Drive by Wire Market - Global Forecast To 2032

Drive By Wire Market by Type (Steer by Wire, Brake by Wire, Shift by Wire, Park by Wire, Throttle by Wire), Autonomous Vehicle, and Region - Global Forecast To 2032

ドライブ・バイ・ワイヤ市場 - タイプ(ステアバイワイヤ、ブレーキバイワイヤ、シフトバイワイヤ、パークバイワイヤ、スロットルバイワイヤ)、自動運転車、地域別 - 2032年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年02月 |

| ページ数 | 351 |

| 図表数 | 593 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-13724 |

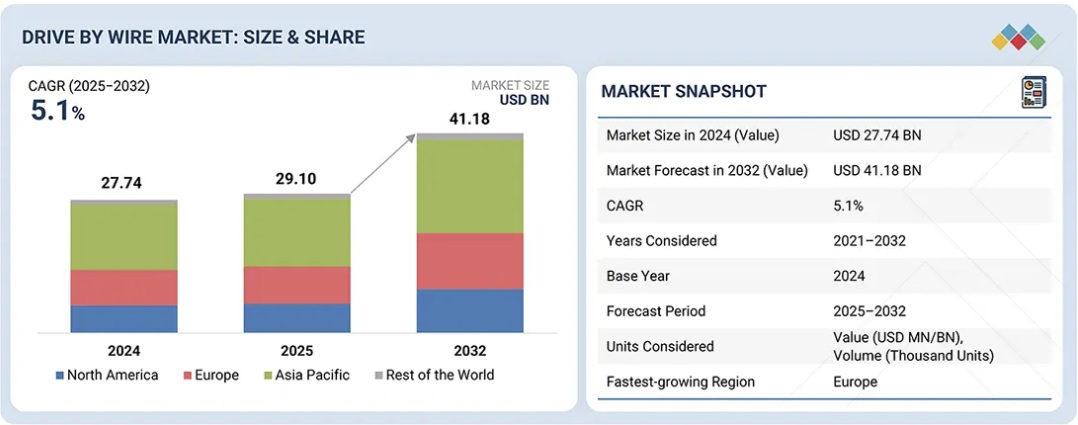

ドライブ・バイ・ワイヤ市場は、2025年の291億米ドルから2032年には411億8000万米ドルに達し、年平均成長率(CAGR)5.1%で成長すると予測されています。シフトバイワイヤとスロットルバイワイヤは、機能面、コスト面、アーキテクチャ面でのメリットをすぐに享受でき、規制遵守要件も低いため、ドライブバイワイヤアプリケーションとして最も広く採用され続けると予想されています。スロットルバイワイヤは、排出ガス規制要件、トルク管理、ADAS統合、電子パワートレインとの互換性確保のため、内燃機関(ICE)、ハイブリッド車、電気自動車で使用されています。シフトバイワイヤの採用はオートマチック車と電気自動車が牽引しており、電子ギア選択によってコンパクトなパッケージング、内装の簡素化、安全性の向上、自動駐車やリモートコントロール機能とのシームレスな統合が可能になります。これらのシステムを組み合わせることで、OEMはソフトウェア定義車両の開発とプラットフォーム標準化への最速の道筋を得ることができ、製造コストの上昇、複雑な安全対策、各国固有の認証を回避できます。

調査範囲

本レポートは、ドライブ・バイ・ワイヤ市場における推進要因、制約要因、機会、課題を詳細に分析し、2032年までの市場予測を示しています。また、様々な市場セグメントについて、定性的および定量的な分析を提供しています。さらに、北米、欧州、アジア太平洋、その他世界の4つの地域における詳細な市場概要を提供しています。

本レポートを購入する主なメリット:

- 本レポートは、市場リーダー/新規参入企業にとって、ドライブバイワイヤ市場全体とそのサブセグメントの収益数値の近似値に関する情報を提供するのに役立ちます。

- 本レポートは、ステークホルダーが競争環境を理解し、ビジネスの位置付けを改善し、適切な市場開拓戦略を策定するための洞察を深めるのに役立ちます。

- また、本レポートは、ステークホルダーが市場の動向を理解し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供するのにも役立ちます。

本レポートでは、以下の点について洞察を提供しています。

- 主要な推進要因(ソフトウェア定義車両アーキテクチャへの移行、高い運用精度と機械損失の低減、商用車および公共交通機関の電動化)、制約要因(成熟したフェイルオペレーショナルな前例がない場合の法的責任、サイバー攻撃の脅威、コンプライアンスコスト)、機会(AI、V2X、OTA対応の安全機能との統合、自動運転車の進歩)、課題(オフハイウェイ機器における統合の課題、電子故障、車載電子機器の急速な発展)の分析

- 製品開発/イノベーション:ドライブ・バイ・ワイヤ市場における今後の技術と研究開発活動に関する詳細な洞察

- 市場開発:さまざまな地域における収益性の高い市場に関する包括的な情報

- 市場多様化:ドライブ・バイ・ワイヤ市場における未開拓地域、最近の開発状況、投資に関する網羅的な情報

- 競合評価:Robert Bosch GmbH(ドイツ)、ZFなどの主要企業の市場シェア、成長戦略、製品提供に関する詳細な評価フリードリヒスハーフェンAG(ドイツ)、コンチネンタルAG(ドイツ)、ネクステア・オートモーティブ(米国)、カーティス・ライト・コーポレーション(米国)

Report Description

The drive by wire market is projected to reach USD 41.18 billion by 2032, from USD 29.10 billion in 2025, with a CAGR of 5.1%. Shift by wire and throttle by wire are expected to remain the most widely adopted drive by wire applications because they deliver immediate functional, cost, and architectural benefits with low regulatory compliance requirements. Throttle by wire is used across ICE, hybrid, and electric vehicles due to emission control requirements, torque management, ADAS integration, and to ensure compatibility with the electronic powertrain. Shift by wire adoption is led by automatic and electric vehicles, where electronic gear selection enables compact packaging, simplified interiors, improved safety, and seamless integration with autonomous parking and remote-control features. Together, these systems offer OEMs the fastest path to developing software-defined vehicles and platform standardization, while avoiding higher manufacturing costs, complex safety backups, and country-specific certifications.

Drive by Wire Market – Global Forecast To 2032

“BEVs are expected to generate the highest demand for drive by wire systems.”

BEVs are expected to generate the highest demand for drive by wire systems, as they lack engines, mechanical gear linkages, or vacuum-based brake systems, making electronic control the default choice for these vehicles. Throttle by wire, brake by wire, and shift by wire can be integrated easily into flat-floor architectures and centralized electrical systems than in ICE-derived vehicles. Technological changes in BEVs are further creating demand for drive by wire systems. BEV architectures support fully electronic braking, enabling accurate brake control and efficient regenerative braking blending. Centralized computing and zonal E/E architectures in these vehicles require steering, braking, throttle, and shifting to be controlled as software functions rather than mechanical linkages. Additionally, BEVs are developed as software-defined platforms, with drive modes, energy management, and ADAS features updated over the air, which is only feasible with by-wire systems. These platform-level changes make mechanical controls incompatible with BEVs’ design goals, accelerating drive by wire adoption.

Drive by Wire Market – Global Forecast To 2032 – region

“Europe is expected to be the fastest-growing market for drive by wire systems.”

Europe is expected to see the fastest growth in the drive by wire market during the forecast period, driven by regulation-driven electrification and premium OEM leadership. The region’s rapid adoption of drive by wire is primarily driven by the need to optimize platform architectures within tightly constrained packaging environments and by strong institutional readiness for software-defined functional safety and electronically controlled braking systems. This environment supports earlier large-scale deployment of brake by wire architectures, with steer by wire adoption advancing selectively where packaging, crash integration, and system-level benefits justify the added validation and redundancy complexity. From a market-outlook perspective, Europe’s leadership in modular vehicle architectures and software-centric safety validation is expected to translate into above-average growth rates for drive by wire systems over the medium term. OEM investments are likely to prioritize brake by wire platforms as a foundation technology, enabling large-scale deployment across high-volume segments while supporting regulatory compliance and platform reuse objectives.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and strategy directors, and executives from various key organizations operating in the drive by wire market.

- By Company Type: Supply-side – 70%, Demand-side – 30%

- By Designation: C level – 25%, Director Level – 30%, Others – 45%

- By Region: Asia Pacific – 55%, Europe – 15%, North America – 20%, Rest of the World – 10%

Drive by Wire Market – Global Forecast To 2032 – ecosystem

Research Coverage

The report details the drivers, restraints, opportunities, and challenges in the drive by wire market and forecasts the market through 2032. It also provides a qualitative and quantitative description of different market segments. The report provides a detailed market overview across four regions: North America, Europe, Asia Pacific, and the Rest of the World.

Key Benefits of Buying this Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall drive by wire market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- The report will also help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insight into the following pointers:

- Analysis of key drivers (shift toward software-defined vehicle architectures, high operational accuracy and reduced mechanical losses, electrification of commercial and public transport fleets) restraints (legal liability in absence of mature fail-operational precedents, threat of cyberattacks and compliance costs), opportunities (Integration with AI, V2X, and OTA-enabled safety functions, advancements in autonomous vehicles), and challenges (integration challenges in off-highway equipment, electronic failures and rapid developments in automotive electronics)

- Product Development/Innovation: Detailed insights into upcoming technologies and R&D activities in the drive by wire market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the drive by wire market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and product offerings of leading players, such as Robert Bosch GmbH (Germany), ZF Friedrichshafen AG (Germany), Continental AG (Germany), Nexteer Automotive (US), and Curtiss-Wright Corporation (US)

Table of Contents

1 INTRODUCTION 33

1.1 STUDY OBJECTIVES 33

1.2 MARKET DEFINITION 34

1.3 STUDY SCOPE 35

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 35

1.3.2 INCLUSIONS AND EXCLUSIONS 36

1.3.3 YEARS CONSIDERED 36

1.4 CURRENCY CONSIDERED 37

1.5 UNIT CONSIDERED 37

1.6 STAKEHOLDERS 37

1.7 SUMMARY OF CHANGES 38

2 EXECUTIVE SUMMARY 39

2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS 39

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 40

2.3 DISRUPTIVE TRENDS IN DRIVE BY WIRE MARKET 41

2.4 HIGH-GROWTH SEGMENTS 41

2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST 42

3 PREMIUM INSIGHTS 43

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DRIVE BY WIRE MARKET 43

3.2 L2 AUTONOMOUS VEHICLE DRIVE BY WIRE MARKET, BY APPLICATION 44

3.3 THROTTLE BY WIRE MARKET, BY ICE VEHICLE TYPE 44

3.4 THROTTLE BY WIRE MARKET, BY EV TYPE 45

3.5 BRAKE BY WIRE MARKET, BY ICE VEHICLE TYPE 45

3.6 BRAKE BY WIRE MARKET, BY EV TYPE 46

3.7 STEER BY WIRE MARKET, BY ICE VEHICLE TYPE 46

3.8 STEER BY WIRE MARKET, BY EV TYPE 47

3.9 SHIFT BY WIRE MARKET, BY ICE VEHICLE TYPE 47

3.10 SHIFT BY WIRE MARKET, BY EV TYPE 48

3.11 PARK BY WIRE MARKET, BY ICE VEHICLE TYPE 48

3.12 PARK BY WIRE MARKET, BY EV TYPE 49

3.13 DRIVE BY WIRE MARKET, BY REGION 49

4 MARKET OVERVIEW 50

4.1 INTRODUCTION 50

4.2 MARKET DYNAMICS 50

4.2.1 DRIVERS 51

4.2.1.1 Transition to software-defined vehicle architectures 51

4.2.1.1.1 Shift toward zonal architectures 52

4.2.1.2 High operational accuracy and reduced mechanical losses 53

4.2.1.3 Electrification of public transport and commercial fleets 53

4.2.2 RESTRAINTS 55

4.2.2.1 Legal liability due to absence of mature fail-operational precedents 55

4.2.2.2 Threat of cyberattacks and compliance costs 55

4.2.3 OPPORTUNITIES 56

4.2.3.1 Integration with AI, V2X, and OTA-enabled safety functions 56

4.2.3.2 Advancements in autonomous vehicles 56

4.2.4 CHALLENGES 57

4.2.4.1 Integration challenges in off-highway equipment 57

4.2.4.2 Electronic failures and rapid developments in automotive electronics 57

4.3 UNMET NEEDS AND WHITE SPACES 58

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 58

4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 58

5 INDUSTRY TRENDS 60

5.1 ECOSYSTEM ANALYSIS 60

5.1.1 RAW MATERIAL SUPPLIERS 61

5.1.2 ACTUATOR AND SENSOR MANUFACTURERS 62

5.1.3 TIER-1 SUPPLIERS/COMPONENT MANUFACTURERS 62

5.1.4 DISTRIBUTORS 62

5.1.5 OEMS 62

5.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 63

5.3 CASE STUDY ANALYSIS 64

5.3.1 FKA’S STEER BY WIRE SYSTEMS 64

5.3.2 CONTINENTAL’S MK C1 INTELLIGENT BRAKING SYSTEM 64

5.3.3 NEXTEER AUTOMOTIVE’S STEER BY WIRE SYSTEM 65

5.4 PRICING ANALYSIS 65

5.5 SUPPLY CHAIN ANALYSIS 66

5.6 COST-BENEFIT ANALYSIS 67

5.6.1 THROTTLE BY WIRE 67

5.6.2 SHIFT BY WIRE 67

5.6.3 PARK BY WIRE 68

5.6.4 BRAKE BY WIRE 69

5.6.5 STEER BY WIRE 70

5.7 KEY CONFERENCES AND EVENTS 71

6 INTEGRATION OF BY-WIRE TECHNOLOGIES 72

6.1 SMART ACTUATORS 72

6.1.1 OVERVIEW 72

6.1.2 KEY SUPPLIERS 72

6.2 ELECTRIC MOTORS 72

6.2.1 OVERVIEW 72

6.2.2 KEY SUPPLIERS 72

6.3 INTEGRATED CHASSIS SYSTEMS 73

6.3.1 OVERVIEW 73

6.3.2 KEY SUPPLIERS 73

6.4 SYNERGIES WITH ADAS/AUTONOMY 73

6.5 TRADITIONAL SYSTEMS VS. BY-WIRE SYSTEMS 73

6.6 FEATURE ANALYSIS OF BY-WIRE TECHNOLOGIES 74

7 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS 75

7.1 KEY TECHNOLOGIES 75

7.1.1 ADVANCED SENSOR TECHNOLOGIES 75

7.1.2 ELECTRICAL/ELECTRONIC ARCHITECTURES 75

7.1.3 CYBERSECURITY IN DRIVE BY WIRE NETWORKS 75

7.2 IMPACT OF AI/GEN AI 76

7.3 PATENT ANALYSIS 77

7.4 FUTURE APPLICATIONS 81

7.4.1 INTEGRATION WITH ADAS AND AUTONOMOUS DRIVING PLATFORMS 81

8 REGULATORY LANDSCAPE 82

8.1 REGIONAL REGULATIONS AND COMPLIANCE 82

8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 82

8.1.2 DRIVE BY WIRE STANDARDS, BY COUNTRY 85

9 BRAKE BY WIRE, BY PROPULSION AND COMPONENT 87

9.1 INTRODUCTION 88

9.2 TYPES 88

9.2.1 PEDAL-BASED BRAKE BY WIRE 88

9.2.2 ELECTRO-HYDRAULIC BRAKE BY WIRE 88

9.2.3 ELECTRO-MECHANICAL BRAKE BY WIRE 88

9.3 CONVENTIONAL BRAKING SYSTEMS VS. BRAKE BY WIRE SYSTEMS 89

9.4 KEY FEATURES 89

9.5 MARKET UPTAKE – BY OEM 90

9.6 MARKET SIZING AND FORECAST 90

9.6.1 BY ICE VEHICLE TYPE 90

9.6.1.1 Passenger car 91

9.6.1.2 Light commercial vehicle 93

9.6.1.3 Truck 94

9.6.1.4 Bus 95

9.6.2 BY EV TYPE 96

9.6.2.1 BEV 98

9.6.2.2 PHEV 99

9.6.2.3 FCEV 100

9.6.3 BY SENSOR TYPE 102

9.6.3.1 Brake pedal sensor 103

9.6.4 BY COMPONENT 104

9.6.4.1 Actuator 106

9.6.4.2 ECU 107

9.7 PRIMARY INSIGHTS 108

10 PARK BY WIRE, BY PROPULSION AND COMPONENT 109

10.1 INTRODUCTION 110

10.2 TYPES 110

10.2.1 TRANSMISSION PARK BY WIRE 110

10.2.2 REDUNDANT PARK BY WIRE 110

10.2.3 ELECTRIC PARKING BRAKE 110

10.3 CONVENTIONAL PARKING SYSTEMS VS. PARK BY WIRE SYSTEMS 110

10.4 KEY FEATURES 111

10.5 MARKET UPTAKE – BY OEM 111

10.6 MARKET SIZING AND FORECAST 112

10.6.1 BY ICE VEHICLE TYPE 112

10.6.1.1 Passenger car 113

10.6.1.2 Light commercial vehicle 114

10.6.1.3 Truck 116

10.6.1.4 Bus 117

10.6.2 BY EV TYPE 118

10.6.2.1 BEV 120

10.6.2.2 PHEV 121

10.6.2.3 FCEV 122

10.6.3 BY SENSOR TYPE 123

10.6.3.1 Park sensor 124

10.6.4 BY COMPONENT 125

10.6.4.1 Actuator 127

10.6.4.2 ECU 128

10.6.4.3 Parking pawl 129

10.7 PRIMARY INSIGHTS 130

11 SHIFT BY WIRE, BY PROPULSION AND COMPONENT 131

11.1 INTRODUCTION 132

11.2 TYPES 132

11.2.1 ELECTRONIC GEAR SELECTOR 132

11.2.2 PUSH-BUTTON SHIFT BY WIRE 132

11.2.3 LEVER-BASED SHIFT BY WIRE 132

11.3 CONVENTIONAL SHIFTING SYSTEMS VS. SHIFT BY WIRE SYSTEMS 132

11.4 KEY FEATURES 133

11.5 MARKET UPTAKE – BY OEM 133

11.6 MARKET SIZING AND FORECAST 134

11.6.1 BY ICE VEHICLE TYPE 134

11.6.1.1 Passenger car 135

11.6.1.2 Light commercial vehicle 136

11.6.1.3 Truck 138

11.6.1.4 Bus 139

11.6.2 BY EV TYPE 140

11.6.2.1 BEV 141

11.6.2.2 PHEV 142

11.6.2.3 FCEV 143

11.6.3 BY SENSOR TYPE 145

11.6.3.1 Gear shift position sensor 146

11.6.4 BY COMPONENT 147

11.6.4.1 Actuator 148

11.6.4.2 ECU 149

11.6.4.3 ETCU 150

11.7 PRIMARY INSIGHTS 151

12 STEER BY WIRE, BY PROPULSION AND COMPONENT 152

12.1 INTRODUCTION 153

12.2 TYPES 153

12.2.1 PINION 153

12.2.2 COLUMN 153

12.2.3 RACK 153

12.3 CONVENTIONAL STEERING SYSTEMS VS. STEER BY WIRE SYSTEMS 153

12.4 KEY FEATURES 154

12.5 MARKET UPTAKE – BY OEM 154

12.6 MARKET SIZING AND FORECAST 155

12.6.1 BY ICE VEHICLE TYPE 155

12.6.1.1 Passenger car 157

12.6.1.2 Light commercial vehicle 158

12.6.1.3 Truck 159

12.6.1.4 Bus 160

12.6.2 BY EV TYPE 162

12.6.2.1 BEV 164

12.6.2.2 PHEV 165

12.6.2.3 FCEV 166

12.6.3 BY SENSOR TYPE 167

12.6.3.1 Hand wheel angle sensor 168

12.6.3.2 Pinion angle sensor 170

12.6.4 BY COMPONENT 171

12.6.4.1 Actuator 173

12.6.4.2 ECU 174

12.6.4.3 Feedback motor 175

12.7 PRIMARY INSIGHTS 176

13 THROTTLE BY WIRE, BY PROPULSION AND COMPONENT 177

13.1 INTRODUCTION 178

13.2 TYPES 178

13.2.1 PEDAL-BASED THROTTLE BY WIRE 178

13.2.2 MOTOR-TORQUE THROTTLE BY WIRE 178

13.2.3 DRIVE-MODE ADAPTIVE THROTTLE BY WIRE 178

13.3 CONVENTIONAL THROTTLE SYSTEMS VS. THROTTLE BY WIRE SYSTEMS 178

13.4 KEY FEATURES 179

13.5 MARKET UPTAKE – BY OEM 179

13.6 MARKET SIZING AND FORECAST 180

13.6.1 BY ICE VEHICLE TYPE 180

13.6.1.1 Passenger car 182

13.6.1.2 Light commercial vehicle 183

13.6.1.3 Truck 184

13.6.1.4 Bus 185

13.6.2 BY EV TYPE 186

13.6.2.1 BEV 188

13.6.2.2 PHEV 189

13.6.2.3 FCEV 190

13.6.3 BY SENSOR TYPE 191

13.6.3.1 Throttle pedal sensor 192

13.6.3.2 Throttle position sensor 194

13.6.4 BY COMPONENT 195

13.6.4.1 Actuator 196

13.6.4.2 ECU 197

13.6.4.3 ECM 198

13.6.4.4 ETCM 199

13.7 PRIMARY INSIGHTS 200

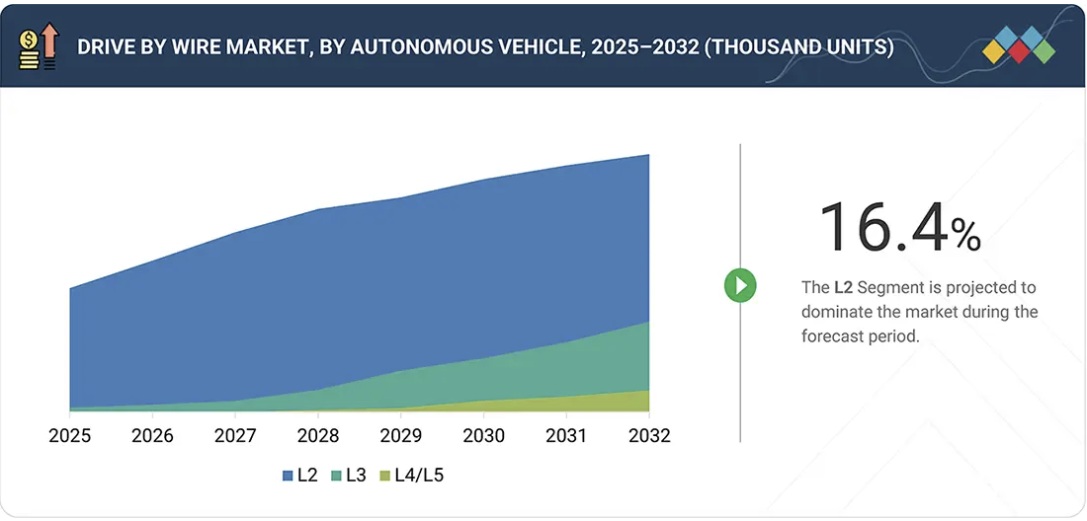

14 AUTONOMOUS VEHICLE DRIVE BY WIRE MARKET, BY APPLICATION 201

14.1 INTRODUCTION 202

14.2 L2 AUTONOMOUS VEHICLE 203

14.3 L3 AUTONOMOUS VEHICLE 204

14.4 L4/L5 AUTONOMOUS VEHICLE 205

14.5 PRIMARY INSIGHTS 206

15 DRIVE BY WIRE MARKET, BY REGION 207

15.1 INTRODUCTION 208

15.2 ASIA PACIFIC 210

15.2.1 CHINA 212

15.2.1.1 Growing popularity of electronic vehicle control to drive market 212

15.2.2 INDIA 213

15.2.2.1 Rising penetration of automatic transmissions to drive market 213

15.2.3 JAPAN 215

15.2.3.1 Product innovations by domestic manufacturers to drive market 215

15.2.4 SOUTH KOREA 217

15.2.4.1 Regulatory and technology alignment to drive market 217

15.2.5 THAILAND 218

15.2.5.1 Surge in EV sales and localization of electronics to drive market 218

15.2.6 REST OF ASIA PACIFIC 219

15.3 EUROPE 221

15.3.1 GERMANY 224

15.3.1.1 Strong premium vehicle base and presence of major by-wire suppliers to drive market 224

15.3.2 FRANCE 225

15.3.2.1 High demand for premium vehicles and stringent emission rules to drive market 225

15.3.3 RUSSIA 227

15.3.3.1 Rise of premium vehicle sales to drive market 227

15.3.4 SPAIN 228

15.3.4.1 Increasing consumer demand for luxury brands to drive market 228

15.3.5 UK 230

15.3.5.1 Mature automotive R&D ecosystem to drive market 230

15.3.6 TURKEY 231

15.3.6.1 Expanding presence of foreign luxury automakers to drive market 231

15.3.7 ITALY 233

15.3.7.1 Ongoing technology partnerships to drive market 233

15.3.8 REST OF EUROPE 234

15.4 NORTH AMERICA 236

15.4.1 CANADA 238

15.4.1.1 Elevated demand for premium and advanced vehicles to drive market 238

15.4.2 MEXICO 239

15.4.2.1 Robust cross-border supply chains to drive market 239

15.4.3 US 241

15.4.3.1 Strong technology adoption to drive market 241

15.5 REST OF THE WORLD 243

15.5.1 BRAZIL 245

15.5.1.1 Localization of advanced components and export-oriented production to drive market 245

15.5.2 IRAN 246

15.5.2.1 Preference for manual transmissions to impede market 246

15.5.3 ARGENTINA 248

15.5.3.1 Reduced import duties to drive market 248

15.5.4 SOUTH AFRICA 249

15.5.4.1 New premium vehicle launches to drive market 249

15.5.5 OTHERS 251

16 COMPETITIVE LANDSCAPE 253

16.1 INTRODUCTION 253

16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2025 253

16.3 MARKET SHARE ANALYSIS, 2024 255

16.4 REVENUE ANALYSIS, 2020–2024 257

16.5 COMPANY VALUATION AND FINANCIAL METRICS 258

16.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 259

16.6.1 STARS 259

16.6.2 EMERGING LEADERS 259

16.6.3 PERVASIVE PLAYERS 260

16.6.4 PARTICIPANTS 260

16.6.5 COMPANY FOOTPRINT 261

16.6.5.1 Company footprint 261

16.6.5.2 Region footprint 261

16.6.5.3 Component footprint 262

16.6.5.4 Application footprint 262

16.7 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024 263

16.7.1 PROGRESSIVE COMPANIES 263

16.7.2 RESPONSIVE COMPANIES 263

16.7.3 DYNAMIC COMPANIES 263

16.7.4 STARTING BLOCKS 263

16.7.5 COMPETITIVE BENCHMARKING 265

16.7.5.1 List of start-ups/SMEs 265

16.7.5.2 Competitive benchmarking of start-ups/SMEs 265

16.8 COMPETITIVE SCENARIO 266

16.8.1 PRODUCT LAUNCHES/DEVELOPMENTS 266

16.8.2 DEALS 268

16.8.3 EXPANSIONS 269

16.8.4 OTHER DEVELOPMENTS 270

17 COMPANY PROFILES 271

17.1 KEY PLAYERS 271

17.1.1 ROBERT BOSCH GMBH 271

17.1.1.1 Business overview 271

17.1.1.2 Products offered 272

17.1.1.3 Recent developments 273

17.1.1.3.1 Product launches/developments 273

17.1.1.3.2 Deals 273

17.1.1.3.3 Other deveopments 275

17.1.1.4 MnM view 275

17.1.1.4.1 Key strengths/Right to win 275

17.1.1.4.2 Strategic choices 275

17.1.1.4.3 Weaknesses and competitive threats 275

17.1.2 CONTINENTAL AG 276

17.1.2.1 Business overview 276

17.1.2.2 Products offered 277

17.1.2.3 Recent developments 278

17.1.2.3.1 Product launches/developments 278

17.1.2.3.2 Deals 278

17.1.2.3.3 Expansions 279

17.1.2.3.4 Other deveopments 279

17.1.2.4 MnM view 279

17.1.2.4.1 Key strengths/Right to win 280

17.1.2.4.2 Strategic choices 280

17.1.2.4.3 Weaknesses and competitive threats 280

17.1.3 ZF FRIEDRICHSHAFEN AG 281

17.1.3.1 Business overview 281

17.1.3.2 Products offered 282

17.1.3.3 Recent developments 283

17.1.3.3.1 Product launches/developments 283

17.1.3.3.2 Deals 284

17.1.3.3.3 Other deveopments 285

17.1.3.4 MnM view 285

17.1.3.4.1 Key strengths/Right to win 285

17.1.3.4.2 Strategic choices 285

17.1.3.4.3 Weaknesses and competitive threats 285

17.1.4 NEXTEER AUTOMOTIVE 286

17.1.4.1 Business overview 286

17.1.4.2 Products offered 287

17.1.4.3 Recent developments 288

17.1.4.3.1 Product launches/developments 288

17.1.4.3.2 Deals 289

17.1.4.3.3 Expansions 289

17.1.4.4 MnM view 290

17.1.4.4.1 Key strengths/Right to win 290

17.1.4.4.2 Strategic choices 290

17.1.4.4.3 Weaknesses and competitive threats 291

17.1.5 HITACHI, LTD. 292

17.1.5.1 Business overview 292

17.1.5.2 Products offered 293

17.1.5.3 Recent developments 294

17.1.5.3.1 Product launches/developments 294

17.1.5.3.2 Deals 294

17.1.5.4 MnM view 296

17.1.5.4.1 Key strengths/Right to win 296

17.1.5.4.2 Strategic choices 296

17.1.5.4.3 Weaknesses and competitive threats 296

17.1.6 HL MANDO CORP. 297

17.1.6.1 Business overview 297

17.1.6.2 Products offered 298

17.1.6.3 Recent developments 299

17.1.6.3.1 Deals 299

17.1.6.3.2 Other developments 300

17.1.7 JTEKT CORPORATION 301

17.1.7.1 Business overview 301

17.1.7.2 Products offered 302

17.1.7.3 Recent developments 302

17.1.7.3.1 Product launches/developments 302

17.1.7.3.2 Deals 303

17.1.7.3.3 Expansions 303

17.1.7.3.4 Other developments 304

17.1.8 THYSSENKRUPP AG 305

17.1.8.1 Business overview 305

17.1.8.2 Products offered 306

17.1.8.3 Recent developments 306

17.1.8.3.1 Deals 306

17.1.9 FICOSA INTERNATIONAL SA 307

17.1.9.1 Business overview 307

17.1.9.2 Products offered 308

17.1.10 KONGSBERG AUTOMOTIVE 309

17.1.10.1 Business overview 309

17.1.10.2 Products offered 310

17.1.10.3 Recent developments 311

17.1.10.3.1 Other developments 311

17.1.11 CURTISS-WRIGHT CORPORATION 312

17.1.11.1 Business overview 312

17.1.11.2 Products offered 313

17.1.11.3 Recent developments 314

17.1.11.3.1 Product launches/developments 314

17.1.11.3.2 Deals 315

17.1.11.3.3 Expansions 316

17.1.11.3.4 Other deveopments 316

17.2 OTHER PLAYERS 317

17.2.1 SCHAEFFLER TECHNOLOGIES AG & CO. KG 317

17.2.2 KSR INTERNATIONAL INC. 318

17.2.3 CTS CORPORATION 319

17.2.4 HYUNDAI MOBIS 320

17.2.5 FORVIA 321

17.2.6 NIDEC CORPORATION 322

17.2.7 NISSAN CORPORATION 323

17.2.8 INFINEON TECHNOLOGIES AG 324

17.2.9 BREMBO S.P.A. 325

17.2.10 DENSO CORPORATION 326

17.2.11 NXP SEMICONDUCTORS NV 327

17.2.12 SNT MOTIV CO., LTD. 328

17.2.13 LEM EUROPE GMBH 328

17.2.14 ALLIED MOTION TECHNOLOGIES INC. 329

17.2.15 DURA AUTOMOTIVE SYSTEMS 330

18 RESEARCH METHODOLOGY 331

18.1 RESEARCH DATA 331

18.1.1 SECONDARY DATA 332

18.1.1.1 List of secondary sources 332

18.1.1.2 Key data from secondary sources 333

18.1.2 PRIMARY DATA 333

18.1.2.1 Primary interviewees from demand and supply sides 334

18.1.2.2 Key primary insights 334

18.1.2.3 Breakdown of primary interviews 335

18.1.2.4 Primary participants 335

18.2 MARKET SIZE ESTIMATION 336

18.2.1 BOTTOM-UP APPROACH 337

18.2.2 TOP-DOWN APPROACH 338

18.3 DATA TRIANGULATION 339

18.4 FACTOR ANALYSIS 340

18.5 RESEARCH ASSUMPTIONS AND RISK ASSESSMENT 341

18.6 RESEARCH LIMITATIONS 342

19 APPENDIX 343

19.1 INSIGHTS FROM INDUSTRY EXPERTS 343

19.2 DISCUSSION GUIDE 344

19.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 347

19.4 CUSTOMIZATION OPTIONS 349

19.5 RELATED REPORTS 349

19.6 AUTHOR DETAILS 350

LIST OF TABLES

TABLE 1 MARKET DEFINITION 34

TABLE 2 CURRENCY EXCHANGE RATES, 2019–2024 37

TABLE 3 POPULAR SOFTWARE-DEFINED VEHICLE MODELS USING DRIVE BY WIRE SYSTEMS 51

TABLE 4 ELECTRIFICATION OF PUBLIC TRANSPORT FLEETS 54

TABLE 5 COMPARISON BETWEEN DRIVE BY WIRE SYSTEMS OFFERED BY TIER-1/2/3 SUPPLIERS 59

TABLE 6 ROLE OF COMPANIES IN ECOSYSTEM 61

TABLE 7 AVERAGE SELLING PRICE OF DRIVE BY WIRE SOLUTIONS, BY APPLICATION AND REGION, 2025 (USD) 65

TABLE 8 THROTTLE BY WIRE COST-BENEFIT ANALYSIS 67

TABLE 9 SHIFT BY WIRE COST-BENEFIT ANALYSIS 68

TABLE 10 PARK BY WIRE COST-BENEFIT ANALYSIS 68

TABLE 11 BRAKE BY WIRE COST-BENEFIT ANALYSIS 69

TABLE 12 STEER BY WIRE COST-BENEFIT ANALYSIS 70

TABLE 13 KEY CONFERENCES AND EVENTS, 2026–2027 71

TABLE 14 MODEL-WISE BY-WIRE TECHNOLOGIES 74

TABLE 15 IMPACT OF AI/GEN AI ON DRIVE BY WIRE SYSTEMS 76

TABLE 16 PATENT ANALYSIS 78

TABLE 17 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 82

TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 83

TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 84

TABLE 20 DRIVE BY WIRE STANDARDS, MAJOR COUNTRIES, AND REGIONS 85

TABLE 21 CONVENTIONAL BRAKING SYSTEMS VS. BRAKE BY WIRE SYSTEMS 89

TABLE 22 BRAKE BY WIRE MARKET, BY ICE VEHICLE TYPE, 2021–2024 (THOUSAND UNITS) 90

TABLE 23 BRAKE BY WIRE MARKET, BY ICE VEHICLE TYPE, 2025–2032 (THOUSAND UNITS) 90

TABLE 24 BRAKE BY WIRE MARKET, BY ICE VEHICLE TYPE, 2021–2024 (USD MILLION) 91

TABLE 25 BRAKE BY WIRE MARKET, BY ICE VEHICLE TYPE, 2025–2032 (USD MILLION) 91

TABLE 26 PASSENGER CAR: BRAKE BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 91

TABLE 27 PASSENGER CAR: BRAKE BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 92

TABLE 28 PASSENGER CAR: BRAKE BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 92

TABLE 29 PASSENGER CAR: BRAKE BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 92

TABLE 30 LIGHT COMMERCIAL VEHICLE: BRAKE BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 93

TABLE 31 LIGHT COMMERCIAL VEHICLE: BRAKE BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 93

TABLE 32 LIGHT COMMERCIAL VEHICLE: BRAKE BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 93

TABLE 33 LIGHT COMMERCIAL VEHICLE: BRAKE BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 94

TABLE 34 TRUCK: BRAKE BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 94

TABLE 35 TRUCK: BRAKE BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 94

TABLE 36 TRUCK: BRAKE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 95

TABLE 37 TRUCK: BRAKE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 95

TABLE 38 BUS: BRAKE BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 95

TABLE 39 BUS: BRAKE BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 96

TABLE 40 BUS: BRAKE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 96

TABLE 41 BUS: BRAKE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 96

TABLE 42 BRAKE BY WIRE MARKET, BY EV TYPE, 2021–2024 (THOUSAND UNITS) 97

TABLE 43 BRAKE BY WIRE MARKET, BY EV TYPE, 2025–2032 (THOUSAND UNITS) 97

TABLE 44 BRAKE BY WIRE MARKET, BY EV TYPE, 2021–2024 (USD MILLION) 97

TABLE 45 BRAKE BY WIRE MARKET, BY EV TYPE, 2025–2032 (USD MILLION) 97

TABLE 46 BEV: BRAKE BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 98

TABLE 47 BEV: BRAKE BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 98

TABLE 48 BEV: BRAKE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 98

TABLE 49 BEV: BRAKE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 99

TABLE 50 PHEV: BRAKE BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 99

TABLE 51 PHEV: BRAKE BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 99

TABLE 52 PHEV: BRAKE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 100

TABLE 53 PHEV: BRAKE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 100

TABLE 54 FCEV: BRAKE BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 100

TABLE 55 FCEV: BRAKE BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 101

TABLE 56 FCEV: BRAKE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 101

TABLE 57 FCEV: BRAKE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 101

TABLE 58 BRAKE BY WIRE MARKET, BY SENSOR TYPE, 2021–2024 (THOUSAND UNITS) 102

TABLE 59 BRAKE BY WIRE MARKET, BY SENSOR TYPE, 2025–2032 (THOUSAND UNITS) 102

TABLE 60 BRAKE BY WIRE MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION) 102

TABLE 61 BRAKE BY WIRE MARKET, BY SENSOR TYPE, 2025–2032 (USD MILLION) 103

TABLE 62 BRAKE PEDAL SENSOR: BRAKE BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 103

TABLE 63 BRAKE PEDAL SENSOR: BRAKE BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 103

TABLE 64 BRAKE PEDAL SENSOR: BRAKE BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 104

TABLE 65 BRAKE PEDAL SENSOR: BRAKE BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 104

TABLE 66 BRAKE BY WIRE MARKET, BY COMPONENT, 2021–2024 (THOUSAND UNITS) 105

TABLE 67 BRAKE BY WIRE MARKET, BY COMPONENT, 2025–2032 (THOUSAND UNITS) 105

TABLE 68 BRAKE BY WIRE MARKET, BY COMPONENT, 2021–2024 (USD MILLION) 105

TABLE 69 BRAKE BY WIRE MARKET, BY COMPONENT, 2025–2032 (USD MILLION) 106

TABLE 70 ACTUATOR: BRAKE BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 106

TABLE 71 ACTUATOR: BRAKE BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 106

TABLE 72 ACTUATOR: BRAKE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 106

TABLE 73 ACTUATOR: BRAKE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 107

TABLE 74 ECU: BRAKE BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 107

TABLE 75 ECU: BRAKE BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 107

TABLE 76 ECU: BRAKE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 107

TABLE 77 ECU: BRAKE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 108

TABLE 78 CONVENTIONAL PARKING SYSTEMS VS. PARK BY WIRE SYSTEM 111

TABLE 79 PARK BY WIRE MARKET, BY ICE VEHICLE TYPE, 2021–2024 (THOUSAND UNITS) 112

TABLE 80 PARK BY WIRE MARKET, BY ICE VEHICLE TYPE, 2025–2032 (THOUSAND UNITS) 112

TABLE 81 PARK BY WIRE MARKET, BY ICE VEHICLE TYPE, 2021–2024 (USD MILLION) 112

TABLE 82 PARK BY WIRE MARKET, BY ICE VEHICLE TYPE, 2025–2032 (USD MILLION) 113

TABLE 83 PASSENGER CAR: PARK BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 113

TABLE 84 PASSENGER CAR: PARK BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 113

TABLE 85 PASSENGER CAR: PARK BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 114

TABLE 86 PASSENGER CAR: PARK BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 114

TABLE 87 LIGHT COMMERCIAL VEHICLE: PARK BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 114

TABLE 88 LIGHT COMMERCIAL VEHICLE: PARK BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 115

TABLE 89 LIGHT COMMERCIAL VEHICLE: PARK BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 115

TABLE 90 LIGHT COMMERCIAL VEHICLE: PARK BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 115

TABLE 91 TRUCK: PARK BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 116

TABLE 92 TRUCK: PARK BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 116

TABLE 93 TRUCK: PARK BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 116

TABLE 94 TRUCK: PARK BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 117

TABLE 95 BUS: PARK BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 117

TABLE 96 BUS: PARK BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 117

TABLE 97 BUS: PARK BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 117

TABLE 98 BUS: PARK BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 118

TABLE 99 PARK BY WIRE MARKET, BY EV TYPE, 2021–2024 (THOUSAND UNITS) 119

TABLE 100 PARK BY WIRE MARKET, BY EV TYPE, 2025–2032 (THOUSAND UNITS) 119

TABLE 101 PARK BY WIRE MARKET, BY EV TYPE, 2021–2024 (USD MILLION) 119

TABLE 102 PARK BY WIRE MARKET, BY EV TYPE, 2025–2032 (USD MILLION) 119

TABLE 103 BEV: PARK BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 120

TABLE 104 BEV: PARK BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 120

TABLE 105 BEV: PARK BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 120

TABLE 106 BEV: PARK BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 121

TABLE 107 PHEV: PARK BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 121

TABLE 108 PHEV: PARK BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 121

TABLE 109 PHEV: PARK BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 122

TABLE 110 PHEV: PARK BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 122

TABLE 111 FCEV: PARK BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 122

TABLE 112 FCEV: PARK BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 122

TABLE 113 FCEV: PARK BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 123

TABLE 114 FCEV: PARK BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 123

TABLE 115 PARK BY WIRE MARKET, BY SENSOR TYPE, 2021–2024 (THOUSAND UNITS) 123

TABLE 116 PARK BY WIRE MARKET, BY SENSOR TYPE, 2025–2032 (THOUSAND UNITS) 124

TABLE 117 PARK BY WIRE MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION) 124

TABLE 118 PARK BY WIRE MARKET, BY SENSOR TYPE, 2025–2032 (USD MILLION) 124

TABLE 119 PARK SENSOR: PARK BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 124

TABLE 120 PARK SENSOR: PARK BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 125

TABLE 121 PARK SENSOR: PARK BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 125

TABLE 122 PARK SENSOR: PARK BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 125

TABLE 123 PARK BY WIRE MARKET, BY COMPONENT, 2021–2024 (THOUSAND UNITS) 126

TABLE 124 PARK BY WIRE MARKET, BY COMPONENT, 2025–2032 (THOUSAND UNITS) 126

TABLE 125 PARK BY WIRE MARKET, BY COMPONENT, 2021–2024 (USD MILLION) 126

TABLE 126 PARK BY WIRE MARKET, BY COMPONENT, 2025–2032 (USD MILLION) 127

TABLE 127 ACTUATOR: PARK BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 127

TABLE 128 ACTUATOR: PARK BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 127

TABLE 129 ACTUATOR: PARK BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 127

TABLE 130 ACTUATOR: PARK BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 128

TABLE 131 ECU: PARK BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 128

TABLE 132 ECU: PARK BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 128

TABLE 133 ECU: PARK BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 129

TABLE 134 ECU: PARK BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 129

TABLE 135 PARKING PAWL: PARK BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 129

TABLE 136 PARKING PAWL: PARK BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 130

TABLE 137 PARKING PAWL: PARK BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 130

TABLE 138 PARKING PAWL: PARK BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 130

TABLE 139 CONVENTIONAL SHIFTING SYSTEMS VS. SHIFT BY WIRE SYSTEMS 133

TABLE 140 SHIFT BY WIRE MARKET, BY ICE VEHICLE TYPE, 2021–2024 (THOUSAND UNITS) 134

TABLE 141 SHIFT BY WIRE MARKET, BY ICE VEHICLE TYPE, 2025–2032 (THOUSAND UNITS) 134

TABLE 142 SHIFT BY WIRE MARKET, BY ICE VEHICLE TYPE, 2021–2024 (USD MILLION) 134

TABLE 143 SHIFT BY WIRE MARKET, BY ICE VEHICLE TYPE, 2025–2032 (USD MILLION) 135

TABLE 144 PASSENGER CAR: SHIFT BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 135

TABLE 145 PASSENGER CAR: SHIFT BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 135

TABLE 146 PASSENGER CAR: SHIFT BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 136

TABLE 147 PASSENGER CAR: SHIFT BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 136

TABLE 148 LIGHT COMMERCIAL VEHICLE: SHIFT BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 136

TABLE 149 LIGHT COMMERCIAL VEHICLE: SHIFT BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 137

TABLE 150 LIGHT COMMERCIAL VEHICLE: SHIFT BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 137

TABLE 151 LIGHT COMMERCIAL VEHICLE: SHIFT BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 137

TABLE 152 TRUCK: SHIFT BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 138

TABLE 153 TRUCK: SHIFT BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 138

TABLE 154 TRUCK: SHIFT BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 138

TABLE 155 TRUCK: SHIFT BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 139

TABLE 156 BUS: SHIFT BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 139

TABLE 157 BUS: SHIFT BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 139

TABLE 158 BUS: SHIFT BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 139

TABLE 159 BUS: SHIFT BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 140

TABLE 160 SHIFT BY WIRE MARKET, BY EV TYPE, 2021–2024 (THOUSAND UNITS) 140

TABLE 161 SHIFT BY WIRE MARKET, BY EV TYPE, 2025–2032 (THOUSAND UNITS) 140

TABLE 162 SHIFT BY WIRE MARKET, BY EV TYPE, 2021–2024 (USD MILLION) 141

TABLE 163 SHIFT BY WIRE MARKET, BY EV TYPE, 2025–2032 (USD MILLION) 141

TABLE 164 BEV: SHIFT BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 141

TABLE 165 BEV: SHIFT BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 141

TABLE 166 BEV: SHIFT BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 142

TABLE 167 BEV: SHIFT BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 142

TABLE 168 PHEV: SHIFT BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 142

TABLE 169 PHEV: SHIFT BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 142

TABLE 170 PHEV: SHIFT BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 143

TABLE 171 PHEV: SHIFT BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 143

TABLE 172 FCEV: SHIFT BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 143

TABLE 173 FCEV: SHIFT BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 144

TABLE 174 FCEV: SHIFT BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 144

TABLE 175 FCEV: SHIFT BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 144

TABLE 176 SHIFT BY WIRE MARKET, BY SENSOR TYPE, 2021–2024 (THOUSAND UNITS) 145

TABLE 177 SHIFT BY WIRE MARKET, BY SENSOR TYPE, 2025–2032 (THOUSAND UNITS) 145

TABLE 178 SHIFT BY WIRE MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION) 145

TABLE 179 SHIFT BY WIRE MARKET, BY SENSOR TYPE, 2025–2032 (USD MILLION) 145

TABLE 180 GEAR SHIFT POSITION SENSOR: SHIFT BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 146

TABLE 181 GEAR SHIFT POSITION SENSOR: SHIFT BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 146

TABLE 182 GEAR SHIFT POSITION SENSOR: SHIFT BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 146

TABLE 183 GEAR SHIFT POSITION SENSOR: SHIFT BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 147

TABLE 184 SHIFT BY WIRE MARKET, BY COMPONENT, 2021–2024 (THOUSAND UNITS) 147

TABLE 185 SHIFT BY WIRE MARKET, BY COMPONENT, 2025–2032 (THOUSAND UNITS) 147

TABLE 186 SHIFT BY WIRE MARKET, BY COMPONENT, 2021–2024 (USD MILLION) 148

TABLE 187 SHIFT BY WIRE MARKET, BY COMPONENT, 2025–2032 (USD MILLION) 148

TABLE 188 ACTUATOR: SHIFT BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 148

TABLE 189 ACTUATOR: SHIFT BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 148

TABLE 190 ACTUATOR: SHIFT BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 149

TABLE 191 ACTUATOR: SHIFT BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 149

TABLE 192 ECU: SHIFT BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 149

TABLE 193 ECU: SHIFT BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 149

TABLE 194 ECU: SHIFT BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 150

TABLE 195 ECU: SHIFT BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 150

TABLE 196 ETCU: SHIFT BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 150

TABLE 197 ETCU: SHIFT BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 150

TABLE 198 ETCU: SHIFT BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 151

TABLE 199 ETCU: SHIFT BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 151

TABLE 200 CONVENTIONAL STEERING SYSTEMS VS. STEER BY WIRE SYSTEMS 154

TABLE 201 STEER BY WIRE MARKET, BY ICE VEHICLE TYPE, 2021–2024 (THOUSAND UNITS) 155

TABLE 202 STEER BY WIRE MARKET, BY ICE VEHICLE TYPE, 2025–2032 (THOUSAND UNITS) 156

TABLE 203 STEER BY WIRE MARKET, BY ICE VEHICLE TYPE, 2021–2024 (USD MILLION) 156

TABLE 204 STEER BY WIRE MARKET, BY ICE VEHICLE TYPE, 2025–2032 (USD MILLION) 156

TABLE 205 PASSENGER CAR: STEER BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 157

TABLE 206 PASSENGER CAR: STEER BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 157

TABLE 207 PASSENGER CAR: STEER BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 157

TABLE 208 PASSENGER CAR: STEER BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 158

TABLE 209 LIGHT COMMERCIAL VEHICLE: STEER BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 158

TABLE 210 LIGHT COMMERCIAL VEHICLE: STEER BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 158

TABLE 211 LIGHT COMMERCIAL VEHICLE: STEER BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 159

TABLE 212 LIGHT COMMERCIAL VEHICLE: STEER BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 159

TABLE 213 TRUCK: STEER BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 159

TABLE 214 TRUCK: STEER BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 160

TABLE 215 TRUCK: STEER BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 160

TABLE 216 TRUCK: STEER BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 160

TABLE 217 BUS: STEER BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 160

TABLE 218 BUS: STEER BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 161

TABLE 219 BUS: STEER BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 161

TABLE 220 BUS: STEER BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 161

TABLE 221 STEER BY WIRE MARKET, BY EV TYPE, 2021–2024 (THOUSAND UNITS) 162

TABLE 222 STEER BY WIRE MARKET, BY EV TYPE, 2025–2032 (THOUSAND UNITS) 163

TABLE 223 STEER BY WIRE MARKET, BY EV TYPE, 2021–2024 (USD MILLION) 163

TABLE 224 STEER BY WIRE MARKET, BY EV TYPE, 2025–2032 (USD MILLION) 163

TABLE 225 BEV: STEER BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 164

TABLE 226 BEV: STEER BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 164

TABLE 227 BEV: STEER BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 164

TABLE 228 BEV: STEER BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 165

TABLE 229 PHEV: STEER BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 165

TABLE 230 PHEV: STEER BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 165

TABLE 231 PHEV: STEER BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 165

TABLE 232 PHEV: STEER BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 166

TABLE 233 FCEV: STEER BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 166

TABLE 234 FCEV: STEER BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 166

TABLE 235 FCEV: STEER BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 166

TABLE 236 FCEV: STEER BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 167

TABLE 237 STEER BY WIRE MARKET, BY SENSOR TYPE, 2021–2024 (THOUSAND UNITS) 167

TABLE 238 STEER BY WIRE MARKET, BY SENSOR TYPE, 2025–2032 (THOUSAND UNITS) 168

TABLE 239 STEER BY WIRE MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION) 168

TABLE 240 STEER BY WIRE MARKET, BY SENSOR TYPE, 2025–2032 (USD MILLION) 168

TABLE 241 HAND WHEEL ANGLE SENSOR: STEER BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 168

TABLE 242 HAND WHEEL ANGLE SENSOR: STEER BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 169

TABLE 243 HAND WHEEL ANGLE SENSOR: STEER BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 169

TABLE 244 HAND WHEEL ANGLE SENSOR: STEER BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 169

TABLE 245 PINION ANGLE SENSOR: STEER BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 170

TABLE 246 PINION ANGLE SENSOR: STEER BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 170

TABLE 247 PINION ANGLE SENSOR: STEER BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 170

TABLE 248 PINION ANGLE SENSOR: STEER BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 171

TABLE 249 STEER BY WIRE MARKET, BY COMPONENT, 2021–2024 (THOUSAND UNITS) 172

TABLE 250 STEER BY WIRE MARKET, BY COMPONENT, 2025–2032 (THOUSAND UNITS) 172

TABLE 251 STEER BY WIRE MARKET, BY COMPONENT, 2021–2024 (USD MILLION) 172

TABLE 252 STEER BY WIRE MARKET, BY COMPONENT, 2025–2032 (USD MILLION) 172

TABLE 253 ACTUATOR: STEER BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 173

TABLE 254 ACTUATOR: STEER BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 173

TABLE 255 ACTUATOR: STEER BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 173

TABLE 256 ACTUATOR: STEER BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 173

TABLE 257 ECU: STEER BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 174

TABLE 258 ECU: STEER BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 174

TABLE 259 ECU: STEER BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 174

TABLE 260 ECU: STEER BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 174

TABLE 261 FEEDBACK MOTOR: STEER BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 175

TABLE 262 FEEDBACK MOTOR: STEER BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 175

TABLE 263 FEEDBACK MOTOR: STEER BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 175

TABLE 264 FEEDBACK MOTOR: STEER BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 176

TABLE 265 CONVENTIONAL THROTTLE SYSTEMS VS. THROTTLE BY WIRE SYSTEMS 179

TABLE 266 THROTTLE BY WIRE MARKET, BY ICE VEHICLE TYPE,

2021–2024 (THOUSAND UNITS) 180

TABLE 267 THROTTLE BY WIRE MARKET, BY ICE VEHICLE TYPE,

2025–2032 (THOUSAND UNITS) 181

TABLE 268 THROTTLE BY WIRE MARKET, BY ICE VEHICLE TYPE, 2021–2024 (USD MILLION) 181

TABLE 269 THROTTLE BY WIRE MARKET, BY ICE VEHICLE TYPE, 2025–2032 (USD MILLION) 181

TABLE 270 PASSENGER CAR: THROTTLE BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 182

TABLE 271 PASSENGER CAR: THROTTLE BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 182

TABLE 272 PASSENGER CAR: THROTTLE BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 182

TABLE 273 PASSENGER CAR: THROTTLE BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 183

TABLE 274 LIGHT COMMERCIAL VEHICLE: THROTTLE BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 183

TABLE 275 LIGHT COMMERCIAL VEHICLE: THROTTLE BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 183

TABLE 276 LIGHT COMMERCIAL VEHICLE: THROTTLE BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 184

TABLE 277 LIGHT COMMERCIAL VEHICLE: THROTTLE BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 184

TABLE 278 TRUCK: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 184

TABLE 279 TRUCK: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 185

TABLE 280 TRUCK: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 185

TABLE 281 TRUCK: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 185

TABLE 282 BUS: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 185

TABLE 283 BUS: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 186

TABLE 284 BUS: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 186

TABLE 285 BUS: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 186

TABLE 286 THROTTLE BY WIRE MARKET, BY EV TYPE, 2021–2024 (THOUSAND UNITS) 187

TABLE 287 THROTTLE BY WIRE MARKET, BY EV TYPE, 2025–2032 (THOUSAND UNITS) 187

TABLE 288 THROTTLE BY WIRE MARKET, BY EV TYPE, 2021–2024 (USD MILLION) 187

TABLE 289 THROTTLE BY WIRE MARKET, BY EV TYPE, 2025–2032 (USD MILLION) 188

TABLE 290 BEV: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 188

TABLE 291 BEV: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 188

TABLE 292 BEV: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 188

TABLE 293 BEV: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 189

TABLE 294 PHEV: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 189

TABLE 295 PHEV: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 189

TABLE 296 PHEV: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 189

TABLE 297 PHEV: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 190

TABLE 298 FCEV: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 190

TABLE 299 FCEV: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 190

TABLE 300 FCEV: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 190

TABLE 301 FCEV: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 191

TABLE 302 THROTTLE BY WIRE MARKET, BY SENSOR TYPE, 2021–2024 (THOUSAND UNITS) 191

TABLE 303 THROTTLE BY WIRE MARKET, BY SENSOR TYPE , 2025–2032 (THOUSAND UNITS) 192

TABLE 304 THROTTLE BY WIRE MARKET, BY SENSOR TYPE, 2021–2024 (USD MILLION) 192

TABLE 305 THROTTLE BY WIRE MARKET, BY SENSOR TYPE, 2025–2032 (USD MILLION) 192

TABLE 306 THROTTLE PEDAL SENSOR: THROTTLE BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 192

TABLE 307 THROTTLE PEDAL SENSOR: THROTTLE BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 193

TABLE 308 THROTTLE PEDAL SENSOR: THROTTLE BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 193

TABLE 309 THROTTLE PEDAL SENSOR: THROTTLE BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 193

TABLE 310 THROTTLE POSITION SENSOR: THROTTLE BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 194

TABLE 311 THROTTLE POSITION SENSOR: THROTTLE BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 194

TABLE 312 THROTTLE POSITION SENSOR: THROTTLE BY WIRE MARKET, BY REGION,

2021–2024 (USD MILLION) 194

TABLE 313 THROTTLE POSITION SENSOR: THROTTLE BY WIRE MARKET, BY REGION,

2025–2032 (USD MILLION) 195

TABLE 314 THROTTLE BY WIRE MARKET, BY COMPONENT, 2021–2024 (THOUSAND UNITS) 195

TABLE 315 THROTTLE BY WIRE MARKET, BY COMPONENT, 2025–2032 (THOUSAND UNITS) 196

TABLE 316 THROTTLE BY WIRE MARKET, BY COMPONENT, 2021–2024 (USD MILLION) 196

TABLE 317 THROTTLE BY WIRE MARKET, BY COMPONENT, 2025–2032 (USD MILLION) 196

TABLE 318 ACTUATOR: THROTTLE BY WIRE MARKET, BY REGION,

2021–2024 (THOUSAND UNITS) 196

TABLE 319 ACTUATOR: THROTTLE BY WIRE MARKET, BY REGION,

2025–2032 (THOUSAND UNITS) 197

TABLE 320 ACTUATOR: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 197

TABLE 321 ACTUATOR: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 197

TABLE 322 ECU: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 197

TABLE 323 ECU: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 198

TABLE 324 ECU: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 198

TABLE 325 ECU: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 198

TABLE 326 ECM: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 198

TABLE 327 ECM: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 199

TABLE 328 ECM: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 199

TABLE 329 ECM: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 199

TABLE 330 ETCM: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 199

TABLE 331 ETCM: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 200

TABLE 332 ETCM: THROTTLE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 200

TABLE 333 ETCM: THROTTLE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 200

TABLE 334 L2 AUTONOMOUS VEHICLE DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 204

TABLE 335 L2 AUTONOMOUS VEHICLE DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 204

TABLE 336 L3 AUTONOMOUS VEHICLE DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 205

TABLE 337 L3 AUTONOMOUS VEHICLE DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 205

TABLE 338 L4/L5 AUTONOMOUS VEHICLE DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 206

TABLE 339 L4/L5 AUTONOMOUS VEHICLE DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 206

TABLE 340 DRIVE BY WIRE MARKET, BY REGION, 2021–2024 (THOUSAND UNITS) 208

TABLE 341 DRIVE BY WIRE MARKET, BY REGION, 2025–2032 (THOUSAND UNITS) 209

TABLE 342 DRIVE BY WIRE MARKET, BY REGION, 2021–2024 (USD MILLION) 209

TABLE 343 DRIVE BY WIRE MARKET, BY REGION, 2025–2032 (USD MILLION) 209

TABLE 344 ASIA PACIFIC: DRIVE BY WIRE MARKET, BY COUNTRY,

2021–2024 (THOUSAND UNITS) 210

TABLE 345 ASIA PACIFIC: DRIVE BY WIRE MARKET, BY COUNTRY,

2025–2032 (THOUSAND UNITS) 211

TABLE 346 ASIA PACIFIC: DRIVE BY WIRE MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 211

TABLE 347 ASIA PACIFIC: DRIVE BY WIRE MARKET, BY COUNTRY, 2025–2032 (USD MILLION) 211

TABLE 348 CHINA: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 212

TABLE 349 CHINA: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 212

TABLE 350 CHINA: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 213

TABLE 351 CHINA: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 213

TABLE 352 INDIA: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (THOUSAND UNITS) 214

TABLE 353 INDIA: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (THOUSAND UNITS) 214

TABLE 354 INDIA: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 214

TABLE 355 INDIA: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 215

TABLE 356 JAPAN: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 215

TABLE 357 JAPAN: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 216

TABLE 358 JAPAN: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 216

TABLE 359 JAPAN: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 216

TABLE 360 SOUTH KOREA: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 217

TABLE 361 SOUTH KOREA: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 217

TABLE 362 SOUTH KOREA: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 218

TABLE 363 SOUTH KOREA: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (USD MILLION) 218

TABLE 364 THAILAND: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 218

TABLE 365 THAILAND: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 219

TABLE 366 THAILAND: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 219

TABLE 367 THAILAND: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 219

TABLE 368 REST OF ASIA PACIFIC: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 220

TABLE 369 REST OF ASIA PACIFIC: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 220

TABLE 370 REST OF ASIA PACIFIC: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 220

TABLE 371 REST OF ASIA PACIFIC: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (USD MILLION) 221

TABLE 372 EUROPE: DRIVE BY WIRE MARKET, BY COUNTRY, 2021–2024 (THOUSAND UNITS) 222

TABLE 373 EUROPE: DRIVE BY WIRE MARKET, BY COUNTRY, 2025–2032 (THOUSAND UNITS) 222

TABLE 374 EUROPE: DRIVE BY WIRE MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 223

TABLE 375 EUROPE: DRIVE BY WIRE MARKET, BY COUNTRY, 2025–2032 (USD MILLION) 223

TABLE 376 GERMANY: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 224

TABLE 377 GERMANY: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 224

TABLE 378 GERMANY: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 225

TABLE 379 GERMANY: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 225

TABLE 380 FRANCE: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 226

TABLE 381 FRANCE: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 226

TABLE 382 FRANCE: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 226

TABLE 383 FRANCE: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 227

TABLE 384 RUSSIA: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 227

TABLE 385 RUSSIA: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 227

TABLE 386 RUSSIA: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 228

TABLE 387 RUSSIA: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 228

TABLE 388 SPAIN: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (THOUSAND UNITS) 228

TABLE 389 SPAIN: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (THOUSAND UNITS) 229

TABLE 390 SPAIN: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 229

TABLE 391 SPAIN: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 229

TABLE 392 UK: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (THOUSAND UNITS) 230

TABLE 393 UK: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (THOUSAND UNITS) 230

TABLE 394 UK: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 231

TABLE 395 UK: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 231

TABLE 396 TURKEY: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 232

TABLE 397 TURKEY: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 232

TABLE 398 TURKEY: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 232

TABLE 399 TURKEY: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 233

TABLE 400 ITALY: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (THOUSAND UNITS) 233

TABLE 401 ITALY: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (THOUSAND UNITS) 234

TABLE 402 ITALY: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 234

TABLE 403 ITALY: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 234

TABLE 404 REST OF EUROPE: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 235

TABLE 405 REST OF EUROPE: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 235

TABLE 406 REST OF EUROPE: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 235

TABLE 407 REST OF EUROPE: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (USD MILLION) 236

TABLE 408 NORTH AMERICA: DRIVE BY WIRE MARKET, BY COUNTRY,

2021–2024 (THOUSAND UNITS) 237

TABLE 409 NORTH AMERICA: DRIVE BY WIRE MARKET, BY COUNTRY,

2025–2032 (THOUSAND UNITS) 237

TABLE 410 NORTH AMERICA: DRIVE BY WIRE MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 237

TABLE 411 NORTH AMERICA: DRIVE BY WIRE MARKET, BY COUNTRY,

2025–2032 (USD MILLION) 237

TABLE 412 CANADA: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 238

TABLE 413 CANADA: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 238

TABLE 414 CANADA: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 239

TABLE 415 CANADA: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 239

TABLE 416 MEXICO: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 240

TABLE 417 MEXICO: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 240

TABLE 418 MEXICO: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 240

TABLE 419 MEXICO: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 241

TABLE 420 US: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (THOUSAND UNITS) 241

TABLE 421 US: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (THOUSAND UNITS) 242

TABLE 422 US: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 242

TABLE 423 US: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 242

TABLE 424 REST OF THE WORLD: DRIVE BY WIRE MARKET, BY COUNTRY,

2021–2024 (THOUSAND UNITS) 243

TABLE 425 REST OF THE WORLD: DRIVE BY WIRE MARKET, BY COUNTRY,

2025–2032 (THOUSAND UNITS) 244

TABLE 426 REST OF THE WORLD: DRIVE BY WIRE MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 244

TABLE 427 REST OF THE WORLD: DRIVE BY WIRE MARKET, BY COUNTRY,

2025–2032 (USD MILLION) 244

TABLE 428 BRAZIL: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 245

TABLE 429 BRAZIL: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 245

TABLE 430 BRAZIL: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 246

TABLE 431 BRAZIL: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 246

TABLE 432 IRAN: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (THOUSAND UNITS) 247

TABLE 433 IRAN: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (THOUSAND UNITS) 247

TABLE 434 IRAN: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 247

TABLE 435 IRAN: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 248

TABLE 436 ARGENTINA: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 248

TABLE 437 ARGENTINA: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 248

TABLE 438 ARGENTINA: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 249

TABLE 439 ARGENTINA: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (USD MILLION) 249

TABLE 440 SOUTH AFRICA: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 250

TABLE 441 SOUTH AFRICA: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 250

TABLE 442 SOUTH AFRICA: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 250

TABLE 443 SOUTH AFRICA: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (USD MILLION) 251

TABLE 444 OTHERS: DRIVE BY WIRE MARKET, BY APPLICATION,

2021–2024 (THOUSAND UNITS) 251

TABLE 445 OTHERS: DRIVE BY WIRE MARKET, BY APPLICATION,

2025–2032 (THOUSAND UNITS) 252

TABLE 446 OTHERS: DRIVE BY WIRE MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 252

TABLE 447 OTHERS: DRIVE BY WIRE MARKET, BY APPLICATION, 2025–2032 (USD MILLION) 252

TABLE 448 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2025 253

TABLE 449 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024 255

TABLE 450 REGION FOOTPRINT 261

TABLE 451 COMPONENT FOOTPRINT 262

TABLE 452 APPLICATION FOOTPRINT 262

TABLE 453 LIST OF START-UPS/SMES 265

TABLE 454 COMPETITIVE BENCHMARKING OF START-UPS/SMES 265

TABLE 455 DRIVE BY WIRE MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, 2021–2025 266

TABLE 456 DRIVE BY WIRE MARKET: DEALS, 2021–2025 268

TABLE 457 DRIVE BY WIRE MARKET: EXPANSIONS, 2021–2025 269

TABLE 458 DRIVE BY WIRE MARKET: OTHER DEVELOPMENTS, 2021–2025 270

TABLE 459 ROBERT BOSCH GMBH: COMPANY OVERVIEW 271

TABLE 460 ROBERT BOSCH GMBH: PRODUCTS OFFERED 272

TABLE 461 ROBERT BOSCH GMBH: PRODUCT LAUNCHES/DEVELOPMENTS 273

TABLE 462 ROBERT BOSCH GMBH: DEALS 273

TABLE 463 ROBERT BOSCH GMBH: OTHER DEVELOPMENTS 275

TABLE 464 CONTINENTAL AG: COMPANY OVERVIEW 276

TABLE 465 CONTINENTAL AG: PRODUCTS OFFERED 277

TABLE 466 CONTINENTAL AG: PRODUCT LAUNCHES/DEVELOPMENTS 278

TABLE 467 CONTINENTAL AG: DEALS 278

TABLE 468 CONTINENTAL AG: EXPANSIONS 279

TABLE 469 CONTINENTAL AG: OTHER DEVELOPMENTS 279

TABLE 470 ZF FRIEDRICHSHAFEN AG: COMPANY OVERVIEW 281

TABLE 471 ZF FRIEDRICHSHAFEN AG: PRODUCTS OFFERED 282

TABLE 472 ZF FRIEDRICHSHAFEN AG: PRODUCT LAUNCHES/DEVELOPMENTS 283

TABLE 473 ZF FRIEDRICHSHAFEN AG: DEALS 284

TABLE 474 ZF FRIEDRICHSHAFEN: OTHER DEVELOPMENTS 285

TABLE 475 NEXTEER AUTOMOTIVE: COMPANY OVERVIEW 286

TABLE 476 NEXTEER AUTOMOTIVE: PRODUCTS OFFERED 287

TABLE 477 NEXTEER AUTOMOTIVE: PRODUCT LAUNCHES/DEVELOPMENTS 288

TABLE 478 NEXTEER AUTOMOTIVE: DEALS 289

TABLE 479 NEXTEER AUTOMOTIVE: EXPANSIONS 289

TABLE 480 HITACHI, LTD.: COMPANY OVERVIEW 292

TABLE 481 HITACHI, LTD.: PRODUCTS OFFERED 293

TABLE 482 HITACHI, LTD.: PRODUCT LAUNCHES/DEVELOPMENTS 294

TABLE 483 HITACHI, LTD.: DEALS 294

TABLE 484 HL MANDO CORP.: COMPANY OVERVIEW 297

TABLE 485 HL MANDO CORP.: PRODUCTS OFFERED 298

TABLE 486 HL MANDO CORP.: DEALS 299

TABLE 487 HL MANDO CORP.: OTHER DEVELOPMENTS 300

TABLE 488 JTEKT CORPORATION: COMPANY OVERVIEW 301

TABLE 489 JTEKT CORPORATION: PRODUCTS OFFERED 302

TABLE 490 JTEKT CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS 302

TABLE 491 JTEKT CORPORATION: DEALS 303

TABLE 492 JTEKT CORPORATION: EXPANSIONS 303

TABLE 493 JTEKT CORPORATION: OTHER DEVELOPMENTS 304

TABLE 494 THYSSENKRUPP AG: COMPANY OVERVIEW 305

TABLE 495 THYSSENKRUPP AG: PRODUCTS OFFERED 306

TABLE 496 THYSSENKRUPP AG: DEALS 306

TABLE 497 FICOSA INTERNATIONAL SA: COMPANY OVERVIEW 307

TABLE 498 FICOSA INTERNATIONAL SA: PRODUCTS OFFERED 308

TABLE 499 KONGSBERG AUTOMOTIVE: COMPANY OVERVIEW 309

TABLE 500 KONGSBERG AUTOMOTIVE: PRODUCTS/S OFFERED 310

TABLE 501 KONGSBERG AUTOMOTIVE: OTHER DEVELOPMENTS 311

TABLE 502 CURTISS-WRIGHT CORPORATION: COMPANY OVERVIEW 312

TABLE 503 CURTISS-WRIGHT CORPORATION: PRODUCTS OFFERED 313

TABLE 504 CURTIS-WRIGHT CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS 314

TABLE 505 CURTIS-WRIGHT CORPORATION: DEALS 315

TABLE 506 CURTIS-WRIGHT CORPORATION: EXPANSIONS 316

TABLE 507 CURTIS-WRIGHT CORPORATION: OTHER DEVELOPMENTS 316

TABLE 508 SCHAEFFLER TECHNOLOGIES AG & CO. KG: COMPANY OVERVIEW 317

TABLE 509 KSR INTERNATIONAL INC.: COMPANY OVERVIEW 318

TABLE 510 CTS CORPORATION: COMPANY OVERVIEW 319

TABLE 511 HYUNDAI MOBIS: COMPANY OVERVIEW 320

TABLE 512 FORVIA: COMPANY OVERVIEW 321

TABLE 513 NIDEC CORPORATION: COMPANY OVERVIEW 322

TABLE 514 NISSAN CORPORATION: COMPANY OVERVIEW 323

TABLE 515 INFINEON TECHNOLOGIES AG: COMPANY OVERVIEW 324

TABLE 516 BREMBO S.P.A.: COMPANY OVERVIEW 325

TABLE 517 DENSO CORPORATION: COMPANY OVERVIEW 326

TABLE 518 NXP SEMICONDUCTORS NV: COMPANY OVERVIEW 327

TABLE 519 SNT MOTIV CO., LTD.: COMPANY OVERVIEW 328

TABLE 520 LEM EUROPE GMBH: COMPANY OVERVIEW 328

TABLE 521 ALLIED MOTION TECHNOLOGIES INC.: COMPANY OVERVIEW 329

TABLE 522 DURA AUTOMOTIVE SYSTEMS: COMPANY OVERVIEW 330

LIST OF FIGURES

FIGURE 1 DRIVE BY WIRE MARKET SEGMENTATION 35

FIGURE 2 MARKET SCENARIO 39

FIGURE 3 THROTTLE BY WIRE MARKET FOR ICE AND ELECTRIC VEHICLES,

2021–2032 (USD MILLION) 40

FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN DRIVE BY WIRE MARKET 40

FIGURE 5 DISRUPTIONS INFLUENCING GROWTH OF DRIVE BY WIRE MARKET 41

FIGURE 6 HIGH-GROWTH SEGMENTS IN DRIVE BY WIRE MARKET 41

FIGURE 7 EUROPE TO RECORD HIGHEST CAGR DURING FORECAST PERIOD 42

FIGURE 8 FAST-GROWING DRIVE BY WIRE APPLICATIONS TO CREATE HIGH-VALUE OPPORTUNITY POCKETS 43

FIGURE 9 THROTTLE BY WIRE SEGMENT TO BE DOMINANT DURING FORECAST PERIOD 44

FIGURE 10 PASSENGER CAR TO SURPASS OTHER SEGMENTS IN THROTTLE

BY WIRE MARKET DURING FORECAST PERIOD 44

FIGURE 11 BEV TO BE LARGEST SEGMENT IN THROTTLE BY WIRE MARKET

DURING FORECAST PERIOD 45

FIGURE 12 PASSENGER CAR TO BE LEADING SEGMENT IN BRAKE BY WIRE MARKET DURING FORECAST PERIOD 45

FIGURE 13 BEV TO HOLD HIGHEST SHARE IN BRAKE BY WIRE MARKET

DURING FORECAST PERIOD 46

FIGURE 14 PASSENGER CAR SEGMENT TO BE PREVALENT IN STEER BY WIRE MARKET DURING FORECAST PERIOD 46

FIGURE 15 BEV TO OUTPACE OTHER SEGMENTS IN STEER BY WIRE

MARKET DURING FORECAST PERIOD 47

FIGURE 16 TRUCK TO EXHIBIT FASTEST GROWTH IN SHIFT BY WIRE MARKET DURING FORECAST PERIOD 47

FIGURE 17 FCEV TO BE FASTEST-GROWING SEGMENT IN SHIFT BY WIRE

MARKET DURING FORECAST PERIOD 48

FIGURE 18 PASSENGER CAR SEGMENT TO LEAD PARK BY WIRE MARKET

DURING FORECAST PERIOD 48

FIGURE 19 FCEV TO REGISTER HIGHER CAGR THAN OTHER SEGMENTS IN PARK BY WIRE MARKET DURING FORECAST PERIOD 49

FIGURE 20 ASIA PACIFIC CAPTURED LARGEST MARKET SHARE IN 2025 49

FIGURE 21 DRIVE BY WIRE MARKET DYNAMICS 50

FIGURE 22 EVOLUTION OF NEXT-GENERATION E/E ARCHITECTURE 52

FIGURE 23 CURRENT AND PROJECTED NUMBERS OF OPERATIONAL AUTONOMOUS VEHICLES, 2022–2030 (UNITS) 56

FIGURE 24 ECOSYSTEM ANALYSIS 60

FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 63

FIGURE 26 SUPPLY CHAIN ANALYSIS 66

FIGURE 27 PATENT ANALYSIS 77

FIGURE 28 BRAKE BY WIRE MARKET, BY COMPONENT, 2025 VS. 2032 (USD MILLION) 105

FIGURE 29 PARK BY WIRE MARKET, BY EV TYPE, 2025 VS. 2032 (USD MILLION) 118

FIGURE 30 PARK BY WIRE MARKET, BY COMPONENT, 2025 VS. 2032 (USD MILLION) 126

FIGURE 31 STEER BY WIRE MARKET, BY ICE VEHICLE TYPE, 2025 VS. 2032 (USD MILLION) 155

FIGURE 32 STEER BY WIRE MARKET, BY EV TYPE, 2025 VS. 2032 (USD MILLION) 162

FIGURE 33 STEER BY WIRE MARKET, BY SENSOR TYPE, 2025 VS. 2032 (USD MILLION) 167

FIGURE 34 STEER BY WIRE MARKET, BY COMPONENT, 2025 VS. 2032 (USD MILLION) 171

FIGURE 35 THROTTLE BY WIRE MARKET, BY ICE VEHICLE TYPE,

2025 VS. 2032 (USD MILLION) 180

FIGURE 36 THROTTLE BY WIRE MARKET, BY EV TYPE, 2025 VS. 2032 (USD MILLION) 187

FIGURE 37 THROTTLE BY WIRE MARKET, BY SENSOR TYPE, 2025 VS. 2032 (USD MILLION) 191

FIGURE 38 THROTTLE BY WIRE MARKET, BY COMPONENT, 2025 VS. 2032 (USD MILLION) 195

FIGURE 39 L2 AUTONOMOUS VEHICLE DRIVE BY WIRE MARKET, BY APPLICATION,

2025 VS. 2032 (THOUSAND UNITS) 202

FIGURE 40 L3 AUTONOMOUS VEHICLE DRIVE BY WIRE MARKET, BY APPLICATION,

2025 VS. 2032 (THOUSAND UNITS) 203

FIGURE 41 L4/L5 AUTONOMOUS VEHICLE DRIVE BY WIRE MARKET, BY APPLICATION, 2025 VS. 2032 (THOUSAND UNITS) 203

FIGURE 42 DRIVE BY WIRE MARKET, BY REGION, 2025 VS. 2032 (USD MILLION) 208

FIGURE 43 ASIA PACIFIC: DRIVE BY WIRE MARKET, BY COUNTRY,

2025 VS. 2032 (USD MILLION) 210

FIGURE 44 EUROPE: DRIVE BY WIRE MARKET, BY COUNTRY, 2025 VS. 2032 (USD MILLION) 221

FIGURE 45 NORTH AMERICA: DRIVE BY WIRE MARKET, BY COUNTRY,

2025 VS. 2032 (USD MILLION) 236

FIGURE 46 REST OF THE WORLD: DRIVE BY WIRE MARKET, BY COUNTRY,

2025 VS. 2032 (USD MILLION) 243

FIGURE 47 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024 256

FIGURE 48 REVENUE ANALYSIS OF TOP LISTED PUBLIC PLAYERS, 2020−2024 258

FIGURE 49 COMPANY VALUATION (USD BILLION) 258

FIGURE 50 FINANCIAL METRICS (EV/EBITDA) 259

FIGURE 51 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024 260

FIGURE 52 COMPANY FOOTPRINT 261

FIGURE 53 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024 264

FIGURE 54 ROBERT BOSCH GMBH: COMPANY SNAPSHOT 272

FIGURE 55 CONTINENTAL AG: COMPANY SNAPSHOT 277

FIGURE 56 ZF FRIEDRICHSHAFEN AG: COMPANY SNAPSHOT 282

FIGURE 57 NEXTEER AUTOMOTIVE: COMPANY SNAPSHOT 287

FIGURE 58 HITACHI, LTD.: COMPANY SNAPSHOT 293

FIGURE 59 HL MANDO CORP.: COMPANY SNAPSHOT 298

FIGURE 60 JTEKT CORPORATION: COMPANY SNAPSHOT 301

FIGURE 61 THYSSENKRUPP AG: COMPANY SNAPSHOT 305

FIGURE 62 FICOSA INTERNATIONAL SA: COMPANY SNAPSHOT 307

FIGURE 63 KONGSBERG AUTOMOTIVE: COMPANY SNAPSHOT 310

FIGURE 64 CURTISS-WRIGHT CORPORATION: COMPANY SNAPSHOT 313

FIGURE 65 RESEARCH DESIGN 331

FIGURE 66 RESEARCH DESIGN MODEL 332

FIGURE 67 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING 336

FIGURE 68 BOTTOM-UP APPROACH 337

FIGURE 69 TOP-DOWN APPROACH 338

FIGURE 70 DATA TRIANGULATION 339

FIGURE 71 FACTOR ANALYSIS FOR MARKET SIZING: DEMAND AND SUPPLY SIDES 341