GLOBAL MEDICAL DISPLAY MONITORS MARKET FORECAST 2026-2034

Global Medical Display Monitors Market by Display Color (Greyscale, Color) Market by Resolution (Up To 2MP, 2.1-4MP, 4.1-8MP, Above 8MP) Market by Technology (CCFL-Backlit LCD Displays, LED-Backlit LCD Displays, OLED Displays) Market by Panel Size (Under 22.9 Inches, 23.0-26.9 Inches, 27.0-41.9 Inches, 42 Inches and Above) Market by Application (Clinical, Dental, Diagnostic, Education & Training, Surgical, Telemedicine), by Geography

世界の医療用ディスプレイモニター市場 - ディスプレイカラー別(グレースケール、カラー) - 解像度別(2MPまで、2.1~4MP、4.1~8MP、8MP以上) - 技術別(CCFLバックライトLCDディスプレイ、LEDバックライトLCDディスプレイ、OLEDディスプレイ) - パネルサイズ別(22.9インチ以下、23.0~26.9インチ、27.0~41.9インチ、42インチ以上) - 用途別(臨床、歯科、診断、教育・トレーニング、外科、遠隔医療) - 地域別

| 出版 | Inkwood Research |

| 出版年月 | 2026年02月 |

| ページ数 | 305 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 2,900 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-13379 |

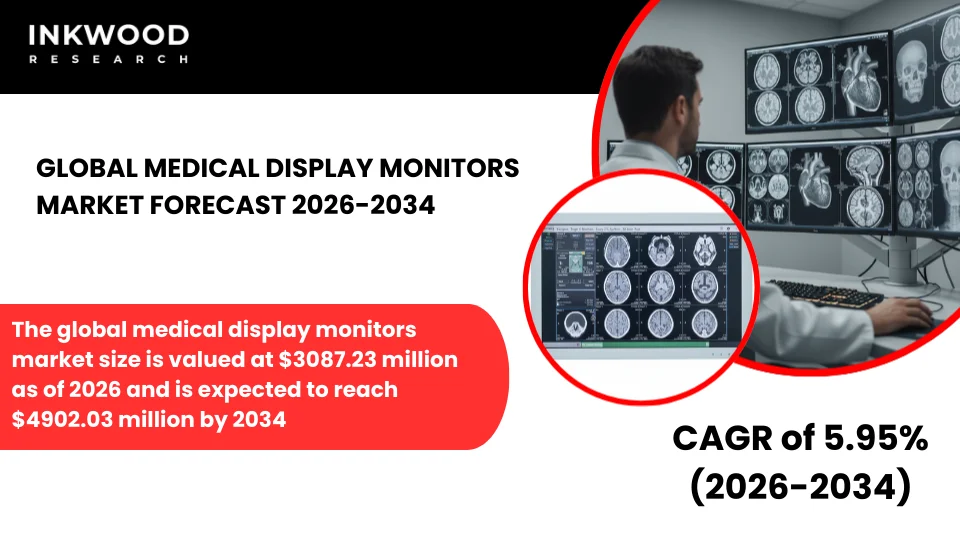

世界の医療用ディスプレイモニター市場規模は、2026年時点で30億8,723万ドルと推定されており、2034年には49億203万ドルに達すると予測されています。予測期間である2026年から2034年にかけては、5.95%の年平均成長率(CAGR)で成長が見込まれています。本調査の基準年は2025年、予測期間は2026年から2034年です。

本市場調査では、医療用ディスプレイモニター市場への危機の影響を定性的にも定量的にも分析しています。 医療用ディスプレイモニターは、医療画像環境の厳しい要求を満たすように設計された特殊な視覚化システムです。一般向けディスプレイとは異なり、これらの医療グレードモニターはDICOM Part 14規格に準拠した厳格なキャリブレーションを受けており、臨床ワークフロー全体にわたって一貫したグレースケールレンダリングを保証します。

KEY FINDINGS

The global medical display monitors market size is valued at $3087.23 million as of 2026 and is expected to reach $4902.03 million by 2034, progressing with a CAGR of 5.95% during the forecast years, 2026-2034. The base year considered for the study is 2025, and the forecast period is between 2026 and 2034. The market study has also analyzed the crisis impact on the medical display monitors market qualitatively as well as quantitatively.

Medical display monitors represent specialized visualization systems engineered to meet the rigorous demands of healthcare imaging environments. Unlike consumer displays, these medical-grade monitors undergo strict calibration to DICOM Part 14 standards, ensuring consistent grayscale rendering across clinical workflows.

Healthcare facilities deploy these advanced systems in radiology suites, operating rooms, and diagnostic centers where image accuracy directly impacts patient outcomes. Medical display monitors for diagnostic imaging deliver superior brightness levels, typically ranging from 400 to 1,000 cd/m², compared to standard displays. Furthermore, these systems incorporate built-in calibration sensors that automatically maintain compliance throughout their operational lifespan, reducing manual quality control requirements.

Growth in the medical display monitors market stems from escalating diagnostic imaging volumes worldwide. According to FDA data, over 3,000 medical devices received 510(k) clearance in fiscal year 2024, many requiring advanced visualization capabilities. Additionally, healthcare facilities are transitioning from legacy systems to high-resolution 4K and 8K displays.

Minimally invasive procedures demand real-time visualization, driving the adoption of medical monitors for operating rooms with low latency and high brightness. Telemedicine expansion also necessitates calibrated displays for remote diagnostics, supporting consistent image interpretation across distributed networks.

MARKET INSIGHTS

Key enablers of the global medical display monitors market growth:

- Rising global volume of medical imaging procedures is driving demand for accurate visualization tools

- Increasing investment in digital hospital infrastructure is supporting monitor upgrades

- Growth in minimally invasive surgeries is boosting demand for high brightness and low latency displays

- Expansion of telemedicine and remote diagnostics is supporting the wider deployment of medical displays

o Telemedicine platforms have fundamentally altered how healthcare providers deliver diagnostic services. Consequently, medical display monitors must now support secure network transmission without compromising image fidelity.

o Remote consultation workflows require displays that maintain DICOM calibration and medical display monitor standards across various locations. Healthcare organizations report that calibrated displays enable consistent interpretation of radiology images transmitted over telehealth networks.

o This trend gained momentum as the FDA authorized over 1,000 AI-enabled medical devices by early 2025, many incorporating advanced imaging analytics requiring precision displays. Moreover, approximately 3 million laparoscopic procedures occur annually in the United States, each demanding real-time visualization through high-performance surgical displays.

Key growth restraining factors of the global medical display monitors market:

- High initial cost of medical-grade display monitors limits adoption in smaller healthcare facilities

- Stringent regulatory and compliance requirements increase product development time

- Long replacement cycles in hospitals slow overall market turnover

- Availability of lower-cost consumer displays creates price pressure in non-critical applications

o Budget-conscious healthcare facilities sometimes opt for consumer-grade displays in non-critical applications, creating downward pricing pressure. Although these alternatives cost significantly less, they lack essential features like automated DICOM calibration and built-in sensors. Hospitals typically maintain medical display monitors for five to seven years before replacement, extending capital expenditure cycles.

o Additionally, stringent FDA 510(k) submission requirements for diagnostic displays lengthen time-to-market for new innovations. Manufacturers must demonstrate substantial equivalence to predicate devices, requiring extensive testing and documentation. This regulatory complexity particularly impacts smaller companies seeking to enter the medical display monitors suppliers worldwide ecosystem.

Global Medical Display Monitors Industry | Top Trends

- Multi-modality and large-format displays are increasingly deployed in operating rooms to accommodate complex surgical workflows. Hybrid operating rooms now feature displays exceeding 42 inches, enabling simultaneous viewing of multiple imaging modalities. Stryker maintains over 11,000 integrated operating rooms in the United States as of 2024, while Karl Storz operates more than 6,000 installations. These expansive displays support real-time visualization during interventional procedures where spatial awareness proves critical. Furthermore, large-format medical display monitors in hospitals facilitate team collaboration by providing clear visibility for entire surgical teams.

- AI-assisted image enhancement features are gaining traction across radiology departments worldwide. These intelligent systems automatically adjust brightness and contrast based on image content and ambient lighting conditions. Medical display monitors for radiology now incorporate algorithms that highlight subtle anomalies, supporting faster diagnosis. Healthcare facilities report that AI-enhanced displays improve interpretation speed without compromising accuracy in clinical workflows.

- Antimicrobial and easy-to-clean display surfaces are becoming standard specifications in infection control protocols. Hospital-acquired infections drive demand for medical monitors with specialized coatings that withstand frequent disinfection. Manufacturers now apply antimicrobial treatments to display housings and touchscreens, reducing pathogen transmission in clinical environments. These hygienic design features align with evolving healthcare standards, emphasizing patient safety. Medical display monitors buying guide criteria increasingly prioritize ease of cleaning alongside traditional performance metrics.

- Energy-efficient and lightweight display designs are emerging to address operational cost concerns and installation flexibility. LED-backlit technology consumes substantially less power than legacy CCFL systems while delivering superior brightness. Healthcare facilities appreciate reduced electricity expenses and lower cooling requirements from efficient displays. Lightweight construction simplifies mounting in constrained spaces like surgical booms and mobile carts. Best medical display monitors for hospitals now balance performance with sustainability, reflecting institutional environmental commitments. These design improvements support both cost reduction initiatives and flexible deployment across diverse clinical settings.

SEGMENTATION ANALYSIS

Market Segmentation – Display Colour, Resolution, Technology, Panel Size, and Application –

Market by Display Colour:

- Greyscale

o Greyscale medical display monitors specialize in rendering monochromatic images with exceptional tonal precision. These displays excel in mammography, general radiography, and chest imaging, where subtle density variations indicate pathology. Features to look for in medical display monitors include DICOM calibration, medical display monitors compliance, typically maintaining accuracy within ±5% of the standard curve.

o Greyscale systems employ sophisticated calibration algorithms that map luminance output to perceptually linear brightness levels. Demand drivers include regulatory requirements mandating calibrated displays for primary diagnostic interpretation. FDA guidance specifies performance criteria for diagnostic radiology displays, supporting continued adoption of greyscale monitors.

o Healthcare providers value these specialized displays for their ability to reveal microcalcifications and other subtle findings invisible on standard displays. This sub-segment supports overall market growth by serving high-acuity diagnostic applications where visualization accuracy directly impacts patient outcomes and clinical decision-making processes.

- Color

Market by Resolution:

- 2.1-4MP

- 4.1-8MP

- Above 8MP

- Up to 2MP

Market by Technology:

- LED-Backlit LCD Displays

- OLED Displays

- CCFL-Backlit LCD Displays

Market by Panel Size:

- 23.0-26.9 Inches

- 27.0-41.9 Inches

- 42 Inches and Above

- Under 22.9 Inches

Market by Application:

- Diagnostic

- Surgical

- Clinical

- Dental

- Education & Training

- Telemedicine

REPORT SYNOPSIS

| REPORT SCOPE | DETAILS |

|---|---|

| Market Forecast Years | 2026-2034 |

| Base Year | 2025 |

| Market Historical Years | 2022-2024 |

| Forecast Units | Revenue ($ Million) |

| Segments Analyzed | Display Colour, Resolution, Technology, Panel Size, and Application |

| Geographies Analyzed | North America, Europe, Asia-Pacific, Rest of World |

| Companies Analyzed | Advantech Co Ltd, Barco, Canvys, Double Black Imaging, EIZO Corporation, HP Development Company LP, NDS Surgical Imaging, Quest International, STERIS, Stryker, UTI Technology Inc, LG Electronics, Sony Electronics Inc, Koninklijke Philips NV, NEC Display Solutions (Sharp NEC Display Solutions) |

REGIONAL ANALYSIS

Geographical Study based on Four Major Regions:

- North America: The United States and Canada

- Europe: The United Kingdom, Germany, France, Italy, Spain, Poland, Belgium, and Rest of Europe

- Asia-Pacific: China, India, Japan, Australia & New Zealand, South Korea, Thailand, Indonesia, Vietnam, and Rest of Asia-Pacific

o China’s medical display monitors market demonstrates robust expansion driven by healthcare infrastructure modernization initiatives. Government investments in digital hospital systems are accelerating the adoption of medical monitors for PACS and imaging across tier-one through tier-four cities. Domestic manufacturers like Jusha Medical and Reshin compete alongside international brands, offering cost-competitive alternatives.

o The proliferation of private hospitals and diagnostic chains expands the addressable market for healthcare display monitors’ use cases. Regulatory alignment with international standards facilitates technology transfer and quality improvements across Chinese manufacturers.

o Telemedicine adoption in rural areas creates demand for calibrated displays supporting remote consultation workflows. China’s aging population drives increasing diagnostic imaging volumes, necessitating continued investment in advanced visualization technologies through 2034 and beyond.

- Rest of World: Latin America, the Middle East & Africa

Our market research reports offer an in-depth analysis of individual country-level market size and growth statistics. We cover the segmentation analysis, key growth factors, and macro-economic trends within the medical display monitors market, providing detailed insights into –

- Japan Medical Display Monitors Market

- Indonesia Medical Display Monitors Market

- The United States Medical Display Monitors Market

COMPETITIVE INSIGHTS

The major players in the global medical display monitors market are:

- Barco

- EIZO Corporation

- Sony Electronics Inc

- LG Electronics

- Advantech Co Ltd

Key strategies adopted by some of these companies:

- In October 2024, Barco unveiled its Coronis OneLook display to commemorate Breast Cancer Awareness Month and the company’s 90th anniversary. This flagship 32-megapixel breast imaging display offers the highest resolution available, enabling radiologists to view complete mammography images without zooming. The launch represents significant innovation in specialized diagnostic displays for breast radiology applications.

- EIZO Corporation introduced the RadiForce RX570 in May 2025, a 21.3-inch 5-megapixel color monitor specifically designed for breast imaging applications, including mammography and tomosynthesis. This product launch demonstrates continued investment in specialized medical imaging solutions addressing evolving clinical requirements in women’s health diagnostics.

- Sony expanded its medical monitor lineup in July 2025 with two new models measuring 27 inches and 43 inches, joining the previously released 32-inch version. These displays earned VESA Display HDR 1000 certification, becoming the first medical monitors to achieve this designation. The expansion strengthens Sony’s surgical display portfolio with enhanced brightness and image detail capabilities.

We Offer 10% Free Customization and 3 Months Analyst Support

Frequently Asked Questions (FAQs):

What are medical display monitors, and why are they important?

Medical display monitors are specialized imaging systems calibrated to DICOM standards for accurate visualization in healthcare settings. They differ from consumer displays through built-in sensors, automated calibration, and superior brightness specifications essential for diagnostic accuracy.

What resolution do medical display monitors require for diagnostic imaging?

Medical display monitor resolution requirements vary by application, ranging from 2MP for clinical review to 8MP and above for mammography. Higher resolutions enable the detection of subtle pathologies like microcalcifications that standard displays cannot reveal.

Which companies are leading medical display monitor manufacturers globally?

Leading medical display monitor companies include Barco, EIZO Corporation, Sony Electronics, LG Electronics, and Advantech. These manufacturers dominate through extensive product portfolios, FDA approvals, and global distribution networks serving healthcare facilities worldwide.

COMPANY PROFILES

- ADVANTECH CO LTD

- BARCO

- CANVYS

- DOUBLE BLACK IMAGING

- EIZO CORPORATION

- HP DEVELOPMENT COMPANY LP

- NDS SURGICAL IMAGING

- QUEST INTERNATIONAL

- STERIS

- STRYKER

- UTI TECHNOLOGY INC

- LG ELECTRONICS

- SONY ELECTRONICS INC

- KONINKLIJKE PHILIPS NV

- NEC DISPLAY SOLUTIONS (SHARP NEC DISPLAY SOLUTIONS)

| タイトル | Single User Price (USD) | |

| 世界の医療用モニターディスプレイ市場予測 2026-2034年 | GLOBAL MEDICAL DISPLAY MONITORS MARKET FORECAST 2026-2034 | USD 2,900 |

| アジア太平洋地域の医療用モニターディスプレイ市場予測 2026-2034年 | ASIA-PACIFIC MEDICAL DISPLAY MONITORS MARKET FORECAST 2026-2034 | USD 1,600 |

| 欧州の医療用モニターディスプレイ市場予測 2026-2034年 | EUROPE MEDICAL DISPLAY MONITORS MARKET FORECAST 2026-2034 | USD 1,600 |

| インドネシアの医療用モニターディスプレイ市場予測 2026-2034年 | INDONESIA MEDICAL DISPLAY MONITORS MARKET FORECAST 2026-2034 | USD 1,100 |

| 日本の医療用モニターディスプレイ市場予測 2026-2034年 | JAPAN MEDICAL DISPLAY MONITORS MARKET FORECAST 2026-2034 | USD 1,100 |

| 北米の医療用モニターディスプレイ市場予測 2026-2034年 | NORTH AMERICA MEDICAL DISPLAY MONITORS MARKET FORECAST 2026-2034 | USD 1,600 |

| 米国の医療用モニターディスプレイ市場予測 2026-2034年 | UNITED STATES MEDICAL DISPLAY MONITORS MARKET FORECAST 2026-2034 | USD 1,100 |

TABLE OF CONTENTS

1. RESEARCH SCOPE & METHODOLOGY

1.1. STUDY OBJECTIVES

1.2. METHODOLOGY

1.3. ASSUMPTIONS & LIMITATIONS

2. EXECUTIVE SUMMARY

2.1. MARKET SIZE & FORECAST

2.2. MARKET OVERVIEW

2.3. SCOPE OF STUDY

2.4. CRISIS SCENARIO ANALYSIS

2.5. MAJOR MARKET FINDINGS

2.5.1. DIAGNOSTIC IMAGING AND SURGICAL SUITES ACCOUNT FOR THE LARGEST SHARE OF MEDICAL DISPLAY MONITOR DEMAND DUE TO HIGH RELIANCE ON IMAGE ACCURACY

2.5.2. HIGH RESOLUTION DISPLAYS INCLUDING 4K AND 8K ARE RAPIDLY REPLACING LEGACY MONITORS IN ADVANCED HEALTHCARE FACILITIES

2.5.3. HOSPITALS REMAIN THE PRIMARY END-USERS, WHILE DIAGNOSTIC CENTERS SHOW FASTER ADOPTION RATES

2.5.4. REGULATORY COMPLIANCE AND MEDICAL GRADE CERTIFICATION STRONGLY INFLUENCE PURCHASING DECISIONS

3. MARKET DYNAMICS

3.1. KEY DRIVERS

3.1.1. RISING GLOBAL VOLUME OF MEDICAL IMAGING PROCEDURES IS DRIVING DEMAND FOR ACCURATE VISUALIZATION TOOLS

3.1.2. INCREASING INVESTMENT IN DIGITAL HOSPITAL INFRASTRUCTURE IS SUPPORTING MONITOR UPGRADES

3.1.3. GROWTH IN MINIMALLY INVASIVE SURGERIES IS BOOSTING DEMAND FOR HIGH BRIGHTNESS AND LOW LATENCY DISPLAYS

3.1.4. EXPANSION OF TELEMEDICINE AND REMOTE DIAGNOSTICS IS SUPPORTING WIDER DEPLOYMENT OF MEDICAL DISPLAYS

3.2. KEY RESTRAINTS

3.2.1. HIGH INITIAL COST OF MEDICAL GRADE DISPLAY MONITORS LIMITS ADOPTION IN SMALLER HEALTHCARE FACILITIES

3.2.2. STRINGENT REGULATORY AND COMPLIANCE REQUIREMENTS INCREASE PRODUCT DEVELOPMENT TIME

3.2.3. LONG REPLACEMENT CYCLES IN HOSPITALS SLOW OVERALL MARKET TURNOVER

3.2.4. AVAILABILITY OF LOWER-COST CONSUMER DISPLAYS CREATES PRICE PRESSURE IN NON-CRITICAL APPLICATIONS

4. KEY ANALYTICS

4.1. KEY MARKET TRENDS

4.1.1. SHIFT TOWARD MULTI-MODALITY AND LARGE FORMAT DISPLAYS IN OPERATING ROOMS IS INCREASING

4.1.2. INTEGRATION OF AI ASSISTED IMAGE ENHANCEMENT FEATURES IS GAINING TRACTION

4.1.3. DEMAND FOR ANTI MICROBIAL AND EASY TO CLEAN DISPLAY SURFACES IS RISING

4.1.4. GROWING PREFERENCE FOR ENERGY-EFFICIENT AND LIGHTWEIGHT DISPLAY DESIGNS IS EMERGING

4.2. PORTER’S FIVE FORCES ANALYSIS

4.2.1. BUYERS POWER

4.2.2. SUPPLIERS POWER

4.2.3. SUBSTITUTION

4.2.4. NEW ENTRANTS

4.2.5. INDUSTRY RIVALRY

4.3. GROWTH PROSPECT MAPPING

4.3.1. GROWTH PROSPECT MAPPING FOR NORTH AMERICA

4.3.2. GROWTH PROSPECT MAPPING FOR EUROPE

4.3.3. GROWTH PROSPECT MAPPING FOR ASIA-PACIFIC

4.3.4. GROWTH PROSPECT MAPPING FOR REST OF WORLD

4.4. MARKET MATURITY ANALYSIS

4.5. MARKET CONCENTRATION ANALYSIS

4.6. VALUE CHAIN ANALYSIS

4.6.1. RAW MATERIAL SOURCING

4.6.2. DISPLAY PANEL MANUFACTURING

4.6.3. ELECTRONICS INTEGRATION

4.6.4. SOFTWARE CALIBRATION

4.6.5. REGULATORY CERTIFICATION

4.6.6. SYSTEM ASSEMBLY

4.6.7. DISTRIBUTION NETWORKS

4.6.8. END USER DEPLOYMENT

4.7. KEY BUYING CRITERIA

4.7.1. IMAGE ACCURACY

4.7.2. REGULATORY COMPLIANCE

4.7.3. DISPLAY RESOLUTION

4.7.4. PRODUCT RELIABILITY

4.8. REGULATORY FRAMEWORK

5. MEDICAL DISPLAY MONITORS MARKET BY DISPLAY COLOUR

5.1. GREYSCALE

5.1.1. MARKET FORECAST FIGURE

5.1.2. SEGMENT ANALYSIS

5.2. COLOR

5.2.1. MARKET FORECAST FIGURE

5.2.2. SEGMENT ANALYSIS

6. MEDICAL DISPLAY MONITORS MARKET BY RESOLUTION

6.1. 2.1-4MP

6.1.1. MARKET FORECAST FIGURE

6.1.2. SEGMENT ANALYSIS

6.2. 4.1-8MP

6.2.1. MARKET FORECAST FIGURE

6.2.2. SEGMENT ANALYSIS

6.3. ABOVE 8MP

6.3.1. MARKET FORECAST FIGURE

6.3.2. SEGMENT ANALYSIS

6.4. UP TO 2MP

6.4.1. MARKET FORECAST FIGURE

6.4.2. SEGMENT ANALYSIS

7. MEDICAL DISPLAY MONITORS MARKET BY TECHNOLOGY

7.1. CCFL-BACKLIT LCD DISPLAYS

7.1.1. MARKET FORECAST FIGURE

7.1.2. SEGMENT ANALYSIS

7.2. LED-BACKLIT LCD DISPLAYS

7.2.1. MARKET FORECAST FIGURE

7.2.2. SEGMENT ANALYSIS

7.3. OLED DISPLAYS

7.3.1. MARKET FORECAST FIGURE

7.3.2. SEGMENT ANALYSIS

8. MEDICAL DISPLAY MONITORS MARKET BY PANEL SIZE

8.1. 23.0-26.9 INCHES

8.1.1. MARKET FORECAST FIGURE

8.1.2. SEGMENT ANALYSIS

8.2. 27.0-41.9 INCHES

8.2.1. MARKET FORECAST FIGURE

8.2.2. SEGMENT ANALYSIS

8.3. 42 INCHES AND ABOVE

8.3.1. MARKET FORECAST FIGURE

8.3.2. SEGMENT ANALYSIS

8.4. UNDER 22.9 INCHES

8.4.1. MARKET FORECAST FIGURE

8.4.2. SEGMENT ANALYSIS

9. MEDICAL DISPLAY MONITORS MARKET BY APPLICATION

9.1. CLINICAL

9.1.1. MARKET FORECAST FIGURE

9.1.2. SEGMENT ANALYSIS

9.2. DENTAL

9.2.1. MARKET FORECAST FIGURE

9.2.2. SEGMENT ANALYSIS

9.3. DIAGNOSTIC

9.3.1. MARKET FORECAST FIGURE

9.3.2. SEGMENT ANALYSIS

9.4. EDUCATION & TRAINING

9.4.1. MARKET FORECAST FIGURE

9.4.2. SEGMENT ANALYSIS

9.5. SURGICAL

9.5.1. MARKET FORECAST FIGURE

9.5.2. SEGMENT ANALYSIS

9.6. TELEMEDICINE

9.6.1. MARKET FORECAST FIGURE

9.6.2. SEGMENT ANALYSIS

10. GEOGRAPHICAL ANALYSIS

10.1. NORTH AMERICA

10.1.1. MARKET SIZE & ESTIMATES

10.1.2. NORTH AMERICA MARKET DRIVERS

10.1.3. NORTH AMERICA MARKET CHALLENGES

10.1.4. KEY PLAYERS IN NORTH AMERICA MEDICAL DISPLAY MONITORS MARKET

10.1.5. COUNTRY ANALYSIS

10.1.5.1. UNITED STATES

10.1.5.1.1. UNITED STATES MARKET SIZE & OPPORTUNITIES

10.1.5.2. CANADA

10.1.5.2.1. CANADA MARKET SIZE & OPPORTUNITIES

10.2. EUROPE

10.2.1. MARKET SIZE & ESTIMATES

10.2.2. EUROPE MARKET DRIVERS

10.2.3. EUROPE MEDICAL DISPLAY MONITORS MARKET CHALLENGES

10.2.4. KEY PLAYERS IN EUROPE MEDICAL DISPLAY MONITORS MARKET

10.2.5. COUNTRY ANALYSIS

10.2.5.1. GERMANY

10.2.5.1.1. GERMANY MARKET SIZE & OPPORTUNITIES

10.2.5.2. UNITED KINGDOM

10.2.5.2.1. UNITED KINGDOM MARKET SIZE & OPPORTUNITIES

10.2.5.3. FRANCE

10.2.5.3.1. FRANCE MARKET SIZE & OPPORTUNITIES

10.2.5.4. ITALY

10.2.5.4.1. ITALY MARKET SIZE & OPPORTUNITIES

10.2.5.5. SPAIN

10.2.5.5.1. SPAIN MARKET SIZE & OPPORTUNITIES

10.2.5.6. BELGIUM

10.2.5.6.1. BELGIUM MARKET SIZE & OPPORTUNITIES

10.2.5.7. POLAND

10.2.5.7.1. POLAND MARKET SIZE & OPPORTUNITIES

10.2.5.8. REST OF EUROPE

10.2.5.8.1. REST OF EUROPE MARKET SIZE & OPPORTUNITIES

10.3. ASIA-PACIFIC

10.3.1. MARKET SIZE & ESTIMATES

10.3.2. ASIA-PACIFIC MARKET DRIVERS

10.3.3. ASIA-PACIFIC MARKET CHALLENGES

10.3.4. KEY PLAYERS IN ASIA-PACIFIC MEDICAL DISPLAY MONITORS MARKET

10.3.5. COUNTRY ANALYSIS

10.3.5.1. CHINA

10.3.5.1.1. CHINA MARKET SIZE & OPPORTUNITIES

10.3.5.2. INDIA

10.3.5.2.1. INDIA MARKET SIZE & OPPORTUNITIES

10.3.5.3. JAPAN

10.3.5.3.1. JAPAN MARKET SIZE & OPPORTUNITIES

10.3.5.4. AUSTRALIA & NEW ZEALAND

10.3.5.4.1. AUSTRALIA & NEW ZEALAND MARKET SIZE & OPPORTUNITIES

10.3.5.5. SOUTH KOREA

10.3.5.5.1. SOUTH KOREA MARKET SIZE & OPPORTUNITIES

10.3.5.6. THAILAND

10.3.5.6.1. THAILAND MARKET SIZE & OPPORTUNITIES

10.3.5.7. INDONESIA

10.3.5.7.1. INDONESIA MARKET SIZE & OPPORTUNITIES

10.3.5.8. VIETNAM

10.3.5.8.1. VIETNAM MARKET SIZE & OPPORTUNITIES

10.3.5.9. REST OF ASIA-PACIFIC

10.3.5.9.1. REST OF ASIA-PACIFIC MARKET SIZE & OPPORTUNITIES

10.4. REST OF WORLD

10.4.1. MARKET SIZE & ESTIMATES

10.4.2. REST OF WORLD MARKET DRIVERS

10.4.3. REST OF WORLD MARKET CHALLENGES

10.4.4. KEY PLAYERS IN REST OF WORLD MEDICAL DISPLAY MONITORS MARKET

10.4.5. REGIONAL ANALYSIS

10.4.5.1. LATIN AMERICA

10.4.5.1.1. LATIN AMERICA MARKET SIZE & OPPORTUNITIES

10.4.5.2. MIDDLE EAST & AFRICA

10.4.5.2.1. MIDDLE EAST & AFRICA MARKET SIZE & OPPORTUNITIES

11. COMPETITIVE LANDSCAPE

11.1. KEY STRATEGIC DEVELOPMENTS

11.1.1. MERGERS & ACQUISITIONS

11.1.2. PRODUCT LAUNCHES & DEVELOPMENTS

11.1.3. PARTNERSHIPS & AGREEMENTS

11.1.4. BUSINESS EXPANSIONS & DIVESTITURES

11.2. COMPANY PROFILES

11.2.1. ADVANTECH CO LTD

11.2.1.1. COMPANY OVERVIEW

11.2.1.2. PRODUCTS

11.2.1.3. STRENGTHS & CHALLENGES

11.2.2. BARCO

11.2.2.1. COMPANY OVERVIEW

11.2.2.2. PRODUCTS

11.2.2.3. STRENGTHS & CHALLENGES

11.2.3. CANVYS

11.2.3.1. COMPANY OVERVIEW

11.2.3.2. PRODUCTS

11.2.3.3. STRENGTHS & CHALLENGES

11.2.4. DOUBLE BLACK IMAGING

11.2.4.1. COMPANY OVERVIEW

11.2.4.2. PRODUCTS

11.2.4.3. STRENGTHS & CHALLENGES

11.2.5. EIZO CORPORATION

11.2.5.1. COMPANY OVERVIEW

11.2.5.2. PRODUCTS

11.2.5.3. STRENGTHS & CHALLENGES

11.2.6. HP DEVELOPMENT COMPANY LP

11.2.6.1. COMPANY OVERVIEW

11.2.6.2. PRODUCTS

11.2.6.3. STRENGTHS & CHALLENGES

11.2.7. NDS SURGICAL IMAGING

11.2.7.1. COMPANY OVERVIEW

11.2.7.2. PRODUCTS

11.2.7.3. STRENGTHS & CHALLENGES

11.2.8. QUEST INTERNATIONAL

11.2.8.1. COMPANY OVERVIEW

11.2.8.2. PRODUCTS

11.2.8.3. STRENGTHS & CHALLENGES

11.2.9. STERIS

11.2.9.1. COMPANY OVERVIEW

11.2.9.2. PRODUCTS

11.2.9.3. STRENGTHS & CHALLENGES

11.2.10. STRYKER

11.2.10.1. COMPANY OVERVIEW

11.2.10.2. PRODUCTS

11.2.10.3. STRENGTHS & CHALLENGES

11.2.11. UTI TECHNOLOGY INC

11.2.11.1. COMPANY OVERVIEW

11.2.11.2. PRODUCTS

11.2.11.3. STRENGTHS & CHALLENGES

11.2.12. LG ELECTRONICS

11.2.12.1. COMPANY OVERVIEW

11.2.12.2. PRODUCTS

11.2.12.3. STRENGTHS & CHALLENGES

11.2.13. SONY ELECTRONICS INC

11.2.13.1. COMPANY OVERVIEW

11.2.13.2. PRODUCTS

11.2.13.3. STRENGTHS & CHALLENGES

11.2.14. KONINKLIJKE PHILIPS NV

11.2.14.1. COMPANY OVERVIEW

11.2.14.2. PRODUCTS

11.2.14.3. STRENGTHS & CHALLENGES

11.2.15. NEC DISPLAY SOLUTIONS (SHARP NEC DISPLAY SOLUTIONS)

11.2.15.1. COMPANY OVERVIEW

11.2.15.2. PRODUCTS

11.2.15.3. STRENGTHS & CHALLENGES

LIST OF TABLES

TABLE 1: MARKET SNAPSHOT – MEDICAL DISPLAY MONITORS

TABLE 2: MARKET BY DISPLAY COLOUR, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 3: MARKET BY DISPLAY COLOUR, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 4: GREYSCALE MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 5: GREYSCALE MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 6: COLOR MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 7: COLOR MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 8: MARKET BY RESOLUTION, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 9: MARKET BY RESOLUTION, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 10: UP TO 2MP MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 11: UP TO 2MP MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 12: 2.1-4MP MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 13: 2.1-4MP MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 14: 4.1-8MP MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 15: 4.1-8MP MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 16: ABOVE 8MP MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 17: ABOVE 8MP MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 18: MARKET BY TECHNOLOGY, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 19: MARKET BY TECHNOLOGY, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 20: CCFL-BACKLIT LCD DISPLAYS MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 21: CCFL-BACKLIT LCD DISPLAYS MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 22: LED-BACKLIT LCD DISPLAYS MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 23: LED-BACKLIT LCD DISPLAYS MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 24: OLED DISPLAYS MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 25: OLED DISPLAYS MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 26: MARKET BY PANEL SIZE, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 27: MARKET BY PANEL SIZE, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 28: UNDER 22.9 INCHES MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 29: UNDER 22.9 INCHES MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 30: 23.0-26.9 INCHES MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 31: 23.0-26.9 INCHES MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 32: 27.0-41.9 INCHES MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 33: 27.0-41.9 INCHES MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 34: 42 INCHES AND ABOVE MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 35: 42 INCHES AND ABOVE MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 36: MARKET BY APPLICATION, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 37: MARKET BY APPLICATION, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 38: CLINICAL MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 39: CLINICAL MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 40: DENTAL MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 41: DENTAL MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 42: DIAGNOSTIC MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 43: DIAGNOSTIC MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 44: EDUCATION & TRAINING MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 45: EDUCATION & TRAINING MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 46: SURGICAL MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 47: SURGICAL MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 48: TELEMEDICINE MARKET, BY REGION, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 49: TELEMEDICINE MARKET, BY REGION, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 50: MARKET BY GEOGRAPHICAL ANALYSIS, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 51: MARKET BY GEOGRAPHICAL ANALYSIS, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 52: NORTH AMERICA MARKET, COUNTRY ANALYSIS, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 53: NORTH AMERICA MARKET, COUNTRY ANALYSIS, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 54: KEY PLAYERS OPERATING IN THE NORTH AMERICAN MARKET

TABLE 55: EUROPE MARKET, COUNTRY ANALYSIS, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 56: EUROPE MARKET, COUNTRY ANALYSIS, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 57: KEY PLAYERS OPERATING IN THE EUROPEAN MARKET

TABLE 58: ASIA-PACIFIC MARKET, COUNTRY ANALYSIS, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 59: ASIA-PACIFIC MARKET, COUNTRY ANALYSIS, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 60: KEY PLAYERS OPERATING IN THE ASIA-PACIFIC MARKET

TABLE 61: REST OF WORLD MARKET, REGIONAL ANALYSIS, HISTORICAL YEARS, 2022-2024 (IN $ MILLION)

TABLE 62: REST OF WORLD MARKET, REGIONAL ANALYSIS, FORECAST YEARS, 2026-2034 (IN $ MILLION)

TABLE 63: KEY PLAYERS OPERATING IN THE REST OF WORLD MARKET

TABLE 64: LIST OF MERGERS & ACQUISITIONS

TABLE 65: LIST OF PRODUCT LAUNCHES & DEVELOPMENTS

TABLE 66: LIST OF PARTNERSHIPS & AGREEMENTS

TABLE 67: LIST OF BUSINESS EXPANSIONS & DIVESTITURES

LIST OF FIGURES

FIGURE 1: KEY MARKET TRENDS

FIGURE 2: PORTER’S FIVE FORCES ANALYSIS

FIGURE 3: GROWTH PROSPECT MAPPING FOR NORTH AMERICA

FIGURE 4: GROWTH PROSPECT MAPPING FOR EUROPE

FIGURE 5: GROWTH PROSPECT MAPPING FOR ASIA-PACIFIC

FIGURE 6: GROWTH PROSPECT MAPPING FOR REST OF WORLD

FIGURE 7: MARKET MATURITY ANALYSIS

FIGURE 8: MARKET CONCENTRATION ANALYSIS

FIGURE 9: VALUE CHAIN ANALYSIS

FIGURE 10: KEY BUYING CRITERIA

FIGURE 11: SEGMENT GROWTH POTENTIAL, BY DISPLAY COLOUR, IN 2025

FIGURE 12: GREYSCALE MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 13: COLOR MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 14: SEGMENT GROWTH POTENTIAL, BY RESOLUTION, IN 2025

FIGURE 15: UP TO 2MP MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 16: 2.1-4MP MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 17: 4.1-8MP MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 18: ABOVE 8MP MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 19: SEGMENT GROWTH POTENTIAL, BY TECHNOLOGY, IN 2025

FIGURE 20: CCFL-BACKLIT LCD DISPLAYS MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 21: LED-BACKLIT LCD DISPLAYS MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 22: OLED DISPLAYS MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 23: SEGMENT GROWTH POTENTIAL, BY PANEL SIZE, IN 2025

FIGURE 24: UNDER 22.9 INCHES MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 25: 23.0-26.9 INCHES MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 26: 27.0-41.9 INCHES MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 27: 42 INCHES AND ABOVE MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 28: SEGMENT GROWTH POTENTIAL, BY APPLICATION, IN 2025

FIGURE 29: CLINICAL MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 30: DENTAL MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 31: DIAGNOSTIC MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 32: EDUCATION & TRAINING MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 33: SURGICAL MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 34: TELEMEDICINE MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 35: NORTH AMERICA MEDICAL DISPLAY MONITORS MARKET, COUNTRY OUTLOOK, 2025 & 2034 (IN %)

FIGURE 36: UNITED STATES MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 37: CANADA MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 38: EUROPE MEDICAL DISPLAY MONITORS MARKET, COUNTRY OUTLOOK, 2025 & 2034 (IN %)

FIGURE 39: GERMANY MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 40: UNITED KINGDOM MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 41: FRANCE MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 42: ITALY MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 43: SPAIN MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 44: BELGIUM MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 45: POLAND MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 46: REST OF EUROPE MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 47: ASIA-PACIFIC MEDICAL DISPLAY MONITORS MARKET, COUNTRY OUTLOOK, 2025 & 2034 (IN %)

FIGURE 48: CHINA MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 49: INDIA MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 50: JAPAN MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 51: AUSTRALIA & NEW ZEALAND MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 52: SOUTH KOREA MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 53: THAILAND MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 54: INDONESIA MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 55: VIETNAM MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 56: REST OF ASIA-PACIFIC MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 57: REST OF WORLD MEDICAL DISPLAY MONITORS MARKET, REGIONAL OUTLOOK, 2025 & 2034 (IN %)

FIGURE 58: LATIN AMERICA MARKET SIZE, 2026-2034 (IN $ MILLION)

FIGURE 59: MIDDLE EAST & AFRICA MARKET SIZE, 2026-2034 (IN $ MILLION)