| 出版社 | Mordor Intelligence |

| 出版年月 | 2025年9月 |

India Used Car Financing – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 – 2030)

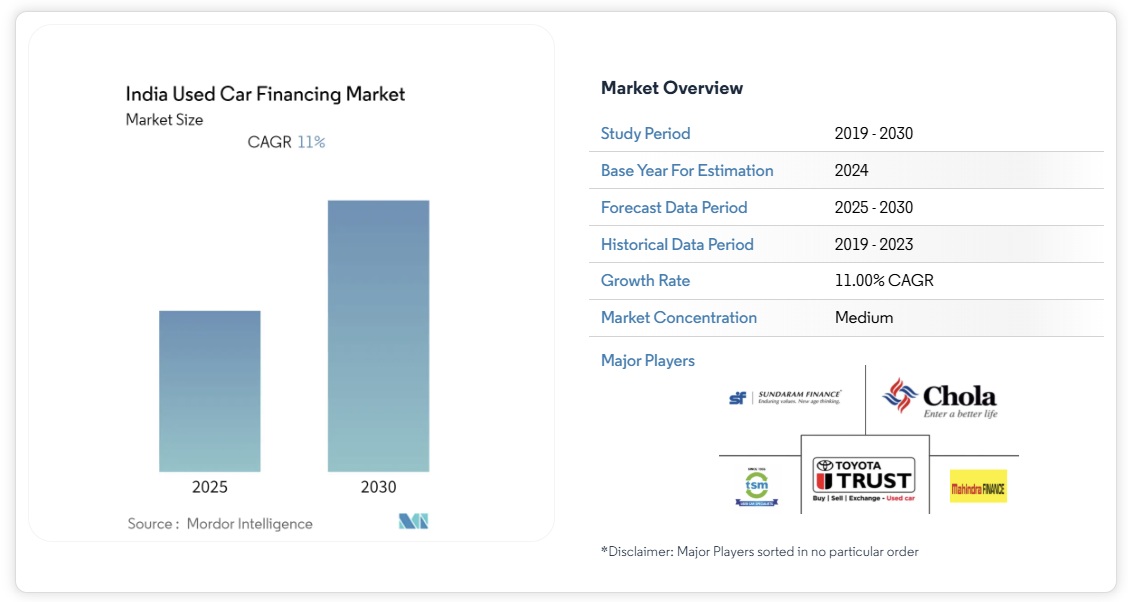

インドの中古車ファイナンス市場は、予測期間中に 11% の CAGR を記録すると予想されています。

パンデミックの影響で新車販売が急増したため、全国の主要消費者は経済的な問題に直面しています。このことが市場の成長を後押しすると予想されます。消費者が自動車を所有し、公共交通機関の利用を避けたいという意識の高まりも、全国の中古車市場にとって重要な要因となっています。かつてはステータスシンボルだった自動車の所有は、近年では必需品となっています。自動車産業は創業以来、飛躍的な成長を遂げてきました。消費者はこれまで以上に中古車に注目しており、中には二輪車よりも中古車を好む人もいます。

今日では、大多数の顧客が何らかの金融支援を受けて自動車を購入しています。中古車の現在のローン金利はわずか13~15%程度であり、メーカーと金融機関の双方にとって大きなチャンスとなっています。現在、インドの中古車市場は新車市場の約1.3倍の規模であり、市場にとって大きなチャンスとなる可能性があります。2020年からBS-VIが導入され、それに続く安全装備の義務化により、新車価格の上昇が見込まれます。また、ディーゼル車の製造を段階的に廃止するメーカーも少なくなく、耐久性と燃費の良さからディーゼル車を好む消費者は中古車市場にも目を向けています。これらの要因が、中古車ファイナンスの促進要因として再び作用すると予想されます。

The India Used Car Financing Market is expected to register a CAGR of 11% during the forecast period.

Major consumers across the country are facing financial issues due to the pandemic surge in the selling of newer cars. This is likely to witness major growth for the market. Rising consumer preference for owning a vehicle and avoiding public transportation is also a key factor for the used car market across the country. Ownership of cars, which used to be a status symbol long ago, has become a necessity in recent times. The automotive industry has witnessed exponential growth since its inception. Consumers are looking at used cars ever more than before, and some are even preferring them over two-wheelers.

India Used Car Financing – Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 – 2030)

Nowadays, the majority of customers opt to purchase an automobile, depending on some type of financial assistance. The current rate of financing for used cars is just around 13-15% and offers a tremendous opportunity for manufacturers as well as financial institutions alike. Currently, the used car industry is around 1.3 times the new car industry in India which is likely to create an opportunity for the market.

With BS-VI rolling out in the country from the year 2020 and subsequent mandates for necessary safety features, the cost of new cars is expected to grow up. Also, few manufacturers are phasing out their diesel portfolio, and consumers who prefer diesel cars for their durability and mileage figures are also looking toward the used car space. These factors are again expected to drive used car financing.

Second Hand Car Finance Market Trends

Burgeoning Used Car Industry Subsequently Driving the Financing Market

The used car business in India has been picking up pace over the past few years. In 2016, roughly 3.3 million used cars were sold, and in FY2019, the number breached the 4 million mark, with pre-owned cars registering more sales than new cars. In FY2021, around 4.4 million used cars were sold in India, which is likely to create an opportunity for the used car financing market.

Growing digitization and startup with new business models is promoting the used car financing market. Digitization helps to store, retain and retrieve data. Almost all information is in digital format. This reduces the capital resources required and reduces the problem of storing documents. An increase in digitization in auto finance will extend end to end, including e-signatures and digital loan documents have an opportunity to gain an advantage over the market. For instance,

- In February 2022, Kuwy launched end to end digital lending platform for online car sellers. The platform allows car manufacturers, dealers, aggregator platforms, and lenders to offer digital retailing to their customers.

The rise in shared mobility services across the country is likely to be a key factor for the used car financing market. Also, the revision of the GST rate on used cars from 28% to 12 – 18% is also acting as a driver of the market. With companies gradually focusing on reducing the production of diesel cars, for instance, Maruti Suzuki’s decision to exit the diesel car segment by April 2020 is also expected to increase the demand for compact diesel cars (mainly due to their higher mileage figures) in the used car market, unless there is a backlash against diesel cars.

The major presence of OEMs, including Maruti Suzuki, Tata Motors, and others, are attracting consumers for used cars and offering better financing options owing to which the demand for used cars is increasing. Even luxury car makers, including Audi, also entered the used car market, which increased the sale of used premium cars. The demand for luxury cars is also witnessing a continual increase, with nearly 50,000 units sold in 2018 compared to around 40,800 in the previous year. Until a few years ago, owning a luxury car used to be a dream for numerous consumers, owing to financial hurdles, but this is gradually changing, as the consumers can easily buy pre-owned luxury vehicles, as the market is becoming more organized with easy access to financing options, annual maintenance contracts, and lower entry prices.

Second Hand Car Finance Industry Overview

The market for used car financing in India is on the fragmented side. The presence of many organized and un-organized players has created such a market scenario. Also, most auto manufacturers, apart from offering their own financing, have tie-ups with banks and other financial institutions to offer a wider choice for their customers. But the relatively easier procedures to procure a loan from various NBFCs are expected to tilt the market in their favor. Maruti Suzuki Limited, Mahindra Finance, Poonawalla Fincorp, Sundaram Finance, Bluecarz, TSM Cars, etc., are some of the major players in the market. Major OEMs are partnering with the NBFCs to provide loans for the consumer. For instance,

- In August 2021, Tata Motors partnered with Sundaram Finance to offer exclusive offers to customers opting to purchase its range of passenger cars. Under the partnership with TATA Motors, Sundaram Finance would offer six-year loans on the new ‘Forever’ range of cars, and with 100% financing, that would require a minimal down payment.