Medical Membranes Market - Global Forecast To 2030

Medical Membranes Market by Material (PSU, PES, PVDF, PTFE, PP, PAN, PA, Modified Acrylics), Process Technology (Ultrafiltration, Microfiltration, Nanofiltration), Application (Pharmaceutical Filtration, Hemodialysis, IV Fusion & Sterile Filtration, Membrane Oxygenator), and Region - Global Forecast to 2030

医療用メンブレン市場 - 材質(PSU、PES、PVDF、PTFE、PP、PAN、PA、改質アクリル)、プロセス技術(限外濾過、精密濾過、ナノ濾過)、用途(医薬品濾過、血液透析、IV融合および滅菌濾過、膜型人工肺)、および地域別 - 2030年までの世界予測

| 出版 | MarketsandMarkets |

| 出版年月 | 2025年11月 |

| ページ数 | 241 |

| 図表数 | 220 |

| 価格 | 記載以外のライセンスについてはお問合せください |

| シングルユーザ | USD 4,950 |

| 企業ライセンス | USD 10,000 |

| 種別 | 英文調査報告書 |

| 商品番号 | SMR-11462 |

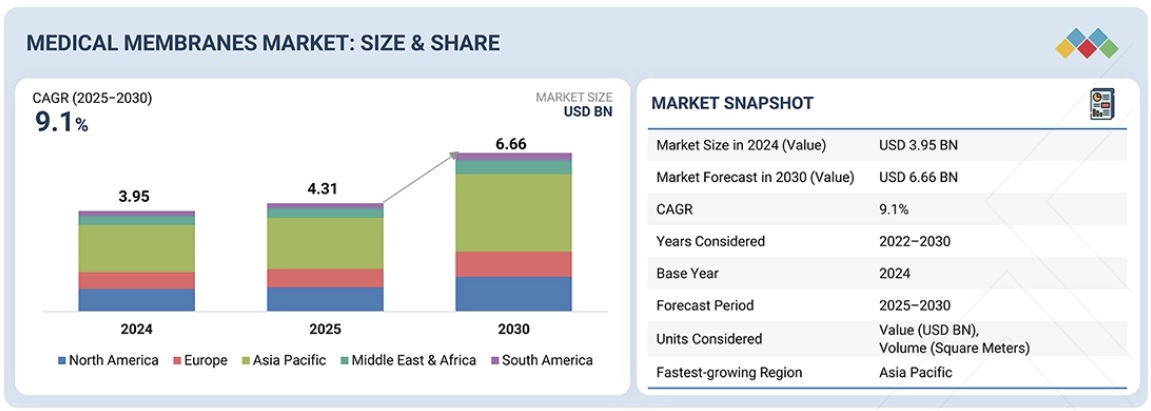

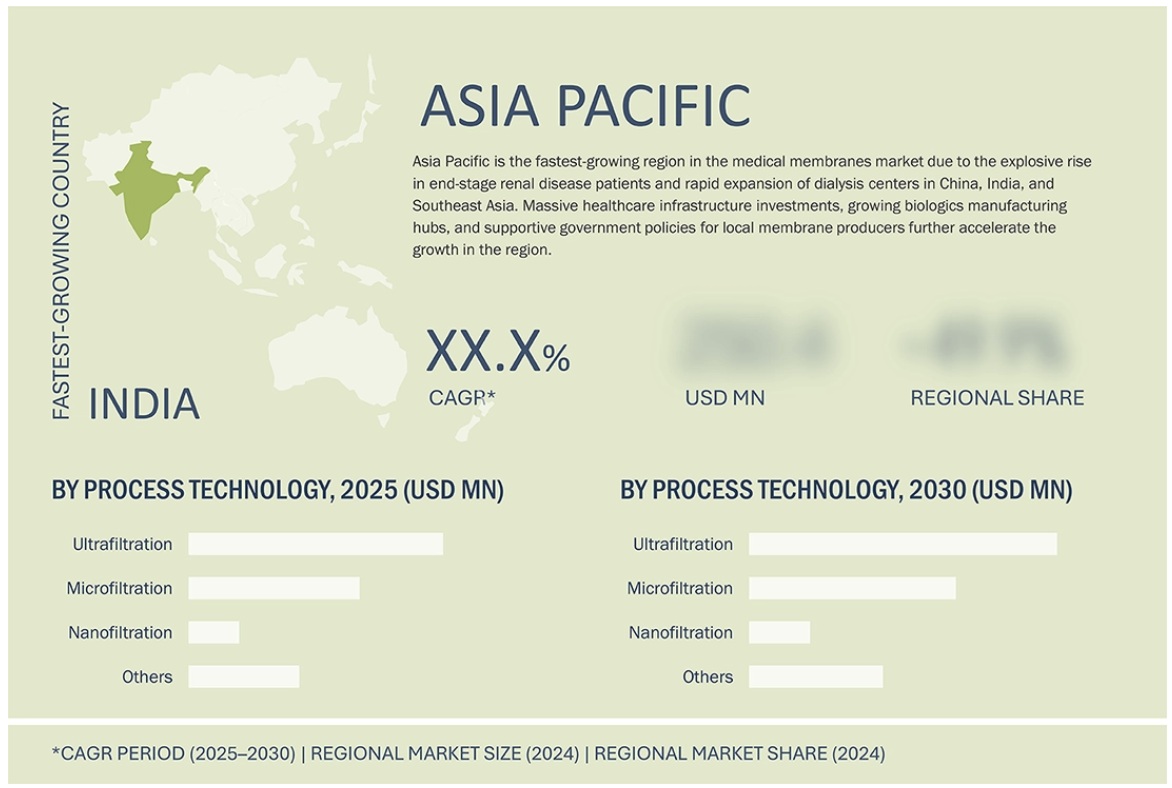

医療用メンブレン市場は、2025年の43億1,000万米ドルから2030年には66億6,000万米ドルに達し、予測期間中に9.1%のCAGRで成長すると予測されています。世界の医療用メンブレン市場は、慢性腎臓病および糖尿病患者の増加によって牽引されています。生体適合性の向上、防汚コーティング、ナノ濾過機能といったメンブレン技術の継続的な革新により、薬剤精製、バイオプロセス、人工臓器への応用が可能になっています。さらに、外科手術の増加、高度な創傷被覆材や組織工学用スキャフォールドの選好も市場の成長を支えています。一方、バイオテクノロジーおよび医薬品製造においては、交差汚染を排除するための単回使用の使い捨てメンブレンシステムへの投資が活発化しています。さらに、新興市場(特にアジア太平洋地域)の医療インフラ、成熟地域における人口の高齢化、バイオ人工臓器および再生医療に関する大規模な研究開発も、市場の成長に貢献しています。

調査対象範囲

本市場調査は、様々なセグメントにわたる医療用メンブレン市場を網羅しています。材料、プロセス技術、用途、地域に基づき、様々なセグメントにおける市場規模と成長の可能性を推定することを目的としています。また、主要プレーヤーの詳細な競合分析、企業概要、製品および事業内容に関する主要な考察、最近の開発状況、そして医療用メンブレン市場における地位向上のために採用されている主要な成長戦略についても取り上げています。

本レポートを購入する主なメリット

本レポートは、医療用メンブレン市場全体、およびそのセグメントとサブセグメントの収益数値に最も近い概算値を提供することで、市場リーダー企業および新規参入企業を支援することが期待されています。本レポートは、市場関係者が市場の競争環境を理解し、事業の地位向上のための洞察を獲得し、適切な市場開拓戦略を策定するのに役立つと期待されています。また、本レポートは、市場関係者が市場の動向を理解し、主要な市場牽引要因、制約要因、課題、そして機会に関する情報を提供することを目的としています。

本レポートでは、以下の点について洞察を提供しています。

主要な推進要因(慢性疾患の有病率上昇、膜分離技術の採用拡大、外科手術件数の増加)、制約要因(先進医療用膜の高コスト、厳格な規制承認プロセス、膜ファウリングのリスクと膜寿命の限界)、機会(バイオプロセスにおけるシングルユース膜システムの需要増加、新興市場における拡大、ナノテクノロジーとスマート膜の統合)、課題(高性能膜の生産規模拡大の複雑さ、環境問題、熾烈な競争)の分析。

- 製品開発/イノベーション:医療用メンブレン市場における今後の技術、研究開発活動、新製品・新サービスの投入に関する詳細な洞察

- 市場開発:収益性の高い市場に関する包括的な情報 ― 本レポートでは、様々な地域における医療用メンブレン市場を分析しています。

- 市場多様化:医療用メンブレン市場における新製品・サービス、未開拓地域、最近の動向、投資に関する包括的な情報

- 競合評価:旭化成株式会社(日本)、Mann+Hummel(ドイツ)、Sartorius AG(ドイツ)、Merck KGaA(ドイツ)、Solventum(米国)、Cytiva(米国)、W. L. Gore & Associates, Inc.(米国)、Kovalus Separation Solutions(米国)、Cobetter(中国)など、主要企業の市場シェア、成長戦略、サービス提供に関する詳細な評価

Report Description

The medical membranes market is projected to reach USD 6.66 billion by 2030 from USD 4.31 billion in 2025, at a CAGR of 9.1% during the forecast period. The global medical membranes market is driven by the increasing number of chronic kidney disease and diabetes patients. Continuous innovations in membrane technology like better biocompatibility, antifouling coatings, and nanofiltration capabilities are making drug purification, bioprocessing, and artificial organ applications possible. Additionally, the increasing number of surgical procedures, preference for advanced wound dressings, and tissue engineering scaffolds are also supporting market growth. Meanwhile, there is strong investment in single-use disposable membrane systems in biotech and pharmaceutical manufacturing for eliminating cross-contamination. Moreover, the healthcare infrastructure in emerging markets (especially Asia Pacific), the aging population in mature regions, and significant R&D on bio-artificial organs and regenerative medicine are all contributing to the market growth.

Medical Membranes Market – Global Forecast To 2030

“Polyvinylidene fluoride (PVDF) is the fastest-growing material segment in the medical membranes market during the forecast period.”

Polyvinylidene fluoride (PVDF) is the fastest-growing segment in the medical membranes market due to its excellent properties. PVDF is known for its chemical resistance, heat stability, physical strength, and low protein adherence and, thus, is widely used in the purification of liquids in pharmaceuticals and biopharmaceuticals, alongside blood filtering, drug purification, and filtration of the final products of biopharmaceuticals. Hydrophilic PVDF membranes are increasingly used in medical diagnostics and biologics production, driven by the worldwide rise in chronic diseases, the growing focus on personalized medicine, and the expanding aging population. PVDF’s biocompatibility is a key factor for innovations in tissue engineering, wound dressings, and virus removal, which makes it superior to competitors such as PTFE or PESU. At the same time, the pandemic-induced surge in pharmaceutical manufacturing and increased investments in advanced filtration technologies also favor PVDF.

Medical Membranes Market – Global Forecast To 2030 – by process technology

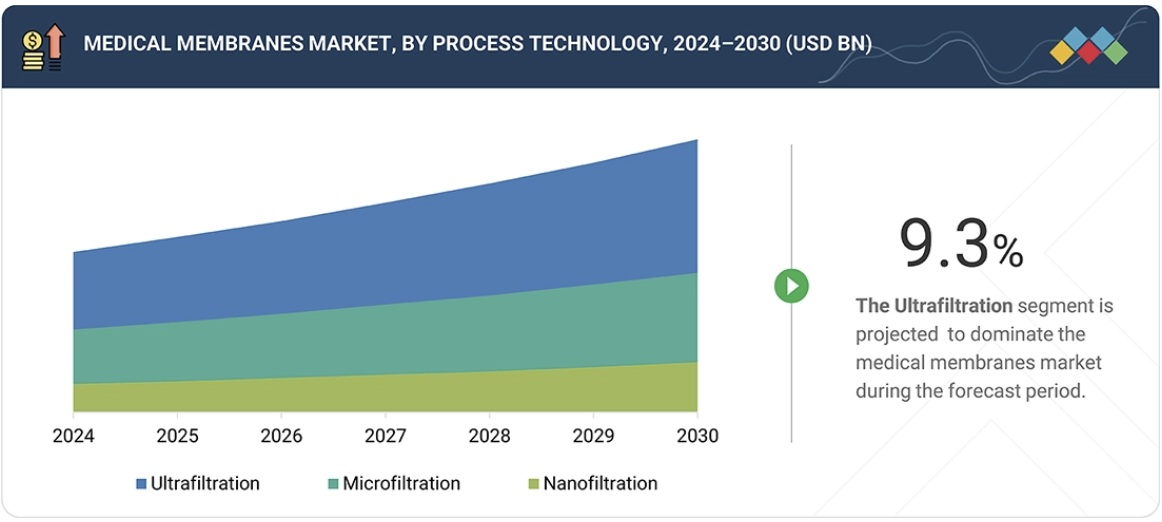

“Ultrafiltration is projected to be the largest process technology segment in the medical membranes market during the forecast period.”

Ultrafiltration (UF) is the largest technology segment in the overall medical membranes market due to its essential application in hemodialysis. Hemodialysis overcomes the limits of kidney function in more than 3 million end-stage renal disease patients, curing them by highly efficient removal of ureotoxins and keeping essential proteins in the body. UF membranes are often made from polysulfone, polyethersulfone, or modified PES, and they have precise corresponding molecular weight cut-offs (5-50kDa) that give excellent biocompatibility as well as high flux rates and superior hemocompatibility. Thus, they have become the standard for purification in dialysis clinics and ICUs. The strong growth of the medical membranes market is also supported by the expanding use of ultrafiltration (UF) beyond renal therapy. UF is widely applied in microbiology and pharmaceutical downstream processing for concentrating, diafiltering, and exchanging buffers in monoclonal antibodies, vaccines, and recombinant proteins, all of which are increasing rapidly with the rise of biologics. Its ability to pump at low transmembrane pressure and usage of advanced surface modifications to reduce fouling make it even more preferred over microfiltration, reverse osmosis, or nanofiltration in high-volume, high-value medical applications.

Medical Membranes Market – Global Forecast To 2030 – region

“Europe is projected to be the second-largest medical membranes market during the forecast period.”

Europe is the second-largest medical membranes market. The market in the region is driven by its excellent healthcare systems, high spending on renal care per capita, and a large number of elderly people with a high prevalence of chronic kidney diseases. The market in the region is also supported by the presence of major membrane manufacturers with significant R&D and production capacity in Germany, France, Italy, and Switzerland. Stringent EU regulatory standards ensure that only the best products are delivered to the market. However, this creates barriers for new players. Moreover, widespread reimbursement for dialysis treatments, the growing use of single-use bioprocessing systems in the fast-expanding biologics sector, and significant public and private investments in fields like regenerative medicine and bioartificial organs contribute to the demand for the product.

Extensive primary interviews were conducted to determine and verify the market size for several segments and subsegments and the information gathered through secondary research.

The breakdown of primary interviews is given below:

- By Department: Tier 1 – 40%, Tier 2 – 25%, and Tier 3 – 35%

- By Designation: C Level – 35%, Director Level – 30%, and Executives – 35%

- By Region: North America – 25%, Europe – 45%, Asia Pacific – 20%, South America – 5%, and Middle East & Africa – 5%

Medical Membranes Market – Global Forecast To 2030 – ecosystem

Asahi Kasei Corporation (Japan), Mann+Hummel (Germany), Sartorius AG (Germany), Merck KGaA (Germany), Solventum (US), Cytiva (US), W. L. Gore & Associates, Inc. (US), Kovalus Separation Solutions (US),and Cobetter (China), among others, are some of the key players in the medical membranes market. The study includes an in-depth competitive analysis of these key players in the medical membranes market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the medical membranes market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on material, process technology, application, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the medical membranes market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market with the closest approximations of the revenue numbers of the overall medical membranes market and its segments and subsegments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provide them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Rising prevalence of chronic diseases, Growing adoption of membrane-based separation technologies, Increasing number of surgical procedures), restraints (High cost of advanced medical membranes, Stringent regulatory approval processes, Risk of membrane fouling and limited lifespan of membranes), opportunities (Growing demand for single-use membrane systems in bioprocessing, Expansion in emerging markets, Integration of nanotechnology and smart membranes), challenges (Complexity in scaling up production of high-performance membranes, Environmental concerns, and Intense competition).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the medical membranes market

- Market Development: Comprehensive information about lucrative markets – the report analyses the medical membranes market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the medical membranes market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Asahi Kasei Corporation (Japan), Mann+Hummel (Germany), Sartorius AG (Germany), Merck KGaA (Germany), Solventum (US), Cytiva (US), W. L. Gore & Associates, Inc. (US), Kovalus Separation Solutions (US), and Cobetter (China), among others

Table of Contents

1 INTRODUCTION 23

1.1 STUDY OBJECTIVES 23

1.2 MARKET DEFINITION 23

1.3 STUDY SCOPE 24

1.3.1 MARKETS COVERED AND REGIONAL SCOPE 24

1.3.2 INCLUSIONS AND EXCLUSIONS 25

1.3.3 YEARS CONSIDERED 25

1.3.4 CURRENCY CONSIDERED 25

1.3.5 UNIT CONSIDERED 26

1.4 STAKEHOLDERS 26

2 EXECUTIVE SUMMARY 27

3 PREMIUM INSIGHTS 31

3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MEDICAL MEMBRANES MARKET 31

3.2 MEDICAL MEMBRANES MARKET, BY APPLICATION 31

3.3 MEDICAL MEMBRANES MARKET, BY MATERIAL 32

3.4 MEDICAL MEMBRANES MARKET, BY PROCESS TECHNOLOGY 32

3.5 MEDICAL MEMBRANES MARKET, BY REGION 33

4 MARKET OVERVIEW 34

4.1 INTRODUCTION 34

4.2 MARKET DYNAMICS 35

4.2.1 DRIVERS 35

4.2.1.1 Rising prevalence of chronic diseases 35

4.2.1.2 Advancements in biotechnology and drug delivery systems 36

4.2.1.3 Rising demand for hemodialysis and filtration technologies 36

4.2.1.4 Expansion of healthcare infrastructure and increasing access globally 37

4.2.2 RESTRAINTS 37

4.2.2.1 High manufacturing and production costs 37

4.2.2.2 Stringent regulatory approvals and compliance 38

4.2.2.3 Membrane fouling and degradation issues 38

4.2.3 OPPORTUNITIES 39

4.2.3.1 Growing demand for single-use membrane systems in bioprocessing 39

4.2.3.2 Rapid expansion of medical membranes into emerging economies 39

4.2.4 CHALLENGES 40

4.2.4.1 Complexity in scaling up production of high-performance membranes 40

4.2.4.2 Environmental concerns 40

4.3 UNMET NEEDS AND WHITE SPACES 41

4.3.1 UNMET NEEDS IN MEDICAL MEMBRANES MARKET 41

4.3.2 WHITE SPACE OPPORTUNITIES 41

4.4 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES 41

4.4.1 INTERCONNECTED MARKETS 41

4.4.2 CROSS-SECTOR OPPORTUNITIES 42

4.5 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFTS 42

4.5.1 EMERGING BUSINESS MODELS 42

4.5.2 ECOSYSTEM SHIFTS 42

4.6 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS 42

4.6.1 KEY MOVES AND STRATEGIC FOCUS 43

5 INDUSTRY TRENDS 44

5.1 PORTER’S FIVE FORCES ANALYSIS 44

5.1.1 THREAT OF NEW ENTRANTS 45

5.1.2 THREAT OF SUBSTITUTES 45

5.1.3 BARGAINING POWER OF SUPPLIERS 45

5.1.4 BARGAINING POWER OF BUYERS 46

5.1.5 INTENSITY OF COMPETITIVE RIVALRY 46

5.2 MACROECONOMIC INDICATORS 46

5.2.1 GLOBAL GDP TRENDS 46

5.3 VALUE CHAIN ANALYSIS 48

5.4 ECOSYSTEM ANALYSIS 50

5.5 PRICING ANALYSIS 52

5.5.1 AVERAGE SELLING PRICE TREND, BY REGION 52

5.6 TRADE ANALYSIS 53

5.6.1 IMPORT SCENARIO (HS CODE 901890) 53

5.6.2 EXPORT SCENARIO (HS CODE 901890) 54

5.7 KEY CONFERENCES AND EVENTS 55

5.8 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS 56

5.9 INVESTMENT AND FUNDING SCENARIO 57

5.10 CASE STUDY ANALYSIS 57

5.10.1 ENSURING RELIABLE CLEANABILITY OF MEDICAL ULTRAFILTRATION MEMBRANES – MERCK MILLIPORE 57

5.10.2 ADVANCED MEDICAL MEMBRANE SOLUTION FOR HOSPITAL WASTEWATER TREATMENT BY IMEMFLO 58

5.11 2025 US TARIFF 58

5.11.1 INTRODUCTION 58

5.11.2 KEY TARIFF RATES 59

5.11.3 PRICE IMPACT ANALYSIS 59

5.11.4 IMPACT ON KEY REGIONS 60

5.11.4.1 North America 60

5.11.4.2 Europe 60

5.11.4.3 Asia Pacific 60

5.11.5 IMPACT ON END-USE INDUSTRIES 61

6 STRATEGIC DISRUPTION THROUGH TECHNOLOGY, PATENTS, DIGITAL, AND AI ADOPTIONS 62

6.1 KEY EMERGING TECHNOLOGIES 62

6.1.1 CELL MEMBRANE–COATED NANOPARTICLES (CNPS) 62

6.1.2 BIOCOMPATIBLE AND BIODEGRADABLE COMPOSITE MEMBRANES 62

6.2 COMPLEMENTARY TECHNOLOGIES 63

6.2.1 SURFACE MODIFICATION & ANTIMICROBIAL/ANTIFOULING COATINGS 63

6.3 TECHNOLOGY/PRODUCT ROADMAP 64

6.3.1 SHORT-TERM (2025–2027) | FOUNDATION & EARLY COMMERCIALIZATION 64

6.3.2 MID-TERM (2027–2030) | EXPANSION & STANDARDIZATION 64

6.3.3 LONG-TERM (2030–2035+) | MASS COMMERCIALIZATION & DISRUPTION 65

6.4 PATENT ANALYSIS 66

6.4.1 INTRODUCTION 66

6.4.2 METHODOLOGY 66

6.4.3 DOCUMENT TYPE 66

6.4.4 INSIGHTS 67

6.4.5 LEGAL STATUS OF PATENTS 68

6.4.6 JURISDICTION ANALYSIS 68

6.4.7 TOP APPLICANTS 69

6.4.8 TOP 10 PATENT OWNERS IN LAST 10 YEARS 69

6.5 FUTURE APPLICATIONS 70

6.5.1 NEXT-GENERATION HEMODIALYSIS & ARTIFICIAL ORGANS 70

6.5.2 ADVANCED WOUND-CARE & TISSUE-ENGINEERING MEMBRANES 71

6.5.3 CONTROLLED DRUG-DELIVERY & IMPLANTABLE THERAPEUTIC MEMBRANES 71

6.5.4 POINT-OF-CARE DIAGNOSTICS & MICROFLUIDIC LAB-ON-CHIP DEVICES 72

6.5.5 WEARABLE HEALTH SENSORS & CONTINUOUS BIOMARKER MONITORING 72

6.6 IMPACT OF AI/GEN AI ON MEDICAL MEMBRANES MARKET 73

6.6.1 TOP USE CASES AND MARKET POTENTIAL 73

6.6.2 BEST PRACTICES IN MEDICAL MEMBRANES PROCESSING 74

6.6.3 CASE STUDIES OF AI IMPLEMENTATION IN MEDICAL MEMBRANES MARKET 74

6.6.4 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 75

6.6.5 CLIENTS’ READINESS TO ADOPT GENERATIVE AI IN MEDICAL MEMBRANES MARKET 75

6.7 SUCCESS STORIES AND REAL-WORLD APPLICATIONS 75

6.7.1 PALL CORPORATION: HEMODIALYSIS MEMBRANES 76

6.7.2 MERCK KGAA: BIOFUNCTIONAL MEMBRANES 76

6.7.3 BAXTER INTERNATIONAL: EXTRACORPOREAL MEMBRANES 76

7 SUSTAINABILITY AND REGULATORY LANDSCAPE 77

7.1 REGIONAL REGULATIONS AND COMPLIANCE 77

7.1.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 77

7.1.2 INDUSTRY STANDARDS 78

7.2 SUSTAINABILITY INITIATIVES 79

7.3 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES 80

7.4 CERTIFICATIONS, LABELING, AND ECO-STANDARDS 81

8 CUSTOMER LANDSCAPE & BUYER BEHAVIOR 82

8.1 DECISION-MAKING PROCESS 82

8.2 KEY STAKEHOLDERS AND BUYING CRITERIA 83

8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS 83

8.2.2 BUYING CRITERIA 84

8.3 ADOPTION BARRIERS & INTERNAL CHALLENGES 86

8.4 UNMET NEEDS IN VARIOUS APPLICATIONS 87

8.5 MARKET PROFITABILITY 87

8.5.1 REVENUE POTENTIAL 87

8.5.2 COST DYNAMICS 88

8.5.3 MARGIN OPPORTUNITIES IN KEY END-USE INDUSTRIES 88

9 MEDICAL MEMBRANES MARKET, BY MATERIAL 89

9.1 INTRODUCTION 90

9.2 POLYSULFONE (PSU) & POLYETHERSULFONE (PESU) 91

9.2.1 ADVANCING DIALYSIS AND CLINICAL FILTRATION WITH BIOCOMPATIBLE, HIGH-FLUX MEMBRANE TECHNOLOGIES TO DRIVE MARKET 91

9.3 POLYVINYLIDENE FLUORIDE (PVDF) 92

9.3.1 EXCELLENT MECHANICAL STRENGTH, THERMAL STABILITY, AND CHEMICAL RESISTANCE TO DRIVE MARKET 92

9.3.2 HYDROPHOBIC PVDF MEMBRANE 93

9.3.3 HYDROPHOBIC PVDF MEMBRANE 93

9.4 POLYTETRAFLUOROETHYLENE (PTFE) 93

9.4.1 ADVANCING MEDICAL VENT FILTRATION WITH ULTRA-RESILIENT MEMBRANE MATERIALS TO DRIVE MARKET 93

9.5 POLYPROPYLENE (PP) 94

9.5.1 OPTIMIZING THERMAL STABILITY FOR HIGH-TEMPERATURE USE TO DRIVE MARKET 94

9.6 POLYACRYLONITRILE (PAN) 94

9.6.1 PROVIDES SUPERIOR CHEMICAL RESISTANCE IN AGGRESSIVE DRUG FILTRATION TO DRIVE MARKET 94

9.7 POLYAMIDE (PA) 95

9.7.1 ENABLES HIGH PERMSELECTIVITY IN PHARMACEUTICAL NANOFILTRATION AND DRUG CONCENTRATION TO DRIVE MARKET 95

9.8 MODIFIED ACRYLICS 95

9.8.1 DELIVERS UNMATCHED OPTICAL CLARITY FOR HIGH-SENSITIVITY DIAGNOSTIC DEVICES TO DRIVE MARKET 95

9.9 OTHER MATERIALS 96

10 MEDICAL MEMBRANES MARKET, BY PROCESS TECHNOLOGY 97

10.1 INTRODUCTION 98

10.2 ULTRAFILTRATION 99

10.2.1 TRANSFORMING MEDICAL PURIFICATION WORKFLOWS WITH HIGH-PERFORMANCE MEMBRANE SOLUTIONS TO DRIVE MARKET 99

10.3 NANOFILTRATION 100

10.3.1 REMOVES ENDOTOXINS, HORMONE RESIDUES, ANTIBIOTICS, AND OTHER TRACES FROM PROCESS WATER AND MEDICAL SOLUTIONS TO DRIVE MARKET 100

10.4 MICROFILTRATION 100

10.4.1 RISING DEMAND FOR ENERGY-EFFICIENT AIR CONDITIONING SYSTEMS AND RETROFITTING OF OLDER BUILDINGS TO DRIVE MARKET 100

10.5 OTHER PROCESS TECHNOLOGIES 101

11 MEDICAL MEMBRANES MARKET, BY APPLICATION 102

11.1 INTRODUCTION 103

11.2 PHARMACEUTICAL FILTRATION 104

11.2.1 ENHANCING BIOPHARMACEUTICAL SAFETY WITH HIGH-PERFORMANCE MEMBRANE SOLUTIONS TO DRIVE MARKET 104

11.3 HEMODIALYSIS 105

11.3.1 EMPOWERING RENAL SUPPORT WITH PRECISION FILTRATION TO DRIVE MARKET 105

11.4 DRUG DELIVERY 106

11.4.1 ENHANCING TREATMENT RELIABILITY THROUGH CONTROLLED DIFFUSION TECHNOLOGY TO DRIVE MARKET 106

11.5 IV FUSION & STERILE FILTRATION 106

11.5.1 ADVANCING CLINICAL OUTCOMES THROUGH CUTTING-EDGE FILTRATION AND DELIVERY TO DRIVE MARKET 106

11.6 MEMBRANE OXYGENATOR 107

11.6.1 DRIVING EFFICIENT AND SAFE OXYGEN DELIVERY WITH MEMBRANE INNOVATION TO DRIVE MARKET 107

11.7 APHERESIS MEMBRANE 107

11.7.1 TRANSFORMING BLOOD TREATMENT THROUGH ADVANCED MEMBRANE TECHNOLOGY TO DRIVE MARKET 107

11.8 OTHER APPLICATIONS 108

12 MEDICAL MEMBRANES MARKET, BY REGION 109

12.1 INTRODUCTION 110

12.2 ASIA PACIFIC 111

12.2.1 CHINA 115

12.2.1.1 Accelerating expansion in healthcare filtration technologies to drive market 115

12.2.2 INDIA 116

12.2.2.1 Seizing opportunities in cost-effective dialysis and filtration to drive market 116

12.2.3 JAPAN 117

12.2.3.1 Strengthening healthcare outcomes with high-tech filtration to drive market 117

12.2.4 SOUTH KOREA 118

12.2.4.1 Rising demand from healthcare, pharmaceutical, and biotechnology sector to drive market 118

12.2.5 REST OF ASIA PACIFIC 119

12.3 NORTH AMERICA 121

12.3.1 US 124

12.3.1.1 Surge in construction activities to drive market 124

12.3.2 CANADA 125

12.3.2.1 Rise of new housing projects to drive market 125

12.3.3 MEXICO 127

12.3.3.1 Expanding industrial capabilities and healthcare systems to drive market 127

12.4 EUROPE 128

12.4.1 GERMANY 132

12.4.1.1 Surge in construction of residential infrastructure to drive market 132

12.4.2 UK 133

12.4.2.1 Rising demand for hemodialysis, pharmaceutical filtration, and IV infusion systems to drive market 133

12.4.3 FRANCE 134

12.4.3.1 Policy and financial incentives for building renovation and low-carbon heating to drive market 134

12.4.4 ITALY 136

12.4.4.1 Investments in residential buildings and renovation activities to drive market 136

12.4.5 SPAIN 137

12.4.5.1 High demand for commercial air conditioning units to drive market 137

12.4.6 REST OF EUROPE 138

12.5 MIDDLE EAST & AFRICA 139

12.5.1 SAUDI ARABIA 142

12.5.1.1 Trend of small and affordable housing units to drive market 142

12.5.2 UAE 143

12.5.2.1 Projects aimed at promoting economic development to drive market 143

12.5.3 SOUTH AFRICA 145

12.5.3.1 Regional copper trade expansion to drive market 145

12.5.4 REST OF MIDDLE EAST & AFRICA 146

12.6 SOUTH AMERICA 147

12.6.1 BRAZIL 150

12.6.1.1 Rapid industrial growth to drive market 150

12.6.2 ARGENTINA 151

12.6.2.1 Economic stabilization to drive market 151

12.6.3 REST OF SOUTH AMERICA 152

13 COMPETITIVE LANDSCAPE 154

13.1 INTRODUCTION 154

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023–2025 154

13.3 REVENUE ANALYSIS, 2022–2024 157

13.4 MARKET SHARE ANALYSIS, 2024 157

13.5 COMPANY VALUATION AND FINANCIAL METRICS 160

13.6 PRODUCT COMPARISON 161

13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024 161

13.7.1 STARS 161

13.7.2 EMERGING LEADERS 161

13.7.3 PERVASIVE PLAYERS 162

13.7.4 PARTICIPANTS 162

13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024 163

13.7.5.1 Company footprint 163

13.7.5.2 Region footprint 163

13.7.5.3 Material footprint 164

13.7.5.4 Process technology footprint 165

13.7.5.5 Application footprint 165

13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024 166

13.8.1 PROGRESSIVE COMPANIES 166

13.8.2 RESPONSIVE COMPANIES 166

13.8.3 DYNAMIC COMPANIES 166

13.8.4 STARTING BLOCKS 166

13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024 168

13.8.5.1 Detailed list of key startups/SMEs 168

13.8.5.2 Competitive benchmarking of startups/SMEs 169

13.9 COMPETITIVE SCENARIO 170

13.9.1 DEALS 170

13.9.2 EXPANSIONS 171

14 COMPANY PROFILES 173

14.1 KEY PLAYERS 173

14.1.1 ASAHI KASEI CORPORATION 173

14.1.1.1 Business overview 173

14.1.1.2 Products offered 174

14.1.1.3 MnM view 175

14.1.1.3.1 Right to win 175

14.1.1.3.2 Strategic choices 175

14.1.1.3.3 Weaknesses and competitive threats 175

14.1.2 MANN+HUMMEL 176

14.1.2.1 Business overview 176

14.1.2.2 Products offered 177

14.1.2.3 MnM view 178

14.1.2.3.1 Right to win 178

14.1.2.3.2 Strategic choices 178

14.1.2.3.3 Weaknesses and competitive threats 178

14.1.3 SARTORIUS AG 179

14.1.3.1 Business overview 179

14.1.3.2 Products offered 180

14.1.3.3 MnM view 181

14.1.3.3.1 Right to win 181

14.1.3.3.2 Strategic choices 181

14.1.3.3.3 Weaknesses and competitive threats 181

14.1.4 MERCK KGAA 182

14.1.4.1 Business overview 182

14.1.4.2 Products offered 183

14.1.4.3 Recent developments 185

14.1.4.3.1 Expansions 185

14.1.4.4 MnM view 186

14.1.4.4.1 Right to win 186

14.1.4.4.2 Strategic choices 186

14.1.4.4.3 Weaknesses and competitive threats 186

14.1.5 SOLVENTUM 187

14.1.5.1 Business overview 187

14.1.5.2 Products offered 188

14.1.5.3 Recent developments 191

14.1.5.3.1 Deals 191

14.1.5.4 MnM view 192

14.1.5.4.1 Right to win 192

14.1.5.4.2 Strategic choices 192

14.1.5.4.3 Weaknesses and competitive threats 192

14.1.6 CYTIVA (DANAHER CORPORATION) 193

14.1.6.1 Business overview 193

14.1.6.2 Products offered 194

14.1.6.3 Recent developments 196

14.1.6.3.1 Deals 196

14.1.6.3.2 Expansions 196

14.1.6.4 MnM view 197

14.1.7 W. L. GORE & ASSOCIATES, INC. 198

14.1.7.1 Business overview 198

14.1.7.2 Products offered 198

14.1.7.3 MnM view 199

14.1.8 KOVALUS SEPARATION SOLUTIONS 200

14.1.8.1 Business overview 200

14.1.8.2 Products offered 200

14.1.8.3 MnM view 201

14.1.9 COBETTER 202

14.1.9.1 Business overview 202

14.1.9.2 Products offered 202

14.1.9.3 MnM view 205

14.1.10 POREX 207

14.1.10.1 Business overview 207

14.1.10.2 Products offered 207

14.1.10.3 MnM view 209

14.2 OTHER PLAYERS 210

14.2.1 ADVANCED MICRODEVICES PVT. LTD. 210

14.2.2 AMERICAN MEMBRANE CORPORATION 211

14.2.3 AMS MEMTECH TECHNOLOGY (ZHEJIANG) CO., LTD 212

14.2.4 APPLIED MEMBRANE TECHNOLOGY, INC. 213

14.2.5 GRAVER TECHNOLOGIES 214

14.2.6 MEDICA SPA 215

14.2.7 MEMBRANE SOLUTIONS (NANTONG) 216

14.2.8 NX FILTRATION 217

14.2.9 OSMOTECH 218

14.2.10 PERMIONICS GROUP 219

14.2.11 REPLIGEN CORPORATION 220

14.2.12 SYNDER FILTRATION, INC. 221

14.2.13 THEWAY MEMBRANES 222

14.2.14 UNISOL MEMBRANE TECHNOLOGY 223

14.2.15 XINNA 224

15 RESEARCH METHODOLOGY 225

15.1 RESEARCH DATA 225

15.1.1 SECONDARY DATA 226

15.1.1.1 List of secondary sources 226

15.1.1.2 Key data from secondary sources 226

15.1.2 PRIMARY DATA 227

15.1.2.1 List of primary interview participants–demand and supply side 227

15.1.2.2 Key data from primary sources 227

15.1.2.3 Breakdown of primary interviews 228

15.1.2.4 Insights from industry experts 228

15.2 MARKET SIZE ESTIMATION 228

15.2.1 BOTTOM-UP APPROACH 229

15.2.2 TOP-DOWN APPROACH 229

15.3 FORECAST NUMBER CALCULATION 230

15.4 DATA TRIANGULATION 231

15.5 FACTOR ANALYSIS 232

15.6 RESEARCH ASSUMPTIONS 232

15.7 RESEARCH LIMITATIONS AND RISK ASSESSMENT 233

16 APPENDIX 234

16.1 DISCUSSION GUIDE 234

16.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL 237

16.3 CUSTOMIZATION OPTIONS 239

16.4 RELATED REPORTS 239

16.5 AUTHOR DETAILS 240

LIST OF TABLES

TABLE 1 PORTER’S FIVE FORCES ANALYSIS 45

TABLE 2 PROJECTED REAL GDP GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2021–2030 47

TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM 51

TABLE 4 AVERAGE SELLING PRICE TREND, BY REGION, 2022–2024 (USD/METER) 52

TABLE 5 IMPORT SCENARIO FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD MILLION) 54

TABLE 6 EXPORT SCENARIO FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD MILLION) 55

TABLE 7 KEY CONFERENCES AND EVENTS, 2026 55

TABLE 8 US-ADJUSTED RECIPROCAL TARIFF RATES 59

TABLE 9 TOTAL NUMBER OF PATENTS 66

TABLE 10 TOP 10 PATENT OWNERS 69

TABLE 11 TOP USE CASES AND MARKET POTENTIAL 73

TABLE 12 BEST PRACTICES: NOTABLE INDUSTRY PRACTICES BY LEADING COMPANIES 74

TABLE 13 MEDICAL MEMBRANES MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION 74

TABLE 14 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS 75

TABLE 15 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 77

TABLE 16 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 77

TABLE 17 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 78

TABLE 18 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS 78

TABLE 19 GLOBAL STANDARDS IN MEDICAL MEMBRANES MARKET 79

TABLE 20 CERTIFICATIONS, LABELING, AND ECO-STANDARDS IN MEDICAL MEMBRANES MARKET 81

TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPICATION (%) 83

TABLE 22 KEY BUYING CRITERIA, BY APPLICATION 84

TABLE 23 MEDICAL MEMBRANES MARKET: UNMET NEEDS IN KEY APPLICATIONS 87

TABLE 24 MEDICAL MEMBRANES MARKET, BY MATERIAL, 2022–2024 (USD MILLION) 91

TABLE 25 MEDICAL MEMBRANES MARKET, BY MATERIAL, 2025–2030 (USD MILLION) 91

TABLE 26 MEDICAL MEMBRANES MARKET, BY PROCESS TECHNOLOGY,

2022–2024 (USD MILLION) 98

TABLE 27 MEDICAL MEMBRANES MARKET, BY PROCESS TECHNOLOGY,

2025–2030 (USD MILLION) 99

TABLE 28 MEDICAL MEMBRANES MARKET, BY APPLICATION, 2022–2024 (USD MILLION) 104

TABLE 29 MEDICAL MEMBRANES MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 104

TABLE 30 MEDICAL MEMBRANES MARKET, BY REGION, 2022–2024 (USD MILLION) 110

TABLE 31 MEDICAL MEMBRANES MARKET, BY REGION, 2025–2030 (USD MILLION) 111

TABLE 32 MEDICAL MEMBRANES MARKET, BY REGION,

2022–2024 (MILLION SQUARE METER) 111

TABLE 33 MEDICAL MEMBRANES MARKET, BY REGION,

2025–2030 (MILLION SQUARE METER) 111

TABLE 34 ASIA PACIFIC: MEDICAL MEMBRANES MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 112

TABLE 35 ASIA PACIFIC: MEDICAL MEMBRANES MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 113

TABLE 36 ASIA PACIFIC: MEDICAL MEMBRANES MARKET, BY MATERIAL,

2022–2024 (USD MILLION) 113

TABLE 37 ASIA PACIFIC: MEDICAL MEMBRANES MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 113

TABLE 38 ASIA PACIFIC: MEDICAL MEMBRANES MARKET, BY PROCESS TECHNOLOGY,

2022–2024 (USD MILLION) 114

TABLE 39 ASIA PACIFIC: MEDICAL MEMBRANES MARKET, BY PROCESS TECHNOLOGY,

2025–2030 (USD MILLION) 114

TABLE 40 ASIA PACIFIC: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 114

TABLE 41 ASIA PACIFIC: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 115

TABLE 42 CHINA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 116

TABLE 43 CHINA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 116

TABLE 44 INDIA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 117

TABLE 45 INDIA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 117

TABLE 46 JAPAN: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 118

TABLE 47 JAPAN: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 118

TABLE 48 SOUTH KOREA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 119

TABLE 49 SOUTH KOREA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 119

TABLE 50 REST OF ASIA PACIFIC: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 120

TABLE 51 REST OF ASIA PACIFIC: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 120

TABLE 52 NORTH AMERICA: MEDICAL MEMBRANES MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 122

TABLE 53 NORTH AMERICA: MEDICAL MEMBRANES MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 122

TABLE 54 NORTH AMERICA: MEDICAL MEMBRANES MARKET, BY MATERIAL,

2022–2024 (USD MILLION) 122

TABLE 55 NORTH AMERICA: MEDICAL MEMBRANES MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 123

TABLE 56 NORTH AMERICA: MEDICAL MEMBRANES MARKET, BY PROCESS TECHNOLOGY, 2022–2024 (USD MILLION) 123

TABLE 57 NORTH AMERICA: MEDICAL MEMBRANES MARKET, BY PROCESS TECHNOLOGY, 2025–2030 (USD MILLION) 123

TABLE 58 NORTH AMERICA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 124

TABLE 59 NORTH AMERICA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 124

TABLE 60 US: MEDICAL MEMBRANES MARKET, BY APPLICATION, 2022–2024 (USD MILLION) 125

TABLE 61 US: MEDICAL MEMBRANES MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 125

TABLE 62 CANADA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 126

TABLE 63 CANADA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 127

TABLE 64 MEXICO: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 128

TABLE 65 MEXICO: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 128

TABLE 66 EUROPE: MEDICAL MEMBRANES MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 129

TABLE 67 EUROPE: MEDICAL MEMBRANES MARKET BY COUNTRY,

2025–2030 (USD MILLION) 130

TABLE 68 EUROPE: MEDICAL MEMBRANES MARKET, BY MATERIAL,

2022–2024 (USD MILLION) 130

TABLE 69 EUROPE: MEDICAL MEMBRANES MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 130

TABLE 70 EUROPE: MEDICAL MEMBRANES MARKET, BY PROCESS TECHNOLOGY,

2022–2024 (USD MILLION) 131

TABLE 71 EUROPE: MEDICAL MEMBRANES MARKET, BY PROCESS TECHNOLOGY,

2025–2030 (USD MILLION) 131

TABLE 72 EUROPE: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 131

TABLE 73 EUROPE: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 132

TABLE 74 GERMANY: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 133

TABLE 75 GERMANY: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 133

TABLE 76 UK: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 134

TABLE 77 UK: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 134

TABLE 78 FRANCE: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 135

TABLE 79 FRANCE: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 135

TABLE 80 ITALY: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 136

TABLE 81 ITALY: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 137

TABLE 82 SPAIN: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 137

TABLE 83 SPAIN: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 138

TABLE 84 REST OF EUROPE: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 138

TABLE 85 REST OF EUROPE: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 139

TABLE 86 MIDDLE EAST & AFRICA: MEDICAL MEMBRANES MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 140

TABLE 87 MIDDLE EAST & AFRICA: MEDICAL MEMBRANES MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 140

TABLE 88 MIDDLE EAST & AFRICA: MEDICAL MEMBRANES MARKET, BY MATERIAL,

2022–2024 (USD MILLION) 140

TABLE 89 MIDDLE EAST & AFRICA: MEDICAL MEMBRANES MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 141

TABLE 90 MIDDLE EAST & AFRICA: MEDICAL MEMBRANES MARKET, BY PROCESS TECHNOLOGY, 2022–2024 (USD MILLION) 141

TABLE 91 MIDDLE EAST & AFRICA: MEDICAL MEMBRANES MARKET, BY PROCESS TECHNOLOGY, 2025–2030 (USD MILLION) 141

TABLE 92 MIDDLE EAST & AFRICA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 142

TABLE 93 MIDDLE EAST & AFRICA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 142

TABLE 94 SAUDI ARABIA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 143

TABLE 95 SAUDI ARABIA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 143

TABLE 96 UAE: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 144

TABLE 97 UAE: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 144

TABLE 98 SOUTH AFRICA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 145

TABLE 99 SOUTH AFRICA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 146

TABLE 100 REST OF MIDDLE EAST: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 147

TABLE 101 REST OF MIDDLE EAST: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 147

TABLE 102 SOUTH AMERICA: MEDICAL MEMBRANES MARKET, BY COUNTRY,

2022–2024 (USD MILLION) 148

TABLE 103 SOUTH AMERICA: MEDICAL MEMBRANES MARKET, BY COUNTRY,

2025–2030 (USD MILLION) 148

TABLE 104 SOUTH AMERICA: MEDICAL MEMBRANES MARKET, BY MATERIAL,

2022–2024 (USD MILLION) 148

TABLE 105 SOUTH AMERICA: MEDICAL MEMBRANES MARKET, BY MATERIAL,

2025–2030 (USD MILLION) 149

TABLE 106 SOUTH AMERICA: MEDICAL MEMBRANES MARKET, BY PROCESS TECHNOLOGY, 2022–2024 (USD MILLION) 149

TABLE 107 SOUTH AMERICA: MEDICAL MEMBRANES MARKET, BY PROCESS TECHNOLOGY, 2025–2030 (USD MILLION) 149

TABLE 108 SOUTH AMERICA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 150

TABLE 109 SOUTH AMERICA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 150

TABLE 110 BRAZIL: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 151

TABLE 111 BRAZIL: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 151

TABLE 112 ARGENTIINA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2022–2024 (USD MILLION) 152

TABLE 113 ARGENTINA: MEDICAL MEMBRANES MARKET, BY APPLICATION,

2025–2030 (USD MILLION) 152

TABLE 114 REST OF SOUTH AMERICA: MEDICAL MEMBRANES MARKET, BY APPLICATION, 2022–2024 (USD MILLION) 153

TABLE 115 REST OF SOUTH AMERICA: MEDICAL MEMBRANES MARKET, BY APPLICATION, 2025–2030 (USD MILLION) 153

TABLE 116 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2023–2025 154

TABLE 117 MEDICAL MEMBRANES MARKET: DEGREE OF COMPETITION 158

TABLE 118 MEDICAL MEMBRANES MARKET: REGION FOOTPRINT 163

TABLE 119 MEDICAL MEMBRANES MARKET: MATERIAL FOOTPRINT 164

TABLE 120 MEDICAL MEMBRANES MARKET: PROCESS TECHNOLOGY FOOTPRINT 165

TABLE 121 MEDICAL MEMBRANES MARKET: APPLICATION FOOTPRINT 165

TABLE 122 MEDICAL MEMBRANES MARKET: DETAILED LIST OF STARTUPS/SMES 168

TABLE 123 MEDICAL MEMBRANES MARKET: COMPETITIVE

BENCHMARKING OF STARTUPS/SMES 169

TABLE 124 MEDICAL MEMBRANES MARKET: DEALS, JANUARY 2023–OCTOBER 2025 170

TABLE 125 MEDICAL MEMBRANES MARKET: EXPANSIONS, JANUARY 2023–OCTOBER 2025 171

TABLE 126 ASAHI KASEI CORPORATION: COMPANY OVERVIEW 173

TABLE 127 ASAHI KASEI CORPORATION: PRODUCTS OFFERED 174

TABLE 128 MANN+HUMMEL: COMPANY OVERVIEW 176

TABLE 129 MANN+HUMMEL: PRODUCTS OFFERED 177

TABLE 130 SARTORIUS AG: COMPANY OVERVIEW 179

TABLE 131 SARTORIUS AG: PRODUCTS OFFERED 180

TABLE 132 MERCK KGAA: COMPANY OVERVIEW 182

TABLE 133 MERCK KGAA: PRODUCTS OFFERED 183

TABLE 134 MERCK KGAA: EXPANSIONS, JANUARY 2023–OCTOBER 2025 185

TABLE 135 SOLVENTUM: COMPANY OVERVIEW 187

TABLE 136 SOLVENTUM: PRODUCTS OFFERED 188

TABLE 137 SOLVENTUM: DEALS 191

TABLE 138 CYTIVA: COMPANY OVERVIEW 193

TABLE 139 CYTIVA: PRODUCTS OFFERED 194

TABLE 140 CYTIVA: DEALS 196

TABLE 141 CYTIVA: EXPANSIONS, JANUARY 2023–OCTOBER 2025 196

TABLE 142 W. L. GORE & ASSOCIATES, INC.: COMPANY OVERVIEW 198

TABLE 143 W. L. GORE & ASSOCIATES, INC.: PRODUCTS OFFERED 198

TABLE 144 KOVALUS SEPARATION SOLUTIONS: COMPANY OVERVIEW 200

TABLE 145 KOVALUS SEPARATION SOLUTIONS: PRODUCTS OFFERED 200

TABLE 146 COBETTER: COMPANY OVERVIEW 202

TABLE 147 COBETTER: PRODUCTS OFFERED 202

TABLE 148 POREX: COMPANY OVERVIEW 207

TABLE 149 POREX: PRODUCTS OFFERED 207

TABLE 150 ADVANCED MICRODEVICES PVT. LTD.: COMPANY OVERVIEW 210

TABLE 151 AMERICAN MEMBRANE CORPORATION: COMPANY OVERVIEW 211

TABLE 152 AMS MEMTECH TECHNOLOGY (ZHEJIANG) CO., LTD: COMPANY OVERVIEW 212

TABLE 153 APPLIED MEMBRANE TECHNOLOGY, INC.: COMPANY OVERVIEW 213

TABLE 154 GRAVER TECHNOLOGIES: COMPANY OVERVIEW 214

TABLE 155 MEDICA SPA: COMPANY OVERVIEW 215

TABLE 156 MEMBRANE SOLUTIONS (NANTONG): COMPANY OVERVIEW 216

TABLE 157 NX FILTRATION: COMPANY OVERVIEW 217

TABLE 158 OSMOTECH: COMPANY OVERVIEW 218

TABLE 159 PERMIONICS GROUP: COMPANY OVERVIEW 219

TABLE 160 REPLIGEN CORPORATION: COMPANY OVERVIEW 220

TABLE 161 SYNDER FILTRATION, INC.: COMPANY OVERVIEW 221

TABLE 162 THEWAY MEMBRANES: COMPANY OVERVIEW 222

TABLE 163 UNISOL MEMBRANE TECHNOLOGY: COMPANY OVERVIEW 223

TABLE 164 XINNA: COMPANY OVERVIEW 224

LIST OF FIGURES

FIGURE 1 MEDICAL MEMBRANES MARKET SEGMENTATION 24

FIGURE 2 PHARMACEUTICAL FILTRATION TO DOMINATE MEDICAL

MEMBRANES MARKET DURING FORECAST PERIOD 28

FIGURE 3 PSU & PESU TO BE FASTEST-GROWING MATERIAL TYPE

DURING FORECAST PERIOD 28

FIGURE 4 ULTRAFILTRATION PROCESS TECHNOLOGY TO DOMINATE

MEDICAL MEMBRANES MARKET 29

FIGURE 5 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD 30

FIGURE 6 INCREASING CHRONIC DISEASES AND GROWING DEMAND FOR FILTRATION SOLUTIONS TO DRIVE MARKET DURING FORECAST PERIOD 31

FIGURE 7 IV FUSION AND STERILE FILTRATION TO BE SECOND FASTEST-GROWING APPLICATION IN MEDICAL MEMBRANES MARKET DURING FORECAST PERIOD 31

FIGURE 8 PVDF TO BE SECOND-LARGEST MATERIAL TYPE SEGMENT DURING FORECAST PERIOD 32

FIGURE 9 NANOFILTRATION PROCESS TECHNOLOGY TO BE FASTEST-GROWING SEGMENT IN MEDICAL MEMBRANES MARKET 32

FIGURE 10 ASIA PACIFIC TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD 33

FIGURE 11 MEDICAL MEMBRANES MARKET: DRIVERS, RESTRAINTS,

OPPORTUNITIES, AND CHALLENGES 35

FIGURE 12 PORTER’S FIVE FORCES ANALYSIS 44

FIGURE 13 VALUE CHAIN ANALYSIS 48

FIGURE 14 ECOSYSTEM ANALYSIS 50

FIGURE 15 AVERAGE SELLING PRICE TREND, BY REGION, 2022–2024 (USD/METER) 52

FIGURE 16 IMPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD MILLION) 53

FIGURE 17 EXPORT DATA FOR HS CODE 901890-COMPLIANT PRODUCTS, BY COUNTRY, 2020–2024 (USD MILLION) 54

FIGURE 18 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS 56

FIGURE 19 INVESTMENT AND FUNDING SCENARIO, 2021–2024 (USD MILLION) 57

FIGURE 20 PATENT ANALYSIS, BY DOCUMENT TYPE, 2016–2025 67

FIGURE 21 PATENT PUBLICATION TRENDS, 2016−2025 67

FIGURE 22 MEDICAL MEMBRANES MARKET: LEGAL STATUS OF PATENTS,

JANUARY 2016–DECEMBER 2025 68

FIGURE 23 JURISDICTION OF US REGISTERED HIGHEST SHARE OF PATENTS,

2016–2025 68

FIGURE 24 TOP PATENT APPLICANTS, 2016–2025 69

FIGURE 25 FUTURE APPLICATIONS OF MEDICAL MEMBRANES 70

FIGURE 26 MEDICAL MEMBRANES MARKET: DECISION-MAKING FACTORS 82

FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY APPLICATION 83

FIGURE 28 KEY BUYING CRITERIA, BY APPLICATION 84

FIGURE 29 ADOPTION BARRIERS & INTERNAL CHALLENGES 86

FIGURE 30 MEDICAL MEMBRANES MARKET, BY MATERIAL, 2025–2030 (USD MILLION) 90

FIGURE 31 MEDICAL MEMBRANES MARKET, BY PROCESS TECHNOLOGY,

2025–2030 (USD MILLION) 98

FIGURE 32 MEDICAL MEMBRANES MARKET, BY PROCESS TECHNOLOGY,

2025–2030 (USD MILLION) 103

FIGURE 33 MEDICAL MEMBRANES MARKET, BY COUNTRY, 2025–2030 110

FIGURE 34 ASIA PACIFIC: MEDICAL MEMBRANES MARKET SNAPSHOT 112

FIGURE 35 NORTH AMERICA: MEDICAL MEMBRANES MARKET SNAPSHOT 121

FIGURE 36 EUROPE: MEDICAL MEMBRANES MARKET SNAPSHOT 129

FIGURE 37 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYER, 2022–2024 157

FIGURE 38 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024 158

FIGURE 39 COMPANY VALUATION (USD BILLION) 160

FIGURE 40 FINANCIAL METRICS (EV/EBITDA) 160

FIGURE 41 PRODUCT COMPARISON 161

FIGURE 42 MEDICAL MEMBRANES MARKET: COMPANY EVALUATION MATRIX

(KEY PLAYERS), 2024 162

FIGURE 43 MEDICAL MEMBRANES MARKET: COMPANY FOOTPRINT 163

FIGURE 44 MEDICAL MEMBRANES MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024 167

FIGURE 45 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT 174

FIGURE 46 MANN+HUMMEL: COMPANY SNAPSHOT 176

FIGURE 47 SARTORIUS AG: COMPANY SNAPSHOT 180

FIGURE 48 MERCK KGAA: COMPANY SNAPSHOT 183

FIGURE 49 SOLVENTUM: COMPANY SNAPSHOT 188

FIGURE 50 DANAHER CORPORATION: COMPANY SNAPSHOT 194

FIGURE 51 RESEARCH DESIGN 225

FIGURE 52 BOTTOM-UP APPROACH 229

FIGURE 53 TOP-DOWN APPROACH 229

FIGURE 54 MARKET SIZE ESTIMATION NOTES 230

FIGURE 55 DEMAND-SIDE FORECAST PROJECTIONS 230

FIGURE 56 DATA TRIANGULATION 231