| 出版社 | MarketsandMarkets |

| 出版年月 | 2025年7月 |

Cybersecurity Insurance Market – Global Forecast to 2030

本市場レポートは、サイバーセキュリティ保険市場を様々なセグメントにわたって網羅しています。提供内容、保険適用範囲、保険の種類、プロバイダーの種類、地域に基づき、多くのセグメントにおける市場規模と成長の可能性を推定しました。主要な市場参加者の徹底的な競合分析、各社の事業情報、製品提供に関する重要な考察、現在のトレンド、そして重要な市場戦略を網羅しています。

The global cybersecurity insurance market will grow from USD 16.54 billion in 2025 to USD 32.19 billion by 2030 at a compounded annual growth rate (CAGR) of 14.2% during the forecast period. The cybersecurity insurance market is driven by the escalating frequency and sophistication of cyberattacks, compelling businesses to seek financial protection against potential losses. Growing regulatory pressures, such as GDPR and other data protection laws, have made cyber insurance a necessary compliance tool. The rapid adoption of digital technologies, remote work, and cloud-based infrastructure has expanded the attack surface, further emphasizing the need for coverage. High-profile data breaches and associated costs ranging from legal liabilities to business disruption have made cyber insurance a strategic investment. Additionally, advances in AI-driven risk analytics are enabling insurers to offer more tailored policies, enhancing market appeal.

世界のサイバーセキュリティ保険市場は、2025年の165億4,000万米ドルから2030年には321億9,000万米ドルに拡大し、予測期間中の年平均成長率(CAGR)は14.2%となる見込みです。サイバーセキュリティ保険市場は、サイバー攻撃の頻度と巧妙化の高まりによって牽引されており、企業は潜在的な損失に対する金銭的な保護を求めています。GDPRやその他のデータ保護法など、規制圧力の高まりにより、サイバー保険はコンプライアンス対策として不可欠なツールとなっています。デジタル技術、リモートワーク、クラウドベースのインフラストラクチャの急速な導入により攻撃対象領域が拡大し、補償の必要性がさらに高まっています。注目度の高いデータ侵害と、法的責任から事業中断に至るまでの関連コストの増加により、サイバー保険は戦略的な投資となっています。さらに、AIを活用したリスク分析の進歩により、保険会社はよりカスタマイズされたポリシーを提供できるようになり、市場の魅力が高まっています。

However, the market faces several restraints. A lack of historical actuarial data makes pricing difficult, and the increasing number of claims has led to rising premiums and restricted coverage. Policy complexity and vague exclusions often result in claim disputes, while low awareness among small and medium enterprises hampers adoption. Moreover, weak cybersecurity practices among insured clients increase loss ratios, discouraging insurer participation. The threat of systemic risks from large-scale or state-sponsored attacks also poses a significant challenge, potentially impacting the financial stability of insurers.

しかし、市場はいくつかの制約に直面しています。過去の保険数理データの不足により価格設定が困難になっているほか、保険金請求件数の増加は保険料の上昇と補償範囲の縮小につながっています。契約内容の複雑さと曖昧な除外規定は、しばしば請求紛争の原因となり、中小企業の認知度の低さも保険加入の妨げとなっています。さらに、加入者のサイバーセキュリティ対策の脆弱さが損害率の上昇を招き、保険会社の参入を阻害しています。大規模攻撃や国家主導の攻撃によるシステミックリスクの脅威も大きな課題となっており、保険会社の財務安定性に影響を及ぼす可能性があります。

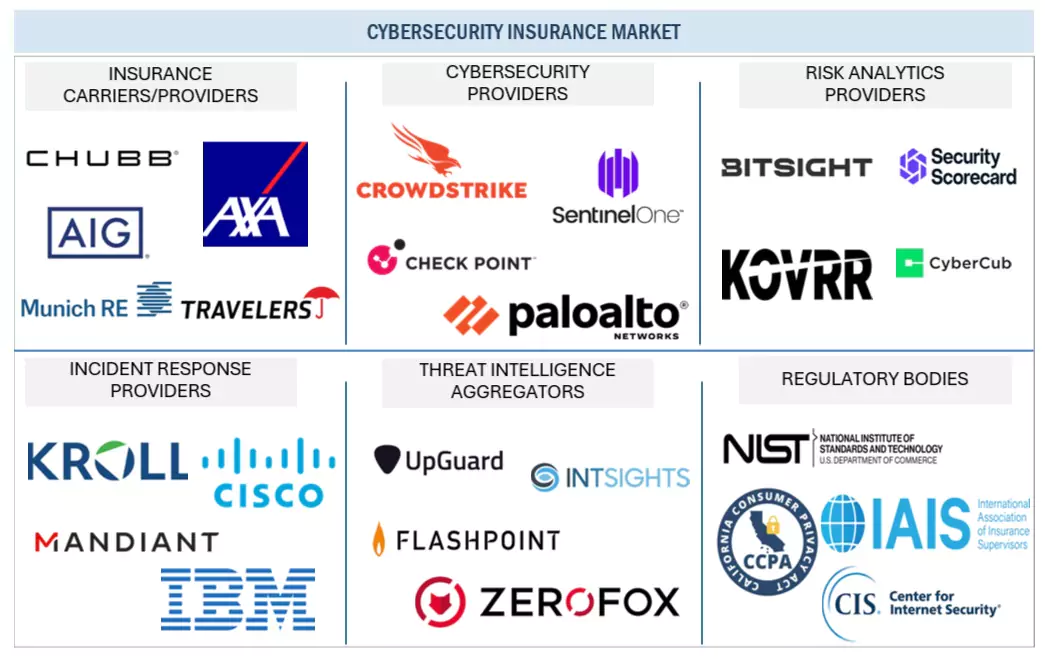

Some of the significant cybersecurity insurance market vendors are BitSight (US), Mitratech (US), RedSeal (US), SecurityScorecard (US), UpGuard (US), Travelers (US), AXA XL (US), AIG (US), Beazley (UK), and Chubb (Switzerland).

cyber-insurance-market-new-ecosystem

Reasons to buy this report:

With information on the most accurate revenue estimates for the whole cybersecurity insurance industry and its subsegments, the research will benefit market leaders and recent newcomers. Stakeholders will benefit from this report’s increased understanding of the competitive environment, which will help them better position their companies and develop go-to-market strategies. The research offers information on the main market drivers, constraints, opportunities, and challenges, as well as aids players in understanding the pulse of the industry.

The report provides insights on the following pointers:

Analysis of key drivers (Surge in mandatory cybersecurity regulations and legislations to boost demand for insurance protection, high rate of recovery of financial losses to promote growth of cybersecurity insurance market, and increase in frequency and sophistication of cyber threats), restraints (Lack of awareness related to cyber insurance and reluctance to choose cybersecurity insurance over cybersecurity solutions, and soaring cybersecurity insurance costs), opportunities (Exclusion of cybersecurity insurance cover from Property and Casualty (P&C) insurance, and adoption of artificial intelligence and blockchain technology for risk analytics), and challenges (Despite soaring cybersecurity risks, cyber insurers grapple to gain traction, data privacy concerns, and lack of understanding, technical knowledge, and absence of historical cyber data for effective underwriting).

- Product Development/Innovation: Comprehensive analysis of emerging technologies, R&D initiatives, and service and product introductions in the cybersecurity insurance market.

- Market Development: In-depth details regarding profitable markets: the paper examines the global cybersecurity insurance market.

- Market Diversification: Comprehensive details regarding recent advancements, investments, unexplored regions, new goods and services, and the cybersecurity insurance market.

- Competitive Assessment: Thorough analysis of the market shares, expansion plans, and service portfolios of the top competitors in the cybersecurity insurance industry, such as BitSight (US), Mitratech (US), RedSeal (US), SecurityScorecard (US), and UpGuard (US), Cisco (US), Microsoft (US), Check Point (US), AttackIQ (US), SentinelOne (US), Broadcom (US), Accenture (Ireland), Cylance (US), Trellix (US), CyberArk (US), CYE (Israel), SecurIT360 (US), Founder Shield (US), Allianz (Germany), AIG (US), Aon (UK), Arthur J. Gallagher (US), Travelers (US), AXA XL (US), AXIS Capital (Bermuda), Beazley (UK), Chubb (Switzerland), CNA Financial (US), Fairfax (Canada), Liberty Mutual (US), Lloyds of London (UK), Lockton (US), Munich Re (Germany), Sompo International (Bermuda), At-Bay (US), Cybernance (US), Resilience (US), Coalition (US), Kovrr (Israel), Sayata Labs (Israel), Zeguro (US), Ivanti (US), SafeBreach (US), and Orchestra Group (US).