Optical Satellite Communication Market - Global Forecast To 2030

光(レーザー)衛星通信市場 - レーザーの種類(半導体ダイオード、ファイバー、固体)、データレート( 10 GBPs)、プラットフォーム、用途、コンポーネント、地域別 - 2030年までの世界予測

Optical (laser) Satellite Communication Market by Laser Type (Semiconductor Diode, Fiber, Solid-state), Data Rate ( 10 GBPs), Platform, Application, Component and Region – Global Forecast To 2030

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年01月 |

| ページ数 | 332 |

| 図表数 | 238 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-12416 |

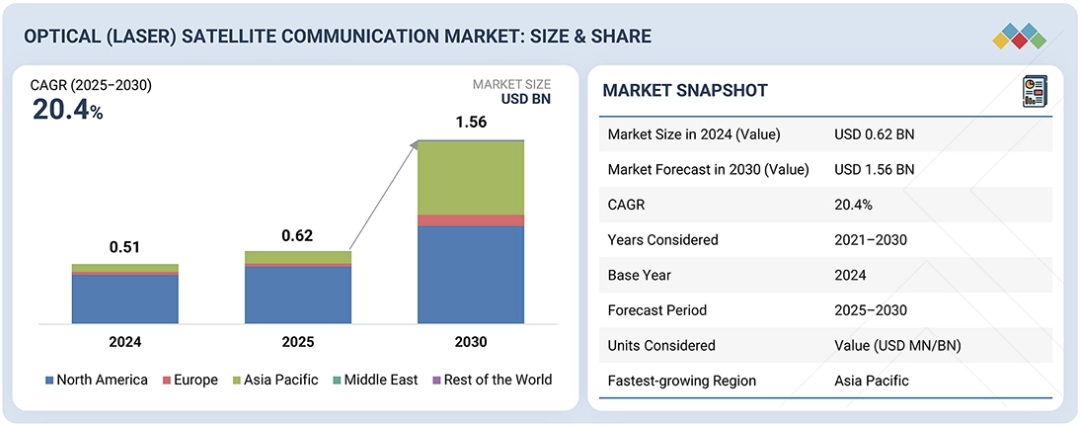

光(レーザー)衛星通信市場は、レーザー衛星間リンクの採用増加と、LEOおよびマルチ軌道衛星ネットワークを介した大容量で安全なデータ伝送の需要増加により、2025年の6億2,000万米ドルから2030年には15億6,000万米ドルに20.4%のCAGRで成長すると予測されています。

調査対象範囲:

本市場調査は、光(レーザー)衛星通信市場を様々なセグメントおよびサブセグメントにわたって網羅しています。様々な地域における市場規模と成長の可能性を予測することを目的としています。また、本調査には、市場の主要プレーヤー、企業概要、製品および事業内容に関する主要な考察、最近の動向、そして主要な市場戦略に関する詳細な競合分析も含まれています。

このレポートを購入する理由:

本レポートは、市場リーダー企業と新規参入企業に対し、光(レーザー)衛星通信市場全体の収益に関する入手可能な最も正確な推定値を提供します。また、ステークホルダーが競争環境を理解し、事業をより効果的にポジショニングし、適切な市場開拓戦略を策定するための洞察を得るのに役立ちます。さらに、本レポートは、ステークホルダーが市場の動向を理解し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供するのにも役立ちます。

本レポートでは、以下の点について洞察を提供しています。

- 市場の推進要因(大容量光衛星間バックボーンを必要とする低軌道ブロードバンド衛星群の拡大、高速光ダウンリンクを必要とする地球観測データ量の増加)、制約要因(大気の乱気流と雲量による宇宙対地上光リンクの可用性への影響、光地上局の高密度化による資本および運用の複雑性の増大)、機会(航空機搭載通信ノードを可能にする宇宙対空光リンクの出現、スペクトル非依存型光トランスポートリンクの導入を促すRFスペクトルの混雑)、課題(衛星群全体における技術準備状況、生産規模拡大、認定取得のタイムライン、モバイルおよびマルチオービットアーキテクチャにおける指向、捕捉、追尾精度の要件)

- 市場浸透:市場トップ企業が提供する光(レーザー)衛星通信に関する包括的な情報

- 製品開発/イノベーション:光(レーザー)衛星通信市場における今後の技術、研究開発活動、製品投入に関する詳細な洞察

- 市場開発:様々な地域における魅力的な市場に関する包括的な情報

- 市場多様化:光(レーザー)衛星通信市場における新製品、未開拓地域、最近の開発状況、投資に関する網羅的な情報

- 競合評価:光(レーザー)衛星通信市場における主要企業の市場シェア、成長戦略、製品、製造能力に関する詳細な評価

Report Description

The optical (laser) satellite communication market is projected to grow from USD 0.62 billion in 2025 to USD 1.56 billion by 2030, at a CAGR of 20.4%, driven by the increasing adoption of laser intersatellite links and rising demand for high-capacity, secure data transmission across LEO and multi-orbit satellite networks.

Optical Satellite Communication Market – Global Forecast To 2030

“By platform, the airborne segment is projected to grow at the highest CAGR during the forecast period.”

By platform, the airborne segment is expected to grow at the highest CAGR during the forecast period, driven by rising demand for high-throughput, low-probability-of-intercept communications on ISR aircraft, UAVs, and high-altitude platforms. Optical links enable secure air-to-satellite and air-to-air data transfer for real-time intelligence and sensor data sharing. Improvements in compact, vibration-tolerant laser terminals are also facilitating easier integration on airborne platforms.

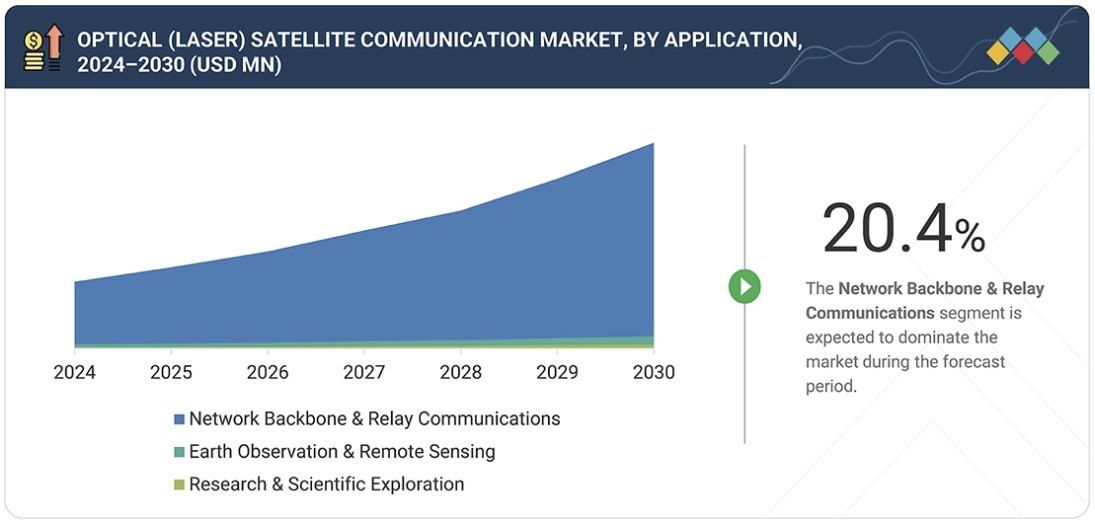

“By application, the network backbone & relay communications segment is projected to be the most dominant during the forecast period.”

By application, the Network Backbone and Relay Communications segment is projected to be the most dominant during the forecast period, driven by the shift toward space-based optical mesh networks. These networks support multi-Gbps inter-satellite data routing, reduce reliance on ground stations, and enable persistent global coverage. This is critical for broadband constellations and time-sensitive defense communications.

Optical Satellite Communication Market – Global Forecast To 2030 – region

“The Asia Pacific is projected to be the fastest growing market during the forecast period.”

The Asia Pacific region is expected to be the fastest-growing market during the forecast period, supported by expanding satellite constellations and national space programs in China, India, Japan, and South Korea. Increased government spending on secure satellite communications and local optical terminal development is accelerating adoption across the region.

The breakdown of profiles for primary participants in the Optical (laser) Satellite Communication Market is provided below:

- By Company Type: Tier 1 – 40%, Tier 2 – 30%, and Tier 3 – 30%

- By Designation: Directors – 20%, Managers – 10%, and Others – 70%

- By Region: North America – 40%, Europe – 20%, Asia Pacific – 20%, Middle East – 10% Rest of the World (RoW) – 10%

Optical Satellite Communication Market – Global Forecast To 2030 – ecosystem

Research Coverage:

This market study covers the optical (laser) satellite communications market across various segments and subsegments. It aims to estimate the market size and growth potential across different regions. This study also includes an in-depth competitive analysis of the key players in the market, their company profiles, key observations on their products and business offerings, recent developments, and key market strategies they adopted.

Reasons to buy this report:

The report will provide market leaders and new entrants with the most accurate available estimates of revenue for the overall optical (laser) satellite communication market. It will also help stakeholders understand the competitive landscape and gain insights to position their businesses more effectively and plan suitable go-to-market strategies. The report will also help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Market Drivers (Expansion of LEO Broadband Constellations Requiring High-Capacity Optical Inter-Satellite Backbones, Growth in Earth Observation Data Volumes Requiring High-Speed Optical Downlinks), Restraints (Atmospheric Turbulence and Cloud Cover Affecting Space-to-Ground Optical Link Availability, Higher Optical Ground Station Density Increasing Capital and Operational Complexity), Opportunities (Emergence of Space-to-Air Optical Links Enabling Airborne Communication Nodes, RF Spectrum Congestion Supporting Adoption of Spectrum-Independent Optical Transport Links), Challenges Technology Readiness, Production Scale-Up, and Qualification Timelines Across Constellations, Pointing, Acquisition, and Tracking Precision Requirements for Mobile and Multi-Orbit Architectures).

- Market Penetration: Comprehensive information on Optical (laser) Satellite Communication offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product launches in the Optical (laser) Satellite Communication Market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the Optical (laser) Satellite Communication Market

- Competitive Assessment: In-depth assessment of market share, growth strategies, products, and manufacturing capabilities of leading players in the Optical (laser) Satellite Communication Market

Table of Contents

1 INTRODUCTION 27

1.1 STUDY OBJECTIVES 27

1.2 MARKET DEFINITION 27

1.3 STUDY SCOPE 28

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 28

1.3.2 INCLUSIONS AND EXCLUSIONS 28

1.3.3 YEARS CONSIDERED 29

1.4 CURRENCY CONSIDERED 29

1.5 STAKEHOLDERS 30

1.6 SUMMARY OF CHANGES 30

2 EXECUTIVE SUMMARY 31

2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS 31

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 33

2.3 HIGH-GROWTH SEGMENTS 34

2.4 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST 35

2.5 BILL OF MATERIALS 35

2.6 TOTAL COST OF OWNERSHIP 37

2.7 BUSINESS MODELS 38

2.7.1 SPACE LASER TERMINAL OEM SALES FOR LEO AND DEFENSE CONSTELLATIONS 38

2.7.2 VERTICALLY INTEGRATED OPTICAL MESH NETWORKS BY CONSTELLATION OPERATORS 38

2.7.3 DATA RELAY AS A SERVICE USING OPTICAL LINKS 38

2.7.4 OPTICAL GROUND STATION NETWORK AND MANAGED SERVICES (OGSAAS) 39

3 PREMIUM INSIGHTS 40

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN OPTICAL SATELLITE COMMUNICATION MARKET 40

3.2 OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION 41

3.3 OPTICAL SATELLITE COMMUNICATION MARKET, BY LASER TYPE 41

3.4 OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT 42

4 MARKET OVERVIEW 43

4.1 INTRODUCTION 43

4.2 MARKET DYNAMICS 44

4.2.1 DRIVERS 44

4.2.1.1 Expansion of LEO broadband constellations requiring high-capacity optical inter-satellite backbones 44

4.2.1.2 Growth in Earth observation (EO) data volumes requiring high-speed optical downlinks 45

4.2.1.3 Demand for resilient, low-intercept space networking in defense industry 45

4.2.1.4 Defense-led space programs accelerating adoption and industrialization of optical satellite communication 45

4.2.2 RESTRAINTS 46

4.2.2.1 Atmospheric turbulence and cloud cover affecting space-to-ground optical link availability 46

4.2.2.2 Higher optical ground station density increasing capital and operational complexity 46

4.2.3 OPPORTUNITIES 46

4.2.3.1 Emergence of space-to-air optical links enabling airborne communication nodes 46

4.2.3.2 RF spectrum congestion supporting adoption of spectrum-independent optical transport links 47

4.2.4 CHALLENGES 47

4.2.4.1 Technology readiness, production scale-up, and qualification timelines across constellations 47

4.2.4.2 Pointing, acquisition, and tracking precision requirements for mobile and multi-orbit architectures 47

4.3 MARKET SCENARIO ANALYSIS 48

4.3.1 MARKET PERSPECTIVE OF OPTICAL SATELLITE TERMINAL COUNT IN DIFFERENT SCENARIOS 48

4.4 UNMET NEEDS AND WHITE SPACES 49

4.4.1 LACK OF GLOBALLY STANDARDIZED OPTICAL COMMUNICATION PROTOCOLS 49

4.4.2 LIMITED AVAILABILITY OF AFFORDABLE OPTICAL GROUND STATION NETWORKS 49

4.4.3 NEED FOR COMPACT AND LOW-POWER TERMINALS WITH PRECISION POINTING 50

4.4.4 WEATHER-RELATED AVAILABILITY LIMITATIONS 50

4.4.5 GAPS IN END-TO-END INFORMATION SECURITY FOR OPTICAL NETWORKS 51

4.4.6 ABSENCE OF MULTI-ORBIT OPTICAL RELAY INFRASTRUCTURE 51

4.4.7 LIMITED INTEGRATION BETWEEN OPTICAL COMMUNICATION AND ONBOARD PROCESSING 51

4.5 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 52

4.5.1 SATELLITE MANUFACTURING & OISL-ENABLED CONSTELLATIONS 53

4.5.2 SATELLITE GROUND STATIONS 53

4.5.3 PHOTONICS, SEMICONDUCTORS, AND INTEGRATED OPTICAL COMPONENTS 53

4.5.4 DEFENSE ISR PLATFORMS – AIRBORNE AND NAVAL 53

4.6 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS 54

5 INDUSTRY TRENDS 56

5.1 ECOSYSTEM ANALYSIS 56

5.1.1 PROMINENT COMPANIES 56

5.1.2 PRIVATE AND SMALL ENTERPRISES 56

5.1.3 END USERS 56

5.2 VALUE CHAIN ANALYSIS 58

5.2.1 CONCEPT & RESEARCH 59

5.2.2 COMPONENT & MATERIAL DEVELOPMENT 59

5.2.3 OPTICAL TERMINAL MANUFACTURING 59

5.2.4 SYSTEM INTEGRATION & VALIDATION 59

5.2.5 POST-DEPLOYMENT SERVICE 59

5.3 TRADE ANALYSIS 60

5.3.1 IMPORT SCENARIO (HS CODE 880260) 60

5.3.2 EXPORT SCENARIO (HS CODE 880260) 61

5.4 TARIFF DATA 63

5.5 CASE STUDY ANALYSIS 63

5.5.1 SPACE DEVELOPMENT AGENCY: TRANCHE 1 OPTICAL ISL NETWORK FOR DEFENSE COMMUNICATIONS 64

5.5.2 SPACEX STARLINK GEN2: OPTICAL CROSS-LINK NETWORK FOR GLOBAL BROADBAND 64

5.5.3 NASA TBIRD: TERABIT-CLASS LASER DOWNLINK DEMONSTRATION 64

5.5.4 ESA HYDRON: HIGH-THROUGHPUT OPTICAL NETWORK FOR EUROPEAN SATCOM 65

5.6 KEY CONFERENCES AND EVENTS (2026-2027) 65

5.7 INVESTMENT AND FUNDING SCENARIO 66

5.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 68

5.9 PRICING ANALYSIS 68

5.9.1 AVERAGE SELLING PRICE, BY REGION, 2021–2024 68

5.9.2 INDICATIVE PRICING ANALYSIS, BY PLATFORM, 2024 69

5.10 MACROECONOMIC OUTLOOK 70

5.10.1 INTRODUCTION 70

5.10.2 GDP TRENDS AND FORECAST 70

5.10.3 TRENDS IN SPACE INDUSTRY 71

6 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR 73

6.1 INTRODUCTION 73

6.2 DECISION-MAKING PROCESS 73

6.3 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA 74

6.3.1 KEY STAKEHOLDERS IN BUYING PROCESS 74

6.3.2 BUYING EVALUATION CRITERIA 75

6.4 ADOPTION BARRIERS AND INTERNAL CHALLENGES 77

6.5 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES 78

6.6 MARKET PROFITABILITY 79

6.6.1 REVENUE POTENTIAL 79

6.6.2 COST DYNAMICS 79

6.6.3 MARGIN OPPORTUNITIES, BY APPLICATION 80

7 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS 81

7.1 KEY TECHNOLOGIES 81

7.1.1 POINTING, ACQUISITION, AND TRACKING (PAT) SYSTEMS 81

7.1.2 FREE-SPACE OPTICAL (FSO) COMMUNICATION TERMINALS 81

7.1.3 HIGH-SPEED MODULATION & CODING (COHERENT MODEMS) 81

7.1.4 WDM/ DWDM OPTICAL MULTIPLEXING 81

7.2 COMPLEMENTARY TECHNOLOGIES 82

7.2.1 HYBRID RF–OPTICAL NETWORK ARCHITECTURES 82

7.2.2 AI-DRIVEN NETWORK ORCHESTRATION & WEATHER-AWARE ROUTING 83

7.2.3 SPACE OPTICAL SWITCHING & ROUTING (OPTICAL MESH NETWORKING) 83

7.2.4 QUANTUM COMMUNICATION & QKD INTEGRATION 83

7.3 TECHNOLOGY ROADMAP 83

7.4 PATENT ANALYSIS 86

7.5 FUTURE APPLICATIONS 89

7.6 IMPACT OF AI/GENAI 91

7.6.1 TOP USE CASES AND MARKET POTENTIAL 92

7.6.2 CASE STUDIES OF AI IMPLEMENTATION 93

7.6.3 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS 94

7.6.4 CLIENTS’ READINESS TO ADOPT AI/GENAI 94

7.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS 95

7.7.1 TESAT-SPACECOM: MULTI-ORBIT LASER DATA RELAY INTEGRATION 95

7.7.2 MYNARIC AG: INDUSTRIAL-SCALE OPTICAL CROSSLINKS FOR PROLIFERATED LEO CONSTELLATIONS 95

7.7.3 SPACEX: OPTICAL INTER-SATELLITE LINKS ENABLING SPACE-BASED NETWORK BACKBONES 96

8 SUSTAINABILITY AND REGULATORY LANDSCAPE 97

8.1 REGIONAL REGULATIONS AND COMPLIANCE 97

8.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 97

8.1.2 INDUSTRY STANDARDS 100

8.2 SUSTAINABILITY INITIATIVES 102

8.2.1 CARBON IMPACT REDUCTION 102

8.2.2 ECO-APPLICATIONS 104

8.3 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 105

9 OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM (MARKET SIZE & FORECAST TO 2030 – IN VALUE, USD MILLION) 107

9.1 INTRODUCTION 108

9.2 CLASSIFICATION OF OPTICAL SATELLITE COMMUNICATION BY DATA LINK TYPE 109

9.2.1 SPACE-TO-SPACE 109

9.2.2 SPACE-TO-GROUND 109

9.2.3 SPACE-TO-AIR 109

9.3 SATELLITE COMMUNICATION TERMINAL 110

9.3.1 RAPID CONSTELLATION EXPANSION TO DRIVE NEED FOR MODULAR OPTICAL TERMINALS 110

9.3.2 USE CASE: SDA’S TRANCHE 1 DEPLOYMENT OF MYNARIC (GERMANY) CONDOR TERMINALS FOR HIGH-CAPACITY LEO TRANSPORT 110

9.3.3 SMALL SATELLITE 110

9.3.4 MEDIUM SATELLITE 110

9.3.5 LARGE SATELLITE 111

9.4 GROUND STATION TERMINAL 111

9.4.1 RISE OF HIGH-RATE OPTICAL DOWNLINK MISSIONS TO DRIVE SEGMENTAL GROWTH 111

9.4.2 USE CASE: SA’S HYDRON OPTICAL GROUND STATIONS ENABLING MULTI-GBPS DOWNLINKS FOR DEMONSTRATION MISSIONS 111

9.4.3 FIXED 111

9.4.4 PORTABLE 111

9.5 AIRBORNE TERMINAL 112

9.5.1 NEED FOR SECURE, HIGH-THROUGHPUT AIRBORNE CONNECTIVITY TO DRIVE ADOPTION OF OPTICAL TERMINALS 112

9.5.2 USE CASE: DARPA BLACK DIAMOND DEMONSTRATION OF AIRBORNE OPTICAL LINKS FOR ISR PLATFORMS 112

9.5.3 MILITARY AIRCRAFT 112

9.5.4 UNMANNED AERIAL VEHICLE (UAV) 112

10 OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION (MARKET SIZE & FORECAST TO 2030 – IN VALUE, USD MILLION) 113

10.1 INTRODUCTION 114

10.2 NETWORK BACKBONE & RELAY COMMUNICATIONS 115

10.2.1 RISING INTER-SATELLITE DATA TRAFFIC TO DRIVE SHIFT TOWARD OPTICAL BACKHAUL FOR BACKBONE AND RELAY COMMUNICATIONS 115

10.2.2 USE CASE: AMAZON KUIPER (US) LASER LINK ARCHITECTURE ENABLING HIGH-CAPACITY SPACE-BASED BACKHAUL 115

10.3 EARTH OBSERVATION (EO) & REMOTE SENSING 116

10.3.1 HIGH-RESOLUTION EO MISSIONS TO ACCELERATE ADOPTION OF OPTICAL LINKS FOR RAPID DATA OFFLOAD AND REAL-TIME DISSEMINATION 116

10.3.2 USE CASE: ESA’S EDRS OPTICAL RELAY SYSTEM ENABLING NEAR-REAL-TIME EO DATA TRANSFER FOR SENTINEL MISSIONS 116

10.4 SCIENTIFIC RESEARCH & EXPLORATION 116

10.4.1 DEEP SPACE AND SCIENTIFIC MISSIONS ADOPT OPTICAL LINKS TO OVERCOME RF LIMITATIONS IN LONG-DISTANCE, DATA-HEAVY COMMUNICATION 116

10.4.2 USE CASE: JAXA (JAPAN) OPTICAL TERMINAL DEMONSTRATIONS FOR LUNAR SURFACE-TO-ORBIT COMMUNICATION UNDER LUPEX 116

11 OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT (MARKET SIZE & FORECAST TO 2030 – IN VALUE, USD MILLION) 117

11.1 INTRODUCTION 118

11.2 OPTICAL FRONT-END 119

11.2.1 PRECISION OPTICAL FRONT-ENDS TO GAIN TRACTION AS CONSTELLATIONS DEMAND HIGHER LINK QUALITY AND TIGHTER POINTING TOLERANCES 119

11.3 TRANSMIT MODULE 119

11.3.1 HIGH-EFFICIENCY LASER TRANSMITTERS TO SCALE RAPIDLY AS SATELLITES MIGRATE TO MULTI-GIGABIT OPTICAL UPLINKS 119

11.4 RECEIVE MODULE 120

11.4.1 ADVANCED PHOTONIC RECEIVERS TO GAIN MOMENTUM AS NETWORKS PUSH FOR HIGHER SENSITIVITY AND LOWER SIGNAL LOSS 120

11.5 POINTING, ACQUISITION, AND TRACKING (PAT) MODULE 120

11.5.1 SOPHISTICATED PAT SYSTEMS TO SURGE IN DEMAND AS MULTI-ORBIT CONSTELLATIONS REQUIRE ULTRA-STABLE BEAM ALIGNMENT 120

11.6 BASEBAND MODEM & PROCESSING ELECTRONICS 120

11.6.1 ADVANCED MODEM ELECTRONICS TO GROW IN DEMAND AS HIGHER-ORDER MODULATION AND ADAPTIVE CODING ENTER MAINSTREAM OPTICAL SATCOM 120

11.7 OTHERS 121

12 OPTICAL SATELLITE COMMUNICATION MARKET, BY LASER TYPE (MARKET SIZE & FORECAST TO 2030 – IN VALUE, USD MILLION) 122

12.1 INTRODUCTION 123

12.2 CLASSIFICATION OF OPTICAL SATELLITE COMMUNICATION BY OPERATING WAVELENGTH 124

12.2.1 C-BAND/1550 NM BAND 124

12.2.2 NEAR-IR 1064 NM BAND 124

12.2.3 AUXILIARY BEACON WAVELENGTHS (850–1000 NM) 125

12.2.4 DEEP SPACE-OPTIMIZED HYBRID WAVELENGTHS (1550/1064 NM) 125

12.3 SEMICONDUCTOR DIODE LASER 125

12.3.1 DEMAND FOR COMPACT, LOW-SWAP TERMINALS TO DRIVE GROWTH 125

12.3.2 USE CASE: HIGH-VOLUME LEO CONSTELLATION DEPLOYMENTS ENABLED BY LOW-SWAP SEMICONDUCTOR DIODE LASERS 125

12.3.2.1 Indium phosphide (InP) Laser 125

12.3.2.2 Gallium Arsenide (GaAs) Laser 126

12.3.2.3 Antimonide Laser 126

12.4 FIBER LASER 126

12.4.1 GROWING NEED FOR HIGHER POWER AND SUPERIOR BEAM QUALITY TO DRIVE SEGMENTAL GROWTH 126

12.4.2 USE CASE: LONG-DISTANCE OPTICAL BACKHAUL IMPROVED USING HIGH-BEAM-QUALITY FIBER LASERS 126

12.4.2.1 YAG Laser 127

12.4.2.2 YVO4 and DPSSL Variants 127

12.5 SOLID-STATE LASER 127

12.5.1 DEEP SPACE AND HIGH-ENERGY MISSIONS TO DRIVE DEMAND FOR SOLID-STATE LASERS OFFERING LONG-TERM STABILITY AND HIGH RELIABILITY 127

12.5.2 USE CASE: DEEP SPACE TELEMETRY CHALLENGES ADDRESSED WITH HIGH-STABILITY SOLID-STATE LASERS 127

12.5.2.1 Erbium-Doped Fiber Laser 128

12.5.2.2 Ytterbium-Doped Fiber Laser 128

12.6 OTHER LASERS 128

13 OPTICAL SATELLITE COMMUNICATION MARKET, BY DATA RATE CLASS 129

13.1 INTRODUCTION 129

13.2 LOW/TACTICAL (≤ 2.5 GBPS) 129

13.2.1 USE CASE: TACTICAL RECONNAISSANCE DATA EXFILTRATION ENHANCED USING LOW-RATE OPTICAL TERMINALS DURING ESA OPS-SAT EXPERIMENTS 129

13.3 HIGH (2.5–10 GBPS) 130

13.3.1 USE CASE: AIRBUS (EUROPE) SPACE DATA HIGHWAY RELAYING MULTI-GIGABIT EO PAYLOAD DATA USING 1.8 GBPS LASER LINKS 130

13.4 ULTRA-HIGH/NEXT-GEN (> 10 GBPS) 130

13.4.1 USE CASE: MIT LINCOLN LABORATORY (US) TERA-BIT-CLASS FREE-SPACE OPTICAL LINK DEMONSTRATED BETWEEN AIRBORNE AND GROUND TERMINALS 131

14 OPTICAL SATELLITE COMMUNICATION MARKET, BY REGION 132

14.1 INTRODUCTION 133

14.2 NORTH AMERICA 134

14.2.1 US 137

14.2.1.1 Rapid commercial constellation expansion to drive growth 137

14.2.2 CANADA 139

14.2.2.1 National space modernization and emerging LEO programs to drive market 139

14.3 EUROPE 141

14.3.1 UK 144

14.3.1.1 Rising demand for secure, high-capacity data transmission across defense, government, and commercial space programs to drive market 144

14.3.2 GERMANY 146

14.3.2.1 Increasing demand for data from Earth observation and climate monitoring missions to drive market 146

14.3.3 FRANCE 148

14.3.3.1 Growing demand for Earth observation, climate monitoring, and scientific satellites to drive market 148

14.3.4 SPAIN 149

14.3.4.1 Strong institutional space programs and ground infrastructure advantages to drive market 149

14.3.5 ITALY 151

14.3.5.1 Rising demand for secure, high-capacity communication technologies to drive market 151

14.4 ASIA PACIFIC 153

14.4.1 JAPAN 156

14.4.1.1 Advanced space technology programs and defense modernization to drive market 156

14.4.2 INDIA 157

14.4.2.1 Next-generation Earth observation and growing broadband connectivity needs to drive market 157

14.4.3 CHINA 159

14.4.3.1 Large-scale space modernization and sovereign communication programs to drive market 159

14.4.4 AUSTRALIA 161

14.4.4.1 Increasing collaboration with global constellation operators and allied space agencies to drive market 161

14.5 MIDDLE EAST 162

14.5.1 GCC COUNTRIES 166

14.5.1.1 Saudi Arabia 166

14.5.1.1.1 Government’s space investments and defense demand for secure, high-speed connectivity to drive market 166

14.5.1.2 UAE 167

14.5.1.2.1 Increasing demand for rapid data transfer between satellites and ground stations to drive market 167

14.5.2 REST OF MIDDLE EAST 169

14.6 REST OF THE WORLD 171

14.6.1 LATIN AMERICA 174

14.6.1.1 Connectivity gaps and expanding space programs to support laser SATCOM adoption 174

14.6.2 AFRICA 176

14.6.2.1 Digital connectivity demand and government push for modern satellite infrastructure to drive market 176

15 COMPETITIVE LANDSCAPE 178

15.1 INTRODUCTION 178

15.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2025 178

15.3 REVENUE ANALYSIS, 2020–2024 180

15.4 MARKET SHARE ANALYSIS, 2024 180

15.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 183

15.5.1 STARS 183

15.5.2 EMERGING LEADERS 183

15.5.3 PERVASIVE PLAYERS 183

15.5.4 PARTICIPANTS 184

15.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 185

15.5.5.1 Company footprint 185

15.5.5.2 Region footprint 185

15.5.5.3 Platform footprint 186

15.5.5.4 Application footprint 187

15.5.5.5 Component footprint 187

15.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 188

15.6.1 PROGRESSIVE COMPANIES 188

15.6.2 RESPONSIVE COMPANIES 188

15.6.3 DYNAMIC COMPANIES 188

15.6.4 STARTING BLOCKS 188

15.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES 190

15.6.5.1 List of startups/SMEs 190

15.6.5.2 Competitive benchmarking of startups/SMEs 191

15.7 COMPANY VALUATION AND FINANCIAL METRICS 192

15.7.1 FINANCIAL METRICS 192

15.8 BRAND/PRODUCT COMPARISON 193

15.9 COMPETITIVE SCENARIO 194

15.9.1 PRODUCT LAUNCHES/DEVELOPMENTS 194

15.9.2 DEALS 195

15.9.3 OTHERS 202

16 COMPANY PROFILES 206

16.1 KEY PLAYERS 206

16.1.1 SPACEX 206

16.1.1.1 Business overview 206

16.1.1.2 Products offered 206

16.1.1.3 Recent developments 207

16.1.1.3.1 Deals 207

16.1.1.3.2 Other developments 208

16.1.1.4 MnM view 208

16.1.1.4.1 Right to win 208

16.1.1.4.2 Strategic choices 208

16.1.1.4.3 Weaknesses and competitive threats 208

16.1.2 MYNARIC AG 209

16.1.2.1 Business overview 209

16.1.2.2 Products offered 210

16.1.2.3 Recent developments 210

16.1.2.3.1 Deals 210

16.1.2.3.2 Others 211

16.1.2.4 MnM view 212

16.1.2.4.1 Right to win 212

16.1.2.4.2 Strategic choices 212

16.1.2.4.3 Weaknesses and competitive threats 212

16.1.3 BRIDGECOMM INC. 213

16.1.3.1 Business overview 213

16.1.3.2 Products offered 213

16.1.3.3 Recent developments 214

16.1.3.3.1 Deals 214

16.1.3.3.2 Other developments 215

16.1.3.4 MnM view 215

16.1.3.4.1 Right to win 215

16.1.3.4.2 Strategic choices 215

16.1.3.4.3 Weaknesses and competitive threats 215

16.1.4 THALES ALENIA SPACE 216

16.1.4.1 Business overview 216

16.1.4.2 Products offered 216

16.1.4.3 Recent developments 217

16.1.4.3.1 Product Launches 217

16.1.4.3.2 Deals 218

16.1.4.3.3 Other developments 218

16.1.4.4 MnM view 218

16.1.4.4.1 Right to win 218

16.1.4.4.2 Strategic choices 219

16.1.4.4.3 Weaknesses and competitive threats 219

16.1.5 TESAT-SPACECOM GMBH & CO. KG 220

16.1.5.1 Business overview 220

16.1.5.2 Product offered 220

16.1.5.3 Recent developments 222

16.1.5.3.1 Deals 222

16.1.5.3.2 Other developments 222

16.1.5.4 MnM view 223

16.1.5.4.1 Right to win 223

16.1.5.4.2 Strategic choices 223

16.1.5.4.3 Weaknesses and competitive threats 223

16.1.6 BAE SYSTEMS 224

16.1.6.1 Business overview 224

16.1.6.2 Products offered 225

16.1.6.3 Recent developments 226

16.1.6.3.1 Deals 226

16.1.7 HONEYWELL INTERNATIONAL INC. 228

16.1.7.1 Business overview 228

16.1.7.2 Products offered 229

16.1.7.3 Recent developments 230

16.1.7.3.1 Deals 230

16.1.8 MITSUBISHI ELECTRIC CORPORATION 231

16.1.8.1 Business overview 231

16.1.8.2 Products offered 232

16.1.8.3 Recent developments 233

16.1.8.3.1 Product launches/developments 233

16.1.8.3.2 Other developments 233

16.1.9 SONY SPACE COMMUNICATIONS 234

16.1.9.1 Business overview 234

16.1.9.2 Products offered 234

16.1.9.3 Recent developments 235

16.1.9.3.1 Product developments 235

16.1.9.3.2 Deals 235

16.1.10 AAC CLYDE SPACE 236

16.1.10.1 Business overview 236

16.1.10.2 Products offered 237

16.1.10.3 Recent developments 238

16.1.10.3.1 Deals 238

16.1.10.3.2 Other developments 238

16.1.11 NEC SPACE TECHNOLOGIES 239

16.1.11.1 Business overview 239

16.1.11.2 Products offered 239

16.1.11.3 Recent developments 240

16.1.11.3.1 Deals 240

16.1.11.3.2 Other developments 241

16.1.12 SKYLOOM GLOBAL 242

16.1.12.1 Business overview 242

16.1.12.2 Products offered 242

16.1.12.3 Recent developments 243

16.1.12.3.1 Deals 243

16.1.13 GENERAL ATOMICS 244

16.1.13.1 Business overview 244

16.1.13.2 Products offered 244

16.1.13.3 Recent developments 245

16.1.13.3.1 Deals 245

16.1.13.3.2 Other developments 245

16.1.14 SPACE MICRO 246

16.1.14.1 Business overview 246

16.1.14.2 Products offered 246

16.1.14.3 Recent developments 247

16.1.14.3.1 Deals 247

16.1.14.3.2 Other developments 247

16.1.15 NORTHROP GRUMMAN 248

16.1.15.1 Business overview 248

16.1.15.2 Products offered 249

16.1.15.3 Recent developments 250

16.1.15.3.1 Deals 250

16.1.15.3.2 Other developments 250

16.1.16 SAFRAN 251

16.1.16.1 Business overview 251

16.1.16.2 Products offered 252

16.1.16.3 Recent developments 253

16.1.16.3.1 Deals 253

16.1.16.3.2 Other developments 253

16.2 OTHER PLAYERS 254

16.2.1 WARPSPACE 254

16.2.2 SITAEL 255

16.2.3 ASTROGATE LABS 256

16.2.4 ARCHANGEL LIGHTWORKS 257

16.2.5 TRANSCELESTIAL 258

16.2.6 CAILABS 259

16.2.7 OLEDCOMM 260

16.2.8 HENSOLDT 261

16.2.9 ASTROLIGHT 262

16.2.10 QINETIQ 263

17 RESEARCH METHODOLOGY 264

17.1 RESEARCH DATA 264

17.1.1 SECONDARY DATA 265

17.1.1.1 Key data from secondary sources 266

17.1.2 PRIMARY DATA 266

17.1.2.1 Primary sources 266

17.1.2.2 Key data from primary sources 267

17.1.3 BREAKDOWN OF PRIMARY INTERVIEWS 267

17.2 FACTOR ANALYSIS 268

17.2.1 INTRODUCTION 268

17.2.2 DEMAND-SIDE INDICATORS 268

17.2.3 SUPPLY-SIDE INDICATORS 268

17.3 MARKET SIZE ESTIMATION 269

17.3.1 BOTTOM-UP APPROACH 269

17.3.1.1 Market size estimation methodology (demand side) 270

17.3.1.2 Market size illustration – US ground station optical satellite communication market size 270

17.3.2 TOP-DOWN APPROACH 271

17.4 DATA TRIANGULATION 272

17.5 RESEARCH ASSUMPTIONS 273

17.6 RESEARCH LIMITATIONS 274

17.7 RISK ASSESSMENT 274

18 APPENDIX 275

18.1 LONG LIST OF COMPANIES 275

18.2 DISCUSSION GUIDE 277

18.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 280

18.4 CUSTOMIZATION OPTIONS 282

18.5 RELATED REPORTS 282

18.6 AUTHOR DETAILS 283

LIST OF TABLES

TABLE 1 USD EXCHANGE RATES, 2021-2024 30

TABLE 2 BILL OF MATERIALS FOR OPTICAL SATELLITE COMMUNICATION 36

TABLE 3 TOTAL COST OF OWNERSHIP 37

TABLE 4 UNMET NEEDS AND WHITE SPACES 52

TABLE 5 CROSS-SECTOR OPPORTUNITIES 54

TABLE 6 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS 55

TABLE 7 ROLE OF COMPANIES IN ECOSYSTEM 57

TABLE 8 IMPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND) 61

TABLE 9 EXPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND) 62

TABLE 10 TARIFF DATA 63

TABLE 11 KEY CONFERENCES AND EVENTS, 2026-2027 65

TABLE 12 INDICATIVE PRICING ANALYSIS, BY PLATFORM, 2024 (USD MILLION) 69

TABLE 13 GDP PERCENTAGE CHANGE, BY COUNTRY, 2021–2029 70

TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY DATA RATE CLASS (%) 75

TABLE 15 KEY BUYING CRITERIA, BY DATA RATE CLASS 76

TABLE 16 UNMET NEEDS IN OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION 78

TABLE 17 GLOBAL VENDOR LANDSCAPE ACROSS KEY AND COMPLEMENTARY OPTICAL SATCOM TECHNOLOGIES 82

TABLE 18 EVOLUTION OF OPTICAL SATELLITE COMMUNICATION 84

TABLE 19 PATENT ANALYSIS 87

TABLE 20 SPACE-BASED OPTICAL INTER-SATELLITE NETWORKS: FUTURE OF TERABIT-SCALE MULTI-ORBIT DATA TRANSPORT 90

TABLE 21 QUANTUM-SECURE OPTICAL COMMUNICATION CONSTELLATIONS: FUTURE OF UNBREACHABLE GLOBAL ENCRYPTED CONNECTIVITY 90

TABLE 22 TOP USE CASES AND MARKET POTENTIAL 92

TABLE 23 CASE STUDIES OF AI IMPLEMENTATION 93

TABLE 24 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS 94

TABLE 25 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 97

TABLE 26 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 98

TABLE 27 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 98

TABLE 28 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 99

TABLE 29 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 100

TABLE 30 GLOBAL DESIGN, STRUCTURAL, AND OPERATIONAL STANDARDS 100

TABLE 31 GLOBAL ELECTRICAL, COMMUNICATION, AND CYBERSECURITY STANDARDS 101

TABLE 32 GLOBAL QUALITY, ENVIRONMENTAL, AND COMPLIANCE STANDARDS 101

TABLE 33 CARBON IMPACT REDUCTION 103

TABLE 34 ECO-APPLICATIONS 104

TABLE 35 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 105

TABLE 36 OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2021–2024 (USD MILLION) 108

TABLE 37 OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2025–2030 (USD MILLION) 109

TABLE 38 OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 114

TABLE 39 OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 115

TABLE 40 OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2021–2024 (USD MILLION) 118

TABLE 41 OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2025–2030 (USD MILLION) 119

TABLE 42 OPTICAL SATELLITE COMMUNICATION MARKET, BY LASER TYPE,

2021–2024 (USD MILLION) 123

TABLE 43 OPTICAL SATELLITE COMMUNICATION MARKET, BY LASER TYPE,

2025–2030 (USD MILLION) 124

TABLE 44 OPTICAL SATELLITE COMMUNICATION MARKET, BY REGION,

2021–2024 (USD MILLION) 134

TABLE 45 OPTICAL SATELLITE COMMUNICATION MARKET, BY REGION,

2025–2030 (USD MILLION) 134

TABLE 46 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 135

TABLE 47 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 135

TABLE 48 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM, 2021–2024 (USD MILLION) 136

TABLE 49 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM, 2025–2030 (USD MILLION) 136

TABLE 50 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET,

BY COMPONENT, 2021–2024 (USD MILLION) 136

TABLE 51 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET,

BY COMPONENT, 2025–2030 (USD MILLION) 137

TABLE 52 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET,

BY APPLICATION, 2021–2024 (USD MILLION) 137

TABLE 53 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET,

BY APPLICATION, 2025–2030 (USD MILLION) 137

TABLE 54 US: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2021–2024 (USD MILLION) 138

TABLE 55 US: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2025–2030 (USD MILLION) 138

TABLE 56 US: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2021–2024 (USD MILLION) 138

TABLE 57 US: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2025–2030 (USD MILLION) 139

TABLE 58 CANADA: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2021–2024 (USD MILLION) 139

TABLE 59 CANADA: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2025–2030 (USD MILLION) 140

TABLE 60 CANADA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2021–2024 (USD MILLION) 140

TABLE 61 CANADA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2025–2030 (USD MILLION) 140

TABLE 62 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET, BY COUNTRY,

2021–2024 (USD MILLION) 142

TABLE 63 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 142

TABLE 64 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2021–2024 (USD MILLION) 142

TABLE 65 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2025–2030 (USD MILLION) 143

TABLE 66 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2021–2024 (USD MILLION) 143

TABLE 67 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2025–2030 (USD MILLION) 143

TABLE 68 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION,

2021–2024 (USD MILLION) 144

TABLE 69 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 144

TABLE 70 UK: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2021–2024 (USD MILLION) 145

TABLE 71 UK: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2025–2030 (USD MILLION) 145

TABLE 72 UK: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2021–2024 (USD MILLION) 145

TABLE 73 UK: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2025–2030 (USD MILLION) 146

TABLE 74 GERMANY: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2021–2024 (USD MILLION) 146

TABLE 75 GERMANY: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2025–2030 (USD MILLION) 147

TABLE 76 GERMANY: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2021–2024 (USD MILLION) 147

TABLE 77 GERMANY: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2025–2030 (USD MILLION) 147

TABLE 78 FRANCE: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2021–2024 (USD MILLION) 148

TABLE 79 FRANCE: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2025–2030 (USD MILLION) 148

TABLE 80 FRANCE: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2021–2024 (USD MILLION) 149

TABLE 81 FRANCE: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2025–2030 (USD MILLION) 149

TABLE 82 SPAIN: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2021–2024 (USD MILLION) 150

TABLE 83 SPAIN: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2025–2030 (USD MILLION) 150

TABLE 84 SPAIN: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2021–2024 (USD MILLION) 150

TABLE 85 SPAIN: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2025–2030 (USD MILLION) 151

TABLE 86 ITALY: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2021–2024 (USD MILLION) 151

TABLE 87 ITALY: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2025–2030 (USD MILLION) 152

TABLE 88 ITALY: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2021–2024 (USD MILLION) 152

TABLE 89 ITALY: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2025–2030 (USD MILLION) 152

TABLE 90 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 154

TABLE 91 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 154

TABLE 92 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM, 2021–2024 (USD MILLION) 154

TABLE 93 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM, 2025–2030 (USD MILLION) 154

TABLE 94 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2021–2024 (USD MILLION) 155

TABLE 95 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2025–2030 (USD MILLION) 155

TABLE 96 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 155

TABLE 97 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 156

TABLE 98 JAPAN: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2021–2024 (USD MILLION) 156

TABLE 99 JAPAN: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2025–2030 (USD MILLION) 156

TABLE 100 JAPAN: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2021–2024 (USD MILLION) 157

TABLE 101 JAPAN: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2025–2030 (USD MILLION) 157

TABLE 102 INDIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2021–2024 (USD MILLION) 158

TABLE 103 INDIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2025–2030 (USD MILLION) 158

TABLE 104 INDIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2021–2024 (USD MILLION) 158

TABLE 105 INDIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2025–2030 (USD MILLION) 159

TABLE 106 CHINA: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2021–2024 (USD MILLION) 159

TABLE 107 CHINA: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2025–2030 (USD MILLION) 160

TABLE 108 CHINA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2021–2024 (USD MILLION) 160

TABLE 109 CHINA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2025–2030 (USD MILLION) 160

TABLE 110 AUSTRALIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2021–2024 (USD MILLION) 161

TABLE 111 AUSTRALIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2025–2030 (USD MILLION) 161

TABLE 112 AUSTRALIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2021–2024 (USD MILLION) 162

TABLE 113 AUSTRALIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2025–2030 (USD MILLION) 162

TABLE 114 MIDDLE EAST: OPTICAL SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2021–2024 (USD MILLION) 163

TABLE 115 MIDDLE EAST: OPTICAL SATELLITE COMMUNICATION MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 164

TABLE 116 MIDDLE EAST: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM, 2021–2024 (USD MILLION) 164

TABLE 117 MIDDLE EAST: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM, 2025–2030 (USD MILLION) 164

TABLE 118 MIDDLE EAST: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2021–2024 (USD MILLION) 164

TABLE 119 MIDDLE EAST: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2025–2030 (USD MILLION) 165

TABLE 120 MIDDLE EAST: OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2021–2024 (USD MILLION) 165

TABLE 121 MIDDLE EAST: OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 165

TABLE 122 SAUDI ARABIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM, 2021–2024 (USD MILLION) 166

TABLE 123 SAUDI ARABIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM, 2025–2030 (USD MILLION) 166

TABLE 124 SAUDI ARABIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2021–2024 (USD MILLION) 167

TABLE 125 SAUDI ARABIA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2025–2030 (USD MILLION) 167

TABLE 126 UAE: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2021–2024 (USD MILLION) 168

TABLE 127 UAE: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2025–2030 (USD MILLION) 168

TABLE 128 UAE: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2021–2024 (USD MILLION) 168

TABLE 129 UAE: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2025–2030 (USD MILLION) 169

TABLE 130 REST OF MIDDLE EAST: OPTICAL SATELLITE COMMUNICATION MARKET,

BY PLATFORM, 2021–2024 (USD MILLION) 169

TABLE 131 REST OF MIDDLE EAST: OPTICAL SATELLITE COMMUNICATION MARKET,

BY PLATFORM, 2025–2030 (USD MILLION) 170

TABLE 132 REST OF MIDDLE EAST: OPTICAL SATELLITE COMMUNICATION MARKET,

BY COMPONENT, 2021–2024 (USD MILLION) 170

TABLE 133 REST OF MIDDLE EAST: OPTICAL SATELLITE COMMUNICATION MARKET,

BY COMPONENT, 2025–2030 (USD MILLION) 170

TABLE 134 REST OF THE WORLD: OPTICAL SATELLITE COMMUNICATION MARKET,

BY COUNTRY, 2021–2024 (USD MILLION) 172

TABLE 135 REST OF THE WORLD: OPTICAL SATELLITE COMMUNICATION MARKET,

BY COUNTRY, 2025–2030 (USD MILLION) 172

TABLE 136 REST OF THE WORLD: OPTICAL SATELLITE COMMUNICATION MARKET,

BY PLATFORM, 2021–2024 (USD MILLION) 172

TABLE 137 REST OF THE WORLD: OPTICAL SATELLITE COMMUNICATION MARKET,

BY PLATFORM, 2025–2030 (USD MILLION) 172

TABLE 138 REST OF THE WORLD: OPTICAL SATELLITE COMMUNICATION MARKET,

BY COMPONENT, 2021–2024 (USD MILLION) 173

TABLE 139 REST OF THE WORLD: OPTICAL SATELLITE COMMUNICATION MARKET,

BY COMPONENT, 2025–2030 (USD MILLION) 173

TABLE 140 REST OF THE WORLD: OPTICAL SATELLITE COMMUNICATION MARKET,

BY APPLICATION, 2021–2024 (USD MILLION) 173

TABLE 141 REST OF THE WORLD: OPTICAL SATELLITE COMMUNICATION MARKET,

BY APPLICATION, 2025–2030 (USD MILLION) 174

TABLE 142 LATIN AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM, 2021–2024 (USD MILLION) 174

TABLE 143 LATIN AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM, 2025–2030 (USD MILLION) 175

TABLE 144 LATIN AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2021–2024 (USD MILLION) 175

TABLE 145 LATIN AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT, 2025–2030 (USD MILLION) 175

TABLE 146 AFRICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2021–2024 (USD MILLION) 176

TABLE 147 AFRICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2025–2030 (USD MILLION) 176

TABLE 148 AFRICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2021–2024 (USD MILLION) 177

TABLE 149 AFRICA: OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2025–2030 (USD MILLION) 177

TABLE 150 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021–2025 178

TABLE 151 OPTICAL SATELLITE COMMUNICATION MARKET: DEGREE OF COMPETITION 181

TABLE 152 OPTICAL SATELLITE COMMUNICATION MARKET: REGION FOOTPRINT 185

TABLE 153 OPTICAL SATELLITE COMMUNICATION MARKET: PLATFORM FOOTPRINT 186

TABLE 154 OPTICAL SATELLITE COMMUNICATION MARKET: APPLICATION FOOTPRINT 187

TABLE 155 OPTICAL SATELLITE COMMUNICATION MARKET: COMPONENT FOOTPRINT 187

TABLE 156 OPTICAL SATELLITE COMMUNICATION MARKET: LIST OF STARTUPS/SMES 190

TABLE 157 OPTICAL SATELLITE COMMUNICATION MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES 191

TABLE 158 OPTICAL SATELLITE COMMUNICATION MARKET: PRODUCT LAUNCHES, JANUARY 2021–DECEMBER 2025 194

TABLE 159 OPTICAL SATELLITE COMMUNICATION MARKET: DEALS, JANUARY 2021–DECEMBER 2025 195

TABLE 160 OPTICAL SATELLITE COMMUNICATION MARKET: OTHERS, JANUARY 2021–DECEMBER 2025 202

TABLE 161 SPACEX: COMPANY OVERVIEW 206

TABLE 162 SPACEX: PRODUCTS OFFERED 206

TABLE 163 SPACEX: DEALS 207

TABLE 164 SPACEX: OTHER DEVELOPMENTS 208

TABLE 165 MYNARIC AG: COMPANY OVERVIEW 209

TABLE 166 MYNARIC AG: PRODUCTS OFFERED 210

TABLE 167 MYNARIC AG: DEALS 210

TABLE 168 MYNARIC AG: OTHER DEVELOPMENTS 211

TABLE 169 BRIDGECOMM INC.: COMPANY OVERVIEW 213

TABLE 170 BRIDGECOMM INC.: PRODUCTS OFFERED 213

TABLE 171 BRIDGECOMM INC.: DEALS 214

TABLE 172 BRIDGECOMM INC.: OTHER DEVELOPMENTS 215

TABLE 173 THALES ALENIA SPACE: COMPANY OVERVIEW 216

TABLE 174 THALES ALENIA SPACE: PRODUCTS OFFERED 216

TABLE 175 THALES ALENIA SPACE: PRODUCT LAUNCHES 217

TABLE 176 THALES ALENIA SPACE: DEALS 218

TABLE 177 THALES ALENIA SPACE: OTHER DEVELOPMENTS 218

TABLE 178 TESAT-SPACECOM GMBH & CO. KG: COMPANY OVERVIEW 220

TABLE 179 TESAT-SPACECOM GMBH & CO. KG: PRODUCTS OFFERED 220

TABLE 180 TESAT-SPACECOM GMBH & CO. KG: DEALS 222

TABLE 181 TESAT-SPACECOM GMBH & CO. KG: OTHER DEVELOPMENTS 222

TABLE 182 BAE SYSTEMS: COMPANY OVERVIEW 224

TABLE 183 BAE SYSTEMS: PRODUCTS OFFERED 225

TABLE 184 BAE SYSTEMS: DEALS 226

TABLE 185 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW 228

TABLE 186 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED 229

TABLE 187 HONEYWELL INTERNATIONAL INC.: DEALS 230

TABLE 188 MITSUBISHI ELECTRIC CORPORATION: COMPANY OVERVIEW 231

TABLE 189 MITSUBISHI ELECTRIC CORPORATION: PRODUCTS OFFERED 232

TABLE 190 MITSUBISHI ELECTRIC CORPORATION: PRODUCT LAUNCHES/DEVELOPMENTS 233

TABLE 191 MITSUBISHI ELECTRIC CORPORATION: OTHER DEVELOPMENTS 233

TABLE 192 SONY SPACE COMMUNICATION: COMPANY OVERVIEW 234

TABLE 193 SONY SPACE COMMUNICATION: PRODUCTS OFFERED 234

TABLE 194 SONY SPACE COMMUNICATION: PRODUCT DEVELOPMENTS 235

TABLE 195 SONY SPACE COMMUNICATION: DEALS 235

TABLE 196 AAC CLYDE SPACE: COMPANY OVERVIEW 236

TABLE 197 AAC CLYDE SPACE: PRODUCTS OFFERED 237

TABLE 198 AAC CLYDE SPACE: DEALS 238

TABLE 199 AAC CLYDE SPACE: OTHER DEVELOPMENTS 238

TABLE 200 NEC SPACE TECHNOLOGIES: COMPANY OVERVIEW 239

TABLE 201 NEC SPACE TECHNOLOGIES: PRODUCTS OFFERED 239

TABLE 202 NEC SPACE TECHNOLOGIES: DEALS 240

TABLE 203 NEC SPACE TECHNOLOGIES: OTHER DEVELOPMENTS 241

TABLE 204 SKYLOOM GLOBAL: COMPANY OVERVIEW 242

TABLE 205 SKYLOOM GLOBAL: PRODUCTS OFFERED 242

TABLE 206 SKYLOOM GLOBAL: DEALS 243

TABLE 207 GENERAL ATOMICS: BUSINESS OVERVIEW 244

TABLE 208 GENERAL ATOMICS: PRODUCTS OFFERED 244

TABLE 209 GENERAL ATOMICS: DEALS 245

TABLE 210 GENERAL ATOMICS: OTHER DEVELOPMENTS 245

TABLE 211 SPACE MICRO: COMPANY OVERVIEW 246

TABLE 212 SPACE MICRO: PRODUCTS OFFERED 246

TABLE 213 SPACE MICRO: DEALS 247

TABLE 214 SPACE MICRO: OTHER DEVELOPMENTS 247

TABLE 215 NORTHROP GRUMMAN: BUSINESS OVERVIEW 248

TABLE 216 NORTHROP GRUMMAN: PRODUCTS OFFERED 249

TABLE 217 NORTHROP GRUMMAN: DEALS 250

TABLE 218 NORTHROP GRUMMAN: OTHER DEVELOPMENTS 250

TABLE 219 SAFRAN: COMPANY OVERVIEW 251

TABLE 220 SAFRAN: PRODUCTS OFFERED 252

TABLE 221 SAFRAN: DEALS 253

TABLE 222 SAFRAN: OTHER DEVELOPMENTS 253

TABLE 223 WARPSPACE: COMPANY OVERVIEW 254

TABLE 224 SITAEL: COMPANY OVERVIEW 255

TABLE 225 ASTROGATE LABS: COMPANY OVERVIEW 256

TABLE 226 ARCHANGEL LIGHTWORKS: COMPANY OVERVIEW 257

TABLE 227 TRANSCELESTIAL: COMPANY OVERVIEW 258

TABLE 228 CAILABS: COMPANY OVERVIEW 259

TABLE 229 OLEDCOMM: COMPANY OVERVIEW 260

TABLE 230 HENSOLDT: COMPANY OVERVIEW 261

TABLE 231 ASTROLIGHT: COMPANY OVERVIEW 262

TABLE 232 QINETIQ: COMPANY OVERVIEW 263

TABLE 233 OPTICAL SATELLITE COMMUNICATION MARKET: LONG LIST OF COMPANIES 275

LIST OF FIGURES

FIGURE 1 OPTICAL SATELLITE COMMUNICATION MARKET SEGMENTATION 28

FIGURE 2 MARKET SCENARIO 31

FIGURE 3 GLOBAL OPTICAL SATELLITE COMMUNICATION MARKET, 2021–2030 32

FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN OPTICAL SATELLITE COMMUNICATION MARKET 33

FIGURE 5 HIGH-GROWTH SEGMENTS IN OPTICAL SATELLITE COMMUNICATION MARKET 34

FIGURE 6 ASIA PACIFIC TO BE FASTEST-GROWING REGIONAL MARKET DURING FORECAST PERIOD 35

FIGURE 7 BILL OF MATERIALS FOR OPTICAL SATELLITE COMMUNICATION 36

FIGURE 8 TOTAL COST OF OWNERSHIP 37

FIGURE 9 BUSINESS MODEL RISK–RETURN MATRIX 39

FIGURE 10 BUYER-WISE ADOPTION OF BUSINESS MODELS 39

FIGURE 11 NEED FOR HIGH-CAPACITY, SECURE, AND LOW-LATENCY SPACE-BASED DATA TRANSFER TO DRIVE OPTICAL SATELLITE COMMUNICATION MARKET 40

FIGURE 12 NETWORK BACKBONE & RELAY COMMUNICATIONS TO HOLD

LARGEST SHARE IN 2030 41

FIGURE 13 SEMICONDUCTOR DIODE LASER TO EXHIBIT FASTEST GROWTH DURING FORECAST PERIOD 41

FIGURE 14 POINTING, ACQUISITION, AND TRACKING MODULE ACCOUNTED FOR LEADING MARKET SHARE IN 2025 42

FIGURE 15 OPTICAL SATELLITE COMMUNICATION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES 44

FIGURE 16 OPTICAL SATELLITE TERMINAL COUNT, 2025–2030 48

FIGURE 17 ECOSYSTEM ANALYSIS 57

FIGURE 18 VALUE CHAIN ANALYSIS 58

FIGURE 19 IMPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND) 60

FIGURE 20 EXPORT DATA FOR HS CODE 880260-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD THOUSAND) 62

FIGURE 21 INVESTMENT AND FUNDING SCENARIO, 2021–2025 (USD MILLION) 66

FIGURE 22 INVESTMENT AND FUNDING SCENARIO, BY COUNTRY, 2021–2025 (USD MILLION) 67

FIGURE 23 INVESTMENT AND FUNDING SCENARIO, BY FUNDING STAGE,

2021–2025 (USD MILLION) 67

FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 68

FIGURE 25 AVERAGE SELLING PRICE, BY REGION, 2021–2024 (USD MILLION) 69

FIGURE 26 DECISION-MAKING PROCESS 74

FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY DATA RATE CLASS 75

FIGURE 28 KEY BUYING CRITERIA, BY DATA RATE CLASS 76

FIGURE 29 ADOPTION BARRIERS AND INTERNAL CHALLENGES 77

FIGURE 30 TECHNOLOGY ROADMAP FOR OPTICAL SATELLITE COMMUNICATION MARKET 85

FIGURE 31 PATENT ANALYSIS, 2021–2025 86

FIGURE 32 FUTURE APPLICATIONS 89

FIGURE 33 IMPACT OF AI/GEN AI 92

FIGURE 34 OPTICAL SATELLITE COMMUNICATION MARKET, BY PLATFORM,

2025–2030 (USD MILLION) 108

FIGURE 35 OPTICAL SATELLITE COMMUNICATION MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 114

FIGURE 36 OPTICAL SATELLITE COMMUNICATION MARKET, BY COMPONENT,

2025–2030 (USD MILLION) 118

FIGURE 37 OPTICAL SATELLITE COMMUNICATION MARKET, BY LASER TYPE,

2025–2030 (USD MILLION) 123

FIGURE 38 OPTICAL SATELLITE COMMUNICATION MARKET, BY REGION, 2025–2030 133

FIGURE 39 NORTH AMERICA: OPTICAL SATELLITE COMMUNICATION MARKET SNAPSHOT 135

FIGURE 40 EUROPE: OPTICAL SATELLITE COMMUNICATION MARKET SNAPSHOT 141

FIGURE 41 ASIA PACIFIC: OPTICAL SATELLITE COMMUNICATION MARKET SNAPSHOT 153

FIGURE 42 MIDDLE EAST: OPTICAL SATELLITE COMMUNICATION MARKET SNAPSHOT 163

FIGURE 43 REST OF THE WORLD: OPTICAL SATELLITE COMMUNICATION MARKET SNAPSHOT 171

FIGURE 44 REVENUE ANALYSIS OF TOP 5 PLAYERS, 2021–2024 180

FIGURE 45 OPTICAL SATELLITE COMMUNICATION MARKET SHARE ANALYSIS OF

KEY PLAYERS, 2024 181

FIGURE 46 OPTICAL SATELLITE COMMUNICATION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024 184

FIGURE 47 OPTICAL SATELLITE COMMUNICATION MARKET: COMPANY FOOTPRINT 185

FIGURE 48 OPTICAL SATELLITE COMMUNICATION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 189

FIGURE 49 EV/EBITDA OF PROMINENT MARKET PLAYERS, 2025 192

FIGURE 50 COMPANY VALUATION, USD BILLION, 2025 192

FIGURE 51 OPTICAL SATELLITE COMMUNICATION MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS 193

FIGURE 52 MYNARIC AG: COMPANY SNAPSHOT 209

FIGURE 53 BAE SYSTEMS: COMPANY SNAPSHOT 225

FIGURE 54 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT 229

FIGURE 55 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT 232

FIGURE 56 AAC CLYDE SPACE: COMPANY SNAPSHOT 237

FIGURE 57 NORTHROP GRUMMAN: COMPANY SNAPSHOT 249

FIGURE 58 SAFRAN: COMPANY SNAPSHOT 252

FIGURE 59 RESEARCH DESIGN MODEL 264

FIGURE 60 RESEARCH DESIGN 265

FIGURE 61 BOTTOM-UP APPROACH 271

FIGURE 62 TOP-DOWN APPROACH 271

FIGURE 63 DATA TRIANGULATION 272