Aluminum Foil Packaging Market - Global Forecast 2030

アルミ箔包装市場 - 製品タイプ(バッグ&パウチ、ラップ&ロール、ブリスター)、包装タイプ(半硬質、フレキシブル、その他)、タイプ(裏打ち箔、ロール箔)、用途(食品、飲料、医薬品)、および地域別 - 2030年までの世界予測

Aluminum Foil Packaging Market by Product Type (Bags & Pouches, Wraps & Rolls, Blisters), Packaging Type (Semi-rigid, Flexible, Others), Type (Backed Foil, Rolled Foil), Application (Food, Beverages, Pharmaceuticals), & Region - Global Forecast to 2030

| 出版 | MarketsandMarkets |

| 出版年月 | 2026年01月 |

| ページ数 | 365 |

| 図表数 | 553 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-11912 |

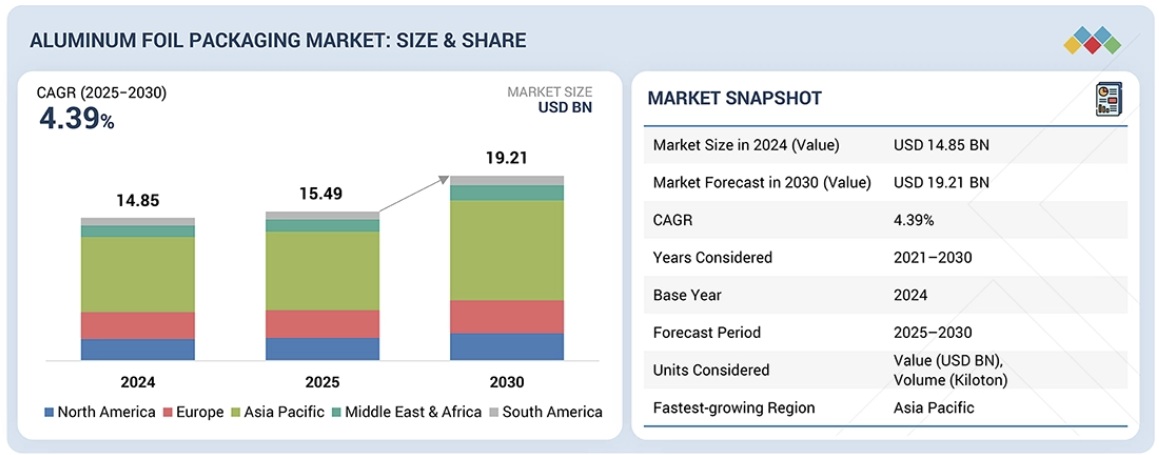

アルミホイル包装市場は、2025年の154億9,000万米ドルから2030年には192億1,000万米ドルに拡大し、予測期間中に年平均成長率(CAGR)4.39%で成長すると予測されています。アルミホイル包装市場は、主にeコマースの売上増加、食品、飲料、医薬品といった様々なエンドユーザーからの需要の高まり、持続可能で環境に優しい包装ソリューションの導入、そして食品の長期保存性という利点によって、急速な成長が見込まれています。

調査対象範囲

本調査レポートは、アルミホイル包装市場を、製品タイプ(バッグ・パウチ、ラップ・ロール、ブリスター、容器、その他)、包装タイプ(半硬質、フレキシブル、その他)、種類(裏打ち箔、ロール箔、その他)、用途(食品、飲料、医薬品、パーソナルケア・化粧品、その他)、地域(アジア太平洋、北米、欧州、南米、中東・アフリカ)に基づいて分類しています。本レポートは、アルミホイル包装市場の成長に影響を与える推進要因、制約要因、課題、機会に関する詳細な情報を網羅しています。主要業界プレーヤーの詳細な分析を実施し、アルミホイル包装市場に関連する事業概要、提供製品、主要戦略(提携、協業、製品発売、事業拡大、買収など)に関する洞察を提供しています。本レポートは、アルミホイル包装市場エコシステムにおける新興企業の競合分析も網羅しています。

レポートを購入する理由

本レポートは、市場リーダー/新規参入企業に対し、アルミホイル包装市場全体とそのサブセグメントの収益数値に関する近似値を提供します。本レポートは、ステークホルダーが競争環境を理解し、事業をより効果的にポジショニングするためのより深い洞察を獲得し、適切な市場開拓戦略を策定するのに役立ちます。また、ステークホルダーが市場の動向を把握し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供するのに役立ちます。

本レポートは、以下の点について洞察を提供しています。

- 主要な推進要因(食品の長期保存性、最終用途産業からのアルミホイル需要の高まり、eコマースセクターの成長、持続可能性への懸念の高まり)、制約要因(原材料価格の変動と代替品の容易な入手性)、機会(今後の規制や政府の取り組み、フードデリバリーや店頭で調理済みの食事の需要)、課題(多層アルミホイルのリサイクル性と貿易の経済的不均衡)の分析。

- 製品開発/イノベーション:アルミホイル包装市場における今後の技術、研究開発活動、製品・サービスの投入に関する詳細な洞察。

- 市場開発:収益性の高い市場に関する包括的な情報。本レポートでは、様々な地域におけるアルミホイル包装市場を分析しています。

- 市場多様化:アルミホイル包装市場における新製品・サービス、未開拓地域、最近の動向、投資に関する包括的な情報。

- 競合評価:RusAL(ロシア)、Hulamin(南アフリカ)、Hindalco Industries Ltd.(インド)、China Hongqiao Group Limited(中国)、Amcor plc(スイス)、Kibar Holding(トルコ)、Constantia Flexibles(オーストリア)、Reynolds Consumer Products(米国)、GARMCO(バーレーン)、Novolex(米国)、Raviraj Foils Limited(インド)といった主要企業の市場シェア、成長戦略、サービス提供に関する詳細な評価。

Report Description

The aluminum foil packaging market is projected to grow from USD 15.49 billion in 2025 to USD 19.21 billion by 2030, at a CAGR of 4.39% during the forecast period. The aluminum foil packaging market is poised for rapid growth, primarily driven by an increase in e-commerce sales, rising demand from various end users like food, beverages, and pharmaceuticals, the adoption of sustainable and eco-friendly packaging solutions, and the advantage of long shelf life offered to food products.

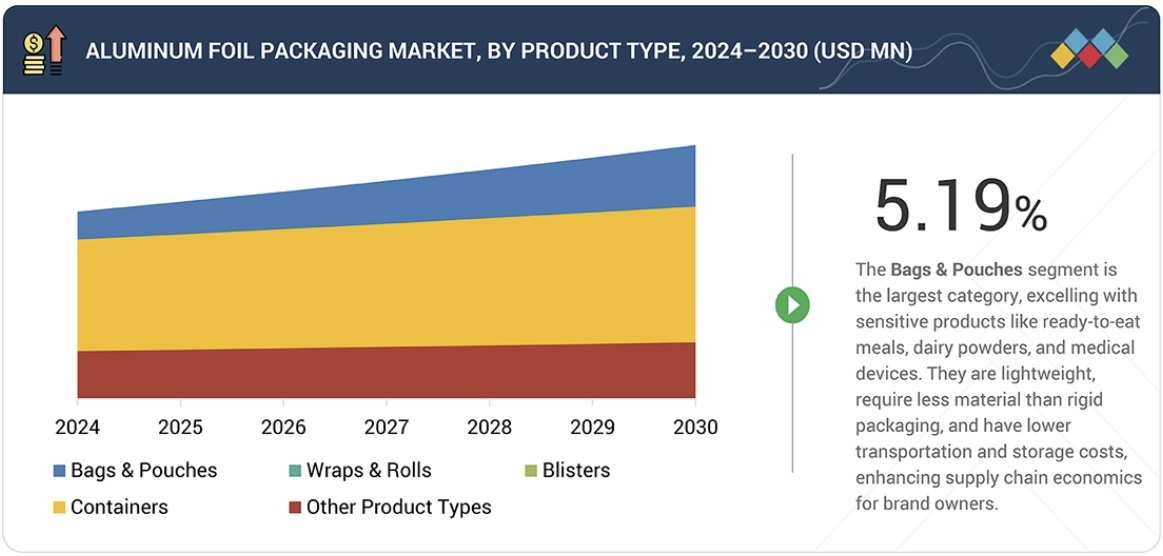

Aluminum Foil Packaging Market – Global Forecast 2030 – by product type

“Blisters are projected to be the fastest-growing segment during the forecast period.”

Blister packaging is anticipated to be the fastest-growing segment in the aluminum foil packaging market. This growth is driven by the increasing demands of various sectors and consumers worldwide. A significant factor behind this trend is the pharmaceutical industry, which benefits from blister aluminum foil’s superior barriers against moisture, light, oxygen, and contaminants. This packaging is particularly effective in preserving the stability, efficacy, and safety of medications, such as tablets, capsules, and unit-dose products. The rising demand for these products is driven by aging populations, the growing prevalence of chronic diseases, and increased global access to healthcare.

Blister packaging offers high-performance features, including tamper-evidence and child-resistance, which meet strict regulatory requirements and enhance patient safety. These advantages explain why pharmaceutical manufacturers prefer blister foil over other types of containers.

“The rolled foil segment is projected to be the second-fastest-growing segment during the forecast period.”

The rolled foil packaging segment is expected to experience the second-fastest growth in the aluminum foil packaging market. This growth can be attributed to its versatility as an economical aluminum foil wrapping solution, which remains relevant for both household and foodservice applications. Rolled foil is primarily used for cooking, baking, grilling, and food storage due to its excellent barrier properties against moisture, light, oxygen, and odors. These properties help preserve food freshness and prevent contamination. The demand for retail aluminum foil rolls is being driven by the increasing number of urban families, rising disposable incomes, and a growing trend towards convenience-oriented cooking, particularly in emerging economies. Additionally, the expansion of quick-service restaurants, catering services, and cloud kitchens has led to a surge in the bulk usage of rolled foil for wrapping, portioning, and retaining heat during food preparation and delivery.

“The beverages segment is expected to register the second-fastest growth during the forecast period.”

Beverages account for the second-fastest-growing segment in the aluminum foil packaging market, primarily due to the crucial role these packages play in protecting products, extending shelf life, and enhancing brand image across various beverage formats. Aluminum foil is widely used in drink cartons, lids, and lidding, especially in the aseptic packaging of juices, dairy-based drinks, functional beverages, and ready-to-drink teas and coffees. In these applications, aluminum foil serves as a superior barrier against oxygen, light, moisture, and microbial contamination, which is essential for preserving flavor, nutritional value, and product safety without the need for refrigeration. The increasing demand for foil-based packaging is driven by the growing global appetite for packaged and long shelf-life beverages, fueled by urbanization, busy lifestyles, and the expansion of cold-chain logistics in emerging markets.

Aluminum Foil Packaging Market – Global Forecast 2030 – region

“In terms of value, Europe is expected to account for the second-largest market share in the aluminum foil packaging market.”

Europe is the second-largest market for aluminum foil packaging, primarily due to its advanced food and beverage sector, a strong emphasis on packaging safety by regulatory authorities, and well-established sustainability practices. A significant portion of the region’s population relies on packaged and processed foods, pharmaceuticals, and beverages, all of which benefit from the superior barrier properties, hygiene, and product protection provided by aluminum foil. Strict EU regulations regarding food contact materials, the integrity of pharmaceutical packaging, and shelf-life preservation further enhance the advantages of aluminum foil over other materials, contributing to steady demand. Additionally, Europe is a global leader in sustainability and circular economy initiatives, with a highly developed aluminum recycling system and recycling rates that surpass those of most other regions.

- By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

- By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

- By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: <USD 500 million

Aluminum Foil Packaging Market – Global Forecast 2030 – ecosystem

Companies Covered

RusAL (Russia), Hulamin (South Africa), Hindalco Industries Ltd. (India), China Hongqiao Group Limited (China), Amcor plc (Switzerland), Kibar Holding (Turkey), Constantia Flexibles (Austria), Reynolds Consumer Products (US), GARMCO (Bahrain), Novolex (US), and Raviraj Foils Limited (India), among others, are covered in the report.

The study includes an in-depth competitive analysis of these key players in the aluminum foil packaging market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the aluminum foil packaging market based on product type (bags & pouches, wraps & rolls, blisters, containers, and other product types), packaging type (semi-rigid, flexible, and other packaging types), type (backed foil, rolled foil, and other types), application (food, beverages, pharmaceuticals, personal care & cosmetics, and other applications), and region (Asia Pacific, North America, Europe, South America, and the Middle East & Africa). The report’s scope encompasses detailed information regarding the drivers, restraints, challenges, and opportunities that influence the growth of the aluminum foil packaging market. A detailed analysis of key industry players has been conducted to provide insights into their business overview, products offered, and key strategies, including partnerships, collaborations, product launches, expansions, and acquisitions, associated with the aluminum foil packaging market. This report covers a competitive analysis of upcoming startups in the aluminum foil packaging market ecosystem.

Reasons to Buy the Report

The report will provide market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall aluminum foil packaging market and its subsegments. This report will help stakeholders understand the competitive landscape, gain deeper insights into positioning their businesses more effectively, and develop suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (long shelf life of food products, high demand for aluminum foils from end-use industries, growth of e-commerce sector, and increasing sustainability concerns), restraints (volatile prices of raw materials and easy availability of substitutes), opportunities (upcoming regulations and government initiatives and demand from food-delivery and retail-ready meals), and challenges (recyclability of multi-layer aluminum foils and economic imbalance of trade).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the aluminum foil packaging market.

- Market Development: Comprehensive information about profitable markets – the report analyzes the aluminum foil packaging market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the aluminum foil packaging market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as RusAL (Russia), Hulamin (South Africa), Hindalco Industries Ltd. (India), China Hongqiao Group Limited (China), Amcor plc (Switzerland), Kibar Holding (Turkey), Constantia Flexibles (Austria), Reynolds Consumer Products (US), GARMCO (Bahrain), Novolex (US), and Raviraj Foils Limited (India).

Table of Contents

1 INTRODUCTION 36

1.1 STUDY OBJECTIVES 36

1.2 MARKET DEFINITION 36

1.3 MARKET SCOPE 37

1.3.1 INCLUSIONS AND EXCLUSIONS OF STUDY 38

1.3.2 YEARS CONSIDERED 38

1.4 CURRENCY CONSIDERED 39

1.5 UNITS CONSIDERED 39

1.6 LIMITATIONS 39

1.7 STAKEHOLDERS 39

1.8 SUMMARY OF CHANGES 40

2 EXECUTIVE SUMMARY 41

2.1 KEY INSIGHTS AND MARKET HIGHLIGHTS 41

2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS 42

2.3 DISRUPTIVE TRENDS SHAPING MARKET 43

2.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS 44

2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST 45

3 PREMIUM INSIGHTS 46

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ALUMINUM FOIL PACKAGING MARKET 46

3.2 ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE 46

3.3 ALUMINUM FOIL PACKAGING MARKET, BY TYPE 47

3.4 ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE 47

3.5 ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION 48

3.6 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE AND COUNTRY, 2024 49

3.7 ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY 49

4 MARKET OVERVIEW 50

4.1 INTRODUCTION 50

4.2 MARKET DYNAMICS 50

4.2.1 DRIVERS 51

4.2.1.1 Long shelf life of food products 51

4.2.1.2 High demand for aluminum foil from end-use industries 51

4.2.1.3 Growth of e-commerce sector 53

4.2.1.4 Increasing concerns about sustainability 54

4.2.2 RESTRAINTS 54

4.2.2.1 Volatile raw material prices 54

4.2.2.2 Easy availability of substitutes 55

4.2.3 OPPORTUNITIES 56

4.2.3.1 Upcoming regulations and government initiatives 56

4.2.3.2 Demand from food delivery and retail-ready meals 56

4.2.4 CHALLENGES 56

4.2.4.1 Recyclability of multi-layer aluminum foils 56

4.2.4.2 Economic imbalance of trade 57

4.3 UNMET NEEDS AND WHITE SPACES 58

4.3.1 RELIABLE, SCALABLE RECYCLING FOR THIN FOIL & MULTILAYER LAMINATE STREAMS 58

4.3.2 MONO-MATERIAL FOIL SOLUTIONS THAT ENABLE SIMPLE RECYCLING 58

4.3.3 PREMIUM AESTHETICS WITH SUSTAINABLE DISPOSAL PATHWAYS 58

4.3.4 SMART FOIL LIDS FOR FRESHNESS INDICATORS AND DIGITAL ENGAGEMENT 58

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 59

4.4.1 INTERCONNECTED MARKETS 59

4.4.2 CROSS-SECTOR OPPORTUNITIES 59

4.4.2.1 Food Beverages 59

4.4.2.2 Food Pharma 59

4.4.2.3 Food Personal Care & Cosmetics 60

4.4.2.4 Beverage Pharma 60

4.5 STRATEGIC MOVES BY TIER 1/2/3 PLAYERS 60

4.5.1 TIER 1 PLAYERS: GLOBAL LEADERS DRIVING CONSOLIDATION AND INNOVATION 60

4.5.1.1 Expansion of thin-gauge aluminum foil capacity by RusAL 60

4.5.1.2 Plastic-free aluminum-paper foil for sustainable wine & spirits by Amcor plc 61

4.5.2 TIER 2 PLAYERS: REGIONAL INNOVATORS AND NICHE LEADERS 61

4.5.2.1 Constantia Flexibles’ acquisition of Drukpol Flexo 61

4.5.2.2 Reynolds Consumer Products’ new product launch 61

4.5.3 TIER 3 PLAYERS: STRENGTHENS ECO-EFFICIENCY WITH ZERO WASTE MILESTONE 62

5 INDUSTRY TRENDS 63

5.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS 63

5.2 PRICING ANALYSIS 64

5.2.1 PRICING ANALYSIS, BY KEY PLAYER 65

5.2.2 PRICING ANALYSIS, BY REGION 65

5.3 VALUE CHAIN ANALYSIS 66

5.4 ECOSYSTEM ANALYSIS 68

5.5 TRADE ANALYSIS 69

5.5.1 IMPORT DATA (HS CODE 7607) 69

5.5.2 EXPORT DATA (HS CODE 7607) 70

5.6 KEY CONFERENCES AND EVENTS, 2025 71

5.7 PORTER’S FIVE FORCES’ ANALYSIS 71

5.7.1 THREAT OF NEW ENTRANTS 72

5.7.2 THREAT OF SUBSTITUTES 73

5.7.3 BARGAINING POWER OF SUPPLIERS 73

5.7.4 BARGAINING POWER OF BUYERS 73

5.7.5 INTENSITY OF COMPETITIVE RIVALRY 74

5.8 CASE STUDY ANALYSIS 74

5.8.1 CONSTANTIA FLEXIBLES: REINVENTING BEVERAGE INNOVATION THROUGH RECYCLABLE ALUMINUM CAPSULES 74

5.8.2 HOLOFLEX: ADVANCED ANTI-COUNTERFEIT FOIL TECHNOLOGY THAT ELIMINATES MARKET FAKE DRUGS 75

5.8.3 AMCOR PLC: DEVELOPMENT OF PLASTIC-FREE ALUMINUM/PAPER FOIL 75

5.9 MACROECONOMIC ANALYSIS 76

5.9.1 INTRODUCTION 76

5.9.2 GDP TRENDS AND FORECASTS 76

5.9.3 RISING POPULATION AND URBANIZATION 77

5.9.4 TRENDS IN GLOBAL FOOD & BEVERAGE INDUSTRY 78

5.9.5 TRENDS IN GLOBAL PERSONAL CARE & COSMETIC INDUSTRY 79

5.10 INVESTMENT AND FUNDING SCENARIO 80

5.11 IMPACT OF 2025 US TARIFF ON ALUMINUM FOIL PACKAGING MARKET 81

5.11.1 INTRODUCTION 81

5.11.2 1.16.2. KEY TARIFF RATES 81

5.11.3 PRICE IMPACT ANALYSIS 81

5.11.4 KEY IMPACT ON VARIOUS COUNTRIES/REGIONS 82

5.11.4.1 US 82

5.11.4.2 Europe 82

5.11.4.3 Asia Pacific 82

5.11.5 END-USE SECTOR IMPACT 82

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, INNOVATIONS, AND FUTURE APPLICATIONS 83

6.1 KEY EMERGING TECHNOLOGIES 83

6.1.1 ANTIMICROBIAL FOILS 83

6.1.2 PRINTING METHODOLOGIES 83

6.1.2.1 Rotogravure 83

6.1.2.2 Lithography 83

6.1.2.3 Flexography 83

6.1.2.4 Digital printing 84

6.1.2.5 High barrier foil technology 84

6.2 COMPLEMENTARY TECHNOLOGIES 84

6.2.1 NANOTECHNOLOGY 84

6.2.2 COLD-FORMING ALUMINUM FOIL 85

6.3 ADJACENT TECHNOLOGIES 85

6.3.1 LIGHTWEIGHTING VIA HIGHER-STRENGTH ALLOY FOILS 85

6.3.2 ADVANCED RECYCLING VALUE CHAINS & CIRCULAR-ECONOMY SYSTEMS 86

6.4 TECHNOLOGY/PRODUCT ROADMAP 86

6.4.1 SHORT-TERM (2025–2027) | TRANSITION & DIGITAL ADOPTION PHASE 86

6.4.2 MID-TERM (2027–2030): CIRCULARITY SCALING, MATERIAL RE-ENGINEERING, & ADVANCED AUTOMATION PHASE 87

6.4.3 LONG-TERM (2030–2035+): FULLY SMART CIRCULAR FOIL ECOSYSTEM, NEXT-GEN COATINGS, & NET-ZERO PRODUCTION PHASE 87

6.5 PATENT ANALYSIS 88

6.5.1 INTRODUCTION 88

6.5.2 APPROACH 88

6.5.3 DOCUMENT TYPE 88

6.5.4 JURISDICTION ANALYSIS 89

6.5.5 TOP APPLICANTS 90

6.6 FUTURE APPLICATIONS 93

6.6.1 SMART SENSOR-INTEGRATED FOIL PACKAGING (IOT/CONDITION MONITORING) 93

6.6.2 PHARMACEUTICAL MICRO-DOSING & SMART-DISPENSING FOIL BLISTER SYSTEMS 93

6.6.3 SHAPE-MORPHING & ADAPTIVE ALUMINUM FOIL PACKAGING (PROGRAMMABLE PACKAGING) 94

6.6.4 HIGH-BARRIER RECYCLABLE FOIL-BASED MONO-MATERIAL STRUCTURES 94

6.7 IMPACT OF AI/GEN AI ON ALUMINUM FOIL PACKAGING MARKET 95

6.7.1 TOP USE CASES AND MARKET POTENTIAL 95

6.7.2 BEST PRACTICES IN E-COMMERCE PACKAGING 96

6.7.3 CASE STUDIES OF AI IMPLEMENTATION IN ALUMINUM FOIL PACKAGING MARKET 96

6.7.4 INTERCONNECTED ECOSYSTEM AND IMPACT ON MARKET PLAYERS 97

6.7.5 CLIENTS’ READINESS TO ADOPT GENERATIVE AI IN ALUMINUM FOIL PACKAGING MARKET 97

7 REGULATORY LANDSCAPE AND SUSTAINABILITY INITIATIVES 98

7.1 REGIONAL REGULATIONS AND COMPLIANCE 98

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 98

7.1.2 INDUSTRY STANDARDS 101

7.2 SUSTAINABILITY INITIATIVES 102

7.2.1 CIRCULAR ECONOMY AND RECYCLING INITIATIVES 102

7.2.2 CIRCULAR POLICY MANDATES 102

7.2.3 CORPORATE INNOVATION AND CIRCULAR SOLUTIONS 102

7.2.4 RECYCLING PERFORMANCE ALLIANCES 102

7.2.5 DESIGN-FOR-CIRCULARITY 102

7.2.6 DIGITAL TRACEABILITY AND CIRCULAR MARKET MECHANISMS 103

7.3 IMPACT OF REGULATORY POLICIES ON SUSTAINABILITY INITIATIVES 103

7.4 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR 104

7.5 DECISION-MAKING PROCESS 104

7.6 BUYER STAKEHOLDERS AND BUYING EVALUATION CRITERIA 105

7.6.1 KEY STAKEHOLDERS IN BUYING PROCESS 105

7.6.2 BUYING CRITERIA 106

7.7 ADOPTION BARRIERS & INTERNAL CHALLENGES 107

7.8 UNMET NEEDS FROM VARIOUS APPLICATIONS 108

7.9 MARKET PROFITABILITY 109

7.9.1 REVENUE POTENTIAL 109

7.9.2 COST DYNAMICS 109

7.9.3 MARGIN OPPORTUNITIES BY END-USE APPLICATIONS 110

7.9.3.1 Food (Medium to High Margins) 110

7.9.3.2 Beverages (Medium Margins) 110

7.9.3.3 Pharmaceuticals (High Margins) 110

7.9.3.4 Personal Care & Cosmetics (Medium to High Margins) 110

8 ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE 111

8.1 INTRODUCTION 112

8.2 BAGS & POUCHES 114

8.2.1 HIGH BARRIER PROTECTION, LIGHTWEIGHT CONSTRUCTION,

AND FLEXIBLE FORMABILITY TO DRIVE ADOPTION 114

8.3 WRAPS & ROLLS 114

8.3.1 THERMAL STABILITY, BARRIER PROTECTION, AND RISING HOUSEHOLD USAGE TO DRIVE DEMAND 114

8.4 BLISTERS 115

8.4.1 GROWTH IN PHARMACEUTICAL INDUSTRY, REGULATORY FOCUS,

AND UNIT-DOSE PACKAGING ADOPTION TO ACCELERATE DEMAND 115

8.5 CONTAINERS 115

8.5.1 RISING PREFERENCE FOR LIGHTWEIGHT RIGID FORMATS, ENHANCED HYGIENE STANDARDS, AND RECYCLING BENEFITS TO DRIVE ADOPTION 115

8.6 OTHER PRODUCT TYPES 116

9 ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION 117

9.1 INTRODUCTION 118

9.2 FOOD 119

9.2.1 RISING PACKAGED FOOD PRODUCTION TO DRIVE DEMAND FOR ALUMINUM FOIL PACKAGING 119

9.3 BEVERAGES 120

9.3.1 GROWING BEVERAGE PRODUCTION AND SUSTAINABILITY FOCUS TO DRIVE DEMAND 120

9.4 PHARMACEUTICALS 121

9.4.1 GROWTH IN PHARMACEUTICAL INDUSTRY TO DRIVE MARKET 121

9.5 PERSONAL CARE & COSMETICS 121

9.5.1 GROWING PERSONAL CARE & COSMETICS INDUSTRY TO DRIVE DEMAND FOR ALUMINUM FOIL PACKAGING 121

9.6 OTHER APPLICATIONS 122

10 ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE 123

10.1 INTRODUCTION 124

10.2 SEMI-RIGID PACKAGING 125

10.2.1 RISING DEMAND FOR HEAT-RESISTANT, HIGH-BARRIER, AND DURABLE SEMI-RIGID FOIL PACKAGING TO DRIVE MARKET 125

10.3 FLEXIBLE PACKAGING 126

10.3.1 RISING ADOPTION OF FLEXIBLE, HIGH-BARRIER, AND RECYCLABLE ALUMINUM FOIL SOLUTIONS TO PROPEL MARKET 126

10.4 OTHER PACKAGING TYPES 126

11 ALUMINUM FOIL PACKAGING MARKET, BY TYPE 127

11.1 INTRODUCTION 128

11.2 ROLLED FOIL 129

11.2.1 RISING DEMAND FOR LIGHTWEIGHT, HIGH-BARRIER, AND RECYCLABLE SOLUTIONS TO DRIVE GROWTH 129

11.3 BACKED FOIL 130

11.3.1 GROWING DEMAND FOR HIGH-BARRIER, DURABLE, AND CUSTOMIZABLE BACKED FOILS TO DRIVE MARKET 130

11.4 OTHER TYPES 130

12 ALUMINUM FOIL PACKAGING MARKET, BY THICKNESS 131

12.1 INTRODUCTION 131

12.2 7–50 MICRONS 131

12.3 51–100 MICRONS 131

12.4 OTHERS 132

13 ALUMINUM FOIL PACKAGING MARKET, BY TECHNOLOGY 133

13.1 INTRODUCTION 133

13.2 COLD FORM FOIL 133

13.3 HOT SEAL FOIL 134

14 ALUMINUM FOIL PACKAGING MARKET, BY REGION 135

14.1 INTRODUCTION 136

14.2 ASIA PACIFIC 139

14.2.1 CHINA 146

14.2.1.1 Rapid expansion of food delivery services to propel market 146

14.2.2 INDIA 151

14.2.2.1 Rapid growth in food delivery, digital commerce, and healthcare spending to drive demand 151

14.2.3 JAPAN 155

14.2.3.1 Rising packaging shipments, sustainability focus, and convenience-driven food consumption support packaging demand 155

14.2.4 AUSTRALIA 159

14.2.4.1 Government initiatives toward sustainability and convenient packaging to drive market 159

14.2.5 REST OF ASIA PACIFIC 164

14.3 EUROPE 168

14.3.1 GERMANY 175

14.3.1.1 Government initiatives toward circular economy to boost market 175

14.3.2 ITALY 180

14.3.2.1 Rising demand from retail, food, and healthcare industries to drive market 180

14.3.3 UK 184

14.3.3.1 Growth of healthcare industry to offer lucrative opportunities 184

14.3.4 FRANCE 188

14.3.4.1 Increase in retail sales of packaged foods to drive market 188

14.3.5 SPAIN 192

14.3.5.1 Increasing demand for aluminum foil in various end-use industries to propel market 192

14.3.6 REST OF EUROPE 196

14.4 NORTH AMERICA 200

14.4.1 US 206

14.4.1.1 Rising consumption of packaged food and large pharmaceutical industry to propel market 206

14.4.2 CANADA 210

14.4.2.1 Growing household expenditure on food and personal care products to accelerate demand 210

14.4.3 MEXICO 215

14.4.3.1 Rising food and personal care consumption to support market growth 215

14.5 MIDDLE EAST & AFRICA 219

14.5.1 GCC COUNTRIES 226

14.5.1.1 Saudi Arabia 230

14.5.1.1.1 Increasing opportunities in end-use industries to fuel market 230

14.5.1.2 UAE 234

14.5.1.2.1 Rising food safety standards and convenience food trends to propel market 234

14.5.1.3 Rest of GCC countries 239

14.5.2 SOUTH AFRICA 243

14.5.2.1 Growing local generics production, expanding F&B sector, and healthcare packaging regulation support to drive demand 243

14.5.3 REST OF MIDDLE EAST & AFRICA 247

14.6 SOUTH AMERICA 251

14.6.1 BRAZIL 257

14.6.1.1 Strong demand from food, beverage, and healthcare sectors to drive demand 257

14.6.2 ARGENTINA 261

14.6.2.1 Dynamic food and personal care industries to support market growth 261

14.6.3 REST OF SOUTH AMERICA 266

15 COMPETITIVE LANDSCAPE 270

15.1 OVERVIEW 270

15.2 KEY PLAYER STRATEGIES 270

15.3 MARKET SHARE ANALYSIS 272

15.4 REVENUE ANALYSIS OF KEY PLAYERS 275

15.5 COMPANY VALUATION AND FINANCIAL METRICS 276

15.6 BRAND COMPARISON 278

15.6.1 RUSAL (ALUMINUM FOIL PRODUCTS) 279

15.6.2 HULAMIN (PACKAGING FOIL SOLUTIONS) 279

15.6.3 HINDALCO INDUSTRIES LTD. (ALUMINIUM FOIL & CONVERTER PRODUCTS) 279

15.6.4 CHINA HONGQIAO GROUP LIMITED (ALUMINIUM PACKAGING STOCK) 279

15.6.5 AMCOR PLC (ALUMINUM-BASED FLEXIBLE PACKAGING) 279

15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 279

15.7.1 STARS 279

15.7.2 EMERGING LEADERS 279

15.7.3 PERVASIVE PLAYERS 280

15.7.4 PARTICIPANTS 280

15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 281

15.7.5.1 Company footprint 281

15.7.5.2 Region footprint 281

15.7.5.3 Type footprint 282

15.7.5.4 Product type footprint 282

15.7.5.5 Packaging type footprint 283

15.7.5.6 Thickness footprint 283

15.7.5.7 Technology footprint 284

15.7.5.8 Application footprint 284

15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 285

15.8.1 PROGRESSIVE COMPANIES 285

15.8.2 RESPONSIVE COMPANIES 285

15.8.3 DYNAMIC COMPANIES 285

15.8.4 STARTING BLOCKS 285

15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 287

15.8.5.1 Detailed list of key startups/SMEs 287

15.8.5.2 Competitive benchmarking of key startups/SMEs 288

15.9 COMPETITIVE SCENARIOS 288

15.9.1 PRODUCT LAUNCHES 289

15.9.2 DEALS 289

15.9.3 EXPANSIONS 291

16 COMPANY PROFILES 293

16.1 KEY PLAYERS 293

16.1.1 RUSAL 293

16.1.1.1 Business overview 293

16.1.1.2 Products offered 295

16.1.1.3 Recent developments 295

16.1.1.3.1 Product launches 295

16.1.1.3.2 Deals 296

16.1.1.3.3 Expansions 296

16.1.1.4 MnM view 297

16.1.1.4.1 Key strengths 297

16.1.1.4.2 Strategic choices 297

16.1.1.4.3 Weaknesses and competitive threats 297

16.1.2 HULAMIN 298

16.1.2.1 Business overview 298

16.1.2.2 Products offered 299

16.1.2.3 MnM view 300

16.1.2.3.1 Key strengths 300

16.1.2.3.2 Strategic choices 300

16.1.2.3.3 Weaknesses and competitive threats 300

16.1.3 HINDALCO INDUSTRIES LTD. 301

16.1.3.1 Business overview 301

16.1.3.2 Products offered 302

16.1.3.3 Recent developments 303

16.1.3.3.1 Deals 303

16.1.3.3.2 Expansions 304

16.1.3.4 MnM view 304

16.1.3.4.1 Key strengths 304

16.1.3.4.2 Strategic choices 304

16.1.3.4.3 Weaknesses and competitive threats 304

16.1.4 CHINA HONGQIAO GROUP LIMITED 305

16.1.4.1 Business overview 305

16.1.4.2 Products offered 307

16.1.4.3 Recent developments 307

16.1.4.3.1 Expansions 307

16.1.4.4 MnM view 308

16.1.4.4.1 Key strengths 308

16.1.4.4.2 Strategic choices 308

16.1.4.4.3 Weaknesses and competitive threats 308

16.1.5 AMCOR PLC 309

16.1.5.1 Business overview 309

16.1.5.2 Products offered 311

16.1.5.3 Recent developments 312

16.1.5.3.1 Product launches 312

16.1.5.3.2 Deals 312

16.1.5.3.3 Expansions 312

16.1.5.4 MnM view 313

16.1.5.4.1 Key strengths 313

16.1.5.4.2 Strategic choices 313

16.1.5.4.3 Weaknesses and competitive threats 313

16.1.6 KIBAR HOLDING 314

16.1.6.1 Business overview 314

16.1.6.2 Products offered 314

16.1.6.3 Recent developments 315

16.1.6.3.1 Expansions 315

16.1.6.4 MnM view 316

16.1.6.4.1 Key strengths 316

16.1.6.4.2 Strategic choices 316

16.1.6.4.3 Weaknesses and competitive threats 316

16.1.7 CONSTANTIA FLEXIBLES 317

16.1.7.1 Business overview 317

16.1.7.2 Products offered 317

16.1.7.3 Recent developments 319

16.1.7.3.1 Deals 319

16.1.7.3.2 Expansions 320

16.1.7.4 MnM view 320

16.1.7.4.1 Key strengths 320

16.1.7.4.2 Strategic choices 320

16.1.7.4.3 Weaknesses and competitive threats 320

16.1.8 REYNOLDS CONSUMER PRODUCTS 321

16.1.8.1 Business overview 321

16.1.8.2 Products offered 323

16.1.8.3 Recent developments 324

16.1.8.3.1 Product launches 324

16.1.8.4 MnM view 324

16.1.8.4.1 Key strengths 324

16.1.8.4.2 Strategic choices 324

16.1.8.4.3 Weaknesses and competitive threats 324

16.1.9 GARMCO 325

16.1.9.1 Business overview 325

16.1.9.2 Products offered 325

16.1.9.3 Recent developments 326

16.1.9.3.1 Deals 326

16.1.9.3.2 Expansions 326

16.1.9.4 MnM view 327

16.1.9.4.1 Key strengths 327

16.1.9.4.2 Strategic choices 327

16.1.9.4.3 Weaknesses and competitive threats 327

16.1.10 NOVOLEX 328

16.1.10.1 Business overview 328

16.1.10.2 Products offered 328

16.1.10.3 Recent developments 329

16.1.10.3.1 Deals 329

16.1.10.4 MnM view 329

16.1.10.4.1 Key strengths 329

16.1.10.4.2 Strategic choices 329

16.1.10.4.3 Weaknesses and competitive threats 329

16.1.11 RAVIRAJ FOILS LIMITED 330

16.1.11.1 Business overview 330

16.1.11.2 Products offered 330

16.1.11.3 MnM view 331

16.1.11.3.1 Key strengths 331

16.1.11.3.2 Strategic choices 331

16.1.11.3.3 Weaknesses and competitive threats 331

16.2 OTHER PLAYERS 332

16.2.1 PENNY PLATE, LLC 332

16.2.2 JINDAL (INDIA) LIMITED 333

16.2.3 PG FOILS LTD. 334

16.2.4 EUROFOIL LUXEMBOURG SA 335

16.2.5 ALUFOIL PRODUCTS CO. 336

16.2.6 FLEXIFOIL PACKAGING PVT LTD 337

16.2.7 ALIBÉRICO 338

16.2.8 CARCANO ANTONIO S.P.A. 339

16.2.9 D&W FINE PACK 340

16.2.10 HANDI-FOIL CORPORATION 341

16.2.11 COPPICE 342

16.2.12 SYMETAL 343

16.2.13 WYDA SOUTH AFRICA 344

16.2.14 AMPCO 345

16.2.15 LSKB ALUMINIUM FOILS PVT. LTD. 346

16.2.16 TAKAMUL INDUSTRIES 347

17 RESEARCH METHODOLOGY 348

17.1 RESEARCH DATA 348

17.1.1 SECONDARY DATA 349

17.1.1.1 Key data from secondary sources 349

17.1.1.2 List of secondary sources 349

17.1.2 PRIMARY DATA 350

17.1.2.1 Key primary participants 350

17.1.2.2 Key data from primary sources 350

17.1.2.3 Breakdown of interviews with experts 351

17.1.2.4 Key industry insights 351

17.2 MARKET SIZE ESTIMATION 352

17.2.1 TOP-DOWN APPROACH 352

17.2.2 BOTTOM-UP APPROACH 353

17.3 BASE NUMBER CALCULATION 353

17.3.1 SUPPLY-SIDE APPROACH 354

17.4 GROWTH FORECAST 354

17.5 DATA TRIANGULATION 355

17.6 RESEARCH ASSUMPTIONS 356

17.7 FACTOR ANALYSIS 356

17.8 RESEARCH LIMITATIONS 357

17.9 RISK ASSESSMENT 357

18 APPENDIX 358

18.1 DISCUSSION GUIDE 358

18.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 361

18.3 CUSTOMIZATION OPTIONS 363

18.4 RELATED REPORTS 363

18.5 AUTHOR DETAILS 364

LIST OF TABLES

TABLE 1 USE OF ALUMINUM FOIL PACKAGING IN VARIOUS END-USE INDUSTRIES 53

TABLE 2 AVERAGE SELLING PRICE OF ALUMINUM FOIL PACKAGING OFFERED

BY KEY PLAYERS, BY PRODUCT TYPE (USD/KG) 65

TABLE 3 AVERAGE SELLING PRICE OF ALUMINUM FOIL PACKAGING,

BY REGION, 2021–2024 (USD/KG) 66

TABLE 4 ALUMINUM FOIL PACKAGING MARKET: ECOSYSTEM 68

TABLE 5 IMPORT DATA FOR HS CODE 7607-COMPLIANT PRODUCTS,

BY COUNTRY, 2020–2024 (USD MILLION) 69

TABLE 6 EXPORT DATA FOR HS CODE 7607-COMPLIANT PRODUCTS,

BY COUNTRY, 2020–2024 (USD MILLION) 70

TABLE 7 ALUMINUM FOIL PACKAGING: KEY CONFERENCES AND EVENTS, 2025 71

TABLE 8 ALUMINUM FOIL PACKAGING MARKET: PORTER’S FIVE FORCES ANALYSIS 72

TABLE 9 WORLD GDP ANNUAL PERCENTAGE CHANGE OF ADVANCED ECONOMIES,

2024–2026 76

TABLE 10 WORLD GDP ANNUAL PERCENTAGE CHANGE OF EMERGING MARKET

AND DEVELOPING ECONOMIES, 2024–2026 77

TABLE 11 ALUMINUM FOIL MARKET: TOTAL NUMBER OF PATENTS,

JANUARY 2015–DECEMBER 2024 88

TABLE 12 ALUMINUM FOIL PACKAGING MARKET: LIST OF MAJOR PATENTS, 2024 91

TABLE 13 TOP USE CASES AND MARKET POTENTIAL 95

TABLE 14 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES 96

TABLE 15 ALUMINUM FOIL PACKAGING MARKET: CASE STUDIES RELATED TO GEN AI IMPLEMENTATION 96

TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 98

TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 99

TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 100

TABLE 19 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES,

AND OTHER ORGANIZATIONS 100

TABLE 20 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 101

TABLE 21 GLOBAL INDUSTRY STANDARDS IN ALUMINUM FOIL PACKAGING MARKET 101

TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS 105

TABLE 23 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS IN ALUMINUM FOIL PACKAGING 106

TABLE 24 UNMET NEEDS IN ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION 108

TABLE 25 ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 112

TABLE 26 ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 113

TABLE 27 ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2021–2023 (KILOTON) 113

TABLE 28 ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE, 2024–2030 (KILOTON) 113

TABLE 29 ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 118

TABLE 30 ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 119

TABLE 31 ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2021–2023 (KILOTON) 119

TABLE 32 ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION, 2024–2030 (KILOTON) 119

TABLE 33 ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE,

2021–2023 (USD MILLION) 124

TABLE 34 ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE,

2024–2030 (USD MILLION) 125

TABLE 35 ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE,

2021–2023 (KILOTON) 125

TABLE 36 ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE,

2024–2030 (KILOTON) 125

TABLE 37 ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (USD MILLION) 128

TABLE 38 ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (USD MILLION) 129

TABLE 39 ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (KILOTON) 129

TABLE 40 ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (KILOTON) 129

TABLE 41 ALUMINUM FOIL PACKAGING MARKET, BY REGION, 2021–2023 (USD MILLION) 137

TABLE 42 ALUMINUM FOIL PACKAGING MARKET, BY REGION, 2024–2030 (USD MILLION) 138

TABLE 43 ALUMINUM FOIL PACKAGING MARKET, BY REGION, 2021–2023 (KILOTON) 138

TABLE 44 ALUMINUM FOIL PACKAGING MARKET, BY REGION, 2024–2030 (KILOTON) 138

TABLE 45 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY COUNTRY, 2021–2023 (USD MILLION) 140

TABLE 46 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY COUNTRY, 2024–2030 (USD MILLION) 141

TABLE 47 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY COUNTRY, 2021–2023 (KILOTON) 141

TABLE 48 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY COUNTRY, 2024–2030 (KILOTON) 141

TABLE 49 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (USD MILLION) 142

TABLE 50 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (USD MILLION) 142

TABLE 51 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (KILOTON) 142

TABLE 52 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (KILOTON) 142

TABLE 53 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (USD MILLION) 143

TABLE 54 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (USD MILLION) 143

TABLE 55 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (KILOTON) 143

TABLE 56 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (KILOTON) 144

TABLE 57 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE, 2021–2023 (USD MILLION) 144

TABLE 58 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE, 2024–2030 (USD MILLION) 144

TABLE 59 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE, 2021–2023 (KILOTON) 144

TABLE 60 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE, 2024–2030 (KILOTON) 145

TABLE 61 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (USD MILLION) 145

TABLE 62 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (USD MILLION) 145

TABLE 63 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (KILOTON) 146

TABLE 64 ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (KILOTON) 146

TABLE 65 CHINA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (USD MILLION) 147

TABLE 66 CHINA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (USD MILLION) 147

TABLE 67 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (KILOTON) 147

TABLE 68 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (KILOTON) 148

TABLE 69 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 148

TABLE 70 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 148

TABLE 71 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (KILOTON) 149

TABLE 72 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (KILOTON) 149

TABLE 73 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 149

TABLE 74 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 150

TABLE 75 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (KILOTON) 150

TABLE 76 CHINA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (KILOTON) 150

TABLE 77 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2021–2023 (USD MILLION) 151

TABLE 78 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2024–2030 (USD MILLION) 152

TABLE 79 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (KILOTON) 152

TABLE 80 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (KILOTON) 152

TABLE 81 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 152

TABLE 82 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 153

TABLE 83 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (KILOTON) 153

TABLE 84 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (KILOTON) 153

TABLE 85 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 154

TABLE 86 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 154

TABLE 87 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (KILOTON) 154

TABLE 88 INDIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (KILOTON) 155

TABLE 89 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2021–2023 (USD MILLION) 156

TABLE 90 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2024–2030 (USD MILLION) 156

TABLE 91 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (KILOTON) 156

TABLE 92 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (KILOTON) 156

TABLE 93 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 157

TABLE 94 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 157

TABLE 95 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (KILOTON) 157

TABLE 96 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (KILOTON) 158

TABLE 97 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 158

TABLE 98 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 158

TABLE 99 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (KILOTON) 159

TABLE 100 JAPAN: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (KILOTON) 159

TABLE 101 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2021–2023 (USD MILLION) 160

TABLE 102 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2024–2030 (USD MILLION) 160

TABLE 103 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2021–2023 (KILOTON) 160

TABLE 104 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2024–2030 (KILOTON) 161

TABLE 105 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 161

TABLE 106 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 161

TABLE 107 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (KILOTON) 162

TABLE 108 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (KILOTON) 162

TABLE 109 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 162

TABLE 110 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 163

TABLE 111 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (KILOTON) 163

TABLE 112 AUSTRALIA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (KILOTON) 163

TABLE 113 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (USD MILLION) 164

TABLE 114 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (USD MILLION) 164

TABLE 115 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (KILOTON) 164

TABLE 116 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (KILOTON) 165

TABLE 117 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (USD MILLION) 165

TABLE 118 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (USD MILLION) 165

TABLE 119 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (KILOTON) 166

TABLE 120 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (KILOTON) 166

TABLE 121 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (USD MILLION) 166

TABLE 122 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (USD MILLION) 167

TABLE 123 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (KILOTON) 167

TABLE 124 REST OF ASIA PACIFIC: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (KILOTON) 167

TABLE 125 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY,

2021–2023 (USD MILLION) 169

TABLE 126 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY,

2024–2030 (USD MILLION) 170

TABLE 127 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY,

2021–2023 (KILOTON) 170

TABLE 128 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY COUNTRY,

2024–2030 (KILOTON) 170

TABLE 129 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2021–2023 (USD MILLION) 171

TABLE 130 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2024–2030 (USD MILLION) 171

TABLE 131 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (KILOTON) 171

TABLE 132 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (KILOTON) 171

TABLE 133 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 172

TABLE 134 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 172

TABLE 135 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (KILOTON) 172

TABLE 136 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (KILOTON) 173

TABLE 137 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE,

2021–2023 (USD MILLION) 173

TABLE 138 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE,

2024–2030 (USD MILLION) 173

TABLE 139 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE,

2021–2023 (KILOTON) 173

TABLE 140 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY PACKAGING TYPE,

2024–2030 (KILOTON) 174

TABLE 141 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 174

TABLE 142 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 174

TABLE 143 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (KILOTON) 175

TABLE 144 EUROPE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (KILOTON) 175

TABLE 145 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2021–2023 (USD MILLION) 176

TABLE 146 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2024–2030 (USD MILLION) 176

TABLE 147 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2021–2023 (KILOTON) 176

TABLE 148 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2024–2030 (KILOTON) 177

TABLE 149 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 177

TABLE 150 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 177

TABLE 151 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (KILOTON) 178

TABLE 152 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (KILOTON) 178

TABLE 153 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 178

TABLE 154 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 179

TABLE 155 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (KILOTON) 179

TABLE 156 GERMANY: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (KILOTON) 179

TABLE 157 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2021–2023 (USD MILLION) 180

TABLE 158 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2024–2030 (USD MILLION) 180

TABLE 159 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (KILOTON) 181

TABLE 160 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (KILOTON) 181

TABLE 161 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 181

TABLE 162 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 181

TABLE 163 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (KILOTON) 182

TABLE 164 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (KILOTON) 182

TABLE 165 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 182

TABLE 166 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 183

TABLE 167 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (KILOTON) 183

TABLE 168 ITALY: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (KILOTON) 183

TABLE 169 UK: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (USD MILLION) 184

TABLE 170 UK: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (USD MILLION) 184

TABLE 171 UK: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (KILOTON) 185

TABLE 172 UK: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (KILOTON) 185

TABLE 173 UK: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 185

TABLE 174 UK: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 185

TABLE 175 UK: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (KILOTON) 186

TABLE 176 UK: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (KILOTON) 186

TABLE 177 UK: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 186

TABLE 178 UK: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 187

TABLE 179 UK: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (KILOTON) 187

TABLE 180 UK: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (KILOTON) 187

TABLE 181 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2021–2023 (USD MILLION) 188

TABLE 182 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2024–2030 (USD MILLION) 188

TABLE 183 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (KILOTON) 189

TABLE 184 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (KILOTON) 189

TABLE 185 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 189

TABLE 186 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 189

TABLE 187 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (KILOTON) 190

TABLE 188 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (KILOTON) 190

TABLE 189 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 190

TABLE 190 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 191

TABLE 191 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (KILOTON) 191

TABLE 192 FRANCE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (KILOTON) 191

TABLE 193 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2021–2023 (USD MILLION) 192

TABLE 194 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2024–2030 (USD MILLION) 192

TABLE 195 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (KILOTON) 193

TABLE 196 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (KILOTON) 193

TABLE 197 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 193

TABLE 198 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 193

TABLE 199 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (KILOTON) 194

TABLE 200 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (KILOTON) 194

TABLE 201 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 194

TABLE 202 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 195

TABLE 203 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (KILOTON) 195

TABLE 204 SPAIN: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (KILOTON) 195

TABLE 205 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (USD MILLION) 196

TABLE 206 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (USD MILLION) 197

TABLE 207 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (KILOTON) 197

TABLE 208 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (KILOTON) 197

TABLE 209 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (USD MILLION) 197

TABLE 210 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (USD MILLION) 198

TABLE 211 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (KILOTON) 198

TABLE 212 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (KILOTON) 198

TABLE 213 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (USD MILLION) 199

TABLE 214 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (USD MILLION) 199

TABLE 215 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (KILOTON) 199

TABLE 216 REST OF EUROPE: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (KILOTON) 200

TABLE 217 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY COUNTRY, 2021–2023 (USD MILLION) 200

TABLE 218 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY COUNTRY, 2024–2030 (USD MILLION) 201

TABLE 219 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY COUNTRY, 2021–2023 (KILOTON) 201

TABLE 220 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY COUNTRY, 2024–2030 (KILOTON) 201

TABLE 221 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (USD MILLION) 201

TABLE 222 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (USD MILLION) 202

TABLE 223 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (KILOTON) 202

TABLE 224 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (KILOTON) 202

TABLE 225 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (USD MILLION) 202

TABLE 226 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (USD MILLION) 203

TABLE 227 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (KILOTON) 203

TABLE 228 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (KILOTON) 203

TABLE 229 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE, 2021–2023 (USD MILLION) 204

TABLE 230 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE, 2024–2030 (USD MILLION) 204

TABLE 231 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE, 2021–2023 (KILOTON) 204

TABLE 232 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE, 2024–2030 (KILOTON) 204

TABLE 233 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (USD MILLION) 205

TABLE 234 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (USD MILLION) 205

TABLE 235 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (KILOTON) 205

TABLE 236 NORTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (KILOTON) 206

TABLE 237 US: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (USD MILLION) 207

TABLE 238 US: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (USD MILLION) 207

TABLE 239 US: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (KILOTON) 207

TABLE 240 US: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (KILOTON) 207

TABLE 241 US: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 208

TABLE 242 US: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 208

TABLE 243 US: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (KILOTON) 208

TABLE 244 US: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (KILOTON) 209

TABLE 245 US: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 209

TABLE 246 US: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 209

TABLE 247 US: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (KILOTON) 210

TABLE 248 US: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (KILOTON) 210

TABLE 249 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2021–2023 (USD MILLION) 211

TABLE 250 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2024–2030 (USD MILLION) 211

TABLE 251 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (KILOTON) 211

TABLE 252 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (KILOTON) 212

TABLE 253 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 212

TABLE 254 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 212

TABLE 255 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (KILOTON) 213

TABLE 256 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (KILOTON) 213

TABLE 257 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 213

TABLE 258 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 214

TABLE 259 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (KILOTON) 214

TABLE 260 CANADA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (KILOTON) 214

TABLE 261 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2021–2023 (USD MILLION) 215

TABLE 262 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2024–2030 (USD MILLION) 216

TABLE 263 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (KILOTON) 216

TABLE 264 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (KILOTON) 216

TABLE 265 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 216

TABLE 266 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 217

TABLE 267 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (KILOTON) 217

TABLE 268 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (KILOTON) 217

TABLE 269 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 218

TABLE 270 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 218

TABLE 271 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (KILOTON) 218

TABLE 272 MEXICO: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (KILOTON) 219

TABLE 273 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY COUNTRY, 2021–2023 (USD MILLION) 220

TABLE 274 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY COUNTRY, 2024–2030 (USD MILLION) 220

TABLE 275 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY COUNTRY, 2021–2023 (KILOTON) 220

TABLE 276 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY COUNTRY, 2024–2030 (KILOTON) 221

TABLE 277 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (USD MILLION) 221

TABLE 278 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (USD MILLION) 221

TABLE 279 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (KILOTON) 222

TABLE 280 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (KILOTON) 222

TABLE 281 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (USD MILLION) 222

TABLE 282 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (USD MILLION) 223

TABLE 283 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (KILOTON) 223

TABLE 284 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (KILOTON) 223

TABLE 285 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE, 2021–2023 (USD MILLION) 224

TABLE 286 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE, 2024–2030 (USD MILLION) 224

TABLE 287 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE, 2021–2023 (KILOTON) 224

TABLE 288 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE, 2024–2030 (KILOTON) 224

TABLE 289 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (USD MILLION) 225

TABLE 290 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (USD MILLION) 225

TABLE 291 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (KILOTON) 225

TABLE 292 MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (KILOTON) 226

TABLE 293 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (USD MILLION) 226

TABLE 294 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (USD MILLION) 227

TABLE 295 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (KILOTON) 227

TABLE 296 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (KILOTON) 227

TABLE 297 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (USD MILLION) 227

TABLE 298 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (USD MILLION) 228

TABLE 299 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (KILOTON) 228

TABLE 300 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (KILOTON) 228

TABLE 301 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (USD MILLION) 229

TABLE 302 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (USD MILLION) 229

TABLE 303 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (KILOTON) 229

TABLE 304 GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (KILOTON) 230

TABLE 305 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (USD MILLION) 231

TABLE 306 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (USD MILLION) 231

TABLE 307 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (KILOTON) 231

TABLE 308 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (KILOTON) 231

TABLE 309 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (USD MILLION) 232

TABLE 310 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (USD MILLION) 232

TABLE 311 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (KILOTON) 232

TABLE 312 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (KILOTON) 233

TABLE 313 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (USD MILLION) 233

TABLE 314 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (USD MILLION) 233

TABLE 315 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (KILOTON) 234

TABLE 316 SAUDI ARABIA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (KILOTON) 234

TABLE 317 UAE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (USD MILLION) 235

TABLE 318 UAE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (USD MILLION) 235

TABLE 319 UAE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (KILOTON) 235

TABLE 320 UAE: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (KILOTON) 236

TABLE 321 UAE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 236

TABLE 322 UAE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 236

TABLE 323 UAE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (KILOTON) 237

TABLE 324 UAE: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (KILOTON) 237

TABLE 325 UAE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 237

TABLE 326 UAE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 238

TABLE 327 UAE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (KILOTON) 238

TABLE 328 UAE: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (KILOTON) 238

TABLE 329 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (USD MILLION) 239

TABLE 330 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (USD MILLION) 239

TABLE 331 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (KILOTON) 239

TABLE 332 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (KILOTON) 240

TABLE 333 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (USD MILLION) 240

TABLE 334 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (USD MILLION) 240

TABLE 335 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (KILOTON) 241

TABLE 336 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (KILOTON) 241

TABLE 337 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (USD MILLION) 241

TABLE 338 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (USD MILLION) 242

TABLE 339 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (KILOTON) 242

TABLE 340 REST OF GCC COUNTRIES: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (KILOTON) 242

TABLE 341 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (USD MILLION) 243

TABLE 342 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (USD MILLION) 244

TABLE 343 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (KILOTON) 244

TABLE 344 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (KILOTON) 244

TABLE 345 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (USD MILLION) 244

TABLE 346 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (USD MILLION) 245

TABLE 347 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (KILOTON) 245

TABLE 348 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (KILOTON) 245

TABLE 349 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (USD MILLION) 246

TABLE 350 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (USD MILLION) 246

TABLE 351 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (KILOTON) 246

TABLE 352 SOUTH AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (KILOTON) 247

TABLE 353 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (USD MILLION) 247

TABLE 354 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (USD MILLION) 248

TABLE 355 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (KILOTON) 248

TABLE 356 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (KILOTON) 248

TABLE 357 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (USD MILLION) 248

TABLE 358 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (USD MILLION) 249

TABLE 359 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (KILOTON) 249

TABLE 360 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (KILOTON) 249

TABLE 361 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (USD MILLION) 250

TABLE 362 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (USD MILLION) 250

TABLE 363 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (KILOTON) 250

TABLE 364 REST OF MIDDLE EAST & AFRICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (KILOTON) 251

TABLE 365 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY COUNTRY, 2021–2023 (USD MILLION) 251

TABLE 366 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY COUNTRY, 2024–2030 (USD MILLION) 252

TABLE 367 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY COUNTRY, 2021–2023 (KILOTON) 252

TABLE 368 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY COUNTRY, 2024–2030 (KILOTON) 252

TABLE 369 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (USD MILLION) 252

TABLE 370 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (USD MILLION) 253

TABLE 371 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (KILOTON) 253

TABLE 372 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (KILOTON) 253

TABLE 373 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (USD MILLION) 253

TABLE 374 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (USD MILLION) 254

TABLE 375 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (KILOTON) 254

TABLE 376 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (KILOTON) 254

TABLE 377 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE, 2021–2023 (USD MILLION) 255

TABLE 378 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE, 2024–2030 (USD MILLION) 255

TABLE 379 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE, 2021–2023 (KILOTON) 255

TABLE 380 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PACKAGING TYPE, 2024–2030 (KILOTON) 255

TABLE 381 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (USD MILLION) 256

TABLE 382 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (USD MILLION) 256

TABLE 383 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (KILOTON) 256

TABLE 384 SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (KILOTON) 257

TABLE 385 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2021–2023 (USD MILLION) 258

TABLE 386 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2024–2030 (USD MILLION) 258

TABLE 387 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2021–2023 (KILOTON) 258

TABLE 388 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY TYPE, 2024–2030 (KILOTON) 258

TABLE 389 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 259

TABLE 390 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 259

TABLE 391 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (KILOTON) 259

TABLE 392 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (KILOTON) 260

TABLE 393 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 260

TABLE 394 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 260

TABLE 395 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (KILOTON) 261

TABLE 396 BRAZIL: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (KILOTON) 261

TABLE 397 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2021–2023 (USD MILLION) 262

TABLE 398 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2024–2030 (USD MILLION) 262

TABLE 399 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2021–2023 (KILOTON) 262

TABLE 400 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY TYPE,

2024–2030 (KILOTON) 263

TABLE 401 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (USD MILLION) 263

TABLE 402 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (USD MILLION) 263

TABLE 403 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2021–2023 (KILOTON) 264

TABLE 404 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY PRODUCT TYPE,

2024–2030 (KILOTON) 264

TABLE 405 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (USD MILLION) 264

TABLE 406 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (USD MILLION) 265

TABLE 407 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2021–2023 (KILOTON) 265

TABLE 408 ARGENTINA: ALUMINUM FOIL PACKAGING MARKET, BY APPLICATION,

2024–2030 (KILOTON) 265

TABLE 409 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (USD MILLION) 266

TABLE 410 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (USD MILLION) 266

TABLE 411 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2021–2023 (KILOTON) 266

TABLE 412 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY TYPE, 2024–2030 (KILOTON) 267

TABLE 413 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (USD MILLION) 267

TABLE 414 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (USD MILLION) 267

TABLE 415 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2021–2023 (KILOTON) 268

TABLE 416 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY PRODUCT TYPE, 2024–2030 (KILOTON) 268

TABLE 417 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (USD MILLION) 268

TABLE 418 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (USD MILLION) 269

TABLE 419 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2021–2023 (KILOTON) 269

TABLE 420 REST OF SOUTH AMERICA: ALUMINUM FOIL PACKAGING MARKET,

BY APPLICATION, 2024–2030 (KILOTON) 269

TABLE 421 ALUMINUM FOIL PACKAGING MARKET: OVERVIEW OF MAJOR STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2020–NOVEMBER 2025 270

TABLE 422 ALUMINUM FOIL PACKAGING MARKET: DEGREE OF COMPETITION, 2024 273

TABLE 423 ALUMINUM FOIL PACKAGING MARKET: REGION FOOTPRINT, 2024 281

TABLE 424 ALUMINUM FOIL PACKAGING MARKET: TYPE FOOTPRINT, 2024 282

TABLE 425 ALUMINUM FOIL PACKAGING MARKET: PRODUCT TYPE FOOTPRINT, 2024 282

TABLE 426 ALUMINUM FOIL PACKAGING MARKET: PACKAGING TYPE FOOTPRINT, 2024 283

TABLE 427 ALUMINUM FOIL PACKAGING MARKET: THICKNESS FOOTPRINT, 2024 283

TABLE 428 ALUMINUM FOIL PACKAGING MARKET: TECHNOLOGY FOOTPRINT, 2024 284

TABLE 429 ALUMINUM FOIL PACKAGING MARKET: APPLICATION FOOTPRINT, 2024 284

TABLE 430 ALUMINUM FOIL PACKAGING MARKET: DETAILED LIST OF

KEY STARTUPS/SMES, 2024 287

TABLE 431 ALUMINUM FOIL PACKAGING MARKET: COMPETITIVE BENCHMARKING OF

KEY STARTUPS/SMES, 2024 288

TABLE 432 ALUMINUM FOIL PACKAGING MARKET: PRODUCT LAUNCHES,

JANUARY 2020–NOVEMBER 2025 289

TABLE 433 ALUMINUM FOIL PACKAGING MARKET: DEALS, JANUARY 2020–NOVEMBER 2025 289

TABLE 434 ALUMINUM FOIL PACKAGING MARKET: EXPANSIONS,

JANUARY 2020–NOVEMBER 2025 291

TABLE 435 RUSAL: COMPANY OVERVIEW 293

TABLE 436 RUSAL: PRODUCTS OFFERED 295

TABLE 437 RUSAL: PRODUCT LAUNCHES, JANUARY 2020–NOVEMBER 2025 295

TABLE 438 RUSAL: DEALS, JANUARY 2020–NOVEMBER 2025 296

TABLE 439 RUSAL: EXPANSIONS, JANUARY 2020–NOVEMBER 2025 296

TABLE 440 HULAMIN: COMPANY OVERVIEW 298

TABLE 441 HULAMIN: PRODUCTS OFFERED 299

TABLE 442 HINDALCO INDUSTRIES LTD.: COMPANY OVERVIEW 301

TABLE 443 HINDALCO INDUSTRIES LTD.: PRODUCTS OFFERED 302

TABLE 444 HINDALCO INDUSTRIES LTD.: DEALS, JANUARY 2020–NOVEMBER 2025 303

TABLE 445 HINDALCO INDUSTRIES LTD.: EXPANSIONS, JANUARY 2020–NOVEMBER 2025 304

TABLE 446 CHINA HONGQIAO GROUP LIMITED: BUSINESS OVERVIEW 305

TABLE 447 CHINA HONGQIAO GROUP LIMITED: PRODUCTS OFFERED 307

TABLE 448 CHINA HONGQIAO GROUP LIMITED: EXPANSIONS,

JANUARY 2020–NOVEMBER 2025 307

TABLE 449 AMCOR PLC: COMPANY OVERVIEW 309

TABLE 450 AMCOR PLC: PRODUCTS OFFERED 311

TABLE 451 AMCOR PLC: PRODUCT LAUNCHES, JANUARY 2020–NOVEMBER 2025 312

TABLE 452 AMCOR PLC: DEALS, JANUARY 2020–NOVEMBER 2025 312

TABLE 453 AMCOR PLC: EXPANSIONS, JANUARY 2020–NOVEMBER 2025 312

TABLE 454 KIBAR HOLDING: COMPANY OVERVIEW 314

TABLE 455 KIBAR HOLDING: PRODUCTS OFFERED 314

TABLE 456 KIBAR HOLDING: EXPANSIONS, JANUARY 2020–NOVEMBER 2025 315

TABLE 457 CONSTANTIA FLEXIBLES: COMPANY OVERVIEW 317

TABLE 458 CONSTANTIA FLEXIBLES: PRODUCTS OFFERED 317

TABLE 459 CONSTANTIA FLEXIBLES: DEALS, JANUARY 2020–NOVEMBER 2025 319

TABLE 460 CONSTANTIA FLEXIBLES: EXPANSIONS, JANUARY 2020–NOVEMBER 2025 320

TABLE 461 REYNOLDS CONSUMER PRODUCTS: COMPANY OVERVIEW 321

TABLE 462 REYNOLDS CONSUMER PRODUCTS: PRODUCTS OFFERED 323

TABLE 463 REYNOLDS CONSUMER PRODUCTS: PRODUCT LAUNCHES,

JANUARY 2020–NOVEMBER 2025 324

TABLE 464 GARMCO: COMPANY OVERVIEW 325

TABLE 465 GARMCO: PRODUCTS OFFERED 325

TABLE 466 GARMCO: DEALS, JANUARY 2020–NOVEMBER 2025 326

TABLE 467 GARMCO: EXPANSIONS, JANUARY 2020–NOVEMBER 2025 326

TABLE 468 NOVOLEX: COMPANY OVERVIEW 328

TABLE 469 NOVOLEX: PRODUCTS OFFERED 328

TABLE 470 NOVOLEX: DEALS, JANUARY 2020–NOVEMBER 2025 329

TABLE 471 RAVIRAJ FOILS LIMITED: COMPANY OVERVIEW 330

TABLE 472 RAVIRAJ FOILS LIMITED: PRODUCTS OFFERED 330

TABLE 473 PENNY PLATE, LLC: COMPANY OVERVIEW 332

TABLE 474 JINDAL (INDIA) LIMITED: COMPANY OVERVIEW 333

TABLE 475 PG FOILS LTD.: COMPANY OVERVIEW 334

TABLE 476 EUROFOIL LUXEMBOURG SA: COMPANY OVERVIEW 335

TABLE 477 ALUFOIL PRODUCTS CO.: COMPANY OVERVIEW 336

TABLE 478 FLEXIFOIL PACKAGING PVT LTD: COMPANY OVERVIEW 337

TABLE 479 ALIBÉRICO: COMPANY OVERVIEW 338

TABLE 480 CARCANO ANTONIO S.P.A.: COMPANY OVERVIEW 339

TABLE 481 D&W FINE PACK: COMPANY OVERVIEW 340

TABLE 482 HANDI-FOIL CORPORATION: COMPANY OVERVIEW 341

TABLE 483 COPPICE: COMPANY OVERVIEW 342