| 出版社 | Grand View Research |

| 出版年月 | 2025年8月 |

Electric Last Mile Delivery Vehicle Market Size, Share & Trends Analysis Report

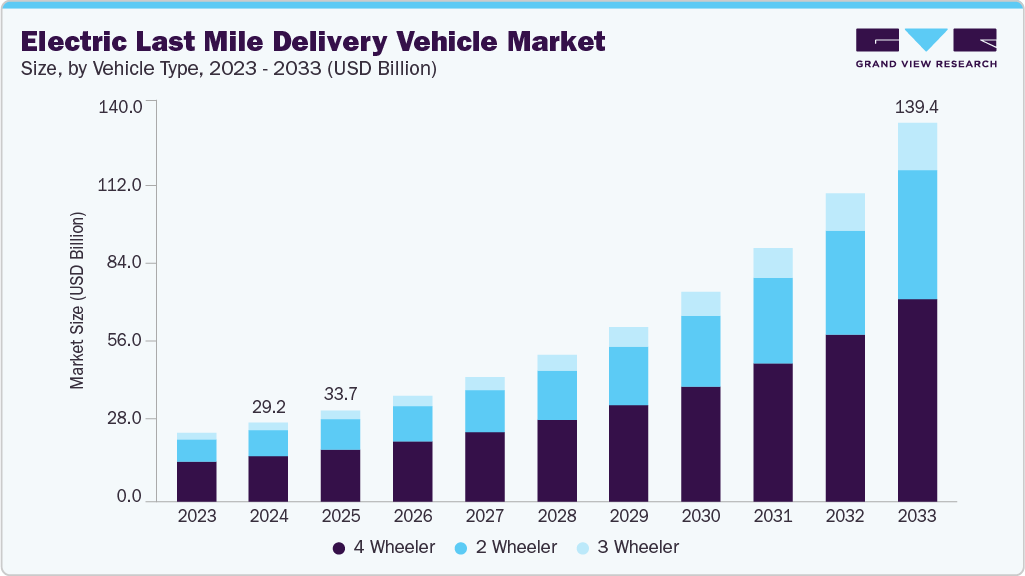

世界の電動ラストマイル配送車両市場規模は、2024年に291.7億米ドルと評価され、2025年から2033年にかけて年平均成長率19.4%で成長し、2033年には1,394.1億米ドルに達すると予測されています。eコマースの需要の高まりと都市の厳しい排出ガス規制により、電動ラストマイル配送車両の導入が加速しています。

特にパンデミック後のeコマースの爆発的な成長により、効率的でタイムリー、かつ費用対効果の高いラストマイル配送ソリューションへの需要が高まっています。都市部や郊外でオンラインショッピングが当たり前になるにつれ、小売業者や物流業者は増加する配送量への対応にプレッシャーを感じています。電動ラストマイル配送車両は、運用コストの削減、混雑した都市部での機動性の向上、スマート物流ネットワークとの互換性向上といった魅力的なソリューションを提供します。このため、大手eコマース企業や3PL事業者は、配送車両の電動化に投資を迫られています。厳格な政府規制と低排出ゾーン(LEZ)の義務化は、ラストマイル配送における電気自動車の導入を促進する上で重要な役割を果たしています。欧州、北米、そして一部のアジア諸国では、都心部から内燃機関(ICE)車両を段階的に廃止する政策が施行されており、これによりラストマイル配送における電気自動車にとって好ましい環境が整えられています。補助金、免税措置、そして車両廃車インセンティブは、電気自動車への移行を進めるフリートオペレーターの総所有コスト(TCO)を削減することで、この移行をさらに加速させています。

近年のバッテリー技術の進歩、特にエネルギー密度、充電速度、そしてライフサイクルの面での進歩により、電気自動車は日常的な商用利用においてより現実的なものとなっています。ラストマイル配送に使用される電気バン、ミニトラック、カーゴバイクは、より長いルートを走行し、より重い積載量に対応し、より速く充電できるため、1日に複数回の配送サイクルにも適しています。さらに、リチウムイオン電池の価格低下により、電気配送車両の初期購入価格が下がり、中小規模の物流企業にとってより利用しやすくなっています。

Electric Last Mile Delivery Vehicle Market Summary

The global electric last mile delivery vehicle market size was valued at USD 29.17 billion in 2024 and is projected to reach USD 139.41 billion by 2033, growing at a CAGR of 19.4% from 2025 to 2033. Rising e-commerce demand and stringent urban emission regulations are accelerating the adoption of electric last mile delivery vehicles.

electric-last-mile-delivery-vehicle-market-size

The explosive growth of e-commerce, especially post-pandemic, has intensified the demand for efficient, timely, and cost-effective last-mile delivery solutions. As online shopping becomes the norm across urban and suburban areas, retailers and logistics providers are under pressure to fulfill growing delivery volumes. Electric last mile delivery vehicles offer a compelling solution with lower operating costs, easier maneuverability in congested urban settings, and increasing compatibility with smart logistics networks. This has pushed major e-commerce companies and 3PL providers to invest in electrifying their delivery fleets.

Stringent government regulations and low-emission zone (LEZ) mandates are playing a critical role in driving the adoption of electric vehicles for last mile delivery. Cities across Europe, North America, and parts of Asia are enacting policies to phase out internal combustion engine (ICE) vehicles from central urban areas, thereby creating a favorable environment for electric last mile delivery vehicles. Subsidies, tax exemptions, and vehicle scrappage incentives are further accelerating this shift by lowering the total cost of ownership for fleet operators transitioning to electric.

Recent improvements in battery technology, especially in terms of energy density, charging speed, and lifecycle, have made electric vehicles more viable for daily commercial use. Electric vans, mini trucks, and cargo bikes used for last-mile deliveries can now cover longer routes, carry heavier payloads, and recharge faster, making them suitable for multiple delivery cycles in a single day. Additionally, the declining cost of lithium-ion batteries is helping reduce the upfront purchase price of electric delivery vehicles, making them more accessible to small and mid-sized logistics firms.

Many large corporations and logistics providers are aligning their operations with environmental, social, and governance (ESG) goals, pushing for carbon neutrality in their supply chains. This has resulted in aggressive fleet electrification commitments from companies such as Amazon, FedEx, DHL, and UPS. These companies view electric last mile delivery vehicles as a key component of their broader sustainability strategy. Fleet-level deployments not only reduce emissions but also enhance brand image and customer loyalty, further motivating adoption.

Electric Last Mile Delivery Vehicle Market Report Scope

| Report Attribute | Details |

| Market size value in 2025 | USD 33.69 billion |

| Revenue forecast in 2033 | USD 139.41 billion |

| Growth rate | CAGR of 19.4% from 2025 to 2033 |

| Base year for estimation | 2024 |

| Historical data | 2021 – 2023 |

| Forecast period | 2025 – 2033 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2025 to 2033 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Vehicle type, payload capacity, application, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa |

| Key companies profiled | Last Mile Mobility (Mahindra Group); GM Envolve; Ford Motor Company; GreenPower Motor Company; Workhorse; Star EV Corporation, USA; Rivian; Chevrolet; Gogoro Inc.; Honda; Tata Motors |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |