Microfluidics Market - Global Forecast To 2030

Microfluidics Market by Product (Chip, Sensor, Valve, Pump, Needle), Material (Silicon, Polymer), Application [Diagnostics (Clinical, PoC), Research (Proteomics, Genomics, Cell), Therapeutics (Drug Delivery Wearables)], End User – Global forecast to 2030

マイクロ流体市場 - 製品(チップ、センサー、バルブ、ポンプ、ニードル)、材料(シリコン、ポリマー)、用途(診断(臨床、PoC)、研究(プロテオミクス、ゲノミクス、細胞)、治療(薬物送達ウェアラブル))、エンドユーザー - 2030年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年02月 |

| ページ数 | 326 |

| 図表数 | 385 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-13093 |

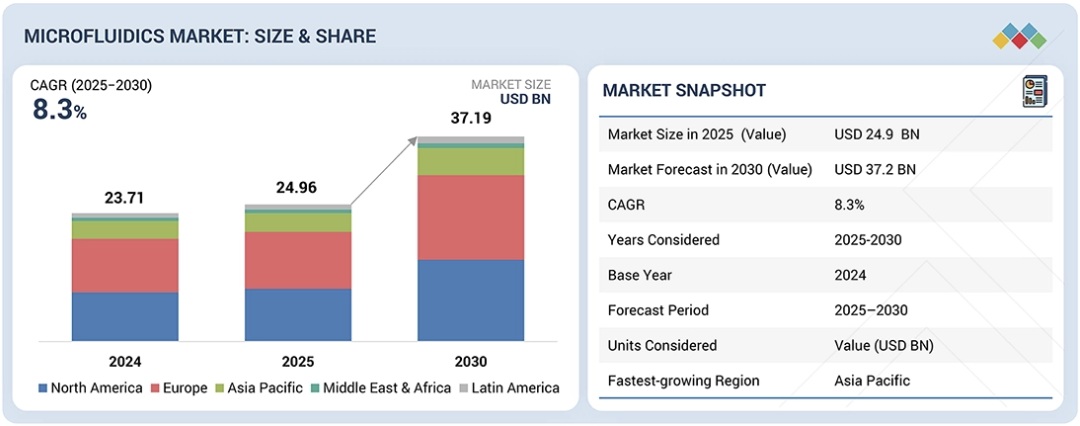

マイクロ流体(マイクロフルイディクス)市場は、2025年の249.6億米ドルから2030年には372億米ドルに達すると予測されており、予測期間中は年平均成長率(CAGR)8.3%で成長します。マイクロフルイディクス市場は、いくつかの重要な要因により拡大しています。ポイントオブケア診断の需要拡大は、その重要な要因の一つです。がんや糖尿病などの慢性疾患の増加に伴い、迅速かつ正確な診断の必要性が高まっており、医療分野におけるマイクロフルイディクスの応用が推進されています。さらに、薬物送達、臓器オンチップ技術、個別化医療における革新により、マイクロフルイディクスデバイスの利用が増加しています。さらに、プロテオミクスおよびゲノミクス関連研究の隆盛も、市場を牽引しています。

調査対象範囲

本レポートは、エンドユーザー、製品、アプリケーション、および地理的地域を網羅したセグメンテーションで構成されています。また、マイクロ流体(マイクロフルイディクス)市場の成長軌道に影響を与える主要な推進要因、制約要因、機会、課題についても網羅しています。本調査は、主要プレーヤーと競合状況に焦点を当て、市場の潜在力と課題に関する詳細な分析を関係者に提供しています。さらに、マイクロ市場は、世界のマイクロ流体セクターへの全体的な影響、成長パターン、および潜在力の観点から分析されています。本分析では、5つの主要地域に焦点を当て、市場セグメントの収益増加を予測しています。

レポート購入の主なメリット:

本調査の目的は、マイクロ流体(マイクロフルイディクス)市場への新規参入企業と既存参入企業の両方に対し、詳細かつ有益な情報を提供することで、投資の持続可能性を評価できるよう支援することです。重要な意思決定を支援するデータセットを提供します。徹底的なリスク評価を促進し、投資判断の指針となる可能性は、本レポートの大きなメリットの一つです。本調査では、エンドユーザーと地域別に市場を細分化することで、正確な分析と洞察を提供しています。また、重要なトレンド、障害、機会、推進要因も提供し、長期的な成長につながる戦略的意思決定に必要な情報を関係者に提供します。

本レポートは、以下の点について洞察を提供します。

- マイクロ流体デバイス市場の成長に影響を与える主要な推進要因、制約要因、機会、課題の分析:革新的な技術と慢性疾患の有病率の増加、機器コストの上昇と厳格な規制、診断センター数の増加。

- 製品開発/イノベーション:マイクロ流体デバイス業界における技術、研究開発ベンチャー、革新的な製品およびサービスの導入の概要。

- 市場開発:収益性の高い市場に関する詳細:本調査では、様々な地域におけるマイクロ流体デバイス事業を調査しています。

- 市場の多様化:マイクロ流体デバイス市場における革新的な製品、未調査地域、最近の開発状況、および支出に関する詳細な理解。

競合評価: Danaher Corporation (米国)、Illumina Inc. (米国)、biomerieux (フランス)、Thermo Fisher Scientific Inc. (米国)、Abbott laboratories (米国) などの有名企業の市場シェア、提供サービス、製品、採用している主要戦略の詳細な分析。

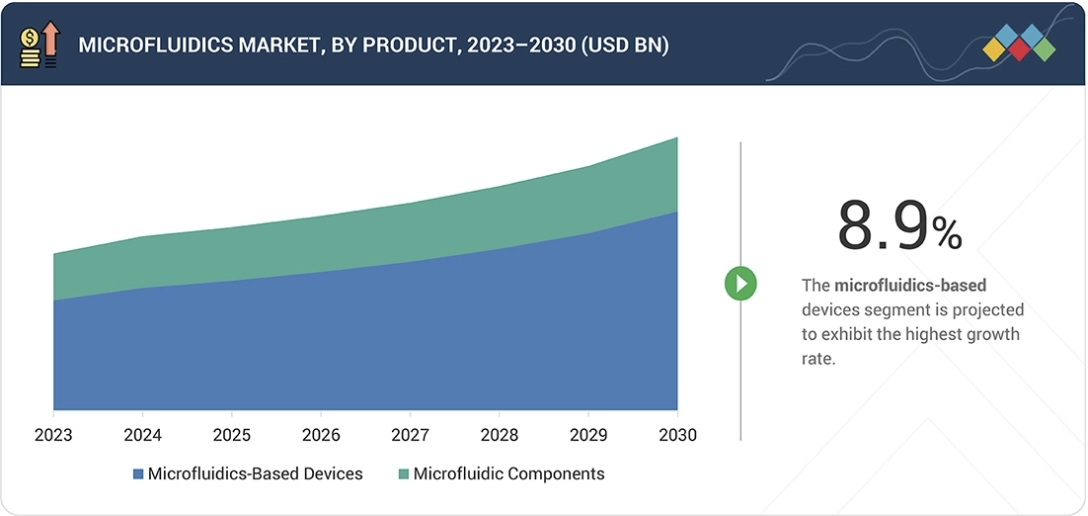

Report Description

The Microfluidics market is projected to reach USD 37.2 Billion by 2030 from USD 24.96 billion in 2025, growing at a CAGR of 8.3% during the forecast period. The microfluidics market is expanding due to a number of important factors. The growing requirement for point-of-care diagnostics is one of the important factors. The necessity for fast and accurate diagnosis has risen due to the increase in chronic diseases like cancer and diabetes, which is propelling the application of microfluidics in healthcare. Furthermore, the use of microfluidic devices is increasing due to innovations in drug delivery, organ-on-a-chip technology, and personalized medicine. Additionally, the market is driven by the rise in proteomics and genomics-associated research.

Microfluidics Market – Global Forecast To 2030

“Polymers to account for the largest market share in 2024.”

The microfluidics market is propelled by polymers because of their low costs, ease of production and adaptability. Microfluidic device manufacturing often requires polymers such as polydimethylsiloxane (PDMS), polymethyl methacrylate (PMMA), and cyclic olefin copolymer (COC). These polymers are helpful in the fabrication of microfluidic channels and structures. Moreover, as compared to conventional materials like silicon or glass, polymers are easier to mold and also enable cheaper manufacturing costs. The biocompatible property of polymers makes them useful for a variety of medical applications, including medication delivery, lab-on-a-chip, and diagnostics. Due to such advantages, polymers account for the largest share in the microfluidics market.

“Hospital and Diagnostic Centers to register the highest growth rate in the market during the forecast period.”

Various significant factors are propelling the growth of hospitals and diagnostic centers in the microfluidics industry. One important factor is the rising requirement for point-of-care diagnostics, as they provides quick, on-site testing that improves patient outcomes. Microfluidics play a major role in this positive outcome as it offers faster and precise result . Moreover, the requirement for efficacious diagnostics in clinical settings has risen due to the increase in infectious diseases like COVID-19. These equipment decreases cost, expedites testing methods, and improve precision and accuracy of diagnosis.

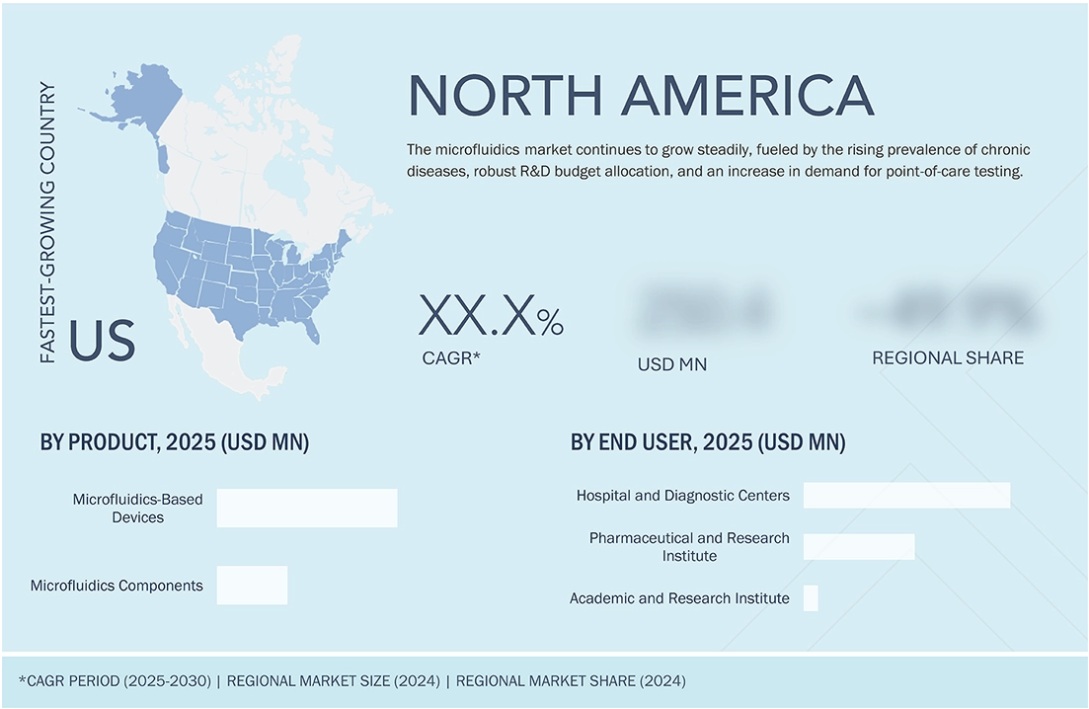

Microfluidics Market – Global Forecast To 2030 – region

“Asia Pacific to register highest growth rate in the market during the forecast period.”

The highest CAGR was recorded in the APAC region during the forecast period of 2024- 2029. Asia Pacific includes India, China, Japan, Australia, South Korea, and RoAPAC. Demand for novel technologies is also on the rise, particularly in China, India, and Japan. The government is striving hard to develop research activities in academic setups. In this regard, the Japanese government has distributed USD 64.26 billion toward its 6th Science and Technology Basic Plan for 2021-2025. The rising incidence of chronic and infectious diseases, coupled with increased interest in early diagnosis and preventive care, has enhanced the utilization of microfluidic devices by tremendous bounds. The pharmaceutical and life sciences sectors, which are fast growing in the region, are also driving the research and development efforts, hence increasing the demand for microfluidics.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1–30%, Tier 2–42%, and Tier 3– 28%

- By Designation: C-level– 10%, Director-level–14%, and Others–76%

- By Region: North America–40%, Europe-30%, Asia Pacific–22%, Rest of the World -8%.

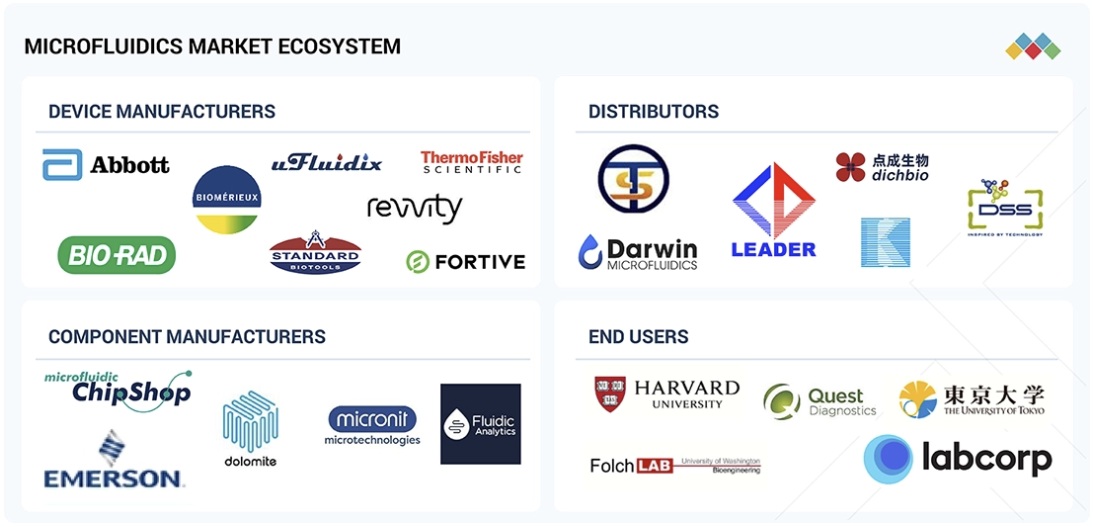

Prominent players in this market are Abbott laboratories (US) , Agilent Technologies, Inc. (US), Aignep S.P.A (Italy), biomerieux (France), BD(US), Bio-Rad laboratories, Inc (US), Danaher Corporation (US), Illumina Inc. (US), Parker Hannifin Coporation (US), Thermo Fisher Scientific Inc. (US), SMC Corporation (Japan), Idex Corporation (US), Fortive Corporation (US), Perkinelmer, Inc. (US), F.Hoffmann-LA Roche Ltd (Switzerland), Standard Biotools Inc. (US), Quidelortho Corporation (US), Hologic Inc. (US), Dolomite Microfluidics (UK) and Elveflow (France).

Microfluidics Market – Global Forecast To 2030 – ecosystem

Research Coverage

The report comprise segmentation that covers end users, products, applications, and geographic regions. It also covers the key drivers, restraints, opportunities, and challenges impacting the growth trajectory of the microfluidics market. The research offers stakeholders an in-depth analysis of market potential and challenges, with a focus on major players and competitive landscapes. Moreover, micromarkets are analysed as per their overall impact to the global microfluidics sector, growth patterns, and potential. The analysis forecasts rise in market segment revenues, focusing on five key regions.

Key Benefits of Buying the Report:

The purpose of this research is to assist both new and existing players in the microfluidics market to assess the sustainability of their investments by providing detailed and knowledgeable information. It offers a dataset to assist in making key decisions. This report’s potential to facilitate thorough risk evaluation and provide direction for investment decisions is one of its major benefit. Market segmentation according to end-users and geographical areas is provided in the study, that provides precise analysis and insights. It also provide significant trends, obstacles, opportunities, and drivers, giving stakeholders the information they require to make strategic decisions that help in their long-term growth.

The report provides the insights on the following pointers:

- Analysis of the key drivers, restraints, opportunities, and challenges affecting the microfluidics market growth: Innovative technology and increase in prevalence of chronic diseases ; increased cost of devices and stringent regulations ; increase in number of diagnostic centers.

- Product Development/Innovation: Overview of technologies, research & development ventures and launch of innovative product & service for the microfluidics industry.

- Market Development: Details associated with profitable markets: this research studies the microfluidics business in various geographical regions.

- Market Diversification: In-depth understanding of innovative products, unexamined regions, recent developments, and expenditures in the microfluidics market.

- Competitive Assessment: Detailed analysis of market share, services and products offered and key strategies adopted by prominent players such as Danaher Corporation (US), Illumina Inc. (US), biomerieux (France), Thermo Fisher Scientific Inc. (US) and Abbott laboratories (US).

Table of Contents

1 INTRODUCTION 30

1.1 STUDY OBJECTIVES 30

1.2 MARKET DEFINITION 30

1.2.1 INCLUSIONS AND EXCLUSIONS 31

1.3 STUDY SCOPE 32

1.3.1 MARKET COVERED 32

1.3.2 YEARS CONSIDERED 33

1.4 CURRENCY CONSIDERED 33

1.5 STAKEHOLDERS 33

1.6 SUMMARY OF CHANGES 34

2 EXECUTIVE SUMMARY 36

2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS 36

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 38

2.3 DISRUPTIVE TRENDS IN MICROFLUIDICS MARKET 39

2.4 HIGH GROWTH SEGMENTS 40

3 PREMIUM INSIGHTS 42

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MICROFLUIDICS MARKET 42

3.2 MICROFLUIDICS MARKET, BY REGION 43

3.3 MICROFLUIDICS MARKET, BY COUNTRY AND END USER 44

3.4 GEOGRAPHIC SNAPSHOT OF MICROFLUIDICS MARKET 45

4 MARKET OVERVIEW 46

4.1 INTRODUCTION 46

4.2 MARKET DYNAMICS 46

4.2.1 DRIVERS 47

4.2.1.1 Integration of microfluidics with 3D printing 47

4.2.2 E-HEALTH AND DIGITAL DIAGNOSTICS DRIVING MICROFLUIDICS ADOPTION 48

4.2.2.1 Increasing prevalence of chronic diseases fueling POC testing 49

4.2.2.2 Increasing focus on data precision and accuracy 50

4.2.3 RESTRAINTS 50

4.2.3.1 Regulatory and clinical validation barriers 50

4.2.3.2 Material selection for microfluidic devices 50

4.2.4 OPPORTUNITIES 51

4.2.4.1 Advancing microfluidics for real-time food safety monitoring 51

4.2.4.2 Rising demand for organ-on-a-chip platforms in precision medicine 52

4.2.5 CHALLENGES 52

4.2.5.1 Limited adoption of microfluidic devices 52

4.2.5.2 Technical and operational limitations 53

4.3 UNMET NEEDS 53

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 54

4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS 54

5 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, AND AI ADOPTION 56

5.1 KEY TECHNOLOGIES 56

5.1.1 MICROFABRICATION 56

5.1.2 MATERIAL SCIENCE 57

5.1.3 OPTOFLUIDICS 58

5.2 COMPLEMENTARY TECHNOLOGIES 58

5.2.1 MICRO-ELECTRO-MECHANICAL SYSTEMS (MEMS) 58

5.2.2 WEARABLE & IMPLANTABLE MICROFLUIDICS 58

5.3 PATENT ANALYSIS 59

5.3.1 INNOVATIONS AND PATENT REGISTRATIONS 60

5.4 FUTURE APPLICATIONS 61

5.5 IMPACT OF AI/GENAI ON MICROFLUIDICS MARKET 61

5.5.1 TOP USE CASES AND MARKET POTENTIAL 61

5.5.2 BEST PRACTICES IN MICROFLUIDICS 62

5.5.3 CASE STUDIES OF AI IMPLEMENTATION IN MICROFLUIDICS MARKET 63

5.5.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 63

5.5.5 CLIENT’S READINESS TO ADOPT GENERATIVE AI IN MICROFLUIDICS MARKET 64

5.6 SUCCESS STORIES AND REAL-WORLD APPLICATIONS 64

5.7 REGULATORY LANDSCAPE 65

5.7.1 NORTH AMERICA 65

5.7.1.1 US 65

5.7.1.2 Canada 66

5.7.2 EUROPE 67

5.7.3 ASIA PACIFIC 68

5.7.3.1 Japan 68

5.7.3.2 China 69

5.7.3.3 India 70

5.7.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 71

6 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 73

6.1 BUYER STAKEHOLDERS & BUYING EVALUATION CRITERIA 73

6.1.1 KEY STAKEHOLDERS IN BUYING PROCESS 73

6.1.2 BUYING CRITERIA 74

6.2 DECISION-MAKING PROCESS 75

6.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 75

6.4 UNMET NEEDS FROM END USERS 76

7 INDUSTRY TRENDS 78

7.1 PORTER’S FIVE FORCES ANALYSIS 78

7.1.1 THREAT OF NEW ENTRANTS 79

7.1.2 THREAT OF SUBSTITUTES 79

7.1.3 BARGAINING POWER OF SUPPLIERS 79

7.1.4 BARGAINING POWER OF BUYERS 79

7.1.5 INTENSITY OF COMPETITIVE RIVALRY 79

7.2 MACROECONOMIC INDICATORS 80

7.2.1 INTRODUCTION 80

7.2.2 HEALTHCARE EXPENDITURE AND INFRASTRUCTURE OUTLOOK 80

7.2.3 MACROECONOMIC OUTLOOK FOR NORTH AMERICA 80

7.2.4 MACROECONOMIC OUTLOOK FOR EUROPE 81

7.2.5 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC 81

7.2.6 MACROECONOMIC OUTLOOK FOR LATIN AMERICA 82

7.2.7 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA 83

7.2.8 TRENDS IN GLOBAL MICROFLUIDICS INDUSTRY 83

7.3 VALUE CHAIN ANALYSIS 84

7.3.1 RESEARCH & DEVELOPMENT 84

7.3.2 RAW MATERIAL PROCUREMENT & MANUFACTURING 84

7.3.3 MARKETING & SALES, DISTRIBUTION, AND POST-SALES SERVICES 84

7.4 ECOSYSTEM ANALYSIS 85

7.5 PRICING ANALYSIS 87

7.5.1 AVERAGE SELLING PRICE TREND, BY REGION 87

7.5.2 AVERAGE SELLING PRICE OF MICROFLUIDIC COMPONENTS, BY KEY PLAYERS 89

7.6 TRADE DATA ANALYSIS 90

7.6.1 IMPORT DATA (HS CODE 3822) 90

7.6.2 EXPORT DATA (HS CODE 3822) 91

7.7 KEY CONFERENCES & EVENTS, 2026-2027 91

7.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 92

7.9 INVESTMENT & FUNDING SCENARIO 93

7.10 CASE STUDY ANALYSIS 94

7.10.1 CASE STUDY 1: MULTIPLEX MICROFLUIDIC CIRCUIT FOR BLOOD VESSEL-ON-A-CHIP PERFUSION USING FLOWEZ 94

7.10.2 CASE STUDY 2: MICROFLUIDIC SYSTEM FOR ROBOTIC HAND PLAYING NINTENDO 95

7.10.3 CASE STUDY 3: 3D-PRINTED MICROFLUIDIC DEVICES USING POLYJET TECHNOLOGY 95

7.11 IMPACT OF 2025 US TARIFFS ON MICROFLUIDICS MARKET 96

7.11.1 INTRODUCTION 96

7.11.2 KEY TARIFF RATES 96

7.11.3 PRICE IMPACT ANALYSIS 97

7.11.4 IMPACT ON COUNTRY/REGION 97

7.11.5 IMPACT ON END-USE INDUSTRIES 98

8 MICROFLUIDICS MARKET, BY PRODUCT 99

8.1 INTRODUCTION 100

8.2 MICROFLUIDICS-BASED DEVICES 100

8.2.1 HIGH UPTAKE OF POC TESTING AND ORGAN-ON-A-CHIP SYSTEMS TO DRIVE MARKET 100

8.2.2 POLYMERASE CHAIN REACTION (PCR) SYSTEMS 101

8.2.3 MICROFLUIDIC CAPILLARY ELECTROPHORESIS 102

8.2.4 NEXT-GENERATION SEQUENCING (NGS) SYSTEMS 103

8.2.5 DROPLET & PARTICLE PRODUCTION SYSTEMS 104

8.3 OTHER DEVICES 105

8.4 MICROFLUIDIC COMPONENTS 106

8.4.1 CRUCIAL FOR CONTINUOUS HEALTH MONITORING 106

8.4.2 MICROFLUIDIC COMPONENTS, BY TYPE 106

8.4.2.1 Microfluidic chips 107

8.4.2.2 Flow & pressure sensors 109

8.4.2.3 Flow & pressure controllers 110

8.4.2.4 Microfluidic valves 111

8.4.2.5 Micropumps 112

8.4.2.6 Microneedles 112

8.4.2.7 Other microfluidic components 113

8.4.3 MICROFLUIDIC COMPONENTS, BY MATERIAL 114

8.4.3.1 Silicon 114

8.4.3.2 Polymethyl methacrylate (PMMA) 115

8.4.3.3 Polydimethylsiloxane (PDMS) 116

8.4.3.4 Cyclic olefin copolymer (COC) 117

8.4.3.5 Glass 117

8.4.3.6 OTHER MATERIALS 118

9 MICROFLUIDICS MARKET, BY APPLICATION 119

9.1 INTRODUCTION 120

9.2 IN VITRO DIAGNOSTICS (IVD) 120

9.2.1 CLINICAL DIAGNOSTICS 121

9.2.1.1 Growing focus on early disease detection to drive market 121

9.2.2 POINT-OF-CARE TESTING (POCT) 122

9.2.2.1 Increasing demand for decentralized infectious disease testing to drive market 122

9.2.3 VETERINARY DIAGNOSTICS 123

9.2.3.1 Rising demand for rapid, field-deployable veterinary diagnostics to drive market 123

9.3 THERAPEUTICS 124

9.3.1 DRUG DELIVERY 125

9.3.1.1 Ability to enable scalable production of polymer-based drug particles to drive market 125

9.3.2 WEARABLE 126

9.3.2.1 Ability to enable proactive management of hydration, metabolic status, and disease biomarkers to drive market 126

9.4 PHARMACEUTICAL & LIFE SCIENCE RESEARCH 127

9.4.1 LAB ANALYTICS 128

9.4.1.1 Proteomic analysis 129

9.4.1.1.1 Utilization of proteomes-on-a-chip devices for therapeutic development to drive market 129

9.4.1.2 Genomic analysis 130

9.4.1.2.1 High-throughput, cost-effective genomic analysis enabled by microfluidics 130

9.4.1.3 Cell-based assays 131

9.4.1.3.1 Microfluidic co-cultures enable precise, high-throughput modeling of complex tissues for drug testing and disease research 131

9.4.1.4 Capillary electrophoresis 132

9.4.1.4.1 Enables high-throughput, precise, and cost-efficient protein and nucleic acid analysis 132

9.4.2 MICRODISPENSING 133

9.4.2.1 Suitability for low-viscosity applications to support market growth 133

9.4.3 MICROREACTORS 134

9.4.3.1 Growing adoption of continuous flow synthesis in research & development to drive market 134

10 MICROFLUIDICS MARKET, BY END USER 135

10.1 INTRODUCTION 136

10.2 HOSPITALS & DIAGNOSTIC CENTERS 137

10.2.1 RISING DEPENDENCE ON RAPID MICROFLUIDIC MOLECULAR DIAGNOSTICS TO DRIVE GROWTH 137

10.3 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES 138

10.3.1 STRONG ADOPTION OF MICROFLUIDIC TECHNOLOGIES FOR PRECISE FORMULATION, NANOPARTICLE PRODUCTION, AND TOXICITY TESTING TO DRIVE GROWTH 138

10.4 ACADEMIC & RESEARCH INSTITUTES 139

10.4.1 INVESTMENTS IN BIOMEDICAL & LIFE SCIENCE RESEARCH TO DRIVE GROWTH 139

11 MICROFLUIDICS MARKET, BY REGION 141

11.1 INTRODUCTION 142

11.2 NORTH AMERICA 142

11.2.1 US 147

11.2.1.1 Expansion of applications beyond traditional diagnostics to drive market 147

11.2.2 CANADA 149

11.2.2.1 Government funding and collaborative ecosystems to support growth 149

11.3 EUROPE 151

11.3.1 GERMANY 155

11.3.1.1 Ongoing investments in semiconductors and microelectronics to drive market 155

11.3.2 FRANCE 157

11.3.2.1 Rising demand for advanced lab-on-chip and organ-on-chip solutions to drive market 157

11.3.3 UK 159

11.3.3.1 Rising cases of chronic diseases and increasing demand for POC testing to boost demand 159

11.3.4 ITALY 161

11.3.4.1 Shift toward cost-efficient microfluidic platforms for diagnostics, environmental testing, and advanced biomedical research to drive market 161

11.3.5 SPAIN 163

11.3.5.1 Increasing demand for accessible point-of-care and lab-on-chip solutions to drive market 163

11.3.6 REST OF EUROPE 165

11.4 ASIA PACIFIC 167

11.4.1 CHINA 172

11.4.1.1 Government support and strategic partnerships to drive market 172

11.4.2 JAPAN 174

11.4.2.1 Government support, innovation, and industry-academia collaboration to drive growth 174

11.4.3 INDIA 176

11.4.3.1 Growing biotech startup ecosystem and research from premier institutions to drive market 176

11.4.4 AUSTRALIA 178

11.4.4.1 Innovation ecosystem, R&D strength, and precision engineering to support growth 178

11.4.5 SOUTH KOREA 180

11.4.5.1 Advanced research, global partnerships, and next-gen technologies to drive market 180

11.4.6 REST OF ASIA PACIFIC 182

11.5 LATIN AMERICA 184

11.5.1 BRAZIL 188

11.5.1.1 Rising investment in healthtech and emphasis on molecular diagnostics to drive market 188

11.5.2 MEXICO 190

11.5.2.1 Growing demand for advanced diagnostics and biotech innovation to drive market 190

11.5.3 REST OF LATIN AMERICA 192

11.6 MIDDLE EAST & AFRICA 194

11.6.1 GCC COUNTRIES 199

11.6.1.1 Disease burden and healthcare modernization to drive market 199

11.6.2 REST OF MIDDLE EAST & AFRICA 200

12 COMPETITIVE LANDSCAPE 203

12.1 INTRODUCTION 203

12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 203

12.3 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MICROFLUIDICS MARKET 203

12.4 REVENUE ANALYSIS, 2022–2024 204

12.5 MARKET SHARE ANALYSIS, 2024 205

12.6 RANKING OF KEY MARKET PLAYERS 207

12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 207

12.7.1 STARS 207

12.7.2 EMERGING LEADERS 207

12.7.3 PERVASIVE PLAYERS 208

12.7.4 PARTICIPANTS 208

12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 209

12.7.5.1 Company footprint 209

12.7.5.2 Region footprint 209

12.7.5.3 Product footprint 210

12.7.5.4 Application footprint 211

12.7.5.5 End user footprint 212

12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 212

12.8.1 PROGRESSIVE COMPANIES 212

12.8.2 RESPONSIVE COMPANIES 213

12.8.3 DYNAMIC COMPANIES 213

12.8.4 STARTING BLOCKS 213

12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 214

12.8.5.1 List of key startup/SME players 214

12.8.5.2 Competitive benchmarking of key startups/SMEs 214

12.9 COMPANY VALUATION & FINANCIAL METRICS 215

12.9.1 FINANCIAL METRICS 215

12.9.2 COMPANY VALUATION 216

12.10 BRAND/PRODUCT COMPARATIVE ANALYSIS 216

12.11 COMPETITIVE SCENARIO 217

12.11.1 PRODUCT LAUNCHES & APPROVALS 217

12.11.2 DEALS 218

12.11.3 EXPANSIONS 219

12.11.4 OTHER DEVELOPMENTS 219

13 COMPANY PROFILES 220

13.1 KEY PLAYERS 220

13.1.1 DANAHER CORPORATION 220

13.1.1.1 Business overview 220

13.1.1.2 Products offered 221

13.1.1.3 Recent developments 222

13.1.1.3.1 Deals 222

13.1.1.3.2 Expansions 223

13.1.1.4 MnM view 223

13.1.1.4.1 Key strengths 223

13.1.1.4.2 Strategic choices 223

13.1.1.4.3 Weaknesses & competitive threats 223

13.1.2 ILLUMINA, INC. 224

13.1.2.1 Business overview 224

13.1.2.2 Products offered 225

13.1.2.3 Recent developments 226

13.1.2.3.1 Product launches 226

13.1.2.3.2 Deals 226

13.1.2.4 MnM view 228

13.1.2.4.1 Key strengths 228

13.1.2.4.2 Strategic choices 228

13.1.2.4.3 Weaknesses & competitive threats 228

13.1.3 BIOMÉRIEUX 229

13.1.3.1 Business overview 229

13.1.3.2 Products offered 230

13.1.3.3 Recent developments 231

13.1.3.3.1 Product launches/approvals 231

13.1.3.3.2 Deals 232

13.1.3.4 MnM view 232

13.1.3.4.1 Key strengths 232

13.1.3.4.2 Strategic choices 232

13.1.3.4.3 Weaknesses & competitive threats 232

13.1.4 THERMO FISHER SCIENTIFIC INC. 233

13.1.4.1 Business overview 233

13.1.4.2 Products offered 234

13.1.4.3 Recent developments 235

13.1.4.3.1 Product launches/approvals 235

13.1.4.3.2 Deals 237

13.1.4.4 MnM view 237

13.1.4.4.1 Key strengths 237

13.1.4.4.2 Strategic choices 237

13.1.4.4.3 Weaknesses & competitive threats 237

13.1.5 ABBOTT LABORATORIES 238

13.1.5.1 Business overview 238

13.1.5.2 Products offered 239

13.1.5.3 MnM view 240

13.1.5.3.1 Key strengths 240

13.1.5.3.2 Strategic choices 240

13.1.5.3.3 Weaknesses & competitive threats 240

13.1.6 PARKER HANNIFIN CORP 241

13.1.6.1 Business overview 241

13.1.6.2 Products offered 242

13.1.7 SMC CORPORATION 245

13.1.7.1 Business overview 245

13.1.7.2 Products offered 246

13.1.7.3 Recent developments 248

13.1.7.3.1 Product launches 248

13.1.8 IDEX CORPORATION 251

13.1.8.1 Business overview 251

13.1.8.2 Products offered 252

13.1.8.3 Recent developments 254

13.1.8.3.1 Deals 254

13.1.9 FORTIVE 255

13.1.9.1 Business overview 255

13.1.9.2 Products offered 256

13.1.10 REVVITY, INC. 257

13.1.10.1 Business overview 257

13.1.10.2 Products offered 258

13.1.10.3 Recent developments 258

13.1.10.3.1 Deals 258

13.1.11 AGILENT TECHNOLOGIES, INC. 259

13.1.11.1 Business overview 259

13.1.11.2 Products offered 260

13.1.11.3 Recent developments 261

13.1.11.3.1 Product approvals/launches 261

13.1.11.3.2 Deals 262

13.1.11.3.3 Expansions 263

13.1.12 BIO-RAD LABORATORIES, INC. 264

13.1.12.1 Business overview 264

13.1.12.2 Products offered 265

13.1.12.3 Recent developments 266

13.1.12.3.1 Product launches 266

13.1.12.3.2 Deals 267

13.1.13 BECTON, DICKINSON AND COMPANY 268

13.1.13.1 Business overview 268

13.1.13.2 Products offered 269

13.1.13.3 Recent developments 270

13.1.13.3.1 Product launches/approvals 270

13.1.13.3.2 Deals 272

13.1.13.3.3 Expansions 273

13.1.14 F. HOFFMANN-LA ROCHE LTD. 274

13.1.14.1 Business overview 274

13.1.14.2 Products offered 275

13.1.14.3 Recent developments 275

13.1.14.3.1 Product launches/approvals 275

13.1.14.3.2 Deals 276

13.1.15 STANDARD BIOTOOLS 277

13.1.15.1 Business overview 277

13.1.15.2 Products offered 278

13.1.15.3 Recent developments 279

13.1.15.3.1 Product launches/approvals 279

13.1.15.3.2 Deals 279

13.1.16 QUIDELORTHO CORPORATION 280

13.1.16.1 Business overview 280

13.1.16.2 Products offered 281

13.1.16.3 Recent developments 282

13.1.16.3.1 Product approvals 282

13.1.16.3.2 Deals 282

13.1.16.3.3 Expansions 283

13.1.17 AIGNEP S.P.A. 284

13.1.17.1 Business overview 284

13.1.17.2 Products offered 284

13.1.17.3 Recent developments 285

13.1.17.3.1 Deals 285

13.1.18 DOLOMITE MICROFLUIDICS 286

13.1.18.1 Business overview 286

13.1.18.2 Products offered 286

13.1.18.3 Recent developments 289

13.1.18.3.1 Product launches 289

13.1.18.3.2 Deals 289

13.1.18.3.3 Other developments 290

13.1.19 ELVEFLOW 291

13.1.19.1 Business overview 291

13.1.19.2 Products offered 291

13.2 OTHER PLAYERS 293

13.2.1 NANOSTRING TECHNOLOGIES 293

13.2.2 INNOVATIVE BIOCHIPS, LLC 294

13.2.3 FLUIDIC ANALYTICS 295

13.2.4 HORIBA 296

13.2.5 MICRONIT B.V. 297

13.2.6 EMULATE, INC. 298

13.2.7 SPHERE BIO 299

13.2.8 ZEON CORPORATION 300

13.2.9 QIAGEN N.V. 301

14 RESEARCH METHODOLOGY 302

14.1 RESEARCH DATA 302

14.2 RESEARCH DESIGN 303

14.2.1 SECONDARY RESEARCH 303

14.2.1.1 Objectives of secondary research 304

14.2.1.2 Key data from secondary sources 305

14.2.2 PRIMARY RESEARCH 305

14.2.2.1 Objectives of primary research 306

14.2.2.2 Key industry insights 307

14.3 MARKET SIZE ESTIMATION METHODOLOGY 308

14.3.1 BOTTOM-UP APPROACH 309

14.3.1.1 Approach 1: Company revenue estimation approach 310

14.3.1.2 Approach 2: Customer-based market estimation 310

14.3.1.3 Approach 3: Primary interviews 311

14.3.2 TOP-DOWN APPROACH 311

14.4 MARKET BREAKDOWN AND DATA TRIANGULATION 313

14.5 MARKET SHARE ASSESSMENT 314

14.6 RESEARCH ASSUMPTIONS 314

14.7 RESEARCH LIMITATIONS 314

14.8 RISK ASSESSMENT 315

15 APPENDIX 316

15.1 DISCUSSION GUIDE 316

15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 322

15.3 CUSTOMIZATION OPTIONS 324

15.4 RELATED REPORTS 324

15.5 AUTHOR DETAILS 325

List of Tables

TABLE 1 MICROFLUIDICS MARKET: INCLUSIONS AND EXCLUSIONS 31

TABLE 2 MICROFLUIDICS MARKET: IMPACT ANALYSIS OF MARKET DYNAMICS 47

TABLE 3 DIFFERENT FABRICATION MATERIALS USED 48

TABLE 4 COMMERCIAL MICROFLUIDIC PCR ASSAYS FOR TB 49

TABLE 5 COMPARISON OF KEY MATERIALS USED IN MICROFLUIDIC DEVICES 51

TABLE 6 MICROFLUIDICS MARKET: UNMET NEEDS 53

TABLE 7 STRATEGIC MOVES BY TIER 1, TIER 2, AND TIER 3 PLAYERS IN MICROFLUIDICS MARKET 55

TABLE 8 MICROFLUIDICS MARKET: INNOVATIONS AND PATENT REGISTRATIONS,

2022–2024 60

TABLE 9 KEY COMPANIES IMPLEMENTING AI/GENAI IN MICROFLUIDICS MARKET 63

TABLE 10 US: CLASSIFICATION OF MICROFLUIDICS TECHNOLOGY-ASSOCIATED DIAGNOSTIC DEVICES 65

TABLE 11 CANADA: TIME, COST, AND COMPLEXITY OF REGISTRATION 66

TABLE 12 EUROPE: CLASSIFICATION OF MICROFLUIDICS ASSOCIATED WITH IVD DEVICES 67

TABLE 13 JAPAN: TIME, COST, AND COMPLEXITY OF REGISTRATION 69

TABLE 14 CHINA: TIME, COST, AND COMPLEXITY OF REGISTRATION 70

TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 71

TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 71

TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 71

TABLE 18 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 72

TABLE 19 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 72

TABLE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MICROFLUIDIC COMPONENTS, BY MATERIAL 73

TABLE 21 KEY BUYING CRITERIA FOR MICROFLUIDIC COMPONENTS, BY MATERIAL 74

TABLE 22 MICROFLUIDICS MARKET: UNMET NEED ANALYSIS 76

TABLE 23 MICROFLUIDICS MARKET: IMPACT OF PORTER’S FIVE FORCES 78

TABLE 24 NORTH AMERICA: MACROECONOMIC OUTLOOK 80

TABLE 25 EUROPE: MACROECONOMIC OUTLOOK 81

TABLE 26 ASIA PACIFIC: MACROECONOMIC INDICATORS 82

TABLE 27 LATIN AMERICA: MACROECONOMIC OUTLOOK 82

TABLE 28 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK 83

TABLE 29 MICROFLUIDICS MARKET: ROLE IN ECOSYSTEM 86

TABLE 30 AVERAGE SELLING PRICE RANGE OF MICROFLUIDICS COMPONENTS, BY REGION, 2023–2025 (USD THOUSAND) 89

TABLE 31 AVERAGE SELLING PRICE TREND OF MICROFLUIDIC COMPONENTS, BY KEY PLAYERS, 2024 (USD) 90

TABLE 32 IMPORT DATA FOR HS CODE 3822, BY COUNTRY, 2020–2024 (USD THOUSAND) 90

TABLE 33 EXPORT DATA FOR HS CODE 3822, BY COUNTRY, 2020–2024 (USD THOUSAND) 91

TABLE 34 MICROFLUIDICS MARKET: KEY CONFERENCES & EVENTS (2026-2027) 91

TABLE 35 CASE STUDY 1: MULTIPLEX MICROFLUIDIC CIRCUIT FOR BLOOD VESSEL-ON-A-CHIP PERFUSION USING FLOWEZ 94

TABLE 36 CASE STUDY 2: MICROFLUIDIC SYSTEM FOR ROBOTIC HAND PLAYING NINTENDO 95

TABLE 37 CASE STUDY 3: 3D-PRINTED MICROFLUIDIC DEVICES USING POLYJET TECHNOLOGY 95

TABLE 38 US ADJUSTED RECIPROCAL TARIFF RATES 96

TABLE 39 TARIFF-INDUCED PRICE INCREASES FOR HEALTHCARE PRODUCTS 97

TABLE 40 MICROFLUIDICS MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 100

TABLE 41 MICROFLUIDICS MARKET, BY REGION, 2023–2030 (USD MILLION) 100

TABLE 42 MICROFLUIDICS-BASED DEVICES MARKET, BY REGION,

2023–2030 (USD MILLION) 101

TABLE 43 MICROFLUIDICS-BASED DEVICES MARKET, BY DEVICE, 2023–2030 (USD MILLION) 101

TABLE 44 PCR SYSTEMS MARKET, BY REGION, 2023–2030 (USD MILLION) 102

TABLE 45 MICROFLUIDIC CAPILLARY ELECTROPHORESIS MARKET, BY REGION,

2023–2030 (USD MILLION) 103

TABLE 46 NEXT-GENERATION SEQUENCING SYSTEMS MARKET, BY REGION,

2023–2030 (USD MILLION) 104

TABLE 47 DROPLET & PARTICLE PRODUCTION SYSTEMS MARKET, BY REGION,

2023–2030 (USD MILLION) 105

TABLE 48 OTHER DEVICES MARKET, BY REGION, 2023–2030 (USD MILLION) 105

TABLE 49 MICROFLUIDIC COMPONENTS MARKET, BY TYPE, 2023–2030 (USD MILLION) 106

TABLE 50 MICROFLUIDIC COMPONENTS MARKET, BY REGION, 2023–2030 (USD MILLION) 107

TABLE 51 MICROFLUIDIC CHIPS OFFERED BY KEY PLAYERS 107

TABLE 52 MICROFLUIDIC CHIPS MARKET, BY REGION, 2023–2030 (USD MILLION) 109

TABLE 53 FLOW & PRESSURE SENSORS MARKET, BY REGION, 2023–2030 (USD MILLION) 110

TABLE 54 FLOW & PRESSURE CONTROLLERS MARKET, BY REGION,

2023–2030 (USD MILLION) 111

TABLE 55 MICROFLUIDIC VALVES MARKET, BY REGION, 2023–2030 (USD MILLION) 111

TABLE 56 MICROPUMPS MARKET, BY REGION, 2023–2030 (USD MILLION) 112

TABLE 57 MICRONEEDLES OFFERED BY KEY PLAYERS 113

TABLE 58 MICRONEEDLES MARKET, BY REGION, 2023–2030 (USD MILLION) 113

TABLE 59 OTHER MICROFLUIDIC COMPONENTS MARKET, BY REGION,

2023–2030 (USD MILLION) 113

TABLE 60 MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL, 2023–2030 (USD MILLION) 114

TABLE 61 MATERIAL-BASED MICROFLUIDIC COMPONENTS MARKET, BY REGION,

2023–2030 (USD MILLION) 114

TABLE 62 SILICON-BASED MICROFLUIDIC COMPONENTS MARKET, BY REGION,

2023–2030 (USD MILLION) 115

TABLE 63 PMMA-BASED MICROFLUIDIC COMPONENTS MARKET, BY REGION,

2023–2030 (USD MILLION) 116

TABLE 64 PDMS-BASED MICROFLUIDIC COMPONENTS MARKET, BY REGION,

2023–2030 (USD MILLION) 116

TABLE 65 COC-BASED MICROFLUIDIC COMPONENTS MARKET, BY REGION,

2023–2030 (USD MILLION) 117

TABLE 66 GLASS-BASED MICROFLUIDIC COMPONENTS MARKET, BY REGION,

2023–2030 (USD MILLION) 118

TABLE 67 OTHER MATERIALS MARKET, BY REGION, 2023–2030 (USD MILLION) 118

TABLE 68 MICROFLUIDICS MARKET, BY APPLICATION, 2023–2030 (USD MILLION) 120

TABLE 69 MICROFLUIDICS MARKET, BY REGION, 2023–2030 (USD MILLION) 120

TABLE 70 MICROFLUIDICS MARKET FOR IVD APPLICATION, BY TYPE,

2023–2030 (USD MILLION) 121

TABLE 71 MICROFLUIDICS MARKET FOR IVD APPLICATION, BY REGION,

2023–2030 (USD MILLION) 121

TABLE 72 MICROFLUIDICS MARKET FOR CLINICAL DIAGNOSTICS, BY REGION,

2023–2030 (USD MILLION) 122

TABLE 73 MICROFLUIDICS MARKET FOR POCT, BY REGION, 2023–2030 (USD MILLION) 123

TABLE 74 MICROFLUIDICS MARKET FOR VETERINARY DIAGNOSTICS, BY REGION,

2023–2030 (USD MILLION) 124

TABLE 75 MICROFLUIDICS MARKET FOR THERAPEUTICS, BY TYPE,

2023–2030 (USD MILLION) 124

TABLE 76 MICROFLUIDICS MARKET FOR THERAPEUTICS, BY REGION,

2023–2030 (USD MILLION) 125

TABLE 77 COMPARISON OF MICROFLUIDIC VS. TRADITIONAL API ENCAPSULATION 125

TABLE 78 MICROFLUIDICS MARKET FOR DRUG DELIVERY, BY REGION,

2023–2030 (USD MILLION) 126

TABLE 79 OVERVIEW OF WEARABLE MICROFLUIDIC PLATFORMS ACROSS BIOFLUIDS: TARGETS, APPLICATIONS, DETECTION STRATEGIES, AND TRANSLATIONAL STATUS 126

TABLE 80 MICROFLUIDICS MARKET FOR WEARABLE DEVICES, BY REGION,

2023–2030 (USD MILLION) 127

TABLE 81 MICROFLUIDICS MARKET FOR PHARMACEUTICAL & LIFE SCIENCE RESEARCH,

BY TYPE, 2023–2030 (USD MILLION) 128

TABLE 82 MICROFLUIDICS MARKET FOR PHARMACEUTICAL & LIFE SCIENCE RESEARCH,

BY REGION, 2023–2030 (USD MILLION) 128

TABLE 83 MICROFLUIDICS MARKET FOR LAB ANALYTICS, BY TYPE,

2023–2030 (USD MILLION) 129

TABLE 84 MICROFLUIDICS MARKET FOR LAB ANALYTICS, BY REGION,

2023–2030 (USD MILLION) 129

TABLE 85 MICROFLUIDICS MARKET FOR PROTEOMIC ANALYSIS, BY REGION,

2023–2030 (USD MILLION) 130

TABLE 86 MICROFLUIDICS MARKET FOR GENOMIC ANALYSIS, BY REGION,

2023–2030 (USD MILLION) 131

TABLE 87 KEY ORGAN-ON-CHIP APPLICATIONS 131

TABLE 88 MICROFLUIDICS MARKET FOR CELL-BASED ASSAYS, BY REGION,

2023–2030 (USD MILLION) 132

TABLE 89 MICROFLUIDICS MARKET FOR CAPILLARY ELECTROPHORESIS, BY REGION,

2023–2030 (USD MILLION) 133

TABLE 90 MICROFLUIDICS MARKET FOR MICRODISPENSING, BY REGION,

2023–2030 (USD MILLION) 134

TABLE 91 MICROFLUIDICS MARKET FOR MICROREACTORS, BY REGION,

2023–2030 (USD MILLION) 134

TABLE 92 MICROFLUIDICS MARKET, BY END USER, 2023–2030 (USD MILLION) 136

TABLE 93 MICROFLUIDICS MARKET, BY REGION, 2023–2030 (USD MILLION) 136

TABLE 94 MICROFLUIDICS MARKET FOR HOSPITALS & DIAGNOSTIC CENTERS, BY REGION, 2023–2030 (USD MILLION) 137

TABLE 95 MICROFLUIDICS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2023–2030 (USD MILLION) 138

TABLE 96 LEADING MICROFLUIDICS RESEARCH INSTITUTES, BY AREA OF INTEREST 139

TABLE 97 MICROFLUIDICS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2023–2030 (USD MILLION) 140

TABLE 98 MICROFLUIDICS MARKET, BY REGION, 2023–2030 (USD MILLION) 142

TABLE 99 NORTH AMERICA: MICROFLUIDICS MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 143

TABLE 100 NORTH AMERICA: MICROFLUIDICS MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 144

TABLE 101 NORTH AMERICA: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 144

TABLE 102 NORTH AMERICA: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 144

TABLE 103 NORTH AMERICA: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 145

TABLE 104 NORTH AMERICA: MICROFLUIDICS MARKET, BY APPLICATION,

2023–2030 (USD MILLION) 145

TABLE 105 NORTH AMERICA: MICROFLUIDICS MARKET FOR IVD APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION) 145

TABLE 106 NORTH AMERICA: MICROFLUIDICS MARKET FOR PHARMACEUTICAL & LIFE SCIENCE RESEARCH, BY TYPE, 2023–2030 (USD MILLION) 146

TABLE 107 NORTH AMERICA: MICROFLUIDICS MARKET FOR LAB ANALYTICS, BY TYPE,

2023–2030 (USD MILLION) 146

TABLE 108 NORTH AMERICA: MICROFLUIDICS MARKET FOR THERAPEUTICS, BY TYPE,

2023–2030 (USD MILLION) 146

TABLE 109 NORTH AMERICA: MICROFLUIDICS MARKET, BY END USER,

2023–2030 (USD MILLION) 147

TABLE 110 US: MICROFLUIDICS MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 147

TABLE 111 US: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 148

TABLE 112 US: MICROFLUIDIC COMPONENTS MARKET, BY TYPE, 2023–2030 (USD MILLION) 148

TABLE 113 US: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 149

TABLE 114 CANADA: MICROFLUIDICS MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 150

TABLE 115 CANADA: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 150

TABLE 116 CANADA: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 150

TABLE 117 CANADA: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 151

TABLE 118 EUROPE: MICROFLUIDICS MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 151

TABLE 119 EUROPE: MICROFLUIDICS MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 152

TABLE 120 EUROPE: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 152

TABLE 121 EUROPE: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 152

TABLE 122 EUROPE: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 153

TABLE 123 EUROPE: MICROFLUIDICS MARKET, BY APPLICATION, 2023–2030 (USD MILLION) 153

TABLE 124 EUROPE: MICROFLUIDICS MARKET FOR IVD APPLICATIONS, BY TYPE,

2023–2030 (USD MILLION) 153

TABLE 125 EUROPE: MICROFLUIDICS MARKET FOR PHARMACEUTICAL & LIFE SCIENCE RESEARCH, BY TYPE, 2023–2030 (USD MILLION) 154

TABLE 126 EUROPE: MICROFLUIDICS MARKET FOR LAB ANALYTICS, BY TYPE,

2023–2030 (USD MILLION) 154

TABLE 127 EUROPE: MICROFLUIDICS MARKET FOR THERAPEUTICS, BY TYPE,

2023–2030 (USD MILLION) 154

TABLE 128 EUROPE: MICROFLUIDICS MARKET, BY END USER, 2023–2030 (USD MILLION) 155

TABLE 129 GERMANY: MICROFLUIDICS MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 156

TABLE 130 GERMANY: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 156

TABLE 131 GERMANY: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 156

TABLE 132 GERMANY: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 157

TABLE 133 FRANCE: MICROFLUIDICS MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 157

TABLE 134 FRANCE: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 158

TABLE 135 FRANCE: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 158

TABLE 136 FRANCE: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 159

TABLE 137 UK: MICROFLUIDICS MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 159

TABLE 138 UK: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 160

TABLE 139 UK: MICROFLUIDIC COMPONENTS MARKET, BY TYPE, 2023–2030 (USD MILLION) 160

TABLE 140 UK: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 161

TABLE 141 ITALY: MICROFLUIDICS MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 162

TABLE 142 ITALY: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 162

TABLE 143 ITALY: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 162

TABLE 144 ITALY: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 163

TABLE 145 SPAIN: MICROFLUIDICS MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 163

TABLE 146 SPAIN: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 164

TABLE 147 SPAIN: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 164

TABLE 148 SPAIN: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 165

TABLE 149 REST OF EUROPE: MICROFLUIDICS MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 165

TABLE 150 REST OF EUROPE: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 166

TABLE 151 REST OF EUROPE: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 166

TABLE 152 REST OF EUROPE: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 167

TABLE 153 ASIA PACIFIC: MICROFLUIDICS MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 168

TABLE 154 ASIA PACIFIC: MICROFLUIDICS MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 169

TABLE 155 ASIA PACIFIC: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 169

TABLE 156 ASIA PACIFIC: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 169

TABLE 157 ASIA PACIFIC: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 170

TABLE 158 ASIA PACIFIC: MICROFLUIDICS MARKET, BY APPLICATION,

2023–2030 (USD MILLION) 170

TABLE 159 ASIA PACIFIC: MICROFLUIDICS MARKET FOR IVD APPLICATIONS, BY TYPE,

2023–2030 (USD MILLION) 170

TABLE 160 ASIA PACIFIC: MICROFLUIDICS MARKET FOR PHARMACEUTICAL & LIFE SCIENCE RESEARCH, BY TYPE, 2023–2030 (USD MILLION) 171

TABLE 161 ASIA PACIFIC: MICROFLUIDICS MARKET FOR LAB ANALYTICS, BY TYPE,

2023–2030 (USD MILLION) 171

TABLE 162 ASIA PACIFIC: MICROFLUIDICS MARKET FOR THERAPEUTICS, BY TYPE,

2023–2030 (USD MILLION) 171

TABLE 163 ASIA PACIFIC: MICROFLUIDICS MARKET, BY END USER, 2023–2030 (USD MILLION) 172

TABLE 164 CHINA: MICROFLUIDICS MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 172

TABLE 165 CHINA: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 173

TABLE 166 CHINA: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 173

TABLE 167 CHINA: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 174

TABLE 168 JAPAN: MICROFLUIDICS MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 175

TABLE 169 JAPAN: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 175

TABLE 170 JAPAN: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 175

TABLE 171 JAPAN: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 176

TABLE 172 INDIA: MICROFLUIDICS MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 176

TABLE 173 INDIA: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 177

TABLE 174 INDIA: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 177

TABLE 175 INDIA: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 178

TABLE 176 AUSTRALIA: MICROFLUIDICS MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 178

TABLE 177 AUSTRALIA: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 179

TABLE 178 AUSTRALIA: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 179

TABLE 179 AUSTRALIA: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 180

TABLE 180 SOUTH KOREA: MICROFLUIDICS MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 181

TABLE 181 SOUTH KOREA: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 181

TABLE 182 SOUTH KOREA: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 181

TABLE 183 SOUTH KOREA: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 182

TABLE 184 REST OF ASIA PACIFIC: MICROFLUIDICS MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 182

TABLE 185 REST OF ASIA PACIFIC: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE, 2023–2030 (USD MILLION) 183

TABLE 186 REST OF ASIA PACIFIC: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 183

TABLE 187 REST OF ASIA PACIFIC: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL, 2023–2030 (USD MILLION) 184

TABLE 188 LATIN AMERICA: MICROFLUIDICS MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 184

TABLE 189 LATIN AMERICA: MICROFLUIDICS MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 185

TABLE 190 LATIN AMERICA: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 185

TABLE 191 LATIN AMERICA: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 185

TABLE 192 LATIN AMERICA: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 186

TABLE 193 LATIN AMERICA: MICROFLUIDICS MARKET, BY APPLICATION,

2023–2030 (USD MILLION) 186

TABLE 194 LATIN AMERICA: MICROFLUIDICS MARKET FOR IVD APPLICATIONS, BY TYPE, 2023–2030 (USD MILLION) 186

TABLE 195 LATIN AMERICA: MICROFLUIDICS MARKET FOR PHARMACEUTICAL & LIFE SCIENCE RESEARCH, BY TYPE, 2023–2030 (USD MILLION) 187

TABLE 196 LATIN AMERICA: MICROFLUIDICS MARKET FOR LAB ANALYTICS, BY TYPE,

2023–2030 (USD MILLION) 187

TABLE 197 LATIN AMERICA: MICROFLUIDICS MARKET FOR THERAPEUTICS, BY TYPE,

2023–2030 (USD MILLION) 187

TABLE 198 LATIN AMERICA: MICROFLUIDICS MARKET, BY END USER,

2023–2030 (USD MILLION) 188

TABLE 199 BRAZIL: MICROFLUIDICS MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 188

TABLE 200 BRAZIL: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 189

TABLE 201 BRAZIL: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 189

TABLE 202 BRAZIL: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 190

TABLE 203 MEXICO: MICROFLUIDICS MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 191

TABLE 204 MEXICO: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 191

TABLE 205 MEXICO: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 191

TABLE 206 MEXICO: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 192

TABLE 207 REST OF LATIN AMERICA: MICROFLUIDICS MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 192

TABLE 208 REST OF LATIN AMERICA: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE, 2023–2030 (USD MILLION) 193

TABLE 209 REST OF LATIN AMERICA: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 193

TABLE 210 REST OF LATIN AMERICA: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL, 2023–2030 (USD MILLION) 194

TABLE 211 MIDDLE EAST & AFRICA: MICROFLUIDICS MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 195

TABLE 212 MIDDLE EAST & AFRICA: MICROFLUIDICS MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 195

TABLE 213 MIDDLE EAST & AFRICA: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE, 2023–2030 (USD MILLION) 195

TABLE 214 MIDDLE EAST & AFRICA: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 196

TABLE 215 MIDDLE EAST & AFRICA: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL, 2023–2030 (USD MILLION) 196

TABLE 216 MIDDLE EAST & AFRICA: MICROFLUIDICS MARKET, BY APPLICATION,

2023–2030 (USD MILLION) 197

TABLE 217 MIDDLE EAST & AFRICA: MICROFLUIDICS MARKET FOR IVD APPLICATIONS,

BY TYPE, 2023–2030 (USD MILLION) 197

TABLE 218 MIDDLE EAST & AFRICA: MICROFLUIDICS MARKET FOR PHARMACEUTICAL & LIFE SCIENCE RESEARCH, BY TYPE, 2023–2030 (USD MILLION) 197

TABLE 219 MIDDLE EAST & AFRICA: MICROFLUIDICS MARKET FOR LAB ANALYTICS, BY TYPE, 2023–2030 (USD MILLION) 198

TABLE 220 MIDDLE EAST & AFRICA: MICROFLUIDICS MARKET FOR THERAPEUTICS, BY TYPE, 2023–2030 (USD MILLION) 198

TABLE 221 MIDDLE EAST & AFRICA: MICROFLUIDICS MARKET, BY END USER,

2023–2030 (USD MILLION) 198

TABLE 222 GCC COUNTRIES: MICROFLUIDICS MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 199

TABLE 223 GCC COUNTRIES: MICROFLUIDIC-BASED DEVICES MARKET, BY DEVICE,

2023–2030 (USD MILLION) 199

TABLE 224 GCC COUNTRIES: MICROFLUIDIC COMPONENTS MARKET, BY TYPE,

2023–2030 (USD MILLION) 200

TABLE 225 GCC COUNTRIES: MICROFLUIDIC COMPONENTS MARKET, BY MATERIAL,

2023–2030 (USD MILLION) 200

TABLE 226 REST OF MIDDLE EAST & AFRICA: MICROFLUIDICS MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 201

TABLE 227 REST OF MIDDLE EAST & AFRICA: MICROFLUIDIC-BASED DEVICES MARKET,

BY DEVICE, 2023–2030 (USD MILLION) 201

TABLE 228 REST OF MIDDLE EAST & AFRICA: MICROFLUIDIC COMPONENTS MARKET, BY TYPE, 2023–2030 (USD MILLION) 202

TABLE 229 REST OF MIDDLE EAST & AFRICA: MICROFLUIDIC COMPONENTS MARKET,

BY MATERIAL, 2023–2030 (USD MILLION) 202

TABLE 230 OVERVIEW OF STRATEGIES DEPLOYED BY KEY MANUFACTURING COMPANIES 203

TABLE 231 MICROFLUIDICS MARKET: DEGREE OF COMPETITION 206

TABLE 232 MICROFLUIDICS MARKET: REGION FOOTPRINT 209

TABLE 233 MICROFLUIDICS MARKET: PRODUCT FOOTPRINT 210

TABLE 234 MICROFLUIDICS MARKET: APPLICATION FOOTPRINT 211

TABLE 235 MICROFLUIDICS MARKET: END USER FOOTPRINT 212

TABLE 236 MICROFLUIDICS MARKET: LIST OF KEY STARTUP/SME PLAYERS 214

TABLE 237 MICROFLUIDICS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES 214

TABLE 238 MICROFLUIDICS MARKET: PRODUCT LAUNCHES & APPROVALS,

JANUARY 2022−NOVEMBER 2025 217

TABLE 239 MICROFLUIDICS MARKET: DEALS, JANUARY 2022–NOVEMBER 2025 218

TABLE 240 MICROFLUIDICS MARKET: EXPANSIONS, JANUARY 2022–NOVEMBER 2025 219

TABLE 241 MICROFLUIDICS MARKET: OTHER DEVELOPMENTS,

JANUARY 2022−NOVEMBER 2025 219

TABLE 242 DANAHER CORPORATION: COMPANY OVERVIEW 220

TABLE 243 DANAHER CORPORATION: PRODUCTS OFFERED 221

TABLE 244 DANAHER CORPORATION: DEALS 222

TABLE 245 DANAHER CORPORATION: EXPANSIONS 223

TABLE 246 ILLUMINA, INC.: COMPANY OVERVIEW 224

TABLE 247 ILLUMINA, INC.: PRODUCTS OFFERED 225

TABLE 248 ILLUMINA, INC.: PRODUCT LAUNCHES 226

TABLE 249 ILLUMINA, INC.: DEALS 226

TABLE 250 BIOMÉRIEUX: COMPANY OVERVIEW 229

TABLE 251 BIOMÉRIEUX: PRODUCTS OFFERED 230

TABLE 252 BIOMÉRIEUX: PRODUCT LAUNCHES/APPROVALS 231

TABLE 253 BIOMÉRIEUX: DEALS 232

TABLE 254 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW 233

TABLE 255 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED 234

TABLE 256 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES/APPROVALS 235

TABLE 257 THERMO FISHER SCIENTIFIC INC.: DEALS 237

TABLE 258 ABBOTT LABORATORIES: COMPANY OVERVIEW 238

TABLE 259 ABBOTT LABORATORIES: PRODUCTS OFFERED 239

TABLE 260 PARKER HANNIFIN CORP: COMPANY OVERVIEW 241

TABLE 261 PARK HANNIFIN CORP: PRODUCTS OFFERED 242

TABLE 262 SMC CORPORATION: COMPANY OVERVIEW 245

TABLE 263 SMC CORPORATION: PRODUCTS OFFERED 246

TABLE 264 SMC CORPORATION: PRODUCT LAUNCHES 248

TABLE 265 IDEX CORPORATION: COMPANY OVERVIEW 251

TABLE 266 IDEX CORPORATION: PRODUCTS OFFERED 252

TABLE 267 IDEX CORPORATION: DEALS 254

TABLE 268 FORTIVE: COMPANY OVERVIEW 255

TABLE 269 FORTIVE: PRODUCTS OFFERED 256

TABLE 270 REVVITY, INC.: COMPANY OVERVIEW 257

TABLE 271 REVVITY, INC.: PRODUCTS OFFERED 258

TABLE 272 REVVITY, INC.: DEALS 258

TABLE 273 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW 259

TABLE 274 AGILENT TECHNOLOGIES, INC.: PRODUCTS OFFERED 260

TABLE 275 AGILENT TECHNOLOGIES, INC. : PRODUCT APPROVALS/LAUNCHES 261

TABLE 276 AGILENT TECHNOLOGIES, INC.: DEALS 262

TABLE 277 AGILENT TECHNOLOGIES, INC.: EXPANSIONS 263

TABLE 278 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW 264

TABLE 279 BIO-RAD LABORATORIES, INC.: PRODUCTS OFFERED 265

TABLE 280 BIO-RAD LABORATORIES, INC.: PRODUCT LAUNCHES 266

TABLE 281 BIO-RAD LABORATORIES, INC.: DEALS 267

TABLE 282 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW 268

TABLE 283 BECTON, DICKINSON AND COMPANY: PRODUCTS OFFERED 269

TABLE 284 BECTON, DICKINSON AND COMPANY: PRODUCT LAUNCHES/APPROVALS, 270

TABLE 285 BECTON, DICKINSON AND COMPANY: DEALS 272

TABLE 286 BECTON, DICKINSON AND COMPANY: EXPANSIONS 273

TABLE 287 F. HOFFMANN-LA ROCHE LTD.: COMPANY OVERVIEW 274

TABLE 288 F. HOFFMANN-LA ROCHE LTD.: PRODUCTS OFFERED 275

TABLE 289 F. HOFFMANN-LA ROCHE LTD.: PRODUCT LAUNCHES/APPROVALS, 275

TABLE 290 F. HOFFMANN-LA ROCHE LTD.: DEALS 276

TABLE 291 STANDARD BIOTOOLS: COMPANY OVERVIEW 277

TABLE 292 STANDARD BIOTOOLS: PRODUCTS OFFERED 278

TABLE 293 STANDARD BIOTOOLS: PRODUCT LAUNCHES/APPROVALS 279

TABLE 294 STANDARD BIOTOOLS: DEALS 279

TABLE 295 QUIDELORTHO CORPORATION: COMPANY OVERVIEW 280

TABLE 296 QUIDELORTHO CORPORATION: PRODUCTS OFFERED 281

TABLE 297 QUIDELORTHO CORPORATION: PRODUCT APPROVALS 282

TABLE 298 QUIDELORTHO CORPORATION: DEALS 282

TABLE 299 QUIDELORTHO CORPORATION: EXPANSIONS 283

TABLE 300 AIGNEP S.P.A.: COMPANY OVERVIEW 284

TABLE 301 AIGNEP S.P.A.: PRODUCTS OFFERED 284

TABLE 302 AIGNEP S.P.A.: DEALS 285

TABLE 303 DOLOMITE MICROFLUIDICS: COMPANY OVERVIEW 286

TABLE 304 DOLOMITE MICROFLUIDICS: PRODUCTS OFFERED 286

TABLE 305 DOLOMITE MICROFLUIDICS: PRODUCT LAUNCHES 289

TABLE 306 DOLOMITE MICROFLUIDICS: DEALS 289

TABLE 307 DOLOMITE MICROFLUIDICS: OTHER DEVELOPMENTS 290

TABLE 308 ELVEFLOW: COMPANY OVERVIEW 291

TABLE 309 ELVEFLOW: PRODUCTS OFFERED 291

TABLE 310 NANOSTRING TECHNOLOGIES: COMPANY OVERVIEW 293

TABLE 311 INNOVATIVE BIOCHIPS, LLC: COMPANY OVERVIEW 294

TABLE 312 FLUIDIC ANALYTICS: COMPANY OVERVIEW 295

TABLE 313 HORIBA: COMPANY OVERVIEW 296

TABLE 314 MICRONIT B.V.: COMPANY OVERVIEW 297

TABLE 315 EMULATE, INC.: COMPANY OVERVIEW 298

TABLE 316 SPHERE BIO: COMPANY OVERVIEW 299

TABLE 317 ZEON CORPORATION: COMPANY OVERVIEW 300

TABLE 318 QIAGEN N.V.: COMPANY OVERVIEW 301

List of Figures

FIGURE 1 MICROFLUIDICS MARKET SEGMENTATION 32

FIGURE 2 MARKET SCENARIO 37

FIGURE 3 GLOBAL MICROFLUIDICS MARKET, 2022–2030 37

FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN MICROFLUIDICS MARKET, 2020–2025 38

FIGURE 5 DISRUPTIONS INFLUENCING GROWTH OF MICROFLUIDICS MARKET 39

FIGURE 6 HIGH-GROWTH SEGMENTS IN MICROFLUIDICS MARKET, 2025–2030 40

FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN MICROFLUIDICS MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD 41

FIGURE 8 RISING ADOPTION OF LAB-ON-A-CHIP TECHNOLOGIES TO DRIVE MARKET 42

FIGURE 9 NORTH AMERICA TO COMMAND LARGEST MARKET SHARE IN 2030 43

FIGURE 10 NORTH AMERICA AND HOSPITALS & DIAGNOSTIC CENTERS ACCOUNTED FOR LARGEST MARKET SHARES IN 2024 44

FIGURE 11 CHINA TO REGISTER FASTEST GROWTH FROM 2025 TO 2030 45

FIGURE 12 MICROFLUIDICS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES 46

FIGURE 13 PATENT ANALYSIS FOR MICROFLUIDICS MARKET,

JANUARY 2015–NOVEMBER 2025 59

FIGURE 14 KEY AI USE CASES IN MICROFLUIDICS MARKET 62

FIGURE 15 US: REGULATORY PROCESS FOR TESTING DEVICES ASSOCIATED WITH MICROFLUIDICS TECHNOLOGY 66

FIGURE 16 CANADA: REGULATORY PROCESS FOR MICROFLUIDICS-ASSOCIATED IVD DEVICES 67

FIGURE 17 EUROPE: REGULATORY PROCESS FOR IVD DEVICES 68

FIGURE 18 INDIA: REGULATORY PROCESS FOR IVD DEVICES 70

FIGURE 19 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS FOR MICROFLUIDIC COMPONENTS, BY MATERIAL 73

FIGURE 20 KEY BUYING CRITERIA FOR MICROFLUIDIC COMPONENTS, BY MATERIAL 74

FIGURE 21 MICROFLUIDICS MARKET: UNMET NEED ANALYSIS 77

FIGURE 22 MICROFLUIDICS MARKET: PORTER’S FIVE FORCES ANALYSIS 78

FIGURE 23 MICROFLUIDICS MARKET: VALUE CHAIN ANALYSIS 85

FIGURE 24 MICROFLUIDICS MARKET: ECOSYSTEM ANALYSIS 86

FIGURE 25 AVERAGE SELLING PRICE TREND OF MICROFLUIDIC COMPONENTS, BY REGION, 2023–2025 (USD) 88

FIGURE 26 AVERAGE SELLING PRICE TREND OF MICROFLUIDIC COMPONENTS, BY KEY PLAYERS, 2024 (USD) 89

FIGURE 27 MICROFLUIDICS MARKET: TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 92

FIGURE 28 MICROFLUIDICS MARKET: FUNDING AND NUMBER OF DEALS,

2019–2023 (USD MILLION) 93

FIGURE 29 NUMBER OF DEALS IN MICROFLUIDICS MARKET, BY KEY PLAYERS, 2019–2023 93

FIGURE 30 VALUE OF DEALS IN MICROFLUIDICS MARKET, BY KEY PLAYERS,

2019–2023 (USD) 94

FIGURE 31 NORTH AMERICA: MICROFLUIDICS MARKET SNAPSHOT 143

FIGURE 32 ASIA PACIFIC: MICROFLUIDICS MARKET SNAPSHOT 168

FIGURE 33 REVENUE ANALYSIS OF KEY PLAYERS IN MICROFLUIDICS MARKET (2022−2024) 205

FIGURE 34 MARKET SHARE ANALYSIS OF KEY PLAYERS IN MICROFLUIDICS MARKET (2024) 205

FIGURE 35 RANKING OF KEY PLAYERS IN MICROFLUIDICS MARKET, 2024 207

FIGURE 36 MICROFLUIDICS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024 208

FIGURE 37 MICROFLUIDICS MARKET: COMPANY FOOTPRINT 209

FIGURE 38 MICROFLUIDICS MARKET: COMPANY EVALUATION MATRIX

(STARTUPS/SMES), 2024 213

FIGURE 39 EV/EBITDA OF KEY VENDORS, 2025 215

FIGURE 40 YEAR-TO-DATE (YTD) PRICE, TOTAL RETURN, AND 5-YEAR STOCK BETA OF KEY VENDORS, 2025 216

FIGURE 41 MICROFLUIDICS MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS 216

FIGURE 42 DANAHER CORPORATION: COMPANY SNAPSHOT 221

FIGURE 43 ILLUMINA, INC.: COMPANY SNAPSHOT 225

FIGURE 44 BIOMÉRIEUX: COMPANY SNAPSHOT 230

FIGURE 45 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT 234

FIGURE 46 ABBOTT LABORATORIES: COMPANY SNAPSHOT 239

FIGURE 47 PARKER HANNIFIN CORP: COMPANY SNAPSHOT 242

FIGURE 48 SMC CORPORATION: COMPANY SNAPSHOT (2024) 245

FIGURE 49 IDEX CORPORATION: COMPANY SNAPSHOT 252

FIGURE 50 FORTIVE: COMPANY SNAPSHOT 256

FIGURE 51 REVVITY, INC.: COMPANY SNAPSHOT 257

FIGURE 52 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT 260

FIGURE 53 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT 265

FIGURE 54 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT 269

FIGURE 55 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT 274

FIGURE 56 STANDARD BIOTOOLS: COMPANY SNAPSHOT 278

FIGURE 57 QUIDELORTHO CORPORATION: COMPANY SNAPSHOT 281

FIGURE 58 MICROFLUIDICS MARKET: RESEARCH DATA 302

FIGURE 59 MICROFLUIDICS MARKET: RESEARCH DESIGN 303

FIGURE 60 PRIMARY SOURCES 306

FIGURE 61 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION 307

FIGURE 62 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS 308

FIGURE 63 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING 309

FIGURE 64 MICROFLUIDICS MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ESTIMATION) 310

FIGURE 65 MICROFLUIDICS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH 311

FIGURE 66 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH 312

FIGURE 67 DATA TRIANGULATION 313