Modular Construction Market - Global Forecast to 2030

Modular Construction Market by Type (Permanent, Relocatable), Material (Wood, Steel, Concrete), Module, End-use Industry (Residential, Office, Educational, Hospitality, Healthcare, Retail & Commercial), and Region – Global Forecast to 2030

モジュール式建設市場 - タイプ(恒久的、移動可能)、材質(木材、鉄鋼、コンクリート)、モジュール、最終用途産業(住宅、オフィス、教育、ホスピタリティ、ヘルスケア、小売・商業)、地域別 – 2030年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年01月 |

| ページ数 | 329 |

| 図表数 | 433 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-13585 |

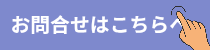

モジュール建築(モジュラー建築)市場は、予測期間中に5.4%のCAGRで成長し、2025年の1,096億米ドルから2030年には1,428.7億米ドルに達すると予想されています。

モジュール建築(モジュラー建築)市場は、迅速な建設、コスト管理、労働力の効率化、そして建築の安全性と持続可能性に関する新たな規制への準拠に対するニーズの高まりにより、住宅、商業、工業、そして公共施設の各分野で急速に重要性を増しています。モジュラー建築協会(MBI)、国際建築基準協議会(ICC)、そして建築規制当局は、モジュール建築(モジュラー建築)市場の耐久性、安全性、そしてエネルギー効率の確保に取り組んでいます。モジュラー建築は、高度な構造技術、機械、電気、配管設備、そして建物エンベロープを用いて設計され、従来の建築基準を満たすか、それを上回る性能を備えています。モジュラー建築は、迅速な建設と繰り返し施工が求められる集合住宅、ホテル、医療施設、データセンター、そして教育機関などに適用できます。さらに、米国住宅都市開発省(HUD)と業界が実施した調査では、モジュール建築により、建設期間を最大30~50%短縮し、建設廃棄物を20~25%削減できることが確認されており、現在および将来の建築環境において持続可能かつ機敏なものとなっています。

調査対象範囲

本調査レポートは、モジュール建築(モジュラー建築)市場市場を、タイプ(恒久型および移設型)、材質(木材、鉄骨、コンクリート)、モジュール(四面モジュール、開放型モジュール、半開放型モジュール、混合モジュールおよびフロアカセット、一次構造で支えられたモジュール、その他のモジュール)、および最終用途産業(住宅、小売・商業施設、オフィス、教育、ホスピタリティ、ヘルスケア、その他の最終用途産業)に基づいて分類しています。本レポートは、モジュラー建設市場の成長に影響を与える推進要因、制約要因、課題、機会に関する詳細な情報を網羅しています。主要業界プレーヤーの詳細な分析により、モジュラー建設市場に関連する事業概要、提供製品、そして合併、買収、製品発売、事業拡大などの主要戦略に関する洞察を提供しています。本レポートは、モジュラー建設市場のエコシステムにおける新興企業の競合分析も網羅しています。

レポートを購入する理由

本レポートは、市場リーダーおよび新規参入企業に対し、モジュール建築(モジュラー建築)市場市場全体および各サブセグメントの収益数値に関する近似値を提供します。本レポートは、関係者が競争環境を理解し、事業のポジショニングを改善するための洞察を深め、適切な市場開拓戦略を策定するのに役立ちます。また、市場の動向を把握し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供するのに役立ちます。

本レポートでは、以下の点について洞察を提供しています。

主要な推進要因(モジュール建築(モジュラー建築)の普及を促進する迅速な建設とコスト削減、急増するインフラ投資、成長を牽引する現場の安全性と持続可能性の向上、そしてより迅速で信頼性の高い高品質なモジュラー建築を可能にするスマートデジタルツール)、制約要因(輸送、物流、現場での組立におけるリスク、発展途上国における認識と認識の不足)、機会(急速な人口増加と都市化による需要の促進、高層・超高層開発の増加による旺盛な需要の創出、先進国における住宅不足の深刻化によるモジュラー建築の普及)、そして課題(サプライチェーンの不安定性と原材料価格の変動、熟練労働力の不足とハイブリッド人材の不足)の分析。

- 製品開発/イノベーション:モジュール建築(モジュラー建築)市場における今後の技術、研究開発活動、製品・サービスの投入に関する詳細な洞察。

- 市場開発:収益性の高い市場に関する包括的な情報。本レポートでは、様々な地域におけるモジュラー建設市場を分析しています。

- 市場多様化:モジュール建築(モジュラー建築)市場における新製品・サービス、未開拓地域、最近の動向、投資に関する包括的な情報。

- 競合評価:Skanska(スウェーデン)、Laing O’Rourke(英国)、ATCO Ltd.(カナダ)、Modulaire Group(英国)、Red Sea International(サウジアラビア)、VINCI(フランス)、THE Bouygues group(フランス)、Bechtel Corporation(米国)、Fluor Corporation(米国)、Lendlease Corporation(オーストラリア)、KLEUSBERG Group(ドイツ)など、主要企業の市場シェア、成長戦略、サービス提供に関する詳細な評価。

Report Description

The modular construction market is expected to reach USD 142.87 billion by 2030 from USD 109.60 billion in 2025, at a CAGR of 5.4% during the forecast period.

Modular Construction Market – Global Forecast to 2030

Modular construction is rapidly finding relevance in the residential, commercial, industrial, and institutional sectors due to the increasing need for fast- track construction, cost management, increased workforce efficiency, and adherence to the newer norms of building safety and sustainability regulations. The Modular Building Institute (MBI), International Code Council (ICC), and building regulations authorities are working toward ensuring the durability, safety, and energy efficiency of modular construction. Modular construction is designed with the use of advanced structural technology, mechanical, electrical, and plumbing assemblies, and building envelopes to meet or surpass the standards of conventional construction. Modular construction can be applied to multi-family residential, hotels, healthcare, data centers, and educational institutions, where there is a need for fast-track construction and repeatability. Moreover, research carried out by the U.S. Department of Housing and Urban Development (HUD) and the industry confirms the ability of modular construction to save up to 30-50% of the construction period and construction waste by as much as 20-25%, thereby making it sustainable and agile in the context of the built environment of the present and the future.

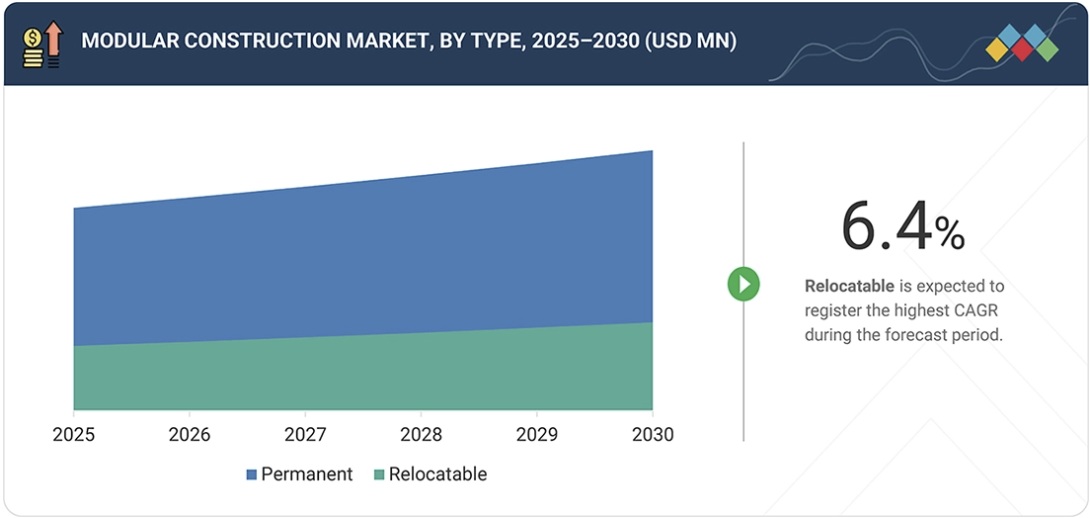

“Relocatable is projected to be the fastest-growing type in the modular construction market during the forecast period.”

Relocatable modular construction is projected to be the fastest-growing type in the modular construction market during the forecast period. This is because relocatable modular constructions are very flexible and easy to set up. These types of constructions are reusable and can be disassembled for easy transfer from place to place. This feature makes them most appropriate for temporary use in educational institutions, health facilities, offices, employee settlements, and temporary aid facilities for disaster victims. Moreover, relocatable modular constructions have various advantages over conventional ones. These include minimizing construction waste, decreasing capital costs, and faster construction time. Government support for modular infrastructure development and the advantages of sustainability and rapid growth potential further contribute to the growth of the relocatable modular construction segment worldwide.

“Steel is projected to be the fastest-growing material in the modular construction market during the forecast period.”

Steel is expected to be a fast-growing material in the modular construction market during the forecast period. This is because steel has unmatched strength, durability, and suitability for construction purposes in multi-story buildings. As steel can be fashioned off-site with great accuracy, this will facilitate faster assembly, better quality control, and faster construction. Additionally, steel has better resistance to fire, pests, and adverse climatic conditions, ensuring better safety. Moreover, with increased focus on greener materials in construction, modular construction involving steel is becoming common all over the globe.

“Hospitality is projected to be the fastest-growing end-use industry in the modular construction market during the forecast period.”

The hospitality sector is expected to be the fastest-growing end-use sector of modular construction in the coming years. In fact, this push in the industry is because of the need for speed and scalability while trying to have tighter cost control. Hotels, resorts, serviced apartments, and budget stays are increasingly incorporating modular builds in their projects, thereby reducing project timelines by as much as 30–50% and speeding up time-to-market, critical in busy tourism and business hubs. On-site/off-site construction, managed during the prep work and facilitated through modular manufacturing, ensures a way around labor shortages, weather delays, and budget overruns. Similar room layouts repeated throughout a property, facilitated through quality inspections within the factory, allow the hospitality industry the way around maintaining consistency within a brand for multiple properties. It encourages greater use, particularly given the investment surge within the tourism infrastructure, leading the way for a middle- to low-end hotel market, pushing the hotel chains’ expansion into new markets, in addition to the sustainable aspect, which resonates given the necessity for a greener approach for a new development within the industry.

Modular Construction Market – Global Forecast to 2030 – region

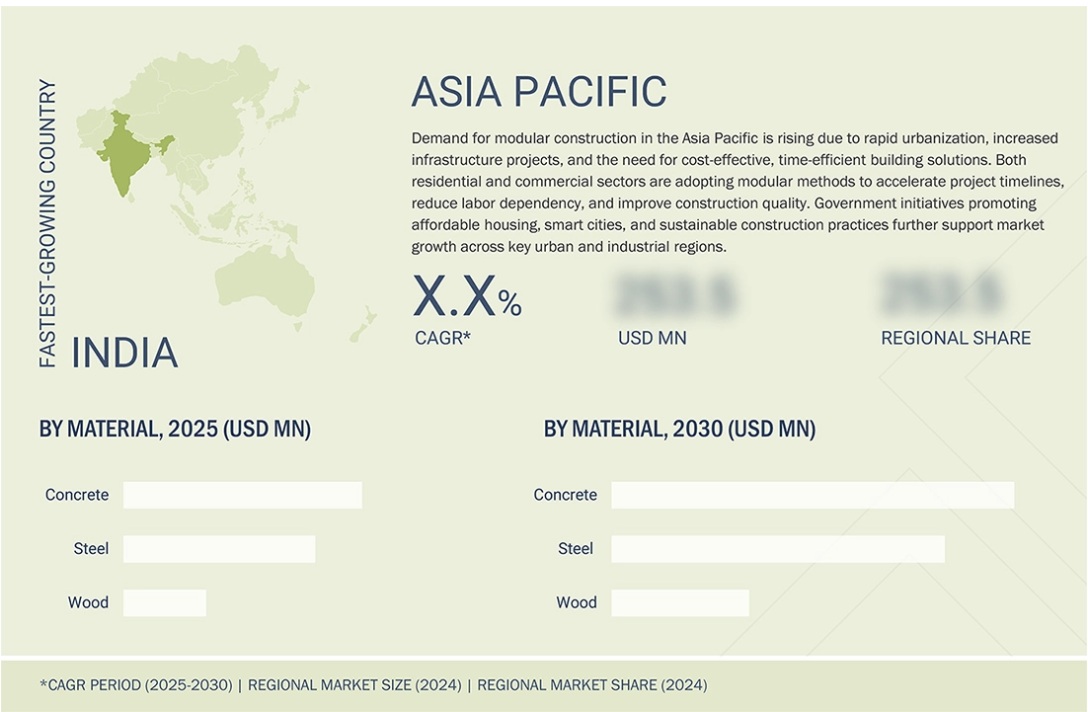

“Asia Pacific is projected to be the fastest-growing region in the modular construction market during the forecast period.”

The modular construction market in the Asia Pacific region is anticipated to be the fastest-growing market during the forecast period, largely reflecting the unfolding urbanization, steady population increase, and upgrading of infrastructure in the emerging economies such as China, India, and the countries of Southeast Asia. Developers, faced with the rising need for affordable housing, commercial spaces, and hotels, are turning to modular construction techniques to speed up the work and lower expenses. Further, the governmental schemes, which are aimed at smart cities, sustainable urban development, and energy-efficient building practices, also help in the widespread legacy of such a market proposal. Furthermore, the region’s expanding industrial base, increased wages, and the increasing awareness of the environmental benefits of prefabricated construction have rendered modular technologies an attractive choice. These factors collectively position the Asia Pacific as a primary hub for growth, presenting significant opportunities for modular construction initiatives in both residential and commercial domains.

- By Company Type: Tier 1: 40%, Tier 2: 30%, and Tier 3: 30%

- By Designation: Directors: 30%, Managers: 20%, and Others: 50%

- By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Others include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million–1 Billion; and Tier 3: <USD 500 million

Companies Covered: Skanska (Sweden), Laing O’Rourke (UK), ATCO Ltd. (Canada), Modulaire Group (UK), Red Sea International (Saudi Arabia), VINCI (France), THE Bouygues group (France), Bechtel Corporation (US), Fluor Corporation (US), Lendlease Corporation (Australia), and KLEUSBERG Group (Germany) are covered in the report.

Modular Construction Market – Global Forecast to 2030 – ecosystem

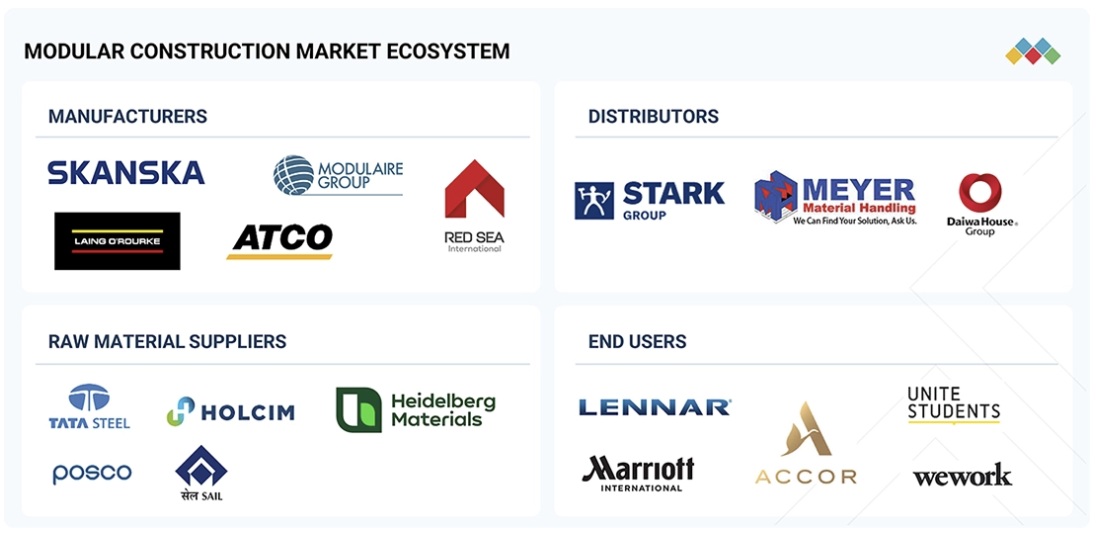

The study includes an in-depth competitive analysis of these key players in the modular construction market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the modular construction market based on type (Permanent and Relocatable), material (Wood, Steel, and Concrete), module (Four-sided Modules, Open-sided Modules, Partially Open-sided Modules, Mixed Modules and Floor Cassettes, Modules Supported by a Primary Structure, and Other Modules), and end-use industry (Residential, Retail & Commercial, Office, Education, Hospitality, Healthcare, and Other End-use Industries). The report’s scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the modular construction market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, and key strategies, such as mergers, acquisitions, product launches, and expansions, associated with the modular construction market. This report covers a competitive analysis of upcoming startups in the modular construction market ecosystem.

Reasons to Buy the Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall modular construction market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Rapid construction and cost savings driving modular adoption, Surging infrastructure investments, Enhanced worksite safety and sustainability driving growth, and Smart digital tools enabling faster, reliable, and high-quality modular builds), restraints (Transportation, logistics, and on-site assembly risks and Lack of awareness and perception barriers in developing economies ), opportunities (Rapid population growth and urbanization fuel demand, Rising high-rise and supertall developments creating strong demand and Rising housing shortages in developed economies driving modular construction adoption), and challenges (Supply chain volatility and raw material price fluctuations and Skilled workforce gap and hybrid talent shortage).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the modular construction market.

- Market Development: Comprehensive information about profitable markets – the report analyzes the modular construction market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the modular construction market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Skanska (Sweden), Laing O’Rourke (UK), ATCO Ltd. (Canada), Modulaire Group (UK), Red Sea International (Saudi Arabia), VINCI (France), THE Bouygues group (France), Bechtel Corporation (US), Fluor Corporation (US), Lendlease Corporation (Australia), and KLEUSBERG Group (Germany), among others.

Table of Contents

1 INTRODUCTION 33

1.1 STUDY OBJECTIVES 33

1.2 MARKET DEFINITION 33

1.3 STUDY SCOPE 34

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 34

1.3.2 INCLUSIONS AND EXCLUSIONS 35

1.3.3 YEARS CONSIDERED 35

1.3.4 CURRENCY CONSIDERED 36

1.3.5 UNITS CONSIDERED 36

1.4 STAKEHOLDERS 36

1.5 SUMMARY OF CHANGES 36

2 EXECUTIVE SUMMARY 37

2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS 37

2.2 KEY MARKET PARTICIPANTS: INSIGHTS AND STRATEGIC DEVELOPMENTS 38

2.3 DISRUPTIVE TRENDS SHAPING THE MARKET 39

2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS 40

2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST 41

3 PREMIUM INSIGHTS 42

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MODULAR CONSTRUCTION MARKET 42

3.2 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY MATERIAL AND COUNTRY 43

3.3 MODULAR CONSTRUCTION MARKET, BY TYPE 43

3.4 MODULAR CONSTRUCTION MARKET, BY MATERIAL 44

3.5 MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY 44

3.6 MODULAR CONSTRUCTION MARKET, BY COUNTRY 45

4 MARKET OVERVIEW 46

4.1 INTRODUCTION 46

4.2 MARKET DYNAMICS 46

4.2.1 DRIVERS 47

4.2.1.1 Rapid construction and cost savings 47

4.2.1.2 Surging infrastructure investments 47

4.2.1.3 Enhanced worksite safety and sustainability 48

4.2.1.4 Smart digital tools enabling faster, reliable, and high-quality modular builds 49

4.2.2 RESTRAINTS 49

4.2.2.1 Transportation, logistics, and on-site assembly risks 49

4.2.2.2 Lack of awareness and perception barriers in developing economies 50

4.2.3 OPPORTUNITIES 50

4.2.3.1 Rapid population growth and urbanization 50

4.2.3.2 Rising high-rise and supertall developments 52

4.2.3.3 Rising housing shortages in developed economies 52

4.2.4 CHALLENGES 53

4.2.4.1 Supply chain volatility and raw material price fluctuations 53

4.2.4.2 Skilled workforce gap and hybrid talent shortage 53

4.3 UNMET NEEDS AND WHITE SPACES 54

4.3.1 UNMET NEEDS IN MODULAR CONSTRUCTION MARKET 54

4.3.2 WHITE SPACE OPPORTUNITIES 54

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 55

4.4.1 INTERCONNECTED MARKETS 55

4.4.2 CROSS-SECTOR OPPORTUNITIES 56

4.4.2.1 Mining & oil/gas ↔ renewable energy 56

4.4.2.2 Industrial & logistics ↔ energy & utilities 56

4.4.2.3 Healthcare ↔ data centers 56

4.4.2.4 Healthcare ↔ emergency & temporary housing 57

4.4.2.5 Aerospace ↔ modular construction 57

4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 57

4.5.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING CONSOLIDATION AND INNOVATION 57

4.5.1.1 ATCO Ltd. – Acquisition of NRB Ltd. to strengthen Canadian modular capabilities 57

4.5.1.2 Modulaire Group – Acquisition of mobile mini UK to strengthen UK modular leadership 58

4.5.2 TIER 2 PLAYERS: REGIONAL INNOVATORS AND NICHE LEADERS 58

4.5.2.1 Red Sea International – Agreement with Baker Hughes to supply modular accommodation facilities in Saudi Arabia 58

4.5.3 TIER 3 PLAYERS: STRENGTHENS ECO-EFFICIENCY WITH ZERO WASTE MILESTONE 59

4.5.3.1 Alho Group — Sustainable modular construction in Europe 59

5 INDUSTRY TRENDS 60

5.1 PORTER’S FIVE FORCES ANALYSIS 60

5.1.1 THREAT OF NEW ENTRANTS 61

5.1.2 THREAT OF SUBSTITUTES 61

5.1.3 BARGAINING POWER OF SUPPLIERS 62

5.1.4 BARGAINING POWER OF BUYERS 62

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 62

5.2 MACROECONOMIC ANALYSIS 63

5.2.1 INTRODUCTION 63

5.2.2 GDP TRENDS AND FORECASTS 63

5.3 VALUE CHAIN ANALYSIS 64

5.4 ECOSYSTEM ANALYSIS 66

5.5 PRICING ANALYSIS 68

5.5.1 INDICATIVE SELLING PRICE, BY MATERIAL 68

5.5.2 AVERAGE SELLING PRICE, BY REGION 69

5.6 TRADE ANALYSIS 70

5.6.1 EXPORT SCENARIO (HS CODE 9406) 70

5.6.2 IMPORT SCENARIO (HS CODE 9406) 71

5.7 KEY CONFERENCES AND EVENTS, 2026–2027 72

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 73

5.9 INVESTMENT AND FUNDING SCENARIO 74

5.10 CASE STUDY ANALYSIS 75

5.10.1 BENCH-SCALE–DRIVEN MODULAR CONSTRUCTION OF EMPLOYEE HOUSING IN KANANASKIS, AB 75

5.10.2 MODULAR AUDI SHOWROOM FOR LELLEK GROUP, KATOWICE 75

5.10.3 MODULAR CONSTRUCTION MANUFACTURER HELPED IN SPEEDY CONSTRUCTION OF SCHOOL 76

5.10.4 CUSTOM MODULAR CLASSROOM WING FOR GLASTONBURY PUBLIC SCHOOL, CONNECTICUT 76

5.11 IMPACT OF 2025 US TARIFF: MODULAR CONSTRUCTION MARKET 77

5.11.1 INTRODUCTION 77

5.11.2 KEY TARIFF RATES 77

5.11.3 PRICE IMPACT ANALYSIS 78

5.11.4 IMPACT ON COUNTRIES/REGIONS 78

5.11.4.1 US 78

5.11.4.2 Canada 79

5.11.4.3 China 79

5.11.5 IMPACT ON END-USE INDUSTRIES 79

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL,

AND AI ADOPTIONS 81

6.1 KEY TECHNOLOGIES 81

6.1.1 BUILDING INFORMATION MODELING (BIM) & DIGITAL TWIN 81

6.1.1.1 3D printing 81

6.1.1.2 Automation and Artificial Intelligence (AI) in modular construction 82

6.2 COMPLEMENTARY TECHNOLOGIES 82

6.2.1 SMART MATERIALS AND HIGH-PERFORMANCE PANELS 82

6.3 TECHNOLOGY/PRODUCT ROADMAP 83

6.3.1 SHORT-TERM (2025–2027) | PROCESS OPTIMIZATION AND EARLY DIGITAL INTEGRATION 83

6.3.2 MID-TERM (2027–2030) | DIGITALIZATION & AUTOMATION EXPANSION 84

6.3.3 LONG-TERM (2030–2035+) | SMART & SUSTAINABLE MODULAR ECOSYSTEM 85

6.4 PATENT ANALYSIS 85

6.4.1 INTRODUCTION 85

6.4.2 METHODOLOGY 86

6.5 FUTURE APPLICATIONS 90

6.5.1 MODULAR CONSTRUCTION FOR DATA CENTERS AND TECH INFRASTRUCTURE 90

6.5.2 MODULAR CONSTRUCTION FOR EMERGENCY AND DISASTER-RELIEF HOUSING 90

6.5.3 MODULAR CONSTRUCTION FOR REMOTE AND HARSH-ENVIRONMENT INFRASTRUCTURE 91

6.6 IMPACT OF AI/GEN AI ON MODULAR CONSTRUCTION MARKET 91

6.6.1 TOP USE CASES AND MARKET POTENTIAL 91

6.6.2 BEST PRACTICES IN MODULAR CONSTRUCTION PROCESSING 92

6.6.3 CASE STUDIES OF AI/GEN IMPLEMENTATION IN MODULAR CONSTRUCTION MARKET 93

6.6.3.1 Interconnected adjacent ecosystem and impact on market players 93

6.6.4 CLIENTS’ READINESS TO ADOPT GENERATIVE AI IN MODULAR CONSTRUCTION MARKET 94

6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS 95

6.7.1 ROC MODULAR DELIVERS AFFORDABLE SUPPORTIVE HOUSING ON STEVESTON HIGHWAY, RICHMOND, CANADA 95

6.7.2 CERNE ABBAS C OF E FIRST SCHOOL EXPANDS WITH MODULAR CONSTRUCTION, DORSET, UK 95

6.7.3 BAYFIELD EARLY EDUCATION PROGRAMS EXPANDS WITH MODULAR CONSTRUCTION, COLORADO, US 95

7 SUSTAINABILITY AND REGULATORY LANDSCAPE 96

7.1 REGIONAL REGULATIONS AND COMPLIANCE 96

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 96

7.1.2 INDUSTRY STANDARDS 100

7.2 SUSTAINABILITY INITIATIVES 101

7.2.1 INTEGRATION OF ECO-FRIENDLY AND RECYCLED MATERIALS 101

7.2.2 PROMOTION OF CIRCULAR CONSTRUCTION PRACTICES 101

7.2.3 REDUCED CONSTRUCTION EMISSIONS AND RESOURCE INTENSITY 101

7.2.4 WASTE REDUCTION THROUGH OFF-SITE FABRICATION 101

7.2.5 ENERGY-EFFICIENT AND NET-ZERO MODULAR BUILDINGS 101

7.3 IMPACT OF REGULATORY POLICY ON SUSTAINABILITY INITIATIVES 102

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 103

8.1 DECISION-MAKING PROCESS 103

8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA 104

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 104

8.2.2 BUYING CRITERIA 105

8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 106

8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES 107

8.5 MARKET PROFITABILITY 108

8.5.1 REVENUE POTENTIAL 108

8.5.2 COST DYNAMICS 108

8.5.3 MARGIN OPPORTUNITIES, BY APPLICATION 108

9 MODULAR CONSTRUCTION MARKET, BY TYPE 110

9.1 INTRODUCTION 111

9.2 PERMANENT 112

9.2.1 OFFERS FASTER, GREENER, AND MORE COST-EFFECTIVE BUILDING 112

9.3 RELOCATABLE 113

9.3.1 DEMAND FOR FLEXIBLE, FAST, AND REUSABLE SPACE SOLUTIONS TO DRIVE MARKET 113

10 MODULAR CONSTRUCTION MARKET, BY MATERIAL 114

10.1 INTRODUCTION 115

10.2 CONCRETE 116

10.2.1 DURABLE, SUSTAINABLE, AND IDEAL FOR HIGH-RISE APPLICATIONS 116

10.3 STEEL 117

10.3.1 LIGHTWEIGHT STRENGTH FOR FASTER, FLEXIBLE, AND HIGH-RISE BUILDS 117

10.4 WOOD 117

10.4.1 DEMAND FOR SUSTAINABLE AND COST-EFFECTIVE SOLUTIONS TO DRIVE MARKET GROWTH 117

11 MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY 118

11.1 INTRODUCTION 119

11.2 RESIDENTIAL 121

11.2.1 EFFICIENT, SUSTAINABLE, AND SCALABLE HOUSING DEVELOPMENT SUPPORTING MARKET GROWTH 121

11.3 RETAIL & COMMERCIAL 121

11.3.1 OFFERS SPEED, FLEXIBILITY, AND SCALABLE BUSINESS SPACES 121

11.4 HEALTHCARE 122

11.4.1 RISING DEMAND FOR RAPID, COST-EFFICIENT, AND COMPLIANT HEALTHCARE INFRASTRUCTURE TO DRIVE MARKET 122

11.5 EDUCATION 122

11.5.1 OFFERS COST-EFFICIENCY, FASTER BUILD TIMELINES, AND MINIMAL ACADEMIC DISRUPTION 122

11.6 HOSPITALITY 122

11.6.1 RAPID TOURISM RECOVERY AND NEED FOR FASTER, COST-EFFICIENT HOSPITALITY DEVELOPMENT SUPPORTING MARKET GROWTH 122

11.7 OFFICE 123

11.7.1 REDUCED CONSTRUCTION TIME AND MINIMAL WORKPLACE DISRUPTION SUPPORTING ADOPTION 123

11.8 OTHER END-USE INDUSTRIES 123

12 MODULAR CONSTRUCTION MARKET, BY MODULE 124

12.1 INTRODUCTION 124

12.2 FOUR-SIDED MODULES 124

12.2.1 USE OF CELLULAR BUILDING DESIGNS TO DRIVE MARKET GROWTH 124

12.3 OPEN-SIDED MODULES 124

12.3.1 RISING ADOPTION IN LOW-RISE AND RESIDENTIAL APPLICATIONS TO SUPPORT MARKET EXPANSION 124

12.4 PARTIALLY OPEN-SIDED MODULES 125

12.4.1 ACCELERATED CONSTRUCTION TIMELINES INDEPENDENT OF WEATHER CONDITIONS TO DRIVE MARKET GROWTH 125

12.5 MIXED MODULES AND FLOOR CASSETTES 125

12.5.1 STRUCTURAL LOAD LIMITATIONS TO CONSTRAIN MARKET EXPANSION 125

12.6 MODULES SUPPORTED BY PRIMARY STRUCTURES 125

12.6.1 USE IN MIXED RETAIL AND COMMERCIAL DEVELOPMENTS TO DRIVE MARKET GROWTH 125

12.7 OTHER MODULES 126

13 MODULAR CONSTRUCTION MARKET, BY REGION 127

13.1 INTRODUCTION 128

13.2 ASIA PACIFIC 130

13.2.1 CHINA 135

13.2.1.1 Urbanization, policy mandates, and green infrastructure to drive market growth 135

13.2.2 INDIA 138

13.2.2.1 Rapid urbanization, massive housing shortages, and PMAY-driven affordable supply propelling demand 138

13.2.3 JAPAN 141

13.2.3.1 Advanced prefab heritage and urban housing demand sustain modular growth 141

13.2.4 SOUTH KOREA 144

13.2.4.1 Housing supply urgency and policy support for modular prefab drive adoption amid construction challenges 144

13.2.5 AUSTRALIA & NEW ZEALAND 147

13.2.5.1 Net-zero 2050 commitments and acute housing shortages accelerate modular adoption 147

13.2.6 REST OF ASIA PACIFIC 150

13.3 EUROPE 153

13.3.1 GERMANY 159

13.3.1.1 Residential construction slump and skilled labor shortages highlighting modular as a cost-effective alternative 159

13.3.2 UK 162

13.3.2.1 Ambitious affordable housing targets and government push for offsite manufacturing driving modular revolution 162

13.3.3 FRANCE 165

13.3.3.1 Public works resilience and housing policy support shaping France’s construction outlook 165

13.3.4 RUSSIA 168

13.3.4.1 Moderating growth and housing demand boost modular construction potential 168

13.3.5 SPAIN 171

13.3.5.1 Housing policies driving construction recovery in Spain 171

13.3.6 ITALY 174

13.3.6.1 Public infrastructure momentum and housing supply gaps accelerating modular construction adoption 174

13.3.7 AUSTRIA 177

13.3.7.1 Urban housing demand, cost pressures, and sustainability goals accelerate modular construction adoption 177

13.3.8 POLAND 180

13.3.8.1 Persistent housing shortage and rising construction costs propel modular solutions 180

13.3.9 REST OF EUROPE 183

13.4 NORTH AMERICA 185

13.4.1 US 189

13.4.1.1 Urban housing crises, sustainability goals, and policy support accelerate modular construction adoption 189

13.4.2 CANADA 193

13.4.2.1 Build Canada Homes agency and federal innovation driving modular housing to tackle supply gaps 193

13.4.3 MEXICO 196

13.4.3.1 Urban housing needs propelling modular construction adoption 196

13.5 MIDDLE EAST & AFRICA 199

13.5.1 GCC COUNTRIES 203

13.5.1.1 Saudi Arabia 204

13.5.1.1.1 Vision 2030 mega-projects and housing shortage driving demand 204

13.5.1.2 UAE 207

13.5.1.2.1 Government-backed affordable housing and mega projects fueling modular adoption 207

13.5.1.3 Rest of GCC Countries 210

13.5.2 SOUTH AFRICA 213

13.5.2.1 Urban density pressures and housing deficits driving market growth 213

13.5.3 REST OF MIDDLE EAST & AFRICA 216

13.6 SOUTH AMERICA 219

13.6.1 BRAZIL 223

13.6.1.1 Government programs and population growth driving modular construction adoption 223

13.6.2 ARGENTINA 226

13.6.2.1 Infrastructure recovery and energy investments supporting modular construction growth 226

13.6.3 REST OF SOUTH AMERICA 229

14 COMPETITIVE LANDSCAPE 232

14.1 OVERVIEW 232

14.2 KEY PLAYERS’ STRATEGIES/RIGHT TO WIN 232

14.3 MARKET SHARE ANALYSIS 234

14.4 REVENUE ANALYSIS 237

14.5 COMPANY VALUATION AND FINANCIAL METRICS 237

14.6 BRAND COMPARISON 239

14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 241

14.7.1 STARS 241

14.7.2 EMERGING LEADERS 241

14.7.3 PERVASIVE PLAYERS 242

14.7.4 PARTICIPANTS 242

14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 243

14.7.5.1 Company footprint 243

14.7.5.2 Regional footprint 244

14.7.5.3 Type footprint 244

14.7.5.4 Material footprint 245

14.7.5.5 End-use industry footprint 246

14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 246

14.8.1 PROGRESSIVE COMPANIES 246

14.8.2 RESPONSIVE COMPANIES 246

14.8.3 DYNAMIC COMPANIES 247

14.8.4 STARTING BLOCKS 247

14.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024 248

14.8.5.1 Detailed list of key startups/SMEs 248

14.8.5.1.1 Competitive benchmarking of key startups/SMEs 249

14.9 COMPETITIVE SCENARIO 250

14.9.1 PRODUCT LAUNCHES 250

14.9.2 DEALS 251

14.9.3 EXPANSIONS 254

15 COMPANY PROFILES 255

15.1 KEY PLAYERS 255

15.1.1 SKANSKA 255

15.1.1.1 Business overview 255

15.1.1.2 Products/Solutions/Services offered 256

15.1.1.3 Recent developments 257

15.1.1.3.1 Deals 257

15.1.1.3.2 Expansions 257

15.1.1.4 MnM view 258

15.1.1.4.1 Right to win 258

15.1.1.4.2 Strategic choices 258

15.1.1.4.3 Weaknesses and competitive threats 258

15.1.2 LAING O’ROURKE 259

15.1.2.1 Business overview 259

15.1.2.2 Products/Solutions/Services offered 260

15.1.2.3 Recent developments 261

15.1.2.3.1 Product launches 261

15.1.2.3.2 Deals 261

15.1.2.4 MNM view 262

15.1.2.4.1 Right to win 262

15.1.2.4.2 Strategic choices 262

15.1.2.4.3 Weaknesses and competitive threats 262

15.1.3 ATCO LTD. 263

15.1.3.1 Business overview 263

15.1.3.2 Products/Solutions/Services offered 264

15.1.3.3 Recent developments 265

15.1.3.3.1 Deals 265

15.1.3.4 MnM view 266

15.1.3.4.1 Right to win 266

15.1.3.4.2 Strategic choices 266

15.1.3.4.3 Weaknesses and competitive threats 266

15.1.4 MODULAIRE GROUP 267

15.1.4.1 Business overview 267

15.1.4.2 Products/Solutions/Services offered 267

15.1.4.3 Recent developments 269

15.1.5 DEALS 269

15.1.5.1 MnM view 270

15.1.5.1.1 Right to win 270

15.1.5.1.2 Strategic choices 270

15.1.5.1.3 Weaknesses and competitive threats 270

15.1.6 RED SEA INTERNATIONAL 271

15.1.6.1 Business overview 271

15.1.6.2 Products/Solutions/Services offered 272

15.1.6.3 Recent developments 274

15.1.6.3.1 Deals 274

15.1.6.4 MnM view 274

15.1.6.4.1 Right to win 274

15.1.6.4.2 Strategic choices 275

15.1.6.4.3 Weaknesses and competitive threats 275

15.1.7 VINCI 276

15.1.7.1 Business overview 276

15.1.7.2 Products/Solutions/Services offered 277

15.1.7.2.1 Deals 278

15.1.7.3 MnM view 278

15.1.8 THE BOUYGUES GROUP 279

15.1.8.1 Business overview 279

15.1.8.2 Products/Solutions/Services offered 280

15.1.8.3 Recent developments 281

15.1.8.3.1 Deals 281

15.1.8.3.2 Expansions 281

15.1.8.4 MnM view 281

15.1.9 BECHTEL CORPORATION 282

15.1.9.1 Business overview 282

15.1.9.2 Products/Solutions/Services offered 283

15.1.9.3 Recent developments 283

15.1.9.3.1 Deals 283

15.1.9.4 MnM view 284

15.1.10 FLUOR CORPORATION 285

15.1.10.1 Business overview 285

15.1.10.2 Products/Solutions/Services offered 286

15.1.10.3 Recent developments 288

15.1.10.3.1 Deals 288

15.1.10.4 MnM view 289

15.1.11 LENDLEASE CORPORATION 290

15.1.11.1 Business overview 290

15.1.11.2 Products/Solutions/Services offered 291

15.1.11.3 Recent developments 292

15.1.11.3.1 Product launches 292

15.1.11.3.2 Deals 292

15.1.11.4 MnM view 294

15.1.12 KLEUSBERG GROUP 295

15.1.12.1 Business overview 295

15.1.12.2 Products/Solutions/Services offered 295

15.1.12.3 Recent developments 296

15.1.12.3.1 Deals 296

15.1.12.4 MnM view 297

15.2 OTHER PLAYERS 298

15.2.1 ALHO GROUP 298

15.2.2 BROAD GROUP 299

15.2.3 KWIKSPACE 300

15.2.4 WESTCHESTER MODULAR HOMES 301

15.2.5 WERNICK GROUP LIMITED 302

15.2.6 KOMA MODULAR 303

15.2.7 PREMIER MODULAR LIMITED 304

15.2.8 LUMUS INC. 305

15.2.9 HARBINGER PRODUCTION INC. 306

15.2.10 MODULOUS 307

15.2.11 NEXII, INC. 308

15.2.12 DUBOX 309

15.2.13 GUERDON, LLC. 310

15.2.14 FULLSTACK MODULAR 311

15.2.15 MODULUS HOUSING 312

16 RESEARCH METHODOLOGY 313

16.1 RESEARCH DATA 313

16.1.1 SECONDARY DATA 314

16.1.1.1 Key data from secondary sources 314

16.1.2 PRIMARY DATA 314

16.1.2.1 Key data from primary sources 315

16.1.2.2 Key industry insights 315

16.2 MARKET SIZE ESTIMATION 316

16.3 BASE NUMBER CALCULATION 318

16.3.1 DEMAND-SIDE APPROACH 318

16.3.2 SUPPLY-SIDE APPROACH 318

16.4 MARKET FORECAST APPROACH 318

16.4.1 SUPPLY SIDE 318

16.4.2 DEMAND SIDE 319

16.5 DATA TRIANGULATION 319

16.6 FACTOR ANALYSIS 320

16.7 RESEARCH ASSUMPTIONS 320

16.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT 321

17 APPENDIX 322

17.1 DISCUSSION GUIDE 322

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 325

17.3 CUSTOMIZATION OPTIONS 327

17.4 RELATED REPORTS 327

17.5 AUTHOR DETAILS 328

LIST OF TABLES

TABLE 1 ASIA PACIFIC URBANIZATION TREND, 1990–2050 51

TABLE 2 MODULAR CONSTRUCTION MARKET: IMPACT OF PORTER’S FIVE FORCES 61

TABLE 3 GLOBAL GDP GROWTH PROJECTION, BY REGION, 2021–2028 (USD TRILLION) 63

TABLE 4 MODULAR CONSTRUCTION MARKET: ROLE OF COMPANIES IN ECOSYSTEM 67

TABLE 5 INDICATIVE SELLING PRICE OF MATERIAL, BY KEY PLAYERS,

2024 (USD/SQUARE FEET) 68

TABLE 6 AVERAGE SELLING PRICE OF KEY PLAYERS, BY REGION, 2021–2025 (USD/SQUARE FEET) 69

TABLE 7 EXPORT DATA RELATED TO HS CODE 9406-COMPLIANT PRODUCTS,

BY COUNTRY, 2020–2024 (USD MILLION) 70

TABLE 8 IMPORT DATA FOR HS CODE 9406-COMPLIANT PRODUCTS,

BY COUNTRY, 2020–2024 (USD MILLION) 71

TABLE 9 MODULAR CONSTRUCTION MARKET: DETAILED LIST OF CONFERENCES

AND EVENTS, 2025–2026 72

TABLE 10 MODULAR CONSTRUCTION MARKET: LIST OF KEY PATENTS, 2023–2025 87

TABLE 11 TOP USE CASES AND MARKET POTENTIAL 91

TABLE 12 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES 92

TABLE 13 MODULAR CONSTRUCTION MARKET: CASE STUDIES RELATED

TO AI/GEN AI IMPLEMENTATION 93

TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS 96

TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS 98

TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS 99

TABLE 17 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS 99

TABLE 18 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS 100

TABLE 19 GLOBAL INDUSTRY STANDARDS IN MODULAR CONSTRUCTION MARKET 100

TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY (%) 105

TABLE 21 KEY BUYING CRITERIA, BY END-USE INDUSTRY 105

TABLE 22 UNMET NEEDS IN MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY 107

TABLE 23 MODULAR CONSTRUCTION MARKET, BY TYPE, 2021–2023 (USD MILLION) 111

TABLE 24 MODULAR CONSTRUCTION MARKET, BY TYPE, 2024–2030 (USD MILLION) 111

TABLE 25 MODULAR CONSTRUCTION MARKET, BY TYPE, 2021–2023

(THOUSAND SQUARE FEET) 112

TABLE 26 MODULAR CONSTRUCTION MARKET, BY TYPE, 2024–2030

(THOUSAND SQUARE FEET) 112

TABLE 27 MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2021–2023 (USD MILLION) 115

TABLE 28 MODULAR CONSTRUCTION MARKET, BY MATERIAL, 2024–2030 (USD MILLION) 115

TABLE 29 MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 116

TABLE 30 MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 116

TABLE 31 MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 119

TABLE 32 MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 120

TABLE 33 MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 120

TABLE 34 MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 120

TABLE 35 MODULAR CONSTRUCTION MARKET, BY REGION, 2021–2023 (USD MILLION) 129

TABLE 36 MODULAR CONSTRUCTION MARKET, BY REGION, 2024–2030 (USD MILLION) 129

TABLE 37 MODULAR CONSTRUCTION MARKET, BY REGION,

2021–2023 (THOUSAND SQUARE FEET) 130

TABLE 38 MODULAR CONSTRUCTION MARKET, BY REGION,

2024–2030 (THOUSAND SQUARE FEET) 130

TABLE 39 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY COUNTRY,

2021–2023 (USD MILLION) 131

TABLE 40 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY COUNTRY,

2024–2030 (USD MILLION) 132

TABLE 41 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY COUNTRY,

2021–2023 (THOUSAND SQUARE FEET) 132

TABLE 42 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY COUNTRY,

2024–2030 (THOUSAND SQUARE FEET) 132

TABLE 43 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 133

TABLE 44 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 133

TABLE 45 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 133

TABLE 46 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 133

TABLE 47 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 134

TABLE 48 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 134

TABLE 49 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 134

TABLE 50 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 135

TABLE 51 CHINA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 136

TABLE 52 CHINA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 136

TABLE 53 CHINA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 136

TABLE 54 CHINA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 136

TABLE 55 CHINA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 137

TABLE 56 CHINA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 137

TABLE 57 CHINA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 137

TABLE 58 CHINA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 138

TABLE 59 INDIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 139

TABLE 60 INDIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 139

TABLE 61 INDIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 139

TABLE 62 INDIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 139

TABLE 63 INDIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 140

TABLE 64 INDIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 140

TABLE 65 INDIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 140

TABLE 66 INDIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 141

TABLE 67 JAPAN: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 141

TABLE 68 JAPAN: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 142

TABLE 69 JAPAN: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 142

TABLE 70 JAPAN: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 142

TABLE 71 JAPAN: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 142

TABLE 72 JAPAN: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 143

TABLE 73 JAPAN: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 143

TABLE 74 JAPAN: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 143

TABLE 75 SOUTH KOREA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 144

TABLE 76 SOUTH KOREA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 145

TABLE 77 SOUTH KOREA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 145

TABLE 78 SOUTH KOREA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 145

TABLE 79 SOUTH KOREA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021–2023 (USD MILLION) 146

TABLE 80 SOUTH KOREA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION) 146

TABLE 81 SOUTH KOREA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021–2023 (THOUSAND SQUARE FEET) 146

TABLE 82 SOUTH KOREA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024–2030 (THOUSAND SQUARE FEET) 147

TABLE 83 AUSTRALIA & NEW ZEALAND: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2021–2023 (USD MILLION) 148

TABLE 84 AUSTRALIA & NEW ZEALAND: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2024–2030 (USD MILLION) 148

TABLE 85 AUSTRALIA & NEW ZEALAND: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2021–2023 (THOUSAND SQUARE FEET) 148

TABLE 86 AUSTRALIA & NEW ZEALAND: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2024–2030 (THOUSAND SQUARE FEET) 148

TABLE 87 AUSTRALIA & NEW ZEALAND: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2021–2023 (USD MILLION) 149

TABLE 88 AUSTRALIA & NEW ZEALAND: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2024–2030 (USD MILLION) 149

TABLE 89 AUSTRALIA & NEW ZEALAND: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2021–2023 (THOUSAND SQUARE FEET) 149

TABLE 90 AUSTRALIA & NEW ZEALAND: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2024–2030 (THOUSAND SQUARE FEET) 150

TABLE 91 REST OF ASIA PACIFIC: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2021–2023 (USD MILLION) 150

TABLE 92 REST OF ASIA PACIFIC: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2024–2030 (USD MILLION) 151

TABLE 93 REST OF ASIA PACIFIC: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2021–2023 (THOUSAND SQUARE FEET) 151

TABLE 94 REST OF ASIA PACIFIC: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2024–2030 (THOUSAND SQUARE FEET) 151

TABLE 95 REST OF ASIA PACIFIC: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2021–2023 (USD MILLION) 152

TABLE 96 REST OF ASIA PACIFIC: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2024–2030 (USD MILLION) 152

TABLE 97 REST OF ASIA PACIFIC: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2021–2023 (THOUSAND SQUARE FEET) 152

TABLE 98 REST OF ASIA PACIFIC: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2024–2030 (THOUSAND SQUARE FEET) 153

TABLE 99 EUROPE: MODULAR CONSTRUCTION MARKET, BY COUNTRY,

2021–2023 (USD MILLION) 154

TABLE 100 EUROPE: MODULAR CONSTRUCTION MARKET, BY COUNTRY,

2024–2030 (USD MILLION) 155

TABLE 101 EUROPE: MODULAR CONSTRUCTION MARKET, BY COUNTRY,

2021–2023 (THOUSAND SQUARE FEET) 155

TABLE 102 EUROPE: MODULAR CONSTRUCTION MARKET, BY COUNTRY,

2024–2030 (THOUSAND SQUARE FEET) 156

TABLE 103 EUROPE: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 156

TABLE 104 EUROPE: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 156

TABLE 105 EUROPE: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 157

TABLE 106 EUROPE: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 157

TABLE 107 EUROPE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 157

TABLE 108 EUROPE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 158

TABLE 109 EUROPE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 158

TABLE 110 EUROPE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 158

TABLE 111 GERMANY: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 159

TABLE 112 GERMANY: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 159

TABLE 113 GERMANY: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 160

TABLE 114 GERMANY: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 160

TABLE 115 GERMANY: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 160

TABLE 116 GERMANY: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 161

TABLE 117 GERMANY: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 161

TABLE 118 GERMANY: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 161

TABLE 119 UK: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 162

TABLE 120 UK: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 162

TABLE 121 UK: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 163

TABLE 122 UK: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 163

TABLE 123 UK: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 163

TABLE 124 UK: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 164

TABLE 125 UK: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 164

TABLE 126 UK: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 164

TABLE 127 FRANCE: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 165

TABLE 128 FRANCE: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 165

TABLE 129 FRANCE: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 166

TABLE 130 FRANCE: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 166

TABLE 131 FRANCE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 166

TABLE 132 FRANCE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 167

TABLE 133 FRANCE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 167

TABLE 134 FRANCE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 167

TABLE 135 RUSSIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 168

TABLE 136 RUSSIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 168

TABLE 137 RUSSIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 169

TABLE 138 RUSSIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 169

TABLE 139 RUSSIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 169

TABLE 140 RUSSIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 170

TABLE 141 RUSSIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 170

TABLE 142 RUSSIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 170

TABLE 143 SPAIN: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 171

TABLE 144 SPAIN: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 171

TABLE 145 SPAIN: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 172

TABLE 146 SPAIN: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 172

TABLE 147 SPAIN: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 172

TABLE 148 SPAIN: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 173

TABLE 149 SPAIN: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 173

TABLE 150 SPAIN: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 173

TABLE 151 ITALY: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 174

TABLE 152 ITALY: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 174

TABLE 153 ITALY: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 175

TABLE 154 ITALY: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 175

TABLE 155 ITALY: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 175

TABLE 156 ITALY: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 176

TABLE 157 ITALY: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 176

TABLE 158 ITALY: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 176

TABLE 159 AUSTRIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 177

TABLE 160 AUSTRIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 177

TABLE 161 AUSTRIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 178

TABLE 162 AUSTRIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 178

TABLE 163 AUSTRIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 178

TABLE 164 AUSTRIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 179

TABLE 165 AUSTRIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 179

TABLE 166 AUSTRIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 179

TABLE 167 POLAND: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 180

TABLE 168 POLAND: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 180

TABLE 169 POLAND: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 181

TABLE 170 POLAND: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 181

TABLE 171 POLAND: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 181

TABLE 172 POLAND: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 182

TABLE 173 POLAND: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 182

TABLE 174 POLAND: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 182

TABLE 175 REST OF EUROPE: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 183

TABLE 176 REST OF EUROPE: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 183

TABLE 177 REST OF EUROPE: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 183

TABLE 178 REST OF EUROPE: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 184

TABLE 179 REST OF EUROPE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021–2023 (USD MILLION) 184

TABLE 180 REST OF EUROPE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION) 184

TABLE 181 REST OF EUROPE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021–2023 (THOUSAND SQUARE FEET) 185

TABLE 182 REST OF EUROPE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024–2030 (THOUSAND SQUARE FEET) 185

TABLE 183 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY,

2021–2023 (USD MILLION) 186

TABLE 184 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY,

2024–2030 (USD MILLION) 186

TABLE 185 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY,

2021–2023 (THOUSAND SQUARE FEET) 186

TABLE 186 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY,

2024–2030 (THOUSAND SQUARE FEET) 187

TABLE 187 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 187

TABLE 188 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 187

TABLE 189 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 187

TABLE 190 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 188

TABLE 191 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021–2023 (USD MILLION) 188

TABLE 192 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION) 188

TABLE 193 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021–2023 (THOUSAND SQUARE FEET) 189

TABLE 194 NORTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024–2030 (THOUSAND SQUARE FEET) 189

TABLE 195 US: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 190

TABLE 196 US: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 190

TABLE 197 US: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 191

TABLE 198 US: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 191

TABLE 199 US: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 191

TABLE 200 US: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 192

TABLE 201 US: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 192

TABLE 202 US: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 192

TABLE 203 CANADA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 193

TABLE 204 CANADA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 194

TABLE 205 CANADA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 194

TABLE 206 CANADA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 194

TABLE 207 CANADA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 194

TABLE 208 CANADA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 195

TABLE 209 CANADA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 195

TABLE 210 CANADA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 195

TABLE 211 MEXICO: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 196

TABLE 212 MEXICO: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 196

TABLE 213 MEXICO: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 197

TABLE 214 MEXICO: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 197

TABLE 215 MEXICO: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 197

TABLE 216 MEXICO: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 198

TABLE 217 MEXICO: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 198

TABLE 218 MEXICO: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 198

TABLE 219 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY COUNTRY, 2021–2023 (USD MILLION) 199

TABLE 220 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY COUNTRY, 2024–2030 (USD MILLION) 200

TABLE 221 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY COUNTRY, 2021–2023 (THOUSAND SQUARE FEET) 200

TABLE 222 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY COUNTRY, 2024–2030 (THOUSAND SQUARE FEET) 200

TABLE 223 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2021–2023 (USD MILLION) 201

TABLE 224 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2024–2030 (USD MILLION) 201

TABLE 225 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2021–2023 (THOUSAND SQUARE FEET) 201

TABLE 226 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2024–2030 (THOUSAND SQUARE FEET) 201

TABLE 227 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2021–2023 (USD MILLION) 202

TABLE 228 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2024–2030 (USD MILLION) 202

TABLE 229 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2021–2023 (THOUSAND SQUARE FEET) 202

TABLE 230 MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2024–2030 (THOUSAND SQUARE FEET) 203

TABLE 231 SAUDI ARABIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 204

TABLE 232 SAUDI ARABIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 205

TABLE 233 SAUDI ARABIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 205

TABLE 234 SAUDI ARABIA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 205

TABLE 235 SAUDI ARABIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021–2023 (USD MILLION) 205

TABLE 236 SAUDI ARABIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION) 206

TABLE 237 SAUDI ARABIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021–2023 (THOUSAND SQUARE FEET) 206

TABLE 238 SAUDI ARABIA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024–2030 (THOUSAND SQUARE FEET) 206

TABLE 239 UAE: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 207

TABLE 240 UAE: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 207

TABLE 241 UAE: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 208

TABLE 242 UAE: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 208

TABLE 243 UAE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 208

TABLE 244 UAE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 209

TABLE 245 UAE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 209

TABLE 246 UAE: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 209

TABLE 247 REST OF GCC COUNTRIES: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2021–2023 (USD MILLION) 210

TABLE 248 REST OF GCC COUNTRIES: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2024–2030 (USD MILLION) 210

TABLE 249 REST OF GCC COUNTRIES: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2021–2023 (THOUSAND SQUARE FEET) 211

TABLE 250 REST OF GCC COUNTRIES: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2024–2030 (THOUSAND SQUARE FEET) 211

TABLE 251 REST OF GCC COUNTRIES: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2021–2023 (USD MILLION) 211

TABLE 252 REST OF GCC COUNTRIES: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2024–2030 (USD MILLION) 212

TABLE 253 REST OF GCC COUNTRIES: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2021–2023 (THOUSAND SQUARE FEET) 212

TABLE 254 REST OF GCC COUNTRIES: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2024–2030 (THOUSAND SQUARE FEET) 212

TABLE 255 SOUTH AFRICA: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2021–2023 (USD MILLION) 213

TABLE 256 SOUTH AFRICA: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2024–2030 (USD MILLION) 213

TABLE 257 SOUTH AFRICA: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2021–2023 (THOUSAND SQUARE FEET) 214

TABLE 258 SOUTH AFRICA: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2024–2030 (THOUSAND SQUARE FEET) 214

TABLE 259 SOUTH AFRICA: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2021–2023 (USD MILLION) 214

TABLE 260 SOUTH AFRICA: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2024–2030 (USD MILLION) 215

TABLE 261 SOUTH AFRICA: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2021–2023 (THOUSAND SQUARE FEET) 215

TABLE 262 SOUTH AFRICA: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2024–2030 (THOUSAND SQUARE FEET) 215

TABLE 263 REST OF MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2021–2023 (USD MILLION) 216

TABLE 264 REST OF MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2024–2030 (USD MILLION) 216

TABLE 265 REST OF MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2021–2023 (THOUSAND SQUARE FEET) 217

TABLE 266 REST OF MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2024–2030 (THOUSAND SQUARE FEET) 217

TABLE 267 REST OF MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2021–2023 (USD MILLION) 217

TABLE 268 REST OF MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2024–2030 (USD MILLION) 218

TABLE 269 REST OF MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2021–2023 (THOUSAND SQUARE FEET) 218

TABLE 270 REST OF MIDDLE EAST & AFRICA: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2024–2030 (THOUSAND SQUARE FEET) 218

TABLE 271 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY,

2021–2023 (USD MILLION) 219

TABLE 272 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY,

2024–2030 (USD MILLION) 220

TABLE 273 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY,

2021–2023 (THOUSAND SQUARE FEET) 220

TABLE 274 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY COUNTRY,

2024–2030 (THOUSAND SQUARE FEET) 220

TABLE 275 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 220

TABLE 276 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 221

TABLE 277 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 221

TABLE 278 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 221

TABLE 279 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021–2023 (USD MILLION) 221

TABLE 280 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024–2030 (USD MILLION) 222

TABLE 281 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2021–2023 (THOUSAND SQUARE FEET) 222

TABLE 282 SOUTH AMERICA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY, 2024–2030 (THOUSAND SQUARE FEET) 222

TABLE 283 BRAZIL: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 223

TABLE 284 BRAZIL: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 223

TABLE 285 BRAZIL: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 224

TABLE 286 BRAZIL: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 224

TABLE 287 BRAZIL: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 224

TABLE 288 BRAZIL: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 225

TABLE 289 BRAZIL: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 225

TABLE 290 BRAZIL: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 225

TABLE 291 ARGENTINA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (USD MILLION) 226

TABLE 292 ARGENTINA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (USD MILLION) 226

TABLE 293 ARGENTINA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2021–2023 (THOUSAND SQUARE FEET) 227

TABLE 294 ARGENTINA: MODULAR CONSTRUCTION MARKET, BY MATERIAL,

2024–2030 (THOUSAND SQUARE FEET) 227

TABLE 295 ARGENTINA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (USD MILLION) 227

TABLE 296 ARGENTINA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (USD MILLION) 228

TABLE 297 ARGENTINA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2021–2023 (THOUSAND SQUARE FEET) 228

TABLE 298 ARGENTINA: MODULAR CONSTRUCTION MARKET, BY END-USE INDUSTRY,

2024–2030 (THOUSAND SQUARE FEET) 228

TABLE 299 REST OF SOUTH AMERICA: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2021–2023 (USD MILLION) 229

TABLE 300 REST OF SOUTH AMERICA: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2024–2030 (USD MILLION) 229

TABLE 301 REST OF SOUTH AMERICA: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2021–2023 (THOUSAND SQUARE FEET) 229

TABLE 302 REST OF SOUTH AMERICA: MODULAR CONSTRUCTION MARKET,

BY MATERIAL, 2024–2030 (THOUSAND SQUARE FEET) 230

TABLE 303 REST OF SOUTH AMERICA: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2021–2023 (USD MILLION) 230

TABLE 304 REST OF SOUTH AMERICA: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2024–2030 (USD MILLION) 230

TABLE 305 REST OF SOUTH AMERICA: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2021–2023 (THOUSAND SQUARE FEET) 231

TABLE 306 REST OF SOUTH AMERICA: MODULAR CONSTRUCTION MARKET,

BY END-USE INDUSTRY, 2024–2030 (THOUSAND SQUARE FEET) 231

TABLE 307 MODULAR CONSTRUCTION MARKET: OVERVIEW OF MAJOR STRATEGIES

ADOPTED BY KEY PLAYERS, 2021–2025 232

TABLE 308 MODULAR CONSTRUCTION MARKET: DEGREE OF COMPETITION, 2024 235

TABLE 309 MODULAR CONSTRUCTION MARKET: REGIONAL FOOTPRINT, 2024 244

TABLE 310 MODULAR CONSTRUCTION MARKET: TYPE FOOTPRINT, 2024 244

TABLE 311 MODULAR CONSTRUCTION MARKET: MATERIAL FOOTPRINT, 2024 245

TABLE 312 MODULAR CONSTRUCTION MARKET: END-USE INDUSTRY FOOTPRINT, 2024 246

TABLE 313 MODULAR CONSTRUCTION MARKET: DETAILED LIST OF

KEY STARTUPS/SMES, 2024 248

TABLE 314 MODULAR CONSTRUCTION MARKET: COMPETITIVE BENCHMARKING OF

KEY STARTUPS/SMES, 2024 249

TABLE 315 MODULAR CONSTRUCTION MARKET: PRODUCT LAUNCHES,

JANUARY 2021–DECEMBER 2025 250

TABLE 316 MODULAR CONSTRUCTION MARKET: DEALS, JANUARY 2021–DECEMBER 2025 251

TABLE 317 MODULAR CONSTRUCTION MARKET: EXPANSIONS,

JANUARY 2021–DECEMBER 2025 254

TABLE 318 SKANSKA: COMPANY OVERVIEW 255

TABLE 319 SKANSKA: PRODUCTS/SOLUTIONS/SERVICES OFFERED 256

TABLE 320 SKANSKA: DEALS, JANUARY 2021–DECEMBER 2025 257

TABLE 321 SKANSKA: EXPANSIONS, JANUARY 2021–DECEMBER 2025 257

TABLE 322 LAING O’ROURKE: COMPANY OVERVIEW 259

TABLE 323 LAING O’ROURKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED 260

TABLE 324 LAING O’ROURKE: PRODUCT LAUNCHES, JANUARY 2021–DECEMBER 2025 261

TABLE 325 LAING O’ROURKE: DEALS, JANUARY 2021–DECEMBER 2025 261

TABLE 326 ATCO LTD.: COMPANY OVERVIEW 263

TABLE 327 ATCO LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 264

TABLE 328 ATCO LTD.: DEALS, JANUARY 2021–DECEMBER 2025 265

TABLE 329 MODULAIRE GROUP: COMPANY OVERVIEW 267

TABLE 330 MODULAIRE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED 267

TABLE 331 MODULAIRE GROUP: DEALS, JANUARY 2021–DECEMBER 2025 269

TABLE 332 RED SEA INTERNATIONAL: COMPANY OVERVIEW 271

TABLE 333 RED SEA INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED 272

TABLE 334 RED SEA INTERNATIONAL: DEALS, JANUARY 2021–DECEMBER 2025 274

TABLE 335 VINCI: COMPANY OVERVIEW 276

TABLE 336 VINCI: PRODUCTS/SOLUTIONS/SERVICES OFFERED 277

TABLE 337 VINCI: DEALS, JANUARY 2021–DECEMBER 2025 278

TABLE 338 THE BOUYGUES GROUP: COMPANY OVERVIEW 279

TABLE 339 THE BOUYGUES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED 280

TABLE 340 THE BOUYGUES GROUP: DEALS, JANUARY 2021–DECEMBER 2025 281

TABLE 341 THE BOUYGUES GROUP: EXPANSIONS, JANUARY 2021–DECEMBER 2025 281

TABLE 342 BECHTEL CORPORATION: COMPANY OVERVIEW 282

TABLE 343 BECHTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 283

TABLE 344 BECHTEL CORPORATION: DEALS, JANUARY 2021–DECEMBER 2025 283

TABLE 345 FLUOR CORPORATION: COMPANY OVERVIEW 285

TABLE 346 FLUOR CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 286

TABLE 347 FLUOR CORPORATION: DEALS, JANUARY 2021–DECEMBER 2025 288

TABLE 348 LENDLEASE CORPORATION: COMPANY OVERVIEW 290

TABLE 349 LENDLEASE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 291

TABLE 350 LENDLEASE CORPORATION: PRODUCT LAUNCHES,

JANUARY 2021–DECEMBER 2025 292

TABLE 351 LENDLEASE CORPORATION: DEALS, JANUARY 2021–DECEMBER 2025 292

TABLE 352 KLEUSBERG GROUP: COMPANY OVERVIEW 295

TABLE 353 KLEUSBERG GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED 295

TABLE 354 KLEUSBERG GROUP: DEALS, JANUARY 2021–DECEMBER 2025 296

TABLE 355 ALHO GROUP: COMPANY OVERVIEW 298

TABLE 356 BROAD GROUP: COMPANY OVERVIEW 299

TABLE 357 KWIKSPACE: COMPANY OVERVIEW 300

TABLE 358 WESTCHESTER MODULAR HOMES: COMPANY OVERVIEW 301

TABLE 359 WERNICK GROUP LIMITED: COMPANY OVERVIEW 302

TABLE 360 KOMA MODULAR: COMPANY OVERVIEW 303

TABLE 361 PREMIER MODULAR LIMITED: COMPANY OVERVIEW 304

TABLE 362 LUMUS INC: COMPANY OVERVIEW 305

TABLE 363 HARBINGER PRODUCTION INC.: COMPANY OVERVIEW 306

TABLE 364 MODULOUS: COMPANY OVERVIEW 307

TABLE 365 NEXII, INC.: COMPANY OVERVIEW 308

TABLE 366 DUBOX: COMPANY OVERVIEW 309

TABLE 367 GUERDON, LLC.: COMPANY OVERVIEW 310

TABLE 368 FULLSTACK MODULAR: COMPANY OVERVIEW 311

TABLE 369 MODULUS HOUSING: COMPANY OVERVIEW 312

LIST OF FIGURES

FIGURE 1 MODULAR CONSTRUCTION MARKET SEGMENTATION AND REGIONAL SCOPE 34

FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS 37

FIGURE 3 MODULAR CONSTRUCTION MARKET, 2021–2030 38

FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN MODULAR CONSTRUCTION MARKET (2020-2025) 38

FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF MODULAR CONSTRUCTION MARKET DURING FORECAST PERIOD 39

FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN MODULAR CONSTRUCTION MARKET, 2025–2030 40

FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD 41

FIGURE 8 HIGH DEMAND FOR MODULAR CONSTRUCTION IN RESIDENTIAL & NON-RESIDENTIAL TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS 42

FIGURE 9 CHINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2024 43

FIGURE 10 PERMANENT SEGMENT DOMINATED MODULAR CONSTRUCTION MARKET IN 2024 43

FIGURE 11 CONCRETE SEGMENT ACCOUNTED FOR LARGEST SHARE OF MODULAR CONSTRUCTION MARKET IN 2024 44

FIGURE 12 RESIDENTIAL DOMINATED MODULAR CONSTRUCTION MARKET IN 2024 44

FIGURE 13 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD 45

FIGURE 14 MODULAR CONSTRUCTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES,

AND CHALLENGES 46

FIGURE 15 GLOBAL BUILDING FLOOR AREA IN ADVANCED, EMERGING, AND DEVELOPING ECONOMIES (2010–2022) WITH 2030 PROJECTION (BILLION M²) 48

FIGURE 16 GROWTH OF URBAN POPULATION, 2020–2024 (MILLION PERSONS) 51

FIGURE 17 GLOBAL COMPLETIONS OF 200M+ AND 300M+ BUILDINGS, (2021–2025) 52

FIGURE 18 MODULAR CONSTRUCTION MARKET: PORTER’S FIVE FORCES ANALYSIS 60

FIGURE 19 MODULAR CONSTRUCTION MARKET: VALUE CHAIN ANALYSIS 64

FIGURE 20 MODULAR CONSTRUCTION MARKET: ECOSYSTEM ANALYSIS 66

FIGURE 21 INDICATIVE SELLING PRICE OF MATERIAL, BY KEY PLAYERS,

2024 (USD/SQUARE FEET) 68

FIGURE 22 MODULAR CONSTRUCTION MARKET: AVERAGE SELLING PRICE TREND,

BY REGION (2021–2025) 69

FIGURE 23 EXPORT DATA FOR HS CODE 9406-COMPLIANT PRODUCTS,

BY COUNTRY, 2020–2024 70

FIGURE 24 IMPORT DATA FOR HS CODE 9406-COMPLIANT PRODUCTS,

BY COUNTRY, 2020–2024 71

FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 74

FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2018–2025 74

FIGURE 27 LIST OF MAJOR PATENTS FOR MODULAR CONSTRUCTION, 2016–2025 86

FIGURE 28 MAJOR PATENTS APPLIED AND GRANTED RELATED TO MODULAR CONSTRUCTION, BY COUNTRY/REGION, 2016–2025 87

FIGURE 29 MODULAR CONSTRUCTION MARKET DECISION-MAKING FACTORS 104

FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY 104

FIGURE 31 KEY BUYING CRITERIA, BY END-USE INDUSTRY 105

FIGURE 32 ADOPTION BARRIERS & INTERNAL CHALLENGES 106

FIGURE 33 PERMANENT SEGMENT DOMINATED MODULAR CONSTRUCTION MARKET IN 2024 111

FIGURE 34 CONCRETE DOMINATED MODULAR CONSTRUCTION MARKET IN 2024 115

FIGURE 35 RESIDENTIAL DOMINATED MODULAR CONSTRUCTION MARKET IN 2024 119

FIGURE 36 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD 128

FIGURE 37 ASIA PACIFIC DOMINATES MODULAR CONSTRUCTION MARKET IN 2025 129

FIGURE 38 ASIA PACIFIC: MODULAR CONSTRUCTION MARKET SNAPSHOT 131

FIGURE 39 EUROPE: MODULAR CONSTRUCTION MARKET SNAPSHOT 154

FIGURE 40 MODULAR CONSTRUCTION: MARKET SHARE ANALYSIS, 2024 234

FIGURE 41 REVENUE ANALYSIS OF KEY PLAYERS, 2020–2024 237

FIGURE 42 MODULAR CONSTRUCTION MARKET: COMPANY VALUATION, 2024 238

FIGURE 43 MODULAR CONSTRUCTION MARKET: FINANCIAL MATRIX: EV/EBITDA RATIO, 2024 238

FIGURE 44 MODULAR CONSTRUCTION MARKET: YEAR-TO-DATE PRICE

AND FIVE-YEAR STOCK BETA, 2024 239

FIGURE 45 MODULAR CONSTRUCTION MARKET: BRAND COMPARISON 240

FIGURE 46 MODULAR CONSTRUCTION MARKET: COMPANY EVALUATION MATRIX

(KEY PLAYERS), 2024 242

FIGURE 47 MODULAR CONSTRUCTION MARKET: COMPANY FOOTPRINT, 2024 243

FIGURE 48 MODULAR CONSTRUCTION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 247

FIGURE 49 SKANSA: COMPANY SNAPSHOT 256

FIGURE 50 LAING O’ROURKE: COMPANY SNAPSHOT 260

FIGURE 51 ATCO LTD.: COMPANY SNAPSHOT 264

FIGURE 52 RED SEA INTERNATIONAL: COMPANY SNAPSHOT 272

FIGURE 53 VINCI: COMPANY SNAPSHOT 277

FIGURE 54 THE BOUYGUES GROUP: COMPANY SNAPSHOT 280

FIGURE 55 BECHTEL CORPORATION: COMPANY SNAPSHOT 282

FIGURE 56 FLUOR CORPORATION: COMPANY SNAPSHOT 286

FIGURE 57 LENDLEASE CORPORATION: COMPANY SNAPSHOT 291

FIGURE 58 MODULAR CONSTRUCTION MARKET: RESEARCH DESIGN 313

FIGURE 59 BREAKDOWN OF INTERVIEWS WITH EXPERTS 316

FIGURE 60 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 317

FIGURE 61 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH 317

FIGURE 62 MODULAR CONSTRUCTION MARKET: APPROACH 1 318

FIGURE 63 MODULAR CONSTRUCTION MARKET: APPROACH 2 318

FIGURE 64 MODULAR CONSTRUCTION MARKET: DATA TRIANGULATION 319