Future of Automotive in India - Forecast to 2030

インドにおける自動車の未来 - 車種(PV、CV、2W、3W)、ボディタイプ別乗用車(ハッチバック、セダン、SUV、MPV)、推進方式(ICE、BEV) - 2030年までの予測

Future of Automotive in India by Vehicle Type (PV, CV, 2W, 3W), PV by Body Type (Hatchback, Sedan, SUV, MPV), Propulsion Type (ICE, BEV) - Forecast to 2030

| 出版 | MarketsandMarkets |

| 出版年月 | 2025年01月 |

| ページ数 | 80 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 企業ライセンス | USD 10,000 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-6682 |

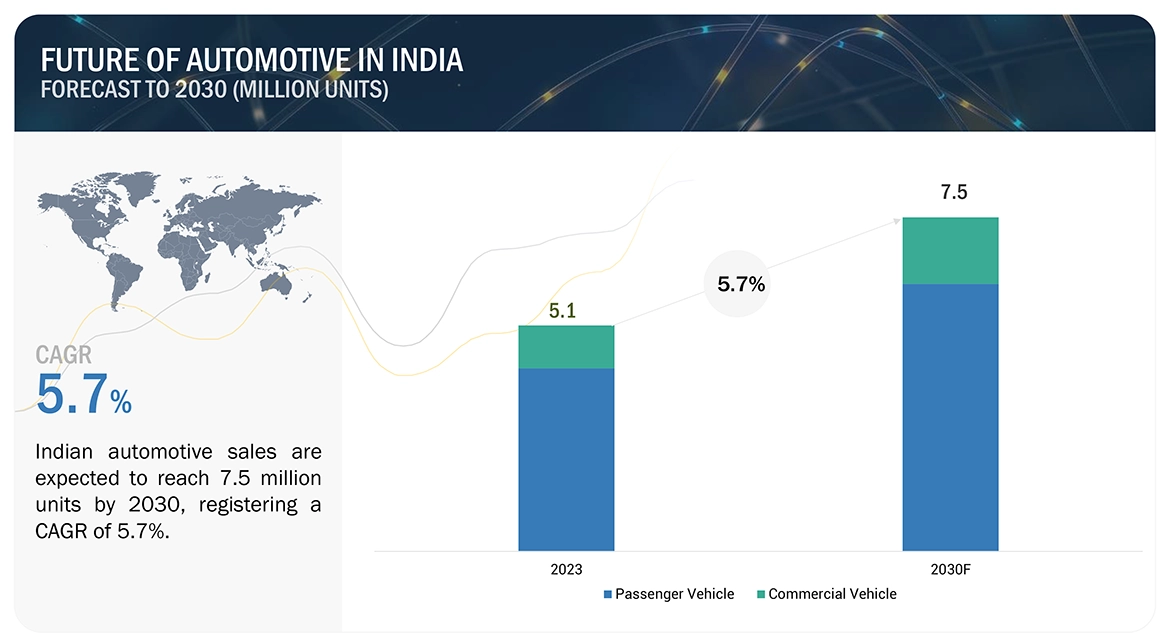

インドの乗用車販売台数は2023年に410万台で、2023年から2030年にかけて5.6%のCAGRで成長し、2030年には600万台に達すると予想されています。インドの自動車(PV+CV)市場は、2023年の510万台から2030年には750万台に成長し、CAGRは5.7%になると予想されています。

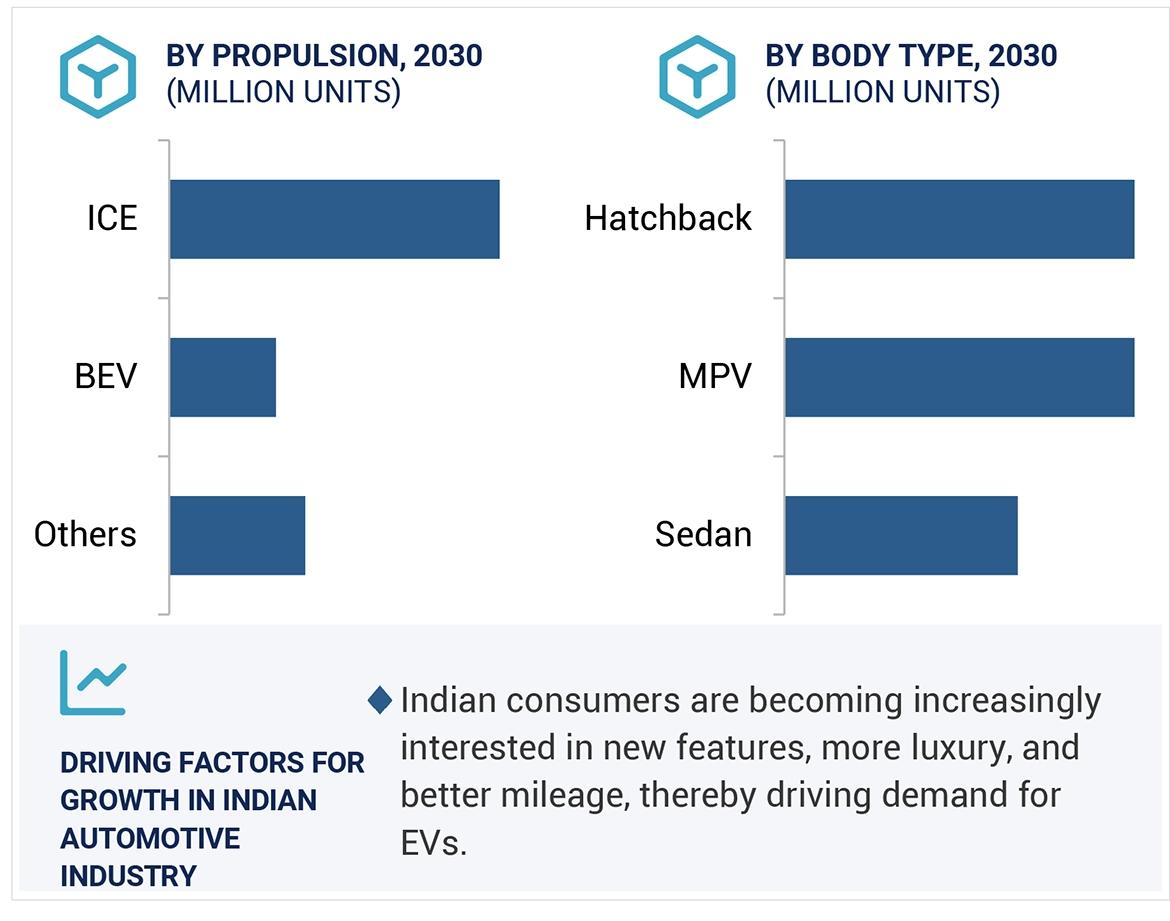

インドの自動車産業は、様々な要因に牽引され、今後成長が見込まれています。自動車業界は、顧客のニーズや、5G、AI、ADAS技術・機能のさらなる向上といった、常に進化する技術の最先端に対応するため、急速に進化しています。電気自動車、ハイブリッド車、CNG車の販売増加は2023年の主要トレンドであり、2030年まで好調に推移すると予想されています。

一方、商用車分野では、小型商用車(LCV)の電動化が急速に進んでいるセグメントに基づき、電動化のトレンドは多様化しています。2030年までに、e-LCVは年間販売台数のうち大きな割合を占めるようになるでしょう。さらに、OEM各社は生産能力の増強に投資しており、マルチ・スズキ、ヒュンダイ、タタ・モーターズなどの主要OEM各社は、2030年までに新たな生産工場の建設に投資しています。

調査範囲:

本市場分析は、インドにおける自動車産業の将来を網羅しており、特に自動車販売台数(PV、CV、2W、3W)に焦点を当てています。さらに、2023年の自動車産業の動向についても分析しています。本レポートでは、自動車セクターを推進するトレンドを深く掘り下げ、2030年の自動車産業に影響を与える要因を分析しています。本調査は、内燃機関(ICE)車と電気自動車(EV)、自動車のオンライン販売、インドのコネクテッドカー市場、製造業の動向、中古車市場の概要など、幅広い分野を網羅しています。

レポートの範囲

本レポートは、2023年の自動車市場およびそのサブセグメントの販売台数に関する近似値に関する情報を提供することで、市場リーダー企業および新規参入企業にとって有益な情報となります。また、ステークホルダーが競争環境を理解し、事業のポジショニングを改善し、適切な市場開拓戦略を策定するための洞察を深める上でも役立ちます。さらに、本レポートは、ステークホルダーが市場の動向を把握し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供する上でも役立ちます。

本レポートでは、以下の点について洞察を提供します。

- 高成長分野の分析(電動化、SUVおよびE-SUVの普及拡大、中古車販売の増加、世界の自動車産業の中心地としてのインドなど)。

- 製品開発/イノベーション:自動車市場における今後の技術、研究開発活動、新製品・新サービスの発売に関する詳細な洞察

- 市場開発:収益性の高い市場に関する包括的な情報 – 本レポートでは、様々な地域の自動車市場を分析しています。

- 市場の多様化:サプライチェーンの多様化、未開拓地域、最近の動向、自動車市場への投資に関する包括的な情報を提供しています。

- 競合評価:軽自動車セグメントにおける主要企業の市場シェア、成長戦略、サービス提供を評価し、さらに内燃機関(ICE)と電気自動車(EV)に分類し、その他の自動車市場戦略についても分析しています。本レポートは、自動運転車市場の動向を関係者が理解する上で役立ち、主要な市場推進要因、課題、機会に関する情報も提供しています。

Report Overview

Indian passenger vehicle sales were 4.1 million units in 2023 and are expected to reach 6.0 million units in 2030, at a CAGR of 5.6% from 2023 to 2030. The India automotive (PV+CV) market is expected to grow from 5.1 million units in 2023 to 7.5 million units in 2030, at a CAGR of 5.7%.

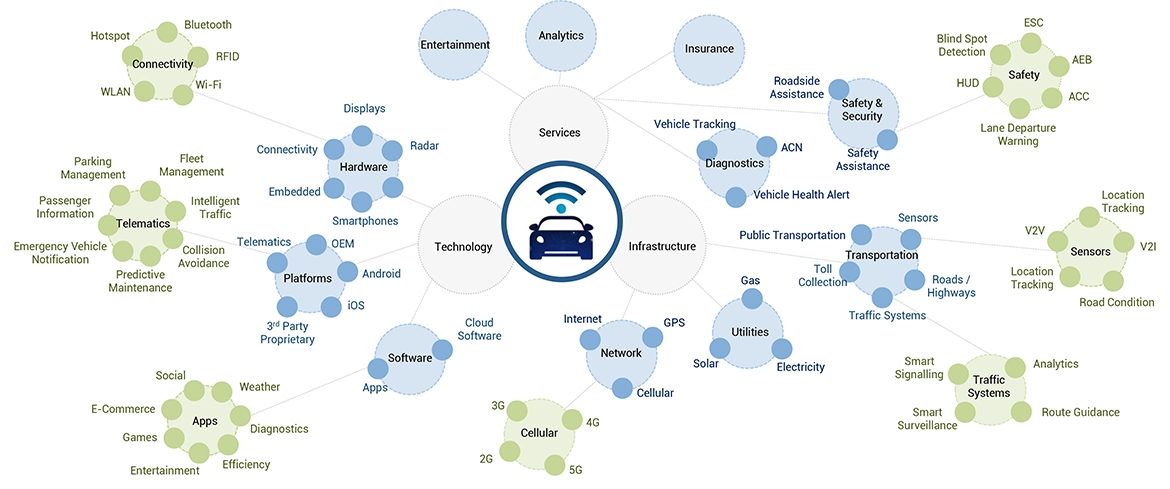

Thsse future of automotive in India is expected to experience growth driven by various factors. The automotive industry is rapidly evolving to adapt to customer demands and ever-evolving frontiers of technologies like 5G, AI and further improvements in ADAS technology and features. The rise in Pure Electric, Hybrids, and CNG sales has been a major trend in 2023 and is expected to continue well till 2030.

On the other hand, in the commercial vehicle segment, the electrification trend is diversified based on segments where LCVs have seen a rapid rise in electrification. By 2030, e-LCVs will constitute a significant portion of annual LCVs sold. Further, OEMs are investing in increasing their production capacity and all major OEMs like Maruti Suzuki, Hyundai,Tata Motors and others have invested to establish new production plants will 2030.

“EV sales pick up pace across all vehicle segments while hybrids and CNG also race ahead.”

Battery Electric Vehicle sales in India have shown positive growth in 2023 and 2024, with OEMs like Tata Motors, Mahindra, Hyundai, and Maruti announcing and launching new BEV models. As battery prices reduce further, the total cost of ownership of BEVs has improved compared to ICE vehicles, which has been a major driver of the growth of BEVs, especially in the Urban and Semi-Urban Indian regions. On the other hand, CNG vehicles have witnessed much faster growth. OEMs like Maruti Suzuki, Tata Motors, etc. launching CNG trims of their existing vehicles. There are 25 CNG models available in the market, and is expected to rise further. Cheaper fuel and no range anxiety associated with CNGs are the major drivers for the growth of CNG cars.

“Electric Light commercial vehicles lead the electrification trend in commercial vehicle segment.”

E-LCVs are projected to grow significantly by 2030 due to the rising demand for efficient and cost-effective commercial vehicles. Tata Motors currently leads the market, but other players have launched or are preparing to launch their E-LCVs soon. The electrification in commercial vehicles is expected to grow to 7% in 2030 from 0.6% in 2023. This electrification spree will be led by rapid rise of sales of electric vehicles in LCV sector which will have a share of 23% EVs by 2030 from 0.3% in 2023.

“Luxury segment is being re-defined by Electric Vehicles”

The luxury car segment and top trim of cars have seen a decent rise in sales due to the fast-growing High net-worth Individuals (HNI) in the country. With the EVs becoming a central to portfolios of all OEMs and all segments especially in luxury car segment, OEMs likes BMW, Mercedes, and also Indian OEMs like Mahindra and Tata Motors have started to offer a higher degree of luxury features. EVs, due to the presence of a large number of sensors and being operated by software to a large degree, provide OEMs a large scope for a more premium, personalized, luxurious experience to the user via a large number of features etc. This is also a major driver of growth in the penetration of connected cars in the Indian market as all EVs come factory-fitted with vehicle telematics systems.

“PLI scheme is a major driver of growth in the production of vehicles in India.”

Under the Performance Linked Incentive scheme, the government of India has launched various programs for the automotive sector to increase the localization of auto component manufacturing and develop new technologies and production capacities for Electric Vehicles. This scheme has also focused on funding the development of newer battery chemistries that seek to reduce dependency on lithium. This has helped to boost domestic production and also helped to create a robust ecosystem and market for aftermarket components.

Research Coverage:

The market analysis encompasses the future of automotive in India, focusing on the sales volume of automotive sales (PV, CV, 2W, 3W) . Additionally, it examines the developments in the automotive industry in 2023. The report delves into the trends propelling the automotive sector, analyzing factors influencing the industry in 2030. The study encompasses a broad range, including Internal Combustion Engine (ICE) vehicles and Electric Vehicles (EVs), online sales of cars, the connected cars market in India, the manufacturing landscape, and an overview of the used cars market.

Report Scope

The report will help market leaders and new entrants in this market with information on the closest approximations of the sales numbers for the automotive market in 2023 and its subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of high growth area (Electrification, rising adoption of SUVs and E-SUVs, rise in used cars sales, India as global chauffeur capital etc).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive market

- Market Development: Comprehensive information about lucrative markets – the report analyses the automotive market across varied regions

- Market Diversification: Exhaustive information about the diversification of supply chains, untapped geographies, recent developments, and investments in the automotive market

- Competitive Assessment: Assessment of market shares, growth strategies, and service offerings of leading players across light vehicle segments, which are then further divided into ICE and electric, among other automotive market strategies. The report also helps stakeholders understand the autonomous vehicle market’s pulse and provides information on key market drivers, challenges, and opportunities.

Table of Contents

1.1 EXECUTIVE SUMMARY

1.2 STUDY OBJECTIVES, METHODOLOGY, SCOPE, AND DEFINITION

1.3 INDIAN AUTOMOTIVE MARKET OVERVIEW

1.3.1 INDIAN AUTOMOTIVE (PV+CV) MARKET AND GDP GROWTH

1.3.2 INDIAN AUTOMOTIVE (PV) MARKET: GLOBAL POSITION

1.3.3 INDIAN AUTOMOTIVE (PV) MARKET: MOTORIZATION RATE

1.3.4 INDIAN AUTOMOTIVE MARKET: FUTURE OUTLOOK

1.3.5 INDIAN AUTOMOTIVE MARKET: PASSENGER AND COMMERCIAL VEHICLE PARC

1.3.6 INDIAN AUTOMOTIVE MARKET: KEY TRENDS AND GROWTH DRIVERS

1.4 INDIAN PASSENGER VEHICLE MARKET

1.4.1 INDIAN PASSENGER VEHICLE MARKET: SIZE AND FORECAST BY SEGMENT AND POWERTRAIN AND KEY TRENDS

1.4.2 INDIAN PASSENGER VEHICLE MARKET: KEY PLAYERS’ SHARES AND SALES SPLIT BY BODY TYPE AND POWERTRAIN

1.4.3 INDIAN PASSENGER VEHICLE MARKET: KEY PLAYERS’ SEGMENTAL SHARE

1.4.4 INDIAN PASSENGER VEHICLE MARKET: SALES BY STATE

1.4.5 INDIA ELECTRIC PASSENGER VEHICLE MARKET: TIPPING POINT

1.4.6 INDIAN PASSENGER VEHICLE MARKET: CONNECTED CARS

1.4.8 INDIAN PASSENGER VEHICLE MARKET: ADVANCED DRIVER ASSISTANCE SYSTEM (ADAS)

1.4.9 INDIAN AUTOMOTIVE AFTERMARKET

1.4.7 INDIAN PASSENGER VEHICLE AFTERMARKET: ECOSYSTEM OVERVIEW

1.5 INDIAN AUTOMOTIVE MARKET: OTHER VEHICLE SEGMENTS

1.5.1 INDIAN COMMERCIAL VEHICLE MARKET: SIZE AND FORECAST BY SEGMENT AND POWERTRAIN AND KEY TRENDS

1.5.2 INDIAN TWO-WHEELER MARKET: SIZE AND FORECAST BY SEGMENT AND POWERTRAIN AND KEY TRENDS

1.5.3 INDIAN THREE-WHEELER MARKET: SIZE AND FORECAST BY SEGMENT AND POWERTRAIN AND KEY TRENDS

1.6 INDIAN AUTOMOTIVE MARKET: LEGISLATION ANALYSIS

1.6.1 INDIAN AUTOMOTIVE MARKET LEGISLATION ANALYSIS: EXISTING AND UPCOMING POLICIES

1.6.2 INDIAN AUTOMOTIVE MARKET LEGISLATION ANALYSIS: PRODUCTION LINKED INCENTIVE (PLI) SCHEME

1.6.3 INDIAN AUTOMOTIVE MARKET LEGISLATION ANALYSIS: BHARAT STAGE-7 (BS7)

1.7 INDIAN AUTOMOTIVE MARKET: HIGH GROWTH AREAS

1.7.1 INDIAN AUTOMOTIVE MARKET: KEY GROWTH SEGMENTS

1.7.2 HIGH GROWTH AREA #1: ELECTRIFICATION

1.7.3 HIGH GROWTH AREA #2: SUV AND E-SUV

1.7.4 HIGH GROWTH AREA #3: USED CAR SALES

1.7.5 HIGH GROWTH AREA #4: INDIA AS CHAUFFEUR CAPITAL

1.7.6 HIGH GROWTH AREA #5: KEY INFOTAINMENT AND CONVENIENCE TRENDS

1.7.7 HIGH GROWTH AREA #6: EVOLUTION OF E-COMMERCE IN AFTERMARKET

1.8 APPENDIX