRODUCTION 81

7.2 VIRGIN ORE ROUTE (WO₃ FROM PRIMARY ORES) 82

7.2.1 INDUSTRIAL-GRADE AMT DERIVED FROM PRIMARY TUNGSTEN ORES 82

7.3 SECONDARY/RECYCLED ROUTE 82

7.3.1 AMT PRODUCTION VIA TUNGSTEN SCRAP AND CARBIDE RECYCLING 82

8 AMMONIUM METATUNGSTATE MARKET, BY FORM 84

8.1 INTRODUCTION 85

8.2 POWDER 86

8.2.1 AMT POWDERS TO DRIVE EFFICIENCY IN TUNGSTEN PROCESSING 86

8.3 AQUEOUS SOLUTION 86

8.3.1 AQUEOUS SOLUTIONS TO DRIVE GROWTH IN CATALYST INDUSTRY 86

8.4 CRYSTALLINE 87

8.4.1 HIGH-PURITY CRYSTALLINE AMT WIDELY USED IN ADVANCED TUNGSTEN APPLICATIONS 87

9 AMMONIUM METATUNGSTATE MARKET, BY GRADE 88

9.1 INTRODUCTION 89

9.2 STANDARD GRADE 90

9.2.1 COST-OPTIMIZED SOLUTION FOR BULK MANUFACTURING 90

9.3 HIGH PURITY GRADE 91

9.3.1 ENABLING ADVANCED APPLICATIONS IN ELECTRONICS AND CATALYSIS 91

9.4 REAGENT GRADE 91

9.4.1 SIGNIFICANCE OF REAGENT GRADE AMT IN EARLY-STAGE MATERIAL DEVELOPMENT 91

10 AMMONIUM METATUNGSTATE MARKET, BY APPLICATION 92

10.1 INTRODUCTION 93

10.2 CATALYST 95

10.2.1 IMPORTANCE IN PETROCHEMICAL AND ENVIRONMENTAL SECTORS 95

10.3 PIGMENTS 95

10.3.1 SUPERIOR COLOR RETENTION UNDER EXTREME CONDITIONS 95

10.4 METAL FINISHING 96

10.4.1 PROCESS-OPTIMIZED AMT FOR INDUSTRIAL APPLICATIONS 96

10.5 X-RAY SHIELDING 96

10.5.1 GROWING DEMAND FOR RADIATION PROTECTION IN HEALTHCARE FACILITIES 96

10.6 ANALYTICAL CHEMISTRY 96

10.6.1 ENABLES SENSITIVE DETECTION OF TRACE METALS AND ANIONS 96

10.7 GLASS & CERAMIC PRODUCTION 97

10.7.1 IMPROVES THERMAL STABILITY AND HEAT RESISTANCE IN GLASS AND CERAMICS 97

10.8 OTHER APPLICATIONS 97

11 AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY 98

11.1 INTRODUCTION 99

11.2 CHEMICAL & PETROCHEMICAL 101

11.2.1 DEMAND FOR CLEANER FUELS TO DRIVE MARKET 101

11.3 ELECTRONICS 101

11.3.1 HIGH-PURITY AMMONIUM METATUNGSTATE ESSENTIAL FOR ELECTRONICS INDUSTRY 101

11.4 MEDICAL 101

11.4.1 REGULATORY PRESSURE ON LEAD SHIELDING TO PROVIDE OPPORTUNITY FOR AMMONIUM METATUNGSTATE 101

11.5 AEROSPACE & DEFENSE 102

11.5.1 DEMAND FOR AMMONIUM METATUNGSTATE OF HIGH SPECIALIZATION AND QUALITY TO DRIVE MARKET 102

11.6 METALLURGY 102

11.6.1 WIDELY USED FOR MAKING SUBSTRATE FOR SEMICONDUCTOR DEVICES 102

11.7 OTHER END-USE INDUSTRIES 103

12 AMMONIUM METATUNGSTATE MARKET, BY REGION 104

12.1 INTRODUCTION 105

12.2 NORTH AMERICA 107

12.2.1 US 112

12.2.1.1 Government support to semiconductor fabrication industry to drive demand 112

12.2.2 CANADA 114

12.2.2.1 Oil sands processing and chemical exports are strong drivers for use of ammonium metatungstate 114

12.2.3 MEXICO 115

12.2.3.1 Country’s transition to trade hub to drive market 115

12.3 ASIA PACIFIC 117

12.3.1 CHINA 122

12.3.1.1 Largest market for ammonium metatungstate 122

12.3.2 INDIA 124

12.3.2.1 Growing semiconductor industry through government initiative to drive market 124

12.3.3 JAPAN 126

12.3.3.1 Initiatives to restabilize semiconductor industry to drive demand for high-quality ammonium metatungstate 126

12.3.4 SOUTH KOREA 127

12.3.4.1 Expansion of electronics industry to directly drive ammonium metatungstate demand 127

12.3.5 REST OF ASIA PACIFIC 129

12.4 EUROPE 131

12.4.1 GERMANY 135

12.4.1.1 Growth of chemical industry to drive market 135

12.4.2 FRANCE 137

12.4.2.1 High quality ammonium metatungstate to drive market 137

12.4.3 UK 139

12.4.3.1 Reliance on local sourcing for growing electronics industry to drive market 139

12.4.4 ITALY 140

12.4.4.1 Coatings for high purity materials to drive demand for ammonium metatungstate 140

12.4.5 SPAIN 142

12.4.5.1 Growing electronic base to support market 142

12.4.6 REST OF EUROPE 144

12.5 MIDDLE EAST & AFRICA 146

12.5.1 GCC COUNTRIES 151

12.5.1.1 Saudi Arabia 151

12.5.1.1.1 Vision 2030 to play major role in driving market 151

12.5.1.2 UAE 153

12.5.1.2.1 Government’s initiative to diversify economy to drive market 153

12.5.1.3 Rest of GCC 155

12.5.2 SOUTH AFRICA 156

12.5.2.1 Ammonium metatungstate demand is directly linked with growing chemical industry 156

12.5.3 REST OF MIDDLE EAST & AFRICA 158

12.6 SOUTH AMERICA 160

12.6.1 BRAZIL 164

12.6.1.1 Government initiatives to drive market 164

12.6.2 ARGENTINA 165

12.6.2.1 Focus on chemical sector to drive market 165

12.6.3 REST OF SOUTH AMERICA 167

13 COMPETITIVE LANDSCAPE 169

13.1 OVERVIEW 169

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2025 169

13.3 REVENUE ANALYSIS 170

13.4 MARKET SHARE ANALYSIS 170

13.4.1 GANZHOU GRAND SEA TUNGSTEN CO., LTD. 171

13.4.2 XIAMEN TUNGSTEN CO., LTD. 172

13.4.3 H.C. STARCK TUNGSTEN GMBH 172

13.4.4 GLOBAL TUNGSTEN & POWDERS 172

13.4.5 GANZHOU CF TUNGSTEN CO., LTD 173

13.5 COMPANY VALUATION AND FINANCIAL METRICS 173

13.6 PRODUCT COMPARISON ANALYSIS 174

13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 175

13.7.1 STARS 175

13.7.2 EMERGING LEADERS 175

13.7.3 PERVASIVE PLAYERS 175

13.7.4 PARTICIPANTS 175

13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 177

13.7.5.1 Company footprint 177

13.7.5.2 Region footprint 177

13.7.5.3 Type footprint 178

13.7.5.4 Raw material footprint 179

13.7.5.5 Form footprint 179

13.7.5.6 Grade footprint 180

13.7.5.7 Application footprint 180

13.7.5.8 End-use industry footprint 181

13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 182

13.8.1 PROGRESSIVE COMPANIES 182

13.8.2 RESPONSIVE COMPANIES 182

13.8.3 DYNAMIC COMPANIES 182

13.8.4 STARTING BLOCKS 182

13.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024 184

13.8.5.1 Detailed list of key startups/SMEs 184

13.8.5.2 Competitive benchmarking of key startups/SMEs 185

13.9 COMPETITIVE SCENARIO 187

13.9.1 DEALS 187

14 COMPANY PROFILES 188

14.1 KEY PLAYERS 188

14.1.1 GANZHOU GRAND SEA TUNGSTEN CO., LTD. 188

14.1.1.1 Business overview 188

14.1.1.2 Products/Solutions/Services offered 189

14.1.1.3 MnM view 189

14.1.2 XIAMEN TUNGSTEN CO., LTD. 190

14.1.2.1 Business overview 190

14.1.2.2 Products/Solutions/Services offered 190

14.1.2.3 MnM view 191

14.1.3 H.C. STARCK TUNGSTEN GMBH 192

14.1.3.1 Business overview 192

14.1.3.2 Products/Solutions/Services offered 192

14.1.3.3 Recent developments 193

14.1.3.3.1 Deals 193

14.1.3.4 MnM view 193

14.1.3.4.1 Key strengths 193

14.1.3.4.2 Strategic choices 193

14.1.3.4.3 Weaknesses and competitive threats 194

14.1.4 GLOBAL TUNGSTEN & POWDERS 195

14.1.4.1 Business overview 195

14.1.4.2 Products/Solutions/Services offered 195

14.1.4.3 Recent developments 196

14.1.4.3.1 Deals 196

14.1.4.4 MnM view 196

14.1.4.4.1 Key strengths 196

14.1.4.4.2 Strategic choices 196

14.1.4.4.3 Weaknesses and competitive threats 197

14.1.5 GANZHOU CF TUNGSTEN CO., LTD 198

14.1.5.1 Business overview 198

14.1.5.2 Products/Solutions/Services offered 198

14.1.5.3 MnM view 199

14.1.6 MASAN HIGH-TECH MATERIALS CORPORATION 200

14.1.6.1 Business overview 200

14.1.6.2 Products/Solutions/Services offered 201

14.1.6.3 MnM view 202

14.1.7 EREZTECH LLC 203

14.1.7.1 Business overview 203

14.1.7.2 Products/Solutions/Services offered 203

14.1.7.3 MnM view 204

14.1.8 UNITED WOLFRAM 205

14.1.8.1 Business overview 205

14.1.8.2 Products/Solutions/Services offered 205

14.1.8.3 MnM view 206

14.1.9 ATT ADVANCED ELEMENTAL MATERIALS CO., LTD. 207

14.1.9.1 Business overview 207

14.1.9.2 Products/Solutions/Services offered 207

14.1.9.3 MnM view 208

14.1.10 NOAH CHEMICALS 209

14.1.10.1 Business overview 209

14.1.10.2 Products/Solutions/Services offered 209

14.1.10.3 MnM view 210

14.1.11 NORTH METAL & CHEMICAL CO. 211

14.1.11.1 Business overview 211

14.1.11.2 Products/Solutions/Services offered 211

14.1.11.3 MnM view 212

14.2 OTHER KEY PLAYERS 213

14.2.1 NINGBO INNO PHARMCHEM CO., LTD. 213

14.2.2 W&Q METAL PRODUCTS CO., LTD. 214

14.2.3 PROCHEM, INC. 215

14.2.4 NIPPON INORGANIC COLOUR & CHEMICAL CO., LTD. 216

14.2.5 SHANGHAI HUZHENG INDUSTRIAL CO., LTD. 217

14.2.6 ZHUZHOU CEMENTED CARBIDE GROUP CORP., LTD. 218

14.2.7 UNILONG INDUSTRY CO., LTD. 219

14.2.8 CAS CHEMICAL 220

14.2.9 MUBY CHEMICALS 221

14.2.10 MARUTI ENTERPRISE 222

15 APPENDIX 223

15.1 DISCUSSION GUIDE 223

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 226

15.3 CUSTOMIZATION OPTIONS 228

15.4 RELATED REPORTS 228

15.5 AUTHOR DETAILS 229

LIST OF TABLES

TABLE 1 LIST OF KEY SECONDARY SOURCES 30

TABLE 2 KEY REGULATIONS CREATING DEMAND FOR AMMONIUM METATUNGSTATE 47

TABLE 3 AMMONIUM METATUNGSTATE MARKET: IMPACT OF PORTER’S FIVE FORCES 53

TABLE 4 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021–2030 53

TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM 57

TABLE 6 EXPORT DATA HS CODE 284180-COMPLIANT PRODUCTS, BY COUNTRY

(USD THOUSAND) 60

TABLE 7 IMPORT DATA HS CODE 284180-COMPLIANT PRODUCTS, BY COUNTRY

(USD THOUSAND) 61

TABLE 8 AMMONIUM METATUNGSTATE MARKET: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 64

TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF KEY END-USE INDUSTRIES (%) 65

TABLE 10 BUYING CRITERIA FOR KEY END-USE INDUSTRIES 66

TABLE 11 AMMONIUM METATUNGSTATE MARKET: KEY CONFERENCES AND EVENTS,

2025–2026 67

TABLE 12 AVERAGE SELLING PRICE TREND OF AMMONIUM METATUNGSTATE, BY REGION, 2022–2030 (USD/KG) 68

TABLE 13 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2022–2030 (USD/KG) 69

TABLE 14 TOTAL PATENT COUNT, 2014–2024 71

TABLE 15 TOP 10 PATENT OWNERS, 2014–2014 73

TABLE 16 US-ADJUSTED RECIPROCAL TARIFF RATES 74

TABLE 17 AMMONIUM METATUNGSTATE MARKET, BY RAW MATERIAL,

2022–2024 (USD MILLION) 81

TABLE 18 AMMONIUM METATUNGSTATE MARKET, BY RAW MATERIAL,

2025–2030 (USD MILLION) 81

TABLE 19 AMMONIUM METATUNGSTATE MARKET, BY RAW MATERIAL, 2022–2024 (TON) 82

TABLE 20 AMMONIUM METATUNGSTATE MARKET, BY RAW MATERIAL, 2025–2030 (TON) 82

TABLE 21 AMMONIUM METATUNGSTATE MARKET, BY FORM, 2022–2024 (USD MILLION) 85

TABLE 22 AMMONIUM METATUNGSTATE MARKET, BY FORM, 2025–2030 (USD MILLION) 85

TABLE 23 AMMONIUM METATUNGSTATE MARKET, BY FORM, 2022–2024 (TON) 86

TABLE 24 AMMONIUM METATUNGSTATE MARKET, BY FORM, 2025–2030 (TON) 86

TABLE 25 AMMONIUM METATUNGSTATE MARKET, BY GRADE, 2022–2024 (USD MILLION) 89

TABLE 26 AMMONIUM METATUNGSTATE MARKET, BY GRADE, 2025–2030 (USD MILLION) 90

TABLE 27 AMMONIUM METATUNGSTATE MARKET, BY GRADE, 2022–2024 (TON) 90

TABLE 28 AMMONIUM METATUNGSTATE MARKET, BY GRADE, 2025–2030 (TON) 90

TABLE 29 AMMONIUM METATUNGSTATE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 94

TABLE 30 AMMONIUM METATUNGSTATE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 94

TABLE 31 AMMONIUM METATUNGSTATE MARKET, BY APPLICATION, 2022–2024 (TON) 94

TABLE 32 AMMONIUM METATUNGSTATE MARKET, BY APPLICATION, 2025–2030 (TON) 95

TABLE 33 AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 99

TABLE 34 AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 100

TABLE 35 AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (TON) 100

TABLE 36 AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (TON) 100

TABLE 37 AMMONIUM METATUNGSTATE MARKET, BY REGION, 2022–2024 (USD MILLION) 105

TABLE 38 AMMONIUM METATUNGSTATE MARKET, BY REGION, 2025–2030 (USD MILLION) 106

TABLE 39 AMMONIUM METATUNGSTATE MARKET, BY REGION, 2022–2024 (TON) 106

TABLE 40 AMMONIUM METATUNGSTATE MARKET, BY REGION, 2025–2030 (TON) 106

TABLE 41 NORTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 107

TABLE 42 NORTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 108

TABLE 43 NORTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY,

2022–2024 (TON) 108

TABLE 44 NORTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY,

2025–2030 (TON) 108

TABLE 45 NORTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION, 2022–2024 (USD MILLION) 109

TABLE 46 NORTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 109

TABLE 47 NORTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION, 2022–2024 (TON) 110

TABLE 48 NORTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION, 2025–2030 (TON) 110

TABLE 49 NORTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 110

TABLE 50 NORTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 111

TABLE 51 NORTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (TON) 111

TABLE 52 NORTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (TON) 111

TABLE 53 US: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 112

TABLE 54 US: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 113

TABLE 55 US: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (TON) 113

TABLE 56 US: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (TON) 113

TABLE 57 CANADA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 114

TABLE 58 CANADA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 114

TABLE 59 CANADA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (TON) 115

TABLE 60 CANADA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (TON) 115

TABLE 61 MEXICO: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 116

TABLE 62 MEXICO: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 116

TABLE 63 MEXICO: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (TON) 116

TABLE 64 MEXICO: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (TON) 117

TABLE 65 ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 118

TABLE 66 ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 118

TABLE 67 ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY,

2022–2024 (TON) 118

TABLE 68 ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY,

2025–2030 (TON) 119

TABLE 69 ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 119

TABLE 70 ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 119

TABLE 71 ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION,

2022–2024 (TON) 120

TABLE 72 ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION,

2025–2030 (TON) 120

TABLE 73 ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 120

TABLE 74 ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 121

TABLE 75 ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (TON) 121

TABLE 76 ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (TON) 121

TABLE 77 CHINA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 122

TABLE 78 CHINA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 123

TABLE 79 CHINA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (TON) 123

TABLE 80 CHINA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (TON) 123

TABLE 81 INDIA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 124

TABLE 82 INDIA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 125

TABLE 83 INDIA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (TON) 125

TABLE 84 INDIA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (TON) 125

TABLE 85 JAPAN: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 126

TABLE 86 JAPAN: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 126

TABLE 87 JAPAN: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (TON) 127

TABLE 88 JAPAN: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (TON) 127

TABLE 89 SOUTH KOREA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 128

TABLE 90 SOUTH KOREA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 128

TABLE 91 SOUTH KOREA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (TON) 128

TABLE 92 SOUTH KOREA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (TON) 129

TABLE 93 REST OF ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET,

BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 129

TABLE 94 REST OF ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET,

BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 130

TABLE 95 REST OF ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET,

BY END-USE INDUSTRY, 2022–2024 (TON) 130

TABLE 96 REST OF ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET,

BY END-USE INDUSTRY, 2025–2030 (TON) 130

TABLE 97 EUROPE: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 131

TABLE 98 EUROPE: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 131

TABLE 99 EUROPE: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY, 2022–2024 (TON) 132

TABLE 100 EUROPE: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY, 2025–2030 (TON) 132

TABLE 101 EUROPE: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 132

TABLE 102 EUROPE: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 133

TABLE 103 EUROPE: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION,

2022–2024 (TON) 133

TABLE 104 EUROPE: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION,

2025–2030 (TON) 133

TABLE 105 EUROPE: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 134

TABLE 106 EUROPE: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 134

TABLE 107 EUROPE: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (TON) 134

TABLE 108 EUROPE: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (TON) 135

TABLE 109 GERMANY: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 136

TABLE 110 GERMANY: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 136

TABLE 111 GERMANY: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (TON) 136

TABLE 112 GERMANY: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (TON) 137

TABLE 113 FRANCE: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 137

TABLE 114 FRANCE: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 138

TABLE 115 FRANCE: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (TON) 138

TABLE 116 FRANCE: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (TON) 138

TABLE 117 UK: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 139

TABLE 118 UK: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 139

TABLE 119 UK: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (TON) 140

TABLE 120 UK: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (TON) 140

TABLE 121 ITALY: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 141

TABLE 122 ITALY: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 141

TABLE 123 ITALY: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (TON) 141

TABLE 124 ITALY: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (TON) 142

TABLE 125 SPAIN: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 142

TABLE 126 SPAIN: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 143

TABLE 127 SPAIN: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (TON) 143

TABLE 128 SPAIN: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (TON) 143

TABLE 129 REST OF EUROPE: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 144

TABLE 130 REST OF EUROPE: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 144

TABLE 131 REST OF EUROPE: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (TON) 145

TABLE 132 REST OF EUROPE: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (TON) 145

TABLE 133 MIDDLE EAST & AFRICA: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY, 2022–2024 (USD MILLION) 146

TABLE 134 MIDDLE EAST & AFRICA: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 146

TABLE 135 MIDDLE EAST & AFRICA: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY, 2022–2024 (TON) 147

TABLE 136 MIDDLE EAST & AFRICA: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY, 2025–2030 (TON) 147

TABLE 137 MIDDLE EAST & AFRICA: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION, 2022–2024 (USD MILLION) 148

TABLE 138 MIDDLE EAST & AFRICA: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 148

TABLE 139 MIDDLE EAST & AFRICA: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION, 2022–2024 (TON) 149

TABLE 140 MIDDLE EAST & AFRICA: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION, 2025–2030 (TON) 149

TABLE 141 MIDDLE EAST & AFRICA: AMMONIUM METATUNGSTATE MARKET,

BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 149

TABLE 142 MIDDLE EAST & AFRICA: AMMONIUM METATUNGSTATE MARKET,

BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 150

TABLE 143 MIDDLE EAST & AFRICA: AMMONIUM METATUNGSTATE MARKET,

BY END-USE INDUSTRY, 2022–2024 (TON) 150

TABLE 144 MIDDLE EAST & AFRICA: AMMONIUM METATUNGSTATE MARKET,

BY END-USE INDUSTRY, 2025–2030 (TON) 150

TABLE 145 SAUDI ARABIA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 151

TABLE 146 SAUDI ARABIA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 152

TABLE 147 SAUDI ARABIA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (TON) 152

TABLE 148 SAUDI ARABIA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (TON) 152

TABLE 149 UAE: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 153

TABLE 150 UAE: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 154

TABLE 151 UAE: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (TON) 154

TABLE 152 UAE: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (TON) 154

TABLE 153 REST OF GCC: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 155

TABLE 154 REST OF GCC: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 155

TABLE 155 REST OF GCC: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (TON) 156

TABLE 156 REST OF GCC: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (TON) 156

TABLE 157 SOUTH AFRICA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 157

TABLE 158 SOUTH AFRICA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 157

TABLE 159 SOUTH AFRICA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (TON) 157

TABLE 160 SOUTH AFRICA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (TON) 158

TABLE 161 REST OF MIDDLE EAST & AFRICA: AMMONIUM METATUNGSTATE MARKET,

BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 158

TABLE 162 REST OF MIDDLE EAST & AFRICA: AMMONIUM METATUNGSTATE MARKET,

BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 159

TABLE 163 REST OF MIDDLE EAST & AFRICA: AMMONIUM METATUNGSTATE MARKET,

BY END-USE INDUSTRY, 2022–2024 (TON) 159

TABLE 164 REST OF MIDDLE EAST & AFRICA: AMMONIUM METATUNGSTATE MARKET,

BY END-USE INDUSTRY, 2025–2030 (TON) 159

TABLE 165 SOUTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 160

TABLE 166 SOUTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 160

TABLE 167 SOUTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY,

2022–2024 (TON) 160

TABLE 168 SOUTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY COUNTRY,

2025–2030 (TON) 161

TABLE 169 SOUTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 161

TABLE 170 SOUTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 161

TABLE 171 SOUTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION,

2022–2024 (TON) 162

TABLE 172 SOUTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY APPLICATION,

2025–2030 (TON) 162

TABLE 173 SOUTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 162

TABLE 174 SOUTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 163

TABLE 175 SOUTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (TON) 163

TABLE 176 SOUTH AMERICA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (TON) 163

TABLE 177 BRAZIL: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (USD MILLION) 164

TABLE 178 BRAZIL: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 164

TABLE 179 BRAZIL: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2022–2024 (TON) 165

TABLE 180 BRAZIL: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY,

2025–2030 (TON) 165

TABLE 181 ARGENTINA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 166

TABLE 182 ARGENTINA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 166

TABLE 183 ARGENTINA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2022–2024 (TON) 166

TABLE 184 ARGENTINA: AMMONIUM METATUNGSTATE MARKET, BY END-USE INDUSTRY, 2025–2030 (TON) 167

TABLE 185 REST OF SOUTH AMERICA: AMMONIUM METATUNGSTATE MARKET,

BY END-USE INDUSTRY, 2022–2024 (USD MILLION) 167

TABLE 186 REST OF SOUTH AMERICA: AMMONIUM METATUNGSTATE MARKET,

BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 168

TABLE 187 REST OF SOUTH AMERICA: AMMONIUM METATUNGSTATE MARKET,

BY END-USE INDUSTRY, 2022–2024 (TON) 168

TABLE 188 REST OF SOUTH AMERICA: AMMONIUM METATUNGSTATE MARKET,

BY END-USE INDUSTRY, 2025–2030 (TON) 168

TABLE 189 AMMONIUM METATUNGSTATE MARKET: OVERVIEW OF STRATEGIES ADOPTED

BY KEY MANUFACTURERS, 2021–2025 169

TABLE 190 AMMONIUM METATUNGSTATE MARKET: DEGREE OF COMPETITION, 2024 171

TABLE 191 AMMONIUM METATUNGSTATE MARKET: REGION FOOTPRINT 177

TABLE 192 AMMONIUM METATUNGSTATE MARKET: TYPE FOOTPRINT 178

TABLE 193 AMMONIUM METATUNGSTATE MARKET: RAW MATERIAL FOOTPRINT 179

TABLE 194 AMMONIUM METATUNGSTATE MARKET: FORM FOOTPRINT 179

TABLE 195 AMMONIUM METATUNGSTATE MARKET: GRADE FOOTPRINT 180

TABLE 196 AMMONIUM METATUNGSTATE MARKET: APPLICATION FOOTPRINT 180

TABLE 197 AMMONIUM METATUNGSTATE MARKET: END-USE INDUSTRY FOOTPRINT 181

TABLE 198 AMMONIUM METATUNGSTATE MARKET: DETAILED LIST OF KEY STARTUPS/SMES 184

TABLE 199 AMMONIUM METATUNGSTATE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES 185

TABLE 200 AMMONIUM METATUNGSTATE MARKET: DEALS, JANUARY 2021–JUNE 2025 187

TABLE 201 GANZHOU GRAND SEA TUNGSTEN CO., LTD.: COMPANY OVERVIEW 188

TABLE 202 GANZHOU GRAND SEA TUNGSTEN CO., LTD.: PRODUCTS/SOLUTIONS/

SERVICES OFFERED 189

TABLE 203 XIAMEN TUNGSTEN CO., LTD.: COMPANY OVERVIEW 190

TABLE 204 XIAMEN TUNGSTEN CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED 190

TABLE 205 H.C. STARCK TUNGSTEN GMBH: COMPANY OVERVIEW 192

TABLE 206 H.C. STARCK TUNGSTEN GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED 192

TABLE 207 H.C. STARCK TUNGSTEN GMBH: DEALS, JANUARY 2021–JUNE 2025 193

TABLE 208 GLOBAL TUNGSTEN & POWDERS: COMPANY OVERVIEW 195

TABLE 209 GLOBAL TUNGSTEN & POWDERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED 195

TABLE 210 GLOBAL TUNGSTEN & POWDERS: DEALS, JANUARY 2021–JUNE 2025 196

TABLE 211 GANZHOU CF TUNGSTEN CO., LTD: COMPANY OVERVIEW 198

TABLE 212 GANZHOU CF TUNGSTEN CO., LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED 198

TABLE 213 MASAN HIGH-TECH MATERIALS CORPORATION: COMPANY OVERVIEW 200

TABLE 214 MASAN HIGH-TECH MATERIALS CORPORATION: PRODUCTS/SOLUTIONS/

SERVICES OFFERED 201

TABLE 215 EREZTECH LLC: COMPANY OVERVIEW 203

TABLE 216 EREZTECH LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED 203

TABLE 217 UNITED WOLFRAM: COMPANY OVERVIEW 205

TABLE 218 UNITED WOLFRAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED 205

TABLE 219 ATT ADVANCED ELEMENTAL MATERIALS CO., LTD.: COMPANY OVERVIEW 207

TABLE 220 ATT ADVANCED ELEMENTAL MATERIALS CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 207

TABLE 221 NOAH CHEMICALS: COMPANY OVERVIEW 209

TABLE 222 NOAH CHEMICALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED 209

TABLE 223 NORTH METAL & CHEMICAL CO.: COMPANY OVERVIEW 211

TABLE 224 NORTH METAL & CHEMICAL CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 211

TABLE 225 NINGBO INNO PHARMCHEM CO., LTD.: COMPANY OVERVIEW 213

TABLE 226 W&Q METAL PRODUCTS CO., LTD.: COMPANY OVERVIEW 214

TABLE 227 PROCHEM, INC.: COMPANY OVERVIEW 215

TABLE 228 NIPPON INORGANIC COLOUR & CHEMICAL CO., LTD.: COMPANY OVERVIEW 216

TABLE 229 SHANGHAI HUZHENG INDUSTRIAL CO., LTD.: COMPANY OVERVIEW 217

TABLE 230 ZHUZHOU CEMENTED CARBIDE GROUP CORP., LTD.: COMPANY OVERVIEW 218

TABLE 231 UNILONG INDUSTRY CO., LTD.: COMPANY OVERVIEW 219

TABLE 232 CAS CHEMICAL: COMPANY OVERVIEW 220

TABLE 233 MUBY CHEMICALS: COMPANY OVERVIEW 221

TABLE 234 MARUTI ENTERPRISE: COMPANY OVERVIEW 222

LIST OF FIGURES

FIGURE 1 AMMONIUM METATUNGSTATE MARKET SEGMENTATION AND REGIONAL SCOPE 26

FIGURE 2 AMMONIUM METATUNGSTATE MARKET: RESEARCH DESIGN 29

FIGURE 3 AMMONIUM METATUNGSTATE MARKET: BOTTOM-UP APPROACH 33

FIGURE 4 AMMONIUM METATUNGSTATE MARKET: TOP-DOWN APPROACH 34

FIGURE 5 AMMONIUM METATUNGSTATE MARKET SIZE ESTIMATION: TOP-DOWN APPROACH 34

FIGURE 6 DEMAND-SIDE FORECAST 35

FIGURE 7 AMMONIUM METATUNGSTATE MARKET: DATA TRIANGULATION 36

FIGURE 8 VIRGIN ORE ROUTE TO BE PREFERRED RAW MATERIAL SOURCE BETWEEN

2025 AND 2030 38

FIGURE 9 AQUEOUS SOLUTION FORM TO LEAD AMMONIUM METATUNGSTATE MARKET, 2025–2030 39

FIGURE 10 STANDARD GRADE AMMONIUM METATUNGSTATE TO BE LARGEST SEGMENT, 2025–2030 39

FIGURE 11 CATALYSTS APPLICATION TO DOMINATE AMMONIUM METATUNGSTATE MARKET, 2025–2030. 40

FIGURE 12 CHEMICALS TO CAPTURE LARGEST SHARE IN AMMONIUM METATUNGSTATE MARKET 40

FIGURE 13 ASIA PACIFIC TO BE LARGEST AND FASTEST-GROWING REGION BETWEEN

2025 AND 2030 41

FIGURE 14 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES DURING FORECAST PERIOD 42

FIGURE 15 VIRGIN ORE ROUTE TO CAPTURE LARGER MARKET SHARE BY 2030 42

FIGURE 16 AQUEOUS SOLUTION FORM TO LEAD MARKET DURING FORECAST PERIOD 43

FIGURE 17 STANDARD GRADE TO LEAD MARKET DURING FORECAST PERIOD 43

FIGURE 18 CATALYSTS TO LEAD MARKET DURING FORECAST PERIOD 44

FIGURE 19 CHEMICAL INDUSTRY TO LEAD MARKET DURING FORECAST PERIOD 44

FIGURE 20 MARKET IN CHINA TO REGISTER HIGHEST CAGR FROM 2025 TO 2030 45

FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN

AMMONIUM METATUNGSTATE MARKET 46

FIGURE 22 AMMONIUM METATUNGSTATE MARKET: PORTER’S FIVE FORCES ANALYSIS 50

FIGURE 23 OVERVIEW OF AMMONIUM METATUNGSTATE MARKET VALUE CHAIN 55

FIGURE 24 AMMONIUM METATUNGSTATE MARKET: ECOSYSTEM 56

FIGURE 25 AMMONIUM METATUNGSTATE MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 59

FIGURE 26 EXPORT DATA FOR TOP 10 COUNTRIES 60

FIGURE 27 IMPORT DATA FOR TOP 10 COUNTRIES 61

FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF KEY

END-USE INDUSTRIES 65

FIGURE 29 BUYING CRITERIA FOR KEY END-USE INDUSTRIES 66

FIGURE 30 AVERAGE SELLING PRICE TREND OF AMMONIUM METATUNGSTATE,

BY REGION (USD/KG), 2022–2024 68

FIGURE 31 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2022–2024 (USD/KG) 69

FIGURE 32 AMMONIUM METATUNGSTATE MARKET: INVESTMENT AND FUNDING SCENARIO 70

FIGURE 33 TOTAL NUMBER OF PATENTS FOR 2014–2024 71

FIGURE 34 NUMBER OF PATENTS YEAR-WISE FROM 2014 TO 2024 71

FIGURE 35 PATENT ANALYSIS, BY LEGAL STATUS 72

FIGURE 36 TOP JURISDICTION, BY DOCUMENT, 2014–2024 72

FIGURE 37 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS,

2014–2024 73

FIGURE 38 VIRGIN ORE ROUTE TO BE LARGER RAW MATERIAL SEGMENT OF

AMMONIUM METATUNGSTATE MARKET BY 2030 81

FIGURE 39 AQUEOUS SOLUTION SEGMENT TO HOLD LARGEST SHARE OF

AMMONIUM METATUNGSTATE MARKET IN 2030 85

FIGURE 40 STANDARD GRADE TO HOLD LARGEST SHARE OF AMMONIUM METATUNGSTATE MARKET IN 2030 89

FIGURE 41 CATALYSTS TO HOLD LARGEST SHARE OF AMMONIUM METATUNGSTATE MARKET IN 2030 93

FIGURE 42 CHEMICAL INDUSTRY TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD 99

FIGURE 43 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD 105

FIGURE 44 NORTH AMERICA: AMMONIUM METATUNGSTATE MARKET SNAPSHOT 107

FIGURE 45 ASIA PACIFIC: AMMONIUM METATUNGSTATE MARKET SNAPSHOT 117

FIGURE 46 AMMONIUM METATUNGSTATE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2022–2024 (USD BILLION) 170

FIGURE 47 AMMONIUM METATUNGSTATE MARKET SHARE ANALYSIS, 2024 171

FIGURE 48 AMMONIUM METATUNGSTATE MARKET: COMPANY VALUATION OF

KEY COMPANIES, 2024 (USD BILLION) 173

FIGURE 49 AMMONIUM METATUNGSTATE MARKET: FINANCIAL METRICS OF

KEY COMPANIES, 2024 173

FIGURE 50 AMMONIUM METATUNGSTATE MARKET: PRODUCT COMPARISON 174

FIGURE 51 AMMONIUM METATUNGSTATE MARKET: COMPANY EVALUATION MATRIX

(KEY PLAYERS), 2024 176

FIGURE 52 AMMONIUM METATUNGSTATE MARKET: COMPANY FOOTPRINT 177

FIGURE 53 AMMONIUM METATUNGSTATE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 183

FIGURE 54 MASAN HIGH-TECH MATERIALS CORPORATION: COMPANY SNAPSHOT 201