Microbiology Testing Market - Global Forecast To 2031

Microbiology Testing Market by Product [Instrument, Reagent & Kit, Consumable], Technology [Traditional (Manual Counting, Culture), Rapid (Nucleic Acid, Viability)], End User [Pharma, Biotech, Food, Water, Environmental Testing]-Global Forecast to 2031

微生物検査市場 - 製品[機器、試薬・キット、消耗品]、技術[従来型(手動計数、培養)、迅速型(核酸、生存率)]、エンドユーザー[医薬品、バイオテクノロジー、食品、水、環境試験] - 2031年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年02月 |

| ページ数 | 321 |

| 図表数 | 409 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-13557 |

世界の微生物検査市場は、2026年の77億9,000万米ドルから2031年には100億9,000万米ドルに達し、予測期間中に5.3%の年平均成長率(CAGR)で成長すると予測されています。食品、水、環境分野における汚染リスクの高まり、工業生産の増加、検査技術の進歩により、市場は急速に成長すると見込まれています。汚染管理、規制遵守、製品安全性への関心の高まりに加え、迅速検査と自動化における革新により、正確で信頼性の高い微生物検査ソリューションへの需要が高まっています。しかしながら、高度な検査システムのコストや低コストソリューションのばらつきに対する懸念が、市場の成長を抑制する可能性があります。とはいえ、検査方法の継続的な改善と、様々な業界での導入増加が相まって、市場拡大を促進すると予想されます。

調査範囲

本レポートは、微生物検査市場を製品、技術、病原体の種類、エンドユーザー、地域別に分析しています。また、市場の成長に影響を与える主要要因(促進要因、阻害要因、機会、課題)を分析するとともに、市場リーダー間の競争環境を詳細に分析しています。さらに、本レポートでは、マイクロ市場を個々の成長傾向に基づいて分析しています。さらに、5つの主要地域(および各地域内の各国)における市場セグメントの収益予測も行っています。

レポートを購入する理由

本レポートは、既存企業だけでなく、新規参入企業も市場の動向を把握し、市場シェアの拡大に役立てることができます。本レポートを購入した企業は、以下に挙げる戦略のいずれか、あるいは複数を活用することで、市場におけるプレゼンスを強化できます。

本レポートでは、以下の点について洞察を提供します。

- 主要な推進要因の分析(迅速な微生物検査における技術の進歩、研究開発費の増加、不適合食品による食品リコールの増加、化粧品・パーソナルケア業界からの需要の増加)、制約要因(検査技術の複雑さ、多額の資本投資、低い費用対効果)、機会(デジタルおよび自動検査プラットフォームの普及、検査業界における技術の進歩)、課題(運用上の障壁、微生物検査機器の調達コストの上昇)

- 市場浸透:微生物検査市場における主要企業が提供する製品ポートフォリオに関する包括的な情報

- 製品開発/イノベーション:微生物検査市場における今後のトレンド、研究開発活動、製品発売に関する詳細な洞察

- 市場開発:収益性の高い新興地域に関する包括的な情報

- 市場多様化:微生物検査市場における新製品、成長地域、最近の動向に関する網羅的な情報

- 競合評価:bioMérieux(フランス)、Thermo Fisher Scientific Inc.(米国)、Merck KGaA(ドイツ)、Becton, Dickinson and Company(米国)、Neogen Corporation(米国)など、主要市場企業の市場セグメント、成長戦略、収益分析、製品に関する詳細な評価

Report Description

The global microbiology testing market is projected to reach USD 10.09 billion by 2031, up from USD 7.79 billion in 2026, at a CAGR of 5.3% during the forecast period. The market is expected to grow rapidly due to rising contamination risks in the food, water, and environmental sectors, increased industrial production, and advances in testing technologies. A growing focus on contamination control, regulatory compliance, and product safety, along with innovations in rapid testing and automation, is driving demand for accurate and reliable microbiology testing solutions. However, concerns about the cost of advanced testing systems and variability in low-cost solutions may restrain market growth. Nonetheless, continuous improvements in testing methodologies, coupled with increasing adoption across various industries, are expected to fuel market expansion.

Microbiology Testing Market – Global Forecast To 2031

The pharmaceutical & biotech companies segment is expected to have the largest market during the forecast period.

By end user, the market is segmented into pharmaceutical & biotech companies, food & beverage companies, environmental & water testing, cosmetics & personal-care companies, and other end users. In 2025, pharmaceutical & biotech companies accounted for the largest share of the market. The pharmaceutical & biotech segment is the largest in the microbiology testing market due to the critical need for contamination control, product safety, and regulatory compliance across drug manufacturing and biotechnological research. These industries rely heavily on microbiological testing to ensure the sterility, quality, and safety of their products, particularly biologics, vaccines, and therapeutic compounds. Stringent regulatory requirements, such as those from the FDA and EMA, mandate rigorous microbial testing at every stage of production, from raw material validation to final product release. Furthermore, the growing prevalence of diseases and the need for new treatments and therapies continue to drive significant demand for microbiology testing solutions, making pharmaceutical & biotech companies the largest consumers of these services.

The bacterial products segment accounted for the largest market share in the microbiology testing market.

The microbiology testing market is segmented by pathogen type into bacterial, viral, fungal, and other pathogens. The bacterial segment is the largest within this category due to the widespread presence and impact of bacterial contamination across various industries. Bacteria are among the most common pathogens in contamination issues across sectors such as food and beverage, water treatment, and environmental monitoring. Their ability to cause spoilage, disease, and quality issues drives strong demand for bacterial testing to ensure product safety, regulatory compliance, and public health. Additionally, well-established, reliable methods for detecting and identifying bacterial pathogens, along with regulatory mandates, further strengthen the dominance of the bacterial segment in microbiology testing.

Microbiology Testing Market – Global Forecast To 2031 – region

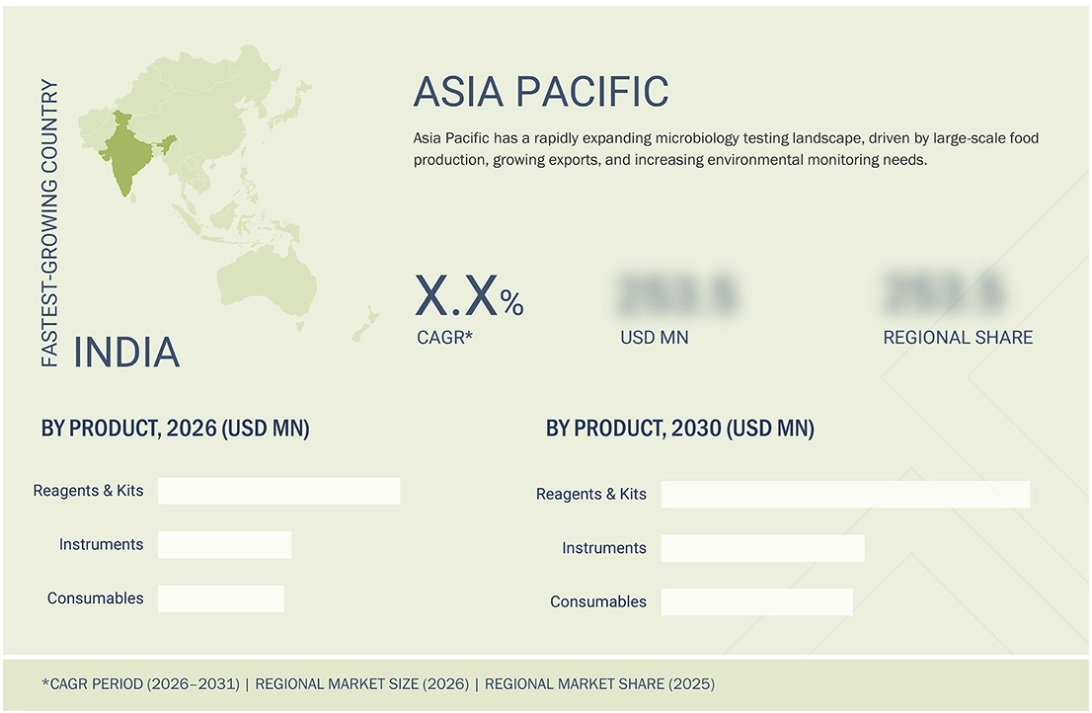

The Asia Pacific is expected to be the fastest-growing market for microbiology testing during the forecast period.

The global microbiology testing market is segmented into six regions: North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa. The Asia Pacific is the fastest-growing market in the microbiology testing sector, driven by rapid industrialization, rising healthcare investments, and a growing focus on contamination control across industries. The region is seeing strong growth in sectors such as food and beverage, water treatment, and environmental monitoring, all of which require extensive microbiological testing to ensure safety and regulatory compliance. Additionally, improving healthcare infrastructure, coupled with rising awareness of food safety and public health, is driving demand for testing solutions. Government initiatives and regulatory developments in countries such as China, India, and across Southeast Asia further support market growth, while the adoption of advanced and automated microbiology testing technologies helps streamline operations and improve accuracy. These factors collectively position Asia-Pacific as the fastest-growing market for microbiology testing.

North America is the leading market for microbiology testing, driven by a strong regulatory framework that creates high demand for testing to ensure product safety and compliance. The region is a leader in adopting advanced, automated testing solutions that improve efficiency and accuracy. Additionally, North America’s diverse industries, including pharmaceuticals, biotechnology, food, and water, continually require reliable microbiology testing. The region’s well-established healthcare and industrial infrastructure, combined with significant investments in research and development, further solidifies its position as the market leader.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1: 40%, Tier 2: 30%, and Tier 3: 30%

- By Designation: C Level: 27%, Director Level: 18%, and Others: 55%

- By Region: North America: 51%, Europe: 21%, Asia Pacific: 18%, Latin America: 6%, and Middle East & Africa: 4%

- Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Microbiology Testing Market – Global Forecast To 2031 – ecosystem

The major players operating in the microbiology testing market are bioMérieux (France), Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Becton, Dickinson and Company (US), and Neogen Corporation (US).

Research Coverage

This report examines the microbiology testing market by product, technology, pathogen type, end user, and region. It also examines key factors (drivers, restraints, opportunities, and challenges) influencing market growth and provides an in-depth analysis of the competitive landscape among market leaders. Furthermore, the report analyzes micro-markets by their individual growth trends. It forecasts market segment revenue for five major regions (and the respective countries within each region).

Reasons to Buy the Report

The report will enable established firms and smaller entrants to gauge the market’s pulse, which, in turn, will help them gain a larger market share. Firms purchasing the report could use one or more of the strategies listed below to strengthen their market presence.

This report provides insights into the following pointers:

- Analysis of key Drivers (Technological advancements in rapid microbiology testing, Increased funding for R&D, Rising food recalls due to non-compliant food products, Rising demand from cosmetics & personal care industry) Restraints (Complexity in testing techniques, High Capital investments, and low cost benefit ratio) Opportunities (Popularity of digital and automated testing platforms, Technological advancements in the testing industry) Challenges (Operational barriers, Increasing cost of procuring microbiology testing equipment)

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the microbiology testing market

- Product Development/Innovation: Detailed insights into the upcoming trends, R&D activities, and product launches in the microbiology testing market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the microbiology testing market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players, such as bioMérieux (France), Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), Becton, Dickinson and Company (US), and Neogen Corporation (US)

Table of Contents

1 INTRODUCTION 30

1.1 STUDY OBJECTIVES 30

1.2 MARKET DEFINITION 30

1.3 STUDY SCOPE 31

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 31

1.3.2 INCLUSIONS AND EXCLUSIONS 32

1.3.3 YEARS CONSIDERED 33

1.4 CURRENCY CONSIDERED 33

1.5 STAKEHOLDERS 33

2 EXECUTIVE SUMMARY 34

2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS 34

2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS 35

2.3 DISRUPTIVE TRENDS SHAPING MARKET 35

2.4 FASTEST-GROWTH SEGMENTS AND EMERGING FRONTIERS 36

2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST 37

3 PREMIUM INSIGHTS 38

3.1 MICROBIOLOGY TESTING MARKET OVERVIEW 38

3.2 MICROBIOLOGY TESTING MARKET, BY PRODUCT 38

3.3 MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY 39

3.4 MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE 39

3.5 MICROBIOLOGY TESTING MARKET, BY END USER 40

3.6 MICROBIOLOGY TESTING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES 40

4 MARKET OVERVIEW 41

4.1 INTRODUCTION 41

4.2 MARKET DYNAMICS 41

4.2.1 DRIVERS 41

4.2.1.1 Technological advancements in rapid microbiology testing 41

4.2.1.2 Increased funding for R&D 42

4.2.1.3 Rising food recalls due to non-compliant food products 42

4.2.1.4 Rising demand from cosmetics & personal care industry 45

4.2.2 RESTRAINTS 45

4.2.2.1 Complexity in testing techniques 45

4.2.2.2 High Capital investments and low cost-benefit ratio 46

4.2.3 OPPORTUNITIES 46

4.2.3.1 Popularity of digital and automated testing platforms 46

4.2.3.2 Technological advancements in testing industry 46

4.2.4 CHALLENGES 47

4.2.4.1 Operational barriers 47

4.2.4.2 Increasing cost of procuring microbiology testing equipment 48

4.3 UNMET NEEDS AND WHITE SPACES 48

4.3.1 UNMET NEEDS IN MICROBIOLOGY TESTING MARKET 48

4.3.2 WHITE SPACE OPPORTUNITIES 49

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 50

4.4.1 INTERCONNECTED MARKETS 50

4.4.2 CROSS-SECTOR OPPORTUNITIES 50

4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS 51

4.5.1 KEY MOVES AND STRATEGIC FOCUS 51

5 INDUSTRY TRENDS 52

5.1 PORTER’S FIVE FORCES ANALYSIS 52

5.1.1 THREAT OF NEW ENTRANTS 53

5.1.2 THREAT OF SUBSTITUTES 53

5.1.3 BARGAINING POWER OF BUYERS 53

5.1.4 BARGAINING POWER OF SUPPLIERS 54

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 54

5.2 MACROECONOMIC INDICATORS 54

5.2.1 INTRODUCTION 54

5.2.2 GDP TRENDS AND FORECAST 54

5.3 SUPPLY CHAIN ANALYSIS 57

5.4 VALUE CHAIN ANALYSIS 58

5.5 ECOSYSTEM ANALYSIS 59

5.6 PRICING ANALYSIS 61

5.6.1 AVERAGE SELLING PRICE TREND OF MICROBIOLOGY TESTING, BY PRODUCT 61

5.6.2 AVERAGE SELLING PRICE TREND OF MICROBIOLOGY TESTING PRODUCTS,

BY KEY PLAYER 61

5.6.3 AVERAGE SELLING PRICE TREND OF MICROBIOLOGY TESTING PRODUCTS,

BY REGION 62

5.7 TRADE ANALYSIS 63

5.7.1 IMPORT SCENARIO (HS CODE 3822) 63

5.7.2 EXPORT SCENARIO (HS CODE 3822) 63

5.8 KEY CONFERENCES & EVENTS, 2026–2027 64

5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES 65

5.10 INVESTMENT & FUNDING SCENARIO 65

5.11 CASE STUDY ANALYSIS 66

5.11.1 YOUNGS SEAFOOD ACCELERATED FOOD TESTING WITH VIDAS 66

5.11.2 RAPID MICROBIOLOGICAL METHOD CASE STUDY FOR ADVANCED THERAPY MEDICINAL PRODUCTS 67

5.11.3 RAPID DETECTION METHOD OF BACTERIAL PATHOGENS IN SURFACE WATERS AND NEW RISK INDICATOR FOR WATER PATHOGENIC POLLUTION 67

5.12 IMPACT OF 2025 US TARIFFS ON MICROBIOLOGY TESTING MARKET 68

5.12.1 INTRODUCTION 68

5.12.2 KEY TARIFF RATES 68

5.12.3 PRICE IMPACT ANALYSIS 69

5.12.4 KEY IMPACT ON COUNTRY/REGION 69

5.12.4.1 North America 69

5.12.4.2 Europe 69

5.12.4.3 Asia Pacific 69

5.12.5 IMPACT ON END-USE INDUSTRIES 70

5.12.5.1 Pharmaceutical & biotech companies 70

5.12.5.2 Food & beverage companies 70

5.12.5.3 Environmental & water testing 70

5.12.5.4 Cosmetics & personal care companies 70

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS 71

6.1 KEY EMERGING TECHNOLOGIES 71

6.1.1 AUTOMATED MULTIPLEX PCR SYSTEMS 71

6.1.2 BIOSENSORS 71

6.2 COMPLEMENTARY TECHNOLOGIES 72

6.2.1 FOOD & WATER SAFETY MONITORING TOOLS 72

6.2.2 ANTIMICROBIAL RESISTANCE TESTING 72

6.3 TECHNOLOGY/PRODUCT ROADMAP 72

6.4 PATENT ANALYSIS 73

6.5 FUTURE APPLICATION 74

6.6 IMPACT OF AI/GENERATIVE AI ON MICROBIOLOGY TESTING MARKET 75

6.6.1 INTRODUCTION 75

6.6.2 TOP USE CASES AND MARKET POTENTIAL 75

6.6.3 USE CASE 76

6.6.3.1 Adoption of Gen AI by CarbConnect to achieve accuracy and consistency in diagnostics 76

6.6.4 EVOLVING ADJACENT ECOSYSTEM THROUGH ADOPTION OF GEN AI 76

7 SUSTAINABILITY AND REGULATORY LANDSCAPE 78

7.1 REGIONAL REGULATIONS AND COMPLIANCE 78

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 78

7.1.2 INDUSTRY STANDARDS 80

7.2 SUSTAINABILITY INITIATIVES 81

7.2.1 ENVIRONMENTAL IMPACT AND ECO-FRIENDLY INITIATIVES IN MICROBIOLOGY TESTING 81

7.2.1.1 Eco-friendly initiatives 81

7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES 82

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 83

8.1 DECISION-MAKING PROCESS 83

8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA 83

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 83

8.2.2 BUYING CRITERIA 84

8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 85

8.4 UNMET NEEDS IN VARIOUS END-USE INDUSTRIES 86

8.5 MARKET PROFITABILITY 87

8.5.1 REVENUE POTENTIAL 87

8.5.2 COST DYNAMICS 87

8.5.3 MARGIN OPPORTUNITIES IN KEY APPLICATIONS 87

9 MICROBIOLOGY TESTING MARKET, BY PRODUCT 88

9.1 INTRODUCTION 89

9.2 INSTRUMENTS 89

9.2.1 WIDESPREAD ADOPTION OF AUTOMATED AND HIGH-THROUGHPUT LABORATORY INSTRUMENTS TO SUPPORT MICROBIOLOGY TESTING DEMAND 89

9.2.2 INCUBATORS 93

9.2.2.1 Controlled environmental conditions to enable reliable microbial growth and detection 93

9.2.3 MICROSCOPES 96

9.2.3.1 Direct visualization and morphological analysis of microorganisms 96

9.2.4 COLONY COUNTERS 98

9.2.4.1 Accurate enumeration of microbial colonies to support quality assurance 98

9.2.5 MASS SPECTROMETERS 100

9.2.5.1 Rapid and accurate microbial identification through advanced mass spectrometry methods 100

9.2.6 AUTOMATED CULTURE SYSTEMS 102

9.2.6.1 High-throughput systems supporting standardized microbiology workflows 102

9.2.7 OTHER INSTRUMENTS 105

9.3 REAGENTS & KITS 107

9.3.1 HIGH RECURRING DEMAND FOR STANDARDIZED AND READY-TO-USE REAGENTS & KITS TO SUPPORT MARKET GROWTH 107

9.4 CONSUMABLES 111

9.4.1 CONSISTENT HIGH-VOLUME CONSUMPTION OF DISPOSABLE LABORATORY SUPPLIES TO FUEL ROUTINE MICROBIOLOGY TESTING MARKET 111

10 MICROBIOLOGY TESTING MARKET: VOLUME ANALYSIS 116

10.1 INTRODUCTION 116

10.2 US: VOLUME OF PHARMA INCUBATOR INSTALLED BASE 116

11 MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY 117

11.1 INTRODUCTION 118

11.2 TRADITIONAL MICROBIOLOGY METHODS (TMM) 118

11.2.1 WIDESPREAD REGULATORY ACCEPTANCE AND COST-EFFECTIVENESS TO SUPPORT CONTINUED ADOPTION 118

11.2.2 CULTURE METHODS 122

11.2.2.1 Continued reliance on culture-based techniques to support routine microbiology testing 122

11.2.3 MICROSCOPY METHODS 125

11.2.3.1 Rapid preliminary microbial screening to support contamination investigations 125

11.2.4 MANUAL COUNTING METHODS 127

11.2.4.1 Regulatory acceptance of plate count techniques to maintain widespread usage 127

11.2.5 STAINING TECHNIQUES 130

11.2.5.1 Low-cost and effective microbial differentiation methods to support quality control 130

11.2.6 OTHER TRADITIONAL MICROBIOLOGY METHODS 132

11.3 RAPID MICROBIOLOGY METHODS (RMM) 135

11.3.1 RAPID MICROBIOLOGY METHODS ENABLE FASTER CONTAMINATION DETECTION AND IMPROVED TESTING EFFICIENCY 135

11.3.2 GROWTH-BASED RAPID MICROBIOLOGY TESTING 139

11.3.2.1 Growing demand for growth-based rapid microbiology testing to drive market growth 139

11.3.3 CELLULAR COMPONENT-BASED RAPID MICROBIOLOGY TESTING 142

11.3.3.1 High level of sensitivity, accuracy, and specificity associated with this method to boost market 142

11.3.4 NUCLEIC ACID-BASED RAPID MICROBIOLOGY TESTING 145

11.3.4.1 High accuracy associated with nucleic acid-based methods to favor market growth 145

11.3.5 VIABILITY-BASED RAPID MICROBIOLOGY TESTING 148

11.3.5.1 Near real-time detection and improved accuracy to drive demand 148

12 MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE 152

12.1 INTRODUCTION 153

12.2 BACTERIAL 153

12.2.1 WIDESPREAD OCCURRENCE OF BACTERIAL CONTAMINATION ACROSS INDUSTRIES TO SUPPORT MARKET DOMINANCE 153

12.3 VIRAL 155

12.3.1 INCREASING FOCUS ON VIRAL SAFETY AND ENVIRONMENTAL SURVEILLANCE TO DRIVE SEGMENT GROWTH 155

12.4 FUNGAL 157

12.4.1 RISING INCIDENCE OF YEAST AND MOLD CONTAMINATION TO FUEL TESTING DEMAND 157

12.5 OTHER PATHOGENS 159

13 MICROBIOLOGY TESTING MARKET, BY END USER 162

13.1 INTRODUCTION 163

13.2 PHARMACEUTICAL & BIOTECH COMPANIES 163

13.2.1 STRINGENT GMP AND CONTAMINATION CONTROL REQUIREMENTS TO DRIVE TESTING DEMAND 163

13.3 FOOD & BEVERAGE COMPANIES 166

13.3.1 STRINGENT FOOD SAFETY REGULATIONS AND QUALITY CONTROL TO SUPPORT MARKET GROWTH 166

13.4 ENVIRONMENTAL & WATER TESTING 168

13.4.1 GROWING FOCUS ON WATER SAFETY AND ENVIRONMENTAL MONITORING TO DRIVE DEMAND 168

13.5 COSMETICS & PERSONAL CARE COMPANIES 171

13.5.1 MICROBIAL SAFETY AND PRODUCT STABILITY REQUIREMENTS TO SUPPORT MARKET GROWTH 171

13.6 OTHER END USERS 173

14 MICROBIOLOGY TESTING MARKET, BY REGION 177

14.1 INTRODUCTION 178

14.2 NORTH AMERICA 178

14.2.1 US 181

14.2.1.1 Increasing adoption of technologically advanced products in US to favor market growth 181

14.2.2 CANADA 183

14.2.2.1 Favorable environment for R&D to drive market 183

14.3 EUROPE 185

14.3.1 GERMANY 188

14.3.1.1 Increase in investments and funding by government to fuel market growth 188

14.3.2 UK 190

14.3.2.1 High prevalence of contaminated food to drive market 190

14.3.3 FRANCE 192

14.3.3.1 Rise in R&D expenditure to favor market growth 192

14.3.4 ITALY 194

14.3.4.1 Increased adoption of advanced diagnostic technologies and growing government healthcare investments to drive market 194

14.3.5 SPAIN 196

14.3.5.1 Water monitoring mandate to boost market growth 196

14.3.6 REST OF EUROPE 198

14.4 ASIA PACIFIC 200

14.4.1 CHINA 204

14.4.1.1 High-profile contamination events and export standards to propel market 204

14.4.2 JAPAN 206

14.4.2.1 Stringent safety laws and foodborne outbreaks to accelerate market 206

14.4.3 INDIA 208

14.4.3.1 Growth in private and public investments in healthcare systems to drive adoption of microbiology testing products 208

14.4.4 SOUTH KOREA 210

14.4.4.1 Increasing demand for infection control products to support market growth 210

14.4.5 AUSTRALIA 212

14.4.5.1 Increase in awareness about antimicrobial resistance to fuel market 212

14.4.6 REST OF ASIA PACIFIC 214

14.5 LATIN AMERICA 216

14.5.1 BRAZIL 218

14.5.1.1 Need for manufacturers to comply with ANVISA’s rules to drive demand 218

14.5.2 MEXICO 220

14.5.2.1 Expanding microbiology testing capacity through trade and food safety enforcement to drive market 220

14.5.3 REST OF LATIN AMERICA 222

14.6 MIDDLE EAST & AFRICA 224

15 COMPETITIVE LANDSCAPE 227

15.1 OVERVIEW 227

15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2025 227

15.3 REVENUE ANALYSIS, 2022–2024 228

15.4 MARKET SHARE ANALYSIS, 2025 229

15.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025 232

15.5.1 STARS 232

15.5.2 EMERGING LEADERS 232

15.5.3 PERVASIVE PLAYERS 232

15.5.4 PARTICIPANTS 232

15.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2025 234

15.5.5.1 Company footprint 234

15.5.5.2 Regional footprint 234

15.5.5.3 Product footprint 235

15.5.5.4 Technology footprint 235

15.5.5.5 End user footprint 236

15.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2025 237

15.6.1 PROGRESSIVE COMPANIES 237

15.6.2 RESPONSIVE COMPANIES 237

15.6.3 DYNAMIC COMPANIES 237

15.6.4 STARTING BLOCKS 237

15.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2025 239

15.6.5.1 List of startups/SMEs 239

15.6.5.2 Competitive benchmarking of startups/SMEs 239

15.6.5.2.1 Competitive benchmarking of startups/SMEs (1/2) 239

15.6.5.2.2 Competitive benchmarking of startups/SMEs (2/2) 240

15.7 COMPANY VALUATION AND FINANCIAL METRICS 240

15.8 BRAND/PRODUCT COMPARISON 241

15.9 COMPETITIVE SCENARIO 242

15.9.1 PRODUCT LAUNCHES AND APPROVALS 242

15.9.2 DEALS 243

15.9.3 EXPANSIONS 243

16 COMPANY PROFILES 244

16.1 KEY PLAYERS 244

16.1.1 BIOMÉRIEUX 244

16.1.1.1 Business overview 244

16.1.1.2 Products offered 245

16.1.1.3 Recent developments 246

16.1.1.3.1 Product launches and approvals 246

16.1.1.3.2 Deals 247

16.1.1.4 MnM view 248

16.1.1.4.1 Right to win 248

16.1.1.4.2 Strategic choices 248

16.1.1.4.3 Weaknesses and competitive threats 248

16.1.2 THERMO FISHER SCIENTIFIC INC. 249

16.1.2.1 Business overview 249

16.1.2.2 Products offered 250

16.1.2.3 Recent developments 251

16.1.2.3.1 Product launches & approvals 251

16.1.2.4 MnM view 251

16.1.2.4.1 Right to win 251

16.1.2.4.2 Strategic choices 252

16.1.2.4.3 Weaknesses and competitive threats 252

16.1.3 MERCK KGAA 253

16.1.3.1 Business overview 253

16.1.3.2 Products/Services offered 254

16.1.3.3 Recent developments 255

16.1.3.3.1 Product launches 255

16.1.3.3.2 Deals 255

16.1.3.3.3 Expansions 256

16.1.3.4 MnM view 256

16.1.3.4.1 Right to win 256

16.1.3.4.2 Strategic choices 257

16.1.3.4.3 Weaknesses and competitive threats 257

16.1.4 BECTON, DICKINSON AND COMPANY (BD) 258

16.1.4.1 Business overview 258

16.1.4.2 Products offered 260

16.1.4.3 Recent developments 260

16.1.4.3.1 Expansions 260

16.1.4.4 MnM view 261

16.1.4.4.1 Right to win 261

16.1.4.4.2 Strategic choices 261

16.1.4.4.3 Weaknesses and competitive threats 261

16.1.5 NEOGEN CORPORATION 262

16.1.5.1 Business overview 262

16.1.5.2 Products/Services offered 263

16.1.5.3 Recent developments 264

16.1.5.3.1 Product/Service launches and approvals 264

16.1.5.3.2 Deals 265

16.1.5.4 MnM view 265

16.1.5.4.1 Right to win 265

16.1.5.4.2 Strategic choices 265

16.1.5.4.3 Weaknesses and competitive threats 265

16.1.6 QIAGEN 266

16.1.6.1 Business overview 266

16.1.6.2 Products offered 267

16.1.6.3 Recent developments 268

16.1.6.3.1 Product launches 268

16.1.7 BIO-RAD LABORATORIES, INC. 269

16.1.7.1 Business overview 269

16.1.7.2 Products/Services offered 270

16.1.7.3 Recent developments 271

16.1.7.3.1 Product launches 271

16.1.8 BRUKER 272

16.1.8.1 Business overview 272

16.1.8.2 Products/Services offered 273

16.1.8.3 Recent developments 274

16.1.8.3.1 Deals 274

16.1.9 SHIMADZU CORPORATION 275

16.1.9.1 Business overview 275

16.1.9.2 Products/Services offered 276

16.1.9.3 Recent developments 277

16.1.9.3.1 Product/Service launches and approvals 277

16.1.9.3.2 Expansions 277

16.1.10 CHARLES RIVER LABORATORIES 278

16.1.10.1 Business overview 278

16.1.10.2 Products/Services offered 279

16.1.10.3 Recent developments 280

16.1.10.3.1 Product/Service launches and approvals 280

16.1.11 EUROFINS SCIENTIFIC 281

16.1.11.1 Business overview 281

16.1.11.2 Products/Services offered 282

16.1.11.3 Recent developments 283

16.1.11.3.1 Deals 283

16.1.12 IDEXX 284

16.1.12.1 Business overview 284

16.1.12.2 Products/Services offered 285

16.1.12.3 Recent developments 286

16.1.12.3.1 Product/Service launches and approvals 286

16.2 OTHER PLAYERS 287

16.2.1 HARDY DIAGNOSTICS 287

16.2.2 CHARM SCIENCES 288

16.2.3 MICROBIOLOGICS 289

16.2.4 LIOFILCHEM S.R.L. 290

16.2.5 R-BIOPHARM 291

16.2.6 ROMER LABS DIVISION HOLDING 292

16.2.7 HYGIENA LLC 293

16.2.8 HIMEDIA LABORATORIES 294

16.2.9 CONDALAB 295

16.2.10 E&O LABORATORIES LTD 296

16.2.11 MAST GROUP LTD. 297

16.2.12 MEDICAL WIRE & EQUIPMENT 298

16.2.13 HACH 299

17 RESEARCH METHODOLOGY 300

17.1 RESEARCH DATA 300

17.2 RESEARCH APPROACH 300

17.2.1 SECONDARY DATA 301

17.2.1.1 Key secondary sources 301

17.2.1.2 Key data from secondary sources 302

17.2.2 PRIMARY DATA 303

17.2.2.1 Primary sources 303

17.2.2.2 Key data from primary sources 304

17.2.2.3 Key industry insights 305

17.2.2.4 Breakdown of primary interviews 306

17.3 MARKET SIZE ESTIMATION 306

17.3.1 BOTTOM-UP APPROACH 307

17.3.1.1 Approach 1: Company revenue estimation approach 307

17.3.1.2 Approach 2: Presentations of companies and primary interviews 307

17.3.1.3 Growth forecast 308

17.3.1.4 CAGR projections 308

17.3.2 TOP-DOWN APPROACH 309

17.4 DATA TRIANGULATION 310

17.5 MARKET SHARE ASSESSMENT 310

17.6 RESEARCH ASSUMPTIONS 311

17.6.1 PARAMETRIC ASSUMPTIONS 311

17.7 RESEARCH LIMITATIONS 311

17.8 RISK ASSESSMENT 312

18 APPENDIX 313

18.1 DISCUSSION GUIDE 313

18.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 317

18.3 CUSTOMIZATION OPTIONS 319

18.4 RELATED REPORTS 319

18.5 AUTHOR DETAILS 320

LIST OF TABLES

TABLE 1 INCLUSIONS AND EXCLUSIONS 32

TABLE 2 US: FOOD RECALLS IN AND REASONS, 2023 44

TABLE 3 US: FOOD RECALLS, BY SPECIES, 2023 44

TABLE 4 TOP INNOVATIONS IN FOOD TESTING TECHNOLOGY 47

TABLE 5 INTERCONNECTED MARKETS 50

TABLE 6 KEY MOVES AND STRATEGIC FOCUS 51

TABLE 7 IMPACT OF PORTER’S FIVE FORCES ON MICROBIOLOGY TESTING MARKET 53

TABLE 8 GDP PERCENTAGE CHANGE, BY KEY COUNTRIES, 2023-2030 55

TABLE 9 NORTH AMERICA: MACROECONOMIC INDICATORS 56

TABLE 10 EUROPE: MACROECONOMIC INDICATORS 56

TABLE 11 ASIA PACIFIC: MACROECONOMIC INDICATORS 56

TABLE 12 LATIN AMERICA: MACROECONOMIC INDICATORS 57

TABLE 13 MIDDLE EAST & AFRICA: MACROECONOMIC INDICATORS 57

TABLE 14 MICROBIOLOGY TESTING MARKET: ROLE OF COMPANIES IN ECOSYSTEM 60

TABLE 15 AVERAGE SELLING PRICING TREND OF MICROBIOLOGY TESTING, BY PRODUCT, 2024–2026 (USD) 61

TABLE 16 AVERAGE SELLING PRICE TREND OF MICROBIOLOGY TESTING, BY KEY PLAYER, 2024–2026 (USD) 61

TABLE 17 AVERAGE SELLING PRICE TREND OF MICROBIOLOGY TESTING PRODUCTS,

BY REGION, 2024–2026 (USD) 62

TABLE 18 IMPORT DATA FOR HS CODE 3822-COMPLIANT PRODUCTS, BY COUNTRY,

2020–2024 (USD MILLION) 63

TABLE 19 EXPORT DATA FOR HS CODE 3822-COMPLIANT PRODUCTS, BY COUNTRY,

2020–2024 (USD MILLION) 63

TABLE 20 MICROBIOLOGY TESTING MARKET: KEY CONFERENCES AND EVENTS,

2026–2027 64

TABLE 21 US-ADJUSTED RECIPROCAL TARIFF RATES 68

TABLE 22 LIST OF MAJOR PATENTS PERTAINING TO MICROBIOLOGY TESTING MARKET, 2023–2025 74

TABLE 23 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 78

TABLE 24 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 78

TABLE 25 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 79

TABLE 26 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 79

TABLE 27 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 80

TABLE 28 GLOBAL STANDARDS IN THE MICROBIOLOGY TESTING MARKET 80

TABLE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT 84

TABLE 30 KEY BUYING CRITERIA, BY PRODUCT 84

TABLE 31 ADOPTION BARRIERS & INTERNAL CHALLENGES 85

TABLE 32 MICROBIOLOGY TESTING MARKET: UNMET NEEDS IN VARIOUS END-USE INDUSTRIES 86

TABLE 33 MICROBIOLOGY TESTING MARKET, BY PRODUCT, 2024–2031 (USD MILLION) 89

TABLE 34 KEY INSTRUMENTS IN MICROBIOLOGY TESTING INSTRUMENTS MARKET 90

TABLE 35 MICROBIOLOGY TESTING INSTRUMENTS MARKET, BY TYPE,

2024–2031 (USD MILLION) 91

TABLE 36 MICROBIOLOGY TESTING INSTRUMENTS MARKET, BY REGION,

2024–2031 (USD MILLION) 91

TABLE 37 NORTH AMERICA: MICROBIOLOGY TESTING INSTRUMENTS MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 92

TABLE 38 EUROPE: MICROBIOLOGY TESTING INSTRUMENTS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 92

TABLE 39 ASIA PACIFIC: MICROBIOLOGY TESTING INSTRUMENTS MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 93

TABLE 40 LATIN AMERICA: MICROBIOLOGY TESTING INSTRUMENTS MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 93

TABLE 41 MICROBIOLOGY TESTING INCUBATORS MARKET, BY REGION,

2024–2031 (USD MILLION) 94

TABLE 42 NORTH AMERICA: MICROBIOLOGY TESTING INCUBATORS MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 94

TABLE 43 EUROPE: MICROBIOLOGY TESTING INCUBATORS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 95

TABLE 44 ASIA PACIFIC: MICROBIOLOGY TESTING INCUBATORS MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 95

TABLE 45 LATIN AMERICA: MICROBIOLOGY TESTING INCUBATORS MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 96

TABLE 46 MICROSCOPES MARKET, BY REGION, 2024–2031 (USD MILLION) 96

TABLE 47 NORTH AMERICA: MICROSCOPES MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 97

TABLE 48 EUROPE: MICROSCOPES MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 97

TABLE 49 ASIA PACIFIC: MICROSCOPES MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 97

TABLE 50 LATIN AMERICA: MICROSCOPES MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 98

TABLE 51 COLONY COUNTERS MARKET, BY REGION, 2024–2031 (USD MILLION) 98

TABLE 52 NORTH AMERICA: COLONY COUNTERS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 99

TABLE 53 EUROPE: COLONY COUNTERS MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 99

TABLE 54 ASIA PACIFIC: COLONY COUNTERS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 100

TABLE 55 LATIN AMERICA: COLONY COUNTERS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 100

TABLE 56 MASS SPECTROMETERS MARKET, BY REGION, 2024–2031 (USD MILLION) 101

TABLE 57 NORTH AMERICA: MASS SPECTROMETERS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 101

TABLE 58 EUROPE: MASS SPECTROMETERS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 101

TABLE 59 ASIA PACIFIC: MASS SPECTROMETERS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 102

TABLE 60 LATIN AMERICA: MASS SPECTROMETERS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 102

TABLE 61 AUTOMATED CULTURE SYSTEMS MARKET, BY REGION,

2024–2031 (USD MILLION) 103

TABLE 62 NORTH AMERICA: AUTOMATED CULTURE SYSTEMS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 103

TABLE 63 EUROPE: AUTOMATED CULTURE SYSTEMS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 104

TABLE 64 ASIA PACIFIC: MICROBIOLOGY TESTING MARKET FOR AUTOMATED CULTURE SYSTEMS, BY COUNTRY, 2024–2031 (USD MILLION) 104

TABLE 65 LATIN AMERICA: MICROBIOLOGY TESTING MARKET FOR AUTOMATED CULTURE SYSTEMS, BY COUNTRY, 2024–2031 (USD MILLION) 105

TABLE 66 OTHER MICROBIOLOGY TESTING INSTRUMENTS MARKET, BY REGION,

2024–2031 (USD MILLION) 105

TABLE 67 NORTH AMERICA: OTHER MICROBIOLOGY TESTING INSTRUMENTS MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 106

TABLE 68 EUROPE: OTHER MICROBIOLOGY TESTING INSTRUMENTS MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 106

TABLE 69 ASIA PACIFIC: OTHER MICROBIOLOGY TESTING INSTRUMENTS MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 107

TABLE 70 LATIN AMERICA: OTHER MICROBIOLOGY TESTING INSTRUMENTS MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 107

TABLE 71 KEY REAGENTS & KITS IN MICROBIOLOGY TESTING INSTRUMENTS MARKET 108

TABLE 72 MICROBIOLOGY TESTING REAGENTS & KITS MARKET, BY REGION,

2024–2031 (USD MILLION) 109

TABLE 73 NORTH AMERICA: MICROBIOLOGY TESTING REAGENTS & KITS MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 110

TABLE 74 EUROPE: MICROBIOLOGY TESTING REAGENTS & KITS MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 110

TABLE 75 ASIA PACIFIC: MICROBIOLOGY TESTING REAGENTS & KITS MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 111

TABLE 76 LATIN AMERICA: MICROBIOLOGY TESTING REAGENTS & KITS MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 111

TABLE 77 KEY CONSUMABLES IN MICROBIOLOGY TESTING INSTRUMENTS MARKET 112

TABLE 78 MICROBIOLOGY TESTING CONSUMABLES MARKET, BY REGION,

2024–2031 (USD MILLION) 113

TABLE 79 NORTH AMERICA: MICROBIOLOGY TESTING CONSUMABLES MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 113

TABLE 80 EUROPE: MICROBIOLOGY TESTING CONSUMABLES MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 114

TABLE 81 ASIA PACIFIC: MICROBIOLOGY TESTING MARKET FOR CONSUMABLES,

BY COUNTRY, 2024–2031 (USD MILLION) 114

TABLE 82 LATIN AMERICA: MICROBIOLOGY TESTING MARKET FOR CONSUMABLES,

BY COUNTRY, 2024–2031 (USD MILLION) 115

TABLE 83 US: PHARMA INCUBATOR INSTALLED BASE VOLUME, 2024–2031 (UNITS) 116

TABLE 84 MICROBIOLOGY TESTING TECHNOLOGY MARKET, BY TECHNOLOGY TYPE,

2024–2031 (USD MILLION) 118

TABLE 85 TYPES OF TECHNOLOGIES USED IN VARIOUS TRADITIONAL MICROBIOLOGY METHODS (TMM) 119

TABLE 86 TRADITIONAL MICROBIOLOGY METHODS (TMM) MARKET, BY TYPE,

2024–2031 (USD MILLION) 120

TABLE 87 TRADITIONAL MICROBIOLOGY METHODS (TMM) MARKET, BY REGION,

2024–2031 (USD MILLION) 120

TABLE 88 NORTH AMERICA: TRADITIONAL MICROBIOLOGY METHODS (TMM) MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 121

TABLE 89 EUROPE: TRADITIONAL MICROBIOLOGY METHODS (TMM) MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 121

TABLE 90 ASIA PACIFIC: TRADITIONAL MICROBIOLOGY METHODS (TMM) MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 122

TABLE 91 LATIN AMERICA: TRADITIONAL MICROBIOLOGY METHODS (TMM) MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 122

TABLE 92 CULTURE METHODS MARKET, BY REGION, 2024–2031 (USD MILLION) 123

TABLE 93 NORTH AMERICA: CULTURE METHODS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 123

TABLE 94 EUROPE: CULTURE METHODS MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 124

TABLE 95 ASIA PACIFIC: CULTURE METHODS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 124

TABLE 96 LATIN AMERICA: CULTURE METHODS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 125

TABLE 97 MICROSCOPY METHODS MARKET, BY REGION, 2024–2031 (USD MILLION) 126

TABLE 98 NORTH AMERICA: MICROSCOPY METHODS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 126

TABLE 99 EUROPE: MICROSCOPY METHODS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 126

TABLE 100 ASIA PACIFIC: MICROSCOPY METHODS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 127

TABLE 101 LATIN AMERICA: MICROSCOPY METHODS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 127

TABLE 102 MANUAL COUNTING METHODS MARKET, BY REGION, 2024–2031 (USD MILLION) 128

TABLE 103 NORTH AMERICA: MANUAL COUNTING METHODS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 128

TABLE 104 EUROPE: MANUAL COUNTING METHODS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 129

TABLE 105 ASIA PACIFIC: MANUAL COUNTING METHODS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 129

TABLE 106 LATIN AMERICA: MANUAL COUNTING METHODS MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 130

TABLE 107 STAINING TECHNIQUES MARKET, BY REGION, 2024–2031 (USD MILLION) 131

TABLE 108 NORTH AMERICA: STAINING TECHNIQUES MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 131

TABLE 109 EUROPE: STAINING TECHNIQUES MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 131

TABLE 110 ASIA PACIFIC: STAINING TECHNIQUES MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 132

TABLE 111 LATIN AMERICA: STAINING TECHNIQUES MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 132

TABLE 112 OTHER TRADITIONAL MICROBIOLOGY METHODS MARKET, BY REGION,

2024–2031 (USD MILLION) 133

TABLE 113 NORTH AMERICA: OTHER TRADITIONAL MICROBIOLOGY METHODS MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 133

TABLE 114 EUROPE: OTHER TRADITIONAL MICROBIOLOGY METHODS MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 134

TABLE 115 ASIA PACIFIC: OTHER TRADITIONAL MICROBIOLOGY METHODS MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 134

TABLE 116 LATIN AMERICA: OTHER TRADITIONAL MICROBIOLOGY METHODS MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 135

TABLE 117 TYPES OF TECHNOLOGIES USED IN VARIOUS RAPID MICROBIOLOGY METHODS (RMM) 136

TABLE 118 RAPID MICROBIOLOGY METHODS (RMM) MARKET, BY TYPE,

2024–2031 (USD MILLION) 136

TABLE 119 RAPID MICROBIOLOGY METHODS (RMM) MARKET, BY REGION,

2024–2031 (USD MILLION) 137

TABLE 120 NORTH AMERICA: RAPID MICROBIOLOGY METHODS (RMM) MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 137

TABLE 121 EUROPE: RAPID MICROBIOLOGY METHODS (RMM) MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 138

TABLE 122 ASIA PACIFIC: RAPID MICROBIOLOGY METHODS (RMM) MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 138

TABLE 123 LATIN AMERICA: RAPID MICROBIOLOGY METHODS (RMM) MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 139

TABLE 124 GROWTH-BASED RAPID MICROBIOLOGY TESTING MARKET, BY REGION,

2024–2031 (USD MILLION) 140

TABLE 125 NORTH AMERICA: GROWTH-BASED RAPID MICROBIOLOGY TESTING MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 140

TABLE 126 EUROPE: GROWTH-BASED RAPID MICROBIOLOGY TESTING MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 141

TABLE 127 ASIA PACIFIC: GROWTH-BASED RAPID MICROBIOLOGY TESTING MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 141

TABLE 128 LATIN AMERICA: GROWTH-BASED RAPID MICROBIOLOGY TESTING MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 142

TABLE 129 CELLULAR COMPONENT-BASED RAPID MICROBIOLOGY TESTING MARKET,

BY REGION, 2024–2031 (USD MILLION) 143

TABLE 130 NORTH AMERICA: CELLULAR COMPONENT-BASED RAPID MICROBIOLOGY TESTING MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 143

TABLE 131 EUROPE: CELLULAR COMPONENT-BASED RAPID MICROBIOLOGY TESTING MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 144

TABLE 132 ASIA PACIFIC: CELLULAR COMPONENT-BASED RAPID MICROBIOLOGY TESTING MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 144

TABLE 133 LATIN AMERICA: CELLULAR COMPONENT-BASED RAPID MICROBIOLOGY TESTING MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 145

TABLE 134 NUCLEIC ACID-BASED RAPID MICROBIOLOGY TESTING MARKET, BY REGION, 2024–2031 (USD MILLION) 146

TABLE 135 NORTH AMERICA: NUCLEIC ACID-BASED RAPID MICROBIOLOGY TESTING MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 146

TABLE 136 EUROPE: NUCLEIC ACID-BASED RAPID MICROBIOLOGY TESTING MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 147

TABLE 137 ASIA PACIFIC: NUCLEIC ACID-BASED RAPID MICROBIOLOGY TESTING MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 147

TABLE 138 LATIN AMERICA: NUCLEIC ACID-BASED RAPID MICROBIOLOGY TESTING MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 148

TABLE 139 VIABILITY-BASED RAPID MICROBIOLOGY TESTING MARKET, BY REGION,

2024–2031 (USD MILLION) 149

TABLE 140 NORTH AMERICA: VIABILITY-BASED RAPID MICROBIOLOGY TESTING MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 149

TABLE 141 EUROPE: VIABILITY-BASED RAPID MICROBIOLOGY TESTING MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 150

TABLE 142 ASIA PACIFIC: VIABILITY-BASED RAPID MICROBIOLOGY TESTING MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 150

TABLE 143 LATIN AMERICA: VIABILITY-BASED RAPID MICROBIOLOGY TESTING MARKET,

BY COUNTRY, 2024–2031 (USD MILLION) 151

TABLE 144 MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 153

TABLE 145 BACTERIAL TESTING MARKET, BY REGION, 2024–2031 (USD MILLION) 154

TABLE 146 NORTH AMERICA: BACTERIAL TESTING MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 154

TABLE 147 EUROPE: BACTERIAL TESTING MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 154

TABLE 148 ASIA PACIFIC: BACTERIAL TESTING MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 155

TABLE 149 LATIN AMERICA: BACTERIAL TESTING MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 155

TABLE 150 VIRAL TESTING MARKET, BY REGION, 2024–2031 (USD MILLION) 156

TABLE 151 NORTH AMERICA: VIRAL TESTING MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 156

TABLE 152 EUROPE: VIRAL TESTING MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 156

TABLE 153 ASIA PACIFIC: VIRAL TESTING MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 157

TABLE 154 LATIN AMERICA: VIRAL TESTING MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 157

TABLE 155 FUNGAL TESTING MARKET, BY REGION, 2024–2031 (USD MILLION) 158

TABLE 156 NORTH AMERICA: FUNGAL TESTING MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 158

TABLE 157 EUROPE: FUNGAL TESTING MARKET, BY COUNTRY, 2024–2031 (USD MILLION) 158

TABLE 158 ASIA PACIFIC: FUNGAL TESTING MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 159

TABLE 159 LATIN AMERICA: FUNGAL TESTING MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 159

TABLE 160 OTHER PATHOGEN TESTING MARKET, BY REGION, 2024–2031 (USD MILLION) 160

TABLE 161 NORTH AMERICA: OTHER PATHOGEN TESTING MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 160

TABLE 162 EUROPE: OTHER PATHOGEN TESTING MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 160

TABLE 163 ASIA PACIFIC: OTHER PATHOGEN TESTING MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 161

TABLE 164 LATIN AMERICA: OTHER PATHOGEN TESTING MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 161

TABLE 165 MICROBIOLOGY TESTING MARKET, BY END USER, 2024–2031 (USD MILLION) 163

TABLE 166 MICROBIOLOGY TESTING MARKET FOR PHARMACEUTICAL & BIOTECH COMPANIES, BY REGION, 2024–2031 (USD MILLION) 164

TABLE 167 NORTH AMERICA: MICROBIOLOGY TESTING MARKET FOR PHARMACEUTICAL & BIOTECH COMPANIES, BY COUNTRY, 2024–2031 (USD MILLION) 164

TABLE 168 EUROPE: MICROBIOLOGY TESTING MARKET FOR PHARMACEUTICAL & BIOTECH COMPANIES, BY COUNTRY, 2024–2031 (USD MILLION) 165

TABLE 169 ASIA PACIFIC: MICROBIOLOGY TESTING MARKET FOR PHARMACEUTICAL & BIOTECH COMPANIES, BY COUNTRY, 2024–2031 (USD MILLION) 165

TABLE 170 LATIN AMERICA: MICROBIOLOGY TESTING MARKET FOR PHARMACEUTICAL & BIOTECH COMPANIES, BY COUNTRY, 2024–2031 (USD MILLION) 166

TABLE 171 MICROBIOLOGY TESTING MARKET FOR FOOD & BEVERAGE COMPANIES,

BY REGION, 2024–2031 (USD MILLION) 166

TABLE 172 NORTH AMERICA: MICROBIOLOGY TESTING MARKET FOR FOOD & BEVERAGE COMPANIES, BY COUNTRY, 2024–2031 (USD MILLION) 167

TABLE 173 EUROPE: MICROBIOLOGY TESTING MARKET FOR FOOD & BEVERAGE COMPANIES, BY COUNTRY, 2024–2031 (USD MILLION) 167

TABLE 174 ASIA PACIFIC: MICROBIOLOGY TESTING MARKET FOR FOOD & BEVERAGE COMPANIES, BY COUNTRY, 2024–2031 (USD MILLION) 168

TABLE 175 LATIN AMERICA: MICROBIOLOGY TESTING MARKET FOR FOOD & BEVERAGE COMPANIES, BY COUNTRY, 2024–2031 (USD MILLION) 168

TABLE 176 MICROBIOLOGY TESTING MARKET FOR ENVIRONMENTAL & WATER TESTING,

BY REGION, 2024–2031 (USD MILLION) 169

TABLE 177 NORTH AMERICA: MICROBIOLOGY TESTING MARKET FOR ENVIRONMENTAL & WATER TESTING, BY COUNTRY, 2024–2031 (USD MILLION) 169

TABLE 178 EUROPE: MICROBIOLOGY TESTING MARKET FOR ENVIRONMENTAL & WATER TESTING, BY COUNTRY, 2024–2031 (USD MILLION) 170

TABLE 179 ASIA PACIFIC: MICROBIOLOGY TESTING MARKET FOR ENVIRONMENTAL & WATER TESTING, BY COUNTRY, 2024–2031 (USD MILLION) 170

TABLE 180 LATIN AMERICA: MICROBIOLOGY TESTING MARKET FOR ENVIRONMENTAL & WATER TESTING, BY COUNTRY, 2024–2031 (USD MILLION) 171

TABLE 181 MICROBIOLOGY TESTING MARKET FOR COSMETICS & PERSONAL CARE COMPANIES, BY REGION, 2024–2031 (USD MILLION) 171

TABLE 182 NORTH AMERICA: MICROBIOLOGY TESTING MARKET FOR COSMETICS & PERSONAL CARE COMPANIES, BY COUNTRY, 2024–2031 (USD MILLION) 172

TABLE 183 EUROPE: MICROBIOLOGY TESTING MARKET FOR COSMETICS & PERSONAL CARE COMPANIES, BY COUNTRY, 2024–2031 (USD MILLION) 172

TABLE 184 ASIA PACIFIC: MICROBIOLOGY TESTING MARKET FOR COSMETICS & PERSONAL CARE COMPANIES, BY COUNTRY, 2024–2031 (USD MILLION) 173

TABLE 185 LATIN AMERICA: MICROBIOLOGY TESTING MARKET FOR COSMETICS & PERSONAL CARE COMPANIES, BY COUNTRY, 2024–2031 (USD MILLION) 173

TABLE 186 MICROBIOLOGY TESTING MARKET FOR OTHER END USERS, BY REGION,

2024–2031 (USD MILLION) 174

TABLE 187 NORTH AMERICA: MICROBIOLOGY TESTING MARKET FOR OTHER END USERS,

BY COUNTRY, 2024–2031 (USD MILLION) 174

TABLE 188 EUROPE: MICROBIOLOGY TESTING MARKET FOR OTHER END USERS, BY COUNTRY, 2024–2031 (USD MILLION) 175

TABLE 189 ASIA PACIFIC: MICROBIOLOGY TESTING MARKET FOR OTHER END USERS,

BY COUNTRY, 2024–2031 (USD MILLION) 175

TABLE 190 LATIN AMERICA: MICROBIOLOGY TESTING MARKET FOR OTHER END USERS,

BY COUNTRY, 2024–2031 (USD MILLION) 176

TABLE 191 MICROBIOLOGY TESTING MARKET, BY REGION, 2024–2031 (USD MILLION) 178

TABLE 192 NORTH AMERICA: MICROBIOLOGY TESTING MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 179

TABLE 193 NORTH AMERICA: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 180

TABLE 194 NORTH AMERICA: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 180

TABLE 195 NORTH AMERICA: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 180

TABLE 196 NORTH AMERICA: MICROBIOLOGY TESTING MARKET, BY END USERS,

2024–2031 (USD MILLION) 181

TABLE 197 US: MICROBIOLOGY TESTING MARKET, BY PRODUCT, 2024–2031 (USD MILLION) 182

TABLE 198 US: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 182

TABLE 199 US: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 182

TABLE 200 US: MICROBIOLOGY TESTING MARKET, BY END USER, 2024–2031 (USD MILLION) 183

TABLE 201 CANADA: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 184

TABLE 202 CANADA: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 184

TABLE 203 CANADA: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 185

TABLE 204 CANADA: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 185

TABLE 205 EUROPE: MICROBIOLOGY TESTING MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 186

TABLE 206 EUROPE: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 186

TABLE 207 EUROPE: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 187

TABLE 208 EUROPE: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 187

TABLE 209 EUROPE: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 188

TABLE 210 GERMANY: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 189

TABLE 211 GERMANY: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 189

TABLE 212 GERMANY: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 189

TABLE 213 GERMANY: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 190

TABLE 214 UK: MICROBIOLOGY TESTING MARKET, BY PRODUCT, 2024–2031 (USD MILLION) 191

TABLE 215 UK: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 191

TABLE 216 UK: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 191

TABLE 217 UK: MICROBIOLOGY TESTING MARKET, BY END USERS,

2024–2031 (USD MILLION) 192

TABLE 218 FRANCE: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 193

TABLE 219 FRANCE: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 193

TABLE 220 FRANCE: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 193

TABLE 221 FRANCE: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 194

TABLE 222 ITALY: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 195

TABLE 223 ITALY: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 195

TABLE 224 ITALY: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 195

TABLE 225 ITALY: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 196

TABLE 226 SPAIN: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 197

TABLE 227 SPAIN: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 197

TABLE 228 SPAIN: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 197

TABLE 229 SPAIN: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 198

TABLE 230 REST OF EUROPE: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 198

TABLE 231 REST OF EUROPE: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 199

TABLE 232 REST OF EUROPE: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 199

TABLE 233 REST OF EUROPE: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 200

TABLE 234 ASIA PACIFIC: MICROBIOLOGY TESTING MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 202

TABLE 235 ASIA PACIFIC: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 202

TABLE 236 ASIA PACIFIC: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 203

TABLE 237 ASIA PACIFIC: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 203

TABLE 238 ASIA PACIFIC: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 204

TABLE 239 CHINA: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 205

TABLE 240 CHINA: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 205

TABLE 241 CHINA: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 205

TABLE 242 CHINA: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 206

TABLE 243 JAPAN: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 207

TABLE 244 JAPAN: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 207

TABLE 245 JAPAN: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 207

TABLE 246 JAPAN: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 208

TABLE 247 INDIA: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 209

TABLE 248 INDIA: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 209

TABLE 249 INDIA: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 209

TABLE 250 INDIA: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 210

TABLE 251 SOUTH KOREA: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 211

TABLE 252 SOUTH KOREA: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 211

TABLE 253 SOUTH KOREA: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 211

TABLE 254 SOUTH KOREA: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 212

TABLE 255 AUSTRALIA: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 213

TABLE 256 AUSTRALIA: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 213

TABLE 257 AUSTRALIA: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 213

TABLE 258 AUSTRALIA: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 214

TABLE 259 REST OF ASIA PACIFIC: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 214

TABLE 260 REST OF ASIA PACIFIC: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY, 2024–2031 (USD MILLION) 215

TABLE 261 REST OF ASIA PACIFIC: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE, 2024–2031 (USD MILLION) 215

TABLE 262 REST OF ASIA PACIFIC: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 216

TABLE 263 LATIN AMERICA: MICROBIOLOGY TESTING MARKET, BY COUNTRY,

2024–2031 (USD MILLION) 217

TABLE 264 LATIN AMERICA: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 217

TABLE 265 LATIN AMERICA: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 217

TABLE 266 LATIN AMERICA: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 218

TABLE 267 LATIN AMERICA: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 218

TABLE 268 BRAZIL: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 219

TABLE 269 BRAZIL: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 219

TABLE 270 BRAZIL: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 219

TABLE 271 BRAZIL: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 220

TABLE 272 MEXICO: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 221

TABLE 273 MEXICO: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY,

2024–2031 (USD MILLION) 221

TABLE 274 MEXICO: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE,

2024–2031 (USD MILLION) 221

TABLE 275 MEXICO: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 222

TABLE 276 REST OF LATIN AMERICA: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 222

TABLE 277 REST OF LATIN AMERICA: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY, 2024–2031 (USD MILLION) 223

TABLE 278 REST OF LATIN AMERICA: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE, 2024–2031 (USD MILLION) 223

TABLE 279 REST OF LATIN AMERICA: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 224

TABLE 280 MIDDLE EAST & AFRICA: MICROBIOLOGY TESTING MARKET, BY PRODUCT,

2024–2031 (USD MILLION) 225

TABLE 281 MIDDLE EAST & AFRICA: MICROBIOLOGY TESTING MARKET, BY TECHNOLOGY, 2024–2031 (USD MILLION) 225

TABLE 282 MIDDLE EAST & AFRICA: MICROBIOLOGY TESTING MARKET, BY PATHOGEN TYPE, 2024–2031 (USD MILLION) 225

TABLE 283 MIDDLE EAST & AFRICA: MICROBIOLOGY TESTING MARKET, BY END USER,

2024–2031 (USD MILLION) 226

TABLE 284 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022–2025 227

TABLE 285 MICROBIOLOGY TESTING MARKET: DEGREE OF COMPETITION 230

TABLE 286 REGIONAL FOOTPRINT, 2025 234

TABLE 287 PRODUCT FOOTPRINT, 2025 235

TABLE 288 TECHNOLOGY FOOTPRINT 235

TABLE 289 END USER FOOTPRINT, 2025 236

TABLE 290 LIST OF STARTUPS/SMES, 2025 239

TABLE 291 MICROBIOLOGY TESTING MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES (1/2), 2025 239

TABLE 292 MICROBIOLOGY TESTING MARKET COMPETITIVE BENCHMARKING OF STARTUPS/SMES (2/2), 2025 240

TABLE 293 MICROBIOLOGY TESTING MARKET: PRODUCT LAUNCHES AND APPROVALS, JANUARY 2022–DECEMBER 2025 242

TABLE 294 MICROBIOLOGY TESTING MARKET: DEALS, JANUARY 2022–DECEMBER 2025 243

TABLE 295 MICROBIOLOGY TESTING MARKET: EXPANSION, JANUARY 2022–DECEMBER 2025 243

TABLE 296 BIOMÉRIEUX: COMPANY OVERVIEW 244

TABLE 297 BIOMÉRIEUX: PRODUCTS OFFERED 245

TABLE 298 BIOMÉRIEUX: PRODUCT LAUNCHES AND APPROVALS 246

TABLE 299 BIOMÉRIEUX: DEALS 247

TABLE 300 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW 249

TABLE 301 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED 250

TABLE 302 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES AND APPROVALS 251

TABLE 303 MERCK KGAA: COMPANY OVERVIEW 253

TABLE 304 MERCK KGAA: PRODUCTS/SERVICES OFFERED 254

TABLE 305 MERCK KGAA: PRODUCT LAUNCHES 255

TABLE 306 MERCK KGAA: DEALS 255

TABLE 307 MERCK KGAA: EXPANSIONS 256

TABLE 308 BECTON, DICKINSON AND COMPANY (BD): COMPANY OVERVIEW 258

TABLE 309 BECTON, DICKINSON AND COMPANY (BD): PRODUCTS OFFERED 260

TABLE 310 BECKTON, DICKINSON AND COMPANY: EXPANSIONS 260

TABLE 311 NEOGEN CORPORATION: COMPANY OVERVIEW 262

TABLE 312 NEOGEN CORPORATION: PRODUCTS/SERVICES OFFERED 263

TABLE 313 NEOGEN CORPORATION: PRODUCT/SERVICE LAUNCHES 264

TABLE 314 NEOGEN CORPORATION: DEALS 265

TABLE 315 QIAGEN: COMPANY OVERVIEW 266

TABLE 316 MCKESSON CORPORATION: PRODUCTS OFFERED 267

TABLE 317 QIAGEN N.V.: PRODUCT LAUNCHES 268

TABLE 318 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW 269

TABLE 319 BIO-RAD LABORATORIES, INC.: PRODUCTS/SERVICES OFFERED 270

TABLE 320 BIO-RAD LABORATORIES, INC.: PRODUCT LAUNCHES 271

TABLE 321 BRUKER: COMPANY OVERVIEW 272

TABLE 322 BRUKER: PRODUCTS/SERVICES OFFERED 273

TABLE 323 BRUKER: DEALS 274

TABLE 324 SHIMADZU CORPORATION: COMPANY OVERVIEW 275

TABLE 325 SHIMADZU CORPORATION: PRODUCTS/SERVICES OFFERED 276

TABLE 326 SHIMADZU CORPORATION: PRODUCT/SERVICE LAUNCHES AND APPROVALS 277

TABLE 327 SHIMADZU CORPORATION: EXPANSIONS 277

TABLE 328 CHARLES RIVER LABORATORIES: COMPANY OVERVIEW 278

TABLE 329 CHARLES RIVER LABORATORIES: PRODUCTS/SERVICES OFFERED 279

TABLE 330 CHARLES RIVER LABORATORIES: PRODUCT/SERVICE LAUNCHES 280

TABLE 331 EUROFINS SCIENTIFIC: COMPANY OVERVIEW 281

TABLE 332 EUROFINS SCIENTIFIC: PRODUCTS/SERVICES OFFERED 282

TABLE 333 EUROFINS SCIENTIFIC: DEALS 283

TABLE 334 IDEXX: COMPANY OVERVIEW 284

TABLE 335 IDEXX: PRODUCTS/SERVICES OFFERED 285

TABLE 336 IDEXX: PRODUCT/SERVICE LAUNCHES AND APPROVALS 286

TABLE 337 HARDY DIAGNOSTICS: COMPANY OVERVIEW 287

TABLE 338 CHARM SCIENCES: COMPANY OVERVIEW 288

TABLE 339 MICROBIOLOGICS: COMPANY OVERVIEW 289

TABLE 340 LIOFILCHEM S.R.L. : COMPANY OVERVIEW 290

TABLE 341 R-BIOPHARM: COMPANY OVERVIEW 291

TABLE 342 ROMER LABS DIVISION HOLDING: COMPANY OVERVIEW 292

TABLE 343 HYGIENA LLC: COMPANY OVERVIEW 293

TABLE 344 HIMEDIA LABORATORIES: COMPANY OVERVIEW 294

TABLE 345 CONDALAB: COMPANY OVERVIEW 295

TABLE 346 E&O LABORATORIES LTD: COMPANY OVERVIEW 296

TABLE 347 MAST GROUP LTD.: COMPANY OVERVIEW 297

TABLE 348 MEDICAL WIRE & EQUIPMENT: COMPANY OVERVIEW 298

TABLE 349 HACH: COMPANY OVERVIEW 299

TABLE 350 MICROBIOLOGY TESTING MARKET: KEY DATA FROM PRIMARY SOURCES 304

TABLE 351 RISK ASSESSMENT 312

LIST OF FIGURES

FIGURE 1 MICROBIOLOGY TESTING MARKET SEGMENTATION 31

FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS 34

FIGURE 3 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN MICROBIOLOGY TESTING MARKET, 2022–2025 35

FIGURE 4 DISRUPTIVE TRENDS IMPACTING GROWTH OF MICROBIOLOGY TESTING MARKET 35

FIGURE 5 FASTEST-GROWTH SEGMENTS AND EMERGING FRONTIERS IN MICROBIOLOGY TESTING MARKET 36

FIGURE 6 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD 37

FIGURE 7 GROWING NEED FOR CONTAMINATION CONTROL TO DRIVE MARKET 38

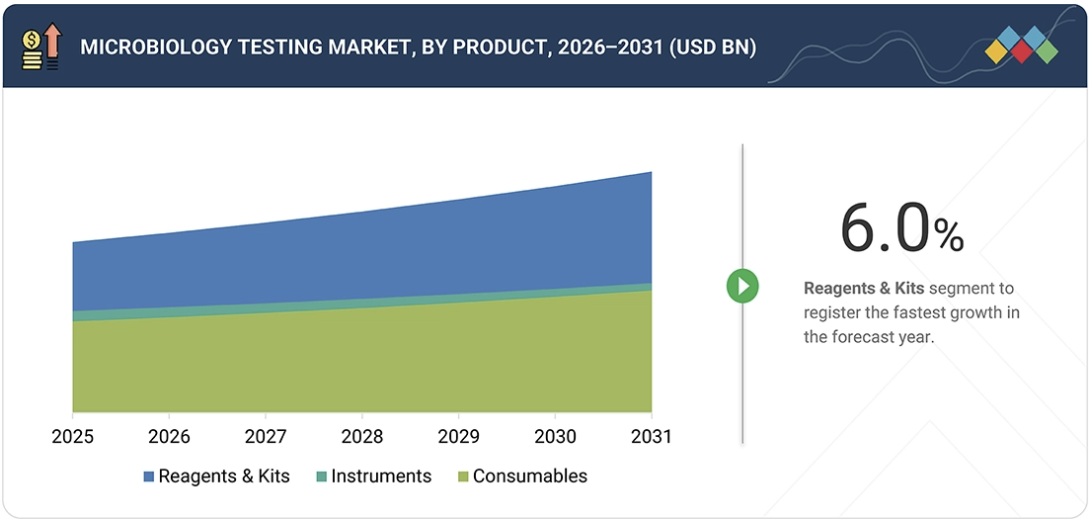

FIGURE 8 REAGENT & KITS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD 38

FIGURE 9 TRADITIONAL MICROBIOLOGY METHODS (TMM) TO LEAD MARKET DURING FORECAST PERIOD 39

FIGURE 10 BACTERIAL TESTING TO CONTINUE LEAD SIGNIFICANTLY

DURING FORECAST PERIOD 39

FIGURE 11 PHARMACEUTICAL & BIOTECH COMPANIES TO COMMAND LARGEST SHARE AMONG END USERS DURING FORECAST PERIOD 40

FIGURE 12 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD 40

FIGURE 13 MICROBIOLOGY TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES 41

FIGURE 14 PRODUCTS RECALLED GLOBALLY, 2012–2022 43

FIGURE 15 MICROBIOLOGY TESTING MARKET: PORTER’S FIVE FORCES ANALYSIS 52

FIGURE 16 MICROBIOLOGY TESTING MARKET: SUPPLY CHAIN ANALYSIS 58

FIGURE 17 MICROBIOLOGY TESTING MARKET: VALUE CHAIN ANALYSIS 59

FIGURE 18 MICROBIOLOGY TESTING MARKET: ECOSYSTEM ANALYSIS 60

FIGURE 19 MICROBIOLOGY TESTING MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES 65

FIGURE 20 NUMBER OF DEALS & FUNDING ACTIVITIES IN MICROBIOLOGY TESTING MARKET 66

FIGURE 21 PATENT ANALYSIS FOR MICROBIOLOGY TESTING,

JANUARY 2016–DECEMBER 2025 73

FIGURE 22 MARKET POTENTIAL OF AI IN MICROBIOLOGY TESTING MARKET 75

FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT 83

FIGURE 24 KEY BUYING CRITERIA, BY PRODUCT 84

FIGURE 25 NORTH AMERICA: MICROBIOLOGY TESTING MARKET SNAPSHOT 179

FIGURE 26 ASIA PACIFIC: MICROBIOLOGY TESTING MARKET SNAPSHOT 201

FIGURE 27 REVENUE ANALYSIS OF KEY PLAYERS, 2022–2024 (USD MILLION) 229

FIGURE 28 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2025 230

FIGURE 29 US MARKET SHARE ANALYSIS OF KEY PLAYERS, 2025 231

FIGURE 30 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2025 233

FIGURE 31 COMPANY FOOTPRINT, 2025 234

FIGURE 32 COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2025 238

FIGURE 33 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND FIVE-YEAR STOCK

BETA OF KEY VENDORS, 2025 240

FIGURE 34 EV/EBITDA OF KEY VENDORS, 2025 241

FIGURE 35 BRAND/PRODUCT COMPARATIVE ANALYSIS 241

FIGURE 36 BIOMÉRIEUX: COMPANY SNAPSHOT (2024) 245

FIGURE 37 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2024) 250

FIGURE 38 MERCK KGAA: COMPANY SNAPSHOT (2024) 254

FIGURE 39 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2024) 259

FIGURE 40 NEOGEN CORPORATION: COMPANY SNAPSHOT (2024) 263

FIGURE 41 QIAGEN: COMPANY SNAPSHOT (2024) 267

FIGURE 42 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2024) 270

FIGURE 43 BRUKER: COMPANY SNAPSHOT (2024) 273

FIGURE 44 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2024) 276

FIGURE 45 CHARLES RIVER LABORATORIES: COMPANY SNAPSHOT (2024) 279

FIGURE 46 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT (2024) 282

FIGURE 47 IDEXX: COMPANY SNAPSHOT (2024) 285

FIGURE 48 MICROBIOLOGY TESTING MARKET: RESEARCH DESIGN METHODOLOGY 300

FIGURE 49 KEY DATA FROM SECONDARY SOURCES 302

FIGURE 50 PRIMARY SOURCES 303

FIGURE 51 INSIGHTS FROM INDUSTRY EXPERTS 305

FIGURE 52 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY SIDE AND DEMAND SIDE PARTICIPANTS 306

FIGURE 53 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION 306

FIGURE 54 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH 307

FIGURE 55 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS 308

FIGURE 56 MICROBIOLOGY TESTING MARKET: TOP-DOWN APPROACH 309

FIGURE 57 DATA TRIANGULATION METHODOLOGY 310

FIGURE 58 MICROBIOLOGY TESTING MARKET: RESEARCH ASSUMPTIONS 311