| 出版社 | IMARC Group |

| 出版年月 | 2025年10月 |

Ride Sharing Market Report

ライドシェア市場レポート : サービスタイプ(E-Hailing、カーシェアリング、ステーションベースのモビリティ、レンタカー)、予約モード(アプリベース、ウェブベース)、メンバーシップタイプ(固定ライドシェアリング、ダイナミックライドシェアリング、コーポレートライドシェアリング)、通勤タイプ(ICE車両、電気自動車、CNG/LPG車両、マイクロモビリティ車両)、および地域 2025-2033年

世界のライドシェア市場規模は2024年に1,313億米ドルに達しました。IMARCグループは、今後、市場規模が2033年までに5,072億米ドルに達し、2025年から2033年にかけて14.62%の年平均成長率(CAGR)で成長すると予測しています。この市場は、技術の進歩、経済効率、持続可能なシェアリング交通モデルへの移行、そしてスマートフォンの普及率の上昇と技術の進歩によって推進されています。

ライドシェアとは、個人が車両を共有することで移動コスト、渋滞、環境への影響を軽減する交通モデルを指します。このコンセプトは、従来のタクシーサービスとは対照的で、デジタルプラットフォームを通じて一般の人々が自家用車をパートタイムのタクシーとして利用できるようにしています。これらのプラットフォーム(通常はスマートフォンアプリ)は、同じ方向に向かう乗客とドライバーをマッチングします。ライドシェアは、その利便性、費用対効果、そしてスマートフォンとモバイルインターネットアクセスの普及により、大きな注目を集めています。市場参加者は、経済的な相乗りオプションから、より贅沢な一人乗りまで、幅広いサービスを提供しています。このモデルの拡張性により、都市部居住者、通勤者、そして自家用車や公共交通機関を利用できない人々にとって魅力的なサービスとなり、世界市場への急速な拡大を可能にしました。ライドシェアの成長は、規制上の課題や、安全性、ドライバーの雇用形態、そして従来のタクシーサービスへの影響に関する懸念を伴ってきました。これらの問題にもかかわらず、ライドシェアは進化する都市交通の不可欠な要素であり、従来の交通手段に代わる柔軟な選択肢を提供しています。

Report Overview

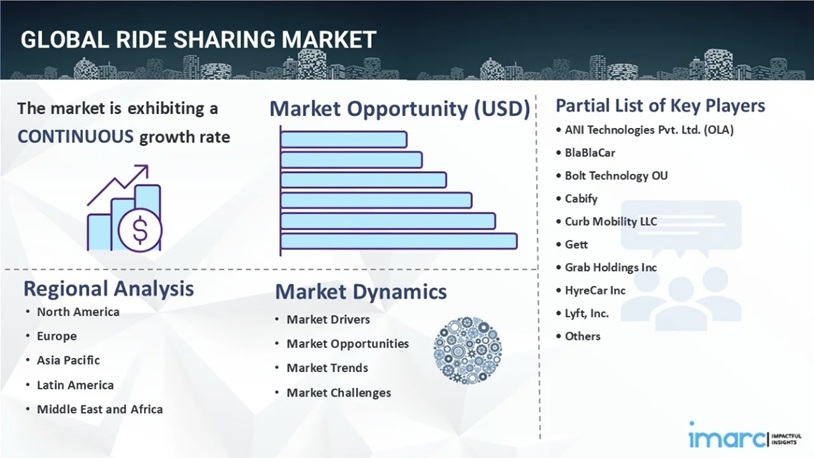

The global ride sharing market size reached USD 131.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 507.2 Billion by 2033, exhibiting a growth rate (CAGR) of 14.62% during 2025-2033. The market is propelled by technological advancements, economic efficiency, and a shift towards sustainable and shared transportation models, along with rising smartphone penetration and technological advancements.

ride sharing market

Ride sharing refers to a transportation model where individuals share a vehicle trip, reducing travel costs, congestion, and environmental impact. This concept contrasts with traditional taxi services by enabling regular people to turn their private vehicles into part-time taxis through a digital platform. These platforms, typically smartphone applications, match passengers with drivers heading in the same direction. Ride sharing has gained significant traction due to its convenience, cost-effectiveness, and the rise of smartphones and mobile internet access. Market players offer a range of services from economical carpool options to more luxurious solo rides. The model’s scalability has enabled rapid expansion into global markets, appealing to urban residents, commuters, and those without access to private or public transportation. The growth of ride sharing has been accompanied by regulatory challenges and concerns over safety, employment status of drivers, and its impact on traditional taxi services. Despite these issues, ride sharing remains an integral part of the evolving urban transportation landscape, offering a flexible alternative to conventional transport modes.

Ride Sharing Market Trends:

Technological advancements, particularly in smartphone technology and mobile internet connectivity, represent one of the key factors driving the global ride sharing market. The widespread adoption of smartphones has facilitated the growth of app-based ride sharing platforms, allowing for real-time matching of drivers and passengers. GPS technology ensures efficient route planning, while digital payment systems enable seamless financial transactions. Additionally, developments in data analytics has helped these platforms optimize pricing and logistics, enhancing user experience. Economically, ride sharing offers cost savings for users, as it typically undercuts traditional taxi fares and reduces the need for personal vehicle ownership, especially in urban areas where parking and maintenance costs are high. This economic efficiency is particularly appealing in the context of growing urbanization and the increasing economic pressure on urban residents.

Social and environmental factors are also significantly contributing to the growth of the ride sharing market. There is a rising awareness of environmental issues, and ride sharing is seen as a more sustainable transportation option. By maximizing vehicle occupancy, it reduces carbon emissions and traffic congestion, aligning with broader environmental goals. Furthermore, changing social attitudes, especially among younger populations, favor access over ownership, leading to a greater acceptance of shared services. This shift is part of a larger trend towards a ‘sharing economy,’ where assets and services are shared between individuals, often facilitated by technology. Ride sharing also addresses gaps in existing public transportation networks, providing a flexible solution for last-mile connectivity. However, the industry faces challenges, including regulatory hurdles, concerns over the safety and rights of both drivers and passengers, and the impact on traditional taxi services. These issues, alongside the potential disruption from autonomous vehicle technology, represent ongoing considerations for the future trajectory of the ride sharing market.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | E-Hailing, Car Sharing, Station-Based Mobility, Car Rental |

| Booking Modes Covered | App-based, Web-based |

| Membership Types Covered | Fixed Ridesharing, Dynamic Ridesharing, Corporate Ridesharing |

| Commute Types Covered | ICE Vehicle, Electric Vehicle, CNG/LPG Vehicle, Micro Mobility Vehicle |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ANI Technologies Pvt. Ltd. (OLA), BlaBlaCar, Bolt Technology OU, Cabify, Curb Mobility LLC, Gett, Grab Holdings Inc, HyreCar Inc, Lyft, Inc., Tomtom International B.V., and Uber Technologies Inc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |