Polyurethane Dispersions Market - Global Forecast To 2030

ポリウレタン分散液市場 - タイプ(無溶剤ポリウレタン分散液、低溶剤ポリウレタン分散液)、化学組成別(アニオン性ポリウレタン分散液、カチオン性ポリウレタン分散液、ノニオン性ポリウレタン分散液、自己架橋型ポリウレタン分散液、ハイブリッドポリウレタン分散液)、機能性別(1成分系(1k)システム、2成分系(2k)システム)、用途別(塗料・コーティング、接着剤・シーラント、皮革製造・仕上げ、繊維仕上げ)、地域別 - 2030年までの世界予測

Polyurethane Dispersions Market By Type (Solvent-Free Polyurethane Dispersions, Low-Solvent Polyurethane Dispersions), By Chemistry (Anionic Polyurethane Dispersions, Cationic Polyurethane Dispersions, Nonionic Polyurethane Dispersions, Self-Crosslinking Polyurethane Dispersions, Hybrid Polyurethane Dispersions), By Functionality [One-Component (1k) Systems, Two-Component (2k) Systems], By Application (Paints & Coatings, Adhesives & Sealants, Leather Manufacturing & Finishing, Textile Finishing), and Region – Global Forecast to 2030

| 出版 | MarketsandMarkets |

| 出版年月 | 2025年12月 |

| ページ数 | 274 |

| 図表数 | 318 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-12105 |

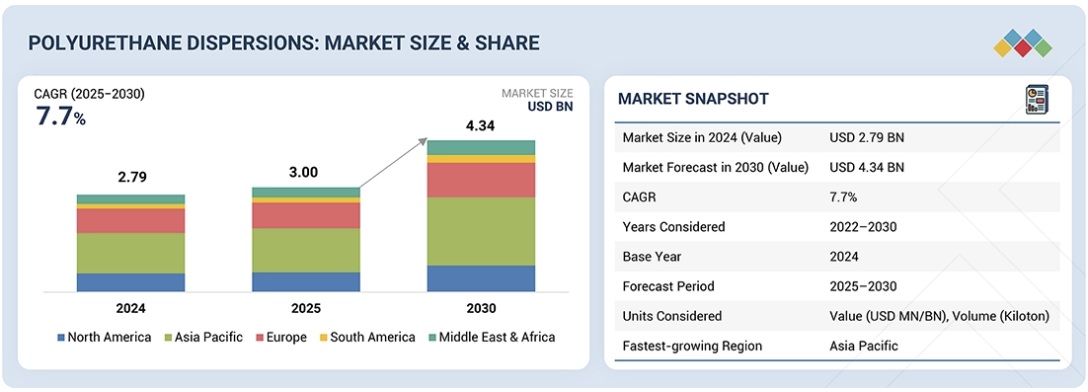

ポリウレタン分散液市場は、予測期間中に年平均成長率7.7%で成長し、2025年の30億米ドルから2030年には43億4,000万米ドルに達すると予測されています。

ポリウレタン分散液(PUD)は、自動車、建設、繊維、接着剤、皮革仕上げ、木材コーティングなど、さまざまな業界で採用が進んでいます。この傾向を牽引する主な要因の一つは、より厳しい環境規制の施行と、溶剤ベースのポリウレタンシステムの急速な段階的廃止です。環境保護庁(EPA)や欧州化学物質庁(ECHA)などの規制当局、そしてREACHやEU塗装指令(2004/42/EC)などの地域VOC指令は、より低い排出基準を施行しており、メーカーは水性PUD技術への移行を促しています。最新のハイブリッド、アニオン、カチオンPUDは、優れたフィルム形成能力、物理的ストレスに対する機械的耐久性、耐薬品性、表面への強力な接着性、低VOCレベルなど、さまざまな利点を備えており、より安全な取り扱い方法も保証されています。これらのタイプの PUD を活用した高性能コーティング システムは、自動車 OEM、皮革仕上げ、防水繊維、工業用木材コーティング、フレキシブル包装用接着剤など、さまざまな分野で使用されています。

調査範囲

本調査レポートは、ポリウレタン分散液市場を、タイプ別(無溶剤ポリウレタン分散液、低溶剤ポリウレタン分散液)、化学組成別(アニオン性ポリウレタン分散液、カチオン性ポリウレタン分散液、ノニオン性ポリウレタン分散液、自己架橋型ポリウレタン分散液、ハイブリッドポリウレタン分散液)、機能性別(一成分系(1K)システム、二成分系(2K)システム)、用途別(塗料・コーティング、接着剤・シーラント、皮革製造・仕上げ、繊維仕上げ)に分類しています。本レポートは、ポリウレタン分散液市場の成長に影響を与える推進要因、制約要因、課題、機会に関する詳細な情報を網羅しています。主要業界プレーヤーの詳細な分析を実施し、ポリウレタン分散液市場に関連する各社の事業概要、提供製品、主要戦略(合併、買収、製品発売、事業拡大など)に関する洞察を提供しています。本レポートは、ポリウレタン分散液市場エコシステムにおける新興企業の競合分析を網羅しています。

レポートを購入する理由

本レポートは、市場リーダーおよび新規参入企業に対し、ポリウレタン分散液市場全体とそのサブセグメントの収益数値に関する近似値を提供します。本レポートは、関係者が競争環境を理解し、事業のポジショニングを改善するための洞察を深め、適切な市場開拓戦略を策定するのに役立ちます。また、本レポートは、市場の動向を把握し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供するのに役立ちます。

本レポートでは、以下の点について洞察を提供しています。

- 主要な推進要因(低VOCおよび環境適合コーティングの採用加速、自動車、建設、産業用途からの需要増加、合成皮革および機能性繊維仕上げの拡大)、制約要因(生産コストの上昇による採用拡大の阻害、特定グレードにおける耐溶剤性および耐薬品性の限界)、機会(持続可能なイノベーションによるバイオベースおよび循環型ポリウレタン分散液市場の拡大、高度なポリウレタン分散液による高性能産業および特殊用途の開拓)、および課題(環境基準を遵守しながら性能を維持すること、低コストの地域ポリウレタン分散液メーカーとの熾烈なコスト競争への対応)の分析。

- 製品開発/イノベーション:ポリウレタン分散液市場における今後の技術、研究開発活動、製品・サービスの投入に関する詳細な洞察。

- 市場開発:収益性の高い市場に関する包括的な情報 ― 本レポートでは、様々な地域におけるポリウレタン分散液市場を分析しています。

- 市場の多様化:ポリウレタン分散液市場における新製品・サービス、未開拓地域、最近の動向、投資に関する包括的な情報。

- 競合評価:Covestro AG(ドイツ)、BASF(ドイツ)、Dow(米国)、Wanhua(中国)、Lubrizol(米国)、三井化学株式会社(日本)、Alberdingk Boley GmbH(ドイツ)、Perstorp(スウェーデン)、Stahl Holdings B.V.(オランダ)、UBE株式会社(日本)など、主要企業の市場シェア、成長戦略、サービス提供に関する詳細な評価。

Report Description

The polyurethane dispersions market is projected to reach USD 4.34 billion by 2030 from USD 3.00 billion in 2025, at a CAGR of 7.7% during the forecast period.

Polyurethane Dispersions Market – Global Forecast To 2030

Polyurethane dispersions (PUDs) are increasingly being adopted across various industries, including automotive, construction, textiles, adhesives, leather finishing, and wood coatings. One major factor driving this trend is the implementation of stricter environmental regulations and the rapid phase-out of solvent-based polyurethane systems. Regulatory agencies, such as the Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), as well as regional VOC directives like REACH and the EU DECO-PAINT DIRECTIVE (2004/42/EC), are enforcing lower emissions standards, prompting manufacturers to switch to waterborne PUD technologies. Modern hybrid, anionic, and cationic PUDs offer a range of advantages, including excellent film-forming capabilities, mechanical durability against physical stressors, chemical resistance, strong adhesion to surfaces, and low VOC levels, all while ensuring safer handling methods. High-performance coating systems that utilize these types of PUDs are found in various sectors, including automotive OEMs, leather finishing, waterproof textiles, industrial wood coatings, and flexible packaging adhesives.

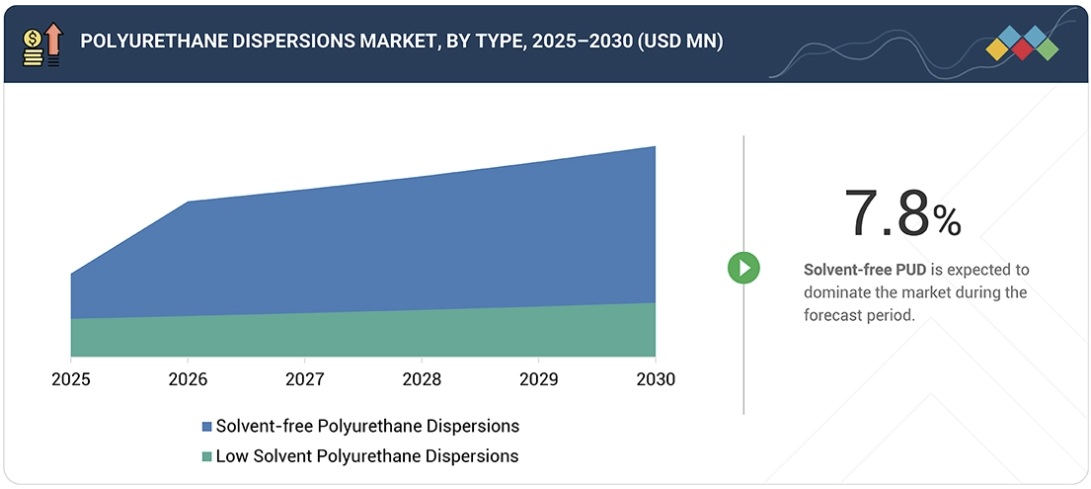

“Solvent-free polyurethane dispersions are projected to be the fastest-growing type during the forecast period.”

Solvent-free polyurethane solutions are projected to grow rapidly in the PUD market due to increasing demand for environmentally friendly products with low VOC content. These solutions, which do not use organic solvents, offer superior physical properties, chemical resistance, and film formation compared to traditional options. Their zero-solvent content makes them ideal for sensitive applications, such as leather, textiles, packaging, wood coatings, and automotive interiors. With rising regulatory pressures to reduce VOC emissions, advancements in polycarbonate polyols and renewable feedstocks are enhancing the durability and performance of solventless PUDs. As manufacturers shift towards greener alternatives without compromising efficiency, solvent-free polyurethane solutions are driving growth in the global PUD market.

“Paints & coatings are projected to be the fastest-growing applications in the market.”

The market is expected to grow rapidly due to the rising demand for low-VOC and eco-friendly coatings in sectors such as construction, automotive, and wood. PUD coatings provide excellent adhesion, chemical and moisture resistance, and flexibility, making them a preferred alternative to solvent-based options amid stricter emission regulations. Their superior durability and improved aesthetics enhance their use in architectural coatings, automotive refinishing, and protective finishes. Additionally, the shift toward sustainable manufacturing practices and the development of waterborne and solvent-free formulations will further drive the adoption of PUD. As industries seek greener technologies and better performance, PUDs will play a crucial role in advancing next-generation coatings, ensuring strong market growth.

Polyurethane Dispersions Market – Global Forecast To 2030 – region

“Asia Pacific is projected to be the fastest-growing region in the polyurethane dispersions market during the forecast period.”

The rapid industrialization, increased manufacturing opportunities, and rising demand for eco-friendly coating technologies are driving market growth in the Asia Pacific. Countries such as China, India, South Korea, and Indonesia have seen significant growth in sectors like automotive, textile, construction, and packaging, which are major consumers of waterborne PUD-based coatings, adhesives, and sealants. The shift toward low-VOC, solvent-free, and sustainable formulations has been fueled by stricter environmental regulations, such as China’s VOC limits, and government-supported Green Chemistry initiatives in India. These factors are increasing the demand for PUD products throughout the region. Furthermore, government investments in building infrastructure, the expansion of local production capabilities, and the presence of competitive manufacturers are also contributing to the market’s growth.

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the PUDs marketplace.

- By Company Type: Tier 1: 40%, Tier 2: 30%, and Tier 3: 30%

- By Designation: Directors: 30%, Managers: 20%, and Others: 50%

- By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and the Middle East & Africa: 20%

Polyurethane Dispersions Market – Global Forecast To 2030 – ecosystem

Covestro AG (Germany), BASF (Germany), Dow (US), Wanhua (China), Lubrizol (US), Mitsui Chemicals, Inc. (Japan), Alberdingk Boley GmbH (Germany), Perstorp (Sweden), Stahl Holdings B.V. (Netherlands), and UBE Corporation (Japan) are some companies covered in the report.

The study includes an in-depth competitive analysis of these key players in the polyurethane dispersions market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the polyurethane dispersions market based on by type (solvent-free polyurethane dispersions, low-solvent polyurethane dispersions), by chemistry (anionic polyurethane dispersions, cationic polyurethane dispersions, nonionic polyurethane dispersions, self-crosslinking polyurethane dispersions, hybrid polyurethane dispersions), by functionality (one-component (1k) systems, two-component (2k) systems), by application (paints & coatings, adhesives & sealants, leather manufacturing & finishing, textile finishing). The report’s scope encompasses detailed information regarding the drivers, restraints, challenges, and opportunities that influence the growth of the polyurethane dispersions market. A detailed analysis of key industry players has been conducted to provide insights into their business overview, products offered, and key strategies, including mergers, acquisitions, product launches, and expansions, associated with the polyurethane dispersions market. This report covers a competitive analysis of upcoming startups in the polyurethane dispersions market ecosystem.

Reasons to Buy the Report

The report will provide market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall polyurethane dispersions market and its subsegments. It will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points.

- Analysis of key drivers (accelerating adoption of low-VOC and environmentally compliant coatings, growing demand from automotive, construction, and industrial applications, expansion in synthetic leather and functional textile finishing), restraints (higher production costs limiting wider adoption, limited solvent and chemical resistance in certain grades), opportunities (expanding the bio‑based & circular polyurethane dispersions market through sustainable innovation, unlocking high-performance industrial & specialty applications with advanced polyurethane dispersions), and challenges (sustaining performance while complying with environmental norms, navigating fierce cost competition from low‑cost regional polyurethane dispersions producers).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the polyurethane dispersions market.

- Market Development: Comprehensive information about profitable markets – the report analyzes the polyurethane dispersions market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the polyurethane dispersions market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Covestro AG (Germany), BASF (Germany), Dow (US), Wanhua (China), Lubrizol (US), Mitsui Chemicals, Inc. (Japan), Alberdingk Boley GmbH (Germany), Perstorp (Sweden), Stahl Holdings B.V. (Netherlands), and UBE Corporation (Japan), among others.

Table of Contents

1 INTRODUCTION 27

1.1 STUDY OBJECTIVES 27

1.2 MARKET DEFINITION 27

1.3 STUDY SCOPE 28

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 28

1.3.2 INCLUSIONS AND EXCLUSIONS 29

1.3.3 YEARS CONSIDERED 29

1.3.4 CURRENCY CONSIDERED 30

1.3.5 UNITS CONSIDERED 30

1.4 STAKEHOLDERS 30

2 EXECUTIVE SUMMARY 31

2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS 31

2.2 KEY MARKET PARTICIPANTS: SHARE INSIGHTS AND STRATEGIC DEVELOPMENTS 32

2.3 DISRUPTIVE TRENDS SHAPING MARKET 33

2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS 34

2.5 SNAPSHOT: GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST 35

3 PREMIUM INSIGHTS 36

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POLYURETHANE DISPERSIONS MARKET 36

3.2 POLYURETHANE DISPERSIONS MARKET, BY TYPE 36

3.3 POLYURETHANE DISPERSIONS MARKET, BY CHEMISTRY 37

3.4 POLYURETHANE DISPERSIONS MARKET, BY FUNCTIONALITY 37

3.5 POLYURETHANE DISPERSIONS MARKET, BY APPLICATION 38

3.6 POLYURETHANE DISPERSIONS MARKET, BY KEY COUNTRY 38

4 MARKET OVERVIEW 39

4.1 INTRODUCTION 39

4.2 MARKET DYNAMICS 39

4.2.1 DRIVERS 40

4.2.1.1 Accelerating adoption of low-VOC and environmentally

compliant coatings 40

4.2.1.2 Growing demand from automotive, construction, and industrial applications 40

4.2.1.3 Expansion in synthetic leather and functional textile finishing 41

4.2.2 RESTRAINTS 41

4.2.2.1 Higher production costs limiting wider adoption 41

4.2.2.2 Limited solvent and chemical resistance in certain grades 42

4.2.3 OPPORTUNITIES 42

4.2.3.1 Expanding bio‑based & circular polyurethane dispersions market through sustainable innovation 42

4.2.3.2 Unlocking high-performance industrial & specialty applications 43

4.2.4 CHALLENGES 43

4.2.4.1 Sustaining performance while complying with environmental norms 43

4.2.4.2 Navigating fierce cost competition from low‑cost regional polyurethane dispersions producers 43

4.3 UNMET NEEDS AND WHITE SPACES 44

4.3.1 UNMET NEEDS IN POLYURETHANE DISPERSIONS MARKET 44

4.3.2 WHITE SPACE OPPORTUNITIES 44

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 45

4.4.1 INTERCONNECTED MARKETS 45

4.4.2 CROSS-SECTOR OPPORTUNITIES 46

4.5 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 46

4.5.1 KEY MOVES AND STRATEGIC FOCUS 46

5 INDUSTRY TRENDS 48

5.1 PORTER’S FIVE FORCES ANALYSIS 48

5.1.1 THREAT OF NEW ENTRANTS 49

5.1.2 THREAT OF SUBSTITUTES 49

5.1.3 BARGAINING POWER OF SUPPLIERS 49

5.1.4 BARGAINING POWER OF BUYERS 50

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 50

5.2 MACROECONOMIC ANALYSIS 50

5.2.1 INTRODUCTION 50

5.2.2 GDP TRENDS AND FORECASTS 51

5.3 VALUE CHAIN ANALYSIS 51

5.4 ECOSYSTEM ANALYSIS 53

5.4.1 PRICING ANALYSIS 54

5.4.1.1 Pricing analysis based on application 55

5.4.1.2 Pricing analysis based on region 55

5.5 TRADE ANALYSIS 56

5.5.1 EXPORT SCENARIO (HS CODE 390950) 56

5.5.2 IMPORT SCENARIO (HS CODE 390950) 57

5.6 KEY CONFERENCES AND EVENTS, 2025–2026 59

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 60

5.7.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 60

5.8 INVESTMENT AND FUNDING SCENARIO 61

5.9 CASE STUDY ANALYSIS 62

5.9.1 COVESTRO & JOWAT (FURNITURE LAMINATION USING DISPERCOLL U) 62

5.9.2 BASF (JONCRYL PUD SYSTEMS FOR INDUSTRIAL WOOD COATINGS) 63

5.9.3 PERMUTHANE WATERBORNE POLYURETHANE DISPERSIONS-STAHL (PUDS FOR AUTOMOTIVE SYNTHETIC LEATHER) 63

5.10 IMPACT OF 2025 US TARIFF: POLYURETHANE DISPERSIONS MARKET 63

5.10.1 INTRODUCTION 63

5.10.2 KEY TARIFF RATES 64

5.10.3 PRICE IMPACT ANALYSIS 64

5.10.4 IMPACT ON COUNTRY/REGION 65

5.10.4.1 US 65

5.10.4.2 China 65

5.10.4.3 Europe 65

5.10.4.4 Mexico 65

5.10.5 END-USE INDUSTRY IMPACT 65

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS 66

6.1 KEY EMERGING TECHNOLOGIES 66

6.1.1 LOW-SOLVENT AND WATERBORNE POLYURETHANE DISPERSIONS 66

6.1.2 FUNCTIONAL ADDITIVES FOR ENHANCED PERFORMANCE 66

6.1.3 SELF-CROSSLINKING AND HYBRID POLYURETHANE SYSTEMS 66

6.2 COMPLEMENTARY TECHNOLOGIES 67

6.2.1 BIO-BASED POLYURETHANE PRECURSORS 67

6.3 ADJACENT TECHNOLOGIES 67

6.3.1 SMART COATINGS AND FUNCTIONAL INTEGRATION 67

6.4 TECHNOLOGY/PRODUCT ROADMAP 67

6.4.1 SHORT-TERM (2025–2027) | FOUNDATION & EARLY COMMERCIALIZATION 67

6.4.2 MID-TERM (2027–2030) | EXPANSION & INTEGRATION 68

6.4.3 LONG-TERM (2030–2035+) | MATURITY & ADVANCED SYSTEMS 68

6.5 PATENT ANALYSIS 69

6.5.1 INTRODUCTION 69

6.5.2 METHODOLOGY 69

6.5.3 POLYURETHANE DISPERSIONS MARKET, PATENT ANALYSIS, 2015–2024 69

6.6 FUTURE APPLICATIONS 73

6.6.1 SMART AND FUNCTIONAL COATINGS FOR INDUSTRY 4.0 APPLICATIONS 73

6.6.2 ECO-FRIENDLY AND BIO-BASED POLYURETHANE DISPERSIONS 74

6.6.3 HIGH-PERFORMANCE COATINGS FOR ADVANCED MATERIALS 74

6.6.4 FUNCTIONAL ADHESIVES AND COATINGS FOR MEDICAL AND PACKAGING APPLICATIONS 75

6.7 IMPACT OF AI/GEN AI ON POLYURETHANE DISPERSIONS MARKET 75

6.7.1 TOP USE CASES AND MARKET POTENTIAL 75

6.7.2 BEST PRACTICES IN POLYURETHANE DISPERSION MANUFACTURING 76

6.7.3 CASE STUDIES OF AI IMPLEMENTATION IN POLYURETHANE

DISPERSIONS MARKET 76

6.7.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT

ON MARKET PLAYERS 76

6.7.5 CLIENTS’ READINESS TO ADOPT GENERATIVE AI IN POLYURETHANE DISPERSIONS MARKET 77

6.8 SUCCESS STORIES AND REAL-WORLD APPLICATIONS 77

6.8.1 AUTOMOTIVE INTERIOR COATINGS & ADHESIVES 77

6.8.2 SUSTAINABLE INTERIOR WALL & FURNITURE COATINGS 77

6.8.3 WOOD AND FURNITURE COATINGS WITH ENHANCED SURFACE FEEL 77

6.8.4 FUNCTIONAL AND ACOUSTIC COATINGS (ACADEMIC/R&D) 78

7 SUSTAINABILITY AND REGULATORY LANDSCAPE 79

7.1 REGIONAL REGULATIONS AND COMPLIANCE 79

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 79

7.1.2 INDUSTRY STANDARDS 82

7.2 SUSTAINABILITY INITIATIVES 82

7.2.1 CARBON IMPACT AND ECO-APPLICATIONS OF POLYURETHANE DISPERSIONS 83

7.2.1.1 Carbon Impact Reduction 83

7.2.1.2 Eco-Applications 83

7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES 84

7.4 CERTIFICATIONS, LABELING, ECO-STANDARDS 84

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 86

8.1 DECISION-MAKING PROCESS 86

8.2 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA 88

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 88

8.2.2 BUYING CRITERIA 89

8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 89

8.4 UNMET NEEDS FROM VARIOUS END-USE INDUSTRIES 91

8.5 MARKET PROFITABILITY 92

8.5.1 REVENUE POTENTIAL 92

8.5.2 COST DYNAMICS 92

8.5.3 MARGIN OPPORTUNITIES BY APPLICATION 93

9 POLYURETHANE DISPERSIONS MARKET, BY TYPE 94

9.1 INTRODUCTION 95

9.2 SOLVENT-FREE POLYURETHANE DISPERSIONS 96

9.2.1 LOW IMPACT ON ENVIRONMENT TO DRIVE MARKET 96

9.3 LOW-SOLVENT POLYURETHANE DISPERSIONS 97

9.3.1 VARIOUS ATTRIBUTES LIKELY TO INFLUENCE MARKET 97

10 POLYURETHANE DISPERSIONS MARKET, BY CHEMISTRY 98

10.1 INTRODUCTION 99

10.2 ANIONIC POLYURETHANE DISPERSIONS 101

10.2.1 WIDESPREAD INDUSTRIAL ADOPTION DRIVEN BY VERSATILITY, COST-EFFICIENCY, AND REGULATORY COMPLIANCE 101

10.3 CATIONIC POLYURETHANE DISPERSIONS 101

10.3.1 GROWING USE IN SPECIALTY APPLICATIONS SUPPORTED BY SUPERIOR SUBSTRATE ADHESION AND ANTIMICROBIAL PERFORMANCE 101

10.4 NONIONIC POLYURETHANE DISPERSIONS 102

10.4.1 INCREASING DEMAND IN HIGH-TEMPERATURE AND SPECIALIZED PLUMBING APPLICATIONS TO PROPEL MARKET 102

10.5 SELF-CROSSLINKING POLYURETHANE DISPERSIONS 102

10.5.1 RISING FOCUS ON HIGH-DURABILITY, LOW-VOC COATINGS ACCELERATES ADOPTION OF SELF-CROSSLINKING SYSTEMS 102

10.6 HYBRID POLYURETHANE DISPERSIONS 103

10.6.1 GROWING PREFERENCE FOR COST-OPTIMIZED, PERFORMANCE-ENHANCED SYSTEMS DRIVES HYBRID PUD ADOPTION 103

11 POLYURETHANE DISPERSIONS MARKET, BY FUNCTIONALITY 104

11.1 INTRODUCTION 105

11.2 ONE-COMPONENT (1) SYSTEMS 106

11.2.1 GROWING PREFERENCE FOR EASY-TO-APPLY, LOW-VOC COATINGS TO DRIVE EXPANSION OF 1K POLYURETHANE DISPERSIONS TECHNOLOGIES 106

11.3 TWO-COMPONENT (2K) SYSTEMS 107

11.3.1 RISING NEED FOR HIGH-DURABILITY AND CHEMICALLY RESISTANT COATINGS TO DRIVE ADOPTION 107

12 POLYURETHANE DISPERSIONS MARKET, BY APPLICATION 108

12.1 INTRODUCTION 109

12.2 PAINTS & COATINGS 111

12.2.1 SHIFT TOWARD LOW-VOC, HIGH-PERFORMANCE FINISHES TO ACCELERATE ADOPTION OF WATERBORNE POLYURETHANE DISPERSION COATINGS 111

12.2.2 AUTOMOTIVE COATING 111

12.2.3 WOOD COATING 111

12.2.4 FLOOR COATING 112

12.2.5 HYGIENE COATING 112

12.3 ADHESIVES & SEALANTS 112

12.3.1 FAVORABLE ATTRIBUTES OF POLYURETHANE DISPERSIONS LIKELY TO DRIVE THEIR USE 112

12.4 LEATHER MANUFACTURING & FINISHING 113

12.4.1 GROWING APPLICATIONS IN LEATHER INDUSTRY TO DRIVE MARKET 113

12.5 TEXTILE FINISHING 113

12.5.1 PHYSICAL AND MECHANICAL PROPERTIES OF POLYURETHANE

DISPERSIONS TO INCREASE APPLICATIONS 113

12.6 OTHER APPLICATIONS 113

12.6.1 GLASS FIBER SIZING 114

12.6.2 MEDICAL FILMS & GLOVES 114

12.6.3 COSMETICS 114

12.6.4 GRAPHIC INKS 114

12.6.5 PAPER FINISHING 114

13 POLYURETHANE DISPERSIONS MARKET, BY REGION 115

13.1 INTRODUCTION 116

13.2 EUROPE 117

13.2.1 GERMANY 122

13.2.1.1 Growing renovation activities to accelerate applications in paints and coatings applications 122

13.2.2 FRANCE 124

13.2.2.1 Expanding construction and foreign investment to drive market 124

13.2.3 ITALY 125

13.2.3.1 Industrial rebound to expand market 125

13.2.4 SPAIN 127

13.2.4.1 Rising industrial investments and strong automotive supply chain to accelerate market growth 127

13.2.5 UK 129

13.2.5.1 Major infrastructure investments and automotive expansion to drive market 129

13.2.6 REST OF EUROPE 130

13.3 ASIA PACIFIC 132

13.3.1 CHINA 137

13.3.1.1 Rapid industrialization and infrastructure development to drive market growth 137

13.3.2 JAPAN 139

13.3.2.1 Urban redevelopment and automotive leadership to propel market growth 139

13.3.3 INDIA 140

13.3.3.1 Government initiatives and industrial growth to fuel market expansion 140

13.3.4 SOUTH KOREA 142

13.3.4.1 Strategic infrastructure investments and EV advancements to boost demand 142

13.3.5 REST OF ASIA PACIFIC 144

13.4 MIDDLE EAST & AFRICA 145

13.4.1 GCC COUNTRIES 149

13.4.1.1 Saudi Arabia 151

13.4.1.1.1 Economic diversification and mega projects propel market 151

13.4.1.2 UAE 153

13.4.1.2.1 Construction activities and automotive initiatives to drive demand 153

13.4.1.3 Rest of GCC countries 154

13.4.2 SOUTH AFRICA 156

13.4.2.1 Government initiatives and industrial growth to increase consumption 156

13.4.3 REST OF MIDDLE EAST & AFRICA 158

13.5 NORTH AMERICA 159

13.5.1 US 163

13.5.1.1 Strengthening construction and EV manufacturing to

drive market growth 163

13.5.2 CANADA 165

13.5.2.1 Net-Zero push and EV infrastructure investments to increase demand 165

13.5.3 MEXICO 167

13.5.3.1 Growth of construction and water infrastructure

sectors to fuel market 167

13.6 SOUTH AMERICA 169

13.6.1 BRAZIL 172

13.6.1.1 Rapid industrialization to influence market growth 172

13.6.2 ARGENTINA 174

13.6.2.1 Improving economic conditions to support market growth 174

13.6.3 REST OF SOUTH AMERICA 176

14 COMPETITIVE LANDSCAPE 179

14.1 OVERVIEW 179

14.2 KEY PLAYERS’ STRATEGIES/RIGHT TO WIN 179

14.3 REVENUE ANALYSIS 181

14.4 MARKET SHARE ANALYSIS 182

14.5 BRAND COMPARISON 185

14.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 186

14.6.1 STARS 186

14.6.2 EMERGING LEADERS 186

14.6.3 PERVASIVE PLAYERS 187

14.6.4 PARTICIPANTS 187

14.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 188

14.6.5.1 Company footprint 188

14.6.5.2 Region footprint 189

14.6.5.3 Type footprint 189

14.6.5.4 Chemistry footprint 190

14.6.5.5 Functionality footprint 191

14.6.5.6 Applications footprint 191

14.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 192

14.7.1 PROGRESSIVE COMPANIES 192

14.7.2 RESPONSIVE COMPANIES 192

14.7.3 DYNAMIC COMPANIES 192

14.7.4 STARTING BLOCKS 192

14.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 194

14.7.5.1 Detailed list of key startups/SMEs 194

14.7.5.2 Competitive benchmarking of key startups/SMEs 195

14.8 COMPANY VALUATION AND FINANCIAL METRICS 197

14.9 COMPETITIVE SCENARIO 198

14.9.1 PRODUCT LAUNCHES 198

14.9.2 DEALS 199

14.9.3 EXPANSIONS 201

15 COMPANY PROFILES 205

15.1 KEY PLAYERS 205

15.1.1 COVESTRO AG 205

15.1.1.1 Business overview 205

15.1.1.2 Products/Solutions/Services offered 206

15.1.1.3 Recent developments 207

15.1.1.3.1 Product launches 207

15.1.1.3.2 Deals 207

15.1.1.3.3 Expansions 208

15.1.1.4 MnM view 209

15.1.1.4.1 Right to win 209

15.1.1.4.2 Strategic choices 209

15.1.1.4.3 Weaknesses and competitive threats 209

15.1.2 BASF 210

15.1.2.1 Business overview 210

15.1.2.2 Products/Solutions/Services offered 212

15.1.2.3 Recent developments 212

15.1.2.3.1 Deals 212

15.1.2.3.2 Expansion 213

15.1.2.4 MnM view 213

15.1.2.4.1 Right to win 213

15.1.2.4.2 Strategic choices 214

15.1.2.4.3 Weaknesses & competitive threats 214

15.1.3 DOW 215

15.1.3.1 Business overview 215

15.1.3.2 Products/Solutions/Services offered 216

15.1.3.3 Recent developments 217

15.1.3.3.1 Expansions 217

15.1.3.4 MnM view 218

15.1.3.4.1 Right to win 218

15.1.3.4.2 Strategic choices 218

15.1.3.4.3 Weaknesses & competitive threats 218

15.1.4 WANHUA 219

15.1.4.1 Business overview 219

15.1.4.2 Products/Solutions/Services offered 220

15.1.4.3 Recent developments 221

15.1.4.3.1 Product launches 221

15.1.4.3.2 Expansions 221

15.1.4.4 MnM view 222

15.1.4.4.1 Right to win 222

15.1.4.4.2 Strategic choices 222

15.1.4.4.3 Weaknesses and competitive threats 222

15.1.5 LUBRIZOL 223

15.1.5.1 Business overview 223

15.1.5.2 Products/Solutions/Services offered 224

15.1.5.3 Recent developments 225

15.1.5.3.1 Product launches 225

15.1.5.4 MnM view 225

15.1.5.4.1 Right to win 225

15.1.5.4.2 Strategic choices 226

15.1.5.4.3 Weaknesses and competitive threats 226

15.1.6 MITSUI CHEMICALS, INC. 227

15.1.6.1 Business overview 227

15.1.6.2 Products/Solutions/Services offered 228

15.1.6.3 Recent development 229

15.1.6.3.1 Expansions 229

15.1.6.4 MnM view 230

15.1.7 ALBERDINGK BOLEY GMBH 231

15.1.7.1 Business overview 231

15.1.7.2 Products/Solutions/Services offered 232

15.1.7.3 Recent developments 232

15.1.7.3.1 Deals 232

15.1.7.4 MnM view 233

15.1.8 PERSTORP HOLDING AB (PETRONAS CHEMICALS GROUP) 234

15.1.8.1 Business overview 234

15.1.8.2 Products/Solutions/Services offered 234

15.1.8.3 MnM view 235

15.1.9 STAHL HOLDINGS B.V. 236

15.1.9.1 Business overview 236

15.1.9.2 Products/Solutions/Services offered 237

15.1.9.3 Recent developments 238

15.1.9.3.1 Expansions 238

15.1.9.4 MnM view 238

15.1.10 UBE CORPORATION 240

15.1.10.1 Business overview 240

15.1.10.2 Products/Solutions/Services offered 241

15.1.10.3 Recent developments 242

15.1.10.3.1 Deals 242

15.1.10.4 MnM view 242

15.2 OTHER PLAYERS 244

15.2.1 DIC CORPORATION 244

15.2.2 ALLNEX GMBH 245

15.2.3 LAMBERTI S.P.A. 246

15.2.4 POLYNT S.P.A 247

15.2.5 CHASE CORP. 248

15.2.6 RUDOLF GMBH 249

15.2.7 C. L. HAUTHAWAY & SONS CORP 250

15.2.8 MICHELMAN, INC. 251

15.2.9 NANPAO RESINS CHEMICAL GROUP 252

15.2.10 INCOREZ 253

15.2.11 SNP, INC. 254

15.2.12 TAIWAN PU CORPORATION 255

15.2.13 SIWOPUD 256

15.2.14 VCM POLYURETHANES PVT. LTD 257

15.2.15 KAMSONS POLYMERS LIMITED 258

16 RESEARCH METHODOLOGY 259

16.1 RESEARCH DATA 259

16.1.1 SECONDARY DATA 260

16.1.1.1 Key data from secondary sources 260

16.1.2 PRIMARY DATA 261

16.1.2.1 Key data from primary sources 261

16.1.2.2 Key industry insights 262

16.1.2.3 Breakdown of primary interviews 262

16.2 MARKET SIZE ESTIMATION 263

16.2.1 BOTTOM-UP APPROACH 263

16.2.2 TOP-DOWN APPROACH 264

16.3 DATA TRIANGULATION 264

16.4 RESEARCH ASSUMPTIONS 266

16.5 LIMITATIONS 266

17 APPENDIX 267

17.1 DISCUSSION GUIDE 267

17.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 270

17.3 CUSTOMIZATION OPTIONS 272

17.4 RELATED REPORTS 272

17.5 AUTHOR DETAILS 273

LIST OF TABLES

TABLE 1 POLYURETHANE DISPERSIONS MARKET: INCLUSIONS AND EXCLUSIONS 29

TABLE 2 PORTER’S FIVE FORCES ANALYSIS 49

TABLE 3 GLOBAL GDP GROWTH PROJECTION, BY REGION, 2021–2028 (USD TRILLION) 51

TABLE 4 ROLES OF COMPANIES IN POLYURETHANE DISPERSIONS ECOSYSTEM 54

TABLE 5 AVERAGE SELLING PRICE OF POLYURETHANE DISPERSIONS OFFERED

BY KEY PLAYERS, BY APPLICATION, 2024 (USD/KG) 55

TABLE 6 AVERAGE SELLING PRICE TREND OF POLYURETHANE DISPERSIONS OFFERED

BY KEY PLAYERS, BY REGION, 2022–2024 (USD/KG) 56

TABLE 7 EXPORT DATA RELATED TO HS CODE 390950-COMPLIANT PRODUCTS,

BY COUNTRY, 2020–2024 (USD MILLION) 57

TABLE 8 IMPORT DATA RELATED TO HS CODE 390950-COMPLIANT PRODUCTS,

BY COUNTRY, 2020–2024 (USD MILLION) 58

TABLE 9 POLYURETHANE DISPERSIONS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2025–2026 59

TABLE 10 POLYURETHANE DISPERSIONS MARKET: LIST OF KEY PATENTS,

2022–2024 71

TABLE 11 TOP USE CASES AND MARKET POTENTIAL 75

TABLE 12 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES 76

TABLE 13 POLYURETHANE DISPERSIONS MARKET: CASE STUDIES RELATED

TO GEN AI IMPLEMENTATION 76

TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS 79

TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES,

INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS 80

TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS 80

TABLE 17 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS 81

TABLE 18 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, INDUSTRY ASSOCIATIONS, AND OTHER ORGANIZATIONS 81

TABLE 19 GLOBAL INDUSTRY STANDARDS IN POLYURETHANE DISPERSIONS MARKET 82

TABLE 20 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN THE POLYURETHANE DISPERSIONS MARKET 84

TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION (%) 88

TABLE 22 KEY BUYING CRITERIA, BY APPLICATION 89

TABLE 23 UNMET NEEDS IN POLYURETHANE DISPERSIONS MARKET BY END-USE INDUSTRY 91

TABLE 24 POLYURETHANE DISPERSIONS MARKET, BY TYPE, 2022–2024 (USD MILLION) 95

TABLE 25 POLYURETHANE DISPERSIONS MARKET, BY TYPE, 2022–2024 (KILOTON) 95

TABLE 26 POLYURETHANE DISPERSIONS MARKET, BY TYPE, 2025–2030 (USD MILLION) 96

TABLE 27 POLYURETHANE DISPERSIONS MARKET, BY TYPE, 2025–2030 (KILOTON) 96

TABLE 28 POLYURETHANE DISPERSIONS MARKET, BY MATERIAL,

2022–2024 (USD MILLION) 99

TABLE 29 POLYURETHANE DISPERSIONS MARKET, BY MATERIAL, 2022–2024 (KILOTON) 100

TABLE 30 POLYURETHANE DISPERSIONS MARKET, BY CHEMISTRY,

2025–2030 (USD MILLION) 100

TABLE 31 POLYURETHANE DISPERSIONS MARKET, BY CHEMISTRY, 2025–2030 (KILOTON) 100

TABLE 32 POLYURETHANE DISPERSIONS MARKET, BY PRODUCT TYPE,

2022–2024 (USD MILLION) 105

TABLE 33 POLYURETHANE DISPERSIONS MARKET, BY PRODUCT TYPE,

2022–2024 (KILOTON) 106

TABLE 34 POLYURETHANE DISPERSIONS MARKET, BY PRODUCT TYPE,

2025–2030 (USD MILLION) 106

TABLE 35 POLYURETHANE DISPERSIONS MARKET, BY PRODUCT TYPE,

2025–2030 (KILOTON) 106

TABLE 36 POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 109

TABLE 37 POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2022–2024 (KILOTON) 110

TABLE 38 POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 110

TABLE 39 POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2025–2030 (KILOTON) 110

TABLE 40 POLYURETHANE DISPERSIONS MARKET, BY REGION, 2022–2024 (USD MILLION) 116

TABLE 41 POLYURETHANE DISPERSIONS MARKET, BY REGION, 2025–2030 (USD MILLION) 116

TABLE 42 POLYURETHANE DISPERSIONS MARKET, BY REGION, 2022–2024 (KILOTON) 117

TABLE 43 POLYURETHANE DISPERSIONS MARKET, BY REGION, 2025–2030 (KILOTON) 117

TABLE 44 EUROPE: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 118

TABLE 45 EUROPE: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 119

TABLE 46 EUROPE: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY,

2022–2024 (KILOTON) 119

TABLE 47 EUROPE: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 119

TABLE 48 EUROPE: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2022–2024 (USD MILLION) 120

TABLE 49 EUROPE: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2025–2030 (USD MILLION) 120

TABLE 50 EUROPE: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2022–2024 (KILOTON) 120

TABLE 51 EUROPE: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2025–2030 (KILOTON) 120

TABLE 52 EUROPE: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 121

TABLE 53 EUROPE: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 121

TABLE 54 EUROPE: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 121

TABLE 55 EUROPE: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 122

TABLE 56 GERMANY: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 122

TABLE 57 GERMANY: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 123

TABLE 58 GERMANY: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 123

TABLE 59 GERMANY: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 123

TABLE 60 FRANCE: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 124

TABLE 61 FRANCE: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 124

TABLE 62 FRANCE: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 125

TABLE 63 FRANCE: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 125

TABLE 64 ITALY: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 126

TABLE 65 ITALY: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 126

TABLE 66 ITALY: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 126

TABLE 67 ITALY: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 127

TABLE 68 SPAIN: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 127

TABLE 69 SPAIN: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 128

TABLE 70 SPAIN: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 128

TABLE 71 SPAIN: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 128

TABLE 72 UK: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 129

TABLE 73 UK: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 129

TABLE 74 UK: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 130

TABLE 75 UK: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 130

TABLE 76 REST OF EUROPE: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2022–2024 (USD MILLION) 131

TABLE 77 REST OF EUROPE: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 131

TABLE 78 REST OF EUROPE: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2022–2024 (KILOTON) 131

TABLE 79 REST OF EUROPE: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2025–2030 (KILOTON) 132

TABLE 80 ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 133

TABLE 81 ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 134

TABLE 82 ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY,

2022–2024 (KILOTON) 134

TABLE 83 ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 134

TABLE 84 ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2022–2024 (USD MILLION) 135

TABLE 85 ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2025–2030 (USD MILLION) 135

TABLE 86 ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2022–2024 (KILOTON) 135

TABLE 87 ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2025–2030 (KILOTON) 135

TABLE 88 ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 136

TABLE 89 ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 136

TABLE 90 ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 136

TABLE 91 ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 137

TABLE 92 CHINA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 137

TABLE 93 CHINA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 138

TABLE 94 CHINA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 138

TABLE 95 CHINA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 138

TABLE 96 JAPAN: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 139

TABLE 97 JAPAN: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 139

TABLE 98 JAPAN: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 140

TABLE 99 JAPAN: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 140

TABLE 100 INDIA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 141

TABLE 101 INDIA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 141

TABLE 102 INDIA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 141

TABLE 103 INDIA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 142

TABLE 104 SOUTH KOREA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 142

TABLE 105 SOUTH KOREA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 143

TABLE 106 SOUTH KOREA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 143

TABLE 107 SOUTH KOREA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 143

TABLE 108 REST OF ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2022–2024 (USD MILLION) 144

TABLE 109 REST OF ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 144

TABLE 110 REST OF ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2022–2024 (KILOTON) 145

TABLE 111 REST OF ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2025–2030 (KILOTON) 145

TABLE 112 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY, 2022–2024 (USD MILLION) 146

TABLE 113 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY, 2025–2030 (USD MILLION) 146

TABLE 114 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY, 2022–2024 (KILOTON) 146

TABLE 115 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY, 2025–2030 (KILOTON) 147

TABLE 116 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2022–2024 (USD MILLION) 147

TABLE 117 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2025–2030 (USD MILLION) 147

TABLE 118 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2022–2024 (KILOTON) 147

TABLE 119 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2025–2030 (KILOTON) 148

TABLE 120 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2022–2024 (USD MILLION) 148

TABLE 121 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 148

TABLE 122 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2022–2024 (KILOTON) 149

TABLE 123 MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2025–2030 (KILOTON) 149

TABLE 124 GCC COUNTRIES: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2022–2024 (USD MILLION) 150

TABLE 125 GCC COUNTRIES: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 150

TABLE 126 GCC COUNTRIES: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2022–2024 (KILOTON) 150

TABLE 127 GCC COUNTRIES: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2025–2030 (KILOTON) 151

TABLE 128 SAUDI ARABIA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 151

TABLE 129 SAUDI ARABIA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 152

TABLE 130 SAUDI ARABIA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 152

TABLE 131 SAUDI ARABIA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 152

TABLE 132 UAE: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 153

TABLE 133 UAE: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 153

TABLE 134 UAE: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 154

TABLE 135 UAE: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 154

TABLE 136 REST OF GCC COUNTRIES: POLYURETHANE DISPERSIONS MARKET,

BY APPLICATION, 2022–2024 (USD MILLION) 155

TABLE 137 REST OF GCC COUNTRIES: POLYURETHANE DISPERSIONS MARKET,

BY APPLICATION, 2025–2030 (USD MILLION) 155

TABLE 138 REST OF GCC COUNTRIES: POLYURETHANE DISPERSIONS MARKET,

BY APPLICATION, 2022–2024 (KILOTON) 155

TABLE 139 REST OF GCC COUNTRIES: POLYURETHANE DISPERSIONS MARKET,

BY APPLICATION, 2025–2030 (KILOTON) 156

TABLE 140 SOUTH AFRICA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 156

TABLE 141 SOUTH AFRICA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 157

TABLE 142 SOUTH AFRICA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 157

TABLE 143 SOUTH AFRICA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 157

TABLE 144 REST OF MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET,

BY APPLICATION, 2022–2024 (USD MILLION) 158

TABLE 145 REST OF MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET,

BY APPLICATION, 2025–2030 (USD MILLION) 158

TABLE 146 REST OF MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET,

BY APPLICATION, 2022–2024 (KILOTON) 159

TABLE 147 REST OF MIDDLE EAST & AFRICA: POLYURETHANE DISPERSIONS MARKET,

BY APPLICATION, 2025–2030 (KILOTON) 159

TABLE 148 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 160

TABLE 149 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 160

TABLE 150 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY,

2022–2024 (KILOTON) 160

TABLE 151 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 161

TABLE 152 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2022–2024 (USD MILLION) 161

TABLE 153 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2025–2030 (USD MILLION) 161

TABLE 154 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2022–2024 (KILOTON) 161

TABLE 155 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2025–2030 (KILOTON) 162

TABLE 156 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2022–2024 (USD MILLION) 162

TABLE 157 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 162

TABLE 158 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2022–2024 (KILOTON) 163

TABLE 159 NORTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2025–2030 (KILOTON) 163

TABLE 160 US: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 164

TABLE 161 US: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 164

TABLE 162 US: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 164

TABLE 163 US: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 165

TABLE 164 CANADA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 165

TABLE 165 CANADA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 166

TABLE 166 CANADA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 166

TABLE 167 CANADA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 166

TABLE 168 MEXICO: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 167

TABLE 169 MEXICO: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 168

TABLE 170 MEXICO: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 168

TABLE 171 MEXICO: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 168

TABLE 172 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 169

TABLE 173 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 169

TABLE 174 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY,

2022–2024 (KILOTON) 170

TABLE 175 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY COUNTRY,

2025–2030 (KILOTON) 170

TABLE 176 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2022–2024 (USD MILLION) 170

TABLE 177 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2025–2030 (USD MILLION) 170

TABLE 178 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2022–2024 (KILOTON) 171

TABLE 179 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY TYPE,

2025–2030 (KILOTON) 171

TABLE 180 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2022–2024 (USD MILLION) 171

TABLE 181 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 171

TABLE 182 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2022–2024 (KILOTON) 172

TABLE 183 SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION, 2025–2030 (KILOTON) 172

TABLE 184 BRAZIL: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 173

TABLE 185 BRAZIL: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 173

TABLE 186 BRAZIL: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 174

TABLE 187 BRAZIL: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 174

TABLE 188 ARGENTINA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 175

TABLE 189 ARGENTINA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 175

TABLE 190 ARGENTINA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2022–2024 (KILOTON) 175

TABLE 191 ARGENTINA: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 176

TABLE 192 REST OF SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET,

BY APPLICATION, 2022–2024 (USD MILLION) 177

TABLE 193 REST OF SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET,

BY APPLICATION, 2025–2030 (USD MILLION) 177

TABLE 194 REST OF SOUTH AMERICA: POLYURETHANE DISPERSIONS MARKET,

BY APPLICATION, 2022–2024 (KILOTON) 177

TABLE 195 BRAZIL: POLYURETHANE DISPERSIONS MARKET, BY APPLICATION,

2025–2030 (KILOTON) 178

TABLE 196 POLYURETHANE DISPERSIONS MARKET: KEY STRATEGIES ADOPTED

BY MAJOR PLAYERS 179

TABLE 197 POLYURETHANE DISPERSION MARKET: DEGREE OF COMPETITION, 2024 182

TABLE 198 POLYURETHANE DISPERSIONS MARKET: REGION FOOTPRINT 189

TABLE 199 POLYURETHANE DISPERSIONS MARKET: TYPE FOOTPRINT 189

TABLE 200 POLYURETHANE DISPERSIONS MARKET: CHEMISTRY FOOTPRINT 190

TABLE 201 POLYURETHANE DISPERSIONS MARKET: FUNCTIONALITY FOOTPRINT 191

TABLE 202 POLYURETHANE DISPERSIONS MARKET: APPLICATION FOOTPRINT 191

TABLE 203 POLYURETHANE DISPERSIONS MARKET: DETAILED LIST OF KEY STARTUPS/SMES 194

TABLE 204 POLYURETHANE DISPERSIONS MARKET: COMPETITIVE BENCHMARKING

OF KEY STARTUPS/SMES (1/2) 195

TABLE 205 POLYURETHANE DISPERSIONS MARKET: COMPETITIVE BENCHMARKING

OF KEY STARTUPS/SMES (2/2) 196

TABLE 206 POLYURETHANE DISPERSIONS MARKET: PRODUCT LAUNCHES,

JANUARY 2020-NOVEMBER 2025 198

TABLE 207 POLYURETHANE DISPERSIONS MARKET: DEALS, JANUARY 2020–

NOVEMBER 2025 199

TABLE 208 POLYURETHANE DISPERSIONS MARKET: EXPANSIONS, JANUARY 2020–NOVEMBER 2025 201

TABLE 209 COVESTRO AG: COMPANY OVERVIEW 205

TABLE 210 COVESTRO AG: PRODUCTS/SOLUTIONS/SERVICES/TECHNOLOGY OFFERED 206

TABLE 211 COVESTRO AG: PRODUCT LAUNCHES, JANUARY 2020–NOVEMBER 2025 207

TABLE 212 COVESTRO AG: DEALS, JANUARY 2020−NOVEMBER 2025 207

TABLE 213 COVESTRO AG: EXPANSION, JANUARY 2020−NOVEMBER 2025 208

TABLE 214 BASF: COMPANY OVERVIEW 210

TABLE 215 BASF: PRODUCTS OFFERED 212

TABLE 216 BASF: DEALS, JANUARY 2020−NOVEMBER 2025 212

TABLE 217 BASF: EXPANSION, JANUARY 2020−NOVEMBER 2025 213

TABLE 218 DOW: COMPANY OVERVIEW 215

TABLE 219 DOW: PRODUCT OFFERED 216

TABLE 220 DOW: EXPANSIONS, JANUARY 2020–OCTOBER 2025 217

TABLE 221 WANHUA: COMPANY OVERVIEW 219

TABLE 222 WANHUA: PRODUCT OFFERINGS 220

TABLE 223 WANHUA: PRODUCT LAUNCHES, JANUARY 2020- NOVEMBER 2025 221

TABLE 224 WANHUA: EXPANSIONS, JANUARY 2020–OCTOBER 2025 221

TABLE 225 LUBRIZOL: COMPANY OVERVIEW 223

TABLE 226 LUBRIZOL: PRODUCTS/SOLUTIONS/SERVICES OFFERED 224

TABLE 227 LUBRIZOL: PRODUCT LAUNCHES, JANUARY 2020- NOVEMBER 2025 225

TABLE 228 MITSUI CHEMICALS, INC.: COMPANY OVERVIEW 227

TABLE 229 MITSUI CHEMICALS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 228

TABLE 230 MITSUI CHEMICALS, INC.: EXPANSIONS, JANUARY 2020–NOVEMBER 2025 229

TABLE 231 ALBERDINGK BOLEY GMBH: COMPANY OVERVIEW 231

TABLE 232 ALBERDINGK BOLEY GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED 232

TABLE 233 ALBERDINGK BOLEY GMBH: DEALS 232

TABLE 234 PERSTORP HOLDING AB: COMPANY OVERVIEW 234

TABLE 235 PERSTORP HOLDING AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED 234

TABLE 236 STAHL HOLDINGS B.V.: COMPANY OVERVIEW 236

TABLE 237 STAHL HOLDINGS B.V.: PRODUCTS/SOLUTIONS/SERVICES OFFERED 237

TABLE 238 STAHL HOLDINGS B.V.: EXPANSIONS, JANUARY 2020–OCTOBER 2025 238

TABLE 239 UBE CORPORATION: COMPANY OVERVIEW 240

TABLE 240 UBE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED 241

TABLE 241 UBE CORPORATION: DEALS, JANUARY 2020–NOVEMBER 2025 242

TABLE 242 DIC CORPORATION: COMPANY OVERVIEW 244

TABLE 243 ALLNEX GMBH: COMPANY OVERVIEW 245

TABLE 244 LAMBERTI S.P.A.: COMPANY OVERVIEW 246

TABLE 245 POLYNT S.P.A: COMPANY OVERVIEW 247

TABLE 246 CHASE CORP.: COMPANY OVERVIEW 248

TABLE 247 RUDOLF GMBH: COMPANY OVERVIEW 249

TABLE 248 C. L. HAUTHAWAY & SONS CORP: COMPANY OVERVIEW 250

TABLE 249 MICHELMAN, INC.: COMPANY OVERVIEW 251

TABLE 250 NANPAO RESINS CHEMICAL GROUP: COMPANY OVERVIEW 252

TABLE 251 INCOREZ: COMPANY OVERVIEW 253

TABLE 252 SNP, INC.: COMPANY OVERVIEW 254

TABLE 253 TAIWAN PU CORPORATION: COMPANY OVERVIEW 255

TABLE 254 SIWOPUD: COMPANY OVERVIEW 256

TABLE 255 VCM POLYURETHANES PVT. LTD.: COMPANY OVERVIEW 257

TABLE 256 KAMSONS POLYMERS LIMITED: COMPANY OVERVIEW 258

LIST OF FIGURES

FIGURE 1 POLYURETHANE DISPERSIONS MARKET SEGMENTATION AND REGIONAL SCOPE 28

FIGURE 2 KEY INSIGHTS AND MARKET HIGHLIGHTS 31

FIGURE 3 GLOBAL POLYURETHANE DISPERSIONS MARKET, 2025–2030 31

FIGURE 4 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN POLYURETHANE DISPERSIONS MARKET (2020–2025) 32

FIGURE 5 DISRUPTIVE TRENDS IMPACTING GROWTH OF POLYURETHANE DISPERSIONS MARKET DURING FORECAST PERIOD 33

FIGURE 6 HIGH-GROWTH SEGMENTS AND EMERGING FRONTIERS IN POLYURETHANE DISPERSIONS MARKET, 2024 34

FIGURE 7 ASIA PACIFIC TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD 35

FIGURE 8 ASIA PACIFIC TO OFFER LUCRATIVE OPPORTUNITIES IN POLYURETHANE DISPERSIONS MARKET DURING FORECAST PERIOD 36

FIGURE 9 SOLVENT-FREE SEGMENT TO BE LARGER IN POLYURETHANE DISPERSIONS MARKET THROUGH 2030 36

FIGURE 10 ANIONIC SEGMENT TO BE LARGEST MARKET DURING FORECAST PERIOD 37

FIGURE 11 ONE-COMPONENT (1K) SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD 37

FIGURE 12 PAINTS & COATINGS SEGMENT TO RECORD FASTEST GROWTH DURING

FORECAST PERIOD 38

FIGURE 13 INDIA TO DOMINATE MARKET DURING FORECAST PERIOD 38

FIGURE 14 POLYURETHANE DISPERSIONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES 39

FIGURE 15 SALES OF NEW VEHICLES – ALL TYPES, 2019–2024 (UNITS) 41

FIGURE 16 POLYURETHANE DISPERSIONS MARKET: PORTER’S FIVE FORCES ANALYSIS 48

FIGURE 17 POLYURETHANE DISPERSIONS MARKET: VALUE CHAIN ANALYSIS 52

FIGURE 18 POLYURETHANE DISPERSIONS MARKET: ECOSYSTEM ANALYSIS 53

FIGURE 19 AVERAGE SELLING PRICE TREND BASED ON APPLICATION,

BY KEY PLAYERS, 2024 (USD/KG) 55

FIGURE 20 POLYURETHANE DISPERSIONS MARKET: AVERAGE SELLING PRICE TREND OF POLYURETHANE DISPERSIONS, BY REGION, (2022–2024) (USD/KG) 56

FIGURE 21 EXPORT DATA FOR HS CODE 390950-COMPLIANT PRODUCTS,

BY COUNTRY, 2020–2024 (USD MILLION) 57

FIGURE 22 IMPORT DATA FOR HS CODE 390950-COMPLIANT PRODUCTS,

BY COUNTRY, 2020–2024 (USD MILLION) 58

FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 61

FIGURE 24 INVESTMENT AND FUNDING SCENARIO, 2018–2024 62

FIGURE 25 LIST OF MAJOR PATENTS FOR POLYURETHANE DISPERSIONS, 2015–2024 70

FIGURE 26 MAJOR PATENTS APPLIED AND GRANTED RELATED TO POLYURETHANE DISPERSIONS, BY COUNTRY/REGION, 2015–2024 70

FIGURE 27 POLYURETHANE DISPERSIONS MARKET DECISION-MAKING FACTORS 87

FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION 88

FIGURE 29 KEY BUYING CRITERIA, BY APPLICATION 89

FIGURE 30 ADOPTION BARRIERS & INTERNAL CHALLENGES 90

FIGURE 31 SOLVENT-FREE SEGMENT TO LEAD POLYURETHANE DISPERSIONS MARKET DURING FORECAST PERIOD 95

FIGURE 32 ANIONIC SEGMENT TO LEAD POLYURETHANE DISPERSIONS MARKET DURING FORECAST PERIOD 99

FIGURE 33 ONE-COMPONENT (1K) SYSTEMS SEGMENT TO LEAD POLYURETHANE DISPERSIONS MARKET DURING FORECAST PERIOD 105

FIGURE 34 PAINTS & COATINGS TO BE LARGEST APPLICATION FOR POLYURETHANE DISPERSIONS 109

FIGURE 35 EUROPE: POLYURETHANE DISPERSIONS MARKET SNAPSHOT 118

FIGURE 36 ASIA PACIFIC: POLYURETHANE DISPERSIONS MARKET SNAPSHOT 133

FIGURE 37 POLYURETHANE DISPERSIONS MARKET: REVENUE ANALYSIS OF

KEY PLAYERS, 2020–2024 181

FIGURE 38 POLYURETHANE DISPERSION MARKET SHARE ANALYSIS, 2024 182

FIGURE 39 POLYURETHANE DISPERSIONS MARKET: BRAND COMPARISON 185

FIGURE 40 POLYURETHANE DISPERSIONS MARKET: COMPANY EVALUATION

MATRIX (KEY PLAYERS), 2024 187

FIGURE 41 POLYURETHANE DISPERSIONS MARKET: COMPANY FOOTPRINT 188

FIGURE 42 POLYURETHANE DISPERSIONS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 193

FIGURE 43 POLYURETHANE DISPERSIONS MARKET: EV/EBITDA OF KEY MANUFACTURERS 197

FIGURE 44 POLYURETHANE DISPERSIONS MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY MANUFACTURERS 197

FIGURE 45 POLYURETHANE DISPERSIONS MARKET: ENTERPRISE VALUATION OF KEY PLAYERS, 2025 198

FIGURE 46 COVESTRO AG: COMPANY SNAPSHOT 206

FIGURE 47 BASF: COMPANY SNAPSHOT 211

FIGURE 48 DOW: COMPANY SNAPSHOT 216

FIGURE 49 WANHUA: COMPANY SNAPSHOT 220

FIGURE 50 LUBRIZOL: COMPANY SNAPSHOT 224

FIGURE 51 MITSUI CHEMICALS, INC.: COMPANY SNAPSHOT 228

FIGURE 52 STAHL HOLDINGS B.V.: COMPANY SNAPSHOT 236

FIGURE 53 UBE CORPORATION: COMPANY SNAPSHOT 241

FIGURE 54 POLYURETHANE DISPERSIONS MARKET: RESEARCH DESIGN 259

FIGURE 55 KEY DATA FROM SECONDARY SOURCES 260

FIGURE 56 KEY DATA FROM PRIMARY SOURCES 261

FIGURE 57 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE,

DESIGNATION, AND REGION 262

FIGURE 58 POLYURETHANE DISPERSIONS MARKET: BOTTOM-UP APPROACH 263

FIGURE 59 POLYURETHANE DISPERSIONS MARKET: TOP-DOWN APPROACH 264

FIGURE 60 POLYURETHANE DISPERSIONS MARKET: DATA TRIANGULATION 265

FIGURE 61 RESEARCH ASSUMPTIONS 266

FIGURE 62 LIMITATIONS 266