Environmental Monitoring Market - Global Forecast To 2030

Environmental Monitoring Market by Product Type (Sensors, Indoor Monitors, Outdoor Monitors), Sampling Method (Continuous, Active, Passive, Intermittent), Component, Application, End User, and Region - Global Forecast to 2030

環境モニタリング市場 - 製品タイプ(センサー、屋内モニター、屋外モニター)、サンプリング方法(連続、アクティブ、パッシブ、間欠)、コンポーネント、用途、エンドユーザー、地域別 - 2030年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年02月 |

| ページ数 | 374 |

| 図表数 | 348 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-13407 |

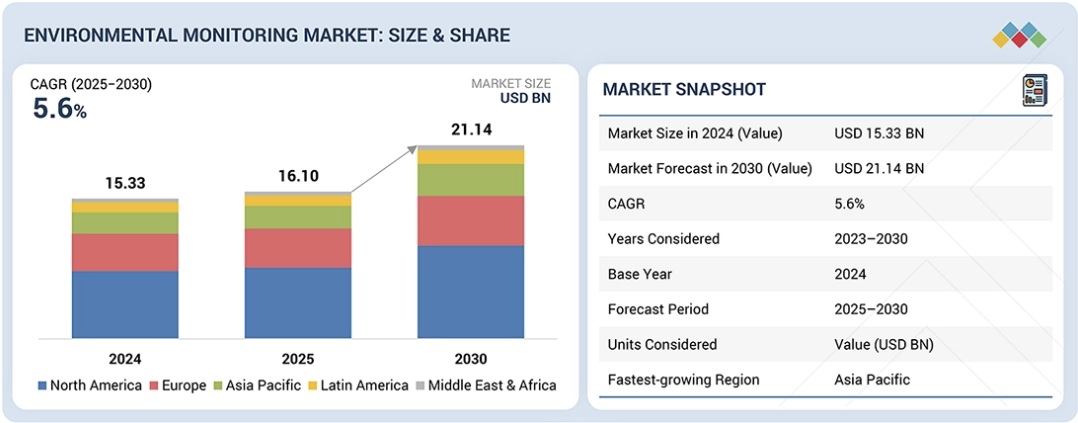

世界の環境モニタリング市場は、2025年の161億米ドルから2030年には211億4000万米ドルに達し、年平均成長率(CAGR)5.6%で成長すると予測されています。厳格な政府による汚染モニタリング基準、PM2.5レベルの上昇による大気質の悪化、そしてこれらのレベルに起因する健康への懸念の高まりといった要因が、環境モニタリング市場の成長を牽引しています。

調査範囲

本レポートは、環境モニタリング市場を製品、コンポーネント、サンプリングタイプ、用途、エンドユーザー、地域別に分析しています。また、市場成長に影響を与える要因、様々な機会と課題を分析し、市場リーダーの競争環境に関する詳細な情報を提供しています。さらに、本レポートは、成長傾向に基づいてマイクロ市場を分析し、5つの主要地域(および各地域に属する国)における市場セグメントの収益予測も行っています。

レポートを購入する理由

本レポートは、環境モニタリング市場全体とそのサブセグメントにおける収益の概算値に関する情報を提供し、市場リーダー/新規参入企業にとって役立ちます。本レポートは、ステークホルダーが競争環境を理解し、より深い洞察を得ることで、事業のポジショニングを改善し、適切な市場開拓戦略を策定するのに役立ちます。また、本レポートは、ステークホルダーが市場の動向を理解し、主要な推進要因、制約要因、課題、そして機会に関する洞察を提供するのにも役立ちます。

本レポートでは、以下の点について洞察を提供します。

環境モニタリング市場の成長に影響を与える主要な推進要因(環境に優しい産業の発展、汚染レベルの上昇による健康への懸念の高まり)、制約要因(環境モニタリング製品の高コスト)、機会(環境汚染の防止と管理のための政府資金の増加、新興市場における成長機会)、課題(環境管理政策の導入の遅れ)の分析

- 製品開発/イノベーション:環境モニタリング市場における今後の技術、研究開発活動、新製品・新サービスの発売に関する詳細な洞察

- 市場開発:様々な地域における環境モニタリング市場分析を提供することで、収益性の高い市場に関する包括的な情報を提供します

- 市場多様化:環境モニタリング市場における新製品・サービス、未開拓地域、最近の動向、投資に関する包括的な情報

- 競合評価:サーモフィッシャーサイエンティフィック(米国)、ダナハー(米国)、アジレント・テクノロジーズ(米国)、3M(米国)、島津製作所(日本)といった主要企業の市場シェア、成長戦略、サービス提供に関する詳細な評価。

Report Description

The global environmental monitoring market is projected to reach USD 21.14 billion by 2030 from USD 16.10 billion in 2025, at a CAGR of 5.6%. Factors such as stringent government pollution-monitoring standards, deteriorating air quality due to rising PM2.5 levels, and increased health concerns stemming from these levels are driving the environmental monitoring market.

Environmental Monitoring Market – Global Forecast To 2030

“The outdoor monitors segment to record fastest growth rate over forecast period”

Based on product, the environmental monitoring market is classified into indoor monitors, outdoor monitors, sensors, wearables, and software. The outdoor monitors segment is further segmented into fixed monitors and portable monitors. The outdoor monitors segment is anticipated to grow at the fastest rate, driven by the growing adoption of advanced monitoring technologies, Internet of Things (IoT) integration, and wireless connectivity solutions. Environmental monitors and sensors are increasingly used to measure particulate matter (PM2.5, PM10), volatile organic compounds (VOCs), and greenhouse gases in real time. The growing demand for these products can majorly be attributed to the rising industrial use of environmental pollution monitoring systems (coupled with the increasingly stringent government regulations for establishing environment-friendly industrial processes), expansion of the end user base of fixed outdoor monitors, increasing government funding to develop large-scale environmental monitoring systems, and continuous public-private initiatives for environmental preservation and limiting the ecological effects of climate change.

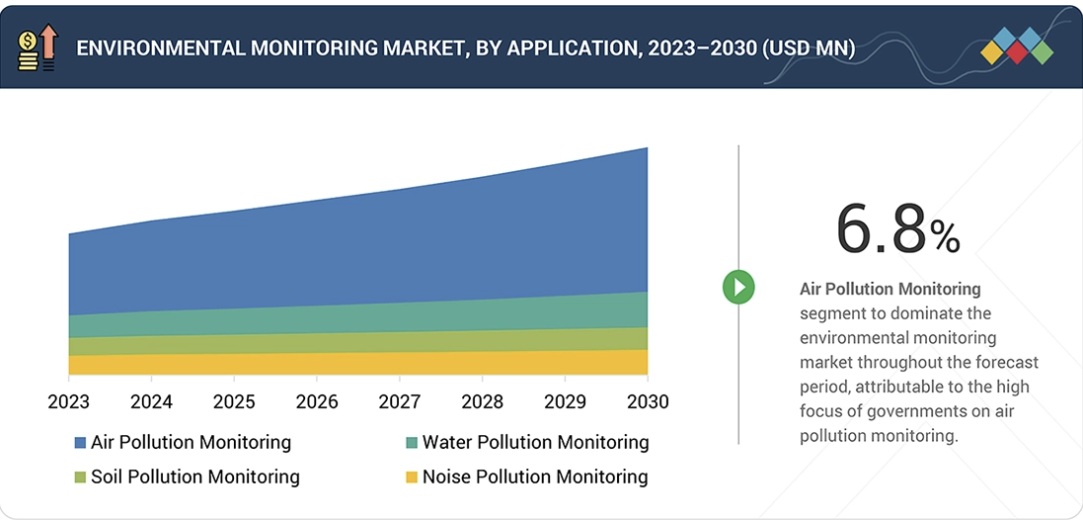

“By application, air pollution monitoring segment to register highest CAGR during forecast period”

Based on application, the environmental monitoring market is divided into air pollution monitoring, water pollution monitoring, soil pollution monitoring, and noise pollution monitoring. The water pollution monitoring segment is further categorized as surface & groundwater monitoring and wastewater monitoring. Air pollution monitoring is expected to be the fastest-growing application during the forecast period due to the rising level of air pollution across key markets (such as the US, Europe, China, India, and the Middle East), growing acceptance and demand for sensor-based air quality monitoring systems, increasing health concerns, and stringent air pollution control legislation by several governments.

Environmental Monitoring Market – Global Forecast To 2030 – region

“Asia Pacific to witness the highest growth rate during the forecast period”

Asia Pacific is anticipated to witness the fastest growth rate over the forecast period. It is segmented into China, India, Japan, South Korea, Australia, and the Rest of Asia Pacific, including Malaysia, Taiwan, Singapore, and New Zealand. The Asia-Pacific region is a major hub for petrochemical refineries and the metals and mining industries, which have contributed significantly to the annual rise in global air and water pollution levels. The government’s increasing emphasis on strict implementation of pollution monitoring strategies, rapid and large-scale industrialization, increasingly stringent environmental regulations, and the growing need to comply with safety regulations are expected to boost the region’s demand for environmental monitoring products. Advanced industrial clusters are integrating IoT-enabled sensor networks with AI-driven monitoring software for anomaly detection and predictive maintenance of environmental systems. Smart-city initiatives in countries such as Japan and India also promote broader networks of ambient sensors to support real-time air-quality dashboards.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 – 45%, Tier 2 – 35%, and Tier 3 – 20%

- By Designation: C-level Executives – 30%, Directors – 20%, and Others – 50%

- By Region: North America – 36%, Europe – 22%, Asia Pacific – 20%, Latin America – 12%, and Middle East and Africa – 10%

The prominent players in the environmental monitoring market are as follows:

Agilent Technologies (US), Danaher (US), Thermo Fisher Scientific (US), Shimadzu Corporation (Japan), PerkinElmer (US), 3M (US), Emerson Electric Co. (US), bioMérieux S.A. (France), Honeywell International Inc. (US), Merck KGaA (Germany), Siemens AG (Germany), Emerson Electric Co. (US), and Forbes Marshall (India), among others.

Environmental Monitoring Market – Global Forecast To 2030 – ecosystem

Research Coverage

This report analyzes the environmental monitoring market by product, component, sampling type, application, end user, and region. It also covers the factors impacting market growth, analyzes various opportunities and challenges, and provides details on the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets by growth trends and forecasts market segment revenue across five main regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will help market leaders/new entrants with information on the closest approximations of revenue for the overall environmental monitoring market and its subsegments. This report will help stakeholders understand the competitive landscape and gain deeper insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides insights into key drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Analysis of key drivers (Development of environment-friendly industries, increased health concerns due to rising pollution levels), restraints (High cost of environmental monitoring products), opportunities (Increased government funding to prevent and control environmental pollution, growth opportunities in emerging markets), and challenges (Slow adoption of environmental control policies) influencing the growth of the environmental monitoring market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the environmental monitoring market

- Market Development: Comprehensive information about lucrative markets by providing the environmental monitoring market analysis across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the environmental monitoring market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Thermo Fisher Scientific Inc. (US), Danaher Corporation (US), Agilent Technologies, Inc. (US), 3M (US), and Shimadzu Corporation (Japan).

Table of Contents

1 INTRODUCTION 29

1.1 STUDY OBJECTIVES 29

1.2 MARKET DEFINITION 29

1.3 STUDY SCOPE 30

1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE 30

1.3.2 INCLUSIONS & EXCLUSIONS 31

1.3.3 YEARS CONSIDERED 32

1.3.4 CURRENCY CONSIDERED 32

1.4 STAKEHOLDERS 32

2 EXECUTIVE SUMMARY 33

2.1 MARKET HIGHLIGHTS & KEY INSIGHTS 33

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 34

2.3 DISRUPTIVE TRENDS IN ENVIRONMENTAL MONITORING MARKET 35

2.4 HIGH-GROWTH SEGMENTS 36

3 PREMIUM INSIGHTS 38

3.1 ENVIRONMENTAL MONITORING MARKET OVERVIEW 38

3.2 ENVIRONMENTAL MONITORING MARKET, BY REGION 39

3.3 ASIA PACIFIC: ENVIRONMENTAL MONITORING MARKET, BY REGION AND END USER 40

3.4 GEOGRAPHIC SNAPSHOT OF ENVIRONMENTAL MONITORING MARKET 41

4 MARKET OVERVIEW 42

4.1 INTRODUCTION 42

4.2 MARKET DYNAMICS 42

4.2.1 DRIVERS 43

4.2.1.1 Growing need for efficient natural resource management 43

4.2.1.2 Development of environment-friendly industries 43

4.2.1.3 Development of wireless cellular and non-cellular communication technologies 44

4.2.1.4 Increased health concerns due to rising pollution levels 44

4.2.2 RESTRAINTS 45

4.2.2.1 High cost of environmental monitoring products 45

4.2.2.2 Limited technical expertise and infrastructure 45

4.2.3 OPPORTUNITIES 46

4.2.3.1 Increased government funding to prevent and control environmental pollution 46

4.2.3.2 Supportive government rules and regulations against environmental pollution 46

4.2.3.3 Growing oil & gas industry 48

4.2.3.4 Growth opportunities in emerging markets 48

4.2.4 CHALLENGES 49

4.2.4.1 Slow adoption of pollution control policies 49

4.2.4.2 Lack of protocol standardization across countries 49

4.3 UNMET NEEDS & WHITE SPACES 49

4.4 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES 50

4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 51

5 INDUSTRY TRENDS 53

5.1 PORTER’S FIVE FORCES ANALYSIS 53

5.1.1 THREAT OF NEW ENTRANTS 54

5.1.2 THREAT OF SUBSTITUTES 55

5.1.3 BARGAINING POWER OF SUPPLIERS 55

5.1.4 BARGAINING POWER OF BUYERS 55

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 55

5.2 MACROECONOMIC OUTLOOK 56

5.2.1 INTRODUCTION 56

5.2.2 GDP TRENDS AND FORECAST 56

5.2.3 TRENDS IN GLOBAL ENVIRONMENTAL MONITORING INDUSTRY 56

5.3 VALUE CHAIN ANALYSIS 57

5.3.1 RESEARCH & DEVELOPMENT 58

5.3.2 RAW MATERIAL PROCUREMENT AND MANUFACTURING 58

5.3.3 DISTRIBUTION AND MARKETING & SALES 58

5.3.4 POST-SALES SERVICES 58

5.4 SUPPLY CHAIN ANALYSIS 58

5.4.1 RAW MATERIAL PROCUREMENT 59

5.4.2 MANUFACTURING 59

5.4.3 SALES & DISTRIBUTION 59

5.4.4 END USERS 59

5.5 ECOSYSTEM ANALYSIS 60

5.5.1 ROLE IN ECOSYSTEM 61

5.6 PRICING ANALYSIS 61

5.6.1 AVERAGE SELLING PRICE OF ENVIRONMENTAL MONITORING ANALYTICAL INSTRUMENTS, BY TYPE, 2024 61

5.6.2 AVERAGE SELLING PRICE OF ENVIRONMENTAL MONITORING PRODUCTS,

BY KEY PLAYER, 2024 63

5.6.3 AVERAGE SELLING PRICE OF ENVIRONMENTAL MONITORING PRODUCTS,

BY REGION, 2023–2025 63

5.7 TRADE ANALYSIS 65

5.7.1 IMPORT SCENARIO FOR HS CODE 9031 65

5.7.2 EXPORT SCENARIO FOR HS CODE 9031 66

5.8 KEY CONFERENCES & EVENTS, 2025–2027 67

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS 68

5.10 INVESTMENT & FUNDING SCENARIO 69

5.11 IMPACT OF 2025 US TARIFF ON ENVIRONMENTAL MONITORING MARKET 70

5.11.1 KEY TARIFF RATES 71

5.11.2 PRICE IMPACT ANALYSIS 71

5.11.3 IMPACT ON COUNTRY/REGION 72

5.11.3.1 North America 72

5.11.3.1.1 US 72

5.11.3.2 Europe 72

5.11.3.3 Asia Pacific 72

5.11.4 IMPACT ON END-USE INDUSTRIES 73

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL,

AND AI ADOPTIONS 74

6.1 TECHNOLOGY ANALYSIS 74

6.1.1 KEY TECHNOLOGIES 74

6.1.1.1 Analytical laboratory technologies 74

6.1.1.2 Remote sensing & satellite technology 75

6.1.1.3 Wireless sensor technologies 75

6.1.2 COMPLEMENTARY TECHNOLOGIES 75

6.1.2.1 Cloud computing and data management 75

6.1.2.2 Automation and robotics 76

6.1.3 ADJACENT TECHNOLOGIES 76

6.1.3.1 Geographic information system (GIS) 76

6.2 PATENT ANALYSIS 76

6.3 IMPACT OF AI/GEN AI ON ENVIRONMENTAL MONITORING MARKET 77

6.3.1 TOP USE CASES AND MARKET POTENTIAL 78

6.3.2 AI USE CASES 78

6.3.3 BEST PRACTICES IN ENVIRONMENTAL MONITORING MARKET 79

6.3.4 CASE STUDIES 79

6.3.5 INTERCONNECTED ADJACENT ECOSYSTEM & IMPACT ON MARKET PLAYERS 80

6.3.6 CLIENTS’ READINESS TO ADOPT GENERATIVE AI 81

6.4 SUCCESS STORIES & REAL-WORLD APPLICATIONS 81

6.5 FUTURE APPLICATIONS 82

7 SUSTAINABILITY AND REGULATORY LANDSCAPE 83

7.1 REGIONAL REGULATIONS & COMPLIANCE 83

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 83

7.1.2 INDUSTRY STANDARDS 86

7.1.2.1 North America 86

7.1.2.1.1 US 86

7.1.2.1.2 Canada 86

7.1.2.2 Europe 87

7.1.2.2.1 UK 87

7.1.2.2.2 France 87

7.1.2.2.3 Germany 87

7.1.2.3 Asia Pacific 88

7.1.2.3.1 China 88

7.1.2.3.2 Japan 88

7.1.2.3.3 India 88

7.1.2.4 Latin America 89

7.1.2.4.1 Brazil 89

7.1.2.4.2 Mexico 89

7.1.2.5 Middle East & Africa 89

7.1.2.5.1 UAE 89

7.1.2.5.2 South Africa 90

7.2 SUSTAINABILITY IMPACT & REGULATORY POLICY INITIATIVES 90

7.3 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 91

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 92

8.1 DECISION-MAKING PROCESS 92

8.2 KEY STAKEHOLDERS & BUYING EVALUATION CRITERIA 92

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 92

8.2.2 KEY STAKEHOLDERS IN BUYING PROCESS 93

8.2.3 KEY BUYING CRITERIA 93

8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 94

8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES 95

9 ENVIRONMENTAL MONITORING MARKET, BY PRODUCT 96

9.1 INTRODUCTION 97

9.2 INDOOR MONITORS 98

9.2.1 FIXED INDOOR MONITORS 101

9.2.1.1 Integration with building systems and regulatory compliance

to drive adoption 101

9.2.2 PORTABLE INDOOR MONITORS 102

9.2.2.1 Personalized and decentralized indoor air quality awareness

to fuel market demand 102

9.3 OUTDOOR MONITORS 103

9.3.1 FIXED OUTDOOR MONITORS 107

9.3.1.1 Integrated multi-media environmental sensing for holistic pollution management to propel market growth 107

9.3.2 PORTABLE OUTDOOR MONITORS 108

9.3.2.1 Focus on ESG/sustainability reporting and corporate risk management to support segment growth 108

9.4 SENSORS 108

9.4.1 INDUSTRIAL DIGITIZATION AND IOT INTEGRATION TO BE KEY GROWTH STRATEGIES FOR ENVIRONMENTAL SENSORS 108

9.5 WEARABLES 112

9.5.1 PERSONALIZED HEALTH AND EXPOSURE ANALYTICS TO FUEL WEARABLE MONITOR ADOPTION 112

9.6 SOFTWARE 115

9.6.1 CLOUD-BASED ENVIRONMENTAL INTELLIGENCE AND DATA INTEGRATION TO DRIVE SOFTWARE ADOPTION 115

10 ENVIRONMENTAL MONITORING MARKET, BY SAMPLING METHOD 119

10.1 INTRODUCTION 120

10.2 CONTINUOUS MONITORING 121

10.2.1 REGULATORY PRESSURE FOR REAL-TIME PUBLIC HEALTH PROTECTION TO FOCUS ON MARKET GROWTH 121

10.3 ACTIVE MONITORING 122

10.3.1 TARGETED SOURCE IDENTIFICATION THROUGH ACTIVELY STIMULATED SAMPLING TO PROPEL MARKET GROWTH 122

10.4 PASSIVE MONITORING 123

10.4.1 LONG-TERM EXPOSURE MAPPING WITH MINIMAL OPERATIONAL

BURDEN TO AUGMENT MARKET GROWTH 123

10.5 INTERMITTENT MONITORING 124

10.5.1 EVENT-DRIVEN SAMPLING FOR EPISODIC POLLUTION MANAGEMENT TO AID MARKET GROWTH 124

11 ENVIRONMENTAL MONITORING MARKET, BY COMPONENT 125

11.1 INTRODUCTION 126

11.2 PARTICULATE DETECTION 127

11.2.1 PM2.5 DETECTION 128

11.2.1.1 Regulatory scrutiny and increased adverse health issues to propel detection 128

11.2.2 PM10 129

11.2.2.1 Focus on urban planning and dust source management to aid market growth 129

11.2.3 OTHER PARTICULATE DETECTION 130

11.3 CHEMICAL DETECTION 131

11.3.1 GAS DETECTION 132

11.3.1.1 Focus on industrial safety and regulatory compliance to aid segment growth 132

11.3.2 VOLATILE ORGANIC COMPOUND DETECTION 133

11.3.2.1 Indoor air quality management and public health protection to augment segment growth 133

11.3.3 PESTICIDE DETECTION 134

11.3.3.1 Agricultural safety and environmental risk mitigation to focus on market growth 134

11.3.4 OTHER CHEMICAL DETECTION 135

11.4 BIOLOGICAL DETECTION 136

11.4.1 INCREASING CONCERNS OVER MICROBIAL EXPOSURE AND FOCUS ON REAL-TIME PATHOGEN MONITORING TO DRIVE MARKET 136

11.5 TEMPERATURE SENSING 137

11.5.1 CONTEXTUALIZATION FOR MULTI-PARAMETER ENVIRONMENTAL ANALYTICS TO AID MARKET GROWTH 137

11.6 MOISTURE DETECTION 138

11.6.1 NEED TO IMPROVE CHEMICAL, PARTICULATE, AND BIOLOGICAL SENSOR ACCURACY TO FOCUS ON MARKET GROWTH 138

11.7 NOISE MEASUREMENT 138

11.7.1 ASSESSMENT OF ENVIRONMENTAL NOISE TO BE ESSENTIAL FOR FAVORABLE URBAN AND PUBLIC HEALTH POLICY 138

12 ENVIRONMENTAL MONITORING MARKET, BY APPLICATION 140

12.1 INTRODUCTION 141

12.2 AIR POLLUTION MONITORING 142

12.2.1 REAL-TIME MULTI-POLLUTANT INTELLIGENCE FOR PUBLIC HEALTH AND URBAN MANAGEMENT TO DRIVE MARKET 142

12.3 WATER POLLUTION MONITORING 143

12.3.1 WASTEWATER MONITORING 144

12.3.1.1 Regulatory compliance and contaminant source control to propel market growth 144

12.3.2 SURFACE & GROUNDWATER MONITORING 145

12.3.2.1 Resource sustainability and environmental risk mitigation to aid market growth 145

12.4 SOIL POLLUTION MONITORING 146

12.4.1 NEED TO SAFEGUARD SOIL HEALTH FOR AGRICULTURE, FORESTRY, AND URBAN DEVELOPMENT TO AUGMENT MARKET GROWTH 146

12.5 NOISE POLLUTION MONITORING 147

12.5.1 RISING GOVERNMENT FUNDING FOR EFFECTIVE NOISE POLLUTION MANAGEMENT TO FAVOR MARKET GROWTH 147

13 ENVIRONMENTAL MONITORING MARKET, BY END USER 149

13.1 INTRODUCTION 150

13.2 GOVERNMENT AGENCIES & SMART CITY AUTHORITIES 150

13.2.1 DATA-DRIVEN URBAN GOVERNANCE AND STRICT REGULATORY ENFORCEMENT TO DRIVE MARKET 150

13.3 ENTERPRISES 151

13.3.1 ENTERPRISES TO DEPLOY ENVIRONMENTAL MONITORING SYSTEMS FOR

ESG DISCLOSURES AND ENVIRONMENTAL RISK MITIGATION 151

13.4 COMMERCIAL USERS 152

13.4.1 FACILITY OPTIMIZATION AND COMPLIANCE ACROSS SERVICE ENVIRONMENTS TO DRIVE MARKET 152

13.5 RESIDENTIAL USERS 153

13.5.1 HEALTH-DRIVEN DEMAND FOR INDOOR AND AMBIENT ENVIRONMENTAL INTELLIGENCE TO AID MARKET ADOPTION 153

13.6 HEALTHCARE & PHARMACEUTICAL INDUSTRIES 154

13.6.1 PRECISION ENVIRONMENTAL CONTROL FOR PATIENT SAFETY

AND PRODUCT INTEGRITY TO PROPEL MARKET GROWTH 154

13.7 INDUSTRIAL USERS 155

13.7.1 FOCUS ON EMISSIONS CONTROL, WORKER SAFETY,

AND OPERATIONAL EFFICIENCY TO FAVOR MARKET GROWTH 155

13.8 OTHER END USERS 156

14 ENVIRONMENTAL MONITORING MARKET, BY REGION 158

14.1 INTRODUCTION 159

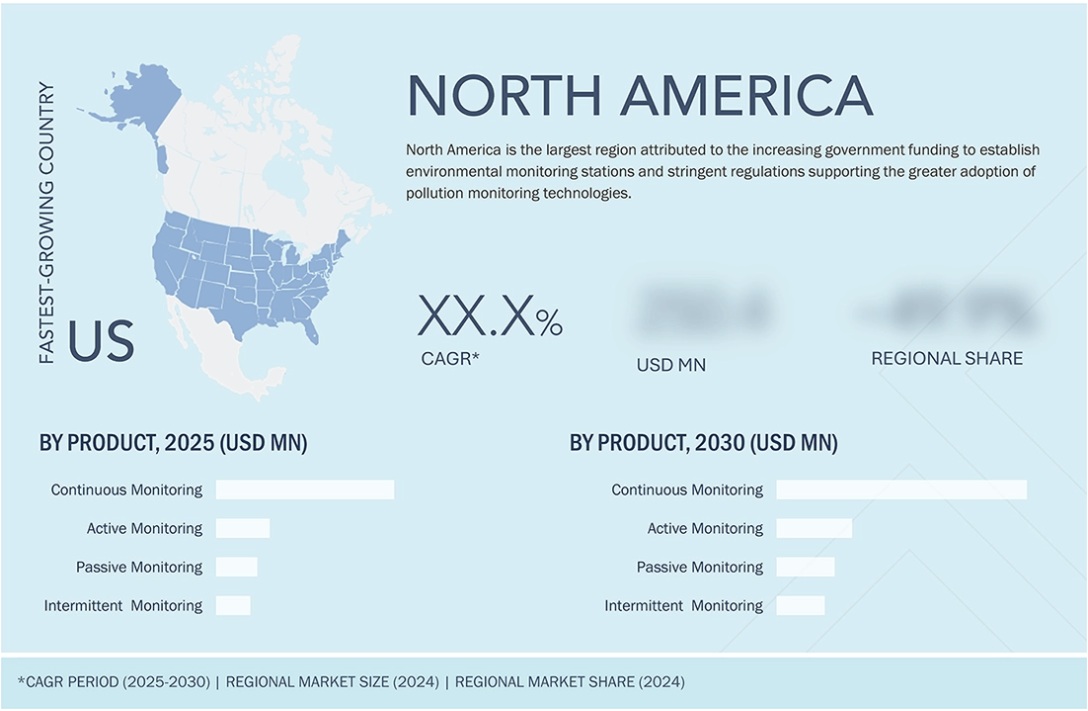

14.2 NORTH AMERICA 159

14.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA 159

14.2.2 US 165

14.2.2.1 US to dominate North American environmental monitoring market during study period 165

14.2.3 CANADA 167

14.2.3.1 Industrial decarbonization, high ESG disclosure pressure, and increased environmental monitoring funding to drive market 167

14.3 EUROPE 169

14.3.1 MACROECONOMIC OUTLOOK FOR EUROPE 169

14.3.2 GERMANY 175

14.3.2.1 Industrial modernization and improved precision manufacturing standards to aid market growth 175

14.3.3 FRANCE 177

14.3.3.1 Focus on urban health and public-space air-quality transformation to augment market growth 177

14.3.4 UK 178

14.3.4.1 Increased importance of infrastructure renewal and environmental risk governance to favor market growth 178

14.3.5 ITALY 180

14.3.5.1 Environmental compliance and regional ecosystem restoration to drive market 180

14.3.6 SPAIN 182

14.3.6.1 Integrated climate resilience across air, water, soil, and noise to aid market growth 182

14.3.7 REST OF EUROPE 184

14.4 ASIA PACIFIC 186

14.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC 186

14.4.2 JAPAN 192

14.4.2.1 High industrial precision standards and environmental compliance in pharmaceuticals to drive market 192

14.4.3 CHINA 194

14.4.3.1 Integration of advanced technology and industrial‑emission precision monitoring to propel market growth 194

14.4.4 INDIA 196

14.4.4.1 Regulatory tightening under National Clean Air Programme (NCAP) to augment market growth 196

14.4.5 SOUTH KOREA 198

14.4.5.1 National push for hyper-precision air-quality forecasting and sensor density expansion to propel market growth 198

14.4.6 AUSTRALIA 199

14.4.6.1 Climate driven wildfire risk and need for early-warning environmental intelligence to boost market growth 199

14.4.7 REST OF ASIA PACIFIC 201

14.5 LATIN AMERICA 203

14.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA 203

14.5.2 BRAZIL 209

14.5.2.1 Climate-amplified water insecurity and basin degradation to fuel adoption of environmental monitoring 209

14.5.3 MEXICO 211

14.5.3.1 Urban water scarcity and wastewater-driven public-health risk to drive market 211

14.5.4 REST OF LATIN AMERICA 213

14.6 MIDDLE EAST & AFRICA 214

14.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA 214

14.6.2 GCC COUNTRIES 220

14.6.2.1 Water scarcity and technological modernization under climate pressure to propel adoption of environmental monitoring 220

14.6.3 REST OF MIDDLE EAST & AFRICA 222

15 COMPETITIVE LANDSCAPE 224

15.1 INTRODUCTION 224

15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 224

15.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ENVIRONMENTAL MONITORING MARKET 224

15.3 REVENUE ANALYSIS, 2020–2024 226

15.4 MARKET SHARE ANALYSIS, 2024 227

15.4.1 RANKING OF KEY PLAYERS 229

15.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 229

15.5.1 STARS 229

15.5.2 EMERGING LEADERS 230

15.5.3 PERVASIVE PLAYERS 230

15.5.4 PARTICIPANTS 230

15.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 231

15.5.5.1 Company footprint 231

15.5.5.2 Region footprint 232

15.5.5.3 Product footprint 233

15.5.5.4 Application footprint 234

15.5.5.5 End-use footprint 235

15.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 236

15.6.1 PROGRESSIVE COMPANIES 236

15.6.2 RESPONSIVE COMPANIES 236

15.6.3 DYNAMIC COMPANIES 236

15.6.4 STARTING BLOCKS 236

15.6.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2024 238

15.6.5.1 Detailed list of key startups/SMEs 238

15.6.5.2 Competitive benchmarking of key startups/SMEs 239

15.7 COMPETITIVE SCENARIO 240

15.7.1 PRODUCT LAUNCHES 240

15.7.2 DEALS 241

15.7.3 EXPANSIONS 242

15.8 COMPANY VALUATION & FINANCIAL METRICS 243

15.8.1 FINANCIAL METRICS 243

15.8.2 COMPANY VALUATION 243

15.9 BRAND/PRODUCT COMPARISON 244

16 COMPANY PROFILES 245

16.1 KEY PLAYERS 245

16.1.1 THERMO FISHER SCIENTIFIC INC. 245

16.1.1.1 Business overview 245

16.1.1.2 Products offered 246

16.1.1.3 Recent developments 256

16.1.1.3.1 Product launches 256

16.1.1.4 MnM view 257

16.1.1.4.1 Right to win 257

16.1.1.4.2 Strategic choices 257

16.1.1.4.3 Weaknesses & competitive threats 258

16.1.2 AGILENT TECHNOLOGIES, INC. 259

16.1.2.1 Business overview 259

16.1.2.2 Products offered 260

16.1.2.3 Recent developments 264

16.1.2.3.1 Product launches 264

16.1.2.3.2 Deals 265

16.1.2.4 MnM view 265

16.1.2.4.1 Right to win 265

16.1.2.4.2 Strategic choices 265

16.1.2.4.3 Weaknesses & competitive threats 266

16.1.3 VERALTO (DANAHER CORPORATION) 267

16.1.3.1 Business overview 267

16.1.3.2 Products offered 268

16.1.3.3 Recent developments 275

16.1.3.3.1 Product launches 275

16.1.3.4 Other developments 275

16.1.3.5 MnM view 275

16.1.3.5.1 Right to win 275

16.1.3.5.2 Strategic choices 276

16.1.3.5.3 Weaknesses & competitive threats 276

16.1.4 SHIMADZU CORPORATION 277

16.1.4.1 Business overview 277

16.1.4.2 Products offered 278

16.1.4.3 Recent developments 281

16.1.4.3.1 Product launches 281

16.1.4.3.2 Expansions 283

16.1.4.4 MnM view 283

16.1.4.4.1 Right to win 283

16.1.4.4.2 Strategic choices 284

16.1.4.4.3 Weaknesses & competitive threats 284

16.1.5 PERKINELMER 285

16.1.5.1 Business overview 285

16.1.5.2 Products offered 286

16.1.5.3 Recent developments 287

16.1.5.3.1 Product launches 287

16.1.5.4 MnM view 288

16.1.5.4.1 Right to win 288

16.1.5.4.2 Strategic choices 288

16.1.5.4.3 Weaknesses & competitive threats 288

16.1.6 3M 289

16.1.6.1 Business overview 289

16.1.6.2 Products offered 290

16.1.6.3 Recent developments 293

16.1.6.3.1 Product launches 293

16.1.7 EMERSON ELECTRIC CO. 294

16.1.7.1 Business overview 294

16.1.7.2 Products offered 295

16.1.7.3 Recent developments 299

16.1.7.3.1 Product launches 299

16.1.8 BIOMÉRIEUX 300

16.1.8.1 Business overview 300

16.1.8.2 Products offered 301

16.1.9 MERCK KGAA 303

16.1.9.1 Business overview 303

16.1.9.2 Products offered 304

16.1.10 HONEYWELL INTERNATIONAL, INC. 307

16.1.10.1 Business overview 307

16.1.10.2 Products offered 308

16.1.10.3 Recent developments 315

16.1.11 SIEMENS 316

16.1.11.1 Business overview 316

16.1.11.2 Products offered 317

16.1.11.3 Recent developments 321

16.1.11.3.1 Expansions 321

16.1.12 FORBES MARSHALL 322

16.1.12.1 Business overview 322

16.1.12.2 Products offered 322

16.1.13 HORIBA LTD. 324

16.1.13.1 Business overview 324

16.1.13.2 Products offered 325

16.1.13.3 Recent developments 328

16.1.13.3.1 Product launches 328

16.1.14 TELEDYNE TECHNOLOGIES 329

16.1.14.1 Business overview 329

16.1.14.2 Products offered 330

16.1.15 TE CONNECTIVITY 333

16.1.15.1 Business overview 333

16.1.15.2 Products offered 334

16.2 OTHER PLAYERS 336

16.2.1 ENVIRONMENTAL SENSORS INC. 336

16.2.2 SPECTRIS 337

16.2.3 RTX 339

16.2.4 AMS-OSRAM AG 340

16.2.5 POWTECHNOLOGY LIMITED 341

16.2.6 RARITAN INC. (LEGRAND) 342

16.2.7 NESA SRL (OFFICINE MACCAFERRI SPA) 343

16.2.8 TEXAS INSTRUMENTS INCORPORATED 344

16.2.9 SENSIRION AG 345

16.2.10 OMEGA ENGINEERING INC. (DWYEROMEGA) 346

16.2.11 AEROQUAL 347

17 RESEARCH METHODOLOGY 348

17.1 RESEARCH DATA 348

17.1.1 SECONDARY RESEARCH 349

17.1.1.1 Key secondary sources 350

17.1.1.2 Key data from secondary sources 350

17.1.1.3 Objectives of secondary research 351

17.1.2 PRIMARY RESEARCH 351

17.1.2.1 Key primary sources 352

17.1.3 KEY PARTICIPANTS 352

17.1.3.1 Breakdown of primary interviews 353

17.1.3.2 Objectives of primary research 353

17.1.3.3 Key industry insights 354

17.2 MARKET SIZE ESTIMATION 354

17.2.1 BOTTOM-UP APPROACH 355

17.2.1.1 Company revenue estimation 356

17.2.1.2 Customer-based market estimation 356

17.2.1.3 Primary interviews 357

17.2.2 TOP-DOWN APPROACH 357

17.3 DATA TRIANGULATION 360

17.4 STUDY ASSUMPTIONS 361

17.5 RESEARCH LIMITATIONS 361

17.6 RISK ASSESSMENT 362

17.7 GROWTH RATE ASSUMPTIONS 362

17.8 SUMMARY OF CHANGES 362

18 APPENDIX 364

18.1 DISCUSSION GUIDE 364

18.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 370

18.3 CUSTOMIZATION OPTIONS 372

18.4 RELATED REPORTS 372

18.5 AUTHOR DETAILS 373

LIST OF TABLES

TABLE 1 ENVIRONMENTAL MONITORING MARKET: INCLUSIONS & EXCLUSIONS 31

TABLE 2 MAJOR US POLLUTION CONTROL LAWS 47

TABLE 3 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS IN ENVIRONMENTAL

MONITORING MARKET 51

TABLE 4 ENVIRONMENTAL MONITORING MARKET: PORTER’S FIVE FORCES 53

TABLE 5 ENVIRONMENTAL MONITORING MARKET: ROLE IN ECOSYSTEM 61

TABLE 6 AVERAGE SELLING PRICE OF ENVIRONMENTAL MONITORING PRODUCTS,

BY KEY PLAYER, 2024 63

TABLE 7 AVERAGE SELLING PRICE OF ENVIRONMENTAL MONITORING PRODUCTS,

BY REGION, 2023–2025 (USD) 63

TABLE 8 IMPORT SCENARIO FOR HS CODE 9031, BY COUNTRY,

2020–2024 (USD THOUSAND) 66

TABLE 9 EXPORT SCENARIO FOR HS CODE 9031, BY COUNTRY,

2020–2024 (USD THOUSAND) 67

TABLE 10 KEY CONFERENCES & EVENTS IN ENVIRONMENTAL MONITORING MARKET, DECEMBER 2025 – MARCH 2027 67

TABLE 11 US-ADJUSTED RECIPROCAL TARIFF RATES 71

TABLE 12 CASE STUDY 1: LEVERAGING AI FOR RAPID AND ACCURATE DETECTION OF MICROPLASTICS AND TOXIC SUBSTANCES IN WASTEWATER 79

TABLE 13 CASE STUDY 2: MACHINE LEARNING WITH FTIR SPECTRA FROM TARA EXPEDITION/ MEDITERRANEAN SEA 80

TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 83

TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 84

TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 85

TABLE 17 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 85

TABLE 18 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT

AGENCIES, AND OTHER ORGANIZATIONS 86

TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP PRODUCTS (%) 93

TABLE 20 KEY BUYING CRITERIA FOR TOP PRODUCTS 94

TABLE 21 KEY BARRIERS TO ADOPTION AND IMPLEMENTATION OF ENVIRONMENTAL MONITORING TECHNOLOGIES 94

TABLE 22 UNMET NEEDS FOR ENVIRONMENTAL MONITORING 95

TABLE 23 ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 97

TABLE 24 ENVIRONMENTAL INDOOR MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 97

TABLE 25 ENVIRONMENTAL OUTDOOR MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 98

TABLE 26 ENVIRONMENTAL INDOOR MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 99

TABLE 27 ENVIRONMENTAL INDOOR MONITORS MARKET, BY REGION,

2023–2030 (USD MILLION) 99

TABLE 28 ENVIRONMENTAL INDOOR MONITORS MARKET, BY SAMPLING METHOD,

2023–2030 (USD MILLION) 99

TABLE 29 ENVIRONMENTAL INDOOR MONITORS MARKET, BY APPLICATION,

2023–2030 (USD MILLION) 100

TABLE 30 ENVIRONMENTAL INDOOR MONITORS MARKET, BY COMPONENT,

2023–2030 (USD MILLION) 100

TABLE 31 ENVIRONMENTAL INDOOR MONITORS MARKET, BY END USER,

2023–2030 (USD MILLION) 101

TABLE 32 FIXED INDOOR MONITORS MARKET, BY REGION, 2023–2030 (USD MILLION) 102

TABLE 33 PORTABLE INDOOR MONITORS MARKET, BY REGION, 2023–2030 (USD MILLION) 103

TABLE 34 OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 104

TABLE 35 OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY REGION,

2023–2030 (USD MILLION) 104

TABLE 36 OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY SAMPLING METHOD,

2023–2030 (USD MILLION) 105

TABLE 37 OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY APPLICATION,

2023–2030 (USD MILLION) 105

TABLE 38 OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY COMPONENT,

2023–2030 (USD MILLION) 106

TABLE 39 OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY END USER,

2023–2030 (USD MILLION) 106

TABLE 40 FIXED OUTDOOR MONITORS MARKET, BY REGION, 2023–2030 (USD MILLION) 107

TABLE 41 PORTABLE OUTDOOR MONITORS MARKET, BY REGION,

2023–2030 (USD MILLION) 108

TABLE 42 ENVIRONMENTAL MONITORING SENSORS MARKET, BY REGION,

2023–2030 (USD MILLION) 109

TABLE 43 ENVIRONMENTAL MONITORING SENSORS MARKET, BY SAMPLING METHOD, 2023–2030 (USD MILLION) 110

TABLE 44 ENVIRONMENTAL MONITORING SENSORS MARKET, BY APPLICATION,

2023–2030 (USD MILLION) 110

TABLE 45 ENVIRONMENTAL MONITORING SENSORS MARKET, BY COMPONENT,

2023–2030 (USD MILLION) 111

TABLE 46 ENVIRONMENTAL MONITORING SENSORS MARKET, BY END USER,

2023–2030 (USD MILLION) 111

TABLE 47 EXAMPLES OF NOTABLE WEARABLES IN MARKET 112

TABLE 48 ENVIRONMENTAL MONITORING WEARABLES MARKET, BY REGION,

2023–2030 (USD MILLION) 113

TABLE 49 ENVIRONMENTAL MONITORING WEARABLES MARKET, BY SAMPLING METHOD, 2023–2030 (USD MILLION) 113

TABLE 50 ENVIRONMENTAL MONITORING WEARABLES MARKET, BY APPLICATION,

2023–2030 (USD MILLION) 114

TABLE 51 ENVIRONMENTAL MONITORING WEARABLES MARKET, BY COMPONENT,

2023–2030 (USD MILLION) 114

TABLE 52 ENVIRONMENTAL MONITORING WEARABLES MARKET, BY END USER,

2023–2030 (USD MILLION) 115

TABLE 53 ENVIRONMENTAL MONITORING SOFTWARE MARKET, BY REGION,

2023–2030 (USD MILLION) 116

TABLE 54 ENVIRONMENTAL MONITORING SOFTWARE MARKET, BY SAMPLING METHOD, 2023–2030 (USD MILLION) 116

TABLE 55 ENVIRONMENTAL MONITORING SOFTWARE MARKET, BY APPLICATION,

2023–2030 (USD MILLION) 117

TABLE 56 ENVIRONMENTAL MONITORING SOFTWARE MARKET, BY COMPONENT,

2023–2030 (USD MILLION) 117

TABLE 57 ENVIRONMENTAL MONITORING SOFTWARE MARKET, BY END-USER,

2023–2030 (USD MILLION) 118

TABLE 58 ENVIRONMENTAL MONITORING MARKET, BY SAMPLING METHOD,

2023–2030 (USD MILLION) 120

TABLE 59 ENVIRONMENTAL MONITORING SAMPLING METHOD MARKET, BY REGION,

2023–2030 (USD MILLION) 120

TABLE 60 CONTINUOUS ENVIRONMENTAL MONITORING MARKET, BY REGION,

2023–2030 (USD MILLION) 121

TABLE 61 ACTIVE ENVIRONMENTAL MONITORING MARKET, BY REGION,

2023–2030 (USD MILLION) 122

TABLE 62 PASSIVE ENVIRONMENTAL MONITORING MARKET, BY REGION,

2023–2030 (USD MILLION) 123

TABLE 63 INTERMITTENT ENVIRONMENTAL MONITORING MARKET, BY REGION,

2023–2030 (USD MILLION) 124

TABLE 64 ENVIRONMENTAL MONITORING MARKET, BY COMPONENT,

2023–2030 (USD MILLION) 126

TABLE 65 ENVIRONMENTAL MONITORING COMPONENT MARKET, BY REGION,

2023–2030 (USD MILLION) 126

TABLE 66 ENVIRONMENTAL MONITORING MARKET FOR PARTICULATE DETECTION,

BY TYPE, 2023–2030 (USD MILLION) 127

TABLE 67 ENVIRONMENTAL MONITORING MARKET FOR PARTICULATE DETECTION,

BY REGION, 2023–2030 (USD MILLION) 128

TABLE 68 PM2.5 DETECTION MARKET, BY REGION, 2023–2030 (USD MILLION) 129

TABLE 69 PM10 DETECTION MARKET, BY REGION, 2023–2030 (USD MILLION) 130

TABLE 70 OTHER PARTICULATE DETECTION MARKET, BY REGION,

2023–2030 (USD MILLION) 130

TABLE 71 ENVIRONMENTAL MONITORING MARKET FOR CHEMICAL DETECTION,

BY TYPE, 2023–2030 (USD MILLION) 131

TABLE 72 ENVIRONMENTAL MONITORING MARKET FOR CHEMICAL DETECTION,

BY REGION, 2023–2030 (USD MILLION) 132

TABLE 73 GAS DETECTION MARKET, BY REGION, 2023–2030 (USD MILLION) 133

TABLE 74 VOLATILE ORGANIC COMPOUND DETECTION MARKET, BY REGION,

2023–2030 (USD MILLION) 134

TABLE 75 PESTICIDE DETECTION MARKET, BY REGION, 2023–2030 (USD MILLION) 135

TABLE 76 OTHER CHEMICAL DETECTION MARKET, BY REGION, 2023–2030 (USD MILLION) 135

TABLE 77 ENVIRONMENTAL MONITORING MARKET FOR BIOLOGICAL DETECTION,

BY REGION, 2023–2030 (USD MILLION) 136

TABLE 78 ENVIRONMENTAL MONITORING MARKET FOR TEMPERATURE SENSING,

BY REGION, 2023–2030 (USD MILLION) 137

TABLE 79 ENVIRONMENTAL MONITORING MARKET FOR MOISTURE DETECTION, BY REGION, 2023–2030 (USD MILLION) 138

TABLE 80 ENVIRONMENTAL MONITORING MARKET FOR NOISE MEASUREMENT, BY REGION, 2023–2030 (USD MILLION) 139

TABLE 81 ENVIRONMENTAL MONITORING MARKET, BY APPLICATION,

2023–2030 (USD MILLION) 141

TABLE 82 ENVIRONMENTAL MONITORING APPLICATION MARKET, BY REGION,

2023–2030 (USD MILLION) 141

TABLE 83 ENVIRONMENTAL AIR POLLUTION MONITORING MARKET: BY REGION,

2023–2030 (USD MILLION) 143

TABLE 84 ENVIRONMENTAL WATER POLLUTION MONITORING MARKET, BY TYPE,

2023–2030 (USD MILLION) 143

TABLE 85 ENVIRONMENTAL WATER POLLUTION MONITORING MARKET, BY REGION,

2023–2030 (USD MILLION) 144

TABLE 86 WASTEWATER MONITORING MARKET, BY REGION, 2023–2030 (USD MILLION) 145

TABLE 87 SURFACE & GROUNDWATER MONITORING MARKET, BY REGION,

2023–2030 (USD MILLION) 146

TABLE 88 ENVIRONMENTAL SOIL POLLUTION MONITORING MARKET, BY REGION,

2023–2030 (USD MILLION) 147

TABLE 89 ENVIRONMENTAL NOISE POLLUTION MONITORING MARKET, BY REGION,

2023–2030 (USD MILLION) 148

TABLE 90 ENVIRONMENTAL MONITORING MARKET, BY END USER,

2023–2030 (USD MILLION) 150

TABLE 91 ENVIRONMENTAL MONITORING MARKET FOR GOVERNMENT AGENCIES & SMART CITY AUTHORITIES, BY REGION, 2023–2030 (USD MILLION) 151

TABLE 92 ENVIRONMENTAL MONITORING MARKET FOR ENTERPRISES, BY REGION,

2023–2030 (USD MILLION) 152

TABLE 93 ENVIRONMENTAL MONITORING MARKET FOR COMMERCIAL USERS, BY REGION, 2023–2030 (USD MILLION) 153

TABLE 94 ENVIRONMENTAL MONITORING MARKET FOR RESIDENTIAL USERS, BY REGION, 2023–2030 (USD MILLION) 154

TABLE 95 ENVIRONMENTAL MONITORING MARKET FOR HEALTHCARE & PHARMACEUTICAL INDUSTRIES, BY REGION, 2023–2030 (USD MILLION) 155

TABLE 96 ENVIRONMENTAL MONITORING MARKET FOR INDUSTRIAL USERS, BY REGION, 2023–2030 (USD MILLION) 156

TABLE 97 ENVIRONMENTAL MONITORING MARKET FOR OTHER END USERS, BY REGION, 2023–2030 (USD MILLION) 157

TABLE 98 ENVIRONMENTAL MONITORING MARKET, BY REGION, 2023–2030 (USD MILLION) 159

TABLE 99 NORTH AMERICA: KEY MACROINDICATORS 160

TABLE 100 NORTH AMERICA: ENVIRONMENTAL MONITORING MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 161

TABLE 101 NORTH AMERICA: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 161

TABLE 102 NORTH AMERICA: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 161

TABLE 103 NORTH AMERICA: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE, 2023–2030 (USD MILLION) 162

TABLE 104 NORTH AMERICA: ENVIRONMENTAL MONITORING MARKET, BY SAMPLING METHOD, 2023–2030 (USD MILLION) 162

TABLE 105 NORTH AMERICA: ENVIRONMENTAL MONITORING MARKET, BY COMPONENT, 2023–2030 (USD MILLION) 162

TABLE 106 NORTH AMERICA: ENVIRONMENTAL MONITORING MARKET FOR PARTICULATE DETECTION, BY TYPE, 2023–2030 (USD MILLION) 163

TABLE 107 NORTH AMERICA: ENVIRONMENTAL MONITORING MARKET FOR CHEMICAL DETECTION, BY TYPE, 2023–2030 (USD MILLION) 163

TABLE 108 NORTH AMERICA: ENVIRONMENTAL MONITORING MARKET, BY APPLICATION, 2023–2030 (USD MILLION) 164

TABLE 109 NORTH AMERICA: ENVIRONMENTAL WATER POLLUTION MONITORING MARKET,

BY TYPE, 2023–2030 (USD MILLION) 164

TABLE 110 NORTH AMERICA: ENVIRONMENTAL MONITORING MARKET, BY END USER,

2023–2030 (USD MILLION) 165

TABLE 111 US: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 166

TABLE 112 US: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 166

TABLE 113 US: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 167

TABLE 114 CANADA: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 168

TABLE 115 CANADA: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 168

TABLE 116 CANADA: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 169

TABLE 117 EUROPE: KEY MACROINDICATORS 170

TABLE 118 EUROPE: ENVIRONMENTAL MONITORING MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 170

TABLE 119 EUROPE: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 171

TABLE 120 EUROPE: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 171

TABLE 121 EUROPE: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 171

TABLE 122 EUROPE: ENVIRONMENTAL MONITORING MARKET, BY SAMPLING METHOD,

2023–2030 (USD MILLION) 172

TABLE 123 EUROPE: ENVIRONMENTAL MONITORING MARKET, BY COMPONENT,

2023–2030 (USD MILLION) 172

TABLE 124 EUROPE: ENVIRONMENTAL MONITORING MARKET FOR PARTICULATE DETECTION, BY TYPE, 2023–2030 (USD MILLION) 173

TABLE 125 EUROPE: ENVIRONMENTAL MONITORING MARKET FOR CHEMICAL DETECTION,

BY TYPE, 2023–2030 (USD MILLION) 173

TABLE 126 EUROPE: ENVIRONMENTAL MONITORING MARKET, BY APPLICATION,

2023–2030 (USD MILLION) 174

TABLE 127 EUROPE: ENVIRONMENTAL WATER POLLUTION MONITORING MARKET,

BY TYPE, 2023–2030 (USD MILLION) 174

TABLE 128 EUROPE: ENVIRONMENTAL MONITORING MARKET, BY END USER,

2023–2030 (USD MILLION) 175

TABLE 129 GERMANY: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 176

TABLE 130 GERMANY: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 176

TABLE 131 GERMANY: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 176

TABLE 132 FRANCE: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 177

TABLE 133 FRANCE: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 178

TABLE 134 FRANCE: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 178

TABLE 135 UK: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 179

TABLE 136 UK: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 179

TABLE 137 UK: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 180

TABLE 138 ITALY: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 181

TABLE 139 ITALY: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 182

TABLE 140 ITALY: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 182

TABLE 141 SPAIN: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 183

TABLE 142 SPAIN: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 183

TABLE 143 SPAIN: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 184

TABLE 144 REST OF EUROPE: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 185

TABLE 145 REST OF EUROPE: INDOOR ENVIRONMENTAL MONITORS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 185

TABLE 146 REST OF EUROPE: OUTDOOR ENVIRONMENTAL MONITORS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 185

TABLE 147 ASIA PACIFIC: KEY MACROINDICATORS 186

TABLE 148 ASIA PACIFIC: ENVIRONMENTAL MONITORING MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 187

TABLE 149 ASIA PACIFIC: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 188

TABLE 150 ASIA PACIFIC: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 188

TABLE 151 ASIA PACIFIC: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 188

TABLE 152 ASIA PACIFIC: ENVIRONMENTAL MONITORING MARKET, BY SAMPLING METHOD, 2023–2030 (USD MILLION) 189

TABLE 153 ASIA PACIFIC: ENVIRONMENTAL MONITORING MARKET, BY COMPONENT,

2023–2030 (USD MILLION) 189

TABLE 154 ASIA PACIFIC: ENVIRONMENTAL MONITORING MARKET FOR PARTICULATE DETECTION, BY TYPE, 2023–2030 (USD MILLION) 190

TABLE 155 ASIA PACIFIC: ENVIRONMENTAL MONITORING MARKET FOR CHEMICAL DETECTION, BY TYPE, 2023–2030 (USD MILLION) 190

TABLE 156 ASIA PACIFIC: ENVIRONMENTAL MONITORING MARKET, BY APPLICATION,

2023–2030 (USD MILLION) 191

TABLE 157 ASIA PACIFIC: ENVIRONMENTAL WATER POLLUTION MONITORING MARKET,

BY TYPE, 2023–2030 (USD MILLION) 191

TABLE 158 ASIA PACIFIC: ENVIRONMENTAL MONITORING MARKET, BY END USER,

2023–2030 (USD MILLION) 192

TABLE 159 JAPAN: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 193

TABLE 160 JAPAN: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 194

TABLE 161 JAPAN: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 194

TABLE 162 CHINA: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 195

TABLE 163 CHINA: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 195

TABLE 164 CHINA: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 196

TABLE 165 INDIA: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 197

TABLE 166 INDIA: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 197

TABLE 167 INDIA: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 197

TABLE 168 SOUTH KOREA: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 198

TABLE 169 SOUTH KOREA: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 199

TABLE 170 SOUTH KOREA: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 199

TABLE 171 AUSTRALIA: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 200

TABLE 172 AUSTRALIA: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 200

TABLE 173 AUSTRALIA: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 201

TABLE 174 REST OF ASIA PACIFIC: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 202

TABLE 175 REST OF ASIA PACIFIC: INDOOR ENVIRONMENTAL MONITORS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 202

TABLE 176 REST OF ASIA PACIFIC: OUTDOOR ENVIRONMENTAL MONITORS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 203

TABLE 177 LATIN AMERICA: KEY MACROINDICATORS 204

TABLE 178 LATIN AMERICA: ENVIRONMENTAL MONITORING MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 204

TABLE 179 LATIN AMERICA: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 205

TABLE 180 LATIN AMERICA: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 205

TABLE 181 LATIN AMERICA: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE, 2023–2030 (USD MILLION) 205

TABLE 182 LATIN AMERICA: ENVIRONMENTAL MONITORING MARKET, BY SAMPLING METHOD, 2023–2030 (USD MILLION) 206

TABLE 183 LATIN AMERICA: ENVIRONMENTAL MONITORING MARKET, BY COMPONENT, 2023–2030 (USD MILLION) 206

TABLE 184 LATIN AMERICA: ENVIRONMENTAL MONITORING MARKET FOR PARTICULATE DETECTION, BY TYPE, 2023–2030 (USD MILLION) 207

TABLE 185 LATIN AMERICA: ENVIRONMENTAL MONITORING MARKET FOR CHEMICAL DETECTION, BY TYPE, 2023–2030 (USD MILLION) 207

TABLE 186 LATIN AMERICA: ENVIRONMENTAL MONITORING MARKET, BY APPLICATION,

2023–2030 (USD MILLION) 208

TABLE 187 LATIN AMERICA: ENVIRONMENTAL WATER POLLUTION MONITORING MARKET,

BY TYPE, 2023–2030 (USD MILLION) 208

TABLE 188 LATIN AMERICA: ENVIRONMENTAL MONITORING MARKET, BY END USER,

2023–2030 (USD MILLION) 209

TABLE 189 BRAZIL: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 210

TABLE 190 BRAZIL: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 210

TABLE 191 BRAZIL: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 211

TABLE 192 MEXICO: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 212

TABLE 193 MEXICO: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 212

TABLE 194 MEXICO: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 212

TABLE 195 REST OF LATIN AMERICA: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT, 2023–2030 (USD MILLION) 213

TABLE 196 REST OF LATIN AMERICA: INDOOR ENVIRONMENTAL MONITORS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 214

TABLE 197 REST OF LATIN AMERICA: OUTDOOR ENVIRONMENTAL MONITORS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 214

TABLE 198 MIDDLE EAST & AFRICA: KEY MACROINDICATORS 215

TABLE 199 MIDDLE EAST & AFRICA: ENVIRONMENTAL MONITORING MARKET,

BY REGION, 2023–2030 (USD MILLION) 215

TABLE 200 MIDDLE EAST & AFRICA: ENVIRONMENTAL MONITORING MARKET,

BY PRODUCT, 2023–2030 (USD MILLION) 216

TABLE 201 MIDDLE EAST & AFRICA: INDOOR ENVIRONMENTAL MONITORS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 216

TABLE 202 MIDDLE EAST & AFRICA: OUTDOOR ENVIRONMENTAL MONITORS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 216

TABLE 203 MIDDLE EAST & AFRICA: ENVIRONMENTAL MONITORING MARKET, BY SAMPLING METHOD, 2023–2030 (USD MILLION) 217

TABLE 204 MIDDLE EAST & AFRICA: ENVIRONMENTAL MONITORING MARKET,

BY COMPONENT, 2023–2030 (USD MILLION) 217

TABLE 205 MIDDLE EAST & AFRICA: ENVIRONMENTAL MONITORING MARKET FOR PARTICULATE DETECTION, BY TYPE, 2023–2030 (USD MILLION) 218

TABLE 206 MIDDLE EAST & AFRICA: ENVIRONMENTAL MONITORING MARKET

FOR CHEMICAL DETECTION, BY TYPE, 2023–2030 (USD MILLION) 218

TABLE 207 MIDDLE EAST & AFRICA: ENVIRONMENTAL MONITORING MARKET,

BY APPLICATION, 2023–2030 (USD MILLION) 219

TABLE 208 MIDDLE EAST & AFRICA: ENVIRONMENTAL WATER POLLUTION MONITORING MARKET, BY TYPE, 2023–2030 (USD MILLION) 219

TABLE 209 MIDDLE EAST & AFRICA: ENVIRONMENTAL MONITORING MARKET,

BY END USER, 2023–2030 (USD MILLION) 220

TABLE 210 GCC COUNTRIES: ENVIRONMENTAL MONITORING MARKET, BY PRODUCT,

2023–2030 (USD MILLION) 221

TABLE 211 GCC COUNTRIES: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE,

2023–2030 (USD MILLION) 221

TABLE 212 GCC COUNTRIES: OUTDOOR ENVIRONMENTAL MONITORS MARKET,

BY TYPE, 2023–2030 (USD MILLION) 222

TABLE 213 REST OF MIDDLE EAST & AFRICA: ENVIRONMENTAL MONITORING MARKET,

BY PRODUCT, 2023–2030 (USD MILLION) 223

TABLE 214 REST OF MIDDLE EAST & AFRICA: INDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE, 2023–2030 (USD MILLION) 223

TABLE 215 REST OF MIDDLE EAST & AFRICA: OUTDOOR ENVIRONMENTAL MONITORS MARKET, BY TYPE, 2023–2030 (USD MILLION) 223

TABLE 216 OVERVIEW OF MAJOR STRATEGIES DEPLOYED BY KEY PLAYERS IN ENVIRONMENTAL MONITORING MARKET 224

TABLE 217 ENVIRONMENTAL MONITORING MARKET: DEGREE OF COMPETITION 227

TABLE 218 ENVIRONMENTAL MONITORING MARKET: REGION FOOTPRINT 232

TABLE 219 ENVIRONMENTAL MONITORING MARKET: PRODUCT FOOTPRINT 233

TABLE 220 ENVIRONMENTAL MONITORING MARKET: APPLICATION FOOTPRINT 234

TABLE 221 ENVIRONMENTAL MONITORING MARKET: END-USER FOOTPRINT 235

TABLE 222 ENVIRONMENTAL MONITORING MARKET: DETAILED LIST OF

KEY STARTUPS/SME PLAYERS 238

TABLE 223 ENVIRONMENTAL MONITORING MARKET: COMPETITIVE BENCHMARKING

OF KEY STARTUPS/SME PLAYERS, BY PRODUCT AND REGION 239

TABLE 224 ENVIRONMENTAL MONITORING MARKET: PRODUCT LAUNCHES,

JANUARY 2022–DECEMBER 2025 240

TABLE 225 ENVIRONMENTAL MONITORING MARKET: DEALS,

JANUARY 2022–DECEMBER 2025 241

TABLE 226 ENVIRONMENTAL MONITORING MARKET: EXPANSIONS,

JANUARY 2022–DECEMBER 2025 242

TABLE 227 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW 245

TABLE 228 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED 246

TABLE 229 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES, JANUARY 2022–DECEMBER 2025 256

TABLE 230 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW 259

TABLE 231 AGILENT TECHNOLOGIES, INC.: PRODUCTS OFFERED 260

TABLE 232 AGILENT TECHNOLOGIES, INC.: PRODUCT LAUNCHES,

JANUARY 2022–DECEMBER 2025 264

TABLE 233 AGILENT TECHNOLOGIES, INC.: DEALS, JANUARY 2022–DECEMBER 2025 265

TABLE 234 VERALTO (DANAHER CORPORATION): COMPANY OVERVIEW 267

TABLE 235 VERALTO (DANAHER CORPORATION): PRODUCTS OFFERED 268

TABLE 236 VERALTO (DANAHER CORPORATION): PRODUCT LAUNCHES,

JANUARY 2022–DECEMBER 2025 275

TABLE 237 VERALTO (DANAHER CORPORATION): OTHER DEVELOPMENTS,

JANUARY 2022–DECEMBER 2025 275

TABLE 238 SHIMADZU CORPORATION: COMPANY OVERVIEW 277

TABLE 239 SHIMADZU CORPORATION: PRODUCTS OFFERED 278

TABLE 240 SHIMADZU CORPORATION: PRODUCT LAUNCHES,

JANUARY 2022–DECEMBER 2025 281

TABLE 241 SHIMADZU CORPORATION: EXPANSIONS, JANUARY 2022–DECEMBER 2025 283

TABLE 242 PERKINELMER: COMPANY OVERVIEW 285

TABLE 243 PERKINELMER: PRODUCTS OFFERED 286

TABLE 244 PERKINELMER: PRODUCT LAUNCHES, JANUARY 2022–DECEMBER 2025 287

TABLE 245 3M: COMPANY OVERVIEW 289

TABLE 246 3M: PRODUCTS OFFERED 290

TABLE 247 3M: PRODUCT LAUNCHES, JANUARY 2022–DECEMBER 2025 293

TABLE 248 EMERSON ELECTRIC CO.: COMPANY OVERVIEW 294

TABLE 249 EMERSON ELECTRIC CO.: PRODUCTS OFFERED 295

TABLE 250 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES, JANUARY 2022–DECEMBER 2025 299

TABLE 251 BIOMÉRIEUX: COMPANY OVERVIEW 300

TABLE 252 BIOMÉRIEUX: PRODUCTS OFFERED 301

TABLE 253 MERCK KGAA: COMPANY OVERVIEW 303

TABLE 254 MERCK KGAA: PRODUCTS OFFERED 304

TABLE 255 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW 307

TABLE 256 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED 308

TABLE 257 HONEYWELL INTERNATIONAL, INC.: PRODUCT LAUNCHES,

JANUARY 2022–DECEMBER 2025 315

TABLE 258 SIEMENS: COMPANY OVERVIEW 316

TABLE 259 SIEMENS: PRODUCTS OFFERED 317

TABLE 260 SIEMENS: EXPANSIONS, JANUARY 2022–DECEMBER 2025 321

TABLE 261 FORBES MARSHALL: COMPANY OVERVIEW 322

TABLE 262 FORBES MARSHALL: PRODUCTS OFFERED 322

TABLE 263 HORIBA, LTD.: COMPANY OVERVIEW 324

TABLE 264 HORIBA, LTD.: PRODUCTS OFFERED 325

TABLE 265 HORIBA, LTD.: PRODUCT LAUNCHES, JANUARY 2022–DECEMBER 2025 328

TABLE 266 TELEDYNE TECHNOLOGIES: COMPANY OVERVIEW 329

TABLE 267 TELEDYNE TECHNOLOGIES: PRODUCTS OFFERED 330

TABLE 268 TE CONNECTIVITY: COMPANY OVERVIEW 333

TABLE 269 TE CONNECTIVITY: PRODUCTS OFFERED 334

TABLE 270 ENVIRONMENTAL SENSORS INC.: COMPANY OVERVIEW 336

TABLE 271 SPECTRIS: COMPANY OVERVIEW 337

TABLE 272 RTX: COMPANY OVERVIEW 339

TABLE 273 AMS-OSRAM AG: COMPANY OVERVIEW 340

TABLE 274 POWTECHNOLOGY LIMITED: COMPANY OVERVIEW 341

TABLE 275 RARITAN INC. (LEGRAND): COMPANY OVERVIEW 342

TABLE 276 NESA SRL (OFFICINE MACCAFERRI SPA): COMPANY OVERVIEW 343

TABLE 277 TEXAS INSTRUMENTS INCORPORATED: COMPANY OVERVIEW 344

TABLE 278 SENSIRION AG: COMPANY OVERVIEW 345

TABLE 279 OMEGA ENGINEERING INC. (DWYEROMEGA): COMPANY OVERVIEW 346

TABLE 280 AEROQUAL: COMPANY OVERVIEW 347

TABLE 281 ENVIRONMENTAL MONITORING MARKET: STUDY ASSUMPTIONS 361

TABLE 282 ENVIRONMENTAL MONITORING MARKET: RISK ASSESSMENT 362

LIST OF FIGURES

FIGURE 1 ENVIRONMENTAL MONITORING MARKET SEGMENTATION & REGIONAL SCOPE 30

FIGURE 2 ENVIRONMENTAL MONITORING MARKET: YEARS CONSIDERED 32

FIGURE 3 ENVIRONMENTAL MONITORING MARKET SCENARIO 33

FIGURE 4 GLOBAL ENVIRONMENTAL MONITORING MARKET, 2022–2030 34

FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN ENVIRONMENTAL MONITORING MARKET, 2020–2025 34

FIGURE 6 DISRUPTIONS INFLUENCING GROWTH OF ENVIRONMENTAL MONITORING MARKET 35

FIGURE 7 HIGH-GROWTH SEGMENTS IN ENVIRONMENTAL MONITORING MARKET,

BY PRODUCT, SAMPLING METHOD, APPLICATION, AND REGION, 2025–2030 36

FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN ENVIRONMENTAL MONITORING MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD 37

FIGURE 9 INCREASED GOVERNMENT FUNDING TO PREVENT AND CONTROL ENVIRONMENTAL POLLUTION TO DRIVE MARKET 38

FIGURE 10 NORTH AMERICA TO COMMAND LARGEST MARKET SHARE DURING STUDY PERIOD 39

FIGURE 11 NORTH AMERICA AND HEALTHCARE & PHARMACEUTICAL INDUSTRIES ACCOUNTED FOR LARGEST MARKET SHARE IN 2024 40

FIGURE 12 CHINA TO REGISTER HIGHEST CAGR FROM 2025 TO 2030 41

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ENVIRONMENTAL MONITORING MARKET 42

FIGURE 14 ENVIRONMENTAL MONITORING MARKET: PORTER’S FIVE FORCES ANALYSIS 54

FIGURE 15 ENVIRONMENTAL MONITORING MARKET: VALUE CHAIN ANALYSIS 57

FIGURE 16 ENVIRONMENTAL MONITORING MARKET: SUPPLY CHAIN ANALYSIS 59

FIGURE 17 ENVIRONMENTAL MONITORING MARKET: ECOSYSTEM ANALYSIS 60

FIGURE 18 AVERAGE SELLING PRICE OF ENVIRONMENTAL MONITORING PRODUCTS,

BY TYPE, 2024 (USD) 62

FIGURE 19 SAVERAGE SELLING PRICE TREND OF ENVIRONMENTAL MONITORING PRODUCTS, BY REGION, 2022–2024 (USD) 64

FIGURE 20 IMPORT SCENARIO FOR HS CODE 9031, 2020–2024 (USD THOUSAND) 65

FIGURE 21 EXPORT SCENARIO FOR HS CODE 9031, 2020–2024 (USD THOUSAND) 66

FIGURE 22 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS IN ENVIRONMENTAL MONITORING MARKET 69

FIGURE 23 FUNDING AND NUMBER OF DEALS IN ENVIRONMENTAL MONITORING MARKET, 2019–2023 (USD MILLION) 69

FIGURE 24 NUMBER OF DEALS IN ENVIRONMENTAL MONITORING MARKET, BY KEY PLAYER, 2019–2023 70

FIGURE 25 VALUE OF DEALS IN ENVIRONMENTAL MONITORING MARKET,

BY KEY PLAYER, 2019–2023 (USD) 70

FIGURE 26 PATENT DETAILS FOR ENVIRONMENTAL MONITORING MARKET

(JANUARY 2015–DECEMBER 2025) 77

FIGURE 27 AI USE CASES IN ENVIRONMENTAL MONITORING MARKET 78

FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP PRODUCTS (%) 93

FIGURE 29 KEY BUYING CRITERIA FOR TOP PRODUCTS 93

FIGURE 30 NORTH AMERICA: ENVIRONMENTAL MONITORING MARKET SNAPSHOT 160

FIGURE 31 ASIA PACIFIC: ENVIRONMENTAL MONITORING MARKET SNAPSHOT 187

FIGURE 32 REVENUE ANALYSIS OF KEY PLAYERS IN ENVIRONMENTAL

MONITORING MARKET, 2020–2024 (USD MILLION) 226

FIGURE 33 MARKET SHARE ANALYSIS OF KEY PLAYERS ENVIRONMENTAL MONITORING MARKET (2024) 227

FIGURE 34 RANKING OF KEY PLAYERS IN ENVIRONMENTAL MONITORING MARKET (2024) 229

FIGURE 35 ENVIRONMENTAL MONITORING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024 230

FIGURE 36 ENVIRONMENTAL MONITORING MARKET: COMPANY FOOTPRINT 231

FIGURE 37 ENVIRONMENTAL MONITORING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 237

FIGURE 38 EV/EBITDA OF KEY VENDORS 243

FIGURE 39 YEAR-TO-DATE (YTD) PRICE, TOTAL RETURN, AND 5-YEAR STOCK

BETA OF KEY VENDORS 243

FIGURE 40 ENVIRONMENTAL MONITORING MARKET: BRAND/PRODUCT

COMPARATIVE ANALYSIS 244

FIGURE 41 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT 246

FIGURE 42 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT 260

FIGURE 43 VERALTO (DANAHER CORPORATION): COMPANY SNAPSHOT 268

FIGURE 44 SHIMADZU CORPORATION: COMPANY SNAPSHOT 278

FIGURE 45 PERKINELMER: COMPANY SNAPSHOT 286

FIGURE 46 3M: COMPANY SNAPSHOT 290

FIGURE 47 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT 295

FIGURE 48 BIOMÉRIEUX: COMPANY SNAPSHOT 301

FIGURE 49 MERCK KGAA: COMPANY SNAPSHOT 304

FIGURE 50 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT 308

FIGURE 51 SIEMENS: COMPANY SNAPSHOT 317

FIGURE 52 HORIBA, LTD.: COMPANY SNAPSHOT 325

FIGURE 53 TELEDYNE TECHNOLOGIES: COMPANY SNAPSHOT 330

FIGURE 54 TE CONNECTIVITY: COMPANY SNAPSHOT 334

FIGURE 55 ENVIRONMENTAL MONITORING MARKET: RESEARCH DATA 348

FIGURE 56 ENVIRONMENTAL MONITORING MARKET: RESEARCH DESIGN METHODOLOGY 349

FIGURE 57 ENVIRONMENTAL MONITORING MARKET: KEY DATA FROM SECONDARY SOURCES 350

FIGURE 58 ENVIRONMENTAL MONITORING MARKET: KEY PRIMARY SOURCES

(DEMAND AND SUPPLY SIDES) 352

FIGURE 59 ENVIRONMENTAL MONITORING MARKET: KEY PARTICIPANTS

(SUPPLY AND DEMAND SIDES) 352

FIGURE 60 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE,

DESIGNATION, AND REGION 353

FIGURE 61 ENVIRONMENTAL MONITORING MARKET: INSIGHTS FROM INDUSTRY EXPERTS 354

FIGURE 62 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING 355

FIGURE 63 ENVIRONMENTAL MONITORING MARKET ESTIMATION: COMPANY REVENUE ESTIMATION 356

FIGURE 64 ENVIRONMENTAL MONITORING MARKET SIZE ESTIMATION METHODOLOGY 357

FIGURE 65 ENVIRONMENTAL MONITORING MARKET SIZE ESTIMATION: TOP-DOWN APPROACH 358

FIGURE 66 ENVIRONMENTAL MONITORING MARKET: DATA TRIANGULATION 360