Advanced Ceramics Market - Global Forecast to 2030

先端セラミックス市場 - 材質(アルミナ、チタン酸塩、ジルコニア、炭化ケイ素、圧電セラミック、その他の材料)、製品タイプ(モノリシックセラミックス、セラミックコーティング、セラミックマトリックス複合材料、セラミックフィルター、その他の製品タイプ)、最終用途産業(電気・電子、輸送、医療、防衛・セキュリティ、環境、化学、その他の最終用途産業)、地域別 - 2030年までの世界予測

Advanced Ceramics Market by Material (Alumina, Titanate, Zirconia, Silicon Carbide, Piezo Ceramic, Other Materials), Product Type (Monolithic Ceramics, Ceramic Coatings, Ceramic Matrix Composites, Ceramic Filters, Other Product Types), End-use Industry (Electrical & Electronics, Transportation, Medical, Defense & Security, Environmental, Chemical, Other end-use industries), By Region – Global Forecast to 2030

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年01月 |

| ページ数 | 315 |

| 図表数 | 342 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-7198 |

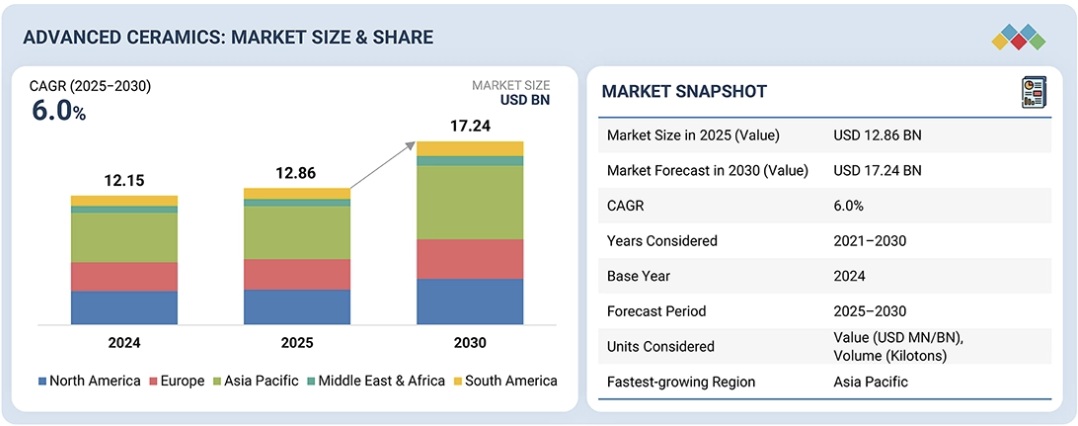

先端セラミックスの市場規模は、2025年の128.6億米ドルから2030年には172.4億米ドルに拡大し、予測期間中に6.0%のCAGRを記録すると予測されています。

主要分野における高品質で信頼性の高い材料への要求が、先進セラミックスの需要を牽引しています。これらのセラミックスは、高い機械的強度、耐熱性、耐摩耗性、耐腐食性、耐薬品性といった特性を備えています。また、絶縁性と寸法安定性も備えているため、高精度が求められる用途にも対応可能です。加工技術の継続的な改善により、材料の品質と安定性が向上しています。耐久性と長寿命への関心が高まるにつれ、採用も増加しています。電気・電子、輸送、医療、防衛・セキュリティ、環境、化学といった業界では、先進セラミックスの使用がますます増加しています。これらの要因が相まって、世界市場における先進セラミックスの需要は着実に成長しています。

調査範囲

本レポートは、先端セラミックス市場をタイプ、容量、用途、地域に基づいてセグメント化し、様々な地域における市場全体の価値を推定しています。主要業界プレーヤーの詳細な分析を実施し、先端セラミックス市場に関連する事業概要、製品・サービス、主要戦略、事業拡大に関する洞察を提供しています。

このレポートを購入する主なメリット

この調査レポートは、業界分析(業界動向)、主要企業の市場ランキング分析、企業プロファイルなど、様々なレベルの分析に焦点を当てており、これらを組み合わせることで、競争環境の全体像、先進セラミックス市場における新興・高成長セグメント、高成長地域、市場牽引要因、制約要因、機会、課題などを明らかにしています。

本レポートは、以下の点について洞察を提供します。

- 先進セラミックス市場の成長に影響を与える推進要因(電子機器および半導体デバイスの小型化と性能向上)、制約要因(複雑で資本集約的な製造プロセス)、機会(半導体製造能力の世界的な拡大とクリーンテクノロジーへのエネルギー転換)、課題(原材料の純度と供給の安定性)の分析。

- 市場浸透:世界の先端セラミックス市場における主要企業が提供する先端セラミックスに関する包括的な情報。

製品開発/イノベーション:先端セラミックス市場における今後の技術、事業拡大、パートナーシップ、契約に関する詳細な洞察。

市場開発:成長著しい新興市場に関する包括的な情報を提供する本レポートでは、地域をまたいで先端セラミックス市場の市場を分析しています。

市場能力:先端セラミックス市場における今後の生産能力に加え、企業の生産能力についても可能な限り提供しています。

競合評価:先端セラミックス市場における主要企業の市場シェア、戦略、製品、製造能力に関する詳細な評価。

Report Description

The Advanced Ceramics market size is projected to grow from USD 12.86 billion in 2025 to USD 17.24 billion by 2030, registering a CAGR of 6.0% during the forecast period.

The demand for advanced ceramics is fueled by the requirement for high-quality and reliable materials in prominent sectors. The properties of these ceramics include high mechanical strength, thermal resistance, and resistance to wear, corrosion, and chemicals. They also possess insulation properties and dimensional stability, thus supporting applications requiring high accuracy. Continuous improvements in processing technologies enhance material quality and consistency. Rising focus on durability and long service life increases adoption. Industries such as electrical & electronics, transportation, medical, defense & security, environmental, and chemical are increasingly using advanced ceramics. These combined factors are driving steady growth in demand for advanced ceramics across global markets.

Advanced Ceramics Market – Global Forecast to 2030

“By End-use Industry, the Electrical & Electronics segment is anticipated to account for the largest market share during the forecast period, (2025-2030).”

The electrical and electronics end-use industry accounts for the largest share in the advanced ceramics market because these materials offer essential functional properties. Advanced ceramics have excellent electrical insulation and good dielectric strength. Thermal stability also remains strong under high operating temperatures. The low thermal expansion of the material supports dimensional stability in precision components. Advanced ceramics resist wear, corrosion, and chemical degradation over long time periods, which allows for reliable performance in compact and high-density electronic systems. Consistent material purity ensures stable electrical performance. All these advantages make advanced ceramics highly important in modern electronic parts and support their dominant market share position.

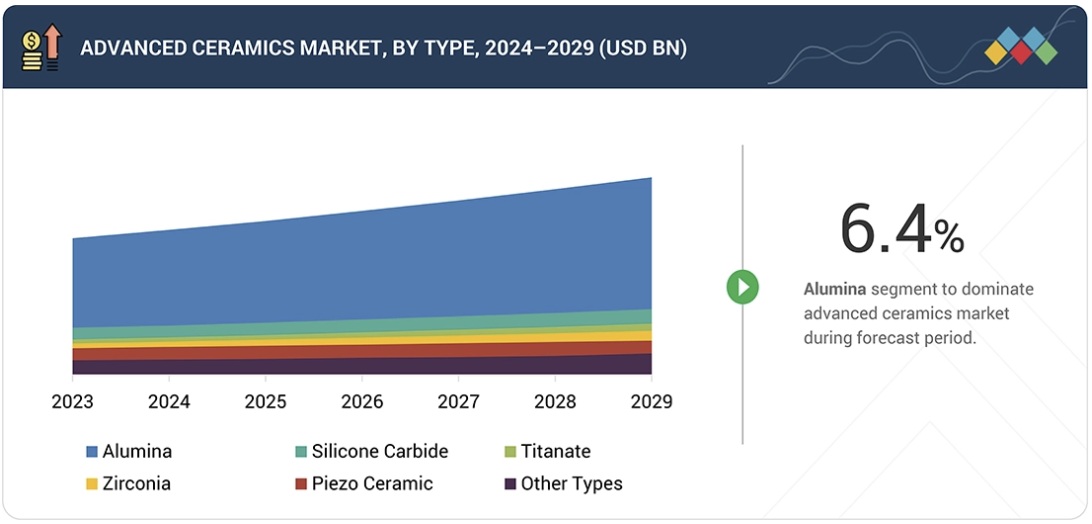

By Material, the alumina segment is anticipated to account for the largest market share during the forecast period, (2025-2030)

Alumina ceramic holds the largest share in the advanced ceramics market because it delivers reliable performance at a reasonable cost. It has high hardness and good mechanical strength. Alumina ceramics possess superior resistance to wear and corrosion. It has excellent ability to withstand high temperatures and extreme conditions. It also provides strong electrical insulation properties. The material is easy to process using established manufacturing methods. It is available in a wide range of purity grades and forms. This supports consistent quality and large-scale production. Alumina also has a long service life, which reduces replacement frequency. These advantages together support its leading position in the advanced ceramics market.

Advanced Ceramics Market – Global Forecast to 2030 – region

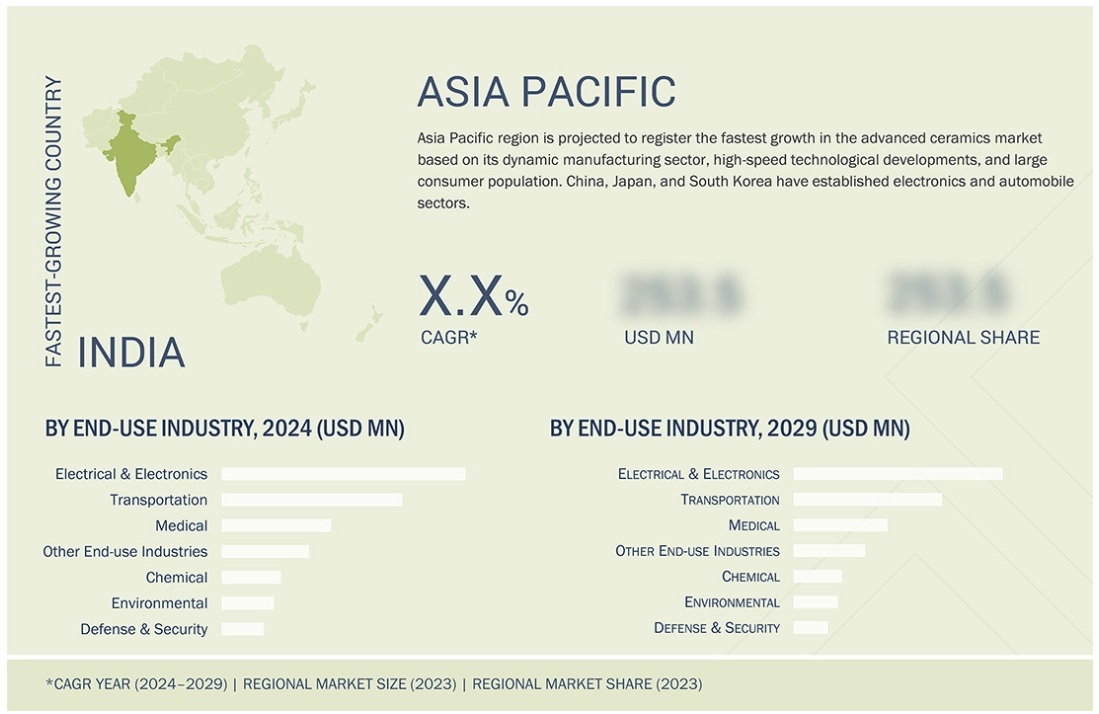

“Asia Pacific is anticipated to account for the largest market share during the forecast period, (2025-2030).

Asia Pacific accounts for the largest share in the advanced ceramics market due to its strong manufacturing base and rapid industrial growth. The region has a high concentration of advanced ceramics producers and raw material suppliers. This supports cost-efficient production and steady supply chains. Asia Pacific also benefits from large-scale production capabilities and skilled technical labor. Continuous investment in manufacturing technologies improves product quality and output. The region has strong demand for high-performance materials driven by expanding industrial activity. Supportive government policies encourage domestic manufacturing and technology development. Growing research capabilities further strengthen material innovation. Together, these factors create a connected growth cycle that supports Asia Pacific’s leading position in the advanced ceramics market.

In-depth interviews were conducted with Chief Executive Officers (CEOs), marketing directors, other innovation and technology directors, and executives from various key organizations operating in the Advanced Ceramics market, and information was gathered from secondary research to determine and verify the market size of several segments.

- By Company Type: Tier 1 – 50%, Tier 2 – 30%, and Tier 3 – 20%

- By Designation: Managers– 15%, Directors – 20%, and Others – 65%

- By Region: North America – 30%, Europe – 25%, Asia Pacific – 35%, the Middle East & Africa –5%, and South America- 5%

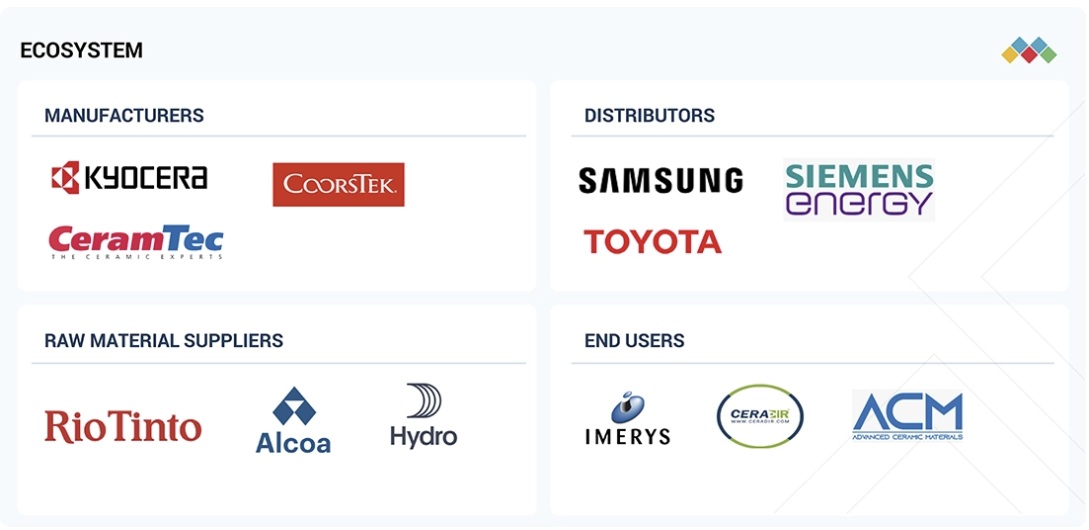

Advanced Ceramics Market – Global Forecast to 2030 – ecosystem

The Advanced Ceramics market comprises major KYOCERA Corporation (Japan), CeramTec GmbH (Germany), CoorsTek (US), Materion Corporation (US), AGC Inc. (Japan), Morgan Advanced Materials (UK), MARUWA Co., Ltd. (Japan), Ferrotec Corporation (Japan), Saint-Gobain Performance Ceramics & Refractories (France), 3M (US). The study includes in-depth competitive analysis of these key players in the Advanced Ceramics market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This report segments the market for Advanced Ceramics market on the basis of Type, Capacity, Application, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, and expansions associated with the Advanced Ceramics market.

Key benefits of buying this report

This research report is focused on various levels of analysis — industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape; emerging and high-growth segments of the Advanced Ceramics market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of drivers: (Miniaturization and performance escalation in electronics and semiconductor devices), restraints (Complex and Capital-Intensive Manufacturing Processes), opportunities (Global Expansion of Semiconductor Fabrication Capacity and the Energy Transition toward Clean Technologies), and challenges (Raw material purity and supply consistency) influencing the growth of Advanced Ceramics market.

- Market Penetration: Comprehensive information on the Advanced Ceramics offered by top players in the global Advanced Ceramics market.

- Product Development/Innovation: Detailed insights on upcoming technologies, expansions, partnerships, and agreements in the Advanced Ceramics market.

- Market Development: Comprehensive information about lucrative emerging markets, the report analyzes the markets for Advanced Ceramics market across regions.

- Market Capacity: Production capacity of the companies is provided wherever available with upcoming capacities for the Advanced Ceramics market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the Advanced Ceramics market.

Table of Contents

1 INTRODUCTION 29

1.1 STUDY OBJECTIVES 29

1.2 MARKET DEFINITION 29

1.3 STUDY SCOPE 30

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 30

1.3.2 INCLUSIONS AND EXCLUSIONS 31

1.3.3 YEARS CONSIDERED 32

1.3.4 CURRENCY CONSIDERED 32

1.3.5 UNIT CONSIDERED 32

1.4 STAKEHOLDERS 33

1.5 SUMMARY OF CHANGES 33

2 EXECUTIVE SUMMARY 34

2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS 34

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 35

2.3 DISRUPTIVE TRENDS IN ADVANCED CERAMICS MARKET 36

2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS 37

2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST 38

3 PREMIUM INSIGHTS 39

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ADVANCED CERAMICS MARKET 39

3.2 ADVANCED CERAMICS MARKET, BY MATERIAL AND REGION 40

3.3 ADVANCED CERAMICS MARKET, BY PRODUCT TYPE 40

3.4 ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY 41

3.5 ADVANCED CERAMICS MARKET, BY COUNTRY 41

4 MARKET OVERVIEW 42

4.1 INTRODUCTION 42

4.2 MARKET DYNAMICS 42

4.2.1 DRIVERS 43

4.2.1.1 Miniaturization and performance escalation in electronics and semiconductor devices 43

4.2.1.2 Growth of electric vehicles and power electronics 43

4.2.1.3 Increased adoption in aerospace and defense applications 44

4.2.1.4 Longer service life and lower lifecycle costs compared to metals and polymers 44

4.2.2 RESTRAINTS 45

4.2.2.1 Complex and capital-intensive manufacturing processes 45

4.2.2.2 Limited design flexibility compared to metals and polymers 45

4.2.3 OPPORTUNITIES 46

4.2.3.1 Global expansion of semiconductor fabrication capacity and energy transition toward clean technologies 46

4.2.3.2 Increasing adoption in medical and dental applications 47

4.2.4 CHALLENGES 48

4.2.4.1 Raw material purity and supply consistency 48

4.3 UNMET NEEDS AND WHITE SPACES 48

4.3.1 UNMET NEEDS IN ADVANCED CERAMICS MARKET 48

4.3.2 WHITE SPACE OPPORTUNITIES 49

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 50

4.4.1 CROSS-SECTOR OPPORTUNITIES 51

4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 52

5 INDUSTRY TRENDS 53

5.1 PORTER’S FIVE FORCES ANALYSIS 53

5.1.1 THREAT OF NEW ENTRANTS 54

5.1.2 THREAT OF SUBSTITUTES 54

5.1.3 BARGAINING POWER OF SUPPLIERS 55

5.1.4 BARGAINING POWER OF BUYERS 55

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 55

5.2 MACROECONOMICS INDICATORS 56

5.2.1 INTRODUCTION 56

5.2.2 GDP TRENDS AND FORECAST 56

5.2.3 TRENDS IN GLOBAL ELECTRICAL & ELECTRONICS INDUSTRY 58

5.3 SUPPLY CHAIN ANALYSIS 58

5.4 PRICING ANALYSIS 60

5.4.1 AVERAGE SELLING PRICE TREND, BY REGION 60

5.4.2 AVERAGE SELLING PRICE TREND, BY MATERIAL 61

5.4.3 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE 62

5.4.4 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY 62

5.4.5 AVERAGE SELLING PRICE OF ADVANCED CERAMICS AMONG KEY PLAYERS, BY MATERIAL 63

5.5 ECOSYSTEM ANALYSIS 64

5.6 TRADE ANALYSIS 65

5.6.1 IMPORT SCENARIO (HS CODE 690390) 66

5.6.2 EXPORT SCENARIO (HS CODE 690390) 66

5.7 KEY CONFERENCES AND EVENTS, 2026 67

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS 67

5.9 INVESTMENT AND FUNDING SCENARIO 68

5.10 CASE STUDY ANALYSIS 69

5.10.1 KYOCERA CORPORATION: SCALING ADVANCED CERAMICS FOR SEMICONDUCTOR AND ELECTRONICS LEADERSHIP 69

5.10.2 COORSTEK: ADVANCING MEDICAL AND INDUSTRIAL CERAMICS THROUGH MATERIALS INNOVATION 70

5.10.3 MORGAN ADVANCED MATERIALS: TRANSFORMING ADVANCED CERAMICS FOR ENERGY AND SUSTAINABILITY APPLICATIONS 71

5.11 IMPACT OF 2025 US TARIFF – ADVANCED CERAMICS MARKET 71

5.11.1 INTRODUCTION 71

5.11.2 KEY TARIFF RATES 72

5.11.3 PRICE IMPACT ANALYSIS 72

5.11.4 IMPACT ON COUNTRIES/REGIONS 73

5.11.4.1 North America 73

5.11.4.2 Europe 74

5.11.4.3 Asia Pacific 74

5.11.5 IMPACT ON END-USE INDUSTRIES 74

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT,

PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS 75

6.1 KEY EMERGING TECHNOLOGIES 75

6.1.1 POWDER SYNTHESIS AND HIGH-PURITY MATERIAL PROCESSING TECHNOLOGY 75

6.1.2 ADVANCED FORMING AND SHAPING TECHNOLOGIES 75

6.1.3 SINTERING AND DENSIFICATION TECHNOLOGIES 75

6.1.4 ADDITIVE MANUFACTURING AND DIGITAL CERAMIC FABRICATION 76

6.1.5 SURFACE ENGINEERING AND COATING TECHNOLOGIES 76

6.2 COMPLEMENTARY TECHNOLOGIES 76

6.2.1 PRECISION MACHINING AND FINISHING TECHNOLOGIES 76

6.2.2 ADVANCED JOINING AND ASSEMBLY TECHNOLOGIES 76

6.2.3 ADVANCED METROLOGY AND QUALITY CONTROL TECHNOLOGIES 77

6.2.4 DIGITAL MANUFACTURING, SIMULATION, AND PROCESS MODELING 77

6.2.5 ADVANCED COATINGS, SURFACE TREATMENTS, AND FUNCTIONALIZATION TECHNOLOGIES 77

6.3 TECHNOLOGY/PRODUCT ROADMAP 77

6.3.1 SHORT-TERM ROADMAP: PROCESS OPTIMIZATION AND COST EFFICIENCY 78

6.3.2 MID-TERM ROADMAP: DIGITALIZATION AND DESIGN ENABLEMENT 78

6.3.3 LONG-TERM ROADMAP: SUSTAINABILITY AND NEXT-GENERATION APPLICATIONS 78

6.4 PATENT ANALYSIS 78

6.4.1 METHODOLOGY 78

6.4.2 GRANTED PATENTS 79

6.4.3 INSIGHTS 80

6.4.4 LEGAL STATUS 80

6.4.5 JURISDICTION ANALYSIS 80

6.4.6 TOP APPLICANTS 81

6.4.7 LIST OF MAJOR PATENTS 81

6.5 FUTURE APPLICATIONS 84

6.5.1 ADVANCED CERAMICS FOR AI-ENABLED AND HIGH-PERFORMANCE SEMICONDUCTOR SYSTEMS 84

6.5.2 ULTRA-HIGH-PURITY AND HERMETIC CERAMICS FOR MEDICAL AND LIFE SCIENCES 85

6.5.3 HYBRID CERAMIC SYSTEMS FOR ENERGY TRANSITION AND STORAGE TECHNOLOGIES 85

6.5.4 STRUCTURAL AND FUNCTIONAL CERAMICS FOR ELECTRIC AND AUTONOMOUS TRANSPORTATION 86

6.5.5 SUSTAINABLE AND CIRCULAR APPLICATIONS USING ADVANCED CERAMICS 86

6.6 IMPACT OF AI/GEN AI ON ADVANCED CERAMICS MARKET 87

6.6.1 TOP USE CASES AND MARKET POTENTIAL 87

6.6.2 BEST PRACTICES IN ADVANCED CERAMICS MANUFACTURING 88

6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN ADVANCED CERAMICS MARKET 89

6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 90

6.6.5 CLIENTS’ READINESS TO ADOPT GENERATIVE AI IN ADVANCED CERAMICS MARKET 90

6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS 90

6.7.1 KYOCERA CORPORATIONS: HIGH-RELIABILITY ADVANCED CERAMICS FOR ELECTRONICS & INDUSTRIAL SYSTEMS 91

6.7.2 COORSTEK/COORS CERAMICS: ENGINEERED CERAMIC COMPONENTS FOR EXTREME OPERATING ENVIRONMENTS 91

6.7.3 MORGAN ADVANCED MATERIALS: MULTI-INDUSTRY ADVANCED CERAMICS FOR ENERGY, TRANSPORTATION & HEALTHCARE 91

7 SUSTAINABILITY AND REGULATORY LANDSCAPE 92

7.1 REGIONAL REGULATIONS AND COMPLIANCE 92

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 92

7.1.2 INDUSTRY STANDARDS 95

7.2 SUSTAINABILITY INITIATIVES 97

7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF ADVANCED CERAMICS 97

7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES 98

7.4 CERTIFICATIONS, LABELING, ECO-STANDARDS 99

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 101

8.1 DECISION-MAKING PROCESS 101

8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA 102

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 102

8.2.2 BUYING CRITERIA 103

8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 103

8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES 104

8.5 MARKET PROFITABILITY 106

8.5.1 HIGH-VALUE ADDITION AND PREMIUM PRICING POWER 106

8.5.2 CAPITAL INTENSITY AND COST STRUCTURE CONSTRAINTS 106

8.5.3 END-USE INDUSTRY MIX AND MARGIN VARIABILITY 106

8.5.4 BARRIERS TO ENTRY AND COMPETITIVE DYNAMICS 107

8.5.5 LONG-TERM PROFITABILITY OUTLOOK 107

9 ADVANCED CERAMICS MARKET, BY MATERIAL 108

9.1 INTRODUCTION 109

9.2 ALUMINA 111

9.2.1 HIGH WEAR RESISTANCE & COMPRESSIVE STRENGTH TO DRIVE MARKET 111

9.3 ZIRCONIA 112

9.3.1 RISE IN DEMAND IN AUTOMOTIVE & MEDICAL SECTORS TO FUEL MARKET 112

9.4 TITANATE 112

9.4.1 ADVANCED INDUSTRIAL AND ELECTRONIC APPLICATIONS OF TITANATE CERAMICS TO PROPEL GROWTH 112

9.5 SILICON CARBIDE 113

9.5.1 EXCEPTIONAL THERMAL CONDUCTIVITY AND LARGE ELASTIC MODULUS TO PROPEL MARKET 113

9.6 PIEZO CERAMIC 114

9.6.1 HIGH DIELECTRIC CONSTANT AND PIEZOELECTRIC EFFECT TO FUEL MARKET GROWTH 114

9.7 OTHER MATERIALS 114

9.7.1 BERYLLIUM OXIDE 114

9.7.2 ALUMINUM NITRIDE 115

9.7.3 MAGNESIUM SILICATE 115

9.7.4 BORON NITRIDE 115

9.7.5 SILICON NITRIDE 116

10 ADVANCED CERAMICS MARKET, BY PRODUCT TYPE 117

10.1 INTRODUCTION 118

10.2 MONOLITHIC CERAMICS 120

10.2.1 HIGH DEMAND FROM MEDICAL AND ELECTRICAL & ELECTRONICS INDUSTRIES TO DRIVE MARKET 120

10.3 CERAMIC MATRIX COMPOSITES 120

10.3.1 HIGHER DEMAND FOR LIGHTWEIGHT, HIGH-TEMPERATURE STRUCTURAL MATERIALS TO DRIVE MARKET 120

10.4 CERAMIC COATINGS 121

10.4.1 GROWTH IN DEMAND FOR HIGH-PERFORMANCE SURFACE PROTECTION TO FUEL MARKET 121

10.5 CERAMIC FILTERS 122

10.5.1 RESISTANCE TO HIGH TEMPERATURES AND EXCELLENT FILTRATION EFFICIENCY TO SUPPORT MARKET GROWTH 122

10.6 OTHER PRODUCT TYPES 122

10.6.1 MULTILAYER CERAMICS 122

10.6.2 ADVANCED COATINGS 123

11 ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY 124

11.1 INTRODUCTION 125

11.2 ELECTRICAL & ELECTRONICS 130

11.2.1 HIGH DEMAND FOR PIEZOELECTRIC DEVICES IN CAPACITORS AND INTEGRATED CIRCUIT PACKAGES TO PROPEL MARKET GROWTH 130

11.2.2 HOME APPLIANCES 130

11.2.3 MOBILE PHONES 131

11.2.4 OTHER ELECTRICAL & ELECTRONIC END USES 131

11.3 TRANSPORTATION 132

11.3.1 INCREASE IN DEMAND FOR SAFE AND RELIABLE CERAMICS FROM AUTOMOTIVE INDUSTRY TO DRIVE MARKET 132

11.3.2 AUTOMOTIVE 132

11.3.3 AEROSPACE 133

11.3.4 OTHER TRANSPORTATION END USES 133

11.4 MEDICAL 134

11.4.1 SURGE IN NEED FOR DENTAL IMPLANTS TO BOOST DEMAND FOR CERAMICS 134

11.4.2 MEDICAL DEVICES 134

11.4.3 DENTISTRY 135

11.4.4 ARTHROPLASTY 135

11.5 DEFENSE & SECURITY 135

11.5.1 INCREASING DEMAND FOR ALUMINA AND SILICON CARBIDE IN ARMOR AND WEAPONS TO DRIVE MARKET 135

11.5.2 MILITARY EQUIPMENT AND ARMOR 136

11.5.3 ARTILLERY WEAPONS AND VEHICLES 136

11.5.4 SECURITY AND SURVEILLANCE SYSTEMS 136

11.6 ENVIRONMENTAL 137

11.6.1 ADVANCED CERAMICS’ APPLICATIONS IN RENEWABLE TECHNOLOGY TO BOOST DEMAND 137

11.6.2 CONVENTIONAL 137

11.6.3 NON-CONVENTIONAL 138

11.7 CHEMICALS 138

11.7.1 GREATER DEMAND FROM CHEMICAL PROCESSING INDUSTRY TO DRIVE MARKET 138

11.7.2 CHEMICAL PROCESSING AND REACTION CONTROL 138

11.7.3 MATERIAL SEPARATION 139

11.7.4 CONVEYING EQUIPMENT 139

11.8 OTHER END-USE INDUSTRIES 139

11.8.1 TEXTILE 139

11.8.2 MARINE 140

11.8.3 MINING 140

12 ADVANCED CERAMICS MARKET, BY REGION 141

12.1 INTRODUCTION 142

12.2 ASIA PACIFIC 144

12.2.1 CHINA 151

12.2.1.1 Presence of huge manufacturing base to drive market growth 151

12.2.2 JAPAN 153

12.2.2.1 Development of advanced technologies, large electronics base,

and efficient use of natural resources to fuel market growth 153

12.2.3 INDIA 155

12.2.3.1 Increase in industrialization to drive market 155

12.2.4 SOUTH KOREA 157

12.2.4.1 Rapid adoption of smart devices, IoT, 5G, and EV electronics to bolster growth 157

12.2.5 TAIWAN 159

12.2.5.1 Strong semiconductor and electronics industry to drive market 159

12.2.6 REST OF ASIA PACIFIC 161

12.3 NORTH AMERICA 163

12.3.1 US 169

12.3.1.1 Advancements in aerospace & defense to fuel consumption of advanced ceramics 169

12.3.2 CANADA 171

12.3.2.1 Mining and heavy industry adopt advanced ceramics for wear-resistant applications and fuel market 171

12.3.3 MEXICO 173

12.3.3.1 Emergence as manufacturing hub to drive demand 173

12.4 EUROPE 175

12.4.1 GERMANY 182

12.4.1.1 Strong automotive industry using ceramics in EVs and thermal components to drive growth 182

12.4.2 ITALY 184

12.4.2.1 Strong industrial machinery sector to propel demand for wear-resistant and high-strength ceramic components 184

12.4.3 FRANCE 186

12.4.3.1 Growth in healthcare sector to boost demand for bioceramics in implants and medical devices 186

12.4.4 UK 188

12.4.4.1 Export-oriented manufacturing to increase demand for high-value ceramic products 188

12.4.5 SPAIN 190

12.4.5.1 Spain’s renewable energy growth to boost market for advanced ceramics 190

12.4.6 REST OF EUROPE 192

12.5 MIDDLE EAST & AFRICA 194

12.5.1 GCC COUNTRIES 200

12.5.1.1 Saudi Arabia 200

12.5.1.1.1 Vision 2030 industrial diversification to increase adoption of advanced materials 200

12.5.1.2 UAE 202

12.5.1.2.1 Rapid industrialization and infrastructural growth to drive market 202

12.5.1.3 Rest of GCC countries 204

12.5.2 SOUTH AFRICA 206

12.5.2.1 Country’s diversified chemical & petrochemical industry to propel market 206

12.5.3 REST OF MIDDLE EAST & AFRICA 208

12.6 SOUTH AMERICA 210

12.6.1 ARGENTINA 216

12.6.1.1 Industrial modernization and import substitution to fuel demand 216

12.6.2 BRAZIL 218

12.6.2.1 Growth in industrial and consumer electronics production to support market growth 218

12.6.3 REST OF SOUTH AMERICA 220

13 COMPETITIVE LANDSCAPE 223

13.1 INTRODUCTION 223

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 223

13.3 MARKET SHARE ANALYSIS, 2024 226

13.3.1 KYOCERA CORPORATION 227

13.3.2 CERAMTEC GMBH 227

13.3.3 COORSTEK INC. 227

13.3.4 MORGAN ADVANCED MATERIALS 228

13.3.5 3M 228

13.4 REVENUE ANALYSIS, 2021–2024 228

13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 229

13.5.1 STARS 229

13.5.2 EMERGING LEADERS 229

13.5.3 PERVASIVE PLAYERS 229

13.5.4 PARTICIPANTS 229

13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 231

13.5.5.1 Company footprint 231

13.5.5.2 Regional footprint 232

13.5.5.3 Material footprint 232

13.5.5.4 Product type footprint 233

13.5.5.5 End-use industry footprint 234

13.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 234

13.6.1 PROGRESSIVE COMPANIES 234

13.6.2 RESPONSIVE COMPANIES 234

13.6.3 DYNAMIC COMPANIES 235

13.6.4 STARTING BLOCKS 235

13.6.5 COMPETITIVE BENCHMARKING 236

13.6.5.1 Detailed list of key startups/SMEs 236

13.6.5.2 Competitive benchmarking of key startups/SMEs 237

13.7 BRAND/PRODUCT COMPARISON 239

13.8 COMPANY VALUATION AND FINANCIAL METRICS 239

13.9 COMPETITIVE SCENARIO AND TRENDS 240

13.9.1 DEALS 240

13.9.2 EXPANSIONS 242

13.9.3 OTHER DEVELOPMENTS 244

14 COMPANY PROFILES 245

14.1 KEY PLAYERS 245

14.1.1 KYOCERA CORPORATION 245

14.1.1.1 Business overview 245

14.1.1.2 Products/Solutions/Services offered 246

14.1.1.3 Recent developments 248

14.1.1.3.1 Deals 248

14.1.1.3.2 Expansions 248

14.1.1.4 MnM view 249

14.1.1.4.1 Key strengths/Right to win 249

14.1.1.4.2 Strategic choices 250

14.1.1.4.3 Weaknesses/Competitive threats 250

14.1.2 CERAMTEC GMBH 251

14.1.2.1 Business overview 251

14.1.2.2 Products/Solutions/Services offered 251

14.1.2.3 MnM view 253

14.1.2.3.1 Key strengths/Right to win 253

14.1.2.3.2 Strategic choices 253

14.1.2.3.3 Weaknesses/Competitive threats 253

14.1.3 COORSTEK INC. 254

14.1.3.1 Business overview 254

14.1.3.2 Products/Solutions/Services offered 254

14.1.3.3 Recent developments 256

14.1.3.3.1 Expansions 256

14.1.3.3.2 Other developments 256

14.1.3.4 MnM view 257

14.1.3.4.1 Key strengths/Right to win 257

14.1.3.4.2 Strategic choices 257

14.1.3.4.3 Weaknesses/Competitive threats 257

14.1.4 MORGAN ADVANCED MATERIALS 258

14.1.4.1 Business overview 258

14.1.4.2 Products/Solutions/Services offered 259

14.1.4.3 Recent developments 261

14.1.4.3.1 Deals 261

14.1.4.3.2 Other developments 261

14.1.4.4 MnM view 262

14.1.4.4.1 Key strengths/Right to win 262

14.1.4.4.2 Strategic choices 262

14.1.4.4.3 Weaknesses/Competitive threats 262

14.1.5 MARUWA CO., LTD. 263

14.1.5.1 Business overview 263

14.1.5.2 Products/Solutions/Services offered 264

14.1.5.3 MnM view 265

14.1.5.3.1 Key strengths/Right to win 265

14.1.5.3.2 Strategic choices 265

14.1.5.3.3 Weaknesses/Competitive threats 265

14.1.6 MATERION CORPORATION 266

14.1.6.1 Business overview 266

14.1.6.2 Products/Solutions/Services offered 267

14.1.6.3 Recent developments 268

14.1.6.3.1 Deals 268

14.1.6.4 MnM view 268

14.1.6.4.1 Key strengths/Right to win 268

14.1.6.4.2 Strategic choices 268

14.1.6.4.3 Weaknesses/Competitive threats 268

14.1.7 FERROTEC CORPORATION 269

14.1.7.1 Business overview 269

14.1.7.2 Products/Solutions/Services offered 270

14.1.7.3 Recent developments 271

14.1.7.3.1 Expansions 271

14.1.7.4 MnM view 271

14.1.7.4.1 Key strengths/Right to win 271

14.1.7.4.2 Strategic choices 272

14.1.7.4.3 Weaknesses/Competitive threats 272

14.1.8 SAINT-GOBAIN PERFORMANCE CERAMICS & REFRACTORIES 273

14.1.8.1 Business overview 273

14.1.8.2 Products/Solutions/Services offered 273

14.1.8.3 MnM view 274

14.1.8.3.1 Key strengths/Right to win 274

14.1.8.3.2 Strategic choices 275

14.1.8.3.3 Weaknesses/Competitive threats 275

14.1.9 AGC INC. 276

14.1.9.1 Business overview 276

14.1.9.2 Products/Solutions/Services offered 277

14.1.9.3 Recent developments 278

14.1.9.3.1 Developments 278

14.1.9.4 MnM view 278

14.1.9.4.1 Key strengths/Right to win 278

14.1.9.4.2 Strategic choices 278

14.1.9.4.3 Weaknesses/Competitive threats 278

14.1.10 3M 279

14.1.10.1 Business overview 279

14.1.10.2 Products/Solutions/Services offered 280

14.1.10.3 MnM view 281

14.1.10.3.1 Right to win 281

14.1.10.3.2 Strategic choices 282

14.1.10.3.3 Weaknesses and competitive threats 282

14.2 OTHER PLAYERS 283

14.2.1 ORTECH, INC. 283

14.2.2 ADVANCED CERAMIC MATERIALS 284

14.2.3 STC MATERIAL SOLUTIONS 285

14.2.4 NISHIMURA ADVANCED CERAMICS CO., LTD. 286

14.2.5 BCE SPECIAL CERAMICS GMBH 287

14.2.6 GREAT CERAMIC 288

14.2.7 ELAN TECHNOLOGY 289

14.2.8 PAUL RAUSCHERT GMBH & CO. KG. 290

14.2.9 ADTECH CERAMICS 291

14.2.10 BAKONY TECHNICAL CERAMICS LTD. 292

14.2.11 WUXI SPECIAL CERAMIC ELECTRICAL CO., LTD. 293

14.2.12 DYSON TECHNICAL CERAMICS 294

14.2.13 BLASCH PRECISION CERAMICS, INC. 295

14.2.14 HEBEI SUOYI NEW MATERIAL TECHNOLOGY CO., LTD. 296

14.2.15 JAPAN FINE CERAMICS CO., LTD. 297

15 RESEARCH METHODOLOGY 298

15.1 RESEARCH DATA 298

15.1.1 SECONDARY DATA 299

15.1.1.1 Key data from secondary sources 299

15.1.2 PRIMARY DATA 300

15.1.2.1 Key data from primary sources 300

15.1.2.2 Key primary interview participants 300

15.1.2.3 Breakdown of primary interviews 301

15.1.2.4 Key industry insights 301

15.2 MARKET SIZE ESTIMATION 302

15.2.1 BOTTOM-UP APPROACH 302

15.2.2 TOP-DOWN APPROACH 303

15.3 BASE NUMBER CALCULATION 303

15.4 MARKET FORECAST APPROACH 304

15.4.1 SUPPLY SIDE 304

15.4.2 DEMAND SIDE 304

15.5 DATA TRIANGULATION 304

15.6 FACTOR ANALYSIS 306

15.7 RESEARCH ASSUMPTIONS 306

15.8 RESEARCH LIMITATIONS AND RISK ASSESSMENT 307

16 APPENDIX 308

16.1 DISCUSSION GUIDE 308

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 311

16.3 CUSTOMIZATION OPTIONS 313

16.4 RELATED REPORTS 313

16.5 AUTHOR DETAILS 314

LIST OF TABLES

TABLE 1 INCLUSIONS AND EXCLUSIONS 31

TABLE 2 INTERCONNECTED MARKETS 50

TABLE 3 KEY MOVES AND STRATEGIC FOCUS 52

TABLE 4 ADVANCED CERAMICS MARKET: PORTER’S FIVE FORCES ANALYSIS 54

TABLE 5 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021–2029 56

TABLE 6 AVERAGE SELLING PRICE TREND, BY REGION, 2021–2024 (USD/KG) 61

TABLE 7 AVERAGE SELLING PRICE TREND, BY MATERIAL, 2021–2024 (USD/KG) 62

TABLE 8 AVERAGE SELLING PRICE TREND, BY PRODUCT TYPE, 2021–2024 (USD/KG) 62

TABLE 9 AVERAGE SELLING PRICE TREND, BY END-USE INDUSTRY, 2021–2024 (USD/KG) 63

TABLE 10 AVERAGE SELLING PRICING OF ADVANCED CERAMICS AMONG KEY PLAYERS,

BY MATERIAL, 2024, (USD/TON) 63

TABLE 11 ROLES OF COMPANIES IN ADVANCED CERAMICS ECOSYSTEM 65

TABLE 12 ADVANCED CERAMICS MARKET: KEY CONFERENCES AND EVENTS, 2026 67

TABLE 13 US-ADJUSTED RECIPROCAL TARIFF RATES 72

TABLE 14 EXPECTED CHANGE IN PRICES AND IMPACT ON END-USE MARKET DUE TO TARIFFS 73

TABLE 15 TOTAL NUMBER OF PATENTS 79

TABLE 16 ADVANCED CERAMICS: LIST OF MAJOR PATENTS, 2016–2025 81

TABLE 17 TOP USE CASES AND MARKET POTENTIAL 87

TABLE 18 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES 88

TABLE 19 ADVANCED CERAMICS MARKET: CASE STUDIES RELATED TO GEN AI IMPLEMENTATION 89

TABLE 20 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 90

TABLE 21 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 92

TABLE 22 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 93

TABLE 23 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 93

TABLE 24 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 94

TABLE 25 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 94

TABLE 26 GLOBAL INDUSTRY STANDARDS IN ADVANCED CERAMICS MARKET 95

TABLE 27 CERTIFICATIONS, LABELING, ECO-STANDARDS IN ADVANCED CERAMICS MARKET 99

TABLE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY 102

TABLE 29 KEY BUYING CRITERIA, BY END-USE INDUSTRY 103

TABLE 30 UNMET NEEDS IN ADVANCED CERAMICS IN VARIOUS END-USE INDUSTRIES 105

TABLE 31 ADVANCED CERAMICS MARKET, BY MATERIAL, 2021–2024 (USD MILLION) 109

TABLE 32 ADVANCED CERAMICS MARKET, BY MATERIAL, 2025–2030 (USD MILLION) 110

TABLE 33 ADVANCED CERAMICS MARKET, BY MATERIAL, 2021–2024 (KILOTON) 110

TABLE 34 ADVANCED CERAMICS MARKET, BY MATERIAL, 2025–2030 (KILOTON) 110

TABLE 35 ADVANCED CERAMICS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION) 118

TABLE 36 ADVANCED CERAMICS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION) 119

TABLE 37 ADVANCED CERAMICS MARKET, BY PRODUCT TYPE, 2021–2024 (KILOTON) 119

TABLE 38 ADVANCED CERAMICS MARKET, BY PRODUCT TYPE, 2025–2030 (KILOTON) 119

TABLE 39 ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 126

TABLE 40 ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 127

TABLE 41 ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY, 2021–2024 (KILOTON) 128

TABLE 42 ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 129

TABLE 43 ADVANCED CERAMICS MARKET, BY REGION, 2021–2024 (USD MILLION) 143

TABLE 44 ADVANCED CERAMICS MARKET, BY REGION, 2025–2030 (USD MILLION) 143

TABLE 45 ADVANCED CERAMICS MARKET, BY REGION, 2021–2024 (KILOTON) 143

TABLE 46 ADVANCED CERAMICS MARKET, BY REGION, 2025–2030 (KILOTON) 144

TABLE 47 ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 145

TABLE 48 ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 146

TABLE 49 ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY COUNTRY,

2021–2024 (KILOTON) 146

TABLE 50 ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 146

TABLE 51 ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 147

TABLE 52 ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 147

TABLE 53 ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY MATERIAL,

2021–2024 (KILOTON) 147

TABLE 54 ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY MATERIAL,

2025–2030 (KILOTON) 148

TABLE 55 ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE,

2021–2024 (USD MILLION) 148

TABLE 56 ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE,

2025–2030 (USD MILLION) 148

TABLE 57 ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE,

2021–2024 (KILOTON) 149

TABLE 58 ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE,

2025–2030 (KILOTON) 149

TABLE 59 ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 149

TABLE 60 ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 150

TABLE 61 ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 150

TABLE 62 ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 150

TABLE 63 CHINA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 151

TABLE 64 CHINA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 152

TABLE 65 CHINA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 152

TABLE 66 CHINA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 152

TABLE 67 JAPAN: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 153

TABLE 68 JAPAN: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 154

TABLE 69 JAPAN: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 154

TABLE 70 JAPAN: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 154

TABLE 71 INDIA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 155

TABLE 72 INDIA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 156

TABLE 73 INDIA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 156

TABLE 74 INDIA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 156

TABLE 75 SOUTH KOREA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 157

TABLE 76 SOUTH KOREA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 158

TABLE 77 SOUTH KOREA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 158

TABLE 78 SOUTH KOREA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 158

TABLE 79 TAIWAN: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 159

TABLE 80 TAIWAN: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 160

TABLE 81 TAIWAN: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 160

TABLE 82 TAIWAN: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 160

TABLE 83 REST OF ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY, 2021–2024 (USD MILLION) 161

TABLE 84 REST OF ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 162

TABLE 85 REST OF ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY, 2021–2024 (KILOTON) 162

TABLE 86 REST OF ASIA PACIFIC: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 162

TABLE 87 NORTH AMERICA: ADVANCED CERAMICS MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 164

TABLE 88 NORTH AMERICA: ADVANCED CERAMICS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 164

TABLE 89 NORTH AMERICA: ADVANCED CERAMICS MARKET, BY COUNTRY,

2021–2024 (KILOTON) 165

TABLE 90 NORTH AMERICA: ADVANCED CERAMICS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 165

TABLE 91 NORTH AMERICA: ADVANCED CERAMICS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 165

TABLE 92 NORTH AMERICA: ADVANCED CERAMICS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 166

TABLE 93 NORTH AMERICA: ADVANCED CERAMICS MARKET, BY MATERIAL,

2021–2024 (KILOTON) 166

TABLE 94 NORTH AMERICA: ADVANCED CERAMICS MARKET, BY MATERIAL,

2025–2030 (KILOTON) 166

TABLE 95 NORTH AMERICA: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE,

2021–2024 (USD MILLION) 167

TABLE 96 NORTH AMERICA: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE,

2025–2030 (USD MILLION) 167

TABLE 97 NORTH AMERICA: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE,

2021–2024 (KILOTON) 167

TABLE 98 NORTH AMERICA: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE,

2025–2030 (KILOTON) 168

TABLE 99 NORTH AMERICA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 168

TABLE 100 NORTH AMERICA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 168

TABLE 101 NORTH AMERICA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 169

TABLE 102 NORTH AMERICA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 169

TABLE 103 US: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 170

TABLE 104 US: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 170

TABLE 105 US: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 171

TABLE 106 US: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 171

TABLE 107 CANADA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 172

TABLE 108 CANADA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 172

TABLE 109 CANADA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 173

TABLE 110 CANADA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 173

TABLE 111 MEXICO: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 174

TABLE 112 MEXICO: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 174

TABLE 113 MEXICO: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 175

TABLE 114 MEXICO: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 175

TABLE 115 EUROPE: ADVANCED CERAMICS MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 176

TABLE 116 EUROPE: ADVANCED CERAMICS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 177

TABLE 117 EUROPE: ADVANCED CERAMICS MARKET, BY COUNTRY,

2021–2024 (TONS) 177

TABLE 118 EUROPE: ADVANCED CERAMICS MARKET, BY COUNTRY, 2025–2030 (TONS) 177

TABLE 119 EUROPE: ADVANCED CERAMICS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 178

TABLE 120 EUROPE: ADVANCED CERAMICS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 178

TABLE 121 EUROPE: ADVANCED CERAMICS MARKET, BY MATERIAL, 2021–2024 (KILOTON) 178

TABLE 122 EUROPE: ADVANCED CERAMICS MARKET, BY MATERIAL, 2025–2030 (KILOTON) 179

TABLE 123 EUROPE: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE,

2021–2024 (USD MILLION) 179

TABLE 124 EUROPE: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE,

2025–2030 (USD MILLION) 179

TABLE 125 EUROPE: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE,

2021–2024 (KILOTON) 180

TABLE 126 EUROPE: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE,

2025–2030 (KILOTON) 180

TABLE 127 EUROPE: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 180

TABLE 128 EUROPE: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 181

TABLE 129 EUROPE: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 181

TABLE 130 EUROPE: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 181

TABLE 131 GERMANY: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 182

TABLE 132 GERMANY: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 183

TABLE 133 GERMANY: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 183

TABLE 134 GERMANY: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 183

TABLE 135 ITALY: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 184

TABLE 136 ITALY: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 185

TABLE 137 ITALY: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 185

TABLE 138 ITALY: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 185

TABLE 139 FRANCE: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 186

TABLE 140 FRANCE: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 187

TABLE 141 FRANCE: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 187

TABLE 142 FRANCE: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 187

TABLE 143 UK: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 188

TABLE 144 UK: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 189

TABLE 145 UK: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 189

TABLE 146 UK: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 189

TABLE 147 SPAIN: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 190

TABLE 148 SPAIN: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 191

TABLE 149 SPAIN: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 191

TABLE 150 SPAIN: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 191

TABLE 151 REST OF EUROPE: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 192

TABLE 152 REST OF EUROPE: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 193

TABLE 153 REST OF EUROPE: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 193

TABLE 154 REST OF EUROPE: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 193

TABLE 155 MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 194

TABLE 156 MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 195

TABLE 157 MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET, BY COUNTRY,

2021–2024 (KILOTON) 195

TABLE 158 MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 195

TABLE 159 MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 196

TABLE 160 MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 196

TABLE 161 MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET, BY MATERIAL,

2021–2024 (KILOTON) 196

TABLE 162 MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET, BY MATERIAL,

2025–2030 (KILOTON) 197

TABLE 163 MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE, 2021–2024 (USD MILLION) 197

TABLE 164 MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE, 2025–2030 (USD MILLION) 197

TABLE 165 MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE, 2021–2024 (KILOTON) 198

TABLE 166 MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE, 2025–2030 (KILOTON) 198

TABLE 167 MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY, 2021–2024 (USD MILLION) 198

TABLE 168 MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 199

TABLE 169 MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY, 2021–2024 (KILOTON) 199

TABLE 170 MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY, 2025–2030 (KILOTON) 199

TABLE 171 SAUDI ARABIA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 201

TABLE 172 SAUDI ARABIA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 201

TABLE 173 SAUDI ARABIA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 201

TABLE 174 SAUDI ARABIA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 202

TABLE 175 UAE: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 203

TABLE 176 UAE: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 203

TABLE 177 UAE: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 203

TABLE 178 UAE: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 204

TABLE 179 REST OF GCC COUNTRIES: ADVANCED CERAMICS MARKET,

BY END-USE INDUSTRY, 2021–2024 (USD MILLION) 205

TABLE 180 REST OF GCC COUNTRIES: ADVANCED CERAMICS MARKET,

BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 205

TABLE 181 REST OF GCC COUNTRIES: ADVANCED CERAMICS MARKET,

BY END-USE INDUSTRY, 2021–2024 (KILOTON) 205

TABLE 182 REST OF GCC COUNTRIES: ADVANCED CERAMICS MARKET,

BY END-USE INDUSTRY, 2025–2030 (KILOTON) 206

TABLE 183 SOUTH AFRICA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 207

TABLE 184 SOUTH AFRICA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 207

TABLE 185 SOUTH AFRICA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 207

TABLE 186 SOUTH AFRICA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 208

TABLE 187 REST OF MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET,

BY END-USE INDUSTRY, 2021–2024 (USD MILLION) 209

TABLE 188 REST OF MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET,

BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 209

TABLE 189 REST OF MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET,

BY END-USE INDUSTRY, 2021–2024 (KILOTON) 209

TABLE 190 REST OF MIDDLE EAST & AFRICA: ADVANCED CERAMICS MARKET,

BY END-USE INDUSTRY, 2025–2030 (KILOTON) 210

TABLE 191 SOUTH AMERICA: ADVANCED CERAMICS MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 211

TABLE 192 SOUTH AMERICA: ADVANCED CERAMICS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 211

TABLE 193 SOUTH AMERICA: ADVANCED CERAMICS MARKET, BY COUNTRY,

2021–2024 (KILOTON) 211

TABLE 194 SOUTH AMERICA: ADVANCED CERAMICS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 212

TABLE 195 SOUTH AMERICA: ADVANCED CERAMICS MARKET, BY MATERIAL,

2021–2024 (USD MILLION) 212

TABLE 196 SOUTH AMERICA: ADVANCED CERAMICS MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 212

TABLE 197 SOUTH AMERICA: ADVANCED CERAMICS MARKET, BY MATERIAL,

2021–2024 (KILOTON) 213

TABLE 198 SOUTH AMERICA: ADVANCED CERAMICS MARKET, BY MATERIAL,

2025–2030 (KILOTON) 213

TABLE 199 SOUTH AMERICA: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE,

2021–2024 (USD MILLION) 213

TABLE 200 SOUTH AMERICA: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE,

2025–2030 (USD MILLION) 214

TABLE 201 SOUTH AMERICA: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE,

2021–2024 (KILOTON) 214

TABLE 202 SOUTH AMERICA: ADVANCED CERAMICS MARKET, BY PRODUCT TYPE,

2025–2030 (KILOTON) 214

TABLE 203 SOUTH AMERICA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 215

TABLE 204 SOUTH AMERICA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 215

TABLE 205 SOUTH AMERICA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 215

TABLE 206 SOUTH AMERICA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 216

TABLE 207 ARGENTINA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 217

TABLE 208 ARGENTINA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 217

TABLE 209 ARGENTINA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 217

TABLE 210 ARGENTINA: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 218

TABLE 211 BRAZIL: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (USD MILLION) 219

TABLE 212 BRAZIL: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (USD MILLION) 219

TABLE 213 BRAZIL: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2021–2024 (KILOTON) 219

TABLE 214 BRAZIL: ADVANCED CERAMICS MARKET, BY END-USE INDUSTRY,

2025–2030 (KILOTON) 220

TABLE 215 REST OF SOUTH AMERICA: ADVANCED CERAMICS MARKET,

BY END-USE INDUSTRY, 2021–2024 (USD MILLION) 221

TABLE 216 REST OF SOUTH AMERICA: ADVANCED CERAMICS MARKET,

BY END-USE INDUSTRY, 2025–2030 (USD MILLION) 221

TABLE 217 REST OF SOUTH AMERICA: ADVANCED CERAMICS MARKET,

BY END-USE INDUSTRY, 2021–2024 (KILOTON) 221

TABLE 218 REST OF SOUTH AMERICA: ADVANCED CERAMICS MARKET,

BY END-USE INDUSTRY, 2025–2030 (KILOTON) 222

TABLE 219 ADVANCED CERAMICS MARKET: OVERVIEW OF STRATEGIES ADOPTED

BY KEY PLAYERS 223

TABLE 220 ADVANCED CERAMICS MARKET: DEGREE OF COMPETITION, 2024 226

TABLE 221 ADVANCED CERAMICS MARKET: REGIONAL FOOTPRINT, 2024 232

TABLE 222 ADVANCED CERAMICS MARKET: MATERIAL FOOTPRINT, 2024 232

TABLE 223 ADVANCED CERAMICS MARKET: PRODUCT TYPE FOOTPRINT, 2024 233

TABLE 224 ADVANCED CERAMICS MARKET: END-USE INDUSTRY FOOTPRINT, 2024 234

TABLE 225 ADVANCED CERAMICS MARKET: DETAILED LIST OF KEY STARTUPS/SMES 236

TABLE 226 ADVANCED CERAMICS MARKET: COMPETITIVE BENCHMARKING OF

KEY STARTUPS/SMES 237

TABLE 227 ADVANCED CERAMICS MARKET: DEALS, JANUARY 2021−DECEMBER 2025 241

TABLE 228 ADVANCED CERAMICS MARKET: EXPANSIONS, JANUARY 2021−DECEMBER 2025 242

TABLE 229 ADVANCED CERAMICS MARKET: OTHER DEVELOPMENTS,

JANUARY 2021−DECEMBER 2025 244

TABLE 230 KYOCERA CORPORATION: COMPANY OVERVIEW 245

TABLE 231 KYOCERA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 246

TABLE 232 KYOCERA CORPORATION: DEALS 248

TABLE 233 KYOCERA CORPORATION: EXPANSIONS 248

TABLE 234 CERAMTEC GMBH: COMPANY OVERVIEW 251

TABLE 235 CERAMTEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED 251

TABLE 236 COORSTEK INC.: COMPANY OVERVIEW 254

TABLE 237 COORSTEK INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 254

TABLE 238 COORSTEK INC.: EXPANSIONS 256

TABLE 239 COORSTEK INC.: OTHER DEVELOPMENTS 256

TABLE 240 MORGAN ADVANCED MATERIALS: COMPANY OVERVIEW 258

TABLE 241 MORGAN ADVANCED MATERIALS: PRODUCTS/SOLUTIONS/SERVICES OFFERED 259

TABLE 242 MORGAN ADVANCED MATERIALS: DEALS 261

TABLE 243 MORGAN ADVANCED MATERIALS: OTHER DEVELOPMENTS 261

TABLE 244 MARUWA CO., LTD.: COMPANY OVERVIEW 263

TABLE 245 MARUWA CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 264

TABLE 246 MATERION CORPORATION: COMPANY OVERVIEW 266

TABLE 247 MATERION CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 267

TABLE 248 MATERION CORPORATION: DEALS 268

TABLE 249 FERROTEC CORPORATION: COMPANY OVERVIEW 269

TABLE 250 FERROTEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 270

TABLE 251 FERROTEC CORPORATION: EXPANSIONS 271

TABLE 252 SAINT-GOBAIN PERFORMANCE CERAMICS & REFRACTORIES: COMPANY OVERVIEW 273

TABLE 253 SAINT-GOBAIN PERFORMANCE CERAMICS & REFRACTORIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED 273

TABLE 254 AGC INC.: COMPANY OVERVIEW 276

TABLE 255 AGC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 277

TABLE 256 AGC INC.: DEVELOPMENTS 278

TABLE 257 3M: COMPANY OVERVIEW 279

TABLE 258 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED 280

TABLE 259 ORTECH, INC.: COMPANY OVERVIEW 283

TABLE 260 ADVANCED CERAMIC MATERIALS: COMPANY OVERVIEW 284

TABLE 261 STMATERIAL SOLUTIONS: COMPANY OVERVIEW 285

TABLE 262 NISHIMURA ADVANCED CERAMICS CO., LTD.: COMPANY OVERVIEW 286

TABLE 263 BCE SPECIAL CERAMICS GMBH: COMPANY OVERVIEW 287

TABLE 264 GREAT CERAMIC: COMPANY OVERVIEW 288

TABLE 265 ELAN TECHNOLOGY: COMPANY OVERVIEW 289

TABLE 266 PAUL RAUSCHERT GMBH & CO. KG.: COMPANY OVERVIEW 290

TABLE 267 ADTECH CERAMICS: COMPANY OVERVIEW 291

TABLE 268 BAKONY TECHNICAL CERAMICS LTD.: COMPANY OVERVIEW 292

TABLE 269 WUXI SPECIAL CERAMIC ELECTRICAL CO., LTD.: COMPANY OVERVIEW 293

TABLE 270 DYSON TECHNICAL CERAMICS: COMPANY OVERVIEW 294

TABLE 271 BLASCH PRECISION CERAMICS, INC.: COMPANY OVERVIEW 295

TABLE 272 HEBEI SUOYI NEW MATERIAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW 296

TABLE 273 JAPAN FINE CERAMICS CO., LTD.: COMPANY OVERVIEW 297

TABLE 274 RESEARCH LIMITATIONS AND RISK ASSESSMENT 307

LIST OF FIGURES

FIGURE 1 ADVANCED CERAMICS MARKET SEGMENTATION AND REGIONAL SCOPE 30

FIGURE 2 STUDY YEARS CONSIDERED 32

FIGURE 3 MARKET SCENARIO 34

FIGURE 4 GLOBAL ADVANCED CERAMICS MARKET, 2021–2030 (USD MILLION) 35

FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN ADVANCED CERAMICS MARKET, 2021–2025 35

FIGURE 6 DISRUPTIVE INFLUENCING GROWTH OF ADVANCED CERAMICS MARKET 36

FIGURE 7 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN ADVANCED CERAMICS MARKET, 2025-2030 37

FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN ADVANCED CERAMICS MARKET,

IN TERMS OF VALUE, DURING FORECAST PERIOD 38

FIGURE 9 HIGH DEMAND IN ELECTRICAL & ELECTRONICS INDUSTRY TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS 39

FIGURE 10 ALUMINA ACCOUNTED FOR LARGEST MARKET SHARE IN 2024 40

FIGURE 11 MONOLITHIC CERAMICS SEGMENT DOMINATED ADVANCED CERAMICS

MARKET IN 2024 40

FIGURE 12 ELECTRICAL & ELECTRONICS SEGMENT ACCOUNTED FOR LARGEST MARKET SHARE IN 2024 41

FIGURE 13 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD 41

FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES:

ADVANCED CERAMICS MARKET 42

FIGURE 15 ADVANCED CERAMICS MARKET: PORTER’S FIVE FORCES ANALYSIS 53

FIGURE 16 ADVANCED CERAMICS MARKET: SUPPLY CHAIN ANALYSIS 59

FIGURE 17 AVERAGE SELLING PRICE TREND, BY REGION, 2021–2024 (USD/KG) 61

FIGURE 18 AVERAGE PRICING OF ADVANCED CERAMICS AMONG KEY PLAYERS,

BY MATERIAL, 2024 (USD/KG) 63

FIGURE 19 KEY PARTICIPANTS IN ADVANCED CERAMICS ECOSYSTEM 64

FIGURE 20 ADVANCED CERAMICS MARKET: ECOSYSTEM ANALYSIS 64

FIGURE 21 IMPORT DATA RELATED TO HS CODE 690390-COMPLIANT PRODUCTS,

BY KEY COUNTRY, 2021–2024 (USD THOUSAND) 66

FIGURE 22 EXPORT DATA RELATED TO HS CODE 690390-COMPLIANT PRODUCTS,

BY KEY COUNTRY, 2021–2024 (USD THOUSAND) 66

FIGURE 23 TRENDS/DISRUPTIONS INFLUENCING CUSTOMERS’ BUSINESS 68

FIGURE 24 PATENT ANALYSIS, BY DOCUMENT TYPE, JANUARY 2016–DECEMBER 2025 79

FIGURE 25 PATENTS PUBLICATION TRENDS, 2016–2025 79

FIGURE 26 PATENT ANALYSIS, BY LEGAL STATUS 80

FIGURE 27 REGIONAL ANALYSIS OF CENTRIFUGE-RELATED PATENTS GRANTED, 2024 80

FIGURE 28 TOP 10 PATENT APPLICANTS IN LAST TEN YEARS 81

FIGURE 29 FUTURE APPLICATIONS 84

FIGURE 30 SUCCESS STORIES AND REAL-WORLD APPLICATIONS 90

FIGURE 31 ADVANCED CERAMICS MARKET DECISION-MAKING FACTORS 101

FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY 102

FIGURE 33 KEY BUYING CRITERIA, BY END-USE INDUSTRY 103

FIGURE 34 ADOPTION BARRIERS & INTERNAL CHALLENGES 104

FIGURE 35 ALUMINA TO LEAD ADVANCED CERAMICS MARKET DURING FORECAST PERIOD 109

FIGURE 36 MONOLITHIC CERAMICS TO LEAD ADVANCED CERAMICS MARKET

DURING FORECAST PERIOD 118

FIGURE 37 ELECTRICAL & ELECTRONICS TO LEAD ADVANCED CERAMICS MARKET

DURING FORECAST PERIOD 125

FIGURE 38 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD 142

FIGURE 39 ASIA PACIFIC: ADVANCED CERAMICS MARKET SNAPSHOT 145

FIGURE 40 NORTH AMERICA: ADVANCED CERAMICS MARKET SNAPSHOT 164

FIGURE 41 EUROPE: ADVANCED CERAMICS MARKET SNAPSHOT 176

FIGURE 42 ADVANCED CERAMICS MARKET SHARE ANALYSIS, 2024 227

FIGURE 43 REVENUE ANALYSIS OF KEY PLAYERS, 2021–2024 (USD BILLION) 228

FIGURE 44 ADVANCED CERAMICS MARKET: COMPANY EVALUATION MATRIX,

KEY PLAYERS, 2024 230

FIGURE 45 ADVANCED CERAMICS MARKET: COMPANY FOOTPRINT, 2024 231

FIGURE 46 ADVANCED CERAMICS MARKET: COMPANY EVALUATION MATRIX, STARTUPS/SMES, 2024 235

FIGURE 47 BRAND/PRODUCT COMPARATIVE ANALYSIS, BY ADVANCED CERAMICS 239

FIGURE 48 ADVANCED CERAMICS MARKET: EV/EBITDA OF KEY COMPANIES, 2025 239

FIGURE 49 ADVANCED CERAMICS MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN, 2025 240

FIGURE 50 KYOCERA CORPORATION: COMPANY SNAPSHOT 246

FIGURE 51 MORGAN ADVANCED MATERIALS: COMPANY SNAPSHOT 259

FIGURE 52 MARUWA CO., LTD.: COMPANY SNAPSHOT 263

FIGURE 53 MATERION CORPORATION: COMPANY SNAPSHOT 267

FIGURE 54 FERROTEC CORPORATION: COMPANY SNAPSHOT 269

FIGURE 55 AGC INC.: COMPANY SNAPSHOT 277

FIGURE 56 3M: COMPANY SNAPSHOT 280

FIGURE 57 ADVANCED CERAMICS MARKET: RESEARCH DESIGN 298

FIGURE 58 KEY DATA FROM SECONDARY SOURCES 299

FIGURE 59 KEY DATA FROM PRIMARY SOURCES 300

FIGURE 60 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION,

AND REGION 301

FIGURE 61 INSIGHTS FROM KEY INDUSTRY EXPERTS 301

FIGURE 62 ADVANCED CERAMICS MARKET: BOTTOM-UP APPROACH 302

FIGURE 63 ADVANCED CERAMICS MARKET: TOP-DOWN APPROACH 303

FIGURE 64 APPROACH 1: SUPPLY-SIDE ANALYSIS 303

FIGURE 65 APPROACH 2: DEMAND-SIDE ANALYSIS 304

FIGURE 66 ADVANCED CERAMICS MARKET: DATA TRIANGULATION 305

FIGURE 67 FACTOR ANALYSIS 306

FIGURE 68 RESEARCH ASSUMPTIONS 306