Smart Metering in Latin America and the Caribbean - 3rd Edition

| 出版 | Berg Insight |

| 出版年月 | 2026年01月 |

| ページ数 | 200 |

| 図表数 | 42 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | EUR 1,800 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-12030 |

Berg Insight(ベルグインサイト)「ラテンアメリカとカリブ海地域のスマート計測 第3版 – Smart Metering in Latin America -3rd Edition」はラテンアメリカとカリブ海地域における電気とガスのスマートメーター)(スマート計測/自動検針)市場の最新動向を分析・解説しています。

主な掲載内容

- スマート計測ソリューション

- IoTネットワークと通信技術

- スマート計測業界のプレイヤ

- メータベンダ

- 通信ソリューション提供会社

- ソフトウェアソリューション提供会社

- システムインテグレータと通信サービスプロバイダ

- 市場概要

- 地域別サマリー

- アルゼンチン

- バハマ

- バルバドス

- べリーゼ

- ボリビア

- ブラジル

- チリ

- コロンビア

- コスタリカ

- ドミニカ共和国

- エクアドル

- エルサルバドル

- グアテマラ

- ホンデュラス

- ジャマイカ

- メキシコ

- パナマ

- パラグアイ

- ペルー

- プエルトリコ

- トリニダード・トバゴ

- ウルグアイ

- 地域別サマリー

- 市場分析

- 電気使用量計測用スマートメーター

- 市場予測

- アルゼンチン

- バハマ

- バルバドス

- ベリーズ

- ボリビア

- ブラジル

- チリ

- コロンビア

- コスタリカ

- ドミニカ共和国

- エクアドル

- エルサルバドル

- グアテマラ

- ホンジュラス

- ジャマイカ

- メキシコ

- パナマ

- パラグアイ

- ペルー

- プエルトリコ

- トリニダード・トバゴ

- ウルグアイ

- 産業分析と技術動向

- ガス使用量計測用スマートメータ

- ケーススタディ

Report Overview

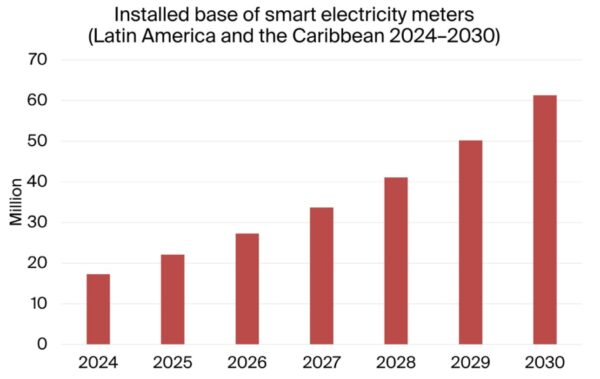

Are you looking for detailed information and comprehensive data about the smart metering market in Latin America and the Caribbean? The study concludes that the installed base of smart electricity meters in Latin America and the Caribbean will grow at a compound annual growth rate (CAGR) of 23.5 percent throughout the forecast period, from 17.3 million in 2024 to 61.3 million in 2030. Get up to date with the latest information about vendors, products and local developments in each country.

Highlights from the report:

- In-depth market profiles of Argentina, Bahamas, Barbados, Belize, Bolivia, Brazil, Chile, Colombia, Costa Rica, the Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Jamaica, Mexico, Panama, Paraguay, Peru, Puerto Rico, Trinidad and Tobago and Uruguay.

- 360-degree overview of next-generation PLC, RF and cellular technologies for smart grid communications.

- Profiles of the key players in the smart metering industry in Latin America and the Caribbean.

- New forecasts for smart electricity metering until 2030.

- Analysis of the latest market and industry developments in each of the countries.

- Case studies of smart metering projects by the leading energy groups.

Smart electricity meter adoption in Latin America and the Caribbean set for strong growth b y 2030

Smart metering is widely regarded as a cornerstone for future smart grids and is currently being deployed all over the developed world, with a growing number of large-scale initiatives now also being launched in developing countries. With more than 223 million electricity customers, Latin America and the Caribbean constitute a large market with significant potential, as well as a significantly lower penetration rate of smart meters in comparison to regions such as East Asia, Europe and North America. The annual demand for electricity meters in Latin America and the Caribbean ranges from 20 to 30 million units, out of which Brazil and Mexico together account for over 65 percent. With the exception of a few countries – mainly in the Caribbean – the region has not yet seen the implementation of many nationwide smart metering projects. However, a number of utilities in the region are scaling up their smart metering initiatives, driven in part by the need to reduce high non-technical electricity losses due to the prevalence of energy theft.

Berg Insight forecasts that the installed base of smart electricity meters in Latin America and the Caribbean – defined as the South American countries Argentina, Bolivia, Brazil, Chile, Colombia, Ecuador, Paraguay, Peru and Uruguay, the Central American countries Belize, Costa Rica, El Salvador, Guatemala, Honduras, Mexico and Panama and the Caribbean countries and territories Bahamas, Barbados, the Dominican Republic, Jamaica, Puerto Rico and Trinidad and Tobago – will grow at a compound annual growth rate of 23.5 percent from 17.3 million in 2024 to 61.3 million in 2030. A total of 48.5 million new smart electricity meters is expected to be installed in the region during the period. Annual shipment volumes are forecasted to grow from 2.8 million units in 2024 to nearly 11.3 million units in 2030. The smart meter penetration rate across Latin America and the Caribbean is meanwhile forecasted to reach 24.8 percent in 2030 – up from 7.7 percent in 2024.

South America is home to 70 percent of all electricity users in Latin America and the Caribbean and accounts for around 60 percent of the installed base of smart electricity meters in the region. South America will also constitute the fastest growing regional smart metering market in Latin America and the Caribbean throughout the forecast period. Brazil in particular is a highly interesting market for smart metering solution vendors with its 94 million electricity users and low penetration rate of smart meters – 6.5 percent in 2024. The market is set to see significant growth over the coming years as the government has recently introduced a number of new laws and policies that actively promote the deployment of smart meters on a large scale, while several utilities have already begun to invest significantly in the technology. Brazil is forecasted to account for more than half of the shipped smart electricity meters in Latin America and the Caribbean during the forecast period.

In Uruguay, the nationwide rollout had largely been completed by the end of 2024 and the country has therefore become the first country in South America to reach near universal smart metering coverage. In neighbouring Argentina, Berg Insight estimates that the installed base of smart meters will increase more than six-fold from around 730,000 units in 2024 to more than 4.6 million in 2030. Smart metering deployments in Chile meanwhile peaked in 2018–2019 and have since decreased, mainly due to regulatory ambiguity. There is however potential for a more positive market development should the regulatory environment in the country improve. Colombia is another country which – despite the existence of a regulatory framework for smart metering – has suffered from a lack of policy uncertainty which has impacted the development of smart metering negatively. The installed base of smart meters in the country is nonetheless expected to increase significantly driven by deployments by the largest utility group Grupo EPM alongside Enel Colombia. Peru is a more nascent market, although a series of positive regulatory developments during the past two years has set the country up for a large-scale rollout that is proposed to start in the late 2020s. In Ecuador, investments in smart metering are similarly expected to increase throughout the forecast period. The only two landlocked countries in South America – Bolivia and Paraguay – are two of the least mature smart metering markets in Latin America and the Caribbean. Berg Insight expects that both markets will continue to be in the smart metering pilot phase throughout the forecast period.

Central America is the most nascent smart metering market in Latin America and the Caribbean, although a few countries are underway with significant smart metering projects. The rollout of smart meters in Costa Rica has now reached a smart meter penetration rate above 50 percent, while Honduras ended 2024 with an installed base of more than 500,000 units. Belize meanwhile initiated a nationwide smart metering rollout in 2024. El Salvador, Guatemala and Panama are all countries with relatively small installed bases of smart meters currently, but Berg Insight expects deployments in these markets to slowly increase in both scope and scale. In Panama, several important policy developments have recently taken place, while El Salvador is also making significant strides in smart metering spearheaded by the country’s two main utilities. In the largest country in Central America – Mexico – the state-owned utility CFE has an ongoing project that seeks to scale the conversion of basic electricity meters to smart meters.

Utilities in the Caribbean were in contrast to their counterparts in South and Central America early to implement smart metering technology. Trinidad and Tobago as well as the US jurisdiction of Puerto Rico are already underway with a second wave of smart metering installations, while Barbados has rolled out smart meters for effectively all customers. Jamaica has similarly achieved a smart meter penetration rate of more than 75 percent. The main utility in the Bahamas is just about to embark on a smart meter rollout, while deployments in the Dominican Republic are expected to steadily increase in line with the country’s national electricity loss reduction plan.

Table of Contents

Executive Summary

1 Smart Metering Solutions

1.1 Introduction to smart grids

1.2 Smart metering

1.2.1 Smart metering applications

1.2.2 Smart metering infrastructure

1.2.3 Benefits of smart metering

1.3 Project strategies

1.3.1 System design and sourcing

1.3.2 Rollout and integration

1.3.3 Implementation and operation

1.3.4 Communication with customers

1.4 Regulatory issues

1.4.1 Models for the introduction of smart meters

1.4.2 Standardisation

1.4.3 Individual rights issues

2 IoT Networks and Communications Technologies

2.1 IoT network technologies

2.1.1 Network architectures

2.1.2 Unlicensed and licensed frequency bands

2.2 PLC technology and standards

2.2.1 International standards organisations

2.2.2 G3-PLC

2.2.3 PRIME

2.2.4 Meters & More

2.3 3GPP cellular and LPWA technologies

2.3.1 2G/3G/4G/5G cellular technologies and IoT

2.3.2 NB-IoT and LTE-M

2.3.3 The role of cellular networks in smart meter communications

2.3.4 LoRa and LoRaWAN

2.3.5 Sigfox

2.4 IEEE 802.15.4-based RF

2.4.1 IEEE 802.15.4

2.4.2 Wi-SUN

2.4.3 Proprietary IPv6 connectivity stacks based on 802.15.4

3 Smart Metering Industry Players

3.1 Meter vendors

3.1.1 Itron

3.1.2 Landis+Gyr

3.1.3 Aclara (Hubbell)

3.1.4 Discar

3.1.5 Elgama Elektronika (Linyang Energy)

3.1.6 Gridspertise

3.1.7 Hexing Electrical

3.1.8 Holley Technology

3.1.9 Honeywell (Elster)

3.1.10 Iskraemeco

3.1.11 KAIFA Technology

3.1.12 Networked Energy Services

3.1.13 Sagemcom

3.1.14 Silexis

3.1.15 Sanxing Electric (Nansen)

3.1.16 Wasion

3.1.17 WEG Group

3.1.18 ZIV

3.2 Communications solution providers

3.2.1 Aviat Networks (4RF)

3.2.2 Corinex

3.2.3 NuriFlex

3.2.4 Tantalus Systems

3.2.5 Trilliant

3.3 Software solution providers

3.3.1 Fluentgrid

3.3.2 Harris Utilities

3.3.3 Indra (Minsait)

3.3.4 EPAM Neoris

3.3.5 SAP

3.3.6 Siemens

3.4 System integrators and communications service providers

3.4.1 Accenture

3.4.2 América Móvil

3.4.3 Ativa Soluções

3.4.4 CAS Tecnologia

3.4.5 Cisco

3.4.6 IBM

3.4.7 NTT

3.4.8 Telefónica

3.4.9 Telecom Italia (TIM)

3.4.10 Trópico

4 Market Profiles

4.1 Regional summary

4.2 Argentina

4.2.1 Electricity and gas utility industry structure

4.2.2 Metering regulatory environment and smart metering market developments

4.3 Bahamas

4.3.1 Electricity utility industry structure

4.3.2 Metering regulatory environment and smart metering market developments

4.4 Barbados

4.4.1 Electricity utility industry structure

4.4.2 Metering regulatory environment and smart metering market developments

4.5 Belize

4.5.1 Electricity utility industry structure

4.5.2 Metering regulatory environment and smart metering market developments

4.6 Bolivia

4.6.1 Electricity utility industry structure

4.6.2 Metering regulatory environment and smart metering market developments

4.7 Brazil

4.7.1 Electricity industry structure

4.7.2 Gas utility industry structure

4.7.3 Metering regulatory environment and smart metering market developments

4.7.4 Smart metering market developments

4.8 Chile

4.8.1 Electricity and gas utility industry structure

4.8.2 Metering regulatory environment and smart metering market developments

4.9 Colombia

4.9.1 Electricity and gas utility industry structure

4.9.2 Metering regulatory environment and smart metering market developments

4.10 Costa Rica

4.10.1 Electricity utility industry structure

4.10.2 Metering regulatory environment and smart metering market developments

4.11 Dominican Republic

4.11.1 Electricity utility industry structure

4.11.2 Metering regulatory environment and smart metering market developments

4.12 Ecuador

4.12.1 Electricity utility industry structure

4.12.2 Metering regulatory environment and smart metering market developments

4.13 El Salvador

4.13.1 Electricity utility industry structure

4.13.2 Metering regulatory environment and smart metering market developments

4.14 Guatemala

4.14.1 Electricity utility industry structure

4.14.2 Metering regulatory environment and smart metering market developments

4.15 Honduras

4.15.1 Electricity and gas utility industry structure

4.15.2 Metering regulatory environment and smart metering market developments

4.16 Jamaica

4.16.1 Electricity utility industry structure

4.16.2 Metering regulatory environment and smart metering market developments

4.17 Mexico

4.17.1 Electricity and gas utility industry structure

4.17.2 Metering regulatory environment and smart metering market developments

4.18 Panama

4.18.1 Electricity utility industry structure

4.18.2 Metering regulatory environment and smart metering market developments

4.19 Paraguay

4.19.1 Electricity utility industry structure

4.19.2 Metering regulatory environment and smart metering market developments

4.20 Peru

4.20.1 Electricity and gas utility industry structure

4.20.2 Metering regulatory environment and smart metering market developments

4.21 Puerto Rico

4.21.1 Electricity utility industry structure

4.21.2 Metering regulatory environment and smart metering market developments

4.22 Trinidad and Tobago

4.22.1 Electricity utility industry structure

4.22.2 Metering regulatory environment and smart metering market developments

4.23 Uruguay

4.23.1 Electricity and gas utility industry structure

4.23.2 Metering regulatory environment and smart metering market developments

5 Market Analysis

5.1 Smart electricity metering

5.2 Market forecasts

5.2.1 Argentina

5.2.2 Bahamas

5.2.3 Barbados

5.2.4 Belize

5.2.5 Bolivia

5.2.6 Brazil

5.2.7 Chile

5.2.8 Colombia

5.2.9 Costa Rica

5.2.10 Dominican Republic

5.2.11 Ecuador

5.2.12 El Salvador

5.2.13 Guatemala

5.2.14 Honduras

5.2.15 Jamaica

5.2.16 Mexico

5.2.17 Panama

5.2.18 Paraguay

5.2.19 Peru

5.2.20 Puerto Rico

5.2.21 Trinidad and Tobago

5.2.22 Uruguay

5.3 Industry analysis and technology trends

5.3.1 Technology vendors

5.3.2 Technology trends

5.4 Smart gas metering

6 Case Studies

6.1 Cemig

6.2 COPEL

6.3 Grupo ICE

6.4 Light

6.5 UTE

Glossary

List of Figures

Figure 1.1: Smart metering infrastructure ………….. 10

Figure 1.2: Examples of smart electricity meters ………… 11

Figure 2.1: Standard model for smart grid communications networks …….. 22

Figure 2.2: Alternative model for smart grid communications networks …… 23

Figure 2.3: Unlicensed and reserved radio frequencies available for wireless IoT ….. 24

Figure 2.4: Selected members of the G3-PLC Alliance by industry ………. 29

Figure 2.5: Selected members of the PRIME Alliance by industry ……… 30

Figure 2.6: Selected members of the Meters & More Association by industry ….. 32

Figure 2.7: Comparison of LTE-M and NB-IoT specifications ………. 34

Figure 2.8: Public LoRaWAN network operators in Latin America (Q2-2025) ……. 36

Figure 2.9: Sigfox network partners in Latin America (Q2-2025) ……… 38

Figure 2.10: Selected members of the Wi-SUN Alliance by industry …….. 40

Figure 2.11: Major 802.15.4 networking platforms for smart metering (Q1-2025) …… 41

Figure 3.1: Major energy meter vendor company data (FY2024/2025)…….. 44

Figure 4.1: Top 30 electricity DSOs in Latin America (2024) ………… 81

Figure 4.2: Top 15 natural gas distributors in Latin America (2024) ………. 83

Figure 4.3: Top 20 electricity DSOs in Argentina (2024) ………… 86

Figure 4.4: List of natural gas distributors in Argentina (2024) ……… 88

Figure 4.5: Electricity DSOs in the Bahamas …………… 93

Figure 4.6: Largest electricity DSOs in Bolivia (2024) ……….. 98

Figure 4.7: Electricity DSOs in Brazil by size (2024) ……….. 100

Figure 4.8: The largest electricity DSOs in Brazil (2024) ………. 101

Figure 4.9: The number of residential gas users in Brazil (2012–2024) …….. 103

Figure 4.10: Top 10 natural gas distributors in Brazil (2024) ………. 104

Figure 4.11: The largest electricity DSOs in Chile (2024) ………… 113

Figure 4.12: The largest natural gas distributors in Chile (2024) ………. 114

Figure 4.13: Top 20 electricity DSOs in Colombia (2024) ……….. 118

Figure 4.14: Top 3 natural gas distributors in Colombia (2024) …….. 119

Figure 4.15: Electricity DSOs in Costa Rica (2024) ………… 124

Figure 4.16: Electricity DSOs in the Dominican Republic (2024) ……… 128

Figure 4.17: Top 10 largest electricity DSOs in Ecuador (2024) ………. 132

Figure 4.18: Top electricity DSOs in El Salvador (2024) ……….. 136

Figure 4.19: Largest electricity DSOs in Guatemala (2024) ………… 139

Figure 4.20: The number of electricity users by state in Mexico (2024) …….. 147

Figure 4.21: Top natural gas distributors in Mexico (2024) ………… 148

Figure 4.22: Panamanian electricity DSOs (2024) ………….. 152

Figure 4.23: Smart metering targets in SNE’s digitalisation roadmap…….. 153

Figure 4.24: Top 10 electricity DSOs in Peru (2024)……….. 158

Figure 4.25: Natural gas distributors in Peru (2024) ……….. 159

Figure 5.1: Smart electricity meter shipments (LAC 2024–2030) ……… 172

Figure 5.2: Smart electricity meter installed base (LAC 2024–2030) ……. 174

Figure 6.1: ICE’s smart metering coverage …………… 197