GLOBAL RETINAL IMAGING DEVICES MARKET FORECAST 2026-2034

Global Retinal Imaging Devices Market by Device (Optical Coherence Tomography (OCT) Devices, Fluorescein Angiography Devices, Fundus Cameras, Retinal Ultrasound Imaging Systems, Ultra Widefield Retinal Imaging Devices, Widefield Retinal Imaging Devices, Other Devices) Market by Application (Disease Diagnosis, Treatment Monitoring, Research and Development) Market by Indication (Diabetic Retinopathy, Age-Related Macular Degeneration (AMD), Glaucoma, Retinal Vein Occlusion, Other Indications), by Geography

世界の網膜撮像デバイス市場:装置別(光干渉断層撮影(OCT)装置、フルオレセイン蛍光眼底造影装置、眼底カメラ、網膜超音波画像診断システム、超広視野網膜イメージング装置、広視野網膜イメージング装置、その他の装置)、用途別(疾患診断、治療モニタリング、研究開発)、適応症別(糖尿病網膜症、加齢黄斑変性症(AMD)、緑内障、網膜静脈閉塞症、その他の適応症)、地域別

| 出版 | Inkwood Research |

| 出版年月 | 2026年02月 |

| ページ数 | 342 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 2,900 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-13383 |

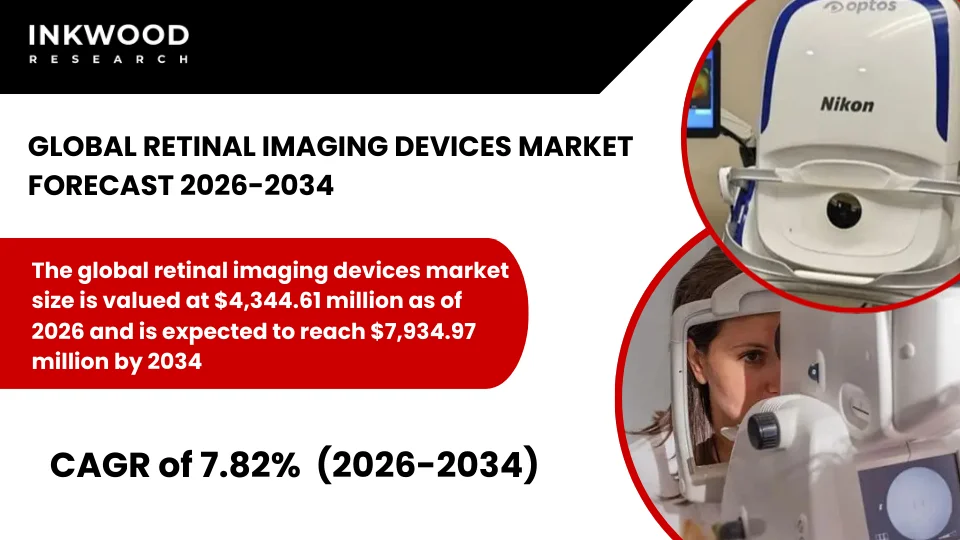

世界の網膜撮像デバイス市場規模は、2026年時点で43億4,461万ドルと推定されており、2034年には79億3,497万ドルに達すると予測されています。予測期間は2026年から2034年で、年平均成長率(CAGR)は7.82%です。本調査の基準年は2025年、予測期間は2026年から2034年です。本市場調査では、網膜撮像デバイス市場への危機的状況の影響を定性的および定量的に分析しています。

網膜撮像デバイスは、網膜の内部構造の詳細な画像を撮影するために使用される高度な診断機器です。これらの高度な眼科用イメージング装置には、光干渉断層撮影システム、眼底カメラ、超広視野網膜イメージング技術が含まれます。医療従事者は、これらの機器を用いて、糖尿病網膜症、加齢黄斑変性症、緑内障といった視力を脅かす疾患の診断と経過観察を行っています。

KEY FINDINGS

The global retinal imaging devices market size is valued at $4,344.61 million as of 2026 and is expected to reach $7,934.97 million by 2034, growing at a CAGR of 7.82% during the forecast period 2026-2034. The base year considered for the study is 2025, and the forecast period is between 2026 and 2034. The market study has also analyzed the crisis impact on the retinal imaging devices market qualitatively as well as quantitatively.

Retinal imaging devices represent sophisticated diagnostic equipment used to capture detailed images of the retina’s internal structures. These advanced ophthalmic imaging devices include optical coherence tomography systems, fundus cameras, and ultra-widefield retinal imaging technology. Healthcare providers utilize these instruments to diagnose and monitor sight-threatening conditions such as diabetic retinopathy, age-related macular degeneration, and glaucoma.

Moreover, technological innovations have transformed retinal screening from simple photography to complex three-dimensional visualization. Modern retinal imaging equipment incorporates artificial intelligence algorithms that enhance diagnostic accuracy. Consequently, these devices have become indispensable tools in ophthalmology clinics, hospitals, and diagnostic centers worldwide.

The global retinal imaging devices market experiences robust growth driven by escalating diabetes prevalence and aging demographics. According to the CDC, approximately 9.6 million Americans lived with diabetic retinopathy in 2021, representing 26.4% of those with diabetes. Furthermore, projections indicate this number will reach 14.7 million by 2050. Similarly, age-related macular degeneration affects millions globally, creating sustained demand for retinal diagnostic imaging equipment. Additionally, government-sponsored screening initiatives and technological breakthroughs in OCT angiography systems continue to accelerate market expansion across developed and emerging economies.

MARKET INSIGHTS

Key enablers of the global retinal imaging devices market growth:

- Increasing global prevalence of diabetes and an aging population is expanding the at-risk patient base

- Government and NGO led eye screening programs are boosting demand for retinal diagnostic tools

- Technological advances in OCT, AI-assisted diagnostics, and image quality are improving clinical outcomes

- Rising awareness among physicians and patients about early detection of retinal disorders is supporting market expansion

o Rising awareness among physicians and patients about early detection of retinal disorders significantly influences market dynamics. Educational campaigns by organizations like the International Agency for the Prevention of Blindness emphasize that approximately 5% of global blindness cases stem from age-related macular degeneration. Meanwhile, healthcare professionals increasingly recognize the value of routine retinal screening for diabetic patients.

o Teleophthalmology programs leverage portable retinal imaging devices to reach underserved populations. Consequently, early detection initiatives reduce treatment costs and prevent irreversible vision loss. Patient advocacy groups also promote regular eye examinations, particularly for high-risk demographics. This heightened awareness drives consistent demand for ophthalmology imaging devices across all care settings.

Key growth restraining factors of the global retinal imaging devices market:

- High capital cost of advanced retinal imaging systems limits adoption in small clinics

- Lack of trained ophthalmologists and technicians constrains effective utilization in low-income regions

- Reimbursement variability across countries affects purchase decisions by healthcare providers

- Regulatory approval and device certification requirements can delay product commercialization

o Regulatory approval and device certification requirements create substantial barriers for market entry and product launches. Manufacturers must navigate complex approval processes across multiple jurisdictions before commercializing new retinal imaging cameras or OCT systems. For instance, the U.S. FDA’s 510(k) clearance process requires extensive clinical validation and safety documentation.

o Similarly, European CE marking and other regional certifications demand rigorous testing protocols. These regulatory pathways typically span 12-24 months, delaying revenue generation.

o Moreover, post-market surveillance obligations and periodic recertification add ongoing compliance costs. Startups and smaller manufacturers face particular challenges in meeting these stringent requirements. Nevertheless, regulatory standards ensure device safety and efficacy, protecting patient welfare despite commercial implications.

Global Retinal Imaging Devices Industry | Top Trends

- AI-powered retinal diagnostic imaging systems now achieve expert-level accuracy in detecting diabetic retinopathy and other sight-threatening conditions. According to research published in JAMA Ophthalmology, foundation models like RETFound demonstrate superior performance in image recognition tasks compared to traditional systems. The FDA has approved algorithms such as IDx-DR, EyeArt, and AEYE Diagnostic Screening for automated diabetic retinopathy detection. Furthermore, deep learning systems can predict disease progression up to five years in advance, enabling personalized screening intervals. Healthcare providers increasingly deploy AI-assisted diagnostics to address ophthalmologist shortages and expand screening capacity in primary care settings.

- Non-mydriatic fundus cameras eliminate the need for pupil dilation, significantly enhancing patient comfort and examination efficiency. In January 2023, Topcon released the NW500 nonmydriatic retinal camera in the United States, providing high-quality imaging without dilation drops. These patient-centric devices reduce appointment duration and eliminate the temporary vision impairment associated with traditional mydriatic photography. Additionally, non-mydriatic retinal imaging systems enable same-day screening in busy clinical environments. Patients appreciate avoiding the inconvenience of dilated pupils, which typically affects vision for several hours. Consequently, this technological advancement removes a significant barrier to regular diabetic eye screenings, improving adherence rates.

- Healthcare systems deploy portable retinal imaging devices equipped with wireless connectivity to serve underserved rural populations. According to recent implementations, approximately 198 AI-equipped cameras have been deployed across five health systems since 2020, covering roughly 151,000 diabetic patients. These connected systems enable primary care physicians to conduct retinal screenings while ophthalmologists review images remotely. Moreover, tele-ophthalmology reduces patient travel burdens and improves screening efficiency. Reimbursement policies increasingly support remote diagnostic services, further accelerating the adoption of networked ophthalmic imaging devices.

- Handheld retinal imaging devices represent one of the fastest-growing segments within the retinal imaging equipment market. These portable systems enable bedside examinations in hospital wards and mobile screening programs in community settings. Topcon’s SIGNAL handheld retinal camera exemplifies this trend, operating for five continuous hours and featuring low-intensity lighting suitable for pediatric examinations. Furthermore, reduced device costs, with some systems priced as low as $5,000, democratize access to retinal screening technology. Portable designs transform ophthalmology imaging devices from fixed installations into versatile diagnostic tools deployable anywhere.

MARKET SEGMENTATION

Market Segmentation – Device, Application, and Indication –

Market by Device:

- Optical Coherence Tomography (OCT) Devices

- Optical coherence tomography devices utilize low-coherence light waves to generate high-resolution cross-sectional images of retinal layers with micron-level precision. These sophisticated ophthalmic diagnostic imaging systems dominate the retinal imaging devices market, capturing the largest revenue share.

- Moreover, OCT technology encompasses spectral-domain OCT (SD-OCT), swept-source OCT (SS-OCT), and handheld OCT variants, each offering distinct advantages. SD-OCT provides rapid scanning speeds up to 100,000 A-scans per second, while SS-OCT delivers superior tissue penetration using 1050nm wavelengths. Additionally, OCT angiography systems visualize retinal vasculature without contrast dye injection.

- This sub-segment supports overall market growth by establishing OCT as the gold standard for retinal disease diagnosis and treatment monitoring. Hospitals, especially tertiary and quaternary care facilities, require sophisticated imaging technology for advanced diagnostics. Furthermore, declining equipment costs and expanding clinical applications beyond ophthalmology, including cardiology and dermatology, broaden the addressable market significantly.

- Spectral-Domain OCT (SD-OCT)

- Swept-Source OCT (SS-OCT)

- Handheld OCT

- Fluorescein Angiography Devices

- Fundus Cameras

- Mydriatic Fundus Cameras

- Non-Mydriatic Fundus Cameras

- Hybrid Fundus Cameras

- ROP fundus cameras

- Retinal Ultrasound Imaging Systems

- Ophthalmic A-Scan Ultrasound

- Ophthalmic B-Scan Ultrasound

- Ophthalmic Ultrasound Biomicroscopes

- Ophthalmic Pachymeters

- Ultra Widefield Retinal Imaging Devices

- Widefield Retinal Imaging Devices

- Other Devices

Market by Application:

- Disease Diagnosis

- Treatment Monitoring

- Research and Development

Market by Indication:

- Diabetic Retinopathy

- Age-Related Macular Degeneration (AMD)

- Glaucoma

- Retinal Vein Occlusion

- Other Indications

REGIONAL ANALYSIS

Geographical Study based on Four Major Regions:

- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Spain, Poland, Belgium, and Rest of Europe

- Asia-Pacific: China, India, Japan, Australia & New Zealand, South Korea, Thailand, Indonesia, Vietnam, and Rest of Asia-Pacific

o China represents a rapidly expanding market for retinal imaging devices, driven by escalating diabetes prevalence, healthcare infrastructure modernization, and government emphasis on preventive eye care. The country’s aging population faces mounting risks of diabetic retinopathy and age-related macular degeneration, creating substantial demand for ophthalmic diagnostic equipment.

o Urban hospitals increasingly adopt advanced optical coherence tomography systems and AI-powered fundus cameras to manage growing patient volumes. Meanwhile, government initiatives promote telemedicine and mobile screening programs to extend retinal diagnostic capabilities into rural areas. However, challenges persist regarding ophthalmologist distribution and reimbursement standardization across provinces.

o Nevertheless, Chinese manufacturers like Topcon’s regional partners contribute to market expansion by offering cost-effective alternatives to Western-branded retinal imaging equipment. Looking forward, China’s “Healthy China 2030” initiative prioritizes chronic disease management, positioning the nation as a critical growth engine for the global retinal imaging devices market through 2034 and beyond.

- Rest of World: Latin America, the Middle East & Africa

Our market research reports offer an in-depth analysis of individual country-level market size and growth statistics. We cover the segmentation analysis, key growth factors, and macro-economic trends within the retinal imaging devices market, providing detailed insights into –

- South Korea Retinal Imaging Devices Market

- India Retinal Imaging Devices Market

- France Retinal Imaging Devices Market

The major players in the global retinal imaging devices market are:

- Canon Inc

- Carl Zeiss Meditec AG

- Escalon Medical Corp

- Forus Health Pvt Ltd

- Heidelberg Engineering GmbH

Key strategies adopted by some of these companies:

In May 2024, Carl Zeiss Meditec AG announced enhancements to its CIRRUS 6000 OCT system, incorporating the largest reference database in the U.S. market alongside newly enhanced cybersecurity features. This advancement enables highly efficient, data-driven workflows for ophthalmologists while ensuring robust patient data protection in clinical environments.

Carl Zeiss Meditec AG, in 2024, acquired 100% ownership of the Dutch Ophthalmic Research Center (D.O.R.C.) from investment firm Eurazeo SE. This acquisition strengthens Zeiss’s position in vitreoretinal surgery and expands its comprehensive ophthalmic device portfolio, enabling integrated solutions across diagnostic and therapeutic ophthalmology segments.

Heidelberg Engineering Inc received FDA approval in July 2024 for its Spectralis OCT angiography (OCTA) module with integrated SHIFT technology. This regulatory milestone enables U.S. clinicians to access advanced OCTA capabilities for improved visualization of retinal vasculature without invasive contrast dye procedures.

We Offer 10% Free Customization and 3 Months Analyst Support

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving growth in the global retinal imaging devices market?

The market experiences robust expansion due to rising diabetes and aging populations, which significantly increase the at-risk patient base for sight-threatening retinal conditions. Additionally, technological innovations in artificial intelligence, OCT angiography, and portable device designs enhance diagnostic capabilities while government-sponsored screening programs expand access to retinal diagnostic tools globally.

Q2: Which device type dominates the retinal imaging equipment market?

Optical coherence tomography (OCT) devices command the largest market share among retinal imaging systems due to their superior resolution and ability to visualize deeper retinal layers with exceptional precision. Hospitals and specialty clinics prefer OCT technology for diagnosing diabetic retinopathy, age-related macular degeneration, and glaucoma, establishing it as the clinical gold standard.

Q3: How is artificial intelligence transforming diabetic retinopathy screening?

AI-powered retinal imaging analysis achieves expert-level accuracy in detecting diabetic retinopathy while addressing ophthalmologist workforce shortages. The FDA has approved multiple autonomous AI systems, including IDx-DR and EyeArt, enabling primary care physicians to conduct screenings with remote specialist oversight through teleophthalmology platforms, significantly improving screening accessibility and efficiency.

COMPANY PROFILES

- CANON INC

- CARL ZEISS MEDITEC AG

- ESCALON MEDICAL CORP

- FORUS HEALTH PVT LTD

- HEIDELBERG ENGINEERING GMBH

- KOWA COMPANY LTD

- NIDEK CO LTD

- OPTOS PLC

- SANTEC CORPORATION

- TOPCON CORPORATION

| タイトル | Single User Price (USD) | |

| 世界の網膜撮像デバイス市場予測 2026-2034年 | GLOBAL RETINAL IMAGING DEVICES MARKET FORECAST 2026-2034 | USD 2,900 |

| アジア太平洋地域の網膜撮像デバイス市場予測 2026-2034年 | ASIA-PACIFIC RETINAL IMAGING DEVICES MARKET FORECAST 2026-2034 | USD 1,600 |

| 欧州の網膜撮像デバイス市場予測 2026-2034年 | EUROPE RETINAL IMAGING DEVICES MARKET FORECAST 2026-2034 | USD 1,600 |

| フランスの網膜撮像デバイス市場予測 2026-2034年 | FRANCE RETINAL IMAGING DEVICES MARKET FORECAST 2026-2034 | USD 1,100 |

| インドの網膜撮像デバイス市場予測 2026-2034年 | INDIA RETINAL IMAGING DEVICES MARKET FORECAST 2026-2034 | USD 1,100 |

| 北米の網膜撮像デバイス市場予測 2026-2034年 | NORTH AMERICA RETINAL IMAGING DEVICES MARKET FORECAST 2026-2034 | USD 1,600 |

| 韓国の網膜撮像デバイス市場予測 2026-2034年 | SOUTH KOREA RETINAL IMAGING DEVICES MARKET FORECAST 2026-2034 | USD 1,100 |

TABLE OF CONTENTS

1. RESEARCH SCOPE & METHODOLOGY

1.1. STUDY OBJECTIVES

1.2. METHODOLOGY

1.3. ASSUMPTIONS & LIMITATIONS

2. EXECUTIVE SUMMARY

2.1. MARKET SIZE & FORECAST

2.2. MARKET OVERVIEW

2.3. SCOPE OF STUDY

2.4. CRISIS SCENARIO ANALYSIS

2.5. MAJOR MARKET FINDINGS

2.5.1. WIDESPREAD ADOPTION OF FUNDUS CAMERAS AND OCT SYSTEMS IS DRIVEN BY RISING SCREENING NEEDS FOR DIABETIC RETINOPATHY AND AGE-RELATED MACULAR DEGENERATION

2.5.2. HOSPITALS AND DIAGNOSTIC CLINICS ACCOUNT FOR THE LARGEST SHARE DUE TO HIGH PATIENT FOOTFALL AND INTEGRATED OPHTHALMOLOGY SETUPS

2.5.3. PORTABLE AND HANDHELD RETINAL IMAGING DEVICES ARE GAINING TRACTION IN RURAL AND PRIMARY CARE SETTINGS

2.5.4. DEVELOPED MARKETS DOMINATE REVENUE, WHILE EMERGING ECONOMIES SHOW FASTER VOLUME GROWTH

3. MARKET DYNAMICS

3.1. KEY DRIVERS

3.1.1. INCREASING GLOBAL PREVALENCE OF DIABETES AND AGING POPULATION IS EXPANDING THE AT-RISK PATIENT BASE

3.1.2. GOVERNMENT AND NGO LED EYE SCREENING PROGRAMS ARE BOOSTING DEMAND FOR RETINAL DIAGNOSTIC TOOLS

3.1.3. TECHNOLOGICAL ADVANCES IN OCT AI ASSISTED DIAGNOSTICS AND IMAGE QUALITY ARE IMPROVING CLINICAL OUTCOMES

3.1.4. RISING AWARENESS AMONG PHYSICIANS AND PATIENTS ABOUT EARLY DETECTION OF RETINAL DISORDERS IS SUPPORTING MARKET EXPANSION

3.2. KEY RESTRAINTS

3.2.1. HIGH CAPITAL COST OF ADVANCED RETINAL IMAGING SYSTEMS LIMITS ADOPTION IN SMALL CLINICS

3.2.2. LACK OF TRAINED OPHTHALMOLOGISTS AND TECHNICIANS CONSTRAINS EFFECTIVE UTILIZATION IN LOW-INCOME REGIONS

3.2.3. REIMBURSEMENT VARIABILITY ACROSS COUNTRIES AFFECTS PURCHASE DECISIONS BY HEALTHCARE PROVIDERS

3.2.4. REGULATORY APPROVAL AND DEVICE CERTIFICATION REQUIREMENTS CAN DELAY PRODUCT COMMERCIALIZATION

4. KEY ANALYTICS

4.1. KEY MARKET TRENDS

4.1.1. INTEGRATION OF ARTIFICIAL INTELLIGENCE FOR AUTOMATED RETINAL IMAGE ANALYSIS IS ACCELERATING

4.1.2. SHIFT TOWARD NON-MYDRIATIC AND PATIENT-FRIENDLY IMAGING SYSTEMS IS IMPROVING SCREENING COMPLIANCE

4.1.3. GROWING USE OF TELE OPHTHALMOLOGY IS DRIVING DEMAND FOR CONNECTED RETINAL IMAGING DEVICES

4.1.4. MANUFACTURERS ARE FOCUSING ON COMPACT AND PORTABLE DESIGNS TO EXPAND POINT OF CARE APPLICATIONS

4.2. PORTER’S FIVE FORCES ANALYSIS

4.2.1. BUYERS POWER

4.2.2. SUPPLIERS POWER

4.2.3. SUBSTITUTION

4.2.4. NEW ENTRANTS

4.2.5. INDUSTRY RIVALRY

4.3. GROWTH PROSPECT MAPPING

4.3.1. GROWTH PROSPECT MAPPING FOR NORTH AMERICA

4.3.2. GROWTH PROSPECT MAPPING FOR EUROPE

4.3.3. GROWTH PROSPECT MAPPING FOR ASIA-PACIFIC

4.3.4. GROWTH PROSPECT MAPPING FOR REST OF WORLD

4.4. MARKET MATURITY ANALYSIS

4.5. MARKET CONCENTRATION ANALYSIS

4.6. VALUE CHAIN ANALYSIS

4.6.1. RAW MATERIAL SUPPLIERS

4.6.2. OPTICAL COMPONENTS

4.6.3. DEVICE MANUFACTURING

4.6.4. SOFTWARE DEVELOPMENT

4.6.5. DISTRIBUTION CHANNELS

4.6.6. HOSPITALS AND CLINICS

4.6.7. AFTERSALES SUPPORT

4.7. KEY BUYING CRITERIA

4.7.1. IMAGE RESOLUTION

4.7.2. CLINICAL ACCURACY

4.7.3. EASE OF USE

4.7.4. TOTAL COST OWNERSHIP

4.8. REGULATORY FRAMEWORK

5. RETINAL IMAGING DEVICES MARKET BY DEVICE

5.1. OPTICAL COHERENCE TOMOGRAPHY (OCT) DEVICES

5.1.1. SPECTRAL-DOMAIN OCT (SD-OCT)

5.1.2. SWEPT-SOURCE OCT (SS-OCT)

5.1.3. HANDHELD OCT

5.2. FLUORESCEIN ANGIOGRAPHY DEVICES

5.3. FUNDUS CAMERAS

5.3.1. MYDRIATIC FUNDUS CAMERAS

5.3.2. NON-MYDRIATIC FUNDUS CAMERAS

5.3.3. HYBRID FUNDUS CAMERAS

5.3.4. ROP FUNDUS CAMERAS

5.4. RETINAL ULTRASOUND IMAGING SYSTEMS

5.4.1. OPHTHALMIC A-SCAN ULTRASOUND

5.4.2. OPHTHALMIC B-SCAN ULTRASOUND

5.4.3. OPHTHALMIC ULTRASOUND BIOMICROSCOPES

5.4.4. OPHTHALMIC PACHYMETERS

5.5. ULTRA WIDEFIELD RETINAL IMAGING DEVICES

5.6. WIDEFIELD RETINAL IMAGING DEVICES

5.7. OTHER DEVICES

6. RETINAL IMAGING DEVICES MARKET BY APPLICATION

6.1. DISEASE DIAGNOSIS

6.2. TREATMENT MONITORING

6.3. RESEARCH AND DEVELOPMENT

7. RETINAL IMAGING DEVICES MARKET BY INDICATION

7.1. DIABETIC RETINOPATHY

7.2. AGE-RELATED MACULAR DEGENERATION (AMD)

7.3. GLAUCOMA

7.4. RETINAL VEIN OCCLUSION

7.5. OTHER INDICATIONS

8. GEOGRAPHICAL ANALYSIS

8.1. NORTH AMERICA

8.1.1. MARKET SIZE & ESTIMATES

8.1.2. NORTH AMERICA MARKET DRIVERS

8.1.3. NORTH AMERICA MARKET CHALLENGES

8.1.4. KEY PLAYERS IN NORTH AMERICA RETINAL IMAGING DEVICES MARKET

8.1.5. COUNTRY ANALYSIS

8.1.5.1. UNITED STATES

8.1.5.1.1. UNITED STATES MARKET SIZE & OPPORTUNITIES

8.1.5.2. CANADA

8.1.5.2.1. CANADA MARKET SIZE & OPPORTUNITIES

8.2. EUROPE

8.2.1. MARKET SIZE & ESTIMATES

8.2.2. EUROPE MARKET DRIVERS

8.2.3. EUROPE RETINAL IMAGING DEVICES MARKET CHALLENGES

8.2.4. KEY PLAYERS IN EUROPE RETINAL IMAGING DEVICES MARKET

8.2.5. COUNTRY ANALYSIS

8.2.5.1. GERMANY

8.2.5.1.1. GERMANY MARKET SIZE & OPPORTUNITIES

8.2.5.2. UNITED KINGDOM

8.2.5.2.1. UNITED KINGDOM MARKET SIZE & OPPORTUNITIES

8.2.5.3. FRANCE

8.2.5.3.1. FRANCE MARKET SIZE & OPPORTUNITIES

8.2.5.4. ITALY

8.2.5.4.1. ITALY MARKET SIZE & OPPORTUNITIES

8.2.5.5. SPAIN

8.2.5.5.1. SPAIN MARKET SIZE & OPPORTUNITIES

8.2.5.6. BELGIUM

8.2.5.6.1. BELGIUM MARKET SIZE & OPPORTUNITIES

8.2.5.7. POLAND

8.2.5.7.1. POLAND MARKET SIZE & OPPORTUNITIES

8.2.5.8. REST OF EUROPE

8.2.5.8.1. REST OF EUROPE MARKET SIZE & OPPORTUNITIES

8.3. ASIA-PACIFIC

8.3.1. MARKET SIZE & ESTIMATES

8.3.2. ASIA-PACIFIC MARKET DRIVERS

8.3.3. ASIA-PACIFIC MARKET CHALLENGES

8.3.4. KEY PLAYERS IN ASIA-PACIFIC RETINAL IMAGING DEVICES MARKET

8.3.5. COUNTRY ANALYSIS

8.3.5.1. CHINA

8.3.5.1.1. CHINA MARKET SIZE & OPPORTUNITIES

8.3.5.2. INDIA

8.3.5.2.1. INDIA MARKET SIZE & OPPORTUNITIES

8.3.5.3. JAPAN

8.3.5.3.1. JAPAN MARKET SIZE & OPPORTUNITIES

8.3.5.4. AUSTRALIA & NEW ZEALAND

8.3.5.4.1. AUSTRALIA & NEW ZEALAND MARKET SIZE & OPPORTUNITIES

8.3.5.5. SOUTH KOREA

8.3.5.5.1. SOUTH KOREA MARKET SIZE & OPPORTUNITIES

8.3.5.6. THAILAND

8.3.5.6.1. THAILAND MARKET SIZE & OPPORTUNITIES

8.3.5.7. INDONESIA

8.3.5.7.1. INDONESIA MARKET SIZE & OPPORTUNITIES

8.3.5.8. VIETNAM

8.3.5.8.1. VIETNAM MARKET SIZE & OPPORTUNITIES

8.3.5.9. REST OF ASIA-PACIFIC

8.3.5.9.1. REST OF ASIA-PACIFIC MARKET SIZE & OPPORTUNITIES

8.4. REST OF WORLD

8.4.1. MARKET SIZE & ESTIMATES

8.4.2. REST OF WORLD MARKET DRIVERS

8.4.3. REST OF WORLD MARKET CHALLENGES

8.4.4. KEY PLAYERS IN REST OF WORLD RETINAL IMAGING DEVICES MARKET

8.4.5. REGIONAL ANALYSIS

8.4.5.1. LATIN AMERICA

8.4.5.1.1. LATIN AMERICA MARKET SIZE & OPPORTUNITIES

8.4.5.2. MIDDLE EAST & AFRICA

8.4.5.2.1. MIDDLE EAST & AFRICA MARKET SIZE & OPPORTUNITIES

9. COMPETITIVE LANDSCAPE

9.1. KEY STRATEGIC DEVELOPMENTS

9.1.1. MERGERS & ACQUISITIONS

9.1.2. PRODUCT LAUNCHES & DEVELOPMENTS

9.1.3. PARTNERSHIPS & AGREEMENTS

9.1.4. BUSINESS EXPANSIONS & DIVESTITURES

9.2. COMPANY PROFILES

9.2.1. CANON INC

9.2.1.1. COMPANY OVERVIEW

9.2.1.2. PRODUCT LIST

9.2.1.3. STRENGTHS & CHALLENGES

9.2.2. CARL ZEISS MEDITEC AG

9.2.2.1. COMPANY OVERVIEW

9.2.2.2. PRODUCT LIST

9.2.2.3. STRENGTHS & CHALLENGES

9.2.3. ESCALON MEDICAL CORP

9.2.3.1. COMPANY OVERVIEW

9.2.3.2. PRODUCT LIST

9.2.3.3. STRENGTHS & CHALLENGES

9.2.4. FORUS HEALTH PVT LTD

9.2.4.1. COMPANY OVERVIEW

9.2.4.2. PRODUCT LIST

9.2.4.3. STRENGTHS & CHALLENGES

9.2.5. HEIDELBERG ENGINEERING GMBH

9.2.5.1. COMPANY OVERVIEW

9.2.5.2. PRODUCT LIST

9.2.5.3. STRENGTHS & CHALLENGES

9.2.6. KOWA COMPANY LTD

9.2.6.1. COMPANY OVERVIEW

9.2.6.2. PRODUCT LIST

9.2.6.3. STRENGTHS & CHALLENGES

9.2.7. NIDEK CO LTD

9.2.7.1. COMPANY OVERVIEW

9.2.7.2. PRODUCT LIST

9.2.7.3. STRENGTHS & CHALLENGES

9.2.8. OPTOS PLC

9.2.8.1. COMPANY OVERVIEW

9.2.8.2. PRODUCT LIST

9.2.8.3. STRENGTHS & CHALLENGES

9.2.9. SANTEC CORPORATION

9.2.9.1. COMPANY OVERVIEW

9.2.9.2. PRODUCT LIST

9.2.9.3. STRENGTHS & CHALLENGES

9.2.10. TOPCON CORPORATION

9.2.10.1. COMPANY OVERVIEW

9.2.10.2. PRODUCT LIST

9.2.10.3. STRENGTHS & CHALLENGES

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – RETINAL IMAGING DEVICES

TABLE 2: MARKET BY DEVICE, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 3: MARKET BY DEVICE, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 4: OPTICAL COHERENCE TOMOGRAPHY (OCT) DEVICES, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 5: OPTICAL COHERENCE TOMOGRAPHY (OCT) DEVICES, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 6: MARKET BY OPTICAL COHERENCE TOMOGRAPHY (OCT) DEVICES, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 7: MARKET BY OPTICAL COHERENCE TOMOGRAPHY (OCT) DEVICES, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 8: SPECTRAL-DOMAIN OCT (SD-OCT), BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 9: SPECTRAL-DOMAIN OCT (SD-OCT), BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 10: SWEPT-SOURCE OCT (SS-OCT), BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 11: SWEPT-SOURCE OCT (SS-OCT), BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 12: HANDHELD OCT, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 13: HANDHELD OCT, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 14: FLUORESCEIN ANGIOGRAPHY DEVICES, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 15: FLUORESCEIN ANGIOGRAPHY DEVICES, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 16: FUNDUS CAMERAS, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 17: FUNDUS CAMERAS, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 18: MARKET BY FUNDUS CAMERAS, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 19: MARKET BY FUNDUS CAMERAS, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 20: MYDRIATIC FUNDUS CAMERAS, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 21: MYDRIATIC FUNDUS CAMERAS, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 22: NON-MYDRIATIC FUNDUS CAMERAS, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 23: NON-MYDRIATIC FUNDUS CAMERAS, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 24: HYBRID FUNDUS CAMERAS, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 25: HYBRID FUNDUS CAMERAS, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 26: ROP FUNDUS CAMERAS, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 27: ROP FUNDUS CAMERAS, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 28: RETINAL ULTRASOUND IMAGING SYSTEMS, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 29: RETINAL ULTRASOUND IMAGING SYSTEMS, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 30: MARKET BY RETINAL ULTRASOUND IMAGING SYSTEMS, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 31: MARKET BY RETINAL ULTRASOUND IMAGING SYSTEMS, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 32: OPHTHALMIC A-SCAN ULTRASOUND, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 33: OPHTHALMIC A-SCAN ULTRASOUND, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 34: OPHTHALMIC B-SCAN ULTRASOUND, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 35: OPHTHALMIC B-SCAN ULTRASOUND, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 36: OPHTHALMIC ULTRASOUND BIOMICROSCOPES, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 37: OPHTHALMIC ULTRASOUND BIOMICROSCOPES, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 38: OPHTHALMIC PACHYMETERS, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 39: OPHTHALMIC PACHYMETERS, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 40: ULTRA WIDEFIELD RETINAL IMAGING DEVICES, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 41: ULTRA WIDEFIELD RETINAL IMAGING DEVICES, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 42: WIDEFIELD RETINAL IMAGING DEVICES, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 43: WIDEFIELD RETINAL IMAGING DEVICES, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 44: OTHER DEVICES, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 45: OTHER DEVICES, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 46: MARKET BY APPLICATION, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 47: MARKET BY APPLICATION, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 48: DISEASE DIAGNOSIS, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 49: DISEASE DIAGNOSIS, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 50: TREATMENT MONITORING, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 51: TREATMENT MONITORING, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 52: RESEARCH AND DEVELOPMENT, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 53: RESEARCH AND DEVELOPMENT, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 54: MARKET BY INDICATION, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 55: MARKET BY INDICATION, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 56: DIABETIC RETINOPATHY, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 57: DIABETIC RETINOPATHY, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 58: AGE-RELATED MACULAR DEGENERATION (AMD), BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 59: AGE-RELATED MACULAR DEGENERATION (AMD), BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 60: GLAUCOMA, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 61: GLAUCOMA, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 62: RETINAL VEIN OCCLUSION, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 63: RETINAL VEIN OCCLUSION, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 64: OTHER INDICATIONS, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 65: OTHER INDICATIONS, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 66: MARKET BY GEOGRAPHICAL ANALYSIS, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 67: MARKET BY GEOGRAPHICAL ANALYSIS, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 68: NORTH AMERICA MARKET, COUNTRY ANALYSIS, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 69: NORTH AMERICA MARKET, COUNTRY ANALYSIS, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 70: KEY PLAYERS OPERATING IN THE NORTH AMERICAN MARKET

TABLE 71: EUROPE MARKET, COUNTRY ANALYSIS, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 72: EUROPE MARKET, COUNTRY ANALYSIS, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 73: KEY PLAYERS OPERATING IN THE EUROPEAN MARKET

TABLE 74: ASIA-PACIFIC MARKET, COUNTRY ANALYSIS, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 75: ASIA-PACIFIC MARKET, COUNTRY ANALYSIS, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 76: KEY PLAYERS OPERATING IN THE ASIA-PACIFIC MARKET

TABLE 77: REST OF WORLD MARKET, REGIONAL ANALYSIS, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 78: REST OF WORLD MARKET, REGIONAL ANALYSIS, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 79: KEY PLAYERS OPERATING IN THE REST OF WORLD MARKET

TABLE 80: LIST OF MERGERS & ACQUISITIONS

TABLE 81: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 82: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 83: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR NORTH AMERICA

FIGURE 4: GROWTH PROSPECT MAPPING FOR EUROPE

FIGURE 5: GROWTH PROSPECT MAPPING FOR ASIA-PACIFIC

FIGURE 6: GROWTH PROSPECT MAPPING FOR REST OF WORLD

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: VALUE CHAIN ANALYSIS

FIGURE 10: KEY BUYING CRITERIA

FIGURE 11: SEGMENT GROWTH POTENTIAL, BY DEVICE, IN 2025

FIGURE 12: OPTICAL COHERENCE TOMOGRAPHY (OCT) DEVICES MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 13: SEGMENT GROWTH POTENTIAL, BY OPTICAL COHERENCE TOMOGRAPHY (OCT) DEVICES, IN 2025

FIGURE 14: SPECTRAL-DOMAIN OCT (SD-OCT) MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 15: SWEPT-SOURCE OCT (SS-OCT) MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 16: HANDHELD OCT MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 17: FLUORESCEIN ANGIOGRAPHY DEVICES MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 18: FUNDUS CAMERAS MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 19: SEGMENT GROWTH POTENTIAL, BY FUNDUS CAMERAS, IN 2025

FIGURE 20: MYDRIATIC FUNDUS CAMERAS MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 21: NON-MYDRIATIC FUNDUS CAMERAS MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 22: HYBRID FUNDUS CAMERAS MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 23: ROP FUNDUS CAMERAS MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 24: RETINAL ULTRASOUND IMAGING SYSTEMS MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 25: SEGMENT GROWTH POTENTIAL, BY RETINAL ULTRASOUND IMAGING SYSTEMS, IN 2025

FIGURE 26: OPHTHALMIC A-SCAN ULTRASOUND MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 27: OPHTHALMIC B-SCAN ULTRASOUND MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 28: OPHTHALMIC ULTRASOUND BIOMICROSCOPES MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 29: OPHTHALMIC PACHYMETERS MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 30: ULTRA WIDEFIELD RETINAL IMAGING DEVICES MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 31: WIDEFIELD RETINAL IMAGING DEVICES MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 32: OTHER DEVICES MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 33: SEGMENT GROWTH POTENTIAL, BY APPLICATION, IN 2025

FIGURE 34: DISEASE DIAGNOSIS MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 35: TREATMENT MONITORING MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 36: RESEARCH AND DEVELOPMENT MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 37: SEGMENT GROWTH POTENTIAL, BY INDICATION, IN 2025

FIGURE 38: DIABETIC RETINOPATHY MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 39: AGE-RELATED MACULAR DEGENERATION (AMD) MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 40: GLAUCOMA MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 41: RETINAL VEIN OCCLUSION MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 42: OTHER INDICATIONS MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 43: NORTH AMERICA RETINAL IMAGING DEVICES MARKET, COUNTRY OUTLOOK, 2025 & 2034 (IN %)

FIGURE 44: UNITED STATES MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 45: CANADA MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 46: EUROPE RETINAL IMAGING DEVICES MARKET, COUNTRY OUTLOOK, 2025 & 2034 (IN %)

FIGURE 47: GERMANY MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 48: UNITED KINGDOM MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 49: FRANCE MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 50: ITALY MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 51: SPAIN MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 52: BELGIUM MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 53: POLAND MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 54: REST OF EUROPE MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 55: ASIA-PACIFIC RETINAL IMAGING DEVICES MARKET, COUNTRY OUTLOOK, 2025 & 2034 (IN %)

FIGURE 56: CHINA MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 57: INDIA MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 58: JAPAN MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 59: AUSTRALIA & NEW ZEALAND MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 60: SOUTH KOREA MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 61: THAILAND MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 62: INDONESIA MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 63: VIETNAM MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 64: REST OF ASIA-PACIFIC MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 65: REST OF WORLD RETINAL IMAGING DEVICES MARKET, REGIONAL OUTLOOK, 2025 & 2034 (IN %)

FIGURE 66: LATIN AMERICA MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 67: MIDDLE EAST & AFRICA MARKET SIZE, 2026-2034 (IN $ MILLION)