| 出版社 | IMARC Group |

| 出版年月 | 2025年9月 |

Silicone Potting Compounds Market Size, Share, Trends and Forecast

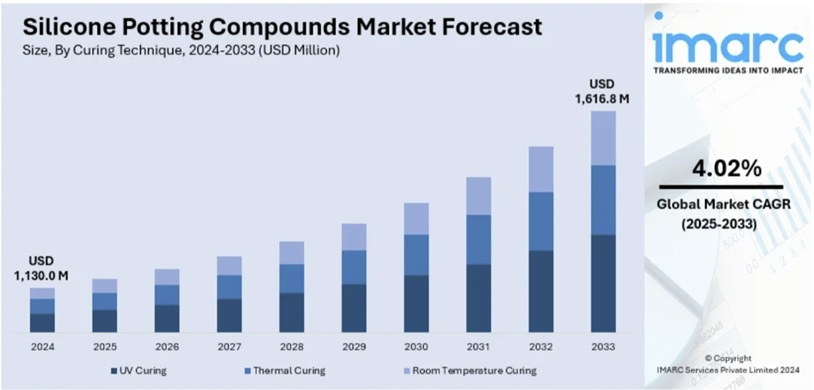

世界のシリコーンポッティングコンパウンド市場規模は、2024年に11億3,000万米ドルと評価されました。IMARCグループは、今後、市場規模は2033年までに16億1,680万米ドルに達し、2025年から2033年にかけて4.02%の年平均成長率(CAGR)で成長すると予測しています。現在、アジア太平洋地域が市場を支配しており、2024年には46.3%を超える市場シェアを獲得しています。これは、民生用電子機器に対する需要の高まり、工業化の進展、そして電子機器製造の急増によるものです。

世界のシリコーンポッティングコンパウンド市場は、通信、民生用電子機器、自動車など、重要な分野における電子部品の確実な保護に対するニーズの高まりに大きく影響を受けています。これらのコンパウンドは、過酷な環境パラメータに対する優れた耐性、熱安定性、電気絶縁性を備えており、重要な用途に不可欠なコンパウンドとなっています。さらに、電気自動車(EV)の需要、小型化、再生可能エネルギーシステムといった新たなトレンドも、シリコーンポッティングソリューションの需要をさらに高めています。さらに、処理効率や製品性能の向上、UV硬化といった硬化技術の急速な革新も、市場の需要を牽引しています。さらに、環境に優しい材料に対する規制の強化も、シリコーンベースのポッティングコンパウンドの人気を高めています。

The global silicone potting compounds market size was valued at USD 1,130.0 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,616.8 Million by 2033, exhibiting a CAGR of 4.02% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 46.3% in 2024. This is due to heightening requirement for consumer electronics, increasing industrialization, and proliferating electronics manufacturing.

Silicone Potting Compounds Market Size, Share, Trends and Forecast

The global silicone potting compounds market is typically influenced by amplifying need for dependable protection of electronic components across critical sectors, including telecommunications, consumer electronics, and automotive. Such compounds provide exceptional resistance against adverse environmental parameters, thermal stability, and electrical insulation, positioning them as a requisite compound in critical applications. Furthermore, emerging trends in electric vehicles (EVs) demand, miniaturization, and renewable energy systems further boost requirement for silicone potting solutions. In addition, rapid innovations in curing technologies, like improve processing efficacy and product performance, UV curing, fueling market demand. Moreover, magnifying regulatory focus on eco-friendly materials also fosters the increasing popularity for silicone-based potting compounds.

The United States represents a chief market for silicone potting compounds, mainly propelled by leading-edge manufacturing abilities and elevated requirement from key sectors like aerospace, electronics, and automotive. The country’s rising emphasis on technological innovations and advancements aids the formulation of exceptional-performance silicone potting solutions, adhering to the strict durability and quality. In addition, heightening utilization of electric vehicles (EVs) and innovations in consumer electronics further boost market expansion. For instance, as per industry reports, in May 2024, electric vehicles accounted for 6.8% of total sales in the U.S., reflecting a 1.6 percentage point increase compared to 2022. Additionally, the magnifying focus on environmental safety and energy-saving solutions fuels the deployment of environmentally friendly silicone potting compounds, facilitating prolonged growth prospects in the United States market.

Silicone Potting Compounds Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Curing Techniques Covered | UV Curing, Thermal Curing, Room Temperature Curing |

| Applications Covered |

|

| End Use Industries | Consumer Electronics, Aerospace, Automotive, Energy and Power, Others |

| Regions Covered | Asia-Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | Altana AG, CHT Germany GmbH, Dymax Corporation, Henkel AG & Co. KGaA, Hernon Manufacturing Inc, Master Bond Inc., MG Chemicals, Novagard Solutions, Parker-Hannifin Corp. The Dow Chemical Company (Dow Inc), etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |