Automated Guided Vehicle Market - Global Forecast to 2032

無人搬送車(AGV)市場 - タイプ(牽引車、ユニットロードキャリア、パレットトラック、組立ライン車両、フォークリフト、AGC、ハイブリッドAGV)、ナビゲーション技術(レーザー、磁気、誘導、光テープ、ビジョン) - 2032年までの世界予測

Automated Guided Vehicle (AGV) Market by Type (Tow Vehicles, Unit Load Carriers, Pallet Trucks, Assembly Line Vehicles, Forklift Trucks, AGCs, Hybrid AGVs), Navigation Technology (Laser, Magnetic, Inductive, Optical Tape, Vision) - Global Forecast to 2032

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年01月 |

| ページ数 | 345 |

| 図表数 | 393 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-6143 |

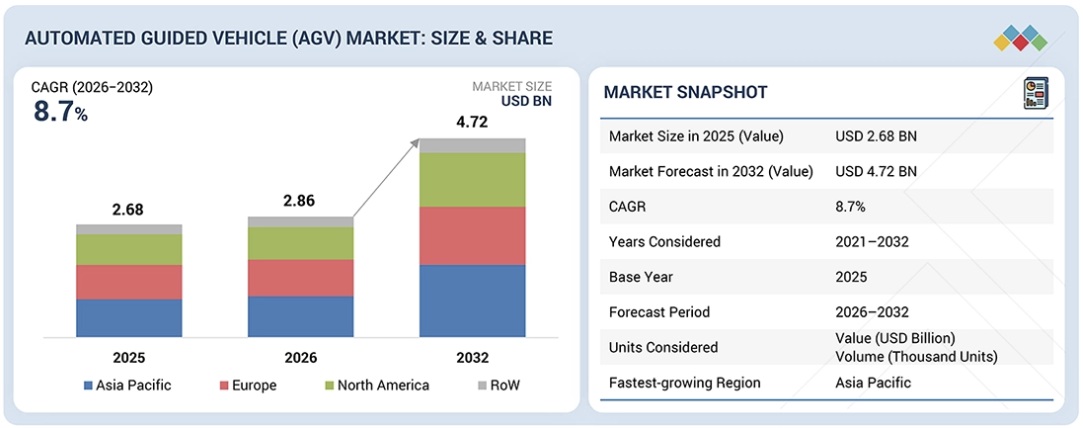

世界の無人搬送車(AGV)市場は、2026年の28億6,000万米ドルから2032年には47億2,000万米ドルに成長し、予測期間中に年平均成長率(CAGR)8.7%を記録すると予測されています。この成長は、企業が社内の資材フローの改善、手作業の削減、そして一貫した運用出力の維持に注力する中で、工場、倉庫、配送施設におけるAGVの導入増加に牽引されています。企業は、信頼性と安全性が極めて重要な構造化環境において、反復的な搬送作業、ラインフィーディング、牽引、パレット移動を支援するために、AGVの導入を拡大しています。安定したナビゲーション、効率的な交通管理、そして連続運転下でも信頼性の高い性能を提供するAGVシステムの需要が高まっています。工場の近代化、物流インフラの拡張、そして自動化のアップグレードへの継続的な投資も、市場の成長をさらに支えています。企業が効率性、コスト管理、そしてスケーラブルな自動化戦略を優先する中で、AGVは世界市場における長期的な資材搬送および運用最適化計画の不可欠な要素となりつつあります。

調査対象範囲

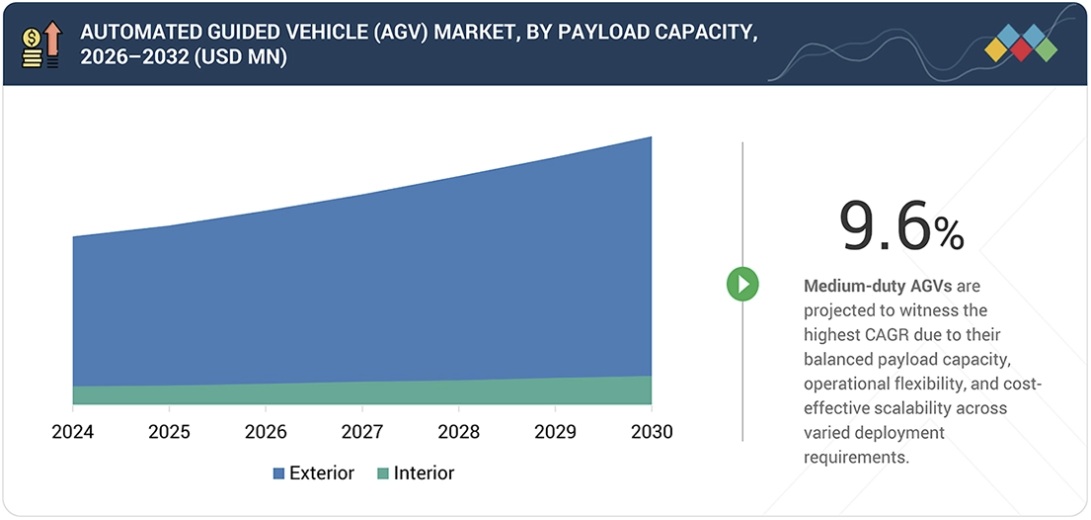

無人搬送車(AGV)市場に関する本レポートは、積載量、タイプ、ナビゲーション技術、業界、地域に基づいた詳細な分析を提供しています。積載量別には、500kg未満の軽量AGV、500~1,500kgの中量AGV、そして1,500kgを超える重量AGVに分類され、多様なマテリアルハンドリング要件に対応しています。タイプ別には、牽引車、ユニットロードキャリア、パレットトラック、組立ライン車両、フォークリフト、そして無人搬送カートやハイブリッドAGVなどのその他のタイプが含まれます。ナビゲーション技術別には、レーザー誘導、磁気誘導、誘導誘導、光テープ誘導、ビジョン誘導、そして慣性誘導、ビーコン誘導、推測航法などのその他のナビゲーション技術に分類されています。業界別に見ると、市場は自動車、化学、航空、半導体・エレクトロニクス、eコマース・小売、食品・飲料、医薬品、医療機器、金属・重機、物流/3PL、パルプ・紙、そして印刷・繊維などのその他の業界を網羅しています。地域別分析は、北米、欧州、アジア太平洋、そしてその他の地域をカバーしています。このセグメンテーションは、世界の無人搬送車(AGV)市場を形成する成長機会、導入パターン、そして技術開発の詳細な評価をサポートします。

本レポートは、市場全体および各サブセグメントの収益数値の近似値に関する情報を提供し、市場のリーダー企業および新規参入企業にとって役立ちます。本レポートは、ステークホルダーが競争環境を理解し、自社のポジショニングを改善し、適切な市場開拓戦略を策定するための洞察を深めるのに役立ちます。また、本レポートは、ステークホルダーが無人搬送車(AGV)市場の動向を理解するのにも役立ち、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供します。

レポートを購入する理由

本レポートは、市場全体および各サブセグメントの収益数値の近似値に関する情報を提供し、市場のリーダー企業および新規参入企業にとって役立ちます。本レポートは、ステークホルダーが競争環境を理解し、自社のポジショニングを改善し、適切な市場開拓戦略を策定するための洞察を深めるのに役立ちます。また、本レポートは、ステークホルダーが無人搬送車(AGV)市場の動向を理解するのにも役立ち、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供します。

本レポートを購入する主なメリット

無人搬送車(AGV)市場の成長に影響を与える主要な推進要因(多様な業界における自動化ソリューションの需要増加、職場の安全性向上への意識の高まり、大量生産から柔軟でカスタマイズされた製造への移行、高度なマテリアルハンドリング技術の需要増加、eコマース業界の成長加速)、制約要因(設置・保守・切り替えコストの高さ、移動ロボットへの需要増加によるAGV需要の抑制、発展途上市場におけるインフラの制約によるAGV導入の抑制)、機会(インダストリー4.0技術の統合拡大による倉庫近代化の加速、中小企業によるAGV投資の増加、新興市場における急速な工業化による自動化への強い需要の創出、東南アジアにおけるイントラロジスティクス部門の急速な成長、継続的なイノベーションによるAGVの機能拡張)、課題(新興市場における人件費の低下によるAGV導入の課題、技術的問題による運用停止時間の増加)の分析。

- 製品開発/イノベーション:無人搬送車(AGV)市場における今後の技術、研究開発活動、新製品投入に関する詳細な洞察。

- 市場開発:有望な市場に関する包括的な情報。本レポートでは、様々な地域における無人搬送車(AGV)市場を分析しています。

- 市場多様化:無人搬送車(AGV)市場における新製品/サービス、未開拓地域、最近の動向、投資に関する包括的な情報。

- 競合評価:ダイフク株式会社(日本)、豊田自動織機株式会社(日本)、KUKA SE & Co. KGaA(ドイツ)、KION GROUP AG(ドイツ)、JBT(米国)などの主要企業の市場シェア、成長戦略、サービス提供に関する詳細な評価。

Report Description

The global Automated Guided Vehicle (AGV) market is projected to grow from USD 2.86 billion in 2026 to USD 4.72 billion by 2032, registering a CAGR of 8.7 % during the forecast period. Growth is driven by increasing adoption of AGVs across factories, warehouses, and distribution facilities as organizations focus on improving internal material flow, reducing manual handling, and maintaining consistent operational output. Companies are expanding AGV deployments to support repetitive transport tasks, line feeding, towing, and pallet movement in structured environments where reliability and safety are critical. Demand is increasing for AGV systems that offer stable navigation, efficient traffic management, and dependable performance under continuous operation. Ongoing investment in factory modernization, logistics infrastructure expansion, and automation upgrades is further supporting market growth. As organizations prioritize efficiency, cost control, and scalable automation strategies, AGVs are becoming an integral component of long term material handling and operational optimization plans across global markets.

Automated Guided Vehicle Market – Global Forecast to 2032

“Light-Duty AGVs to Hold a Significant Share in the Automated Guided Vehicle Market”

The light-duty AGV segment is expected to hold a significant share of the Automated Guided Vehicle market during the forecast period, supported by strong adoption in applications requiring frequent and short distance material movement. Light-duty AGVs are widely deployed for tasks such as tote handling, small pallet transport, kitting, and line side replenishment across factories, warehouses, and distribution facilities. Their lower acquisition cost, compact form factor, and ease of deployment make them suitable for facilities with space constraints and moderate payload requirements. Companies are adopting light-duty AGVs to automate repetitive internal transport, improve workplace safety, and reduce reliance on manual labor. These systems support efficient traffic flow and continuous operation, helping organizations maintain consistent throughput and operational control. As automation expands across small and mid scale facilities and retrofit projects, demand for light-duty AGVs continues to grow, reinforcing their importance within the overall AGV market.

“Laser Guidance to Grow at a Significant CAGR in the Automated Guided Vehicle Market”

The laser guidance segment is expected to grow at a significant CAGR in the Automated Guided Vehicle market during the forecast period, supported by rising demand for high navigation accuracy and stable performance in structured industrial environments. Laser guided AGVs are widely adopted in facilities that require precise positioning, repeatable routing, and consistent operation over long duty cycles. These systems are well suited for factories, warehouses, and distribution centres where layout stability and predictable material flow are critical. Companies are adopting laser guidance to support higher throughput, reduce navigation errors, and improve safety in shared traffic areas. Laser guided AGVs also enable faster commissioning and reliable operation without frequent path adjustments, making them attractive for large scale deployments. As organizations expand automation in environments that prioritize accuracy, reliability, and controlled workflows, demand for laser guided AGVs continues to increase, supporting strong growth for this segment.

Automated Guided Vehicle Market – Global Forecast to 2032 – region

“Asia Pacific Emerges as the Fastest Growing Region in the Automated Guided Vehicle Market”

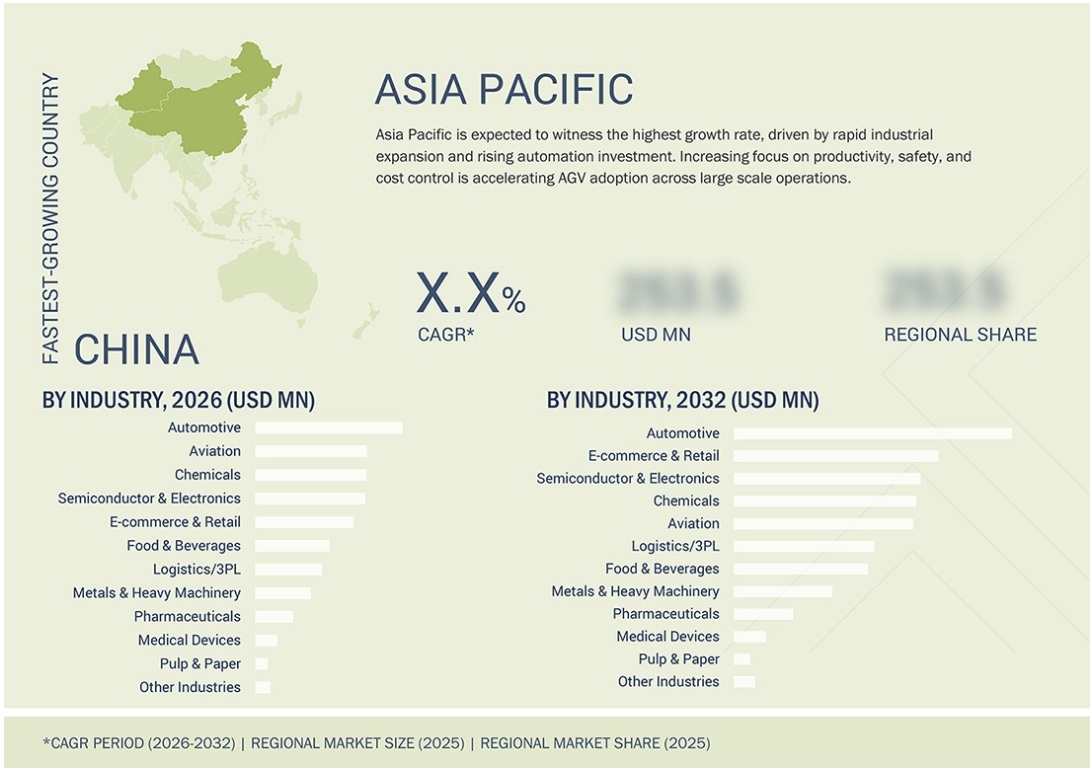

The Asia Pacific region is expected to witness the highest growth in the Automated Guided Vehicle market during the forecast period, supported by rapid expansion of manufacturing capacity, large scale warehouse development, and rising adoption of automation across production and logistics facilities. Companies across the region are deploying AGVs to improve internal material flow, reduce manual handling, and maintain consistent throughput in high volume operations. Strong growth in factory automation, distribution infrastructure, and intra facility transport requirements is increasing demand for structured and repeatable AGV based material handling systems. Government support for industrial modernization, smart manufacturing initiatives, and automation focused investment programs is further strengthening market momentum. Asia Pacific also benefits from a strong production base, cost competitive manufacturing, and a growing ecosystem of AGV suppliers and system integrators, which accelerates deployment across both new facilities and retrofit projects. With continued investment in automation, safety improvement, and operational efficiency, Asia Pacific is expected to remain the fastest growing region in the global AGV market throughout the forecast period.

Breakdown of primaries

A variety of executives from key organizations operating in the Automated Guided Vehicle (AGV) market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 –40%, Tier 2 – 35%, and Tier 3 – 25%

- By Designation: Directors – 40%, C-level – 45%, and Others – 15%

- By Region: Asia Pacific – 41%, North America – 26%, Europe – 28%, and RoW – 5%

Note: The RoW region includes the Middle East, Africa, and South America. Other designations include product, sales, and marketing managers. Three tiers of companies have been defined based on their total revenues: tier 3: revenue lesser than USD 100 million; tier 2: revenue between USD 100 million and USD 1 billion; and tier 1: revenue more than USD 1 billion.

Automated Guided Vehicle Market – Global Forecast to 2032 – ecosystem

Major players profiled in this report are as follows: Major companies operating in the Automated Guided Vehicle market include Daifuku Co., Ltd. (Japan), JBT (US), KION GROUP AG (Germany), Toyota Industries Corporation (Japan), KUKA SE & Co. KGaA (Germany), Jungheinrich AG (Germany), Scott (New Zealand), SSI SCHAEFER (Germany), Hyster-Yale Inc. (US), NEURA Mobile Robots GmbH (Germany), MEIDENSHA CORPORATION (Japan), MITSUBISHI LOGISNEXT CO., LTD (Japan), Oceaneering International, Inc. (US), AMERICA IN MOTION, INC. (US), Asseco CEIT, a.s. (Slovakia), Suzhou Casun Intelligent Robot Co., Ltd. (China), Jiangxi Danbao Robot Co., Ltd. (China), E80 Group S.p.A. (Italy), Global AGV (Denmark), Grenzebach Group (Germany), IDC Corporation (US), Nanchang Industrial Control Robot Co., Ltd. (China), SAFELOG GmbH (Germany), Simplex Robotics Pvt. Ltd. (India), System Logistics S.p.A. (Italy), and Balyo (France).

These companies compete through expansion of AGV portfolios, improvements in vehicle reliability and navigation performance, and alignment with structured material handling requirements across factories, warehouses, and distribution facilities. Strategic focus areas include scalable vehicle platforms, standardized safety compliance, flexible deployment models, and long term service support. Continued investment in automation programs, facility modernization, and internal logistics optimization is expected to sustain competition and drive steady innovation across the global AGV market.

The study provides a detailed competitive analysis of these key players in the Automated Guided Vehicle (AGV) market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

This report on the Automated Guided Vehicle (AGV) market presents a detailed analysis based on payload capacity, type, navigation technology, industry, and region. By payload capacity, the market is segmented into light-duty AGVs below 500 kg, medium-duty AGVs ranging from 500 to 1,500 kg, and heavy-duty AGVs above 1,500 kg to address varying material handling requirements. By type, the market includes tow vehicles, unit load carriers, pallet trucks, assembly line vehicles, forklift trucks, and other types such as automated guided carts and hybrid AGVs. By navigation technology, the market is segmented into laser guidance, magnetic guidance, inductive guidance, optical tape guidance, vision guidance, and other navigation technologies including inertial, beacon, and dead reckoning guidance. By industry, the market covers automotive, chemicals, aviation, semiconductor and electronics, e-commerce and retail, food and beverages, pharmaceuticals, medical devices, metals and heavy machinery, logistics/3PL, pulp and paper, and other industries such as printing and textile. The regional analysis covers North America, Europe, Asia Pacific, and Rest of the World. This segmentation supports detailed assessment of growth opportunities, adoption patterns, and technology developments shaping the global Automated Guided Vehicle (AGV) Market.

Reasons to buy the report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the Automated Guided Vehicle (AGV) market’s pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

Analysis of key drivers (Rising demand for automation solutions in diverse industries, rising emphasis on improving workplace safety, transition from mass production toward flexible, customized manufacturing, rising demand for advanced material handling technologies, and accelerating growth of the e-commerce industry), restraints (High installation, maintenance, and switching costs, growing preference for mobile robots limits AGV demand, and infrastructure limitations in developing markets restrain AGV adoption), opportunities (Rising integration of Industry 4.0 technologies accelerates warehousing modernization, growing investment in AGVs by small and medium-sized enterprises, rapid industrialization in emerging markets creates strong demand for automation, rapid growth of the intralogistics sector in Southeast Asia, ongoing innovation expands the functional capabilities of AGVs), and challenges (Lower labour expenses in emerging markets pose a challenge to AGV adoption, operational downtime driven by technical issues) influencing the growth of the Automated Guided Vehicle (AGV) market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the Automated Guided Vehicle (AGV) market.

- Market Development: Comprehensive information about lucrative markets – the report analyses the Automated Guided Vehicle (AGV) market across varied regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the Automated Guided Vehicle (AGV) market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Daifuku Co., Ltd. (Japan), Toyota Industries Corporation (Japan), KUKA SE & Co. KGaA (Germany), KION GROUP AG (Germany), JBT (US) and others.

Table of Contents

1 INTRODUCTION 32

1.1 STUDY OBJECTIVES 32

1.2 MARKET DEFINITION 32

1.3 MARKET SCOPE 33

1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE 33

1.3.2 YEARS CONSIDERED 34

1.3.3 INCLUSIONS AND EXCLUSIONS 34

1.4 CURRENCY CONSIDERED 36

1.5 UNIT CONSIDERED 36

1.6 LIMITATIONS 36

1.7 STAKEHOLDERS 36

1.8 SUMMARY OF CHANGES 37

2 EXECUTIVE SUMMARY 38

2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS 38

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 39

2.3 DISRUPTIVE TRENDS IN AUTOMATED GUIDED VEHICLE MARKET 40

2.4 HIGH-GROWTH SEGMENTS 41

2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST 42

3 PREMIUM INSIGHTS 44

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMATED GUIDED VEHICLE MARKET 44

3.2 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE 44

3.3 AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY 45

3.4 AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY 45

3.5 AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY 46

3.6 AUTOMATED GUIDED VEHICLE MARKET IN NORTH AMERICA, BY INDUSTRY AND COUNTRY 46

3.7 AUTOMATED GUIDED VEHICLE MARKET, BY GEOGRAPHY 47

4 MARKET OVERVIEW 48

4.1 INTRODUCTION 48

4.2 MARKET DYNAMICS 48

4.2.1 DRIVERS 48

4.2.1.1 Rising demand for automation across diverse industries 48

4.2.1.2 Growing emphasis on improving workplace safety 49

4.2.1.3 Transition from mass production toward flexible, customized manufacturing 49

4.2.1.4 Surging demand for advanced material handling technologies 49

4.2.1.5 Booming e-commerce industry 50

4.2.2 RESTRAINTS 51

4.2.2.1 High installation, maintenance, and switching costs 51

4.2.2.2 Growing preference for mobile robots over AGVs 51

4.2.2.3 Infrastructure limitations in developing markets 51

4.2.3 OPPORTUNITIES 52

4.2.3.1 Transformation of warehousing through adoption of Industry 4.0 technologies 52

4.2.3.2 Growing investment in AGVs by small and medium-sized enterprises 52

4.2.3.3 Rapid industrialization and e-commerce expansion in emerging markets 53

4.2.3.4 Ongoing innovations to improve AGV performance 53

4.2.4 CHALLENGES 54

4.2.4.1 Lower labor expenses in emerging markets 54

4.2.4.2 Operational downtime due to technical issues 55

4.3 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 55

4.4 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 57

5 INDUSTRY TRENDS 58

5.1 PORTER’S FIVE FORCES ANALYSIS 58

5.1.1 BARGAINING POWER OF SUPPLIERS 59

5.1.2 BARGAINING POWER OF BUYERS 59

5.1.3 THREAT OF NEW ENTRANTS 60

5.1.4 THREAT OF SUBSTITUTES 60

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 60

5.2 MACROECONOMIC OUTLOOK 60

5.2.1 INTRODUCTION 60

5.2.2 GDP TRENDS AND FORECAST 60

5.2.3 TRENDS IN GLOBAL E-COMMERCE & RETAIL INDUSTRY 62

5.2.4 TRENDS IN AUTOMOTIVE INDUSTRY 63

5.3 VALUE CHAIN ANALYSIS 64

5.4 ECOSYSTEM ANALYSIS 66

5.5 PRICING ANALYSIS 67

5.5.1 PRICING RANGE OF AUTOMATED GUIDED VEHICLES, BY KEY PLAYER, 2025 68

5.5.2 AVERAGE SELLING PRICE TREND OF AUTOMATED GUIDED VEHICLES, BY TYPE, 2021–2025 68

5.5.3 AVERAGE SELLING PRICE TREND OF TOW VEHICLES, BY REGION, 2021–2025 69

5.6 INVESTMENT AND FUNDING SCENARIO 70

5.7 TRADE ANALYSIS 71

5.7.1 IMPORT SCENARIO (842710) 71

5.7.2 EXPORT SCENARIO (842710) 72

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 73

5.9 KEY CONFERENCES AND EVENTS, 2026 73

5.10 CASE STUDY ANALYSIS 74

5.10.1 TOYOTA ADOPTS MASTERMOVER’S AGV300 TO ENHANCE PRODUCTIVITY AND REDUCE WASTE 74

5.10.2 SCOTT PROVIDES AGV AND PALLETISING SYSTEM TO ENHANCE PRODUCT AND WORKER SAFETY AND MINIMIZE DOWNTIME 75

5.10.3 E80 GROUP IMPLEMENTS LGVS AT METSÄ TISSUE’S WAREHOUSES TO IMPROVE OPERATIONAL PERFORMANCE 75

5.11 IMPACT OF 2025 US TARIFF – AUTOMATED GUIDED VEHICLE MARKET 76

5.11.1 INTRODUCTION 76

5.11.2 KEY TARIFF RATES 77

5.11.3 PRICE IMPACT ANALYSIS 77

5.11.4 IMPACT ON COUNTRIES/REGIONS 78

5.11.4.1 US 78

5.11.4.2 Europe 79

5.11.4.3 Asia Pacific 80

5.11.5 IMPACT ON INDUSTRIES 80

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT,

PATENTS, AND INNOVATIONS 82

6.1 KEY TECHNOLOGIES 82

6.1.1 ARTIFICIAL INTELLIGENCE 82

6.1.2 MACHINE LEARNING 82

6.2 ADJACENT TECHNOLOGIES 82

6.2.1 INDUSTRIAL INTERNET OF THINGS 82

6.2.2 NEXT-GENERATION WIRELESS TECHNOLOGIES 82

6.3 COMPLEMENTARY TECHNOLOGIES 83

6.3.1 COLLABORATIVE ROBOTS 83

6.3.2 DIGITAL TWIN TECHNOLOGY 83

6.4 TECHNOLOGY/PRODUCT ROADMAP 83

6.5 PATENT ANALYSIS 85

6.6 IMPACT OF AI ON AUTOMATED GUIDED VEHICLE MARKET 87

6.6.1 TOP USE CASES AND MARKET POTENTIAL 87

6.6.2 BEST PRACTICES FOLLOWED BY OEMS IN AUTOMATED GUIDED VEHICLE MARKET 88

6.6.3 CASE STUDIES RELATED TO AI IMPLEMENTATION IN AUTOMATED GUIDED VEHICLE MARKET 89

6.6.4 INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 89

6.6.5 CLIENTS’ READINESS TO ADOPT AI-INTEGRATED AUTOMATED GUIDED VEHICLES 90

7 REGULATORY LANDSCAPE 91

7.1 REGULATORY LANDSCAPE AND COMPLIANCE 91

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 91

7.1.2 INDUSTRY STANDARDS 94

7.1.3 REGULATIONS 95

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR 97

8.1 DECISION-MAKING PROCESS 97

8.2 KEY STAKEHOLDERS INVOLVED IN BUYING PROCESS AND THEIR EVALUATION CRITERIA 99

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 99

8.2.2 BUYING CRITERIA 100

8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES 100

8.4 UNMET NEEDS OF VARIOUS INDUSTRIES 102

9 TECHNOLOGIES AND POTENTIAL APPLICATIONS OF

AUTOMATED GUIDED VEHICLES 103

9.1 INTRODUCTION 103

9.2 STANDARD TECHNOLOGIES USED IN AUTOMATED GUIDED VEHICLES 103

9.2.1 LIDAR SENSORS 103

9.2.2 CAMERA VISION 104

9.3 POTENTIAL APPLICATIONS OF AUTOMATED GUIDED VEHICLES 104

9.3.1 AIRPORTS 104

9.3.2 CONSTRUCTION AND INFRASTRUCTURE DEVELOPMENT PROJECTS 105

10 BATTERY TYPES AND CHARGING ALTERNATIVES FOR

AUTOMATED GUIDED VEHICLES 106

10.1 INTRODUCTION 106

10.2 TYPES OF BATTERIES USED IN AUTOMATED GUIDED VEHICLES 106

10.2.1 LEAD-ACID BATTERIES 106

10.2.2 LITHIUM-ION BATTERIES 106

10.2.3 NICKEL-BASED BATTERIES 106

10.2.4 PURE LEAD BATTERIES 107

10.3 BATTERY CHARGING ALTERNATIVES 107

10.3.1 AUTOMATIC AND OPPORTUNITY CHARGING 107

10.3.1.1 Wireless charging 107

10.3.2 BATTERY SWAP 107

10.3.2.1 Manual battery swap 107

10.3.2.2 Automatic battery swap 108

10.3.3 PLUG-IN CHARGING 108

10.3.3.1 Manual plug-in charging 108

10.3.3.2 Automatic plug-in charging 108

11 COMPONENTS AND SERVICES OFFERED FOR AUTOMATED GUIDED VEHICLES 109

11.1 INTRODUCTION 109

11.2 HARDWARE 109

11.3 SOFTWARE AND SERVICES 110

12 RECENT TRENDS IN AUTOMATED GUIDED VEHICLES 111

12.1 INTRODUCTION 111

12.2 INTERNET OF THINGS CONNECTIVITY 111

12.3 ADOPTION OF COLLABORATIVE AGVS 111

12.4 SCALABILITY AND MODULAR DESIGN 111

12.5 ADVANCED NAVIGATION TECHNOLOGIES 111

12.6 ENERGY EFFICIENCY AND SUSTAINABILITY 112

12.7 INTEGRATION OF ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING 112

12.8 EDGE COMPUTING FOR REAL-TIME DATA PROCESSING 112

13 APPLICATIONS OF AUTOMATED GUIDED VEHICLES 113

13.1 INTRODUCTION 113

13.2 PICK-AND-PLACE 113

13.3 PACKAGING AND PALLETIZING 114

13.4 ASSEMBLY AND STORAGE 114

14 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE 116

14.1 INTRODUCTION 117

14.2 TOW VEHICLES 120

14.2.1 POTENTIAL TO AUTOMATE MATERIAL MOVEMENT AND IMPROVE OPERATIONAL EFFICIENCY TO BOOST DEMAND 120

14.3 UNIT LOAD CARRIERS 122

14.3.1 FOCUS ON MINIMIZING PRODUCT DAMAGE WHILE TRANSPORTING TO EXTERNAL LOGISTICS DEPARTMENT TO DRIVE DEMAND 122

14.4 PALLET TRUCKS 125

14.4.1 ABILITY TO HANDLE PALLETS, SKELETON CONTAINERS, RACKS, TUBS, BOXES, AND ROLLS TO ACCELERATE ADOPTION 125

14.5 ASSEMBLY LINE VEHICLES 127

14.5.1 COST ADVANTAGES OVER CHAIN-BASED CONVEYANCE SYSTEMS TO SUPPORT DEPLOYMENT 127

14.6 FORKLIFT TRUCKS 130

14.6.1 PROFICIENCY IN HANDLING DIFFERENT PALLET SIZES AND LOAD FORMATS TO INCREASE DEMAND 130

14.7 OTHER TYPES 132

15 AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY 135

15.1 INTRODUCTION 136

15.2 LIGHT-DUTY AGVS 138

15.2.1 ABILITY TO EFFICIENTLY MANAGE SMALL LOADS AND REDUCE WORKFORCE FATIGUE TO ENHANCE ADOPTION 138

15.3 MEDIUM-DUTY AGVS 138

15.3.1 POTENTIAL TO REDUCE WORKPLACE CONGESTION AND EFFECTIVELY MANAGE INVENTORY TO FACILITATE DEPLOYMENT 138

15.4 HEAVY-DUTY AGVS 139

15.4.1 ABILITY TO HANDLE VERY HEAVY LOADS TO DRIVE SEGMENT GROWTH 139

16 AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY 140

16.1 INTRODUCTION 141

16.2 LASER GUIDANCE 143

16.2.1 ENHANCED ACCURACY AND FLEXIBILITY TO CONTRIBUTE TO MARKET EXPANSION 143

16.3 MAGNETIC GUIDANCE 144

16.3.1 SIMPLE INSTALLATION, ROBUST PERFORMANCE, AND MINIMAL MAINTENANCE TO ACCELERATE ADOPTION 144

16.4 INDUCTIVE GUIDANCE 145

16.4.1 ABILITY TO PERFORM EFFECTIVELY IN DUSTY AND HIGH-TRAFFIC INDUSTRIAL ENVIRONMENTS TO PROMOTE IMPLEMENTATION 145

16.5 OPTICAL TAPE GUIDANCE 147

16.5.1 EASE OF DEPLOYMENT AND HIGH FLEXIBILITY TO SUPPORT MARKET GROWTH 147

16.6 VISION GUIDANCE 148

16.6.1 HIGH RELIABILITY AND EASY MANEUVERABILITY IN COMPLEX SPACES TO BOOST ADOPTION 148

16.7 OTHER NAVIGATION TECHNOLOGIES 149

17 AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY 151

17.1 INTRODUCTION 152

17.2 AUTOMOTIVE 154

17.2.1 INCREASING DEMAND FOR AFTER-SALES SPARE PARTS TO SUPPORT MARKET GROWTH 154

17.3 CHEMICALS 158

17.3.1 SIGNIFICANT FOCUS ON ENHANCING SAFETY, EFFICIENCY, AND COMPETITIVENESS TO ACCELERATE MARKET GROWTH 158

17.4 AVIATION 161

17.4.1 RISING DEMAND FOR STREAMLINED AIRCRAFT PRODUCTION TO FUEL MARKET GROWTH 161

17.5 SEMICONDUCTOR & ELECTRONICS 165

17.5.1 EMPHASIS ON REVOLUTIONIZING CLEANROOM OPERATIONS TO DRIVE MARKET 165

17.6 E-COMMERCE & RETAIL 168

17.6.1 NECESSITY TO ENHANCE ORDER ACCURACY AND PROMPT DELIVERY TO FUEL ADOPTION 168

17.7 FOOD & BEVERAGES 171

17.7.1 SURGING DEMAND FOR FRESH, SAFE, AND READILY ACCESSIBLE FOOD PRODUCTS TO STIMULATE MARKET GROWTH 171

17.8 PHARMACEUTICALS 175

17.8.1 STRINGENT REGULATORY AND CLEANLINESS REQUIREMENTS TO SPIKE DEMAND 175

17.9 MEDICAL DEVICES 178

17.9.1 NEED TO FOLLOW INFECTION CONTROL PRACTICES AND IMPROVE WORKPLACE SAFETY TO PROPEL MARKET 178

17.10 METALS & HEAVY MACHINERY 181

17.10.1 SIGNIFICANT FOCUS ON IMPROVING SAFETY AND OPTIMIZING WORKFLOW TO SPUR DEMAND 181

17.11 LOGISTICS/3PL 184

17.11.1 EMPHASIS ON REDUCING WAREHOUSE SPACE AND LABOR COSTS TO ELEVATE ADOPTION 184

17.12 PULP & PAPER 187

17.12.1 NEED TO ADHERE TO SAFETY STANDARDS AND ENSURE HIGHER THROUGHPUT TO SPIKE DEPLOYMENT 187

17.13 OTHER INDUSTRIES 190

18 AUTOMATED GUIDED VEHICLE MARKET, BY REGION 194

18.1 INTRODUCTION 195

18.2 NORTH AMERICA 197

18.2.1 US 200

18.2.1.1 Established automotive and warehousing base to accelerate market growth 200

18.2.2 CANADA 202

18.2.2.1 Continued adoption of automation across key industries to support market growth 202

18.2.3 MEXICO 203

18.2.3.1 Strong manufacturing base to contribute to market growth 203

18.3 EUROPE 205

18.3.1 GERMANY 207

18.3.1.1 Strong focus on launching innovative and advanced AGVs to expedite market growth 207

18.3.2 UK 209

18.3.2.1 Thriving automotive sector to fuel market growth 209

18.3.3 FRANCE 211

18.3.3.1 Expansion of e-commerce sector to drive market 211

18.3.4 ITALY 212

18.3.4.1 Rising demand for smart logistics and automation solutions to foster market growth 212

18.3.5 SPAIN 214

18.3.5.1 Integration of AI, IoT, blockchain, 5G technologies in logistics to boost demand 214

18.3.6 NETHERLANDS 215

18.3.6.1 Advanced supply chain networks and modern warehousing infrastructure to spike demand 215

18.3.7 REST OF EUROPE 217

18.4 ASIA PACIFIC 218

18.4.1 CHINA 222

18.4.1.1 Increasing investments in transportation, warehousing, and logistics ecosystem to drive market 222

18.4.2 JAPAN 224

18.4.2.1 Rising labor costs and diversified industrial base to facilitate adoption 224

18.4.3 AUSTRALIA 225

18.4.3.1 Sustained automation across manufacturing, logistics, and mining operations to stimulate demand 225

18.4.4 SOUTH KOREA 227

18.4.4.1 Presence of global AGV players to propel market 227

18.4.5 INDIA 228

18.4.5.1 Emphasis on building smart factories to create growth opportunities 228

18.4.6 MALAYSIA 230

18.4.6.1 Thriving manufacturing and logistics sectors to promote AGV adoption 230

18.4.7 INDONESIA 232

18.4.7.1 Focus on expanding domestic manufacturing capacity to spur demand 232

18.4.8 SINGAPORE 233

18.4.8.1 Rising adoption of digital technologies across industries to fuel market growth 233

18.4.9 THAILAND 235

18.4.9.1 Ongoing infrastructure development projects to create lucrative opportunities 235

18.4.10 REST OF ASIA PACIFIC 236

18.5 ROW 238

18.5.1 MIDDLE EAST 240

18.5.1.1 GCC 242

18.5.1.1.1 Saudi Arabia 242

18.5.1.1.1.1 Increasing emphasis on economic diversification under Vision 2030 to accelerate adoption 242

18.5.1.1.2 UAE 243

18.5.1.1.2.1 Rising demand for transportation, warehousing, and logistics services to drive market 243

18.5.1.1.3 Rest of GCC 243

18.5.1.2 Rest of Middle East 244

18.5.2 SOUTH AMERICA 244

18.5.2.1 Government initiatives to automate food & beverages industry to spur demand 244

18.5.3 AFRICA 246

18.5.3.1 Growing imports of consumer goods to foster market growth 246

19 COMPETITIVE LANDSCAPE 248

19.1 INTRODUCTION 248

19.2 KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN, 2021–2025 248

19.3 REVENUE ANALYSIS, 2020–2024 251

19.4 MARKET SHARE ANALYSIS, 2025 251

19.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025 254

19.6 BRAND/PRODUCT COMPARISON 255

19.6.1 DAIFUKU CO., LTD. (JAPAN) 255

19.6.2 JBT (US) 255

19.6.3 KION GROUP AG (GERMANY) 255

19.6.4 KUKA SE & CO. KGAA (GERMANY) 256

19.6.5 TOYOTA INDUSTRIES CORPORATION (JAPAN) 256

19.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025 256

19.7.1 STARS 256

19.7.2 EMERGING LEADERS 256

19.7.3 PERVASIVE PLAYERS 257

19.7.4 PARTICIPANTS 257

19.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2025 258

19.7.5.1 Company footprint 258

19.7.5.2 Region footprint 259

19.7.5.3 Navigation technology footprint 260

19.7.5.4 Type footprint 261

19.7.5.5 Industry footprint 263

19.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2025 264

19.8.1 PROGRESSIVE COMPANIES 264

19.8.2 RESPONSIVE COMPANIES 264

19.8.3 DYNAMIC COMPANIES 265

19.8.4 STARTING BLOCKS 265

19.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023 266

19.8.5.1 Detailed list of key startups/SMEs 266

19.8.5.2 Competitive benchmarking of key startups/SMEs 266

19.9 COMPETITIVE SCENARIO 267

19.9.1 PRODUCT LAUNCHES 267

19.9.2 DEALS 268

19.9.3 EXPANSIONS 269

19.9.4 OTHER DEVELOPMENTS 270

20 COMPANY PROFILES 271

20.1 KEY PLAYERS 271

20.1.1 DAIFUKU CO., LTD. 271

20.1.1.1 Business overview 271

20.1.1.2 Products/Solutions/Services offered 273

20.1.1.3 Recent developments 273

20.1.1.3.1 Deals 273

20.1.1.3.2 Expansions 274

20.1.1.4 MnM view 275

20.1.1.4.1 Key strengths 275

20.1.1.4.2 Strategic choices 275

20.1.1.4.3 Weaknesses and competitive threats 275

20.1.2 JBT 276

20.1.2.1 Business overview 276

20.1.2.2 Products/Solutions/Services offered 277

20.1.2.3 Recent developments 278

20.1.2.3.1 Product launches 278

20.1.2.4 MnM view 278

20.1.2.4.1 Key strengths 278

20.1.2.4.2 Strategic choices 278

20.1.2.4.3 Weaknesses and competitive threats 278

20.1.3 KION GROUP AG 279

20.1.3.1 Business overview 279

20.1.3.2 Products/Solutions/Services offered 281

20.1.3.3 Recent developments 282

20.1.3.3.1 Product launches 282

20.1.3.3.2 Expansions 282

20.1.3.4 MnM view 283

20.1.3.4.1 Key strengths 283

20.1.3.4.2 Strategic choices 283

20.1.3.4.3 Weaknesses and competitive threats 283

20.1.4 TOYOTA INDUSTRIES CORPORATION 284

20.1.4.1 Business overview 284

20.1.4.2 Products/Solutions/Services offered 285

20.1.4.3 Recent developments 286

20.1.4.3.1 Product launches 286

20.1.4.3.2 Deals 287

20.1.4.4 MnM view 288

20.1.4.4.1 Key strengths 288

20.1.4.4.2 Strategic choices 288

20.1.4.4.3 Weaknesses and competitive threats 288

20.1.5 KUKA SE & CO. KGAA 289

20.1.5.1 Business overview 289

20.1.5.2 Products/Solutions/Services offered 291

20.1.5.3 Recent developments 291

20.1.5.3.1 Product launches 291

20.1.5.3.2 Deals 292

20.1.5.4 MnM view 292

20.1.5.4.1 Key strengths 292

20.1.5.4.2 Strategic choices 292

20.1.5.4.3 Weaknesses and competitive threats 292

20.1.6 SCOTT 293

20.1.6.1 Business overview 293

20.1.6.2 Products/Solutions/Services offered 294

20.1.6.3 Recent developments 295

20.1.6.3.1 Product launches 295

20.1.7 SSI SCHAEFER 296

20.1.7.1 Business overview 296

20.1.7.2 Products/Solutions/Services offered 296

20.1.7.3 Recent developments 297

20.1.7.3.1 Deals 297

20.1.7.3.2 Other developments 298

20.1.8 HYSTER-YALE, INC. 299

20.1.8.1 Business overview 299

20.1.8.2 Products/Solutions/Services offered 300

20.1.8.3 Recent developments 301

20.1.8.3.1 Developments 301

20.1.9 JUNGHEINRICH AG 302

20.1.9.1 Business overview 302

20.1.9.2 Products/Solutions/Services offered 303

20.1.9.3 Recent developments 304

20.1.9.3.1 Product launches 304

20.1.9.3.2 Deals 305

20.1.9.3.3 Expansions 305

20.1.10 MEIDENSHA CORPORATION 306

20.1.10.1 Business overview 306

20.1.10.2 Products/Solutions/Services offered 308

20.1.10.3 Recent developments 309

20.1.10.3.1 Product launches 309

20.1.11 MITSUBISHI LOGISNEXT CO., LTD. 310

20.1.11.1 Business overview 310

20.1.11.2 Products/Solutions/Services offered 312

20.1.11.3 Recent developments 313

20.1.11.3.1 Deals 313

20.1.12 OCEANEERING INTERNATIONAL, INC. 314

20.1.12.1 Business overview 314

20.1.12.2 Products/Solutions/Services offered 315

20.1.12.3 Recent developments 316

20.1.12.3.1 Expansions 316

20.1.12.3.2 Other developments 316

20.2 OTHER PLAYERS 317

20.2.1 NEURA MOBILE ROBOTS GMBH 317

20.2.2 AMERICA IN MOTION, INC. 318

20.2.3 ASSECO CEIT, A.S. 318

20.2.4 SUZHOU CASUN INTELLIGENT ROBOT CO., LTD. 319

20.2.5 JIANGXI DANBAHE ROBOT CO., LTD. 320

20.2.6 E80 GROUP S.P.A. 320

20.2.7 GLOBAL AGV 321

20.2.8 GRENZEBACH GROUP 321

20.2.9 IDC CORPORATION 322

20.2.10 NANCHANG INDUSTRIAL CONTROL ROBOT CO., LTD. 322

20.2.11 SAFELOG GMBH 323

20.2.12 SIMPLEX ROBOTICS PVT. LTD. 323

20.2.13 SYSTEM LOGISTICS S.P.A. 324

20.2.14 BALYO 325

21 RESEARCH METHODOLOGY 326

21.1 RESEARCH DATA 326

21.1.1 SECONDARY AND PRIMARY RESEARCH 327

21.1.2 SECONDARY DATA 328

21.1.2.1 List of major secondary sources 328

21.1.2.2 Key data from secondary sources 328

21.1.3 PRIMARY DATA 329

21.1.3.1 Primary interviews with experts 329

21.1.3.2 Key data from primary sources 329

21.1.3.3 Key industry insights 330

21.1.3.4 Breakdown of primaries 331

21.2 MARKET SIZE ESTIMATION 331

21.2.1 BOTTOM-UP APPROACH 331

21.2.2 TOP-DOWN APPROACH 332

21.2.3 MARKET SIZE CALCULATION FOR BASE YEAR 332

21.3 MARKET FORECAST APPROACH 333

21.3.1 SUPPLY SIDE 333

21.3.2 DEMAND SIDE 333

21.4 DATA TRIANGULATION 334

21.5 RESEARCH ASSUMPTIONS 335

21.6 RESEARCH LIMITATIONS 335

21.7 RISK ASSESSMENT 336

22 APPENDIX 337

22.1 DISCUSSION GUIDE 337

22.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 341

22.3 CUSTOMIZATION OPTIONS 343

22.4 RELATED REPORTS 343

22.5 AUTHOR DETAILS 344

LIST OF TABLES

TABLE 1 INCLUSIONS AND EXCLUSIONS IN AUTOMATED GUIDED VEHICLE MARKET 34

TABLE 2 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 56

TABLE 3 STRATEGIC FOCUS OF MAJOR COMPANIES IN AUTOMATED GUIDED VEHICLE MARKET 57

TABLE 4 AUTOMATED GUIDED VEHICLE MARKET: PORTER’S FIVE FORCES ANALYSIS 58

TABLE 5 GDP GROWTH RATES (%), BY KEY COUNTRY, 2021–2030 61

TABLE 6 ROLE OF PLAYERS IN ECOSYSTEM 66

TABLE 7 PRICING RANGE OF AUTOMATED GUIDED VEHICLES, BY KEY PLAYER, 2025 68

TABLE 8 AVERAGE SELLING PRICE TREND OF AUTOMATED GUIDED VEHICLES, BY TYPE, 2021–2025 (USD) 69

TABLE 9 AVERAGE SELLING PRICE TREND OF TOW VEHICLES, BY REGION,

2021–2025 (USD) 70

TABLE 10 IMPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD MILLION) 71

TABLE 11 EXPORT DATA FOR HS CODE 842710-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD MILLION) 72

TABLE 12 AUTOMATED GUIDED VEHICLE MARKET: LIST OF KEY CONFERENCES AND EVENTS 73

TABLE 13 US-ADJUSTED RECIPROCAL TARIFF RATES 77

TABLE 14 TECHNOLOGY ROADMAP IN AUTOMATED GUIDED VEHICLE MARKET 83

TABLE 15 AUTOMATED GUIDED VEHICLE MARKET: LIST OF KEY PATENTS, 2021–2024 86

TABLE 16 TOP USE CASES AND MARKET POTENTIAL 87

TABLE 17 BEST PRACTICES FOLLOWED BY COMPANIES IN AUTOMATED GUIDED VEHICLE MARKET 88

TABLE 18 CASE STUDIES RELATED TO AI IMPLEMENTATION IN AUTOMATED GUIDED VEHICLES 89

TABLE 19 INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 89

TABLE 20 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 91

TABLE 21 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 92

TABLE 22 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 93

TABLE 23 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 93

TABLE 24 AUTOMATED GUIDED VEHICLE INDUSTRY STANDARDS 94

TABLE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR INDUSTRIES (%) 99

TABLE 26 KEY BUYING CRITERIA FOR MAJOR INDUSTRIES 100

TABLE 27 UNMET NEEDS IN AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY 102

TABLE 28 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION) 118

TABLE 29 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION) 118

TABLE 30 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (THOUSAND UNITS) 119

TABLE 31 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (THOUSAND UNITS) 119

TABLE 32 TOW VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 120

TABLE 33 TOW VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 121

TABLE 34 TOW VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 121

TABLE 35 TOW VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 122

TABLE 36 UNIT LOAD CARRIERS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 123

TABLE 37 UNIT LOAD CARRIERS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 123

TABLE 38 UNIT LOAD CARRIERS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION) 124

TABLE 39 UNIT LOAD CARRIERS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION) 124

TABLE 40 PALLET TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 125

TABLE 41 PALLET TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 126

TABLE 42 PALLET TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 126

TABLE 43 PALLET TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 127

TABLE 44 ASSEMBLY LINE VEHICLES: AUTOMATED GUIDED VEHICLE MARKET,

BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 128

TABLE 45 ASSEMBLY LINE VEHICLES: AUTOMATED GUIDED VEHICLE MARKET,

BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 128

TABLE 46 ASSEMBLY LINE VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION) 129

TABLE 47 ASSEMBLY LINE VEHICLES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION) 129

TABLE 48 FORKLIFT TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 130

TABLE 49 FORKLIFT TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 131

TABLE 50 FORKLIFT TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 131

TABLE 51 FORKLIFT TRUCKS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 132

TABLE 52 OTHER TYPES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 133

TABLE 53 OTHER TYPES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 133

TABLE 54 OTHER TYPES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 134

TABLE 55 OTHER TYPES: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 134

TABLE 56 AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY,

2021–2025 (USD MILLION) 137

TABLE 57 AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY,

2026–2032 (USD MILLION) 137

TABLE 58 AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY,

2021–2025 (USD MILLION) 142

TABLE 59 AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY,

2026–2032 (USD MILLION) 142

TABLE 60 LASER GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2021–2025 (USD MILLION) 143

TABLE 61 LASER GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2026–2032 (USD MILLION) 144

TABLE 62 MAGNETIC GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2021–2025 (USD MILLION) 145

TABLE 63 MAGNETIC GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2026–2032 (USD MILLION) 145

TABLE 64 INDUCTIVE GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2021–2025 (USD MILLION) 146

TABLE 65 INDUCTIVE GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2026–2032 (USD MILLION) 146

TABLE 66 OPTICAL TAPE GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION) 147

TABLE 67 OPTICAL TAPE GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION) 148

TABLE 68 VISION GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2021–2025 (USD MILLION) 149

TABLE 69 VISION GUIDANCE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2026–2032 (USD MILLION) 149

TABLE 70 OTHER NAVIGATION TECHNOLOGIES: AUTOMATED GUIDED VEHICLE MARKET,

BY TYPE, 2021–2025 (USD MILLION) 150

TABLE 71 OTHER NAVIGATION TECHNOLOGIES: AUTOMATED GUIDED VEHICLE MARKET,

BY TYPE, 2026–2032 (USD MILLION) 150

TABLE 72 AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 153

TABLE 73 AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 154

TABLE 74 AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION) 155

TABLE 75 AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION) 155

TABLE 76 AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 156

TABLE 77 AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 156

TABLE 78 AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2021–2025 (USD MILLION) 156

TABLE 79 AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2026–2032 (USD MILLION) 157

TABLE 80 AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2021–2025 (USD MILLION) 157

TABLE 81 AUTOMOTIVE: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2026–2032 (USD MILLION) 157

TABLE 82 CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION) 158

TABLE 83 CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION) 159

TABLE 84 CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 159

TABLE 85 CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 159

TABLE 86 CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2021–2025 (USD MILLION) 160

TABLE 87 CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2026–2032 (USD MILLION) 160

TABLE 88 CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2021–2025 (USD MILLION) 161

TABLE 89 CHEMICALS: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2026–2032 (USD MILLION) 161

TABLE 90 AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY,

2021–2025 (USD MILLION) 162

TABLE 91 AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY,

2026–2032 (USD MILLION) 162

TABLE 92 AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 163

TABLE 93 AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 163

TABLE 94 AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2021–2025 (USD MILLION) 163

TABLE 95 AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2026–2032 (USD MILLION) 164

TABLE 96 AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2021–2025 (USD MILLION) 164

TABLE 97 AVIATION: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2026–2032 (USD MILLION) 164

TABLE 98 SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET,

BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION) 165

TABLE 99 SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET,

BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION) 166

TABLE 100 SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET,

BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 166

TABLE 101 SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET,

BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 166

TABLE 102 SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET,

BY TYPE, 2021–2025 (USD MILLION) 167

TABLE 103 SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET,

BY TYPE, 2026–2032 (USD MILLION) 167

TABLE 104 SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET,

BY REGION, 2021–2025 (USD MILLION) 167

TABLE 105 SEMICONDUCTOR & ELECTRONICS: AUTOMATED GUIDED VEHICLE MARKET,

BY REGION, 2026–2032 (USD MILLION) 168

TABLE 106 E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION) 169

TABLE 107 E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION) 169

TABLE 108 E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 169

TABLE 109 E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 170

TABLE 110 E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2021–2025 (USD MILLION) 170

TABLE 111 E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2026–2032 (USD MILLION) 170

TABLE 112 E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021–2025 (USD MILLION) 171

TABLE 113 E-COMMERCE & RETAIL: AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026–2032 (USD MILLION) 171

TABLE 114 FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION) 172

TABLE 115 FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION) 172

TABLE 116 FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 173

TABLE 117 FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 173

TABLE 118 FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2021–2025 (USD MILLION) 173

TABLE 119 FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2026–2032 (USD MILLION) 174

TABLE 120 FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2021–2025 (USD MILLION) 174

TABLE 121 FOOD & BEVERAGES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2026–2032 (USD MILLION) 175

TABLE 122 PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION) 175

TABLE 123 PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION) 176

TABLE 124 PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 176

TABLE 125 PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 176

TABLE 126 PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2021–2025 (USD MILLION) 177

TABLE 127 PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2026–2032 (USD MILLION) 177

TABLE 128 PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2021–2025 (USD MILLION) 177

TABLE 129 PHARMACEUTICALS: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2026–2032 (USD MILLION) 178

TABLE 130 MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION) 178

TABLE 131 MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION) 179

TABLE 132 MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 179

TABLE 133 MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 179

TABLE 134 MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2021–2025 (USD MILLION) 180

TABLE 135 MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2026–2032 (USD MILLION) 180

TABLE 136 MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2021–2025 (USD MILLION) 180

TABLE 137 MEDICAL DEVICES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2026–2032 (USD MILLION) 181

TABLE 138 METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET,

BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION) 181

TABLE 139 METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET,

BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION) 182

TABLE 140 METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET,

BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 182

TABLE 141 METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET,

BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 182

TABLE 142 METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2021–2025 (USD MILLION) 183

TABLE 143 METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE, 2026–2032 (USD MILLION) 183

TABLE 144 METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET,

BY REGION, 2021–2025 (USD MILLION) 183

TABLE 145 METALS & HEAVY MACHINERY: AUTOMATED GUIDED VEHICLE MARKET,

BY REGION, 2026–2032 (USD MILLION) 184

TABLE 146 LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION) 185

TABLE 147 LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION) 185

TABLE 148 LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 185

TABLE 149 LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 186

TABLE 150 LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2021–2025 (USD MILLION) 186

TABLE 151 LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2026–2032 (USD MILLION) 186

TABLE 152 LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2021–2025 (USD MILLION) 187

TABLE 153 LOGISTICS/3PL: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2026–2032 (USD MILLION) 187

TABLE 154 PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION) 188

TABLE 155 PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION) 188

TABLE 156 PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 188

TABLE 157 PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 189

TABLE 158 PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2021–2025 (USD MILLION) 189

TABLE 159 PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2026–2032 (USD MILLION) 189

TABLE 160 PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2021–2025 (USD MILLION) 190

TABLE 161 PULP & PAPER: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2026–2032 (USD MILLION) 190

TABLE 162 OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2021–2025 (USD MILLION) 191

TABLE 163 OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY, 2026–2032 (USD MILLION) 191

TABLE 164 OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2021–2025 (USD MILLION) 191

TABLE 165 OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY, 2026–2032 (USD MILLION) 192

TABLE 166 OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2021–2025 (USD MILLION) 192

TABLE 167 OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY TYPE,

2026–2032 (USD MILLION) 192

TABLE 168 OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2021–2025 (USD MILLION) 193

TABLE 169 OTHER INDUSTRIES: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2026–2032 (USD MILLION) 193

TABLE 170 AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2021–2025 (USD MILLION) 196

TABLE 171 AUTOMATED GUIDED VEHICLE MARKET, BY REGION, 2026–2032 (USD MILLION) 196

TABLE 172 NORTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 199

TABLE 173 NORTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 199

TABLE 174 NORTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY,

2021–2025 (USD MILLION) 200

TABLE 175 NORTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY,

2026–2032 (USD MILLION) 200

TABLE 176 US: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 201

TABLE 177 US: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 201

TABLE 178 CANADA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 202

TABLE 179 CANADA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 203

TABLE 180 MEXICO: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 204

TABLE 181 MEXICO: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 204

TABLE 182 EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 206

TABLE 183 EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 206

TABLE 184 EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY,

2021–2025 (USD MILLION) 207

TABLE 185 EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY,

2026–2032 (USD MILLION) 207

TABLE 186 GERMANY: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 208

TABLE 187 GERMANY: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 209

TABLE 188 UK: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 210

TABLE 189 UK: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 210

TABLE 190 FRANCE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 211

TABLE 191 FRANCE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 212

TABLE 192 ITALY: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 213

TABLE 193 ITALY: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 213

TABLE 194 SPAIN: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 214

TABLE 195 SPAIN: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 215

TABLE 196 NETHERLANDS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 216

TABLE 197 NETHERLANDS: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 216

TABLE 198 REST OF EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 217

TABLE 199 REST OF EUROPE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 218

TABLE 200 ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 220

TABLE 201 ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 220

TABLE 202 ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY,

2021–2025 (USD MILLION) 221

TABLE 203 ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY,

2026–2032 (USD MILLION) 221

TABLE 204 CHINA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 223

TABLE 205 CHINA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 223

TABLE 206 JAPAN: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 224

TABLE 207 JAPAN: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 225

TABLE 208 AUSTRALIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 226

TABLE 209 AUSTRALIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 226

TABLE 210 SOUTH KOREA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 227

TABLE 211 SOUTH KOREA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 228

TABLE 212 INDIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 229

TABLE 213 INDIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 230

TABLE 214 MALAYSIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 231

TABLE 215 MALAYSIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 231

TABLE 216 INDONESIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 232

TABLE 217 INDONESIA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 233

TABLE 218 SINGAPORE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 234

TABLE 219 SINGAPORE: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 234

TABLE 220 THAILAND: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 235

TABLE 221 THAILAND: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 236

TABLE 222 REST OF ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2021–2025 (USD MILLION) 237

TABLE 223 REST OF ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY, 2026–2032 (USD MILLION) 237

TABLE 224 ROW: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 239

TABLE 225 ROW: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 239

TABLE 226 ROW: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2021–2025 (USD MILLION) 240

TABLE 227 ROW: AUTOMATED GUIDED VEHICLE MARKET, BY REGION,

2026–2032 (USD MILLION) 240

TABLE 228 MIDDLE EAST: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 241

TABLE 229 MIDDLE EAST: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 241

TABLE 230 MIDDLE EAST: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY,

2021–2025 (USD MILLION) 242

TABLE 231 MIDDLE EAST: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY,

2026–2032 (USD MILLION) 242

TABLE 232 GCC: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY,

2021–2025 (USD MILLION) 243

TABLE 233 GCC: AUTOMATED GUIDED VEHICLE MARKET, BY COUNTRY,

2026–2032 (USD MILLION) 243

TABLE 234 SOUTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 245

TABLE 235 SOUTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 245

TABLE 236 AFRICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2021–2025 (USD MILLION) 246

TABLE 237 AFRICA: AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY,

2026–2032 (USD MILLION) 247

TABLE 238 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN AUTOMATED GUIDED VEHICLE MARKET, 2021–2025 248

TABLE 239 AUTOMATED GUIDED VEHICLE MARKET: DEGREE OF COMPETITION 252

TABLE 240 AUTOMATED GUIDED VEHICLE MARKET: REGION FOOTPRINT 259

TABLE 241 AUTOMATED GUIDED VEHICLE MARKET: NAVIGATION TECHNOLOGY FOOTPRINT 260

TABLE 242 AUTOMATED GUIDED VEHICLE MARKET: TYPE FOOTPRINT 261

TABLE 243 AUTOMATED GUIDED VEHICLE MARKET: INDUSTRY FOOTPRINT 263

TABLE 244 AUTOMATED GUIDED VEHICLE MARKET: DETAILED LIST OF KEY STARTUP/SMES 266

TABLE 245 AUTOMATED GUIDED VEHICLE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES 266

TABLE 246 AUTOMATED GUIDED VEHICLE MARKET: PRODUCT LAUNCHES,

MARCH 2021 AND NOVEMBER 2025 267

TABLE 247 AUTOMATED GUIDED VEHICLE MARKET: DEALS,

MARCH 2021 AND NOVEMBER 2025 268

TABLE 248 AUTOMATED GUIDED VEHICLE MARKET: EXPANSIONS,

MARCH 2021 AND NOVEMBER 2025 269

TABLE 249 AUTOMATED GUIDED VEHICLE MARKET: OTHER DEVELOPMENTS,

MARCH 2021 AND NOVEMBER 2025 270

TABLE 250 DAIFUKU CO., LTD.: COMPANY OVERVIEW 271

TABLE 251 DAIFUKU CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 273

TABLE 252 DAIFUKU CO., LTD.: DEALS 273

TABLE 253 DAIFUKU CO., LTD.: EXPANSIONS 274

TABLE 254 JBT: COMPANY OVERVIEW 276

TABLE 255 JBT: PRODUCTS/SOLUTIONS/SERVICES OFFERED 277

TABLE 256 JBT: PRODUCT LAUNCHES 278

TABLE 257 KION GROUP AG: BUSINESS OVERVIEW 279

TABLE 258 KION GROUP AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED 281

TABLE 259 KION GROUP AG: PRODUCT LAUNCHES 282

TABLE 260 KION GROUP AG: EXPANSIONS 282

TABLE 261 TOYOTA INDUSTRIES CORPORATION: COMPANY OVERVIEW 284

TABLE 262 TOYOTA INDUSTRIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 285

TABLE 263 TOYOTA INDUSTRIES CORPORATION: PRODUCT LAUNCHES 286

TABLE 264 TOYOTA INDUSTRIES CORPORATION: DEALS 287

TABLE 265 KUKA SE & CO. KGAA: COMPANY OVERVIEW 289

TABLE 266 KUKA SE & CO. KGAA: PRODUCTS/SOLUTIONS/SERVICES OFFERED 291

TABLE 267 KUKA SE & CO. KGAA: PRODUCT LAUNCHES 291

TABLE 268 KUKA SE & CO. KGAA: DEALS 292

TABLE 269 SCOTT: COMPANY OVERVIEW 293

TABLE 270 SCOTT: PRODUCTS/SOLUTIONS/SERVICES OFFERED 294

TABLE 271 SCOTT: PRODUCT LAUNCHES 295

TABLE 272 SSI SCHAEFER: COMPANY OVERVIEW 296

TABLE 273 SSI SCHAEFER: PRODUCTS/SOLUTIONS/SERVICES OFFERED 296

TABLE 274 SSI SCHAEFER: DEALS 297

TABLE 275 SSI SCHAEFER: OTHER DEVELOPMENTS 298

TABLE 276 HYSTER-YALE, INC.: COMPANY OVERVIEW 299

TABLE 277 HYSTER-YALE, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 300

TABLE 278 HYSTER-YALE, INC.: DEVELOPMENTS 301

TABLE 279 JUNGHEINRICH AG: COMPANY OVERVIEW 302

TABLE 280 JUNGHEINRICH AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED 303

TABLE 281 JUNGHEINRICH AG: PRODUCT LAUNCHES 304

TABLE 282 JUNGHEINRICH AG: DEALS 305

TABLE 283 JUNGHEINRICH AG: EXPANSIONS 305

TABLE 284 MEIDENSHA CORPORATION: COMPANY OVERVIEW 306

TABLE 285 MEIDENSHA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 308

TABLE 286 MEIDENSHA CORPORATION: PRODUCT LAUNCHES 309

TABLE 287 MITSUBISHI LOGISNEXT CO., LTD.: COMPANY OVERVIEW 310

TABLE 288 MITSUBISHI LOGISNEXT CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 312

TABLE 289 MITSUBISHI LOGISNEXT CO., LTD.: DEALS 313

TABLE 290 OCEANEERING INTERNATIONAL, INC.: COMPANY OVERVIEW 314

TABLE 291 OCEANEERING INTERNATIONAL, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 315

TABLE 292 OCEANEERING INTERNATIONAL, INC.: EXPANSIONS 316

TABLE 293 OCEANEERING INTERNATIONAL, INC.: OTHER DEVELOPMENTS 316

TABLE 294 NEURA MOBILE ROBOTS GMBH: COMPANY OVERVIEW 317

TABLE 295 AMERICA IN MOTION, INC.: COMPANY OVERVIEW 318

TABLE 296 ASSECO CEIT, A.S.: COMPANY OVERVIEW 318

TABLE 297 SUZHOU CASUN INTELLIGENT ROBOT CO., LTD.: COMPANY OVERVIEW 319

TABLE 298 JIANGXI DANBAHE ROBOT CO., LTD.: COMPANY OVERVIEW 320

TABLE 299 E80 GROUP S.P.A.: COMPANY OVERVIEW 320

TABLE 300 GLOBAL AGV: COMPANY OVERVIEW 321

TABLE 301 GRENZEBACH GROUP: COMPANY OVERVIEW 321

TABLE 302 IDC CORPORATION: COMPANY OVERVIEW 322

TABLE 303 NANCHANG INDUSTRIAL CONTROL ROBOT CO., LTD.: COMPANY OVERVIEW 322

TABLE 304 SAFELOG GMBH: COMPANY OVERVIEW 323

TABLE 305 SIMPLEX ROBOTICS PVT. LTD.: COMPANY OVERVIEW 323

TABLE 306 SYSTEM LOGISTICS S.P.A.: COMPANY OVERVIEW 324

TABLE 307 BALYO: COMPANY OVERVIEW 325

TABLE 308 LIST OF KEY SECONDARY SOURCES 328

TABLE 309 PRIMARY INTERVIEW PARTICIPANTS 329

TABLE 310 KEY DATA FROM PRIMARY SOURCES 329

TABLE 311 AUTOMATED GUIDED VEHICLE MARKET: RISK ASSESSMENT 336

LIST OF FIGURES

FIGURE 1 AUTOMATED GUIDED VEHICLE MARKET SEGMENTATION AND REGIONAL SCOPE 33

FIGURE 2 DURATION COVERED 34

FIGURE 3 MARKET SCENARIO 38

FIGURE 4 GLOBAL AUTOMATED GUIDED VEHICLE MARKET, 2021–2032 39

FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN AUTOMATED

GUIDED VEHICLE MARKET, 2021–2025 39

FIGURE 6 DISRUPTIONS INFLUENCING GROWTH OF AUTOMATED GUIDED VEHICLE MARKET 40

FIGURE 7 HIGH-GROWTH SEGMENTS IN AUTOMATED GUIDED VEHICLE

MARKET, 2026–2032 41

FIGURE 8 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN AUTOMATED GUIDED VEHICLE MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD 42

FIGURE 9 RISING DEMAND FOR AUTOMATION SOLUTIONS IN VARIOUS INDUSTRIES TO DRIVE MARKET 44

FIGURE 10 TOW VEHICLES TO CAPTURE MAJORITY OF MARKET SHARE IN 2032 44

FIGURE 11 LASER GUIDANCE TECHNOLOGY TO ACCOUNT FOR PROMINENT

MARKET SHARE IN 2032 45

FIGURE 12 AUTOMOTIVE INDUSTRY TO HOLD LEADING MARKET SHARE IN 2032 45

FIGURE 13 MEDIUM-DUTY AGVS TO LEAD MARKET IN 2032 46

FIGURE 14 E-COMMERCE & RETAIL INDUSTRY AND US TO HOLD LARGEST

MARKET SHARE IN 2032 46

FIGURE 15 CHINA TO BE FASTEST-GROWING MARKET FOR AUTOMATED GUIDED VEHICLES DURING FORECAST PERIOD 47

FIGURE 16 AUTOMATED GUIDED VEHICLE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES 48

FIGURE 17 IMPACT ANALYSIS OF DRIVERS 50

FIGURE 18 IMPACT ANALYSIS OF RESTRAINTS 52

FIGURE 19 IMPACT ANALYSIS OF OPPORTUNITIES 54

FIGURE 20 IMPACT ANALYSIS OF CHALLENGES 55

FIGURE 21 AUTOMATED GUIDED VEHICLE MARKET: PORTER’S FIVE FORCES ANALYSIS 59

FIGURE 22 AUTOMATED GUIDED VEHICLE VALUE CHAIN ANALYSIS 64

FIGURE 23 AUTOMATED GUIDED VEHICLE ECOSYSTEM 66

FIGURE 24 AVERAGE SELLING PRICE TREND OF AUTOMATED GUIDED VEHICLES,

BY TYPE, 2021–2025 68

FIGURE 25 AVERAGE SELLING PRICE TREND OF TOW VEHICLES, BY REGION, 2021–2025 69

FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2021–2024 70

FIGURE 27 IMPORT SCENARIO FOR HS CODE 842710-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020–2024 71

FIGURE 28 EXPORT SCENARIO FOR HS CODE 842710-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020–2024 72

FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 73

FIGURE 30 AUTOMATED GUIDED VEHICLE MARKET: PATENT ANALYSIS, 2015–2024 85

FIGURE 31 DECISION-MAKING FACTORS CONSIDERED WHILE BUYING AUTOMATED GUIDED VEHICLES 98

FIGURE 32 INFLUENCE OF STAKEHOLDERS FROM MAJOR INDUSTRIES ON BUYING PROCESS 99

FIGURE 33 KEY BUYING CRITERIA FOR MAJOR INDUSTRIES 100

FIGURE 34 ADOPTION BARRIERS AND INTERNAL CHALLENGES 101

FIGURE 35 EMERGING TECHNOLOGIES USED IN AUTOMATED GUIDED VEHICLES 103

FIGURE 36 TYPES OF BATTERIES USED IN AUTOMATED GUIDED VEHICLES 106

FIGURE 37 AUTOMATED GUIDED VEHICLE COMPONENTS AND SERVICES 109

FIGURE 38 KEY APPLICATIONS OF AUTOMATED GUIDED VEHICLES 113

FIGURE 39 AUTOMATED GUIDED VEHICLE MARKET, BY TYPE 117

FIGURE 40 TOW VEHICLES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2032 118

FIGURE 41 AUTOMATED GUIDED VEHICLE MARKET, BY PAYLOAD CAPACITY 136

FIGURE 42 MEDIUM-DUTY AGVS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2032 137

FIGURE 43 AUTOMATED GUIDED VEHICLE MARKET, BY NAVIGATION TECHNOLOGY 141

FIGURE 44 LASER GUIDANCE NAVIGATION TECHNOLOGY TO CAPTURE LARGEST MARKET SHARE IN 2032 141

FIGURE 45 AUTOMATED GUIDED VEHICLE MARKET, BY INDUSTRY 152

FIGURE 46 AUTOMOTIVE INDUSTRY TO HOLD LARGEST MARKET SHARE IN 2032 153

FIGURE 47 AUTOMATED GUIDED VEHICLE MARKET, BY REGION 195

FIGURE 48 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL AUTOMATED GUIDED VEHICLE MARKET FROM 2026 TO 2032 195

FIGURE 49 ASIA PACIFIC TO HOLD LARGEST SHARE OF AUTOMATED GUIDED VEHICLE MARKET IN 2026 196

FIGURE 50 NORTH AMERICA: AUTOMATED GUIDED VEHICLE MARKET SNAPSHOT 198

FIGURE 51 EUROPE: AUTOMATED GUIDED VEHICLE MARKET SNAPSHOT 205

FIGURE 52 ASIA PACIFIC: AUTOMATED GUIDED VEHICLE MARKET SNAPSHOT 219

FIGURE 53 ROW: AUTOMATED GUIDED VEHICLE MARKET SNAPSHOT 238

FIGURE 54 REVENUE ANALYSIS OF KEY PLAYERS IN AUTOMATED

GUIDED VEHICLE MARKET, 2020–2024 251

FIGURE 55 AUTOMATED GUIDED VEHICLE MARKET SHARE ANALYSIS, 2025 252

FIGURE 56 COMPANY VALUATION, 2025 254

FIGURE 57 FINANCIAL METRICS (EV/EBITDA), 2025 254

FIGURE 58 BRAND/PRODUCT COMPARISON 255

FIGURE 59 AUTOMATED GUIDED VEHICLE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2025 257

FIGURE 60 COMPANY FOOTPRINT 258

FIGURE 61 AUTOMATED GUIDED VEHICLE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2025 265

FIGURE 62 DAIFUKU CO., LTD.: COMPANY SNAPSHOT 272

FIGURE 63 JBT: COMPANY SNAPSHOT 277

FIGURE 64 KION GROUP AG: COMPANY SNAPSHOT 280

FIGURE 65 TOYOTA INDUSTRIES CORPORATION: COMPANY SNAPSHOT 285

FIGURE 66 KUKA SE & CO. KGAA: COMPANY SNAPSHOT 290

FIGURE 67 SCOTT: COMPANY SNAPSHOT 294

FIGURE 68 HYSTER-YALE, INC.: COMPANY SNAPSHOT 300

FIGURE 69 JUNGHEINRICH AG: COMPANY SNAPSHOT 303

FIGURE 70 MEIDENSHA CORPORATION: COMPANY SNAPSHOT 307

FIGURE 71 MITSUBISHI LOGISNEXT CO., LTD.: COMPANY SNAPSHOT 311

FIGURE 72 OCEANEERING INTERNATIONAL, INC.: COMPANY SNAPSHOT 315

FIGURE 73 AUTOMATED GUIDED VEHICLE MARKET: RESEARCH DESIGN 326

FIGURE 74 AUTOMATED GUIDED VEHICLE MARKET: RESEARCH APPROACH 327

FIGURE 75 KEY DATA FROM SECONDARY SOURCES 328

FIGURE 76 KEY INSIGHTS FROM INDUSTRY EXPERTS 330

FIGURE 77 BREAKDOWN OF PRIMARIES, BY COMPANY TYPE, DESIGNATION, AND REGION 331

FIGURE 78 AUTOMATED GUIDED VEHICLE MARKET: BOTTOM-UP APPROACH 331

FIGURE 79 AUTOMATED GUIDED VEHICLE MARKET: TOP-DOWN APPROACH 332

FIGURE 80 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS 332

FIGURE 81 AUTOMATED GUIDED VEHICLE MARKET: DATA TRIANGULATION 334

FIGURE 82 ASSUMPTIONS FOR RESEARCH STUDY 335