| 出版社 | Fortune Business Insights |

| 出版年月 | 2025年11月 |

Grain Oriented Electrical Steel Market Size, Share, Growth and Global Industry Analysis

方向性電磁鋼板市場の規模、シェア、成長、タイプと用途別の世界業界分析、製品タイプ(従来型、高磁力鋼板、磁区微細化)、厚さ別(0.2 mm以下、0.23 mm、0.27 mm、0.30 mm、0.35 mm以上)、用途別(変圧器、発電機、電動機、その他)、および地域別予測、2024-2032年までの予測

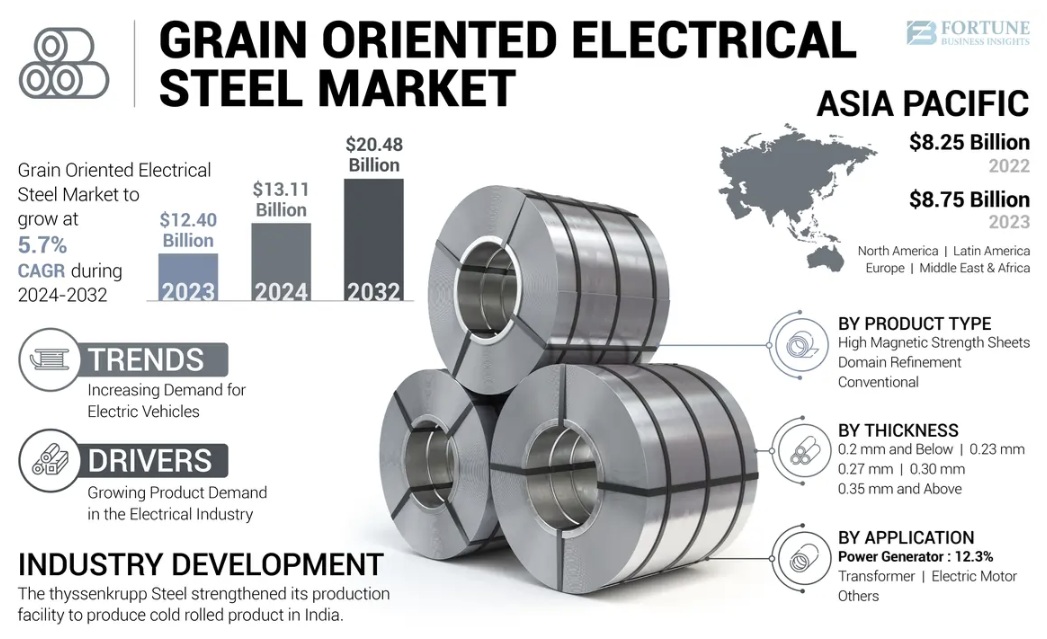

世界の方向性電磁鋼板市場規模は、2023年に114.4億米ドルと評価され、送電・配電網全体におけるエネルギー効率の高いソリューションへの需要の高まりを反映し、2024年の119.7億米ドルから2032年には173.6億米ドルに成長すると予測されています。この方向性電磁鋼板セグメントは、世界のエネルギーエコシステムにおいて極めて重要な役割を果たしており、主に交流(AC)で動作する変圧器や大型電気機械に使用されています。

Growth Factors of Grain Oriented Electrical Steel Market

The global grain oriented electrical steel market size was valued at USD 11.44 billion in 2023 and is projected to grow from USD 11.97 billion in 2024 to USD 17.36 billion by 2032, reflecting the growing demand for energy-efficient solutions across power transmission and distribution networks. This segment of electrical steel plays a pivotal role in the global energy ecosystem, primarily used in transformers and large electrical machines that operate on alternating current (AC).

Grain Oriented Electrical Steel Market Size, Share, Growth and Global Industry Analysis

What is Grain Oriented Electrical Steel?

Grain oriented electrical steel (GOES) is a special type of steel with a unique grain structure, developed specifically for use in energy-efficient electrical applications. The steel undergoes a special rolling and annealing process to align its grain structure in a single direction, significantly enhancing magnetic properties and reducing core loss in transformers. It is essential in manufacturing distribution transformers, power transformers, and high-efficiency electric motors, which are critical for transmitting electricity with minimal energy loss.

Driving Forces Behind Market Growth

The grain oriented electrical steel market is seeing a strong upswing due to the accelerated demand for electricity and the corresponding infrastructure development. In 2023 alone, global electricity consumption rose by over 2.2%, driven by rapid urbanization, industrialization, and electrification in developing nations. Additionally, governments across the globe are heavily investing in grid modernization projects. For instance, the U.S. Department of Energy allocated USD 13 billion in 2023 towards modernizing the electric grid, directly stimulating demand for transformer cores made from GOES.

Another critical driver is the shift towards renewable energy. As solar and wind installations grow, efficient transformer technology becomes imperative. GOES helps minimize losses in these systems, thus improving overall grid efficiency. The push for zero-carbon goals and sustainable energy solutions is also resulting in increased adoption of high-performance materials like grain oriented electrical steel.

Segmentation Insights

By type, the market is segmented into conventional grain-oriented steel (CGO) and high permeability grain-oriented steel (HGO). HGO holds a larger share due to its superior magnetic properties and is increasingly preferred for large-scale transformers.

By application, the market is dominated by the transformers segment, which accounted for over 65% of the market share in 2023. The rising deployment of smart grids and replacement of aging power infrastructure globally are expanding transformer demand, thereby fueling growth in GOES.

Regional Market Performance

In 2023, Asia Pacific emerged as the leading region, capturing over 42% of the global market share. China, India, and Japan are the key contributors due to their large-scale power generation and distribution networks. China alone accounts for over 60% of Asia’s transformer production, with growing investments in ultra-high voltage (UHV) transmission projects further propelling demand.

Europe follows as the second-largest market, accounting for approximately 26% of the share. The region’s strict energy efficiency regulations, especially in Germany and France, have led to increased adoption of GOES in grid and industrial applications.

North America held a market share of around 18%, supported by the modernization of grid infrastructure and the growing focus on renewable energy integration, particularly in the United States and Canada.

Competitive Landscape

The market is moderately consolidated, with major players focusing on capacity expansion, technological innovation, and strategic mergers to strengthen their position. Key companies include:

- Nippon Steel Corporation

- POSCO

- Baoshan Iron & Steel Co., Ltd. (Baosteel)

- JFE Steel Corporation

- ThyssenKrupp Electrical Steel

- AK Steel (Cleveland-Cliffs Inc.)

In September 2023, Nippon Steel announced a USD 400 million investment to boost its GOES production in response to rising global demand. Similarly, Baosteel expanded its capacity in China, targeting export opportunities across Southeast Asia and the Middle East.