Radiology Al Market - Global Forecast to 2030

Radiology AI Market by Offering (On-Device, SaaS), Function (Triage, Workflow, CDSS, Acquisition, Processing, Reporting), Modality (CT, MRI, X-ray), Indication (Onco, Cardio, Neuro), End User (Hospital, Imaging Center), Region - Global Forecast to 2030

放射線科におけるAI市場 - 提供内容(オンデバイス、SaaS)、機能(トリアージ、ワークフロー、CDSS、取得、処理、レポート)、モダリティ(CT、MRI、X線)、適応症(腫瘍、心臓、神経)、エンドユーザー(病院、画像診断センター)、地域別 - 2030年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2025年11月 |

| ページ数 | 347 |

| 図表数 | 348 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-13530 |

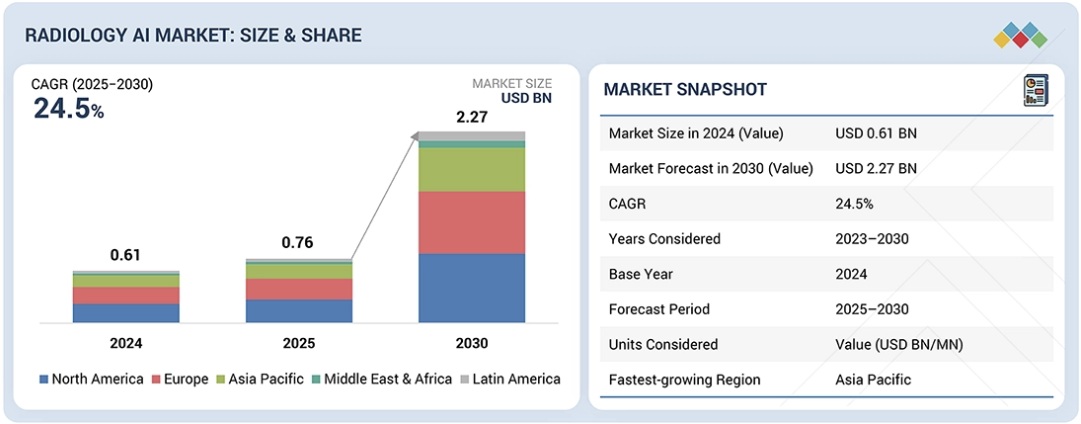

放射線科におけるAI市場は、2025年の7億6,000万米ドルから2030年には22億7,000万米ドルに達し、年平均成長率(CAGR)24.5%で成長すると予測されています。この成長は、がんの早期発見、病変のセグメンテーション、予測的な治療計画といったAIを活用した診断ツールの導入拡大によって牽引されており、診断精度の向上と放射線科医の作業負荷軽減に寄与しています。腫瘍学、神経画像診断、心血管画像診断におけるこれらのソリューションの適用拡大は、リアルタイムの洞察、個別診断、ワークフローの最適化を可能にするインテリジェントAIプラットフォームへの需要を大幅に押し上げ、ヘルスケアテクノロジー分野において価値の高いビジネスチャンスを生み出しています。

調査範囲:

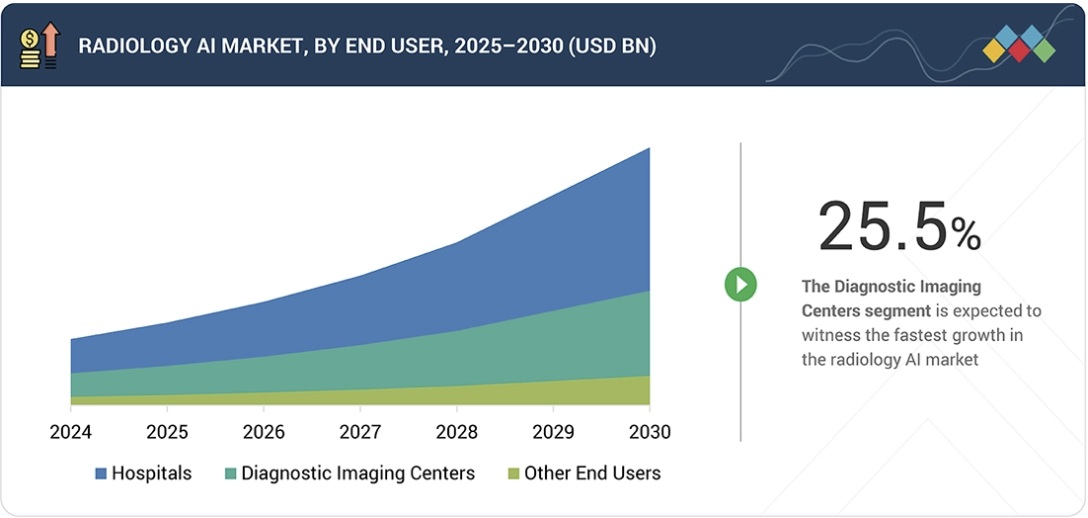

本レポートは、放射線科におけるAI市場を分析しています。提供内容、機能、モダリティ、適応症、エンドユーザー、地域に基づき、様々な市場セグメントの市場規模と将来の成長可能性を推定することを目的としています。また、主要プレーヤーの競合分析に加え、企業概要、製品ラインナップ、最近の動向、主要な市場戦略についても提供しています。

レポートを購入する理由

本レポートは、既存企業、新規参入企業、中小企業が市場の動向を把握し、市場シェアの拡大を図るのに役立ちます。本レポートを購入した企業は、以下の戦略のいずれか、または組み合わせて活用することで、市場における地位を強化できます。

本レポートでは、以下の点について洞察を提供します。

主要な推進要因の分析:推進要因(医療画像撮影量の増加、放射線科医の作業負荷軽減のためのAIソリューションへの需要の高まり、規制の明確化、承認取得と政府支援の迅速化、AIを活用した放射線画像処理への需要の高まり、AIに特化したスタートアップ企業への資金提供の増加、AI、テクノロジー、アナリティクスソリューションプロバイダーとの連携の増加)、制約要因(導入コストの高さとROIの不確実性、地域間での規制の断片化、希少疾患におけるデータ品質とラベルの不足)、機会(プラットフォーム、マルチモーダルデータ、OEM統合(PACS/EHR/マーケットプレイス)への需要の高まり、新興ヘルスケア市場における未開拓の成長ポテンシャル、予防医療と集団健康管理の拡大、AI統合型ポータブルデバイスまたはハンドヘルドデバイスの拡大)、課題(従来の放射線システムとの統合課題、医師の信頼と説明可能性への要求の低さ、データのプライバシーとセキュリティに関する懸念)が、放射線AI市場の成長に影響を与えています。

- 製品開発/イノベーション:放射線科におけるAI市場における今後の技術、研究開発活動、新製品発売に関する詳細な洞察

- 市場開発:製品、機能、モダリティ、適応症、エンドユーザー、地域別に、収益性の高い新興市場に関する包括的な情報。

- 市場多様化:放射線科におけるAI市場における製品ポートフォリオ、成長地域、最近の開発状況、投資に関する包括的な情報。

- 競合評価:Siemens Healthineers AG(ドイツ)、Microsoft(米国)、Koninklijke Philips N.V.(オランダ)、GE HealthCare(米国)、富士フイルムホールディングス株式会社(日本)、キヤノンメディカルシステムズ株式会社(日本)、Merative(米国)、DeepHealth(RadNet, Inc.)(米国)、Shanghai United Imaging Healthcare Co., LTD(中国)、Hologic, Inc.(米国)、Enlitic, Inc.(米国)など、放射線AI市場の主要プレーヤーの市場シェア、成長戦略、製品提供、および能力の詳細な評価。

Report Description

The radiology AI market is projected to reach USD 2.27 billion by 2030 from USD 0.76 billion in 2025, at a CAGR of 24.5%. The growth is fueled by the increasing adoption of AI-driven diagnostic tools for early cancer detection, lesion segmentation, and predictive treatment planning, which enhance diagnostic accuracy and reduce radiologist workload. The expanding application of these solutions in oncology, neuroimaging, and cardiovascular imaging is significantly boosting demand for intelligent AI platforms capable of delivering real-time insights, personalized diagnostics, and workflow optimization, creating a high-value opportunity in the healthcare technology landscape.

Radiology Al Market – Global Forecast to 2030

The workflow optimization segment is expected to witness significant market share during the forecast period.

Based on the function, the radiology AI market is segmented into screening & triage, diagnostic imaging & interpretation (image acquisition, reconstruction & enhancement, image processing, analysis & detection, clinical decision support, others), treatment planning & intervention support (dose planning & optimization, surgical planning & guidance, image-based segmentation & anatomical modeling, others), monitoring & follow-up, reporting & documentation, workflow optimization, research & clinical development, and others. Workflow optimization is projected to record the fastest CAGR in the radiology AI market, driven by its strong economic and operational impact across imaging departments. With global radiologist shortages and rising imaging volumes, health systems are prioritizing AI that enhances productivity through intelligent worklist orchestration and automated case routing, as well as real-time modality utilization and turnaround-time reduction. These solutions streamline communication between technologists and radiologists, reduce the need for repeat scans, facilitate protocol standardization, and help eliminate manual administrative tasks. As hospitals increasingly shift toward value-based care, workflow AI directly supports cost containment, faster patient throughput, and an improved patient experience, making it a key investment area over the forecast period.

The software/SaaS segment is expected to have the largest share in 2025 in the radiology AI market.

By offering, the software/SaaS solutions segment is expected to hold the largest market share in 2025, primarily because they are easier to deploy, update, and scale across multiple imaging modalities. These platforms seamlessly integrate with existing Picture Archiving and Communication Systems (PACS), Radiology Information Systems (RIS), and Electronic Health Record (EHR) systems, enabling radiologists to access AI insights directly within their routine workflows without requiring major infrastructure changes. Cloud-based architectures enhance accessibility, support continuous model improvement, and lower upfront capital expenditure.

Additionally, software vendors leverage subscription and usage-based pricing, making adoption budget-friendly while driving strong recurring revenue. Growing regulatory approvals for diagnostic AI tools, along with strong use cases in oncology, neurology, and cardiology, further accelerate the dominance of this technology in the market.

Radiology Al Market – Global Forecast to 2030 – region

The North America region accounted for a substantial share of the radiology AI market in 2025.

The North American region accounted for a substantial share of the radiology AI market in 2025, driven by significant investments in healthcare infrastructure, the adoption of advanced technology, and high demand for imaging services. The US, in particular, has seen widespread integration of AI into radiology workflows, supported by federal incentives for digital health adoption and regulatory approvals for AI-powered diagnostic tools. In addition, the growing prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions has increased the demand for advanced imaging solutions, fueling the adoption of AI algorithms for image analysis, triage, and workflow optimization. For instance, in April 2025, according to the NIHCM Foundation, chronic diseases continue to pose a major burden on the US healthcare system, accounting for approximately 90% of the USD 4.5 trillion spent on healthcare in 2022, affecting around 60% of people in the US with multiple chronic conditions, thus driving high costs and complex care needs.

Robust investment from both private and public sectors, along with a high concentration of AI startups and established technology companies, further reinforced North American market leadership. Companies such as Aidoc (US), Enlitic, Inc. (US), and GE HealthCare (US) are actively developing AI-enabled platforms for CT, MRI, X-ray, and PET imaging, enhancing diagnostic accuracy and operational efficiency.

However, challenges such as data privacy concerns under HIPAA and clinician hesitancy to fully adopt AI tools remain. Despite these hurdles, the region continues to lead the global radiology AI market due to a combination of advanced healthcare infrastructure, favorable reimbursement policies, high R&D investment, and early adoption of innovative AI technologies.

These factors collectively reinforce North America’s leadership in the radiology AI market.

The breakdown of primary participants is as mentioned below:

- By Company Type – Tier 1: 45%, Tier 2: 30%, and Tier 3: 25%

- By Designation – C Level: 40%, Director Level: 30%, and Others: 30%

- By Region – North America: 40%, Europe: 30%, Asia Pacific: 25%, Latin America: 3%, Middle East & Africa: 2%

Key Players in the Radiology AI Market

The key players functioning in the radiology AI market include Siemens Healthineers AG (Germany), Microsoft (US), Koninklijke Philips N.V. (Netherlands), GE HealthCare (US), Fujifilm Holdings Corporation (Japan), Canon Medical Systems Corporation (Japan), Merative (US), DeepHealth (RadNet, Inc.) (US), Shanghai United Imaging Healthcare Co., LTD (China), Hologic, Inc. (US), and Enlitic, Inc. (US).

Radiology Al Market – Global Forecast to 2030 – ecosystem

Research Coverage:

The report analyses the radiology AI market. It aims to estimate the market size and future growth potential of various market segments based on offering, function, modality, indication, end user, and region. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

This report will help established firms and new entrants/smaller firms gauge the market’s pulse, which, in turn, will help them garner a greater share of the market. Firms purchasing the report could use one or a combination of the following strategies to strengthen their positions in the market.

This report provides insights into:

Analysis of key drivers: Drivers (increasing medical imaging volumes, rising demand for AI solutions to alleviate radiologist workload, increase in regulatory clarity, accelerated approvals and government support, growing demand for AI-driven radiological image processing, growing funding for AI-focused startups, and rising collaborations with AI, tech, and analytics solution providers, Restraints (high implementation costs and ROI uncertainty, regulatory fragmentation across regions, and data quality and label scarcity for rarer indications), Opportunities (Growing demand for platform, multi-modal data, and OEM integration [PACS/EHR/marketplaces], untapped growth potential in emerging healthcare markets, expansion of preventive care and population health management, and expansion of portable or handheld devices with AI integration), Challenges (integration challenges with legacy radiology systems, limited clinician trust and explainability demands, and concerns over data privacy and security) influencing the growth of the radiology AI market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and new product launches in the radiology AI market

- Market Development: Comprehensive information on the lucrative emerging markets, by offering, function, modality, indication, end user, and region.

- Market Diversification: Exhaustive information about the product portfolios, growing geographies, recent developments, and investments in the radiology AI market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, and capabilities of the leading players in the radiology AI market such as Siemens Healthineers AG (Germany), Microsoft (US), Koninklijke Philips N.V. (Netherlands), GE HealthCare (US), Fujifilm Holdings Corporation (Japan), Canon Medical Systems Corporation (Japan), Merative (US), DeepHealth (RadNet, Inc.) (US), Shanghai United Imaging Healthcare Co., LTD (China), Hologic, Inc. (US), and Enlitic, Inc. (US).

Table of Contents

1 INTRODUCTION 27

1.1 STUDY OBJECTIVES 27

1.2 MARKET DEFINITION 27

1.3 STUDY SCOPE 28

1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE 28

1.3.2 INCLUSIONS & EXCLUSIONS 29

1.3.3 YEARS CONSIDERED 30

1.4 CURRENCY 30

1.5 STAKEHOLDERS 31

2 EXECUTIVE SUMMARY 32

2.1 KEY INSIGHTS & MARKET HIGHLIGHTS 32

2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS & STRATEGIC DEVELOPMENTS 33

2.3 DISRUPTIVE TRENDS SHAPING MARKET 34

2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS 35

2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST 36

3 PREMIUM INSIGHTS 37

3.1 RADIOLOGY AI MARKET OVERVIEW 37

3.2 NORTH AMERICA: RADIOLOGY AI MARKET, BY OFFERING & COUNTRY 38

3.3 RADIOLOGY AI MARKET: GEOGRAPHIC SNAPSHOT 38

4 MARKET OVERVIEW 39

4.1 INTRODUCTION 39

4.2 MARKET DYNAMICS 39

4.2.1 DRIVERS 41

4.2.1.1 Increasing medical imaging volumes 41

4.2.1.2 Rising demand for AI solutions to alleviate radiologist workload 42

4.2.1.3 Increased regulatory clarity, accelerated approvals, and government support 42

4.2.1.4 Growing demand for AI-driven radiological image processing 44

4.2.1.5 Growing funding for AI-focused startups 45

4.2.1.6 Rising collaborations with AI, tech, and analytics solution providers 45

4.2.2 RESTRAINTS 46

4.2.2.1 High implementation costs and ROI uncertainty 46

4.2.2.2 Regulatory fragmentation across regions 47

4.2.2.3 Data quality and label scarcity for rarer indications 48

4.2.3 OPPORTUNITIES 48

4.2.3.1 Growing demand for platform, multi-modal data, and OEM integration (PACS/EHR/marketplaces) 48

4.2.3.2 Untapped growth potential in emerging healthcare markets 49

4.2.3.3 Expansion of preventive care and population health management 50

4.2.3.4 Expansion of portable/handheld devices with AI integration 51

4.2.4 CHALLENGES 51

4.2.4.1 Integration challenges with legacy radiology systems 51

4.2.4.2 Limited clinician trust and explainability demands 52

4.2.4.3 Concerns over data privacy and security 53

4.3 UNMET NEEDS & WHITE SPACES 56

4.4 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES 57

4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 57

5 INDUSTRY TRENDS 59

5.1 PORTER’S FIVE FORCES ANALYSIS 59

5.1.1 BARGAINING POWER OF SUPPLIERS 60

5.1.2 BARGAINING POWER OF BUYERS 60

5.1.3 THREAT OF SUBSTITUTES 60

5.1.4 THREAT OF NEW ENTRANTS 60

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 61

5.2 MACROECONOMIC INDICATORS 61

5.2.1 INTRODUCTION 61

5.2.2 GDP TRENDS & FORECAST 61

5.2.3 TRENDS IN GLOBAL HEALTHCARE IT INDUSTRY 61

5.3 SUPPLY CHAIN ANALYSIS 61

5.4 ECOSYSTEM ANALYSIS 63

5.5 PRICING ANALYSIS 65

5.5.1 INDICATIVE PRICING FOR RADIOLOGY AI SOLUTIONS, BY OFFERING (2024) 66

5.5.2 INDICATIVE PRICING FOR RADIOLOGY AI SOLUTIONS, BY REGION (2024) 66

5.6 KEY CONFERENCES & EVENTS, 2026–2027 67

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES 68

5.8 INVESTMENT & FUNDING SCENARIO 69

5.9 CASE STUDY ANALYSIS 69

5.10 IMPACT OF 2025 US TARIFFS ON RADIOLOGY AI MARKET 70

5.10.1 INTRODUCTION 70

5.10.2 KEY TARIFF RATES 71

5.10.3 PRICE IMPACT ANALYSIS 72

5.10.4 IMPACT ON COUNTRY/REGION 72

5.10.4.1 US 72

5.10.4.2 Europe 72

5.10.4.3 Asia Pacific 73

5.10.5 IMPACT ON END-USE INDUSTRIES 73

5.10.5.1 Hospitals & healthcare systems 73

5.10.5.2 Diagnostic imaging centers & independent radiology practices 73

5.10.5.3 Academic, research, and life science institutions 74

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS 75

6.1 KEY EMERGING TECHNOLOGIES 75

6.1.1 GENERATIVE AI FOR IMAGE RECONSTRUCTION 75

6.1.2 MULTIMODAL AI INTEGRATION 75

6.1.3 FEDERATED LEARNING FRAMEWORKS 76

6.2 COMPLEMENTARY TECHNOLOGIES 76

6.2.1 CLOUD-BASED IMAGING PLATFORMS 76

6.2.2 BLOCKCHAIN FOR DATA INTEGRITY & TRACEABILITY 77

6.2.3 ADVANCED VISUALIZATION & AR/VR TOOLS 77

6.3 TECHNOLOGY/PRODUCT ROADMAP 78

6.4 PATENT ANALYSIS 78

6.4.1 PATENT PUBLICATION TRENDS FOR RADIOLOGY AI MARKET 79

6.4.2 INSIGHTS: JURISDICTION & TOP APPLICANT ANALYSIS 79

6.5 FUTURE APPLICATIONS 82

6.5.1 AI-DRIVEN PRECISION RADIOLOGY & PERSONALIZED TREATMENT PLANNING 82

6.5.2 AUTONOMOUS IMAGING & WORKFLOW ORCHESTRATION 82

6.5.3 PREDICTIVE & PREVENTIVE DIAGNOSTIC PLATFORMS 83

7 REGULATORY LANDSCAPE 84

7.1 REGIONAL REGULATIONS & COMPLIANCE 84

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 84

7.1.2 REGULATORY FRAMEWORK 89

7.1.2.1 North America 89

7.1.2.2 Europe 90

7.1.2.3 Asia Pacific 90

7.1.2.4 Latin America 92

7.1.2.5 Middle East & Africa 92

7.1.3 INDUSTRY STANDARDS 92

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 94

8.1 DECISION-MAKING PROCESS 94

8.2 BUYER STAKEHOLDERS & BUYING EVALUATION CRITERIA 94

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 94

8.2.2 BUYING CRITERIA 95

8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 96

8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES 97

8.4.1 UNMET NEEDS 97

8.4.2 END-USER EXPECTATIONS 98

8.5 MARKET PROFITABILITY 99

9 RADIOLOGY AI MARKET, BY OFFERING 100

9.1 INTRODUCTION 101

9.2 ON-DEVICE SOFTWARE 101

9.2.1 RISING DEMAND FOR REAL-TIME, SECURE, AND LOW-LATENCY DIAGNOSTIC INTELLIGENCE TO ACCELERATE ADOPTION 101

9.3 SOFTWARE/SAAS 102

9.3.1 GROWING DEMAND FOR SCALABLE, COST-EFFICIENT, CLOUD-BASED RADIOLOGY AI TO SUPPORT MARKET GROWTH 102

10 RADIOLOGY AI MARKET, BY FUNCTION 104

10.1 INTRODUCTION 105

10.2 SCREENING & TRIAGE 106

10.2.1 RISING NEED FOR RAPID IDENTIFICATION AND PRIORITIZATION OF CRITICAL FINDINGS TO DRIVE ADOPTION OF SCREENING & TRIAGE AI 106

10.3 DIAGNOSTIC IMAGING & INTERPRETATION 106

10.3.1 GROWING DEMAND FOR HIGHER DIAGNOSTIC ACCURACY AND WORKLOAD REDUCTION TO ACCELERATE ADOPTION 106

10.4 TREATMENT PLANNING & INTERVENTION SUPPORT 107

10.4.1 RISING DEMAND FOR PRECISE, PERSONALIZED TREATMENT PLANNING TO SUPPORT MARKET GROWTH 107

10.5 MONITORING & FOLLOW-UP 108

10.5.1 RISING NEED FOR QUANTITATIVE, LONG-TERM DISEASE MONITORING TO BOOST MARKET GROWTH 108

10.6 REPORTING & DOCUMENTATION 109

10.6.1 GROWING NEED FOR STANDARDIZED, AUTOMATED RADIOLOGY REPORTING TO CONTRIBUTE TO GROWTH 109

10.7 WORKFLOW OPTIMIZATION 110

10.7.1 RISING NEED FOR EFFICIENT, AUTOMATED RADIOLOGY WORKFLOWS TO FUEL GROWTH 110

10.8 RESEARCH & CLINICAL DEVELOPMENT 111

10.8.1 GROWING DEMAND FOR AI-ACCELERATED IMAGING RESEARCH TO PROPEL MARKET 111

10.9 OTHER FUNCTIONS 112

11 RADIOLOGY AI MARKET, BY MODALITY 113

11.1 INTRODUCTION 114

11.2 CT 115

11.2.1 GROWING NEED FOR FASTER, MORE ACCURATE CT DIAGNOSIS TO DRIVE MARKET GROWTH 115

11.3 MRI 116

11.3.1 ONGOING TECHNOLOGICAL ADVANCEMENTS IN MRI TECHNOLOGY TO SUPPORT GROWTH 116

11.4 X-RAY 116

11.4.1 GROWING NEED TO MANAGE RISING IMAGING VOLUMES TO DRIVE DEMAND FOR AI-ENHANCED X-RAY SYSTEMS 116

11.5 ULTRASOUND 117

11.5.1 ADVANTAGES SUCH AS MINIMALLY INVASIVE NATURE, LOW COST, AND ABSENCE OF IONIZING RADIATION TO BOOST ADOPTION 117

11.6 MAMMOGRAPHY 118

11.6.1 RISING BREAST CANCER BURDEN TO DRIVE AI ADOPTION IN MAMMOGRAPHY 118

11.7 OTHER MODALITIES 119

12 RADIOLOGY AI MARKET, BY INDICATION 120

12.1 INTRODUCTION 121

12.2 ONCOLOGY 121

12.2.1 RISING GLOBAL CANCER BURDEN TO ACCELERATE NEED FOR AI-DRIVEN DIAGNOSTICS 121

12.3 CARDIOLOGY 122

12.3.1 GROWING CARDIOVASCULAR DISEASE PREVALENCE TO BOOST ADOPTION OF CARDIAC IMAGING AI 122

12.4 NEUROLOGY 123

12.4.1 INCREASING STROKE AND NEURODEGENERATIVE CASES TO DRIVE RAPID AI INTEGRATION 123

12.5 PULMONOLOGY/RESPIRATORY DISEASES 124

12.5.1 EXPANDING LUNG DISEASE INCIDENCE TO FUEL DEMAND FOR AI-BASED DETECTION 124

12.6 ORTHOPEDICS 125

12.6.1 RISING TRAUMA AND OSTEOARTHRITIS CASES TO INCREASE NEED FOR MSK AI 125

12.7 WOMEN’S HEALTH 126

12.7.1 GROWING BREAST CANCER SCREENING VOLUMES TO ACCELERATE AI-ENABLED IMAGING ADOPTION 126

12.8 OTHER INDICATIONS 127

13 RADIOLOGY AI MARKET, BY END USER 128

13.1 INTRODUCTION 129

13.2 HOSPITALS 129

13.2.1 INCREASING DEPLOYMENT OF ADVANCED RADIOLOGY AI-ENABLED IMAGING SYSTEMS IN HOSPITALS TO DRIVE MARKET GROWTH 129

13.3 DIAGNOSTIC IMAGING CENTERS 130

13.3.1 RISING VOLUME OF IMAGING PROCEDURES TO STRENGTHEN NEED FOR AI-SUPPORTED IMAGE INTERPRETATION 130

13.4 OTHER END USERS 131

14 RADIOLOGY AI MARKET, BY REGION 133

14.1 INTRODUCTION 134

14.2 NORTH AMERICA 134

14.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA 136

14.2.2 US 139

14.2.2.1 US to dominate global radiology AI market 139

14.2.3 CANADA 142

14.2.3.1 Growing integration of AI in radiology supported by strong research & regulatory frameworks to drive market 142

14.3 EUROPE 145

14.3.1 MACROECONOMIC OUTLOOK FOR EUROPE 146

14.3.2 GERMANY 148

14.3.2.1 Growing need to advance diagnostic precision through AI-driven imaging to boost market 148

14.3.3 FRANCE 151

14.3.3.1 Need to address regulatory, ethical, and integration challenges in France’s radiology AI market to boost growth 151

14.3.4 UK 154

14.3.4.1 Accelerating AI integration in diagnostic imaging across NHS to spur market growth 154

14.3.5 ITALY 157

14.3.5.1 Regulatory complexity and infrastructure gaps to constrain radiology AI expansion 157

14.3.6 SPAIN 160

14.3.6.1 Advancing digital imaging and AI integration across Spain’s healthcare system to support growth 160

14.3.7 REST OF EUROPE 163

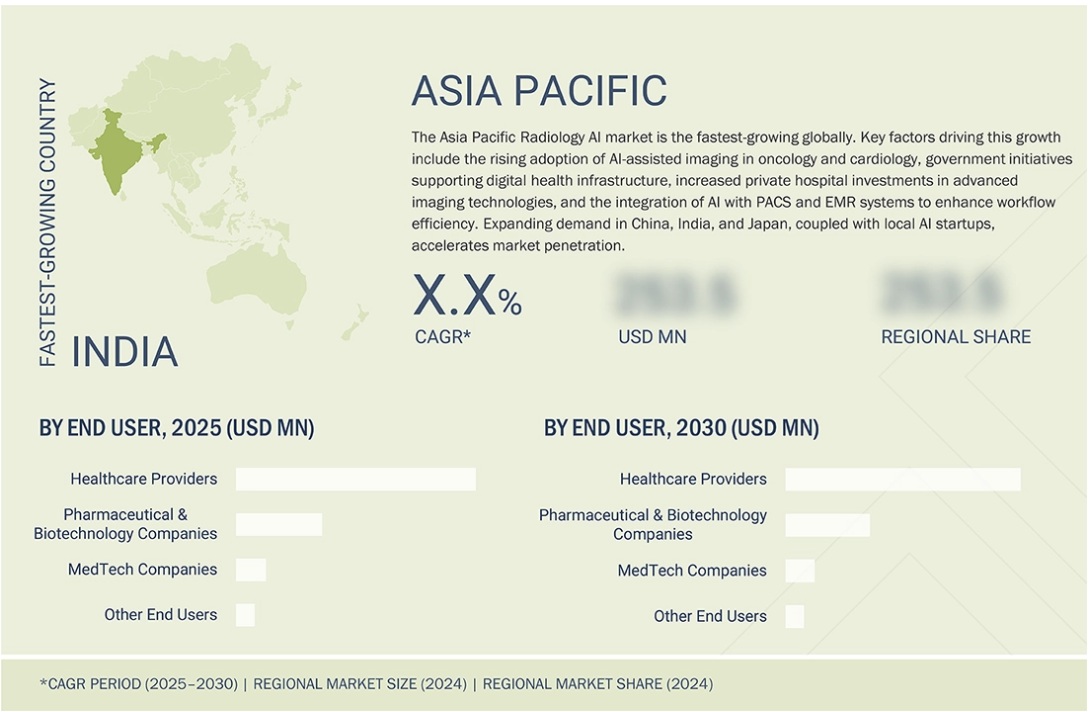

14.4 ASIA PACIFIC 165

14.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC 167

14.4.2 JAPAN 169

14.4.2.1 Strong digital health infrastructure and government-led innovation programs to support growth 169

14.4.3 CHINA 172

14.4.3.1 Rapid adoption and scale-up of AI-enabled radiology in China to drive growth 172

14.4.4 INDIA 176

14.4.4.1 Rising imaging volumes and need for scalable diagnostic solutions to fuel growth 176

14.4.5 SOUTH KOREA 179

14.4.5.1 Integration and validation challenges in South Korea’s radiology AI market to slow growth 179

14.4.6 AUSTRALIA 182

14.4.6.1 Scaling clinical AI from pilot programs to nationwide deployment to boost market 182

14.4.7 REST OF ASIA PACIFIC 184

14.5 LATIN AMERICA 187

14.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA 188

14.5.2 BRAZIL 191

14.5.2.1 Expanding clinical integration and local innovation in radiology AI to fuel market 191

14.5.3 MEXICO 193

14.5.3.1 Integration and regulatory barriers to hinder AI adoption in radiology 193

14.5.4 REST OF LATIN AMERICA 196

14.6 MIDDLE EAST & AFRICA 199

14.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA 199

14.6.2 GCC COUNTRIES 202

14.6.2.1 Saudi Arabia 205

14.6.2.1.1 Advancing diagnostic intelligence through healthcare digitalization and AI integration to fuel growth 205

14.6.2.2 UAE 209

14.6.2.2.1 Accelerating smart healthcare transformation through AI-enabled radiology to spur growth 209

14.6.2.3 Rest of GCC Countries 212

14.6.3 SOUTH AFRICA 214

14.6.3.1 Growing integration of AI to strengthen diagnostic imaging and clinical efficiency 214

14.6.4 REST OF MIDDLE EAST & AFRICA 217

15 COMPETITIVE LANDSCAPE 221

15.1 OVERVIEW 221

15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN 221

15.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN RADIOLOGY AI MARKET 221

15.3 REVENUE ANALYSIS, 2020–2024 224

15.4 MARKET SHARE ANALYSIS, 2024 225

15.5 BRAND/SOFTWARE COMPARISON 227

15.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 228

15.6.1 STARS 228

15.6.2 EMERGING LEADERS 228

15.6.3 PERVASIVE PLAYERS 228

15.6.4 PARTICIPANTS 228

15.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 230

15.6.5.1 Company footprint 230

15.6.5.2 Region footprint 231

15.6.5.3 Offering footprint 231

15.6.5.4 Function footprint 232

15.6.5.5 Modality footprint 233

15.6.5.6 End-user footprint 234

15.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 235

15.7.1 PROGRESSIVE COMPANIES 235

15.7.2 RESPONSIVE COMPANIES 235

15.7.3 DYNAMIC COMPANIES 235

15.7.4 STARTING BLOCKS 235

15.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 237

15.7.5.1 Detailed list of key startups/SMEs 237

15.7.5.2 Competitive benchmarking of startups/SMEs 238

15.8 COMPANY VALUATION & FINANCIAL METRICS 240

15.8.1 FINANCIAL METRICS 240

15.8.2 COMPANY VALUATION 241

15.9 COMPETITIVE SCENARIO 241

15.9.1 PRODUCT LAUNCHES, APPROVALS, AND ENHANCEMENTS 241

15.9.2 DEALS 242

15.9.3 OTHER DEVELOPMENTS 243

15.10 KEY PLAYERS 244

15.10.1 SIEMENS HEALTHINEERS AG 244

15.10.1.1 Business overview 244

15.10.1.2 Solutions offered 245

15.10.1.3 Recent developments 247

15.10.1.3.1 Product launches 247

15.10.1.3.2 Deals 247

15.10.1.3.3 Other developments 249

15.10.1.4 MnM view 250

15.10.1.4.1 Right to win 250

15.10.1.4.2 Strategic choices 250

15.10.1.4.3 Weaknesses & competitive threats 250

15.10.2 MICROSOFT 251

15.10.2.1 Business overview 251

15.10.2.2 Solutions offered 252

15.10.2.3 Recent developments 253

15.10.2.3.1 Product launches 253

15.10.2.3.2 Deals 254

15.10.2.3.3 Other developments 255

15.10.2.4 MnM view 255

15.10.2.4.1 Right to win 255

15.10.2.4.2 Strategic choices 256

15.10.2.4.3 Weaknesses & competitive threats 256

15.10.3 KONINKLIJKE PHILIPS N.V. 257

15.10.3.1 Business overview 257

15.10.3.2 Solutions offered 259

15.10.3.3 Recent developments 261

15.10.3.3.1 Product launches & approvals 261

15.10.3.3.2 Deals 262

15.10.3.3.3 Other developments 263

15.10.3.4 MnM view 264

15.10.3.4.1 Right to win 264

15.10.3.4.2 Strategic choices 264

15.10.3.4.3 Weaknesses & competitive threats 264

15.10.4 GE HEALTHCARE 265

15.10.4.1 Business overview 265

15.10.4.2 Solutions offered 266

15.10.4.3 Recent developments 267

15.10.4.3.1 Product launches & approvals 267

15.10.4.3.2 Deals 268

15.10.4.3.3 Expansions 270

15.10.4.3.4 Other developments 270

15.10.4.4 MnM view 271

15.10.4.4.1 Right to win 271

15.10.4.4.2 Strategic choices 271

15.10.4.4.3 Weaknesses & competitive threats 271

15.10.5 FUJIFILM HOLDINGS CORPORATION 272

15.10.5.1 Business overview 272

15.10.5.2 Solutions offered 273

15.10.5.3 Recent developments 276

15.10.5.3.1 Product launches & approvals 276

15.10.5.3.2 Deals 276

15.10.5.3.3 Other developments 277

15.10.5.4 MnM view 277

15.10.5.4.1 Right to win 277

15.10.5.4.2 Strategic choices 278

15.10.5.4.3 Weaknesses & competitive threats 278

15.10.6 CANON MEDICAL SYSTEMS CORPORATION (CANON INC.) 279

15.10.6.1 Business overview 279

15.10.6.2 Solutions offered 280

15.10.6.3 Recent developments 281

15.10.6.3.1 Product launches & approvals 281

15.10.6.3.2 Deals 282

15.10.6.3.3 Other developments 282

15.10.7 MERATIVE 283

15.10.7.1 Business overview 283

15.10.7.2 Solutions offered 284

15.10.7.3 Recent developments 285

15.10.7.3.1 Deals 285

15.10.7.3.2 Expansions 286

15.10.7.3.3 Other developments 287

15.10.8 RADNET, INC. (DEEPHEALTH) 288

15.10.8.1 Business overview 288

15.10.8.2 Solutions offered 289

15.10.8.3 Recent developments 291

15.10.8.3.1 Product launches & approvals 291

15.10.8.3.2 Deals 292

15.10.9 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD. 293

15.10.9.1 Business overview 293

15.10.9.2 Solutions offered 294

15.10.9.3 Recent developments 295

15.10.9.3.1 Product launches & approvals 295

15.10.9.3.2 Deals 296

15.10.9.3.3 Other developments 296

15.10.10 HOLOGIC, INC. 298

15.10.10.1 Business overview 298

15.10.10.2 Solutions offered 299

15.10.10.3 Recent developments 300

15.10.10.3.1 Product launches & approvals 300

15.10.10.3.2 Deals 301

15.10.10.3.3 Other developments 301

15.10.11 ENLITIC, INC. 303

15.10.11.1 Business overview 303

15.10.11.2 Solutions offered 304

15.10.11.3 Recent developments 305

15.10.11.3.1 Product launches & approvals 305

15.10.11.3.2 Deals 305

15.10.11.3.3 Other developments 306

15.11 OTHER PLAYERS 307

15.11.1 AIDOC 307

15.11.2 VIZ.AI, INC. 308

15.11.3 NANOX 309

15.11.4 QURE.AI 310

15.11.5 ESAOTE S.P.A. 311

15.11.6 BUTTERFLY NETWORK INC. 312

15.11.7 HEARTFLOW INC. 313

15.11.8 SUBTLE MEDICAL, INC. 314

15.11.9 HARISSON.AI 315

15.11.10 ECHONOUS INC. 316

15.11.11 QUIBIM 317

15.11.12 IMAGEN 318

15.11.13 EXO IMAGING, INC. 319

15.11.14 RAD AI 320

16 RESEARCH METHODOLOGY 321

16.1 RESEARCH DATA 321

16.1.1 SECONDARY DATA 322

16.1.1.1 Key data from secondary sources 322

16.1.2 PRIMARY DATA 323

16.1.2.1 Key data from primary sources 324

16.1.2.2 Breakdown of primary sources 325

16.2 RESEARCH APPROACH 326

16.3 MARKET SIZE ESTIMATION 327

16.4 MARKET BREAKDOWN & DATA TRIANGULATION 334

16.5 RESEARCH ASSUMPTIONS 335

16.5.1 MARKET SIZING ASSUMPTIONS 335

16.5.2 OVERALL STUDY ASSUMPTIONS 335

16.6 RISK ASSESSMENT 336

16.7 RESEARCH LIMITATIONS 336

16.7.1 METHODOLOGY-RELATED LIMITATIONS 336

16.7.2 SCOPE-RELATED LIMITATIONS 336

17 APPENDIX 337

17.1 DISCUSSION GUIDE 337

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 342

17.3 CUSTOMIZATION OPTIONS 344

17.4 RELATED REPORTS 345

17.5 AUTHOR DETAILS 346

LIST OF TABLES

TABLE 1 EXCHANGE RATES UTILIZED FOR CONVERSION TO USD 30

TABLE 2 RADIOLOGY AI MARKET: IMPACT ANALYSIS 40

TABLE 3 TOP 30 HEALTHCARE DATA BREACHES IN US, 2011–2024 55

TABLE 4 RADIOLOGY AI MARKET: PORTER’S FIVE FORCES ANALYSIS 60

TABLE 5 RADIOLOGY AI MARKET: ROLE IN ECOSYSTEM 64

TABLE 6 INDICATIVE PRICING FOR RADIOLOGY AI SOLUTIONS, BY OFFERING (2024) 66

TABLE 7 INDICATIVE PRICING FOR RADIOLOGY AI SOLUTIONS, BY REGION (2024) 67

TABLE 8 RADIOLOGY AI MARKET: KEY CONFERENCES & EVENTS, 2026–2027 67

TABLE 9 CASE STUDY 1: PRINCESS ALEXANDRA HOSPITAL NHS TRUST: ENHANCING DIAGNOSTIC CONFIDENCE WITH INTEGRATED AI 69

TABLE 10 CASE STUDY 2: EMBRACING AI FOR EFFICIENT CHEST X-RAY REPORTING AND QUALITY ASSURANCE 70

TABLE 11 US-ADJUSTED RECIPROCAL TARIFF RATES 71

TABLE 12 JURISDICTION ANALYSIS OF TOP APPLICANT COUNTRIES FOR

RADIOLOGY AI MARKET 80

TABLE 13 RADIOLOGY AI MARKET: LIST OF PATENTS/PATENT APPLICATIONS 81

TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 85

TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 86

TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 86

TABLE 17 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 88

TABLE 18 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT

AGENCIES, AND OTHER ORGANIZATIONS 88

TABLE 19 REGULATORY SCENARIO OF NORTH AMERICA 89

TABLE 20 REGULATORY SCENARIO OF EUROPE 90

TABLE 21 REGULATORY SCENARIO OF ASIA PACIFIC 90

TABLE 22 REGULATORY SCENARIO OF LATIN AMERICA 92

TABLE 23 REGULATORY SCENARIO OF MIDDLE EAST & AFRICA 92

TABLE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF

TOP THREE END USERS (%) 95

TABLE 25 KEY BUYING CRITERIA FOR TOP THREE END USERS 96

TABLE 26 UNMET NEEDS IN RADIOLOGY AI MARKET 97

TABLE 27 END-USER EXPECTATIONS IN RADIOLOGY AI MARKET 98

TABLE 28 RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 101

TABLE 29 RADIOLOGY AI MARKET FOR ON-DEVICE SOFTWARE, BY REGION,

2023–2030 (USD MILLION) 102

TABLE 30 RADIOLOGY AI MARKET FOR SOFTWARE/SAAS, BY REGION,

2023–2030 (USD MILLION) 103

TABLE 31 RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 105

TABLE 32 RADIOLOGY AI MARKET FOR SCREENING & TRIAGE, BY REGION,

2023–2030 (USD MILLION) 106

TABLE 33 RADIOLOGY AI MARKET FOR DIAGNOSTIC IMAGING & INTERPRETATION,

BY REGION, 2023–2030 (USD MILLION) 107

TABLE 34 RADIOLOGY AI MARKET FOR TREATMENT PLANNING & INTERVENTION SUPPORT, BY REGION, 2023–2030 (USD MILLION) 108

TABLE 35 RADIOLOGY AI MARKET FOR MONITORING & FOLLOW-UP, BY REGION,

2023–2030 (USD MILLION) 109

TABLE 36 RADIOLOGY AI MARKET FOR REPORTING & DOCUMENTATION, BY REGION,

2023–2030 (USD MILLION) 110

TABLE 37 RADIOLOGY AI MARKET FOR WORKFLOW OPTIMIZATION, BY REGION,

2023–2030 (USD MILLION) 111

TABLE 38 RADIOLOGY AI MARKET FOR RESEARCH & CLINICAL DEVELOPMENT,

BY REGION, 2023–2030 (USD MILLION) 112

TABLE 39 RADIOLOGY AI MARKET FOR OTHER FUNCTIONS, BY REGION,

2023–2030 (USD MILLION) 112

TABLE 40 RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 114

TABLE 41 RADIOLOGY AI MARKET FOR CT, BY REGION, 2023–2030 (USD MILLION) 115

TABLE 42 RADIOLOGY AI MARKET FOR MRI, BY REGION, 2023–2030 (USD MILLION) 116

TABLE 43 RADIOLOGY AI MARKET FOR X-RAY, BY REGION, 2023–2030 (USD MILLION) 117

TABLE 44 RADIOLOGY AI MARKET FOR ULTRASOUND, BY REGION,

2023–2030 (USD MILLION) 118

TABLE 45 RADIOLOGY AI MARKET FOR MAMMOGRAPHY, BY REGION,

2023–2030 (USD MILLION) 119

TABLE 46 RADIOLOGY AI MARKET FOR OTHER MODALITIES, BY REGION,

2023–2030 (USD MILLION) 119

TABLE 47 RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 121

TABLE 48 RADIOLOGY AI MARKET FOR ONCOLOGY, BY REGION, 2023–2030 (USD MILLION) 122

TABLE 49 RADIOLOGY AI MARKET FOR CARDIOLOGY, BY REGION,

2023–2030 (USD MILLION) 123

TABLE 50 RADIOLOGY AI MARKET FOR NEUROLOGY, BY REGION, 2023–2030 (USD MILLION) 124

TABLE 51 RADIOLOGY AI MARKET FOR PULMONOLOGY/RESPIRATORY DISEASES,

BY REGION, 2023–2030 (USD MILLION) 125

TABLE 52 RADIOLOGY AI MARKET FOR ORTHOPEDICS, BY REGION,

2023–2030 (USD MILLION) 126

TABLE 53 RADIOLOGY AI MARKET FOR WOMEN’S HEALTH, BY REGION,

2023–2030 (USD MILLION) 126

TABLE 54 RADIOLOGY AI MARKET FOR OTHER INDICATIONS, BY REGION,

2023–2030 (USD MILLION) 127

TABLE 55 RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 129

TABLE 56 RADIOLOGY AI MARKET FOR HOSPITALS, BY REGION, 2023–2030 (USD MILLION) 130

TABLE 57 RADIOLOGY AI MARKET FOR DIAGNOSTIC IMAGING CENTERS,

BY REGION, 2023–2030 (USD MILLION) 131

TABLE 58 RADIOLOGY AI MARKET FOR OTHER END USERS, BY REGION,

2023–2030 (USD MILLION) 132

TABLE 59 RADIOLOGY AI MARKET, BY REGION, 2023–2030 (USD MILLION) 134

TABLE 60 NORTH AMERICA: RADIOLOGY AI MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 137

TABLE 61 NORTH AMERICA: RADIOLOGY AI MARKET, BY OFFERING,

2023–2030 (USD MILLION) 137

TABLE 62 NORTH AMERICA: RADIOLOGY AI MARKET, BY FUNCTION,

2023–2030 (USD MILLION) 137

TABLE 63 NORTH AMERICA: RADIOLOGY AI MARKET, BY MODALITY,

2023–2030 (USD MILLION) 138

TABLE 64 NORTH AMERICA: RADIOLOGY AI MARKET, BY INDICATION,

2023–2030 (USD MILLION) 138

TABLE 65 NORTH AMERICA: RADIOLOGY AI MARKET, BY END USER,

2023–2030 (USD MILLION) 139

TABLE 66 US: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 140

TABLE 67 US: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 140

TABLE 68 US: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 141

TABLE 69 US: RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 141

TABLE 70 US: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 142

TABLE 71 CANADA: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 143

TABLE 72 CANADA: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 143

TABLE 73 CANADA: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 144

TABLE 74 CANADA: RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 144

TABLE 75 CANADA: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 145

TABLE 76 EUROPE: RADIOLOGY AI MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 146

TABLE 77 EUROPE: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 146

TABLE 78 EUROPE: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 147

TABLE 79 EUROPE: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 147

TABLE 80 EUROPE: RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 148

TABLE 81 EUROPE: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 148

TABLE 82 GERMANY: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 149

TABLE 83 GERMANY: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 149

TABLE 84 GERMANY: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 150

TABLE 85 GERMANY: RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 150

TABLE 86 GERMANY: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 151

TABLE 87 FRANCE: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 152

TABLE 88 FRANCE: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 152

TABLE 89 FRANCE: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 153

TABLE 90 FRANCE: RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 153

TABLE 91 FRANCE: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 154

TABLE 92 UK: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 155

TABLE 93 UK: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 155

TABLE 94 UK: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 156

TABLE 95 UK: RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 156

TABLE 96 UK: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 157

TABLE 97 ITALY: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 158

TABLE 98 ITALY: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 158

TABLE 99 ITALY: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 159

TABLE 100 ITALY: RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 159

TABLE 101 ITALY: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 160

TABLE 102 SPAIN: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 161

TABLE 103 SPAIN: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 161

TABLE 104 SPAIN: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 162

TABLE 105 SPAIN: RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 162

TABLE 106 SPAIN: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 163

TABLE 107 REST OF EUROPE: RADIOLOGY AI MARKET, BY OFFERING,

2023–2030 (USD MILLION) 163

TABLE 108 REST OF EUROPE: RADIOLOGY AI MARKET, BY FUNCTION,

2023–2030 (USD MILLION) 164

TABLE 109 REST OF EUROPE: RADIOLOGY AI MARKET, BY MODALITY,

2023–2030 (USD MILLION) 164

TABLE 110 REST OF EUROPE: RADIOLOGY AI MARKET, BY INDICATION,

2023–2030 (USD MILLION) 165

TABLE 111 REST OF EUROPE: RADIOLOGY AI MARKET, BY END USER,

2023–2030 (USD MILLION) 165

TABLE 112 ASIA PACIFIC: RADIOLOGY AI MARKET, BY COUNTRY, 2023–2030 (USD MILLION) 167

TABLE 113 ASIA PACIFIC: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 167

TABLE 114 ASIA PACIFIC: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 168

TABLE 115 ASIA PACIFIC: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 168

TABLE 116 ASIA PACIFIC: RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 169

TABLE 117 ASIA PACIFIC: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 169

TABLE 118 JAPAN: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 170

TABLE 119 JAPAN: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 171

TABLE 120 JAPAN: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 171

TABLE 121 JAPAN: RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 172

TABLE 122 JAPAN: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 172

TABLE 123 CHINA: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 173

TABLE 124 CHINA: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 174

TABLE 125 CHINA: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 174

TABLE 126 CHINA: RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 175

TABLE 127 CHINA: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 175

TABLE 128 INDIA: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 176

TABLE 129 INDIA: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 177

TABLE 130 INDIA: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 177

TABLE 131 INDIA: RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 178

TABLE 132 INDIA: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 178

TABLE 133 SOUTH KOREA: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 179

TABLE 134 SOUTH KOREA: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 180

TABLE 135 SOUTH KOREA: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 180

TABLE 136 SOUTH KOREA: RADIOLOGY AI MARKET, BY INDICATION,

2023–2030 (USD MILLION) 181

TABLE 137 SOUTH KOREA: RADIOLOGY AI MARKET, BY END USER,

2023–2030 (USD MILLION) 181

TABLE 138 AUSTRALIA: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 182

TABLE 139 AUSTRALIA: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 183

TABLE 140 AUSTRALIA: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 183

TABLE 141 AUSTRALIA: RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 184

TABLE 142 AUSTRALIA: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 184

TABLE 143 REST OF ASIA PACIFIC: RADIOLOGY AI MARKET, BY OFFERING,

2023–2030 (USD MILLION) 185

TABLE 144 REST OF ASIA PACIFIC: RADIOLOGY AI MARKET, BY FUNCTION,

2023–2030 (USD MILLION) 185

TABLE 145 REST OF ASIA PACIFIC: RADIOLOGY AI MARKET, BY MODALITY,

2023–2030 (USD MILLION) 186

TABLE 146 REST OF ASIA PACIFIC: RADIOLOGY AI MARKET, BY INDICATION,

2023–2030 (USD MILLION) 186

TABLE 147 REST OF ASIA PACIFIC: RADIOLOGY AI MARKET, BY END USER,

2023–2030 (USD MILLION) 187

TABLE 148 LATIN AMERICA: RADIOLOGY AI MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 188

TABLE 149 LATIN AMERICA: RADIOLOGY AI MARKET, BY OFFERING,

2023–2030 (USD MILLION) 188

TABLE 150 LATIN AMERICA: RADIOLOGY AI MARKET, BY FUNCTION,

2023–2030 (USD MILLION) 189

TABLE 151 LATIN AMERICA: RADIOLOGY AI MARKET, BY MODALITY,

2023–2030 (USD MILLION) 189

TABLE 152 LATIN AMERICA: RADIOLOGY AI MARKET, BY INDICATION,

2023–2030 (USD MILLION) 190

TABLE 153 LATIN AMERICA: RADIOLOGY AI MARKET, BY END USER,

2023–2030 (USD MILLION) 190

TABLE 154 BRAZIL: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 191

TABLE 155 BRAZIL: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 192

TABLE 156 BRAZIL: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 192

TABLE 157 BRAZIL: RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 193

TABLE 158 BRAZIL: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 193

TABLE 159 MEXICO: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 194

TABLE 160 MEXICO: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 194

TABLE 161 MEXICO: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 195

TABLE 162 MEXICO: RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 195

TABLE 163 MEXICO: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 196

TABLE 164 REST OF LATIN AMERICA: RADIOLOGY AI MARKET, BY OFFERING,

2023–2030 (USD MILLION) 197

TABLE 165 REST OF LATIN AMERICA: RADIOLOGY AI MARKET, BY FUNCTION,

2023–2030 (USD MILLION) 197

TABLE 166 REST OF LATIN AMERICA: RADIOLOGY AI MARKET, BY MODALITY,

2023–2030 (USD MILLION) 198

TABLE 167 REST OF LATIN AMERICA: RADIOLOGY AI MARKET, BY INDICATION,

2023–2030 (USD MILLION) 198

TABLE 168 REST OF LATIN AMERICA: RADIOLOGY AI MARKET, BY END USER,

2023–2030 (USD MILLION) 199

TABLE 169 MIDDLE EAST & AFRICA: RADIOLOGY AI MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 200

TABLE 170 MIDDLE EAST & AFRICA: RADIOLOGY AI MARKET, BY OFFERING,

2023–2030 (USD MILLION) 200

TABLE 171 MIDDLE EAST & AFRICA: RADIOLOGY AI MARKET, BY FUNCTION,

2023–2030 (USD MILLION) 201

TABLE 172 MIDDLE EAST & AFRICA: RADIOLOGY AI MARKET, BY MODALITY,

2023–2030 (USD MILLION) 201

TABLE 173 MIDDLE EAST & AFRICA: RADIOLOGY AI MARKET, BY INDICATION,

2023–2030 (USD MILLION) 202

TABLE 174 MIDDLE EAST & AFRICA: RADIOLOGY AI MARKET, BY END USER,

2023–2030 (USD MILLION) 202

TABLE 175 GCC COUNTRIES: RADIOLOGY AI MARKET, BY COUNTRY,

2023–2030 (USD MILLION) 203

TABLE 176 GCC COUNTRIES: RADIOLOGY AI MARKET, BY OFFERING,

2023–2030 (USD MILLION) 203

TABLE 177 GCC COUNTRIES: RADIOLOGY AI MARKET, BY FUNCTION,

2023–2030 (USD MILLION) 204

TABLE 178 GCC COUNTRIES: RADIOLOGY AI MARKET, BY MODALITY,

2023–2030 (USD MILLION) 204

TABLE 179 GCC COUNTRIES: RADIOLOGY AI MARKET, BY INDICATION,

2023–2030 (USD MILLION) 205

TABLE 180 GCC COUNTRIES: RADIOLOGY AI MARKET, BY END USER,

2023–2030 (USD MILLION) 205

TABLE 181 SAUDI ARABIA: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 206

TABLE 182 SAUDI ARABIA: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 207

TABLE 183 SAUDI ARABIA: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 207

TABLE 184 SAUDI ARABIA: RADIOLOGY AI MARKET, BY INDICATION,

2023–2030 (USD MILLION) 208

TABLE 185 SAUDI ARABIA: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 208

TABLE 186 UAE: RADIOLOGY AI MARKET, BY OFFERING, 2023–2030 (USD MILLION) 209

TABLE 187 UAE: RADIOLOGY AI MARKET, BY FUNCTION, 2023–2030 (USD MILLION) 210

TABLE 188 UAE: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 210

TABLE 189 UAE: RADIOLOGY AI MARKET, BY INDICATION, 2023–2030 (USD MILLION) 211

TABLE 190 UAE: RADIOLOGY AI MARKET, BY END USER, 2023–2030 (USD MILLION) 211

TABLE 191 REST OF GCC COUNTRIES: RADIOLOGY AI MARKET, BY OFFERING,

2023–2030 (USD MILLION) 212

TABLE 192 REST OF GCC COUNTRIES: RADIOLOGY AI MARKET, BY FUNCTION,

2023–2030 (USD MILLION) 213

TABLE 193 REST OF GCC COUNTRIES: RADIOLOGY AI MARKET, BY MODALITY,

2023–2030 (USD MILLION) 213

TABLE 194 REST OF GCC COUNTRIES: RADIOLOGY AI MARKET, BY INDICATION,

2023–2030 (USD MILLION) 214

TABLE 195 REST OF GCC COUNTRIES: RADIOLOGY AI MARKET, BY END USER,

2023–2030 (USD MILLION) 214

TABLE 196 SOUTH AFRICA: RADIOLOGY AI MARKET, BY OFFERING,

2023–2030 (USD MILLION) 215

TABLE 197 SOUTH AFRICA: RADIOLOGY AI MARKET, BY FUNCTION,

2023–2030 (USD MILLION) 215

TABLE 198 SOUTH AFRICA: RADIOLOGY AI MARKET, BY MODALITY, 2023–2030 (USD MILLION) 216

TABLE 199 SOUTH AFRICA: RADIOLOGY AI MARKET, BY INDICATION,

2023–2030 (USD MILLION) 216

TABLE 200 SOUTH AFRICA: RADIOLOGY AI MARKET, BY END USER,

2023–2030 (USD MILLION) 217

TABLE 201 REST OF MIDDLE EAST & AFRICA: RADIOLOGY AI MARKET, BY OFFERING,

2023–2030 (USD MILLION) 218

TABLE 202 REST OF MIDDLE EAST & AFRICA: RADIOLOGY AI MARKET, BY FUNCTION,

2023–2030 (USD MILLION) 218

TABLE 203 REST OF MIDDLE EAST & AFRICA: RADIOLOGY AI MARKET, BY MODALITY,

2023–2030 (USD MILLION) 219

TABLE 204 REST OF MIDDLE EAST & AFRICA: RADIOLOGY AI MARKET, BY INDICATION,

2023–2030 (USD MILLION) 219

TABLE 205 REST OF MIDDLE EAST & AFRICA: RADIOLOGY AI MARKET, BY END USER,

2023–2030 (USD MILLION) 220

TABLE 206 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN RADIOLOGY AI MARKET, JANUARY 2022–NOVEMBER 2025 221

TABLE 207 RADIOLOGY AI MARKET: DEGREE OF COMPETITION 226

TABLE 208 RADIOLOGY AI MARKET: REGION FOOTPRINT 231

TABLE 209 RADIOLOGY AI MARKET: OFFERING FOOTPRINT 231

TABLE 210 RADIOLOGY AI MARKET: FUNCTION FOOTPRINT 232

TABLE 211 RADIOLOGY AI MARKET: MODALITY FOOTPRINT 233

TABLE 212 RADIOLOGY AI MARKET: END-USER FOOTPRINT 234

TABLE 213 RADIOLOGY AI MARKET: DETAILED LIST OF KEY STARTUP/SME PLAYERS 237

TABLE 214 RADIOLOGY AI MARKET: COMPETITIVE BENCHMARKING OF

KEY STARTUPS AND SMES, BY REGION 238

TABLE 215 RADIOLOGY AI MARKET: COMPETITIVE BENCHMARKING OF

KEY STARTUPS AND SMES, BY MODALITY 239

TABLE 216 RADIOLOGY AI MARKET: COMPETITIVE BENCHMARKING OF

KEY STARTUPS AND SMES, BY END USER 240

TABLE 217 RADIOLOGY AI MARKET: PRODUCT LAUNCHES, APPROVALS, AND ENHANCEMENTS, JANUARY 2022–NOVEMBER 2025 241

TABLE 218 RADIOLOGY AI MARKET: DEALS, JANUARY 2022–NOVEMBER 2025 242

TABLE 219 RADIOLOGY AI MARKET: OTHER DEVELOPMENTS,

JANUARY 2022–NOVEMBER 2025 243

TABLE 220 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW 244

TABLE 221 SIEMENS HEALTHINEERS AG: SOLUTIONS OFFERED 245

TABLE 222 SIEMENS HEALTHINEERS AG: PRODUCT LAUNCHES,

JANUARY 2022–NOVEMBER 2025 247

TABLE 223 SIEMENS HEALTHINEERS AG: DEALS, JANUARY 2022–NOVEMBER 2025 247

TABLE 224 SIEMENS HEALTHINEERS AG: OTHER DEVELOPMENTS,

JANUARY 2022–NOVEMBER 2025 249

TABLE 225 MICROSOFT: COMPANY OVERVIEW 251

TABLE 226 MICROSOFT: SOLUTIONS OFFERED 252

TABLE 227 MICROSOFT: PRODUCT LAUNCHES, JANUARY 2022–NOVEMBER 2025 253

TABLE 228 MICROSOFT: DEALS, JANUARY 2022–NOVEMBER 2025 254

TABLE 229 MICROSOFT: OTHER DEVELOPMENTS, JANUARY 2022–NOVEMBER 2025 255

TABLE 230 KONINKLIJKE PHILIPS N.V.: COMPANY OVERVIEW 257

TABLE 231 KONINKLIJKE PHILIPS N.V.: SOLUTIONS OFFERED 259

TABLE 232 KONINKLIJKE PHILIPS N.V.: PRODUCT LAUNCHES & APPROVALS,

JANUARY 2022–NOVEMBER 2025 261

TABLE 233 KONINKLIJKE PHILIPS N.V.: DEALS, JANUARY 2022–NOVEMBER 2025 262

TABLE 234 KONINKLIJKE PHILIPS N.V.: OTHER DEVELOPMENTS,

JANUARY 2022–NOVEMBER 2025 263

TABLE 235 GE HEALTHCARE: COMPANY OVERVIEW 265

TABLE 236 GE HEALTHCARE: SOLUTIONS OFFERED 266

TABLE 237 GE HEALTHCARE: PRODUCT LAUNCHES & APPROVALS,

JANUARY 2022–NOVEMBER 2025 267

TABLE 238 GE HEALTHCARE: DEALS, JANUARY 2022–NOVEMBER 2025 268

TABLE 239 GE HEALTHCARE: EXPANSIONS, JANUARY 2022–NOVEMBER 2025 270

TABLE 240 GE HEALTHCARE: OTHER DEVELOPMENTS, JANUARY 2022–NOVEMBER 2025 270

TABLE 241 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW 272

TABLE 242 FUJIFILM HOLDINGS CORPORATION: SOLUTIONS OFFERED 273

TABLE 243 FUJIFILM HOLDINGS CORPORATION: PRODUCT LAUNCHES & APPROVALS,

JANUARY 2022–NOVEMBER 2025 276

TABLE 244 FUJIFILM HOLDINGS CORPORATION: DEALS, JANUARY 2022–NOVEMBER 2025 276

TABLE 245 FUJIFILM HOLDINGS CORPORATION: OTHER DEVELOPMENTS,

JANUARY 2022–NOVEMBER 2025 277

TABLE 246 CANON MEDICAL SYSTEMS CORPORATION (CANON INC.): COMPANY OVERVIEW 279

TABLE 247 CANON MEDICAL SYSTEMS CORPORATION (CANON INC.): SOLUTIONS OFFERED 280

TABLE 248 CANON MEDICAL SYSTEMS CORPORATION (CANON INC.): PRODUCT LAUNCHES & APPROVALS, JANUARY 2022–NOVEMBER 2025 281

TABLE 249 CANON MEDICAL SYSTEMS CORPORATION (CANON INC.): DEALS,

JANUARY 2022–NOVEMBER 2025 282

TABLE 250 CANON MEDICAL SYSTEMS CORPORATION (CANON INC.):

OTHER DEVELOPMENTS, JANUARY 2022–NOVEMBER 2025 282

TABLE 251 MERATIVE: COMPANY OVERVIEW 283

TABLE 252 MERATIVE: SOLUTIONS OFFERED 284

TABLE 253 MERATIVE: DEALS, JANUARY 2022–NOVEMBER 2025 285

TABLE 254 MERATIVE: EXPANSIONS, JANUARY 2022–NOVEMBER 2025 286

TABLE 255 MERATIVE: OTHER DEVELOPMENTS, JANUARY 2022–NOVEMBER 2025 287

TABLE 256 RADNET, INC. (DEEPHEALTH): COMPANY OVERVIEW 288

TABLE 257 RADNET, INC. (DEEPHEALTH): SOLUTIONS OFFERED 289

TABLE 258 RADNET, INC. (DEEPHEALTH): PRODUCT LAUNCHES & APPROVALS, JANUARY 2022–NOVEMBER 2025 291

TABLE 259 RADNET, INC. (DEEPHEALTH): DEALS, JANUARY 2022–NOVEMBER 2025 292

TABLE 260 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.: COMPANY OVERVIEW 293

TABLE 261 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.: SOLUTIONS OFFERED 294

TABLE 262 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.: PRODUCT LAUNCHES & APPROVALS, JANUARY 2022–NOVEMBER 2025 295

TABLE 263 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.: DEALS,

JANUARY 2022–NOVEMBER 2025 296

TABLE 264 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.:

OTHER DEVELOPMENTS, JANUARY 2022–NOVEMBER 2025 296

TABLE 265 HOLOGIC, INC.: COMPANY OVERVIEW 298

TABLE 266 HOLOGIC, INC.: SOLUTIONS OFFERED 299

TABLE 267 HOLOGIC, INC.: PRODUCT LAUNCHES & APPROVALS,

JANUARY 2022–NOVEMBER 2025 300

TABLE 268 HOLOGIC, INC. : DEALS, JANUARY 2022–NOVEMBER 2025 301

TABLE 269 HOLOGIC, INC.: OTHER DEVELOPMENTS, JANUARY 2022–NOVEMBER 2025 301

TABLE 270 ENLITIC, INC.: COMPANY OVERVIEW 303

TABLE 271 ENLITIC, INC.: SOLUTIONS OFFERED 304

TABLE 272 ENLITIC, INC.: PRODUCT LAUNCHES & APPROVALS,

JANUARY 2022–NOVEMBER 2025 305

TABLE 273 ENLITIC, INC.: DEALS, JANUARY 2022–NOVEMBER 2025 305

TABLE 274 ENLITIC, INC.: OTHER DEVELOPMENTS, JANUARY 2022–NOVEMBER 2025 306

TABLE 275 AIDOC: COMPANY OVERVIEW 307

TABLE 276 VIZ.AI, INC.: COMPANY OVERVIEW 308

TABLE 277 NANOX: COMPANY OVERVIEW 309

TABLE 278 QURE.AI: COMPANY OVERVIEW 310

TABLE 279 ESAOTE S.P.A.: COMPANY OVERVIEW 311

TABLE 280 BUTTERFLY NETWORK INC.: COMPANY OVERVIEW 312

TABLE 281 HEARTFLOW, INC.: COMPANY OVERVIEW 313

TABLE 282 SUBTLE MEDICAL, INC.: COMPANY OVERVIEW 314

TABLE 283 HARISSON.AI: COMPANY OVERVIEW 315

TABLE 284 ECHONOUS INC.: COMPANY OVERVIEW 316

TABLE 285 QUIBIM: COMPANY OVERVIEW 317

TABLE 286 IMAGEN: COMPANY OVERVIEW 318

TABLE 287 EXO IMAGING, INC.: COMPANY OVERVIEW 319

TABLE 288 RAD AI: COMPANY OVERVIEW 320

TABLE 289 FACTOR ANALYSIS 331

TABLE 290 RISK ASSESSMENT: RADIOLOGY AI MARKET 336

LIST OF FIGURES

FIGURE 1 RADIOLOGY AI MARKET SEGMENTATION & REGIONAL SCOPE 28

FIGURE 2 MARKET SCENARIO 32

FIGURE 3 GLOBAL RADIOLOGY AI MARKET, 2023–2030 33

FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN RADIOLOGY AI MARKET,

2020–2025 33

FIGURE 5 DISRUPTIONS INFLUENCING GROWTH OF RADIOLOGY AI MARKET 34

FIGURE 6 HIGH-GROWTH SEGMENTS IN RADIOLOGY AI MARKET, 2025–2030 35

FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN RADIOLOGY AI MARKET, IN TERMS OF VALUE, DURING FORECAST PERIOD 36

FIGURE 8 RISING IMAGING VOLUMES TO DRIVE GROWTH IN RADIOLOGY AI MARKET 37

FIGURE 9 SOFTWARE/SAAS SEGMENT IN NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2024 38

FIGURE 10 INDIA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD 38

FIGURE 11 RADIOLOGY AI MARKET: DRIVERS, RESTRAINTS,

OPPORTUNITIES, AND CHALLENGES 39

FIGURE 12 FDA-APPROVED AI-ENABLED RADIOLOGY (2019–MAY 2025) 43

FIGURE 13 PROVEN ACCURACY RATES OF AI IN DIAGNOSTIC IMAGING 44

FIGURE 14 HEALTHCARE SECURITY BREACHES OF 500+ RECORDS IN US, 2009–2024 53

FIGURE 15 US: MEDIAN HEALTHCARE DATA BREACH SIZE BY YEAR, 2009–2024 54

FIGURE 16 INDIVIDUALS AFFECTED BY HEALTHCARE SECURITY BREACHES IN US, 2009–2023 54

FIGURE 17 RADIOLOGY AI MARKET: PORTER’S FIVE FORCES ANALYSIS 59

FIGURE 18 RADIOLOGY AI MARKET: SUPPLY CHAIN ANALYSIS (2024) 62

FIGURE 19 RADIOLOGY AI MARKET: ECOSYSTEM ANALYSIS 64

FIGURE 20 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES 68

FIGURE 22 PATENT PUBLICATION TRENDS IN RADIOLOGY AI MARKET, 2015–2025 79

FIGURE 23 JURISDICTION & TOP APPLICANT ANALYSIS FOR RADIOLOGY AI MARKET 79

FIGURE 24 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR RADIOLOGY AI MARKET (JANUARY 2015 TO NOVEMBER 2025) 80

FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS 95

FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE END USERS 96

FIGURE 27 NORTH AMERICA: RADIOLOGY AI MARKET SNAPSHOT 136

FIGURE 28 ASIA PACIFIC: RADIOLOGY AI MARKET SNAPSHOT 166

FIGURE 29 REVENUE ANALYSIS OF KEY PLAYERS IN RADIOLOGY AI MARKET,

2020–2024 (USD MILLION) 224

FIGURE 30 MARKET SHARE ANALYSIS OF KEY PLAYERS IN RADIOLOGY AI MARKET (2024) 225

FIGURE 31 RADIOLOGY AI MARKET: BRAND/SOFTWARE COMPARATIVE ANALYSIS 227

FIGURE 32 RADIOLOGY AI MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024 229

FIGURE 33 RADIOLOGY AI MARKET: COMPANY FOOTPRINT 230

FIGURE 34 RADIOLOGY AI MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 236

FIGURE 35 EV/EBITDA OF KEY VENDORS 240

FIGURE 36 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK

BETA OF KEY VENDORS 241

FIGURE 37 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT 245

FIGURE 38 MICROSOFT: COMPANY SNAPSHOT 252

FIGURE 39 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT 258

FIGURE 40 GE HEALTHCARE: COMPANY SNAPSHOT 266

FIGURE 41 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT 273

FIGURE 42 CANON MEDICAL SYSTEMS CORPORATION (CANON INC.): COMPANY SNAPSHOT 280

FIGURE 43 RADNET, INC. (DEEPHEALTH): COMPANY SNAPSHOT 289

FIGURE 44 SHANGHAI UNITED IMAGING HEALTHCARE CO., LTD.: COMPANY SNAPSHOT 293

FIGURE 45 HOLOGIC, INC.: COMPANY SNAPSHOT 299

FIGURE 46 ENLITIC, INC.: COMPANY SNAPSHOT 304

FIGURE 47 RESEARCH DESIGN 321

FIGURE 48 PRIMARY SOURCES 323

FIGURE 49 INSIGHTS FROM INDUSTRY EXPERTS 325

FIGURE 50 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE,

DESIGNATION, AND REGION 325

FIGURE 51 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING 326

FIGURE 52 SUPPLY-SIDE MARKET ESTIMATION 328

FIGURE 53 RADIOLOGY AI MARKET: REVENUE ESTIMATION APPROACH 328

FIGURE 54 BOTTOM-UP APPROACH: END-USER SPENDING ON RADIOLOGY AI 330

FIGURE 55 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2025–2030) 332

FIGURE 56 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS 333

FIGURE 57 TOP-DOWN APPROACH 333

FIGURE 58 DATA TRIANGULATION METHODOLOGY 334