Loitering Munition Market - Global Forecast To 2030

徘徊型兵器市場 - タイプ(回収型、拡張型)、クラス[短距離(100 km)]、滞空時間[短距離滞空時間(120分)]、弾頭タイプ、ナビセンサー、発射モード、エンドユーザー、および地域 - 2030年までの世界予測

Loitering Munition Market by Type (Recoverable, Expandable), Class [Short Range (100 km)], Air Time [Short Endurance (120 min)], Warhead Type, Navsensor, Launch Mode, End User, and Region – Global Forecast to 2030

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年01月 |

| ページ数 | 310 |

| 図表数 | 303 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-12566 |

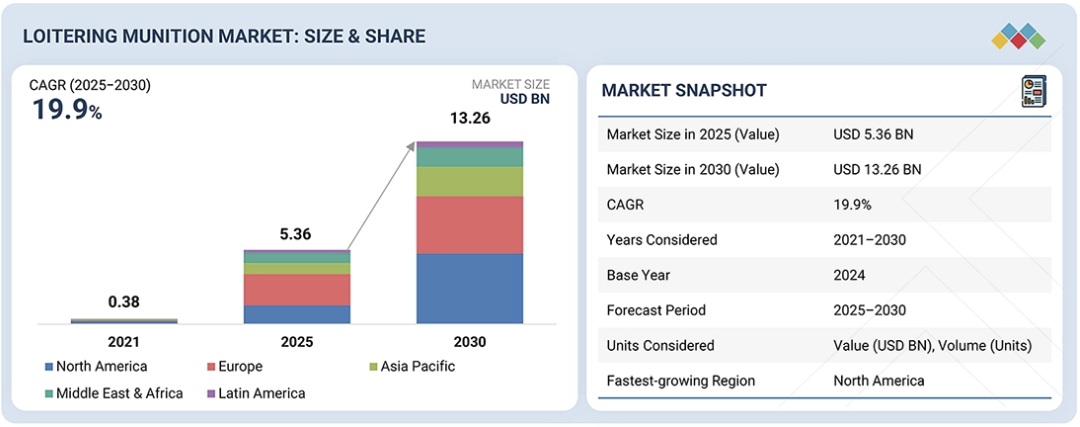

世界の徘徊型兵器市場規模は、2025年には53億6,000万米ドルと推定され、2030年には132億6,000万米ドルに達すると予測されています。同期間の年平均成長率(CAGR)は19.9%です。この成長は、精密で費用対効果の高い戦闘システムに対する需要の高まりによって牽引されています。軍隊は、照準精度を向上させるため、徘徊型ミサイルの使用を増やしています。人工知能(AI)と自律型照準は、より迅速な意思決定を可能にし、ミッションの有効性を向上させています。国防近代化プログラムは、長距離徘徊型ミサイルシステムへの投資を支援しています。小型化とモジュール化により、複数のプラットフォームにわたる運用の柔軟性が向上しています。また、マルチドメインおよび迅速な展開作戦を支援するシステムの需要も高まっています。

調査範囲:

本市場調査は、徘徊型兵器市場を様々なセグメントおよびサブセグメントにわたって調査対象としています。本調査は、様々な分野および地域における市場規模と成長の可能性を推定することを目的としています。また、本調査には、市場の主要プレーヤー、企業概要、製品および事業内容に関する主要な考察、最近の動向、そして主要な市場戦略に関する詳細な競合分析も含まれています。

このレポートを購入する理由:

本レポートは、市場リーダー企業と新規参入企業にとって、徘徊型兵器市場全体の収益に関する近似値に関する情報を提供するのに役立ちます。また、ステークホルダーが競争環境を理解し、より深い洞察を得て、事業のポジショニングを改善し、適切な市場参入戦略を策定するのに役立ちます。さらに、本レポートは、ステークホルダーが市場の動向を把握し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供するのに役立ちます。

本レポートでは、以下の点について洞察を提供しています。

- 市場の牽引要因(戦闘任務におけるコストとリスクを低減する精密攻撃システムへの移行)、制約要因(自律的な攻撃判断に関連する倫理的および法的懸念)、機会(協調任務のための群集型徘徊システムの統合)、課題(戦闘作戦における人間による制御を維持しながら自律性を管理すること)

- 市場浸透:市場トップ企業が提供する徘徊兵器市場に関する包括的な情報

- 製品開発/イノベーション:徘徊兵器市場における今後の技術、研究開発活動、製品発売に関する詳細な洞察

- 市場開発:様々な地域における収益性の高い市場に関する包括的な情報

- 市場多様化:徘徊型兵器市場における新製品、未開拓地域、最近の動向、投資に関する網羅的な情報

- 競合評価:徘徊型兵器市場における主要企業の市場シェア、成長戦略、製品、製造能力に関する詳細な評価

Report Description

.The global loitering munition market size is estimated at USD 5.36 billion in 2025 and is projected to reach USD 13.26 billion by 2030, at a CAGR of 19.9% over the same period. Growth is driven by rising demand for precision, cost-efficient combat systems. Armed forces are increasing the use of loitering munitions to improve targeting accuracy. Artificial Intelligence (AI) and autonomous targeting are enabling faster decision-making, which improves mission effectiveness. Defense modernization programs are supporting investments in long-range loitering missile systems. Miniaturized and modular designs are improving operational flexibility across multiple platforms. Demand is also rising for systems that support multi-domain and rapid deployment operations.

Loitering Munition Market – Global Forecast To 2030

“By air time, the long endurance (>120 min) segment is projected to grow at the highest CAGR during the forecast period.”

The long endurance segment is growing as defense forces need loitering systems that can stay airborne for extended periods. Longer flight time allows units to monitor areas before taking action. This helps in missions where targets appear after long wait times. Forces prefer these systems for wide zone patrol tasks. Demand is rising as surveillance needs increase in border areas. Longer endurance also supports better timing during strike missions. This capability is becoming important as operations grow more complex.

“By Navsensor, the Inertial Navigation systems segment is projected to grow at the highest CAGR of 30.9%.”

The inertial navigation segment is growing as defense forces require guidance systems that operate independently. These systems support missions where external signals are unreliable. This is useful in conflict zones with high electronic interference. Buyers prefer inertial navigation for consistent flight performance. Demand is rising as operations face more signal disruption.

Loitering Munition Market – Global Forecast To 2030 – region

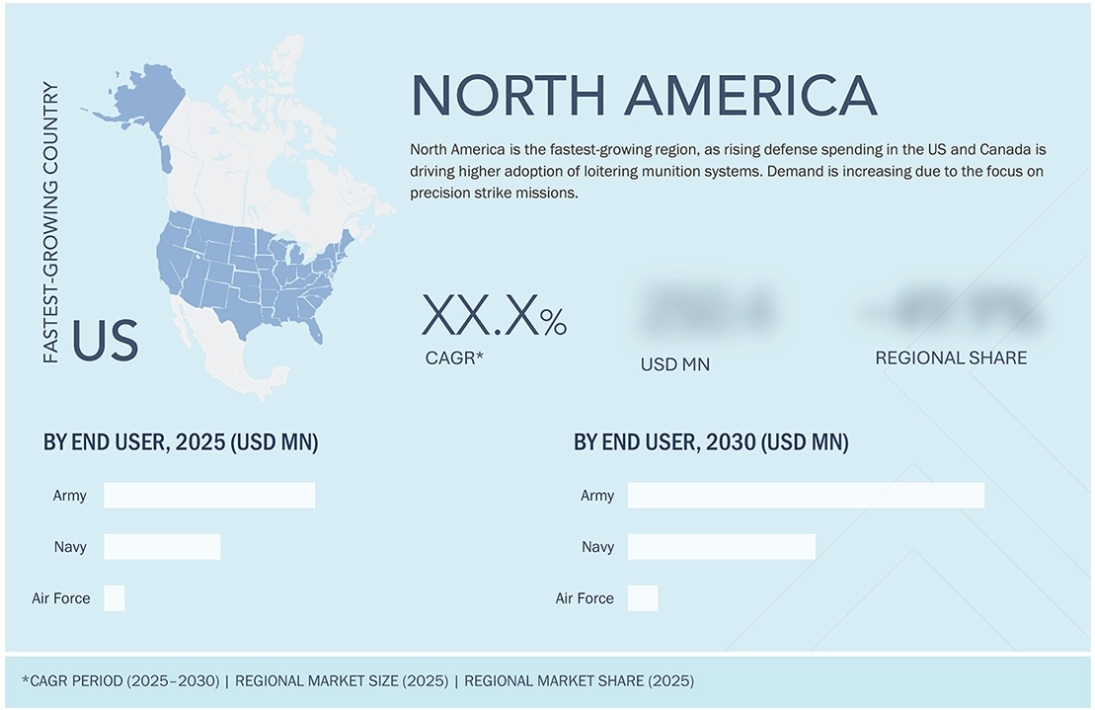

“North America is projected to grow at the highest rate during the forecast period.”

The market in North America is growing fast as the US and Canada increase focus on loitering munition programs. Defense forces in this region are adding these systems for field use and training needs. The US is driving demand through active trials and new procurement plans. Canada is also investing in modern strike tools for border and defense roles. Budget support in both countries is helping with faster adoption. Interest is rising as forces shift toward flexible and rapid strike options.

The breakdown of profiles for primary participants in the loitering munition market is provided below:

- By Company Type: Tier 1 – 35%, Tier 2 – 45%, and Tier 3 – 20%

- By Designation: C Level – 35%, Director Level – 25%, and Others – 40%

- By Region: North America – 25%, Europe – 15%, Asia Pacific – 45%, Middle East – 10% Rest of the World (RoW) – 5%

Loitering Munition Market – Global Forecast To 2030 – ecosystem

Research Coverage:

This market study covers the loitering munition market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different parts and regions. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations on their products and business offerings, recent developments, and the key market strategies they have adopted.

Reasons to buy this report:

The report will help market leaders and new entrants with information on the closest approximations of revenue for the overall loitering munition market. It will also help stakeholders understand the competitive landscape and gain deeper insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the market pulse and will provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Market Drivers (Shift toward precision strike systems that reduce cost and risk in combat missions), Restraints (Ethical and legal concerns linked to autonomous strike decisions), Opportunities (Integration of swarm-based loitering systems for coordinated missions), Challenges (Managing autonomy while keeping human control in combat operations)

- Market Penetration: Comprehensive information on the loitering munition market offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the loitering munition market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the loitering munition market

- Competitive Assessment: In-depth assessment of market share, growth strategies, products, and manufacturing capabilities of leading players in the loitering munition market

Table of Contents

1 INTRODUCTION 30

1.1 STUDY OBJECTIVES 30

1.2 MARKET DEFINITION 30

1.3 STUDY SCOPE 31

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 31

1.3.2 INCLUSIONS AND EXCLUSIONS 32

1.3.3 YEARS CONSIDERED 33

1.4 CURRENCY CONSIDERED 33

1.5 STAKEHOLDERS 34

1.6 SUMMARY OF CHANGES 34

2 EXECUTIVE SUMMARY 36

2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS 36

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 37

2.3 DISRUPTIVE TRENDS IN LOITERING MUNITION MARKET 37

2.4 HIGH-GROWTH SEGMENTS 38

2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST 39

3 PREMIUM INSIGHTS 40

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LOITERING MUNITION MARKET 40

3.2 LOITERING MUNITION MARKET, BY TYPE 41

3.3 LOITERING MUNITION MARKET, BY WARHEAD 41

3.4 LOITERING MUNITION MARKET, BY END USER 42

3.5 LOITERING MUNITION MARKET, BY LAUNCH MODE 42

4 MARKET OVERVIEW 43

4.1 INTRODUCTION 43

4.2 MARKET DYNAMICS 44

4.2.1 DRIVERS 44

4.2.1.1 Shift toward precision and cost-effective warfare 44

4.2.1.2 Integration of AI and autonomous targeting 45

4.2.1.3 Geopolitical tensions and modernization of defense forces 45

4.2.1.4 Rise of miniaturization and modularity 45

4.2.1.5 Expansion of tactical and strategic multi-domain operations 45

4.2.2 RESTRAINTS 46

4.2.2.1 Ethical and legal concerns surrounding autonomous lethality 46

4.2.2.2 Export control restrictions and technology transfer limitations 46

4.2.2.3 Limited endurance and payload constraints 46

4.2.2.4 High development and integration costs 46

4.2.2.5 Vulnerability to electronic warfare and C-UAS technologies 46

4.2.3 OPPORTUNITIES 47

4.2.3.1 Integration of swarm and collaborative mission systems 47

4.2.3.2 Expansion across emerging defense markets 47

4.2.3.3 Advancements in AI-driven autonomy and target recognition 47

4.2.3.4 Trend of modular and multi-mission configurations 47

4.2.4 CHALLENGES 48

4.2.4.1 Balancing autonomy with human oversight in combat decision-making 48

4.2.4.2 Evolving threat landscape 48

4.2.4.3 Interoperability and integration within existing defense architectures 48

4.2.4.4 Supply chain complexity and component dependency 48

4.3 UNMET NEEDS AND WHITE SPACES 49

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 49

4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 49

5 INDUSTRY TRENDS 51

5.1 INTRODUCTION 51

5.2 MACROECONOMIC OUTLOOK 51

5.2.1 INTRODUCTION 51

5.2.2 GDP TRENDS AND FORECAST 51

5.2.3 TRENDS IN GLOBAL DEFENSE INDUSTRY 53

5.2.4 TRENDS IN GLOBAL LOITERING MUNITION INDUSTRY 53

5.3 VALUE CHAIN ANALYSIS 54

5.3.1 PLANNING AND REVISING FUNDING (~15%) 54

5.3.2 RESEARCH AND DEVELOPMENT (~20%) 54

5.3.3 RAW MATERIAL PROCUREMENT AND MANUFACTURING (~15%) 55

5.3.4 ASSEMBLY, TESTING, AND APPROVAL (~30%) 55

5.3.5 DISTRIBUTION (~10%) 55

5.3.6 AFTER-SALES SERVICE (~10%) 55

5.4 ECOSYSTEM ANALYSIS 55

5.4.1 MANUFACTURERS 56

5.4.2 SOLUTION AND SERVICE PROVIDERS 56

5.4.3 END USERS 56

5.5 INVESTMENT AND FUNDING SCENARIO 58

5.6 PRICING ANALYSIS 58

5.6.1 INDICATIVE PRICING ANALYSIS OF LOITERING MUNITIONS OFFERED BY KEY PLAYERS 59

5.6.2 INDICATIVE PRICING ANALYSIS, BY REGION 59

5.7 TRADE ANALYSIS 60

5.7.1 IMPORT SCENARIO (HS CODE 9306) 60

5.7.2 EXPORT SCENARIO (HS CODE 9306) 61

5.8 CASE STUDY ANALYSIS 63

5.8.1 AEROVIRONMENT INC.’S SWITCHBLADE NEXT-GENERATION LOITERING MUNITION SYSTEM 63

5.8.2 ISRAEL AEROSPACE INDUSTRIES’ HAROP LOITERING MUNITION 64

5.8.3 STM’S KARGU ROTARY-WING LOITERING MUNITION 64

5.8.4 UVISION’S HERO SERIES LOITERING MUNITION 64

5.9 2025 US TARIFF 65

5.9.1 INTRODUCTION 65

5.9.2 KEY TARIFF RATES 65

5.9.3 PRICE IMPACT ANALYSIS 66

5.9.4 IMPACT ON COUNTRY/REGION 66

5.9.4.1 US 66

5.9.4.2 Europe 67

5.9.4.3 Asia Pacific 67

5.9.5 IMPACT ON APPLICATION 67

5.9.5.1 Anti-armor strike applications 67

5.9.5.2 ISR 68

5.9.5.3 SEAD 68

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS. 69

6.1 KEY TECHNOLOGIES 69

6.1.1 AI-DRIVEN TARGET RECOGNITION AND AUTONOMOUS NAVIGATION 69

6.1.2 MULTI-DOMAIN SWARM COORDINATION SYSTEMS 69

6.1.3 ENHANCED PROPULSION AND POWER SYSTEMS 69

6.1.4 SECURE DATA LINKS AND ANTI-JAMMING COMMUNICATION NETWORKS 69

6.2 COMPLEMENTARY TECHNOLOGIES 70

6.2.1 MULTI-SPECTRAL SENSOR FUSION AND MINIATURIZED PAYLOADS 70

6.2.2 EDGE COMPUTING AND ONBOARD PROCESSING 70

6.2.3 ADDITIVE MANUFACTURING AND RAPID PROTOTYPING 70

6.2.4 PREDICTIVE MAINTENANCE AND DIGITAL TWIN PLATFORMS 70

6.3 TECHNOLOGY ROADMAP 71

6.4 PATENT ANALYSIS 72

6.5 FUTURE APPLICATIONS 77

6.6 IMPACT OF AI/GEN AI 79

6.6.1 TOP USE CASES AND MARKET POTENTIAL 80

6.6.2 CASE STUDIES OF AI IMPLEMENTATION 81

6.6.3 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS 81

6.6.4 CLIENTS’ READINESS TO ADOPT AI/GEN AI 82

6.6.5 SUCCESS STORIES AND REAL-WORLD APPLICATIONS 82

6.6.5.1 AeroVironment: Gen AI-optimized target recognition for Switchblade systems 83

6.6.5.2 Israel Aerospace Industries: Gen AI-driven autonomous mission planning for Harop and Harpy 83

6.6.5.3 UVision: Gen AI-enhanced flight efficiency and impact precision for HERO Series 83

7 SUSTAINABILITY AND REGULATORY LANDSCAPE 84

7.1 REGIONAL REGULATIONS AND COMPLIANCE 84

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 84

7.1.2 INDUSTRY STANDARDS 88

7.2 SUSTAINABILITY INITIATIVES 90

7.2.1 CARBON IMPACT REDUCTION 90

7.2.2 ECO-APPLICATIONS 92

7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES 93

7.3.1 SUSTAINABILITY IMPACT ON LOITERING MUNITION MARKET 93

7.3.2 REGULATORY POLICY INITIATIVES DRIVING LOITERING MUNITION DEPLOYMENT 94

7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 96

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR 97

8.1 DECISION-MAKING PROCESS 97

8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA 98

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 98

8.2.2 BUYING CRITERIA 99

8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES 100

8.4 UNMET NEEDS FROM VARIOUS END USERS 101

8.4.1 NEED FOR EXTENDED-ENDURANCE AND MULTI-MISSION LOITERING CAPABILITIES 101

8.4.2 NEED FOR ENHANCED SURVIVABILITY AND C-UAS RESISTANCE 101

8.4.3 NEED FOR LOWER-COST, SCALABLE, AND RAPIDLY DEPLOYABLE SOLUTIONS 101

9 LOITERING MUNITION MARKET, BY TYPE (MARKET SIZE &

FORECAST TO 2030, USD MILLION) 102

9.1 INTRODUCTION 103

9.2 ASSESSMENT OF LOITERING MUNITION (RECOVERABLE VS. EXPENDABLE) 104

9.2.1 PROCUREMENT TRENDS 104

9.2.2 SUSTAINMENT/UPGRADES 104

9.3 RECOVERABLE 105

9.3.1 OPERATIONAL FLEXIBILITY AND COST EFFICIENCY TO DRIVE MARKET 105

9.3.2 USE CASE: SPIKE FIREFLY BY RAFAEL ADVANCED DEFENSE SYSTEMS 105

9.4 EXPENDABLE 105

9.4.1 HIGH-IMPACT PRECISION STRIKE AND RAPID DEPLOYMENT TO DRIVE MARKET 105

9.4.2 USE CASE: PHOENIX GHOST BY AEVEX AEROSPACE 106

10 LOITERING MUNITION MARKET, BY CLASS (MARKET SIZE & FORECAST TO 2030, USD MILLION) 107

10.1 INTRODUCTION 108

10.2 CLASSIFICATION OF LOITERING MUNITION BASED ON WEIGHT 109

10.2.1 SMALL LOITERING MUNITION (<25 KG): TOP THREE USE CASES 109

10.2.1.1 Use case: Switchblade 300 for infantry-level precision strike 109

10.2.1.2 Use case: HERO-30 for special operations and low-collateral damage 109

10.2.1.3 Use case: Warmate for border security and static target neutralization 109

10.2.2 TACTICAL LOITERING MUNITION (25–150 KG): TOP THREE USE CASES 110

10.2.2.1 Use case: Lancet-3 for anti-armor and air defense suppression 110

10.2.2.2 Use case: HERO-120 for anti-tank and heavy fortification strike missions 110

10.2.2.3 Use case: Warmate 2 for battlefield interdiction and delayed strike operations 110

10.2.3 STRATEGIC LOITERING MUNITION (>150 KG): TOP THREE USE CASES 111

10.2.3.1 Use case: Harop for deep-strike electronic warfare and radar neutralization 111

10.2.3.2 Use case: HERO-900 for long-endurance target persistence and time-sensitive strike decisions 111

10.2.3.3 Use case: Harpy for anti-radar suppression and air defense neutralization 111

10.3 SHORT RANGE (<25 KM) 111

10.3.1 EXTENSIVE USE IN CLOSE COMBAT TO DRIVE MARKET 111

10.3.2 USE CASE: NAGASTRA 1R BY SOLAR GROUP 112

10.4 MEDIUM RANGE (25–100 KM) 112

10.4.1 NEED FOR ENHANCED OPERATIONAL AGILITY AND PRECISION STRIKES TO DRIVE MARKET 112

10.4.2 USE CASE: LANCET BY ZALA AERO 112

10.5 LONG RANGE (>100 KM) 113

10.5.1 INCREASED PREFERENCE FOR DEEP-STRIKE CAPABILITIES AMONG MILITARY FORCES TO DRIVE MARKET 113

10.5.2 USE CASE: HARPY BY ISRAEL AEROSPACE INDUSTRIES 113

11 LOITERING MUNITION MARKET, BY AIR TIME (MARKET SIZE &

FORECAST TO 2030, USD MILLION) 114

11.1 INTRODUCTION 115

11.2 CLASSIFICATION OF LOITERING MUNITION BASED ON LOITER TIME 116

11.2.1 BELOW 60 MINUTES: TOP THREE USE CASES 116

11.2.1.1 Use case: Switchblade 300 for rapid infantry strike and mobile target neutralization 116

11.2.1.2 Use case: HERO-30 for special operations and urban close-quarters strike 116

11.2.1.3 Use case: Warmate for border patrol and rapid engagement missions 116

11.2.2 ABOVE 60 MINUTES: TOP THREE USE CASES 116

11.2.2.1 Use case: Harop for extended strike and electronic warfare target elimination 116

11.2.2.2 Use case: HERO-900 for time-sensitive target tracking and delayed strike operations 117

11.2.2.3 Use case: Switchblade 600 for extended anti-armor and precision strike missions 117

11.3 SHORT ENDURANCE (<45 MINUTES) 117

11.3.1 HIGH DEMAND FOR MICRO/NANO TACTICAL EXPENDABLE LOITERERS TO DRIVE MARKET 117

11.3.2 USE CASE: BLACK HORNET-STYLE NANO EXPENDABLE LOITERER 117

11.4 MEDIUM ENDURANCE (45–120 MINUTES) 118

11.4.1 EMPHASIS ON MINI AND TACTICAL LOITERING STRIKE PLATFORMS TO DRIVE MARKET 118

11.4.2 USE CASE: WARMATE 1 BY WB GROUP 118

11.5 LONG ENDURANCE (>120 MINUTES) 118

11.5.1 SHIFT TOWARD HIGH-ENDURANCE EXPENDABLE LOITERERS TO DRIVE MARKET 118

11.5.2 USE CASE: HAROP BY ISRAEL AEROSPACE INDUSTRIES 119

12 LOITERING MUNITION MARKET, BY WARHEAD TYPE

(MARKET SIZE & FORECAST TO 2030, USD MILLION) 120

12.1 INTRODUCTION 121

12.2 CLASSIFICATION OF LOITERING MUNITION BASED ON WARHEAD WEIGHT 122

12.2.1 BELOW 5 KG: TOP THREE USE CASES 122

12.2.1.1 Use case: Switchblade 300 for low-collateral precision strike in urban combat 122

12.2.1.2 Use case: HERO-30 for special forces covert strike operations 122

12.2.1.3 Use case: Warmate 1 Micro for border security and rapid engagement 123

12.2.2 5–10 KG: TOP THREE USE CASES 123

12.2.2.1 Use case: Switchblade 600 for anti-armor precision strike 123

12.2.2.2 Use case: HERO-70 for counter-insurgency and light vehicle neutralization 123

12.2.2.3 Use case: Warmate 2 for mobile launch and battlefield interdiction 123

12.2.3 ABOVE 10 KG: TOP THREE USE CASES 124

12.2.3.1 Use case: Harop for long-duration deep strike and target confirmation 124

12.2.3.2 Use case: HERO-1250 for strategic infrastructure and high-value target elimination 124

12.2.3.3 Use case: Harpy NG for autonomous anti-radiation strike and electronic warfare suppression 124

12.3 HIGH-EXPLOSIVE WARHEAD 125

12.3.1 MODERN ARMED FORCES’ PUSH FOR PRECISION AND AUTONOMY IN STRIKE OPERATIONS TO DRIVE MARKET 125

12.3.2 USE CASE: SWITCHBLADE 600 BY AEROVIRONMENT 125

12.4 FRAGMENTATION WARHEAD 125

12.4.1 INCREASING REQUIREMENT FOR SWARM-ENABLED MINI LOITERERS TO DRIVE MARKET 125

12.4.2 USE CASE: HERO-120 BY UVISION 126

12.5 ANTI-ARMOR/SHAPE-CHARGED WARHEAD 126

12.5.1 RAPID ADOPTION OF AUTONOMOUS ANTI-ARMOR LOITERING STRIKE PLATFORMS TO DRIVE MARKET 126

12.5.2 USE CASE: LANCET-3 BY ZALA AERO 126

12.6 ANTI-RADIATION WARHEAD 127

12.6.1 FOCUS ON SUPPRESSING ENEMY AIR DEFENSE AND RADAR INFRASTRUCTURE TO DRIVE MARKET 127

12.6.2 USE CASE: HARPY BY ISRAEL AEROSPACE INDUSTRIES 127

12.7 THERMOBARIC WARHEAD 127

12.7.1 COMPLEX URBAN AND ASYMMETRIC COMBAT ENVIRONMENTS TO DRIVE MARKET 127

12.7.2 USE CASE: HERO-30 THERMOBARIC BY UVISION 128

13 LOITERING MUNITION MARKET, BY NAVSENSOR (MARKET SIZE &

FORECAST TO 2030, USD MILLION) 129

13.1 INTRODUCTION 130

13.2 CLASSIFICATION OF LOITERING MUNITION BASED ON SEEKER TECHNOLOGY 131

13.2.1 EO CAMERAS: TOP THREE USE CASES 131

13.2.1.1 Use case: EO-guided micro strike via Switchblade 300 for urban precision engagement 131

13.2.1.2 Use case: EO-guided HERO-120 for area surveillance and target-directed strike 131

13.2.1.3 Use case: EO-seeker Lancet-3 for moving target neutralization and battlefield interdiction 132

13.2.2 IR/THERMAL IMAGERS: TOP THREE USE CASES 132

13.2.2.1 Use case: Phoenix Ghost for thermal-guided night strike and hidden target engagement 132

13.2.2.2 Use case: HERO-400EC for heat-signature targeting against armored and fortified assets 132

13.2.2.3 Use case: Lancet-3 for IR-guided counter-artillery and air defense target neutralization 132

13.2.3 RF SEEKERS: TOP THREE USE CASES 133

13.2.3.1 Use case: Harpy for autonomous RF-homing anti-radiation strike 133

13.2.3.2 Use case: Harpy NG multi-frequency RF-guided loitering missile for advanced electronic warfare targets 133

13.2.3.3 Use case: RF-enabled HERO-1250 for electronic warfare target attrition 133

13.3 EO 133

13.3.1 INTEGRATION OF COMPUTER-VISION AUTONOMY IN TACTICAL LOITERERS TO DRIVE MARKET 133

13.3.2 USE CASE: EO-GUIDED ROTEM ALPHA BY ISRAEL AEROSPACE INDUSTRIES 134

13.4 GPS/GNSS 134

13.4.1 RISING DEMAND FOR LONG-RANGE EXPENDABLE LOITERERS

TO DRIVE MARKET 134

13.4.2 USE CASE: GNSS-GUIDED SKYSTRIKER BY ELBIT SYSTEMS 134

13.5 IR/THERMAL 135

13.5.1 RAPID ADOPTION OF AUTONOMOUS IR-BASED MICRO/

MINI LOITERING SYSTEMS TO DRIVE MARKET 135

13.5.2 USE CASE: THERMAL-GUIDED PHOENIX GHOST BY AEVEX AEROSPACE 135

13.6 INS 135

13.6.1 DEMAND FOR NAVIGATION-RESILIENT EXPENDABLE LOITERERS TO DRIVE MARKET 135

13.6.2 USE CASE: INS-ENABLED HAROP BY ISRAEL AEROSPACE INDUSTRIES 136

13.7 RF-BASED 136

13.7.1 INCREASING COMPLEXITY OF ELECTRONIC WARFARE TO DRIVE MARKET 136

13.7.2 USE CASE: RF-HOMING HARPY NG BY ISRAEL AEROSPACE INDUSTRIES 136

14 LOITERING MUNITION MARKET, BY LAUNCH MODE (MARKET SIZE & FORECAST TO 2030, USD MILLION) 137

14.1 INTRODUCTION 138

14.2 CLASSIFICATION OF LOITERING MUNITION BASED ON AUTOMATION LEVEL 139

14.2.1 HUMAN-IN-THE-LOOP: TOP THREE USE CASES 139

14.2.1.1 Use case: Switchblade 300 operator-controlled precision strike for small tactical units 139

14.2.1.2 Use case: HERO-30 for human-validated anti-personnel and light-vehicle engagements 139

14.2.1.3 Use case: SkyStriker for human-supervised long-endurance precision engagements 140

14.2.2 HUMAN-ON-THE-LOOP: TOP THREE USE CASES 140

14.2.2.1 Use case: STM Kargu-2 for autonomous swarm-enabled target tracking with operator override 140

14.2.2.2 Use case: Harop for autonomous SEAD missions with human oversight 140

14.2.2.3 Use case: HERO-120 for anti-armor missions with operator intervention capability 140

14.2.3 HUMAN-OUT-OF-THE-LOOP: TOP THREE USE CASES 141

14.2.3.1 Use case: Harpy for fully autonomous anti-radiation strike against enemy air defense networks 141

14.2.3.2 Use case: STM Kargu for AI-driven target identification in communication-denied environments 141

14.2.3.3 Use case: Shahed-136 for high-density saturation strikes against strategic targets 141

14.3 AIR-LAUNCHED 142

14.3.1 NEED FOR RAPID RESPONSE TIMES IN MILITARY OPERATIONS

TO DRIVE MARKET 142

14.3.2 USE CASE: ALTIUS-700M BY ANDURIL INDUSTRIES 142

14.4 VERTICAL TAKE-OFF 142

14.4.1 MODERNIZATION OF MILITARY ARSENALS AMID EVOLVING THREATS

TO DRIVE MARKET 142

14.4.2 USE CASE: ROTEM ALPHA BY ISRAEL AEROSPACE INDUSTRIES 143

14.5 CANISTER-LAUNCHED 143

14.5.1 HIGH DEMAND FOR VERSATILE DEPLOYMENT METHODS FROM MILITARY FORCES TO DRIVE MARKET 143

14.5.2 USE CASE: SKYSTRIKER BY ELBIT SYSTEMS 143

14.6 CATAPULT-LAUNCHED 144

14.6.1 SHIFT TOWARD INTEGRATED COMBAT SOLUTIONS TO DRIVE MARKET 144

14.6.2 USE CASE: WARMATE BY WB GROUP 144

14.7 HAND-LAUNCHED 144

14.7.1 FOCUS ON PRECISION STRIKES IN URBAN WARFARE TO DRIVE MARKET 144

14.7.2 USE CASE: HERO-30 BY UVISION 145

15 LOITERING MUNITION MARKET, BY END USER (MARKET SIZE &

FORECAST TO 2030, USD MILLION) 146

15.1 INTRODUCTION 147

15.2 CLASSIFICATION OF LOITERING MUNITION PROCUREMENT BASED ON ACQUISITION 148

15.2.1 DEFENSE BUDGET ALLOCATION 148

15.2.2 NEAR-TERM PROCUREMENT ORDERS 148

15.2.3 MULTI-YEAR ACQUISITION PLANS 148

15.3 ARMY 149

15.3.1 PUSH FOR ENHANCING OPERATIONAL CAPABILITIES TO DRIVE MARKET 149

15.3.2 USE CASE: LONG-RANGE LOITERING WEAPONS FOR SATURATION STRIKES AGAINST CRITICAL INFRASTRUCTURE 149

15.4 NAVY 149

15.4.1 SHARP RISE OF ASYMMETRIC THREATS TO DRIVE MARKET 149

15.4.2 USE CASE: LOITERING MISSILES FOR COASTAL DEFENSE AND SHORELINE ATTACKS 150

15.5 AIR FORCE 150

15.5.1 SURGE IN DEFENSE BUDGETS AND MODERNIZATION EFFORTS TO DRIVE MARKET 150

15.5.2 USE CASE: GROUND-LAUNCHED LOITERING WEAPONS FOR SEAD MISSIONS 150

16 LOITERING MUNITION MARKET, BY REGION (USD MILLION) 151

16.1 INTRODUCTION 152

16.2 NORTH AMERICA 153

16.2.1 US 156

16.2.1.1 Rising operational integration and industrial expansion to drive market 156

16.2.1.2 Top three loitering munitions and specifications 156

16.2.2 CANADA 158

16.2.2.1 Domestic capability development and strategic alignment to drive market 158

16.2.2.2 Top three loitering munitions and specifications 158

16.3 EUROPE 160

16.3.1 FRANCE 163

16.3.1.1 Strategic autonomy and indigenous production to drive market 163

16.3.1.2 Top three loitering munitions and specifications 163

16.3.2 GERMANY 165

16.3.2.1 Defense restructuring and multinational collaboration to drive market 165

16.3.2.2 Top three loitering munitions and specifications 166

16.3.3 UK 167

16.3.3.1 Advanced autonomy programs and regulatory integration to drive market 167

16.3.3.2 Top three loitering munitions and specifications 168

16.3.4 ITALY 169

16.3.4.1 Industrial revitalization and European defense alignment to drive market 169

16.3.4.2 Top three loitering munitions and specifications 170

16.3.5 REST OF EUROPE 171

16.3.5.1 Top three loitering munitions and specifications 172

16.4 ASIA PACIFIC 173

16.4.1 INDIA 176

16.4.1.1 Indigenization and operational readiness to drive market 176

16.4.1.2 Top three loitering munitions and specifications 177

16.4.2 JAPAN 178

16.4.2.1 Strategic defense expansion and indigenous R&D to drive market 178

16.4.2.2 Top three loitering munitions and specifications 179

16.4.3 AUSTRALIA 181

16.4.3.1 Sovereign capability development and strategic partnerships to drive market 181

16.4.3.2 Top three loitering munitions and specifications 181

16.4.4 REST OF ASIA PACIFIC 183

16.5 MIDDLE EAST 186

16.5.1 SAUDI ARABIA 188

16.5.1.1 Defense industrialization and capability diversification to drive market 188

16.5.1.2 Top three loitering munitions and specifications 189

16.5.2 ISRAEL 190

16.5.2.1 Robust export and innovation capabilities to drive market 190

16.5.2.2 Top three loitering munitions and specifications 191

16.5.3 TURKEY 193

16.5.3.1 Rapid industrial growth and export momentum to drive market 193

16.5.3.2 Top three loitering munitions and specifications 193

16.6 REST OF THE WORLD 195

16.6.1 LATIN AMERICA 198

16.6.1.1 Growing demand for cost-efficient loitering strike and surveillance systems to drive market 198

16.6.1.2 Top three loitering munitions and specifications 198

16.6.2 AFRICA 200

16.6.2.1 Rising border security needs and cost-effective precision strike capabilities to drive market 200

16.6.2.2 Top three loitering munitions and specifications 200

17 COMPETITIVE LANDSCAPE 202

17.1 INTRODUCTION 202

17.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2025 202

17.3 REVENUE ANALYSIS, 2021–2024 204

17.4 MARKET SHARE ANALYSIS, 2024 204

17.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 207

17.5.1 STARS 207

17.5.2 EMERGING LEADERS 208

17.5.3 PERVASIVE PLAYERS 208

17.5.4 PARTICIPANTS 208

17.5.5 COMPANY FOOTPRINT 209

17.5.5.1 Company footprint 209

17.5.5.2 Type footprint 210

17.5.5.3 End user footprint 211

17.5.5.4 Launch mode footprint 212

17.5.5.5 Region footprint 213

17.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024 214

17.6.1 PROGRESSIVE COMPANIES 214

17.6.2 RESPONSIVE COMPANIES 214

17.6.3 DYNAMIC COMPANIES 214

17.6.4 STARTING BLOCKS 214

17.6.5 COMPETITIVE BENCHMARKING 216

17.6.5.1 List of start-ups/SMEs 216

17.6.5.2 Competitive benchmarking of start-ups/SMEs 217

17.7 COMPANY VALUATION AND FINANCIAL METRICS 217

17.8 BRAND/PRODUCT COMPARISON 218

17.9 COMPETITIVE SCENARIO 219

17.9.1 PRODUCT LAUNCHES 219

17.9.2 DEALS 221

17.9.3 OTHERS 225

18 COMPANY PROFILES 229

18.1 KEY PLAYERS 229

18.1.1 AEROVIRONMENT, INC. 229

18.1.1.1 Business overview 229

18.1.1.2 Products offered 231

18.1.1.3 Recent developments 232

18.1.1.3.1 Product launches 232

18.1.1.3.2 Deals 233

18.1.1.3.3 Others 233

18.1.1.4 MnM view 234

18.1.1.4.1 Right to win 234

18.1.1.4.2 Strategic choices 234

18.1.1.4.3 Weaknesses and competitive threats 234

18.1.2 ELBIT SYSTEMS LTD. 235

18.1.2.1 Business overview 235

18.1.2.2 Products offered 236

18.1.2.3 Recent developments 237

18.1.2.3.1 Product launches 237

18.1.2.3.2 Others 237

18.1.2.4 MnM view 238

18.1.2.4.1 Right to win 238

18.1.2.4.2 Strategic choices 238

18.1.2.4.3 Weaknesses and competitive threats 238

18.1.3 RHEINMETALL AG 239

18.1.3.1 Business overview 239

18.1.3.2 Products offered 240

18.1.3.3 Recent developments 241

18.1.3.3.1 Product launches 241

18.1.3.3.2 Deals 241

18.1.3.3.3 Others 242

18.1.3.4 MnM view 242

18.1.3.4.1 Right to win 242

18.1.3.4.2 Strategic choices 242

18.1.3.4.3 Weaknesses and competitive threats 243

18.1.4 ISRAEL AEROSPACE INDUSTRIES 244

18.1.4.1 Business overview 244

18.1.4.2 Products offered 245

18.1.4.3 Recent developments 246

18.1.4.3.1 Product launches 246

18.1.4.3.2 Deals 247

18.1.4.3.3 Others 247

18.1.4.4 MnM view 248

18.1.4.4.1 Right to win 248

18.1.4.4.2 Strategic choices 248

18.1.4.4.3 Weaknesses and competitive threats 248

18.1.5 UVISION 249

18.1.5.1 Business overview 249

18.1.5.2 Products offered 249

18.1.5.3 Recent developments 250

18.1.5.3.1 Deals 250

18.1.5.3.2 Others 250

18.1.5.4 MnM view 250

18.1.5.4.1 Right to win 250

18.1.5.4.2 Strategic choices 251

18.1.5.4.3 Weaknesses and competitive threats 251

18.1.6 THALES 252

18.1.6.1 Business overview 252

18.1.6.2 Products offered 253

18.1.6.3 Recent developments 253

18.1.6.3.1 Deals 253

18.1.7 NORTHROP GRUMMAN 254

18.1.7.1 Business overview 254

18.1.7.2 Products offered 255

18.1.7.3 Recent developments 256

18.1.7.3.1 Product Launches 256

18.1.8 WB GROUP 257

18.1.8.1 Business overview 257

18.1.8.2 Products offered 257

18.1.8.3 Recent developments 258

18.1.8.3.1 Others 258

18.1.9 EDGE GROUP PJSC 259

18.1.9.1 Business overview 259

18.1.9.2 Products offered 259

18.1.9.3 Recent developments 261

18.1.9.3.1 Product launches 261

18.1.9.3.2 Deals 262

18.1.9.3.3 Others 262

18.1.10 ANDURIL INDUSTRIES 263

18.1.10.1 Business overview 263

18.1.10.2 Products offered 263

18.1.10.3 Recent developments 265

18.1.10.3.1 Product launches 265

18.1.10.3.2 Deals 265

18.1.10.3.3 Others 266

18.1.11 AEVEX AEROSPACE 267

18.1.11.1 Business overview 267

18.1.11.2 Products offered 267

18.1.11.3 Recent developments 268

18.1.11.3.1 Deals 268

18.1.12 STM 269

18.1.12.1 Business overview 269

18.1.12.2 Products offered 269

18.1.12.3 Recent developments 270

18.1.12.3.1 Deals 270

18.1.12.3.2 Others 270

18.1.13 KNDS 271

18.1.13.1 Business overview 271

18.1.13.2 Products offered 271

18.1.13.3 Recent developments 272

18.1.13.3.1 Deals 272

18.1.13.3.2 Others 272

18.1.14 PARAMOUNT GROUP 273

18.1.14.1 Business overview 273

18.1.14.2 Products offered 273

18.1.14.3 Recent developments 274

18.1.14.3.1 Deals 274

18.1.15 MBDA 275

18.1.15.1 Business overview 275

18.1.15.2 Products offered 275

18.1.15.3 Recent developments 276

18.1.15.3.1 Deals 276

18.1.15.3.2 Others 276

18.1.16 TELEDYNE FLIR LLC 277

18.1.16.1 Business overview 277

18.1.16.2 Products offered 277

18.1.16.3 Recent developments 278

18.1.16.3.1 Others 278

18.1.17 SOLAR GROUP 279

18.1.17.1 Business overview 279

18.1.17.2 Products offered 280

18.1.17.3 Recent developments 281

18.1.17.3.1 Others 281

18.2 OTHER PLAYERS 282

18.2.1 ARQUIMEA 282

18.2.2 ROKETSAN 283

18.2.3 TATA ADVANCED SYSTEMS LIMITED 284

18.2.4 SPEAR 285

18.2.5 TRANSVARO ELEKTRON ALETLERI 286

18.2.6 BAYKAR TECH 287

18.2.7 OVERWATCH GROUP 288

18.2.8 KADET DEFENCE SYSTEMS 289

18.2.9 DEFENDTEX 290

18.2.10 JOHNNETTE GROUP 291

19 RESEARCH METHODOLOGY 292

19.1 RESEARCH DATA 292

19.1.1 SECONDARY DATA 293

19.1.1.1 Key data from secondary sources 294

19.1.2 PRIMARY DATA 294

19.1.2.1 Primary interview participants 294

19.1.2.2 Key data from primary sources 295

19.1.2.3 Breakdown of primary interviews 295

19.1.2.4 Insights from industry experts 296

19.2 FACTOR ANALYSIS 296

19.2.1 SUPPLY-SIDE INDICATORS 297

19.2.2 DEMAND-SIDE INDICATORS 297

19.3 MARKET SIZE ESTIMATION 297

19.3.1 BOTTOM-UP APPROACH 297

19.3.2 TOP-DOWN APPROACH 298

19.3.3 BASE NUMBER CALCULATION 299

19.4 DATA TRIANGULATION 300

19.5 RESEARCH ASSUMPTIONS 301

19.6 RESEARCH LIMITATIONS 301

19.7 RISK ASSESSMENT 302

20 APPENDIX 303

20.1 DISCUSSION GUIDE 303

20.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 306

20.3 CUSTOMIZATION OPTIONS 308

20.4 RELATED REPORTS 308

20.5 AUTHOR DETAILS 309

LIST OF TABLES

TABLE 1 INCLUSIONS AND EXCLUSIONS 32

TABLE 2 USD EXCHANGE RATES 33

TABLE 3 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 50

TABLE 4 GDP PERCENTAGE CHANGE, BY COUNTRY, 2021–2029 52

TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM 57

TABLE 6 IMPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY,

2020–2024 (USD THOUSAND) 61

TABLE 7 EXPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY,

2020–2024 (USD THOUSAND) 63

TABLE 8 US-IMPOSED TARIFFS FOR LOITERING MUNITIONS AND THEIR SYSTEMS,

BY COUNTRY 65

TABLE 9 MODEL-WISE PRICE IMPACT ANALYSIS 66

TABLE 10 PATENT ANALYSIS 73

TABLE 11 AI-ENABLED AUTONOMY, ADVANCED SEEKERS, HYBRID PROPULSION,

AND SMART WARHEAD SYSTEMS 77

TABLE 12 EMERGING DIGITAL, MATERIAL, AND PROPULSION TECHNOLOGIES 78

TABLE 13 TOP USE CASES AND MARKET POTENTIAL 80

TABLE 14 CASE STUDIES OF AI IMPLEMENTATION 81

TABLE 15 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS 81

TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 84

TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 85

TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 86

TABLE 19 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 87

TABLE 20 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 87

TABLE 21 GLOBAL DESIGN, STRUCTURAL, AND OPERATIONAL STANDARDS IN LOITERING MUNITION MARKET 88

TABLE 22 GLOBAL ELECTRICAL, COMMUNICATION, AND CYBERSECURITY STANDARDS IN LOITERING MUNITION MARKET 89

TABLE 23 GLOBAL QUALITY, ENVIRONMENTAL, AND COMPLIANCE STANDARDS IN LOITERING MUNITION MARKET 90

TABLE 24 CARBON IMPACT REDUCTION IN LOITERING MUNITION MARKET 91

TABLE 25 ECO APPLICATIONS IN LOITERING MUNITION MARKET 92

TABLE 26 GLOBAL REGULATORY FRAMEWORKS IMPACTING LOITERING MUNITION MARKET 95

TABLE 27 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN

LOITERING MUNITION MARKET 96

TABLE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%) 98

TABLE 29 KEY BUYING CRITERIA, BY APPLICATION 99

TABLE 30 LOITERING MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION) 103

TABLE 31 LOITERING MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION) 103

TABLE 32 LOITERING MUNITION MARKET, BY RANGE, 2021–2024 (USD MILLION) 108

TABLE 33 LOITERING MUNITION MARKET, BY RANGE, 2025–2030 (USD MILLION) 108

TABLE 34 LOITERING MUNITION MARKET, BY AIR TIME, 2021–2024 (USD MILLION) 115

TABLE 35 LOITERING MUNITION MARKET, BY AIR TIME, 2025–2030 (USD MILLION) 115

TABLE 36 LOITERING MUNITION MARKET, BY WARHEAD TYPE, 2021–2024 (USD MILLION) 121

TABLE 37 LOITERING MUNITION MARKET, BY WARHEAD TYPE, 2025–2030 (USD MILLION) 122

TABLE 38 LOITERING MUNITION MARKET, BY NAVSENSOR, 2021–2024 (USD MILLION) 130

TABLE 39 LOITERING MUNITION MARKET, BY NAVSENSOR, 2025–2030 (USD MILLION) 131

TABLE 40 LOITERING MUNITION MARKET, BY LAUNCH MODE, 2021–2024 (USD MILLION) 138

TABLE 41 LOITERING MUNITION MARKET, BY LAUNCH MODE, 2025–2030 (USD MILLION) 139

TABLE 42 LOITERING MUNITION MARKET, BY END USER, 2021–2024 (USD MILLION) 147

TABLE 43 LOITERING MUNITION MARKET, BY END USER, 2025–2030 (USD MILLION) 148

TABLE 44 LOITERING MUNITION MARKET, BY REGION, 2021–2024 (USD MILLION) 153

TABLE 45 LOITERING MUNITION MARKET, BY REGION, 2025–2030 (USD MILLION) 153

TABLE 46 NORTH AMERICA: LOITERING MUNITION MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 154

TABLE 47 NORTH AMERICA: LOITERING MUNITION MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 154

TABLE 48 NORTH AMERICA: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 155

TABLE 49 NORTH AMERICA: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 155

TABLE 50 NORTH AMERICA: LOITERING MUNITION MARKET, BY TYPE,

2021–2024 (USD MILLION) 155

TABLE 51 NORTH AMERICA: LOITERING MUNITION MARKET, BY TYPE,

2025–2030 (USD MILLION) 155

TABLE 52 US: TOP THREE LOITERING MUNITIONS AND SPECIFICATIONS 156

TABLE 53 US: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 157

TABLE 54 US: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 157

TABLE 55 US: LOITERING MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION) 157

TABLE 56 US: LOITERING MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION) 157

TABLE 57 CANADA: TOP THREE LOITERING MUNITIONS AND SPECIFICATIONS 158

TABLE 58 CANADA: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 159

TABLE 59 CANADA: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 159

TABLE 60 CANADA: LOITERING MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION) 159

TABLE 61 CANADA: LOITERING MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION) 160

TABLE 62 EUROPE: LOITERING MUNITION MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 161

TABLE 63 EUROPE: LOITERING MUNITION MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 162

TABLE 64 EUROPE: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 162

TABLE 65 EUROPE: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 162

TABLE 66 EUROPE: LOITERING MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION) 162

TABLE 67 EUROPE: LOITERING MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION) 163

TABLE 68 FRANCE: TOP THREE LOITERING MUNITIONS AND SPECIFICATIONS 163

TABLE 69 FRANCE: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 164

TABLE 70 FRANCE: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 164

TABLE 71 FRANCE: LOITERING MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION) 165

TABLE 72 FRANCE: LOITERING MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION) 165

TABLE 73 GERMANY: TOP THREE LOITERING MUNITIONS AND SPECIFICATIONS 166

TABLE 74 GERMANY: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 166

TABLE 75 GERMANY: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 167

TABLE 76 GERMANY: LOITERING MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION) 167

TABLE 77 GERMANY: LOITERING MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION) 167

TABLE 78 UK: TOP THREE LOITERING MUNITIONS AND SPECIFICATIONS 168

TABLE 79 UK: LOITERING MUNITION MARKET, BY LAUNCH MODE, 2

021–2024 (USD MILLION) 168

TABLE 80 UK: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 169

TABLE 81 UK: LOITERING MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION) 169

TABLE 82 UK: LOITERING MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION) 169

TABLE 83 ITALY: TOP THREE LOITERING MUNITIONS AND SPECIFICATIONS 170

TABLE 84 ITALY: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 170

TABLE 85 ITALY: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 171

TABLE 86 ITALY: LOITERING MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION) 171

TABLE 87 ITALY: LOITERING MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION) 171

TABLE 88 REST OF EUROPE: TOP THREE LOITERING MUNITIONS AND SPECIFICATIONS 172

TABLE 89 REST OF EUROPE: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 172

TABLE 90 REST OF EUROPE: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 173

TABLE 91 REST OF EUROPE: LOITERING MUNITION MARKET, BY TYPE,

2021–2024 (USD MILLION) 173

TABLE 92 REST OF EUROPE: LOITERING MUNITION MARKET, BY TYPE,

2025–2030 (USD MILLION) 173

TABLE 93 ASIA PACIFIC: LOITERING MUNITION MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 174

TABLE 94 ASIA PACIFIC: LOITERING MUNITION MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 175

TABLE 95 ASIA PACIFIC: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 175

TABLE 96 ASIA PACIFIC: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 175

TABLE 97 ASIA PACIFIC: LOITERING MUNITION MARKET, BY TYPE,

2021–2024 (USD MILLION) 175

TABLE 98 ASIA PACIFIC: LOITERING MUNITION MARKET, BY TYPE,

2025–2030 (USD MILLION) 176

TABLE 99 INDIA: TOP THREE LOITERING MUNITIONS AND SPECIFICATIONS 177

TABLE 100 INDIA: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 177

TABLE 101 INDIA: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 178

TABLE 102 INDIA: LOITERING MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION) 178

TABLE 103 INDIA: LOITERING MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION) 178

TABLE 104 JAPAN: TOP THREE LOITERING MUNITIONS AND SPECIFICATIONS 179

TABLE 105 JAPAN: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 180

TABLE 106 JAPAN: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 180

TABLE 107 JAPAN: LOITERING MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION) 180

TABLE 108 JAPAN: LOITERING MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION) 180

TABLE 109 AUSTRALIA: TOP THREE LOITERING MUNITIONS AND SPECIFICATIONS 181

TABLE 110 AUSTRALIA: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 182

TABLE 111 AUSTRALIA: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 182

TABLE 112 AUSTRALIA: LOITERING MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION) 182

TABLE 113 AUSTRALIA: LOITERING MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION) 183

TABLE 114 REST OF ASIA PACIFIC: TOP THREE LOITERING MUNITIONS AND SPECIFICATIONS 184

TABLE 115 REST OF ASIA PACIFIC: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 184

TABLE 116 REST OF ASIA PACIFIC: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 185

TABLE 117 REST OF ASIA PACIFIC: LOITERING MUNITION MARKET, BY TYPE,

2021–2024 (USD MILLION) 185

TABLE 118 REST OF ASIA PACIFIC: LOITERING MUNITION MARKET, BY TYPE,

2025–2030 (USD MILLION) 185

TABLE 119 MIDDLE EAST: LOITERING MUNITION MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 186

TABLE 120 MIDDLE EAST: LOITERING MUNITION MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 187

TABLE 121 MIDDLE EAST: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 187

TABLE 122 MIDDLE EAST: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 187

TABLE 123 MIDDLE EAST: LOITERING MUNITION MARKET, BY TYPE,

2021–2024 (USD MILLION) 187

TABLE 124 MIDDLE EAST: LOITERING MUNITION MARKET, BY TYPE,

2025–2030 (USD MILLION) 188

TABLE 125 SAUDI ARABIA: TOP THREE LOITERING MUNITIONS AND SPECIFICATIONS 189

TABLE 126 SAUDI ARABIA: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 189

TABLE 127 SAUDI ARABIA: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 190

TABLE 128 SAUDI ARABIA: LOITERING MUNITION MARKET, BY TYPE,

2021–2024 (USD MILLION) 190

TABLE 129 SAUDI ARABIA: LOITERING MUNITION MARKET, BY TYPE,

2025–2030 (USD MILLION) 190

TABLE 130 ISRAEL: TOP THREE LOITERING MUNITIONS AND SPECIFICATIONS 191

TABLE 131 ISRAEL: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 192

TABLE 132 ISRAEL: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 192

TABLE 133 ISRAEL: LOITERING MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION) 192

TABLE 134 ISRAEL: LOITERING MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION) 192

TABLE 135 TURKEY: TOP THREE LOITERING MUNITIONS AND SPECIFICATIONS 193

TABLE 136 TURKEY: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 194

TABLE 137 TURKEY: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 194

TABLE 138 TURKEY: LOITERING MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION) 194

TABLE 139 TURKEY: LOITERING MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION) 194

TABLE 140 REST OF THE WORLD: LOITERING MUNITION MARKET, BY REGION,

2021–2024 (USD MILLION) 196

TABLE 141 REST OF THE WORLD: LOITERING MUNITION MARKET, BY REGION,

2025–2030 (USD MILLION) 196

TABLE 142 REST OF THE WORLD: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 197

TABLE 143 REST OF THE WORLD: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 197

TABLE 144 REST OF THE WORLD: LOITERING MUNITION MARKET, BY TYPE,

2021–2024 (USD MILLION) 197

TABLE 145 REST OF THE WORLD: LOITERING MUNITION MARKET, BY TYPE,

2025–2030 (USD MILLION) 197

TABLE 146 LATIN AMERICA: TOP THREE LOITERING MUNITIONS AND SPECIFICATIONS 198

TABLE 147 LATIN AMERICA: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 199

TABLE 148 LATIN AMERICA: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 199

TABLE 149 LATIN AMERICA: LOITERING MUNITION MARKET, BY TYPE,

2021–2024 (USD MILLION) 199

TABLE 150 LATIN AMERICA: LOITERING MUNITION MARKET, BY TYPE,

2025–2030 (USD MILLION) 199

TABLE 151 AFRICA: TOP THREE LOITERING MUNITIONS AND SPECIFICATIONS 200

TABLE 152 AFRICA: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2021–2024 (USD MILLION) 201

TABLE 153 AFRICA: LOITERING MUNITION MARKET, BY LAUNCH MODE,

2025–2030 (USD MILLION) 201

TABLE 154 AFRICA: LOITERING MUNITION MARKET, BY TYPE, 2021–2024 (USD MILLION) 201

TABLE 155 AFRICA: LOITERING MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION) 201

TABLE 156 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2025 202

TABLE 157 LOITERING MUNITION MARKET: DEGREE OF COMPETITION 205

TABLE 158 TYPE FOOTPRINT 210

TABLE 159 END USER FOOTPRINT 211

TABLE 160 LAUNCH MODE FOOTPRINT 212

TABLE 161 REGION FOOTPRINT 213

TABLE 162 LIST OF START-UPS/SMES 216

TABLE 163 COMPETITIVE BENCHMARKING OF START-UPS/SMES 217

TABLE 164 LOITERING MUNITION MARKET: PRODUCT LAUNCHES, 2021–2025 219

TABLE 165 LOITERING MUNITION MARKET: DEALS, 2021–2025 221

TABLE 166 LOITERING MUNITION MARKET: OTHERS, 2021–2025 225

TABLE 167 AEROVIRONMENT, INC.: COMPANY OVERVIEW 229

TABLE 168 AEROVIRONMENT, INC.: PRODUCTS OFFERED 231

TABLE 169 AEROVIRONMENT, INC.: PRODUCT LAUNCHES 232

TABLE 170 AEROVIRONMENT, INC.: DEALS 233

TABLE 171 AEROVIRONMENT, INC.: OTHERS 233

TABLE 172 ELBIT SYSTEMS LTD.: COMPANY OVERVIEW 235

TABLE 173 ELBIT SYSTEMS LTD.: PRODUCTS OFFERED 236

TABLE 174 ELBIT SYSTEMS LTD: PRODUCT LAUNCHES 237

TABLE 175 ELBIT SYSTEMS LTD.: OTHERS 237

TABLE 176 RHEINMETALL AG: COMPANY OVERVIEW 239

TABLE 177 RHEINMETALL AG: PRODUCTS OFFERED 240

TABLE 178 RHEINMETALL AG: PRODUCT LAUNCHES 241

TABLE 179 RHEINMETALL AG: DEALS 241

TABLE 180 RHEINMETALL AG: OTHERS 242

TABLE 181 ISRAEL AEROSPACE INDUSTRIES: COMPANY OVERVIEW 244

TABLE 182 ISRAEL AEROSPACE INDUSTRIES: PRODUCTS OFFERED 245

TABLE 183 ISRAEL AEROSPACE INDUSTRIES: PRODUCT LAUNCHES 246

TABLE 184 ISRAEL AEROSPACE INDUSTRIES: DEALS 247

TABLE 185 ISRAEL AEROSPACE INDUSTRIES: OTHERS 247

TABLE 186 UVISION: COMPANY OVERVIEW 249

TABLE 187 UVISION: PRODUCTS OFFERED 249

TABLE 188 UVISION: DEALS 250

TABLE 189 UVISION: OTHERS 250

TABLE 190 THALES: COMPANY OVERVIEW 252

TABLE 191 THALES: PRODUCTS OFFERED 253

TABLE 192 THALES: DEALS 253

TABLE 193 NORTHROP GRUMMAN: COMPANY OVERVIEW 254

TABLE 194 NORTHROP GRUMMAN: PRODUCTS OFFERED 255

TABLE 195 NORTHROP GRUMMAN: PRODUCT LAUNCHES 256

TABLE 196 WB GROUP: COMPANY OVERVIEW 257

TABLE 197 WB GROUP: PRODUCTS OFFERED 257

TABLE 198 WB GROUP: OTHERS 258

TABLE 199 EDGE GROUP PJSC: COMPANY OVERVIEW 259

TABLE 200 EDGE GROUP PJSC: PRODUCTS OFFERED 259

TABLE 201 EDGE GROUP PJSC: PRODUCT LAUNCHES 261

TABLE 202 EDGE GROUP PJSC: DEALS 262

TABLE 203 EDGE GROUP PJSC: OTHERS 262

TABLE 204 ANDURIL INDUSTRIES: COMPANY OVERVIEW 263

TABLE 205 ANDURIL INDUSTRIES: PRODUCTS OFFERED 263

TABLE 206 ANDURIL INDUSTRIES: PRODUCT LAUNCHES 265

TABLE 207 ANDURIL INDUSTRIES: DEALS 265

TABLE 208 ANDURIL INDUSTRIES: OTHERS 266

TABLE 209 AEVEX AEROSPACE: COMPANY OVERVIEW 267

TABLE 210 AEVEX AEROSPACE: PRODUCTS OFFERED 267

TABLE 211 AEVEX AEROSPACE: DEALS 268

TABLE 212 STM: COMPANY OVERVIEW 269

TABLE 213 STM: PRODUCTS OFFERED 269

TABLE 214 STM: DEALS 270

TABLE 215 STM: OTHERS 270

TABLE 216 KNDS: COMPANY OVERVIEW 271

TABLE 217 KNDS: PRODUCTS OFFERED 271

TABLE 218 KNDS: DEALS 272

TABLE 219 KNDS: OTHERS 272

TABLE 220 PARAMOUNT GROUP: COMPANY OVERVIEW 273

TABLE 221 PARAMOUNT GROUP: PRODUCTS OFFERED 273

TABLE 222 PARAMOUNT GROUP: DEALS 274

TABLE 223 MBDA: COMPANY OVERVIEW 275

TABLE 224 MBDA: PRODUCTS OFFERED 275

TABLE 225 MBDA: DEALS 276

TABLE 226 MBDA: OTHERS 276

TABLE 227 TELEDYNE FLIR LLC: COMPANY OVERVIEW 277

TABLE 228 TELEDYNE FLIR LLC: PRODUCTS OFFERED 277

TABLE 229 TELEDYNE FLIR LLC: OTHERS 278

TABLE 230 SOLAR GROUP: COMPANY OVERVIEW 279

TABLE 231 SOLAR GROUP: PRODUCTS OFFERED 280

TABLE 232 SOLAR GROUP: OTHERS 281

TABLE 233 ARQUIMEA: COMPANY OVERVIEW 282

TABLE 234 ROKETSAN: COMPANY OVERVIEW 283

TABLE 235 TATA ADVANCED SYSTEMS LIMITED: COMPANY OVERVIEW 284

TABLE 236 SPEAR: COMPANY OVERVIEW 285

TABLE 237 TRANSVARO ELEKTRON ALETLERI: COMPANY OVERVIEW 286

TABLE 238 BAYKAR TECH: COMPANY OVERVIEW 287

TABLE 239 OVERWATCH GROUP: COMPANY OVERVIEW 288

TABLE 240 KADET DEFENCE SYSTEMS: COMPANY OVERVIEW 289

TABLE 241 DEFENDTEX: COMPANY OVERVIEW 290

TABLE 242 JOHNNETTE GROUP: COMPANY OVERVIEW 291

LIST OF FIGURES

FIGURE 1 LOITERING MUNITION MARKET SEGMENTATION 31

FIGURE 2 MARKET SCENARIO 36

FIGURE 3 GLOBAL LOITERING MUNITION MARKET, 2021–2030 36

FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN LOITERING MUNITION MARKET 37

FIGURE 5 DISRUPTIONS INFLUENCING GROWTH OF LOITERING MUNITION MARKET 38

FIGURE 6 HIGH-GROWTH SEGMENTS IN LOITERING MUNITION MARKET, (2025–2030) 38

FIGURE 7 NORTH AMERICA TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD 39

FIGURE 8 GROWING DEMAND FOR AUTONOMOUS PRECISION-STRIKE CAPABILITIES AND REAL-TIME TARGETING TO DRIVE MARKET 40

FIGURE 9 EXPENDABLE SEGMENT TO HOLD HIGHER SHARE THAN RECOVERABLE

SEGMENT IN 2025 41

FIGURE 10 HIGH EXPLOSIVE WARHEAD SEGMENT TO EXHIBIT FASTEST

GROWTH DURING FORECAST PERIOD 41

FIGURE 11 ARMY TO SURPASS OTHER SEGMENTS DURING FORECAST PERIOD 42

FIGURE 12 CANISTER-LAUNCHED SEGMENT TO SECURE LEADING POSITION IN 2025 42

FIGURE 13 LOITERING MUNITION MARKET DYNAMICS 44

FIGURE 14 VALUE CHAIN ANALYSIS 54

FIGURE 15 ECOSYSTEM ANALYSIS 57

FIGURE 16 INVESTMENT AND FUNDING SCENARIO 58

FIGURE 17 IMPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY,

2020–2024 (USD THOUSAND) 60

FIGURE 18 EXPORT DATA FOR HS CODE 9306-COMPLIANT PRODUCTS, BY COUNTRY,

2020–2024 (USD THOUSAND) 62

FIGURE 19 EVOLUTION OF LOITERING MUNITION TECHNOLOGY 71

FIGURE 20 EMERGING TECHNOLOGY TRENDS 71

FIGURE 21 PATENT ANALYSIS 72

FIGURE 22 FUTURE APPLICATIONS 77

FIGURE 23 IMPACT OF AI/GEN AI 79

FIGURE 24 SUCCESS STORIES AND REAL-WORLD APPLICATIONS 82

FIGURE 25 DECISION-MAKING FACTORS 97

FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION 98

FIGURE 27 KEY BUYING CRITERIA, BY APPLICATION 99

FIGURE 28 ADOPTION BARRIERS AND INTERNAL CHALLENGES 100

FIGURE 29 LOITERING MUNITION MARKET, BY TYPE, 2025–2030 (USD MILLION) 103

FIGURE 30 LOITERING MUNITION MARKET, BY RANGE, 2025–2030 (USD MILLION) 108

FIGURE 31 LOITERING MUNITION MARKET, BY AIR TIME, 2025–2030 (USD MILLION) 115

FIGURE 32 LOITERING MUNITION MARKET, BY WARHEAD TYPE, 2025–2030 (USD MILLION) 121

FIGURE 33 LOITERING MUNITION MARKET, BY NAVSENSOR, 2025–2030 (USD MILLION) 130

FIGURE 34 LOITERING MUNITION MARKET, BY LAUNCH MODE, 2025–2030 (USD MILLION) 138

FIGURE 35 LOITERING MUNITION MARKET, BY END USER, 2025–2030 (USD MILLION) 147

FIGURE 36 LOITERING MUNITION MARKET, BY REGION, 2025–2030 152

FIGURE 37 NORTH AMERICA: LOITERING MUNITION MARKET SNAPSHOT 154

FIGURE 38 EUROPE: LOITERING MUNITION MARKET SNAPSHOT 161

FIGURE 39 ASIA PACIFIC: LOITERING MUNITION MARKET SNAPSHOT 174

FIGURE 40 MIDDLE EAST: LOITERING MUNITION MARKET SNAPSHOT 186

FIGURE 41 REST OF THE WORLD: LOITERING MUNITION MARKET SNAPSHOT 196

FIGURE 42 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021–2024 204

FIGURE 43 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024 205

FIGURE 44 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024 208

FIGURE 45 COMPANY FOOTPRINT 209

FIGURE 46 COMPANY EVALUATION MATRIX (START-UPS/SMES), 2024 215

FIGURE 47 COMPANY VALUATION (USD BILLION) 217

FIGURE 48 FINANCIAL METRICS (EV/EBIDTA) 218

FIGURE 49 BRAND/PRODUCT COMPARISON 218

FIGURE 50 AEROVIRONMENT, INC.: COMPANY SNAPSHOT 230

FIGURE 51 ELBIT SYSTEMS LTD.: COMPANY SNAPSHOT 236

FIGURE 52 RHEINMETALL AG: COMPANY SNAPSHOT 240

FIGURE 53 ISRAEL AEROSPACE INDUSTRIES: COMPANY SNAPSHOT 245

FIGURE 54 THALES: COMPANY SNAPSHOT 252

FIGURE 55 NORTHROP GRUMMAN: COMPANY SNAPSHOT 255

FIGURE 56 SOLAR GROUP: COMPANY SNAPSHOT 280

FIGURE 57 RESEARCH DESIGN MODEL 292

FIGURE 58 RESEARCH DESIGN 293

FIGURE 59 BOTTOM-UP APPROACH 298

FIGURE 60 TOP-DOWN APPROACH 299

FIGURE 61 DATA TRIANGULATION 300