| 出版社 | IMARC Group |

| 出版年月 | 2025年10月 |

RegTech Market Size, Share, Trends, and Forecast

RegTech市場規模、シェア、トレンド、および予測 : コンポーネント、展開モード、企業規模、用途、エンドユーザー、地域別、2025-2033年

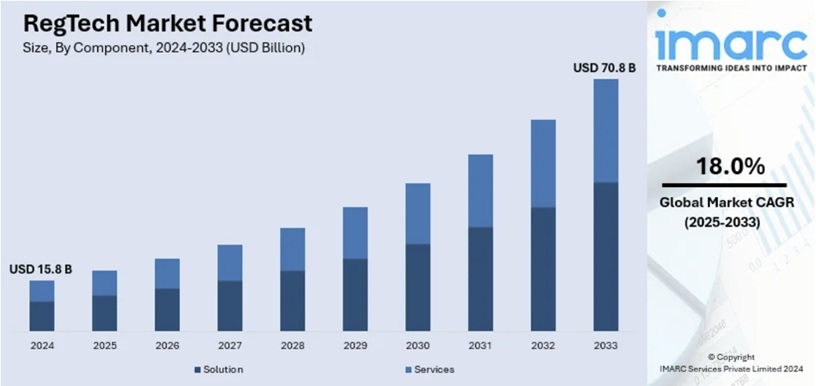

世界のRegTech(レグテック)市場規模は、2024年には158億米ドルと評価されました。IMARCグループは、今後、市場規模は2033年までに708億米ドルに達し、2025年から2033年にかけて年平均成長率(CAGR)18.0%で成長すると予測しています。北米は現在、市場を支配しており、2024年には41%以上の市場シェアを占めています。マネーロンダリングやフィッシングなどの不正行為の増加、オンライン決済の利用増加、そして各国の規制当局と金融機関間の連携強化が、北米市場の成長を牽引しています。

リスク管理の向上と優れたデータ分析機能を提供するRegTechサービスの需要の高まりにより、市場は拡大しています。さらに、マネーロンダリング、フィッシング、不正取引、他の顧客からの金銭窃盗といった不正行為の増加も、市場にとってプラスの影響を与えています。多様な商品を販売し、玄関先まで配送するeコマース事業者の増加、そして商品やサービスの購入手段としてのオンラインショッピングの普及も、市場需要を押し上げています。さらに、プロセスのデジタル化によって生じる課題への対応や、金融当局による競争のダイナミクスに関するより深い洞察の提供を目的として、RegTechの利用が拡大していることも、市場見通しに明るい材料となっています。

様々な業界で規制要件が複雑化する中、米国はRegTech(レグテック)の主要地域市場として台頭しています。金融機関は、コンプライアンス手続きの簡素化、運用コストの削減、そしてコンプライアンス違反に伴うリスクの軽減を目的として、RegTechソリューションの活用を加速させています。さらに、人工知能(AI)、ブロックチェーンなどの技術の活用により、リアルタイムのデータ分析が可能になり、規制報告の精度が向上しています。さらに、規制当局の監視強化とコンプライアンス違反に対する巨額の罰金リスクを背景に、コンプライアンスの自動化を重視する組織が増えています。IMARCグループは、米国のRegTech市場が2024年から2032年にかけて年平均成長率(CAGR)21.84%で成長すると予測しています。

Report Overview

The global RegTech market size was valued at USD 15.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 70.8 Billion by 2033, exhibiting a CAGR of 18.0% from 2025-2033. North America currently dominates the market, holding a market share of over 41% in 2024. The growing prevalence of fraudulent activities, which include money laundering and phishing, rising usage of online payment modes, and increasing collaborations among national regulators and financial institutions are propelling the North American market growth.

global RegTech market

The market is expanding due to the growing demand for RegTech services, which improve risk management and provide superior data analytic capabilities. Furthermore, the market is positively impacted by the growing incidence of fraudulent activities, such as money laundering, phishing, illicit transactions, and stealing money from other customers. The expanding number of e-commerce businesses that sell a variety of goods and offer doorstep delivery, as well as the popularity of online shopping choices for purchasing goods and services are boosting the market demand. Additionally, the growing use of RegTech to address issues emerging because of the digitization of processes and give financial authorities deeper insights into the dynamics of competition is offering a favorable market outlook.

The United States has emerged as a key regional market for RegTech as regulatory requirements are becoming more complex in various industries. Financial institutions are increasingly utilizing RegTech solutions to simplify compliance procedures, cut operational expenses, and lessen risks related to non-compliance. Moreover, the use of artificial intelligence (AI), blockchain, and other technologies is enabling real-time data analysis and improving regulatory reporting. Furthermore, organizations are increasingly prioritizing compliance automation due to heightened regulatory scrutiny and the risk of substantial penalties for non-compliance. The IMARC Group forecasts that the United States RegTech market will experience a 21.84% compound annual growth rate (CAGR) from 2024 to 2032.

RegTech Market Trends:

Rapid adoption of cloud computing solutions

Cloud computing refers to the on-demand delivery of various information and technology (IT) resources over the Internet with pay-as-you-go pricing. More than 94% of organizations with over 1,000 employees utilize cloud computing globally. It assists businesses in hiring and paying only for selective tools and resources for managing their operations. It also companies enhance their operational efficiency, reduce maintenance costs, and improve the productivity of their employees. Besides this, it allows organizations to store massive amounts of data and streamline operations efficiently. Cloud computing offers spontaneous software updates and integration. It integrates common DevOps tools and logging systems, which makes it easier to monitor and detect complications in various production procedures. The integration of cloud computing within the RegTech sector has significantly contributed to the RegTech market share, enabling scalable, cost-effective compliance solutions and driving adoption among financial institutions and enterprises globally.

Rising adoption of online payment methods

Online payment methods and online payment gateways provide a seamless experience to individuals while paying for goods and services. The global digital payment market size is expected to exhibit a growth rate (CAGR) of 15.6% during 2024-2032, according to the IMARC Group’s predictions. Online payments are convenient and enable individuals to make cashless payments while shopping online. They also provide various offers and cashback features, which is encouraging more people to adopt online payment gateways. The accelerated digital transformation of payment transaction processing is impelling banks to deliver innovative payment tools to their customers. This, along with the changing regulatory landscape due to increasing volumes of online payments, is positively influencing the demand for RegTech services. These services efficiently solve compliance and regulatory complications faced by banks.

Increasing digital transformation of processes in the banking, financial services, and insurance (BFSI) sector

The BFSI sector plays an essential role in supporting the growth of the market. In 2022-23, BFSI firms achieved a net hiring of 172,000 employees to their workforce. Hence, it is important for the sector to continuously evolve and transform according to the current requirements. Digital transformation is a necessary step for the BFSI sector to enable individuals to make simpler, spontaneous, and secured transactions. It also enables the BFSI sector to present various personalized services to customers along with tailor-made investment and insurance options that suit the income range. Moreover, BFSI digital transformation can resolve customer issues and queries much faster as data is centralized and can be accessed from any branch of financial institutions. Besides this, RegTech market trends indicate a rising emphasis on digital transformation in the BFSI sector, leveraging advanced technologies like AI and blockchain to enhance compliance processes and deliver personalized, secure financial solutions.

RegTech Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical, and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Modes Covered | Cloud-based, On-premises |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Applications Covered | Anti-Money Laundering (AML) and Fraud Management, Regulatory Intelligence, Risk and Compliance Management, Regulatory Reporting, Identity Management |

| End Users Covered | Banks, Insurance Companies, FinTech Firms, IT and Telecom, Public Sector, Energy and Utilities, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ACTICO GmbH, Acuant Inc., Ascent, Broadridge Financial Solutions Inc., ComplyAdvantage, Deloitte Touche Tohmatsu Limited, International Business Machines Corporation, Jumio, London Stock Exchange Group plc, MetricStream Inc., NICE Ltd., PricewaterhouseCoopers, Thomson Reuters Corporation, Trulioo, Wolters Kluwer N.V., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |